West Palm Beach

PREPARED BY

Teneka James

Office Submarket Report

Palm Beach - FL

Overview

West Palm Beach Office

6K 191K 9.3% 7.5%

12 Mo Deliveries in SF 12 Mo Net Absorption in SF Vacancy Rate 12 Mo Rent Growth

After a supply-driven increase in early 2021, the

submarket vacancy rate in West Palm Beach has

trended lower over the past few quarters. The

submarket's supply pipeline has emptied out, and supply-

side pressure should not have an impact on

fundamentals or rent growth in the near term.

The recent delivery of The Press, a 277,000-SF project,

brought new office space to the submarket for the first

time in more than a decade. The project was about 50%

available when it opened in 21Q1 and was still roughly

50% available for lease as of mid-2022. The asset is

anchored by Schwarzberg & Associates and the Palm

Beach Post, while the remainder of the office space is

being marketed for about $40/SF gross, some of the

highest rents in the submarket.

The submarket has the lowest average asking rents

among Palm Beach office submarkets. Submarket rent

growth hardly took a hit in the months following the onset

of the coronavirus pandemic, and owners have pushed

rents over the past few quarters. Year-over-year rent

growth of 7.5% is right around the Palm Beach metro

average and is above the submarket's five-year annual

average of 4.2%.

Office sales volume has increased in West Palm Beach

in recent quarters, but it remains below the submarket's

pre-pandemic norms. One of the largest recent deals

here was the June 2021 sale of Congress Center North

at Congress Crossings for $8.6 million ($205/SF).

Nashville-based Excelsior Capital acquired the 42,000-

SF office from Calidus Holdings at a 7% cap rate. In a

similar deal, the 63,000-SF Village Executive Offices

changed hands in October 2021 for $13.9 million

($221/SF) at a 6.8% cap rate. The late 1980s-built

property was fully leased at the time of sale. Individual

investors were on both the buyer and seller side of the

deal. The asset previously sold in 2017 for $8.3 million

($132/SF).

KEY INDICATORS

Market RentVacancy RateRBA

Current Quarter

Availability Rate

Net Absorption

SF

Deliveries SF

Under

Construction

$39.1518.2%1,667,670

4 & 5 Star

18.6% 37,587 0 0

$29.759.5%3,892,823

3 Star

12.5% 4,737 0 0

$26.904.0%2,908,677

1 & 2 Star

4.9% (19,089) 0 0

$30.629.3%8,469,170

Submarket

11.1% 23,235 0 0

Forecast

Average

Historical

Average

12 Month

Annual Trends

Peak When Trough When

7.7%11.3%-2.2%

Vacancy Change (YOY)

16.6% 2009 Q3 7.0% 2005 Q3

82,79963,331191K

Net Absorption SF

319,386 2006 Q1 (291,546) 2009 Q3

59,40890,4976K

Deliveries SF

355,830 2006 Q3 0 2018 Q2

3.2%2.4%7.5%

Rent Growth

10.5% 2016 Q3 -8.0% 2011 Q3

N/A$70.6M$207M

Sales Volume

$172.1M 2017 Q3 $8.7M 2009 Q3

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 2

Leasing

West Palm Beach Office

NET ABSORPTION, NET DELIVERIES & VACANCY

VACANCY RATE

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 3

Leasing

West Palm Beach Office

AVAILABILITY RATE

4 & 5 STAR MOST ACTIVE BUILDINGS IN SUBMARKET - PAST 12 MONTHS

Property Name/Address Rating RBA Deals Leased SF 12 Mo Vacancy 12 Mo Net Absorp SF

30,883

1641 Worthington Rd

EcoPlex At Centrepark West

100,525 4 26.5% 19,728

49,535

1700 Palm Beach Lakes Blvd

119,055 4 16.4% 18,514

20,094

1645 Palm Beach Lakes Blvd

The 1645 at Palm Beach Lakes

113,862 9 5.4% 8,241

7,849

2101 Vista Pky

The Nexus at Vista Park

60,000 7 0.9% 826

20,731

1601 Forum Pl

Centurion Tower

143,966 6 21.7% (4,916)

31,454

1555 Palm Beach Lakes Blvd

Tower 1555

180,000 8 17.4% (6,473)

4,879

1401 Forum Way

Horizon Office Center

67,185 1 34.2% (8,838)

46,378

2751 S Dixie Hwy

The Press

276,600 6 56.1% (14,868)

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 4

Leasing

West Palm Beach Office

3 STAR MOST ACTIVE BUILDINGS IN SUBMARKET - PAST 12 MONTHS

Property Name/Address Rating RBA Deals Leased SF 12 Mo Vacancy 12 Mo Net Absorp SF

