New Medium-term Business Plan (FY2025/3-FY2027/3)

SQUARE ENIX HOLDINGS CO., LTD.

Takashi Kiryu, President and Representative Director

May 13, 2024

Statements made in this document with respect to SQUARE ENIX HOLDINGS CO., LTD. and its consolidated subsidiaries’

(together, “SQUARE ENIX GROUP") plans, estimates, strategies, and beliefs are forward‐looking statements about the future performance of

SQUARE ENIX GROUP.

These statements are based on management's assumptions and beliefs in light of information available to it at the time these materials were

drafted and, therefore, the reader should not place undue reliance on them. Also, the reader should not assume that statements made in this

document will remain accurate or operative at a later time.

A number of factors could cause actual results to be materially different from and worse than those discussed in forward‐looking statements.

Such factors include but are not limited to:

1. changes in economic conditions affecting SQUARE ENIX GROUP’s operations;

2. fluctuations in currency exchange rates, particularly with respect to the value of the Japanese yen, the U.S. dollar, and the Euro;

3. SQUARE ENIX GROUP’s ability to continue to win acceptance of its products and services, which are offered in highly competitive

markets characterized by the continuous introduction of new products and services, rapid developments in technology, and subjective

and changing consumer preferences;

4. SQUARE ENIX GROUP’s ability to expand international success with a focus on its businesses; and

5. regulatory developments and changes and SQUARE ENIX GROUP’s ability to respond and adapt to those changes.

The forward‐looking statements regarding earnings contained in these materials were valid at the time these materials were drafted.

SQUARE ENIX GROUP assumes no obligation to update or revise any forward‐looking statements, including forecasts or projections, whether

as a result of new information, subsequent events, or otherwise.

The financial information presented in this document is prepared according to generally accepted accounting principles in Japan.

