2024-25 Financial Aid Info Guide

Cleveland Institute of Music

Revised July 2024

CIM Financial Aid Office Contact Information

Staff:

Kristine Gripp, Director of Financial Aid

Phone: 216-795-3192

Email: kristine.grip[email protected] or financialaid@cim.edu

CIM Room 246

Mailing Address

Cleveland Institute of Music

Financial Aid Office

11021 East Boulevard

Cleveland, OH 44106

Introduction

This guide is a supplement to www.cim.edu, the CIM catalog, Populi (CIM’s Student Information System;

enrolled students only), and the Financial Aid tab of STUDIO (CIM intranet; enrolled students only). If you

have any questions not addressed here, please reach out to the Financial Aid Office via the contact

information above. We can also schedule zoom chats, as needed.

This document is updated periodically as cyclical time-sensitive information becomes known and new

links, forms, or topics are added. Not all forms or documents for the 2024-25 year are finalized, they

should all be set prior to the start of the fall term.

Equal Opportunity Policy

In the administration of its educational and admission policies, scholarship, loan, and other school-

administered programs, the Cleveland Institute of Music is committed to nondiscrimination and equal

opportunity. The Institute admits students to all the rights, privileges, programs, and activities generally

accorded or made available to students at the school regardless of race, color, national or ethnic origin,

citizenship, religion, age, sex, sexual orientation, or disability.

Student Rights and Responsibilities

You have the right to:

• Be advised of what financial aid programs are available and how to apply for them,

• Be advised of requirements in the case of withdrawal, refunds, and repayment of financial aid

• Have all application information treated in the highest professional confidentiality,

• Be advised of financial aid procedures and deadlines,

• Be advised of how and when financial aid is disbursed,

• Request a review of your financial aid award if you believe a mistake has been made, if your

enrollment status changes, and/or if your financial circumstances have changed,

• Be advised of how CIM determines whether you are making satisfactory progress for financial aid

and what happens if you are not,

• Be advised of campus security and crime statistics (Available at CIM in the Dean’s Office)

You are required to:

• To participate in performances or events serving the interests of CIM, as requested,

• Report to the Financial Aid Office any scholarships or other awards received from sources other

than CIM, including free/sponsored housing arrangements,

• Establish plans to meet your educational and living expenses,

• Apply for financial aid early if you need financial assistance,

• Submit all forms required to complete the application process in a timely manner,

• Read, understand (if you do not understand, ask!) and retain copies of all information and/or

forms that are sent to you, or that you must sign,

• Maintain an accurate permanent and current residence address on your Populi account,

• Keep CIM (and any loan servicer) informed of any change of address or name while attending CIM,

and until all loans have been paid in full, if applicable,

• Maintain Satisfactory GPA, Academic and Artistic Progress as detailed in our Satisfactory

Academic Progress Policy and CIM Catalog,

• Regularly check your CIM email and CIM mail folder for important CIM communications. This

includes always reading the weekly Student News emails which cover a wide range of important

information and deadlines from all offices at CIM,

• Satisfactorily perform any work assignment accepted through student employment programs

Communication

Students must check their CIM email regularly. The weekly Student News email sent to all students every

Thursday during the academic year is the source of most important information about CIM news,

deadlines, reminders, etc.

Please add [email protected] and [email protected] to your list of accepted email recipients to

ensure you do not miss any important communications.

Populi

Populi is CIM’s student information system and incorporates the Registrar, Financial Aid, Billing, and

Student Life functions at CIM. It is accessible only via single-sign-on to confirmed/enrolled students. This

site will be the main financial aid reference point for enrolled students. Login credentials will be provided

to new students in summer after they have fully confirmed enrollment to CIM.

STUDIO

STUDIO is the CIM intranet site for enrolled students, accessible via single-sign-on. Most school-wide

forms and basic information students need on a day-to-day basis is linked within this site. The Financial

Aid tab is the best quick-reference spot for students and contains the most requested resources and

information.

Applying for Financial Aid

(New applicants and current students applying to a NEW program)

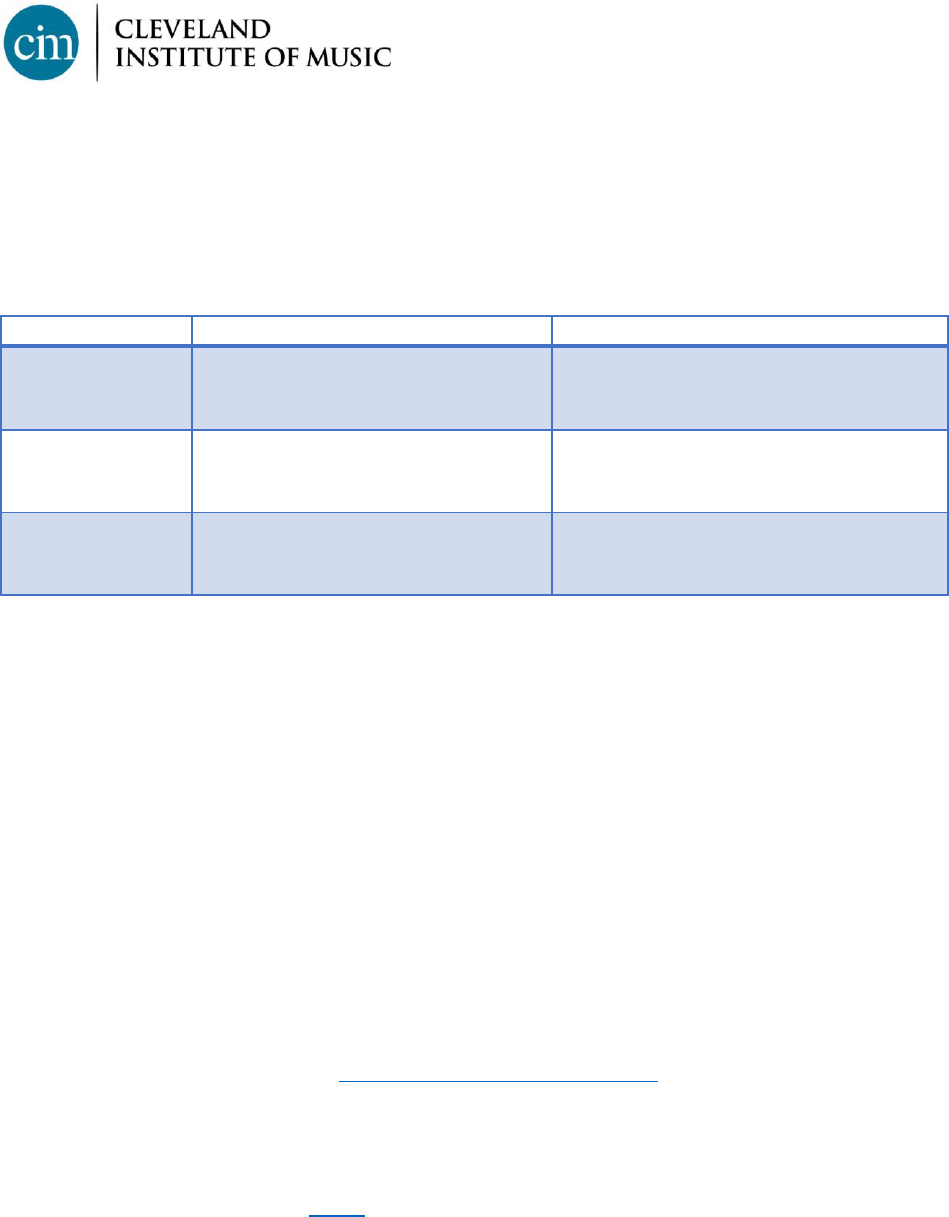

FORM

TO APPLY FOR

WHO FILES

FAFSA

CIM Institutional Need-Based Aid &

All Federal / State Aid (Work Study,

grants, loans)

U.S. Citizens & Permanent Residents

annually seeking federal aid and/or need-

based institutional aid

CSS Profile

CIM Institutional Need-Based Aid

ALL Undergraduate domestic, and ALL

International APPLCIANTS seeking

need-based institutional aid

CIM Financial

Aid Application

Any/All CIM scholarship, including

merit-only awards

All Applicants

This is an online form via the Materials

Checklist on the Admission Status Page

How to apply and who is eligible?

