Ce document contient des informations confidentielles appartenant exclusivement à American Express. Il ne peut être communiqué à des tiers sans le consentement écrit d'American Express.

American Express @ Work

®

Introducing Online Card Applications

A smart function within Global Online Programme Management

American Express @ Work

2

American Express @ Work

American Express @ Work is an online portal that provides you with easy access to the tools and functions

you need to manage your American Express programme to best effect.

Now you can access Online Card Applications through Global Online Programme Management.

The benefits of Online Card Applications

3

Flexibility, control & visibility

Improved accuracy, fewer

form rejections

Greater speed, faster Card

issue

• Raised visibility of new applications

• Review process with Status Tracking

• Choice of who initiates application:

• Employee initiated

• Programme Administrator initiated

• More robust application approval process

• Specific benefits for the employee :

- Application form & Terms & Conditions

available in French & English

- Choose PIN code

• Reduced scope for error due to:

• Pre-populated company information

• Data validation

• Application can only be submitted w

hen

m

andatory fields are complete

• No risk of rejection due to out-of-dat

e

paper-bas

ed forms

• Elimination of errors due to incomplete/

illegible forms

• Version control of Terms & Conditions

• Full end-to-end online applicati

on and

appr

oval process

• E-signature solution compliant with t

he

F

rench law (see appendix)

• Application flows directly to New

Accounts system

• Inefficiencies of paper-based submissions

eliminated

• Reduction in Application –to-Card issue

processing time

• Faster enablement for employees

requiring Cards

• Streamlined process and enhanced user

experience

• Bulk application provide convenienc

e

and t

ime-saving

How does the new Online Card Applications process work?

4

Applicant is informed

of Corporate Card

application process,

Access Key (as

required) & approval

process either by:

• Line Manager

• On-boarding Guide

• Intranet

• Programme

Administrator

• Other internal

communication

Applicant Requires

Corporate Card

1. Programme

Administrato

r

i

nitiates Card

application in @

Work

Applicant receives

two automated

emails with URL

link & log-in details

OR:

2. Cardmember

initiates Card

application via

ge

neric URL a

nd

d

esignated

Access Key

Application Initiated & Completed

Applicant

completes secure

online application

form

Including the

ability to upload

supporting

documentation (ID

documents + RIB

for individually pay

option)

And e-sign the

Application Form

via a secret code

sent by e-mail

The benefits include:

• Paperless and intuitive process in a secure

env

ironment

• Flexibility, control and visibility

• Improved accuracy, fewer form rejections

• Accelerated card issuance

SUBMIT for Processing

• Programme

A

dministrator receives

notification of new

Applications

• Optional: if Additional

Approver required,

Programme

A

dministrator t

o

v

alidate upl

oaded

doc

umentation.

• Applications reviewed,

approved

and

submitted to American

E

xpress on @ Work

• Upon company

approval, the applicant

receives an automat

ed

c

onfirmation e-mail with

a link to Corporate Card

T

&C’s

Application Approved

& Submitted

Card issued* and

delivered to

Cardmember in a

Welcome Pack.

(Applicant can track

application process

and dispatch status

via Apply For Card)

*Subject to American

Express credit approval

criteria.

Application

Processed

@ Work Online Card Applications Process

Online Card Applications checklist

5

Programme Administrator Overview and Checklist

1

Make sure you are enrolled in @

Work

There are different types of @ Work access. You will need to ensure you have

Online Programme Management privileges to manage online Card Applications.

Your Account Manager can confirm what type of access you have.

2

Decide how Applicants should

access the online Form

To give you more flexibility and help you create a workflow that fits with your

Company processes, Applications can be initiated either by a Programme

Administrator or by the Applicant themselves. You should choose the option that

suits your needs best.

3

Decide how Applicants will receive

their Access Key

Regardless of how you decide to initiate Applications for your Company, every

Applicant will need to know the right Access Key to start their Application. You need

to decide how the right Access Key will be communicated.

