WORLD ECONOMIC

LEAGUE TABLE 2023

A world economic league table with

forecasts for 191 countries to 2037

December 2022, 14th edition

1

World Economic League Table 2021

World Economic League Table 2023

Contents

WORLD ECONOMIC LEAGUE TABLE 2023

Introduction ................................................................................................................................................................... 7

League Table A to Z ................................................................................................................................................ 17

League Table by 2022 ranking ...................................................................................................................... 22

League Table by 2037 ranking ...................................................................................................................... 27

Country forecasts ........................................................................................... 32

Albania ............................................................................................................................................................................................................ 32

Algeria ............................................................................................................................................................................................................. 33

Angola ............................................................................................................................................................................................................. 34

Antigua and Barbuda ......................................................................................................................................................................... 35

Argentina ...................................................................................................................................................................................................... 36

Armenia ......................................................................................................................................................................................................... 37

Aruba ............................................................................................................................................................................................................... 38

Australia ......................................................................................................................................................................................................... 39

Austria ............................................................................................................................................................................................................ 40

Azerbaijan .................................................................................................................................................................................................... 42

The Bahamas ............................................................................................................................................................................................. 43

Bahrain .......................................................................................................................................................................................................... 44

Bangladesh ................................................................................................................................................................................................. 45

Barbados ....................................................................................................................................................................................................... 46

Belarus ............................................................................................................................................................................................................ 47

Belgium ......................................................................................................................................................................................................... 48

Belize ............................................................................................................................................................................................................... 50

Benin................................................................................................................................................................................................................. 51

Bhutan ............................................................................................................................................................................................................ 52

Bolivia .............................................................................................................................................................................................................. 53

Bosnia and Herzegovina ................................................................................................................................................................... 54

Botswana ...................................................................................................................................................................................................... 55

Brazil ................................................................................................................................................................................................................ 56

Brunei Darussalam ............................................................................................................................................................................... 57

Bulgaria ......................................................................................................................................................................................................... 58

Burkina Faso .............................................................................................................................................................................................. 59

2

World Economic League Table 2021

World Economic League Table 2023

Burundi .......................................................................................................................................................................................................... 60

Cabo Verde ................................................................................................................................................................................................... 61

Cambodia ..................................................................................................................................................................................................... 62

Cameroon .................................................................................................................................................................................................... 63

Canada ........................................................................................................................................................................................................... 64

Central African Republic ................................................................................................................................................................... 66

Chad ................................................................................................................................................................................................................. 67

Chile .................................................................................................................................................................................................................. 68

China ................................................................................................................................................................................................................ 69

Colombia ....................................................................................................................................................................................................... 71

Comoros ........................................................................................................................................................................................................ 72

Democratic Republic of the Congo .......................................................................................................................................... 73

Republic of Congo ................................................................................................................................................................................. 74

Costa Rica ..................................................................................................................................................................................................... 75

Côte d'Ivoire ................................................................................................................................................................................................ 76

Croatia ............................................................................................................................................................................................................. 77

Cyprus ............................................................................................................................................................................................................. 78

Czech Republic ........................................................................................................................................................................................ 79

Denmark .......................................................................................................................................................................................................80

Djibouti............................................................................................................................................................................................................ 81

Dominica ...................................................................................................................................................................................................... 82

Dominican Republic ............................................................................................................................................................................ 83

Ecuador .......................................................................................................................................................................................................... 84

Egypt................................................................................................................................................................................................................ 85

El Salvador ................................................................................................................................................................................................... 86

Equatorial Guinea .................................................................................................................................................................................. 87

Eritrea .............................................................................................................................................................................................................. 88

Estonia ............................................................................................................................................................................................................ 89

Eswatini ......................................................................................................................................................................................................... 90

Ethiopia ........................................................................................................................................................................................................... 91

Fiji ....................................................................................................................................................................................................................... 92

Finland ............................................................................................................................................................................................................ 93

France ............................................................................................................................................................................................................. 94

Gabon .............................................................................................................................................................................................................. 95

The Gambia ................................................................................................................................................................................................ 96

Georgia ........................................................................................................................................................................................................... 97

Germany ....................................................................................................................................................................................................... 98

3

World Economic League Table 2021

World Economic League Table 2023

Ghana .............................................................................................................................................................................................................. 99

Greece ........................................................................................................................................................................................................... 100

Grenada ........................................................................................................................................................................................................ 101

Guatemala ................................................................................................................................................................................................. 102

Guinea ........................................................................................................................................................................................................... 103

Guinea-Bissau ......................................................................................................................................................................................... 104

Guyana ......................................................................................................................................................................................................... 105

Haiti ................................................................................................................................................................................................................. 106

Honduras .................................................................................................................................................................................................... 107

Hong Kong SAR ..................................................................................................................................................................................... 108

Hungary ....................................................................................................................................................................................................... 109

Iceland ........................................................................................................................................................................................................... 110

India ................................................................................................................................................................................................................... 111

Indonesia ...................................................................................................................................................................................................... 112

Islamic Republic of Iran ..................................................................................................................................................................... 113

Iraq .................................................................................................................................................................................................................... 115

Ireland ............................................................................................................................................................................................................ 116

Israel ................................................................................................................................................................................................................. 117

Italy ................................................................................................................................................................................................................... 118

