Community Reinvestment Act (CRA)

CRA Public File

CRA Public File

Introduction

In accordance with the Community Reinvestment Act (CRA) regulation, the Bank is required to

maintain and, upon request, make available for public inspection, our complete CRA Public File.

As required by the CRA, the information contained in this file is current as of April 1 of each year.

Information Request

If any person requests a copy of this file, the Manager or Officer in charge will provide them with

a copy of the document. Subsequently, the Officer must notify the CRA Department of this

request through this email: [email protected]om

All branch employees must know to whom they should refer any request for information.

AVISO

LEY DE REINVERSIÓN EN LA COMUNIDAD

NOTICE

COMMUNITY REINVESTMENT ACT

BRA-940 / 3-14 (PDF)

Under the Federal Community Reinvestment Act (CRA), the Federal

Reserve Board (Board) evaluates our record of helping to meet

the credit needs of this community consistent with safe and sound

operations. The Board also takes this record into account when

deciding on certain applications submitted by us.

Your involvement is encouraged.

You are entitled to certain information about our operations and

our performance under the CRA. You may review today the public

section of our most recent CRA evaluation, prepared by the Federal

Reserve Bank of New York, 33 Liberty Street, New York, N.Y. 10045,

and a list of services provided at this branch.

(1) a map showing the assessment area containing this branch,

which is the area in which the Board evaluates our CRA

performance in this community;

(2) information about our branches in this assessment area;

(3) a list of services we provide at those locations;

(4) data on our lending performance in this assessment area;

and

(5) copies of all written comments received by us that specifically

relate to our CRA performance in its assessment area, and

any responses we have made to those comments.

If you would like to review information about our CRA performance

in other communities served by us, the public file for our entire bank

is available at the Community Reinvestment Act Department (CRA),

located at Calle Popular Building, 153 Ponce de León Ave., 11th Floor,

Hato Rey, PR 00918.

At least 30 days before the beginning of each quarter, the Federal

Reserve System publishes a list of the banks that are scheduled for

CRA examination by the Reserve Bank in that quarter. This list is

available from the Ocer in Charge of Supervision, Federal Reserve

Bank of New York, 33 Liberty Street, New York, NY 10045. Your may

send written comments about our performance in helping to meet

community credit needs to the CRA Ocer, PO Box 362708, San

Juan, PR 00936-2708 and to the Ocer in Charge of Supervision,

Federal Reserve Bank of New York, 33 Liberty Street, New York,

NY 10045. Your letter, together with any response by us, will be

considered by the Federal Reserve System in evaluating our CRA

performance and may be made public.

You may ask to look at any comments received by the Federal Reserve

Bank. You may also request from the Reserve Bank an announcement

of our applications covered by the CRA filed with the Reserve Bank.

We are an aliate of Popular, Inc., a bank holding company.

You may request from the Ocer in Charge of Supervision, Federal

Reserve Bank of New York, 33 Liberty Street, New York, NY 10045,

an announcement of applications covered by the CRA filed by bank

holding companies.

Bajo la Ley Federal de Reinversión en la Comunidad (CRA), la Junta

de la Reserva Federal (Junta) evalúa nuestro desempeño en ayudar a

satisfacer las necesidades de crédito de esta comunidad, consistente

con una operación segura y prudente. La Junta también considera esta

evaluación cuando vaya a tomar una decisión sobre ciertas solicitudes

sometidas por nosotros.

Su participación es bienvenida.

Usted tiene el derecho de obtener cierta información sobre nuestras

operaciones y nuestra ejecutoria de CRA. Usted puede revisar hoy

mismo la sección pública de nuestra evaluación de CRA más reciente

preparada por el Banco de la Reserva Federal de Nueva York, 33 Liberty

Street, New York, N.Y. 10045, y una lista de los servicios que brinda

esta sucursal.

(1) un mapa que demuestra el área de evaluación (assessment area)

que incluye esta sucursal, que es el área utilizada por la Junta

para evaluar nuestra ejecutoria de CRA en esta comunidad;

(2) información sobre nuestras sucursales en el área de evaluación;

(3) una lista de los servicios que proveemos en esas localidades;

(4) datos sobre nuestra ejecutoria de préstamos en el área de

evaluación; y

(5) copias de todos los comentarios recibidos por nosotros que

específicamente se refieren a nuestra ejecutoria de CRA en el

área de evaluación y nuestras respuestas a esos comentarios.

Si le interesa revisar la información sobre nuestra ejecutoria de CRA en

otras comunidades donde proveemos servicios, el expediente público

para nuestro Banco está disponible en el Departamento Reinversión

en la Comunidad (CRA), localizado en Edif. Calle Popular, Piso 11, Ave.

Ponce de León 153, Hato Rey, PR 00918.

Por lo menos treinta (30) días antes de cada trimestre, el Sistema

de la Reserva Federal publica una lista de los Bancos que están

programados para ser auditados por el Banco de la Reserva durante

ese trimestre. Esta lista está disponible en la oficina del Ocer in

Charge of Supervision, Federal Reserve Bank of New York, 33 Liberty

Street, New York, NY 10045. Usted puede enviar sus comentarios por

escrito sobre nuestra ejecutoria en ayudar a satisfacer las necesidades

de crédito de la comunidad al Oficial de CRA, PO Box 362708, San

Juan, PR 00936-2708 y al Ocer in Charge of Supervision, Federal

Reserve Bank of New York, 33 Liberty Street, New York, NY 10045. Su

carta, así como cualquier respuesta nuestra, será considerada por el

Sistema de la Reserva Federal en la evaluación de nuestra ejecutoria

de CRA y puede ser divulgada públicamente.

Usted puede solicitar ver cualquier comentario recibido por el Banco

de la Reserva. También, puede solicitar del Banco de la Reserva el

anuncio de nuestras solicitudes cubiertas por CRA radicadas con el

Banco de la Reserva. Nosotros somos una subsidiaria de Popular, Inc.,

una corporación tenedora de acciones bancarias.

Usted puede solicitar del Ocer in Charge of Supervision, Federal

Reserve Bank of New, York, 33 Liberty Street, New York, NY 10045, el

anuncio de nuestras solicitudes cubiertas por CRA, radicadas por las

corporaciones tenedoras de acciones bancarias.

Public Comments

We appreciate your comments; these help us to improve our level of quality and service in the

communities. The Community Reinvestment Act (CRA) requires that all public comments

received in writing about how we are meeting financial needs in the community be published in

the current year and two prior years.

Popular has not received public comments related to CRA.

PUBLIC DISCLOSURE

June 21, 2022

COMMUNITY REINVESTMENT ACT

PERFORMANCE EVALUATION

Banco Popular de Puerto Rico

RSSD No. 940311

209 Munoz Rivera Avenue

San Juan, PR 00918

FEDERAL RESERVE BANK OF NEW YORK

33 LIBERTY STREET

NEW YORK, NY 10045

NOTE:

This document is an evaluation of this institution's record of meeting the credit

needs of its entire community, including low- and moderate-income

neighborhoods, consistent with safe and sound operation of the institution. This

evaluation is not, nor should it be construed as, an assessment of the financial

condition of this institution. The rating assigned to this institution does not

represent an analysis, conclusion, or opinion of the federal financial supervisory

agency concerning the safety and soundness of this financial institution.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

i

TABLE OF CONTENTS

INSTITUTION'S CRA RATING ................................................................................................................. 1

INSTITUTION'S CRA RATING ............................................................................................................. 1

PERFORMANCE TEST RATINGS TABLE .......................................................................................... 1

SUMMARY OF MAJOR FACTORS SUPPORTING RATINGS .......................................................... 1

INSTITUTION ............................................................................................................................................. 3

DESCRIPTION OF INSTITUTION ........................................................................................................ 3

SCOPE OF EXAMINATION ................................................................................................................... 5

CONCLUSION WITH RESPECT TO PERFORMANCE TESTS .......................................................... 9

COMMONWEALTH OF PUERTO RICO ................................................................................................ 19

CRA RATING FOR PUERTO RICO .................................................................................................... 19

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 20

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS IN PUERTO RICO ..................... 23

MSA 41980 (SAN JUAN-BAYAMÓN-CAGUAS, PR) (FULL REVIEW) ............................................. 27

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 27

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 36

MSA 10380 (AGUADILLA-ISABELA, PR) (FULL REVIEW) ............................................................... 45

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 45

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 50

MSA 38660 (PONCE, PR) (FULL REVIEW) .......................................................................................... 59

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 59

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 63

MSA 11640 (ARECIBO, PR) (LIMITED REVIEW) ............................................................................... 72

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 72

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 72

MSA 25020 (GUAYAMA, PR) (LIMITED REVIEW) ............................................................................ 74

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 74

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 74

MSA 32420 (MAYAGÜEZ, PR) (LIMITED REVIEW) .......................................................................... 76

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 76

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 76

MSA 41900 (SAN GERMÁN, PR) (LIMITED REVIEW) ....................................................................... 78

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 78

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 78

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

ii

MSA 49500 (YAUCO, PR) (LIMITED REVIEW) ................................................................................... 80

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 80

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 80

NON-METROPOLITAN PUERTO RICO (LIMITED REVIEW) ............................................................ 82

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 82

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 82

U.S. VIRGIN ISLANDS ............................................................................................................................. 84

CRA RATING FOR U.S. VIRGIN ISLANDS ....................................................................................... 84

DESCRIPTION OF INSTITUTION'S OPERATIONS .......................................................................... 85

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS ...................................................... 87

CRA APPENDICES

APPENDIX A - AGGREGATE COMPARISON LOAN DISTRIBUTION TABLES 2019-2020 ....... 93

APPENDIX B - SCOPE OF EXAMINATION TABLE ...................................................................... 116

APPENDIX C - SUMMARY OF STATE RATINGS ......................................................................... 117

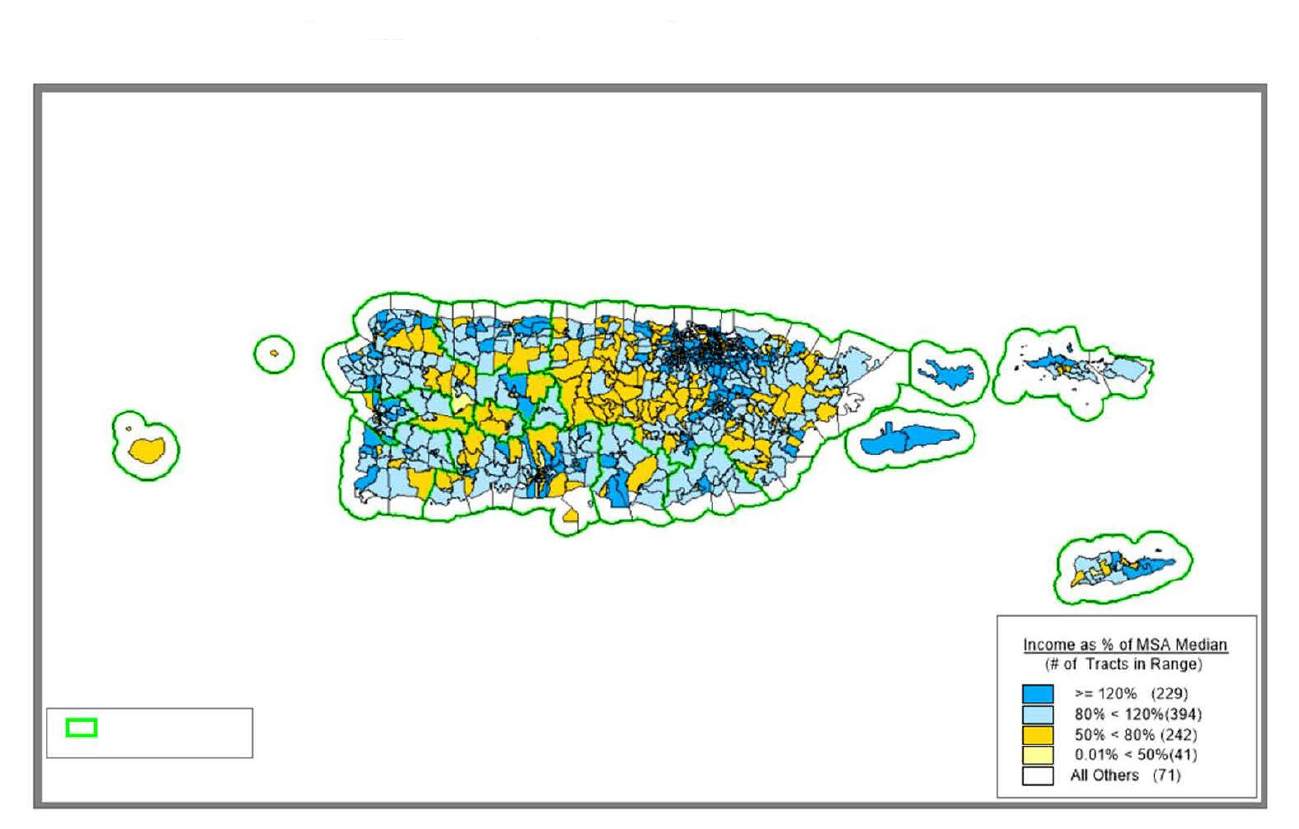

APPENDIX D - MAP OF ASSESSMENT AREA .............................................................................. 114

APPENDIX E - GLOSSARY .............................................................................................................. 115

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

1

INSTITUTION'S CRA RATING

INSTITUTION'S CRA RATING: SATISFACTORY

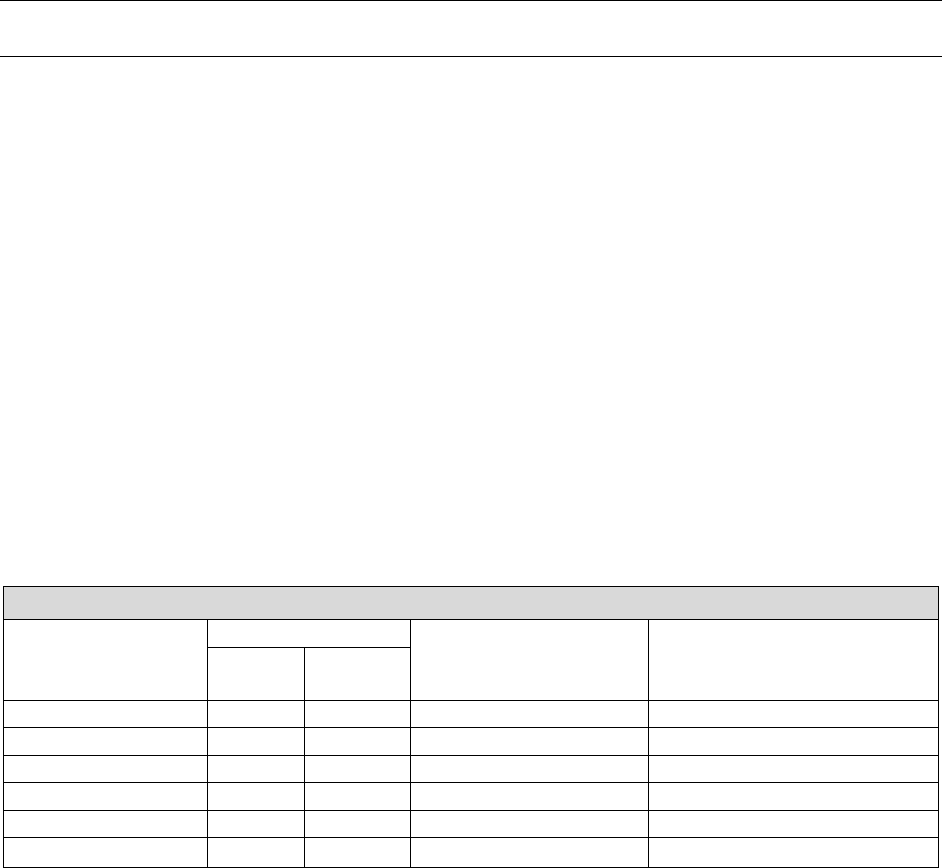

The following table indicates the performance level of Banco Popular de Puerto Rico with respect to the

lending, investment, and service tests.