4

Define who will approve Applications

in @ Work

All Applications are submitted to American Express in @ Work. If your Company

requires approvals from other individuals (e.g. line manager, Finance Officer) you

need to incorporate this into your workflow. These can be attached to the

Application, or managed separately.

5

Create Access Keys

To prepare your Account for online Applications, you will need to create an Access

Key for each Basic Control Account (BCA). This is a quick and simple, one-time

set-up that ensures the correct company information is processed with every

application.

6

Update information sources

However your Company provides the relevant information to Applicants (be it

Company Intranet, On-boarding Guide, line manager or direct from the Programme

Administrator), you need to ensure that all information is up to date and reflects the

online Card Application process.

6

Choose the application process that suits your Company’s policies

and procedures

Step 1

PA creates Access Key and

provides this to employee.

Step 2

Employee access the application via

the generic url, enters the Access Key

and their email address to initiate

,complete, e-sign & submit their

application.

The application is then automatically

transmitted to the PA for online

approval in @ Work.

Step 3

American Express sends 2 emails

to the Applicant with a unique link

to their application, Tracking

Number & Access Key to allow

them to check the status of their

application.

Employee initiated application process

Step 1

Line manager contacts PA

to initiate Card application

for an employee

Step 2

PA initiates the application

using the Access Key for the

BCA.

Step 3

Employee receives two

automated system generated

emails containing (1) Access

Key details (2) a unique link to

their application and Tracking

Number.

Employee completes, e-signs

and submits the application that

is automatically transmitted to

the PA for online approval in @

Work.

Step 4

American Express sends an

email to the Applicant with a

unique link to their

application and Tracking

Number to allow them to

check the status of their

application.

.

Programme Administrator initiated application process

* Both options can be implemented in your company.

Resources to support your transition to Online Card Applications

7

American Express understands that not all businesses operate in the same way. Your

Account Manager will support you to help make sure the new Online Card Applications

process is fully integrated with your Company policies and procedures.

e-Signature – Legal framework

Automated Emails

Getting sta

rted quick PA user guide

Appendix

8

E-signature requirements* :

Signer Identification : establishes the link between the signer and the signed document

Signer’s agreement on the signed document

Ensure integrity of the signed document : the document must be protected and can’t be modified

Document is time stamped : no back datable

Document is archived together with the support documents

American Express Digital Signature Solution relies on a trusted third party, QuickSign, for cryptographic operations

and the technical tasks.

1. American Express generates the electronic contract (card application and supporting documents ) :

The card applicant populates the fields within the Online Application form which are saved on American Express’s servers, accept Corporate Card

Terms & Conditions and upload supporting documents.

Once the form is validated by the applicant, the customer’s field data is converted into a PDF contract that can be downloaded and printed and

displayed to the customer along with a link to the e-signature Terms and Conditions.

The card applicant must accept the e-signature Terms & Conditions and e-sign the PDF contract by entering the secret code sent to their e-mail

address.

3. Keynectis, the Certification Service Provider issues the qualified certificate, creates the electronic proof (signature, time

stamping and add it to the supporting docs)

4. The Application and Supporting Documents are then archived at CDC (Caissedes Dépôts) and can be produced in an

appropriate format for evidentiary purposes at a future point.

*As per the decrees of March 30th 2001 and April 18th 2002

e-Signature – Legal framework

9

Online Card Applications

10

Automated Emails

Content Purpose Trigger Recipient

Batch /

Realtime

1

Unique URL and Tracking

Number

Used by Applicant to login to the

application

(a) PA initiated applications: when PA initiates the

application., or

(b) Employee initiated applications: when

applicant submits/saves the application as

draft or,

(c) PA can resend those e-mails from @ Work

Applicant Realtime

2

Access Key

Used by Applicant to login to the

application

3

Additional/Internal

Approval

Routing

Asks the Internal/Additional

approver to send his/her approval

via email to the Applicant.