Jamaica ......................................................................................................................................................................................................... 119

Japan ............................................................................................................................................................................................................. 120

Jordan ............................................................................................................................................................................................................. 121

Kazakhstan ................................................................................................................................................................................................. 122

Kenya .............................................................................................................................................................................................................. 123

Kiribati ........................................................................................................................................................................................................... 124

Korea ............................................................................................................................................................................................................... 125

Kosovo........................................................................................................................................................................................................... 126

Kuwait ............................................................................................................................................................................................................127

Kyrgyz Republic ..................................................................................................................................................................................... 128

Lao P.D.R. .................................................................................................................................................................................................... 129

Latvia .............................................................................................................................................................................................................. 130

Lesotho........................................................................................................................................................................................................... 131

Liberia............................................................................................................................................................................................................. 132

Libya ................................................................................................................................................................................................................ 133

Lithuania ..................................................................................................................................................................................................... 134

Luxembourg ............................................................................................................................................................................................. 135

Macao SAR .................................................................................................................................................................................................. 137

4

World Economic League Table 2021

World Economic League Table 2023

North Macedonia.................................................................................................................................................................................. 138

Madagascar .............................................................................................................................................................................................. 139

Malawi ........................................................................................................................................................................................................... 140

Malaysia ........................................................................................................................................................................................................ 141

Maldives ....................................................................................................................................................................................................... 142

Mali .................................................................................................................................................................................................................. 143

Malta .............................................................................................................................................................................................................. 144

Marshall Islands ..................................................................................................................................................................................... 145

Mauritania .................................................................................................................................................................................................. 146

Mauritius ..................................................................................................................................................................................................... 147

Mexico ........................................................................................................................................................................................................... 148

Micronesia .................................................................................................................................................................................................. 150

Moldova ......................................................................................................................................................................................................... 151

Mongolia ...................................................................................................................................................................................................... 152

Montenegro............................................................................................................................................................................................... 153

Morocco ....................................................................................................................................................................................................... 154

Mozambique ............................................................................................................................................................................................. 155

Namibia ........................................................................................................................................................................................................ 157

Nauru ............................................................................................................................................................................................................. 158

Nepal .............................................................................................................................................................................................................. 159

Netherlands .............................................................................................................................................................................................. 160

New Zealand ............................................................................................................................................................................................. 161

Nicaragua ................................................................................................................................................................................................... 162

Niger............................................................................................................................................................................................................... 163

Nigeria .......................................................................................................................................................................................................... 164

Norway ......................................................................................................................................................................................................... 165

Oman............................................................................................................................................................................................................. 167

Pakistan ....................................................................................................................................................................................................... 168

Palau .............................................................................................................................................................................................................. 170

Panama ......................................................................................................................................................................................................... 171

Papua New Guinea ..............................................................................................................................................................................172

Paraguay ...................................................................................................................................................................................................... 173

Peru ................................................................................................................................................................................................................ 174

Philippines .................................................................................................................................................................................................. 175

Poland ........................................................................................................................................................................................................... 176

Portugal ....................................................................................................................................................................................................... 177

Puerto Rico................................................................................................................................................................................................ 178

5

World Economic League Table 2021

World Economic League Table 2023

Qatar .............................................................................................................................................................................................................. 179

Romania ...................................................................................................................................................................................................... 180

Russia ............................................................................................................................................................................................................. 181

Rwanda ........................................................................................................................................................................................................ 183

Samoa ........................................................................................................................................................................................................... 184

San Marino................................................................................................................................................................................................. 185

São Tomé and Príncipe .................................................................................................................................................................... 186

Saudi Arabia ............................................................................................................................................................................................. 187

Senegal ........................................................................................................................................................................................................ 188

Serbia ............................................................................................................................................................................................................. 189

Seychelles ................................................................................................................................................................................................... 190

Sierra Leone ............................................................................................................................................................................................... 191

Singapore ................................................................................................................................................................................................... 192

Slovak Republic ..................................................................................................................................................................................... 193

Slovenia ........................................................................................................................................................................................................ 194

Solomon Islands .................................................................................................................................................................................... 195

Somalia ........................................................................................................................................................................................................ 196

South Africa .............................................................................................................................................................................................. 197

South Sudan ............................................................................................................................................................................................ 198

Spain .............................................................................................................................................................................................................. 199

Sri Lanka ..................................................................................................................................................................................................... 200

St. Kitts and Nevis ................................................................................................................................................................................. 201

St. Lucia ....................................................................................................................................................................................................... 202

St. Vincent and the Grenadines ................................................................................................................................................ 203

Sudan ........................................................................................................................................................................................................... 204

Suriname ................................................................................................................................................................................................... 205

Sweden ....................................................................................................................................................................................................... 206

Switzerland .............................................................................................................................................................................................. 207

Taiwan Province of China .............................................................................................................................................................. 209

Tajikistan ..................................................................................................................................................................................................... 210

Tanzania ........................................................................................................................................................................................................ 211

Thailand ........................................................................................................................................................................................................ 212

Timor-Leste ................................................................................................................................................................................................ 213

Togo ................................................................................................................................................................................................................ 214

Tonga .............................................................................................................................................................................................................. 215

Trinidad and Tobago .......................................................................................................................................................................... 216

Tunisia ............................................................................................................................................................................................................217

