1

Bank Reconciliation

Guide Sheet

Grant Financial Management

Requirement

The DOJ Grants Financial Guide states: “Award

recipients must conduct a nancial reconciliation

of their accounting records to the nal Federal

Financial Report (FFR/SF-425) at closeout.” Financial

reconciliation is an accounting process that explains

the dierence, on a specied date, between the

balance shown in two dierent accounts records.

Important Information to Know

For a bank reconciliation, you are making sure

an entity’s accounting records match the balance

shown on the entity’s bank statement. The dierence

that occurs is due to items reected on the entity’s

accounting records that have not yet been recorded

by the entity’s bank. The bank reconciliation is used

to compare the cash balance on the bank statement

with the corresponding information presented in the

general ledger. This process provides the opportunity

to recognize irregularities.

What information is needed to reconcile a bank

account?

The bank reconciliation requires the follow

information:

f General ledger account balance for the bank account

being reconciled.

f Bank statement, which is a document sent by the

bank or nancial institution showing the transactions

posted to a bank account during a specic period

(usually 30 days).

f Deposits recorded in the general ledger account,

which have not yet been received and recorded by the

bank.

f Checks written and recorded in the general ledger

account but have yet to clear the bank account.

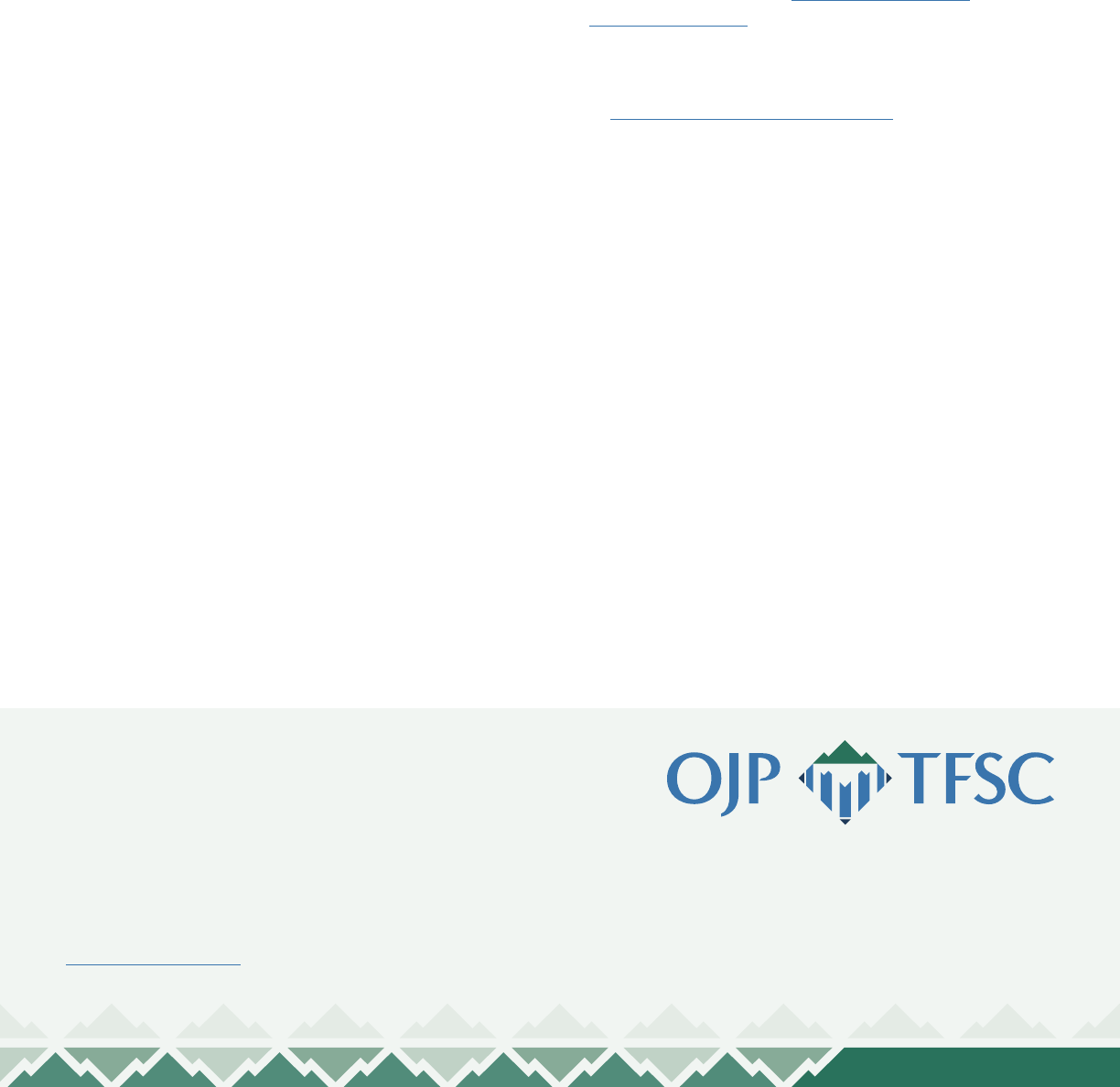

What is the bank reconciliation process?