PERFORMANCE TEST RATINGS TABLE

PERFORMANCE

LEVELS

BANCO POPULAR DE PUERTO RICO

PERFORMANCE

TESTS

Lending Test* Investment Test Service Test

Outstanding

High Satisfactory X X X

Low Satisfactory

Needs to Improve

Substantial

Noncompliance

* The lending test is weighted more heavily than the investment and service tests in determining the

overall rating.

Summary of Major Factors Supporting Ratings

The major factors supporting the institution's rating follow:

Lending Test:

• Lending levels reflected good responsiveness to assessment area credit needs.

• A substantial majority of loans were made in the bank's assessment area.

• The geographic distribution of loans reflected adequate penetration throughout the assessment area.

• The distribution of borrowers reflected, given the product lines offered, adequate penetration

among customers of different income levels and businesses of different sizes.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

2

• Exhibited an adequate record of serving the credit needs of low-income individuals and areas and

very small businesses.

• Made a relatively high level of community development loans.

• Made use of innovative and/or flexible lending practices in serving assessment area credit needs.

Investment Test:

• Made a significant level of qualified community development investments and grants, particularly

those not routinely provided by private investors, occasionally in a leadership position.

• Made significant use of innovative and/or complex investments to support community development

initiatives.

• Exhibited adequate responsiveness to credit and community development needs.

Service Test:

• Delivery systems were readily accessible to the bank's geographies and individuals of different

income levels in its assessment area.

• Record of opening and closing of branches did not adversely affect the accessibility of its delivery

systems, particularly to low- and moderate-income (“LMI”) geographies and/or LMI individuals.

• Services were tailored to convenience and needs of its assessment area, particularly LMI

geographies and/or LMI individuals.

• Provided a relatively high level of community development services.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

3

INSTITUTION

DESCRIPTION OF INSTITUTION

Banco Popular de Puerto Rico (“Banco Popular”, “BPPR”, or “the bank”) is a full-service commercial bank

headquartered in San Juan, Puerto Rico. Banco Popular is primarily engaged in retail and commercial

banking services, including automobile and equipment financing, investment banking, and broker-dealer

and insurance services through specialized subsidiaries. All products and services are offered through

Banco Popular’s 167 branch network and alternative delivery channels, such as by telephone, internet, or

through automated teller machines (“ATMs”). BPPR is a publicly traded, wholly-owned subsidiary of

Popular Inc., a multi-regional diversified financial holding company with $64.2 billion in combined total

assets as of December 31, 2021.

During the review period, BPPR was the leading financial institution in the Commonwealth of Puerto Rico

(“Puerto Rico”, “PR”, or “the Commonwealth”), ranking first in deposit market share, small business

lending, home purchase, refinance, and home improvement lending. BPPR operated 159 retail branches in

its Puerto Rico assessment area and eight branches in the U.S. Virgin Islands (“USVI”) assessment area.

Major competitors included Citibank N.A., FirstBank, Oriental Bank, Sun West Mortgage Company, Inc.,

and Banco Santander PR.

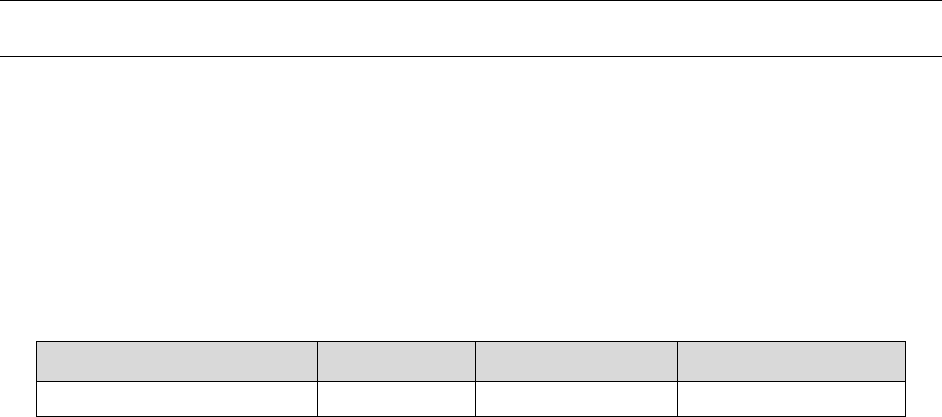

Based on the December 31, 2021 FFIEC Consolidated Report of Condition and Income ("Call Report"),

Banco Popular’s loan portfolio by dollar volume consisted of a mix of residential real estate and commercial

loans as summarized in the following table:

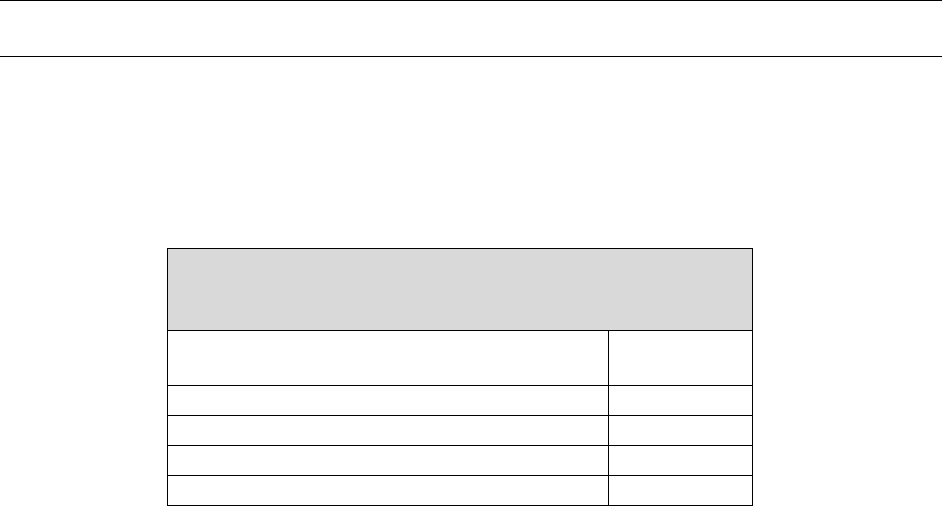

Loan Type Total Loans % of Total

1-4 Residential Real Estate Secured

$6,360,000,000 41.7%

Construction

$197,000,000 1.3%

Multifamily Dwelling

$169,000,000 1.1%

HELOCs

$4,000,000 0.0%

Consumer

$2,150,000,000 14.1%

Agriculture

$36,000,000 0.2%

Commercial & Industrial

$2,185,000,000 14.3%

Nonfarm Nonresidential Secured

$3,682,000,000 24.2%

Other

$452,000,000 3.0%

Total

$15,235,000,000 100.0%

*Data as of December 31, 2021

Based on the December 31, 2021 Uniform Bank Performance Report ("UBPR"), Banco Popular’s deposit

portfolio by dollar volume was comprised primarily of demand deposits and NOW and ATS accounts, as

summarized in the following table:

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

4

Deposit Type Total Deposits % of Total

Demand Deposits

$24,034,000,000 40.5%

All NOW and ATS Accounts

$13,852,000,000 23.3%

Money Market Deposit Accounts

$1,087,000,000 1.8%

Other Savings Deposits

$14,436,000,000 24.3%

Time Deposits at or below Insurance Limit

$3,110,000,000 5.2%

Time Deposits Above Insurance Limit

$2,628,000,000 4.4%

Brokered Deposits

$220,000,000 0.4%

Total

$59,367,000,000 100.0%

*Data as of December 31, 2021

DESCRIPTION OF ASSESSMENT AREA

Banco Popular’s assessment areas included all of Puerto Rico and the U.S. Virgin Islands. Within Puerto

Rico, the assessment areas included eight Metropolitan Statistical Area (“MSA”) assessment areas and one

non-metropolitan (“non-metro”) assessment area. In the USVI, the assessment area consisted of one non-

metro assessment area. While BPPR did not change the delineation of its assessment areas from the last

CRA examination, in September 2018, the Office of Management and Budget (“OMB”) adjusted three

MSAs that comprise three of the bank’s assessment areas.

1

The adjustments resulted in the reassignment

of the previously non-metro municipios

2

of Las Marías and Adjuntas to MSA 32420 and MSA 38660,

respectively, and the reassignment of the municipios of Guánica, Guayanilla, Peñuelas, and Yauco from

MSA 38660 to the newly created MSA 49500. Consequently, while the bank did not change its assessment

area delineation in 2019 or 2020, four of the bank’s assessment areas reflected the new OMB geographic

delineations. The assessment areas (“AA(s)”) were as follows:

Commonwealth of Puerto Rico

• MSA 41980 (San Juan-Bayamón-Caguas, PR)

3

• MSA 10380 (Aguadilla-Isabela, PR)

• MSA 38660 (Ponce, PR)

• MSA 11640 (Arecibo, PR)

• MSA 25020 (Guayama, PR)

• MSA 32420 (Mayagüez, PR)

• MSA 41900 (San Germán, PR)

• MSA 49500 (Yauco, PR)

• Non-Metro, PR (Municipios of Coamo, Culebra, Jayuya, Maricao, Salinas, Santa Isabel, and

Vieques.)

1

OMB BULLETIN NO. 18-04 - Revised Delineations of MSAs (9-14-2018)

2

Counties are referred to interchangeably throughout as “county(ies)” or “municipio(s)”.

3

In September 2018, the OMB changed the full name of MSA 41980 from San Juan-Carolina-Caguas, PR to San

Juan-Bayamón-Caguas, PR.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

5

U.S. Virgin Islands

• U.S. Virgin Islands: (Islands of St. Thomas, St. Croix and St. John)

Full scope assessment areas within Puerto Rico included: MSA 41980 (San Juan-Bayamón-Caguas, PR),

MSA 10380 (Aguadilla-Isabela, PR), and MSA 38660 (Ponce, PR). The remaining assessment areas were

evaluated as limited scope reviews due to limited lending and deposit market share and included: MSA

11640 (Arecibo, PR), MSA 25020 (Guayama, PR), MSA 32420 (Mayagüez, PR), MSA 41900 (San

Germán, PR), MSA 49500 (Yauco, PR) and the non-metro, PR assessment area.

The USVI assessment area was given full scope review since this was the only assessment area in the

territory.

Banco Popular’s assessment areas were in compliance with the requirements of Section 228.41 of

Regulation BB and did not arbitrarily exclude any LMI geographies. There were no financial or legal

factors that would prevent the bank from fulfilling its responsibilities under CRA.

Previous Performance Evaluation

Banco Popular received an “Outstanding” rating as a result of the January 13, 2020 performance evaluation

by the Federal Reserve Bank of New York. The lending test was rated “Outstanding,” the investment test

was rated “Low Satisfactory,” and the service test was rated “Outstanding.”

SCOPE OF EXAMINATION

Procedures

BPPR's CRA performance was evaluated using the Federal Financial Institutions Examination Council's

(“FFIEC”) Interagency CRA Procedures for Large Retail Financial Institutions, which consists of the

lending, investment, and service tests. The evaluation considered the CRA performance context, including

the bank's asset size, financial condition, market competition, assessment area demographics and credit and

community development needs.

Products

Home purchase, refinance, and home improvement loans reportable under the Home Mortgage Disclosure

Act (“HMDA”) and small business and small farm loans reportable under CRA were analyzed for overall

lending activity. However, small farm lending in the USVI was insufficient to analyze and HMDA loans

were insufficient to analyze separately by product. Examiners verified the integrity of a sample of 2019

and 2020 HMDA and small business loans reported by BPPR.

Evaluation Period

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

6

Home mortgage, refinance, home improvement

4

, small farm, and small business loans originated or

purchased between January 1, 2019 and December 31, 2020 were verified and analyzed. Examiners also

reviewed community development loans, qualified investments, philanthropic grants, and community

development services from July 1, 2019 through March 31, 2022.

Lending Analysis

Under the lending test, borrower and geographic distribution analyses were based on loans made in BPPR's

assessment areas. BPPR’s performance in 2019 and 2020 was compared to the U.S. Department of

Commerce’s Bureau of the Census 2015 American Community Survey (“2015 ACS”) demographic data.

To evaluate the geographic distribution, the proportion of home purchase, refinance, and home

improvement loan originations located in low- and moderate-income (“LMI”) geographies was compared

to the proportion of owner-occupied housing units located in LMI geographies of the assessment area. For

small business loans, the analysis compared the proportion of loan originations located in LMI geographies

with the proportion of businesses located in LMI geographies, based on Dun & Bradstreet (“D&B”) data.

Performance in low-income and in moderate-income geographies were analyzed separately.

To analyze the distribution of home purchase, refinance, and home improvement lending by borrower

characteristics, the proportion of originations to LMI borrowers was compared to the proportion of LMI

families residing in the assessment area. Median family income (“MFI”) estimates from the FFIEC were

used to categorize borrower income. For small business lending, BPPR’s proportion of loans to businesses

with gross annual revenues (“GAR”) of $1 million or less, based on D&B data, were compared to the

proportion of all such businesses located in the assessment area. The size of the small business loans was

also used as a proxy to identify lending to businesses with GAR of $1 million or less.

