Handbook for Rering Ocials

The handbook has been prepared for the benet of rering

employees. The book is not intended to be a substute for bank

circular instrucons. For any doubt, readers are advised to refer

to bank circular for claricaon.

Dear Colleagues,

I am immensely happy to introduce the ‘Handbook for Rering ocials’

which I am sure will be of great help to you. The booklet is designed in such

a way as to guide you step by step in planning your superannuaon. Besides

providing informaon on what is required to be done for selement of

your rerement benets in mely manner, it also gives you a glimpse of the

benets available to a reree.

The booklet contains very useful informaon for the rerees as regards various

facilies made available to them through HRMS. Besides the informaon

on Pension, Provident Fund, Gratuity, EMWS and REMBS, the booklet also

contains the list of Holiday Homes and Diagnosc Centers under e up etc.

It is proposed to update the booklet on ongoing basis and make it accessible

to rerees on the pensioners’ portal for ready reference.

I place on record my sincere appreciaon to Shri. K. T. Ajit, CGM(HR), Shri.

Somnath Adhya, Dy. General Manager (PM &PPG) & Shri. C. P. Mulye,

Chief Manager (S), PPG Department, Corporate Centre, Mumbai for having

performed a commendable task in the compilaon of this booklet in the

service of the elder’s fraternity.

I have great pleasure in releasing this handbook and trust you shall nd it

useful.

With warm regards

01

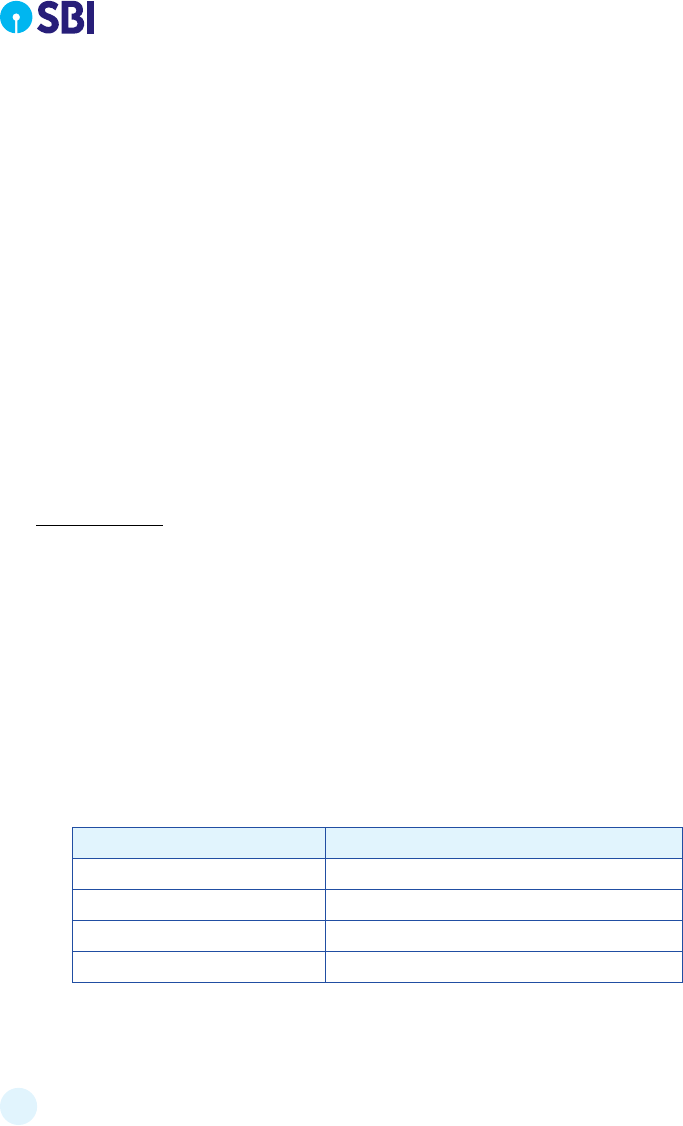

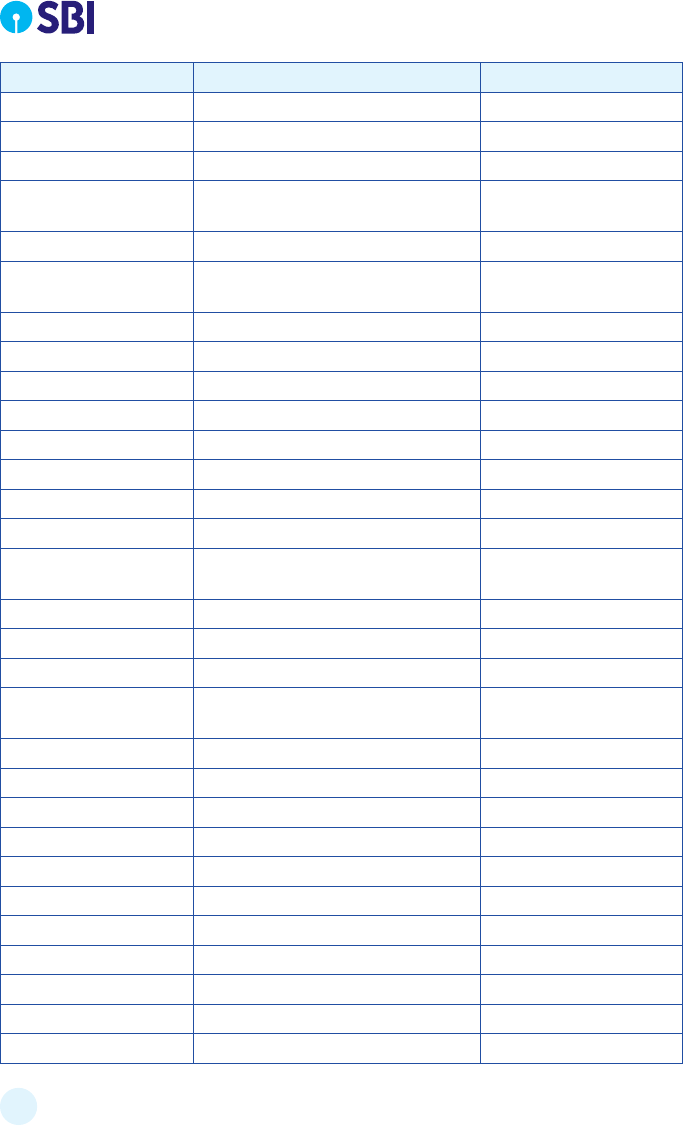

Provident Fund

1

02 Gratuity

2

03

Pension

4

04 Commutaon of Pension

6

05 Table of commutaon factors

7

06 Dearness Relief Payable to Bank’s Pensioners

9

07 Overdue Interest on Pension, Gratuity and Provident Fund

11

08 Standard Operang Procedure for payment of Family Pension

13

09 SBI Employees Mutual Welfare Scheme

19

10

Leave Encashment

19

11 Retenon of Accommodaon, Car & Telephone aer rerement 20

12

Travelling Expenses on rerement

20

13 Retenon of Furniture/Fixture aer rerement 20

14 Retenon of Mobile Handset 20

15 Retenon of Laptop 21

16 Retenon of I Pad 21

17 Availing LFC / HTC aer rerement 21

18

Payment of 1% addional rate of interest on deposit

21

19

Connuance of Sta Housing Loan aer rerement

21

20

Connuance of Sta Vehicle Loan aer rerement

21

21 Presentaon of Memento 22

22

Availing Holiday Home, Transit House & Vising Ocers’ at

22

23 Transion to Rerement Programme for TEGS-VI & above 22

24 Permission for Employment aer rerement 22

25

Pensioner’s Identy Card

22

26 Pension Slip & Investment Declaraon 23

27

Medical facilies at Bank’s Dispensaries

23

28 Entertainment Facilies 23

29

Canteen Facilies

23

30 Mobile No., Email ID and HRMS login aer rerement 23

31 Admissibility of superannuaon benets to VRS optees 24

32 Grievance Redressal and Sanjeevani 25

33 Extending legal & nancial support to rered employees/ocers 26

34 Pensioners’ Portal 26

35 Submission of Life Cercate 26

36 Assistance to Rered Employees in case of Crical Illness 27

37 SBI Scheme for Compassionate Appointment in exceponal circumstances 31

38 Group Life Insurance - Sampoorna Suraksha 32

39 Voluntary Life Insurance - Swarna Ganga 32

40 Rered Employees Medical Benet Scheme - REMBS 33

41 Table of Eligibility for terminal benets 59

42 Applicaon for rerement

63

43 Applicaon for Refund of Provident Fund Balance on rerement

64

44 Applicaon for Payment of Gratuity

65

45 Applicaon for Payment of Pension

66

46 Money Receipt of Provident Fund

67

47 Money Receipt of Gratuity

68

48

Applicaon for Leave Encashment

69

49

Mandate for Keeping proceeds of Leave Encashment

70

50 Declaraon of Family Members

71

51 Declaraon of Loans & Advances

72

52

Applicaon for Pensioner’s Identy Card

73

53 Applicaon for Refund under SBI-EMWS

75

54 Life Cercate format

76

55 Applicaon To Be Submied By The Rered Ocial Seeking Permission

Taking Up Employment Aer Rerement Without Prejudice To Pension

77

56 List of Diagnosc Centers Empaneled with Bank 79

57 Details of Holiday Homes 88

58 To do list before rerement 96

1

When a member resigns or reres from service of the Bank he shall, if he has served

the Bank for a period of ve years or more, be entled to receive the balance

(Member’s Contribuon + Bank’s Contribuons) at his credit in the Provident Fund.

When to apply : Within 3 months before rerement date.

How to apply : Member should apply through HRMS portal as under:

• Log on to HRMS portal

• Go to Employee Self Service -> PPFG -> Full &

Final Selement ->Fill up the Form ->Submit the

form

• Print the submied form

Submit following (duly signed) forms to Salary Disbursing Authority:

i. Printed copy of the applicaon submied through HRMS

ii. C.O.S. 448 (Annex-5)

iii. Parcular of loans (Annex-10)

• First Level Recommendaon in HRMS is accorded by the Branch Manager /

OAD AGM

• Then the proposal is sent to RBO – Admin Oce – for checking the

correctness of the data – especially leave on loss of pay, if any, aecng the

payment of Provident Fund.

• RBO sends the proposal to Admin Oce and Admin Oce, aer scruny

sends the same to PPG Department, Local Head Oce.

• At PPG Department, Local Head Oce, consolidated statement of PF Refund

Proposals is generated and Second Level Recommendaon is accorded by

AGM PPG. The consolidated statement duly signed by AGM (PPG), DGM &

CDO and CGM of the Circle & is sent to PPG Department, Corporate Centre.

• At Corporate Centre, PPG Department, Circle-wise summary is prepared

and submied for sancon of Trustees. On sancon, third level approval is

accorded in HRMS.

• On approval at Corporate Centre the amount of Refund is credited to the

BGL account of the Branch / Oce where the reree was last posted and

2

Branch Manager aer recovering dues/loans outstanding, if any, credits the

amount to the reree’s account.

• If you have Overdra sanconed in Current Account, please arrange to

cancel the limit else even if the Overdra Balance is NIL, the full amount of

PF will not be released.

An employee who has put in a minimum of 5 years service is eligible for payment of

gratuity under the Payment of Gratuity Act, 1972. The amount will be payable @ 15

days wages for each completed year of service on the basis of 26 working days in a

month, subject to a ceiling of Rs.20 lacs w.e.f. 29.03.2018.

For the purpose of Gratuity, wages include the following:

Wages = Basic Pay + D.A. + Personal Allowance + Acng

Allowance + Fixed Personal Allowance (FPA) + Professional Qualicaon Pay

(PQA)

Wages = Basic Pay + D.A. + FPA + PQA

Formula for calculaon of Gratuity:

Wages x 15 x No. of completed years of service / 26

Example: Name - MR. AJIT KUMAR

Total Service (for Gratuity Calculaon): 30 years.

Gratuity Payable= (99,340.09 x 15 X 33)/26 = 49173344.55/26 = Rs. 18,91,282/-

Maximum amount of Gratuity Payable = Rs. 20,00,000/- (Rupees twenty lacs only)

When to apply : Within 3 months before rerement date.

