1

STATE BANK OF INDIA

KNOW YOUR SUPERANNUATION BENEFITS

(KYSB)

(UPDATED AS ON 31

ST

MAY,2018)

STATE BANK OF INDIA

HR (PPG) DEPARTMENT,

CORPORATE CENTRE, MUMBAI

2

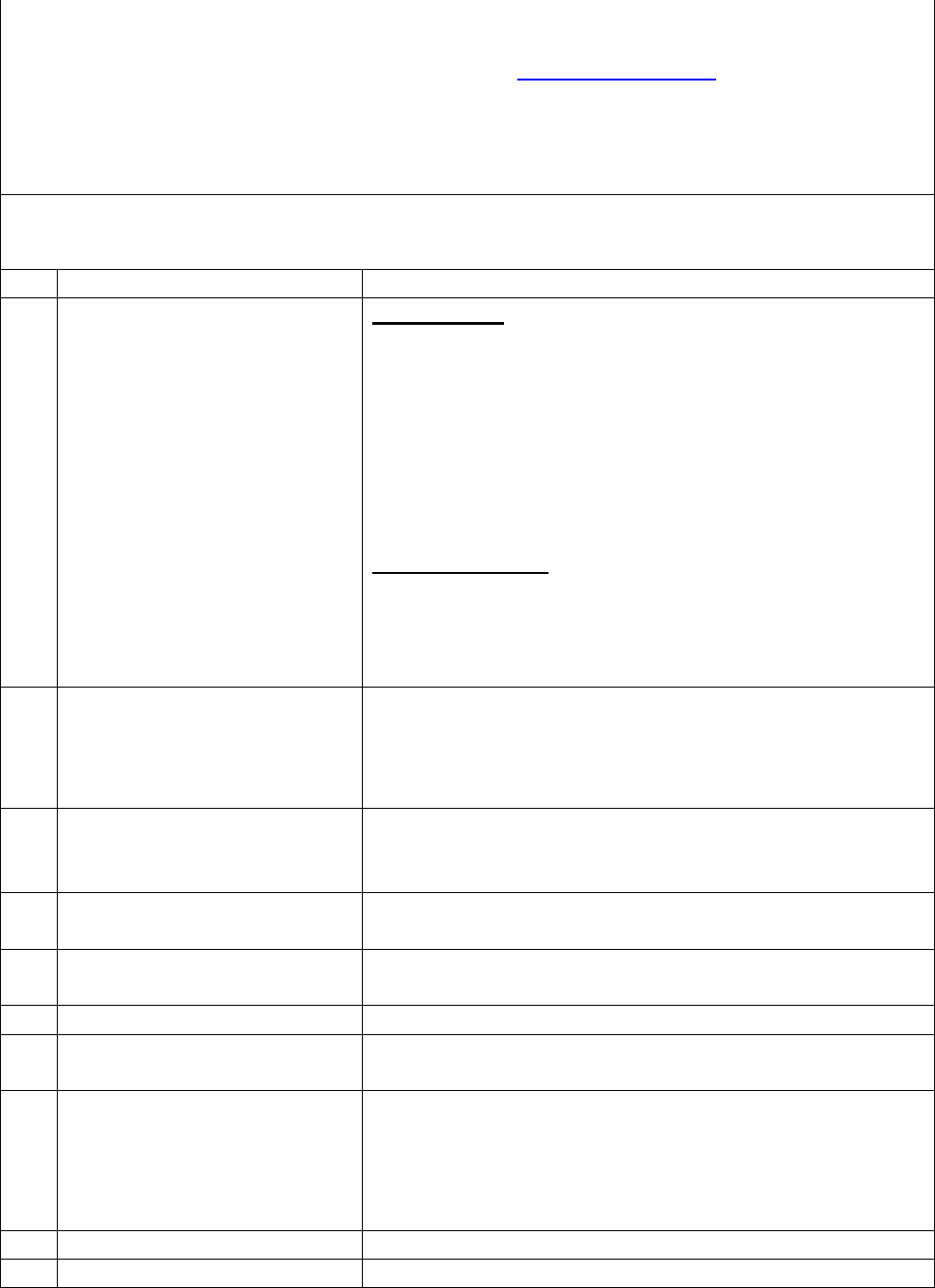

INDEX

Sl.

Subject

Page No.

01

Provident Fund

3

02

Gratuity

3

03

Pension

4

04

Commutation of Pension

5

05

Table of commutation factors

6

06

Family Pension

7

07

Group Mediclaim Policies for SBI Retirees

8

08

SBI Employees’ Mutual Welfare Scheme (SBIEMWS)

9

09

Leave Encashment

9

10

Retention of Accommodation, Car & Telephone after retirement

9

11

Travelling Expenses on retirement

10

12

Retention of Furniture/Fixture after retirement

10

13

Retention of Mobile Handset

10

14

Retention of Laptop

10

15

Ownership of Car- for Chairman, MDs, TEGSS-I & TEGSS-II

10

16

Retention of Apple i-PAD-2

10

17

Availing LTC

/

HTC after retirement

10

18

Concessionary Interest Rate Benefit

11

19

Continuance of Staff Housing Loan after retirement

11

20

Presentation of Memento

11

21

Availing Holiday Home, Transit House & Visiting Officers’ flat

11

22

Transition to Retirement Programme for TEGS-VI & above

11

23

Permission for Employment after retirement

11

24

Pensioner’s Identity Card

11

25

Pension Slip & Investment Declaration

11

26

Medical facilities at Bank’s Dispensaries

11

27

Entertainment Facilities

12

28

Canteen Facilities

12

29

Continuance of Group Insurance Schemes of SBI Life Insurance

12

30

No need to open new account for getting pension

/

family pension

12

31

Email Facility after retirement

12

32

Admissibility of superannuation benefits to VRS optees

13

33

Conditional admissibility of superannuation benefits to VRS optees

14

34

To do list before retirement

15

35

Application for retirement

Annex-1

36

Application for Refund of Provident Fund Balance on retirement

Annex-2

37

Application for Payment of Gratuity

Annex-3

38

Application for Payment of Pension

Annex-4

39

Money Receipt of Provident Fund

Annex-5

40

Money Receipt of Gratuity

Annex-6

41

Application for Leave Encashment

Annex-7

42

Mandate for Keeping proceeds of Leave Encashment

Annex-8

43

Declaration of Family Members

Annex-9

44

Declaration of Loans & Advances

Annex-10

45

Application for Pensioner’s Identity Card

Annex-11

46

Application for Refund under SBI-EMWS

Annex-12

47

Life Certificate format

Annex-13

48

Group Mediclaim Policy Application, Deceases covered, Room rent

capping, Categorization Centers, Deceaseswise Capping

Annex-14

3

Benefits available on Superannuation

1. Provident Fund

When a member resigns or retire from service of the Bank he shall, if he has served the Bank for a

period of five years or more, be entitled to receive the balance (Member’s Contribution + Bank’s

Contributions) at his credit in the fund.