Applicant triggered: When the Applicant clicks the

button to send Approval email to Additional/Internal

Approver while completing the application.

Note:

This email is triggered only when the PA sets the

Internal Approver to 'yes' on the Access Key.

Internal/

Additional

Approver

Realtime

4

Route to Applicant Action

Advises the Applicant that the

PA/Final Approver has routed the

application back to him.

Note: The PA is responsible to

add comments on the email for the

Applicant.

PA triggered: When the PA needs the Applicant to

modify information on the

application and resubmit.

Applicant Realtime

5

Reminder

Reminds the Applicant that an

application is pending to be

completed and /or submitted to PA

for approval.

First email is triggered on the eighth day and every

seven days thereafter if t

he application is 'Saved as

Draft'/'with Applicant‘; email stops when 90 days

have elapsed since application initiation,

application is cancelled, or completed.

Applicant

Batch, every 7

days Card

application is

pending

submission

Online Card Applications cont’d

11

Automated Emails

Content Purpose Trigger Recipient

Batch /

Realtime

6

Application form

approved by the

company

Confirms application is approved by

the company and sent to American

Express for review and processing.

Provides the link to the Terms &

Conditions that were accepted.

When the PA or Final

Approver approves the

application.

Applicant Realtime

7

Pending Approval

(Urgent)

Notifies the PA that an Urgent

application has been submitted by the

Applicant and approval is needed for

processing.

When an Urgent application

is submitted by the Applicant.

(a)

Employee Initiated Applications:

PA who created the Access

Key.

(b) PA Initiated applications: PA

who initiated the application.

(c) Final Approver (FA): when a FA

e-mail address has been

captured at Access Key level

Realtime

8

Summary of Pending

Approvals

This email advises the PA that few

applications are pending for his

approval.

Whenever there is at least

one application pending

approval for the PA (whether

normal or urgent).

(a)

Employee Initiated Applications:

PA who created the Access

Key.

(b) PA Initiated applications: PA

who initiated the application.

(a) Final Approver (FA) : when a

FA e-mail address has been

captured at Access Key level

Batch

(23:30hrs local

market time)

9

Change in Template

This email advises the Card Applicant

that some changes have taken place to

the card application form and hence he

needs to resubmit the application

When the application has not

been submitted to American

Express, and application form

template changes occur

Applicant Batch

Creating an Access Key

Initiating a card application (PA initiated process)

Initiating a bulk application (PA initiated process)

Employee initiated card application

Completing an application

Approving application forms

Other actions : rerouting or rejecting an application

Other actions : changing the priority

Status tracking tab

Getting started – Quick PA user guide

12

Access Keys must be created in @ Work before Card applications can be initiated for a Basic Control

Account (BCA). Once created, an Access Key is used to initiate and process all Card applications for a

BCA.

– Log in to AmericanExpress @ Work: www.americanexpress.fr/atwork

– From the Card Accounts section, select the Process Applications link

– Click Submit Card Applications

Creating an Access Key

13

Select Create New on the Access Key Maintenance & Initiate Application tab

Creating an Access Key

14

Note: the first time you access this screen, the table

is empty. You first need to create access keys for

each BCA you manage in order to be able to initiate

card applications.

Select your BCA number from the dropdown

The list of BCAs available is driven by your @ Work access

Product Type, Liability Type, and Billing Type are all pre-populated for each BCA

Creating an Access Key

15

Creating an Access Key

16

1. Choose a Name for your Access Key (30

alphanumeric characters maximum). Use your

own naming convention, for example, cost centre

or department

2. Set Access Key parameters by filling in the optional

fields (ie: Customised Field(s) allows to mandate

the Department Code and / or Employee Number. If

your company has opted for the individual payment,

you can make Direct Debit mandate optional or

mandatory or simply delete it. Other options allow

you to send reminder e-mails to employee who did

not complete their application form, set up an

Additional Approver, or change the Access Key

expiry date).