For need-based financial aid consideration, all applicants must fill out the FAFSA and/or CSS PROFILE,

based on citizenship and graduate/undergraduate program level. Neither the FAFSA nor CSS Profile are

required if the only aid requested is merit based CIM Scholarship. The FAFSA must be filed annually for

consideration for any federal student aid, as all federal student aid eligibility is year specific. CIM financial

aid assumes the student enrolls full time. The full-time minimum enrollment is 12 credit hours for

undergraduates and 9 credit hours for graduate students, per semester. Part time enrollment at CIM is

rare and must be pre-approved by the Office of the Dean. No CIM scholarship aid is offered to part time

enrolled students; however, half-time prorated federal aid may be offered, if eligible.

• February 15: Applicant priority deadline for CIM Financial Aid Application, FAFSA, and/or CSS

Profile, as applicable. This includes current students applying for a new program.

• May 1: Students returning in the same program, the FAFSA is required annually for all federal

student aid eligibility (grants, work study, loans); renewal FAFSA priority deadline.

CSS Profile

All international applicants and undergraduate domestic applicants seeking any need-based institutional

aid complete the CSS Profile online at https://cssprofile.collegeboard.org/. The CSS Profile is not required

for renewal aid in the same program of study.

FAFSA (Free Application for Federal Student Aid)

All U.S. citizens and permanent residents (green card holders) seeking need-based aid (federal, state

and/or institutional) must file the FAFSA. The FAFSA is not required if the student only seeks CIM Merit

Scholarship. The CIM School Code for the FAFSA is 003031.

Renewal FAFSA is needed annually for those who seek any federal aid as such aid eligibility is year-specific

to that year’s FAFSA and many fluctuate year to year.

***Due to the many changes in the 2024-25 FAFSA form and related items, we have created a 2024-25

FAFSA Changes page to summarize the changes and how they may impact prior CIM processes. Due to the

processing delays of the 2024-25 FAFSA from Dept. of Education (ED), the normal processing timelines for

all schools had to be modified. As of the date of this document, the delays are still in places and timelines

continue to be tentative.***

Once a FAFSA is submitted and normal processing timelines are underway, it will result in a FAFSA

Submission Summary (FSS) emailed to the student in 1-3 days. A corresponding Institutional Student

Information Record (ISIR) will be sent to all schools listed on the FAFSA application. It is very important to

review the FSS to make sure the FAFSA was successfully processed and there are no errors that need to

be resolved. If the FAFSA is missing consent signatures, either student or parent(s), as applicable, it will

not process.

The Student Aid Index (SAI) is calculated by a standard formula established by Congress to determine a

family’s financial strength. The SAI is used to determine the eligibility for of federal aid (both need based

and non-need based). The lower the SAI, the higher the calculated financial need is for the student.

Financial need is based on the following equation:

COA minus SAI = Need Based Eligibility

FAFSA Verification

Each year the U.S. Department of Education requires schools participating in the distribution of federal

student aid to verify the consistency and accuracy of data submitted on the Free Application for Federal

Student Aid (FAFSA). This verification process involves the review of FAFSA data to ensure the accuracy of

the FAFSA application. To complete verification, students, and parents, as applicable, are asked to submit

federal tax documents and forms to the CIM Financial Aid Office. Selected students will find the

Verification Worksheet Dependent and Verification Worksheet Independent, and/or Identity and

Statement of Educational Purpose as applicable, as listed on the Aid Application Components of the

Financial Aid tab of Populi. Any student selected for Verification will be notified by CIM Financial Aid via

email by April 10 or within two weeks of receipt of the FAFSA. The applicable Verification Form will be

included in that messaging. Schools may also select any FAFSA for this review process. For more detailed

information about Verification, please see our Verification Policy and Procedures. Enrolled students may

upload forms to Financial Aid securely within their Populi Financial Aid tab via the Files > Add link.

Applicants may securely upload via their Admission Status Page Materials Upload tab.

Award Notification

Newly admitted students will receive their Financial Aid Offer via their Application for Admission Status

page and/or email from the CIM Financial Aid Office.

Aid Offer Delivery Timelines (estimated, federal aid pending FAFSA processing delays):

• Fall 2024 admitted new students: Due to the ongoing FAFSA processing delays, we expect to

deliver Admission Status Decisions and CIM Scholarship awards on or before April 1. Federal aid

will likely need to be added on a follow-up aid offer letter once we have FAFSA data for the bulk

of applicants who indicated they were filing. Schools need time to import and review all the FAFSA

records and to review funding allocations relative to number of eligible students for limited

funded programs such as the Federal Work Study (FWS) and Federal Supplemental Educational

Opportunity Grant (FSEOG). Most likely federal aid update would follow approximately two weeks

after the FAFSA is received at CIM.

• Returning Students: On or around May 31, 2024. Annual renewal FAFSA must be on file for us to

consider federal work study, grants, or loans.

As all federal aid processes are done between the school and Department of Education electronically, so

are nearly all aid transactions between CIM and a student. Students have the right to request a paper

copy of any item. A student must submit a written request to the applicable office to obtain a paper copy.

Be advised that paper processes may add significant time to the processing of any request.

Newly admitted students who sign the Enrollment Agreement are formally accepting any CIM Scholarship

and/or Grant awards as final at that time. Any other funds offered (loans or work study) are formally

accepted or declined at student discretion via Populi after the student has confirmed enrollment and

subsequently receives their Populi login credentials (early summer). Each line item of aid may be

accepted/reduced/declined independent of each other. Once an award has been accepted, any wish to

reduce or cancel it will require written notice from the student to the CIM Financial Aid Office at

financialaid@cim.edu. Once a confirmed student, generally all aid -related communications will occur via

Populi and email from the Financial Aid Office.

Deadlines to accept financial aid awards:

Newly Admitted Students:

• April 15: Graduate Students

• May 1: Undergraduate Students

Current Students returning in the same program:

• June 30

Renewal of Financial Aid

Federal aid offered at this time is for the 2024-25 academic year only. To renew aid for subsequent years

of study in the same program, students must submit the Renewal FAFSA by May 1 (for U.S. citizens and

permanent residents seeking federal and/or state aid). Most CIM Scholarships* are renewed at the same

dollar amount annually, based on the program length guidelines as mentioned previously (assuming GPA

and progress standards are met), but other aid may vary year to year based on year specific FAFSA

eligibility results and CIM funding for certain programs. Late renewal applicants will be awarded on a

funds-available basis. Students applying for a new program or overlap program should review the

Admission section of cim.edu and may contact the CIM Admission Office for more information.

*This renewal policy applies to most scholarship/grant aid funded by CIM, including but not

limited to: CIM Institutional Scholarship, CIM Scholarship, CIM Grant, CIM Recognition Award,

Outstanding Scholar Award, Ernest Bloch Artistic Distinction Scholarship, Martha Bell Sanders

Excellence Scholarship, Emma Eels Crowell Achievement Scholarship, Presidential Scholarship,

Director’s Award, Dean’s Scholarship, Starling, SPHINX, Dual Degree/Double Major Grant.

These CIM awards are one-time and are NOT renewable: Hardship Grant, Unrestricted Grant.

• 1609 Hazel Grants and OCF 1609 Hazel Grants are applicable only to the year(s) when student

resides in 1609 Hazel, which is generally only first- and second-year undergraduates or

Orchestral Career Fellowship students.

Renewal student aid should be accepted/declined via Populi by June 30. Renewal aid not accepted by

these dates may be forfeited and re-allocated to students on the waiting list for certain funds. This

particularly applies to Work Study, which often has higher demand than funds available.

Cost of Attendance Budget (COA)

Cost of Attendance is the estimated amount it will cost a student to go to school. It is based on expected

total cost for the 9-month academic year only (fall and spring semesters), but not include the summer. If

a student enrolls in summer, those costs will be considered separately.

CIM’s current year COA estimated budgets are found here. Note there are separate budgets depending

on what semester a student began enrollment in their current program, due to the Tuition Promise, which

is also detailed on that page and mentioned below.

Both direct (billed) and indirect (non-billed) expense categories are listed and include:

• tuition and fees,

• cost of housing and food (living expenses),

• cost of books and supplies (including a reasonable amount for the cost of a personal computer),

• cost of transportation,

• loan fees,

• miscellaneous expenses,

• allowance for childcare or other dependent care, *

• costs related to a disability, * and

• reasonable costs for eligible study abroad programs *

*These categories are included on a case-by-case basis, as applicable. Contact

financialaid@cim.edu if such expenses apply to you.

Tuition Promise

CIM’s Tuition Promise is a guarantee that the base tuition fee will not increase for the duration of the

student’s current program. This does not apply to any other items in the COA budget such as fees,

tuition surcharges, living expense or any other CIM billed expense which may fluctuate annually.