29,832

1655 Palm Beach Lakes Blvd

Forum C

92,556 10 10.7% 23,107

33,753

1665 Palm Beach Lakes Blvd

Forum B

92,473 7 11.8% 17,720

35,752

1720 Centrepark Dr E

Cemex Building

17,876 2 31.7% 14,166

25,998

1450 Centrepark Blvd

Centrepark 1450

74,413 4 21.1% 14,006

18,803

2090 Palm Beach Lakes Blvd

West Tower

74,199 5 20.9% 8,793

3,563

2465 Mercer Ave

Airport Professional Center

35,500 3 14.3% 7,594

6,000

1620 Southern Blvd

6,000 2 0% 6,000

26,828

1475 Centrepark Blvd

Centrepark 1475

74,695 2 2.4% 3,468

11,508

1818 S Australian Ave

57,940 4 9.0% 3,355

5,566

2500 Metrocentre Blvd

2500 Metrocentre Blvd

17,848 2 3.4% 3,055

3,553

6415 Lake Worth Rd

Lakeview Corporate Center

29,016 5 12.8% 2,913

5,800

560 Village Blvd

Village Executive Offices

62,875 2 3.1% 2,871

7,162

2001-2007 Palm Beach Lakes…

2001 Professional Building

49,648 6 7.2% 1,150

3,567

2328 10th Ave N

Lakeworth Corporate Center -…

46,703 3 3.0% 0

9,014

1926 10th Ave N

CenterPoint Plaza

88,544 2 5.0% (856)

10,378

2290 10th Ave N

Lakeworth Proffesional & Me…

50,500 8 5.2% (3,295)

14,183

120 N Federal Hwy

The Promenade at Lake Worth

63,423 6 18.2% (6,634)

2,257

2000 Palm Beach Lakes Blvd

East Tower

75,999 2 23.5% (7,429)

27,538

2056 Vista Parkway

Emerald View

70,000 5 27.8% (8,920)

14,236

580 Village Blvd

Palm Beach Business Center

60,615 10 13.7% (11,787)

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 5

Rent

West Palm Beach Office

Office rents in West Palm Beach run for about $31.00/SF

gross, which is moderately below the metro average. The

same is true for 3 Star space, proportionally the

submarket's largest subtype, which at $30.00/SF rents

for less than the $37.00/SF metro average for that slice.

Rents grew by a remarkable 7.5% over the past year,

which brought the three-year average annual rent

growth up to 4.4%.

In a longer-term view, office rents in West Palm

Beach have increased at levels that border on

transformative. Office rents today are 54.7% above their

10-year-ago levels. Notably, this trails the even stronger

62.3% metro-wide uptick over the past decade.

MARKET RENT GROWTH (YOY)

