Head Office

Survey No. 115/1, Financial District

Nanakramguda, Gachibowli, Hyderabad – 500032, India

Phone: +91-40-20204000

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

ANNUAL REPORT

2022-23

This Report is in conformity with the format as per the

Insurance Regulatory and Development Authority

(Annual Report-Furnishing of Return, Statements and

Other Particulars) Rules, 2000.

PART – I

POLICIES AND PROGRAMMES

PART II–

REVIEW OF WORKING AND OPERATIONS

I.1 Review of General Economic Environment 1

I.2 Appraisal ofInsuranceMarket 3

I.3 Number and Details of Authorised Insurers/Reinsurers 22

I.4 Policies and Measures to Develop Insurance Market 23

I.5 Research and DevelopmentActivitiesUndertaken by the Insurers 29

I.6 Review 31

I.6.1 Protection of Interests ofPolicyholders 31

I.6.2 Maintenance of SolvencyMarginsofInsurers 32

I.6.3 Monitoring of Reinsurance 33

I.6.4 Monitoring InvestmentsoftheInsurers 36

I.6.5 Health Insurance 39

I.6.6 Specified Percentage of Business to be done in Rural and

Social Sector 47

I.6.7 Accounts andActuarial Standards 48

I.6.8 Directions,Ordersand Regulations Given by theAuthority 49

I.6.9 Powers and Functions Delegated bytheAuthority 49

I.6.10 OtherPolicies and Programmes having Bearing on the

Working of the InsuranceMarket 49

.1 Regulation of Insurance and Reinsurance Companies 55II

.2 InsuranceAgents and IntermediariesAssociated with Insurance Business 59II

.3 ProfessionalInstitutes connected with InsuranceEducation 70II

.4 Litigations, Appeals and Court Pronouncements 71II

.5 International Cooperationin Insurance 72II

.6 75II

Grievances

.7 Functioning of theAdvisory Committee 77II

.8 Functioning ofOmbudsman 77II

.9 InsuranceAssociationsandInsuranceCouncils 78II

.10 OtherActivities having a Bearing on the Insurance Market 80II

CONTENTS

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

Mission Statement ix

Members of the Authority xi

Senior Officials of xiiiIRDAI

PART III–

STATUTORY AND DEVELOPMENTAL FUNCTIONS OF THE AUTHORITY

PART IV–

ORGANISATIONAL MATTERS

.1 Issue to the applicant a certificate of registration, renew, modify,III

withdraw, suspend or cancel such registration 83

.2 Protection of the interests of policyholders in matters concerningIII

assigning of policy, nomination by policyholders, insurable interest,

settlement of insurance claim, surrender value of policy and other

terms and conditions of contracts of insurance 83

.3 Specifying requisite qualifications, code of conduct and practicalIII

training for intermediaries or Insurance Intermediaries and agents 84

.4 Specifying the code of conduct for surveyors and loss assessors 84III

.5 Promoting efficiency in the conduct of insurance business 87III

.6 Promoting and regulating professional organisationsIII

connected with the insurance and reinsurance business 92

.7 Levying fees and other charges for carrying out the purposes of the Act 93III

.8 Calling information from, undertaking inspection of, conductingIII

enquiries and investigations including audit of the insurers,

intermediaries, insurance intermediaries and other organisations

connected with the insurance business 93

.9 Control and Regulation of Rates, Advantages, Terms and ConditionsIII

that may be offered by insurers in respect of general insurance business

not so controlled and regulated by the Tariff Advisory Committee under

section 64U of the Insurance Act, 1938 (4 of 1938) 96

.10 Specifying the form and manner in which books of accounts shall beIII

maintained and statements of accounts shall be rendered by Insurers

and other insurance intermediaries 96

.11 Regulating investment of funds by insurance companies 96III

.12 Regulating maintenance of margin of solvency 98III

.13 Adjudication of disputes between Insurers and Intermediaries orIII

Insurance Intermediaries 99

.14 Specifying the percentage of life insurance business and generalIII

insurance business to be undertaken by the Insurers in the rural

and social sector 99

.1 Organisation 103IV

.2 Human Resources 104IV

.3 Promotion of Official Language 108IV

.4 Information Technology 110IV

.5 Accounts 111IV

.6 Acknowledgements 111IV

ii

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

BOX ITEMS

TABLES

I.1 Participation of Women in Life Insurance 7

I.2 Use and File (U&F) - Simplification of Product Filing Procedure 20

I.3 Surety Insurance 27

I.4 InsurTech Initiatives 28

.1 Reforms and Regulatory Initiatives in Indian Insurance Sector 85III

.2 State Insurance Plan 86III

.3 Working towards a Future Ready Insurance Industry 91III

I.1 National Income Estimates of India 1

I.2 Estimates of Gross Value Added ( ) by Economic Activity 1GVA

I.3 Financial Saving of the Household Sector 3

I.4 Growth in Real Premium by Region in the World in 2022 3

I.5 Premium Volume by Region in the World in 2022 4

I.6 Performance of Life Insurance Business 9

I.7 Financial Performance Indicators of Life Insurers 10

I.8 Death Claims of Life Insurers 11

I.9 Performance of General, Health & Specialised Insurers 14

I.10 Financial Performance of General, Health and Specialised Insurers 15

I.11 Segment-wise Incurred Claims Ratio of General, Health & Specialised Insurers 17

I.12 Offices of Life Insurers 21

I.13 Office of General, Health, and Specialized Insurers 22

I.14 Number of Registered Insurers and Reinsurers 22

I.15 Grievances on Unfair Business Practices ( ) registered against Life Insurers 31UFBP

I.16 Net Retention of General and Health Insurers 33

I.17 Reinsurance Placement by General and Health Insurers 33

I.18 Investments of Life Insurers: Category-wise 37

I.19 Investments of General, Health, Specialized Insurers & Reinsurers: Category wise 37

I.20 Investments of Insurance Industry 38

I.21 Investments of Life Insurers: Fund-wise (As on March 31) 38

I.22 Health Insurance Premium Underwritten by General and Health Insurers 39

I.23 Policies, Lives Covered and Premium under Health Insurance Business of

General and Health Insurers 40

I.24 Incurred Claims Ratio under Health Insurance Business of General and

Health Insurers 41

I.25 Claims Paid under Health Insurance Business of General and Health Insurers 43

I.26 Status of Claims under Health Insurance Business of General and Health

Insurers 43

I.27 Policies, Lives Covered and Premium under Health Insurance Business of

Life Insurers 44

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

iii

I.28 Status of Claims under Health Insurance Business of Life Insurers 44

I.29 Business under Personal Accident Insurance 45

I.30 Coverage under Government Sponsored Personal Accident Schemes 45

I.31 Business under Overseas Travel Insurance 46

I.32 Business under Domestic Travel Insurance 46

I.33 Health, and Travel Insurance Business Underwritten Outside India 46PA

.1 Insurance Agents Associated with Life Insurers 60II

.2 Gender-wise Distribution of Individual Agents associated with Life InsurersII

as on 31st March 2023 60

.3 Insurance Agents Active with General & Health Insurers 61II

.4 Gender-wise Distribution of Insurance Agents associated with General andII

Health Insurers (2022-23) 61

.5 Corporate Agents Active with Insurance Business (As on March 31, 2023) 62II

.6 Performance of Micro Insurance Business in Life Insurance Sector (2022-23) 62II

