2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-1

VOLUME 4, CHAPTER 24: “REAL PROPERTY”

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an (*) symbol preceding the section, paragraph,

table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated June 2019 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

Policy Memo

The Deputy Chief Financial Officer policy memorandum,

“Real Property Financial Reporting Responsibilities Policy

Update (FPM #19-05),” dated March 15, 2019, was

incorporated into the chapter and cancelled.

Cancellation

2.4

(240204)

Revised the accountability and financial reporting

requirements for real property assets based on

implementation of the Federal Accounting Standards

Advisory Board Technical Bulletin 2017-2, “Assigning

Assets to Component Reporting Entities.”

Revision

2.5.6.

(240205.F)

Revised the accounting and financial reporting

requirements for capital improvements.

Revision

3.5.2.

(240305.B)

Added requirement that the management representation

letter and the notes to the financial statements must include

a disclosure related to the Department of Defense real

property reporting policy.

Addition

Annex 5

Added illustrative examples, journal entries, and note

disclosures relating to financial reporting responsibilities

for real property.

Addition

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-2

Table of Contents

VOLUME 4, CHAPTER 24: “REAL PROPERTY” ..................................................................... 1

1.0 GENERAL (2401) ............................................................................................................. 3

1.1 Overview (240101) .............................................................................................. 3

1.2 Purpose (240102) ................................................................................................. 4

1.3 Authoritative Guidance (240103)......................................................................... 4

2.0 ACCOUNTING FOR REAL PROPERTY (2402) ........................................................... 6

2.1 Definitions (240201) ............................................................................................ 6

2.2 Relevant USSGL Accounts (240202) .................................................................. 8

2.3 Valuation of Acquisitions and Transfers (240203) .............................................. 9

*2.4 Recognition (240204) ......................................................................................... 13

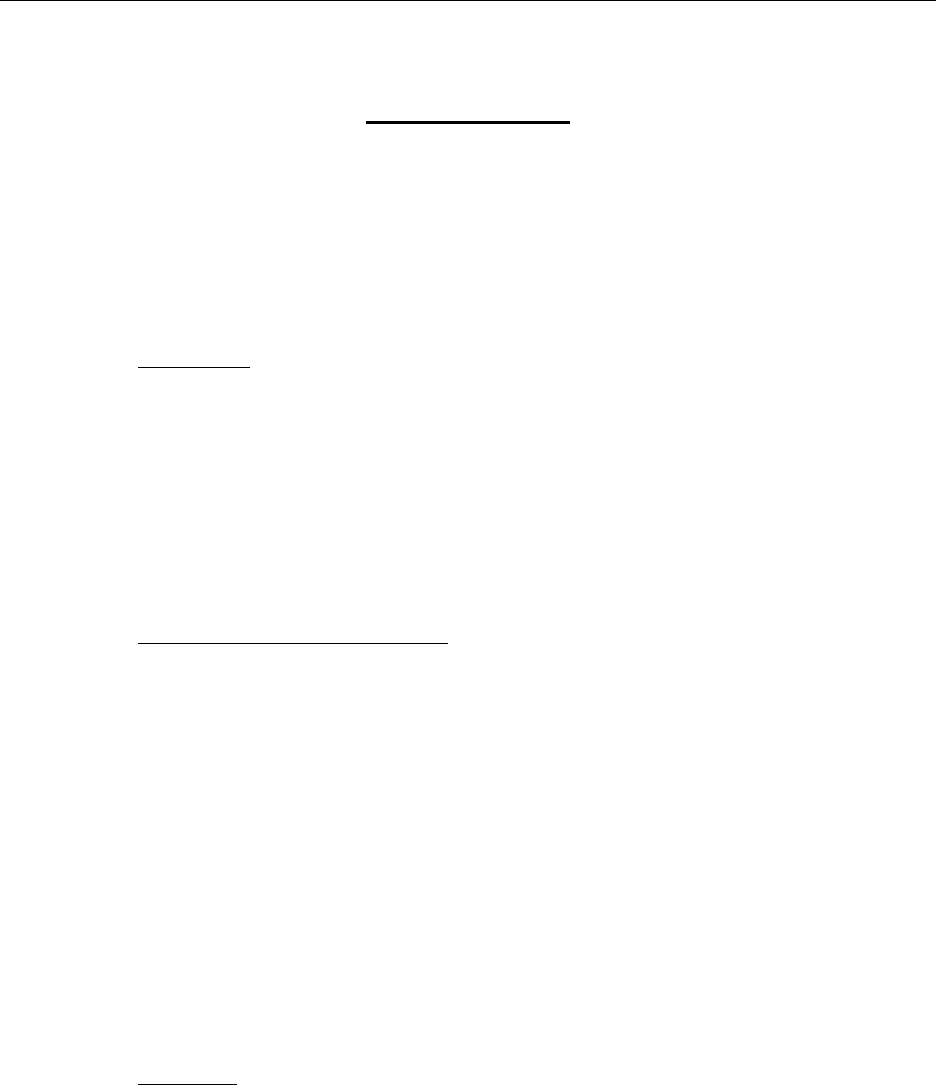

Figure 24-1. Relationships among a Construction Project, RPUID, and CIP Account ........ 19

2.5 Capital Improvements (240205) ......................................................................... 22

2.6 Depreciation (240206) ........................................................................................ 23

Table 24-1. DoD Useful Lives for Depreciable Real Property Assets .................................. 24

2.7 Impairment (240207) .......................................................................................... 25

2.8 Removal/Disposal (240208) ............................................................................... 28

3.0 ADDITIONAL CONSIDERATIONS (2403) ................................................................. 29

3.1 Use of Cancelled Treasury Account Symbol (240301) ..................................... 29

3.2 Supporting Documentation (240302) ................................................................. 30

Table 24-2. Examples of Supporting Documentation for Real Property Acquisition .......... 31

3.3 Physical Inventories of Real Property (240303) ................................................ 33

3.4 DM&R (240304) ................................................................................................ 33

3.5 Financial Statement Disclosure Reporting and Representation Requirements

(240305) ………………………………………………………………………………….35

3.6 Environmental Liabilities/Cleanup Costs (240306) ........................................... 36

Annex 1. Construction-in-Progress Cost Matrix .................................................................. A1-1

Annex 2. Decision Tree for Determining Imputed Costs ..................................................... A2-1

Annex 3. Capital Improvement Depreciation ....................................................................... A3-1

Annex 4. Alternative Valuation Methodology for Establishing Opening Balances for

Buildings, Structures, Linear Structures, Land and Land Rights .......................................... A4-1

*Annex 5. Illustrative Examples, Journal Entries and Note Disclosures Relating to Financial

Reporting Responsibilities for Real Property ........................................................................ A5-1

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-3

CHAPTER 24

REAL PROPERTY

1.0 GENERAL (2401)

1.1 Overview (240101)

This chapter prescribes Department of Defense (DoD) accounting policy for real property,

which is a subset of General Property, Plant, and Equipment (General PP&E).

1.1.1. Description. General PP&E, which includes real property, consists of tangible

assets that:

1.1.1.1. Have an estimated useful life of two years or more;

1.1.1.2. Are not intended for sale in the ordinary course of operations; and

1.1.1.3. Are acquired or constructed with the intention of being used or being

available for use by the entity.

1.1.2. Characteristics of Real Property. Real property items are used in providing goods

or services, or support the mission of the entity, and typically have one or more of these

characteristics:

1.1.2.1. The item could be used for alternative purposes (e.g., by other DoD or

federal programs, state or local governments, or nongovernmental entities), but it is used to

produce goods or services, or to support the mission of the entity;

1.1.2.2. The item is used in business-type activities which are defined as a

significantly self-sustaining activity which finances its continuing cycle of operations through

collection of exchange revenue; and/or

1.1.2.3. The item is used by entities in activities whose costs can be compared to

those of other entities performing similar activities (e.g., federal hospital services in comparison

to commercial hospitals).

1.1.3. Inclusions. Real property also includes:

1.1.3.1. Items acquired through capital leases, including leasehold improvements

(see Chapter 26 for a discussion of accounting for real property acquired through leases);

1.1.3.2. Items under the accountability of the reporting DoD Component even

though it may be in the possession of others (e.g., state and local governments, colleges and

universities, or contractors);

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-4

1.1.3.3. Land, other than Stewardship Land that was specifically acquired for, or

in connection with other General PP&E. See paragraph 240204 for election to expense land under

Federal Accounting Standards Advisory Board (FASAB) Statement of Federal Financial

Accounting Standards (SFFAS) 50.

