FINANCIAL

RESOURCE

PACKET

SHOW ME THE MONEY DAY

F L I N T 2 0 2 2

Tax Assistance.................................1

Rent and Utility Assistance.........13

Financial Tools...............................15

Food Distribution..........................21

Employment Tools........................25

Table of Contents

The materials prepared or distributed by Communities First, Inc., (CFI) may include data, commentary, quotes, research,

analysis, tools, news and other information provided by companies that are not affiliated with CFI. CFI does not take

responsibility for any errors or omissions in this packet.

1

Tax Assistance

People who generally make $58,000 or less

Persons with disabilities; and

Limited English-speaking taxpayers

Federal tax return: April 18, 2022.

State of Michigan tax return: Jan. 24 - April 18, 2022

There are two types of free basic tax return

preparation services that are reliable and

trusted by the IRS:

You must meet one of the requirements below to qualify:

By living and/or working in the City of Flint, you have to pay

your city taxes in addition to state and federal taxes. The

deadline to file each personal tax return is below:

Luckily you can file for all tax returns in one go!

To learn more, visit: www.irs.gov

www.cityofflint.com/finance/income-tax/

Volunteer

Income Tax

Assistance

(VITA)

Tax Counseling

for the Elderly

(TCE)

2

Tax Assistance

?

A W-2 form from each employer

Other earning and interest statements (1099 and 1099-INT forms)

Receipts for charitable donations and medical and business

expenses if you are itemizing your return

Other relevant documents (visit page 7)

The percentage you pay toward household expenses affects your

filing status. Are you filing single? Are you filing married-joint or

separately?

Tax Preparer (free options available)

Online tax filing service (free options available)

How do I actually file my taxes?

Gather your paperwork, including:

Choose your filing status.

Decide how you want to file your taxes.

Determine if you are taking the standard deduction or

itemizing your return. Visit the glossary page for more info.

If you owe money, you can apply for a payment plan. Learn

more ways to pay a tax by visiting www.irs.gov/payment.

File your taxes by April 18, 2022.

To learn more, visit www.usa.gov/file-taxes

3

Tax Assistance

2022 VITA Tax Preparation Sites

4

Tax Assistance

I want to hire a TAX PREPARER but I don't

know where to begin or how to choose one.

Check the Tax Preparer's credentials.

Be sure they have an IRS Preparer Tax ID Number (PTIN).

To verify yourself, go to https://irs.treasury.gov/rpo/rpo.jsf

Review your return before signing and ask any questions to

make sure you're comfortable.

Any professional credentials?

Do they belong to a professional organization?

Do they attend continuing education classes?

Will they be available after April 18 if any questions arise?

Ask the Tax Preparer relevant questions.

preparers who are willing to file without necessary documents. Always

provide records and receipts.

preparers who say they can get larger refunds than others OR those that

base their fee on a % of a refund. Always check the service fees upfront.

preparers who want to transfer the refund to you. Make sure the refund

is deposited into YOUR account and not theirs.

preparers who want you to sign an incomplete or blank return.

Avoid tax preparers who do the following:

Make sure the preparer signs and includes their PTIN and

gives you a copy of the return.

Paid preparers should always sign.

Make sure the preparer files electronically.

It is the safest and most accurate way.

!

5

https://apps.irs.gov/app/freeFile

Tax Assistance

I want to self-file my taxes online but don't

know where to start. Can I file for free?

If your adjusted gross income (AGI) was $73,000 or less, go to the

website below and read under each provider’s offer to make sure you

qualify. Some offers include a free state tax return.

IRS Free File Online Options

6

Tax Assistance

###-##-####

What documents do I need for a tax return?

Photo ID

Social Security

Cards

Birthdays

Copies of Last Tax

Returns

Income Statements

Expense Records

Direct Deposit

Child Care info

Health Insurance

Valid driver's license or photo ID for

both you and your spouse (if married).

Social Security (SS) cards or verification

letter for all persons listed on the return.

Know birth dates for all persons listed

on return.

C

opies of last year's state and federal

tax returns, if you have them.

Forms W-2, 1099, Social Security,

unemployment, and other statements,

like pensions, stocks, interests, and any

documents showing tax withheld.

All records of expenses, such as tuition,

mortgage interest, or real estate taxes.