2

Today’s agenda

3

Our previous medium-term business plan: A review

1

Our long-term vision & new corporate philosophy structure

2

4 strategies

3 targets

Our new medium-term business plan

3

Today’s agenda

4

Our previous medium-term business plan: A review

1

Our long-term vision & new corporate philosophy structure

2

4 strategies

3 targets

Our new medium-term business plan

3

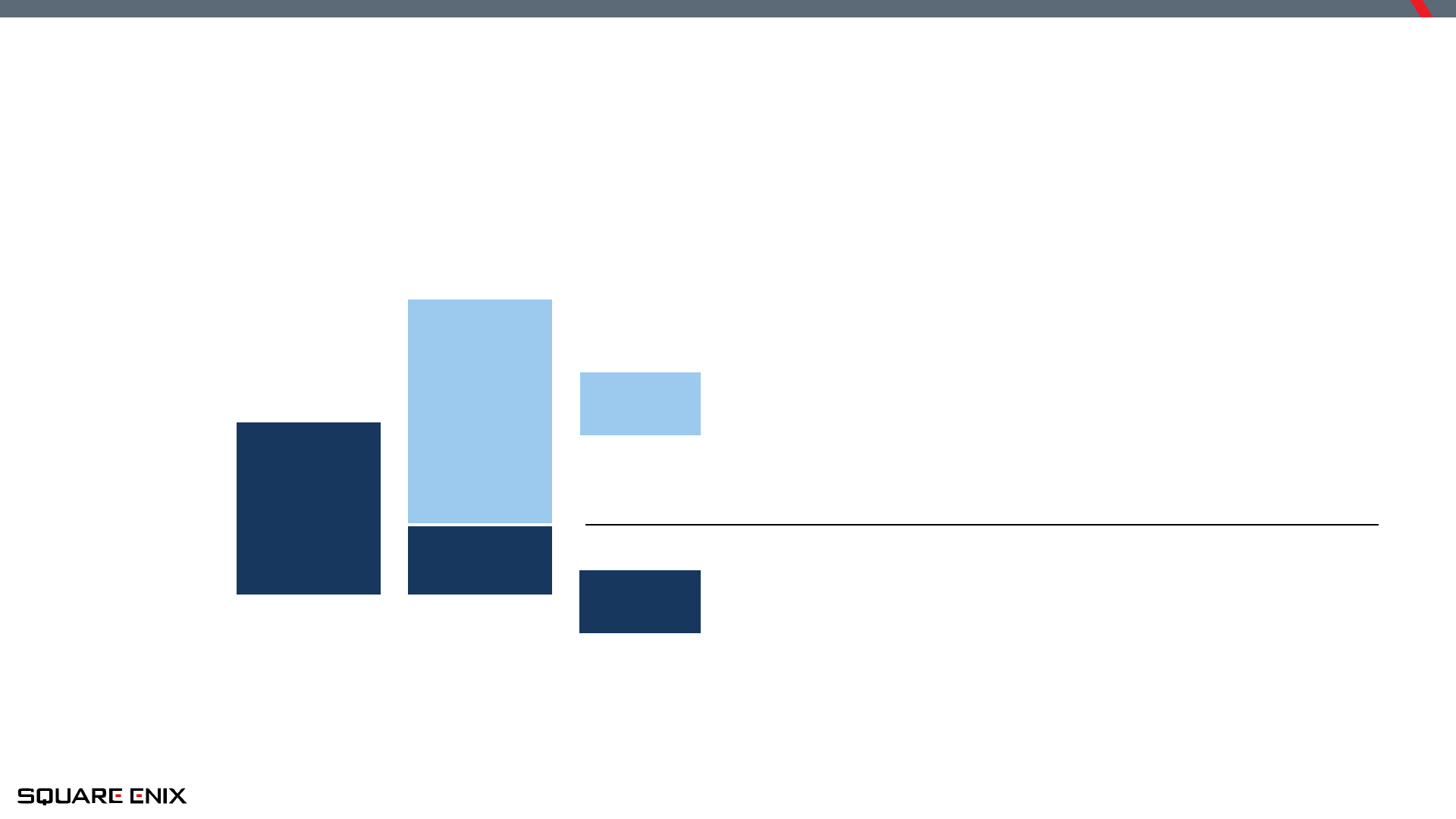

Our previous medium-term business plan: A review (1/3)

5

1

400~500bn yen

356.3bn yen

60~75 bn yen

32.5 bn yen

FY2024/3

Previous mid-term

target

FY2024/3 Actual FY2024/3

Previous mid-term

target

FY2024/3 Actual

Net Sales

Operating Income

Did not reach our quantitative targets for net sales or operating income under our previous medium-term business plan

● Began rebuild of HD Game (HD) & Smart Devices/PC Browser (SD) portfolios

└ Divested three overseas studios and IPs

● Expanded MMO business to strengthen our earnings base

● Achieved a smooth transition to stable growth in the Publication segment

● Achieved a V-shaped recovery in the Amusement segment

└ Committed to cost cutting during the pandemic

● Sustained growth in the Merchandising segment

Achievements

6

Our previous medium-term business plan: A review (1/3)

1

Our previous medium-term business plan: A review (3/3)

7

1

● HD game development profitability

└ Launched many titles but some failed to live up to profit expectations, especially outsourced

titles and some AAA titles

● Slowdown in SD games

└ Unable to create hit titles to offset maturation of Japanese market, aging of existing titles

● Insufficient Group-wide portfolio management

└ Cannibalization between our own titles due to overlapping launch schedules

● Gaps in our management infrastructure

Challenges

Our long-term vision & new corporate philosophy structure

Today’s agenda

8

Our previous medium-term business plan: A review

1

2

4 strategies

3 targets

Our new medium-term business plan

3

9

The power of content is the power to move people

Enriching people’s lives by helping them create

unforgettable experiences

With the passage of time, the moments that move us the most form

unforgettable experiences

that leave indelible marks on our hearts

Our long-term vision & new corporate philosophy structure

2

Unforgettable experiences help shape the values that ground us

Unforgettable experiences enrich our lives

We want to help create unforgettable experiences

by delivering content full of undeniable fun

Introduced our new corporate philosophy structure, comprising our Purpose, which clearly states why we are here, and our

Values, which are to guide our employees in thought and deed

Our long-term vision & new corporate philosophy structure

10

2

Creating New Worlds with Boundless Imagination

to Enhance People’s Lives.

Purpose

Values

Deliver Unforgettable Experiences

Embrace Challenges

Act Swiftly

Stronger Together

Continuously Evolve

Cultivate Integrity

11

© ARMOR PROJECT/BIRD STUDIO/SQUARE ENIX © SQUARE ENIX LOGO ILLUSTRATION:© YOSHITAKA AMANO © SQUARE ENIX CHARACTER DESIGN: TETSUYA NOMURA/ROBERTO FERRARI LOGO ILLUSTRATION:©1997

YOSHITAKA AMANO © SQUARE ENIX LOGO & IMAGE ILLUSTRATION:© YOSHITAKA AMANO LIFE IS STRANGE: TRUE COLORS © 2021, 2022 Square Enix Ltd. All rights reserved. Developed by Deck Nine Games. LIFE IS STRANGE,

LIFE IS STRANGE: TRUE COLORS, SQUARE ENIX and the SQUARE ENIX logo are registered trademarks or trademarks of the Square Enix group of companies. DECK NINE and the DECK NINE GAMES are registered trademarks of Idol

Minds, LLC. All other trademarks are the property of their respective owners. © SQUARE ENIX 「スペースインベーダー」(C) TAITO CORPORATION 1978 ALL RIGHTS RESERVED. © Hiromu Arakawa/SQUARE ENIX

Our long-term vision & new corporate philosophy structure

2

With IP as our core competence, we will deliver a rich variety of content offering undeniable fun to our customers around the world.