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 6

Rent

West Palm Beach Office

MARKET RENT PER SQUARE FEET

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 7

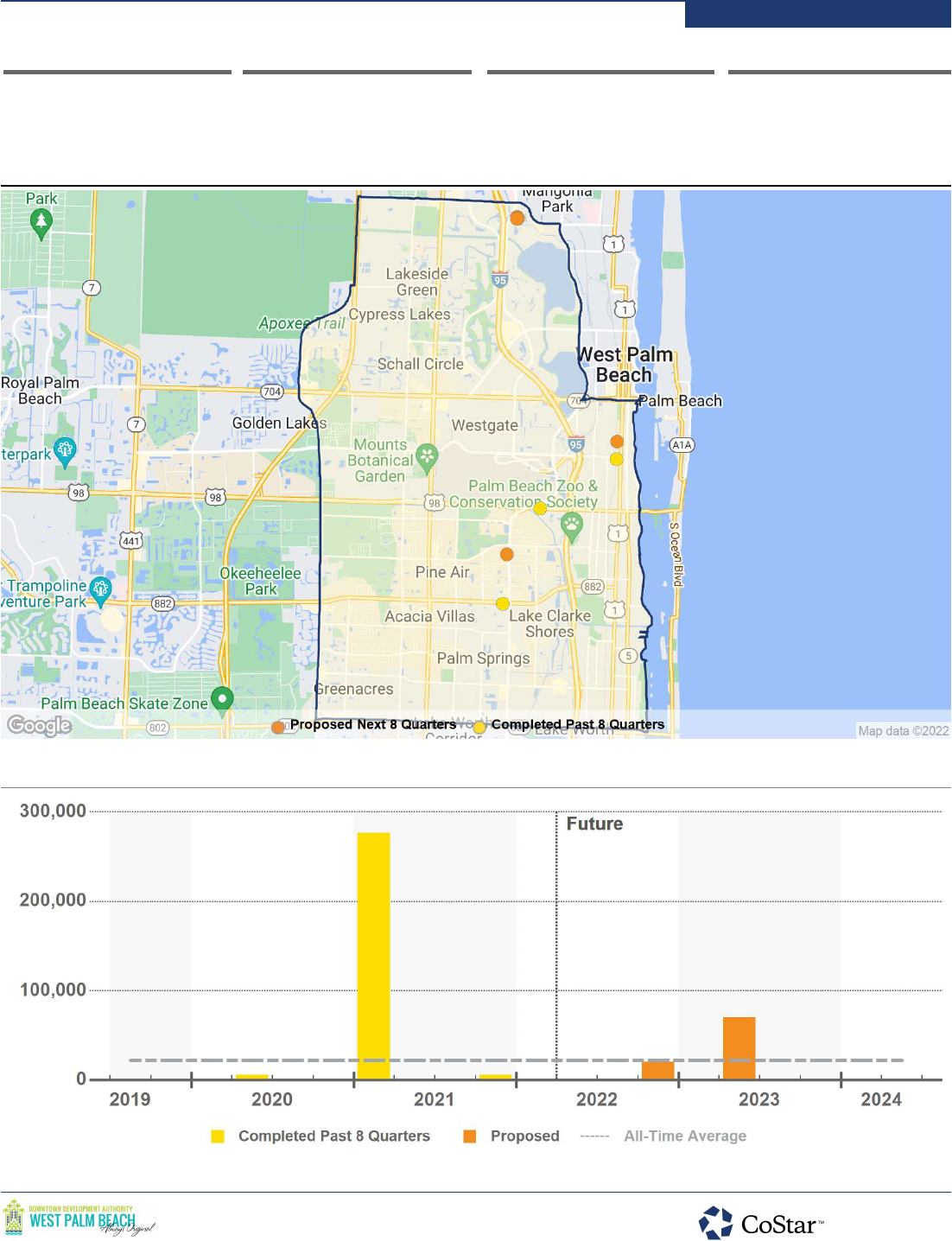

Construction

West Palm Beach Office

DELIVERIES & DEMOLITIONS

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 8

Construction

West Palm Beach Office

88,188 288,400 0 90,122

All-Time Annual Avg. Square Feet Delivered Square Feet Past 8 Qtrs Delivered Square Feet Next 8 Qtrs Proposed Square Feet Next 8 Qtrs