.7 Micro Insurance Agents of Life Insurers 63II

.8 Number of Micro insurance Policies Issued 63II

.9 Business Performance of s 64II IMF

.10 Number of s with various Sponsoring Agencies 64II POSP

.11 Number of s with various Sponsoring Agencies 65II MISP

.12 Number of applications 65II ISNP

.13 Surveyor and Loss Assessor Licenses Issued 66II

.14 Business Performance of Intermediaries in Life Insurance (2022-23) 67II

.15 Business Performance of Insurance Agents and Intermediaries associatedII

with General Insurers (2022-23) 69

.16 Business Performance of Insurance Agents and Intermediaries inII

Health Insurance (Excl. and Travel Insurance) (2022-23) 70PA

.17 Details of the cases filed during 2022-23 72II

.18 Details of Cases Disposed for the period 2022-23 72II

.19 Status of Grievances as per Bima Bharosa portal 76II

.20 Grievances Registered in Portal and Referred to 77II DARPG IRDAI

.21 Pendency of Grievances 77II

.1 Details of Onsite Inspections 79III

.2 On-site and remote inspection reports concluded by Enforcement andIII

Compliance Department during 2022-23 95FY

.3 Details of Regulatory actions taken on the Observations 95III

.1 Composition of the Authority as on March 31, 2023 103IV

.2 Details of Meetings of the Authority held during 2022-23 104IV

.3 Sanctioned and Actual Staff Strength in 104IV IRDAI

.4 Category-wise Staff Strength in 105IV IRDAI

.5 Age-wise Distribution of Staff in 105IV IRDAI

.6 Grade-wise Staff Strength in 105IV IRDAI

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

iv

CHARTS

I.1 Percentage Shares of Sectors in at Current Price in 2022-23 2GVA

I.2 Domestic Savings in Indian Economy 2

I.3 Trend in Insurance Penetration in India 4

I.4 Insurance Density in India 5

I.5 Insurance Penetration in Select Countries in 2022 5

I.6 Insurance Density In Select Countries 2022 5

I.7 Proportion of Policies on Women in Life Insurance sector 8

I.8 Performance of Life Insurance Sector 12

I.9 Segment wise Share in Life Insurance Premium 12

I.10 New Business Premium of Life Insurers 12

I.11 Profit after Tax of Life Insurers 13

I.12 Benefits Paid by Life Insurers 13

I.13 Premium underwritten within India by Non-Life Insurers 18

I.14 Segment wise Share of premium of General and Health Insurers 18

I.15 Operating Expenses of General and Health insurers 19

I.16 Net Incurred Claims of General and Health Insurers 19

I.17 Tier wise Distribution of Offices of Life Insurers 22

I.18 Tier wise Distribution of Offices of Non-Life Insurers 22

I.19 Gross Reinsurance Premium of Reinsurers including s 35FRB

I.20 Sector-Wise Share In Premium Of Health Insurance (2022-23) 39

I.21 Trend In Health Insurance Premium (Excl. Pa & Travel Insurance) 40

I.22 Lives Covered (in lakhs) and Premium under Health Insurance

(2022-23) excl. & Travel 40PA

I.23 Share of top 5 states in Total Health Insurance Premium 2022-23 41

I.24 Net Incurred Claims Under Health Insurance 41

I.25 Trend in Incurred Claim ratio under Health Insurance: Sector wise 42

I.26 Trend in Incurred Claim Ratio under Health Insurance:Segment wise 42

I.27 Health Insurance Premium of Life Insurers 43

.1 Channel-wise Individual New Business Performance in Life InsuranceII

Business 68

.2 Channel-wise Group New Business Performance in Life Insurance Business 68II

.3 Channel-Wise Performance Of Health Insurance Business(2022-23) 69II

.4 Channel-Wise Performance Of General Insurance Business(2022-23) 69II

.5 Classification of Life Insurance Complaints 76II

.6 Classification of General Insurance Complaints 76II

.1 Grade-wise Distribution of Staff in (2022-23) 105IV IRDAI

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

v

STATEMENTS

ANNEXURES

1 International Comparison of Insurance Penetration 115

2 International Comparison of Insurance Density 116

3 Premium Underwritten by Life Insurers 117

4 Linked and Non-Linked Premium of Life Insurers 118

5 Segment-wise Total Premium of Life Insurers 119

6 Equity Share Capital of Life Insurers 120

7 Gross Direct Premium of General and Health Insurers (Within and Outside India) 121

8 Segment-wise Gross Direct Premium of General & Health Insurers (Within India) 122

9 Equity Share Capital of General, Health and Reinsurers 124

10 Incurred Claims Ratio of General and Health Insurers (Within India) 125

11 Solvency Position of Life Insurers 127

12 Solvency Position of General, Health, Specialised, and Reinsurance Companies 128

13 Solvency Position of Branches of Foreign Reinsurers ( s) 129FRB

14 Assigned Capital of Branches of Foreign Reinsurers ( s) 130FRB

15 131Assigned Capital of s ( Crore)FRB

16 Assets Under Management of Life Insurers 132

17 Assets Under Management of General, Health, Specialized, and Reinsurers 135

1 List of Registered Insurers/Reinsurers Operating In India

(as On 31 March 2023) 139

st

2 (i) Share of Members in Indian Market Terrorism Risk Insurance Pool ( ) 141IMTRIP

(ii) Share of Members in Indian Nuclear Insurance Pool ( ) 142INIP

(iii) Marine Cargo Excluded Territories Pool ( Pool) 143MCET

3 Data for calculating Motor Obligations for 2023-24 144TP

4 Circulars/Orders/Guidelines/Instructions issued from

April 01, 2022 to March 31, 2023 145

5 Regulations framed under the Act, 1999 up to March 31, 2023 149IRDA

6 List of Micro Insurance Products of Life Insurers 154

7 Number of Products and Riders Approved by in 2022-23 155IRDAI

8 Fee Structure for Insurers and Intermediaries & Fee Collected in 2022-23 156FY

9 (i) Indian Assured Lives Mortality ( ) - 2012-14 157IALM

(iii) Indian Individual Annuitant's Mortality Table (2012-15) 158

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

vi

ABBREVIATIONS

AFIR : Asian Forum of Insurance Regulators

AML : Anti-Money Laundering

ASSOCHAM : Associated Chambers of Commerce & Industry of India

CAD : Consumer Affairs Department

CBR : Cross Border Reinsurer

CFT : Countering the Financing of Terrorism

CII : Confederation of Indian Industry

CoR : Certificate of Registration

CPIO : Central Public Information Officer

CPSC : Common Public Service Center

CSC : Common Service Centre

DARPG : Department of Administrative Reforms and Public Grievances

DCF : District Consumer Forum

DFS : Department of Financial Services

FAA : First Appellate Authority

FATF : Financial Action Task Force

FICCI : Federation of Indian Chambers of Commerce & Industry

FIU IND- : Financial Intelligence Unit- India

FRB : Foreign Reinsurance Branch

FRN : Filing Reference Number

FSB : Financial Stability Board

FoF : Fund of Funds

GDP : Gross Domestic Product

GNDI : Gross National Disposable Income

GVA : Gross Value Added

HOD : Head of Department

IAC : Insurance Advisory Committee

IAIS : International Association of Insurance Supervisors

ICR : Incurred Claims Ratio

IFRS : International Financial Reporting Standard

IGCC IRDAI: Grievance Call Centre

IGMS : Integrated Grievance Management System

IIB : Insurance Information Bureau of India

IIISLA : Indian Institute of Insurance Surveyors and Loss Assessors

IIRM : Institute of Insurance and Risk Management

IMCC : Inter-Ministerial Co-ordination Committee

IMFs : Insurance Marketing Firms

INFE : International Network on Financial Education

IRCTC : Indian Railway Catering and Tourism Corporation

IRDAI : Insurance Regulatory and Development Authority of India

ISNP : Insurance Self-Network Platform

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

vii

Inv s : Infrastructure Investment TrustsIT

KMP : Key Managerial Personnel

KYC : Know Your Customer

LPA : Letter Patent Appeal

MACT : Motor Accident Claims Tribunal

MFI : Micro Finance Institution

MISP : Motor Insurance Service Provider

Mo : Ministry of Road Transport & HighwaysRTH

NBFC : Non-Banking Financial Company

NCDRC : National Consumer Disputes Redressal Commission

NGOs : Non-Government Organizations

NOC : No Objection Certificate

NSO : National Statistical Office

OECD : Organization for Economic Co-operation and Development

OMOP : One More Option Plan

PM JAY- : Pradhan Mantri Jan Arogya Yojana

PMFBY : Pradhan Mantri Fasal Bima Yojana

PMJDY : Pradhan Mantri Jan Dhan Yojana

PMJJBY : Pradhan Mantri Jeevan Jyoti Bima Yojana

PMLA : Prevention of Money Laundering Act

PMSBY : Pradhan Mantri Suraksha Bima Yojana

PMVVY : Pradhan Mantri Vaya Vandana Yojana

POSP : Point of Sales Person

PSU : Public Sector Undertaking

RAP : Rural Authorized Person

RBI : Reserve Bank of India

RBSF : Risk Based Supervisory Framework

RBC : Risk Based Capital

REITs : Real Estate Investment Trusts

RSM : Required Solvency Margin

RTI : Right to Information

SAHI : Stand-alone Health Insurer

SCDRC : State Consumer Disputes Redressal Commission

SEBI : Securities and Exchange Board of India

SHGs : Self Help Groups

SLA : Surveyors and Loss Assessors

SPV : Special Purpose Vehicle

TOLIC : Town Official Language Implementation Committee

TPA : Third Party Administrator

UFBP : Unfair Business Practices

ULIP : Unit-Linked Product

USD : United States Dollar

VLE : Village Level Entrepreneur

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

viii

To protect the interest of and secure fair treatment to

policyholders;

To bring about speedy and orderly growth of the

insurance industry (including annuity and

superannuation payments), for the benefit of the

common man and to provide long term funds for

accelerating growth of the economy;

To set, promote, monitor and enforce high standards

of integrity, financial soundness, fair dealing and

competence of those it regulates;

To ensure speedy settlement of genuine claims, to

prevent insurance frauds and other malpractices and

put in place effective grievanceredressalmachinery;

To promote fairness, transparency and orderly

conduct in financial markets dealing with insurance

and build a reliable management information system

to enforce high standards of financial soundness

amongst market players;

To take action where such standards are inadequate

orineffectively enforced;

To bring about optimum amount of self-regulation in

day-to-day working of the industry consistent with

the requirements of prudential regulation.

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

भारतीय बीमा वनयामक एव

ं

वकास ाधकरण

ix

MISSION STATEMENT

x

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

MEMBERS OF THE AUTHORITY

CHAIRPERSON

Shri Debasish Panda

WHOLE TIME MEMBERS-

Ms. T L Alamelu

(Upto 06.05.2022)

Shri K Ganesh

(Upto 30.07.2022)

Shri Parmod Kumar Arora

Ms. S N Rajeswari

Shri Rakesh Joshi

Shri Thomas Devasia

(From 19.09.2022)

Shri B C Patnaik

(From 01.05.2023)

PART TIME MEMBERS-

Shri Amit Agrawal

(Upto 03.07.2022)

Shri Suchindra Misra

(From 04.07.2022 up to 28.06.2023)

Shri Maruthi Prasad Tangirala

(From 28.06.2023)

CA (Dr.) Debashis Mitra

(Up to 11.02.2023)

CA Aniket Sunil Talati

(From 12.02.2023)

xi

xii

Shri D V S Ramesh

Chief General Manager

Smt. Nimisha Srivastava

General Manager

Smt. Arundhati Chakrabarty

Assistant Manager

Shri Pranav V

Assistant Manager

Shri Ravi Ranjan

Assistant Manager

Shri M. N. Munshi

Deputy General Manager

Shri Rupesh Dhinde

Manager

Shri D. S. Murali Mohan

Manager

GENERAL MANAGERS

SENIOR OFFICIALS OF IRDAI

(As on March 31, 2023)

EXECUTIVE DIRECTORS

Shri Suresh Mathur

On deputation at ,IIRM

Hyderabad

CHIEF GENERAL MANAGERS

Shri A. R. Nithiyanantham,

Legal

Smt. J. Meena Kumari

Life

Dr Mamta Suri

Enforcement and Compliance,

Finance and Investment, Internal Audit

Shri Randip Singh Jagpal

Policyholder Protection &

Grievance Redressal

Smt. Anita Josyula

Intermediaries

Shri P. S. Jagannatham

General Administration and

Human Resources

Shri G. R. Suryakumar

Supervision

Shri D. V. S. Ramesh

Insurance Inclusion and Development

Shri Raj Kumar Sharma

On deputation to Sahara

India Life Insurance Co. Ltd.

