2

KATHRYN J. MURPHY

GORANSON BAIN AUSLEY, PLLC

Dallas and Plano, Texas

Email: kmurphy@gbafamilylaw.com

EDUCATION:

J.D. 1989 Southern Methodist University, Dallas, Texas

B.A. 1986 University of Texas at Tyler, Tyler, Texas, with Honors

PROFESSIONAL ACTIVITIES AND AFFILIATIONS include:

Partner - Goranson Bain Ausley, PLLC

Board Certified Family Law - Texas Board of Legal Specialization (since 1995)

Fellow - American Academy of Matrimonial Lawyers since 2004; Bd of Gov 2015-2017

Fellow - International Academy of Family Lawyers

Fellow - Texas Chapter of the Academy of Matrimonial Lawyers (Executive Committee

(2006 - 2010; Past President)

Member/Chair - Family Law Council, State Bar of Texas (2005 - Present)(Executive Committee

2012-2017, Chair 2016-2017)

Representative - State Bar of Texas Board of Directors (3-year elected term beginning 2019)

SPECIAL RECOGNITIONS AND HONORS include:

Named the “Best Lawyers in America” 2015, 2017 and 2019 Family Law “Lawyer of the Year” in

Dallas-Only one lawyer in each practice area within a community is honored with this distinction.

Recipient of the Dan Price Award from the State Bar of Texas in 2018 – This award is presented to a

lawyer who has had a significant impact on the Family Law Section for the past year – teaching, writing

and advancing the practice of family law.

University of Texas at Tyler, Alumni Association Distinguished Alumni Award (2016)

Named "Best Lawyers in Dallas" Family Law by D Magazine (2001, 2005, 2006, 2007, 2008, 2009, 2010,

2017, 2018 and 2019).

Named “The Best Lawyers in America” – Woodward and White Press (2003 - 2018).

Named “Top 50 Women Texas Super Lawyers” by Texas Monthly (2003 - 2018).

Named “Top 100 Texas Super Lawyers” by Texas Monthly (2004 - 2009; 2011; 2013-2018).

Named “Top 100 Dallas/Fort Worth Super Lawyers” by Texas Monthly (2003-2009; 2011-2018).

Best Family Law CLE Article, State Bar of Texas, 2004.

Annette Stewart Inn of Court, Serjeant of the Inn Award – January 2013 (awarded to an attorney who

has significantly contributed to the profession and the community through his or her career).

PUBLICATIONS, SPEAKING ENGAGEMENTS AND LECTURES include:

Co-Author, Thomson Reuters Publishing Company, TEXAS FAMILY LAW PRACTICE GUIDE

(published March 2000, supplemented each year to the present).

Primary Author, PROTECTING YOUR ASSETS FROM A TEXAS DIVORCE, Professional Solutions

Group (2005).

Co-Author, Protecting Children From Incompetent Forensic Evaluations and Expert Testimony, Journal

of the American Academy of Matrimonial Lawyers (2006).

Author, Family Law at Your Fingertips, Family Law Section, State Bar of Texas, 2015 - 2018.

Author, Family Law at Your Fingertips – Children Issues, Family Law Section, State Bar of Texas, 2018.

Author – Numerous articles concerning various family law topics such as business valuation,

characterization of property, division of property, child support, alimony, electronic evidence, premarital

agreements, relocation, parentage, evidence and discovery.

Speaker – Numerous State Bar of Texas and other CLE courses concerning family law topics.

3

I. Introduction

This article discusses reimbursement, fraud on the community (which includes actual

fraud, constructive fraud, and waste), and the reconstituted estate. Numerous cites to recent cases

addressing these topics are included. The goal of this paper is to provide a succinct and

comprehensive reference tool for these issues when they arise in our family law cases.

II. Reimbursement

A. Reimbursement Generally

1. Equitable Remedy

Reimbursement is an equitable remedy and a court of equity is bound to look at all facts

and circumstances and determine what is fair, just and equitable. Penick v. Penick, 783 S.W.2d

194 (Tex. 1988); Horlock v. Horlock, 533 S.W.2d 52 (Tex. App.–Houston [14

th

Dist.] 1975, writ

dism’d)(the right of reimbursement is an equitable right that may be considered by the trial court

in dividing the marital estate--husband was “entitled to reimbursement by reason of using his

separate funds to enhance, improve and increase the value of the community estate.”)

2. Discretion with Court

Reimbursement is not available as a matter of law but lies within the discretion of the court.

Zieba v. Martin, 928 S.W.2d 782 (Tex. App.–Houston [14

th

Dist.] 1996, no writ).

3. Reimbursement Arises

An equitable right of reimbursement arises when the funds or assets of one estate are used

to benefit and enhance another estate without itself receiving some benefit. TFC 3.402; Penick v.

Penick, 783 S.W.2d 194 (Tex. 1988).

4. Pleading

A claim for reimbursement must be pled. Trevino v. Garza, 2016 WL1072627 (Tex. App.–

Corpus Christi 2016, no pet. h.)(mem. op.)(trial court’s award for reimbursement was void where

it was not supported by the pleadings; a claim for waste is distinct from a claim for reimbursement).

B. Proving a Claim for Reimbursement

1. Requirements

To prove a claim for reimbursement, the spouse seeking reimbursement must establish the

following:

4

a. a contribution was made by one marital estate to another;

b. the contribution was reimbursable; and

c. the value of the contribution.

2. Value of Reimbursement Claim

To prevail on a reimbursement claim, the value of the claim must be established. In re

Marriage of McCoy and Els, 488 S.W.3d 430 (Tex. App.–Houston [14

th

Dist.] 2016, no pet.

h.)(value of reimbursement claim not established – wife failed to prove enhanced value due to

capital improvements -- a connection between capital improvements and enhanced value must be

established, not just that improvements were made and there was an increase in value); see Vallone

v. Vallone, 644 S.W.2d 455 (Tex. 1982); Gutierrez v. Gutierrez, 791 S.W.2d 659 (Tex. App.–San

Antonio 1990, no writ); Richardson v. Richardson, 424 S.W.3d 691 (Tex. App.—El Paso 2014,

no pet.)(to prove a claim for reimbursement, the value of the contribution must be established).

A claim for reimbursement for funds expended by an estate to pay debts, taxes, interest, or

insurance for the property of another estate is measured by the amount paid. Penick v. Penick, 783

S.W.2d 194 (Tex. 1988).

3. No Guarantee of Reimbursement Award

Proving a claim for reimbursement does not guarantee an award for reimbursement.

Hinton v. Burns, 433 S.W.3d 189 (Tex. App.—Dallas 2014, no pet.).

4. Reimbursement from the Community Estate

A spouse seeking reimbursement from the community estate for contributions made by his

separate estate must prove by clear and convincing evidence that the funds expended were separate

property. Hinton v. Burns, 433 S.W.3d 189 (Tex. App.—Dallas 2014, no pet.); Henry v. Henry,

48 S.W.3d 468 (Tex. App.–Houston [15

th

Dist.] 2001, no pet.); Williams v. Williams, No. 2-04-

230-CV (Tex. App.–Fort Worth 2005, no pet.)(mem. op.); Beard v. Beard, 49 S.W.3d 40 (Tex.

App.–Waco 2001, pet. denied). Clear and convincing evidence is defined as that measure or degree

of proof that will produce in the mind of the trier of fact a firm belief or conviction as to the truth

of the allegations sought to be established. Boyd v. Boyd, 131 S.W.2d 605 (Tex. App.–Fort Worth

2004, no pet.)

5. Reimbursement from a Separate Estate

A spouse seeking reimbursement for contributions made by the community estate has the

burden to prove the contributions were made by the community estate. Contributions made during

marriage are presumed to be made with community property. Horlock v. Horlock, 533 S.W.2d 52

(Tex. App.–Houston [14

th

Dist.] 1975, writ dism’d); McCann v. McCann, 22 S.W.3d 21 (Tex.

App.—Houston [14

th

Dist.] 2000, pet. denied); Kimsey v. Kimsey, 965 S.W.2d 690 (Tex. App.—

El Paso 1998, pet. denied); see Tex. Fam. Code 3.003(a); but see Williams v. Clark, 03-03-00585-

5

CV (Tex. App.—Austin 2004, no pet.)(petitioner did not show that funds were community

property even though payments were made during the marriage).

6. Improvements

Reimbursement for funds expended by a marital estate for improvements to another marital

estate are measured by the enhancement in value to the benefitted marital estate. Tex. Fam. Code

3.402(d); Anderson v. Gilliland, 684 S.W.2d 673 (Tex. 1985).

C. Offsets

A trial court must resolve a claim for reimbursement by using equitable principles,

including the principle that claims for reimbursement may be offset if the court determines it to be

appropriate. Tex. Fam. Code 3.402(b); Penick v. Penick, 783 S.W.2d 194 (Tex. 1988).