1.1.3.4. Land rights held by a DoD Component in land owned by others. See

paragraph 240204 for election to expense land rights under FASAB SFFAS 50.

1.1.4. Examples. Real property examples include:

1.1.4.1. Real property including land, land rights, and facilities (includes buildings,

structures, and linear structures) (addressed in this chapter);

1.1.4.2. Construction-in-progress (CIP) (addressed in this chapter);

1.1.4.3. Assets under capital lease (addressed in chapter 26); and

1.1.4.4. Leasehold improvements (addressed in this chapter).

1.1.5. Exclusions. Real property excludes items:

1.1.5.1. In which the DoD has a reversionary interest (for example, the DoD

sometimes retains an interest in real property acquired with grant money in the event that the

recipient no longer uses the real property in the activity for which the grant was originally provided

and the real property reverts to the DoD); and

1.1.5.2. Classified as non-Multi-Use Heritage Assets or Stewardship Land (as

described in Chapter 28).

1.2 Purpose (240102)

This chapter prescribes DoD accounting policy for real property, a subset of General

PP&E. The applicable general ledger accounts are listed in the United States Standard General

Ledger (USSGL) contained in Volume 1, Chapter 7, and the accounting entries for these accounts

are specified in the DoD USSGL Transaction Library. Unless otherwise stated, this chapter is

applicable to all DoD Components, both General Fund and Working Capital Fund (WCF)

activities.

1.3 Authoritative Guidance (240103)

The accounting policy and related requirements prescribed by this chapter are in

accordance with the applicable provisions of:

1.3.1. FASAB Statement of Federal Financial Accounting Concepts (SFFAC) 5,

“Definitions of Elements and Basic Recognition Criteria for Accrual-Basis Financial Statements;”

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-5

1.3.2. FASAB SFFAC 7, “Measurement of the Elements of Accrual-Basis Financial

Statements in Periods After Initial Recording;”

1.3.3. FASAB SFFAS 1, “Accounting for Selected Assets and Liabilities;”

1.3.4. FASAB SFFAS 4, “Managerial Cost Accounting Standards and Concepts;”

1.3.5. FASAB SFFAS 6, “Accounting for Property, Plant, and Equipment;”

1.3.6. FASAB SFFAS 23, “Eliminating the Category National Defense Property, Plant,

and Equipment;”

1.3.7. FASAB SFFAS 29, “Heritage Assets and Stewardship Land;”

1.3.8. FASAB SFFAS 40, “Definitional Changes Related to Deferred Maintenance and

Repairs: Amending Statement of Federal Financial Accounting Standards 6, Accounting for

Property, Plant, and Equipment;”

1.3.9. FASAB SFFAS 42, “Deferred Maintenance and Repairs: Amending Statements of

Federal Financial Accounting Standards 6, 14, 29, and 32;”

1.3.10. FASAB SFFAS 44, “Accounting For Impairment of General Property, Plant, and

Equipment Remaining In Use;”

1.3.11. FASAB SFFAS 50, “Establishing Opening Balances for General Property, Plant

and Equipment: Amending Statement of Federal Financial Accounting Standards (SFFAS) 6,

SFFAS 10, SFFAS 23, and Rescinding SFFAS 35;”

1.3.12. FASAB SFFAS 55, “Amending Inter-entity Cost Provisions;”

1.3.13. FASAB Technical Bulletin (TB) 2017-2, “Assigning Assets to Component

Reporting Entities;”

1.3.14. FASAB Technical Release (TR) 13, “Implementation Guide for Estimating the

Historical Cost of General Property, Plant, and Equipment;”

1.3.15. FASAB TR 14, “Implementation Guidance on the Accounting for the Disposal of

General Property, Plant & Equipment;”

1.3.16. FASAB TR 15, “Implementation Guidance for General Property, Plant, and

Equipment Cost Accumulation, Assignment and Allocation;”

1.3.17. FASAB TR 17, “Conforming Amendments to Technical Releases for SFFAS 50,

Establishing Opening Balances for General Property, Plant, and Equipment;”

1.3.18. FASAB TR 18, “Implementation Guidance for Establishing Opening Balances;”

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-6

1.3.19. FASAB Staff Implementation Guidance 23.1, “Guidance for Implementation of

SFFAS 23, Eliminating the Category National Defense Property, Plant, and Equipment:

Classification of Items Formerly Considered National Defense PP&E;”

1.3.20. FASAB Staff Implementation Guidance 6.1, “Clarification of Paragraphs 40 – 41

of SFFAS 6, Accounting for Property, Plant, and Equipment, as Amended;”

1.3.21. Office of Management and Budget (OMB) Circular No. A-136, “Financial

Reporting Requirements;”

1.3.22. DoD Directive (DoDD) 4165.06, “Real Property;”

1.3.23. DoDD 5110.04, “Washington Headquarters Services (WHS);”

1.3.24. DoD Instruction (DoDI) 1015.15, “Establishment, Management, and

Control of Nonappropriated Fund Instrumentalities and Financial Management of Supporting

Resources;”

1.3.25. DoDI 4000.19, “Support Agreements;”

1.3.26. DoDI 4165.14, “Real Property Inventory (RPI) and Forecasting;”

1.3.27. DoDI 4165.70, “Real Property Management;”

1.3.28. DoDI 4165.71, “Real Property Acquisition;”

1.3.29. DoDI 4165.72, “Real Property Disposal;”

1.3.30. Treasury Financial Manual (TFM) Volume 1, Part 2, Chapter 4700, “Federal

Entity Reporting Requirements for the Financial Report of the United States Government;”

1.3.31. Title 10, United States Code, section 2674 (10 U.S.C. § 2674)

1.3.32. 10 U.S.C. § 2682;

1.3.33. 10 U.S.C. § 2721; and

1.3.34. Title 41, Code of Federal Regulations, part 102-75 (41 CFR 102-75)

2.0 ACCOUNTING FOR REAL PROPERTY (2402)

2.1 Definitions (240201)

2.1.1. Facility. A facility is a building, structure, or linear structure whose footprint

extends to an imaginary line surrounding a facility at a distance of five feet from the foundation

that, barring specific direction to the contrary such as a utility privatization agreement, denotes

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-7

what is included in the basic record for the facility (e.g., landscaping, sidewalks, and utility

connections). This imaginary line is commonly referred to as the “5-foot line.” A facility will

have a Real Property Unique Identifier (RPUID) received from the Data Analytics & Integration

Support platform, which is entered into an Accountable Property System of Record (APSR) as a

unique real property record.

2.1.2. Funding DoD Component. The funding DoD Component is the entity paying to

acquire the real property asset or improvement, regardless of the specific types of funds used (e.g.,

appropriation or working capital funds).

2.1.3. Installation Host. Installation Host is a term used by the DoD to describe the

Military Department (i.e., Department of the Army, Department of the Navy which includes the

U.S. Marine Corps, or Department of the Air Force) or Washington Headquarter Services (WHS)

on whose installation a real property asset is located. An Installation Host may be either a General

Fund or a WCF operation.

2.1.4. Materiality. Materiality, as defined by the SFFAS 1, is the degree to which an item's

omission or misstatement in a financial statement makes it probable that the judgment of a

reasonable person relying on the information would have been changed or influenced by the

omission or the misstatement.

2.1.5. Net Realizable Value (NRV). NRV is the estimated amount that can be recovered

from selling, or any other method of disposing, of an item less estimated costs of completion,

holding, and disposal.

2.1.6. Real Property. Real property assets consist of buildings, structures, linear structures

(collectively called facilities), land, and land rights.

2.1.6.1. A building is a roofed and floored facility enclosed by exterior walls and

consisting of one or more levels that is suitable for single or multiple functions and that protects

human beings and their properties from direct harsh effects of weather such as rain, wind, sun and

other natural factors.

2.1.6.2. A structure is a facility, other than a building or linear structure that is

constructed on or in the land.