Shri Shyama Prasad Chakraborty

Actuarial

Shri A. Ramana Rao

Non-Life

Shri S. N. Jayasimhan

Economic & Policy Analysis & Research

Smt. Yegna Priya Bharath

Health

Shri T. S. Naik,

Life

Shri A. Venkateswara Rao

Policyholder Protection and

Grievance Redressal

Shri Prabhat Kumar Maiti

Actuarial and Chief Vigilance Officer

Smt. K.G. P. L. Ramadevi

General Administration and HR

Shri Sudipta Bhattacharya

Intermediaries

Shri M. S. Jayakumar

Supervision

Shri K. Mahipal Reddy

Intermediaries

Shri T. Venkateswara Rao

Enforcement and Compliance, Internal Audit

Shri Pankaj Kumar Tewari

Health

Shri Ammu Venkata Ramana

Finance and Investment

Shri C. Srinivas Kumar

Actuarial

Shri N. S. K. Prabhakar

Life

Shri Manoj Kumar

Finance and Investment

Shri Mahesh Agarwal

Finance and Investment

Shri Shardul Admane

Reinsurance

Smt. B. Padmaja

Chairman's Secretariat and

Board Secretariat

Shri D. S. Murthy

Non-Life

Shri Deepak Khanna

General Administration and

Human Resources

Shri Deepak Gaikwad

Intermediaries

Shri Prassad Rao Kalayru

Legal

Shri Suresh Nair

Non-Life

Smt. Nimisha Srivastava

Insurance Inclusion and Development

Smt. R. Uma Maheswari

Intermediaries

Smt. Latha C

Economic and Policy

Analysis and Research

ANNUAL REPORT TEAM

xiii

xiv

POLICIES AND PROGRAMMES

I

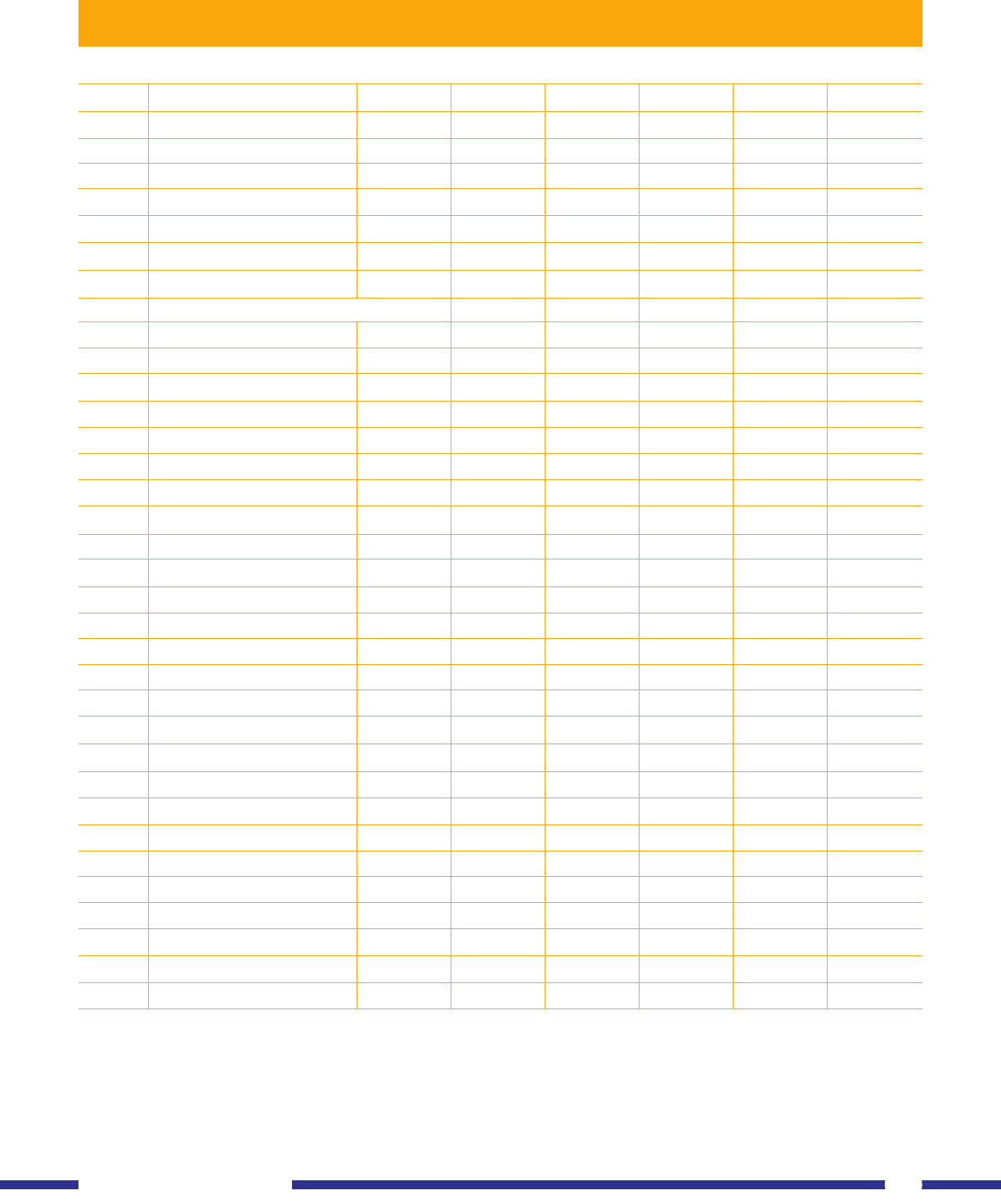

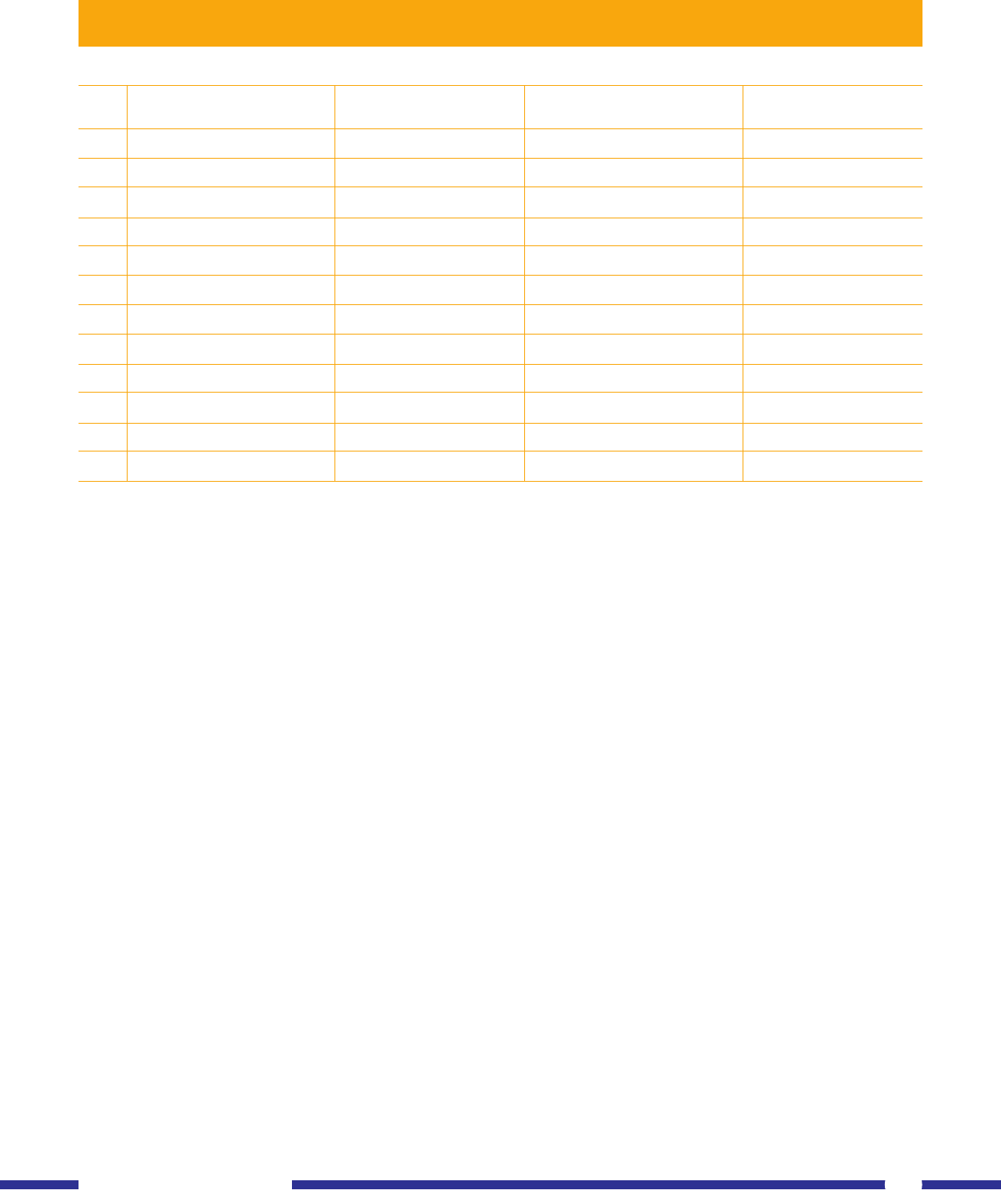

Industry 2021-22* 2022-23# Growth (%)

2021-22 2022-23

I. Agriculture, Forestry and Fishing 40.67 45.58 10.0 12.1

II. Industry

Mining & Quarrying 4.29 5.84 35.8 35.9

Manufacturing 33.97 36.36 21.3 7.0

Electricity, Gas, Water Supply & Other Utility Services 5.56 7.42 10.9 33.5

III. Services

Construction 17.38 20.28 29.3 16.7

Trade, Hotels, Transport, Communication & Services

related to Broadcasting 36.12 44.48 25.8 23.1

Financial, Real Estate & Professional Services 46.12 53.00 14.3 14.9

Public Administration, Defence & Other Services 30.29 34.48 15.4 13.8

GVA at Basic Prices 214.39 247.43 17.9 15.4

PART POLICIES AND PROGRAMMESI:

1.1 ReviewofGeneralEconomicEnvironment

I.1.1 . As per provisional estimates of National

Income released by National Statistical Office

( ), India's Gross Domestic Product ( ) atNSO GDP

current prices in the year 2022-23 is estimated at

272.41 lakh crore, as against 234.71 lakh crore

in 2021-22, showing a growth rate of 16.1

percent. The Gross National Disposable Income

( ) at current prices is estimated at 273.36GNDI

lakh crore during 2022-23, as compared to

236.06 lakh crore during 2021-22, showing a

rise of 15.8 per cent.

