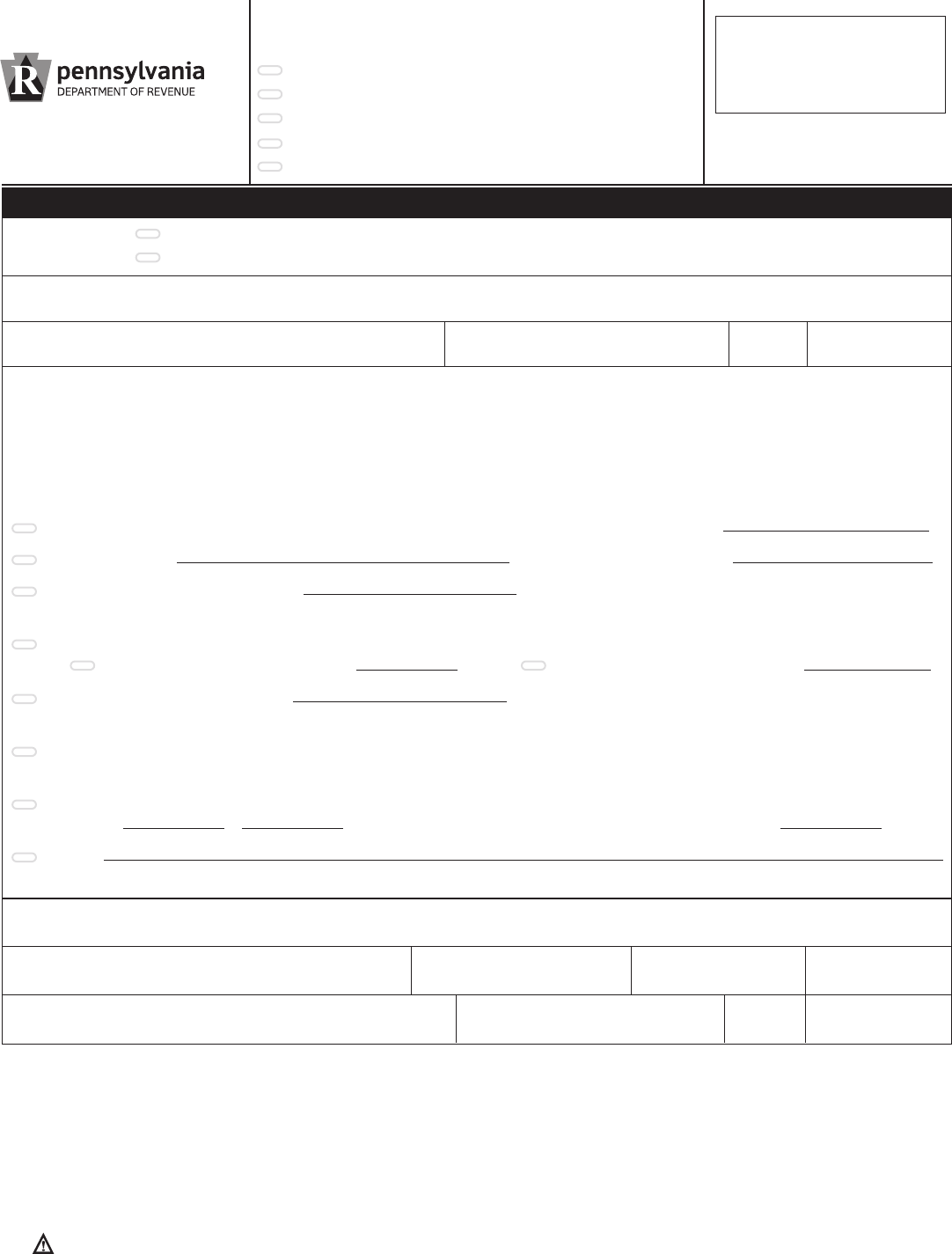

CHECK ONE:

PENNSYLVANIA TAX UNIT EXEMPTION CERTIFICATE (USE FOR ONE TRANSACTION)

PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE (USE FOR MULTIPLE TRANSACTIONS)

Name of Seller, Vendor or Lessor

Street City State ZIP Code

NOTE: Do not use this form for claiming an exemption on the registration of a vehicle. To claim an exemption from tax for a motor vehi-

cle, trailer, semi-trailer or tractor with the PA Department of Transportation, Bureau of Motor Vehicles, use one of the following forms:

FORM MV-1, Application for Certificate of Title (first-time registrations)

FORM MV-4ST, Vehicle Sales and Use Tax Return/Application for Registration (other registrations)

Property and services purchased or leased using this certificate are exempt from tax because: (Select the appropriate paragraph

from the back of this form, check the corresponding block below and insert information requested).