6

World Economic League Table 2021

World Economic League Table 2023

Türkiye .......................................................................................................................................................................................................... 218

Turkmenistan .......................................................................................................................................................................................... 219

Tuvalu ........................................................................................................................................................................................................... 220

Uganda ......................................................................................................................................................................................................... 221

Ukraine ......................................................................................................................................................................................................... 222

United Arab Emirates ....................................................................................................................................................................... 223

United Kingdom .................................................................................................................................................................................. 224

United States .......................................................................................................................................................................................... 226

Uruguay .......................................................................................................................................................................................................227

Uzbekistan ................................................................................................................................................................................................ 228

Vanuatu ...................................................................................................................................................................................................... 229

Vietnam ...................................................................................................................................................................................................... 230

West Bank and Gaza ......................................................................................................................................................................... 232

Yemen ........................................................................................................................................................................................................... 233

Zambia ........................................................................................................................................................................................................ 234

Zimbabwe .................................................................................................................................................................................................. 235

7

World Economic League Table 2021

World Economic League Table 2023

Introduction

This introduction sets out some of the key underlying themes in the report and some of the major

changes since last year. Our previous report struck a largely optimistic tone as the vaccination

campaign against Covid-19 was well under way globally and, despite the Omicron wave, a path out of

lockdown restrictions and back to more normal levels of economic activity seemed likely. As

predicted 12 months ago, world GDP in USD rose above $100 trillion for the first time ever in 2022

and is now projected to reach $207 trillion by the end of our forecast horizon in 2037.

A key question we asked 12 months ago was whether inflation, which had started to accelerate in

various parts of the globe in the wake of the pandemic bounce back, would be as easy to tame as

central bankers were still confidently predicting at the time. Following Russia’s invasion of Ukraine on

24th February 2022 and the subsequent turmoil in global commodity and energy markets, price

increases saw a dramatic acceleration. Inflation has become the main economic story of the past year

and even though we are starting to see price growth decelerating in some economies, volatility in

global energy markets and entrenched core inflation suggest that it will remain front and centre in

2023 as well.

Beyond inflation and energy, this section will also cover the global transition to a greener economy

and changes to the predicted date when China will overtake the US as the largest economy, as well

as a summary of the biggest movers over the 15-year forecast horizon of this year’s WELT rankings.

Inflation becomes the dominant story

In 2022, the global economy experienced an inflationary shock of a magnitude not seen since the

start of the 1970s. After a concerted effort in the early 1980s, central bankers around the world finally

won the battle against inflation, but at the cost of deep recessions in the US and Europe. The

question for the year ahead is how painful measures to rein in inflation will be for the world economy

and if any potential economic contractions can be kept short and shallow or whether a more

prolonged reduction in demand will be required to get price growth back to more comfortable levels.

Supply chain disruptions, a lack of input materials and shifting consumer demand patterns brought

about by the pandemic were already causing price pressures in a number of sectors and economies

in 2021. This was the backdrop against which Russia’s invasion of Ukraine sent global commodity

markets into turmoil. In 2021, Russia was the world’s second-largest exporter of crude oil and largest

exporter of natural gas and Europe in particular had become increasingly reliant on its gas. Upon

Russia’s invasion, the US, UK, European Union and other allied countries condemned the aggression

and agreed on several sanction packages targeting the Russian economy. This caused global oil

prices to exceed $120 per barrel of Brent over the summer, before falling back again to around $90 in

Q4 2022, as shown in Figure 1.

8

World Economic League Table 2021

World Economic League Table 2023

Figure 1 – Price of Brent Crude, USD (with forecast)

Source: Macrobond, Cebr forecasts

Both Russia and Ukraine are also important producers and exporters of wheat and other agricultural

products, further stoking inflationary pressures in global food prices.

The impacts of this energy price shock were felt globally, though particularly European economies

experienced a terms of trade shock as the cost of energy imports rose drastically, leading to higher

inflation, lower real incomes and a weakening in current account balances. To protect consumers and

businesses from the highly volatile market prices for energy, European governments have rolled out

various energy subsidy schemes, intervening at a large scale only months after pandemic support

programmes were wound down.

Easing supply chain pressures, falling shipping rates and lower commodity prices suggest that

inflation rates will fall back over the course of 2023. Headline inflation in the US, for example, seems

to have peaked at 9.1% in June 2022 and has decelerated steadily over the second half of the year, as

shown in Figure 2. Nevertheless, policy makers at the US Federal Reserve, the Bank of England and

the European Central Bank have all been at pains to reiterate that interest rates will need to raise

further in 2023 and that the battle against inflation is not won yet. The fact that core inflation rates,

which strip out volatile food and energy prices, have crept up across developed economies and are

several times above central banks’ inflation targets confirms that inflationary pressures have indeed

become more entrenched in the global economy, which could lead inflation expectations to become

unanchored. We, therefore, expect central bankers to stick to their guns in 2023, despite the

economic costs. This will invariably lead to relatively sizeable asset price corrections. Following a

decade of record-low interest rates, the sharp pace of monetary tightening has started to weigh on

house prices in the US and the UK. Meanwhile, global tech stocks have taken a battering in 2022, as

have crypto assets, as interest rates increased and future earnings potential were discounted more

0

20

40

60

80

100

120

140

Jan

2020

Jul

2020

Jan

2021

Jul

2021

Jan

2022

Jul

2022

Jan

2023

Jul

2023

Jan

2024

Jul

2024

$ per barrel Forecast

9

World Economic League Table 2021

World Economic League Table 2023

heavily. We expect 2023 to be a challenging year for markets and downside risks are prevalent in the

housing market, where higher borrowing costs are compounded by falling real incomes and an

anticipated uptick in unemployment over the year.

