Effective Date: 4-10-2023 Page 1 of 11

CASE WESTERN RESERVE UNIVERSITY

RESEARCH PARTICIPANT PAYMENT GUIDANCE

PURPOSE

This document aims to inform the campus community of the approved methods available to

compensate research participants on projects conducted by CWRU, and to assist them in

choosing the payment method that is most appropriate for their particular study. Furthermore, this

document provides guidelines and procedures regarding utilization of the various payment

methods: gift cards, petty cash, payment requests, PNC ePayments (preferred method), and

contactless payment apps, to ensure compliance with the University’s tax withholding and

reporting obligations, funding agency guidelines, and the approved IRB protocol.

BACKGROUND

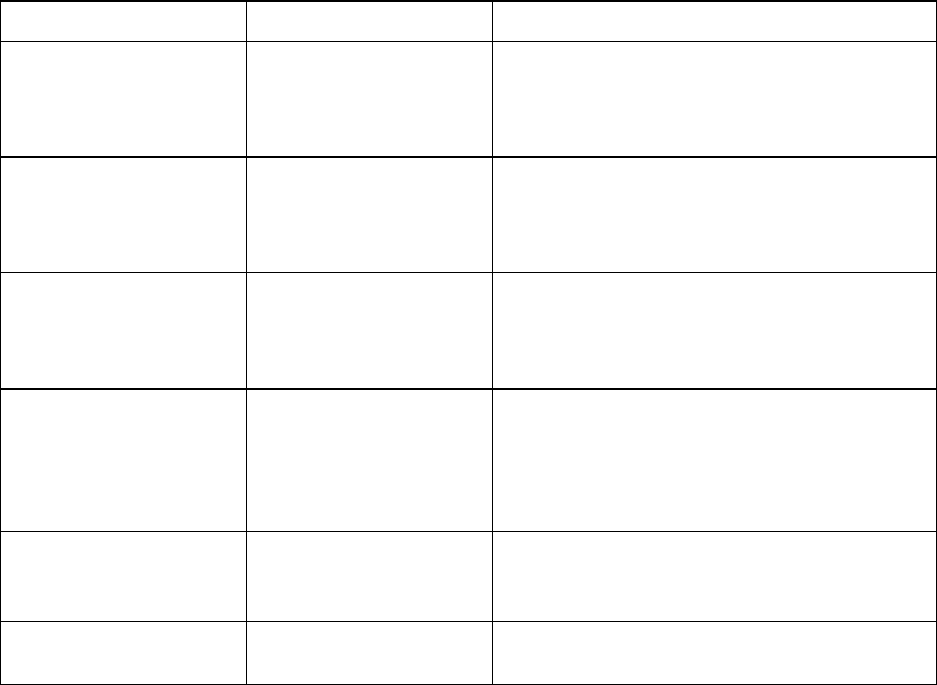

Each of the approved payment methods has both benefits and drawbacks. The chart below

contains a list of payment methods, the type of participant, and scenarios where the method would

be most appropriate to use. The information regarding each payment method’s procedure is also

included to inform you of the approved practices for use and help you assess the most suitable

payment method. Appendix A assesses each payment method, including information oversight,

benefits, drawbacks, risks, and cost evaluation.

Before engaging in any financial activities, it is the responsibility of the employee to make sure

that the intended transaction is consistent with all federal, state, sponsor, and university laws,

policies, and guidelines. Furthermore, the below methods are applicable only for study

participants, and should not be used for employee compensation or recognition. If there are any

questions regarding the appropriateness or allocability of a transaction, the employee should

contact their finance administrator for further guidance.

Per the Internal Revenue Service (the IRS), cash and cash equivalents, such as gift cards, have

a readily ascertainable value. They are taxable income regardless of the face amount. For

employees, all gift cards (and any gifts) are considered compensation and are subject to federal,

state, and employment tax withholding and reporting on Form W-2 via completion and

submission of this form via [email protected]

. There is no minimum dollar amount for this rule.

For non-employees, the value of all gifts and gift cards/debit cards in an aggregate amount of

$600 or more across campus, per calendar year must be reported to the IRS on Form

1099-MISC as other compensation. Therefore, it is necessary to collect the payee’s unique

taxpayer ID (SSN) in order to report cumulative payments in excess of $600 per calendar year.

