1

REAL PROPERTY RENTALS

Scottsdale Privilege & Use Tax

This publication is for general information only. For complete details, refer to the

Model City Tax Code located at https://azdor.gov/model-city-tax-code

September 2023

WHO MUST PAY THE TAX?

You must be licensed and pay tax if you are in the business of leasing or renting real property or

licensing for use of real property to the final licensee located within the City of Scottsdale.

Licensing means any agreement between the property owner and the final user of real property.

Examples include commissions received for licensing space for vending and amusement game

machines, pay telephones, and the use of a portion of a business or property for filming movies

or commercials.

The governor signed Senate Bill 1131 into law on August 1, 2023. This bill will make residential

rental non-taxable (business class 045) beginning January 1, 2025. This bill does not apply to

health care facilities, long-term care facilities, hotels, motels, short term rentals, or other

transient lodging businesses.

WHEN IS TAX DUE?

Tax is due on the 20

th

day of the month following the month in which the revenue was

recognized.

WHAT IS THE CITY TAX RATE?

The City of Scottsdale tax rate for real property rentals is 1.75% of taxable rental income.

2

RESIDENTIAL RENTALS

A person who has three or more residential units rented or available for rent in the State of

Arizona must pay tax to the City of Scottsdale on the units located within the City of Scottsdale.

A person who has one unit of commercial property for rent plus one or more units of residential

property available for rent in the State of Arizona must pay tax on the units located within the

City of Scottsdale.

A property manager or broker who manages one or more residential rental units must pay tax to

the City of Scottsdale on the units located within the City of Scottsdale. The owner of the

property would obtain a transaction privilege tax license with the Arizona Department of

Revenue and engage the property manager to file taxes on their license. The property manager

or broker would obtain a property manager company license with the Arizona Department of

Revenue and link their account with the property owner’s account.

The property manager or broker is taxable even if an individual owner would not be taxable.

Examples of residential rentals include:

• Houses

• Apartments

• Manufactured Homes

• Time Shares

Residential rentals for less than 30 days are subject to an additional 5.0% transient tax.

(See Hotel/Motel brochure)

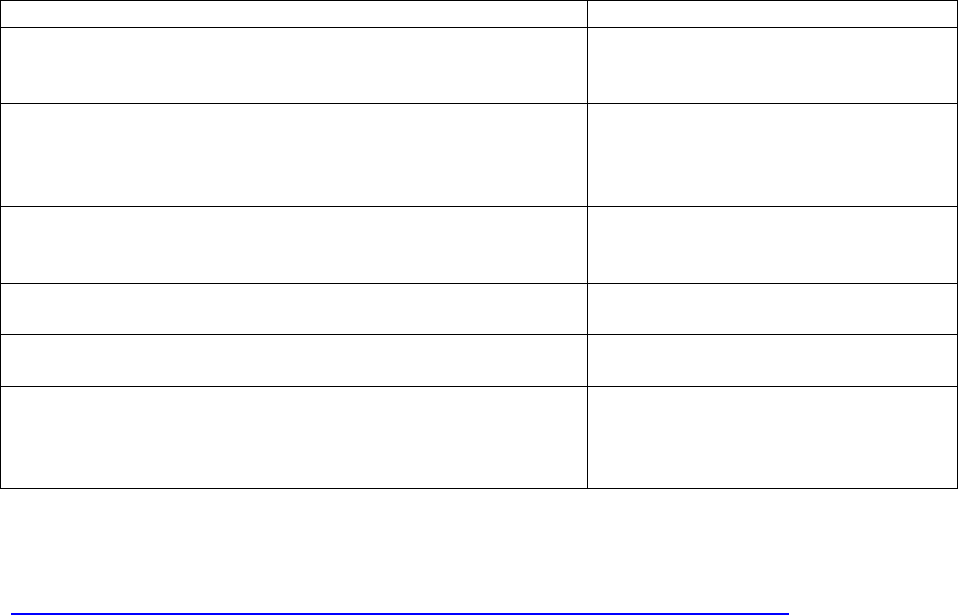

Scenario:

Scottsdale Property Treatment

Owner has one residential rental property in Scottsdale

that is rented on a long term basis (greater than 29 days)

and no other residential or commercial rentals in the State

Non-taxable since the rental is on a

long-term basis

Owner has one residential rental property in Scottsdale

that is rented on a short term basis (less than 30 days)

and no other residential or commercial property rentals in

the State

Taxable under the transient lodging

classification since the rental is on

a short-

term basis of less than 30

days

Owner has one residential rental property in Scottsdale

and one commercial property in another city/town in

Arizona

Taxable due to the commercial

rental property

Owner has a tri-plex rental property in Scottsdale with all

units rented or available for rent

Taxable since a tri-plex has three

separate units

Owner has one residential rental property in three

different cities/towns, with one in Scottsdale

Taxable due to having three units in

the State

Owner has a property manager taking care of renting their

one residential rental property in Scottsdale

Taxable due to the property

manager renting the property for

the owner. Property manager

would report on the owner’s license

*This is not an exhaustive list of scenarios.

Other cities and towns in Arizona may tax residential rentals differently. For additional

information on taxability for other cities/towns for residential rentals see:

https://azdor.gov/sites/default/files/media/TPT_2017_residentialrental-matrix.pdf

3

COMMERCIAL PROPERTY RENTALS

A person in the business of leasing, renting, or licensing for use any non-residential land,

building, or space must pay tax to the City of Scottsdale on the units located within the City of

Scottsdale.

Examples of taxable commercial rentals include:

• Office Buildings

• Stores

• Factories

• Churches

• Vacant Land

• Parking Lots

• Banquet Halls

• Meeting Rooms

• Storage Facilities

Rentals to Non-Profit Organizations and Governmental Agencies are taxable.

Commercial property includes residential property that is used for commercial purposes (e.g. an

office operated out of a bedroom).

WHAT IS TAXABLE? (RESIDENTIAL & COMMERCIAL)

All payments made by the renter to, or on behalf of, the lessor are taxable. Taxable income

includes payments for property taxes, repairs, improvements, telecommunications, utilities, pet

fees, non-refundable deposits, forfeited deposits, and common area maintenance charges.

NON-TAXABLE RENTAL REVENUE (DEDUCTIONS)

• Refundable security deposits, unless they are retained.

• Utility charges if individual utility meters are installed and each tenant pays the exact amount

billed by the utility company.

• Room charges to patients in qualifying hospitals, qualifying community health centers, or

qualifying health care organizations.

• Gross receipts derived from incarcerating or detaining inmates.

• Gross receipts derived from a lease between affiliated companies, businesses or persons if

the lessor holds a controlling interest in the lessee, the lessee holds a controlling interest in

the lessor, an affiliated entity holds a controlling interest in both the lessor and lessee or an

unrelated person holds a controlling interest in both the lessor and lessee. Controlling

interest means an 80% ownership of the voting shares of a corporation or of the interests in

a company, business or person other than a corporation.

4

CALCULATING THE TAX

You may choose to charge the tax separately or you may include tax in your sales price. If you

include tax in your sales price, you may factor in order to “compute” the amount of tax included

in your gross income for deduction purposes.

To determine the factor, add one (1.00) to the total of state, county, and city tax rates.

Commercial Example: 1.00 + 0.0225 = 1.0225

Calculate as follows:

Gross Taxable Income = Computed Taxable

Factor (1.0225) Income

Residential Example: 1.00 + 0.0175 = 1.0175

Calculate as follows:

Gross Taxable Income = Computed Taxable

Factor (1.0175) Income

Gross taxable income less computed taxable income equals your deduction for tax collected.

If more City tax was collected than was due, the excess tax collected must be remitted to the

City.

USE TAX

This is a tax on items that were purchased, leased, or rented without paying privilege or sales

tax. The purchased, leased, or rented items become taxable when they are used, stored, or

consumed within the City. Most commonly, purchases, leases, or rentals from out-of-state

vendors will fall into this category. The use tax does not apply to purchases, leases, or rentals

which are resold or re-leased in the normal course of business.

The City of Scottsdale use tax rate is 1.55%. Businesses are responsible for computing and

paying use tax.

For more information call (480) 312-7788.

Write or visit:

CITY OF SCOTTSDALE

Business Regulations

7447 E. Indian School Rd., Suite 230

Scottsdale, Arizona 85251

www.ScottsdaleAZ.gov