:

Log on to HRMS portal

Go to Employee Self Service -> HR Iniaves -> PPFG ->

Apply Gratuity Payment Request ->Submit the form

Take out the print by clicking on the ‘Print’ buon & submit

(duly signed & witnessed) forms to Salary Disbursing

Authority.

• First Level Recommendaon in HRMS is accorded by the Branch Manager /

AGM, OAD

• Then the proposal is sent to RBO / Admin Oce – for checking the correctness

of the data – especially leave on loss of pay, if any, aecng the payment of

Gratuity.

3

• RBO sends the proposal to Admin Oce and Admin Oce aer scruny

sends the same to PPG Department, Local Head Oce.

• At LHO, AGM PPG is the sanconing authority for Award Sta. For Supervising

Sta, DGM and CDO of the Circle is authority to sancon. At Corporate

Centre, AGM (OAD) is the sanconing authority for Award Sta and DGM

(PM & PPG) is the sanconing authority for Ocers.

• On approval at Corporate Centre / LHO, the amount of Gratuity is credited to

the BGL account of the Branch and Branch Manager aer recovering dues/

loans outstanding, if any, credits the amount to the reree’s account.

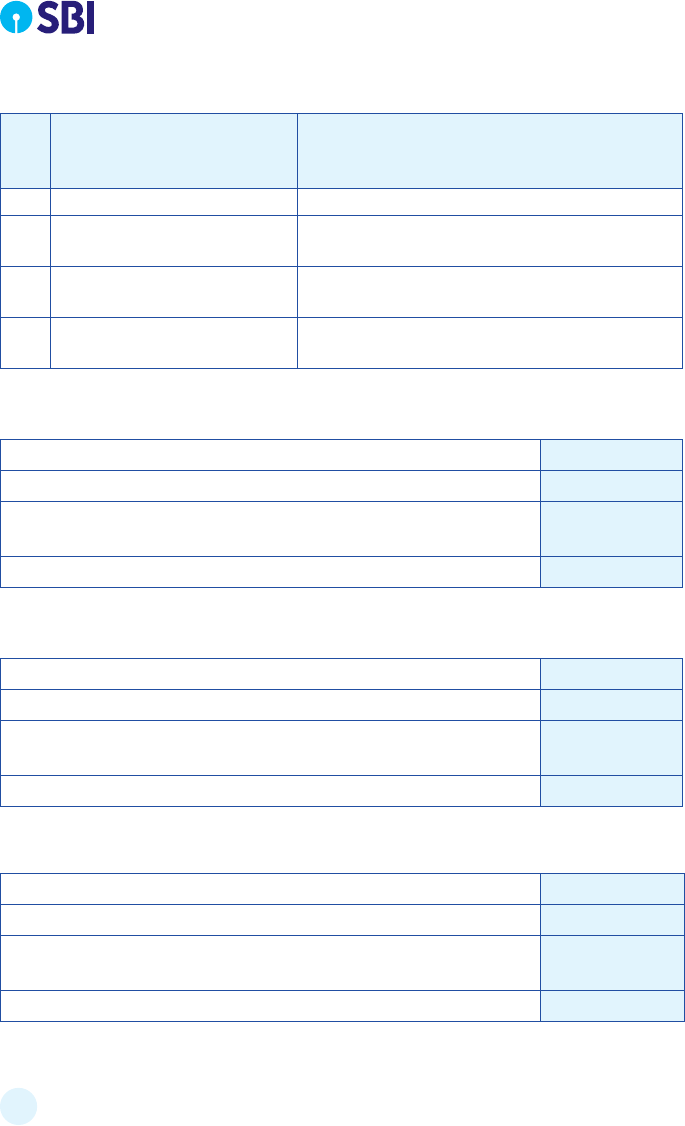

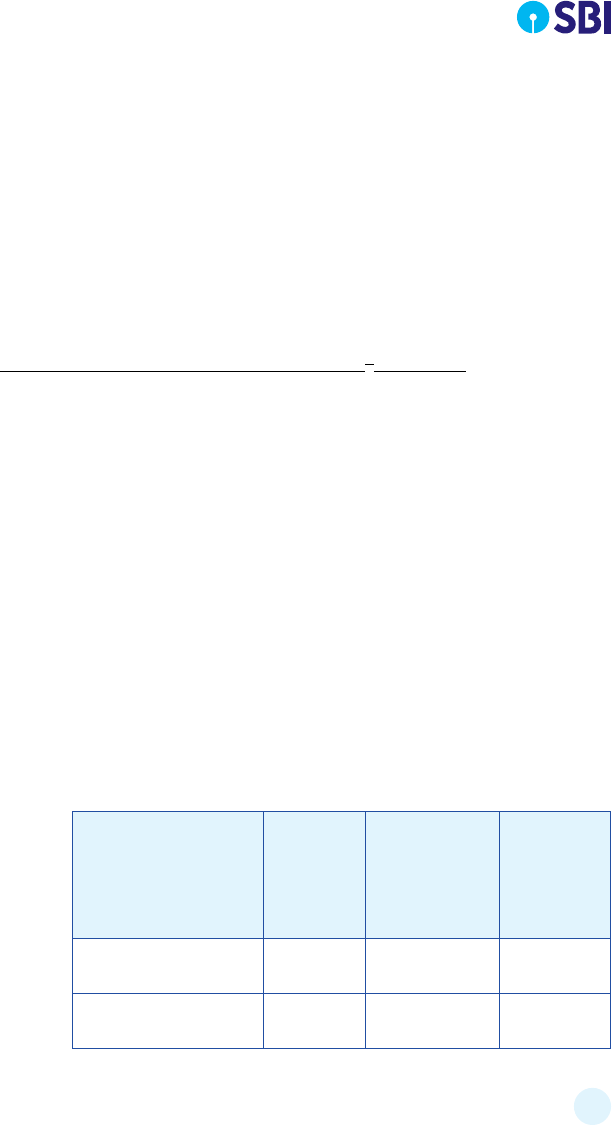

Date of Birth 15.01.1960

Date of Joining 02.08.1984

Date of Conrmaon 02.02.1985

Date of Rerement 31.01.2020

Eligible Service Yrs Months Days

Total Service 35 5 0

Temporary Service 0 0 0

Suspension Period 0 0 0

EOL Not counted for service 0 0 0

Eligible Service 35 6 0

Basic Salary 60820

D.A. 44812

PQA 1680

Increamental FPP 1650

Special Pay 0

Acng Allowance 0

Total Wages 108962

Gratuity Under Act. 35*15/26*108932

Gratuity Calculaon

One Months Pay * 15 962250 64150*15

Pay * Years (15 To 30)/4

Pay * Years (Above >30 )/2 160375 64150*5/2

Award / Service / Comp. 1122625 1122625

Maximum Payable 2000000

4

When to apply: Within 3 months before rerement date.

How to apply Log on to HRMS portal

• Go to Self Service -> HR Iniaves -> PF/Pension/Gratuity -> Apply Pension

Proposal Request -> Fill up the necessary details -> Click on ‘submit’ buon.

• Click on the ‘Print’ buon -> four copies will be printed along with the

forwarding leer.

• Put signature on all the copies in original, ax joint photographs (self-

aested) and submit to Branch Head / OAD.

• Status can be viewed in the HRMS portal

1. A member of the State Bank of India Employees’ Pension Fund shall be

entled for pension under Rule 22 (i) while rering from the Bank’s service:

a. Aer having completed 20 years’ pensionable service provided

that he has aained the age of 50 years; or

b. If he is in the service of the Bank on or aer 01.11.1993 aer

having completed 10 years pensionable service provided that he

has aained the age of 58 years. Further, if he is in the service of

the Bank on or aer 22.05.1998, aer having completed 10 years’

pensionable service provided that he has aained the age of 60

years.

c. Aer having completed 20 years’ pensionable service irrespecve

of the age he shall have aained, if he shall sasfy the Authority

Competent to sancon his rerement by subming approved

medical cercate that he is incapacitated for further acve

service.

d. Aer having completed 20 years pensionable service, irrespecve

of age he shall have aained, at his request in wring, if accepted

by the Competent Authority with eect from 20th September

1986.

e. Aer having completed 25 years’ pensionable service.

5

The maximum amount of pension for members of the Fund eligible for pension, who

rered / rere while in service or otherwise cease to be in employment on or aer

01.11.2012, shall be computed as under:

PENSION CALCULATION FORMULA:

(a) No. of years

pensionable service

X Average substanve salary drawn during the last

12 months’ pensionable Service (not to be rounded o)

60

(b) (i). Where the average of monthly substanve salary drawn during the last 12

months’ pensionable service is upto Rs. 51,490/- p.m.:

50% of the average of monthly substanve salary drawn during the last 12

months’ pensionable service + ½ of PQP + 1/2 of incremental component of

FPP, wherever applicable.

(ii). Where the average of monthly substanve salary drawn during the last 12

months’ pensionable service is above Rs. 51,490/- p.m.:

40% of the average of monthly substanve salary drawn during the last 12

months’ pensionable service subject to minimum of Rs. 25,745/- + ½ of PQP

+ ½ of incremental component of FPP, wherever applicable.

In the case of (b)(i) : Lower of (a) and (b)(i) will be the Basic Pension.

In the case of (b)(ii) : Lower of (a) and (b)(ii) will be the Basic Pension.

Example:

Name - MR. AJIT KUMAR (Date of Birth: 14.07.1960)

(a) (Rs. 66,070 +1,990+1,680= 69,740) x 366 months/720 months = Rs. 35,451/-

(b) (i) (40% of Rs. 66,070) = Rs. 26,428 +

(ii) (1/2 of incremental component of FPA (1,990/-) = Rs. 995.00) +

(iii) (1/2 of PQA (Rs. 1680/-) = Rs. 840.00

Total: Rs. 28,263/-

Basic Pension = Lower of (a) and (b)= Rs. 28,263.

(iv) Dearness Relief (75.90% as on 29/02/2020) (+) Rs. 21,451

Total Pension (without commutaon) = Rs. 49,714

Dearness Relief on the Basic Pension is payable on the basis of quarterly

average of the All India Consumer Price Index gures for Industrial workers

(base 1960=100).

Circulars on Dearness Relief are issued by Corporate Centre on half yearly basis in the

month of February and August every year as per the guidelines prescribed by IBA.

6

Rerees on or aer 01.01.1986 are eligible for commutaon of pension up to 1/3rd

of their Basic Pension. Request for commutaon may be submied by the rered

employee within one year of the date of rerement. However, if he applies for

commutaon aer one year from the date of rerement the amount of commutaon

is payable only aer he has been medically examined by the Medical Ocer

designated by the Bank.

Commutaon factor is arrived at depending upon the age of the pensioner as on his

next birthday. If a member reres at the age of 60 years, for commutaon, factor will

be taken into account applicable for the age of 61 years, which is 6.60.

Formula for Commutaon:

1/3rd of Basic Pension x Commutaon Factor as on next Birthday x 12

Example:

In the above example Basic Pension : Rs. 28,263.00

1/3rd of Basic Pension = 9421

Age on next Birthday = 61 years (Commutaon Factor = 6.60) Total Commutaon=

9421 x 6.60 x 12 = Rs. 746143.00

Total monthly pension aer commutaon will be Rs. 49,714 – Rs. 9,421 = Rs. 40,543/-

• Commuted poron of pension will be recovered from monthly pension over a

period of 15 years from the date of commutaon.

• Commuted poron of pension will be restored aer the expiry of a period of 15

years from the date of commutaon.

• No Medical examinaon is required if the pensioner opts for commutaon within

one year of his rerement.

• An employee is empowered to revoke his opon for commutaon any day up

to the date of rerement. However, aer the date of rerement, revocaon of

opon for commutaon is not possible.