• For current student programs that started Spring 2024 or before, the guarantee is for the

$40,000 tuition fee.

• For new program enrollments beginning Fall 2024, the guarantee is for the $50,000 tuition

fee.

FERPA

The Family Educational Rights and Privacy Act (FERPA) (20 U.S.C. § 1232g; 34 CFR Part 99) is a Federal

law that protects the privacy of student education records. When a student reaches 18 years of age or

attends a postsecondary institution (this kicks in when a student confirms Intent to Enroll), he or she

becomes an “eligible student,” and all FERPA rights transfer from the parent to the student. More about

this federal regulation via the Department of Education is found here.

If a CIM student wishes to give permission to CIM to speak to a parent, spouse, or any other person with

any protected student-specific information about the student’s educational record, the student must first

submit written consent to CIM. Details of how to do this are found in CIM’s FERPA Policy (Annual Policy

is updated online on July 1).

TYPES OF FINANCIAL ASSISTANCE

Total aid from all sources (combined CIM, federal, state, and private/outside aid) may never exceed cost

of attendance.

All federal and/or state aid eligibility is subject to ever-changing rules, regulations and funding from the

Department of Education and the various states. If rules or funding changes, student aid packages may

also change to remain compliant with such rules. CIM Financial Aid Office will always email the student if

such changes occur to their aid package.

SCHOLARSHIPS AND GRANTS (do not need to be repaid)

• CIM Scholarships and other gift aid are generally awarded with one or more of the following

names, though some fund names may no longer be active:

CIM Scholarship, CIM Grant, Ernest Bloch Artistic Distinction Scholarship, Martha Bell Sanders

Excellence Scholarship, Emma Eels Crowell Achievement Scholarship, Dean’s Scholarship,

Starling, SPHINX, Presidential Award, Director’s Award, Outstanding Scholar Award.

The institutional scholarship / grant awards listed above are renewed at the same fixed dollar

amount yearly, so long as the student meets all Satisfactory Academic and Artistic Progress

standards, for the normal duration of the program as follows:

▪ Bachelor of Music = 8 semesters (10 semesters for BM dual degree with CWRU)

▪ Artist Certificate = 6 semesters

▪ Master of Music = 4 semesters

▪ Artist Diploma = 4 semesters

▪ Professional Studies = 4 semesters*

▪ Graduate Diploma = 4 semesters*

▪ Doctor of Musical Arts = 6 semesters

*Professional Studies (PS) program name has ended and is now replaced by the Graduate Diploma

(GD) name. The programs are otherwise identical. Some students already enrolled in PS chose to

keep the old PS program name, but no new admissions are made to that program name.

CIM Hardship Grants and Unrestricted Grants are one-time, non-renewable awards.

1609 Housing Grants are applicable only to years the student lives at 1609 Hazel.

o SPHINX Music Assistance Fund Scholarship

Up to one student per year may be selected as the recipient of a full tuition scholarship to an

eligible SPHINX competition participant. Eligible students must self-report to CIM their status as

a SPHINX candidate on their application for admission. http://www.sphinxmusic.org/sphinx-

competition

o CIM Endowed (Named Scholarships)

These named awards are not applied for directly by the student. CIM will consider all applicants

and/or currently enrolled students, per the specific criteria set by the donor(s) of these awards,

at various times throughout the academic year. They do not represent additional aid, rather they

are the funding source behind all or part of the student's existing CIM Institutional Scholarship

award (may be for one year or multiple years). Not all awards have a recipient each year. Award

amounts may fluctuate annually. If a student is selected as a recipient of any of these awards,

they may be asked to write a letter of thanks to the donor and be asked to participate in various

CIM events recognizing the award(s). Full listing to be added soon.

• Federal Pell Grant

The Federal Pell Grant is a need-based federal grant that does not have to be repaid. Eligibility

and award amounts are determined by the U.S. Department of Education for first time bachelor’s

degree students. Eligibility is solely based on FAFSA. The 2024-25 maximum Pell Grant award is

$7,395. The process on how the Pell Grant is calculated has changed significantly from prior years.

Learn more here: https://studentaid.gov/understand-aid/types/grants/pell

• Federal Supplemental Educational Opportunity Grant (SEOG)

FSEOG is a need-based federal grant administered by CIM that does not have to be repaid. Priority

is given to students eligible for the Federal Pell Grant. Funding is extremely limited for this award.

Federal limits on this fund range from $100 to $4000 annually. CIM FSEOG awards for 2024-25

year are expected to be in the $500-750 range, to eligible Pell recipients with the highest financial

need. Not all Pell recipients will receive FSEOG due to limited funding.

• State Grant Aid

Many states have established state grant and/or scholarship programs that may be available to

eligible students. Students must apply for these state programs individually (generally via the

FAFSA). Please contact your state department of education for more information on eligibility and

application process. These grants and/or award amounts are not always available at the time CIM

prepares initial award packages and award amounts and disbursement timing is subject to the

applicable state’s budget appropriations and approval. They are added if/when CIM becomes

aware of a student’s eligibility, per the applicable state. Please refer to your own state agency for

more information. A link to all state sites is found here. These awards may not be known or added

to student aid packages until July of the award year, due to dependence on state budget approval.

• Outside / Private Scholarships

Outside or private scholarships may or may not be need-based. Many students receive

scholarships from outside sources, and these must be reported to CIM whether paid to CIM or to

the student directly, per Department of Education regulations. All external aid must be reported

to the CIM Financial Aid Office via the Private Scholarship & External Aid information Form. If

federal need-based aid has been awarded and federal demonstrated need (Cost of Attendance

minus FAFSA SAI) has been met, loans, work-study and/or federal/state grants (in that order) may

need to be adjusted, reduced, or canceled to prevent an “over-award,” which federal law

prohibits. Total aid may not exceed total cost. Federal Pell Grant and CIM Scholarship would be

the last things reduced, if necessary, except as noted below (for tuition-specific awards).

CIM reserves the right to reduce institutional aid awards in cases where external funding is also

applied specifically only to the tuition fee. This may occur when a student receives GI Bill / Yellow

Ribbon, parent employer-paid tuition benefits, Fulbright Scholarship, Outside/Private

Scholarship, etc. In such cases, we may adjust to allow for the student to receive the most possible

assistance between CIM and the external funding combined, but the external funding will be

applied first, and the CIM award(s) adjusted so that the allowable tuition-applicable amount is

not exceeded. This would be a case-by-case, year-by-year adjustment, as applicable.

• Veteran Benefits

Students who are veterans of the armed services or dependents of veterans should review their

educational benefit options through the US Department of Veterans Affairs (DVA).

CIM’s Veteran Affairs Benefit liaison is the CIM Registrar, who may be reached at

registrarweb@cim.edu. Any CIM-specific VA questions should be directed there.

➢ Apply for educational benefits through the DVA. Notify CIM’s Registrar’s Office that you are

eligible and applying for veteran’s educational benefits.

➢ Dependent of a veteran? Your parent transfers a portion (or all) of his/her benefit to you

through Transfer of Entitlement. After the transfer is approved, you apply for the educational

benefit through the DVA. You notify CIM’s Financial Aid Office that you are eligible and

applying for veteran’s educational benefits.

➢ For CIM to process veteran’s educational benefits, please provide to CIM:

o Veteran: a photocopy of your VA Certificate of Eligibility sent to you by the DVA.

o Dependent of Veteran: a photocopy of approved Transfer of Educational Benefit

(TEB) from your parent AND a photocopy of your VA Certificate of Eligibility sent to

you by the DVA.

➢ Questions about the status of your educational benefits claim? Contact DVA at 1-888-442-

4551 to speak with an Educational Case Manager.

➢ CIM participates in the Yellow Ribbon Program, which is a partnership with the U.S.

Department of Veterans Affairs (Yellow Ribbon Scholarship) and CIM (CIM Yellow Ribbon

Match Scholarship). You or your parent must qualify for 100% of the Post-9/11 GI Bill to

qualify for the Yellow Ribbon Program. See Yellow Ribbon section above for details about

participation and CIM match/award amounts.

Yellow Ribbon Program details:

Up to 5 students annually may be awarded this CIM Match support to accompany the VA GI

Bill/Yellow Ribbon award as a veteran benefit. The combination of the CIM Yellow Ribbon

Match and any other CIM-funded gift aid will be at least $10,000, renewable for the normal

duration of the program, so long as the student remains an eligible recipient of the GI Bill and

maintains a minimum 3.0 Cumulative GPA. The student or parent must qualify for 100% of

the Post 9/11 GI Bill to be eligible for the Yellow Ribbon program. Applicants must disclose

that status to the CIM Financial Aid Office by March 1 for consideration. If there are more

than 5 eligible students, returning students get priority. Any remaining openings are

determined by the date the student's complete application for admission was submitted;

earliest application date gets first consideration. For eligibility details, see

http://www.benefits.va.gov/gibill/post911_gibill.asp.