2.1.6.3. A linear structure is a facility whose function requires that it traverse land

(e.g., runway, road, rail line, pipeline, fence, pavement, electrical distribution line) or is otherwise

managed or reported by a linear unit of measure at the category code (commonly known as

CATCODE) level.

2.1.6.4. Land is defined as a portion of the earth’s surface distinguishable by

boundaries. Land must be accountable by parcel starting when the parcel was transferred into an

Installation Host’s custody and control. Excluded from the definition are natural resources

(e.g., depletable resources, such as mineral deposits and petroleum, renewable resources such as

timber and the outer continental shelf resources) related to land.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-8

2.1.6.5. A land right is an interest and privilege held by DoD or a DoD Component

in land owned by others, such as leaseholds, easements, water and water power rights, diversion

rights, submersion rights, rights-of-way, mineral rights and other like interests in land.

2.1.7. Value-In-Use. SFFAC 7 describes value-in-use as the benefit to be obtained by an

entity from the continuing use of an asset and from its disposal at the end of its useful life.

2.2 Relevant USSGL Accounts (240202)

2.2.1. Land and Land Rights (USSGL 171100). The amount of identifiable cost of land

and land rights of unlimited duration acquired for or in connection with General PP&E used in

general operations and permanent improvements are recorded in this account.

2.2.2. Construction-in-Progress (USSGL 172000). The CIP is used to accumulate the

costs of new construction of General PP&E (except for internal use software) and capital

improvements while the asset is under construction. CIP accounts include all costs (e.g., direct

labor, direct material, supervision, inspection and overhead) incurred in construction. Upon

completion, these costs will be transferred to the appropriate General PP&E account.

2.2.3. Buildings, Improvements, and Renovations (USSGL 173000). The Buildings,

Improvements, and Renovations account is used to record the cost of buildings acquired and

improvement(s) to them, under the legal jurisdiction of the Installation Hosts, which are used in

providing DoD services or goods. This account also includes the cost of renovation, improvement,

or restoration of multi-use heritage assets classified as buildings after transfer from the CIP

account.

2.2.4. Accumulated Depreciation on Buildings, Improvements, and Renovations (USSGL

173900). The Accumulated Depreciation on Buildings, Improvements, and Renovations account

is used to record the amount of accumulated depreciation charged to expense for assets and

improvements recorded in the USSGL 173000 account.

2.2.5. Other Structures and Facilities (USSGL 174000). The Other Structures and

Facilities account is used to record the cost or appraised value of structures and linear structures

and improvements to them, under the legal jurisdiction of the Installation Hosts, which are used in

providing DoD services or goods. This account also includes the cost of renovation, improvement,

or restoration of multi-use heritage assets classified as structures or linear structures after transfer

from the CIP account.

2.2.6. Accumulated Depreciation on Other Structures and Facilities (USSGL 174900).

The Accumulated Depreciation on Other Structures and Facilities account is used to record the

amount of accumulated depreciation charged to expense for assets and improvements recorded in

the USSGL 174000 account.

2.2.7. General Property, Plant, and Equipment Permanently Removed but Not Yet

Disposed (USSGL 199500). The General Property, Plant, and Equipment Permanently Removed

but Not Yet Disposed account is used to record the value of General PP&E assets, which have

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-9

been permanently removed from service but not yet disposed. Upon permanent removal from

service, General PP&E assets must be recorded at their expected NRV and must cease to be

depreciated.

2.2.8. Financing Sources Transferred In Without Reimbursement (USSGL 572000). The

amount determined to increase the financing source of a reporting Federal entity that occurs as a

result of an asset being transferred in. The amount of the asset is recorded at book value of the

transferring Federal entity.

2.2.9. Financing Sources Transferred Out Without Reimbursement (USSGL 573000). The

amount determined to decrease the financing source of a reporting Federal entity that occurs as a

result of an asset being transferred out. The amount of the asset is recorded at book value as of

the transfer date.

2.2.10. Depreciation, Amortization and Depletion (USSGL 671000). The expense

recognized by the process of allocating costs of an asset (tangible or intangible) over the period of

time benefited or the assets useful life is recorded in this account.

2.3 Valuation of Acquisitions and Transfers (240203)

2.3.1. Recorded Cost. When acquiring a real property asset, the recorded cost must be

recognized in accordance with paragraph 240204. The recorded cost of a real property asset is the

basis for computing depreciation. The recorded cost must include all amounts paid to bring the

real property asset to its form and location suitable for its intended use. This subparagraph defines

and prescribes the use of acquisition cost, net book value (NBV), fair value, and ancillary cost

when recording the cost of newly acquired real property assets. The funding source (e.g.,

appropriation and WCFs) is not a factor in determining whether or not an item should be

capitalized.

2.3.1.1. Acquisition Cost. For purposes of this chapter, acquisition cost refers to

the original purchase or construction cost, net of (less) any purchase discounts. Purchase discounts

lost and late payment interest expenses must not be included as a cost of the asset; rather, such

costs must be recognized as operating expenses. Although the measurement basis for valuing real

property remains historical cost, for purposes of establishing auditable opening balances, DoD

Components should use the Plant Replacement Value as the methodology for calculating deemed

cost as a surrogate for the historical cost for real property as described in SFFAS 6 as amended by

SFFAS 50 (see Annex 4 for additional guidance).

2.3.1.2. NBV. NBV is the recorded cost of a real property asset, less its

accumulated depreciation.

2.3.1.3. Fair Value. Fair value is the amount at which an asset or liability could be

exchanged in a current transaction between willing parties, other than in a forced or liquidation

sale.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-10

2.3.1.4. Ancillary Cost. Ancillary costs are included in the recorded cost in

addition to the acquisition cost of the asset. These costs are identifiable and necessary to bring the

asset to its form and location suitable for its intended use including other direct and indirect costs.

Examples include:

2.3.1.4.1. Labor and other direct or indirect production costs (for assets

produced or constructed);

2.3.1.4.2. Engineering, architectural, and other outside services for designs,

plans, specifications, and surveys after funding and design authorization;

2.3.1.4.3. Acquisition and preparation costs of buildings and other

facilities;

2.3.1.4.4. An appropriate share of the cost of the equipment used in

construction work;

2.3.1.4.5. Fixed equipment and related installation costs required for

activities in a building or facility;

2.3.1.4.6. Allowable direct costs of inspection, supervision, and

administration of construction contracts and construction work;

2.3.1.4.7. Legal and recording fees and damage claims;

2.3.1.4.8. Fair value of facilities and installed equipment donated to the

DoD;

2.3.1.4.9. Interest paid directly to providers of goods or services related to

the acquisition or construction (not including late payment interest penalties).

2.3.2. Method of Acquisition or Transfer Determines Recorded Cost

2.3.2.1. Purchased Real Property. The cost to be recorded for real property assets

acquired by purchase from a third party (private, commercial, or state or local government) is its

purchase contract cost plus applicable ancillary costs. Examples of ancillary costs are included in

the listing in subparagraph 240203.A.4. For purposes of this guidance, purchase includes

procurements of real property by cash, check, or installment or progress payments on contracts or

purchase agreements.

2.3.2.2. Constructed Real Property. The cost to be recorded for constructed real

property asset(s) is the sum of all the costs incurred to bring the real property asset(s) to a form

and condition suitable for its intended use. These costs include the costs of project design and

actual construction such as labor, materials, and overhead costs (see Annex 1 for a list and

description of the costs to be accumulated for constructed assets). Note that preliminary planning

and design costs accumulated prior to funding and design authorization must be expensed and not

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-11

be captured as part of the recorded cost of constructed assets. The cost of real property under

construction must be recognized in accordance with the CIP guidance prescribed in

subparagraph 240204.G.

2.3.2.3. Donated Real Property. The cost to be recorded for real property received

through donation, execution of a will, or judicial process excluding forfeiture must be its estimated

fair value at the time received by the DoD and any costs incurred by the DoD to bring the asset

into service (e.g., legal fees).