PAST 8 QUARTERS DELIVERIES, UNDER CONSTRUCTION, & PROPOSED

PAST & FUTURE DELIVERIES IN SQUARE FEET

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 9

Construction

West Palm Beach Office

RECENT DELIVERIES

Property Name/Address Rating Bldg SF Stories Start Complete

Developer/Owner

Oct 2020

1620 Southern Blvd

6,000 1 Oct 2021

-

-

1

Aug 2019

2751 S Dixie Hwy

The Press

276,600 4 Jan 2021

Tricera Capital

Tricera Capital

2

Sep 2019

3098 Forest Hill Blvd

5,800 - Jun 2020

-

-

3

PROPOSED

Property Name/Address Rating Bldg SF Stories Start Complete

Developer/Owner

Aug 2022

412-420 Calremore Dr

Falmingo Place

25,522 2 Apr 2023

-

-

1

Sep 2022

839 S Congress Ave

20,000 2 Nov 2022

-

Matthew and Jennifer O'Conner

2

Apr 2022

4400 Beacon Cir

ECF Engeneering HQ Bl…

20,000 2 Apr 2023

E C Fennell PA

E C Fennell PA

3

Aug 2022

4400 Beacon Cir

ECF Engineering HQ Bld…

14,600 2 May 2023

E C Fennell PA

E C Fennell PA

4

Jul 2022

4400 Beacon Cir

ECF Engeneering HQ Bl…

10,000 2 Apr 2023

E C Fennell PA

E C Fennell PA

5

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 10

Sales

West Palm Beach Office

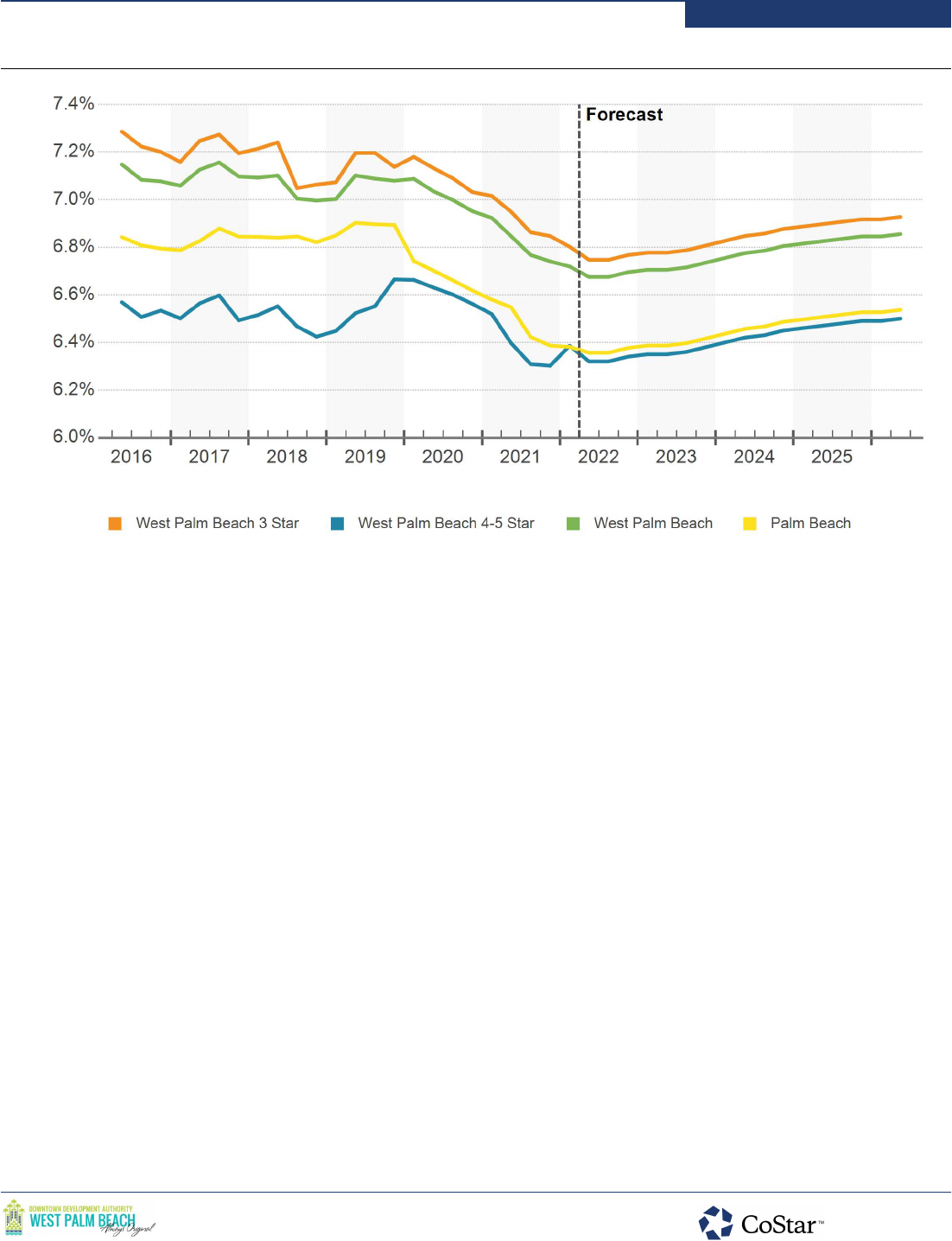

Office investors have shown a significant appetite for

office assets in West Palm Beach, making it one of the

most heavily traded office submarkets in the region over

the past several years. Historical investment activity

trends have largely held true in the past 12 months. Over

the past five years, annualized sales volume has

averaged $108 million. But volume hit $205 million during

these past 12 months, the highest level recorded over

that five-year period.

The market price, based on the estimated price

movement of all office properties in the submarket, sat at

$249/SF during the second quarter of 2022. That figure

is up from this time last year, although the level is still a

significant discount relative to the average price for the

region. The market cap rate has contracted since last

year and currently sits at 6.7%. This is the lowest cap

rate that has been seen in five years, but it's still higher

than the region's average yield.