Demographic and economic information was also considered. Information was obtained from publicly

available sources including the 2015 ACS, the U.S. Department of Labor (“DOL”), FFIEC, and U.S.

Department of Housing and Urban Development (“HUD”). USVI demographic and economic sources also

included the USVI Bureau of Economic Research and USVI Bureau of Labor Statistics.

Borrower profile and geographic distribution analyses were also based on BPPR’s 2019 and 2020

performance, which was compared, respectively, to 2019 and 2020 performance data for the aggregate of

all loan reporters in the bank’s assessment areas. Aggregate lenders included all lenders required to report

HMDA-reportable and CRA small business lending data within the assessment areas, except for the USVI

assessment area, as market aggregate data for HMDA lending were not available. For retail services,

BPPR’s branch distribution analysis was conducted using data as of December 31, 2021.

Only loans inside the assessment areas were included in the analysis of geographic and borrower

distribution. Before reaching a conclusion about the bank’s overall performance regarding geographic

distribution and borrower characteristics in each assessment area, examiners gave greater weight to certain

loan products. In each assessment area, a product’s volume compared to total retail lending volume

determined the weight of a product’s performance in the overall conclusion. Multifamily loans were not

analyzed for geographic and borrower loan distribution in any assessment area as the volume was

4

Home mortgage, refinance, and home improvement loans are referred to as “HMDA-related” loans throughout the

performance evaluation.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

7

insufficient; however, multifamily loans were considered in the evaluation of assessment area concentration

and community development lending.

Community Development Activity Analysis

Community development activities were reviewed to determine whether the activities had community

development as a primary purpose and whether the community development activities benefitted the

assessment area. The eligibility of a loan, investment, or service as a community development activity was

based on demographic information available to the bank at the time the community development activity

was undertaken.

In addition, Puerto Rico and the US Virgin Islands were originally designated as major disaster areas due

to Hurricane Maria on September 20, 2017 and CRA consideration was given for CD activities in response

to the natural disaster. Per CA Letter 21-9 issued on May 27, 2021, the agencies granted a 36-month

extension to the original period provided in CA 18-1 as a result of an earthquake that hit Puerto Rico in

2020 and Hurricane Ida in 2021. Examiners reviewed submitted CD loans responding to the disaster

declaration for CD consideration.

Due to the impacts of the 2020 COVID-19 pandemic, in accordance with CA Letter 21-5 Community

Reinvestment Act (CRA) Consideration for Activities in Response to the Coronavirus and its attachments,

qualified community development activities supporting community needs related to the COVD-19

pandemic were also given consideration.

Qualified community development activities were analyzed from both the quantitative and qualitative

perspectives to understand the volume of activity impacting the assessment area, the innovativeness of those

activities, and the responsiveness to local community development and credit needs. When appropriate,

peer comparisons were conducted using annualized metrics to gauge the relative performance of the

institution in a particular assessment area. Peer banks were selected based on asset size, deposits, branching

structure, and presence within Puerto Rico and the USVI.

Community Contacts and Additional Performance Context Information

In order to learn more about community credit needs, examiners conducted interviews and received

comments from three non-profit agencies. Due to the coverage of these community contacts, discussions

of the identification of community credit needs is provided at the Institution level instead of at the individual

assessment area level.

The first community contact was held with a Community Development Financial Institution (“CDFI”)

operating throughout Puerto Rico and the U.S. Virgin Islands. The CDFI’s main foci include workforce,

housing, and economic development. The CDFI representative stated that access to capital for small

businesses in rural areas, very small “mom and pop” businesses, entrepreneurs who are starting businesses,

and small businesses is needed and particularly for working capital to fund repairs and post disaster

reconstruction. The representative said that access to credit was a challenge as traditional banks lend very

little to small businesses in LMI areas, especially those that are not established. Additionally, they stated

that access to credit for small business in the USVI is more of a challenge than PR and there is less access

to technical assistance, thus this is a need.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

8

The representative stated that the largest banks in PR and the USVI have invested in community programs.

However, these are mostly focused on social programs and affordable housing and less focused on lending

to small and very small/new business in LMI areas. The contact mentioned that PPP lending during the

COVID-19 pandemic did increase lending to businesses. However, only a small percentage of these loans

went to small and very small businesses, especially those without existing banking relationships.

A second community contact was conducted with a community foundation, focused on promoting access

to renewable energy, drinking water, housing, community economic development and education in Puerto

Rico, which launched a Community Investment Fund in 2016. The contact stated that all banks in Puerto

Rico have invested small amounts in the fund, which supported affordable housing and economic

development and provided capital to non-profit organizations. The representative noted that economic

conditions have improved slightly since 2020 due to the influx of federal funds during the pandemic and

the rise in tourism. However, for LMI areas and individuals, credit needs continue to be significant and

unmet. There continues to be a significant need for capital to fund reconstruction and mitigation projects

in recovery areas prior to federal fund reimbursement.

The third contact also emphasized that affordable housing remains a significant credit need and noted that

the shortage in affordable housing inventory is in part due to the high number of abandoned or dilapidated

properties stemming from the lack of available credit for restoration of LMI housing. The contact explained

that the need for affordable housing is spread out across Puerto Rico. However, there is a greater need in

areas of lowest economic development which include the south and central rural areas of the island. Non-

profits, which are well suited to meet community development needs, also face challenges in getting

working capital. The representative noted that the large banks in Puerto Rico have invested in their

Community Investment Fund and others, but that their investments are typically better suited for larger-

scale, more traditional infrastructure or housing projects than for smaller, more targeted non-profit funding.

Additionally, it was noted that smaller non-profits are often not set up to be able to manage large dollar

funding or projects as they are tailored for small dollar amounts and micro-loans.

A fourth community contact was held with a representative of the USVI hotel industry. The representative

noted that the tourism industry in the USVI has been booming since 2021 and the hotels and restaurants

cannot open fast enough. Several large hotels and restaurants that closed because of damage from the last

hurricane are expected to reopen post hurricanes in 2022. The representative stated that the biggest need

in the USVI currently is affordable housing, especially for workers in the tourism industry. Due to the lack

of hotel rooms during the pandemic when tourism demand was surging, there was a significant shift from

longer term rentals to short-term Airbnb vacation rentals, in turn drastically reducing the supply of

affordable longer-term rentals and noticeably driving up costs across the board.

Performance Context

The annual unemployment rate for the Commonwealth experienced an overall downward trend from 2019

to 2021 with the unemployment rate declining from 8.3% in 2019 to 7.8% in 2021. The COVID-19

pandemic caused businesses to close or reduce their workforce across Puerto Rico which increased the

unemployment rate by 0.6% in 2020. However, the rate decreased rapidly to below the pre-pandemic level

in 2021, though Puerto Rico’s unemployment rate was still higher than that of the mainland U.S.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

9

Puerto Rico has suffered from a severe and prolonged economic slump for more than a decade, with gross

domestic product, population, and employment all on a downward trend since 2006

5

, when a tax incentive

for manufacturers—Section 936—was phased out. The pharmaceutical industry continued as a key part of

the PR’s economy, though employment in this industry was cut in half since the phase-out began. While

Puerto Rico’s tourism sector was relatively small, it was one of the few industries that adding jobs in recent

years. In addition, a fledgling aerospace industry emerged around Aguadilla and Arecibo. Wages and

educational attainment in Puerto Rico tended to be about half the level of the U.S. mainland, and income

inequality was considerably higher. Puerto Rico also suffered from high sovereign debt and experienced a

fiscal crisis.

Puerto Rico has a very high poverty rate; based on estimates, approximately 40.5% of persons in Puerto

Rico lived in poverty

6

compared to, for example, the 11.6% of people in the mainland United States in

2021.

7

The Commonwealth experienced an economic crises in the recent past, with government funding

reductions due to the debt crisis, and required oversight by a financial control board under the Puerto Rico

Oversight Management and Economic Stability Act (PROMESA), as well as the effects of Hurricane Maria.

The PROMESA law required austerity measures and provided Puerto Rico with a mechanism to restructure

their debt which occurred in March 2022.

The economic challenges led to substantial consolidation of the banking industry in Puerto Rico.

Management noted that over the past decade, the number of consumer banks were reduced by half. The

Bank of Nova Scotia had been reducing its operations and, in 2019, Oriental Bank and FirstBank acquired

Scotiabank’s and Banco Santander SA’s operations, respectively.

Natural Disasters

Puerto Rico has been significantly impacted by natural disasters which have had prolonged impacts on the

island’s economy, population, and infrastructure. These included Hurricane Maria in September 2017,

earthquakes in late 2019 and early 2020, and the ongoing COVID-19 pandemic of 2020-2021.

Hurricane Maria had a severe effect on Puerto Rico, causing significant challenges to the population and

infrastructure, including the most extensive blackout in U.S. history, and also exacerbated preexisting

economic difficulties. In total, Hurricane Maria caused approximately $90 billion in damage. In the

aftermath, over 200,000 Puerto Ricans left for the mainland U.S., many temporarily and some permanently,

and island residents had no access to public utilities for almost a year. Three years after Hurricane Maria,

the island experienced destructive earthquakes followed by the COVID-19 pandemic.

Deriving Overall Conclusions

Before reaching a conclusion about the overall performance regarding geographic distribution and borrower

characteristics in the assessment areas, examiners compared loan originations in each loan product category

5

Federal Reserve Bank of New York - Regional Economy Profile: Puerto Rico

6

U.S. Census Bureau: Puerto Rico

7

Poverty in the United States: 2021 (census.gov)

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

10

to total retail lending volume to determine the influence of performance by product on the overall

conclusion.

In deriving overall conclusions, BPPR's performance in Puerto Rico received the most weight in

determining the overall rating because of the high concentration of deposits, branches, and lending in the

Commonwealth. BPPR's performance in the Puerto Rico assessment areas accounted for 97.5% of its total

retail deposits and 98.9% of total HMDA-reportable and small business lending activity. Performance in

the USVI had the second highest weight in determining the bank's overall rating. In reaching a conclusion

about BPPR's overall performance within an individual assessment area, products were weighted based on

their volume in that area.

In order to derive the rating for Puerto Rico, full-scope assessment areas were weighted based on the

proportion of loan originations and deposits in each. As a result, MSA 41980 (San Juan-Bayamón-Caguas,

PR) had a significant impact on assessing the overall performance of the bank, capturing 87.9% of the

branch deposits and 70.5% of total loans within Puerto Rico. Two additional assessment areas, MSA 10380

(Aguadilla-Isabela, PR) and MSA 38660 (Ponce, PR), that had a lesser, but still important, impact on the

overall rating, were also chosen as full scope assessment areas.

The combined full scope review areas made up 83.0% of the bank's loan volume, 76.0% of the bank’s

branches, and 90.6% of the bank’s deposits in Puerto Rico. Limited scope reviews were conducted of the

bank's performance in the other Puerto Rico assessment areas.

CONCLUSION WITH RESPECT TO PERFORMANCE TESTS

LENDING TEST

Banco Popular de Puerto Rico's overall performance in meeting the credit needs of its assessment area is

rated High Satisfactory. Lending levels reflected good responsiveness to Assessment Area (AA) credit

needs. A substantial majority of loans were made in the bank's AA. The geographic distribution of loans

reflected adequate penetration throughout the AA. The distribution of borrowers reflected, given the

product lines offered, adequate penetration among customers of different income levels and businesses of

different sizes. The bank exhibited an adequate record of serving the credit needs of low-income individuals

and areas and very small businesses. The bank made a relatively high level of CD loans. The bank made

use of innovative and/or flexible lending practices in serving AA credit needs.

Lending Activity

BPPR’s lending levels reflected good responsiveness to assessment area credit needs given the bank’s

capacity and overall market conditions, including the state of the housing market and economic conditions

in Puerto Rico and the USVI. Overall, BPPR originated or purchased 68,602 HMDA-related, small

business, and small farm loans during the evaluation period, totaling approximately $5.2 billion.

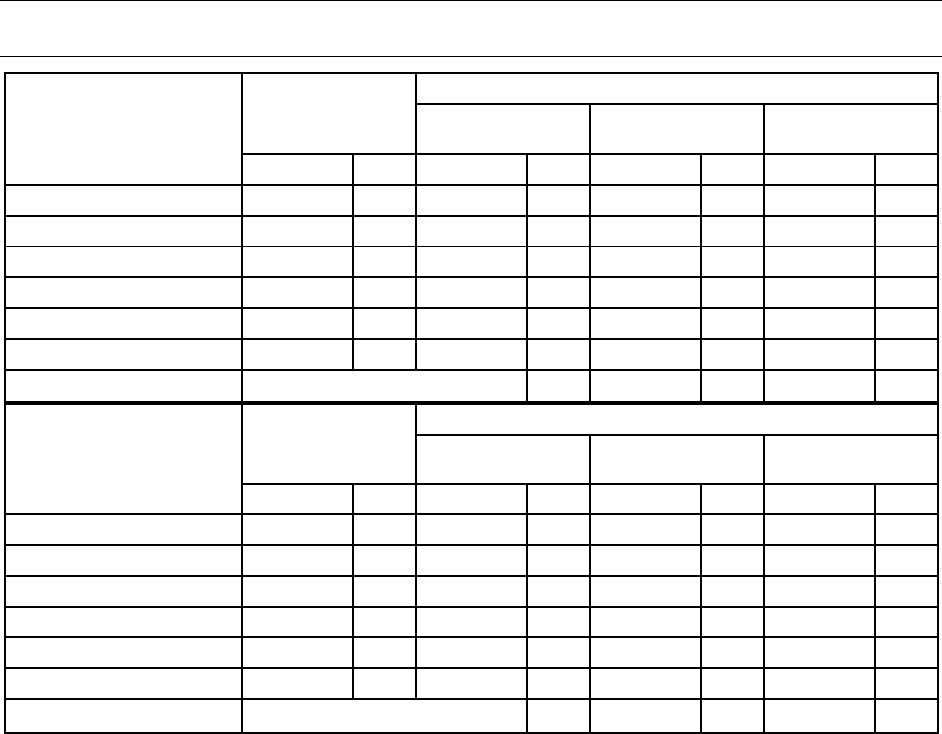

The following table summarizes BPPR’s lending activity during the review period.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