2.3.2.4. Exchanged Real Property. The cost to be recorded for real property

acquired through exchange between the DoD and a nonfederal entity is the fair value of the

consideration surrendered at the time of exchange. If the fair value of the real property acquired

is more readily determinable than that of the consideration surrendered, the cost will be the fair

value of the real property acquired. If neither fair value can be determined, the cost of the real

property acquired will be the cost recorded for the consideration surrendered, net of any

accumulated depreciation/amortization. Any difference between the net recorded amount of the

consideration surrendered and the cost of the real property acquired must be recognized as a gain

or loss. In the event that additional cash consideration is included in the exchange, the cost of real

property acquired will be increased by the amount of cash consideration surrendered or decreased

by the amount of cash consideration received. If the DoD Component enters into an exchange in

which the fair value of the real property acquired is less than that of the consideration surrendered,

the real property acquired will be recognized at the amount of consideration surrendered, as

described previously and subsequently reduced to its fair value. A loss must be recognized in an

amount equal to the difference between the amount of consideration surrendered for the real

property acquired and its fair value. This guidance on exchanges applies only to exchanges

between a DoD Component and a nonfederal entity. Exchanges between a DoD Component and

another DoD Component or federal agency must be accounted for as a transfer.

2.3.2.5. Capital Leases. The recorded cost of real property acquired under a capital

lease is the present value of the rental and other minimum lease payments during the lease term,

excluding that portion of the payments representing executory costs (e.g., insurance, maintenance

and taxes) to be paid by the lessor. The present value is the value of future cash flows (e.g., lease

payments) discounted to the present at a certain interest rate (such as the reporting entity’s cost of

capital), assuming compound interest. However, if the amount so determined exceeds the fair

value of the leased property at the inception of the lease, the amount recorded will be the fair value.

If the portion of minimum lease payments representing executory costs is not determinable from

the lease provisions, the amount should be estimated. See Chapter 26 for additional guidance on

capital leases.

2.3.2.6. Seized and Forfeited Real Property. The cost recorded for real property

acquired through seizure or forfeiture is its fair value, less an allowance for any liens or claims

from a third party.

2.3.2.7. Vested and Seized Property During Times of War. See Volume 12,

Chapter 29, for discussion of vested and seized property during times of contingency operations.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-12

2.3.2.8. Transferred Real Property from a non-DoD Federal agency to DoD. The

cost recorded for real property transferred from a non-DoD Federal agency to a DoD Component

is the cost recorded on the transferring entity’s books for the real property, net of any accumulated

depreciation/amortization. If the receiving DoD Component cannot reasonably ascertain those

amounts, the cost of the asset will be its fair value at the time of transfer.

2.3.2.9. Transfer of Capitalized Real Property between DoD Components. DoD

Components must adhere to the following:

2.3.2.9.1. The cost recorded for real property transferred from one DoD

Component to another DoD Component shall be the gross cost recorded net of accumulated

depreciation/amortization on the transferring DoD Component’s books. The DoD Component

transferring the real property is responsible for providing the gross cost net of accumulated

depreciation/amortization of the asset being transferred to the DoD Component receiving the

transfer. Both parties must agree to the transfer and the agreement must be documented using the

appropriate documentation. Each DoD Component has execution responsibility to ensure that

requisite tasks are being completed in a timely manner for all transfers.

2.3.2.9.2. When completing a transfer, the transferring DoD Component, is

required to provide financial reporting information to the receiving DoD Component whenever the

asset is transferred throughout the asset lifecycle. When transfers are implemented, supporting

documentation which includes financial reporting information, trading partner information, and

associated data elements must be provided. These data elements include, Project/Work Order

Number, Name, RPUID, Real Property Site Unique Identifier (RPSUID), Contract Number(s),

Operational Status Code, Acquisition Original Recorded Cost Amount and Capital Improvement

Recorded Cost Amount (for all capitalized improvements), Placed in-Service Date, Capital

Improvement Placed in-Service Date (for all capitalized improvements), Facility Total

Accumulated Depreciation Amount, Capital Improvement Estimated Useful Life Year Quantity,

Facility Estimated Useful Life Quantity, Facility Estimated Useful Life Adjustment Quantity,

transaction details to include Acquisition Fund Source Code, Acquisition Method Code, and Real

Property Asset Predominate Design Use Facility Analysis Code (FAC). If this information is not

available, the receiving and transferring entities must develop and document an estimate to support

the financial transfer of the asset. See Volume 12, Chapter 14, for further policy on transfers of

DoD real property between Installation Hosts.

2.3.2.9.3. Within DoD Components, there are different capitalization

thresholds. For transferred real property between DoD Components if an asset was capitalized at

acquisition, it will continue to be capitalized and depreciated after transfer regardless of the new

financial reporting entity’s capitalization threshold. If an asset was expensed at acquisition, it will

not be capitalized and depreciated after transfer to the new financial reporting entity, even if the

new financial reporting entity has a lower capitalization threshold than the original entity that

acquired the asset. The receiving DoD Component will include the item in its APSR as

accountable real property.

2.3.2.10. Joint Venture Type Arrangements. Joint venture type arrangements

should be accounted for as follows:

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-13

2.3.2.10.1. There may be situations where a DoD Component jointly funds

the acquisition or construction of real property with a Nonappropriated Fund Instrumentality

(NAFI). As defined in DoDI 1015.15, a NAFI is a DoD organizational and fiscal entity that is

supported in whole or in part by nonappropriated funds (NAFs). It acts in its own name to provide

or assist Secretaries of Military Departments in providing programs for DoD personnel. It is not

incorporated under the laws of any State or the District of Columbia, but has the legal status of an

instrumentality of the U.S. Under current GAAP, NAFI entities are not included in the DoD

consolidated financial statements. An example of a NAFI would be an Armed Services Exchange.

2.3.2.10.2. Where a DoD Component jointly funds the acquisition or

construction of real property with a NAFI, the DoD Component will, assuming the amount meets

the capitalization threshold in effect at the time of the acquisition, record the real property on its

Balance Sheet and report it in its financial statements in the amount of its share of the funding.

For example, if a DoD Component and a NAFI each fund $10 million in the acquisition of a real

property asset with a total of 50,000 square feet (with each acquiring 25,000 square feet); the DoD

Component would record the real property at $10 million. Subsequent to the acquisition, the DoD

Component, that jointly funded the acquisition, should evaluate whether the real property asset

should be transferred to another DoD Component in accordance with paragraph 240204 and follow

the requirements to transfer the real property asset to another DoD Component, if applicable.

2.3.3. Documentation. When recording the acquisition of a real property asset in the

APSR and/or accounting system, the asset must be assigned a dollar value (i.e., recorded cost) as

detailed in this chapter. The dollar value must be supported by appropriate documentation. A

complete discussion of supporting documentation can be found at paragraph 240302. To establish

proper financial control when acquiring real property from another DoD Component or Federal

agency, the acquiring DoD Component must request from the transferring DoD Component or

other Federal agency, the necessary source information and financial transfer documents. Such

information and documents must include unique identifier(s) for the asset(s); location; original

acquisition cost(s); cost of any improvements; the date the asset was constructed, or acquired; the

estimated useful life; the amount of accumulated depreciation; the condition; and other relevant

information linked to that asset. If this information is not available, the receiving and transferring

entities must develop and document an estimate to support the financial transfer of the asset. See

Volume 12, Chapter 14 for further policy on transfers of DoD real property between Installation

Hosts. See Volume 12, Chapter 14 and DoDI 4165.70 for further policy on transfers of DoD real

property between Installation Hosts.

*2.4 Recognition (240204)

All real property assets acquired by DoD Components must be recognized for

accountability and financially reported as required by this chapter. Recognition requires the

appropriate accounting treatment (expensed or capitalized) and the reporting of capitalized

amounts and accumulated depreciation/amortization on the appropriate DoD Component’s

financial statements.

Note, SFFAS 50 applies to a reporting DoD Component that is presenting financial

statements, or one or more line items in the financial statements, following Generally Accepted

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-14

Accounting Principles (GAAP) promulgated by FASAB either (1) for the first time or (2) after a

period during which existing systems could not provide the information necessary for producing

such GAAP based financial statements without use of the alternative methods for opening balances

set out in SFFAS 50. A reporting DoD Component meeting either one of these criteria may elect

to apply the alternative valuation method described in SFFAS 50, including the election to record

a zero value for land and land rights. However, if the reporting DoD Component has previously

undergone a financial statement audit and received an unmodified audit opinion, they would not

meet either of these two criteria and therefore would not be able to elect this alternative valuation

method. Refer to Annex 4 for additional guidance on alternative valuation methodology for

establishing opening balances for buildings, structures, linear structures, land and land rights.