SALES VOLUME & MARKET SALE PRICE PER SF

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 11

Sales

West Palm Beach Office

MARKET CAP RATE

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 12

Sales Past 12 Months

West Palm Beach Office

61 6.3% $213 8.2%

Sale Comparables Avg. Cap Rate Avg. Price/SF Avg. Vacancy At Sale

SALE COMPARABLE LOCATIONS

SALE COMPARABLES SUMMARY STATISTICS

Sales Attributes Low Average Median

High

Sale Price $260,100 $5,642,488 $2,927,141 $32,500,000

Price/SF $34 $213 $194 $1,481

Cap Rate 3.7% 6.3% 7.0% 7.1%

Time Since Sale in Months 0.7 6.4 5.6 11.9

Property Attributes Low Average Median

High

Building SF 550 27,764 15,235 100,525

Stories 1 2 1 10

Typical Floor SF 550 12,080 11,043 39,899

Vacancy Rate At Sale 0% 8.2% 0% 71.7%

Year Built 1947 1981 1984 2008

Star Rating

2.5

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 13

Sales Past 12 Months

West Palm Beach Office

Property Name - Address Rating

Yr Built

Bldg SF Vacancy Price Price/SF

Property

Sale Date

Sale

Cap Rate

RECENT SIGNIFICANT SALES

-

1

EcoPlex At Centrepark…

2008 100,525 15.8% $32,500,000 $323

1641 Worthington Rd

4/1/2022 -

-

2

Belcan Engineering

2000 65,770 0% $21,666,666 $329

2410 Metrocentre Blvd E

2/1/2022 -

-

3

Forum B

1973 92,473 3.2% $15,114,090 $163

1665 Palm Beach Lakes B…

1/28/2022 7.1%

-

4

Forum C

1973 92,556 4.0% $14,135,910 $153

1655 Palm Beach Lakes B…

1/28/2022 7.1%

-

5

Village Executive Offices

1989 62,875 6.0% $13,900,000 $221

560 Village Blvd

10/21/2021 6.8%

-

6

District Pointe

1983 72,600 0% $13,400,000 $185

1501 Belvedere Rd

11/19/2021 -

-

7

Horizon Office Center

1985 67,185 38.0% $13,025,000 $194

1401 Forum Way

2/2/2022 -

-

8

1551 Forum Pl

1980 39,899 15.8% $6,950,000 $1745/3/2022 -

-

9

Century Village

1970 28,346 27.5% $6,000,000 $212

100 Century Blvd

11/23/2021 3.7%

-

10

2400 Metrocentre Blvd E

1992 26,959 0% $5,975,000 $2227/14/2021 -

-

11

500 Columbia Dr

2000 24,857 0% $5,701,310 $22912/29/2021 -

-

12

Congress Professional C…

1997 15,200 0% $5,000,000 $329

1620 S Congress Ave

6/21/2021 -

-

13

1814 N Federal Hwy

1957 3,308 0% $4,900,000 $1,4814/11/2022 -

-

14

3071 Continental Dr

1992 26,500 0% $3,800,000 $1434/19/2022 -

-

15

1280 N Congress Ave

1984 22,085 0% $3,450,000 $15610/5/2021 7.1%

-

16

Four Harvard Circle

1988 15,235 26.3% $3,355,566 $220

4 Harvard Cir

5/24/2022 -

-

17

Peterson, Bernard Attor…

1986 20,000 54.4% $3,100,000 $155

1550 Southern Blvd

10/4/2021 -

-

18

2050 Vista Pky

1995 15,252 0% $3,050,400 $2007/22/2021 -

-

19

400 Columbia Dr

1990 17,009 16.1% $2,803,881 $16512/29/2021 -

-

20

1800 Building

1988 20,000 10.5% $2,800,000 $140

1800 Old Okeechobee Rd

9/24/2021 5.9%

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 14

Supply & Demand Trends

West Palm Beach Office

OVERALL SUPPLY & DEMAND

Net AbsorptionInventory

% of Inv Construction RatioSF SF Growth % Growth SFYear

2026 70,081 0.8% 0.5%41,371 1.78,703,519

2025 76,916 0.9% 0.6%50,602 1.58,633,438

2024 73,367 0.9% 0.4%38,038 1.98,556,522

2023 21,400 0.3% 0.9%75,143 0.38,483,155

2022 (7,415) -0.1% 2.2%188,122 -8,461,755

YTD 0 0% 0.7%61,859 08,469,170

2021 282,600 3.5% 3.0%253,414 1.18,469,170

2020 5,800 0.1% 1.0%84,531 0.18,186,570

2019 (144,849) -1.7% -1.0%(80,442) -8,180,770

2018 (79,723) -0.9% -1.6%(130,272) -8,325,619

2017 (2,400) 0% 0.6%48,579 -8,405,342

2016 (52,525) -0.6% -3.4%(284,978) -8,407,742

2015 (48,816) -0.6% 2.3%190,734 -8,460,267

2014 907 0% 0.7%59,549 08,509,083

2013 (4,606) -0.1% 0.8%64,938 -8,508,176

2012 (24,070) -0.3% 2.0%170,003 -8,512,782

2011 (2,573) 0% 1.3%109,442 -8,536,852

2010 7,000 0.1% -0.2%(19,857) -8,539,425

4 & 5 STAR SUPPLY & DEMAND

Net AbsorptionInventory

% of Inv Construction RatioSF SF Growth % Growth SFYear

2026 85,992 4.6% 3.7%72,529 1.21,972,334