1. Use and Enjoyment of Property

Benefits for the use and enjoyment of property may be offset against a claim for

reimbursement for expenditures to benefit a marital estate, except that the separate estate of a

spouse may not claim an offset for use and enjoyment of a primary or secondary residence owned

wholly or partly by the separate estate against contributions made by the community estate to the

separate estate. Tex. Fam. Code 3.402(c).

2. Burden of Proof

The party seeking an offset to a claim for reimbursement has the burden of proof with

respect to the offset. Tex. Fam. Code 3.402(e).

3. Other Offsets

Offsets include use and enjoyment of the property, tax benefits and income enjoyed by the

contributing estate. Penick v. Penick, 783 S.W.2d 194 (Tex. 1988)(tax benefits received by the

contributing estate can be offset against a reimbursement claim); Hunt v. Hunt, 952 S.W.2d 564

(Tex. App.—Eastland 1997, no writ)(community received offsetting benefits from rents and

royalties from husband’s separate property).

D. Claims for Reimbursement

Certain claims for reimbursement are listed in Section 3.401(a) of the Texas Family Code,

although this list is not exhaustive. Other claims for reimbursement may be established. The

Texas Family Code provides that a claim for reimbursement includes:

1. Payment by one marital estate of the unsecured liabilities of another marital

estate;

6

2. Inadequate compensation for the time, toil, talent, and effort of a spouse by

a business entity under the control and direction of that spouse;

3. The reduction of the principal amount of a debt secured by a lien on property

owned before marriage, to the extent the debt existed at the time of marriage;

4. The reduction of the principal amount of a debt secured by a lien on property

received by a spouse by gift, devise, or descent during a marriage, to the extent the debt existed at

the time the property was received.

5. The reduction of the principal amount of that part of a debt, including a

home equity loan:

a. incurred during a marriage;

b. secured by a lien on property;

c. incurred for the acquisition of, or for capital improvements to,

property;

6. The reduction of the principal amount of that part of a debt:

a. incurred during a marriage;

b. secured by a lien on property owned by a spouse;

c. for which the creditor agreed to look for repayment solely to the

separate marital estate of the spouse on whose property the lien attached; and

d. incurred for the acquisition of, or for capital improvements to,

property;

7. The refinancing of the principal amount described by 3-6 above to the extent

the refinancing reduces that principal amount in a manner described by the applicable subdivision;

8. Capital improvements to property other than by incurring debt; and

9. The reduction by the community property estate of an unsecured debt

incurred by the separate estate of one of the spouses. Tex Fam. Code 3.402(a).

E. Reimbursement for Payment of Unsecured Liabilities

Reimbursement for the payment by one marital estate of the unsecured liabilities of another

marital estate under Section 3.402(a)(1) would include credit card debt, taxes, utility payments for

separate property, or judgment debts. A payment made by the community estate to reduce the

amount of an unsecured debt that was incurred by a spouse’s separate estate is reimbursable. Tex.

Fam. Code 3.402(a)(9).

F. Marital Estate Defined

Marital estate means one of three estates:

7

1. The community property owned by the spouses together and referred to as

the community marital estate;

2. The separate property owned individually by the husband and referred to as

a separate marital estate; or

3. The separate property owned individually by the wife, also referred to as a

separate marital estate. Tex. Fam. Code 3.401(4).

G. Reimbursement for Separate Property Lost to the Community Estate

In Horlock v. Horlock, 533 S.W.2d 52 (Tex. App.–Houston [14

th

Dist.] 1975, writ dism’d),

the court held that the trial court could consider the fact that the husband owned assets of

approximately $1,000,000 at the time of the marriage and that the assets were utilized in

developing the community estate. At trial, the husband made no attempt to trace the use of the

proceeds of the sale of his separate property into other transactions. The trial court found that the

husband was “entitled to reimbursement by reason of using his separate funds to enhance, improve

and increase the value of the community estate.”

The case of Monroe v. Monroe, 358 S.W.3d 711 (Tex. App.—San Antonio 2011, no pet.

h.) relates to reimbursement. The court in Monroe made a disproportionate division of the marital

estate in favor of the husband. The court found that without the husband’s contributions of his

separate property, the value of the community estate would be minimal and that an unequal

division of the property was justified because virtually all the community estate was property

owned by the husband prior to the marriage.

H. Jensen Reimbursement Claim

There is a common law reimbursement claim (Jensen claim) and a statutory claim for

compensation for the time, toil, talent and effort of a spouse. Jensen v. Jensen, 665 S.W.2d 107

(Tex. 1984); Tex. Fam. Code 3.402(a)(2). During marriage, a spouse’s time, toil, talent, and effort

belongs to the community estate. Jensen v. Jensen, 665 S.W.2d 107 (Tex. 1984). Under the Texas

Family Code, a claim for reimbursement arises when the community estate receives inadequate

compensation for a spouse’s time, toil, talent, and effort from a business under that spouse’s control

and direction. Tex. Fam. Code 3.402(a)(2); Slagle v. Slagle, No. 14-16-00113-CV (Tex. App.—

Houston [14

th

Dist.] 2018)(mem. op.)(community estate had a reimbursement claim for

community funds used to benefit husband’s separate property company – wife established by clear

and convincing evidence the company was husband’s separate property).

The statutory Jensen reimbursement claim is easier to prove than the common law claim

in that it is only necessary to prove inadequate compensation for the time toil, talent, and effort

of a spouse by a business entity under the control and direction of that spouse. Tex. Fam. Code

8

3.402(a)(2). A salary expert can be hired in these situations, and CPAs have tables for reasonable

compensation.

The common law claim is difficult to prove since the following must be shown: reasonable

value of the time and effort expended to enhance the separate property estate, other than that

reasonably necessary to manage and preserve the estate, less the compensation received for that

time and effort in the form of salary, bonus, dividends. Jensen v. Jensen, 665 S.W.2d 107 (Tex.

1984).

I. Ownership Interest Not Created

A claim for reimbursement under the Texas Family Code does not create an ownership

interest in property, but it does create a claim against the property of the benefited estate by the

contributing estate. Tex. Fam. Code 3.404(b).

J. Inception of Title Rule Not Affected

The Texas Family Code section on reimbursement does not affect the rule of inception of

title under which the character of property is determined at the time the right to own or claim the

property arises. Tex. Fam. Code 3.403(a).

K. Nonreimbursable Claims

The court may not recognize a marital estate’s claim for reimbursement for the following:

1. Child support, alimony or spousal maintenance;

2. Living expenses of a spouse or child;

3. Contributions of property of a nominal value;

4. Payment of a liability of a nominal amount; or

5. Student loans. Tex. Fam. Code 3.409.

L. Equitable Lien

The court may impose an equitable lien on the property of a benefitted marital estate to

secure a claim for reimbursement against that property by a contributing marital estate. Tex. Fam.

Code 3.406(a).

On the death of a spouse, a court may, on application for a claim for reimbursement brought

by the surviving spouse, the personal representative of the estate of the deceased spouse, or any

other person interest in the estate, as defined by Chapter 22 of the Estates Code, impose an

equitable lien on the property of a benefitted marital estate to secure a claim for reimbursement

against that property by a contributing marital estate. Tex. Fam. Code 3.406(b).

9

M. Disposition of Claim for Reimbursement

The court must determine the rights of the spouses in a claim for reimbursement and apply

equitable principles to:

1. determine whether to recognize the claim after taking into account all the

relative circumstances of the spouses; and

2. order a division of the claim for reimbursement, if appropriate, in a manner

that the court considers just and right, having due regard for the rights of each party and any

children of the marriage. Tex. Fam. Code 7.007.

N. Jury Issues

1. Character of Contribution

The jury may determine the character of the contribution. Marr v. Marr, 905 S.W.2d 331

(Tex. App.—Waco 1995, no writ).

2. Value of Contribution and Offsets

The jury may also determine the value of the contribution and the dollar value of any

offsetting benefits. Phillips v. Phillips, 296 S.W.3d 656 (Tex. App.—El Paso 2009, pet.

denied)(jury determined amount of contribution and offset).

3. Advisory Questions

The Pattern Jury Charge Committee believes the submission of advisory jury questions is

generally inappropriate. See Texas Pattern Jury Charges – Family (2018), PJC 204.1. The Pattern

Jury Charge does not contain instructions or questions seeking an advisory opinion on whether

reimbursement should actually be awarded and, if so, to what extent and the manner and method

by which this result could be accomplished. PJC 204.2.

4. Separate Trials

The Pattern Jury Charge Committee suggests that if a claim of reimbursement involves a

dispute over the characterization of property, the court should consider a separate trial to determine

this issue. PJC 204.3; Tex. R. Civ. P. 174(b). Otherwise the sets of alternative instructions on

reimbursement will be confusing. Also, if the characterization and reimbursement are tried

together, the litigants will have to advance alternative theories and produce evidence supporting

those theories. On the other hand, if the determination of the characterization of the property is

made first, the presentation of evidence and the jury’s task are greatly simplified. PJC 204.3.

10

11

III. Fraud on the Community

A. Claim for Fraud on the Community

Fraud on the community can be committed through actual fraud or constructive fraud.

