ice.com ICE | Mortgage Monitor report 1

Mortgage

Monitor report

April 2024

ice.com ICE | Mortgage Monitor report 2

Contents

Overview – April 2024

Each month, the ICE Mortgage Monitor looks at a variety of issues related to the mortgage finance and housing

industries.

To begin, we recap high-level mortgage performance statistics reported in our most recent First Look

, tracking

improvement in both delinquencies and foreclosures through the end of February.

This month, we provide an update on recent interest rate fluctuations and their impact on home affordability. Next,

we dig into the data to help quantify the lingering effects of record-low mortgage rates during the COVID era; the

so-called “lock-in” effect weighing on owners’ decision whether to trade homes.

In producing the Mortgage Monitor, the ICE Data & Analytics division aggregates, analyzes and reports on the

most-recently available data from the company’s

vast mortgage and housing-related data assets. Information is

gathered from the McDash

and McDash Flash loan-level mortgage-performance data sets, Collateral Analytics

home price and sales trends data, eMBS agency securities data, Market Trends origination insights, the ICE

Home Price Index, and the company’s robust public records database covering 99.99% of the U.S. population.

For more information on gaining access to ICE data assets, please call 844-474-2537 or email

Mortgage.Monitor@bkfs.com

.

3 First Look

4 Mortgage performance and foreclosure metrics

9 Interest rates, affordability and the lock-in effect

15 Housing market update

21 Appendix

ice.com ICE | Mortgage Monitor report 3

The ICE First Look at mortgage performance provides a high-level overview compiled from the ICE McDash loan-

level database.

First Look at mortgage performance

Serious delinquencies fell to their lowest

level in three months, while foreclosure

starts, sales and inventory were all down on

both a monthly and annual basis

Overview of mortgage performance

-4 bps -27.7% +6.3%

Delinquency

rate

Delinquencies continued to

improve in February, as more

loans cured to current status

………………………..................

The number of loans 90+ days

past due decreased by -18%

year over year

Foreclosure

starts

February's 25K starts marked

the second fewest monthly

actions in the last year

………………………..................

The number of loans in active

foreclosure, as well as

completions of the process,

declined both MoM and YoY

Prepayment

activity

Single-month mortality rose 3

bps to 0.42%, a level not seen

since October

……………………….................

Prepays rose as January's

slight pullback in interest rates

provided a modest bump in

refinance incentive

ice.com ICE | Mortgage Monitor report 4

The ICE McDash loan-level database provides key performance metrics for a clearer picture of the mortgage

landscape. In this section we take an in-depth look at mortgage performance metrics for February, including a

breakdown of recent delinquency numbers, foreclosure statistics and prepayment trends.

Mortgage performance and foreclosure metrics

The national delinquency rate eased to 3.34% in February, an 11 basis point improvement over last year

Although the number of borrowers one payment behind rose modestly (+10K), more advanced delinquencies improved to

their lowest level in three months

Serious delinquencies – loans 90 or more days past due, but not yet in active foreclosure – fell to 459K, an 18% year-over-

year improvement

Although delinquency rates typically fall in March, this year’s Sunday month-end is expected to offset that seasonal trend

somewhat, as payments made on the last calendar day of the month will not be processed until April

0.0M

0.5M

1.0M

1.5M

2.0M

2.5M

3.0M

3.5M

4.0M

4.5M

Mortgage delinquencies by severity

30 days delinquent

60 days delinquent

90+ days delinquent Total delinquent

Source: ICE, McDash

Source: ICE, McDash

ice.com ICE | Mortgage Monitor report 5

0K

100K

200K

300K

400K

500K

600K

700K

800K

Cures to current by previous delinquency bucket

Cures from

30/60 days delinquent Cures from

90+ days delinquent

Total cures

0.0M

0.5M

1.0M

1.5M

2.0M

Loans rolling to a more delinquent status

Current to 30 days delinquent 30 to 60 days delinquent 60 to 90 days delinquent

Source: ICE, McDash

Source: ICE, McDash

Mortgage performance and foreclosure metrics

The population of borrowers who fell one payment behind rose 6.5% from January’s 8-month low, but remains close to the

12-month average

Fewer borrowers sank further into delinquency in February, with the roll rate from 30 to 60 days past due falling -6.7% to a six-

month low, and rolls from 30 to 60 days late down -4.9% to their lowest point in four months

Cures from early-stage delinquency pulled back from last month’s high, though late-stage cures rose 14.4% to a six-month

peak

Rolls from 60 to 90 days delinquent have held below 110K every month since March 2021, averaging 90K per month

ice.com ICE | Mortgage Monitor report 6

0%

5%

10%

15%

20%

25%

Origination Year

Delinquency rate by vintage

Delinquency rate Share of active mortgages

0%

2%

4%

6%

8%

10%

12%

14%

Delinquency rate of mortgages originated 6 months ago

Conventional

FHA

VA

Source: ICE, McDash

Source: ICE, McDash

Mortgage performance and foreclosure metrics

Early-payment delinquencies remain elevated among recent originations, particularly FHA and VA loan products

Such delinquencies have edged upward in recent years but remain well below pre-Great Financial Crisis levels, while FHA

and conventional mortgages have both improved modestly year over year, with VA loans holding roughly flat