When to apply

Within 3 months before retirement date.

How to apply

Member should apply through HRMS portal as under:

Log on to HRMS portal

Go to Employee Self Service -> PPFG -> Full & Final Settlement ->

fill up the form -> submit the form

Print the submitted form

Submit following (duly signed) forms to salary disbursing

authority

/

OAD:

i.

Printed copy of the application submitted online through

HRMS

ii.

C.O.S. 448 (Annex-5)

iii.

Particular of loans (Annex-10)

2. Gratuity

An employee who has put in a minimum of 5 years’ service is eligible for payment of gratuity under

the Payment of Gratuity Act, 1972. The amount will be payable @ 15 days wages for each

completed year of service on the basis of 26 working days in a month, subject to a ceiling of Rs.

20 lacs w.e.f. 29.03.2018. For the purpose of Gratuity, wages include the following:

i)

For Award Staff

: Wages = Basic Pay + D.A. + Personal Allowance + Acting Allowance +

Fixed Personal Allowance (FPA) + Professional Qualification Pay (PQA)

ii)

For Officers

: Wages = Basic Pay + D.A. + FPA + PQA

Formula for calculation of Gratuity:

Wages x 15 x No. of completed years of service

26

Example: Name - MR. AJIT KUMAR

Total Service (for Gratuity Calculation): 30 years.

Gratuity Payable= 99,340.09 x 15 X 33 = 49173344.55 = Rs. 18,91,282/-

26 26

Date of Joining

16/01/1985

Date of Confirmation

16/01/1985

Date of Retirement

31/03/2018

Extra Ordinary leave

0 days

Total Service

30 years, 6 months and 15 days

Last drawn salary Details:

Basic : Rs. 66,070/-, D.A. : Rs. 29,594.09, FPA : Rs. 1,996/-, PQA : Rs. 1,680/-

Total Salary : Rs. 99,340.09

4

Maximum amount of Gratuity Payable = Rs. 20,00,000=00 (Rupees twenty lacs only)

When to apply

Within 3 months before retirement date.

How to apply

Log on to HRMS portal

Go to Employee Self Service -> HR Initiatives -> PPFG -> Apply

Gratuity Payment Request -> submit the form

Take out the print by clicking on the ‘Print’ button & submit

(duly signed & witnessed) forms to salary disbursing authority /

OAD.

3. Pension

A member of the State Bank of India Employees’ Pension Fund shall be entitled for pension under

Rule 22 (i) while retiring from the Bank’s service :

a)

After having completed

20 years’ pensionable service

provided that he has attained the

age of 50 years; or

b)

If he is in the service of the Bank on or after 01.11.1993 after having completed 10 years

pensionable service

provided that he has attained the

age of 58 years

. Further, if he is in

the service of the Bank on or after 22.05.1998, after having completed 10 years’

pensionable service provided that he has attained the age of 60 years.

c)

After having completed

20 years’ pensionable service

irrespective of the age he shall have

attained, if he shall satisfy the Authority Competent to sanction his retirement by approved

medical certificate or otherwise that he has incapacitated for further active service,

d)

After having completed

20 years pensionable service

, irrespective of age he shall have

attained at his request in writing if accepted by the Competent Authority with effect from

20

th

September 1986.

e)

After having completed 25 years’ pensionable service.

Computation of amount of Basic Pension:

The maximum amount of pension for members of the Fund eligible for pension, who retired

/

retire while in service or otherwise cease to be in employment on or after 01.11.2012, shall be

computed as under:

PENSION CALCULATION FORMULA:

(a)

No. of years pensionable service

x Average substantive salary drawn

during the last 12 months’ pensionable

Service (not to be rounded off)

60

(b)

(i).

Where the average of monthly substantive salary drawn during the last 12 months’

pensionable service is upto Rs. 51,490/- p.m.

:

50%

of the average of monthly

substantive salary drawn during the last 12 months’ pensionable service + ½ of PQP + 1/2

of incremental component of FPP, wherever applicable.

(ii).

Where the average of monthly substantive salary drawn during the last 12 months’

pensionable service is above Rs. 51,490/- p.m. : 40% of the average of monthly

substantive salary drawn during the last 12 months’ pensionable service subject to

minimum of Rs. 25,745/- + ½ of PQP + ½ of incremental component of FPP, wherever

applicable.

5

In the case of (b)(i) : Lower of (a) and (b)(i) will be the basic Pension.

In the case of (b)(ii) : Lower of (a) and (b)(ii) will be the basic Pension.

Example:

Name - MR. AJIT KUMAR (Date of Birth: 14.07.1960)

(a) 66,070 x 366 months = Rs. 33,586.00

60 x 12

(b) (ii) 40% of 66,070 = Rs. 26,428.00

Plus : 1/2 of incremental component of FPA (1,990/-) = Rs. 995.00

Plus : 1/2 of PQA (Rs. 1680/-) = Rs. 840.00

Total : Rs. 28,263/-

Basic Pension = Lower of (a) and (b)(ii)

= Rs. 28,263=00

Dearness Relief (52.70% as on 31/05/2018) (+) Rs. 14,895=00

Total Pension (without commutation)

= Rs. 43,158=00

Dearness Relief on the basic pension is payable on the basis of

quarterly average of the All

India Consumer Price Index figures

for Industrial workers (base 1960=100).

Circulars on Dearness Relief are issued by Corporate Centre on half yearly basis in the

month of February and August every year as per the guidelines prescribed by IBA.

When to apply

Within 3 months before retirement date.

How to apply

Log on to HRMS portal

Go to Employee Self Service -> HR Initiatives -> PPFG -> Apply

Pension Proposal Request -> Fill up the necessary details -> Click

on ‘submit’ button.

Click on the ‘Print’ button -> four copies will be printed along

with the forwarding letter.

Put signature on all the copies in original, affix joint photographs

(self-attested) and submit to Branch Head

/

OAD.

Status can be viewed in the HRMS portal

4. Commutation of Pension

Retirees on or after 01.01.1986 are eligible for commutation of pension @

upto

1/3

rd

of their Basic

Pension. Request for commutation may be submitted by the retired employee within one year of

the date of retirement. However, if he applies for commutation after one year from the date of

retirement the amount of commutation is payable only after he has been medically examined by

the Medical Officer designated by the Bank.

Commutation factor is arrived at depending upon the age of the pensioner as on his next birthday.