Strong v. Strong, 350 S.W.3d 759, 771 (Tex. App.—Dallas 2011, pet. denied); Sprick v. Sprick,

25 S.W.3d 7 (Tex. App.—El Paso, 1999, pet. denied). Some courts have mistakenly equated

“fraud on the community” to constructive fraud. Id.

B. No Independent Cause of Action for Fraud on the Community

The Schleuter court held that because spouses have an adequate remedy for fraud on the

community through the “just and right” property division upon divorce, there is no independent

tort cause of action between spouses for damages to the community estate. Schleuter v. Schleuter,

975 S.W.2d 584 (Tex. 1998).

C. Independent Tort for Actual Fraud Concerning Separate Estate

A spouse can sue the other spouse as an independent cause of action for actual fraud

concerning the defrauded spouse’s separate estate. In such a case, punitive damages should be

available. Schleuter v. Schleuter, 975 S.W.2d 584 (Tex. 1998).

D. Actual Fraud

1. Elements

Actual fraud involves dishonesty of purpose or intent to deceive. Horlock v. Horlock, 533

S.W.2d 52 (Tex. App.–Houston [14

th

Dist.] 1975, writ dism’d); In re Marriage of DeVine, 869

S.W.2d 415 (Tex. App.—Amarillo 1993, writ denied).

A spouse commits actual fraud if the following exist:

a. that spouse transfers community property or expends community

funds;

b. for the primary purpose of depriving the other spouse of the use and

enjoyment of the assets involved in the transaction; and

c. with dishonesty or intent to deceive. Texas Pattern Jury Charges—

Family & Probate (2016), PJC 206.2A.

2. Intent to Harm

Actual fraud requires intent to harm by transferring or expending community property to

deprive the other spouse of the use and enjoyment of the assets involved in the transaction. In re

Marriage of DeVine, 869 S.W.2d 415 (Tex. App.—Amarillo 1993, writ denied)(actual fraud found

12

where wife persuaded husband to invest community funds with her paramour without informing

him of their true relationship); Wright v. Wright, 280 S.W.3d 901 (Tex. App.—Eastland 2009, no

pet.)(actual fraud found -- husband drained bank accounts and transferred property to third parties

days after wife filed for divorce and without wife’s knowledge or consent); Logsdon v. Logsdon,

2015 WL 7690034 (Tex. App.—Fort Worth 2015, no pet.)(mem. op.)(trial court found wife

committed actual fraud against the community estate by transferring and expending community

funds to benefit herself and her adult son with intentional dishonesty and with the intent to deceive

husband).

3. Burden of Proof

The burden of proof for a claim of actual fraud is on the complaining party. Horlock v.

Horlock, 533 S.W.2d 52 (Tex. App.–Houston [14

th

Dist.] 1975, writ dism’d).

4. Heightened Culpability

The Texas Supreme Court has suggested that actual fraud involves “heightened

culpability” and should yield a more disproportionate split of community property than

constructive fraud. Schleuter v. Schleuter, 975 S.W.2d 584 (Tex. 1998).

5. Third Party Liability

The Texas Supreme Court has held that a third party cannot be held liable in tort when

community property is taken by one of the spouses. Chu v. Hong, 249 S.W.3d 441 (Tex. 2008).

The Court in Chu noted that “in Schleuter we did not decide whether torts against the community

estate could be alleged against a third-party. As a general matter, they clearly can; if a third party

steals community property, surely either spouse or both can seek recovery in tort for it.”

Generally, the remedy available is limited to recovery of the fraudulently obtained property or

damages limited to the value of the property transferred. Id; West v. West, No. 01-11-00051-CV

(Tex. App.—Houston [1

st

Dist.] 2012, no pet.)(mem. op.)(husband and his parents found to have

committed fraud when wife was told that she and husband had an ownership interest in property

that they made payments towards; trial court judgment against parents in the amount of $30,000

was affirmed); Schleuter v. Schleuter, 975 S.W.2d 584 (Tex. 1998)(affirmed monetary award in

divorce action against husband’s father based on transfer of community assets to father

immediately prior to divorce).

A spouse who gives away community property to friends or relatives when divorce is

imminent has defrauded the community estate. In such cases, a trial court can order the spouse to

return the property or take the fraud into account in making a just and right division. Id.; Kite v.

King, 492 S.W.3d 468 (Tex. App.—Amarillo 2016, no pet.)(a third party is not liable in tort when

community property is transferred to them by one of the spouses -- the remedy is to seek a

reconstituted estate at the time of divorce).

13

See also Thomas v. Casale, 924 S.W.2d 433 (Tex. App.—Fort Worth 1996, writ

denied)(third parties are jointly and severally liable for actual fraud along with the fraudulent

spouse if they knew about the spouse’s fraudulent intent to injure the other spouse’s rights; Osuna

v. Quintana, 993 S.W.2d 201, 207-08 (Tex. App.—Corpus Christi 1999, no writ)(joint and several

judgment against husband and mistress upheld, which represented total community funds diverted

by husband to mistress).

E. Constructive Fraud

1. Constructive Fraud and Breach of Fiduciary Duty

A fiduciary duty exists between a husband and a wife as to the community property

controlled by each spouse. In re Marriage of Moore, 890 S.W.2d 821 (Tex. App—Amarillo 1994,

no writ); Sprick v. Sprick, 25 S.W.3d 7 (Tex. App.—El Paso, 1999, pet. denied). Constructive

fraud is based upon the existence of a fiduciary duty requiring utmost good faith. In re Marriage

of Moore, 890 S.W.2d 821 (Tex. App—Amarillo 1994, no writ); Matter of Marriage of DeVine,

869 S.W.2d 415 (Tex. App.—Amarillo 1993, writ denied).

Constructive fraud claims are also referred to as waste claims. Puntarelli v. Peterson, 405

S.W.3d 131 (Tex. App.–Houston [1

st

Dist.] 2013, no pet.); Schleuter v. Schleuter, 975 S.W.2d 584

(Tex. 1998)(waste occurs when a spouse, without the other spouse’s knowledge or consent,

wrongfully depletes the marital estate of community assets).

Constructive fraud includes actions of one spouse in unfairly disposing of or encumbering

the other spouse’s interest in community property or unfairly incurring community indebtedness

without the other spouse’s knowledge or consent. Massey v. Massey, 807 SW.2d 391 (Tex. App—

Houston [1

st

Dist.] 1991), writ denied, 867 S.W.2d 766 (Tex. 1993)(per curiam). In the absence

of fraud, a spouse has the right to control and dispose of community property subject to his sole

management. Mazique v. Mazique, 742 S.W.2d 805, 807 (Tex. App.—Houston [1

st

Dist.] 1987,

no writ).

Although the managing spouse need not obtain approval or consent for dispositions made

of special community property, the fiduciary relationship between a husband and wife requires

that a spouse’s disposition of special community property be “fair” to the other spouse. Horlock v.

Horlock, 533 S.W.2d 52 (Tex. App.–Houston [14

th

Dist.] 1975, writ dism’d). The managing

spouse carries the burden of establishing that the disposition of property was fair. Id.

2. Presumption/Burden of Proof

A presumption of constructive fraud arises where one spouse disposes of the other spouse’s

one-half interest in community property without the other spouse’s knowledge or consent. Zieba

v. Martin, 928 S.W.2d 782 (Tex. App.–Houston [14

th

Dist.] 1996, no writ); Wheeling v. Wheeling,

546 S.W.3d 216 (Tex. App.—El Paso 2017, no pet.); Puntarelli v. Peterson, 405 S.W.3d 131 (Tex.

App.–Houston [1

st

Dist.] 2013, no pet.); Knight v. Knight, 301 S.W.3d 723 (Tex. App.—Houston

[14

th

Dist.] 2009, no pet.); Mazique v. Mazique, 742 S.W.2d 805, 807 (Tex. App.—Houston [1

st

14

Dist.] 1987, no writ); Cantu v. Cantu, No. 14-17-00175-CV (Tex. App.—Houston [14

th

Dist.]

2018, no pet.).

Once the presumption arises, the burden of proof shifts to the disposing spouse to show

fairness in disposing of community assets. Puntarelli v. Peterson, 405 S.W.3d 131 (Tex. App.–

Houston [1

st

Dist.] 2013, no pet.);Wheeling v. Wheeling, 546 S.W.3d 246 (Tex. App.—El Paso

2017, no pet.); Knight v. Knight, 301 S.W.3d 723 (Tex. App.—Houston [14

th

Dist.] 2009, no pet.);

Mazique v. Mazique, 742 S.W.2d 805, 807 (Tex. App.—Houston [1

st

Dist.] 1987, no writ); Walzel

v. Walzel, No. 14-16-00637-CV (Tex. App—Houston [14

th

Dist.] 2018)( mem. op.)(husband

disposed of community funds without wife’s knowledge creating a presumption of waste –

husband then failed to offer evidence establishing the fairness of the transactions).