Though early-payment delinquencies on conventional mortgages remain low, performance of late-2023 FHA and VA

loans, originated when rates neared 8% and debt-to-income ratios reached series highs, remain worth watching

Overall, performance remains historically strong, as the large volume of loans originated in 2020/2021 locked in fixed

mortgage payments at low rates that have served to counter inflationary headwinds for these borrowers

In total, 39% of all currently active loans were originated in those two years and have delinquency rates 36% below the

market average, exerting a strong downward pull on the overall market

ice.com ICE | Mortgage Monitor report 7

Mortgage performance and foreclosure metrics

Active foreclosure inventory fell 7K (-3.7%) to 211K – a 23-month low – still 25% (-72K) below pre-pandemic levels and the

lowest it’s been since March 2022

Foreclosure starts decreased -27.7% in February to 25K – representing 5.3% of seriously delinquent inventory – the

second-lowest level in over a year

6K foreclosure sales were completed nationally in February, down -9.5% from the month prior and near the current cycle

low of 5.4K sales in December 2023

Serious delinquencies remain low, and with around 70% protected through forbearance, loss mitigation, or bankruptcy,

foreclosure starts remain almost 40% below pre-pandemic levels

0K

5K

10K

15K

20K

25K

0K

10K

20K

30K

40K

50K

60K

70K

Foreclosure starts and sales

FC starts (left) FC sales (completions, right)

0%

1%

2%

3%

4%

5%

0.0 M

0.5 M

1.0 M

1.5 M

2.0 M

2.5 M

Foreclosure inventory

Foreclosure inventory (left)

Foreclosure % (right)

Source: ICE, McDash

Source: ICE, McDash

ice.com ICE | Mortgage Monitor report 8

Mortgage performance and foreclosure metrics

Prepayment activity (SMM) rose 3 basis points (bps) in February to a level not seen since October as the pullback in rates

at the start of 2024 provided modest boosts in refinance incentive and homebuyer demand

Home sales and curtailments continue to drive the bulk of prepays, but refinance activity rose in February

In fact, refinance-related prepayments rose 14% in February, driving the largest such single-month mortality (SMM) rate in

17 months

Perhaps unsurprisingly, the 2023 vintage leads all others in prepayment speeds due to higher interest rates among such

loans, with activity among 2023 originations rising noticeably in recent months

Overall, the conditional prepayment rate (CPR) for the 2023 vintage is up 68% over the past three months – from 5.53% in

November to 9.33% in February – and warrants close observation, as even modest rate increases can have an oversized

impact on refinance incentive among such loans

Source: ICE, McDash

2018

2019

2020

2023

0%

10%

20%

30%

40%

50%

CPR

Prepayment speeds by vintage

<2013 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

2023

ice.com ICE | Mortgage Monitor report 9

This month we examine the relationship among interest rates, affordability and the so-called “lock-in” effect

caused by an unusually high percentage of mortgage holders sitting on rates significantly below current levels.

This information comes from ICE, the McDash

loan-level mortgage performance database and other public and

proprietary data sets.

Interest rates, affordability and the lock-in effect

According to the ICE US Conforming 30-year Fixed Mortgage Rate Lock Index, mortgage rates reached 6.93% on Mar. 18,

before easing 4 bps on Mar. 20, following the Fed press conference

While mortgage rates remain well below October’s highs, they are 44 bps higher than at this time last year – important to

note for those analyzing year-over-year changes in originations and housing market demand

Mortgage rates have climbed nearly 40 bps since starting February at 6.53%; the 10-year Treasury effective yield has risen

45 bps over the same period

The spread between the 30-year fixed mortgage rate and the 10-year Treasury yield fluctuated between 250 and 270 bps in

February, still down as much as 20 bps since early January and ~50 bps from August

Following the March FOMC meeting, CME FedWatch projected the Fed funds rate would be in the 4.50%-4.75% range by

year’s end, not falling to 4.00%-4.25% until April 2025 – a significant upward shift from February’s end of 2024 projection

Composite industry forecasts now have mortgage rates ending 2024 near 6.25% and closer to 5.8% by the end of 2025

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

0

50

100

150

200

250

300

350

400

450

Interest rates ( %)

Spread (bps)

30-year mortgage to 10-year Treasury yield spread

Spread (bps, left) ICE 30-year FRM conf. rate lock index (right) ICE 10-year Treasury eff. yield (right)