2.4.1. Recognition Responsibility.

2.4.1.1. General Requirements for Recognition Responsibility

2.4.1.1.1. 10 U.S.C. § 2682 states “a real property facility under the

jurisdiction of the Department of Defense which is used solely by an activity or agency of the

Department of Defense (other than a military department) shall be under the jurisdiction of a

military department designated by the Secretary of Defense.” The DoD determined that because

the entities with jurisdiction over real property assets have existing requirements to manage the

asset-related data required for financial reporting, it is rational and consistent that those entities

carry the financial reporting responsibility for those assets in accordance with FASAB TB 2017-2.

In addition, WHS is delegated jurisdiction over its facilities via 10 U.S.C. § 2674 and

DoDD 5110.04.

2.4.1.1.2. Real property is generally reported on the General Fund’s

financial statements of a Military Department or WHS, but a Military Department WCF can report

real property on its financial statements if it has been given jurisdiction over a specific installation.

2.4.1.1.3. Financial reporting responsibility for real property assets

includes all aspects of financial reporting and disclosures such as, but not limited to, footnote

disclosures, deferred maintenance and repair (DM&R), and other required supplemental

information (RSI).

2.4.1.1.4. Financial reporting responsibility for real property assets must be

supported by documentation establishing the rights and obligations of the reporting entity for each

asset (see paragraph 240302). Such documentation may include real property records reflecting

the jurisdiction of an Installation Host over real property, as well as inter- and intra-agency

agreements and records reflecting host-tenant support relationships.

2.4.1.1.5. See Annex 5 for illustrative examples and journal entries relating

to financial reporting responsibilities for real property.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-15

2.4.1.2. Construction-In-Progress

2.4.1.2.1. The funding DoD Component reports CIP for real property

(including improvements) in its CIP account until the asset or improvement is placed in service.

The funding DoD Component also relieves CIP when the asset or improvement is placed in service.

At this time, an asset or improvement will be recorded by the funding DoD Component and an

interim DoD (DD) Form 1354 will be used to document the construction in accordance with

existing DoD real property policy. If additional costs continue to be incurred after the asset or

improvement is placed in service, those costs will continue to be recorded in the funding DoD

Component’s CIP account. Upon final contract closeout, the CIP will be relieved and a final

DD Form 1354 will be completed.

2.4.1.2.2. Once the asset is placed in service, if the funding DoD

Component is not the Installation Host, then the asset will need to be transferred from the funding

DoD Component to the Installation Host.

2.4.1.3. In-Service Real Property

2.4.1.3.1. Real property must be reported on the financial statements of the

Installation Host on whose installation a real property asset is located.

2.4.1.3.2. DoD real property that is not located on a DoD installation

(including property located on an installation that is hosted by an entity other than DoD) will be

reported on the financial statements of the Military Department that is the Installation Host having

jurisdiction of the real property asset. Jurisdiction of real property is identified in the Office of the

Secretary of Defense (OSD) consolidated real property database. This database is maintained and

managed by the Office of the Assistant Secretary of Defense (Sustainment). Disputes between

Installation Hosts regarding who should be the financial reporting organization may be resolved

by contacting the Office of the Assistant Secretary of Defense (Sustainment). If a real property

asset is located on a DoD installation that is funded by an entity that is not part of the consolidated

DoD financial statements, it will be the financial reporting responsibility of the non-DoD entity.

2.4.1.3.3. For DoD Components that do not already have an unmodified

audit opinion, existing land and land rights will be valued at zero dollars and future land

acquisitions will be expensed as described in SFFAS 50.

2.4.1.3.4. Assets assigned to/from one reporting DoD Component to

another reporting DoD Component should be treated as transfers of assets per SFFAS 7,

“Accounting for Revenue and Other Financing Sources.”

2.4.1.4. Capitalized Improvements to Real Property

2.4.1.4.1. Capital improvements to an asset will be reported by the DoD

Component that reports the real property asset that is being improved. Capital improvements that

are under construction will be reported in accordance with subparagraph 240204.A.2.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-16

2.4.1.4.2. The cost of a capitalized improvement will be accumulated and

reported by the funding DoD Component until the improvement to the asset is placed in service,

at which time it will be transferred to the entity responsible for reporting the real property base

asset. The funding DoD Component will coordinate the delivery of the final DD Form 1354 and

supporting documentation to the Installation Host.

2.4.2. Intra-DoD Transfers

2.4.2.1. Both parties must agree to the transfer and the agreement must be

documented using the appropriate documentation (e.g., DD Form 1354). In addition, the entity

transferring the real property must provide adequate and appropriate supporting documentation for

financial statement reporting (financial reporting information). Data elements included in the

financial reporting information, should include but are not limited to, Project/Work Order Number,

Name, RPUID, RPSUID, Contract Number(s), Operational Status Code, Acquisition Original

Recorded Cost Amount and Capital Improvement Recorded Cost Amount (for all capitalized

improvements), Placed in-Service Date, Capital Improvement Placed in-Service Date (for all

capitalized improvements), Facility Total Accumulated Depreciation Amount, Capital

Improvement Estimated Useful Life Year Quantity, Facility Estimated Useful Life Quantity,

Facility Estimated Useful Life Adjustment Quantity, transaction details to include Acquisition

Fund Source Code, Acquisition Method Code, and Real Property Asset Predominate Design Use

FAC. The financial reporting information will be maintained with the asset throughout the asset

lifecycle.

2.4.2.2. Transfers between DoD Components may occur regularly due to

construction or improvement of real property. When a transfer occurs due to the construction or

improvement of real property, the Installation Host will accept the transfer on their installation

when the funding entity provides the appropriate transfer documentation. In cases where property

is transferred, the values transferred should be the same on each side of the transfer to ensure there

are no discrepancies between DoD Components. Adjustments to the transferred value recorded

may subsequently be made to record value at deemed cost in accordance with SFFAS 50.

2.4.3. Memorandum of Agreement (MOA). All DoD Component tenants must have

MOAs in place with the Installation Host. A MOA will be executed to establish rights and

obligations between the Installation Host and the DoD Component using the real property asset.

All tenants must maintain a list of real property facilities they occupy and for which they have

facility operations and maintenance or facility improvement responsibility. The MOA should also

identify the respective maintenance and other operational responsibilities of the host and tenant.

DoDI 4000.19 prescribes DoD policy on intra-departmental support, to include establishment of

MOAs to document host-tenant relationships.

2.4.4. WCF Capital Recovery Rate and Accounting Treatment. WCF will continue to

recover costs associated with the construction of real property that is funded by the WCF regardless

of financial reporting responsibility. In cases where a capital improvement is transferred to a

different reporting entity, the WCF will record an imputed cost in lieu of an actual depreciation

expense for the improvement. Capital recovery rates will be set in accordance with Volume 2B,

Chapter 9.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-17

2.4.5. Inter-Entity Costs.

2.4.5.1. SFFAS 55 requires the continued recognition of significant inter-entity

costs among and between federal agencies by business-type activities (e.g., WCFs) and allows

non-business type activities to elect not to recognize inter-entity costs, with the exception of inter-

entity costs for personnel benefits and the U.S. Department of the Treasury (Treasury) Judgment

Fund settlements unless otherwise directed by the OMB. DoD has elected to not recognize

imputed costs and corresponding imputed financing from non-business-type-activities, aside from

the exceptions stated in this subparagraph.

2.4.5.2. WCFs or other business like activities must impute costs in accordance

with SFFAS 55. These imputed costs would include depreciation expense. The imputed costs

will include what would otherwise have been depreciation expense for real property assets and

improvements that were funded by the WCF and subsequently transferred to the General Fund, as

well as any depreciation expense or other costs for assets not funded by the WCF (see Annex 2).

Imputed costs are recorded as a debit to Imputed Cost (USSGL 673000) and a credit to Imputed

Financing Sources (USSGL 578000).

2.4.5.3. Disclosure requirements for inter-entity costs are described in

subparagraph 240305.D.

2.4.6. Recognition Uncertainty. It is important that the overall accounting records of the

DoD and the Federal Government are not duplicative.

2.4.6.1. In situations where doubt exists as to which DoD Component should

recognize the real property asset, DoD Components involved must reach agreement with the other

applicable DoD Components or Federal agencies as to which DoD Component or Federal Agency

will record the asset for financial reporting purposes.