Finally, gift cards/debit cards given to nonresident aliens are subject to federal tax withholding.

All IRB submissions and consent forms shall include language to address the collection of this

data.

Departments purchasing and distributing gift cards are responsible for compliance with IRS

Effective Date: 4-10-2023 Page 2 of 11

regulations and university policies. The purpose of these procedures is to set forth the

requirements for use, approval, purchase, accounting, tax reporting, and safeguarding of gift

cards. Please keep in mind that unused gift cards cannot be returned.

Internal Participant: Any person on payroll, and/or students with an active status.

External Participant: Persons not on CWRU payroll nor active students.

Type of Payment Method

Type of Participant Recommended Usage

PNC

ePayments

(pref

erred method)

External

One time or multiple payments, all types of

interactions

Gift Card- Physical Card

External and Internal

Known finite group of participants, One to two

payments, when anonymity is required, when

interaction is face to face and payment is

expected at time of participation

Gift Card- Electronic

External and Internal

Known finite group of participants, One to two

payments per participant, when group of

participants have access to email, cell phone

and or computer, all types of interaction.

Payment Requests

External Volunteers

Recommended when payment to volunteer is a

one time payment of $250 or more, when you

know that the volunteer will be paid more than

$599 for participation per year in multiple

payments

Venmo/PayPal or other

Cash Apps.

External Volunteers

Only to be used in specific situations that are

approved by Research Administration and

Procurement

Petty Cash External

Last resort -Only recommended when no other

method will work

PROCEDURE OF EACH PAYMENT METHOD

Your chosen method of payment should be reflected in your approved IRB protocol and consent

form.

1.

PNC ePayments (preferred method)

PNC’s ePayments is a secure, fast, cost-effective electronic payment initiation solution

which allows the study participant to choose how they want to be paid (Zelle, Direct Deposit

or check). The study participant will receive payment within minutes or up to 5 business

days, depending on the payment method the payee selects. The module is available for

use 7 days a week and some electronic payment types can be sent on non-business days.

The ePayments module provides greater security than gift cards and petty cash since it

uses muti-factor authentication and requires two users to initiate payment. Additionally,

the ePayments system provides account validation services which authenticates account

ownership for the payee and whether the account is in an active or closed status.

Payments are sent directly to the study participant, thereby minimizing the risks associated

Effective Date: 4-10-2023 Page 3 of 11

with carrying cash and gift cards. Departments do not need to obtain the payee’s personal

account information. Only the name, email, cell phone and address are needed to initiate

payments. The study participants enter their own account information after selecting the

payment method.

For ePayments access or additional information, please contact the following:

School of Medicine

Robin Martorello

rxm23@case.edu

368-2799

Dental School

Patricia Mehosky

pam17@case.edu

368-7573

All others

treasurersoffice@case.edu

Twyla Miller - ext. 5399

Michael Lee, Treasurer ext. 8630

2. GIFT CARD - PHYSICAL CARD & ELECTRONIC CARD

● PROCESS AND APPROVALS

You must order non-Visa physical and electronic gift cards using SmartCART (SmartCART

User Manual) in PeopleSoft Requisitions under the vendor National Gift Card. Due to

recent acquisition of National Gift Card by Blackhawk Network Inc, the process for ordering

Visa Gifts Cards (physical and electronic gift cards) can be found by

clicking here. This

process change is temporary until we can launch the new Blackhawk Network Catalog on

Sm

artCart. You cannot purchase gift cards on a Payment Request, a PCard, DCard, or be

reimbursed on a T&E expense report for purchasing them out of pocket. Faculty and staff

should buy gift cards based on participant enrollment plans from the research strategy study

timeline. Gift cards have a 5-7 business day delivery time after the purchase order is

issued. Please plan orders accordingly for your enrollment plans. Unused gift cards cannot

be returned and many gifts cards DO expire within a year. Reissuance of a gift card can cost

$6 - $13 or more. Please reach out to

in procuring gift cards that are not within the National Gift Card punch out catalog.