3. Intent to Deceive Not Required

Unlike actual fraud, constructive fraud does not require the intent to deceive. Puntarelli v.

Peterson, 405 S.W.3d 131 (Tex. App.–Houston [1

st

Dist.] 2013, no pet.); Mazique v. Mazique, 742

S.W.2d 805, 807 (Tex. App.—Houston [1

st

Dist.] 1987, no writ). Sprick v. Sprick, 25 S.W.3d 7

(Tex. App.—El Paso, 1999, pet. denied).

4. Moderate Gifts or Expenditures Not Constructive Fraud

A spouse may make moderate gifts, transfers, or expenditures of community property for

just causes to a third party. In re Marriage of DeVine, 869 S.W.2d 415 (Tex. App.—Amarillo

1993, writ denied). Mazique v. Mazique, 742 S.W.2d 805, 808 (Tex. App.—Houston [1

st

Dist.]

1987, no writ).

5. Excessive Gifts

A gift, transfer, or expenditure of community property that is capricious, excessive, or

arbitrary is unfair to the other spouse. Osuna v. Quintana, 993 S.W.2d 201, 207-08 (Tex. App.—

Corpus Christi 1999, no writ); Horlock v. Horlock, 533 S.W.2d 52 (Tex. App.–Houston [14

th

Dist.]

1975, writ dism’d); Mazique v. Mazique, 742 S.W.2d 805, 808 (Tex. App.—Houston [1

st

Dist.]

1987, no writ)(husband used community funds to pay expenses for several extramarital affairs that

included trips, meals, gifts, and hotels).

6. Fairness of Gift, Transfer or Expenditure

A presumption of constructive fraud can be rebutted if the spouse who disposed of the

community property shows that the disposal was fair. Massey v. Massey, 807 SW.2d 391 (Tex.

App—Houston [1

st

Dist.] 1991), writ denied, 867 S.W.2d 766 (Tex. 1993)(per curiam); Wheeling

v. Wheeling, 546 S.W.3d 246 (Tex. App.—El Paso 2017, no pet.); Wright v. Wright, 280 S.W.3d

901 (Tex. App.—Eastland 2009, no pet.)(husband did not prove that transfer of community stock

to third party was fair).

15

Factors the court can consider in determining the fairness of a gift, transfer, or expenditure

are—

a. The relationship of the parties involved in the transaction;

b. The size of the property in relation to the total size of the community

estate.

c. The adequacy of the remaining estate; and

d. Whether there were any special circumstances tending to justify the

gift, transfer, or expenditure. Massey v. Massey, 807 SW.2d 391 (Tex. App—Houston [1

st

Dist.]

1991), writ denied, 867 S.W.2d 766 (Tex. 1993)(per curiam). Wheeling v. Wheeling, 546 S.W.3d

246 (Tex. App.—El Paso 2017, no pet.); Puntarelli v. Peterson, 405 S.W.3d 131 (Tex. App.–

Houston [1

st

Dist.] 2013, no pet.).

7. Gifts or Transfers of Community Property

Constructive fraud can be established by evidence of specific gifts or transfers of

community property outside the community estate. Puntarelli v. Peterson, 405 S.W.3d 131 (Tex.

App.–Houston [1

st

Dist.] 2013, no pet.); In re Marriage of Notash, 118 S.W.2d 805 (Tex. App.—

Texarkana 2003, no pet.); Mazique v. Mazique, 742 S.W.2d 805, 807 (Tex. App.—Houston [1

st

Dist.] 1987, no writ); Loaiza v. Loaiza, 130 S.W.3d 894 (Tex. App.—Fort Worth 2004, no

pet.)(waste found where husband made expenditures out of community funds over $800,000 to his

girlfriend without wife’s knowledge or consent).

8. Missing or Unaccounted for Property

Constructive fraud can be established by evidence that community property is unaccounted

for by the spouse who was in control of that property. Wheeling v. Wheeling, 546 S.W.3d 246

(Tex. App.—El Paso 2017, no pet.); Slicker v. Slicker, 464 S.W.3d 850 (Tex. App.—Dallas 2015,

no pet.)(trial court award of judgment for waste and constructive fraud affirmed where husband

unable to show where withdrawn funds went); Dailey v. Dailey, 2013 WL 105667 (Tex. App.—

Fort Worth 2013, no pet. h.)(mem. op.)(husband did not explain $600,000 withdrawal from

community funds); Miller v. Miller, No. 14-17-00293-CV (Tex. App.—Houston [14

th

Dist.] 2018,

no pet.)(mem. op.)(husband committed fraud on the community and community estate was

reconstituted – husband failed to account for significant distributions that were unaccounted for or

were spent for non-community purposes).

In cases of unaccounted for property, it is not necessary to show that community property

has been specifically gifted or transferred outside the community estate. All that must be shown

is that the community property cannot be accounted for. Puntarelli v. Peterson, 405 S.W.3d 131

(Tex. App.–Houston [1

st

Dist.] 2013, no pet.)(constructive fraud established when, among other

things, husband could not account for income).

16

9. Using Excessive Funds

Evidence of a spouse using excessive funds without the other spouse’s consent supports a

waste finding. Graves v. Tomlinson, 329 S.W.3d 128 (Tex. App.—Houston [14

th

Dist.] 2010, pet.

denied)(waste found where excessive attorney’s fees were incurred during divorce proceedings).

10. Without Knowledge or Consent

A presumption of constructive arises when a claimant spouse shows that the other spouse

has disposed of community property without his or her knowledge or consent. Wheeling v.

Wheeling, 546 S.W.3d 216 (Tex. App.—El Paso 2017, no pet.); Puntarelli v. Peterson, 405 S.W.3d

131 (Tex. App.–Houston [1

st

Dist.] 2013, no pet.); Slicker v. Slicker, 464 S.W.3d 850 (Tex. App.—

Dallas 2015, no pet.)(wife testified she was unaware of husband’s large withdrawals of community

funds, and husband did not present evidence showing otherwise); Akukoro v. Akukoro, WL

6729661 (Tex. App.—Houston [1

st

Dist.] 2013, no pet.)(mem. op.)(husband had no knowledge

that wife disposed of community funds until trial); Everitt v. Everitt, No. 01-11-00031-CV (Tex.

App.—Houston [1

st

Dist.] 2012, no pet.)(mem. op.)(no evidence that wife consented to using

community funds to establish college savings accounts); Marshall v. Marshall, 735 S.W.2d 587

(Tex. App.—Dallas 1987, writ ref’d n.r.e.)(wife’s claim of constructive fraud for husband’s gifts

to his children from a prior marriage was denied where gifts were equal to 11 percent of the

husband’s total earnings during their brief marriage, and where wife was advised of the gifts --

although wife did not actively consent to the gifts, she raised no objection to the gifts at the time

they were made).

There is no requirement of diligence on the non-managing spouse, particularly when a

relationship of trust and confidence exists between spouses as to that portion of the community

property controlled by the managing spouse. Miller v. Miller, No. 14-17-00293-CV (Tex. App.—

Houston [14

th

Dist.] 2018, no pet.)(mem. op.)(constructive fraud can still be found when a spouse

is uninformed by personal choice in the matters of the community estate). For the presumption of

constructive fraud to arise, one spouse need only dispose of the other spouse’s interest in

community property without the other’s knowledge or consent. Everitt v. Everitt, No. 01-11-

00031-CV (Tex. App.—Houston [1

st

Dist.] 2012, no pet.)(mem. op.). The presumption may arise

even when the other spouse has knowledge of the disposition, so long as he or she did not also

consent to the disposition. Id.

11. Investment Losses

Spending money or losing money on a business venture or investments is not considered

fraud or waste. Connell v. Connell, 889 S.W.2d 534, 544 (Tex. App.—San Antonio 1994, writ

denied); Andrews v. Andrews, 677 S.W.2d 171 (Tex. App.—Austin 1984, no writ)(a spouse’s good

faith, but unwise, investment of community funds resulting in losses to the community estate does

not justify an unequal division of the remaining community estate).

12. Investment Decisions

17

The “community opportunity doctrine” discussed in Sprick v. Sprick, 25 S.W.3d 7 (Tex.

App.—El Paso, 1999, pet. denied) provides that a spouse has an obligation to maximize the

community estate by taking advantage of an opportunity to invest in a lucrative venture using

community, rather than separate, funds. The “community jeopardy doctrine provides that a spouse

has an obligation to protect the community estate from risky pursuits by investing separate, rather

than community, funds. The Court stated that “whether an investment is potentially lucrative or

risky is easier to discern in hindsight and is ordinarily fact specific.”

If a spouse has an opportunity to make an investment decision that will deliver a financial

result, that spouse has a fiduciary duty to make the investment on behalf of the community estate

if funds exist. Massey v. Massey, 807 SW.2d 391 (Tex. App—Houston [1

st

Dist.] 1991), writ

denied, 867 S.W.2d 766 (Tex. 1993)(per curiam)(husband’s investments in expenditures was

constructive fraud).