Figure 2 – Consumer Price Inflation in selected countries

Source: Macrobond, Cebr analysis

Energy security in focus

In previous years, energy markets were predominantly seen through the lens of the net zero

transition and climate change. This changed in 2022, following the Russian invasion of Ukraine, which

forced more fundamental questions up the agenda: How can energy costs be kept affordable for

consumers and businesses? And is there enough energy to go around to keep the lights on this

winter? While fears of supply shortages and energy rationing are predominantly discussed in Europe,

the knock-on effects have been felt globally in the form of higher prices for gas and oil.

The price of oil jumped over the summer, further stoking global inflationary pressures, but has come

down since. In the US, President Biden allowed the release of 180 million barrels from the national

strategic petroleum reserve over the course of 2022, partly to help lower petrol costs for Americans.

Meanwhile, China’s zero-Covid strategy resulted in various lockdowns of major economic areas

throughout the year, supressing oil demand as its economic recovery stalled. Looking ahead, there is

considerable uncertainty regarding the future path of Chinese demand for oil, depending on the

speed of vaccine roll-out and the removal of remaining Covid restrictions. The slowdown in economic

-2%

0%

2%

4%

6%

8%

10%

12%

14%

UK France Germany US Japan

India China Brazil 2% target

10

World Economic League Table 2021

World Economic League Table 2023

momentum in the rest of the world is, however, a clearly negative price signal for oil and we expect

brent crude to average $94 a barrel in 2023 before falling to below $80 a barrel in 2024.

At the end of 2022, the EU, G7 and Australia implemented a price cap on seaborne Russian oil, set at

$60 a barrel. The sanctioning countries aim to implement this ban by prohibiting domestic firms to

offer shipping, insurance, and other services to shipments of Russian-origin oil priced above the cap.

This complements an EU import ban for Russian oil that came into effect on 5 December. However,

the fact that the price cap was designed with the twin aims of reducing Russian oil revenues while

avoiding a contraction in global oil supplies, as well as the potential for Russia to evade the measures

by using insurance and shipping firms located outside the sanctioning countries, suggests that the

overall impact of the price cap will be muted.

Gas markets differ from oil, mainly because pipelines cannot be easily redirected and due to the

relative fixed supply of liquefied natural gas at the global level, at least in the short term. European

countries have scrambled to secure alternative gas supplies from around the world in response to

Russia’s decision to drastically reduce pipeline gas exports. This has meant greater competition in

world markets for a limited supply of LNG, causing the drastic spike in prices seen throughout the

year. Through a combination of demand reduction and their financial capacity to pay for higher prices,

EU countries have successfully managed to fill up their gas storages ahead of winter, though a

residual risk of shortages remains. Unfortunately, things are not looking much better for 2023, and

notably the coming winter, as European countries will need to prepare themselves to pay

substantially more for energy than what they have become accustomed to. In the longer run, this has

the potential to change the industrial structure of the continent should energy-intensive companies

no longer be able to compete with firms who have access to cheaper energy, e.g. in the US or in parts

of Asia.

Will China’s economy ever overtake that of the US?

Until recently this question seemed unnecessary – of course China would overtake the US, and

probably quite soon. China’s population is 4.2 times that of the United States so when GDP per capita

reaches a quarter of that in the US, by simple mathematics China will have higher GDP than the US.

But various headwinds – adverse demographics as China’s labour force growth goes into reverse (we

expect an annual decline of 0.5% over the forecast period), slowing productivity growth, the

encumbrance of high debt levels leading to collapsing property companies and the damaging effects

of lockdowns needed to enforce the zero covid policy (which nevertheless failed to prevent what

looks to be a devastating wave of infections this winter) – are leading some economic commentators

(for example editorials and op-eds in the Economist and the Financial Times) to surmise that this

particular ‘il sorpasso’ may never actually take place.

We estimate that China’s dollar GDP in 2022 was 73% of that in the US. We expect Chinese annual

growth to slow gradually to 3% in the medium term. We also expect China’s cost of living (currently

61% of the US level) to rise gradually. So on this basis, although China is not forecast to hit its

11

World Economic League Table 2021

World Economic League Table 2023

government’s growth target of becoming a medium level developed economy by 2035, we do

expect it to be larger than the US before the end of our forecast period in 2037. We think that China’s

scale means that its economy is different from many smaller economies that have found it hard to

escape the middle income trap. And while China’s sheer size and political significance mean that its

exports to the West are likely to be constrained, it has a sufficiently large internal market to offset

many of the disadvantages of this.

When will China’s economy overtake? With China’s growth slowing and the US remaining robust,

there is likely to be quite a long period where the two economies are very close to each other in size

and a relatively small adjustment to a growth forecast (or indeed a small revision to a base level of

GDP) could change the ‘il sorpasso’ year fairly considerably. But our current prediction is that China

overtakes the US in 2036.