11

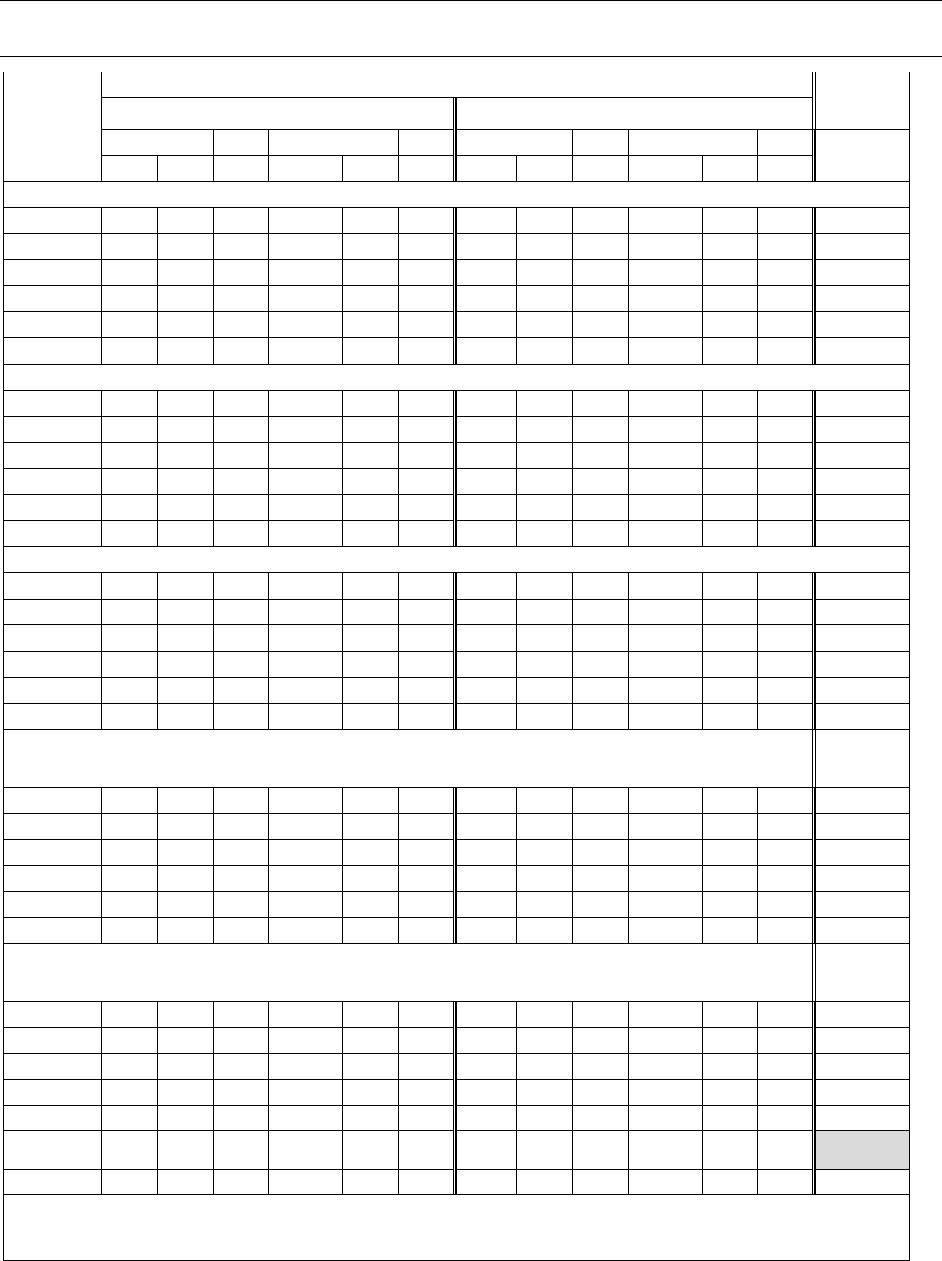

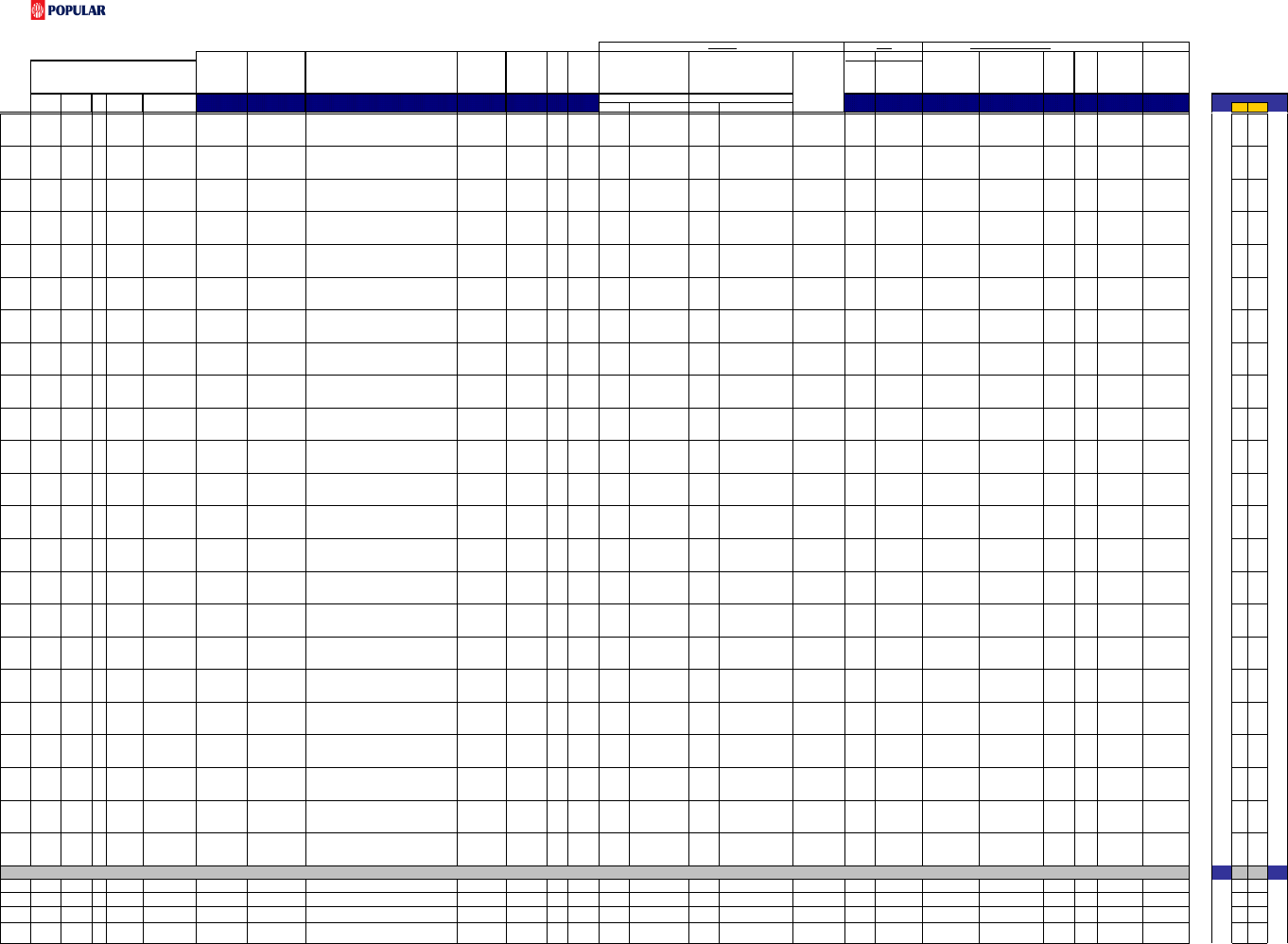

SUMMARY OF LENDING ACTIVITY

January 1, 2019– December 31, 2020

Loan Type

#

%

$(000s)

%

Home Purchase

7,829 11.4% $1,249,005 24.2%

Refinancing

2,209 3.2% $387,579 7.5%

Home Improvement

133 0.2% $16,892 0.3%

Multi-Family

15 0.0% $74,124 1.4%

Loan Purpose Not Applicable

12,048 17.6% $1,093,672 21.2%

Total HMDA-related

22,234 32.4% $2,821,271 54.6%

Small Business

45,289 66.0% $2,299,702 44.5%

Small Farm

1,079 1.6% $44,500 0.9%

TOTAL LOANS 68,602 100.0% $5,165,473 100.0%

*Note: Affiliate loans not included.

Assessment Area Concentration

A substantial majority of the loans originated or purchased by BPPR were made in the bank’s assessment

areas as detailed in the Lending Inside and Outside the Assessment Area chart below. All but 0.1% of

BPPR’s loans during the 2019 and 2020 review period were originated or purchased in its assessment areas.

LENDING INSIDE AND OUTSIDE THE ASSESSMENT AREA

January 1, 2019– December 31, 2020

Loan Type Inside Outside Total

#

%

$(000s)

%

#

%

$(000s)

%

#

%

$(000s)

%

Home

Purchase

7,829 100% $1,249,005 100.0% 0 0.0% $0 0.0% 7,829 100.0% $1,249,005 100.0%

Refinancing 2,207 99.9% $386,498 99.7% 2 0.1% $1,080 0.3% 2,209 100.0% $387,579 100.0%

Home

Improvement

133 100.0% $16,892 100.0% 0 0.0% $0 0.0% 133 100.0% $16,892 100.0%

Multi-Family 12 80% $73,908 99.7% 3 20% $216 0.3% 15 100.0% $74,124 100.0%

Loan Purpose

NA

12,048 100.0% $1,093,672 100.0% 0 0.0% $0 0.0% 12,048 100.0% $1,093,672 100.0%

Total HMDA-

related

22,229 100.0% $2,819,975 100.0% 5 0.0% $1,296 0.0% 22,234 100.0% $2,821,271 100.0%

Small

Business

45,265 99.9% $2,297,926 99.9% 24 0.1% $1,776 0.1% 45,289 100.0% $2,299,702 100.0%

Small Farm 1,078 99.9% $44,479 100.0% 1 0.1% $21 0.0% 1,079 100.0% $44,500 100.0%

TOTAL

LOANS

68,572 99.9% $5,162,380 99.9% 30 0.1% $3,093 0.1% 68,602 100.0% $5,165,473 100.0%

Geographic Distribution of Loans

Overall, the geographic distribution of HMDA-related and small business and small farm loans reflected

adequate penetration throughout the assessment area based on the lending performance in Puerto Rico, and

the bank’s level of loan penetration in LMI geographies in MSA 41980 (San Juan-Bayamón-Caguas, PR),

MSA 10380 (Aguadilla-Isabela, PR) and MSA 38660 (Ponce, PR), and to a lesser extent, the bank’s

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

12

adequate performance in the USVI. The analysis considered performance context factors such as the

number of owner-occupied housing units in LMI geographies and the market aggregate’s performance.

Distribution by Borrower Income and Revenue Size of Business

The overall distribution of loans among borrowers of different income levels and businesses and farms of

different sizes was adequate based on the lending performance in Puerto Rico, driven primarily by the

bank’s performance in MSA 41980 (San Juan-Bayamón-Caguas, PR), MSA 38660 (Ponce, PR), the USVI

and the bank’s good performance in the lesser weighted MSA 10380 (Aguadilla-Isabela, PR). The lending

analysis considered performance context factors such as the disparity between housing prices and incomes,

which generally places owner-occupied housing beyond the reach of LMI families.

Community Development Lending

BPPR made a relatively high level of community development loans. During the evaluation period, the

bank made 535 qualified community development loans, totaling $1.1 billion in its assessment areas.

Annualized, the bank made 195 CD loans totaling $385 million. This represented a 25.0% decrease by

number and a 27.3% decrease by dollar when compared to the bank’s annualized CD lending during the

previous exam period. When compared to two peer banks and its own performance during the last exam

period, BPPR ranked fourth when comparing annualized community development loans to total deposits,

ranked third when comparing annualized CD loans as a percentage of Tier 1 capital, and ranked fourth

relative to annualized CD loans as a percentage of average assets.

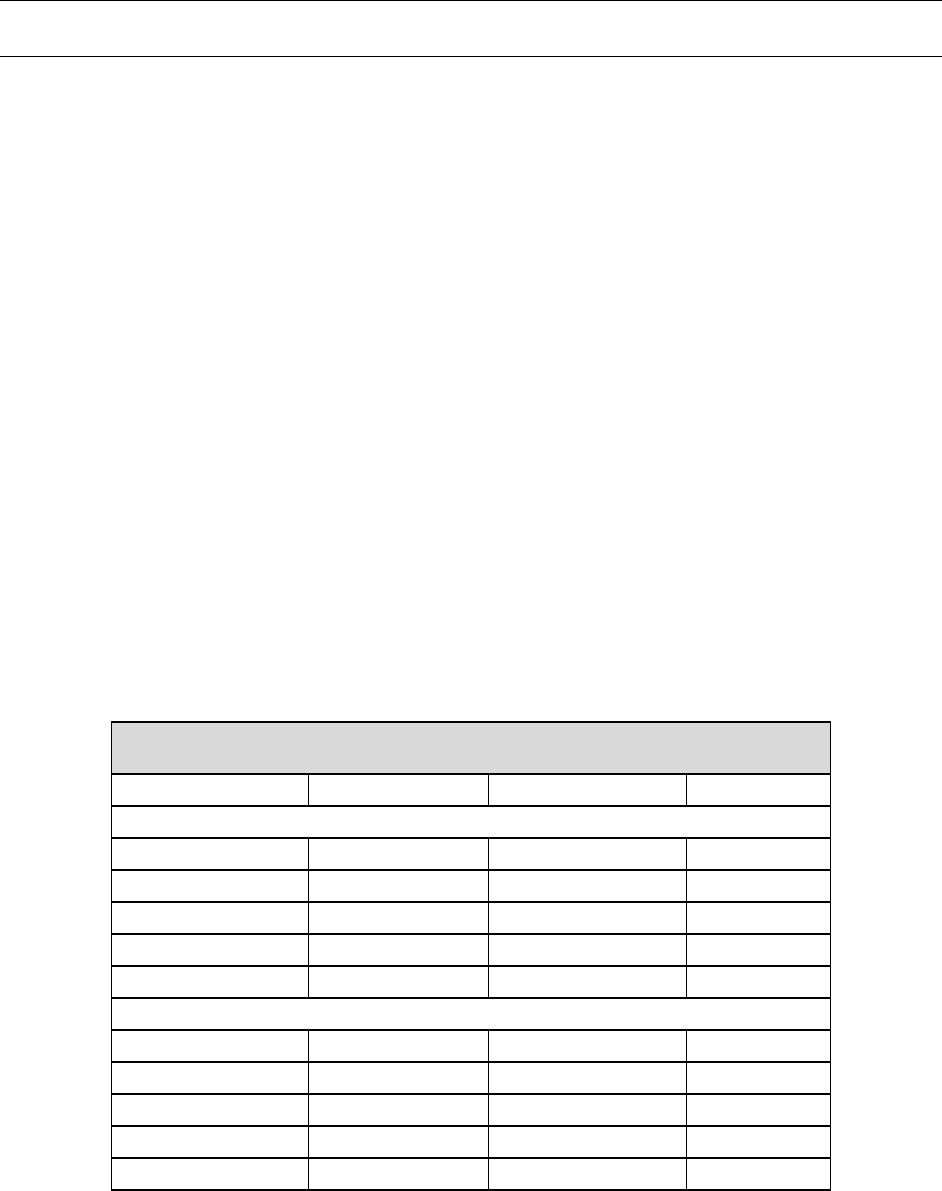

As detailed in the chart below, the bank’s qualified community development lending was responsive to

identified economic development, revitalization and stabilization, and community service needs.