Source: ICE

Data through March 21, 2024

ice.com ICE | Mortgage Monitor report 10

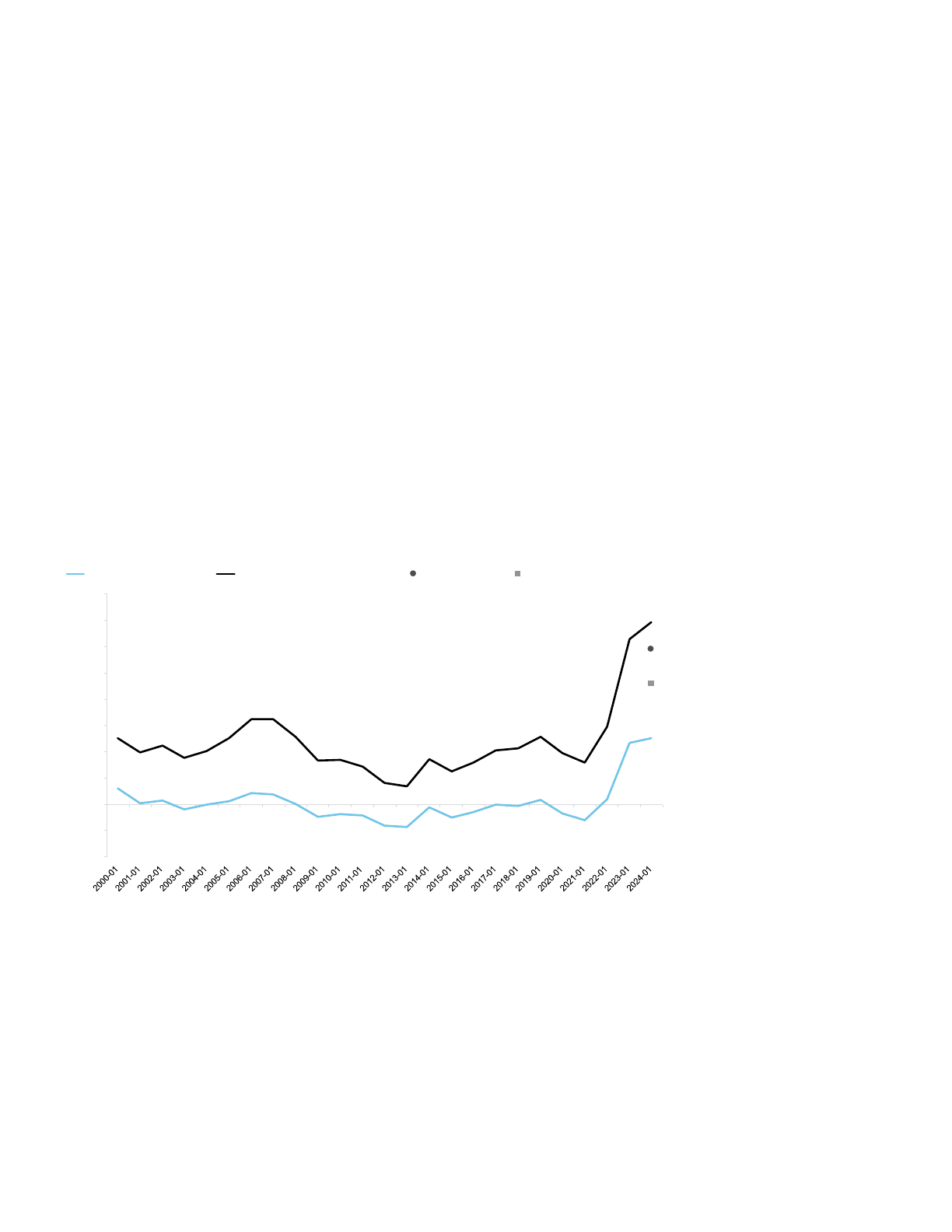

1:1

2:1

3:1

4:1

5:1

6:1

7:1

Ratio of median home price to median household income

33.8%

38.2%

34.4%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

0%

10%

20%

30%

40%

50%

60%

National payment-to-income ratio*

Payment

-to-Income Ratio (Left Axis

) Freddie 30-Year Fixed Mortgage Rate (Right Axis)

Source: ICE Home

Price Index, Census

Bureau

Source: ICE Home

Price Index, FHLMC

PMMS, Census Bureau

March 2024 reading is

based on Mar. 21, 2024

FHLMC PMMS of

6.87%

Interest rates, affordability and the lock-in effect

*The national payment-to-income ratio is the share of median income needed to make the monthly principal and interest payment

on the purchase of the average-priced home using a 20% down 30-year fixed rate mortgage at the prevailing interest rate

As of Mar. 21, with mortgage rates at 6.87% according to the Freddie Mac PMMS, it required $2,325 to make the monthly

principal and interest (P&I) payment on the median-priced home, representing 34.4% of the median household income

That’s down $174 from October’s record high, but is effectively twice the payment (+96%) required in March 2021, when

rates were in the low 3% range

Every one of the nation’s 100 largest markets is less affordable today than its long-run average, although to varying

degrees on a geographic level

Affordability in the Midwest is only modestly worse, with payment-to-income ratios in markets such as Cleveland, Des

Moines, Toledo, Akron, Dayton and Detroit all within 1.5 percentage points (pp) of their long-run averages

On the other end of the spectrum, it takes at least 20 pp more of median income than ‘normal’ in markets like Miami (+21 pp),

Oxnard (+23 pp), San Jose (+25 pp), San Diego (+25 pp) and Los Angeles (+32 pp)

The median home price as of March was 5.5 times the median household income and, while an improvement from the record

5.9 times income in June 2022, it’s the second highest multiple for any March on record dating back to the mid-1970s

ice.com ICE | Mortgage Monitor report 11

Source: ICE, MBA, FHLMC (PMMS)

3.5%

4.0%

4.5%

5.0%

5.5%

6.0%

6.5%

7.0%

7.5%

8.0%-60%

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

Mortgage applications to purchase a home

Purchase application deficit vs

. 2018/

2019 average 30-Year FRM rate (inverted, right)