2.4.6.2. If an agreement cannot be reached, the matter must be referred to Office

of the Assistant Secretary of Defense (Sustainment) for resolution. Requests for resolution must

be accompanied by adequate supporting documentation to assist in resolution of the matter and be

submitted through the Financial Management and Comptroller of the submitting DoD Component.

2.4.7. Recognition Timing. Recognition of real property for financial reporting purposes

must occur upon acceptance to the acquiring DoD Component. Contract progress payments made

must be recorded in the CIP account until the real property asset is accepted. See subparagraph

240204.I for guidance on the use of the CIP account.

2.4.8. Capitalization Thresholds. The capitalization threshold for real property is

$250,000 for both the General Fund and WCF, except for the National Security Agency and the

Office of the Director of National Intelligence for which the threshold is $1 million. Real property

assets with a recorded cost that equals or exceeds the capitalization threshold and have a useful

life of at least two years must be capitalized as an asset in the appropriate DoD Component’s

accounting records and depreciated/amortized over its useful life. Real property assets with a

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-18

recorded cost below the applicable capitalization threshold or which has a useful life of less than

two years must be expensed.

2.4.9. CIP Process. CIP must be used to accumulate costs of new real property

construction and capital improvements, which are anticipated to meet the capitalization criteria.

2.4.9.1. A CIP account will be created when either of these triggering events

occurs: (i) work order and funding authorizations are received for an in-house construction project;

or (ii) design and fund authorizations are received for construction projects performed by a

construction agent (i.e., another DoD Component, Federal agency or commercial entity). When a

DoD Component is constructing a real property asset to be transferred to another DoD Component,

as the construction agent they must accumulate all costs since project inception in a CIP account

until the costs are billed to the funding (purchasing) DoD Component. The billed costs in such a

scenario must be removed from the CIP account of the construction agent when billed to the

funding (purchasing) DoD Component entity and the funding (purchasing) DoD Component must

record such billed amounts in their appropriate CIP account. See Volume 3, Chapter 17 for

additional guidance on inter-governmental construction work or services.

2.4.9.1.1. When there is a cost shared project between Federal and

nonfederal entities, a CIP account must only be created when the real property asset will be

federally owned. Only the federal share of construction costs in conjunction with a nonfederal

cost shared project should be captured in a CIP account. In the case of a cost shared project

between DoD and another Federal agency (e.g., Department of State), only the DoD share of

construction costs should be captured in a CIP account within DoD’s financial statements. At the

time the asset is placed in service, the real property asset must be recognized in the financial

statements of the acquiring DoD Component for the value of the DoD Component’s share of the

costs.

2.4.9.1.2. For cost shared projects where a DoD Component is the

construction agent and constructing a non-federally owned real property asset, costs must be

accumulated in a CIP account to be billed to the customer. If a DoD Component is not the

construction agent and the real property asset is not DoD owned, the DoD Component’s share of

construction cost must be expensed as incurred. If the real property asset’s final ownership was

not determined at project funding and design authorization, this cost must be relieved from the CIP

account and properly expensed when it is determined that the real property asset will not be

federally owned.

2.4.9.2. DoD Components must assign a Component unique project number and

the Installation Host will assign at least one RPUID for each approved construction project. The

project number and RPUID will be associated to a CIP account when created. The Component

unique project number must remain the same and be used for all phases of a particular construction

project regardless of the fiscal year.

2.4.9.3. All costs for a construction project will be accumulated in a CIP account.

A reasonable allocation methodology must be established and documented to assign project costs,

direct and indirect, to all real property assets that will be constructed or improved with

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-19

corresponding RPUIDs. Any indirect project costs must be allocated to the project CIP account

as they are incurred. Thus, the full cost of constructed items must be adequately captured, reported

and distributed across real property assets by RPUID, no later than the time the real property assets

are placed in service and available for use. See Chapter 19 Managerial Cost Accounting for

additional information on indirect costs.

2.4.9.4. CIP costs must be tracked by both the Component unique project number

and the RPUID to ensure visibility, traceability, and accountability. The relationship among a

construction project, RPUID and CIP account is provided in Figure 24-1.

Figure 24-1. Relationships among a Construction Project, RPUID, and CIP Account

End

RPUID

Yes

No

RPUID

RPUID

Unique Project Number

Construction project

funding and design

authorization received

Cost incurred

Should this be captured

as CIP?

Expense General Ledger

Account

CIP Account

CIP General Ledger

Summary Account No.

172000

Unallocated

Indirect Costs

Direct and Indirect Costs as a

part of a contract are captured

by Project Number and RPUID

Maintenance / repair

costs

2.4.9.5. The funding DoD Component must continue to report CIP on their

financial statements until the constructed item is accepted by the accountable DoD Component (if

the accountable DoD Component is different than the funding DoD Component). The minimum

information associated with the CIP amount reported for financial statement preparation purposes

must include the funding DoD Component’s Project Number, Project Detail Fund Code(s), Project

Detail Fund Code Cost Amount, Project Detail Organization Code(s), Programmed Amount, and

RPUID(s). For a specified project and for the purpose of an audit trail of the CIP account, the

construction agent and the funding DoD Component must retain the supporting documentation for

their respective portion(s) of the project to which they have fiscal accountability. For additional

information regarding representative documentation for a construction project, refer to

paragraph 240302. Upon acceptance of the constructed real property asset(s) or improvements,

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-20

the construction agent must provide the funding DoD Component and the military service real

property accountable officer with auditable supporting documentation. The funding DoD

Component and military service real property accountable officer, in turn, must ensure the

documentation is retained in accordance with applicable laws, regulations, and instructions.

2.4.9.6. When constructed real property asset(s) or improvements are accepted and

placed in service, the costs accumulated in the CIP account must be relieved in a manner that

recognizes the cost of each individual real property asset with a RPUID (i.e., transferred to the

appropriate real property account). To ensure constructed real property asset(s) or improvements

are recorded at full cost, the recorded cost of the real property asset(s) or improvements accepted

must equal the sum of all construction and applicable design costs. (See Annex 1 for a

comprehensive list of cost types.) In addition, the funding DoD Component of a construction

project must ensure that all costs incurred by the funding DoD Component are provided to the

construction agent on a formal document for inclusion in the full cost of the real property asset(s)

or improvements prior to acceptance by the accountable DoD Component.

2.4.9.7. For construction projects that are completed in multiple phases, the cost of

each phase is transferred from the CIP account to the appropriate asset account, by RPUID, at the

time each real property asset or useable portion of the asset in the phase is placed in service. Each

constructed real property asset or useable portion of the asset, therefore, may have one or more

placed in-service dates, which will be used to initiate the capitalization of each corresponding

phase. Each phase must be depreciated over its estimated useful life when placed in service.

2.4.9.8. If a construction project is cancelled, all cost accumulated in the associated

CIP account must be expensed. When a portion of a project is cancelled or decreased in scope,

the cost directly associated to that portion of the project, and an allocated portion of the common

cost in the CIP, must be expensed. All projects deferred for more than two years must be reviewed

for continuance or cancellation during the review cycle.

2.4.10. Accounting for Real Property Outside of the U.S. As used in this chapter, U.S.

means the 50 States of the U.S., the District of Columbia, and the commonwealths, territories, and

possessions of the U.S. In carrying out their mission, operations and objectives, there are

circumstances in which DoD Components occupy and use real property facilities outside of the

U.S. DoD's rights to real property outside of the U.S. are different from those within the U.S. For

financial reporting purposes, a DoD Component that occupies and uses facilities outside of the

U.S. must adhere to the following guidance:

2.4.10.1. DoD real property that is not located on a DoD installation (including

property located on an installation of a host nation) will be reported on the financial statements,

(including capital improvements) of the Installation Host that is identified in the OSD approved

Enduring Location Master List, which is maintained and managed by the Office of the Under

Secretary of Defense for Policy, when all of the following criteria are met:

2.4.10.1.1. An agreement exists between the U.S. and the host

nation/foreign government (e.g., Cooperative Security Agreement, Bilateral Security Agreement

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-21

and Status of Forces Agreement) and the agreement conveys a right to construct and operate

facilities (i.e., real property);

2.4.10.1.2. The U.S. Government/DoD Component funded the asset's

acquisition (e.g., purchase and construction) and/or capital improvements. See

subparagraphs 240204.A and 240204.B for transfers between DoD Components when the real

property acquisition is funded by a DoD Component other than an Installation Host having

jurisdiction over the installation on which the real property resides.