13. Property Must No Longer Be Part of Community Estate

When a claim for constructive fraud is based on a gift or transfer of community property,

the disposed-of property must no longer be a part of the community estate. Everitt v. Everitt, No.

01-11-00031-CV (Tex. App.—Houston [1

st

Dist.] 2012, no pet.)(mem. op.)(husband’s

nonconsensual transfer of community funds to purchase condo was excluded from constructive

fraud claim because condo was a community asset subject to the court’s division); White v. White,

No. 02-07-159-CV (Tex. App.—Fort Worth 2008, no pet.)(mem. op.)(wife’s nonconsensual

transfer of community funds into new account that only she could access did not support claim for

constructive fraud because funds were still available and subject to court’s division).

14. Fiduciary Duty When Spouses are Represented by Counsel

Courts have recognized fraud on the community when the wrongful disposition of

community property occurred during the divorce. Everitt v. Everitt, No. 01-11-00031-CV (Tex.

App.—Houston [1

st

Dist.] 2012, no pet.)(mem. op.)(affirming trial court’s finding that husband

committed constructive fraud by spending $249,970 of community property during divorce);

Hancock v. Hancock, No. 2-06-376-CV, WL 2930586 (Tex. App—Fort Worth, 2008, no

pet.)(mem. op.)(affirming trial court’s finding that husband committed fraud on the community by

“improperly disposing of certain community property during the pendency of the divorce”).

A claim for fraud on the community is not barred as a matter of law if the wrongful

disposition of community property occurs during the divorce proceedings. Miller v. Miller, No.

14-17-00293-CV (Tex. App.—Houston [14

th

Dist.] 2018, no pet.)(mem. op.). Such a conclusion

would deprive a wronged spouse of the constructive fraud remedy at a time when that spouse’s

community property interest may be most vulnerable to wrongdoing. Id.

15. Change of Life Insurance Beneficiaries

A spouse’s unilateral change of the beneficiary on a life insurance policy can be considered

constructive fraud. Givens v. Gerard Life Ins. Co. of America, 480 S.W.2d 421, 427 (Tex. App.—

18

Dallas 1972, writ ref’d n.r.e.)(husband replacing wife as beneficiary of life insurance policy with

his paramour was constructive fraud); Murphy v. Metropolitan Life Ins. Co., 498 S.W.2d 278 (Tex.

Civ. App.—Houston [14

th

Dist.] 1973, writ ref’d n.r.e.)(husband’s change in beneficiary

designation to his mother constituted constructive fraud).

However, in Redfearn v. Ford, 579 S.W.2d 295 (Tex. Civ. App.—Dallas 1979, writ ref’d

n.r.e.), when the husband changed the beneficiary designation on a life insurance policy from his

wife to their son, the court held the transaction was not unfair to the wife because it diminished

her obligation to provide support for the minor child and it was not an unreasonable, excessive or

arbitrary transfer); see also Korzekwa v. Prudential Ins. Co. of America, 669 S.W.2d 775 (Tex.

App.—San Antonio 1984, writ dism’d)(husband changed beneficiary designation of life insurance

policy from his wife to his daughter during divorce action in violation of temporary restraining

order -- court held the change was not void because the defrauded spouse could be reimbursed

from other assets in the estate).

F. Schleuter v. Schleuter

Fraud on the Community -- In Schleuter v. Schleuter, 975 S.W.2d 584 (Tex. 1998)(J. Hecht

dissenting), the Texas Supreme Court addressed the remedies that are available to a spouse alleging

“fraud on the community” committed by the other spouse. In Schleuter, the husband transferred

various community assets to his father shortly before he filed for divorce. The wife brought

independent tort claims against her husband and father-in-law, seeking damages for fraud, breach

of fiduciary duty and conspiracy.

Disproportionate Division of Community Estate – A wronged spouse has an adequate

remedy for fraud on the community through the “just and right” property division upon divorce.

Tex. Fam. Code 7.001.

No Independent Cause of Action for Fraud on the Community -- The Schleuter court held

that because spouses have an adequate remedy for fraud on the community through the “just and

right” property division upon divorce, there is no independent tort cause of action between spouses

for damages to the community estate. Id. at 586. However, one spouse can still sue another as an

independent cause of action for actual fraud concerning the defrauded spouse’s separate estate. In

such a case, punitive damages should be available.

Money Judgment Available -- In making a just and right division, the Schleuter Court held

that a spouse should be allowed to recover their appropriate share of not only that property existing

in the community at the time of the divorce, but also that which was improperly depleted from the

community estate. The Court held that a trial court could award a money judgment to one spouse

against the other in order to achieve the just and right division and that the money judgment was a

means for the wronged spouse to recoup the value of his or her share of the community estate lost

through the wrongdoer spouse’s actions. However, the Court stated that “because the amount of

the judgment is directly referable to a specific value of lost community property, it will never

exceed the total value of the community estate.” Id. at 586.

19

No Punitive Damages -- The Schleuter Court held that a wronged spouse may not recover

punitive damages from the other spouse since there was no independent tort cause of action for a

spouse’s wrongful disposition of community assets. However, a spouse can still sue the other

spouse for fraud relating to separate property and recover damages, including mental anguish and

punitive damages, as in any other case.

G. Reconstituted Estate for Fraud on the Community

In 2011, the Texas Legislature codified and further clarified the Texas Supreme Court

decision in Schlueter v. Schlueter, 975 S.W.2d 584 (Tex. 1998), setting forth statutory remedies

for actual or constructive fraud on the community estate. Tex. Fam. Code 7.009.

This statute requires the court to reconstitute the community estate by valuing the depletion

of the community estate and adding the missing value back to the community estate in order to

reconstitute what should be the actual, existing value of the estate absent the fraud. TFC 7.009.

Once the court has determined the reconstituted community estate, the court is given discretion to

render a just and right division of the reconstituted value. This may include the award of a share

of the remaining estate to the injured spouse, a money judgment, or both. Tex. Fam. Code 7.009(c);

Puntarelli v. Peterson, 405 S.W.3d 131 (Tex. App.–Houston [1

st

Dist.] 2013, no pet.).

1. Reconstituted Estate Defined

A reconstituted estate means the total value of the community estate that would exist if an

actual or constructive fraud on the community had not occurred. Tex. Fam. Code 7.009(a).

2. Remedy for Fraud

If it is determined that a spouse has committed actual or constructive fraud on the

community, the court shall:

a. calculate the value by which the community estate was depleted as

a result of the fraud on the community and calculate the amount of the reconstituted estate; and

b. divide the value of the reconstituted estate between the parties in a

manner the court deems just and right. Tex. Fam. Code 7.009(b).

3. Just and Right Division of Reconstituted Estate

In making a just and right division of the reconstituted estate under Texas Family Code

7.001, the court may grant any legal or equitable relief necessary to accomplish a just and right

division, including:

a. awarding to the wronged spouse an appropriate share of the

community estate remaining after the actual or constructive fraud on the community;

20

b. awarding a money judgment in favor of the wronged spouse against

the spouse who committed the actual or constructive fraud on the community; or

c. awarding to the wronged spouse both a money judgement and an

appropriate share of the community estate. Tex. Fam. Code 7.009(c).

The just and right division of a reconstituted estate does not have to be equal. Logsdon v.

Logsdon, 2015 WL 7690034 (Tex. App.—Fort Worth 2015, no pet.)(mem. op.); Miller v. Miller,

No. 14-17-00293-CV (Tex. App.—Houston [14

th

Dist.] 2018, no pet.)(mem. op.).

4. Pleadings

A request for a reconstituted estate must be pled to preserve the issue for appeal. Ford v.

Ford, 435 S.W.3d 347 (Tex. App. – Texarkana 2014, no pet.)(a party relying on Section 7.009

must request that the trial court reconstitute the community estate in order to complain about the

trial court’s failure to do so on appeal); Alfayoumi v. Alzoubi, No. 13-15-00094-CV (Tex. App.—

Corpus Christi 2017, no pet.)(mem. op.)(wife never requested that the community estate be

reconstituted pursuant to Section 7.009, either in her pleadings or in her argument to the trial court

at the time of trial).

H. Jury Charge

SEE Exhibit A for the Pattern Jury Charge for fraud against the community estate.