Interest rates, affordability and the lock-in effect

Purchase applications have held at a consistent 40-41% deficit compared to their 2018-2019 same-week averages as

mortgage rates pushed above 6.8%

Purchase application volumes continue to trend alongside 30-year rates, reacting negatively to rate increases and

recovering slowly during declines

When mortgage rates held in a similar window in July 2023, purchase application deficits stood at -37%, 3pp less severe

than what we’re seeing now

In addition to high interest rates, a shortage of homes for sale is also suppressing application volumes, as the lock-in effect

of low rates on existing loans keeps many would-be sellers sidelined

ice.com ICE | Mortgage Monitor report 12

Interest rates, affordability and the lock-in effect

-$400

-$200

$0

+$200

+$400

+$600

+$800

+$1,000

+$1,200

+$1,400

+$1,600

Average change in mortgage payment ($) needed to move

To move across the street To trade up to nicer home

(+25%)

if rates fell to 6% if rates fell to 5

%

Source: ICE, McDash

Loan level analysis of borrowers currently in 30-year fixed rate mortgages; assumes relocations costs of 6% on the sale of their existing home

with the remaining equity being rolled over to the new home purchase with borrower taking out a new 30-year mortgage for the remaining

balance at the prevailing 30-year rate. ‘Trade up’ analysis assumes borrowers are purchasing a home valued 25% higher than the current

market to market value of their existing home.

Today’s homeowners face a trifecta of elevated rates, sky-high home prices and record equity, making the existing payment

on their home incredibly attractive

That being the case, it’s worthwhile to try and quantify just how locked in these homeowners are but looking at how much it

would cost to give up their current rate to simply move across the street, or upgrade to a 25% more expensive home

From January 2000 to January 2022, before the Fed’s latest tightening cycle, giving up one's existing mortgage to purchase

a home of equivalent value across the street would have been a relatively break-even endeavor for the homeowner

The homeowner would lose a bit of equity to relocation fees, but also recoup some of that cost with a lower interest rate and

the recasting of their mortgage back out to a full 30-year term

Historically, in this hypothetical even swap, a homeowner could expect to reduce their mortgage payment by a modest

$25/mo. (-2%)

Performing the same loan level analysis on today’s mortgage holders – and factoring in current prevailing 30-year rates –

that same move across the street today would require a $500 (+38%) jump in the average monthly mortgage payment

The numbers become even more staggering when seen against the skyrocketing monthly cost of trading up to a bigger or

better home

ice.com ICE | Mortgage Monitor report 13

Interest rates, affordability and the lock-in effect

From January 2000 through January 2022, the average mortgage holder trading up to a home worth 25% more would have

had a monthly P&I payment increase of 39% (+$400)

Today, that same trade would more than double the average monthly payment (+103% or +1,384/mo.), highlighting the real-

world pressures keeping current mortgage holders locked into their current homes and loans

Lower interest rates would provide some moderate relief

If rates fell from to 6%, the monthly payment increase to trade up to a 25% more expensive home would ease from +103% to

+88% – a modest but welcome improvement

At 5%, it would require a +68% larger payment, still much higher than the long-run average of +39%, but perhaps enough to

motivate someone with a compelling need or desire to upgrade

-40%

-20%

0%

+20%

+40%

+60%

+80%

+100%

+120%

Average change in mortgage payment (%) needed to move

To move across the street

To trade up to nicer home (+25%)

if rates fell to 6% if rates fell to 5%

Source: ICE, McDash

Loan level analysis of borrowers currently in 30-year fixed rate mortgages; assumes relocations costs of 6% on the sale of their existing home

with the remaining equity being rolled over to the new home purchase with borrower taking out a new 30-year mortgage for the remaining

balance at the prevailing 30-year rate. ‘Trade up’ analysis assumes borrowers are purchasing a home valued 25% higher than the current

market to market value of their existing home.

ice.com ICE | Mortgage Monitor report 14

The cost to give up one’s existing mortgage and buy a 25% more expensive home varies significantly across geographies,

requiring payment increases ranging from 72% on the low end in Buffalo to more than 140% in Los Angeles and San Jose

Homeowners in these more expensive markets would be giving up low rates on much larger unpaid balances – an effect

compounded by the fact that such borrowers also tend to have lower mortgage rates on their existing homes

This is due in part to the fact that the breakeven point on a refinance transaction is typically lower for higher-balance

borrowers, which means they tend to refinance earlier and more frequently when rates fall

Because of this, the lock-in effect on inventories may be strongest in more expensive California metros such as San Jose,

Los Angeles, San Diego, and San Francisco – markets that also face challenges in terms of new construction

25% is a good rule of thumb for middle-market trade-ups, but ICE’s Home Price Index shows a much larger payment

increase is needed to move out of the bottom or into the top tier, helping to constrain entry-level and trade-up inventory

35%

23%

27%

61%

0%

10%

20%

30%

40%

50%

60%

70%

Tier 1 (Bottom 20%) to

Tier 2 (20th-40th Percentile)

Tier 2 (20th-40th Percentile) to

Tier 3 (40th-60th Percentile)

Tier 3 (40th-60th Percentile) to

Tier 4 (60th-80th Percentile)

Tier 4 (60th-80th Percentile) to

Tier 5 (80th-100th Percentile)