Does this matter? Not really. Given the uncertainty about the base data and the differences in the

structures of the two economies, the actual overtaking means very little. The fact that the two

economies are likely to be of similar orders of magnitude for a long time means rather more. And of

course, eventually in the latter part of the current century they are both likely to be joined by India as

a third economic superpower.

If China invades Taiwan…

We do however believe that there is one set of circumstances that might inhibit China’s overtaking of

the US.

In his opening speech to the 20th National Congress of the Chinese Communist Party (CPC) President

Xi has vowed to ‘take back’ Taiwan. He has stated clearly that while he would prefer this to happen by

peaceful means, he would not rule out the use of force. This reaffirms what has been known to be

Chinese policy for some while. However, in the wake of the Russian invasion of Ukraine, there are

renewed fears that an attempt could be made using force in the not-too-distant future.

It seems improbable that if this were to happen the West could stand by without taking some

retaliatory action. At one level, the US would be likely to transfer high tech arms to Taiwan as has

been done in Ukraine. At another level, economic sanctions on China would be likely – again the

Ukraine template has shown that the West is willing to disconnect with a country that is seen to be

disrupting the world order even at considerable cost to itself. It would seem silly to have gone to such

lengths over the Russian invasion of Ukraine but stand idly by while China acts on a much bigger

scale.

If such trade action does take place, both the world economy and the Chinese economy would be

affected. China exported 20.0% of GDP in 2021 of which half went to Asia, and just over 20% each to

the US and Europe. If you include those Asian countries with a Western orientation, it is likely that

complete trade sanctions on China would leave 15% of Chinese GDP exposed.

12

World Economic League Table 2021

World Economic League Table 2023

Obviously, the loss of Chinese imports would damage the countries that are reliant on them and

hugely disrupt global supply chains. For many Western companies, China is also an important export

market which cannot be easily replaced. The consequences of economic warfare between China and

the West would therefore be several times more severe than what we have seen following Russia’s

attack on Ukraine. There would almost certainly be quite a sharp world recession and a resurgence of

inflation. But the damage to China would be many times greater and this could well torpedo any

attempt to lead the world economy.

We assume that the Chinese, who have often showed that they have some of the world’s most

competent officials working in their bureaucracy, know this. And so we think it is more likely than not

that they will limit any action they take against Taiwan. But sometimes unchallenged leaders get

tempted by grandiose ambitions or try to engage in foreign adventures to distract from problems at

home. We hope that this does not happen.

The environmental consequences of growth

The COP26 conference in Glasgow highlighted the problem of climate change and secured a series

of commitments from different countries on a range of subjects. Especially important were the

commitments to carbon reduction. The subsequent COP27 conference in Cairo last year achieved

less, though a fund to help poor countries (especially small island nations) cope with the

consequences of climate change was agreed.

But in reality decarbonisation is now a critical element of most countries’ growth strategies. Although

the high energy prices associated with the invasion of Ukraine have given a temporary extension to

the use of some fossil fuels, these prices have also made renewables significantly more economic. In

addition, the new focus on energy security (see above) means that countries will wish to become less

dependent on imported fossil fuels which in many cases will further promote use of domestic

renewables.

Our model is predicting cumulative output growth of 46.9% from 2022 to 2037. If carbon emissions

were proportional to GDP this would imply an equivalent percentage rise in emissions. In practice,

there is considerable controversy about the link between GDP and emissions. The environmental

Kuznets curve (EKC) theory suggests that above a certain level of GDP per capita, emissions start to

decline even if economies continue to grow. Unfortunately, empirical research suggests that this

level at which emissions decline stands around $80,000 of GDP per capita

1

at 2016 prices

2

. Our

forecasts show world GDP per capita rising from $11,879 at 2016 prices to $15,393 at the same price

level so well below the turning point for the EKC.

1

Is there a relationship between economic growth and carbon dioxide emissions? Jenny Cederborg & Sara Snöbohm.

Södertörns University | Institution of Social Sciences Stockholm 2016

2

P18 op cit

13

World Economic League Table 2021

World Economic League Table 2023

This means that reduction in emissions growth, let alone the absolute level of emissions will not

happen naturally and will have to be encouraged by policy.

In practice most of the world has now adopted such policies, though doubts remain about the fervour

with which they will be applied and enforced. And even if the announced policies are adopted, the

link between carbon emissions and climate change is sufficiently uncertain that a climate catastrophe

cannot be ruled out.

However, even after taking into account the currently proposed actions, the central forecast of IPCC

scientists is that the world will warm by around 1.5°C by 2040 (compared with pre industrial levels) -

a change in temperature that is expected to take us beyond the likely tipping point at which climate

change could become self-reinforcing.

They conclude

3

that:

Near-term warming and increased frequency, severity and duration of extreme events will

place many terrestrial, freshwater, coastal and marine ecosystems at high or very high risks of

biodiversity loss (medium to very high confidence, depending on ecosystem).

Near-term risks for biodiversity loss are moderate to high in forest ecosystems (medium

confidence), kelp and seagrass ecosystems(high to very high confidence), and high to very

high in Arctic sea-ice and terrestrial ecosystems (high confidence) and warm-water coral reefs

(very high confidence). Continued and accelerating sea level rise will encroach on coastal

settlements and infrastructure (high confidence) and commit low-lying coastal ecosystems to

submergence and loss (medium confidence).