Additionally, of the bank’s total qualified community development lending, 133 loans, totaling $272

million, were originated under the PPP loan program established by the Coronavirus Aid, Relief, and

Economic Security Act (“CARES Act”) of 2020 and designed to provide direct capital for small businesses

adversely affected by the COVID-19 pandemic to keep workers on small business payrolls and is found to

be particularly responsive to the acute credit needs during this timeframe.

8

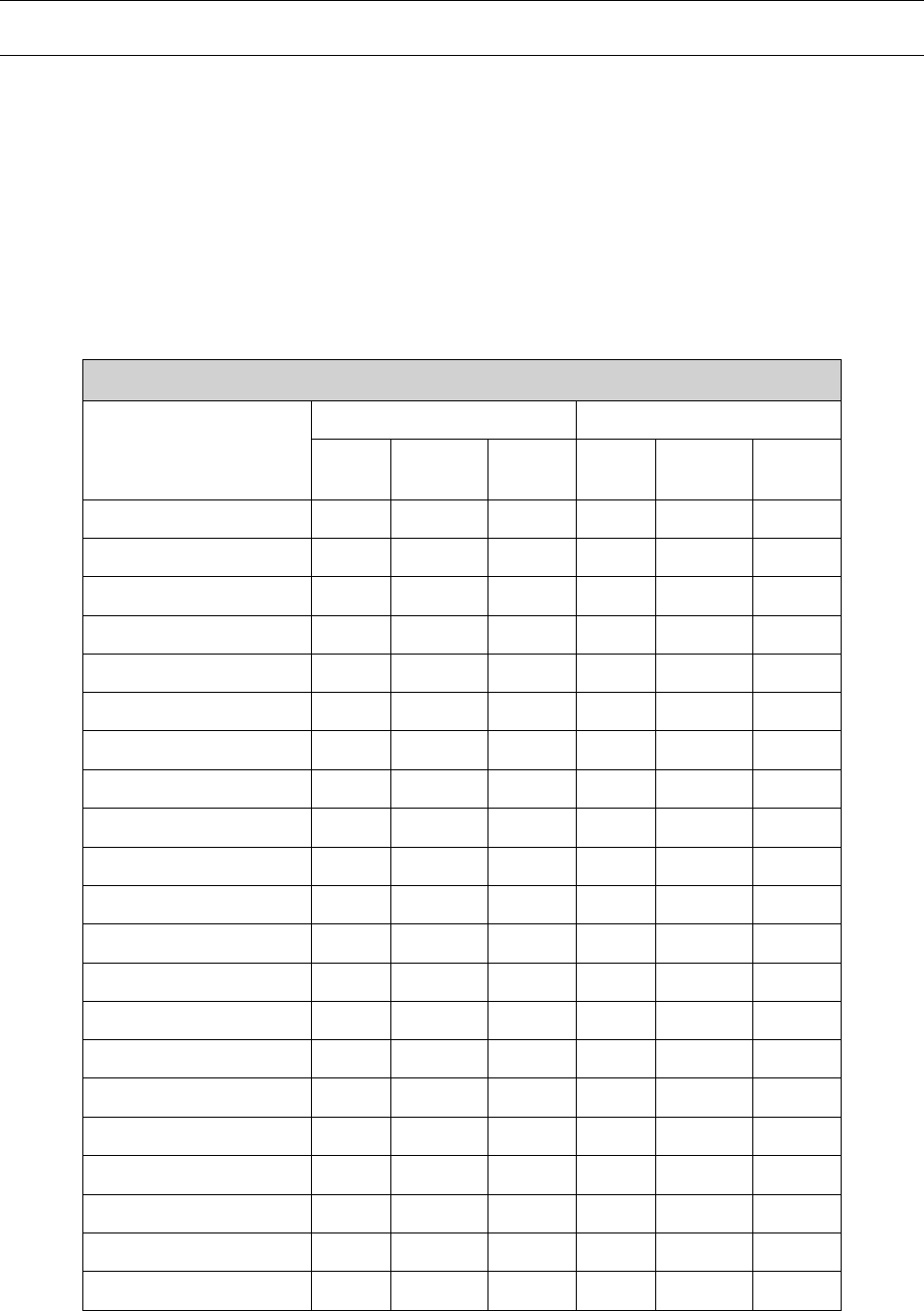

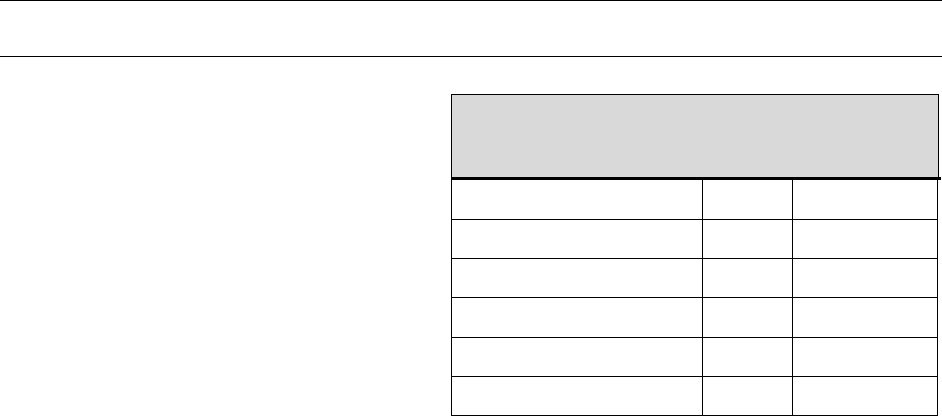

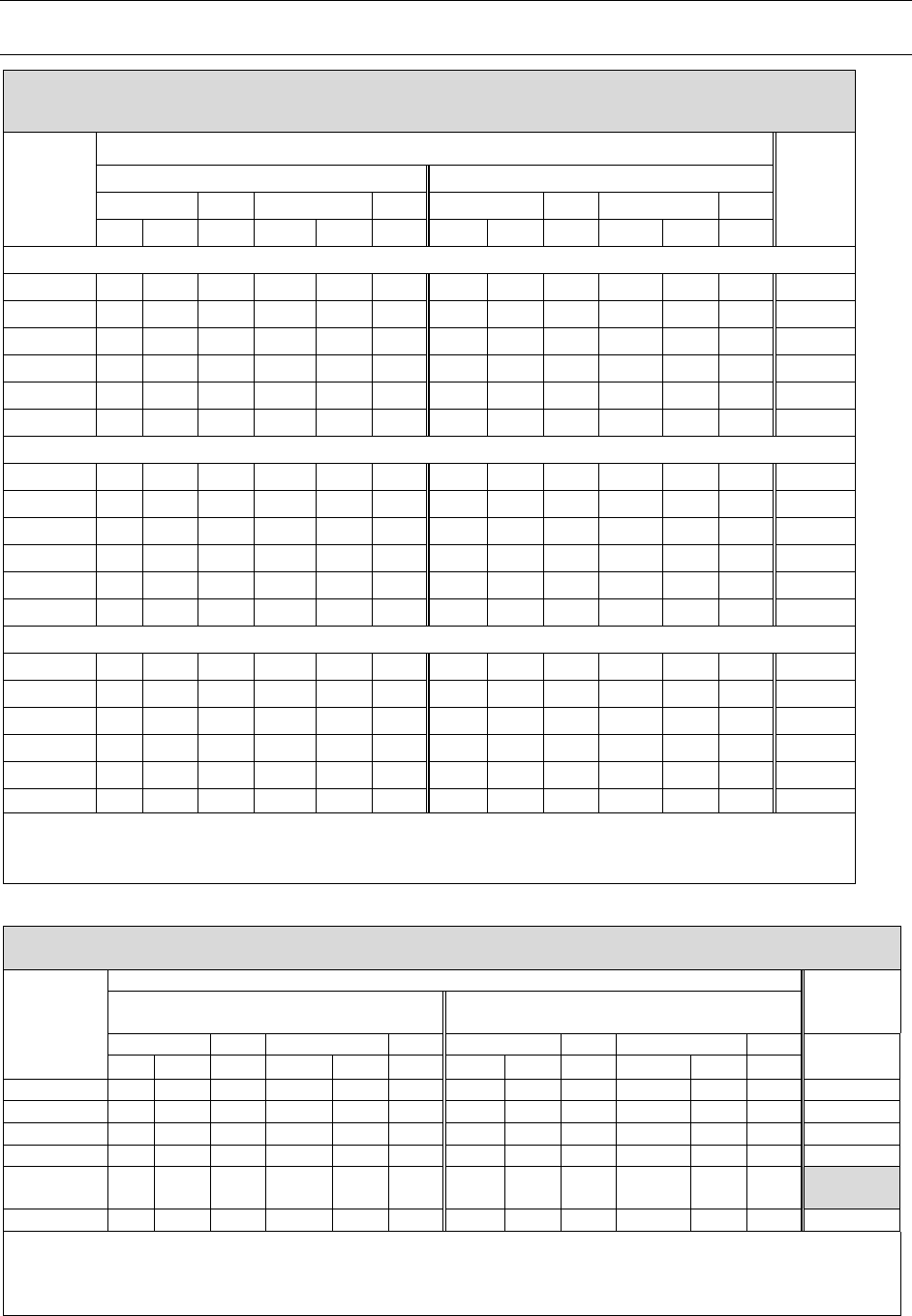

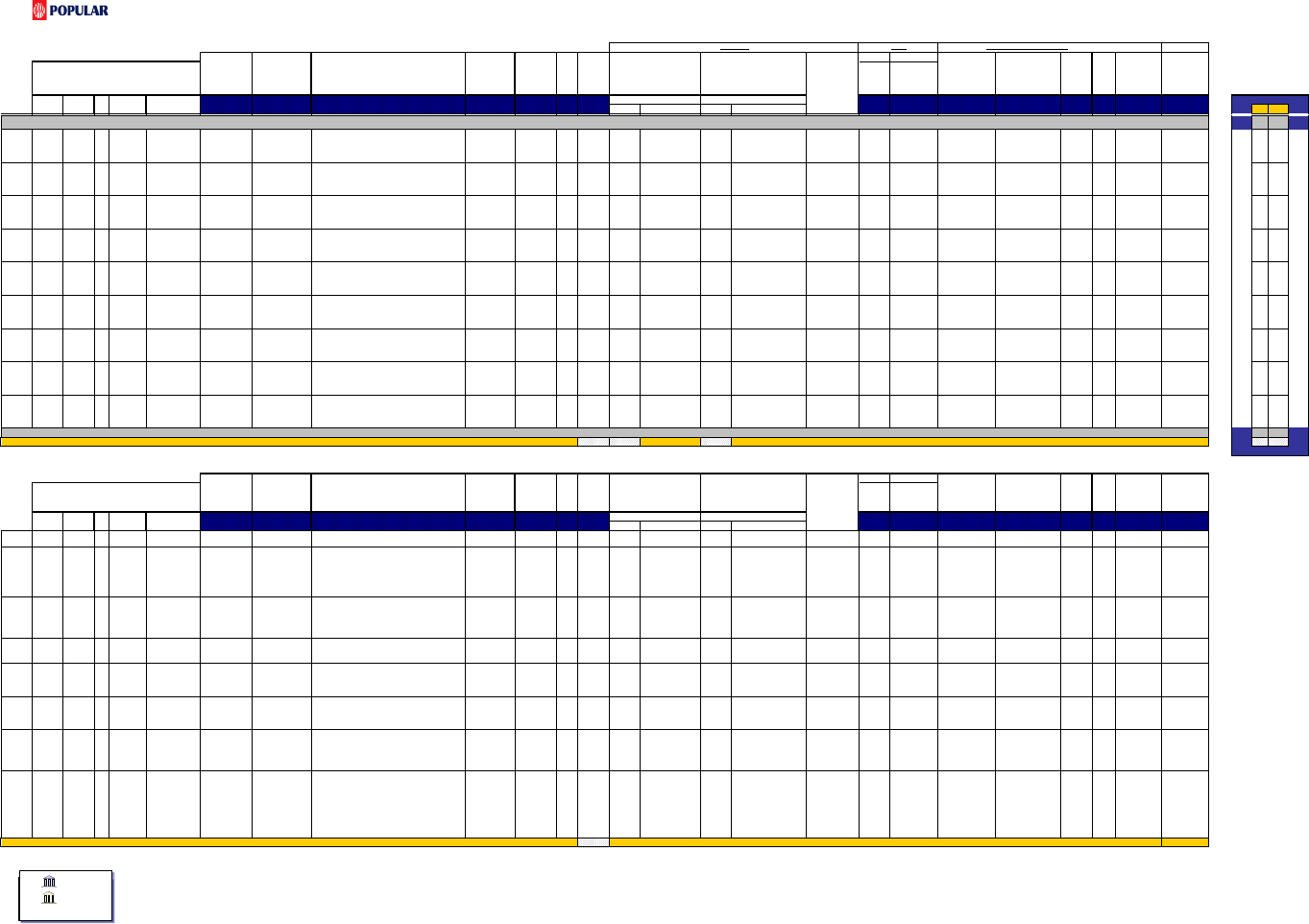

COMMUNITY DEVELOPMENT LOAN SUMMARY

July 1, 2019 - March 31, 2022

Assessment

Area

Affordable

Housing

Economic

Development

Community

Service

Revitalization &

Stabilization

Total

# $(000s) # $(000s) # $(000s) # $(000s) # $(000s)

MSA 41980 4 $13,301 31 $141,419 225 $261,922 121 $421,035 381 $837,677

MSA 10380 1 $714 3 $4,601 24 $3,425 7 $18,536 35 $27,276

8

Pursuant to CA 21-5: CRA Considerations for Activities in Response to the Coronavirus - FAQs, PPP in amounts

greater than $1 million submitted by the bank were reviewed and qualified for consideration as community

development loans if they also had a primary purpose of community development as defined under the CRA.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

13

MSA 38660 0 $0 3 $1,265 27 $16,849 9 $14,832 39 $32,946

MSA 11640 0 $0 2 $1,427 10 $1,754 3 $4,494 15 $7,676

MSA 25020 0 $0 1 $20,929 1 $4,000 2 $4,586 4 $29,515

MSA 32420 4 $1,453 5 $15,795 13 $5,581 5 $11,312 28 $34,141

MSA 41900 3 $3,831 1 $32 4 $3,174 0 $0 7 $7,038

MSA 49500 0 $0 0 $0 0 $0 0 $0 0 $0

Non-Metro

PR

0 $0 3 $1,564 10 $1,239 0 $0 12 $2,803

Puerto Rico

12

$19,299

49

$187,032

314

$297,944

147

$474,795

522

$979,072

USVI

0

$0

0

$0

3

$2,670

10

$76,057

13

$78,725

Total CD

Loans

12 $19,299 49 $187,032 317 $300,614 157 $550,852 535 $1,057,797

% of Total 2.2% 1.8% 9.2% 17.7% 59.3% 28.4% 29.3% 52.1% 100.0% 100.0%

Innovative and/or Flexible Lending Practices

BPPR made use of innovative and/or flexible lending practices in serving assessment area credit needs. A

number of BPPR’s products, while not new, were responsive to community needs in the bank’s assessment

areas. These included:

• Small Business Administration (“SBA”) lender programs were offered, including the Certified

Lenders Program (“CLP”), and Preferred Lenders Program (“PLP”). BPPR offered loans through

the SBA 504 program.