Intellectual

Property

Digital

Entertainment

Comics /

Novels / Books

Merchandising

Amusement

Today’s agenda

12

1

2

3

4 strategies

3 targets

Our previous medium-term business plan: A review

Our long-term vision & new corporate philosophy structure

Our new medium-term business plan

13

Square Enix Reboots and Awakens

~A 3-year reboot for long-term growth~

3

Our new medium-term business plan

Positioning of our new medium-term business plan

Evolve to deliver a rich variety of content

offering undeniable fun all over the world

14

HD

Establish a development footprint capable of consistently and

regularly releasing titles that beat our customers’ expectations

SD

Resume growth trajectory by sustaining our reach to both existing

and new customers and by exploring new business models

MMO, Publication,

Amusement

Maintain and develop momentum and expand our global fan base

Expand the breadth of the business by growing the licensing

business and adding to our lineup of services

Merchandising

Develop management infrastructure to make us a more efficient organization

Create and sow the seeds for new IPs and businesses

that will lead to further growth for the next generation

3

Square Enix Reboots and Awakens

~A 3-year reboot for long-term growth~

Our new medium-term plan: 4 strategies

15

3

Enhance productivity by optimizing the development footprint in the

Digital Entertainment (DE) segment

Diversify earnings opportunities by strengthening customer contact points

Roll out initiatives to create additional foundational stability

Allocate capital giving consideration to the balance between growth

investment and shareholder returns

Square Enix Reboots and Awakens

~A 3-year reboot for long-term growth~

16

Enhance productivity by optimizing DE segment development footprint

Our content production account

● Recognized ¥38.8 bn in content production account

write-downs/extraordinary losses in FY2024/3 based on

a careful review of the account in keeping with the

mid/long-term portfolio philosophy under our new

medium-term business plan

1

● Took preliminary steps to establish a disciplined

pipeline strategy that will enable us to create an

attractive, layered lineup of titles

50.6bn yen

71.4bn yen

78.1bn yen

96.7bn yen

87.2bn yen

87.3bn yen

48.5bn yen

0.0

20.0

40.0

60.0

80.0

100.0

120.0

FY2019/3 FY2020/3 FY2021/3 FY2022/3 FY2023/3 FY2024/3

(before

impairment)

FY2024/3

(after

impairment)

1. The content subject to impairment losses consisted largely of titles slated for release in FY2027/3 and beyond, so any impact on our income statements during this medium-term

business plan will be minimal. The content product account write-downs were recognized as operating losses, while the disposal losses were recognized as extraordinary losses. The

operating losses and disposal losses are referred to collectively as “impairment” on the above chart.

Mid/long-term portfolio philosophy

Shift from quantity to quality,

delivering undeniable fun

17

Ensure that our development process strikes a good balance between a “product-out”

approach driven by content reflecting the creativity that springs from our employees’

imaginations, and a “market-in” approach driven by customers’ voices and market

trends

When allocating human talent and development investments, prioritize titles with

strong potential to be loved for years, while also enhancing the skill sets of the core

teams responsible for developing titles that sustain each IP

Strive to establish a layered title lineup that enables a schedule based on the optimal

cadence and timing of launches from the perspectives of both the total portfolio and

individual IPs

Enhance productivity by optimizing DE segment development footprint

18

Focus on developing titles that deliver fun only Square Enix can create

Enhance productivity by optimizing DE segment development footprint

● Strive to maintain and grow the fan bases for our major and mid-class HD titles by

focusing on consistent fun

● Strive to increase our hit rate with SD titles by focusing on fun that ensures

customers can play for a long time with confidence

● With new IPs, prioritize fun that is novel and creative to enable the development of

new fan bases

● Also strengthen lineup of catalog titles by leveraging rich IP library

19

Establish a development footprint that produces fun only Square Enix can create

Enhance productivity by optimizing DE segment development footprint

● Strengthen in-house development capabilities by revamping our internal development

footprint

└ Retire our organizational design based around business units and introduce an operationally integrated

organization focused around our development functions

● Transition to a framework that advances projects by harmonizing individual creativity

and organizational management

└ Redefine the missions of producers and associated job types and establish internal support capabilities