The per capita at current prices is 1,96,983GDP

during 2022-23 as compared to 1,71,498 in

2021-22 showing a growth of 14.9 per cent. Per

Capita Private Final Consumption Expenditure

increased to 1,19,277 in 2022-23 from

1,04,811 in 2021-22 registering a 13.8 per cent

increase.

I.1.2. Aggregate supply, measured by Gross

Value Added ( ) at basic prices, expanded byGVA

15.4 percent in 2022-23 after registering an

expansionof 17.9 per cent in 2021-22.

Item 2021-22* 2022-23# Growth (%)

2021-22 2022-23

Gross Value Added ( ) at basic prices ( lakh crore) 214.39 247.43 17.9 15.4GVA

Gross Domesc Product ( ) ( lakh crore) 234.71 272.41 18.4 16.1GDP

Gross Naonal Disposable Income ( ) ( lakh crore) 236.07 273.36 17.4 15.8GNDI

Per Capita ( ) 1,71,498 1,96,983 17.2 14.9GDP

Per Capita ( ) 1,72,490 1,97,676 16.2 14.6GNDI

Per Capita Private Final Consumpon Expenditure ( ) ( ) 1,04,811 1,19,277 16.9 13.8PFCE

Table I.1: National Income Estimates of India

Table I.2: Estimates of Gross Value Added ( ) by Economic ActivityGVA

*First Revised Estimates, #Provisional Estimates

Source: , Press Note dated May 31, 2023.NSO

(at current prices)

(At current prices) ( lakh crore)

*First Revised Estimates; Provisional Estimates;

#

Source: , Press Note dated May 31, 2023.NSO

Annual Report 2022-23

1

Chart I.1: Percentage Shares of Sectors in at Current Price in 2022-23GVA

I.1.3 The rate of gross domestic saving as per

cent to gross national disposable income ( )GNDI

surged to 30 per cent in 2021-22 from 28.4 per

cent in the preceding year, led by lower dissaving

of the general government sector, which offset

the drop in household savings.

The net financial savings of the household sector

– the most important source of funds for the two

deficit sectors, namely, the general government

sector and the non-financial corporations –

moderated to 7.6 per cent of in 2021-22.TheGNDI

moderation in household financial saving in India

is reflective of the release of pent-up demand,

and the associated drawdown in precautionary

saving as concerns relating to income flows

subsided in 2021-22.

Mining & Quarrying

2%

Electricity, Gas, Water Supply

& Other Utility Services

3%

Construction

8%

Manufacturing

15%

Public Administration,

Defence & Other Services

14%

Trade, Hotels, Transport,

Communication & Services

related to Broadcasting

18%

Agriculture, Forestry and Fishing

18%

Financial, Real Estate &

Professional Services

21%

Chart I.2: Domestic Savings in the Indian Economy

Household Sector

General Government

Financial Corporations

Non-Financial Corporations

2021-22

2020-21

-3%

3%

-7%

20%

22%

3%

10%

11%

Annual Report 2022-23

2

(Per cent of Gross National Disposable Income)

Table I.3: Financial Saving of the

Household Sector

Source: Annual Report 2022-23.(Table .2.2)RBI II

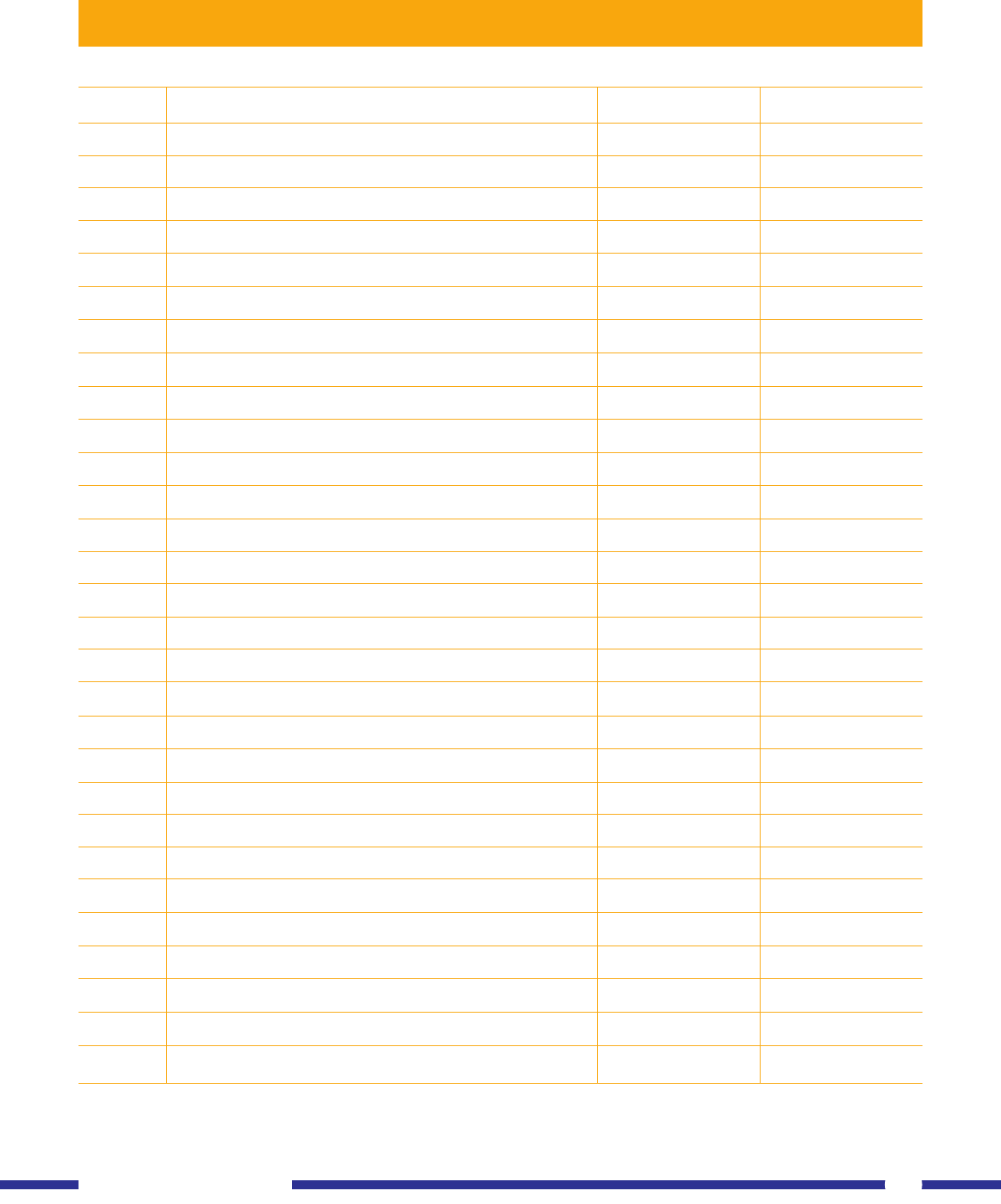

Regions Life Non-Life Total

Advanced markets -4.4 0.0 -1.8

Emerging markets 1.4 2.8 2.1

Asia-Pacific -2.0 2.9 -0.1

India# 8.2 6.0 7.7

World -3.1 0.5 -1.1

Source: Swiss Re Sigma World Insurance Report (No. 03/2023)

# 2022-23FY

(In per cent)

Item 2020-21 2021-22

Household sector savings 22 19.6

I Net financial savings (A-B) 11.3 7.6

ii. Savings in physical assets 10.5 11.7

iii. Savings in the form of

valuables 0.2 0.3

A. Gross Financial Savings 15.2 11

of which:

1. Currency 1.9 1.1

2. Deposits 6.2 3.5

3. Shares and Debentures 0.5 0.9

4. Claims on Government 1.3 1.2

5. Insurance Funds 2.8 1.9

6. Provident & Pension Funds 2.4 2.4

B. Financial Liabilities 3.9 3.4

I.2 Appraisalof Insurance Market

I.2.1 Appraisalof global insurance market

I.2.1.1 As per Swiss Re Sigma Report (No.

03/2023), the global economy continues to slow

down and inflation remains a primary global

macroeconomic concern. Despite such

challenges, the insurance industry is expected to

remain resilient in 2023 as the global economy is

projected to growby 2.3 per cent during the year.

I.2.1.2 Swiss Re forecasts global premiums for

life insurance to grow by 0.7 per cent in real terms

in 2023 in comparison to the 10-year trend of 1.3

per cent growth. High inflation leading to high

level of policy surrenders is likely to impact the

profitability of the sector.

I.2.1.3 Whereas, global insurance premium for

non-life insurance is estimated to grow by 1.4 per

cent in real terms in 2023. Within non-life sector,

motor insurance segment is anticipated to

rebound with a 2.8 per cent growth in global

premiums in real terms in 2023 whereas Health

insurance premiums are estimated to fall by 0.6

percent during the same period.

I.2.1.4 Overall, the global insurance premium

volumes (non-life and life) are projected to grow by

1.1 per cent in 2023 and 1.7 per cent in 2024 in real

terms, below the 10-yeartrend of 2.6 percent.

I.2.1.5 As per the Report, the United States is

the largest insurance market with total

premiums close to 3 trillion in 2022 andUSD

followed by China with total premium volume of

USD USD698 billion. United Kingdom ( 363

billion), Japan ( 338 billion) and France (USD USD

261 billion) are third, fourth and fifth largest

insurance markets.