Such changes themselves will have an impact on health and on economic performance.

So we conclude that despite considerable policy effort, there are likely to be more extreme weather

conditions, melting of polar ice caps and other glaciers, and rising sea levels that will create

difficulties for low lying areas.

The top risers and fallers in this year’s ranking

Looking at the countries making the biggest jumps in the WELT rankings based on our projections for

the 15-year period ahead, we see that two groups of countries stand out. For a handful of developing

economies, natural resources will deliver a substantial boost to GDP growth in the coming years.

Other countries are focussing more on working their way up the global value chain through smart

reforms and investing in the skills of their workforce.

3

IPCC Sixth Assessment Report 2022

14

World Economic League Table 2021

World Economic League Table 2023

In our report, we highlight the countries that have pledged – or written into law in some cases – a

move towards limiting greenhouse gas emissions and reducing their carbon footprint. However, in

the interim, while the global economy readies itself for this fundamental change through

electrification and the mass deployment of renewable energy sources, fossil fuels will continue to

play an important role in our energy mix. Niger will start exporting oil through a new pipeline from

mid-2023 onwards, helping the country gain a projected 23 spots in the WELT ranking and reach 113th

position by 2037. Likewise, proceeds from the production and sale of oil have been the main drivers

of Guyana’s economy since 2020, causing an expected jump of 58% in its GDP in 2022. By 2037, we

expect the South American country to have climbed 18 positions in the WELT ranking tables, putting it

at 117th position. Mozambique is projected to make similar gains on the back of LNG sales, rising to

106th. In cases where natural resource extraction has such a large impact on GDP, there are several

downside risks that need to be managed. Economies can become less competitive as the revenue

from natural resources artificially pushes up the exchange rate. The effects of the so-called ‘Dutch

disease’ can also include severe misallocations of capital as investment in the extractive sectors

crowds out other productive parts of the economy, leaving national output dangerously lopsided.

A different growth story can be seen in the rankings for countries who improve their standing by

finding a niche in the global value chain, by implementing domestic reforms, and/or by improving

labour productivity by mobilising both private and public capital. Bangladesh and Vietnam are prime

examples of this approach to fostering more sustainable economic growth, resulting in

improvements of 14 and 13 places, respectively, by 2037. This will see Bangladesh become a Top 20

economy by 2035, while Vietnam is projected to rise to 26th by the end of our forecast horizon. The

Philippines is also projected to continue its growth run in the coming years, fuelled by electronics

manufacturing, lifting the country from 38th spot in the ranking as of 2022 to 27th by 2037.

The biggest drop in the WELT ranking is projected for Equatorial Guinea, which is struggling to offset

the medium-term decline in its oil production sector, causing the country to slide 23 places to stand

at 154th position in 2037. Other countries predicted to drop down the rankings include Haiti (-20

places), El Salvador (-18 places) and Belarus (-18 places).

Further up the rankings, the economies of Iran and Russia are expected to suffer from international

isolation and further sanctions. Iran has climbed the WELT rankings in recent years due to a

combination of high domestic inflation and a system of capital and currency controls. In the long run,

we expect the currency to devalue against the dollar, causing the Islamic Republic to lose 10 places

by 2037, falling back to 21st in the ranking.

Although the Russian economy is expected to have contracted in 2022, a combination of domestic

inflation and an overall appreciating currency are set to have seen the country rise in the WELT

rankings from 11th place in 2021 to 9th place. However, the country’s growth prospects deteriorated

substantially following its invasion of Ukraine, while Cebr expects the ruble to lose its value against

the dollar over the years ahead.

15

World Economic League Table 2021

World Economic League Table 2023

Trade with Europe has slowed substantially throughout 2022 and while closer relations to India and

China can offset this to some degree, in the long run we expect a Russian economy starved of

Western machinery and tech imports to perform significantly worse. The war itself also weighs on

Russian economic output in various ways, not least through a brain drain effect of large numbers of

often well-educated men emigrating to avoid mobilisation orders. In terms of income derived from

fossil fuel exports, Russia benefitted from the increase in world market prices, which has meant that

total export revenues are expected to have increased in 2022 despites lower trading volumes. We

expect Russia to be able to mostly offset losses in market share in Europe and North America

through increased trade with China, India, Turkey and other friendly countries, though this will be

more easily done for oil than for gas, as the pipeline infrastructure largely determines who can buy

Russian gas. With these developments in mind, Russia is expected to lose five places in the WELT

rankings over the next 15 years, dropping to 14th place by 2037.