WORK / SELF-HELP

All types of aid that are work-related require the student to complete new hire tax forms with the CIM

Human Resources Office prior to beginning the job. This is taxable income, and the student will receive a

W-2 at year-end for tax return purposes. If the student does not have a U.S. Social Security Number, one

must be applied for upon hire and is needed before any funds from these aid programs may be disbursed.

These awards may fluctuate year to year based on student financial need (annual FAFSA), CIM funding

levels, and institutional need. They shall not be expected or assumed to automatically renew.

Please note that while we have limited funds for Work Study, many students find off campus work. Do

not assume the only work options are awarded via the Financial Aid Office. All work-based self-help noted

below will require the student to submit timesheets for approval and renewal reconsideration in

subsequent years of study in the same program.

**International students should review the “International Student Special Considerations” later in this

guide for details about what work is permitted.

• Federal Work Study

Federal Work Study (FWS) is a limited, need-based aid program that provides on-campus jobs for

students. Students must indicate their interest on the FAFSA and if awarded, complete the annual

FWS Contract, which is provided in May. Students apply for available jobs beginning in mid-August

for the upcoming school year. FWS awards are not applied to the student tuition account. FWS is

paid via payroll on a semi-monthly basis as submitted hours worked are approved by the

supervisor. There is no guarantee that the award amount will be earned by the student. Not all

students who are eligible (per federal student aid definitions) will be awarded FWS due to limited

funding; awards go to those with highest unmet need, first. Requires semi-monthly timesheets.

More general information about CIM’s WS program may be found here:

o Work Study Process & Timeline - 2024-25 to be updated mid August

o WORK STUDY FAQ'S

• Graduate Assistantships

Graduate Assistantships are awarded institutionally to students in exchange for work

responsibilities within CIM. These awards are extremely limited and are only applicable to

students in specific areas, i.e., Orchestral Conducting, Composition. Graduate Assistantships are

paid semi-monthly via an hourly rate per a Graduate Assistantship Contract. Renewal of this

award in subsequent years of study may fluctuate and will include a review of prior year’s work.

Federally eligible students may have their graduate assistant positions funded in part by the

federal work study program, which may be listed separately from a traditional Work Study award,

as applicable.

❖ Students at CIM perform at many gigging opportunities, including weddings, parties, benefits, and a

wide variety of community functions. International students have more restricted rules for any off-

campus work, per visa and immigration employment law. Such work is generally considered “self-

employment” for federal tax filing consideration and is generally not permitted for F-1 visa holders.

❖ Northeast Ohio is home to several Regional Orchestras that hold yearly substitute auditions, including

the Akron, Canton, Youngstown, Firelands, and Erie (PA). These orchestras would also hold a formal

audition for an open contract/full-time position, but that isn't predictable. Other orchestras hire

without auditions, such as Cleveland Opera Theater, Cleveland Pops, and City Music. There are various

other gig opportunities in the area, including musicals and shows, and special events (weddings,

parties, etc.) that CIM students and recent alums often take; the CIM Facebook community is also

very good about sharing gig information. Teaching is less predictable, but there are several local music

schools where CIM students currently teach, in addition to taking private students. As with most

freelance work, it is difficult to predict how much you could earn in any given month.

LOANS – MUST BE REPAID

Federal Loan Interest Rates for 2024-25 are noted below as of May 2024.

You may review current federal interest rate information here.

Federal Loan Type (borrower) Interest Rate Origination Fee

Direct Subsidized Loan (undergraduate) 6.53% 1.057%

Direct Unsubsidized Loan (undergraduate) 6.53% 1.057%

Direct Unsubsidized Loan (graduate) 8.08% 1.057%

Parent PLUS Loan (undergraduate's parent) 9.08% 4.228%

Graduate PLUS Loan (graduate) 9.08% 4.228%

Direct Loan - CIM packages (offers) the annual maximum Direct Loan amount to each student with a valid

FAFSA on file for that year. Students may accept, decline, or reduce this award amount, as they wish.

Everything there is to know about federal loans, including annual and lifetime loan limits, interest rates

and fees, repayment options and more is found here.

• Federal Direct Subsidized Loan

• Federal Direct Unsubsidized Loan

These loans are added to aid packages after the borrower applies and has been approved. Click the links

below for more information. Applications for these loans will go live for the 2024-25 year in mid April

2024:

• Federal Direct Parent PLUS Loan

• Federal Direct Graduate PLUS Loan

Direct Loan Processing (How to Apply?)

Federal Direct Student Loans are available to all eligible students with a valid FAFSA for the applicable

year. The FAFSA is the only application necessary to receive Federal Direct Student Loans. PLUS loans

require a separate, additional application and are subject to credit approval.

The processing of all Federal Direct Student Loans will begin in July before the start of the Fall semester.

Additional Federal Loan Document Requirements (all found via StudentAid.gov and require an FSA ID).

Schools are sent an electronic receipt for all the following studentaid.gov processes within 1-2 days from

when the borrower completes them online:

• Entrance Counseling - Required of all first-time student borrowers who have accepted the Federal

Direct Student Loans (subsidized & unsubsidized) or Graduate PLUS Loans as part of their financial

aid package.

• Master Promissory Note (aka Loan Agreement) separate MPN needed for each of the following

types of federal loans. Must be on file prior to loan origination and disbursement – general due

date is June 30.

o For Student Direct Loan Borrowers – Required of all first-time student borrowers who

have accepted the Federal Direct Student Loans (subsidized & unsubsidized) as part of

their financial aid package.

o For Parent PLUS Borrowers – Required of all first-time parent borrowers who have

applied (paper or online) and been approved for a Federal PLUS Loan.

o For Graduate PLUS Borrowers – Required of all first-time graduate student borrowers

who have applied (paper or online) and been approved for a Federal Graduate PLUS Loan.

• PLUS/Graduate PLUS (Adverse Credit) Entrance Counseling – Required of all PLUS Loan or

Graduate PLUS Loan borrowers who have applied with an adverse credit decision.

• Annual Student Loan Acknowledgment – This is a voluntary, but strongly suggested, process for

all Direct Loan and Direct PLUS Borrowers.

LOAN EXIT COUNSELING / CHANGE OF ENROLLMENT STATUS - When a Federal Loan student borrower is

no longer enrolled at least half time for any reason (graduation, withdrawal, leave of absence, part time

enrollment, etc.), the student must complete Exit Counseling online and will enter the loan repayment

process. Since this is a Federal requirement, students who fail to complete a timely Exit Counseling Session

will have a financial aid hold placed on their Populi account which will block release of an official transcript

(unofficial transcripts may always be received), diploma, and/or future registration enrollment, until the

counseling is completed.

Students with questions about their Federal Loans after completing the applicable exit counseling are

encouraged to contact their federal loan servicer first, then the Financial Aid Office if questions remain.

For in-depth information about the loan repayment process, please visit Federal Student Loan Repayment

Plans.

Federal Direct Loan Exit Counseling – (studentaid.gov) - Required of all Federal Direct Loan

student borrowers at the time they graduate, drop below half-time status, take a leave of

absence, or withdraw.

Perkins Loan Exit Counseling – (https://heartland.ecsi.net/) - Required of all CIM Perkins Loan

borrowers at the time they graduate, drop below half-time status (6 credits), take a leave of

absence, withdraw, or become enrolled less than half time for any reason. Since this is a Federal

requirement, those students who fail to complete their Perkins Exit Counseling will have a hold

placed on their official transcript until completed.

REPAYMENT TERMS & RESOURCES

• National Student Loan Data System (NSLDS) - The National Student Loan Data System (NSLDS) is

the Department of Education’s central database for Federal Student Aid. Borrowers can

visit NSLDS to view information about all their federal student loans received and to find contact

information for their loan servicers (lenders). FSA ID is needed (How to Create an FSA ID) to

access this information. Check your current federal loan record on NSLDS.

• Federal Direct Loan Servicer A loan servicer is a company that handles the billing and other

services on a federal student loan. The loan servicer administers repayment plans, loan

consolidation and assists with other tasks related to federal student loans. Borrowers should

maintain contact with their loan servicer. A loan servicer is assigned to a loan by the U.S.

Department of Education after when the loan has been disbursed. Check the accuracy of your

Federal Direct Loan servicer contact information here.