21

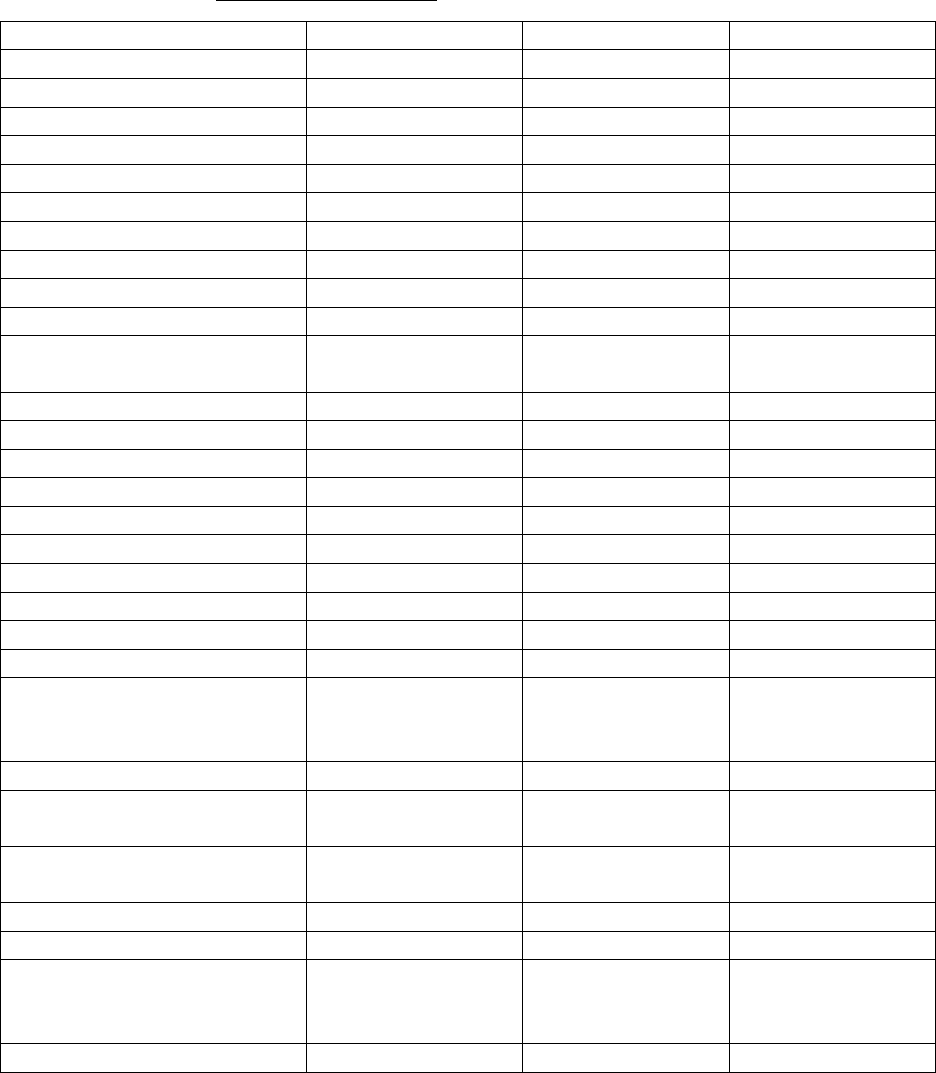

I. Examples of a Reconstituted Estate

1. No Money Judgment

Assets

Value

Husband

Wife

House

2,000,000

1,000,000

1,000,000

Chase Bank Checking

500,000

500,000

Chase Bank Savings

200,000

100,000

100,000

Fidelity Brokerage

1,000,000

500,000

500,000

Merrill Lynch Brokerage

2,000,000

1,000,000

1,000,000

Husband’s 401K

600,000

600,000

Wife’s 401K

300,000

300,000

Husband’s Car

50,000

50,000

Wife’s Car

20,000

20,000

Husband’s Waste

50,000

50,000

Husband’s Gifts to

Girlfriend

180,000

180,000

Total Assets

6,900,000

3,480,000

3,420,000

Liabilities

Line of Credit

50,000

50,000

Chase Credit Card (H)

20,000

20,000

BofA Credit Card (W)

10,000

10,000

Federal Income Taxes

30,000

15,000

15,000

Total Liabilities

110,000

85,000

25,000

Net Estate (includes

reconstituted amounts for

H’s fraud ($230,000)

6,790,000

3,395,000

3,395,000

50%

50%

22

2. With Money Judgment

Assets

Value

Husband

Wife

House

2,000,000

1,000,000

1,000,000

Chase Bank Checking

500,000

500,000

Chase Bank Savings

200,000

100,000

100,000

Fidelity Brokerage

1,000,000

500,000

500,000

Merrill Lynch Brokerage

2,000,000

1,000,000

1,000,000

Husband’s 401K

600,000

600,000

Wife’s 401K

300,000

300,000

Husband’s Car

50,000

50,000

Wife’s Car

20,000

20,000

Husband’s Waste

50,000

50,000

Husband’s Gifts to

Girlfriend

180,000

180,000

Total Assets

6,900,000

3,480,000

3,420,000

Liabilities

Line of Credit

50,000

50,000

Chase Credit Card (H)

20,000

20,000

BofA Credit Card (W)

10,000

10,000

Federal Income Taxes

30,000

15,000

15,000

Total Liabilities

110,000

85,000

25,000

Net Estate (includes

reconstituted amounts for

H’s fraud ($230,000)

6,790,000

3,395,000

3,395,000

50%

50%

Money Judgment in Favor of

Wife Against Husband

-500,000

500,000

Reconstituted Estate After

Money Judgment

6,790,000

2,895,000

3,895,000

43%

57%

Less H’s Waste and Gifts

-230,000

-230,000

Actual Property Division

Considering Reconstituted

Estate and Money Judgment

6,560,000

2,665,000

3,895,000

41%

59%

23

J. Case Law Involving Fraud on the Community and Reconstituted Estate

1. Constructive Fraud Found

The following are cases where constructive fraud or waste of community assets was found:

a. Walzel v. Walzel, No. 14-16-00637-CV (Tex. App—Houston [14

th

Dist.] 2018)( mem. op.)(husband disposed of community funds without wife’s knowledge creating

a presumption of waste – husband then failed to offer evidence establishing the fairness of the

transactions).

b. Sykes v. Sykes, No. 14-17-00049-CV (Tex. App.—Houston [14

th

Dist.] 2018, no pet.)(mem. op.)(husband’s gifts of money to a female and cashing funds out of his

401(k) supported a presumption of fraud on the community – husband did not establish the fairness

of the disposition).

c. Miller v. Miller, No. 14-17-00293-CV (Tex. App.—Houston [14

th

Dist.] 2018, no pet.)(mem. op.)(husband committed fraud on the community and the community

estate was reconstituted).

d. Cantu v. Cantu, No. 14-17-00175-CV (Tex. App.—Houston [14

th

Dist.] 2018, no pet.)(trial court found that husband committed fraud on the community and gave

wife a disproportionate share of the remaining community assets – husband had numerous affairs

during the marriage and spent lots of money on paramours).

e. Wheeling v. Wheeling, 546 S.W.3d 216 (Tex. App.—El Paso 2017,

no pet.)(wife and husband both committed waste and the waste claims offset each other).

f. In re M.G., 05-15-00234-CV (Tex. App.—Dallas, 2016, mem.

op.)(court upheld disproportionate division in favor of wife due to husband’s fraud on the

community).

g. In re K.R.C., 2015 WL 7731784 (Tex. App.—Dallas 2015, no

pet.)(reconstituted estate claim included partnership property transferred fraudulently where

husband and wife were equal owners of community property partnership).

h. Logsdon v. Logsdon, 2015 WL 7690034 (Tex. App.—Fort Worth

2015, no pet.)(trial court found wife committed a fraud on the community and upheld a

disproportionate division of the community estate – 57.6% to the husband and 42.4% to the wife).

i. Slicker v. Slicker, 464 S.W.3d 850 (Tex. App.—Dallas 2015, no

pet.)(trial court award of judgment for waste and constructive fraud affirmed where husband

24

unable to show where withdrawn funds went – court found that the value of the reconstituted estate

was $900,000).

j. Puntarelli v. Peterson, 405 S.W.3d 131 (Tex. App.—Houston [1

st

Dist.] 2013, no pet. h.)(husband’s failure to disclose a community property account and explain

depleted community property funds triggered the constructive fraud presumption -- husband failed

to overcome the presumption).

k. Dailey v. Dailey, 2013 WL 105667 (Tex. App.—Fort Worth 2013,

no pet. h.)(mem. op.)(trial court found husband committed constructive fraud and awarded wife a

disproportionate division of the community estate and a money judgment in favor of the wife

secured with an equitable lien on one of the husband’s separate properties).

l. Akukoro v. Akukoro, WL 6729661 (Tex. App.—Houston [1

st

Dist.]