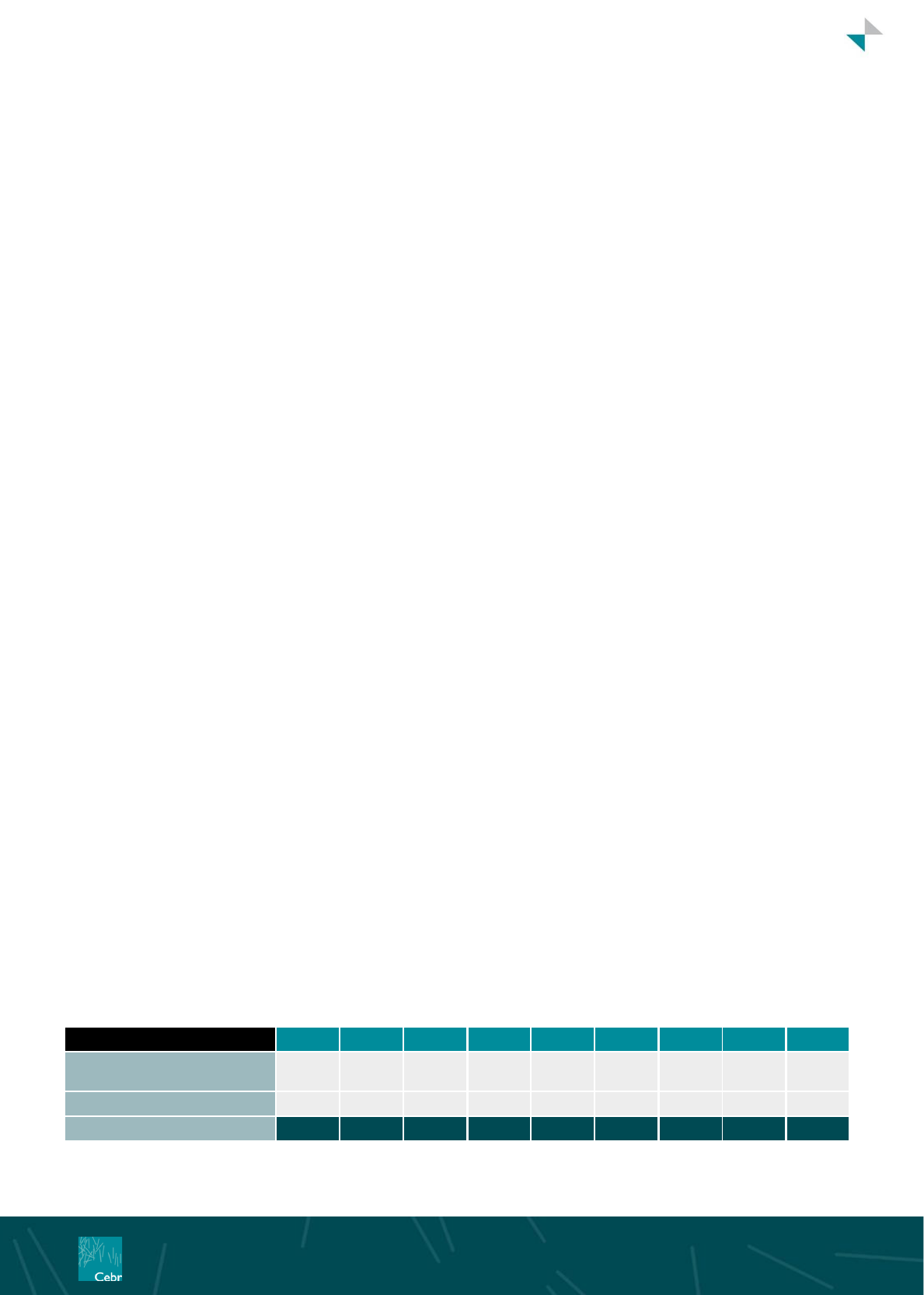

As depicted in Figure 3, by 2037, we expect that under a fifth (19.4%) of global dollar GDP will be

accounted for by Europe. This compares to an expected 21.9% in 2022 and over a third (33.8%) 15

years ago. By contrast, the picture for East Asian economies is almost exactly the reverse, with the

share held by such economies expected to almost double from 19.5% to 33.7% over this 30-year

horizon. Meanwhile, South Asia’s share is expected to expand by the largest relative amount, almost

tripling from 2.7% in 2007 to 7.2% in 2037.

Figure 3 – Regional share of current price dollar GDP (forecast from 2022)

Source: IMF, Cebr forecasts and analysis

34%

26%

24%

22%

21%

20%

19%

6%

7%

6%

8%

7%

7%

7%

5%

7%

7%

7%

7%

8%

9%

21%

28%

30%

31%

35%

35%

35%

6%

8%

7%

6%

6%

6%

6%

27%

24%

26%

27%

25%

24%

23%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2007 2012 2017 2022 2027 2032 2037

North America

Latin America

East Asia and Pacific

Central and South Asia

Middle East and Africa

Europe

16

World Economic League Table 2021

World Economic League Table 2023

Energy crisis and home-made problems for the UK

For European countries, the energy crisis has had several negative implications, many of which are

likely to persist throughout 2023. While the initial inflationary shock is starting to slowly subside, we

expect the focus to shift towards the implications of higher energy prices for public finances and the

global competitiveness of European businesses. This is also reflected in our forecast for the region,

which has been shifted down compared to the previous year.

While higher energy prices have been a shared experience across European countries, the UK also

suffered from a highly volatile political environment in 2022, reaching its peak in the 45-day

Premiership of Liz Truss. Her ambitious ‘Plan for Growth’ amounted to a significant fiscal loosening in

an attempt to stimulate growth via higher borrowing. However, the following administration under

Rishi Sunak reversed almost all the announced policies and announced a return to public spending

restraint.