7

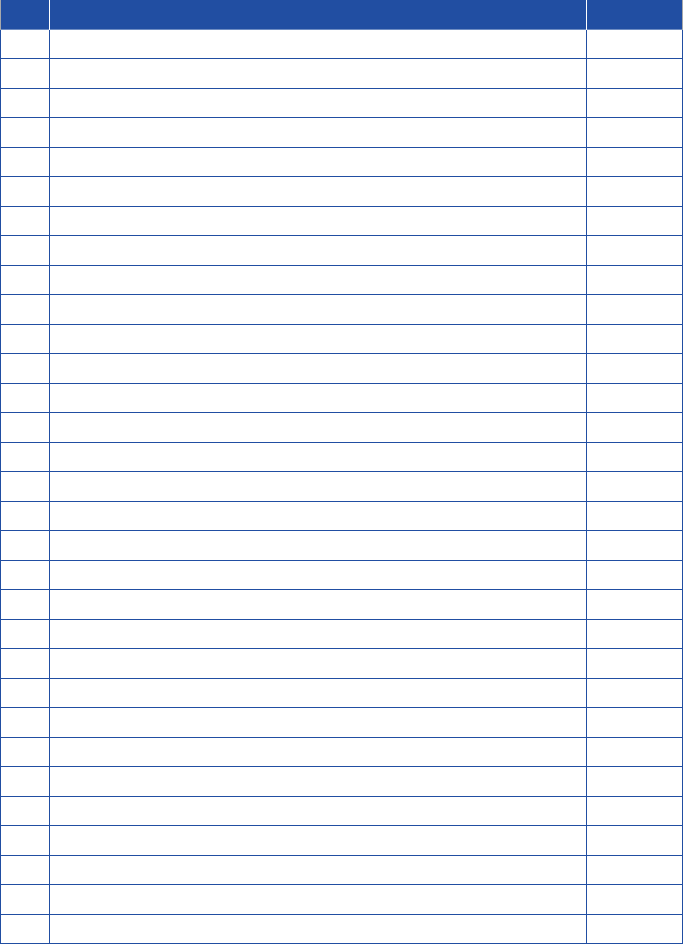

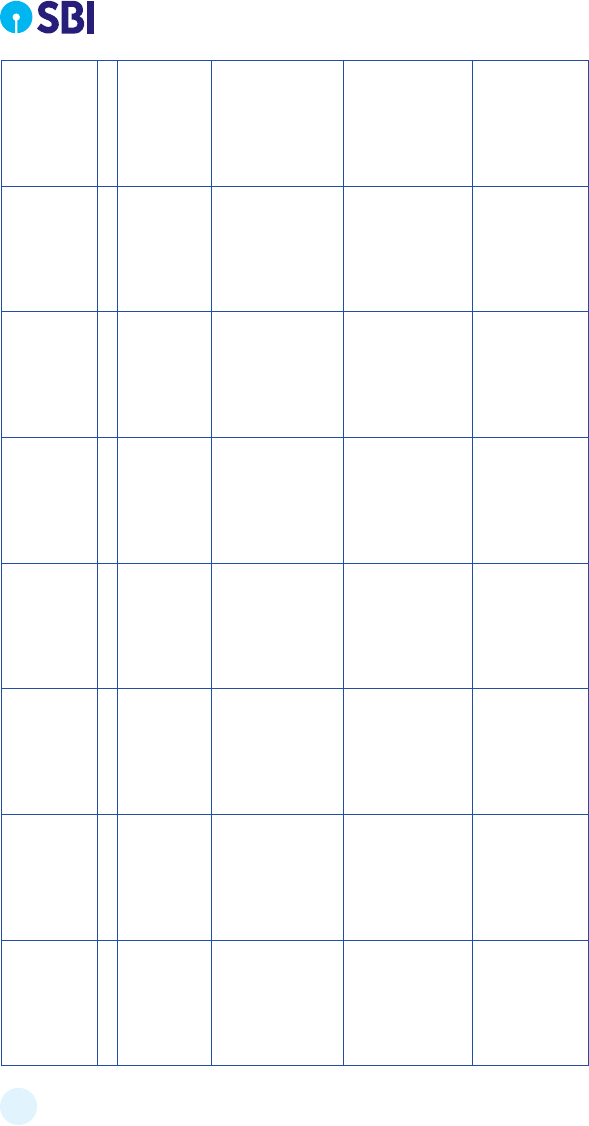

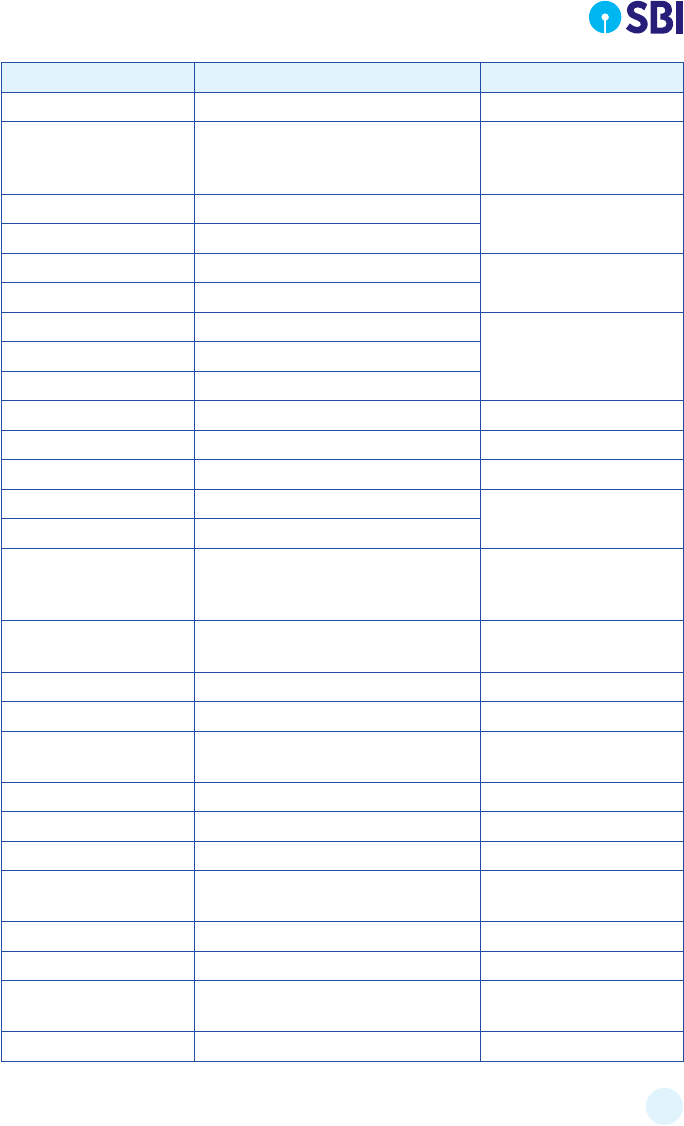

21 17.62 54 08.82

22 17.46 55 08.50

23 17.29 56 08.17

24 17.11 57 07.85

25 16.92 58 07.53

26 16.72 59 07.22

27 16.52 60 06.91

28 16.31 61 06.60

29 16.09 62 06.30

30 15.87 63 06.01

31 15.64 64 05.72

32 15.40 65 05.44

33 15.15 66 05.17

34 14.90 67 04.90

35 14.64 68 04.65

36 14.37 69 04.40

37 14.10 70 04.17

38 13.82 71 03.94

39 13.54 72 03.72

40 13.25 73 03.52

41 12.95 74 03.32

42 12.66 75 03.13

43 12.35 76 02.94

44 12.05 77 02.75

45 11.73 78 02.56

46 11.42 79 02.38

47 11.10 80 02.20

48 10.78 81 02.02

49 10.46 82 01.84

50 10.13 83 01.67

51 09.81 84 01.50

52 09.48 85 01.33

53 09.15

8

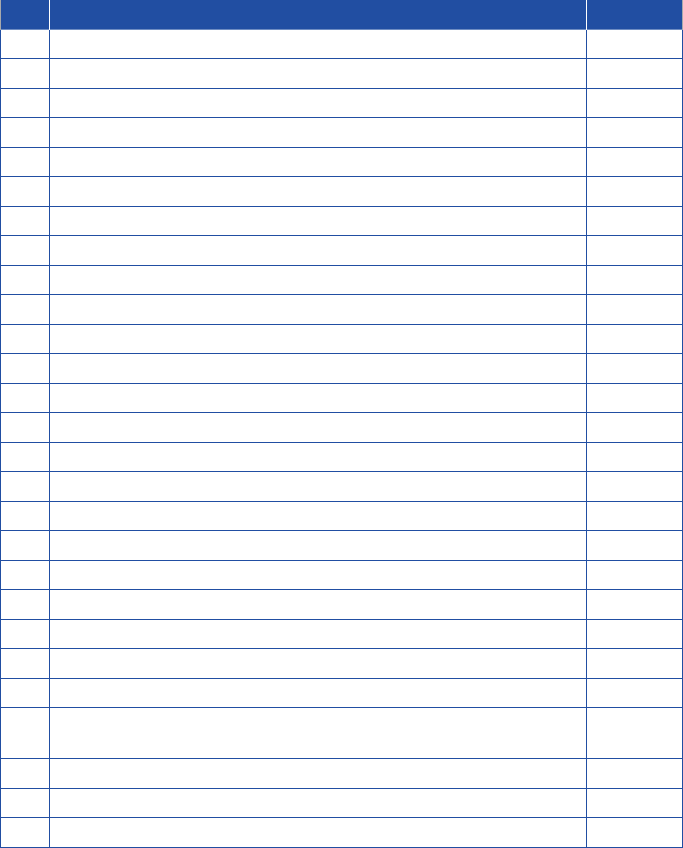

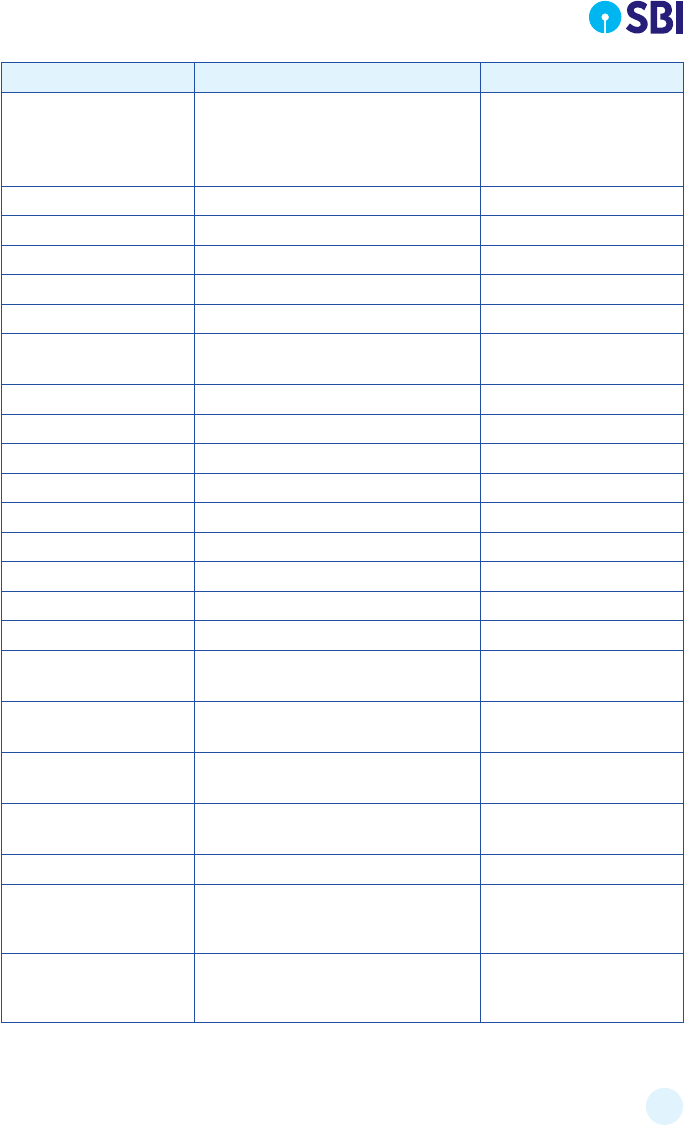

17 19.28 52 12.66

18 19.20 53 12.35

19 19.11 54 12.05

20 19.01 55 11.73

21 18.91 56 11.42

22 18.81 57 11.10

23 18.70 58 10.78

24 18.59 59 10.46

25 18.47 60 10.13

26 18.34 61 9.81

27 18.21 62 9.48

28 18.07 63 9.15

29 17.93 64 8.82

30 17.78 65 8.50

31 17.62 66 8.17

32 17.46 67 7.85

33 17.29 68 7.53

34 17.11 69 7.22

35 16.92 70 6.91

36 16.72 71 6.60

37 16.52 72 6.30

38 16.31 73 6.01

39 16.09 74 5.72

40 15.87 75 5.44

41 15.64 76 5.17

42 15.40 77 4.90

43 15.15 78 4.65

44 14.90 79 4.40

45 14.64 80 4.17

46 14.37 81 3.94

47 14.10 82 3.72

48 13.82 83 3.52

49 13.54 84 3.32

50 13.25 85 3.13

51 12.95

9

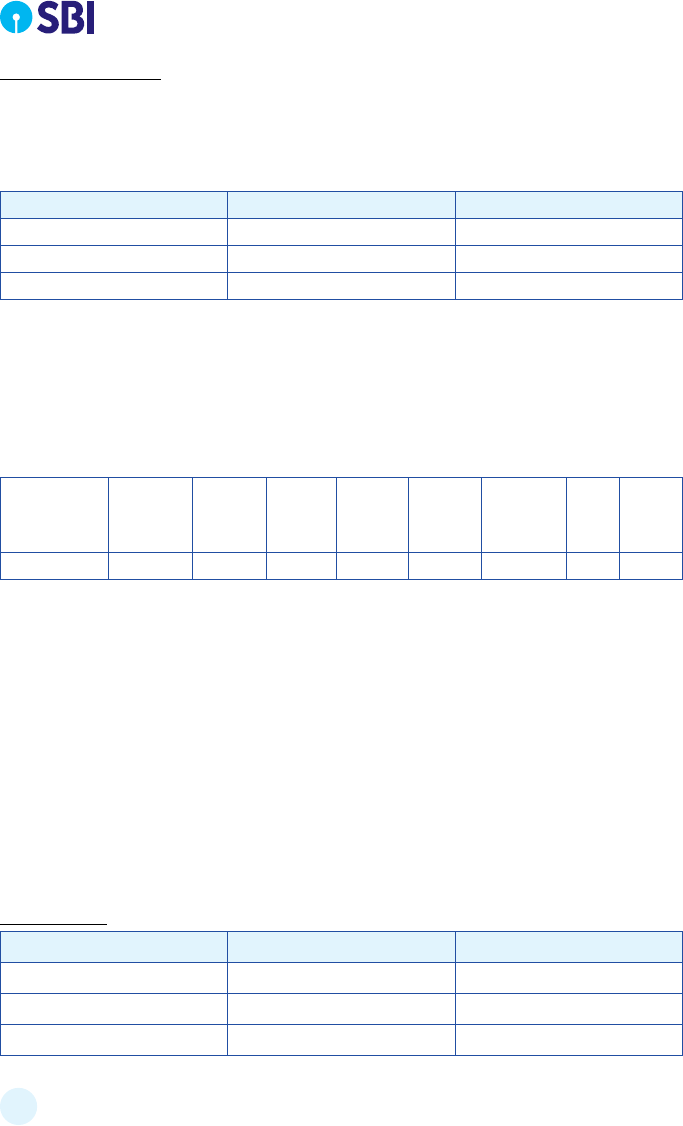

RATES OF DEARNESS RELIEF PAYABLE TO PENSIONERS WHO RETIRED

A) PRIOR TO 1.11.1987 AND

B) BETWEEN 1.11.1987 AND 31.10.1992 / 30.06.1993

Sr.

No.

Basic Pension + F.D.R.

(as applicable)

Dearness Relief for the months February

2020 to July 2020

(Average Index – 7479) (Slabs – 1719)

i) Upto Rs. 1250.00 1151.73% of aggregate of Basic Pension &

F.D.R.

ii) Rs. 1251.00 to Rs. 2000.00 Rs. 14,396.62 + 945.45% of aggregate of Basic

Pension & F.D.R in excess of Rs. 1250.00.

iii) Rs. 2001.00 to Rs. 2130.00 Rs 21,487.49 + 567.27% of aggregate of Basic

Pension & F.D.R in excess of Rs. 2000.00.

iv) Above Rs. 2130.00 Rs. 22,224.94 + 292.23% of aggregate of Basic

Pension & F.D.R in excess of Rs. 2130.00.

DEARNESS RELIEF PAYABLE TO PENSIONERS

WHO RETIRED ON OR AFTER 1.11.1992 / 1.7.1993 UP TO 31.10.1997 / 31.03.1998

Sr.

No.

Basic Pension Dearness Relief for the months February 2020

to July 2020

(Average Index – 7479) (Slabs – 1582)

i) Upto Rs. 2400.00 553.70% of Basic Pension.

ii) Rs. 2401.00 to Rs. 3850.00 Rs. 13,288.80 + 458.78% of Basic Pension in

excess of Rs. 2400.00

iii) Rs. 3851.00 to Rs. 4100.00 Rs. 19,941.11 + 268.94% of Basic Pension in

excess of Rs. 3850.00

iv) Above Rs. 4100.00 Rs. 20,613.46 + 142.38% of Basic Pension in

excess of Rs. 4100.00

10

DEARNESS RELIEF PAYABLE TO PENSIONERS WHO RETIRED

ON OR AFTER 1.11.1997 / 1.4.1998 UPTO 31.10.2002

Sr.

No.

Basic Pension Dearness Relief for the months

February 2020 to July 2020

(Average Index – 7479) (Slabs – 1448)

i) Upto Rs. 3550.00 347.52%

ii) Rs. 3551.00 to Rs. 5650.00 Rs. 12,336.96 + 289.60% of Basic Pension in

excess of Rs. 3550.00

iii) Rs. 5651.00 to Rs. 6010.00 Rs. 18,418.56 + 173.76% of Basic Pension in

excess of Rs. 5650.00

iv) Above Rs. 6010.00 Rs. 19,044.09 + 86.88% of Basic Pension in

excess of Rs. 6010.00

DEARNESS RELIEF TO PENSIONERS WHO RETIRED

ON OR AFTER 1.11.2002 UP TO 31.10.2007