If a member retires at the age of 60 years, for commutation, factor will be taken into account

Date of Joining

16/01/1985

Date of Confirmation

16/01/1985

Date of Retirement

31/07/2015

Extra Ordinary leave

366 days

Pensionable service

30 years, 6 months and 15 days or 366 months

Average salary drawn during last 12 months :

Basic : Rs. 66,070/-, D.A. : Rs. 29,594.09, FPA : Rs. 1,996/-, PQA : Rs. 1,680/-

Pensionable Pay : Basic : Rs. 66,070/-, FPA: Rs. 1,990/- & PQA : Rs. 1,680/-

6

applicable for the age of 61 years, which is 6.60.

Table of Commutation Factors:

Formula for Commutation:

1/3

rd

of Basic Pension x Commutation Factor as on next Birthday x 12

Example :

In the above example Basic Pension : Rs. 28,263.00

1/3

rd

of Basic Pension = 9421

Age on next Birthday = 55 years (Commutation Factor = 8.50)

Total Commutation = 9421 x 8.50 x 12 = Rs. 9,60,942.00

Total monthly pension after commutation will be Rs. 43,158 – Rs. 9,421 = Rs. 33,737

Commuted portion of pension will be recovered from monthly pension for a period of 15

years from the date of commutation.

Commuted portion of pension will be restored after the expiry of a period of 15 years from

the date of commutation.

No Medical examination is required if the pensioner opts for commutation within one year

of his retirement.

When to apply Simultaneously with Application for Pension

An employee is empowered to revoke his option for commutation any day up to the date

of retirement. However, after the date of retirement revocation of option for

commutation is

not possible.

Age as on next

Birthday

Commutation factor

Age as on next Birthday

Commutation factor

21

17.62

54

08.82

22

17.46

55

08.50

23

17.29

56

08.17

24

17.11

57

07.85

25

16.92

58

07.53

26

16.72

59

07.22

27

16.52

60

06.91

28

16.31

61

06.60

29

16.09

62

06.30

30

15.87

63

06.01

31

15.64

64

05.72

32

15.40

65

05.44

33

15.15

66

05.17

34

14.90

67

04.90

35

14.64

68

04.65

36

14.37

69

04.40

37

14.10

70

04.17

38

13.82

71

03.94

39

13.54

72

03.72

40

13.25

73

03.52

41

12.95

74

03.32

42

12.66

75

03.13

43

12.35

76

02.94

44

12.05

77

02.75

45

11.73

78

02.56

46

11.42

79

02.38

47

11.10

80

02.20

48

10.78

81

02.02

49

10.46

82

01.84

50

10.13

83

01.67

51

09.81

84

01.50

52

09.48

85

01.33

53

09.15

7

5. Family Pension

Spouse and dependent children of deceased pensioners & employees who died during service

after

one year of pensionable service are eligible for family pension.

Revised family pension is payable eligible members of the fund, who retired

/

retire on or after

01.11.2012 as under:

Scale of pay per month

Amount of monthly family pension

Up to Rs. 11,100/-

30% of ‘pay’ subject to minimum of Rs. 2,785/- per month

Rs. 11,101 to Rs.

22,200/-

20% of ‘pay’ subject to minimum of Rs. 3,422/- per month

Above Rs. 22,200/-

15% of ‘pay’ subject to minimum of Rs. 4,448/- per month and

Maximum of Rs. 9,284/-per month.

In case of part-time employees, the minimum amount of family pension and maximum amount of

family pension shall he in proportion to the rate of scale wages drawn by the employee.

In respect of employees other than part-time employees, who retired on or after 01.11.2012, the

amount of minimum pension shall be Rs. 2,785/- p.m. In respect of part-time employees who

retired on or after 01.11.2012, the minimum pension payable shall be as under:

(i)

Rs. 932/- p.m. for part-time employees drawing 1/3 scale wages,

(ii)

Rs. 1,397/- p.m. for part-time employees drawing 1/2 scale wages,

(iii)

Rs. 2,096/- p.m. for part-time employees drawing 3/4 scale wages.

GROUP MEDICLAIM POLICY FOR SBI RETIREES

(POLICY – ‘B’)

PRESENT POLICY TERM: 16.01.2018 – 15.01.2019

The policy is exclusively designed for the new retirees. This policy covers permanent employees

of the Bank, who retire on or after 1

st

January, 2016

/

Spouses of employees who die while in

service on or after 1

st

January, 2016.

Eligibility:

i.

SBI retirees on completion of pensionable service in the Bank.

ii.

Members of

National Pension System

on completion of 20 years of confirmed service

in

the Bank.

iii.

Spouse of SBI employee who died while in service or after retirement.

2.

Salient features of present policy term:

8

(i)

Separate policies for ‘With Domiciliary Cover’ and ‘Without Domiciliary Cover’

under each Plan (Sum Insured) to enable retirees to choose plans as per their

requirement.

(ii)

Under the ‘With Domiciliary Cover’ option, domiciliary treatment cover would be

available up to 10% of the Basic Sum Insured.

(iii)

Discontinuation of Plans I & J i.e. Sum Insured of Rs. 1.00 lacs & 2.00 lacs, which

were introduced last year, as these were basic plans with limited benefits and

membership under these plans has not been very encouraging.

(iv)

Rationalization of ceiling on room rents and ceiling on expenditures for certain

common diseases / ailments on the basis of categorization of centres where

treatment is taken. (Details placed in Annexure I).

(v)

There shall be restrictions on free entry / exit from the policy and also restrictions

on free movement between plans on renewal.

3.

Following are the premium terms:

Plan

Sum

Insured

Without Domiciliary Cover

With Domiciliary Cover

Premium

Rate

GST @

18%

Actual

Premium

Premium

Rate

GST @

18%

Actual

Premium

A

3,00,000

16,524

2,974

19,498

28,110

5,060

33,170

B

4,00,000

26,088

4,696

30,784

42,480

7,646

50,126

C

5,00,000

37,175

6,692

43,867

59,293

10,673

69,966

D

7,50,000

73,062

13,151

86,213

1,03,099

18,558

1,21,657

E

10,00,000

1,10,996

19,979

1,30,975

1,50,702

27,126

1,77,828

F

15,00,000

2,17,790

39,202

2,56,992

2,76,084

49,695

3,25,779

H

25,00,000

2,33,055

41,950

2,75,005

2,89,275

52,070

3,41,345

4.

Eligibility for Membership:

a)

The policy will continue to be available to the existing members enrolled and to

members of Policy ‘A’ subject to payment of renewal premium.

b)

The policy will continue to be available to the Independent Directors of the Bank,

subject to payment of premium from own sources.

(i)

Eligible new retirees / spouses of deceased employees may join the Policy

‘B’ within 60 days from the date retirement / death by paying the premium

from their own sources.