The rst step of the bank reconciliation process is to

compare the business records deposits to the bank

statements deposits, and mark the items that are

located on both records. Once that is completed, add

the deposits in transit and deduct the outstanding

checks and other bank errors/corrections to

appropriately adjust the bank balance. The nal part

of the process is to adjust the cash balance by adding

interest and receivables and deducting monthly

charges and any overdraft fees. You can track these

steps in the sample bank reconciliation statement

shown in Exhibit 1.

Exhibit 1. Sample Bank Reconciliation Statement

Bank Reconciliation Statement

Month ended March 31, 2020

Ending balance as per bank statement $100,000

Addition: Deposits in transit $20,000

Deduction: Outstanding checks

Check #547 $5,000

Check #549 $3,500

Check #560 $12,500 $21,000

Adjusted bank balance $99,000

Ending balance per accounting records $97,600

Receivables $2,000

Interest earned $50 $2,050

Deduction

EFT for utilities $745

Service charges $45 $790

Adjusted cash balance $99,000

Grant Financial Management

Requirement

The DOJ Grants Financial Guide states: “Award

recipients must conduct a nancial reconciliation

of their accounting records to the nal Federal

Financial Report (FFR/SF-425) at closeout.” Financial

reconciliation is an accounting process that explains

the dierence, on a specied date, between the

balance shown in two dierent accounts records.

Important Information to Know

For a bank reconciliation, you are making sure

an entity’s accounting records match the balance

shown on the entity’s bank statement. The dierence

that occurs is due to items reected on the entity’s

accounting records that have not yet been recorded

by the entity’s bank. The bank reconciliation is used

to compare the cash balance on the bank statement

with the corresponding information presented in the

general ledger. This process provides the opportunity

to recognize irregularities.

What information is needed to reconcile a bank

account?

The bank reconciliation requires the follow

information:

f General ledger account balance for the bank account

being reconciled.

f Bank statement, which is a document sent by the

bank or nancial institution showing the transactions

posted to a bank account during a specic period

(usually 30 days).

f Deposits recorded in the general ledger account,

which have not yet been received and recorded by the

bank.

f Checks written and recorded in the general ledger

account but have yet to clear the bank account.

What is the bank reconciliation process?

The rst step of the bank reconciliation process is to

compare the business records deposits to the bank

statements deposits, and mark the items that are

located on both records. Once that is completed, add

the deposits in transit and deduct the outstanding

checks and other bank errors/corrections to

appropriately adjust the bank balance. The nal part

of the process is to adjust the cash balance by adding

interest and receivables and deducting monthly

charges and any overdraft fees. You can track these

steps in the sample bank reconciliation statement

shown in Exhibit 1.

Exhibit 1. Sample Bank Reconciliation Statement

Bank Reconciliation Statement

Month ended March 31, 2020

Ending balance as per bank statement $100,000

Addition: Deposits in transit $20,000

Deduction: Outstanding checks

Check #547 $5,000

Check #549 $3,500

Check #560 $12,500 $21,000

Adjusted bank balance $99,000

Ending balance per accounting records $97,600

Receivables $2,000

Interest earned $50 $2,050

Deduction

EFT for utilities $745

Service charges $45 $790

Adjusted cash balance $99,000

Deposits in transit—funds received and

recorded in a company’s records that have not

yet been processed by the bank.

Outstanding checks—checks that were issued

but have not yet been cleared by the bank.

How This Applies to Your Grant

Reconciliation throughout the grant is important in

making sure that records are matching at the end

of the accounting periods. Through reconciliation,

grantees can identify errors and fraudulent activities

and work toward addressing them. Per the DOJ

Grants Financial Guide, grant fraud includes failure to

adequately account for, track, or support transactions.

Grantees have the responsibility to ensure that all

their federal funds are accounted for and being used

as authorized by OJP.

The appropriate internal control process is to provide

for separation of duties for the individuals preparing

the reconciliation. An employee who is not involved

with recording cash receipts and disbursement

of accounting transactions should be the one

responsible for completing the reconciliations. This

internal control process also helps deter fraud.

Additionally, all bank accounts should be reconciled

at least monthly, within 30 days of receiving the bank

statement. The reconciliation documentation should

be saved so it is available during the annual audit

process.

Resources

U.S. Department of Justice. (2017). DOJ

Grants Financial Guide. https://www.ojp.gov/

DOJFinancialGuide.

OJP TFSC oers resources on a variety of grants nancial

management topics, which can be found on our website

at https://www.ojp.gov/tfsc/resources.

About the OJP Territories

Financial Support Center

The Oce of Justice Programs Territories Financial

Support Center (OJP TFSC) oers free resources,

training, and technical assistance for grantees in the

U.S. territories. OJP TFSC services focus on building nancial

management capacity and can be accessed by emailing

[email protected] via our Virtual Support Center.

This product was prepared under contract/call order number

GS-00F-010CA/15PCFD20F00000200 awarded by the Oce of Justice

Programs, U.S. Department of Justice and does not constitute nancial

or other professional advice. The opinions, ndings, and conclusions

expressed in this product are those of OJP TFSC and do not represent

the ocial position or policies of the U.S. Department of Justice.

OJP.GOV/ T FS C