Office of the Ombudsman - The Federal Student Aid (FSA) Ombudsman Group of the U.S. Department of

Education is dedicated to helping resolve disputes related to Direct Loans, Guaranteed Student Loans, and

Perkins Loans. The Ombudsman Group is a neutral, informal, and confidential resource to help resolve

disputes about your federal student loans. The easiest way to contact the Ombudsman is to file an on-line

assistance request at https://studentaid.ed.gov/sa/repay-loans/disputes/prepare/contact-ombudsman.

Other contact options are:

• Telephone: 877-557-2575

• Fax: 606-396-4821

• Mail: FSA Ombudsman Group, P.O. Box 1843, Monticello, KY 42633

STATE EDUCATIONAL LOANS

Some state governments offer an educational loan program. To learn if your state has a loan program

contact your State Education Agency through the Department of Education’s Educational Resource

Organizations Directory.

PRIVATE / ALTERNATIVE LOANS

Domestic students and international students who have a U.S. citizen or eligible permanent resident as a

co-applicant, may apply for a private loan to help bridge the gap between the student’s cost of attendance

and the student’s family resources and financial aid package.

Some students and families choose to borrow a private loan to cover a portion of the cost of education

not already paid for by scholarships and Federal grants/loans. We encourage students and parents to

exhaust all Federal loan options prior to applying for a private loan. The Federal loan programs generally

offer lower interest rates and fees than private loans and more repayment options.

Please review this informational page by ED comparing federal and private loans:

https://studentaid.gov/understand-aid/types/loans/federal-vs-private

If a student chooses to pursue a private loan, we recommend comparing the costs associated with various

lenders before completing an application. Interest rates, fees, repayment periods, and other benefits can

vary significantly between lenders. Often these loans are based on creditworthiness and approvals are

not automatic. The FinAid.org website provides some comparative information regarding private loans.

When selecting a loan through a comparative website, be sure to go to the lender’s website to ensure you

are considering the most up-to-date information about the loan/lender.

Students should notify the CIM Financial Aid Office when they apply for any private loan and include the

name of the lender being used, so we know to be on the lookout for a school certification form, which will

be needed before the loan may be processed.

CANADA PROVINCIAL LOANS

Canadian citizens: for information on student loans in your home province, please see the Canada

Student Grants and Loans page. We encourage students to apply for such loans before July 15 to

ensure funds are available for the fall term.

Other Resources and Options for Paying Tuition Bill

If you still have a balance due for your semester bill after your aid is posted, and you are unable to pay

the balance outright (by cash, check, EFT, or credit card), you may use:

• Federal Direct PLUS Loan (U.S./Permanent Resident students with a valid FAFSA) – Parents of

undergraduates or graduate students may apply for the Federal PLUS Loan via studentaid.gov (see

details about this federal loan in the text above).

• CIM Payment Plan – CIM’s in-house monthly payment plan allows you to pay monthly (4 months

per semester) instead of the entire semester balance upfront. Students can enroll in this payment

plan themselves within Populi on the Financial tab and/or Financial Dashboard within the Make a

Payment button. The cost is $50 per semester; no interest. The first of four monthly payments

are due 2 weeks before the semester begins.

• Private / Alternative Loan - Should you need to borrow additional funds beyond federal loan

programs, you may wish to consider a private education loan. It is your responsibility to research

these options to find the one best suited to your needs. Be sure to review interest rate, fees, and

special features. Be aware that each lender performs its own credit check and multiple checks can

have an adverse effect on your credit score. You should opt for a loan that has no prepayment

penalty and is deferred until graduation. CIM is not affiliated with and does not endorse any

lender; you may apply via any lender of your choice. A historical lender list CIM students have

used in recent years is found at https://www.cim.edu/conservatory/finaid/aid_types.php.

Additional private loan information is found here.

• Private/Outside Scholarships - There are many sources for student scholarships, outside of any

financial aid package that you may be awarded from CIM. We encourage students to review

options annually and apply for grants and scholarships to help support educational endeavors. If

a recipient of any such aid, it must be reported as a resource to the CIM Financial Aid Office via

the Private Scholarship & External Aid Information Form. Below is a list of some organizations and

search tools. These listings are not exhaustive.

• Scholarship search engines:

o College Board Fund Finder

o CollegeData

o FastWeb

o FinAid.org Scholarship Tips

o Find Tuition

o Sallie Mae Scholarship

o ScholarshipExperts

• Places to pursue private scholarships:

o private foundations and charities

o professional or trade associations

o music organizations & orchestras

o religious organizations

o Ethnic and cultural organizations

o high school counseling office

o parent employers

• SNAP Benefit Eligibility - Students who participate in the Federal Work Study (FWS) Program may

qualify for SNAP benefits. FWS is a need-based aid federal student aid program with eligibility

determined annually per the FAFSA. Students who are approved for SNAP benefits may receive

$234 per month for purchase of groceries. Students would apply via benefits.ohio.gov upon arrival

to CIM in the fall (after they have secured a WS job) and must meet other eligibility requirements.

CIM cannot determine individual student eligibility. More information about this program may be

found via these links:

• https://www.fns.usda.gov/snap/students

• https://hhs.cuyahogacounty.us/programs/detail/supplemental-nutrition-assistance-

program

• Steps to Getting & Keeping SNAP Funds for College Students Flyer via benefits.ohio.gov

Tuition Insurance

Like health, car, homeowner, or rental insurance, tuition insurance may be valuable. In the event of an

emergency that necessitates a student take a leave of absence or withdraw mid-semester, there may be

an unexpected balance owed to the school, even if the student had a zero balance before the

leave/withdrawal. This can happen per the terms of CIM Refund Policy and Federal Return to Title IV

Policies (2024-25 policies to be posted early summer). We urge students and families to consider if this is

an investment that makes sense for you. More information may be found at these links:

• https://finaid.org/about/contact/tuition-insurance/

• https://www.consumerreports.org/tuition-insurance/should-you-buy-college-tuition-

insurance-a1139739045/

• https://thecollegeinvestor.com/23889/best-tuition-insurance/#tab-con-12

Coursework Eligible for Federal Student Aid

If a student is enrolled in courses that do not count toward their CIM degree, certificate, or other

recognized credential, they cannot be used to determine enrollment status unless they are eligible

remedial courses. A student may not receive federal aid for classes that do not count towards the

degree/program.

To be considered full time for federal aid purposes, a student must be registered and have begun

attendance with a full-time class load (12 credits undergraduate; 9 credits graduate) applicable to the

student’s program as a general education requirement, a major requirement, or elective. A student can

receive aid for a limited amount of remedial coursework that is included as a part of a regular program.

(34 CFR 668.20).

Additionally, a student who completes the academic requirements for a program but does not yet have

the degree or certificate is not eligible for further additional federal student aid funds for that program.

E.g., in situations where all required course work is complete, but the GPA does not meet graduation

requirements or there is still a recital to complete (0 credits), that student will not be eligible for further

federal aid.

Basic federal aid eligibility details may be found here.

Important CWRU Dual Degree impact: as the CWRU degree is not a CIM degree, courses specific to that

degree are not eligible for federal student aid. However, so long as a dual degree student carefully plots

out their CIM degree coursework each year, so they always have at least 12 credits enrolled that ARE for

their CIM degree, they can certainly take the additional credits each semester that may apply to the CWRU

degree.

*Dual Degree students with federal aid should plan to set up a time to discuss this with the CIM

Financial Aid Office, and then with the CIM Registrar, so we can ensure this is clearly understood.

Satisfactory Academic Progress (SAP)

To be eligible for Title IV (federal), state and CIM aid, a student must maintain Satisfactory Academic

Progress (SAP), which has three separate components. SAP includes maintaining a minimum cumulative

GPA, number of credit hours that must be completed per semester and cumulatively, as well as the

maximum timeframe students must complete their program. Failure to meet these standards will have

significant financial implications. CIM Offices of the Registrar, Dean and Financial Aid work together to

evaluate these metrics at the end of every semester.

Disbursement of Financial Aid to the Student’s Account

• CIM Scholarship aid may be disbursed to the student billing account at the time each semester’s

billing statements are posted.

• Disbursement of each semester’s federal financial aid will be made to the student tuition billing

account after the Drop/Add period is complete and only after all supplemental required

documents are received (promissory notes, entrance counseling, FAFSA Verification, etc.). CIM

must also document each student has begun attendance, to be eligible for federal aid

disbursement. The student billing account may include Scheduled/Expected Aid, but it will not be

officially disbursed until all required documents are complete and confirmed as requested from

the Financial Aid Office. Attendance documentation is required before federal aid may officially

disburse. This is usually documented within Populi by faculty in the week after drop/add ends.