A

ll gift card orders require you to provide the following information in the requisition

approval justifications section in PeopleSoft Financials. Please use this form

for all gift card

orders.

● Requestor Name, Department, Speedtype, Project Name, Project Description

● How are the gift cards used to meet project aims?

● How are the gift cards secured? Where will they be stored (room and location)?

Who will have access to the gift cards (provide a list)?

● How are the gift cards documented/logged for participants' receipt? Where is this

doc

ument stored?

As gift cards cannot be returned or refunded, please consider these best practices:

● Estimate the total number of cards needed for a project and purchase no mor

e

t

han 25% at one time.

● If the gift card order’s total value is greater than $2,500, the gift cards’ quantity

should be restricted by the following formula:

The number of cards allowed per order = total number of participants receiving

payment divided by the number of months of the enrollment period. If the length of

the enrollment period is less than one month, use one month to calculate.

● ACCOUNTING AND TAX REPORTING

Please record gift card expenses according to their intended use/purpose. Frequently used

Account ChartField values are:

533770 – Study Participants

External participants will receive a 1099 on a calendar basis. Internal participants will s

ee

t

he payment on their pay stub under the description of “Txbl Pymnt.”

● SAFEGUARDING

Internal controls over gift cards are required at all times. Each department should have

written procedures in place that provide for the proper safeguarding of gift cards. At a

minimum, the following internal controls should be in place.

Custody:

For each purchase, a single individual must be the designated custodian of the gift cards.

The custodian is responsible for ensuring that all purchasing, security, dispensing, tracking,

and replenishing procedures are followed. Transfers of gift cards to another custodian is

permitted within the same project. The original custodian should retain information related

to the cards being transferred, such as card number, card value, and signature of the

individual taking ownership of the new cards.

As a reminder, gift cards cannot be returned. If excess cards exist at the end of a study,

please contact your Finance Director for guidance.

Security:

Gift cards must be secured at all times, e.g., in a locked box inside a locked cabinet or drawer

accessible only by the custodian.

Receipts (issuance):

Investigators should maintain payment logs for all studies that provide payments to

participants. The record must uniquely identify each payment to document the appropriate

use of the card for audit purposes. Information to be included for each card shall include at

a minimum: Recipient name or study subject ID (the study subject ID is any number

assigned by the Department to identify the individual to protect confidentiality); Date;

Purpose of payment; Serial number of the gift card; Payment amount; Signature or initials of

the recipient when applicable.

Audit Log:

The custodian must also keep a log (e.g., a spreadsheet) of gift card purchases and

disbursements for audit purposes. This log must tie the above receipts (e.g., by receipt

number and card number) to purchase gift cards recorded in the PeopleSoft Finance

System. This is particularly important in demonstrating that gift cards are reasonably

allocable to a grant. These records must be available for audit purposes.

● LOST / MISSING CARDS

Custodians are responsible for lost or stolen gift cards and may be held personally liable

for the value of any missing cards. The value of receipt logs and gift cards must total the

purchased amount. Any shortage must be reported immediately to the campus police

department and your school’s finance office.

● VOIDS/CANCELLATIONS

Refunds will not be provided for any gift cards. As a result, departments are cautioned to

only purchase gift cards as they are ready to issue them. See above for best practices

under the approval and purchase process.

● RECONCILIATION AND AUDIT

A reconciliation of gift cards should be conducted whenever gift cards are purchased or at

least quarterly. This reconciliation should consist of verifying that the number of cards

purchased minus the number of cards disbursed agrees with the number of cards on hand.

Also, the value of the cards purchased should agree with the amount recorded in

PeopleSoft Financials. The inventory should be performed by an individual who is not

responsible for the issuance or custody of the gift cards (preferably the department

approver), and should be done in the custodian’s presence.

Relevant records to maintain include:

● Vendor receipts (from purchase)

● Issuance receipts (from distribution to recipients)

● Log

● Inventory of unused gift cards (minimization of card inventory at any one time, the

record of card inventory, the security of card inventory, appropriate disposition of

unused cards at the end of study)

● Whether receipts and logs support the gift card purchase transactions

● All gift card inventories must be available for an unannounced audit.