• Pronto Popular offers the First Home Club (“FHC”) grant program in conjunction with the Federal

Home Loan Bank of New York (“FHLBNY”). The program is a non-competitive set-aside

program which assists first-time homebuyers with incomes at or below 80% of Area Median

Income (“AMI”). Assistance is provided in the form of matching funds based on the household’s

systematic savings within a dedicated savings account. Based on a 4:1 match of household’s

savings, the maximum grant is $7,500. The matching funds may be used toward the down payment

and/or closing costs for the purchase of a home. Additionally, FHC provided up to $500 towards

the defrayment of non-profit housing agency counseling costs which is added to the grant resulting

in the potential maximum assistance of $8,000.

• Homebuyer Dream Program (“HDP”) is a homeownership set-aside program established by the

FHLBNY and offered by BPPR. The HDP provides funds in the form of a grant to be used towards

down payment and closing cost assistance to first-time homebuyers earning at or below 80% of the

AMI and purchasing homes in New York, New Jersey, Puerto Rico or the U.S. Virgin Islands. The

HDP offered grants up to $10,000 and granted up to $9,500 towards down payment and closing

cost assistance to eligible first-time homebuyers. Additionally, the HDP offered up to $500 towards

the defrayment of homeownership counseling costs which is added to the grant.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

14

• HOME Investment Partnerships Program provides annually awarded grants through the Puerto

Rico Housing Authority and HUD to participating jurisdictions for a wide range of activities to

create affordable housing for low-income households.

• Homebuyer Assistance Program (“HAP”) that utilized Community Development Block Grant

Disaster Recovery (“CDBG-DR”) funds to provide direct assistance to homebuyers to facilitate

and expand homeownership. CDBG-DR funds subsidize interest rates and mortgage principal

amounts, pay up to 100 percent (100%) of the down payment required by the mortgage for, or

reasonable closing costs associated with, the purchase on behalf of the purchaser.

• BPPR offered two disaster recovery grant programs through the FHLBNY: Homeowner Recovery

Grant Program and the Small Business Recovery Grant program. These programs assisted

homeowners and small businesses in Puerto Rico and the U.S. Virgin Islands that sustained damage

as a direct result of Hurricanes Irma and Maria in September 2017, the earthquake in 2020, and

Hurricane Ida in 2021. BPPR served as an intermediary and was responsible for identifying

potential beneficiaries and for collecting, verifying, and retaining eligibility documentation.

• StartUp Popular provided financing, coaching, and networking for business with proven ideas that

have been operating for less than two years. Financing was provided through loans structured to

meet the needs and profiles of start-up clients, such as lower interest rates and payments during

initial repayment. In addition, loans provided up to a full year of lower payments to invest the

provided funds and build a cash flow. Other benefits included commercial service fee discounts

such as: free online banking for 12 months, free commercial checking for 12 months, direct service

with the StartUp team, and free marketing through the StartUp initiative campaign.

• The JumpStart program, an initiative for commercial customers affected by the earthquakes in

municipalities declared an emergency by the Federal Emergency Management Agency (“FEMA”),

consisted of allocating funds for any need that arose in the wake of the earthquakes. In addition,

the program provided an accelerated evaluation process and more attractive financing terms than a

regular loan.

• BPPR participated in HUD’s Neighborhood Stabilization Program (“NSP”) which provided

emergency assistance to state and local governments to acquire and redevelop foreclosed properties

that might otherwise become sources of abandonment and blight within their communities. The

NSP provided grants to states, certain local communities, and other organizations to purchase

foreclosed or abandoned homes and to rehabilitate, resell, or redevelop these homes in order to

stabilize neighborhoods and stem the decline of house values of neighboring homes. Additionally,

very low, low to moderate- and median-income families received a discount of appraisal value to

use toward down payment for the purchase of the rehabilitated property.

• Other innovative and/or flexible lending programs included:

o Section 8 to Homeownership – housing Choice Voucher Program;

o Veterans Administration Loans;

o Special loan modifications;

o SBA PPP loans; and

o COVID-19 payment relief program that offered a 90-day forbearance on retail loans.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

15

INVESTMENT TEST

BPPR’s performance relative to the investment test is rated High Satisfactory based on a significant level

of qualified CD investments and grants, particularly those not routinely provided by private investors,

occasionally in a leadership position. Overall, the bank made significant use of innovative and/or complex

investments to support CD initiatives based on significant use in Puerto Rico and occasional use in the

USVI. The bank exhibited adequate responsiveness to credit and CD needs in its assessment areas.

During the current evaluation period, the bank made 490 qualified CD investments totaling $200.5 million,

of which, 446 totaling $13 million were CD grants and 44 totaling $187.5 million were investments. Of

the 44 investments, 17, or 38.6%, were prior period investments with a book value of $70.1 million as of

March 31, 2022.

Over the 33-month evaluation period, the bank’s annualized total qualified investments, including

investments and grants, equaled 178 by number and $72.9 million by dollar. Annualized separately, the

bank’s CD investments totaled 16 by number and $68.2 million by dollar, while the bank’s grants totaled

162 by number and $4.7 million by dollar. When comparing BPPR’s annualized CD investment activity

to levels exhibited during the prior exam period, the bank’s total qualified CD investments, including grants,

increased 70.3% by dollar. More specifically, when compared to the prior exam levels, the bank’s

annualized CD investments alone increased 106% by number and 77.1% by dollar, while the bank’s

annualized CD grants decreased 65.2% by number but increased 10.1% by dollar. The bank’s increase in

annualized CD investments was noteworthy and supported a performance rating upgrade in the investment

test from the last exam, in which the bank’s investment test performance was rated a low satisfactory.

When compared to two peer banks and its own performance during the last exam period, BPPR ranked

second when comparing annualized CD investments loans to total deposits, ranked second when comparing

annualized CD investments as a percentage of Tier 1 capital, and ranked second relative to annualized CD

investments as a percentage of average assets.

Overall, the bank made significant use of innovative and complex investments to support CD initiatives,

driven by significant use in Puerto Rico and occasional use in the USVI. Out of 44 investments, two,

totaling $8.5 million, were considered complex and three, totaling $109 million, were considered

innovative.

One complex investment was made in Popular Community Capital (“PCC”).

• Established by BPPR in 2016, PCC’s focus was on job creation and support services targeted to

LMI individuals and communities. PCC accomplished this by providing capital to small businesses

located in LMI census tracts, and to businesses of all sizes serving LMI individuals. PCC qualified

for a New Markets Tax Credits (“NMTC”) allocation; a complex structure aimed at serving low-

income communities.

BPPR’s innovative investments also included investments in the Popular Mezzanine Fund and the Impact

Fund.

• In 2017, BPPR established the Popular Mezzanine Fund, an innovative way to invest in the Puerto

Rico amid the shift in available government investment vehicles. This fund was aimed exclusively

at meeting the credit needs of Puerto Rican communities, including those that were LMI, as public

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

16

welfare investments. Economic development and job creation were core objectives, as was

providing capital to those unable to obtain traditional financing.

• The Impact Fund, an investment product established by the bank, invested in companies that

fostered innovation in the financial services sector or sought to address challenges faced by the

communities in which the bank does business, such as access to financial services, community

development, and environmental sustainability. BPPR made an initial investment of $9 million to

the Impact Fund.

BPPR exhibited adequate responsiveness to credit and community development needs. The bank invested

and donated across Puerto Rico and the USVI, supporting small businesses and LMI individuals through

the creation and retention of jobs, community service, and worked to rebuild PR and the USVI after natural

disasters and the COVID-19 pandemic.

As for CD investments in affordable housing, a significant need in LMI communities across PR and the

USVI, 36 of the bank’s 37 investments with a primary purpose of affordable housing were mortgage-backed

securities, which is considered less complex.

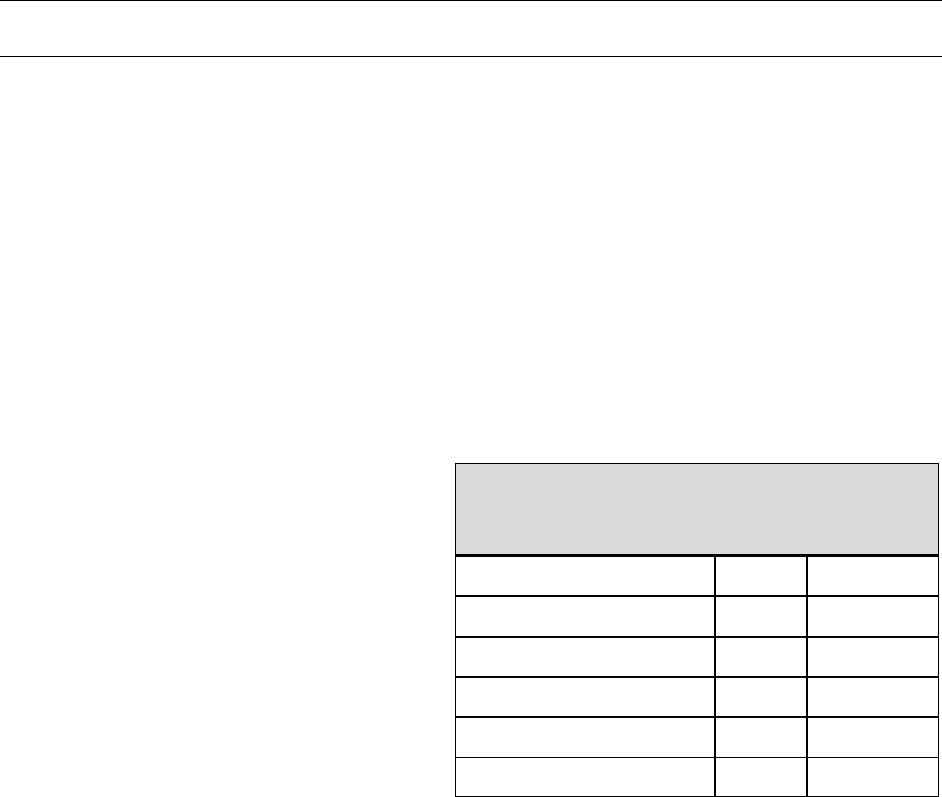

BPPR’s investment activity is illustrated in the Qualified Investments and Grants Summary table. BPPR’s

investments impacted many areas of Puerto Rico and were not targeted to one county, MSA, or non-

metropolitan area. Because the bank did not exclude any areas in Puerto Rico from its assessment areas,

investments that did not have geographic specifications or exclusions are attributed to benefitting all of

Puerto Rico in the analysis and are represented under “All PR” in the subsequent table.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