2013, no pet.)(mem. op.)(presumption of waste arose when wife spent all of a community account

which husband was supposed to receive half of without husband’s knowledge or consent).

m. Everitt v. Everitt, No. 01-11-00031-CV (Tex. App.—Houston [1

st

Dist.] 2012, no pet.)(mem. op.)(affirming trial court’s finding that husband committed constructive

fraud by spending $249,970 of community property during divorce).

n. Graves v. Tomlinson, 329 S.W.3d 128 (Tex. App.—Houston [14

th

Dist.] 2010, pet. denied)(waste found where excessive attorney’s fees were incurred during divorce

proceedings).

o. Wright v. Wright, 280 S.W.3d 901 (Tex. App.—Eastland 2009, no

pet.)(husband committed actual and constructive fraud when he transferred community stock

valued over $600,000 to a company employee for no consideration – husband did not prove the

transfer was fair).

p. Wells v. Wells, 251 S.W.3d 834 (Tex. App.—Eastland 2008, no

pet.)(husband paid $7,000 of community money to his parents in “wages,” although his parents

did not work for him).

q. Loaiza v. Loaiza, 130 S.W.3d 894 (Tex. App.—Fort Worth 2004,

no pet.)(husband made expenditures out of community funds of over $800,000 to his girlfriend

without wife’s knowledge or consent -- court held expenditures for the benefit of husband’s

girlfriend constituted a breach of fiduciary duty and constructive fraud).

r. Madrigal v. Madrigal, 115 S.W.3d 32 (Tex. App.—San Antonio

2003, no pet.)(husband acquired a life insurance policy while married to his new wife and changed

the beneficiary of the policy to his former wife -- constructive fraud existed because the policy

was funded with community funds for the benefit of someone outside the community).

25

s. Strenk v. Strenk, WL 1379924 (Tex. App.—Austin 2001, no

pet.)(mem. op.)(court found that husband had wasted community assets by selling stock before the

divorce for $15,000 when the reasonable value was found to be $168,000).

t. Grant v. Grant, 1999 WL 1063433 (Tex. App—Houston [1

st

Dist.]

1999, no pet.)(mem. op.)(husband used community property to fund a trust for his son from a

former marriage -- court found gift was constructive fraud because husband failed to prove the

disposition was fair to the wife).

u. Osuna v. Quintana, 993 S.W.2d 201, 207-08 (Tex. App.—Corpus

Christi 1999, no writ)(joint and several judgment against husband and mistress upheld, which

represented total community funds diverted by husband to mistress).

v. Zimmerman v. Zimmerman, WL 1076981 (Tex. App.—Dallas 1999,

no pet.)(mem. op.)(husband spent $10,000 on gifts for his girlfriend and was unable to account for

$16,500 in checks -- wife received a disproportionate division of the estate in her favor).

w. Zieba v. Martin, 928 S.W.2d 782 (Tex. App.–Houston [14

th

Dist.]

1996, no writ)(trial court failed to find husband breached fiduciary duty by not properly accounting

for the withdrawal of community funds, wasting community funds, or spending community funds

without wife’s knowledge or consent, however, court of appeals reversed, finding that the evidence

supported a finding of constructive fraud).

x. Faram v Gervitz-Faram, 895 S.W.2d 839 (Tex. App.—Fort Worth

1995, no writ)(husband committed waste of the community estate by acquiring property, incurring

debt, and escalating attorney’s fees after separation).

y. Ramirez v. Ramirez, 873 S.W.2d 735 (Tex. App.—El Paso 1994, no

writ)(husband’s testimony concerning gifts to paramours was sufficient evidence for a finding of

constructive fraud).

z. Fanning v. Fanning, 828 S.W.2d 135 (Tex. App.—Waco 1992),

aff’d in part, rev’d in part on other grounds, 847 S.W.2d 225 (Tex. 1993)(husband breached

fiduciary duty by diverting community assets for the use and benefit of his paramour).

aa. Falor v. Falor, 840 S.W.2d 683 (Tex. App.—San Antonio 1992, no

writ)(husband disbursed community assets three days after separation to his father, brother, and

friend to pay off separate property debts and debts that were either fictitious or improper).

bb. Mazique v. Mazique, 742 S.W.2d 805, 807 (Tex. App.—Houston

[1

st

Dist.] 1987, no writ)(during the 25 year marriage, husband engaged in numerous extramarital

26

affairs which he funded with community funds -- court found the husband had committed

constructive fraud).

cc. Morrison v. Morrison, 713 S.W.2d 377 (Tex. App.—Dallas 1986,

writ dism’d)(husband spent substantial amounts on paramours -- trial court’s disproportionate

division of the community estate of 83% in favor of wife was affirmed).

dd. Reaney v. Reaney, 505 S.w.2d 338 (Tex. Civ. App.—Dallas 1974,

no writ)(court took into account husband’s dissipation of community assets when dividing estate).

ee. In re McCurdy’s Marriage, 489 S.W.2d 712 (Tex. Civ. App.—

Amarillo 1973, no writ)(husband’s gifts to educational fund for parties’ children held to be

constructive fraud on wife where wife was not fully informed of gifts).

ff. Murphy v. Metropolitan Life Ins. Co., 498 S.W.2d 278 (Tex. Civ.

App.—Houston [14

th

Dist.] 1973, writ ref’d n.r.e.)(change in beneficiary designation constituted

constructive fraud on wife even though husband had right of sole management and control of the

policy; husband’s attempt to gift wife’s share of the policy to his mother was set aside).

gg. Givens v. Gerard Life Ins. Co. of America, 480 S.W.2d 421, 427

(Tex. App.—Dallas 1972, writ ref’d n.r.e.)(husband replaced wife as beneficiary of life insurance

policy with his paramour – insurance proceeds held to be community property and change in

beneficiary held to constitute constructive fraud on wife’s share of the community estate in the

absence of a showing of “special justifying factors”).

2. No Constructive Fraud Found

The following cases are situations where no constructive fraud or waste of community

assets was found:

a. In re D.V.D., 05-17-00268-CV (Tex. App.—Dallas 2018, mem.

op.)(trial court did not abuse its discretion in failing to reconstitute the marital estate before making

its just and right division -- husband testified that the expenses he incurred were authorized by the

temporary orders).

b. McBride v. McBride, 09-14-00040 (Tex. App.—Beaumont 2016,

mem. op.)(court upheld jury finding that husband did not commit constructive fraud).

c. Menchaca v. Menchaca, No. 13-12-00450-CV (Tex. App.—Corpus

Christi 2013, no pet.)(mem. op.)(no constructive fraud found where wife transferred one-half of

community interest in business to her son because her son kept the business running when she was

27

ill, and husband had contributed little to the business’s operation and success – court found the

transfer was reasonable and fair).

d. Greco v. Greco, No. 04-07-00748-CV (Tex. App.—San Antonio

2008, no pet.)(court upheld jury finding of no constructive fraud).

e. In re Marriage of Notash, 118 S.W.2d 805 (Tex. App.—Texarkana

2003, no pet.)(court of appeals reversed jury finding of fraud on the community).

f. Marshall v. Marshall, 735 S.W.2d 587 (Tex. App.—Dallas 1987,

writ ref’d n.r.e.)(wife’s claim of constructive fraud for husband’s gifts to his children from a prior

marriage was denied where gifts were equal to 11 percent of the husband’s total earnings during

their brief marriage, and where wife was advised of the gifts. Although wife did not actively

consent to the gifts, she raised no objection to the gifts at the time they were made).

g. Korzekwa v. Prudential Ins. Co. of America, 669 S.W.2d 775 (Tex.

App.—San Antonio 1984, writ dism’d)(husband changed beneficiary designation of life insurance

policy from his wife to his daughter during the divorce action in violation of the temporary

restraining order -- court held the change was not void even though the policy was community

property because the defrauded spouse could be reimbursed from other assets in the estate).

h. Redfearn v. Ford, 579 S.W.2d 295 (Tex. Civ. App.—Dallas 1979,

writ ref’d n.r.e.)(husband changed beneficiary designation on life insurance policy from wife to

their son – the court held transaction was not unfair to wife because it diminished her obligation

to provide support for the minor child and was not an unreasonable, excessive or arbitrary transfer).

IV. Fraud Against a Spouse’s Separate Property

A. Independent Tort Cause of Action to Injury to Separate Estate

Section 7.009 of the Texas Family Code only relates to fraud on the community. There is

an independent cause of action for a tortious wrong by a spouse causing personal injury to the

other spouse. A spouse may also sue the other spouse for tortious injury to the spouse’s separate

estate. Schleuter v. Schleuter, 975 S.W.2d 584 (Tex. 1998); Chu v. Hong, 249 S.W.3d 441 (Tex.

2008).

B. Pattern Jury Charge – See Exhibit B for the Pattern Jury Charges relating to fraud

against a separate estate.

28

IV. Just and Right Division of the Marital Estate

A. Texas Family Code

Section 7.001 of the Texas Family Code provides as follows:

“In a decree of divorce or annulment, the court shall order a division of the estate of the

parties in a manner that the court deems just and right, having due regard for the rights of

each party and any children of the marriage.” Tex. Fam. Code 7.001.

B. Factors in Making Just and Right Division

The trial court can consider many factors in making a just and right division of the

community estate, including the following:

1. The disparity of incomes or earning capacities of the spouses;

2. The spouses’ capacities and abilities;

3. Benefits which the party not at fault would have derived from a continuation of the

marriage;

4. Business opportunities of the spouses;

5. Education of the spouses;

6. Relative physical conditions of the spouses;

7. Relative financial conditions of the spouses;

8. Differences in the size of each spouse’s separate estate;

9. The nature of the property to be divided;

10. Fault in the breakup of the marriage;

11. Attorney’s fees of the parties;

12. Whether one of the parties has wasted community assets;

13. Proof of one spouse’s dishonesty or intent to deceive, constituting actual fraud,

regarding the community assets.