Indian Insurance in the Global Scenario

I.2.1.6 In 2022, India was ranked as 10 largest

th

insurance market in the world with a premium

volume of 131 billion (with 1.9 per cent shareUSD

in global insurance premium) and it is projected

to become the sixth largest by the year 2032 as

India's insurance market is one of the fastest

growing insurance markets in the world. The

growth outlook for India is based on strong

economic growth, rising disposable incomes, a

young population, increased risk awareness,

digital penetration, and regulatory

developments.

InsurancePenetration and Density

I.2.1.7 Insurance penetration and density are

two metrics, among others, often used to assess

the level of development of the insurance sector

Table I.4: Growth in Real Premium by

Region in the World in 2022

Annual Report 2022-23

3

(Per cent of Gross National Disposable Income)

in a country. While insurance penetration is

measured as the percentage of insurance

premiums to ,insurance density is calculatedGDP

as the ratio of premium to population (per capita

premium).

I.2.1.8 As per Swiss Re Sigma Report, the

insurance penetration of Life Insurance sector in

India is reduced from 3.2 per cent in 2021-22 to 3

per cent in 2022-23 and the same for Non-Life

Insurance sector remained at 1 per cent in both

these years. As such, India's overall insurance

penetration reduced to 4 per cent in 2022-23

from the level of4.2 per cent in 2021-22.

I.2.1.9 In 2022-23, the life insurance density

increased to 70 from 69 in 2021-22.USD USD

Whereas, non-life insurance density remained

stable.

In 2022-23,the insurance density in India incresed

from 91 in 2021-22to 92in 2022-23.USD USD

I.2.1.10 As per Swiss Re Sigma World Insurance

Report, globally insurance penetration and

density were 2.8 per cent and 354 for the lifeUSD

segment and 4 per cent and 499 forthe Non-USD

life segment. Overall, insurance penetration and

density were 6.8 per cent and 853USD

respectively in 2022.

Insurance penetration in selected countries are

reproduced from Swiss Re Sigma World

Insurance Report in Statement 1 and 2,

respectively.

A long term trend in the insurance penetration

and insurance density of India is provided in the

Charts I.3 & I.4. Trends in penetration and

densities across the world in select countries is

depicted in Charts I.5 & I.6.

Table I.5: Premium Volume by Region in the

World in 2022

( Billions)USD

Source: Swiss Re Sigma World Insurance Report (No. 03/2023)

Note: Figures in bracket represent percent to total

Region Life Non-Life Total

Advanced Markets 2,140.47 3,356.40 5,496.87

(38.93) (61.07) (100)

Emerging markets 672.56 612.80 1,285.35

(52.32) (47.67) (100)

Asia-Pacific 1,032.81 692.16 1,724.97

(59.87) (40.12) (100)

India 99.50 31.53 131.60

(75.60) (24.40) (100)

World 2,813.03 3,969.20 6,782.23

(41.47) (58.52) (100)

Source: Swiss Re, Sigma World Insurance Report, various issues (Penetration - in per cent)

Chart I.3: Trend in Insurance Penetration in India

6

in per cent

4

2

0

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

2017-18

2018-19

2019-20

2020-21

2021-22

2022-23

Life Non-Life Total

Annual Report 2022-23

4

Source: Swiss Re Sigma World Insurance Report, Various issues (Density In )USD

# Data Relates to financial year

Note: Insurance Penetration is measured as percentage of

Insurance premium to GDP

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

2017-18

2018-19

2019-20

2020-21

2021-22

2022-23

100

80

60

40

20

0

in USD

Chart I.4: Insurance Density in India

Life

Chart I.5: Insurance Penetration in select

Countries in 2022

Chart I.6: Insurance Density in select

Countries in 2022

Non-Life Total

# Data Relates to financial year

Note: Insurance Density is measured as ratio of Insurance premium

to population

Source: Swiss Re Sigma World Insurance Report (No 03/2023)

Russia

Pakistan

Saudi Arabia

Indonesia

Turkey

Argentina

Mexico

New Zealand

China

Brazil

India#

Australia

Spain

Malaysia

Thailand

Germany

World

Switzerland

Canada

Italy

Japan#

Netherlands

France

Singapore

Sweden

Uk

South Korea#

Taiwan

South Africa

USA

Life Non-Life Life Non-Life

0.0

0 1000 2000 3000 4000 5000 6000 7000 8000 9000 10000

2.0 4.0 6.0

Per Cent USD

8.0 10.0 12.0 14.0

Pakistan

Indonesia

India#

Russia

Turkey

Mexico

Argentina

Brazil

Thailand

Saudi Arabia

China

Malaysia#

South Africa

World

Spain

New Zealand

Japan#

Italy

Australia

Germany

South Korea#

France

Taiwan

Canada

Netherlands

Uk

Sweden

Switzerland

Singapore

USA

Annual Report 2022-23

5

Annual Report 2022-23

6

I.2.2.3 Life Insurance Corporation of India ( )LIC

is the only life insurer underwriting business

outside of India and collected a total premium of

404.78 crore during 2022-23.

I.2.2.4 Traditional products contributed 6.77

lakh crore, constituting 86.59 per cent of total

premium and the share of s stood at 13.41ULIP

per cent. The business from traditional products

grew by 14.40 per cent and the same for Unit-

linkedproducts ( s) is 4.61per cent.ULIP

I.2.2.5 Life insurance segment constitutes 77

per cent of total life insurance premium followed

by pension and annuity segments together about

23 per cent. A detailed statement is provided at

Statement 5

I.2.2.6 During 2022-23, life insurers issued

284.70 lakh new policies under individual

business, out of which the public sector insurer

issued 204.29 lakh policies (71.75 per cent) and

the private life insurers issued 80.42 lakh policies

(28.25 per cent). The private sector insurers

registered a growth of 8.76 per cent, the public

sector insurer registered a de-growth of 5.94 per

cent and the Industry registered a de-growth of

2.21 per cent in the number of new policies issued

against the previous year.

I.2.2Appraisal OfIndian Insurance Market

Business Performance of Life Insurance

Sector

I.2.2.1 The Life Insurance market in India has

recorded a consistent premium growth over the

years. During 2022-23, the Life insurance

industry recorded premium income of 7.83 lakh

crore registering 12.98 per cent growth. The

private sector life insurers have clocked a growth

of 16.34 per cent in premium, while the public

sector life insurer recorded 10.90 per cent growth

in premium.

I.2.2.2 Renewal premium continues to

contribute majority of total premium

underwritten by Life insurers in 2022-23 at 52.56

per cent. The balance 47.44 per cent is

contributed by the new business premium.

However, the growth in new business premium

was higher at 17.90 per cent compared to renewal

business at 8.88 per cent. Single premium

products continue to play a major role for public

sector with a contribution of 40.65 per cent of its

total premium while it was 22.20 per cent for

private life insurers. The insurer-wise data for life

insurance premium is provided in Statement 3.

The bifurcation of total premium underwritten

into linked and Non-linked is provided at

Statement 4.

BOX I.1

Women comprise roughly 49 per cent of the total

population in India. Their contribution to the

economic activity of the country is significant

and is increasing every year. Life insurers are

rising to the occasion by catering to the the

growing demands of the women population, and

are offering suitable product solutions to provide

adequate life insurance coverage.

A brief study is made on the share of female lives

covered in life insurance business. Only individual

new business data – number of policies and first

year premium for the year 2022-23 has been

considered forthe purpose.

The number of policies issued to women in the

year 2022-23 is around 97.38 lakhs which is

34.20 per cent of 2.84 crore total policies as

against a share of34.7 percent in 2021-22.

The proportion of policies on women amongst

privatelife insurers and Public.

In 15 States/ s, the share in number of policiesUT

bought by women to the total policies sold is

higher than the all-India average of 34.20 per

cent.

Chart I.7: Proportion of Policies on Women in

Life Insurance sector

69.85%

30.13%

PRIVATE

PUBLIC

64.19%

35.81%

Male Female

(Approximately 0.01 per cent of Policies were sold in the 'others'

gender category in 2022-23)FY

Participation of women in Life Insurance

Marketing

7.45 lakh number of women are working as

agents in the life insurance industry, making it

28.35 per cent of the total individual agency

force as at March 31, 2023. Out of the total

number of women agents in the industry, the

share of private life insurers was 57.33 per cent

and public sector was 42.67per cent.

Top 5 States/UT

State Share to total

Policies in the State (%)

KARNATAKA 44.23

KERALA 43.96

MIZORAM 42.97

SIKKIM 42.60

MEGHALAYA 41.81

Bottom 5 States/UT

State Share to total

Policies in the State (%)

GUJARAT 29.59

UTTAR PRADESH 29.53

JAMMU KASHMIR& 28.07

HARYANA 27.16

LADAKH 23.10

PARTICIPATION OF WOMEN IN LIFE INSURANCE

Financial Performance of Life Insurers

I.2.2.7. As of March 31, 2023, total paid-up

capital of the life insurance sector stood at

34,957 crore, reflecting a 1.66 percent decline

compared to the previous year. This decrease

was primarily attributed to an 1,850 crore

reduction in the paid-up capital of Exide Life

Insurance Company Limited due to its

acquisition by Life Insurance Co. Ltd.HDFC

Nevertheless, ten other insurers injected an

additional 1,262 crore into the life insurance

industry. Consequently, the net impact on the

total paid-up capital for the fiscal year 2022-23

wasa decrease of 590 crore.

During the year, two private life insurers have

raised a total of amount of 838 crore under

Other Forms of Capital and one private insurer

has redeemed Other Forms of Capital by 100

crore. As on March 31, 2023, the total amount of

Other Forms of Capital with life insurers was

4,932crore.

I.2.2.8 Investment income (Policyholder's and

Shareholder's) including capital gains and other

income of life insurance industry declined by 6.63

per cent to 3.89 lakh crore as on 31 March

st

2023. While the public sector insurer recorded

7.25 per cent growth, private sector insurers

experienced 39.86 per cent decline in investment

income in the year2022-23.

I.2.2.9 Out of the 24 life insurers in operation

during 2022-23, 17 companies reported profits.

Profits of life insurance industry grew by 452 per

cent in 2022-23 with profit after tax ( ) ofPAT

42,788 crore as against 7,751 crore in 2021-22.