17

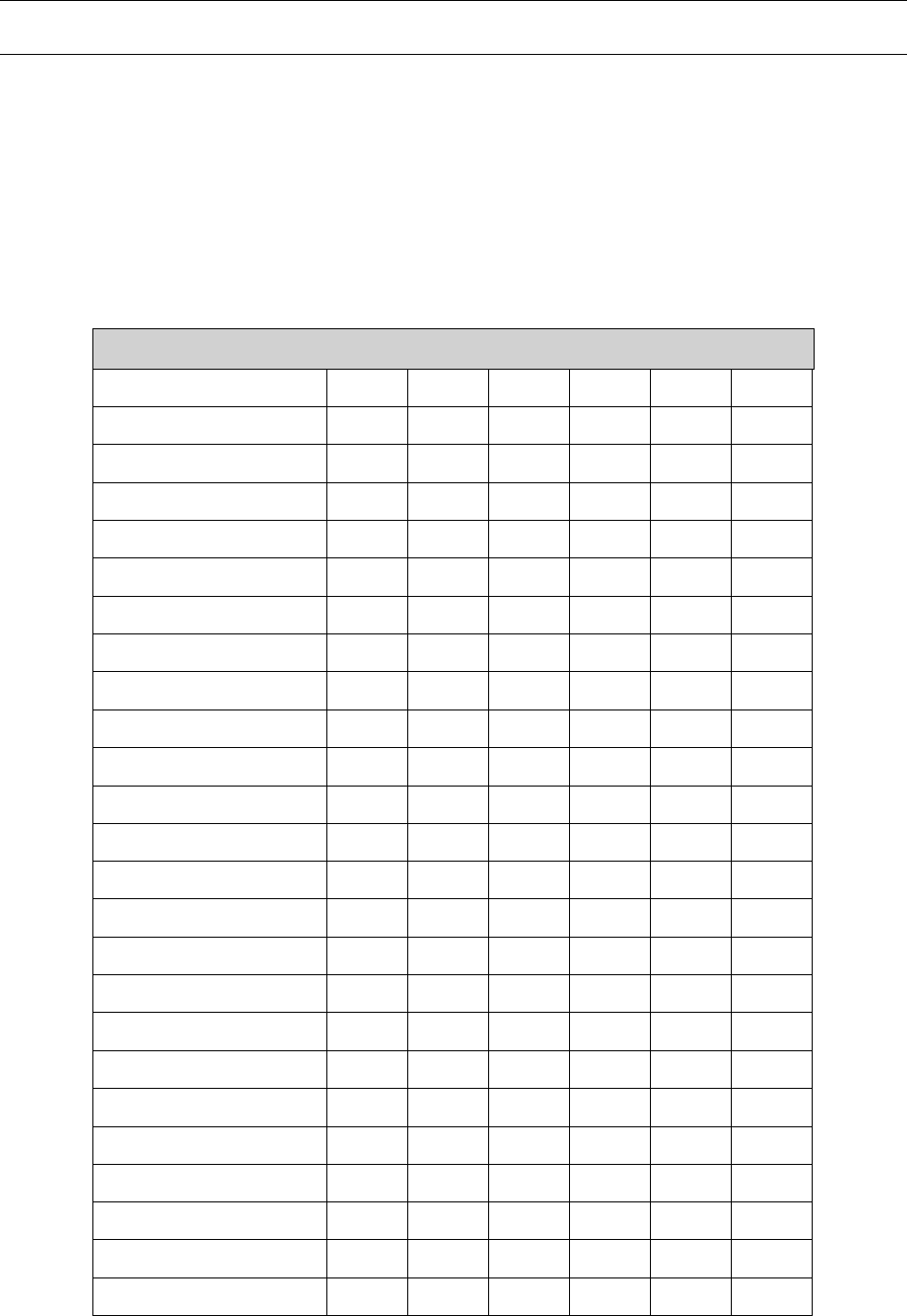

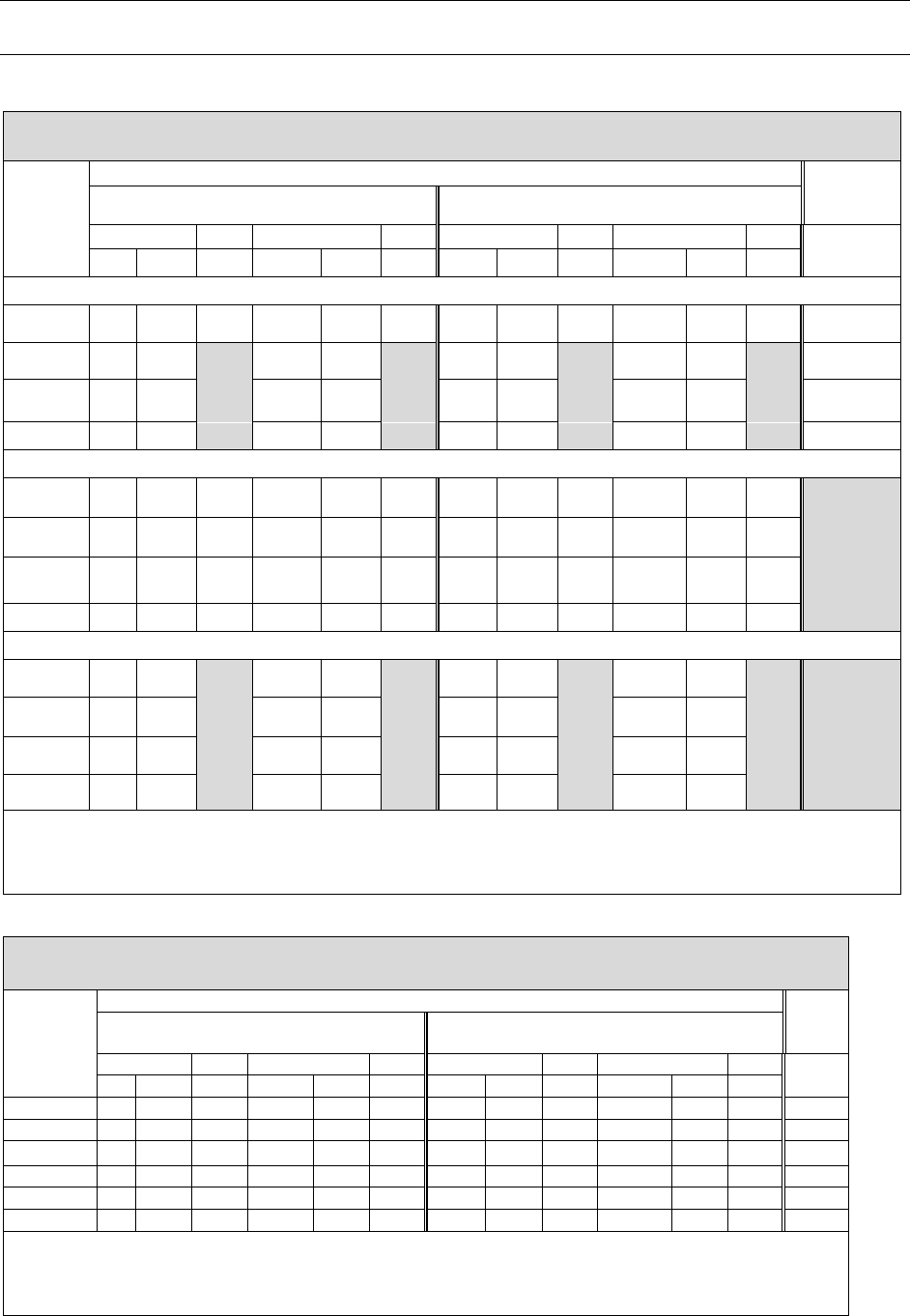

COMMUNITY DEVELOPMENT INVESTMENT SUMMARY

July 1, 2019 - March 31, 2022

Assessment

Area

Affordable

Housing

Economic

Development

Community

Service

Revitalization &

Stabilization

Total

# $(000s) # $(000s) # $(000s) # $(000s) # $(000s)

MSA 41980 0 $0 28 $5,934 263 $6,591 15 $745 306 $13,270

MSA 10380 0 $0 0 $0 8 $169 1 $25 9 $194

MSA 38660 0 $0 1 $53 16 $422 1 $55 18 $530

MSA 11640 0 $0 0 $0 5 $70 0 $0 5 $70

MSA 25020 0 $0 0 $0 0 $0 0 $0 0 $0

MSA 32420 0 $0 1 $160 10 $106 0 $0 11 $266

MSA 41900 0 $0 0 $0 1 $25 0 $0 1 $25

MSA 49500 0 $0 0 $0 0 $0 0 $0 0 $0

Non-Metro PR 0 $0 0 $0 5 $81 1 $28 6 $109

All PR 25 $90,304 13 $92,515 43 $1,395 3 $495 84 $184,709

Puerto Rico

25

$90,304

43

$98,662

351

$8,859

21

$1,348

440

$199,173

USVI

12

$1,039

0

$0

37

$243

1

$40

50

$1,322

Total CD

Investments

37 $91,343 43 $98,662 388 $9,102 22 $1,388 490 $200,495

% of Total 7.6% 44.2% 8.8% 50.7% 79.2% 4.4% 4.5% 0.7% 100.0% 100.0%

SERVICE TEST

BPPR’s overall rating on the service test is High Satisfactory based primarily on ratings for the full scope

assessment areas.

Delivery systems were readily accessible to the bank's geographies and individuals of

different income levels in its AA. The bank's record of opening and closing of branches did not adversely

affect the accessibility of its delivery systems, particularly to low- and moderate-income (LMI) geographies

and/or LMI individuals. Services were tailored to convenience and needs of its AA, particularly LMI

geographies and/or LMI individuals. The bank provided a relatively high level of CD services.

Retail Services

BPPR’s branches were readily accessible to all geographies of its assessment areas. The bank operated 167

branches, of which one was a limited purpose-branch. Of the bank’s total branches, 49, or 29.3%, were in

LMI areas, compared to 26.7% of the assessment areas’ population residing in LMI areas. Additionally,

seven, or 4.2%, of the branches were in distressed or underserved non-metropolitan middle-income

geographies.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

18

Alternative delivery systems somewhat enhanced BPPR’s performance in its assessment areas. BPPR

operated a total of 635 ATMs throughout its assessment areas, of which 341 ATMs were located on-site at

BPPR’s branches. Of the 294 ATMs located off-site, 10, or 3.4%, were located in low-income geographies

and 46, or 15.6%, were in moderate-income geographies. BPPR’s ATMS were equipped with a new feature

called Easy Payment which allowed customers to make payments to the businesses registered in their profile

and to all Popular brand businesses: Popular Mortgage, Popular Auto, credit cards, personal loans, and

reserve lines. Easy Payment could also be used to pay bills to the Aqueduct and Sewer Authority (PRASA),

Liberty, DirecTV, Claro, and Open Mobile. BPPR offered other alternative delivery systems such as bank-

by-mail, internet banking, mobile banking, Mi Banco Alerts, ATH Móvil, and Easy Deposits service. In

addition, BPPR provided 24/7/365 customer service.

BPPR’s record of opening and closing branches did not adversely affect the overall accessibility of its

delivery systems to low- and moderate-income geographies and individuals. During the evaluation period,

BPPR opened one branch in a low-income census tract and relocated two branches, of which one was in a

moderate-income census tract. Additionally, BPPR consolidated five branches into existing branches, none

of which were in LMI census tracts.

Saturday, Sunday, and holiday hours were widely scheduled and tailored to meet the convenience and needs

of the assessment areas, particularly LMI geographies and individuals. Of the 49 branches in LMI areas,

27, or 55.1%, had Saturday, Sunday or holiday hours.