14. Evidence of one spouse’s constructive fraud in transactions involving community

property. Massey v. Massey, 807 SW.2d 391 (Tex. App—Houston [1

st

Dist.] 1991), writ denied,

867 S.W.2d 766 (Tex. 1993)(per curiam); Zorilla v. Wahid, 83 S.W.3d 247 (Tex. App.—Corpus

Christi 2002, no pet.); Schleuter v. Schleuter, 975 S.W.2d 584 (Tex. 1998). The list is not

exhaustive, and so long as there is a reasonable basis for the unequal division, it will be affirmed

on appeal. Loaiza v. Loaiza, 130 S.W.3d 894 (Tex. App.—Fort Worth 2004, no pet.)

In Murff v. Murff, 615 S.W.2d 696 (Tex. 1981) the Texas Supreme Court stated:

“The trial court in a divorce case has the opportunity to observe the parties on the witness

stand, determine their credibility, and evaluate their needs and potentials, both social and

29

economic. As the trier of fact, the court is empowered to use its legal knowledge and its

human understanding and experience. Although many divorce cases have similarities, no

two of them are exactly alike. Mathematical precision in dividing property in a divorce is

usually not possible. Wide latitude and discretion rests in these trial courts and that

discretion should only be disturbed in the case of clear abuse.”

C. Trial Court Has Broad Discretion

A trial court has broad discretion in dividing the community estate in a divorce action. The

court can order an unequal division of the community property if there is a reasonable basis for

doing so. Murff v. Murff, 615 S.W.2d 696 (Tex. 1981); Tran v. Nguyen 480 S.W.3d 119 (Tex.

App.—Houston [14

th

Dist.] 2015, no pet.); In re Marriage of C.A.S., 405 S.W.3d 373 (Tex. App.—

Dallas 2013, no pet); Heard v. Heard, No. 02-12-00406-CV (Tex. App.—Fort Worth 2014, pet.

denied)(mem. op.); Howe v. Howe, 551 S.W.3d 236 (Tex. App.—El Paso 2018, no pet.);

Kaftousian v. Rezaeipanah, 511 S.W.3d 618 (Tex. App.—El Paso 2015, no pet.).

In making an equitable division, the court should consider all of the surrounding

circumstances, and the division need not be equal as long as it is not so disproportionate as to be

inequitable, and the circumstances justify awarding more than one-half to one spouse. Naguib v.

Naguib, 137 S.W.3d 367 (Tex. App.—Dallas 2004, pet. denied); Menchaca v. Menchaca, No. 13-

12-00450-CV (Tex. App.—Corpus Christi 2013, no pet.)(mem. op.).

A just and right division of the community estate can be a 50-50 division or a

disproportionate split, depending on whether the circumstances justify awarding one spouse more

than half of the community estate. Neyland v. Raymond, 324 S.W.3d 646 (Tex. App.—Fort Worth

2010, no pet.); Logsdon v. Logsdon, 2015 WL 7690034 (Tex. App.—Fort Worth 2015, no

pet.)(just and right division of reconstituted estate does not have to be equal -- disproportionate

division of the community estate upheld – 57.6% to the husband and 42.4% to the wife—where

the trial court found that the wife had committed a fraud on the community); Garcia v. Garcia,

No. 02-11-00276-CV 2012 WL 3115763 (Tex. App.—Fort Worth 2012, no pet.)(mem.

op.)(upholding disproportionate award of community estate 68% to 32% in favor of wife based on

multiple factors including husband’s fraud on the community).

Several courts of appeals have upheld the award of a disproportionate division of the

community property in favor of a spouse for a variety of factors. Villalpando v. Villalpando, 480

S.W.3d 801 (Tex. App.—Houston [14

th

Dist.] 2015, no pet.); Chafino v. Chafino, 228 S.W.3d 467

(Tex. App—El Paso 2007, no pet.)(upholding 70/30 split); Golias v. Golias, 861 S.W.2d 401 (Tex.

App.—Beaumont 1993, no writ)(upholding 79/21 split); Menchaca v. Menchaca, No. 13-12-

00450-CV (Tex. App.—Corpus Christi 2013, no pet.)(mem. op.)(trial court’s division of property

was not so disproportionate as to be inequitable); Sprick v. Sprick, 25 S.W.3d 7 (Tex. App.—El

30

Paso, 1999, pet. denied)(court upheld an award of 76.6% of the community property estate to the

wife as equitable).

In Monroe v. Monroe, 358 S.W.3d 711 (Tex. App.—San Antonio 2011, no pet. h.), the

court made a disproportionate division of the marital estate in favor of the husband. The court

found that without the husband’s contributions of his separate property, the value of the community

estate would be minimal and that an unequal division of the property was justified because virtually

all the community estate was property owned by the husband prior to the marriage.

Community liabilities are part of the estate that must be divided. Walston v. Walston, 971

S.W.2d 687 693-94 (Tex. App.—Waco 1998, pet. denied); In re Marriage of Jeffries, 144 S.W.3d

636 (Tex. App.—Texarkana 2004, no pet.)(court erred in not considering value of liabilities in

making its just and right division of community estate).

VI. Conclusion

Hopefully this paper will be a valuable resource for family law practitioners when dealing

with reimbursement, waste, fraud on the community matters and the reconstituted estate. These

topics arise frequently in our family law cases, and it is imperative to have a thorough

understanding of the law in these areas.

31

Exhibit A

Pattern Jury Charges – Fraud Against Community Estate

PJC 206.2A – Actual Fraud by Spouse against Community Estate – Instruction

A spouse commits fraud if that spouse transfers community property or expends community funds

for the primary purpose of depriving the other spouse of the use and enjoyment of the assets

involved in the transaction. Such fraud involves dishonesty of purpose or intent to deceive.

PJC 206.2B – Actual Fraud by Spouse against Community Estate – Questions

QUESTION 1:

Did SPOUSE A commit fraud with respect to the community property rights of SPOUSE B?

Answer “Yes” or “No.”

Answer: _________________

If you have answered Question 1 “Yes,” then answer Question 2. Otherwise, do not answer

Question 2.

QUESTION 2:

State in dollars the value, if any, by which the community estate was depleted as a result of

SPOUSE A’s fraud.

Answer: _________________

PJC 206.4A Constructive Fraud by Spouse against Community Estate – Instruction

A spouse may make moderate gifts, transfers, or expenditures of community property for just

causes to a third party. However, a gift, transfer, or expenditure of community property that is

capricious, excessive, or arbitrary is unfair to the other spouse. Factors to be considered in

determining the fairness of a gift, transfer, or expenditure are—

1. The relationship between the spouse making the gift, transfer, or expenditure and the

recipient.

2. Whether there were any special circumstances tending to justify the gift, transfer, or

expenditure.

3. Whether the community funds used for the gift, transfer, or expenditure were reasonable

in proportion to the community estate remaining.

32

PJC 206.4B Constructive Fraud by Spouse against Community Estate – Questions

QUESTION 1:

Was the transfer made by SPOUSE A to THIRD PARTY fair? Answer “Yes” or “No.”

Answer: ______________

If you have answered Question 1 “No,” then answer Question 2. Otherwise, do not answer

Question 2.

QUESTION 2:

State in dollars the value, if any, by which the community estate was depleted as a result of the

transfer made by SPOUSE A to THIRD PARTY.

Answer: ________________

33

Exhibit B

Pattern Jury Charges – Fraud Against Separate Estate

PJC 206.3A – Actual Fraud by Spouse against Separate Estate – Instruction

A spouse commits fraud if that spouse transfers separate property of the other spouse or expends

separate funds of the other spouse for the primary purpose of depriving the other spouse of the use

and enjoyment of that property or those funds. Such fraud involves dishonesty of purpose or intent

to deceive.

PJC 206.3B – Actual Fraud by Spouse against Separate Estate – Questions

QUESTION 1:

Did SPOUSE A commit fraud with respect to the separate property rights of SPOUSE B? Answer

“Yes” or “No.”

Answer: ___________

If you have answered Question 1 “No,” then answer Question 2. Otherwise, do not answer

Question 2.

QUESTION 2:

What sum of money, if paid now in cash, would fairly and reasonably compensate the separate

estate of SPOUSE B for the damages, if any, resulting from the fraud of SPOUSE A?

Answer in dollars.

Answer: ______________

PJC 206.4B – Constructive Fraud by Spouse against Separate Estate – Questions

QUESTION 1:

Was the transfer made by SPOUSE A to THIRD PARTY fair? Answer “Yes” or “No.”

Answer: _______________

If you have answered Question 1 “No,” then answer Question 2. Otherwise, do not answer

Question 2.

34

QUESTION 2:

What sum of money, if paid now in cash, would fairly and reasonably compensate the separate

estate of SPOUSE B for the damages, if any, resulting from the transfer made by SPOUSE A to

THIRD PARTY? Answer in dollars.

Answer: ________________