Credit Balance Refund

Each semester, financial aid is applied to the student tuition account to offset CIM charges (tuition, fees,

on campus room and board, etc.). Once all CIM charges have been paid, refund checks are issued if there

is a credit balance remaining, when total aid exceeds the balance owed. Refunds of credit balances will

be processed via paper check payable to the student within 14 days after the date of disbursement that

created the credit balance. If aid is disbursed after the semester has begun, then any subsequent credit

balance will be refunded within 14 days of disbursement date to student account, per federal regulations.

A student should make provisions to cover all expenses that will be incurred before the issuance of a

refund check. Financial aid actual disbursements are posted to student accounts after Drop/Add

processing is complete. Prior to that time, all aid will appear as Scheduled / Expected Aid and is not eligible

for refund. Students should expect credit balance refund checks no earlier than the fourth week of classes

each semester.

Advances of up to $2,500 of pending credit balances may be requested the first week of classes (issued

first Friday of the semester) assuming the student file is 100% complete at that time (no missing or

incomplete documents, full time course load verified in Populi, attendance documentation is on file, etc.).

Advance request forms will be posted to the financial aid tab of STUDIO a week before the start of each

semester.

If the credit balance is created because of a Parent PLUS Loan, the credit balance is refunded to the parent

borrower, unless the parent indicated on the PLUS application that their credit balance is to be paid to

the student.

**Exception, for Pell Grant recipients and/or any student whose federal aid alone (not counting CIM

Scholarship) exceeds the semester billed charges, if there is a pending credit balance as of two weeks

before classes begin for a semester; up to $800 of that credit will be advanced the first week of classes,

per federal regulations for use towards purchasing necessary books and supplies.

Title IV Credit Authorization (“Excess Aid” Authorization option in Populi)

Federal student aid recipients may opt-in to give CIM consent to apply possible Title IV aid to non-

institutional charges.

Title IV funds are federal funds that may be used to pay institutional charges of tuition, required fees, and

room and board (if billed by the institution). Federal law states that any federal funds in exceeding these

charges must be refunded to the student unless CIM is authorized by the student to apply those funds to

other current term charges on the account.

Title IV Federal aid includes:

• Federal Pell Grant

• Federal Supplemental Educational Opportunity Grant (SEOG)

• Federal Direct Loan (subsidized and unsubsidized)

• Federal Direct PLUS Loan (graduate and parent*)

To voluntarily authorize to CIM to allow federal financial aid to pay for non-institutional charges such as

health insurance, parking permit, incidental fees, etc., students must agree to this authorization. The

agreement must be in place before federal financial aid is disbursed to the student financial account and

may not be applied retroactively. Federal regulations require a student to complete this Title IV Credit

Excess Authorization only once for CIM to disburse any federal funds with this agreement. It will remain

in effect for the duration of the student’s enrollment at CIM unless formally rescinded in writing.

Parent borrowers to the Federal Direct Parent PLUS Loan are asked if they’d like to opt in to this for any

proceeds relating the Parent PLUS Loan on the loan application itself. Such consent for the parent is

applicable only to that year’s PLUS Loan.

Billing & Financial Aid Processing Dates for 2024-25 (tentative)

Per academic calendar found here.

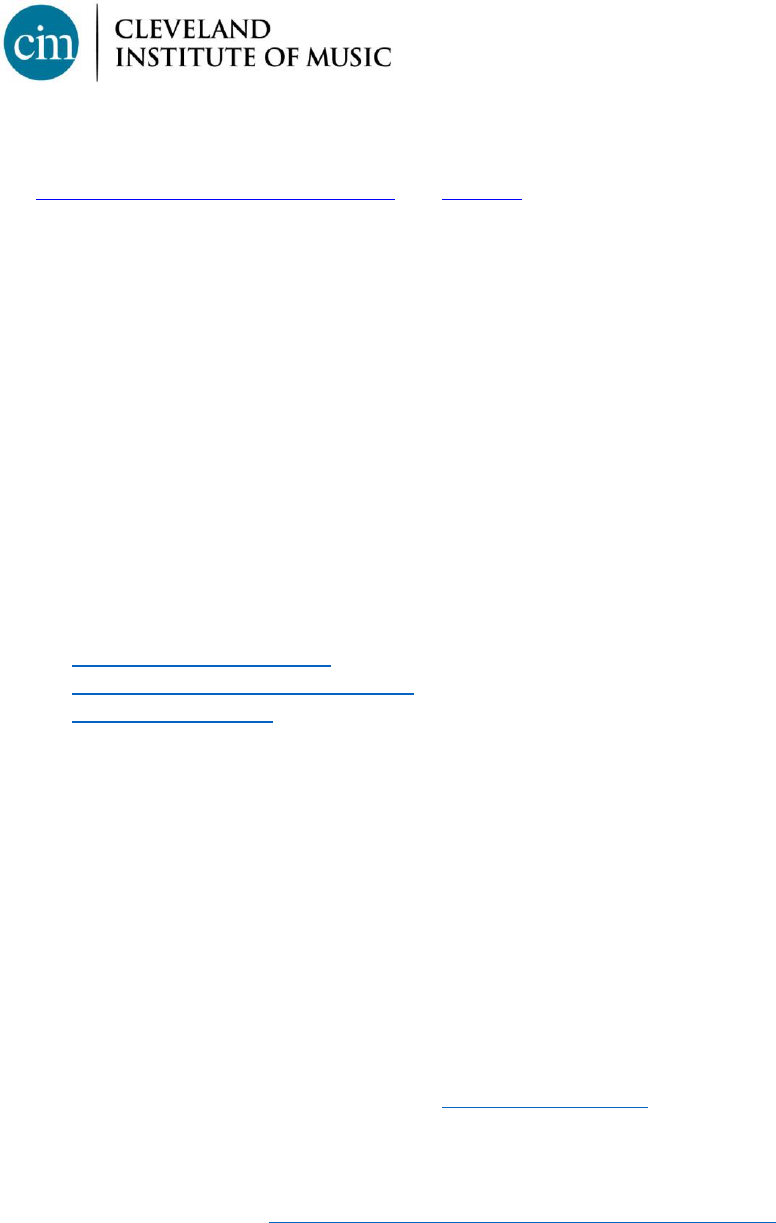

Activity

Fall 24

Spring 25

Billing statements prepared (estimate)

Students not formally registered for classes by published due date (TBD) prior will incur a $250

late registration fee.

CIM scholarships will be disbursed to appear on the billing statements on or before the billing

date.

08/01/24

12/15/24

Date tuition and fees due (or first installment of semester payment plan)

Incomplete aid files or missing final transcripts will have Financial Aid Holds on academic

record as of this date

08/12/24

01/01/25

First day of classes

08/26/24

01/13/25

Registration Drop/Add ends for semester

Students must be enrolled full time by this date to retain scheduled aid eligibility

08/30/24

01/17/25

*Federal Aid disbursement date

This assumes the student has all aid related documents submitted by CIM due dates

09/16/24

02/03/25

**Standard credit balance refund date

This assumes aid was disbursed on the standard disbursement date above. If disbursed later,

there is a 14-day window between disbursement date and credit balance refund date

09/30/24

02/17/25

***Last date to reduce or cancel loans for the semester via CIM

09/30/24

02/17/25

*The Federal Aid disbursement date is when CIM electronically receives federal aid payments from the

Dept. of Education and is when a loan becomes an actual disbursement on the student NSLDS federal loan

history and is assigned to a federal loan servicer (though it may not display there for a week or two). The

refund by the school to the borrower of any pending credit balance due to federal aid will be refunded via

check within 14 days of the disbursement date. Any loans processed after the normal cycle will have 14

days from that later date for any credit balance to be refunded. Before federal aid may be disbursed, CIM

must be able to document the student has begun attendance in the minimum number of credits/classes to

warrant the aid offered (full time, half time, etc.).

** Credit balances are refunded to the student (or to parent, when a Parent PLUS Loan creates the credit

balance) via paper check by the Business Office. Students deposit via the bank of their choice. CIM does

not cash checks.