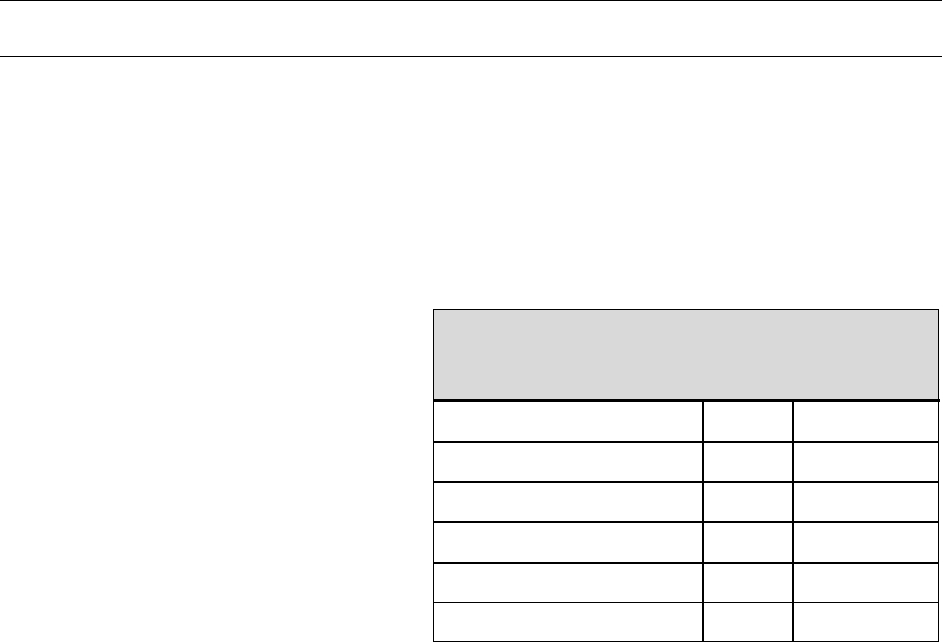

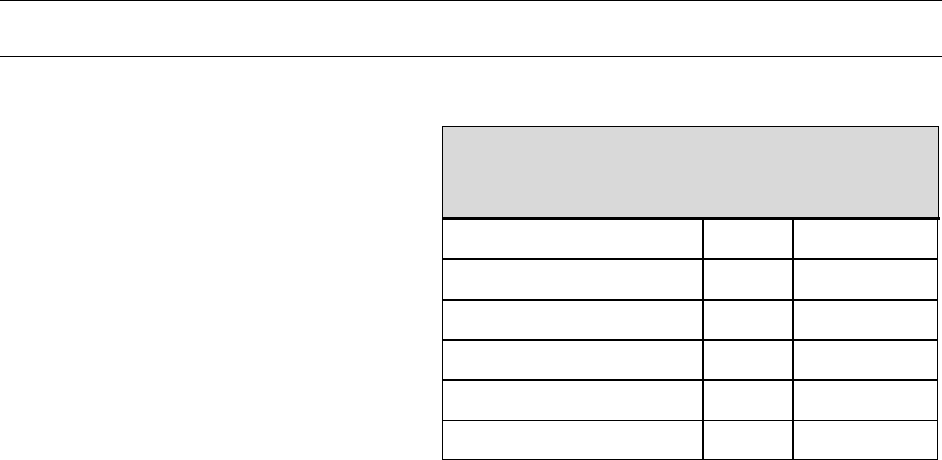

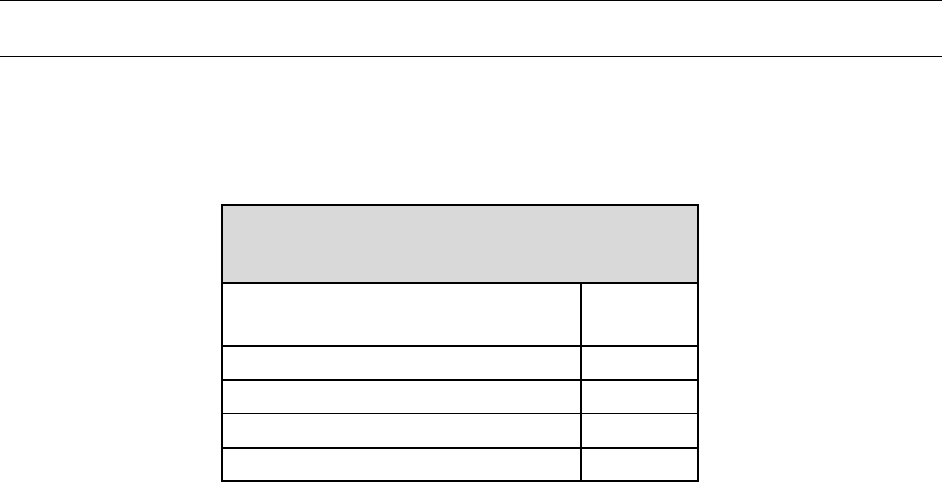

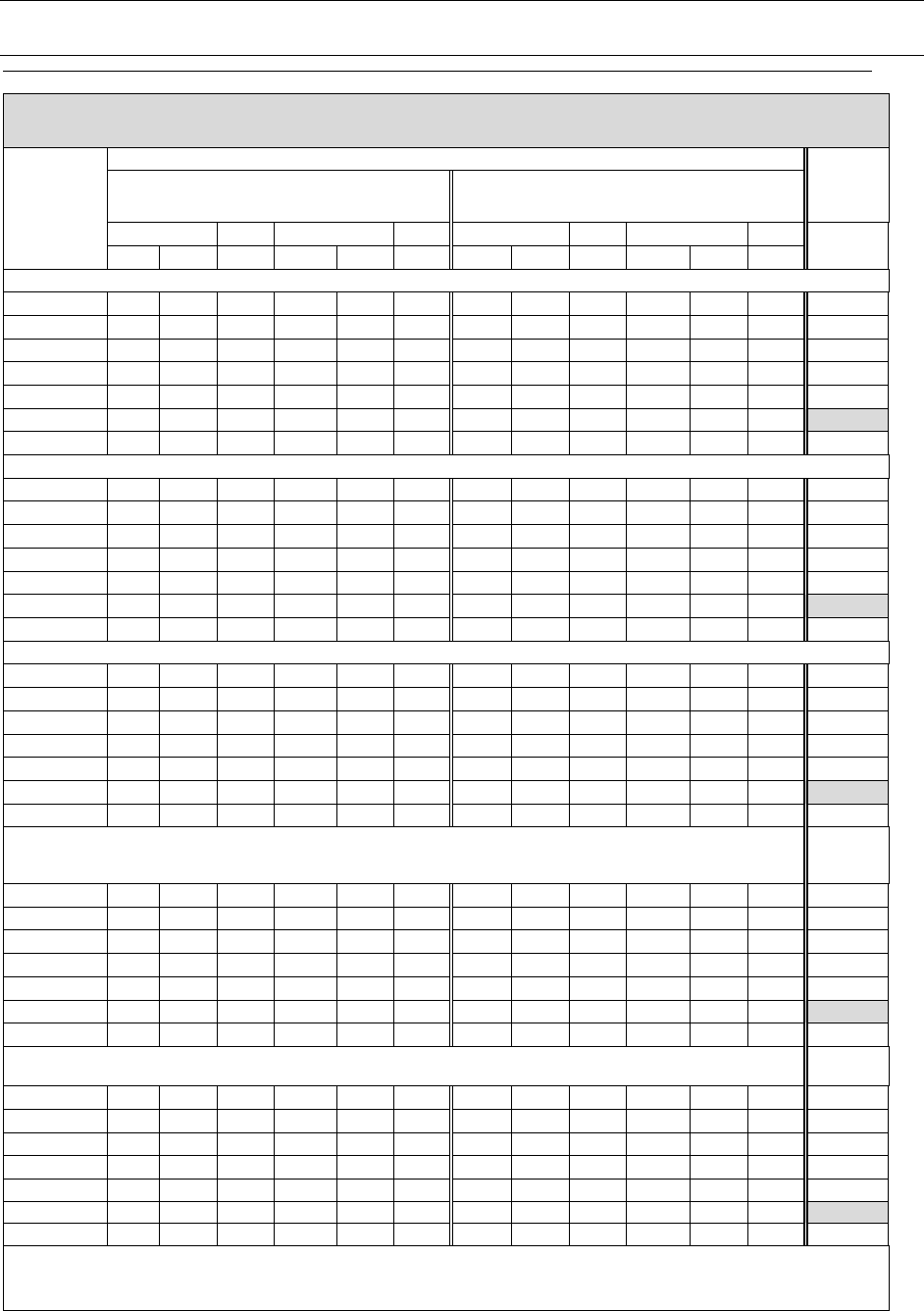

BRANCH LOCATION BY INCOME TRACT

As of December 31, 2021

Tract

Income

Category

Branches ATMs

# % # %

Low 15 9.0% 40 6.3%

Moderate 34 20.4% 107 16.9%

LMI Combined 49 29.3% 147 23.2%

Middle 58 34.7% 209 32.9%

Upper 57 34.1% 261 41.1%

Unknown 3 1.8% 18 2.8%

Total 167 100.0% 635 100.0%

Community Development Services

BPPR provided a relatively high level of CD services in its assessment areas. BPPR conducted 2,599

qualified community service events, representing an overall decrease of 6.0% in annualized community

development services since the previous CRA examination. The bank’s qualified community development

services consisted of a wide variety of events related to the financial education of children and adults, first-

time homebuyers, economic development, and technical assistance.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

19

The Community Development Services table below illustrates the type and number of community

development services provided. The bank’s community development events included participation in a

significant number of financial education seminars targeted to LMI individuals and technical assistance

provided to community organizations and small businesses.

COMMUNITY DEVELOPMENT SERVICES SUMMARY

July 1, 2019 - March 31, 2022

Activity Type

CD Activity

Number

Board & Committee Memberships 172

Technical Assistance 1,023

Seminars and Other Services 1,404

Total 2,599

FAIR LENDING OR OTHER ILLEGAL CREDIT PRACTICES REVIEW

BPPR was in compliance with the substantive provisions of the anti-discrimination laws and regulations.

No evidence of discriminatory of other illegal credit practices was identified as being inconsistent with

helping to meet the credit needs of the assessment area. The Dodd-Frank Wall Street Reform and Consumer

Protection Act of 2010 (Dodd-Frank Act) established the Consumer Financial Protection Bureau (CFPB).

In general, the Dodd-Frank Act gives the CFPB, among other things, primary evaluation and enforcement

authority over insured depository institutions with total assets of more than $10 billion when assessing

compliance with the requirements of Federal consumer financial laws, including BPPR. The Federal

Reserve, however, retains authority to enforce compliance with the CRA and certain other consumer

compliance laws and regulations. During the review period of this evaluation, January 1, 2019 through

December 31, 2020, the Federal Reserve did not cite violations involving discriminatory or other illegal

credit practices that adversely affected the Federal Reserve's evaluation of the bank's CRA performance.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

20

COMMONWEALTH OF PUERTO RICO

CRA RATING FOR PUERTO RICO: SATISFACTORY

The Lending Test is rated: High Satisfactory

The Investment Test is rated: High Satisfactory

The Service Test is rated: High Satisfactory

The major factors supporting the rating include:

Lending Test

• Lending levels reflected good responsiveness to assessment area credit needs.

• The geographic distribution of loans reflected adequate penetration throughout the AA.

• The distribution of borrowers reflected, given the product lines offered, adequate penetration

among customers of different income levels and businesses of different sizes.

• Exhibited an adequate record of serving the credit needs of low-income individuals and areas and

very small businesses.

• Made a relatively high level of community development loans.

• Made use of innovative and/or flexible lending practices in serving assessment area credit needs.

Investment Test

• Made a significant level of qualified community development investments and grants, particularly

those not routinely provided by private investors, occasionally in a leadership position.

• Made significant use of innovative and/or complex investments to support community development

initiatives.

• Exhibited adequate responsiveness to credit and community development needs.

Service Test

• Delivery systems were readily accessible to the bank's geographies and individuals of different

income levels in its assessment area.

• Record of opening and closing of branches did not adversely affect the accessibility of its delivery

systems, particularly to LMI geographies and/or LMI individuals.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

21

• Services were tailored to convenience and needs of its assessment area, particularly LMI

geographies and/or LMI individuals.

• Provided a relatively high level of community development services.

SCOPE OF EXAMINATION

Examiner evaluation of BPPR’s activities in the Commonwealth of Puerto Rico consisted of full-

scope reviews of MSA 41980 (San Juan-Bayamón-Caguas, PR), MSA 10380 (Aguadilla-Isabela,

PR), and MSA 38660 (Ponce, PR). Additionally, limited scope assessment areas in Puerto Rico

were conducted for MSA 11640 (Arecibo, PR), MSA 25020 (Guayama, PR), MSA 32420

(Mayagüez, PR), MSA 41900 (San Germán, PR), MSA 49500 (Yauco, PR), and Non-Metropolitan

Puerto Rico, which did not contribute to the overall rating. BPPR's performance in the Puerto

Rico’s combined full scope review areas made up 83.0% of the bank's loan volume, 76.0% of the

bank’s branches, and 90.6% of the bank’s deposits in Puerto Rico and accounted for 97.5% of its

total retail deposits and 98.9% of total HMDA-reportable and small business lending activity.

In order to derive the rating for Puerto Rico, full-scope assessment areas were weighted based on

the proportion of loan originations and deposits in each. As a result, MSA 41980 (San Juan-

Bayamón-Caguas, PR) had a significant impact on assessing the overall performance of the bank,

capturing 87.9% of the branch deposits and 70.5% of total loans within Puerto Rico.

DESCRIPTION OF INSTITUTION'S OPERATIONS

As of December 31, 2021, BPPR operated the largest branch network in Puerto Rico with and 294 off-site

ATMs. Based on deposits reported to the Federal Deposit Insurance Corporation (“FDIC”) as of June 30,

2021, BPPR’s branch deposits represented 51.9% of all bank deposits in the Commonwealth of Puerto

Rico. BPPR’s primary bank competitors in Puerto Rico for assessment area deposits included Citibank,

N.A., with 26.5% of deposit market share; FirstBank, which captured 13.3% of deposit market share; and

Oriental Bank, with 8.2% of deposit market share.

CONCLUSIONS WITH RESPECT TO PERFORMANCE TESTS

Conclusions regarding BPPR’s performance in the Commonwealth of Puerto Rico with respect to the

lending, investment, and service tests are based on performance in

MSA 41980 (San Juan-Bayamón-

Caguas, PR), MSA 10380 (Aguadilla-Isabela, PR), and MSA 38660 (Ponce, PR). BPPR’s

performance under the lending, investment and service tests are rated High Satisfactory. Specific comments

regarding the lending, investment, and service tests are discussed below.

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

22

METROPOLITAN AREA

MSA 41980 (SAN JUAN-BAYAMÓN-CAGUAS, PR)

(FULL REVIEW)

DESCRIPTION OF INSTITUTION'S OPERATIONS

As of December 31, 2021, the bank operated 106 branches in the MSA 41980 (San Juan-Bayamón-Caguas,

PR), of which 32 were in low- and moderate-income tracts. The assessment area is comprised of 30 low-,

160 moderate-, 215 middle -, and 154 upper-income tracts, as well as 39 unknown income tracts.

BPPR was the leader in deposit market share in MSA 41980 (San Juan-Bayamón-Caguas, PR), according

to the June 30, 2021 FDIC Summary of Deposit Report. The bank ranked first out of five financial

institutions in the assessment area with $48.5 billion in deposits, representing approximately 50.5% of

deposit market share and 87.2% of all BPPR’s deposits in Puerto Rico. MSA 41980 had the largest share

of the bank’s loans during the exam period with approximately 70.5% of BPPR’s lending volume in the

assessment area. The primary competitors in the area included Citibank, NA, FirstBank, and Oriental Bank.

PERFORMANCE CONTEXT

The following demographic and economic information were obtained from publicly available sources that

included the 2015 ACS, U.S. Department of Labor ("DOL"), D&B, FFIEC, and U.S. Department of

Housing and Urban Development ("HUD").

Demographic Characteristics

The MSA 41980 assessment area included Aguas Buenas, Aibonito, Barceloneta, Barranquitas, Bayamón,

Caguas, Canóvanas, Carolina, Cataño, Cayey, Ceiba, Ciales, Cidra, Comerío, Corozal, Dorado, Fajardo,

Florida, Guaynabo, Gurabo, Humacao, Juncos, Las Piedras, Loíza, Luquillo, Manatí, Maunabo, Morovis,

Naguabo, Naranjito, Orocovis, Río Grande, San Juan, San Lorenzo, Toa Alta, Toa Baja, Trujillo Alto, Vega

Alta, Vega Baja, and Yabucoa counties. The assessment area was comprised of the entire MSA. According

to the 2015 ACS, the population of the assessment area was 2,263,582. The assessment area consisted of

598 census tracts, of which 30 or 5.0% were low-income, 160 or 26.8% were moderate-income, 215 or

36.0% were middle-income, 154 or 25.8% were upper-income, and 39 or 6.5% were of unknown-income.

Income Characteristics

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

23

Based on the 2015 ACS data, the MSA 41980 assessment area had 558,600 families, of which 26.5% were

low-income (37.8% of which were below the poverty level), 15.0% were moderate-income, 15.7% were

middle-income, and 42.8% were upper income.

The FFIEC median family incomes for the counties that comprised the MSA as of the 2015 ACS were as

follows:

MSA 41980 (San Juan-Bayamón-Caguas, PR) - Median Family Income

Area

2010 Median

Family Income

2015 Median

Family Income

Percent

Change

MSA 41980 AA

$27,017

$25,617

-5.18%

Aguas Buenas Municipio, PR

$19,044

$18,123

-4.83%

Aibonito Municipio, PR

$20,679

$20,897

1.05%

Barceloneta Municipio, PR

$20,020

$17,260

-13.79%

Barranquitas Municipio, PR

$17,184

$15,274

-11.11%

Bayamón Municipio, PR

$32,071

$28,660

-10.63%

Caguas Municipio, PR

$28,834

$27,775

-3.67%

Canóvanas Municipio, PR

$26,268

$23,990

-8.67%

Carolina Municipio, PR

$33,906

$31,903

-5.91%

Cataño Municipio, PR

$23,816

$23,240

-2.42%

Cayey Municipio, PR

$24,142

$23,815

-1.35%

Ceiba Municipio, PR

$24,793

$23,504

-5.20%

Ciales Municipio, PR

$16,636

$16,419

-1.30%

Cidra Municipio, PR

$26,145

$25,033

-4.25%

Comerío Municipio, PR

$16,115

$14,889

-7.61%

Corozal Municipio, PR

$18,145

$17,669

-2.62%

Dorado Municipio, PR

$33,304

$32,144

-3.48%

Fajardo Municipio, PR

$24,060

$23,454

-2.52%

Florida Municipio, PR

$19,367

$18,837

-2.74%

Guaynabo Municipio, PR

$41,411

$42,763

3.27%

Gurabo Municipio, PR

$32,867

$34,612

5.31%

Humacao Municipio, PR

$23,497

$22,165

-5.67%

Juncos Municipio, PR

$22,086

$21,489

-2.70%

Las Piedras Municipio, PR

$22,793

$22,485

-1.35%

Loíza Municipio, PR

$24,418

$20,781

-14.89%

Luquillo Municipio, PR

$24,900

$22,476

-9.73%

Banco Popular de Puerto Rico CRA Public Evaluation

San Juan, PR June 21, 2022

24

Manatí Municipio, PR

$21,516

$23,289

8.24%

Maunabo Municipio, PR

$19,240

$21,563

12.08%

Morovis Municipio, PR

$16,085

$18,809

16.94%

Naguabo Municipio, PR

$19,720

$21,008

6.53%

Naranjito Municipio, PR

$18,046

$21,185

17.39%

Orocovis Municipio, PR

$15,707

$15,778

0.45%

Río Grande Municipio, PR

$26,309

$25,671

-2.43%

San Juan Municipio, PR

$30,598

$26,498

-13.40%

San Lorenzo Municipio, PR

$21,947

$20,300

-7.50%

Toa Alta Municipio, PR

$28,502

$33,043