3. PAYMENT REQUEST

Payment Requests differ from Purchase Orders in that Payment Requests are submitted

via the Accounts Payables module in PeopleSoft and are used to reimburse persons, pay

persons (non-service-related), or pay a limited subset of vendors such as INS Visas/fees

and insurance.

● PROCESS AND APPROVALS (How to Create a Payment Request

)

If the participant you wish to pay is not in the Payment Request system, please send a

completed Supplier Information Form to customercareteam-[email protected]

to have the

person/vendor added to the system. A tax identification number (social security number) is

a mandatory field on the Supplier Information Form. The Payment Request system

requires approval by someone other than the requester.

(How to Approve a Payment

Request)

● ACCOUNTING AND TAX REPORTING

Please record payment request expenses according to their intended use/purpose.

Frequently used Account ChartField values are:

533770 – Study Participants

● VOIDS/CANCELLATIONS

To cancel a Payment Request that has not been submitted for approval, click the report

and select cancel at the bottom of the page. See page 11 of How to Create a

Payment

Request for details or contact your department administrator..

4. PETTY CASH

A petty cash account is an advance from the University that allows project teams to pay

participants with actual cash. Petty cash accounts are managed by General Accounting in

the Controller’s office. There are several specific policies related to the setup and use of

petty cash accounts, to be detailed below. The petty cash custodian and the Principal

Investigator of the human subjects research should monitor all petty cash expenditures and

reconcile on a frequent (monthly) basis.

You can find the policy document here

.

PROCESS AND APPROVALS

Establishing Petty Cash Fund

Any school or department that wishes to establish a Petty Cash Fund must demonstrate a

need. This is done by completing a Speedtype Request form

which is located on the

Controller’s website. The form must be approved by the Management Center Finance

Office and sent to General Accounting.

Each section of the form must be completed. If for study participants, indicate what

speedtype(s) will be charged for the subject participation, the IRB’s it will be associated

with and how much each participant will be paid, as applicable. Also, list what types of

expenses will be reimbursed using the petty cash.

Once the establishment of the fund is approved, a petty cash speedtype (PTYXXXXXX) will

be assigned by General Accounting. The custodian will be notified through e-mail and

receive the Petty Cash Fund Statement of Receipt and Responsibility along with a copy of

the Petty Cash Funds policy. The custodian must review the policy, sign and return the

Statement of Receipt and Responsibility to General Accounting. The review and signing

must be witnessed by the custodian’s supervisor. The witness must also sign the

Statement of Responsibility prior to returning it to General Accounting. Once this is

completed, General Accounting will submit a payment request and Accounts Payable will

issue a check and send it to the Cashier’s Office for pick up by the custodian. Petty Cash

Fund checks can be cashed at the Cashier’s Office by presenting a valid Case

identification card. General Accounting will also provide the custodian with a list of the

Custodian Responsibilities.

When requesting a Petty Cash Fund, please fill out the Speedtype Request Form. Please fill

out the form according to the following instructions:

● Please select whether you are requesting a new Petty Cash fund speedtype or

changing an existing one at the top of the form. If requesting a new Petty Cash

fund, the requested name should be “P/C – “ and the custodian’s name. Custodians

must be CWRU employees. Please describe what the fund will be used for in the

REASON/PURPOSE box. If you need to change the custodian of a Petty Cash fund,

you will need to close the current fund and open a new fund for the new custodian.

An acceptable change would be if the fund is being used for a different purpose (a

new research study, for example) then created initially, or to increase/decrease the

amount.

● All fields below the BOLD divider line MUST be filled out.

● REQUEST DATE – the date the form is filled out

● REQUESTOR NAME/TITLE – the name of the person filling out the request form

and their position title

● DEPARTMENT #/NAME – Requestor’s department

● REQUESTOR PHONE #/E-MAIL - contact information for the person filling out the

form

● Any Restrictions (drop-down box: yes/no) – Select NO for Petty Cash.

● DESCRIPTION OF INCOME – N/A for Petty Cash

● DESCRIPTION OF EXPENSES – explanation of the types of expenses the fund is

being set up to cover; if the fund is for research study participants, list the

sponsored project speedtype here

● RECONCILER NAME/TITLE – this will be the Custodian.