9

7.

SBI Employees’ Mutual Welfare Scheme

The following benefits are available to the retired employees and their spouse who are the members

of SBI Employees Mutual Welfare Scheme:

(i)

Full refund of contributions at the time of retirement without interest.

(ii)

Medical Benefits are payable as under:

Unit

90% of cost of

Hospitalization subject

to

life time limit of (Rs.)

Serious / special diseases

with or without

hospitalization subject to

life time limit of (Rs.)

General diseases life long as

per

column (c) within financial

limit of (Rs.)

Rs. 10/-

6,000/-

6,000/-

500/- per year

Rs. 20/-

15,000/-

15,000/-

1,000/- per year

Rs. 30/-

22,500/-

22,500/-

1,500/- per year

Rs. 40/-

30,000/-

30,000/-

2,000/- per year

(iii)

One time Lumpsum payment on death of member during service or after retirement; and

(iv)

Payment of Monthly Financial Relief on death of member during service or after

retirement as under:

Unit

One time lumpsum payment

Monthly Financial Relief

Rs. 10/-

10,000/-

200/- p.m.

Rs. 20/-

10,000/-

250/- p.m.

Rs. 30/-

15,000/-

375/- p.m.

Rs. 40/-

20,000/-

500/- p.m.

One time lumpsum payment is made to spouse (if married) and to nominees

/

legal heirs (if

unmarried).

Monthly Financial Relief is given to spouse (if married) and to nominees

/

legal heirs (if

unmarried).

For getting refund submit application as per the specimen in (Annex-13)

8.

Encashment of Leave

Retirees are eligible for encashment of Privilege Leave upto a maximum of 240 days against

available leave balance on the date of retirement (IT exemption available upto Rs. 3.00 lac).

When to apply Within 3 months before retirement date.

How to apply Submit the following forms to the salary disbursing authority

/

OAD:

i.

Application as per specimen in (Annex-7)

ii.

Mandate as per (Annex-8)

9.

Retention of Accommodation

/

Car

/

Telephone after Retirement

Officers may retain the accommodation (including designated house), telephone and car upto the

maximum period of 2 months from the date of normal retirement without any approval. Submit

application to the Controlling Authority

Cases relating to

Retention Period

Voluntary Retirement

1 month from the date of Voluntary (with or without re-

employment) Retirement

Resignation from service

15 days from the date of resignation.

Dismissal: Removal from

service

15 days from the date of receipt of order of dismissal

/

removal

from service.

1

0

10.Travelling Expenses on Retirement On retirement,

an officer is eligible to claim travelling allowance, baggage and other expenses for

himself

/

herself and his

/

her family as on transfer from the last station at which he

/

she is posted to the place where he

/

she

proposes to settle down on retirement.

The period of extension sought for in availing the facility of travelling allowance after retirement must not

exceed the period for which residential accommodation has been allowed by the competent authority

to be retained. In other words, the period for extension of the facility should be co-terminus with

vacation of the official residence.

11. Retention of Furniture

i.

If the date of purchase of furniture is more than five years- Ownership will be

transferred without any recovery.

ii.

If it is less than 5 year old – depreciated value based on the actual age of furniture

/

fixture

will be recovered.

12. Retention of Mobile Handset

To be retained without any cost if the age of handset is 1 year and above.

13. Retention of Laptop

To be retained without any cost if the age of laptop is 1 year and above. However, in case of VR

/

resignation, it can be retained after paying the book value of the laptop.

14. Ownership of Car applicable to: Chairman & MDs,

TEGSS-I & TEGSS-II

Ownership Options:

Existing vehicle in use by paying the depreciated value

Or

Bank’s owned vehicle from the car pool after paying the depreciated value

Or

New car under buy back arrangement of car in use and paying the difference amount i,e.

(depreciated value – buy back amount)

/

(Price of the Car – buy back value) as the case may be.

The price of car to be purchased shall be original cost without cost of registration, tax etc.

Calculation of Depreciated Value of Car

:

Age of the Car

Upto 1 year : 80% of Original Cost

> 1 year – upto 2 years

: 60% of Original Cost

> 2 years – upto 3 years

: 40% of Original Cost

> 3 years – upto 4 years

: 20% of Original Cost

> 4 years : Free of Cost

15. Retention of Apple i-PAD-2

Can be retained at no cost on retirement on superannuation.

16. Availing LTC

/

HTC after retirement

1

1

LTC

/

HTC may be permitted to be carried forward for maximum 4 months beyond the date of

retirement and in exceptional circumstance it is 6 months.

17. Concessionary Interest Rate Benefit

On deposit as applicable to staff members.

On advances against specified securities as applicable to staff members.

18. Continuance of Staff Housing Loan after retirement

In the cases of normal retirement repayment of Staff Housing Loan may be continued upto 75

years of age, irrespective of date of joining, subject to adequate and verifiable cash flows for

repayment of the loan to the satisfaction of sanctioning authority. To be reviewed at the time of

retirement, wherever necessary to ensure adequate repayment capacity as done hitherto.

19. Presentation of Memento

With effect from 16.03.2011:

Subordinate Staff

2500/-

TEG VI & VII

20,000/-

Clerical Staff

3750/-

TEG SS I & II

30,000/-

JMG-I & MMG-II

6250/-

Managing Directors

40,000/-

SMGS- III to V

10,000/-

Chairman

50,000/-

20. Holiday Home and Bank’s Guest House / Transit House /

Visiting Officers’ Flat

The benefit can be availed after retirement.

21. Transition to Retirement Programmed for retiring

Executives for TEGS-VI & above and their spouses

3 days training programme to enable the Executive to self-introspect and plan for the momentous

change in their lives on demitting office to ensure a smooth and enjoyable transition in post-

retirement life.Staff College, Hyderabad will advise in this matter.

22. Permission for Employment after retirement

Prior permission from competent authority is required for seeking employment in any other Bank

at any time or any other commercial employment within one year from the date of retirement to

protect their pension.

23. Pensioner’s Identity Card

Can be obtained from the Pension Paying Branch.

Submit application as per specimen in ( Annex-11)

24. Pension Slip & Investment Declaration

The Bank has again shifted the payment and processing of staff pension to HRMS from

CSPPC and Investment Declaration Form and Pension Slip is now available on

https://www.hrms.onlinesbi.com wherein you can log in by your PF Index as user ID and default

password as Hrms@123. Please contact LHO, PPG department for password problems.

25. Medical facilities – Dispensaries

1

2

Medicines are provided from the available stock at dispensaries run by Corporate Centre, Local

Head Offices, Administrative Offices and at a few selected dispensaries to the pensioners and their

family members (spouse). Services of specialist doctors are also available in these dispensaries.