Average Index (CPI) for quarter ended December 2019 7479

No. of Slabs 1297

Rate of dearness relief on pension for the months February 2020

to July 2020

233.46%

(ignore decimals from 3

rd

place onwards)

DEARNESS RELIEF TO PENSIONERS WHO RETIRED

ON OR AFTER 1.11.2007 UPTO 31.10.2012

Average Index (CPI) for quarter ended December 2019 7479

No. of Slabs 1160

Rate of dearness relief on pension for the months February 2020

to July 2020

174.00%

(ignore decimals from 3

rd

place onwards)

DEARNESS RELIEF TO PENSIONERS WHO RETIRED

ON OR AFTER 1.11.2012

Average Index (CPI) for quarter ended December 2019 7479

No. of Slabs 759

Rate of dearness relief on pension for the months February 2020

to July 2020

75.90%

(ignore decimals from 3

rd

place onwards)

11

Dearness Relief for Family Pensioners who died or rered

(a) before 1.11.1992 / 1.7.1993

(b) on or aer 1.11.1992 / 1.7.1993 but before 1.11.1997 / 1.4.1998

(c) on or aer 1.11.1997 / 1.4.1998 but before 01.11.2002

(d) on or aer 1.11.2002 but before 1.11.2007 and

(e) on or aer 1.11.2007 but before 1.11.2012

(f) on or aer 1.11.2012

will be paid as per the tables given for the pensioners.

• Overdue interest or payment of interest on delayed selement of superannuaon

benets is payable only when delay is on the part of the Bank. However, where

the delay is aributed to administrave reasons, the request for overdue interest

should be considered and recommended on merits of each case. The Circle

may submit their recommendaons for payment of interest with full details of

the case and along with their specic comments on sta lapses (if any) to the

Dy General Manager, PPG department at Corporate Centre who shall obtain

sancon from the appropriate Authority. The period of delay will be from the

date it is due or the date of order by the Appropriate authority to the preceding

date of actual payment of pension to the pensioner. The rate of interest will be

same as applicable to the Provident Fund for respecve periods vide Corporate

Centre Circular NoPA/CIR/83 dated 16

th

May 1986.

• Overdue interest on delayed payment of P.F. is calculated at the interest on

SB Account if the reason is aributable to the employee and fund was laying

with the Bank. However, if the delay is aributed to the Bank then the overdue

interest is payable to the reree at the exisng P.F. interest rate.

• Payment of Gratuity is to be seled within 30 days from the date of rerement.

However, if it is delayed for more than 30 days overdue interest is payable from

the date of rerement at the rate 10%.

12

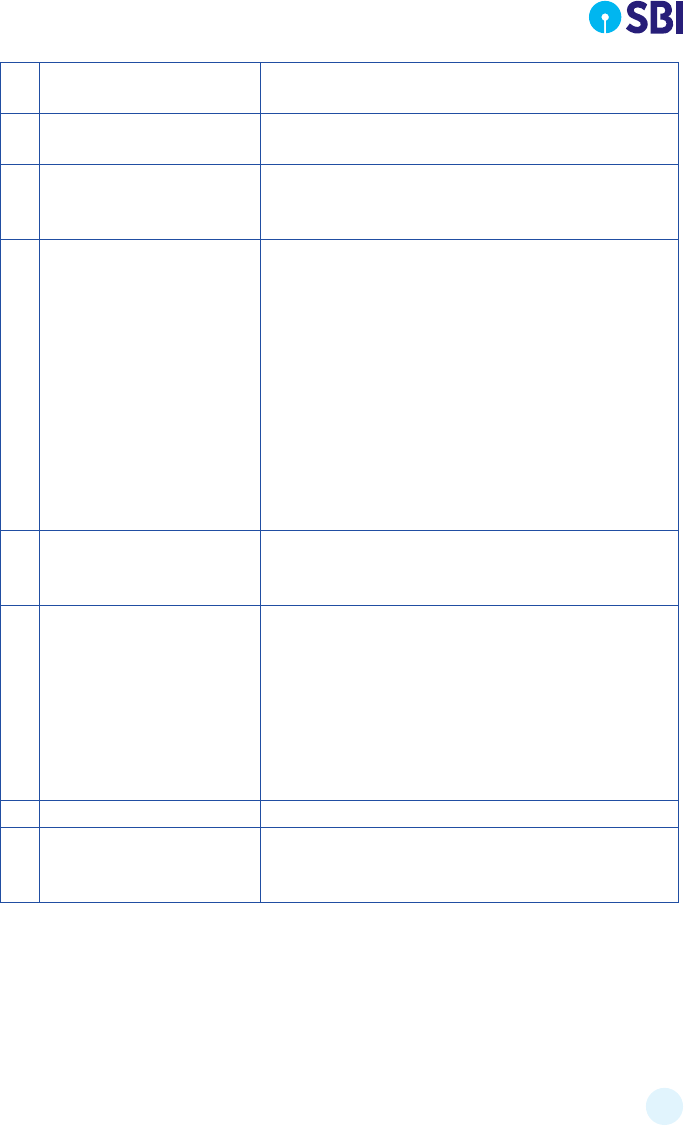

The delegaon of discreonary powers for sancon of interest on delayed payment

of pension upto Rs.5000/- is as below:

For Circles CGM of the Circle

For Corporate Centre, Mumbai General Manager (Corporate Services)

For other Corporate Centre

establishment at Mumbai

An authority not below the rank of TEG Scale

VII (GM). Where the incumbency is below

the rank of GM, the GM (CS) at State Bank

Bhavan.

For Corporate Centre establishments

located outside Mumbai

An authority not below the rank of TEG Scale

VII posted at the relave establishment, who

processes the pension proposals.

For Ocers on deputaon to

subsidiaries like SBI Caps, SBI Fund

Mgmt. Etc. and other Organisaons/

other Banks located in Mumbai

General Manager (Corporate Services),

Corporate Centre.