● ROLLUP DEPT #/NAME – the department providing the cash for the fund.

● LOCATION CODE – the campus mail code for the Custodian.

Increase Petty Cash Fund

A Petty Cash Fund may be increased only in those instances where the amount of the fund

no longer meets the needs of the department. If this occurs, the custodian should forward a

Speedtype Request form, selecting the “Change a Speedtype” option and indicating the

requested amount and the reason for the increase. The Management Center Finance Office

must also sign off on the request. Note that a petty cash fund amount should not exceed

25% of the annual reimbursements of the fund.

Decrease Petty Cash Fund

A Petty Cash Fund may be decreased if the amount of the fund exceeds the actual needs of

the department. Additionally, on an annual basis, General Accounting will evaluate the size

of Petty Cash Funds based on the prior year reimbursements of the fund. If the size of the

fund exceeds ¼ of the prior year reimbursements, General Accounting will request

adjustment to the fund. The amount which is no longer needed should be deposited at the

Cashier’s Office into the respective petty cash speedtype. The Cashier’s Office will issue

an approved deposit receipt via email, which the custodian will then forward to General

Accounting along with a Speedtype Request form, (selecting the “Change a Speedtype”

option).

Closing a Petty Cash Fund

Petty Cash Funds are not transferable from one employee to another. General Accounting

will audit the fund before proceeding with the closing process. The custodian and their

supervisor must be present during the duration of the audit. Upon completion of the audit,

any cash remaining in the fund must be deposited at the Cashier’s Office to the respective

petty cash speedtype. The Cashier’s Office will issue the custodian an approved deposit

receipt via email, which should then be forwarded to General Accounting. General

accounting will use the completed audit forms and deposit receipt to close the fund. The

fund will not be closed until all necessary forms are completed, approved and signed by a

supervisor, and returned to General Accounting.

The custodian must close the fund prior to transferring or terminating employment.

Change of Custodian

To change a custodian of an established fund, the existing fund must be closed (see

“Closing a Petty Cash Fund” section) and a new Petty Cash Fund must be requested (see

“Establishing Petty Cash Fund” section).

If a “Temporary Custodian” is needed for an extended period of absence, such as Parental or

Medical Leave, a Speedtype Request form must be filled out, approved, and submitted to

General Accounting. On the Speedtype Request form, select “Change a Speedtype” and

indicate that the custodian will be absent for an extended period of time and a temporary

custodian is needed. Include the name of the temporary custodian as well as the

approximate dates that the individual will be responsible for the funds. General Accounting

will perform an audit of the fund before changing the name of the

custodian and another audit will be performed when the original custodian returns, before

the custodian is changed back to the original owner. If for some reason, the original

custodian does not return to their position the fund must be closed and a new fund must be

opened.

● ACCOUNTING AND TAX REPORTING

Procedure for Replenishing Petty Cash Funds

Clinical Study Participants

For human subject reimbursement, the study coordinator should distribute the cash to the

subject and prepare a receipt for the subject to sign. Each receipt is required to have a

unique identifier that cannot be duplicated, such as a numbered receipt book. The original

receipts should be maintained by the custodian for safekeeping. List the unique receipt ID in

the ‘Paid To’ column of the Report of Petty Cash Expenditures Replenishment Form. Due

to HIPAA regulations General Accounting cannot see the whole name of the study

participants. Please either assign participants a unique number or use only initials

Replenishing Petty Cash Funds

The University has developed this policy to provide a standard process to handle

compensation of research subjects through Petty Cash Funds and to protect the

confidentiality of subjects, to the extent allowable by law, during the reimbursement

process.

Petty Cash Funds should be replenished at minimum on a monthly basis. All Petty Cash

Funds must be replenished at the fiscal year end so there are no outstanding receipts as of

June 30.

To replenish, the custodian should:

1. Enter the information electronically via PeopleSoft Financials by completing a

payment request in the Employee Self-Service module

a. For Request Type: select Petty Cash

b. For Return Check to: select Pick up Cashiers

c. For Supplier ID: select the Custodian’s ID that has “P/C” in front of their

name.