2025 92,678 5.2% 4.2%78,597 1.21,886,342

2024 89,011 5.2% 3.5%62,134 1.41,793,664

2023 36,983 2.2% 3.2%54,937 0.71,704,653

2022 0 0% 8.6%142,788 01,667,670

YTD 0 0% 1.4%23,174 01,667,670

2021 276,600 19.9% 7.5%125,302 2.21,667,670

2020 0 0% -3.0%(41,854) -1,391,070

2019 0 0% 1.6%21,646 01,391,070

2018 12,294 0.9% -1.1%(15,954) -1,391,070

2017 0 0% 5.9%81,588 01,378,776

2016 0 0% -0.3%(4,590) -1,378,776

2015 0 0% -2.4%(33,433) -1,378,776

2014 7,500 0.5% 0.7%9,667 0.81,378,776

2013 0 0% 0%(328) -1,371,276

2012 0 0% 3.1%43,013 01,371,276

2011 0 0% -0.2%(2,953) -1,371,276

2010 0 0% 2.0%27,616 01,371,276

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 15

Supply & Demand Trends

West Palm Beach Office

3 STAR SUPPLY & DEMAND

Net AbsorptionInventory

% of Inv Construction RatioSF SF Growth % Growth SFYear

2026 0 0% -0.3%(11,887) -3,892,823

2025 0 0% -0.2%(9,572) -3,892,823

2024 0 0% -0.2%(6,745) -3,892,823

2023 0 0% 0.6%24,086 03,892,823

2022 0 0% 1.9%72,901 03,892,823

YTD 0 0% 1.4%53,719 03,892,823

2021 6,000 0.2% 1.0%39,714 0.23,892,823

2020 5,800 0.1% 3.4%131,844 03,886,823

2019 (4,320) -0.1% -4.2%(162,762) -3,881,023

2018 (92,017) -2.3% -2.3%(89,501) -3,885,343

2017 0 0% 0.6%24,110 03,977,360

2016 0 0% -2.9%(115,072) -3,977,360

2015 (47,568) -1.2% 3.8%151,184 -3,977,360

2014 0 0% 0.1%5,425 04,024,928

2013 (2,864) -0.1% 2.3%92,714 -4,024,928

2012 0 0% 2.3%93,679 04,027,792

2011 0 0% 1.8%73,555 04,027,792

2010 13,000 0.3% -0.5%(19,420) -4,027,792

1 & 2 STAR SUPPLY & DEMAND

Net AbsorptionInventory

% of Inv Construction RatioSF SF Growth % Growth SFYear

2026 (15,911) -0.6% -0.7%(19,271) -2,838,362

2025 (15,762) -0.5% -0.6%(18,423) -2,854,273

2024 (15,644) -0.5% -0.6%(17,351) -2,870,035

2023 (15,583) -0.5% -0.1%(3,880) -2,885,679

2022 (7,415) -0.3% -1.0%(27,567) -2,901,262

YTD 0 0% -0.5%(15,034) -2,908,677

2021 0 0% 3.0%88,398 02,908,677

2020 0 0% -0.2%(5,459) -2,908,677

2019 (140,529) -4.6% 2.1%60,674 -2,908,677

2018 0 0% -0.8%(24,817) -3,049,206

2017 (2,400) -0.1% -1.9%(57,119) -3,049,206

2016 (52,525) -1.7% -5.4%(165,316) -3,051,606

2015 (1,248) 0% 2.4%72,983 -3,104,131

2014 (6,593) -0.2% 1.4%44,457 -3,105,379

2013 (1,742) -0.1% -0.9%(27,448) -3,111,972

2012 (24,070) -0.8% 1.1%33,311 -3,113,714

2011 (2,573) -0.1% 1.2%38,840 -3,137,784

2010 (6,000) -0.2% -0.9%(28,053) -3,140,357

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 16

Rent & Vacancy

West Palm Beach Office

OVERALL RENT & VACANCY

Market Rent

Per SF Index % Growth Vs Hist PeakYear

Vacancy

SF Percent Ppts Chg

2026 152 0.9% 15.5%$34.61 696,803 8.0% 0.3%

2025 151 1.4% 14.5%$34.31 667,384 7.7% 0.2%

2024 149 2.3% 13.0%$33.84 640,358 7.5% 0.4%

2023 145 4.3% 10.5%$33.10 604,281 7.1% -0.6%

2022 139 5.9% 5.9%$31.73 657,418 7.8% -2.3%

YTD 134 7.5% 2.2%$30.62 790,775 9.3% -0.7%

2021 131 7.6% 0%$29.96 852,634 10.1% 0.1%

2020 122 4.0% -7.0%$27.85 816,941 10.0% -1.0%

2019 118 1.3% -10.6%$26.78 895,672 10.9% -0.6%

2018 116 7.6% -11.7%$26.45 960,079 11.5% 0.7%

2017 108 -0.4% -18.0%$24.57 909,530 10.8% -0.6%

2016 108 10.3% -17.7%$24.66 960,509 11.4% 2.8%

2015 98 7.9% -25.4%$22.36 728,056 8.6% -2.8%

2014 91 6.0% -30.9%$20.71 970,631 11.4% -0.7%

2013 86 -0.4% -34.8%$19.53 1,029,273 12.1% -0.8%

2012 86 -0.1% -34.5%$19.61 1,098,817 12.9% -2.2%

2011 86 -5.8% -34.5%$19.63 1,292,890 15.1% -1.3%

2010 91 -2.7% -30.4%$20.84 1,404,905 16.5% 0.3%

4 & 5 STAR RENT & VACANCY

Market Rent

Per SF Index % Growth Vs Hist PeakYear

Vacancy

SF Percent Ppts Chg

2026 157 0.6% 14.3%$43.73 220,646 11.2% 0.2%

2025 156 1.1% 13.6%$43.47 207,224 11.0% 0.2%

2024 154 1.9% 12.4%$43.02 193,176 10.8% 1.0%

2023 151 4.1% 10.3%$42.21 166,333 9.8% -1.3%

2022 145 6.0% 6.0%$40.53 184,316 11.1% -8.6%

YTD 140 7.1% 2.3%$39.15 303,928 18.2% -1.4%

2021 137 6.2% 0%$38.26 327,102 19.6% 7.4%

2020 129 2.4% -5.8%$36.03 169,297 12.2% 3.0%