The public sector reported increase in profits by

800 per cent while private insurers together

reported an increase in profit by 72.36 per cent in

2022-23. The dividend paid by private life

insurers stands at 925.88 crore for 2022-23. FY

The public sector has paid 948.75 crore in

dividend to its shareholders forthe year2022-23.

I.2.2.10 (Expenses of Management ofIRDAI

Insurers transacting life insurance business)

Regulations, 2016 prescribe the allowable limits

of expenses of management taking into account,

inter alia the type and nature of product, premium

paying term and duration of insurance business.

During the year 2022-23, out of 24 life insurers,

18 were compliant with the aforementioned

regulations. Six life insurers had exceeded the

limits of expenses on an overall basis or

segmental basis and their request for

forbearance is under examination. The life

insurance industry reported gross expenses of

management of 1.31 lakh crore during 2022-23

which was 16.88 per cent of total gross premium.

I.2.2.11 During 2022-23, life insurers paid total

amount of 42,322 crore as commission. The

commission expenses ratio (commission

expenses expressed as a percentage of

premium) slightly increased to 5.41 per cent in

2022-23 from 5.18 per cent in 2021-22. However,

total commission outgo increased by 17.93 per

cent (total premium growth 12.98 per cent)

during 2022-23 as compared to previous year.

I.2.2.12 The operating expenses of the life

insurers increased by 25.21 per cent to 89,443

crore in 2022-23 and operating expenses ratio

(operating expenses as a per cent of gross

premium underwritten) of life insurance industry

increased from 10.31 per cent in 2021-22 to

11.43 per cent in 2022-23.

Annual Report 2022-23

8

Annual Report 2022-23

9

4

Segment-wise

Premium Under-

written ( crore)

Linked Non-Linked

Industry

Total

Linked Non-Linked Total

4(a)

Annuity

-

27,855.71 27,855.71

-

33,637.33 33,637.33

4(b)

Health

163.64 634.04 797.68 146.6 594.58 741.18

4(c)

Life

88,625.45 4,45,678.26 5,34,303.71

91,479.51

5,05,741.57 5,97,221.08

4(d)

Pension

11,537.61 1,12,987.92 1,24,525.52 13,329.79 1,35,295.68 1,48,625.46

4(e)

Variable

-

5,131.51 5,131.51

-

2,278.91 2,278.91

4(f)

Total

1,00,326.69 5,92,287.45 6,92,614.14 1,04,955.90 6,77,548.07 7,82,503.97

5

Benefits Paid

( crore)

Public

Sector

Private

Sector

Industry

Total

Public

Sector

Private

Sector

Industry

Total

5(a)

Death Claim

35,720.29 25,101.57 60,821.86 23,423.34 18,034.00 41,457.34

5(b)

Maturity

2,05,526.54 34,129.53 2,39,656.07 1,85,043.90 27,941.45 2,12,985.34

5(c) Surrender/Withdrawal

95,118.04 63,166.90 1,58,284.94 1,11,896.15 86,943.27 1,98,839.42

5(d) Annuities/ Pensions

16,257.21 1,990.77 18,247.97 17,892.71 2,803.55 20,696.26

5(e)

Others

815.51

24,270.57 25,086.08 1,056.57 21,830.19 22,886.77

5(f)

Total

3,53,437.58 1,48,659.34 5,02,096.92 3,39,312.67 1,57,552.46 4,96,865.13

Note: 1. Figures in bracket indicates growth over the previous year in per cent.

2. Death Claim is net of Reinsurance

S.

No.

2021 -22 2022-23

Particulars

Public

Sector

Private

Sector

Industry

Total

Public

Sector

Private

Sector

Industry

Total

1

Premium Underwritten within India ( Crore)

1

(a)

First Year Premium

36,649.35 73,943.39 1,10,592.74 39,089.94 70,834.75 1,09,924.69

(8.01) (57.77) (36.87) (6.66) (

-

4.20) (

-

0.60)

1

(b)

Single Premium

1,62,282.83 41,992.25 2,04,275.08 1,92,960.65 68,340.47 2,61,301.13

(7.83) (

-

11.41)

3.22

(18.9) (62.75) (27.92)

1

(c)

New Business

( +Single Premium)FY

1,98,932.18 1,15,935.64 3,14,867.82 2,32,050.60 1,39,175.22 3,71,225.82

(7.86) (22.98) (12.98) (16.65) (20.05) (17.9)

1

(d)

Renewal Premium

2,29,092.80 1,48,653.53 3,77,746.32 2,42,617.54 1,68,660.61 4,11,278.15

(4.68) (13.33) (7.92) (5.9) (13.46) (8.88)

1

(e)

Total Premium

(New + Renewal)

4,28,024.97 2,64,589.17 6,92,614.14 4,74,668.14 3,07,835.83 7,82,503.97

(6.13) (17.36) (10.16) (10.9) (16.34) (12.98)

2

Premium from

Outside India

( Crore)

419.7 0 419.7 404.78 0 404.78

3

New Individual

Policies issued

(in lakh)

217.19

73.94 291.13 204.24 80.42 284.7

(

-

3.54 ) (

-

3.38) (

-

3.51) (

-

5.96) (8.77) (

-

2.21)

Table I.6: Performance of Life Insurance Business

(rore)C

2021-22

2022-23

1

Paid up Capital ( Crore )

Public Sector

Private Sector

Industry Total

Public Sector

Private Sector

Industry Total

1(a)

Beginning of the FY

100.00

28,246.37

28,346.37

6,325.00

29,221.75

35,546.75

1(b)

Additions during the FY

6,225.00

975.38

7,200.38

0.00

(-) 589.70

(-) 589.70

1(c)

End of the Financial Year

6,325.00

29,221.75

35,546.75

6,325.00

28,632.05

34,957.05

2

Commission Expenses (and Rewards) in crore

2(a)

First Year Commission

9,730.97

8,088.84

17,819.80

10,791.81

11,175.84

21,967.65

In per cent

26.55

10.94

16.11

27.61

15.78

19.98

2(b)

Commission on Single

Premium

490.27

829.73

1,320.01

514.77

1,085.84

1,600.6

In per cent

0.3

1.98

0.65

0.27

1.59

0.61

2(c)

Rewards on New Business

Commission

1,099.57

441.61

1,541.18

1,766.81

696.21

2,463.02

In per cent

0.55

0.38

0.49

0.76

0.5

0.66

2(d)

11,320.81

9,360.18

20,680.99

13,073.39

12,957.88

26,031.28

In per cent

5.69

8.07

6.57

5.63

9.31

7.01

2(e)

Renewal Commission

11,850.65

3,355.68

15,206.33

12,506.97

3,783.67

16,290.65

In per cent

5.17

2.26

4.03

5.16

2.24

3.96

2(f)

Total Commission (d+e)

23,171.46

12,715.86

35,887.31

25,580.37

16,741.56

42,321.92

In per cent

5.41

4.81

5.18

5.39

5.44

5.41

3

Operating Expenses ( crore)

38,890.68

32,544.34

71,435.02

48,145.60

41,297.02

89,442.62

In per cent

9.09

14.44

10.31

10.14

13.42

11.43

4

Investment Income ( crore)

2,93,875

1,22,835

4,16,711

3,15,189

73,873

3,89,062

5

Profit after Tax ( crore)

4,043

3,708

7,751

36,397

6,391

42,788

6

Dividend Paid ( crore)

0.00

381.53

381.53

948.75

925.88

1,874.63

New Business

Commission (a+b+c)

Table I.7: Financial Performance of Life Insurers

Annual Report 2022-23

10

Table I.8: Actual Death Claims of Life Insurers

Segment

Particulars

Total

Claims

Claims

paid

Claims

Repudiated

Claims

rejected

Claims

Unclaimed

Claims

pending at

end of FY

Individual

Business:

Number of

Policies

10,76,467 10,59,776 10,822 4,340

696 833

In per cent

100 98.45 1.01 0.40 0.06 0.08

30,216 28,611 1,026

24

206 350

In per cent

100 94.69 3.39 0.08 0.68 1.16

Group

Business

Number of

Lives

12,48,378 12,40,247 3,183

849 13

4,086

In per cent

100 99.35 0.25 0.07 0.001 0.33

Amount Paid

( crore)

Amount Paid

( crore)

17,769 17,178

393 23

2

174

In per cent

100 96.67

2.21

0.13 0.01 0.98

Benefits Paid byLife Insurers

I.2.2.13 The life insurance industry paid total

benefits of 4.96 lakh crore in 2022-23 which

constitutes 64.08 per cent of the net premium.

The benefits paid on account of surrenders /

withdrawals increased by 25.62 per cent to 1.98

lakh crore in 2022-23 of which public sector

insurer accounted for 56.27 per cent. During the

current year, out of the total surrender benefits,

benefits for policies accounted for 62.51 perULIP

cent for private insurers and 1.56 per cent for the

public life insurer.

I.2.2.14 In case of individual life insurance

business, during the year 2022-23, out of the

10.76 lakh total death claims, the life insurance

companies paid 10.60 lakh death claims, with a

total benefit amount of 28,611 crore. The

number of claims repudiated was 10,822 for an

amount of 1,026 crore and the number of claims

rejected was 4,340 for an amount of 24 crore.

The claims pending at the end of the year were

833 for 350 crore. The claim settlement ratio of

the public sector insurer was 98.52 per cent as at

March 31, 2023 compared to 98.74 % as at March

31, 2022. The claim settlement ratio of private

insurers was 98.02 per cent during 2022-23

compared to 98.11 per cent during the previous

year.The industry's settlement ratio decreased to

98.45 per cent in 2022-23 from 98.64 per cent in

2021-22.

I.2.2.15 In case of group life insurance business,

out of 12.48 lakhs total claims during 2022-23,

life insurance companies paid 12.40 lakh claims

with a settlement ratio of 99.35 per cent. While

the public sector insurer paid 98.97 per cent of

the claims, the private life insurers paid 99.41 per

cent of the claims.

Annual Report 2022-23

11

(rore)C

Note: Claims rejected are those claims that cannot be considered due to policy terms and conditions.