26. Entertainment Facilities

Pensioners can avail the benefit of Bank’s Library at SBLCs & ATIs. They can also utilize the facilities

of Book Bank wherever it is maintained.

27. Canteen Facilities

Pensioners can avail Canteen Facility, wherever it is available at the Bank’s Offices.

28. Group Insurance Scheme of SBI Life – ‘Super Surakshya’

and ‘New Swarna Ganga Scheme’

Group Insurance Schemes of SBI Life viz. ‘Super Surakshya’ and ‘New Swarna Ganga Scheme’ may

be extended upto 65 years and the pensioner will arrange to pay the premium amount.

29. No need to open a new account for getting pension

/

Family Pension

Retiring SBI employees are not required to open a separate SB/CA for the purpose of getting

pension. Pension can be credited to the existing staff SB/CA of the pensioner.

On death of the staff pensioner, the family pensioner need not open a new SB/CA for the purpose

of getting family pension. Family pension can be credited to the existing joint SB/CA of staff

pensioner with ‘E or S’ facility.

30. Email ID

The outgoing mails from ‘@sbi.co.in’ domain will be stopped from the date of retirement

/

resignation. However, the retiring official is permitted to receive emails and use the mailbox on

EMS for two months after retirement.

2. Thereafter, the user will have to send the request through email for the creation of email-ID

under thistle domain providing the following details:

Sl

Field

Value

Remarks

1

Username

2

PF Index No.

3

Designation

4

Department

5

Circle

6

Bank

7

Mode of Retirement

8

Date of Retirement

9

Previous email-ID (sbi.co.in)

10

Contact details

11

Alternative email-ID

12

Pension drawing Branch details

(Branch code & Address)

1

3

3.

The email is to be sent to the following email-ID with the subject ‘New Email-ID under

thistle.co.in:<Name of the applicant>, <PF Index> : [email protected].

4.

After validating the data provided in the above form with the HRMS (or any other concerned

department) data, the email-ID will be created and informed to user on his alternative email-ID.

31. Non Admissibility / Conditional Admissibility of Superannuation

Benefits to Voluntary Retirement Optees

Sl

Benefits

Applicability on Voluntary Retirement

i.

Pension

(Not applicable to Members

of New Pension Scheme:

those employees who joined

the Bank on or after

01.08.2010)

For Officers : Payable, on completion of 20 years of

pensionable service (excluding confirmation period in case

of non direct officers), if permitted by the Competent

Authority to retire from Bank’s service subject to giving

three months’ notice in writing or pay in lieu thereof,

unless this requirement is wholly or partly waived by the

Competent Authority [Proviso 4 of Rule 19(1) of SBI

Officers’ Service Rules, 1992].

For Clerical Staff : Payable, on completion of 20 years of

pensionable service (excluding confirmation period), if

permitted by the Competent Authority to retire from

Bank’s service subject to giving one month’s notice in

writing or pay in lieu thereof.

ii.

SBI Retired Employees

Medical Benefit Scheme

(SBIREMBS)

Eligible only if retired under medical ground with

recommendation of medical board constituted by the Bank

and he

/

she is eligible for pension under applicable SBI

Employees’ Pension Fund Regulations.

iii.

Retention of Accommodation

/ Car / Telephone after

retirement

Officer may retain the

accommodation

(including

designated house), telephone and car upto the maximum

period of 1 month from the date of Voluntary Retirement.

iv.

Laptop to TEGS-VI and above

It can be retained after paying the book value of the

laptop.

v.

Ownership of Car (applicable

to TEGSS-I & above

Not available

vi.

i-Pad to TEGS-VI and above

It can be retained after paying the book value of i-Pad.

vii.

Availing LTC

/

HTC after

retirement

Not eligible

vii.

Continuance of Staff Housing

Loan after retirement.

Not permitted under Voluntary Retirement. However, the

same can be continued in

public terms

on production of an

in-principal approval from the authority competent to

sanction the Housing Term Loan on Public Terms before

Voluntary Retirement.

viii.

Presentation of Memento

Not eligible

ix.

Transition to Retirement

Not eligible

14

Programme for retiring

Officers of applicable grades

and their spouses

x.

Engagement in Bank on

contract basis

Not eligible

xii.

Medical facilities in Bank’s

dispensaries

Same as normal retirement if he is not gainfully employed

elsewhere.

32. All the above benefits allowed at par with normal retirees to

VRS Optees on fulfillment of certain conditions w.e.f.

07.10.2015

In terms of e-Circular No. CDO/P&HRD-PM/58/2015-16 dated 07.10.2015, employees who

retire after putting in at least

30 years of pensionable service

and after attaining the

age of 58

years and

above (both the conditions to be fulfilled) as on the date of applying for voluntary

retirement have been made eligible for all the benefits

/

facilities as available on normal

retirement on opting for Voluntary Retirement with effect from 07.10.2015 subject to fulfillment

of the following additional

stipulations:

Category

Additional stipulation

Clerical

No additional stipulation

Officers upto

SMGS-V

Minimum 3 (three) chances missed out for promotion from the present

grade to the next higher grade in the Bank. While reckoning missed

promotion opportunities from officers, the last two years of service before

normal age of superannuation called as ‘Residual Service’ will not be

counted.

‘OR’

On health ground :

Request of officers on extreme medical/health ground

may be considered on case to case basis depending on the seriousness of

ailments provided he/she is declared unfit by the Medical Officer/Medical

Board of the Bank for continuing in the service of the Bank.

Officers in TEGS-VI

and

above

Minimum 5 (five) chances missed out for promotion from the present

grade to the next higher grade in the Bank. While reckoning missed

promotion opportunities from officers, the last two years of service before

normal age of superannuation called as ‘Residual Service’ will not be

counted.

‘OR’

On health ground :

Request of officers on extreme medical/health ground

may be considered on case to case basis depending on the seriousness of

ailments provided he/she is declared unfit by the Medical Officer/Medical

Board of the Bank for continuing in the service of the Bank.

15

To do list before retirement

Obtain set of prescribed form for payment of Gratuity, Pension, Leave Encashment

etc. from OAD and submit the same (duly filled

/

signed) together with one passport

sized photograph for Pensioner’s Identity Card and 6 joint photographs with spouse

to OAD, Corporate Centre. (Specimen given in Annexures)

Arrange for cancellation of lien in respect of closed loan accounts through HRMS and

get the same approved by the Home Branch of the loan accounts.

Obtain in-principal approval from Housing Loan sanctioning authority for

continuance and repayment of Staff Housing Loan upto the age of 75 years and

/

or

Commercial Housing Loan, if any, after retirement (if desired).

Arrange for repayment of all other loans and dues to the Bank on or before date of

retirement, or else, the same will be liquidated from the proceeds of terminal

benefits.