└ Enhance development investment efficiency by revisiting the entire progress management process for

title development

Our new medium-term plan: 4 strategies

20

3

Enhance productivity by optimizing the development footprint in the

Digital Entertainment (DE) segment

Diversify earnings opportunities by strengthening customer contact points

Roll out initiatives to create additional foundational stability

Allocate capital giving consideration to the balance between growth

investment and shareholder returns

Square Enix Reboots and Awakens

~A 3-year reboot for long-term growth~

Diversify earnings opportunities by strengthening customer contact points

21

Shift to a multiplatform strategy

● Aggressively pursue a multiplatform strategy for HD titles that includes Nintendo

platforms, PlayStation, Xbox, and PCs

└ Create an environment where more customers can enjoy major franchises and AAA titles, including from

our back catalog

● For SD titles, explore PC launches and other options in addition to iOS and Android

└ Maximize new user acquisitions on launch and over the course of the game’s life

22

Continuously establish contact points for our titles by stepping up digital sales

Diversify earnings opportunities by strengthening customer contact points

● Step up digital sales of new titles

└ Deploy promotional initiatives on launch that better direct customers toward digital purchases

● Strengthen earnings base by expanding sales of catalog titles

└ Create opportunities to generate earnings from our rich library of back titles

● Pursue initiatives focused on attracting PC users

23

Create interaction with customers

by increasing sophistication of publishing function

Diversify earnings opportunities by strengthening customer contact points

● Pursue operational integration of publishing-related functions in Japan

└ Consolidate the marketing functions that were previously spread across creative business units,

expanding shared knowledge and eliminating duplicate functions to pursue greater efficiency

└ Create new reporting lines designed to enhance collaboration between sales and marketing functions

● Increase sophistication of marketing by leveraging first-party data

└ Utilize CRM solutions and data analytics in launch campaigns for HD and SD titles

24

Create earnings opportunities by offering IP

across a range of entertainment experiences

Diversify earnings opportunities by strengthening customer contact points

● Reach new markets by furthering our pursuit of a cross-media strategy

└ Expand geographic coverage of our licensing business by establishing a new IP business development

department focused on global markets

● Establish an organization that promotes the use of our IP across a range of entertainment

experiences

└ Generate synergies by integrating organizations affiliated with the Merchandising segment

Our new medium-term plan: 4 strategies

25

3

Enhance productivity by optimizing the development footprint in the

Digital Entertainment (DE) segment

Diversify earnings opportunities by strengthening customer contact points

Roll out initiatives to create additional foundational stability

Allocate capital giving consideration to the balance between growth

investment and shareholder returns

Square Enix Reboots and Awakens

~A 3-year reboot for long-term growth~

Roll out initiatives to create additional foundational stability

26

Revisit overseas business division functions & organizational structures

● Revisit European and American functions/organizational structures, thereby

optimizing costs

└ Redesign organizational structures in line with new development organization in Japan

● Strengthen functions of London development site by promoting collaboration

between Group resources in Japan and abroad

└ Close collaboration with divisions in Japan (creative studios and publishing)

└ Enable greater mobility of talent across the Group

Roll out initiatives to create additional foundational stability

27

Introduce organizational and HR-related initiatives aimed at

balancing creativity and productivity in our businesses in Japan

● Build a flat organization

└ Expand opportunities to select existing employees for specific roles, thereby tapping new talent

└ Simplify decision-making mechanisms

● Implement HR initiatives aligned to the operationally integrated organizational structure

of our development functions

└ Develop and roll out a single recruitment, promotion, and management appointment system for our

integrated development functions

● Establish a mid/long-term talent development system

└ Rebuild training and development system for new hires

└ Introduce internal programs to enhance capabilities of junior and mid-level employees

28

Roll out initiatives to create additional foundational stability

Enhance business infrastructure to bolster employee productivity

● Invest capital to enhance our development environment

└ Invest in infrastructure that maximizes employee productivity in a hybrid work environment

└ Create an attractive office environment that helps unleash the creativity of our development teams

● Refine our management accounting system to enable greater visibility into our

business activities

Our new medium-term plan: 4 strategies

29

3

Enhance productivity by optimizing the development footprint in the

Digital Entertainment (DE) segment

Diversify earnings opportunities by strengthening customer contact points

Roll out initiatives to create additional foundational stability

Allocate capital giving consideration to the balance between growth

investment and shareholder returns

Square Enix Reboots and Awakens

~A 3-year reboot for long-term growth~

Under our new medium-term business plan, we will give consideration to the balance between growth investment and

shareholder returns in allocating capital, with the framework below serving as our basic philosophy.