1. Property or services will be used directly and predominately by purchaser in performing purchaser's operation of:

2. Purchaser is a/an: holding Sales Tax Exemption Number

3. Property will be resold under License ID (If purchaser does not have a PA Sales Tax License ID, include a

statement under Number 8 explaining why a number is not required).

4. Property or services will be used directly and predominately by purchaser performing a public utility service.

PA Public Utility Commission PUC Number and/or U.S. Department of Transportation MC/MX

5. Exempt wrapping supplies, License ID (If purchaser does not have a PA Sales Tax License ID, include

a statement under Number 8 explaining why a number is not required).

6. Canned computer software purchased by a financial institution subject to the Bank and Trust Company Shares Tax (Article VII) or the Mutual Thrift

Institutions Tax (Article XV).

7. Canned computer software licenses that are billed to a PA address but used outside of PA. The total number of software licenses purchased for

invoice # is . The total number of users accessing and using the software outside PA is .

8. Other

(Explain in detail. Additional space on reverse side).

I am authorized to execute this certificate and claim this exemption. Misuse of this certificate by seller, lessor, buyer, lessee or their

representative is punishable by fine and imprisonment.

Name of Purchaser or Lessee Signature EIN Date

Street City State ZIP Code

REV-1220 (TR) 07-23 (FI)

Read Instructions

On Reverse Carefully

PENNSYLVANIA EXEMPTION

CERTIFICATE

STATE AND LOCAL SALES AND USE TAX

STATE 6% AND LOCAL 1% HOTEL OCCUPANCY TAX

PUBLIC TRANSPORTATION ASSISTANCE TAXES AND FEES (PTA)

VEHICLE RENTAL TAX (VRT)

ADDITIONAL LOCAL, CITY, COUNTY HOTEL TAX

*

This form cannot be used to

obtain a Sales Tax License ID,

PTA License ID or Exempt

Status.

THIS FORM MAY BE PHOTOCOPIED – VOID UNLESS COMPLETE INFORMATION IS SUPPLIED

1. ACCEPTANCE AND VALIDITY:

For this certificate to be valid, the seller/lessor shall exercise good faith in accepting this certificate, which includes: (1) the certificate shall be completed

properly; (2) the certificate shall be in the seller/lessor's possession within 60 days from the date of sale/lease; (3) the certificate does not contain infor-

mation which is knowingly false; and (4) the property or service is consistent with the exemption to which the customer is entitled. For more information,

refer to Exemption Certificates, Title 61 PA Code §32.2. An invalid certificate may subject the seller/lessor to the tax.

2. REPRODUCTION OF FORM:

This form may be reproduced but shall contain the same information as appears on this form.

3. RETENTION:

The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies.

IMPORTANT: DO NOT RETURN THIS FORM TO THE PA DEPARTMENT OF REVENUE.

4. NONPROFIT EXEMPT ORGANIZATIONS:

This form may be used in conjunction with form REV-1715, Exempt Organization Declaration of Sales Tax Exemption, when a purchase of $200 or more

is made by an organization which is registered with the PA Department of Revenue as an exempt organization. These organizations are assigned an

exemption number, beginning with the two digits 75 (example: 75000000).

(Please Print or Type)

START

➜

Please sign after printing.

PRINT

NEXT PAGE

TOP OF PAGE

Reset Entire Form

1.) Property and/or services will be used directly and predominately by pur-

chaser in performing purchaser's operation of:

A. Manufacturing

B. Mining

C. Dairying

D. Processing

E. Farming

F. Shipbuilding

G. Timbering

This exemption is not valid for property or services used in: (a) construct-

ing, repairing or remodeling of real property, other than real property used

directly in exempt operations; or (b) maintenance, managerial, administra-

tive, supervisory, sales, delivery, warehousing or other nonoperational

activities. This exemption is not valid for vehicles that are required to be

registered under the Vehicle Code, as well as supplies and repair parts for

such vehicles, the PTA tire fee, and certain taxable services.

2.) Purchaser is a/an:

+ A. Instrumentality of the commonwealth (to include public

schools and state universities).

+ B. Political subdivision of the commonwealth (includes townships

and boroughs).