For Ocers on deputaon to

subsidiaries like SBI Caps, SBI Fund

Mgmt. Etc. and other Organisaons/

other Banks located outside Mumbai

CGM of the Circle, where oce of the

Subsidiary/Organisaon/other Banks is

located.

The CGM (HR) at Corporate Centre will sancon proposals for payment of interest

beyond Rs.5000/-. All the Circles are required to submit a report to the DGM (PPG)

at Corporate Centre on the number of cases and amount of interest paid to the ex-

employees at quarterly intervals, which will be controlled by the DMD (HR) & CDO

at Corporate Centre vide Corporate Centre leer No. CDO/PPG/BHD/169 dated the

31

st

May, 2006.

Rering SBI employees are not required to open a separate SB/CA for the purpose of

geng pension. Pension can be credited to the exisng sta SB/CA of the pensioner.

On death of the sta pensioner, the family pensioner need not open a new SB/CA for

the purpose of geng family pension. Family pension can be credited to the exisng

joint SB/CA of sta pensioner with ‘E or S’ facility.

13

Procedure required to be followed for sanconing/payment of family pension for

the employees who died in service.

PPG Department at Circles and Oce Administraon Departments at

Administrave Oces are responsible for processing and selement of Family

Pension of those employees who die while in service.

i) Spouse of the employee, if the member dies during service aer pung in a

minimum of one-year pensionable service.

ii) Eligible only if the deceased employee is / was eligible to become a member of a

pension fund. If the employee was not eligible / deprived of pension benets or

is a member of NPS, then his family will not get benets under this scheme.

iii) Family pension is payable: -

(a) To widow / widower up to her / his death or remarriage whichever is earlier.

(b) Failing (a) above, to the eldest surviving children in order of their birth up to

the age of 25 years or he/she is gainfully employed whichever is earlier.

(c) In case the beneciary is an unmarried daughter, unl she aains 25 years

of age or is married or is gainfully employed whichever occurs rst.

(d) This process will connue ll the last beneciary aains the age of 25 years

or is gainfully employed or married in case of daughter, whichever is earlier.

(e) Fresh sancon should be obtained in respect of every beneciary as and

when there is change of beneciary as above, where simultaneous sancon

of family pension was not obtained along with sancon of pension as per

new instrucons.

(f) In case of twin children, family pension will be payable to both in the

proporon of 50:50.

(g) Family pension will be payable even if the widow/widower is working in the

Bank on compassionate grounds.

(h) If the pensioner leaves two legally wedded wives, the family pension is

payable to both the wives in equal proporons.

14

(i) The family pension shall be payable to such son or daughter for life if he/she

is physically crippled or disabled so as to render him or her unable to earn

a living even aer aaining the age of 25 years. Only that disability, which

manifests itself in the child before rerement or death of the employee

while in service, shall be taken into account.

Vide cicular no. CDO/P7HRD-PM/83/2012-13 dated March 04,2013 vide Cicular No.

CDO/P7HRD-PM/83/2012-13 dated March 04,2013 Family Pension will be paid to the

deceased ex-servicemen employees / pensioners of the Bank who are also drawing

family pension from the Government. The revised instrucons will be eecve from

24

th

September,2012 and thereaer. The benets of these provisions shall be allowed

to past cases and the nancial benet shall be granted from 24

th

September, 2012.

Vide Circular No. : CDO/P&HRD-PM/87/2014 - 15, March 04,2015. Family pension is

payable to the parents who were wholly dependent upon the employee when he/

she was alive provided the deceased employee has le behind neither a widow nor a

child. Among the parents, mother will have precedence over father.

1. Obtain the death cercate of the deceased and PAN card, Aadhar Card, Account

number of family pensioner.

2. Ocer from Branch has to update date of death in HRMS to stop the monthly

salary and for running separaon acon in HRMS.

3. On behalf of the employee who has died, some funconary from Branch /

Department has to apply in HRMS- MSS (Manager Self Services) and ocial has

to approve the same – First Level Recommendaon.

4. Four copies of the proposals are then sent to RBO and Admin Oces for scruny

and to check the extra ordinary leave not counng for service, if any.

5. Then three copies are forwarded to PPG Department, Local Head Oce. At LHO

it is scrunized again and approved in HRMS – Second Level Recommendaon

6. LHO PPG prepares a Consolidated Statement of proposal through HRMS for

sancon of Trustees at PPG department, Corporate Centre.

15

7. Consolidated Statement of Proposal for sancon of family pension is duly

approved by Execuve Trustee. (Tracking mechanism is available in HRMS under

PF/Pension/Gratuity as ‘Dashboard for Death Cases’).

8. Then it is approved at PPG department, Corporate Centre – in HRMS as nal

Approval

9. HRMS calculates the amount of family pension ll date from the date of death of

an employee. Branch has to rst recover the salary paid aer the date of death

and then only family pension is credited to the account of the family pensioner.

10. If the family pension is recommended to a beneciary other than the spouse,

it should be ensured by the Branch Manager that either the spouse who was

drawing family pension has died or he/she has pre-deceased the pensioner/

employee or has remarried. Hence in such a case either the spouse should

declare having re-married or his/her death cercate should be forwarded with

the family pension proposal.

On scruny of the applicaons submied by Circles for sancon of family pension it

is observed that in a few cases Death Cercates are omied to be enclosed to the

applicaon. Further, the death cercates in many cases are issued in the regional/

local language. As it is extremely dicult to decipher the informaon furnished on

such Death Cercates, vital informaon, such as Date of Death, Name of Deceased

etc. be translated into either English or Hindi before submission to Corporate Centre

for obtaining sancon of family pension from the Trustees (Corporate Centre leer

No PPG/KPE/3828 dated 30th October 1993).

A. On the death of an employee, an ocer of Sta Cell / Branch should be deputed

to call on the legal heirs of the deceased employee as early as possible to guide

and help them in compleon of necessary papers/formalies relang to release

of terminal benets to be submied by them.

B. The informaon of death of an employee should, however, be sent to PPG

Department without loss of me, so that the original nominaon registered with

Central Accounts Oce, Kolkata may be called for well in me.

1. Government of India vide their leer No. 4/8/6/2006-IR dated 7th December,2007

advised that family pension in SBI may be revised in line with the Family Pension

Scheme in the Naonalized Bank.

The Central Board in its meeng held on 29th December, 2007 approved

Revision in Family Pension in our Bank on the same lines as that applicable

in the Naonalized Banks and as menoned in the approval accorded by the

Government of India. The revised rates are eecve from 1st May, 2005. The

16

Revised Family Pension should be approved by the Trustees’ for individual cases

vide Corporate Centre Circular No. CDO/P&HRD/PM/62/2007-08 dated 28th

January,2008.

For Ocers : Basic Pay + PQP + FPP

For Award Sta :Basic Pay + PQP + FPP + SPL. Pay

The family pension is revised w.e.f. 01.05.2005

Those who died or rered before 01.11.1993:

Substanve Salary Per Month Rates of Family Pension Per Month

Rs. 1500.00 and below 30% of the substanve salary subject to minimum

of Rs.375.00 p.m.

Rs.1501.00 to Rs.3000.00 20% of the substanve salary subject to a

minimum of Rs.450.00 p.m.

Above Rs.3000.00 15% of the substanve salary subject to a

minimum of Rs.600.00 p.m. and maximum of

Rs.1250.00 p.m.

In respect of employees who rered/died on or aer 01.11.1993 but before

01.04.1998:

Substanve Salary Per Month Rates of Family Pension Per Month

Rs.2870.00 and below 30% of the substanve salary subject to minimum

of Rs.720.00 p.m.

Rs.2871.00 to Rs.5740.00 20% of the substanve salary subject to a

minimum of Rs.860.00 p.m.

Above Rs.5740.00 15% of the substanve salary subject to a

minimum of Rs.1150.00 p.m. and maximum of

Rs.2400.00 p.m.

Those who rered/died on or aer 01.04.1998but before 31.10.2002

Substanve Salary Per Month Rates of Family Pension Per Month

Rs.4210.00 and below 30% of the substanve salary subject to minimum

of Rs.1056.00 p.m.

Rs.4210.00 to Rs.8420.00 20% of the substanve salary subject to a

minimum of Rs.1262.00 p.m.

Above Rs.8420.00 15% of the substanve salary subject to a

minimum of Rs.1687.00 p.m. and maximum of

Rs.3521.00 p.m.

17

Those who rered/died on or aer 01.11.2002 but before 31.10.2007

Substanve Salary Per Month Rates of Family Pension Per Month

Rs.5720.00 and below 30% of the substanve salary subject to

minimum of Rs.1435.00 p.m.

Rs.5720.00 to Rs.11440.00 20% of the substanve salary subject to a

minimum of Rs.1715.00 p.m.

Above Rs.11440.00 15% of the substanve salary subject to a

minimum of Rs.2292.00 p.m. and maximum of

Rs.4784.00 p.m.

Those who rered/died on or aer 01.11.2007 but before 31.10.2012:

Substanve Salary Per Month Rates of Family Pension Per Month

Rs.7090.00 and below 30% of the substanve salary subject to minimum

of Rs.1799.00 p.m.

Rs.7091.00 to Rs.14180.00 20% of the substanve salary subject to a

minimum of Rs.2186.00 p.m.

Above Rs.14181.00 15% of the substanve salary subject to a

minimum of Rs.2841.00 p.m. and maximum of

Rs.5930.00 p.m.

Those who rered/died on or aer 01.11.2012:

Substanve Salary Per Month Rates of Family Pension Per Month

Rs.11100.00 and below 30% of the substanve salary subject to minimum

of Rs.2785.00 p.m.

Rs.11101.00 to Rs.22200.00 20% of the substanve salary subject to a

minimum of Rs.3422.00 p.m.

Above Rs.22200.00 15% of the substanve salary subject to a

minimum of Rs.4448.00 p.m. and maximum of

Rs.9284.00 p.m.

NOTE: - In the case of part me employees, the minimum and maximum amount

of family pension shall be in proporon to the rate of scale wages drawn by the

employee.

a) The words “gainfully employed” shall mean that he/she is either self-employed

or is otherwise employed and is earning from such employment an income

more than the amount of family pension to which he/she is entled. Where the

earning is less than the entled family pension, the amount of family pension

will be payable but be reduced by the amount of such income.

18

b) In case where the employee leaves behind him more than one wife, if the personal

law applicable to such an employee permits such marriage, family pension shall

be payable to the widows in equal proporon. In the event of remarriage or

death of one widow, her share of the family pension shall be payable to her

surviving son or unmarried daughter as the case may be for such period as he or

she is eligible in terms of para 1(iii) above.

c) In the case of minor child, the family pension shall be payable through the natural

guardian, unl he or she aains legal majority.

d) The substanve salary for the purpose of Family Pension shall mean the average

substanve salary drawn during the last 12 months pensionable service as taken

for calculaon of pension.

e) In the event of the eldest eligible child, who is entled to family pension, becoming

ineligible thereto aer 25 years of age or on being employed or married (in case

of daughter), as the case may be, the family pension shall become payable to the

next child in line of eligibility under the scheme.

f) In no case the amount of family pension determined shall exceed the pension

drawn by the pensioner vide CDO/PPG/CPM/711 dated 29th November, 2008.

g) Cercate of re-marriage/unemployment and a Life Cercate should be

obtained by the Branch Manager from family pensioner annually in the month of

November each year.

h) In case the Life cercate, or other required Cercates to be submied annually

in the month of November are not forthcoming before February next year, the

amount of family pension should not be credited the Savings Bank Account and

beneciary advised accordingly. The payments may be restored only on receipt

of the required cercates.

i) In case of both natural guardians, i.e. father as well as mother, have expired

and the beneciary child is minor, either the guardian will have to be appointed

by the competent Court or the minor will have to wait ll he/she aains legal

majority, for claiming Family Pension.

j) Step-mother or father cannot be construed to be a natural guardian of the minor

child.

k) If both the family pensions are payable to the eligible child then the aggregate

amount of two pensions shall be limited to the corresponding maximum ceiling

of family pension payable in respect of any of the parents, whichever is higher,

for the specied period as per biparte selement Circular No. CDO/P&HRD-

PM/82/2012-13 dated March 04, 2013.