Claims repudiated are claims that cannot be considered as per the provisions of section 45 of Insurance Act, 1938.

Chart I.8: Performance of Life Insurance Sector

Chart I.9: Segment wise Share in Life Insurance Premium

Chart I.10: New Business Premium of Life Insurers ( Crore)

Total Premium of Life Insurers ( Crore)

Public Sector

Public Sector

Pension

18.99%

Variable

0.29%

Annuity

4.30%

Health

0.09%

Life

76.32%

Private Sector

Private Sector

Total

Total

2022-232021-22

4,28,025

2,64,589

6,92,614

4,74,668

7,82,504

3,07,836

1,98,932

1,15,936

3,14,868

2,32,051

1,39,175

3,71,226

2021-22 2022-23

Annual Report 2022-23

12

Chart I.11: Profit After Tax of Insurers ( Crore)

Chart I.12: Benefits Paid by Life Insurers ( Crore)

50,000

40,000

30,000

20,000

10,000

0

4,045

2021-22 2022-23

3,708

7,751

36,397

6,391

42,788

Public Sector

Public Sector

Death Claim

Maturity

Surrender/withdrawal

Annuities/Pensions

Others

Total

600,000

500,000

400,000

300,000

200,000

100,000

18,034

Total

Total

Private Sector

Private Sector

23,423

41,457

185,044

27,941

212,985

111,896

86,943

198,839

17,893

2,804

20,696

1,057

21,830

22,887

339,313

157,552

496,865

Annual Report 2022-23

13

Particulars

2021-22

2022-23

Public

Sector

Private

Sector

SAHI

Specialized

Insurers

Industry

Total

Public

Sector

Private

Sector

SAHI

Specialized

Insurers

Industry

Total

Gross Direct

Premium within

India

75,032.84 1,09,753.37

20,867.18

15,046.83

2,20,700.21

82,891.26 1,31,941.83

26,243.85 15,817.32

2,56,894.27

(4.44)

3,302.61

-

-

-

-

-

-

3,302.61

3,433.55

3,433.55

(11.99)

(32.45)

(14.73)

(11.06)

(10.47)

(20.22)

(25.77)

(5.12)

Gross Direct

Premium outside

India

Segment-Wise Premium (Within India) Underwritten ( crore)

Fire

8,514.95

13,036.08

NA

NA

21,551.03

8,889.69

15,046.44

NA

NA

23,936.12

Marine

1,834.43

2,333.18

NA

NA

4,167.61

2,155.49

2,903.17

NA

NA

5,058.66

Motor

21,768.98

48,664.50

NA

NA

70,433.48

23,689.90

57,590.14

NA

NA

81,280.04

Health (including

Personal

Accident)

35,374.27

24,260.83

20,867.18

NA

80,502.27

41,172.21 30,247.44

26,243.85

NA

97,663.50

Others

7,540.22

21,458.78

NA

15,046.83

44,045.82

6,983.97

26,154.66

NA

15,817.32

48,955.94

Total

75,032.84 1,09,753.37

20,867.18

15,046.83

2,20,700.21

82,891.26 1,31,941.83

26,243.85 15,817.32

2,56,894.27

New Policies

Issued (in lakhs)

Net Incurred

Claims

631.93

67,986.46

1,423.53

52,713.97

125.94

12,7818.95

475.3

7,146.94

2,656.7

1,40,565.96

603.74

70,643.49

1,699.84

60,201.57

138.26

12,787.28

576.26

5,680.40

(7.65)

(13)

(19.47)

(13.73)

(7.68)

(-4.46)

(19.41)

(9.78)

(21.24)

1,49,312.74

SN

1

(16.4)

2

3

3(a)

3(b)

3(c)

3(d)

3(e)

3(f)

4

5

3,018.1

(13.6)

Note: Figures in Brackets indicate growth (in per cent) over the previews year

Table I.9: Performance of General, Health and Specialised Insurers

Annual Report 2022-23

14

( crore)

Table I.10: Financial Performance of General, Health and Specialised Insurers

S.N

Particulars

2021-22

2022-23

Segments

Public

Sector

Private

Sector

SAHI

Specialized

Insurers

Total

Public

Sector

Private

Sector

SAHI

Specialized

Insurers

Total

1

Paid-up Capital

At the beginning

of the FY

13,724.00

11,493.19

4,235.06

3,390.00

32,842.24 18,724.00

10,341.76

4,639.33

4,150.00

37,855.09

Additions during

the year

5,000.00

1,151.43

4.4.27

760.00

5,012.84

0

1,691.43

440.77

388

2,520.20

End of the FY

18,724.00

10,341.76

4,639.33

4,150.00

37,855.09

18,724.00

12,033.19 5,080.10

4,538.00

40,375.29

2

Commission Expenses

2(a)

Fire

990.04

1,171.05

NA

NA

2,161.09

1,051.91

1,322.54

NA

NA

2,374.45

2(b)

Marine

179.27

256.61

NA

NA

435.88

193.4

324

NA

NA

517.4

2(c)

Motor

1,940.11

4,053.25

NA

NA

5,993.36 2,355.06

4,890.36

NA

NA

7,245.42

2(d)

Health

1,890.39

2,117.16

2,758.69

NA

6,766.24 1,958.56 2,732.89

3,486.64

NA

8,178.09

2(e)

Others

746.02

776.53

NA

51.98

1,574.53

781.96

922.54

NA

124.84

1,829.34

2(f)

Total

5,745.83

8,374.60

2,758.69

51.98

16,931.10

6,340.89

10,192.33 3,486.64

124.84

20,144.7

3

Operating

Expenses

14,149.65

21,689.65

4,925.24

690.74

41,455.29 21,012.59 27,169.30

5,955.18

719.00

54,856.06

4

Investment Income

14,609.74

14,654.42

1,277.19

2,005.15 32,546.

49

19,655.63

15,585.69

1,551.59

2,046.48

38,839.38

5

Profit After Tax

- 6,761.16

4,098.77

- 1,808.01

1,613.46

-2,856.93

-10,607.44

4,664.69

447.21

2,929.84

- 2,565.7

6

Underwriting

Experience

-20,443.55

-8,158.25 -3,263.34

55.56

-31,809.59

-25,316.56 -8,698.81

-528.8

1,746.69

-32797.47

7

Dividends Paid

0 1,197.70

0

0 1,197.70

0 1,166.20

0

40.00

1,206.20

Annual Report 2022-23

15

(rore)C

AppraisalOf Non-life InsuranceMarket

Business Performance of General, Health

and Specialised Insurers

I.2.2.16 During 2022-23, the non-life insurance

industry underwrote a total direct premium of

2.57 lakh crore in India registering a growth of

16.40 per cent from previous year. Out of which,

27 private sector insurers (including standalone

health insurers) have underwritten 1.58 lakh

crore as against 1.30 lakh crore in 2021-22. The

specialized insurers underwrote gross direct

premium amounting to 15,818 crore. The public

sector general insurers together contributed to

38.42 per cent of the market share while the

private sector general insurers contributed to the

remaining 61.58 per cent.

I.2.2.17 Three public sector insurers except

United India are underwriting general insurance

business outside India. The total premium

underwritten outside the country by the three

public sector insurers stood at 3,434 crore in

2022-23 as against 3,303 crore in 2021-22

registering a growthof 3.96 percent.

I.2.2.18 Among various segments under non-life

insurance business, health insurance business is

the largest segment with a contribution of 38.02

percent (36.48 percent in 2021-22) of the total

premium. Health Insurance Segment reported

growth of 21.32 percent (26.27 percent growth in

2021-22) with the premium amounting to

97,633 crore from 80,502 crore in 2021-22.

The Motor segment witnessed a year-on-year

growth of 15.40 percent with premium collection

amounted to 81,280 crore in 2022-23 from

70,433 crore of 2021-22. However, the share of

the Motor segment in the total premium slightly

decreased to 31.64 percent from 31.91 percent of

previous year. The premium collection in fire

segment increased by 11.07 percent to 23,936

crore and in Marine segments increased by 21.38

per cent to 5,059 crore in 2022-23. The non-life

insurers have issued 30.18 crore policies in the year

2022-23reportinganincreaseof13.60percent.

Financial Performance of General, Health

Insurersand Specialised Insurers

I.2.2.19 As of March 31, 2023, the combined

paid-up capital of all non-life insurers amounted

to 40,375 crore, an increase from the previous

year's amount of 37,855 crore. Over the course

of 2022-23, general and health insurers added

2,520 crore to their equity capital base. Private

sector general insurers alone infused 1,691

crore in 2022-23, while standalone health

insurers and specialized insurers injected capital

amounts of 441 crore and 388 crore,

respectively.

I.2.2.20 During 2022-23, the non-life insurers

have redeemed Other Forms of Capital

amounting to 824 crore. Total other forms of

capital as on 31 March 2023 was 4,327 crore.

st

I.2.2.21 Commission expenses and operating

expenses constitute a major part of the total

expenses. The gross commission expenses of

public sector general insurers, private general

insurers, standalone health insurers and

specialized insurers stood at 6,341 crore,

10,192 crore, 3,487 crore and 125 crore

respectively for 2022-23, thus cumulatively

amounting to a total gross commission expense

of 20,145 crore for the non-life insurance

industry. The operating expenses of non-life

insurers stood at 54,856 crore in 2022-23 as

against 41,455 crore in 2021-22, showing an

overall increase of 32.33 percent. The operating

expenses of public sector general insurers,

private general insurers, standalone health

insurers and specialized insurers stood at

21,013 crore, 27,169 crore, 5,955 crore and

719 crore respectively for 2022-23.

Annual Report 2022-23

16

constituted 77 per cent of non-life industry losses

amounting to 25,317 crore and remaining by

private sector insurers amounting to 8,699

crore. Standalone health insurers reported a

decrease in underwriting losses in 2022-23

which is 529 crore as compared to underwriting

loss of 3,263 crore in 2021-22. The underwriting

profit of Specialized insurers increased to 1,747

crorein 2022-23 from 56 crorein 2021-22.