3. and click Save

An Access Key number is automatically generated (8 characters digit and/or numbers). At that point,

Application Forms can be initiated to applicants for that BC.

The Applicant will need to know the correct Access Key to initiate an application

The default expiration for Access Keys is 20 years and can be changed.

Creating an Access Key

17

You can initiate card applications for one employee or for a group.

To initiate a single card application, select the access key the employee is linked to, and click on Initiate application.

Initiating a card application (PA initiated process)

18

XXXXXXXX XXXXXXXX

XXXXXXXX

Fill in the fields : priority (normal or urgent card issuance), employee title, first name, name & e-mail address.

Then click on « Initiate application »

Initiating a card application (PA initiated process)

19

The applicant will receive 2 system generated e-mails to

access the card application form.

Initiating a card application (PA initiated process)

20

Tracking number and link

to personal online

application form

Access key

To access pre-filled application, the

applicant will just need to open the

emailed URL and copy-paste the

tracking number and access key.

The pre-filled card application can then

be opened, completed with requested

attachments and signed electronically

prior to being submitted for approval.

The Programme Administrator can initiate multiple card application in one go, all linked to the same basic control account.

From Access Key Maintenance & Initiate Application Tab, select an Access key

Select Initiate Bulk Applications

2121

Initiating a bulk application (PA initiated process)

In the next page, an Excel file will need to be uploaded.

2222

This file contains 4 mandatory fields to be completed : Gender, first name, name & email address for each employee.

Save it in your computer and upload it into the web page as per the instructions.

Once uploaded, you’ll need to confirm your request to send a application to all specified email addresses. If required, the

system may inform you about formatting errors to be corrected in the file.

Targeted employees will then receive 2 emails to access their customized card application (see page 20).

Initiating a bulk application (PA initiated process)

Your employees can access the online card application form directly. To do so they will need to :

Click the following genericURL : https://www360.americanexpress.com/ATWORK/un/AFC/fr_FR/empInitLogin.do

Capture the access key supplied by their company and their email address (as per below screen) and click Submit.

23

Employee initiated card application

The applicant will need to follow the instructions : fill in all tabs, accept Terms & Conditions, etc. A FAQ is available

to get additional support (a switch language button allows to display the card application in English).

24

Quit will close the

application without saving

it

The applicant can save the form and finalize it

later on.

Once all fields have been completed and

required documentation is attached, click on

Continue to sign the application electronically..