19

The following benets are available to the rered employees and their spouse who

are the members of SBI Employees’ Mutual Welfare Scheme:

(i) Full refund of contribuons at the me of rerement without interest.

(ii) Medical Benets are payable as under:

Unit 90% of cost of

Hospitalizaon

subject to life me

limit of (Rs.)

Serious / special

diseases with

or without

hospitalizaon

subject to life me

limit of (Rs.)

General diseases

life long as per

column (c) within

nancial limit of

(Rs.)

Rs. 20/- 6,000/- 6,000/- 500/- per year

Rs. 40/- 15,000/- 15,000/- 1,000/- per year

Rs. 60/- 22,500/- 22,500/- 1,500/- per year

Rs. 80/- 30,000/- 30,000/- 2,000/- per year

(iv) One-me Lumpsum payment on death of member during service or aer

rerement; and

(v) Payment of Monthly Financial Relief on death of member during service or aer

rerement as under:

Unit One-me lumpsum payment Monthly Financial Relief

Rs. 20/- 10,000/- 200/- p.m.

Rs. 40/- 10,000/- 250/- p.m.

Rs. 60/- 15,000/- 375/- p.m.

Rs. 80/- 20,000/- 500/- p.m.

Ø One-me Lumpsum payment is made to spouse and to nominees / legal

heirs (if the member is unmarried)

Ø Monthly Financial Relief is given to spouse and to nominees / legal heirs (if

the member is unmarried) lifeme.

Ø For geng refund - applicaon is to be submied as per the specimen in

(Annex-13)

Rerees are eligible for encashment of Privilege Leave upto a maximum of 240 days

against available leave balance on the date of rerement (IT exempon available

upto Rs. 3.00 lac).

20

When to apply Within 3 months before rerement date.

How to apply Submit the following forms to the Salary Disbursing Authority:

i. Applicaon as per specimen in Annex-7.

ii. Mandate as per Annex-8.

Ø Ocers may retain the accommodaon (including designated house), telephone

and car upto the maximum period of 2 months from the date of normal

rerement without any approval.

Voluntary Rerement 1 month from the date of Voluntary Rerement

(with or without re-employment)

Resignaon from service 15 days from the date of resignaon.

Dismissal: Removal from

service

15 days from the date of receipt of order of

dismissal / removal from service.

An ocer is eligible to claim travelling allowance, baggage and other expenses for

himself / herself and his / her family as on transfer from the last staon at which he

/ she is posted to the place where he / she proposes to sele down on rerement.

The period of extension sought for in availing the facility of travelling allowance aer

rerement must not exceed the period for which residenal accommodaon has

been allowed to be retained. In other words, the period for extension of the facility

should be co-terminus with vacaon of the ocial residence.

Furniture Items: (i) If the date of purchase of furniture is more than ve years-

Ownership will be transferred without any recovery. (ii) If it is less than 5-year-old

– depreciated value based on the actual age of furniture / xture will be recovered.

Electronic Items: (i) If the date of purchase is > 3 years – free of cost

(ii) If the date of purchase is <3 years – depreciated value

(iii) If the date of purchase is < 1 year – full cost

To be retained without any cost on normal rerement.

To be retained at book value at voluntary rerement/resignaon.

21

To be retained without any cost irrespecve of period of use on normal rerement.

However, in case of VR / resignaon, it can be retained aer paying the book value

of the laptop.

To be retained without any cost irrespecve of period of use on normal rerement.

However, in case of VR / resignaon, it can be retained aer paying the book value

of the I-PAD.

LTC / HTC may be permied to be carried forward for maximum period of 4 months

beyond the date of rerement and in exceponal circumstance upto 6 months.

l The benet of addional 1% interest is payable to a rered member of Bank sta

if eligible as per the provision of Circular No. CDO/P&HRD-IR/17/2019-20 dated

22.05.2019).

l On advances against specied securies as applicable to sta members, provided

the employee / ocial is eligible for pensionary benets.

In the cases of normal rerement repayment of Sta Housing Loan may be connued

upto 75 years of age, irrespecve of date of joining, subject to adequate and veriable

cash ows for repayment of the loan to the sasfacon of sanconing authority.

To be reviewed at the me of rerement, wherever necessary to ensure adequate

repayment capacity.(Circular No.: CDO/P&HRD-IR/15/20178- 19 dated 21.05.2018)

In case the employee / ocial reres on superannuaon or takes voluntary rerement

aer 58 years of age as per approved Scheme (30 years of service) but before full

repayment of loan, the outstanding as on the date of rerement shall be repaid in

equal instalments over a period of 60 months from the date of rerement.(Circular

No.: CDO/P&HRD-IR/61/2017 - 18 dated 15.11.2017)

22

Circular No. CDO/P&HRD-PM/64/2016 – 17, September 06,2016.

In terms of the extant instrucons, every rering sta member (excluding voluntary

rerement or compulsory rerement) is presented with a memento on Bank’s behalf

preferably in the form of a silver salver/ arcle with suitable inscripon/ legend which

could be preserved with pride and cherished memories, with cost ceiling in respect of

various categories of employees as under:

Subordinate Sta 4000/- TEGS VI 47000/-

Clerical Sta 6000/- TEGS VII 48500/-

JMGS-I 10000/- TEGSS I 73000/-

MMGS- II 11250/- TESGSS II 75000/-

MMGS III 14000/-

SMGS IV 22500/--

SMGS V 23500/-

The benet can be availed aer rerement.

Available to execuves in TEGS VI & Above with their spouse. 3 days training

programme to enable the Execuve to self-introspect and plan for the change in

their lives on deming oce to ensure a smooth and enjoyable transion to post-

rerement life.

Prior permission from competent authority is required for seeking employment in any

other Bank at any me or any other commercial employment within one year from

the date of rerement to protect their pension. Commercial employment includes

business and self-employment also.

Can be obtained from the Pension Paying Branch. Joint photograph with spouse

required along with applicaon as per specimen in Annexure -11.(aached)

Military

23

The Bank has shied the payment and processing of sta pension to HRMS

from CPPC. Investment Declaraon Form and Pension Slip are now available on

hps://www.hrms.onlinesbi.com wherein a reree can log on using his/her PF Index

as user ID and the same password may be connued as used before rerement.

Medicines are provided from the available stock at dispensaries run by Corporate

Centre, Local Head Oces, Administrave Oces and at a few selected dispensaries

to the pensioners and their eligible family members. Services of specialist doctors are

also available in some of these dispensaries.

Pensioners can avail the benet of Bank’s Library at SBLCs & ATIs. They can also ulize

the facilies of Book Bank wherever it is maintained.

Pensioners can avail Canteen Facility, wherever it is available at the Bank’s Oces.

Please note that the outgoing as well as incoming mails from ‘@sbi.co.in’ domain will

be stopped from the date of rerement / resignaon. Please therefore, arrange to

save the important emails received on ocial email Id. However, pensioners can use

any other mail ID (yahoo, Gmail etc.) aer rerement. For registering other Email ID

it can be provided while subming pension proposal in HRMS or can be updated by

the pension paying branch or by PPG Department of the Circle on the basis of mail

send by the pensioners.

For using facilies under HRMS, pensioners are supposed to connue PF ID as USER

ID even aer rerement and same password to be connued. In case a password is

forgoen, then go to opon FORGOT PASSWORD, then the password will be reset by

HRMS and will be mailed to registered mail ID of a pensioner. For all purposes the

MOBILE Number and MAIL ID should be necessarily available in HRMS.

24

i. Pension

(Not applicable to Members of

New Pension Scheme: those

employees who joined the

Bank on or aer 01.08.2010)

For Ocers: Payable, on compleon of 20

years of pensionable service (excluding

probaon period in case of non-direct

ocers), if permied by the Competent

Authority to rere from Bank’s service

subject to giving three months’ noce in

wring or pay in lieu thereof, unless this

requirement is wholly or partly waived by

the Competent Authority [Proviso 4 of Rule

19(1) of SBI Ocers’ Service Rules, 1992].

For Clerical Sta : Payable, on compleon of

20 years of pensionable service (excluding

probaon period), if permied by the

Competent Authority to rere from Bank’s

service subject to giving one month’s noce

in wring or pay in lieu thereof.

ii. SBI Rered Employees Medical

Benet Scheme (SBIREMBS)

Eligible if the VRS optee has completed 30

years of service and 58 years of age. Both

the condions are to be fullled.

iii. Retenon of Accommodaon

/ Car / Telephone aer

rerement

Ocer may retain the accommodaon

(including designated house), telephone

and car upto the maximum period of

1 month from the date of Voluntary

Rerement.

iv. Laptop to TEGS-VI and above It can be retained aer paying the book

value of the laptop.

v. Ownership of Car (applicable)

to TEGSS-I & above

Not available

vi. i-Pad to TEGS-VI and above It can be retained aer paying the book

value of i-Pad.

vii. Availing LTC / HTC aer

rerement

Not eligible

25

vii. Connuance of Sta Housing

Loan aer rerement.

Not permied under Voluntary Rerement.

However, the same can be connued

on public terms on producon of an in-

principle approval from the authority

competent to sancon the Housing Term

Loan on Public Terms before Voluntary

Rerement.

viii. Presentaon of Memento Not eligible

x. Transion to Rerement

Programme for rering Ocers

of applicable grades and their

spouses

Not eligible

x. Engagement in Bank on

contract basis

Not eligible

xii. Medical facilies in Bank’s

dispensaries

Same as normal rerement if he is not

gainfully employed elsewhere.

In terms of e-Circular No. P&HRD-PM/67/2018-19 dated 31.10.2018, employees

who rere aer pung in at least 30 years of pensionable service and aer aaining

the age of 58 years and above (both the condions to be fullled) as on the date

of applying for voluntary rerement have been made eligible for all the benets /

facilies as available on normal rerement on opng for Voluntary Rerement

In case of grievance the pensioner can approach AGM (PPG) of the LHO controlling

his / her pension paying Branch on email-id as under:

26

A new plaorm for lodging complaints and grievances introduced for the benet of

pensioners / family pensioners by mail is SANJEEVANI. Aggrieved pensioner can sent

mail to

As per Circular No. CDO/P&HRD-PM/58/2011-12 dated 23

rd

August,2011 and CSO/

P&HRD-PM/25/2018-19 dated 11

th

July,2018

Pensioner is supposed to submit the Life Cercate in the month of November every

year to the pension paying Branch or at any nearby Branch. It is updated in HRMS and

accordingly SMS and E-mail conrming the updaon is sent to the pensioner. Regular

SMS and E-mails are also sent to the defaulng pensioners. Pensioner can also submit

Life Cercate biometrically through Jeevan Praman for which Aadhar number is to

be seeded in HRMS as well as in CBS.

However, if Life Cercate is not submied even upto the end of January, then the

Pension payment is disconnued from the month of February. There is a provision

in HRMS to restore the payment of the Pension and payment of arrears along with

monthly Pension as soon as the Life Cercate is submied.

27

A scheme for ‘Assistance to Rered Employees in case of Crical Illness’ has been

introduced to provide assistance to rered employees/ family pensioners for meeng

medical expenses in respect of idened crical diseases. The fund allocated under

the head is kept at Corporate Centre for centralised payment of medical bills. The

details of the Scheme, Standard Operang Procedure (SOP) and the format of

‘Applicaon by Rered Employees/ Family Pensioners for Assistance’ are enclosed as

respecvely.

All employees of State Bank of India on superannuaon from the Bank or those who

have taken VRS aer aaining 58 years of age, their spouses and disabled children, if

any, shall be covered under the scheme. The coverage shall also be extended to family

pensioners. The employees who were discharged/ dismissed/ removed/ compulsorily

rered/ terminated from service will not be covered. The scheme will cover medical

expenses incurred by the rered employees/ family pensioners on or aer 1st April

of the nancial year for crical diseases.