Bank routing numbers and account

numbers to direct deposit any refunds.

If you purchased coverage through the

H

ealth Insurance Marketplace

Dependent child care info: name,

address of paid caretakers, and either

their SS numbers or other tax ID #.

7

Tax Assistance

Glossary

8

Tax Assistance

Glossary cont.

9

Tax Assistance

Glossary cont.

10

Who can I claim as my dependent?

?

Tax Assistance

11

Tax Assistance

What kinds of deductions can be itemized?

12

Tax Assistance

I have virtual currency. Are those taxable?

Source: WatchBlog: Official Blog of the U.S. Government Accountability Office

Examples of virtual currency transactions that

can affect taxes:

Income is generally taxable regardless of the source it comes from.

That's why virtual currency is taxable just like "traditional" transactions

involving money for goods or services, or exchange of property or services.

Transactions conducted in virtual currency are generally reported on

the same forms as transactions in other property.

They are also reported on a new checkbox in Form 1040.

For more information visit:

https://www.irs.gov/businesses/small-businesses-self-employed/virtual-currencies

Virtual currency is treated as property by the IRS and general

tax principles apply if you sell, exchange, receive services etc.

13

Rent & Utility

Assistance

14

Rent & Utility

Assistance

MI State Housing Development Authority

COVID-19 Response to Q&A

My income has been reduced. Will my voucher or subsidy pay the

difference?

Please contact your assigned Housing Agent right away so that they can process

your income change.

If you need further assistance, contact MSHDA and ask to be referred to the

Section 8 housing agent or RAHS/Section 8 for their area. Telephone (toll-free) 1-

8

55-646-7432 or email [email protected]

I need to move as a result of COVID-19. Where can I find rental housing

in Michigan?

Affordable Rental Housing Directory (ARHD): housing.state.mi.us/

Affordable Housing Locator: www.affordablehousing.com/

I was laid off due to COVID-19. How do I get Section 8 (low-income

Housing Choice Voucher rental assistance)?

MSHDA’s Housing Choice Voucher program provides federal rent subsidies for

very low-income people.

Applications are only accepted for open waiting lists.

For a list of open waiting lists visit www.Michigan.gov/mshda and click the Rental tab,

followed by the Housing Choice Voucher link, where you will find the “HCV Waiting List

Information” link.

If assistance with completing the application is required due to a disability, please call

Toll free: 1-855-646-7432

If I have a MSHDA voucher and I have a maintenance issue with my

home right now, can I get an inspection?

Please notify your Housing Agent of any maintenance issues that have been

reported to your landlord and have not been repaired or addressed. While a

physical inspection of your unit may not take place, your Housing Agent will notify

your landlord of the issues and request confirmation that the repairs have been

c

ompleted or addressed.

1.

a.

b.

2.

a.

b.

3.

a.

i.

ii.

iii.

4.

a.

For more Q&A and other related information, visit:

https://www.michigan.gov/mshda/about/covid-19

15

Financial Tools

16

Financial Tools

continue on next page

17

continued

Budgeting

Truebill

Trim

Digit

Albert

Chime

Everydollar

Investments

Acorns

Stash

Mint

Fidelity

Charles Schwab

Voyager (crypto)

Perks/Coupons

Kroger

Shopkick

Flipp

Target

Circle

mPerks (Meijer)

Ibotta

Free Media

Libby (library)

LibriVox

Open Culture

Lit2Go

Storynory (kids)

Project Gutenberg

Internet Archive

If your INCOME is MORE than your EXPENSES, you have money left to

save or spend. If your expenses are more than your income, look at your

budget to find expenses to cut.