Average change in home value between price tiers

3.5%

3.8%

4.0%

4.3%

4.5%

4.8%

5.0%

+0%

+25%

+50%

+75%

+100%

+125%

+150%

Buffalo, NY

Miami, FL

Cleveland, OH

Oklahoma City, OK

Memphis, TN

San Antonio, TX

New Orleans, LA

Houston, TX

Indianapolis, IN

Cincinnati, OH

Birmingham, AL

Louisville, KY

Chicago, IL

Virginia Beach, VA

Pittsburgh, PA

Dallas, TX

Columbus, OH

St. Louis, MO

Hartford, CT

Minneapolis, MN

Kansas City, MO

Philadelphia, PA

Phoenix

, AZ

Baltimore, MD

Richmond,

VA

Las Vegas,

NV

Orlando, FL

Jacksonville, FL

Milwaukee, WI

Detroit

, MI

Austin, TX

Atlanta, GA

Tampa, FL

All Other

Washington, DC

Nashville,

TN

Raleigh, NC

Charlotte, NC

New York, NY

Portland, OR

Sacramento, CA

Providence

, RI

Denver,

CO

Riverside, CA

Salt Lake City

, UT

Seattle, WA

Boston, MA

San Francisco, CA

San Diego, CA

Los Angeles, CA

San Jose, CA

Percentage change in monthly payment needed for average

mortgage holder to upgrade to a 25% more expensive home

Change in monthly P

&I payment needed

(%) Average interest rate among current mortgage holders (right axis)

Source: ICE, ICE Home

Price Index

Change in value between price

tiers is the average different

between price tiers at the CBSA

level across the more than 900

CBSAs covered by the ICE

Home Price Index

Source: ICE, McDash

Interest rates, affordability and the lock-in effect

Loan level analysis of borrowers currently in 30-year fixed rate mortgages; assumes relocations costs of 6% on the sale of their existing home

with the remaining equity being rolled over to the new home purchase with borrower taking out a new 30-year mortgage for the remaining

balance at the prevailing 30-year rate. ‘Trade up’ analysis assumes borrowers are purchasing a home valued 25% higher than the current

market to market value of their existing home.