To do list after retirement

Remember to submit Life Certificate at pension paying branch/ any other branch in

the month of November every year

(as per the specimen contained in Annex-14)

Remember to submit proofs of Investment at pension paying branch for effecting

calculation of income tax.

Remember to collect Form-16 from pension paying branch.

Retain a copy of Pension Payment Order (PPO) which is sent by Circle PPG

Department through Pension Paying Branch to you.

********

*******

*****

16

ANNEXURE-1

FORM “A”

The Chief General Manager,

State Bank of India,

Local Head Office,

_______________

Through : The Branch Manager

State Bank of India

____________ Branch

Dear Sir,

APPLICATION FOR RETIREMENT

I beg to inform you that I shall attain 60 years of age as at the close of business on ________

I shall be glad if you will kindly permit me to retire from Bank’s service as from the above date. I give

hereunder my address after retirement.

Address after retirement

Yours faithfully,

Name :____________________

Designation : ____________________

State Bank of India

______________________ Branch.

____________________

17

ANNEXURE-2

Form “D”

The Trustees,

State Bank of India Employees’ Provident Fund

State Bank of India,

Corporate Centre, MUMBAI

Through the :

State Bank of India

________________

Gentlemen,

APPLICATION FOR REFUND OF PROVIDENT FUND BALANCE ON RETIREMENT

I beg to advise that I shall finally retire from the service of the Bank as at the close of business on the

___________________.

2. I shall feel obliged if you will kindly arrange to refund me the balance standing at the credit of my account in

Provident Fund at an early date through Bank’s ___________ Branch.

My present address is given below.

Yours faithfully,

(Signature)

Name :____________________

Designation : ____________________

State Bank of India

______________________ Branch.

My present address:

____________________

____________________

Date : Signature verified

Branch Manager

State Bank of India

_______________ Branch.

18

ANNEXURE-3

The Chief General Manager,

State Bank of India,

Local Head Office,

_______________

Through : The _______________

State Bank of India

____________ Branch/Office

Dear Sir,

PAYMENT OF GRATUITY UNDER PAYMENT OF GRATUITY ACT, 1972

I shall retire / have retired from the service of the Bank as at the close of business on _________________ in terms

of the provisions of the Payment of Gratuity Act, 1972. I shall be glad if you will please arrange to pay me the gratuity

for which I am eligible, through your ____________________ Branch.

Yours faithfully,

(Signature)

Name :____________________

Designation : ____________________

State Bank of India

______________________ Branch.

Date :

Signature verified

Branch Manager

State Bank of India

Date : _______________ Branch.

19

ANNEXURE-4

Form “E”

The Trustees,

State Bank of India Employees’ Pension Fund

State Bank of India,

Corporate Centre, MUMBAI

Through the : ________________

State Bank of India

________________

Gentlemen,

APPLICATION FOR PAYMENT OF PENSION

I beg to inform you that I shall finally retire from the Bank’s service as at the close of business on _______________.

I shall be feel obliged if you will kindly arrange to pay me pension for which I am willing to drawn through the Bank’s

________________ Branch.

2. I also opt to commute 1/3

rd

of my pension : ( YES / NO)

My Present address is as under:

Yours faithfully,

(Signature)

Name :____________________

Designation : ____________________

P.F. Index No. :____________________

State Bank of India

_____________________ Branch/Office.

My present address:

____________________

____________________

Date : Signature verified

Branch Manager

State Bank of India

_______________ Branch/Office.

20

ANNEXURE-5

C.O.S. 448

STATE BANK OF INDIA EMPLOYEES’ PROVIDENT FUND

Rs. ________________________

Received from the Trustees of the State Bank of India Employees’ Provident Fund the sum of Rupees

____________________________________________________________ (in words) being the balance at my credit

in the Fund with interest thereon on the date of my leaving the Bank’s service.

Revenue Stamp

if over Rs. 500/-

Place : ________________

Date : ________________

(Signature)

WITNESS:-

Signature ___________________

Designation ___________________

Address ___________________

___________________

21

ANNEXURE-6

STATE BANK OF INDIA

RECEIPT

Received from State Bank of India a sum of Rs. ____________ (Rupees__________________

______________________________________________ only) being the amount of Gratuity sanctioned to me by the

Chief General Manager in terms of the provisions of payment of Gratuity Act, 1972.

Revenue Stamp if

over Rs. 500/-

Place :

Date : Receiver’s Signature

P.F. Index No. ___________

Name :

22

ANNEXURE-7

The Chief General Manager,

State Bank of India,

Local Head Office,

_______________

Through : The _______________

State Bank of India

____________ Branch/Office.

Dear Sir,

ENCASHMENT OF LEAVE

As I will be retiring from the Bank’s service as at the close of business on the ____________

_______________, I shall be glad if you will please permit me to encash the Privilege leave due to me at the time of

my retirement.

Thanking you,

Yours faithfully,

(Signature of Employee / Official)

Name : _____________________

Designation : _________________

P.F. Index No. _________________

Branch / Office _______________

____________________________

Date :

23

ANNEXURE-8

The Branch Manager /

AGM / CM, Office Administration Department,

State Bank of India,

__________________________ Branch / Office

Dear Sir,

LEAVE ENCASHMENT ON RETIREMENT

I have to state that I am retiring from Bank’s service as at the close of business on ________

_________ . Please keep the proceeds of my leave encashment on retirement in TDR / STDR for a period of

_________ months / year and mark a Lien over it till I vacate the Bank’s Quarter / Adjust my advance amount taken

against LFC / T.A. Bill.

Yours faithfully,

(Signature of Employee / Official)

Name : _____________________

Designation : _________________

P.F. Index No. _________________

Branch / Office _______________

____________________________

Date :

24

ANNEXURE-9

FAMILY PARTICULARS

I Name of wife (in full) : ________________________________________

Date of birth : ________________________________________

Occupation : ________________________________________

II Name of dependent children : ________________________________________

(Unmarried daughter etc.) : ________________________________________

Name Date of birth Occupation

1. ______________________ _____________ ___________

2. ______________________ _____________ ___________

3. ______________________ _____________ ___________

4. ______________________ _____________ ___________

III Permanent address after retirement : ___________________________________

________________________________________________________________________

________________________________________________________________________

________________________________________________________________________

IV Six (6) Joint passport sized photographs with spouse (enclosed).

25

ANNEXURE-10

The Branch Manager /

AGM / CM, Office Administration Department,

State Bank of India,

__________________________ Branch / Office

Dear Sir,

DETAILS / SETTLEMENT OF LOANS / ADVANCES

I will be retiring from the Bank’s service as at the close of business on ______________ . Following are my liabilities

towards the Bank as on the date of my retirement.