I.2.2.25 During the year 2022-23, the net loss of

the non-life insurance sector marginally

decreased to 2,566 crore as against a net loss of

2,857 crore in 2021-22. The public sector

companies reported a loss of 10,607 crore. The

profit after tax for private sector general insurers

was 4,665 crore, specialized insurers was

2,930 crore and the standalone health insurers

was 447 crore.

I.2.2.26 During the year 2022-23, none of the

public sector general insurers paid dividends.

However, seven private sector general insurers

paid dividends with total amounting to 1,166.20

crore. None of the stand-alone health insurers

paid dividends in both 2022-23 and 2021-22. AIC

ofIndia Ltd paid 40 crore dividend in 2022-23.

I.2.2.22 During 2022-23, four private insurers

were under exemption period of the norms

pertaining to expenses of management (EoM) as

the insurers were yet to complete the first five

years of their operations. Out of remaining

insurers, 14 insurers were compliant. 13 insurers

were non-compliant and their request for

forbearance is under examination. In case of

Reliance Health Insurance Ltd., its business

portfolio has been transferred to Reliance

General Insurance Co. Ltd and one new insurer

which has not started operationsin 2022-23.FY

I.2.2.23 The investment income of all general

insurers during 2022-23 was 38,839 crore

( 32,546 crore in 2021-22) registering a growth

of 19.34 percent. The growth in investment

income of public sector insurers, private sector

insurers, standalone health insurers and

specialized insurers was 34.54 percent, 6.35

percent, 21.48 percent and 2.06 percent

respectively.

I.2.2.24 The underwriting losses of non-life

insurers increased to 32,797 crore in 2022-23

( 31,810 crore in the previous year). The losses

increased by 3.11 percent over the previous year.

The public sector insurers' underwriting losses

Table I.11: Segment-wise Incurred Claims Ratio of General,

Health and Specialised Insurers

S.

No

Segments

2021-22 2022-23

Public

Sector

Private

Sector

Stand-

alone

Health

Insurers

Stand-

alone

Health

Insurers

Specialized

Insurers

Total Public

Sector

Private

Sector

Specialized

Insurers

Total

a.

Fire

66.96 51.27 NA NA 60.33 66.21

44.11

NA NA

57.99

b. Marine

86.02 85.78 NA NA 85.8 56.89 87.9 NA NA 75.13

c.

Motor

94.03 74.53 NA NA 81.3 102.55 75.6 NA NA 84.48

d. Health

126.8 94.66 79.06 NA 105.68 105.77 80.09 61.44 NA 87.27

e.

Others

58.54 64.96 NA

92.47

72.72

78.15 69.58 NA 73.71 73.1

f.

Total

103.17

77.95

79.06

92.47

89.08 99.02 75.13 61.44 73.71 82.95

Annual Report 2022-23

17

(in per cent)

Claims of General Insurers, Health Insurers

and Specialised Insurers:

I.2.2.27 During 2022-23, the aggregate net

incurred claims reported an increase by 6.22 per

cent over the previous year amounted to

1,49,313 crore ( 1,40,566 crore during previous

year), Separately, the public sector general

insurers, private sector general insurers and

standalone health insurers reported an increase

in the incurred claims amount of 3.91 per cent,

14.20 per cent and 0.54 per cent respectively,

while the specialized insurers reported a

decrease of 20.52 percent.

I.2.2.28 The incurred claims ratio (net incurred

claims to net earned premium) of the non-life

insurance industry was 82.95 per cent during

2022-23 against 89.08 per cent of previous year.

The incurred claims ratio for public sector

insurers was 99.02 per cent for the year 2022-23

as against the previous year's incurred claims

ratio of 103.17 percent. Whereas for the private

sector general insurers, standalone health

insurers and specialized insurers have improved

ICR with 75.13 per cent, 61.44 per cent and 73.71

per cent respectively for the year 2022-23 as

compared to the previous year's ratio of 77.95 per

cent, 79.06 per cent and 92.47 per cent

respectively.

Chart I.13: Premium underwritten within india by Non-Life Insurers

2021-22 2022-23

75,033

82,891

1,09,753

1,31,942

20,867

26,244

15,047 15,817

2,20,700

2,56,894

Public Sector

Insurers

Private Sector

Insurers

Stand alone

Health Insurers

Specialized

Insurers

Total

Fire

9%

Fire Marine

Motor

Health Others

Chart I.14: Segment wise share of premium of General and Health Insurers

Others

19%

Marine

2%

Motor

32%

Health

38%

Annual Report 2022-23

18

( crore)

Chart I.15: Operating Expenses of General and Health Insurers

Chart I.16: Net Incurred Claims of General and Health Insurers

2021-22

2022-23

Total

5,680

12,787

60,202

70,643

1,49,313

7,147

12,719

52,714

67,986

1,40,566

Specialised

Insurers

Stand-alone Health

Insurers

Private Sector

Insurers

Public Sector

Insurers

0 20000 40000 60000 80000 100000 120000 140000 160000

2022-23

2021-22

Public Sector

Insurers

Private Sector

Insurers

Stand-alone Health

Insurers

Specialised

Insurers

Total

14,150

21,690

4,925

691

41,456

21,013

27,169

5,955

719

54,856

Annual Report 2022-23

19

( crore)

( crore)

1. IRDAI has implemented a significant change

in the product filing process for non-life

insurers during the financial year 2022-23.

The transition is from the traditional "File &

Use" procedure (which requires approval from

IRDAI before launch) to the "Use & File"

procedure (where products can be launched

without prior approval). This change has been

made to assist general insurers in designing

and promptly launching new and innovative

products that align with to the market

requirements and better serve the

policyholders, thereby furthering the

insurance penetration in India.

2. The circular / /Misc/115/06/2022IRDAI CIR

dated 10.06.2022 brought a significant

number of Life Insurance products under 'Use

& File' approach where the insurers can launch

in the market both new products and

modifications of existing products without

going through the approval process.

Necessary provisions have been incorporated

in the circular to safeguard interest of

stakeholders including the protection of

policyholders' interest. This initiative

facilitates ease of doing business by enabling

the insurers to quickly launch the products or

modify the products as per the emerging

needs of the market and policyholders.

3. in its sustained endeavour to promoteIRDAI

creative innovation and ease of doing

business in the Indian Insurance Sector, has

extended the 'Use and File' procedure, i.e.

launching of all products by general insurers

under Fire, Marine, Motor and Engineering

lines of business for both Retail and

Commercial categories without prior approval

vide circular / / / /IRDAI NL CIR MISC

107/06/2022 dated 01/06/2022. However,

the retail products of Miscellaneous lines of

business (including modifications of current

products) having initial sum insured up to 5

crores were to be continued to be filed with the

Authority under the F&U Procedure. The scope

was further extended for general Insurers

where they were additionally allowed to file

retail products foragriculture & allied activities

under the U&F procedure vide circular IRDAI

/ / / /146/07/2022 datedNL CIR PRO

14/07/2022.

4. Subsequently, the general Insurers were

allowed to file all products under

Miscellaneous lines of business (including

modifications of current products) under U&F

procedure for both retail and commercial

categories vide circular

IRDAI NL CIR MISC/ / / /212/10/2022 dated

13/10/2022. With this move, all general

insurance products, are permitted to be filed

under 'Use and File' procedure and can be

launched without any prior approval.

5. , in an endeavour to simplify productIRDAI

filing has further modified the U&F procedure

vide circular / / / /IRDAI ACTL CIR PRO

81/3/2023 dated 31/03/2023 to enable

dynamism and to speed up the marketing of

insurance products as under:

The documents that are required to be

submitted under the above-mentioned U&F

circulars shall hereafter be submitted to the

Product Management Committee ( ),PMC

instead of being filed with . The shallIRDAI PMC

be responsible for the final approval of the

products.

The shall be responsible to ensure thatPMC

the entire set of documents required under

U&F Procedure is complete, correct, digitally

signed and are in compliance with the extant

applicable legal and regulatory framework,

and maintained by the .PMC

BOX I.2

Use and File (U&F) - Simplification of Product Filing Procedure

may call for documents in respect of aIRDAI

few products identified on monthly basis and

insurer shall submit the entire set of

documents to , whenever called for,IRDAI

within a period of 2 days.

The insurer is required to file with the , aIRDAI

Compliance certificate signed by the andCEO

Quarterly report on the products launched

signed by Chief Compliance Officer, in the

specified format.

The insurers to upload on their website the

policy wordings/documents, sales literature,

and the premium calculator, before the

product is launched or within seven days of

allotment of , whicheveris earlier.UIN

Insurers to further ensure that the essential

infrastructure required for launching the

product and maintenance of insurance

policies is in place.

6. It is envisaged that the above initiatives will

enable the insurance industry in launching

customized and innovative products in a

timely manner in order to address the dynamic

needs of the market, which will further help in

making insurance inclusive and enhancing

insurance penetration in India.

Table I.12: Offices of Life Insurers

Location

as on 31 st March, 2022 as on 31 st March, 2023

Public

Sector

Private

sector

Total

Public

Sector

Private

Sector

Total

Tier I 1,848 4,746 6,594

1,855 4,834 6,689

Tier II 561 706 1,267

562 749 1,311

Tier III 1,357 458 1,815

1,360 496 1,856

Tier IV 1,042 106 1,148

1,043 114 1,157

Tier V 123 30 153

126 31 157

Tier VI 54 29 83

55 31 86

Total 4,985 6,075 11,060

5,001 6,255 11,256

Places of Business of Insurers

Life Insurance Sector:

I.2.2.29 The number of life insurance offices

stood at 11,256 as on March 31, 2023 which is

196 more than the previous year. Around 59 per

cent of life insurance offices are located in Tier I

centres where the population is one lakh and

above. About 0.76 per cent of life insurance

offices are in Tier centres with a population ofVI

less than 5,000.

I.2.2.30 As at March 31, 2023, the public sector

life insurer had offices in 688 districts out of 750

districts in the country, covering 92 per cent of all

districts in the country, whereas the private

sector insurers had offices in 604 districts

covering 81 per cent of all districts in the country.

The public and private insurers together have

covered 92 per cent of all districts in the country.

In 21 out of 36 states/ s , all the districts wereUT

covered through life insurance offices . The

number of districts without a life insurance office