2019 126 2.2% -8.0%$35.18 127,443 9.2% -1.6%

2018 123 10.3% -10.0%$34.43 149,089 10.7% 2.0%

2017 112 6.1% -18.4%$31.21 120,841 8.8% -5.9%

2016 105 10.8% -23.1%$29.41 202,429 14.7% 0.3%

2015 95 5.9% -30.6%$26.53 197,839 14.3% 2.4%

2014 90 3.2% -34.5%$25.06 164,406 11.9% -0.2%

2013 87 -0.3% -36.5%$24.29 166,573 12.1% 0%

2012 87 2.9% -36.3%$24.37 166,245 12.1% -3.1%

2011 85 -8.7% -38.1%$23.69 209,258 15.3% 0.2%

2010 93 -4.2% -32.2%$25.95 206,305 15.0% -2.0%

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 17

Rent & Vacancy

West Palm Beach Office

3 STAR RENT & VACANCY

Market Rent

Per SF Index % Growth Vs Hist PeakYear

Vacancy

SF Percent Ppts Chg

2026 150 0.9% 16.1%$33.62 355,820 9.1% 0.3%

2025 148 1.4% 15.1%$33.33 343,933 8.8% 0.2%

2024 146 2.3% 13.5%$32.87 334,361 8.6% 0.2%

2023 143 4.3% 11.0%$32.15 327,616 8.4% -0.6%

2022 137 6.5% 6.5%$30.83 351,702 9.0% -1.9%

YTD 132 8.6% 2.7%$29.75 370,880 9.5% -1.4%

2021 129 8.8% 0%$28.96 424,599 10.9% -0.9%

2020 118 4.6% -8.1%$26.62 458,313 11.8% -3.3%

2019 113 -0.9% -12.1%$25.45 584,357 15.1% 4.1%

2018 114 4.1% -11.4%$25.67 425,915 11.0% 0.2%

2017 110 -0.1% -14.9%$24.65 428,431 10.8% -0.6%

2016 110 9.8% -14.8%$24.67 452,541 11.4% 2.9%

2015 100 8.6% -22.4%$22.46 337,469 8.5% -4.9%

2014 92 4.6% -28.6%$20.68 539,246 13.4% -0.1%

2013 88 0.6% -31.8%$19.76 544,671 13.5% -2.4%

2012 87 0.2% -32.2%$19.63 640,249 15.9% -2.3%

2011 87 -3.0% -32.3%$19.60 733,928 18.2% -1.8%

2010 90 -3.5% -30.2%$20.21 807,483 20.0% 0.7%

1 & 2 STAR RENT & VACANCY

Market Rent

Per SF

Index % Growth Vs Hist Peak

Year

Vacancy

SF Percent Ppts Chg

2026 152 1.1% 15.7%$30.71 120,337 4.2% 0.2%

2025 150 1.6% 14.4%$30.36 116,227 4.1% 0.1%

2024 148 2.5% 12.6%$29.88 112,821 3.9% 0.1%

2023 144 4.5% 9.8%$29.15 110,332 3.8% -0.4%

2022 138 5.1% 5.1%$27.89 121,400 4.2% 0.7%

YTD 133 6.2% 1.3%$26.90 115,967 4.0% 0.5%

2021 131 7.0% 0%$26.55 100,933 3.5% -3.0%

2020 123 4.5% -6.5%$24.82 189,331 6.5% 0.2%

2019 117 3.6% -10.5%$23.75 183,872 6.3% -6.3%

2018 113 10.9% -13.7%$22.91 385,075 12.6% 0.8%

2017 102 -5.8% -22.2%$20.65 360,258 11.8% 1.8%

2016 108 10.6% -17.4%$21.92 305,539 10.0% 3.8%

2015 98 8.5% -25.4%$19.82 192,748 6.2% -2.4%

2014 90 10.7% -31.2%$18.26 266,979 8.6% -1.6%

2013 81 -2.2% -37.9%$16.49 318,029 10.2% 0.8%

2012 83 -2.8% -36.5%$16.85 292,323 9.4% -1.8%

2011 86 -7.6% -34.7%$17.35 349,704 11.1% -1.3%

2010 93 -0.1% -29.3%$18.77 391,117 12.5% 0.7%

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 18

Sale Trends

West Palm Beach Office

OVERALL SALES

Completed Transactions (1)

Turnover Avg Price/SFDeals

Volume

Year

Market Pricing Trends (2)

Avg Price

Price Index

Avg Cap Rate Price/SF Cap Rate

2026 -- - -- 211- $278.16 6.9%

2025 -- - -- 210- $277 6.8%

2024 -- - -- 209- $274.97 6.8%

2023 -- - -- 206- $270.74 6.7%

2022 -- - -- 196- $258.60 6.7%

YTD $123.5M25 7.8% $223.33$6,177,213 1896.3% $249.30 6.7%

2021 $110.7M49 8.3% $199.47$3,163,732 1846.5% $242.49 6.7%

2020 $76.7M57 7.4% $153.68$1,916,295 1706.6% $224.05 7.0%

2019 $127.8M40 7.8% $208.58$3,992,289 1637.2% $215.09 7.1%

2018 $82.9M51 6.8% $159.82$2,762,488 1586.8% $208.58 7.0%

2017 $80.8M48 9.2% $112.55$2,308,014 1456.2% $190.57 7.1%

2016 $171M73 15.6% $135.01$3,489,167 1407.4% $183.84 7.1%

2015 $59.1M56 7.9% $95.92$1,285,849 1277.8% $167.79 7.3%

2014 $32.5M52 6.2% $75.27$903,805 11810.7% $155.99 7.4%

2013 $20.1M40 3.7% $69.44$592,255 10810.3% $142.83 7.7%

2012 $52.6M27 5.6% $117.53$2,767,036 1078.0% $140.92 7.8%

2011 $37.1M24 5.7% $78.77$2,318,674 1067.8% $139.16 7.9%

(1) Completed transaction data is based on actual arms-length sales transactions and levels are dependent on the mix of what happened to sell in the period.

(2) Market price trends data is based on the estimated price movement of all properties in the market, informed by actual transactions that have occurred.