TYPE OF LOAN ACCOUNT NO. BRANCH (CODE) OUTSTANDING

1. _____________ _____________ ______________ _____________

2. _____________ _____________ ______________ _____________

3. _____________ _____________ ______________ _____________

4. _____________ _____________ ______________ _____________

5. _____________ _____________ ______________ _____________

I propose to liquidate above loans / Advances from my Terminal Benefits / own sources / to continue after my

retirement (applicable only in case of Housing Loan)

Yours faithfully,

(Signature of Employee / Official)

Name : _____________________

Designation : _________________

P.F. Index No. _________________

Branch / Office _______________

____________________________

Date :

26

ANNEXURE-11

The Branch Manager /

AGM / CM, Office Administration Department,

State Bank of India,

__________________________ Branch / Office

Date :

Dear Sir,

PENSIONER’S IDENTITY CARD

I request you to kindly arrange to issue me Pensioner’s Identity Card, as I am retiring on ________________. My Bio-

data is furnished below. I am also enclosing one passport sized photograph of myself.

1. NAME :____________________________

2. DESIGNATION (at the time of retirement) : ____________________________

3. P.F. INDEX NO. : ____________________________

4. DATE OF BIRTH : ____________________________

5. DATE OF RETIREMENT :_____________________________

6. BLOOD GROUP : ____________________________

7. POST RETIREMENT ADDRESS : ____________________________

____________________________

____________________________

8. TELEPHONE NO. (at the above address) : ____________________________

Yours faithfully,

(Signature of Employee / Official)

27

ANNEXURE-12

To,

The Chief Manager (HR)

State Bank of India,

________________Zonal Office,

__________________________

__________________________,

Date :

Dear Sir,

SUB : EMWS REFUND APPLICATION

I am a member of EMW Scheme. My unit of EMWS is Rs. _____ from ________________.

I have completed _______ years of age as on __________ and retired from Bank as ___________________

from _______________ Branch / Office on __________. The particulars of my membership/ posting since

_________till date is given below:-

Sl.

Name of the Branch

No. of

Months

Contribution

From

To

You are therefore, requested to refund my dues. Cheque may be sent to State Bank of India, __________________

Branch Saving Bank Account No. ___________________

Yours faithfully,

(Signature of Employee / Official)

Name : _____________________

Designation : ________________

P.F. Index No. ________________

Branch / Office _______________

____________________________

28

ANNEXURE-13

IBI/SBI/SBS/SBIN PENSION LIFE CERTIFICATE

Certified that Shri / Smt. ……………………………………. a pensioner of the Bank appeared before me today and signed /

affixed his / her L.T.I below in my presence.

_____________ _____________________________

Signature / L.T.I Branch Manager/Gazetted Officer

Date ……………. (Office seal)

Name of the Pensioner : ______________________

P.F. Index Number : ______________________

Pension A/c No. : ______________________

Name and Code of the

Pension paying Branch : ______________________

--------------------------------------------------------------------------------------------------------------------------

ACKNOWLEDGEMENT

(to be given to the applicant by the Branch receiving the Life Certificate)

Received from Shri/Smt. ________________________________ his / her Life Certificate on

_____________.

Date ____________

Branch __________ Signature of the officer

receiving Life Certificate

Seal of the Branch

29

ANNEXURE-14

GROUP MEDICLAIM POLICY FOR SBI RETIREES (POLICY-B)

For new members

APPLICATION FORM FOR POLICY-‘B’ (16.01.2018 – 15.01.2019)

Chief Manager State

Bank of India,

Branch / Zonal office,

Dear Sir,

SUB

:

F

a

m

il

y

Flo

a

t

e

r

Gr

o

u

p

H

ea

l

t

h

I

ns

ur

a

n

c

e

P

olicy

f

o

r

S

B

I

R

et

ir

ees Policy Period : 16.01.2018 –

15.01.2019

I

am

i

nt

e

r

e

s

ted

i

n

j

oin

i

ng

th

e

F

am

il

y

F

l

o

ate

r

Group

H

ea

l

th

I

nsur

an

c

e

P

ol

i

c

y

‘

B’

of

Stat

e

Ba

nk

of

I

ndi

a

and

fu

r

ni

s

h

th

e

r

e

qu

i

r

ed

i

nform

ati

on

as

un

der

:

Sl.

Particulars

Remarks

01

P.F Index No.

02

Name

03

Date of joining the Bank

04

Date of confirmation in service

05

Date of Retirement

06

Retired from

07

Retired as

Cle

r

ica

l/

Sub

-

s

t

a

ff/

JMG

S

-

I/

MM

G

S

-

I

I/MM

G

S

-

II

I/S

MGS

-

IV/

SM

G

S

-

V

/

T

EGS

-

V

I/T

EGS

-

V

II

/

T

EGS

S

-

I/TEGSS-II

08

Age (in years) as on the date of

retirement

09

Gender

i.

Male

ii.

Female

10

Type

i.

Pensioner

ii.

Family Pensioner

11

Category

(Please tick mark)

i.

SBI

retirees on completion of

pensionable service in the Bank.

ii.

Members of National Pension System

on completion of 20 years of

confirmed service in the Bank.

Affix colored joint photograph of

the member and spouse

30

iii. Spouse of SBI employee who died whilst in

service or after retirement.

12

Whether dismissed or terminated from

service. (Tick)

Yes / No

13

Whether Rule 19(3) was invoked on

attaining the age of retirement

(If yes, please furnish the details of the

disciplinary case, date of its

conclusion and penalty, if any

imposed )

Yes / No

14

Date of Birth

dd/mm/yy

15

Date of Death (in case of

deceased employee / pensioner)

dd/mm/yy

16

Address for communication

House No.

Street No.

Nearest Landmark

Post Office

Police Station

City

State

Pin Code

17

Landline No. (with STD code)

18

Mobile No.

19

Email ID

20

Name of Spouse (if any)

21

Date of Birth of Spouse

dd/mm/yy

22

Name of disabled Child

/

Children (if any).

(Attach valid disability certificate

issued by medical officer

not

below the rank of Civil Surgeon)

Sl

Name of the disabled child

Date of Birth

1

dd/mm/yy

2

dd/mm/yy

23

Name of the

pension/family

pension paying branch

Name of the Branch

Code No.

24

Pension Account No. (11 digit)

25

I

F

S

C

Code

26

Sl

no.

Tick

here

Sum Insured

Premium

GST @ 18

%

Total (Rs.)