*** After this date, you may repay your federal loan servicer.

Financial Aid Appeal Process

➢ Applicants

CIM makes its best offer of financial assistance in the initial award made to students prior to the

first semester of study. CIM understands that certain circumstances may present students and

families with unique financial challenges and therefore newly admitted students may contact the

Financial Aid Office at [email protected] or 216-795-3192 to discuss the situation. Once CIM

has received a tuition deposit and/or and accepted Enrollment Decision, all institutional aid

offered is considered final. The only exception would be if there is an involuntary, documentable,

and unexpected event that occurs after the date of signed Enrollment Decision, which may be

reviewed via appeal, though additional aid is not guaranteed.

➢ Current Students

Hardship Appeal Current student hardship appeals may only be considered in the event of a

recent, involuntary, unexpected, and documentable event such as parent loss of job/reduction of

income, major illness or death of immediate family member, natural disaster, etc. If approved,

such appeals may result with a one-time, non-renewable modest Hardship Grant. Receipts,

canceled checks, letters from employers, doctors or other applicable documentation may be

requested. If a domestic student, the 2024-25 FAFSA must already be on file and all federal aid

options have been exhausted. If applicable, the student should first submit the 2024-25 FAFSA

Special Circumstance Professional Judgement Review Form discussed below. Please allow 2

weeks for the results of this appeal. CIM will not begin reviewing current student hardship appeals

for the 2024-25 year until after June 1, after renewal aid has been posted to Populi. This date

may change if FAFSA processing delays persist. There will be a separate Fall 2024 Hardship

Appeal Form on STUDIO at that time.

CIM specifically CANNOT consider an appeal for any of the following reasons, whether singly or

in combination:

• Increase in overall cost of attendance

• Parent retirement, unless due to disability - This is considered a voluntary change in income

• Illness/death of family member other than spouse, parent, or sibling - This is outside the scope

of financial status of immediate family

• Student wins competitions or excels academically - Being a good student is not a “special

circumstance,” students are admitted with the expectation they will thrive at CIM

• Graduate students: Parent reduction of income (for any reason) for U.S. or permanent

resident - No parental income/assets are included on your FAFSA for your financial need

determination, as all graduate students are classified as independent for federal aid purposes.

As such, there is an assumed $0 parent contribution for all graduate students, already

• Fluctuations in currency exchange rates between the U.S. and another country

• Loss or reduction of sponsor or external support

• In addition, the Department of Education specifically states the following are not subject to

special circumstance consideration: Vacation expenses, Tithing expenses, Standard living

expenses, Mortgage payments, Car payments, Credit card debt payments

The following forms may be applicable to any FAFSA filer with special circumstances (excluding the

ones noted above):

• 2024-25 FAFSA Special Circumstance Professional Judgement Review Form this form may

be applicable if there is a significant change in family income or other financially impactful

changes to finances since the 2022 tax return data. This compares the 2022 federal tax

return data as is entered on the 2024-25 FAFSA to current 2024 income projections. 2024-

25 FAFSA must be on file before a review may occur. Such an appeal would not change

CIM funded support but may allow for additional federal student aid eligibility. A more

generic semester appeal form will be found on the Financial Aid tab of STUDIO, as needed.

• 2024-25 Dependency Override Information and Request Form (undergraduates only) In

situations such as parent incarceration, abandonment, abuse, or neglect, you may be able

to submit your FAFSA form without parent information despite being considered a

dependent student.

• 2024-25 Unusual Circumstances / Unsubsidized Loan Only - If parent cannot or will not sign

FAFSA (dependent undergraduates only) students may submit their FAFSA and indicate they

seek only the Unsubsidized Loan and may forgot the need for a form to request this as was

needed in prior years. No SAI is calculated on such a FAFSA. Only the Federal Direct

Unsubsidized Loan may be offered, per the normal annual and aggregate borrowing limits.

No other federal aid may be possible.

Notes for ALL appeals: All appeals are considered on a case-by-case basis. Not all appeals will result

in increased aid. CIM should not be expected to provide institutional financial aid to cover an

unexpected loss of financial resources while enrolled for study. In such circumstances, the student

may need to take out additional loans privately, take a leave of absence, or withdraw from school.

Ability to pay is a consideration that must be made when deciding which school to attend. CIM's

admission philosophy is to encourage students and parents to find a school that is "the best fit," which

includes financial affordability.

Cost of Attendance Budget Increase Adjustments (Appeal)

The Cost of Attendance (COA) is an estimated student budget that is designed to provide students, living

within a moderate lifestyle, an accurate projection of reasonable costs for a typical academic year (9

months; does not include summer). There is statutory language that determines what cost items schools

are to include in these budgets. In limited cases, a student may petition to have the estimated COA

adjusted to account for their costs being significantly different (higher) than the averages we set for the

standard budget. If such an adjustment occurs (documentation of expense and a form is required), it will

never result in any additional CIM funding, but may allow a student additional borrowing options via

federal and/or private loans. Schools are limited by law on what may be adjusted within the COA and such

adjustments may only occur for expenses that occur during the applicable period of enrollment. Expenses

incurred in the summer or in a prior or future semester are not applicable for COA adjustment

consideration. See COA Increase Appeal Form: (applicants may contact the CIM Financial Aid Office for

this form) Linked on STUDIO for enrolled students.

• While schools are not permitted to add any category of expense to a student budget that is not

already in the federal COA, other adjustments to the existing categories may be possible, as

applicable, for unique situations as reviewed on a case-by-case basis. These may include:

o Study Abroad expenses

o Dependent Care Costs

o Disability Related expenses

• Instrument Purchase - CIM permits students to petition one time in their CIM enrollment

(lifetime) an appeal to adjust (increase) the student’s COA of up to $10,000 for an instrument

purchase (or the cost of the instrument, whichever is less).

• Tuition Surcharges - for Dual Degree and Double Major Surcharges are automatically added to

applicable student’s budgets. Any other CIM surcharge, such as Secondary Study Fee or Over 18

Credit Surcharge would need to be requested by the student specifically to be added.

• Loan Fees - While the budgeted loan fees in the standard COA are based on standard year-in-

school borrowing averages, some students may borrow significantly more via plus loans, etc.,

which would incur higher loan fee cost. We may adjust add the actual loan fee amount to the

COA, but the student must request such a revision in writing to the Financial Aid Office.

• CWRU Meal Plans – As 1609 Hazel includes in-suite kitchens, CIM no longer requires students

living on campus to purchase formal meal plans. Most opt to buy their own groceries and cook

their own meals. However, if a student prefers the traditional dining all plan, they may still do so.

If the cost of the CWRU plan exceeds the standard estimated budget we have already in place for

food for all students, the difference may be added, by request, to that student’s cost of

attendance budget, to allow increased loan borrowing.

Unusual Enrollment History (UEH) Policy

The U.S. Department of Education has established regulations to prevent fraud and abuse in the Federal

Pell Grant and Federal Student Loan Programs. They have done this by identifying financial aid students

with unusual enrollment histories (UEH). If a student has received Pell Grant or Federal Loan funding while

attending multiple institutions during the last three academic years, the student may be flagged for UEH.

Unusual Enrollment History must be resolved before a student can receive federal financial aid.

https://www.cim.edu/sites/default/files/inline-files/unusual_enrollment_history.pdf

Financial Aid Student Attendance Policy

Students are expected to attend all class sessions beginning with and including the first class session. The

Department of Education requires the verification of attendance prior to the disbursement of any federal

aid funds. Until attendance is verified for a student, no federal financial aid will be disbursed.

Our policy on attendance is found here:

https://www.cim.edu/sites/default/files/inline-files/attendance_policy.pdf

Federal Requirements for Home-Schooled Applicants

Status as a home-schooled student may affect your eligibility for Federal financial aid. Home schooled

applicants are eligible to receive Federal Student Aid funds if their secondary school education was in a

home school that state law treats as a home or private school. Some states issue a secondary school

completion credential to home schooled students. If this is the case in the state where the student was

home schooled, they must obtain this credential to be eligible for Federal Student Aid funds. Many home-

schooled students also obtain a GED, which will fulfill the federal aid eligibility issue. If your state does

NOT issue such certificates, you need to provide CIM documentation of that from an official source from

your state of residence and we may waive need to obtain the certificate or proof of GED.

Taxability of Financial Aid

If you receive CIM scholarship, grants (Pell, FSEOG, etc.), sponsor payments, and/or other U.S. sourced

outside private scholarships and those combined types of gift aid exceed the cost of tuition and other

qualified fees as defined by the IRS, the amount exceeding qualified tuition and fees is taxable to the

student and must be reported on the student’s tax return. Whether or not any tax liability will occur can

vary from student to student based on total income the student may have.

Any scholarship or gift aid that covers housing or food costs specifically is always taxable.