ice.com ICE | Mortgage Monitor report 15

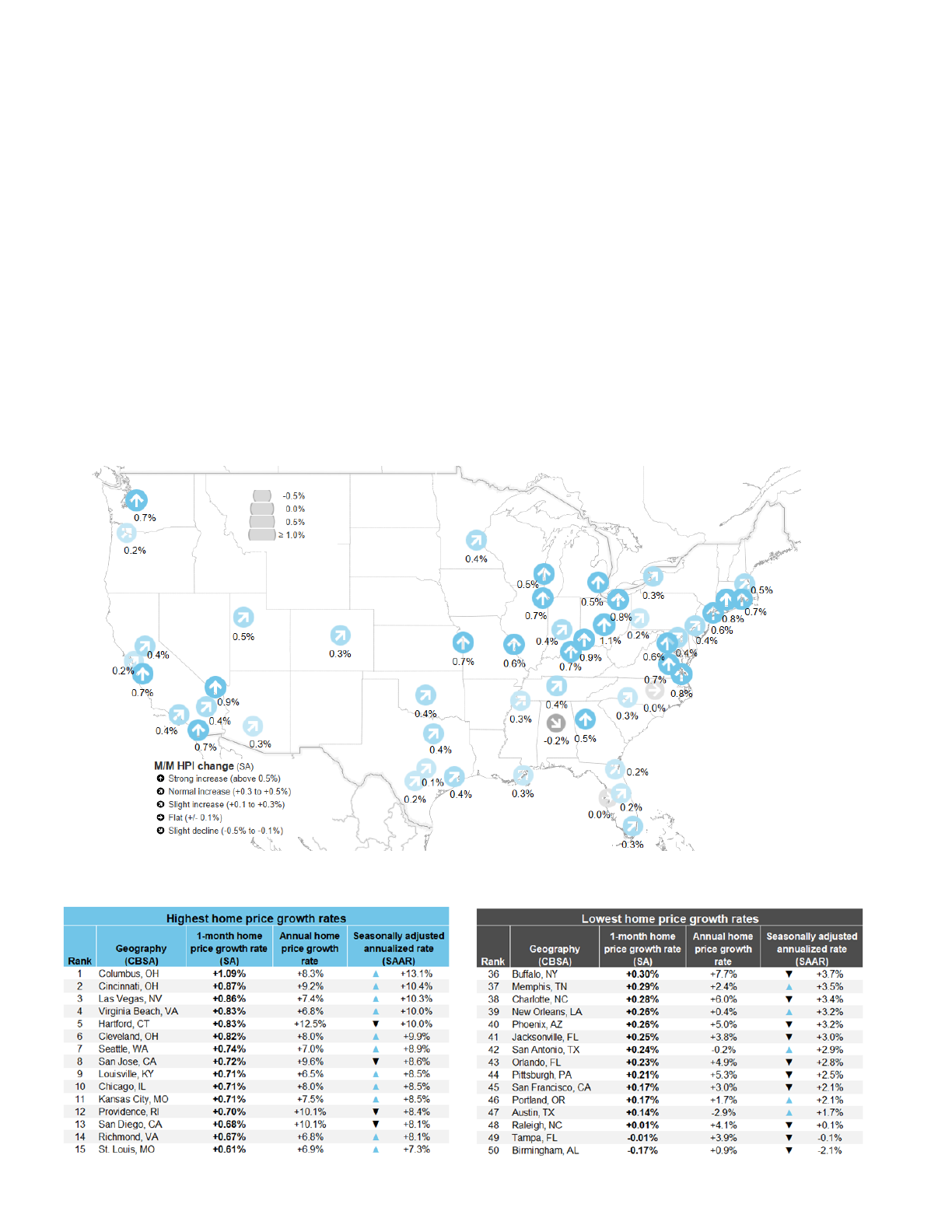

With home affordability continuing to impact demand and transaction speeds, here we take a closer look at the

inventory of homes for sale, sales volumes, and home prices across the U.S. This information has been compiled

from the ICE Home Price Index and Collateral Analytics database.

Housing market update

National

San Antonio, TX

Orlando, FL

Aus tin, TX

Hartford, CT

Boise City, ID

Los Angeles, CA

San Diego, CA

San Francis co, CA

New Orleans, LA

Providence, RI

-90%

-75%

-60%

-45%

-30%

-15%

0%

15%

30%

Deficit of homes listed for sale

(% change from 2017-2019 same month average

)

-37%

-31%

-24%

-21%

-40%

-30%

-20%

-10%

0%

+10%

+20%

Deficit of new real estate listings

% Difference from

2017-2019 same month average

Source: ICE,

Realtor.com

Source: ICE,

Realtor.com

The national inventory deficit held flat in February at 40% below the same-month pre-pandemic average

While slightly worse than the 36% shortage at the start of 2024, it’s the shallowest deficit for any February since 2020,

which translates to more inventory for prospective homebuyers

Indeed, February saw inventory rise in 60 of the 100 largest U.S. markets, and 65% have more homes for sale today than

at this point last year.

Connecticut markets (Hartford, Bridgeport, New Haven) and Providence, R.I., continue to see the deepest deficits (-70%

or more), while only San Antonio, Austin, and Dallas, plus Lakeland, Fla., had inventory surpluses

New Orleans, San Francisco, Los Angeles and San Diego all reported deepening deficits

Following a 24% deficit in new listings in January, February’s -21% is an improvement, but still well below pre-pandemic

levels

ice.com ICE | Mortgage Monitor report 16

65% of markets had more inventory for sale in February than they did at the same time last year

Some of the largest increases were in Florida, with Cape Coral and North Port each erasing deficits of almost 50%

Inventory in Lakeland, Orlando, Tampa, Jacksonville, and Miami have all increased significantly in the past 12 months

San Antonio, Dallas, New Orleans, Denver, Omaha, Houston, Portland, Memphis and Birmingham have also experienced

notable improvement

California markets are among the minority with worsening deficits this year, although the declines have been modest in

most cases

Boise has been an outlier overall, seeing inventory fall sharply over the past 12 months after moving into surplus territory

in late 2022

Housing market update

* Percent change from 2017-2019 same month average

Source: ICE, Realtor.com

Change in inventory deficit/surplus from same time last year

ice.com ICE | Mortgage Monitor report 17

New construction has a larger role to play in addressing inventory challenges in today’s market

Single-family residential (SFR) construction permits reached a seasonally adjusted annualized rate (SAAR) of 1.03M in

February – a level last seen in May 2022

SFR starts reached a SAAR of 1.13M in February, up 12% month over month and 35% year over year

At a SAAR of 1.07M, SFR completions bounced 20% between January and February, while the number of SFR units

under construction stayed flat at 683K on a seasonally-adjusted basis

SFRs accounted for 41% of total residential construction in February, up from a low of less than 40% in October 2023 but

down from a high of nearly 51% two years ago

0.0M

0.2M

0.4M

0.6M

0.8M

1.0M

1.2M

1.4M

1.6M

1.8M

2.0M

New private housing under construction by type

SFR Constr. (NSA) 2-4 Units Constr. (NSA)

5+ Units Constr. (NSA) Total Constr. (NSA)

0.0M

0.3M

0.6M

0.9M

1.2M

1.5M

1.8M

2.1M

New private SFR housing by stage of construction

(Seasonally adjusted – starts, permits, completions annualized)

SFR Under Construction

(SA

) SFR Permit Unstarted (SA) SFR Permits (SAAR)

SFR Starts (SAAR) SFR Completed (SAAR)

Source: ICE; U.S. Census

Bureau; U.S. Department of

Housing and Urban

Development (HUD); St. Louis

Federal Reserve Bank (FRED)

Source: ICE; U.S. Census

Bureau; U.S. Department of

Housing and Urban

Development (HUD); St. Louis

Federal Reserve Bank (FRED)

Housing market update

ice.com ICE | Mortgage Monitor report 18

Home sales have rebounded modestly over the last two months, after closing out 2023 at an 11-year low

February home sales hit their highest adjusted level since March 2023, driven by lower interest rates in late Q4 and early