Completing a card application

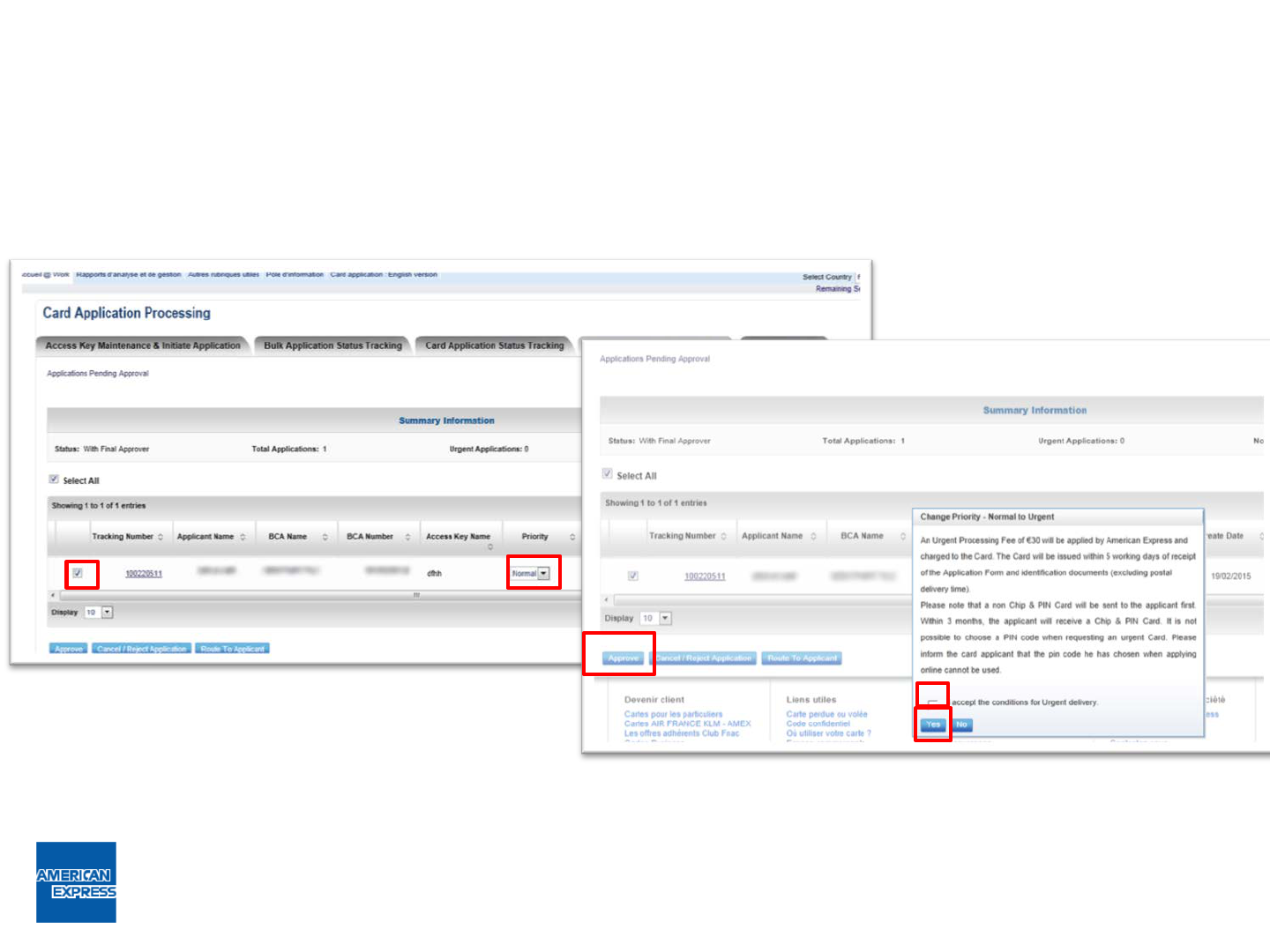

On the top menu, click on the « Application Pending Approval” Tab.

Approving application forms

25

Select the application to approve (you can select multiple applications at the same time by clicking « Select all ». Click

on the « Approve » button as shown below. To view an application before approving, just click on the corresponding

tracking number.

Approving application forms

26

Other actions : rerouting or rejecting an application

27

You can route an application back to the applicant (or to multiple applicants) if some information is missing or wrong in

the card application. You can also cancel/reject an application.

28

In the Application Pending Approval” Tab, you can change the priority of an application.

1. Select the application(s) you wish to change

2. In the column « priority », change the priority : for instance : from Normal to Urgent (see below example).

3. Approve the conditions displayed in the pop up and confirm your choice

4. Approve your request

Other actions : changing the priority

To change the priority from from Urgent to Normal,

proceed the same way. Please note that however (as

indicated in a pop up window), you will not be able to

approve the application immediately. Instead, you will

need to reroute it to the applicant for them to choose their

PIN code.

29

This tab allows you to follow up the status of any of the application under the BCA you manage.

By clicking the number under each status, you will be able to access all related applications up to their individual level.

Status tracking tab

View individual application

30

American Express Carte-France

Société anonyme au capital de 77 873 000 € - R.C.S. Nanterre B 313 536 898

Siège social : 4, rue Louis Blériot, 92561 Rueil-Malmaison Cedex.

September 2020