Medical expenses incurred on crical illness in respect of specied diseases as

menoned below shall be covered-

1 Cancer

2 Cardiac Surgery/ Serious Heart Ailments

3 Kidney/ Liver Transplant

4 Dialysis

5 Illness/ Accidents of serious nature involving major surgeries/ life support

system

i) In case of rered employees / family pensioners covered under ‘SBI Health Assist’

/ ‘SBI Health Care’, the Bank Shall provide assistance to the extent of 50% of the

28

medical expenses incurred above the amount payable under the medical scheme

/ insurance policy. The maximum amount of assistance shall be restricted to Rs.

5.00 lacs.

ii) In case of rered employees / family pensioners not covered under ‘SBI Health

Assist’ / ‘SBI Health Care’ the Bank shall provide assistance to the extent of 50%

of the medical expenses incurred above Rs. 3.00 lacs. The maximum amount of

assistance shall be restricted to Rs. 5.00 lacs.

iii) The assistance shall be provided on rst come rst serve basis, subject to

availability of fund.

iv) The facility can be availed only on one instance per rered employee / family

pensioner in a year in respect of specied diseases.

The ‘Standard Operang Procedure’ for submission of claims under the scheme is

placed as Annexure ‘B’.

i) The rered employees / family pensioners shall submit their applicaon for

assistance regarding their medical expenses for crical illness at the respecve

Administrave Oces, under whose control they are geng pension. The

doctor’s prescripon along with discharge summary of hospitalisaon and other

original bills / receipts should be aached to the applicaon.

ii) The Chief Manager (HR) shall be the Nodal Ocer at Administrave Oces. He/

she will arrange to enter the details of applicaon immediately in the portal

opened for the purpose. The Link for the portal is available on intranet at:

Human Resources - Important News- Assistance to Rered Employees/ Family

Pensioners in case of crical illness.

The user ID of employee at each AO shall be created by the IR Department,

Corporate Centre, Mumbai. The details of applicaons shall be entered within

the portal under ‘User Menu’ Create new Applicaon. A cket number will be

generated, which shall be menoned on the applicaon form.

iii) The bills shall be scrunized by the Bank Medical Ocer at Administrave Oce

before submission. The Administrave Oces shall ensure that all relevant

papers as menoned in para 2 (i) above are aached to the applicaons and

shall forward the same to the Deputy General Manager (IR), State Bank of

India, Industrial Relaons Department, Corporate Centre, Madame Cama Road,

Mumbai, under the signature of the Deputy General Manager (B&O).

29

iv) The Industrial Relaons Department at Corporate Centre shall be responsible

for processing of applicaons and obtaining the approval of the concerned

commiee.

v) Once approved by the Commiee, the Industrial Relaons Department at

Corporate Centre shall enter the date of approval in the portal and forward the

approved applicaons to Oce Administraon Department at Corporate Centre

for payment.

vi) In case the applicaon is not approved, the Commiee shall specify the reason

and the same shall be menoned in the portal by the Industrial Relaons

Department at Corporate Centre.

vii) The Oce Administraon Department at Corporate Centre will make payment

by debing the BGL Account ‘Sta Welfare Fund’.

viii) The declined applicaons shall be returned by the Industrial Relaons Department

at Corporate Centre to the concerned Administrave Oce, assigning the reason

of return.

ix) The Administrave Oce will, in turn, return the applicaons to the applicant at

the recorded address.

Medicines are provided from the available stock at dispensaries run by Corporate

Centre, Local Head Oces, Administrave Oces and at a few selected

dispensaries to the pensioners and their eligible family members. Services of

specialist doctors are also available in some of these dispensaries.

i. Up to the

scale of

MMGS-III

In Circles:

An Authority not below the rank of DGM.

In CC & its establishments:

An Authority not below the rank of DGM.

If DGM or above is not available, DGM (PM &

PPG).

No Change

ii. SMGS-IV &V In Circles: Authority not below the rank of GM of

respecve Network. For other establishments

in the Circles, senior-most

GM will be the authority.

In CC & its establishments/ on deputaon:

Authority not below the rank of GM.

If the Department is not headed by GM or

above, GM (CS).

No Change

30

iii. TEGS VI & VII CGM (Circle)/ An authority not below the rank

of CGM for CC/ CC establishments/deputaon

to other organizaon. If the Department is not

headed by CGM or above, CGM (HR) is the

competent authority.

No Change

iv. TEGSS-I DMD (COO) for Circles and DMD (HR) & CDO

for CC & CC Establishments/deputaon to

other organizaons

No Change

v. TEGSS-II Respecve MD of the Vercal/If the vercal is

not headed by MD, Chairman is the competent

authority.

No Change

vi. Ex-MDs &

Chairman

ECCB No Change

-

1. Name of the Rered Employee/ Family Pensioner

2. Name of the Rered Employee (in case of family pensioner)

3. PF No.

4. Address & Mobile No.

5. Grade in which the employee rered

6. Name & Code of Pension Paying Branch

7. Account No.

8. Name of the family member hospitalised/undergoing treatment & Relaonship

with the Rered Employee

9. Parculars of Treatment

a) Name of the Disease

b) Period of Hospitalisaon / Treatment

10. Total Expenses Incurred

11. Insurance Cover Available, if any

a) Policy No.

b) Amount

31

We have scrunised the applicaon and recommend it for Corporate Centre

consideraon.

Place:

Date:

Stamp/Seal

Sr. No.

Parculars Details

1. Total expenses

2. Amount payable under Medical Scheme/Insurance Policy, if any

3. a) Amount (1 minus 2)

b) 50% of the above amount i.e. 3 (a)

c) Admissible Assistance (Maximum Rs. 5.00 lacs)

4. a) Amount (Item 1 minus Rs. 3.00 lacs)

b) 50% of the above amount i.e. 4 (a)

c) Admissible Assistance (Maximum Rs. 5.00 lacs)

Ex-graa lumpsum amount will be paid to the dependents/s of employee who dies in

service of prematurely rered due to incapacitaon before reaching 55 years of age,

subject to fullment of laid down eligibility norms.

Coverage:

The scheme will be applicable in the following cases of employees:

(i) Employees dying in harness

(ii) Employees seeking premature rerement due to incapacitaon before reaching

the age of 55 years.

32

Amount of Ex-graa

The amount of ex-graa to be calculated as 60% of the last drawn salary, net of taxes,

for each month of remaining service of the employee up to the age of superannuaon

at the me of his death/ incapacitaon, subject to cadre wise ceiling and oor amount

as menoned below:

Supervising Rs.14.00 lacs Rs. 7.00 lacs

Clerical Rs. 12.00 lacs Rs. 6.00 lacs

Subordinate Rs. 10.00 lacs Rs. 5.00 lacs

Sampoorn Suraksha”

Bank has taken graded group life insurance policy “Sampoorn Suraksha Policy” from

SBI Life Insurance Ltd. to cover the life of all permanent employees in the Bank. This

policy is uniformly applicable throughout the country and covers all deaths during

service, whether on duty or otherwise. The sum assured for various grades of the

employees as per the exisng policy is as under:

Grade Chairman/

MD/ DMD

TEGSS-I/

TEGS-VII

TEGS-VI SMGS-V SMGS-IV MMGS-III/

MMGS-II/

JMGS-I

Clerk Sub-

Sta

Sum Assured 24 lacs 20 lacs 16 lacs 14 lacs 12 lacs 10 lacs 8 lacs 6 lacs

Path to download claim form:

SBI Times>Human Resources> PM & PPG> PMD> SBI Life Claim Form

The branch last served by the employee, would advise the nominee regarding the

procedure of applying for the claim on death of the employee. The nominee will have

to submit the claim form along with requisite document at the branch for further

submission to SBI Life Insurance Co. Ltd.

Swarna Ganga”

Bank had launched on a one me basis, a voluntary Group Saving Linked Insurance

scheme for the employees and their spouse in the year 2011-12. Under this product

monthly regular premiums are deducted from the salary of the employees who have

already enrolled under the scheme.

Sum-Assured

Sub-sta Rs.2,00,000/- Rs. 2,00,000/-

Award Sta Rs. 4,00,000/- Rs. 4,00,000/-

Ocers Rs. 6,00,000/- Rs. 6,00,000/-

*Accident Death and total permanent disability rider.

33

Benets:

i. Death Benets: If the member is in-force on the date of death, SBI Life will pay

Basic Sum Assured. It will also pay Fund Value. If the member cover is in lapse

status on the date of death, only Fund Value will be paid.

ii. Rider Benets: If the member opts for ADTPD rider and the rider cover is in force,

SBI Life will pay the rider sum assured on death due to accident. On occurrence

of total permanent disability due to accident, the rider sum assured and Fund

Value will be paid.

iii. Maturity Benets: Fund Value will be paid.

How to claim:

1. On rerement-

The rered employee has to submit the applicaon for claiming the maturity

amount through online portal of SBI Life.

The employee can extend the term of the policy up to the age of 65 years by

applying to SBI Life through the branch & making payment of monthly premium

amount.

2. On death during currency of the policy:-

The branch last served by the employee would inmate the nominee of the

deceased employee and would arrange for submission of requisite claim form

through online portal of SBI Life.

Path: (hps:/www.sbilife.co.in)

Ø Services

Ø Claim & Maturity

1. Please refer to e-circular No. CDO/P&HRD-PPFG/70/2018-19 dated 1

st

January,

2019 advising renewal of Group Mediclaim Policy for SBI rerees (Policy ‘B’) with

eect from January 16, 2019 and modicaons in terms and condions of the

policy. The policy is due for renewal on 16.01.2020.

2. In view of rising annual premium under both the above policies coupled with

inaon in cost of medical treatment, it has now been decided to recast the

exisng schemes with the following objecves;

i. To provide holisc soluon with new Health Care plans

ii. To provide good health care to our rerees at an aordable cost

iii. To subsidize a part of the health expenditure of rerees

34

3. The policies are renamed as under;

Policy ‘B’ Annual Payment Plan (APP) “SBI Health Assist”

SBI-REMBS One Time Payment Plan (OTPP) “SBI Health Care”

A. “SBI Health Assist”

has been selected for serving both the

policies i.e. APP and OTPP with a provision for

annual renewal. Membership of Annual Payment Plan (exisng Policy ‘B’)

will be voluntary and those eligible can obtain membership of the same by

paying the annual premium from their own sources.

a) Exisng members under Policy ‘B’.

b) Employees who rered during the months of October, November &

December 2019 would be eligible to join the policy and no waing

period clause will be applicable for them.

c) Eligible new rerees (rered on or aer 16.01.2020) may join APP (Policy

‘B’) within 90 daysfrom the date of rerement by paying the premium

from their own sources. Pro-rata premium would be applicable in case

of such rerees.

d) Spouses of deceased employees may join APP (Policy ‘B’) within 120

daysfrom the date of death by paying the premium from their own

sources. Pro-rata premium would be payable in such cases.

(a) Members of SBI-REMBS will be given the opon to join APP (Policy-B)

irrespecve of their residual balances. It is also proposed that they

would be able to opt for any Sum Insured with or without Crical

Illness cover at any point of me during the cover period by paying

full year’s premium as per the plan chosen. However, for such rerees,

there will be 30 days’ waing period from the date of their joining APP

(Policy-B) and Sum Insured under APP (Policy-B) for these members will

not be available for reimbursement of expenses incurred on ongoing

hospitalizaon at the me of taking such membership.

(b) All le out rerees, e-AB rerees, spouses of le out rerees & e-AB

rerees will be eligible to become members of APP (Policy-B) by paying

premium from their own sources. However, for these members, there

will be a waing period of 30 days from the date of their joining APP

(Policy-B). Sum Insured under APP (Policy-B) for these members will

35

not be available for reimbursement of expenses incurred on ongoing

hospitalizaon at the me of taking such membership.

Employees who are / were discharged / dismissed / compulsorily rered

/ terminated from service will not be eligible to join the policy.

“SBI Health Assist”

The exisng structure of four plans has been done away with. Now,

there will be only two Basic Sum Insured limits of Rs. 3.00 lakhs & Rs.

5.00 lakhs under the APP. There will be no bar for rerees in opng for

any Sum Insured :

3.00 16,542 2,978 19,520

5.00 36,771 6,619 43,390

Super Top-up plan will be available to all members for Rs. 6.00 lakhs

along with the Basic Plans as an addional health cover.