CIM is required to report to the IRS these taxable situations for nonresident alien students (and withhold

federal tax on this taxable amount at the rate of 14%). Such withholding will be reported to the student

and I.R.S. via a 1042S form the following March. U.S. citizens and Green Card holders are still liable to

report on their own. To see if you have taxable aid, please consult a tax accountant or the IRS. CIM does

not provide tax advice.

Helpful tax publications include:

• IRS Topic No. 421 Scholarships, Fellowship Grants, and Other Grants

• Tax Benefits for Education

• IRS Publication 17

Educational Tax Credits

American Opportunity Tax Credit: Parents or students may qualify to receive up to $2,500 by claiming the

American Opportunity Tax Credit on their U.S. federal tax return during the following calendar year. CIM’s

Business Office issues applicable 1098T forms annually by January 31 to students who may be eligible to

claim these benefits.

Changing Class Rank (Year of Enrollment) During the Academic Year

If you change class rank, based on number of earned credits, during the academic year, you may be eligible

for additional Federal Direct Stafford Loan. If you change from a freshman to a sophomore, from a

sophomore to a junior or from an undergraduate to a graduate during the academic year, and you wish

to be considered for additional Direct Stafford Loan, please contact the Financial Aid Office to have your

loan eligibility reviewed mid-year for this scenario. The Registrar’s Office must verify such change in status.

Transfer students may also have changes in expected class rank due to how many credits ultimately

transfer in to CIM once we have the final transcript from the prior school. Please be sure to submit a final

transcript as soon as possible, once the term is complete.

Undergraduate class standing is defined as:

First Year: up to 23 credits earned

Second Year: 24 to 47 credits earned

Junior: 47 to 71 credits earned

Senior: 72 or more credits earned

Refund Policies for Withdrawals (or LOA)

Withdrawing from CIM after the start of a semester may result in significant changes to the student billing

account. Determination of official withdrawal date is at the discretion of the Registrar and Dean per the

following guidelines:

• CIM Refund Policy (applicable to both LOA and Withdrawals):

https://www.cim.edu/file/refund-policy (2024-25 Policy will be posted early summer)

• Return to Title IV Refund Policy (how federal aid is addressed for a LOA or withdrawal)

https://www.cim.edu/file/return-title-iv-policy (2024-25 Policy will be posted early summer)

• Leave of Absence (LOA) Policy: https://www.cim.edu/sites/default/files/inline-

files/leave_of_absence_policy_0.pdf

• Withdrawal Policy: https://www.cim.edu/sites/default/files/inline-

files/Withdrawal%20Policy_0.pdf

Transcript Requirements (Admission Policy)

Please review the CIM Admission Policy and ensure all necessary final official transcripts are on file with

the CIM Registrar by stated deadlines. Official Transcripts for high school (or home school or GED) and/or

college degrees are required prior to first day of classes (holds will be placed on accounts before classes

begin). Before a new student may be officially enrolled, the following must be on file with the CIM

Registrar’s Office. You may not begin classes, obtain your registration sticker, or have any aid disbursed

until:

• First year or transfer undergraduate students must have one of the following on file with the

CIM Registrar:

➢ Complete Official High School transcript, indicating high school diploma earned or

➢ Complete Official Home School transcript indicating high school equivalency earned (if

student resides in a state that issues a home school certificate, that certificate must be on

file at CIM), or

➢ Official GED documentation

• First year or transfer graduate students must have on file with the CIM Registrar:

➢ Official prior transcript(s) showing undergraduate degree earned

• First year DMA students must have on file with the CIM Registrar:

➢ Official prior transcript(s) showing Master of Music degree earned

International Student Special Considerations

I-20 Documentation of Funding Requirement

Colleges must obtain complete and accurate information about the funds available to international

applicants who want to study in the United States. Strict government regulations, rising educational costs

and economic conditions have made verification of financial resources of international applicants

essential. Such verification must be made prior to CIM issuance of Certificates of Eligibility (Form I-20).

Schools must verify the student has available funding to cover all costs for the first year of enrollment (9

month academic year comprised of two full time semesters of study). Although CIM is required to verify

funding only for your first year, please ensure your ability to cover costs associated with the subsequent

year(s) of study needed to complete your program. The amount you need to document is the value listed

on your Aid Offer as COA MINUS ALL AID OFFERED.

• Students with a spouse or dependent coming with them to CIM via the student’s F-1 visa will also

be required to document an additional $8,000 USD per person, for the mandatory I-20 funding

documentation requirement.

Once you have accepted your Enrollment Decision and paid your Enrollment Deposit, you will need to

send your I-20 Documentation of Funding Form to our International Student Advisor, Mia O'Riordan, in

our Registrar's Office at [email protected]. Funding documents in a parent or any other person not

the student must also complete and sign an I-20 Sponsor Agreement.

• More about the I-20 Funding Requirements are found here. Prospective F-1 students must have

the financial resources to live and study in the United States. This includes being able to cover

the cost of tuition, books, living expenses and travel. Designated school officials (DSOs) must

collect evidence of the student’s financial ability before issuing a Form I-20, “Certificate of

Eligibility for Nonimmigrant Student Status.” Additionally, prospective students must bring

their evidence of financial ability when applying for their student visa with the U.S. Department

of State. It is also advised to have the originals of all the evidence on-hand when entering the

country at a U.S. port of entry, in the event a U.S. Customs and Border Protection officer asks

to review it.

Summer English Language Training Program (ELTP)

For students required to enroll in ESL, this online summer program will also be required. The fee for this

is $3,750. This cost will be added into the amount which is required to have funding documentation

provided by students for CIM to issue the I-20.

While international students are only required to document funding for the first year at CIM for student

visa/I-20 paperwork, please be sure there will be an ability to fund the remaining years of enrollment. If a

sponsor or other funding used to help pay the first year is not available in subsequent years, CIM shall not

be expected to make up the difference. Remember, CIM scholarship is renewable at the SAME level each

year (assuming GPA, academic and artistic progress requirements are being met). While our base tuition

fee will not go up, per the Tuition Promise, fees and living expenses generally increase modestly each

year. Ensure you have adequate funding to complete the program for which you are applying.

International students are not eligible for U.S. federal student aid. To be approved for a loan from a U.S.

lender (bank), a U.S. citizen is required as a co-signer. Also:

• It is MANDATORY all new international students attend the International Student Orientation

during the new student orientation prior to the start of fall classes.

• Refer to the International Student Page on the CIM website for more information.

• Each semester, CIM will require completion of a Country of Residence for Tax Purposes Form to

ensure CIM is treating any possible payments, awards, prizes, and federal reporting obligations

correctly. Schools need to correctly categorize international students as resident or nonresident

aliens, per the IRS Substantial Presence Test. See IRS Topic No. 850 Resident and Nonresident

Aliens for more details on this subject.

• Students with a spouse or dependent coming with them to CIM via the student’s F-1 visa will also

be required to document an additional $5,000 USD per person, for the mandatory I-20 funding

documentation requirement.

• If at any time during your CIM enrollment, you obtain a U.S. Social Security Number (SSN), you

must provide that legal number to the CIM Registrar’s Office and the CIM Financial Aid Office.

Generally, we must see your actual signed, Social Security Card. Similarly, if you obtain Permanent

Lawful Resident status (green card), CIM must be notified and provided with your Alien

Registration number.

• Students from Canada: Never use your Canada Social Insurance Number when a U.S. form asks

for a Social Security Number. They are not interchangeable.

Tax filing requirements for international students

• Every international student, along with their dependents, will need to file Form 8843 separately.

• If you have received income in the last calendar year then you will need to file Form 8843 and

most likely Form 1040-NR also.

• Students may have additional filing requirements for state and local tax authorities.

While CIM cannot provide tax advice, the links below better explain these regulations:

• IRS - Foreign Students, Scholars - Who Must File

• EDUPass Filing Taxes as an International Student

• International Students Learn About Filing Taxes

Employment regulations for F-1 students: Refer to this federal webpage for more employment

regulations for F-1 visa students: http://studyinthestates.dhs.gov/working-in-the-united-states:

➢ Working in the United States - The U.S. government takes working illegally very seriously. If you

decide to work, the first step is always to talk with your designated school official (DSO).If your DSO

knows you are working without permission, your DSO must report it through SEVIS and your record

can be terminated. That means that you will have to leave the United States immediately, and you

may not be allowed to return. There are many opportunities to work and getting permission is easy.

➢ On-Campus Employment - As an F-1 student in Active status, you immediately have an option for one

kind of work: on-campus employment. However, there are some things to keep in mind. Although you

may work shortly after you arrive, you must be in Active status and your DSO must approve your