Q1

With sales rising, and inventory falling slightly since December, months of supply edged lower to 3.2 months in February,

continuing to provide a floor to home prices

That’s the leanest months-of-supply metric we’ve seen in five months, but better than the 2.8 months of supply at the

same time last year, which led to above-average price growth in spring 2023

Housing market update

Source: ICE, Collateral Analytics

0

2

4

6

8

10

12

14

16

0

20

40

60

80

100

120

140

160

180

200

Months of inventory

Home sales (Indexed: jan 2005 = 100)

Home sales and months of remaining inventory

Seasonally adjusted

- single family residences and condos

Home sales

Months of inventory

(right axis)

ice.com ICE | Mortgage Monitor report 19

Though annual home price growth edged slightly lower in February to +5.7% from an upwardly revised +5.8% in January,

seasonally adjusted month-over-month gains moved higher

Adjusted home prices rose by +0.43% in February, noticeably higher than the +0.33% revised single-month gain in

January and equivalent to a +5.3% SAAR

Seasonally adjusted annualized growth had fallen below 1% as recently as October, when 30-year rates near 8% pushed

home affordability to a 39-year low

While still expected to modestly decelerate over the next few months, sales activity on falling rates in January and

February suggests annual home price growth could remain firmer than anticipated

The lock-in phenomenon continues to impact inventory more strongly in the spring months, with the housing market falling

into a pattern of super-seasonality in recent years as prices hold firmer in the spring and weaken in the fall and winter –

even when accounting for traditional seasonal patterns

-0.6%

-0.3%

0.0%

+0.3%

+0.6%

+0.9%

+1.2%

+1.5%

+1.8%

Jan '23 Feb '23 Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan '24 Feb '24

1-month change in home prices

(ICE Home Price Index, NSA)

25-year average (1998-2022) Current year (2023-24)

+5.7%

-15%

-10%

-5%

0%

+5%

+10%

+15%

+20%

+25%

+30%

Annual Home Price Growth Rate

ICE Home Price Index

(HPI)

1-Month Change, Annualized (SAAR) 1-Month Home Price Change (SA) Annual Home Price Growth Rate (NSA)

Source: ICE Home Price Index (HPI)

Housing market update

Source: ICE Home Price Index (HPI)

ice.com ICE | Mortgage Monitor report 20

Housing market update

1-month home price growth (seasonally adjusted)

Source: ICE Home Price Index (HPI)

February 2024

Columbus (+1.09%) and Cincinnati, Ohio (+0.87%) saw the largest single month adjusted gains in February, followed by

Las Vegas (+0.86%), Virginia Beach, (+0.83%), Hartford (+0.83%), and Cleveland (+0.82%)

Birmingham (-0.17%) and Tampa (-0.01%) were the only markets where prices fell on an adjusted basis, with Raleigh

(+0.01%) Austin (+0.14%), Portland, Ore. (+0.17%), and San Francisco (+0.17%) experiencing the smallest increases

Price growth across Florida was muted, with growth rates in all nine of the state’s largest markets below the national

average, and smaller markets like North Port and Cape Coral easing slightly in February

Price gains accelerated in 42 of the 50 largest markets in February, led by Columbus and Cincinnati with Las Vegas and

Denver picking up steam as well

Six of the eight markets where home price growth slowed are in California (Riverside, Sacramento, Los Angeles, San

Diego, San Francisco and San Jose), somewhat surprising given that inventory deficits have grown in many of these

metros

California remains split, with half of markets – including San Jose (+0.72%), San Diego (+0.68%) and Stockton (+0.53%) –

experiencing above-average growth, and half below; San Francisco, at +0.17%, was somewhere in the middle

Arrows indicate whether the seasonally adjusted annualized

rate is higher (▲) or lower (▼) than the annual growth rate

ice.com ICE | Mortgage Monitor report 21

Appendix

Summary statistics

Feb. 29, 2024

Non-current loans by state

ice.com ICE | Mortgage Monitor report 22

Appendix

Loan counts and average days delinquent

Feb. 29, 2024

Loan counts and average days delinquent – recent months

ice.com ICE | Mortgage Monitor report 23

Appendix

0M

1M

2M

3M

4M

5M

Active forbearance plans

FHA/VA Fannie/Freddie Other Total

0 K

20 K

40 K

60 K

80 K

100 K

120 K

Week Ending

New forbearance-plan starts by investor

FHA / VA GSE Portfolio / PLS

ice.com ICE | Mortgage Monitor report 24

Source: ICE, McDash Flash

Data as of Mar. 12, 2024

Source: ICE, McDash Flash

Data as of Mar. 12, 2024

Appendix

Removed/expired – performing

4,130K

46%

Removed/expired –

delinquent – active loss mit

216K

3%

Removed/expired –

delinquent

462K

5%

Removed/expired –

active foreclosure

98K

1%

Distressed Liquidation

109K

1%

Paid off

3,558K

40%

Active forbearance –

original term

154K

2%

Active forbearance –

term extended

172K

2%

Current status of COVID

-19

related forbearances

8.9 million

forbearances

0K

50K

100K

150K

200K

250K

300K

30 Days DQ 60 Days DQ 90 Days DQ 120+ Days DQ

Breakdown of loans that remain delinquent following

forbearance-plan exit

(Excluding loans in active loss mitigation or foreclosure)