2.4.10.1.3. The cost incurred is over the DoD Component's real property

capitalization threshold (if the asset is partially funded by DoD, only the portion funded by DoD

will be evaluated against the capitalization threshold and recognized as an asset if applicable);

2.4.10.1.4. The asset has an estimated useful life of two years or more; and

2.4.10.1.5. The DoD Component is using the asset in its operations.

2.4.10.2. Such capitalized assets will be depreciated over their estimated useful

lives. Should the use of the asset terminate earlier than the estimated useful life, the asset's

remaining NBV will be written off.

2.4.10.3. When a DoD Component occupies a facility but the DoD did not fund its

acquisition, the DoD Component will recognize such facilities on its financial statements as assets

under a capital lease, if a specific agreement with the host nation/foreign government exists and

addresses the use of the facility. See Chapter 26 for guidance on applying the lease criteria for

real property outside of the U.S.

2.4.10.4. SFFAS 4 “Managerial Cost Accounting Standards and Concepts”

addresses imputed costs between federal agencies but does not extend to entities outside of the

federal context. The concept of imputed costs does not apply to activities between a DoD

Component and a host nation/foreign government. Therefore, a DoD Component will not record

imputed costs for the use and/or occupancy of facilities, for which it does not pay directly or pay

through reimbursement, provided by international organizations (e.g., North Atlantic Treaty

Organization) or host nation/foreign government.

2.4.10.5. The Installation Host with jurisdiction over the installation outside of the

U.S. must record all real property occupied and used by it in an APSR, regardless of interest type,

including those that have not been capitalized for accounting and financial reporting purposes, in

accordance with 10 U.S.C. § 2721, DoDI 4165.14 and subparagraphs 240204.J.1 and 240204.J.3.

Assets that do not meet the criteria for capitalization in accordance with subparagraphs 240204.J.1

and 240204.J.3 will be expensed in the period received for use by DoD.

2.4.10.6. The Installation Host with jurisdiction over the installation outside of the

U.S. must record an expense for any maintenance and sustainment costs relating to the real

property paid, or to be paid by them in the period incurred regardless of real property interest type.

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-22

2.5 Capital Improvements (240205)

2.5.1. Capital improvements to real property assets must be capitalized when (1) the

improvement increases the asset's useful life by two or more years, or increases its capacity or size,

and (2) the cost of the improvement equals or exceeds the capitalization threshold (see

subparagraph 240204.H). If capital improvements do not meet these two criteria, they should be

expensed. Funding source (e.g., appropriation or WCFs) is not a factor in determining whether or

not an improvement will be capitalized. If the capital improvement increases the underlying asset's

useful life by two years or more, the DoD Component must capitalize and depreciate the

improvement with the original asset over the revised estimated useful life. Costs of capital

improvements which do not extend the useful life of an existing real property asset but enlarge or

improve its capacity and have a useful life of two years or more must be capitalized and depreciated

over the lesser of the useful life of the improvement or the remaining economic useful life of the

underlying asset. Note that the economic life of the real property asset, in certain instances, may

be different than the original estimated accounting useful life. The economic life reflects the

remaining period of utility for the real property.

2.5.2. The cost of improvements to more than one real property asset as identified by a

RPUID when constructed under a single project or work order, and that cannot be specifically

identified by asset, will be capitalized only if the allocated cost per real property asset equals or

exceeds the capitalization threshold. When more than one improvement is made to a single real

property asset, in a single project and the improvements are part of one effort to increase the real

property’s capacity, size, and/or useful life, the sum of the costs of the improvements must be

capitalized, if the summed costs equal or exceed the capitalization threshold. This is required even

when the improvements are funded by different fund sources. Once a determination has been

made that the aggregate costs of the improvements will be capitalized, the summed costs of

improvements should be capitalized and depreciated upon being placed in service as described in

paragraph 240205.A.

2.5.3. Maintenance and repair costs are not considered capital improvements, regardless

of whether the cost equals or exceeds the capitalization threshold. Per SFFAS 42, maintenance

and repairs are defined as activities directed toward keeping fixed assets in an acceptable condition.

Maintenance and repair activities include preventative maintenance; replacement of parts, systems,

or components; and other activities needed to preserve or maintain assets. Maintenance and repair

activities also include cyclic work done to prevent damage that would be more costly to restore

than to prevent (e.g., painting). A roof or a heating and air conditioning system that is replaced

due to failure should be classified as a repair and should be expensed, even if the replacement

incorporated a better quality and longer life shingle or a more efficient heating and air conditioning

unit.

2.5.4. Although maintenance and repairs are generally expensed in the period incurred,

certain replacements of parts, systems, or components may or may not be an improvement for

accounting purposes. Crucial to the determination of whether a replacement must be recognized

as a repair or an improvement is the intent behind the replacement. Replacement of parts, systems,

or components that have failed, are in the incipient stages of failing, or are no longer performing

the functions for which they were designated are classified as a repair; replacements falling into

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-23

this category must be expensed. If the replacement was undertaken to expand the capacity or

extend the life of a real property asset that was in good working order, then the replacement must

be recognized as an improvement. A replacement classified as a repair does not include rebuilding

entire structures within the same physical area (footprint).

2.5.5. For the purpose of capital improvements, capacity is defined as an increased

footprint, or internal structural reconfiguration that increases the amount of usable space, number

of personnel, or increased throughput. Increased capacity includes activities that upgrade the asset

to serve needs different from, or significantly greater than its current use.

* 2.5.6. Capital Improvements (which includes leasehold improvements), at or over the

capitalization threshold in effect at the time the capital improvements/leasehold improvements are

acquired, must be capitalized. The cost of a capitalized improvement should be accumulated and

reported by the funding DoD Component in a CIP account until the improvement to the asset is

placed in service, at which time it will be transferred to the entity responsible for reporting the real

property base asset. See subparagraph 240204.B for intra-DoD transfers. Only Installation Hosts

with jurisdiction over a specific installation have financial reporting responsibility for real property

and completed capital improvements.

2.6 Depreciation (240206)

2.6.1. The recorded cost of real property and capital improvements which have been

capitalized in accordance with the guidance prescribed by paragraphs 240204 and 240205 must be

depreciated over the shorter of (i) the period of time benefited, or (ii) the asset’s useful life. Such

capitalized amounts, as well as associated amounts of accumulated depreciation and depreciation

expense, must be reflected in DoD financial statements.

2.6.2. Depreciation is the systematic and rational allocation of the recorded cost of an asset

over its estimated useful life. Estimates of useful life for real property assets must consider factors

such as usage, physical wear and tear and technological change. For purposes of computing

depreciation on DoD real property assets, specific useful lives are prescribed. Table 24-1 reflects

the useful lives to be used for DoD real property in establishing opening balances as well as for

real property acquired after establishment of opening balances.

2B

2.6.3. The event that triggers the calculation of depreciation is the date the real property

asset is placed in service (regardless of whether it is actually used). The actual commencement of

depreciation will generally be based on the Month Available for Service method. Under this

method, the month the asset was available for use, regardless of whether it was actually used, is

the month used to commence the calculation of depreciation expense for the first year.

2.6.4. DoD policy permits only the use of the straight-line method of depreciation for real

property assets. Straight-line depreciation expense is calculated as the recorded cost divided

equally among accounting periods during the asset’s useful life based on useful lives in Table 24-1.

2.6.5. If an asset remains in use longer than its estimated useful life, it must be retained in

the APSR, as well as the accounting records, and reflect both its recorded cost and accumulated

depreciation until disposition of the asset.

2.6.6. WCF activities are required to depreciate real property assets in accordance with the

guidance in this chapter without regard to whether such assets are procured through the WCF

activity’s Capital Purchase/Investment Program budget or whether depreciation for such assets is

included in rates charged to customers. The recognition of real property assets and the depreciation

of such assets by WCF activities, therefore, may be different for financial statement reporting

purposes than the depreciation amounts used for WCF rate development and budget presentation.