4 & 5 STAR SALES

Completed Transactions (1)

Turnover Avg Price/SFDeals

Volume

Year

Market Pricing Trends (2)

Avg Price

Price Index

Avg Cap Rate Price/SF Cap Rate

2026 -- - -- 210- $326.62 6.5%

2025 -- - -- 210- $326.12 6.5%

2024 -- - -- 209- $324.69 6.5%

2023 -- - -- 207- $320.77 6.4%

2022 -- - -- 198- $306.92 6.3%

YTD $67.2M3 14.0% $287.78$22,397,222 191- $296.18 6.3%

2021 -- - -- 189- $294.23 6.3%

2020 -- - -- 172- $267.56 6.6%

2019 $51.9M2 18.9% $197.13$25,925,000 1667.3% $257.63 6.7%

2018 $22.3M1 4.7% $339.06$22,300,000 1655.7% $256.80 6.4%

2017 $11.8M1 4.8% $179.81$11,825,953 152- $236.32 6.5%

2016 $60.3M4 25.2% $173.64$15,073,514 1448.0% $223.85 6.5%

2015 $10.2M1 4.9% $151.82$10,200,000 1347.2% $207.93 6.6%

2014 $500K1 0.4% $83.33$500,000 125- $194.53 6.7%

2013 $3.5M1 4.4% $57.95$3,477,091 115- $179.02 7.0%

2012 $33.9M2 17.0% $145.48$16,942,750 1118.5% $173.01 7.1%

2011 $14.3M2 13.2% $78.71$7,125,000 111- $171.90 7.2%

(1) Completed transaction data is based on actual arms-length sales transactions and levels are dependent on the mix of what happened to sell in the period.

(2) Market price trends data is based on the estimated price movement of all properties in the market, informed by actual transactions that have occurred.

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 19

Sale Trends

West Palm Beach Office

3 STAR SALES

Completed Transactions (1)

Turnover Avg Price/SFDeals

Volume

Year

Market Pricing Trends (2)

Avg Price

Price Index

Avg Cap Rate Price/SF Cap Rate

2026 -- - -- 207- $266.11 6.9%

2025 -- - -- 206- $265.02 6.9%

2024 -- - -- 205- $263.08 6.9%

2023 -- - -- 202- $258.98 6.8%

2022 -- - -- 193- $247.49 6.8%

YTD $37.3M8 8.6% $161.68$6,216,761 1867.1% $238.55 6.7%

2021 $68.1M14 10.9% $198.65$6,805,167 1796.2% $230.07 6.8%

2020 $48.8M22 9.6% $163.50$2,869,659 1686.3% $216.18 7.0%

2019 $62M17 7.0% $230.01$3,873,094 1637.2% $209.10 7.1%

2018 $46.1M19 10.0% $121.60$4,188,159 1588.0% $202.78 7.1%

2017 $45.2M19 13.1% $93.46$2,823,311 1437.0% $183.89 7.2%

2016 $95.9M23 20.2% $121.97$5,329,826 1377.2% $176.11 7.2%

2015 $30.6M17 10.2% $82.97$2,184,352 1258.0% $160.77 7.4%

2014 $21.5M21 9.4% $74.14$1,537,652 1178.9% $149.89 7.5%

2013 $6.1M11 3.4% $48.16$609,397 10715.0% $137.52 7.8%

2012 $13.1M5 3.9% $83.12$2,618,000 1085.7% $138.51 7.8%

2011 $13.7M5 4.7% $74.43$4,557,260 106- $136.03 7.9%

(1) Completed transaction data is based on actual arms-length sales transactions and levels are dependent on the mix of what happened to sell in the period.

(2) Market price trends data is based on the estimated price movement of all properties in the market, informed by actual transactions that have occurred.

1 & 2 STAR SALES

Completed Transactions (1)

Turnover Avg Price/SFDeals

Volume

Year

Market Pricing Trends (2)

Avg Price

Price Index

Avg Cap Rate Price/SF Cap Rate

2026 -- - -- 217- $266.52 7.0%

2025 -- - -- 216- $264.87 7.0%

2024 -- - -- 214- $262.39 6.9%

2023 -- - -- 210- $257.79 6.8%

2022 -- - -- 200- $245.76 6.8%

YTD $19.1M14 3.2% $214.02$1,732,003 1934.8% $236.81 6.8%

2021 $42.7M35 9.8% $200.80$1,707,158 1876.8% $229.45 6.8%

2020 $27.9M35 8.0% $139.05$1,211,635 1717.1% $209.65 7.1%

2019 $13.9M21 3.6% $174.10$995,269 1627.1% $198.72 7.2%

2018 $14.5M31 3.5% $196.17$805,828 1545.4% $188.71 7.2%

2017 $23.8M28 6.0% $141.01$1,321,197 1416.1% $173.29 7.3%

2016 $14.7M46 5.2% $111.21$545,862 140- $171.26 7.2%

2015 $18.4M38 6.2% $101.55$592,520 1267.9% $154.19 7.5%

2014 $10.5M30 4.7% $77.34$500,470 11611.6% $142.06 7.6%

2013 $10.6M28 3.8% $102.13$459,375 1057.9% $129.20 8.0%

2012 $5.6M20 2.8% $98.35$466,516 10312.0% $125.74 8.2%

2011 $9.2M17 3.8% $86.36$834,273 1027.8% $124.56 8.2%

(1) Completed transaction data is based on actual arms-length sales transactions and levels are dependent on the mix of what happened to sell in the period.

(2) Market price trends data is based on the estimated price movement of all properties in the market, informed by actual transactions that have occurred.

6/17/2022

© 2022 CoStar Group - Licensed to Downtown Development Authority -

551652

Page 20