The upshot of this tumultuous time is that the near-term growth outlook for the UK has weakened

substantially, with economic growth now expected to average 1.6% between 2022 and 2026, down

from our forecast of 2.4% last year. In the outer years of our forecast horizon, we saw the UK

economy growing at 1.8% per annum last year, while this has now also fallen to just 1.6%. Some of

this downgrade is of course due to the war in Ukraine and the energy crisis, but an absence of growth-

oriented policies and the ongoing lack of a clear vision of how the country will find its role outside of

the European Union have also contributed to our more pessimistic assessment of the UK economic

outlook. Between 2022 and 2037, we expect the UK’s share of the world economy in nominal US

dollars to fall by 11.8%, in line with the decline seen among the rest of Europe (-11.7%).

Conclusions

The changes in this year’s Cebr World Economic League Table are amongst the largest we have

made in the 14 years that we have been producing the report.

After about 50 years of opening up, China now looks again to be turning in on itself which is likely to

hold back its performance much in the same ways as in the past. Meanwhile India now seems

unstoppable in its momentum to become the third economic superpower. In 2035 we forecast that

India will become the third $10 trillion economy. Although there are political factors that could hold

India back, it has demographics on its side.

Although our forecast for the UK’s ranking doesn’t show any change, our underlying forecasts are

much more pessimistic. Underpinning this is the expectation of much higher taxes to pay for the

collapse in productivity in the public sector. Whereas before we expected UK growth to exceed that in

the rest of Europe, now we expect it to be much the same.

Although we still expect the world to grow, the tone of this report is much more pessimistic than

those of its predecessors. The instability evidenced by the war in Ukraine and increasing international

tensions provide an unpromising background.

17

World Economic League Table 2021

World Economic League Table 2023

League Table A to Z

Ranking out of 191

2007

2012

2017

2022

2023

2027

2032

2037

Afghanistan

129

110

114

n/a

n/a

n/a

n/a

n/a

Albania

117

129

130

122

122

126

128

128

Algeria

51

48

54

56

56

57

58

59

Angola

64

60

58

61

60

69

66

68

Antigua and Barbuda

169

174

178

173

173

174

174

174

Argentina

31

21

21

24

33

32

35

36

Armenia

124

137

136

118

115

130

129

129

Aruba

157

162

163

161

160

162

163

166

Australia

15

12

13

14

14

13

13

13

Austria

26

30

28

33

32

37

39

40

Azerbaijan

83

68

93

78

82

88

89

92

The Bahamas

118

136

133

139

139

141

145

148

Bahrain

95

97

98

93

93

98

100

101

Bangladesh

57

58

42

34

35

26

24

20

Barbados

145

154

153

153

153

155

156

158

Belarus

71

70

81

79

74

86

90

97

Belgium

20

25

25

26

24

28

33

37

Belize

164

167

167

163

163

165

167

170

Benin

132

135

132

126

126

120

114

109

Bhutan

174

169

166

164

164

163

162

161

Bolivia

111

101

96

94

92

94

97

100

Bosnia and

Herzegovina

107

115

115

113

114

116

119

121

Botswana

119

123

119

125

127

122

123

123

Brazil

10

7

8

12

11

8

8

8

Brunei Darussalam

110

111

135

119

124

136

134

134

Bulgaria

72

78

79

70

71

76

77

77

Burkina Faso

137

126

124

123

121

118

116

112

Burundi

166

165

162

160

159

160

160

160

Cabo Verde

165

170

171

170

171

166

166

164

Cambodia

128

122

111

106

104

103

102

94

Cameroon

91

98

97

92

94

90

87

87

Canada

9

10

10

8

8

10

10

10

Central African

Republic

163

163

168

166

166

164

164

165

Chad

127

128

142

142

142

143

142

142

Chile

45

38

44

45

47

45

46

46

18

World Economic League Table 2021

World Economic League Table 2023

China

3

2

2

2

2

2

2

1

Colombia

39

33

41

44

46

42

41

38

Comoros

175

179

180

177

178

177

176

175

Democratic Republic

of the Congo

106

99

95

84

79

78

74

72

Republic of Congo

125

113

140

137

136

139

140

138

Costa Rica

87

83

77

83

78

77

76

76

Côte d'Ivoire

85

92

84

81

83

71

65

65

Croatia

65

74

80

80

84

80

80

82

Cyprus

90

104

109

111

110

110

109

111

Czech Republic

41

49

48

47

45

47

47

48

Denmark

29

34

38

40

40

43

43

43

Djibouti

171

168

164

159

158

158

158

156

Dominica

184

185

185

183

183

183

183

183

Dominican Republic

73

71

68

66

61

64

63

62

Ecuador

68

65

62

63

65

65

70

73

Egypt

50

37

46

37

42

36

34

31

El Salvador

105

108

105

102

101

105

112

120

Equatorial Guinea

112

106

134

131

137

149

152

154

Eritrea

173

166

170

168

165

169

169

171

Estonia

92

105

102

100

98

100

99

99

Eswatini

155

153

157

156

156

156

157

159

Ethiopia

99

89

69

64

68

61

59

55

Fiji

152

155

152

155

155

154

154

152

Finland

36

42

45

49

49

50

51

52

France

6

6

7

7

7

7

7

7

Gabon

114

116

122

115

116

124

125

126

The Gambia

170

173

175

169

168

167

165

163

Georgia

120

118

117

112

109

114

110

108

Germany

4

4

4

4

3

5

5

5