(Rupees in Lakhs)

3.00 6.00 9.00 2.50

5.00 6.00 11.00 2.50

There will be a ‘Deducble’ limit of Rs. 2.50 lakhs under the Super Top-

up cover. In case of a claim being raised, Basic Sum Insured will trigger

rst and only aer Basic Sum Insured is completely exhausted, Super

Top Up policy will be acvated / ulized. The ‘Deducble’ amount will

be taken from the Base policy, if triggered.

For example, in case there is a claim of Rs. 5.00 lakhs under Super Top-

up plan of Rs. 6.00 lakhs with a Base policy of Rs. 3.00 lakhs, base policy

of Rs. 3.00 lakhs will be used rst and it will be considered that the

pensioner has contributed his poron of ‘Deducble’ amount out of the

Base plan, and thereby, remaining amount of Rs. 2.00 lakhs of the claim

will be seled from the Super Top-up plan. The rerees will not have to

pay the ‘Deducble’ amount of Rs. 2.50 lakhs from their own pocket.

36

The ailment wise cappings were introduced in the year 2017-18 with the

idea to restrict the premium from increasing abnormally. The cappings

have been revised commensurate with the present cost for treatment

of these ailments as under:

(Amount in Rupees)

1 Angioplasty 1,50,000

2 Coronary Artery

Bypass Gra

2,50,000

3 Cataract 30,000

4 Cholecystectomy 70,000

5 Hernia 70,000

6 Knee Replacement -

Unilateral

1,75,000

7 Knee Replacement -

Bilateral

2,50,000

8 Prostate (Other than

treatment of Prostate

Cancer)

80,000

Based on reports regarding deducons on account of lower Room Rent

/ ICU Rent / ICCU Rent eligibilies, it is also proposed to revise Room

Rent / ICU Rent / ICCU Rent caps under the policy as under :

(Amount in Rupees)

(Rs. in Lakhs)

Rent

Rent

3.00 4,000 7,500 5,000 9,500

5.00 4,000 7,500 7,500 12,000

As a measure of nancial support to family pensioners / senior rerees,

it has been decided to allow 50 % subsidy on Base Premium of Rs. 3.00

lakhs under APP (Policy ‘B’) to all Family Pensioners and to pensioners

37

70 years of age and above on the date of renewal (i.e. on 16.01.2020).

Rerees 70 years of age and above & family pensioners, who are not in

the exisng policy, shall also be eligible to avail subsidy on enrolment.

(Amount in Rupees)

(Rs. in Lakhs)

3.00 16,542 8,271

5.00 36,771 8,271

GST or other taxes / surcharges, if any, on premium will be borne by the

rerees.

Members would be required to make payment of premium in full. Aer

compleon of renewal process, member wise list of eligible rerees

will be prepared by concerned Administrave Oces and sent to their

LHOs for compilaon of data. LHOs shall submit the consolidated data

to Corporate Centre for reimbursement of subsidy to eligible members.

Reimbursement of subsidy will be made by Corporate Centre directly to

the pension accounts of members.

As per the terms and condions of our Request for Proposal (RFP),

premium quotes were obtained for three year period with a provision

of annual renewal. Annual renewal will be done as per the terms of the

RFP accepted by SBI General Insurance Co. Ltd. This is done with a view

to ensure connuity of Insurance Co. / TPAs etc. The premium will not

undergo an upward revision during the three year period, if the policy is

connued with SBI General Insurance Co.

It has been observed that rerees / family pensioners face dicules

with the two policies (Policy ‘B’ and Policy ‘A’) running with two dierent

companies. Operaonal funconaries at Administrave Oces also face

dicules in idenfying the TPA for members. Therefore, it has been

decided to make both the policies co-terminus from 16

th

January, 2021

onwards. AAP (Policy ‘B’) will be renewed with SBI General Insurance

Co. Ltd. on its due date i.e. on 16

th

January, 2020 and OTPP (Policy ‘A’)

will be renewed with SBI General Insurance Co. Ltd. from 1

st

June, 2020

to 15

th

January, 2021. From 16

th

January, 2021, both the policies will

run concurrently. Exisng Policy-A will connue to be with IFFCO Tokio

General Insurance Co. Ltd. unl 31

st

may, 2020.

38

There will be no provision of domiciliary cover in APP (Policy ‘B’). To

support the members of APP meet the domiciliary medical expenses, it

has been decided to provide e-Pharmacy facility to all members of APP

(Policy ‘B’) upto Rs. 18,000/- with an own contribuon of Rs. 6,000/-.

Bank is in the process of making arrangements with a reputed company

in e-Pharmacy eld for provision of such services.

(Amount in Rupees)

(to be provided outside

Insurance Policy)

Rs.18,000/- Rs.6,000/- Rs.12,000/-

The details of the scheme / modus of operaon etc. will be circularized

separately.

An oponal Crical Illness cover for Rs. 5.00 lakhs was provided in the

policy during the last renewal for the undernoted six specied diseases:

i) Stroke resulng in permanent symptoms

ii) Cancer of specied severity

iii) Kidney failure requiring regular dialysis

iv) Major organ / bone marrow transplant

v) Mulple sclerosis with persisng symptoms

vi) Open chest CABG (Coronary Artery Surgery)

It is proposed to include the following addional diseases under the

Crical Illness cover:

i) First Heart aack

ii) Coma of specied severity

iii) Heart valve replacement

iv) Permanent paralysis of limbs

v) Motor neuron disease with permanent symptoms

vi) Aorta Gra surgery

vii) Total blindness

viii) Open heart replacement or repair of heart valves

39

The premium applicable for the oponal Crical Illness cover is as under:

(Amount in Rupees)

5,00,000 13,774 2,479 16,253

Other terms & condions for availing Crical Illness cover shall be

as under:

a) Crical Illness Cover will not be available separately and can only be

taken with Basic and Super Top up covers taken together.

b) Entry shall be available only upto the age of 65 (as on 16.01.2020).

However, renewals can be done beyond 65 years on a connuous

basis.

c) There will be a waing period of 90 days and surviving period of 30

days under the policy.

d) Members who have opted for Crical Illness Cover in the past may

connue to take the cover. Waing period of 90 days will not be

applicable to such members.

e) Pre-exisng ailments will not be covered under the Crical Illness

Cover.

f) Crical Illness Cover will be available only to the primary member

and not to spouse / dependent.

In an event of the insured person being diagnosed with one of

the crical illnesses dened in the policy aer the lapse of waing

period of 90 days and surviving period of 30 days, the Insurance

Co. would pay the full sum insured under the crical illness cover

to the insured member. However, waing period & entry age

of 65 yrs. would not be applicable for those Rerees who are

exisng members of Crical illness cover under the expiring Policy

for ailments from serial number I to VI. Thus, for a claim to be

admissible under Crical Illness cover, two condions have to be

complied with – (i) no claim would be admissible for rst 90 days (ii)

Aer the waing period of 90 days, if the insured is diagnosed with

any of the 14 listed ailments and survives for 30 days aer the rst

detecon of the disease, total cover amount (Rs. 5.00 lakhs) under

the crical illness will become admissible.

The Insurance company shall pay the insured person only once

in respect of any one of the covered illness under the policy. The

40

Crical Illness Cover ceases aer admission of any claim and no

further claim will be admissible under the said Cover. However,

benets under the Base plan or the Super Top-up Plan would

connue to be available as per the terms & condions of the said

coverage and the available sum insured.

The opon for Crical Illness plan has to be exercised simultaneously

with the Base Plan + Super Top-up Plan taken together and the

premium for the same is to be paid along with main policy (premium

on Super Top-up cover will be paid by the Bank). Crical Illness plan

cannot be availed at a later date if it is not opted for at the me of

enrolment / renewal.

The policy will cover reimbursement of expenses on dental treatment

only for Root Canal Treatment up to a maximum of Rs. 7,500 per annum

per family. Dental cover will not include extracon, lling, crowning or

restoraon. This will be an add-on benet to the members and will form

part of the Basic Sum Insured.

It is proposed that the membership under present structure to SBI-REMBS

will be frozen as on 31

st

December, 2019 and memberships will be allowed

to subsequent rerees only under a new structure / plan. All the members

(exisng & new) will connue to avail their benets upto their residual

balances under the REMB Trust Rules as at present.

One Time Payment Plan (OTPP) – “SBI Health care” :

The plan under SBI-REMBT will be applicable for the employees rering

on or aer 1

st

January, 2020. Based on actuarial assessment, member’s

contribuon towards the Life me Limits under the new plan have been

revised as under :

(Rupees in lakhs)

7.00 1.63

10.00 2.30

15.00 3.00

20.00 3.75

Eligibility criteria for membership will be same as exisng SBI Rered

Employees’ Medical Benet Scheme. However, rerees eligible for cover

under OTPP can choose any of the Life me Limits as per their medical need

by paying the contribuon amount and the same shall not be designaon

41

linked. The plan will cover pensioners, their spouses and disabled children, if

any. Other terms & condions of the scheme will be as under:

a. New members under OTPP will be migrated to an insurance policy as

is done in case of exisng members of SBI-REMBS one month aer

racaon of their membership in the Trust.

b. The exisng policy with IFFCO Tokio General Insurance Co. Ltd. will

connue up to 31

st

May, 2020 with no changes in policy terms.

c. Old and new members joining OTPP will be covered under the exisng

policy ll 31

st

May, 2020.

d. Insurance cover for members under SBI-REMBS / OTPP will be provided

by SBI General Insurance Co. Ltd. from 1

st

June, 2020 onwards.

Modied Policy ‘A’ (OTPP) with eect from 1

st

June, 2020

Insurance cover for SBI-REMBS / OTPP members w.e.f. 1

st

June, 2020 will be

as under:

a. The insurance cover will be provided by SBI General Insurance Co. Ltd.

b. Insurance will be taken for the members whose residual balance is Rs.

3.00 lakhs and above.

c. Medical claims of members having balance below Rs. 3.00 lakhs will be

paid by the Trust and they will be out of the insurance scheme.

d. Any amount of claim beyond total allocated limit in the Insurance Policy

will be paid by the Trust.

As a measure to control the premium and for allocang jused

Basic Cover, members having residual balance of Rs. 3.00 lakhs to

Rs. 10.00 lakhs will be provided Basic Cover of Rs. 3.00 lakhs with a

Super Top Up cover of 6.00 lakhs. Proposed insurance cover under

OTPP will be as under w.e.f. 01.06.2020:

(Rupees in lakhs)

Rs. 3.00 lakhs to

below Rs. 10.00 lakhs

3.00 6.00 9.00

Rs. 10.00 lakhs and

above

5.00 6.00 11.00

42

Premium on both the Base Plan and Super Top-up cover will be

paid by the Trust.

There will be a ‘Deducble’ poron of Rs. 2.50 lakhs within the

Super Top-up cover. If Super Top-up cover is triggered, ‘Deducble’

poron will be taken from Base Plan, and members will not have to

pay from their own pocket.

For example, in case there is a claim of Rs. 5.00 lakhs under

Super Top-up plan of Rs. 6.00 lakhs with a Base policy of Rs. 3.00

lakhs, base policy of Rs. 3.00 lakhs will be used rst and it will

be considered that the pensioner has contributed his poron of

‘Deducble’ amount out of the Base plan, and thereby, remaining

amount of Rs. 2.00 lakhs of the claim will be seled from the Super

Top-up plan. In case the claim exceeds total cover taken by the

Bank, the excess amount over and above total cover will be paid by

the Trust (up to the residual amount under SBI-REMBS).

The domiciliary limit under OTPP will be upto 1 % of Life me Limit

annually subject to a cap of total 10 % for the life me. Annual

domiciliary limit under various Life me limits will be as under :

300000 3000

400000 4000

500000 5000

700000 7000

1000000 10000

1500000 15000

2000000 20000

Ailment wise expenditure capping under OTPP (SBI Health Care)

will be as under :

43

1 Angioplasty 1,50,000

2 Coronary Artery

Bypass Gra

2,50,000

3 Cataract 30,000

4 Cholecystectomy 70,000

5 Hernia 70,000