Already DQ Entering Pandemic Became DQ During Pandemic

ice.com ICE | Mortgage Monitor report 25

Source: ICE, McDash Flash

March 2024 data through the

12th of the month

Source: ICE, McDash Flash

March 2024 data through the

12th of the month

Appendix

0K

100K

200K

300K

400K

500K

600K

700K

800K

2020-04

2020-05

2020-06

2020-07

2020-08

2020-09

2020-10

2020-11

2020-12

2021-01

2021-02

2021-03

2021-04

2021-05

2021-06

2021-07

2021-08

2021-09

2021-10

2021-11

2021-12

2022-01

2022-02

2022-03

2022-04

2022-05

2022-06

2022-07

2022-08

2022-09

2022-10

2022-11

2022-12

2023-01

2023-02

2023-03

2023-04

2023-05

2023-06

2023-07

2023-08

2023-09

2023-10

2023-11

2023-12

2024-01

2024-02

2024-03

Plan Exit Month

Current status of loans that left COVID-19 forbearance plans

Performing Paid Off Active Loss Mit Delinquent Active Foreclosure Distressed Liquidation

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2020-04

2020-05

2020-06

2020-07

2020-08

2020-09

2020-10

2020-11

2020-12

2021-01

2021-02

2021-03

2021-04

2021-05

2021-06

2021-07

2021-08

2021-09

2021-10

2021-11

2021-12

2022-01

2022-02

2022-03

2022-04

2022-05

2022-06

2022-07

2022-08

2022-09

2022-10

2022-11

2022-12

2023-01

2023-02

2023-03

2023-04

2023-05

2023-06

2023-07

2023-08

2023-09

2023-10

2023-11

2023-12

2024-01

2024-02

2024-03

Plan Exit Month

Current status of loans that left COVID-19 forbearance plans

Performing Paid Off Active Loss Mit Delinquent Active Foreclosure Distressed Liquidation

ice.com ICE | Mortgage Monitor report 26

Definitions

Total active count

All active loans as of month-

end, including loans in any state of delinquency

or foreclosure. Post-sale loans and loans in REO are excluded from the

total active count.

Delinquency

statuses

(30, 60, 90+, etc.)

All delinquency statuses are calculated using the MBA methodology based

on the payment due date provided by the servicer. Loans in foreclosure are

reported separately and are not included in the MBA days delinquent.

90-day defaults

Loans that were less than 90 days delinquent in the prior month and were

90 days delinquent, but not in foreclosure, in the current month.

Foreclosure

inventory

The servicer has referred the loan to an attorney for foreclosure. Loans

remain in foreclosure inventory from referral to sale.

Foreclosure starts

Any active loan that was not in foreclosure in the prior month that moves

into foreclosure inventory in the current month.

Non-current Loans in any stage of delinquency or foreclosure.

Foreclosure sale /

new REO

Any loan that was in foreclosure in the prior month that moves into post-

sale status or is flagged as a foreclosure liquidation.

REO

The loan is in post-sale foreclosure status. Listing status is not a

consideration; this includes all properties on and off the market.

Deterioration ratio

The ratio of the percentage of loans deteriorating in delinquency status vs.

those improving.

Extrapolation methodology: Mortgage statistics are scaled to estimate the total

market performance based on coverage within the McDash database.

ice.com ICE | Mortgage Monitor report 27

Disclosures

You can reach us by email at

mortgage.monitor@

ice.com

The information contained in this paper - including text, graphics, links or other items - are provided “as is” and “as available.” Intercontinental Exchange, Inc. its subsidiaries and affiliates (“ICE”)

and third party providers do not warrant the accuracy, adequacy, timeliness, or completeness of this information, and expressly disclaims liability for errors, omissions or other defects, or delays

or interruptions in this information. ICE does not verify any data and disclaims any obligation to do so. The information provided in this paper is also liable to change at short notice. You should

not rely on any information contained in this paper without first checking with us that it is correct and up to date.

No warranty of any kind, implied, express or statutory, is given in conjunction with the information. The reliance on any information contained in this paper is done at your own risk and discretion

and you alone will be responsible for any damage or loss to you, including but not limited to loss of data or loss or damage to any property or loss of data or loss of revenue that results from the

use and reliance on such information.

In no event will ICE or its third party providers be liable for any damages, including without limitation direct or indirect, special, incidental, punitive, or consequential damages, losses or expenses

arising out of or relating to your use of this information. Past performance is no guarantee of future results.

The content provided in this paper is not to be construed as a recommendation or offer to buy or sell or the solicitation of an offer to buy or sell any security, financial product or instrument, or to

participate in any particular trading strategy. ICE does not make any recommendations regarding the merit of any company, security or other financial product or investment identified in this

paper, nor does it make any recommendation regarding the purchase or sale of any such company, security, financial product or investment that may be described or referred to in this paper,

nor endorse or sponsor any company identified in this paper. Prior to the execution of a purchase or sale of any security or investment, you are advised to consult with your banker, financial

advisor or other relevant professionals (e.g. legal, tax and/or accounting counsel). Neither ICE nor its third party providers shall be liable for any investment decisions based upon or results

obtained from the content provided in this paper. Nothing contained on this paper is intended to be, nor shall it be construed to be, legal, tax, accounting or investment advice.

View the full Mortgage Monitor disclosures with the link above.

Mortgage Monitor disclosures