Capital allocation: Balancing growth investment & shareholder returns

30

• M&A等

• 安定的な配当

• 特別配当

• 自己株式の取得

Total 3-year

operating cash flow

Balance

sheet

¥50~70 bn

Funding

Strategic

investments

Capex

Use

¥30 bn

¥60 bn

Total

¥80~100 bn

● M&A/investment

└ Leverage insights from our own businesses to

execute inorganic investments aimed at

expansion into additional domains and the

creation of greater stability

└ Exercise strict selectivity in identifying

investment opportunities that will help enhance

our corporate value

● Shareholder returns (dividends and

share buybacks)

└ Flexibly repurchase shares in addition to

offering regular dividends

└ Allocated 20 billion yen for potential

share buybacks today

We devised the following policy based on a reassessment of our approach to capital allocation, giving consideration to the

balance between growth investments and shareholder return.

Shareholder return policy

31

• Set a dividend payout ratio of 30%

• Revised the breakdown of per-share dividends

(interim dividend and year-end dividend)

• Allocated funds for the flexible repurchase of shares,

subject to considerations including strategic investment

opportunities, financial conditions, and the share price

• Revised our approach to capital allocation, taking the

balance between growth investment and shareholder

returns into consideration, and rewarded shareholders

with an amount equivalent to the growth in our cash and

deposits from end-FY2023/3 to end-FY2024/3

Our total shareholder return

Total payout ratio

Dividend per share

¥124

¥38

¥20 bn

earmarked

for buybacks

¥4.5 bn

¥14.8 bn

Regular

dividend

Share

buybacks

30%

165% *

FY2023/3

Actual

FY2024/3

Forecast

*Arrived at by dividing 24.5 billion yen (the total of 4.5 billion yen in expected dividends for the fiscal year ended March 31, 2024 and 20 billion yen in potential

share buybacks) by 14.9bn yen in profit attributable to owners of parent for the fiscal year ended March 31, 2024

(billions of yen)

Our new medium-term plan

32

Allocate capital giving consideration to the balance

between growth investment and shareholder return

Diversify earnings opportunities by strengthening

customer contact points

Enhance productivity by optimizing the development

footprint in the Digital Entertainment (DE) segment

Roll out initiatives to create additional foundational

stability

Initiatives

4 strategies

• Focus on developing titles that deliver fun only Square Enix can

create and establish a development footprint that enables that

• Shift to a multiplatform strategy

• Continuously establish contact points for our titles by stepping

up digital sales

• Create interaction with customers by increasing sophistication of

publishing function

• Create earnings opportunities by offering IP across a range of

entertainment experiences

• Revisit overseas business division functions & organizational

structures

• Introduce organizational and HR-related initiatives aimed at

balancing creativity and productivity in our business in Japan

• Enhance business infrastructure to bolster employee productivity

• Allocated up to 100 billion yen for total strategic investments over a

three-year period

By executing our new medium-term business plan,

we will achieve a shift from quantity to quality

and evolve to deliver a rich variety of content offering undeniable fun all over the world

33

Target ROE of at least 10%, shifting to a management

approach mindful of capital efficiency

Achieve stable profit generation from the overall DE segment

and target a consolidated operating margin of 15%

in the fiscal year ending March 31, 2027

Allocated up to 100 billion yen for total strategic

investments

over a three-year period

(including up to 20 billion yen for potential share repurchases

over the next year)

Our new medium-term plan: 3 financial targets

Enhance productivity by optimizing the development

footprint in the Digital Entertainment (DE) segment

Diversify earnings opportunities

by strengthening customer contact points

Roll out initiatives to create additional foundational

stability

Allocate capital giving consideration to the balance

between growth investment and shareholder

returns

Consolidated Financial Forecasts: Fiscal Year ending March 31, 2025

34

Fiscal Year Ended

March 31, 2024

Fiscal Year Ending

March 31, 2025

Full Year Results Full Year Forecasts Change

Net Sales 356.3

310.0

(46.3)

Operating Income 32.5

40.0

7.5

Operating Income Margin 9.1%

12.9%

3.8pt

Ordinary Income 41.5

40.0

(1.5)

Ordinary Income Margin 11.7%

12.9%

1.2pt

Profit attributable to owners

of parent

14.9

28.0

13.1

Dividends per share

(Yen)

Interim

10

28

18

Year-end

28

43

15

Total

38

71

33

(Billions of Yen)

35

Creating New Worlds with Boundless Imagination

to Enhance People’s Lives.