WEB &

MOBILE

APPS

Financial Tools

18

Financial Tools

DIY &

COUPONING

19

Financial Tools

20

Financial Tools

21

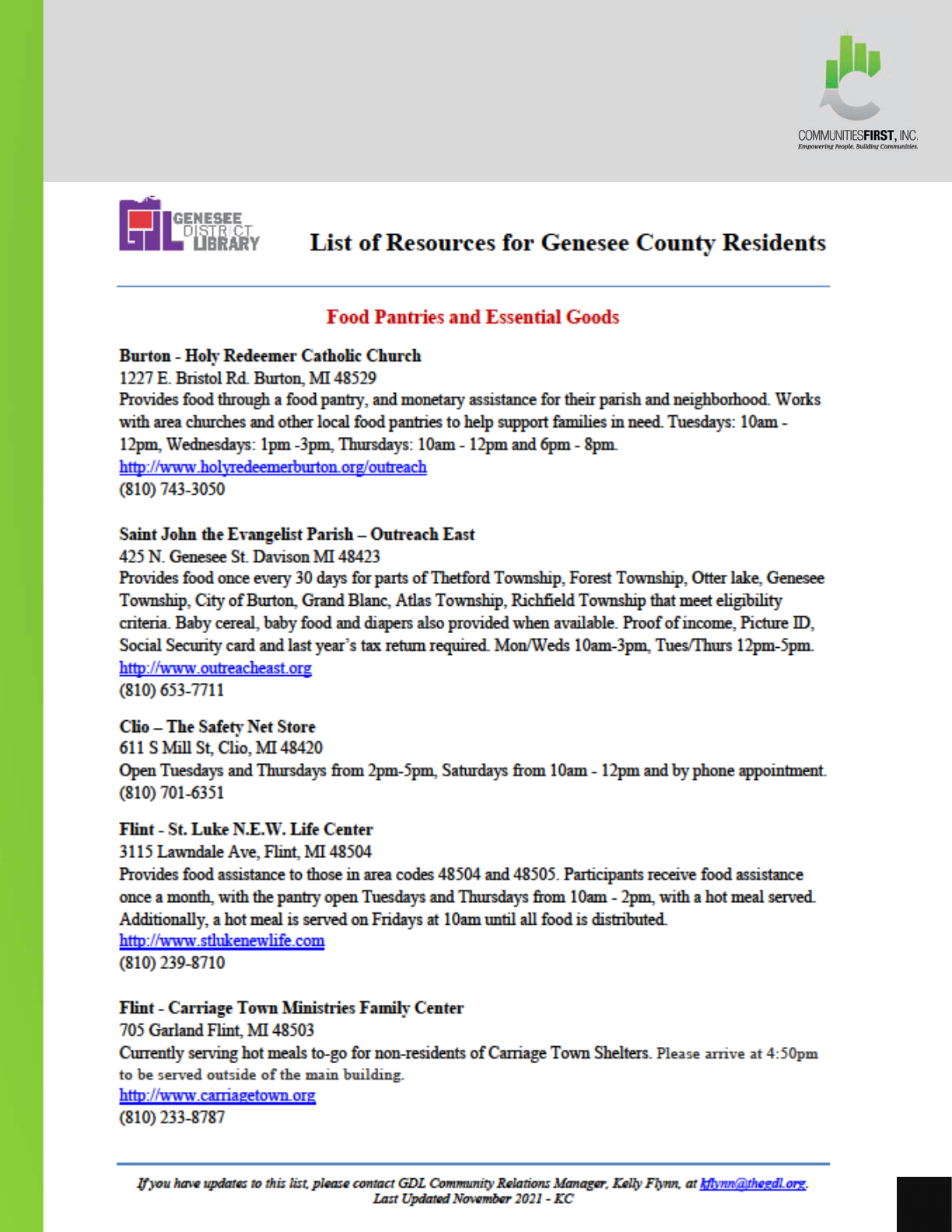

Food Assistance

Bethel United Methodist Church

1309 N Ballenger Hwy Flint MI 48504

(810) 238-3843 - call for more info and free resources

22

Food Assistance

23

Food Assistance

24

Food Assistance

25

Employment

Tools

Your Personal FREE Online Job Tool

RESUME BUILDING

Grab an employer's attention

quickly with resume assistance.

PERSONALITY ASSESSMENTS

Identify the best career fit for

you by taking an assessment.

ACCESS TO A U.S. JOB BOARD

Filter millions of careers by

location and receive automated

alerts.

DEVELOPING CAREER GOALS

Pick from different goals and

refine employment skills.

INTERVIEW PRACTICE

Use an nteractive vi

deo tool to

r

eview how you answer questions.

To start, go to: www.nextjobtraining.com

Enter Access Code: FT158132150

Learn More: www.nextjob.com

A NextJob Account helps with:

YOUR DIGITAL FOOTPRINT

Learn tips to clean up your social

media profile.