+ l C. Municipal authority created under the Municipality Authorities

Acts.

+ l D. Electric cooperative corporations created under the Electric

Cooperative Law of 1990.

l E. Cooperative agricultural associations required to pay corpo-

rate net income tax under the Cooperative Agricultural

Association Corporate Net Income Tax Act (exemption not

valid for registered vehicles).

+ l F. Credit unions organized under Federal Credit Union Act or

Commonwealth Credit Union Act.

+ l G. U.S. government, its agencies and instrumentalities.

l H. Federal employee on official business (exemption limited to

hotel occupancy tax only. A copy of orders or statement from

supervisor must be attached to this certificate).

I. School bus operator (This exemption certificate is limited to

the purchase of parts, repairs or maintenance services upon

vehicles licensed as school buses by the PA Department of

Transportation).

J. Charter Schools and Community Colleges.

Renewable Entities beginning with “75”:

K. Religious Organization

L. Nonprofit Educational Institution

M. Charitable Organization

Permanent Exemptions beginning with the two numbers “75”:

N. Volunteer Fire Company

O. Relief Association

Special Exemptions

P. Direct Pay Permit Holder

Q. Individual Holding Diplomatic ID

R. Keystone Opportunity Zone (beginning with two digit 72

account number)

S. Tourist Promotion Agency

Exemptions for exempt organizations K through S are limited to purchases

of tangible personal property or services for use and not for sale. Exempt

organizations K - O above, shall have an sales tax exemption certificate

number assigned by the PA Department of Revenue. Exempt organiza-

tions K-O above, are not exempt for purchases used for the following: (1)

constructions, improvement, repair or maintenance or any real property,

except supplies and materials used for routine repair or maintenance of the

real property; (2) any unrelated activities or operation of a public trade or

business; or (3) equipment used to maintain real property.

3.) Property and/or services will be resold or rented in the ordinary course of

purchaser's business. If purchaser does not have a PA Sales Tax License

ID (8 digit number assigned by the department), complete Number 8

explaining why such number is not required. This exemption is valid for

property or services to be resold: (1) in original form; or (2) as an ingredient

or component of other property.

4.) Property or services will be used directly and predominately by purchaser

in the production, delivery or rendition of public utility services as defined

by the PA Utility Code.

This exemption is not valid for property or services used for the following:

(1) construction, improvement, repair or maintenance of real property,

other than real property used directly in rendering the public utility services;

or (2) managerial, administrative, supervisor, sales or other nonopera-

tional activities; or (3) vehicles, as well as supplies and repair parts for

such vehicles, unless the predominant use is for providing a common car-

rier service; or (4) tools and equipment used but not installed in mainte-

nance of facilities or direct use equipment. Tools and equipment used to

repair "direct use" property are exempt from tax.

5.) Vendor/seller purchasing wrapping supplies and nonreturnable containers

used to wrap property which is sold to others.

6.) Canned computer software or services to canned computer software

directly utilized in conducting the business of banking purchased by a

financial institution subject to the Bank and Trust Company Shares Tax

(Article VII) or the Mutual Thrift Institutions Tax (Article XV).

7.) Seller is required to collect tax on canned software accessed remotely

when the user is located in PA. If the billing address is a PA address, the

presumption is that all users are located in PA. Purchaser is responsible

for apportioning and remitting the tax due to each taxing jurisdiction and

must provide the total number of licenses purchased and the number of

those licenses used outside PA on Line 8. Please note that any unused

licenses will be considered to be allocated to PA.

8.) Other (Attach a separate sheet of paper if more space is required).

*

Employees or representatives of the Commonwealth traveling on

Commonwealth duty are exempt from any taxes on hotel stays or room rentals

imposed by local governments that are in addition to the 6% state tax and the

1% Philadelphia and Allegheny County hotel occupancy tax.

GENERAL INSTRUCTIONS

Those purchasers set forth below may use this form in connection with the claim

for exemption for the following taxes:

a. State and local sales and use tax;

b. PTA rental fee or tax on leases of motor vehicles;

c. Hotel occupancy tax (state 6%, Philadelphia 1%, Allegheny 1%) if

referenced with the symbol (●);

d. PTA fee on the purchase of tires if referenced with the symbol (+);

e. Vehicle rental tax (VRT).

EXEMPTION REASONS

PRINT

TOP OF PAGE

RETURN TO PAGE 1

Reset Entire Form