All real property depreciation of WCF activities must be recognized as an expense on the

Statement of Net Cost, included in accumulated depreciation amounts on the Balance Sheet, and

reported in the “Defense Working Capital Fund Accounting Report [Accounting Report (Monthly)

1307] (AR(M)1307).” Depreciation recorded on real property that was not acquired nor will be

replaced through use of Defense WCF resources must be classified as non-recoverable for rate

setting purposes and reported appropriately on the AR(M)1307. Defense WCF rates charged to

customers are based on guidance in Volume 2B and Volume 11B.

DoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

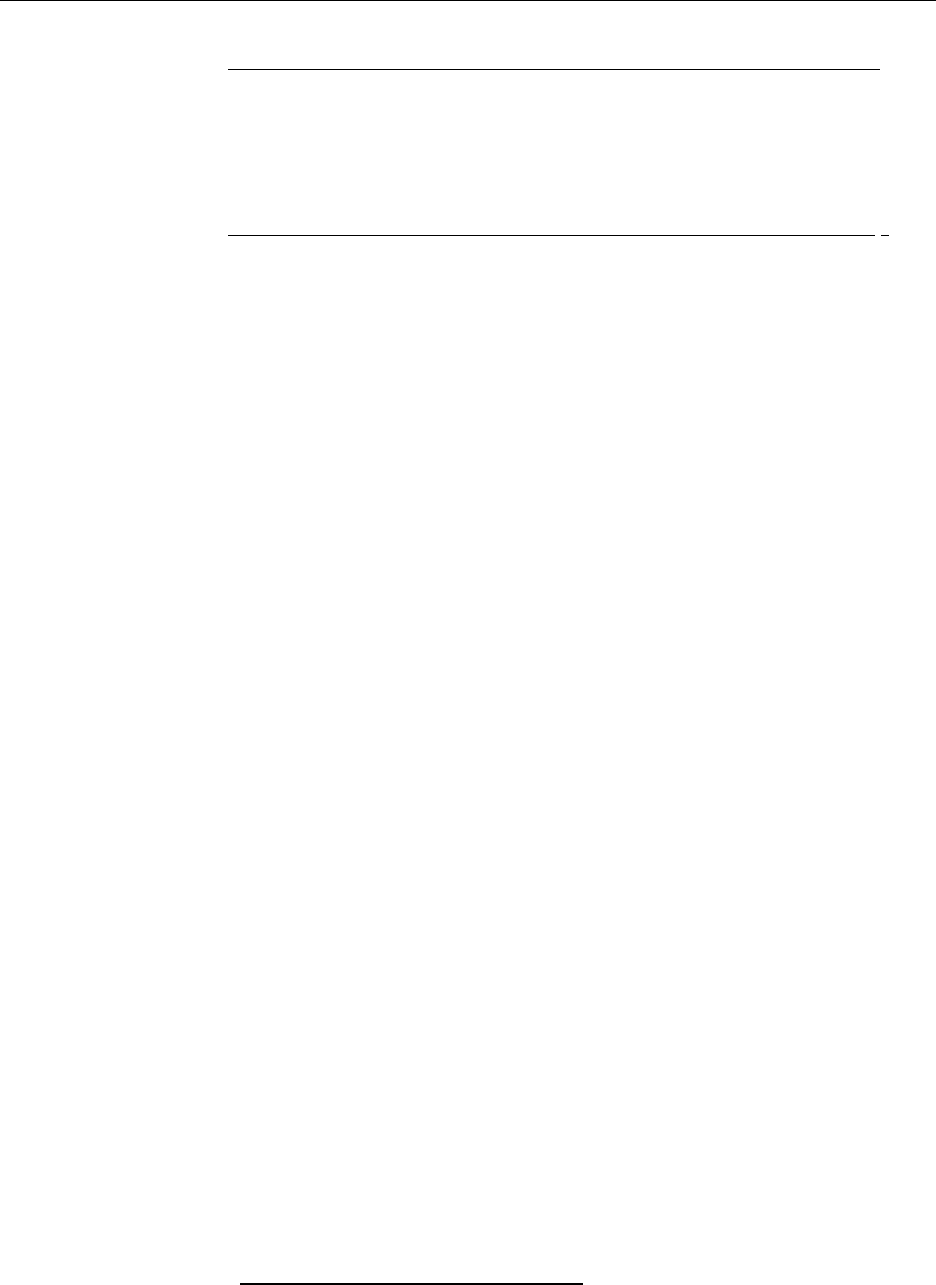

Table 24-1. DoD Useful Lives for Depreciable Real Property Assets

Real Property

Classification

Real Property Useful Lives Capital Improvements (if useful

life is not provided by an

en

g

ineerin

g

estimate)(ii)

Buildin

g

s 45

y

ears 20

y

ears

Structures 35

y

ears 15

y

ears

Linear Structures 40

y

ears 20

y

ears

Land Rights of a

Limited Duration (i)

Over the specified duration -

i. Land Rights are included on the balance sheet in General PP&E only if the

DoD Component did not make the election to implement the provisions of SFFAS 50,

paragraph 13 to exclude land rights from the opening balance of General PP&E and

expense future land rights acquisitions after establishment of the opening balance.

ii. Engineering estimates are of particular importance when evaluating full restoration or

conversion.

24-24

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-25

2.7 Impairment (240207)

2.7.1. Description. SFFAS 44 defines impairment as a significant and permanent decline

in the service utility of General PP&E (which includes real property assets) or expected service

utility of CIP that results from events or changes in circumstances that are not considered normal

and ordinary. Identified real property (i.e., real property for which a significant decline in the

service utility has occurred) should be tested for impairment by determining whether the

magnitude of the decline in the service utility is significant and whether the decline in the service

utility is expected to be permanent.

2.7.1.1. See subparagraph 240207.B.2 for a discussion of determining the

significance and permanence of a service utility decline.

2.7.1.2. The service utility of real property is the usable capacity that, at acquisition

or after improvement, was expected to be used to provide service. The current usable capacity of

real property may be less than its original usable capacity due to the normal or expected decline in

useful life or to impairing events or changes in circumstances, such as physical damage,

obsolescence, enactment of approval of laws or regulations or other changes in environmental or

economic factors, or changes in the manner or duration of use.

2.7.1.3. Normal and ordinary events or circumstances are those that fall within the

expected useful life of the real property such as standard maintenance and repair requirements.

Events or circumstances that are not considered normal are those that, at the time the real property

was acquired or improved, the event or change in circumstance would not have been expected to

occur during the useful life of the real property or, if expected, was not sufficiently predictable to

be considered in estimating the real property’s useful life.

2.7.2. Identification of Potential Impairment Loss. The determination of whether real

property remaining in use is impaired is a two-step process which includes (1) identifying potential

impairment indicators and (2) testing for impairment.

2.7.2.1. Step 1 – Identify Indicators of Potential Impairment. Indicators of

potential impairment can be identified and brought to DoD Component’s attention in a variety of

ways, such as procedures related to DM&R. Although DoD Components are not required to

establish additional or separate procedures beyond those that may already exist, they should

evaluate existing processes and internal controls to determine if they are sufficient to reasonably

assure the identification of potential impairment indicators and implement appropriate additional

processes and internal controls if necessary. Once identified, indicators are not conclusive

evidence that a measurable or reportable impairment exists; DoD Components should carefully

consider the surrounding circumstances to determine whether a test of potential impairment is

necessary given the circumstances. Some common indicators of potential impairment include:

2.7.2.1.1. Evidence of physical damage;

2.7.2.1.2. Enactment or approval of laws or regulations which limit or

restrict the usage of the real property asset;

2BDoD 7000.14-R Financial Management Regulation Volume 4, Chapter 24

* October 2019

24-26

2.7.2.1.3. Changes in environmental factors (e.g., change in floodplain);

2.7.2.1.4. Technological changes or evidence of obsolescence (however, if

obsolete real property continues to be used, the service utility expected at acquisition may not be

diminished);

2.7.2.1.5. Changes in the manner or duration of use of real property;

2.7.2.1.6. Construction stoppage or contract termination; and

2.7.2.1.7. Real property idled or unserviceable for excessively long

periods.

2.7.2.2. Step 2 – Impairment Test. Identified real property should be tested for

impairment by determining whether these two factors are present: (1) the magnitude of the decline

in service utility is significant and (2) the decline in service utility is expected to be permanent.