2. The following Backup Documentation must be attached:

a. The Petty Cash Report of Expenditures

filled out completely with the

following information:

i. The date of service

ii. List the unique receipt identifier in the “Paid To” column

iii. Description of study

iv. Amount paid

v. Speedtype/account to be charged

b. Receipts

i. Receipts are required for all cash paid out, including study

participants

ii. No receipt over $100.00 will be reimbursed through Petty Cash

Replenishment Requests

iii. On receipts make sure the date, dollar amount, the unique identifier,

and speedtype are legible

iv. The University will not reimburse sales tax. Please circle the pre-

tax total on your receipts for reimbursement. You can contact

Accounts Payable to obtain a tax exempt form.

IRS Compliance

According to IRS regulations, annual compensation (subject incentives) to study subjects of

$600 or greater is considered taxable compensation and reportable to the IRS.

1. If a series of subject payments result in total compensation greater than $600 for a

calendar year the custodian should:

a. Complete a W-9 form (obtained from the Accounts Payable website)

providing the subject’s name, address and social security number.

2. A

memorandum

must accompany the W-9 form

providing

the

amount

of

compensation to the subject.

3. Submit the memo and W-9 form to Accounts Payable.

a. Accounts Payable will issue a 1099 form to the custodian for the

participant.

Please record participant petty cash expenses according to their intended use/purpose.

Frequently used Account ChartField values are:

533770 – Study Participants

● SAFEGUARDING

The Petty Cash Fund is the property of the University and must be used in accordance with

its applicable policies. Petty Cash Funds are to be maintained in cash and may not be

commingled with other University or personal funds.

It is the custodians’ responsibility to provide adequate precautions for the safekeeping of

the funds under their control. All Petty Cash Funds must be kept in a secured, locked office

safe, file safe or reinforced lockable file at all times.

Funds should never be left unattended and unsecured. In the event funds are lost or

stolen, the custodian must contact the University’s Security Office to file a security report.

Additionally, the custodian should notify General Accounting and Internal Audit of the loss.

Any funds missing from petty cash will be charged to the responsible department. A copy of

the security report should be provided to General Accounting and Internal Audit

within five

business days of occurrence.

● RECONCILIATION AND AUDIT

It is the responsibility of the Custodian to ensure that each set of Petty Cash

Reimbursement records is complete, accurate, and accompanied by original

documentation/receipts. The Custodian should keep copies of all reimbursement and

replenishment documentation for their departmental files.

Petty Cash Audits

General Accounting will conduct physical Petty Cash Fund audits at least once every two

years. A General Accounting staff member will schedule a time to visit each location to

verify the applicable Petty Cash Fund. All cash/coins in the petty cash box will be counted,

and the total amount of receipts will be verified. All discrepancies identified during the audit

procedures will be noted within the Petty Cash Fund Audit Log. If a discrepancy is found,

the fund will be subject to a second audit. The custodian’s immediate supervisor, the

Assistant Controller of General Accounting and Cashiering, and Internal Audit will be

notified of the discrepancy, and an appropriate action will be determined. The General

Accountant and custodian will sign off on the audit log at the end of the audit.

In addition to these routine announced audits, General Accounting will also conduct

random unannounced physical audits on petty cash funds throughout the fiscal year. Audit

procedures will remain consistent with the routine audits as described above.

Type of Payment Method

Type of Participant

Recommended Usage

PNC’s

ePayments

External

One time or multiple payments, all types of

interactions

Gift Card- Physical Card

External and Internal

Known finite group of participants, One to two

payments, when anonymity is required, when

interaction is face to face and payment is expected at

time of participation

Gift- Electronic

External and Internal

Known finite group of participants, One to two

payments per participant, when group of participants

have access to email, cell phone and or computer, all

types of interaction

Payment Requests

External Volunteers

Recommended when payment to volunteer is a one

time payment of

$250 or more, when you know that the volunteer will

be paid more than $599 for participation per year in

multiple payments

Venmo/PayPal or other

Cash Apps.

External Volunteers

Only to be used in specific situations that are approved

by Research Administration and Procurement

Petty Cash

External

Last resort -Only recommended when no other method

will work