NON-DOMICILIARY PLANS

31

Sum

I

nsur

e

d

opte

d

for Plan

(Please tick the box

of Plan chosen)

GST @18%

1

Rs. 3.00 lakhs

16,524

2,974

19,498

2

Rs. 4.00 lakhs

26,088

4,696

30,784

3

Rs. 5.00 lakhs

37,175

6,692

43,867

4

Rs. 7.50 lakhs

73,062

13,151

86,213

5

Rs. 10.00

lakhs

1,10,996

19,979

1,30,975

6

Rs. 15.00

lakhs

2,17,790

39,202

2,56,992

7

Rs. 25.00

lakhs

2,33,055

41,950

2,75,005

DOMICILIARY PLANS

8

Rs. 3.00 lakhs

28,110

5,060

33,170

9

Rs. 4.00 lakhs

42,480

7,646

50,126

10

Rs. 5.00 lakhs

59,293

10,673

69,966

11

Rs. 7.50 lakhs

1,03,099

18,558

1,21,657

12

Rs. 10.00

lakhs

1,50,702

27,126

1,77,828

13

Rs. 15.00

lakhs

2,76,084

49,695

3,25,779

14

Rs. 25.00

lakhs

2,89,275

52,070

3,41,345

Undertaking:

I

undertake that

I

have chosen Plan at serial no. above and have agreed to make

payment of the corresponding premium of the Plan.

I

am also aware that the Bank has decided to

support the pensioners by allowing subsidy depending upon the Plan chosen.

I

also know that the

amount of subsidy will depend upon the pension drawn by me (Basic + DA). To arrive at the correct

amount of subsidy

I

am attaching my Pension Slip for the month of December 2017 with this

application form.

I

undertake that if any excess amount

of subsidy is paid on my behalf, the same may be recovered from my account.

Declaration of Nominee/s :

I, Mr./Mrs./Ms.

, a retired employee / spouse of the deceased employee /

pensioner of the Bank do hereby assign the money payable by “United India Insurance Co. Ltd.” in

case of my death to Mr. / Mrs./ Ms. _

Relation

and further declare that his/her receipt shall be sufficient discharge

of the company.

Debit Authority :

I

am aware that

I

along with my spouse and disabled child/children will be eligible for a

hea

l

th

i

nsu

r

an

c

e

c

o

ve

r

of

Rs

.

l

a

c

under

th

e

F

ami

l

y

F

l

o

ater

Group

He

a

l

th

I

nsu

r

an

c

e

policy.

I

hereby authorize the Bank to debit the annual insurance premium amount of Rs.

to my pension / family pension account No. to my above

account.

I

undertake to keep sufficient balance in my above account for debiting the insurance

premium failing which my policy may not be issued / renewed.

I

am also aware

that Bank may at its sole discretion modify the terms and conditions of the policy from time to time.

Place :

Date :

Pension Slip for the month of

………………. attached.

Signature of Retired Employee / Spouse

For office use only

32

Certified that Shri / Smt. is a retired employee / spouse of the retired /

deceased employee of the Bank and he / she has paid the insurance premium as

per the following details:

Amount of Premium as per Plan chosen :

Rs.

Less amount of subsidy as per Pension Slip : Rs.

-----------------------

Amount paid by the pensioner

: Rs.

State Bank of India

Name of the Forwarding Branch (Code No.):

Place :

Date :

Signature of the Branch Manager with seal

………………………………………………………………………………

ACKNOWLEDGEMENT

(to be given to the applicant by the branch receiving the Form)

Received from Shri/Smt.

Application for membership of Family Floater Group Mediclaim Policy ‘B’ along with

I

n

s

ur

an

c

e

P

r

emium

i

nc

l

ud

i

ng

Go

od

s

&

Se

r

vi

c

e

s

Tax

of

Rs

.

submission to Admin Office.

Date

Name of officer receiving the form

33

Name of Disease

Sl

Name of Disease

1

Cancer

33

Diphtheria

2

Leukemia

34

Malaria

3

Thalassemia

35

Non-Alcoholic Cirrhosis of Liver

4

Tuberculosis

36

Purpura

5

Paralysis

37

Typhoid,

6

Cardiac Ailments

38

Accidents of Serious Nature

7

Pleurisy

39

Cerebral Palsy

8

Leprosy

40

Polio

9

Kidney Ailment

41

All Strokes Leading to Paralysis

10

All Seizure disorders

42

Hemorrhages caused by accidents

11

Parkinson's diseases

43

All animal/reptile/insect bite or sting

12

Psychiatric disorder including

Schizophrenia and Psychotherapy

44

Chronic pancreatitis

13

Diabetes and its complications

45

Immuno Suppressants

14

Hypertension

46

Multiple sclerosis / motor neuron disease

15

Asthma

47

Status Asthmatics

16

Hepatitis – B

48

Sequalea of Meningitis

17

Hepatitis – C

49

Osteoporosis

18

Hemophilia

50

Muscular Dystrophies

19

Myasthenia gravis

51

Sleep apnea syndrome (not related to obesity)

20

Wilson's disease

52

Prostate

21

Ulcerative Colitis

53

Sickle cell disease

22

Epidermolysis bullosa

54

Systemic lupus Erythematous (SLE)

23

Venous Thrombosis(not caused by

smoking)

55

Any connective tissue disorder

24

Aplastic Anaemia

56

Varicose veins

25

Psoriasis

57

Thrombo Embolism Venous Thrombosis /

Venous Thrombo embolism (VTE)

26

Third Degree burns

58

Growth disorders

27

Arthritis

59

Graves' disease

28

Hypothyroidism

60

Chronic Pulmonary Disease

29

Hyperthyroidism

61

Chronic Bronchitis

30

Expenses incurred on Radiotherapy

and Chemotherapy in the treatment

of Cancer and Leukemia

62

Physiotherapy

31

Glaucoma

63

Swine flu

32

Tumor

34

CATEGORISATION OF CENTRES

Tier – 1

Ahmedabad, Bangalore, Chennai, Delhi, Hyderabad, Kolkata, Mumbai,

Pune

Tier – 2

Agra, Ajmer, Aligarh, Allahabad, Amravati, Amritsar, Asansol, Aurangabad, Bareilly, Belgaum,

Bhavnagar, Bhiwandi, Bhopal, Bhubaneshwar, Bikaner, Bokaro Steel City, Chandigarh,

Coimbatore, Cuttack, Dehradun, Dhanbad, Durg – Bhilai Nagar, Durgapur, Erode,

Faridabad, Firozabad, Ghaziabad, Gorakhpur, Gulbarga, Guntur, Gurgaon, Guwahati,

Gwalior, Hubli – Dharwad, Indore, Jabalpur, Jaipur, Jalandhar, jammu, Jamnagar,

Jamshedpur, Jhansi, Jodhpur, Kannur, Kanpur, Kakinada, Kochi, Kottayam, Kolhapur, Kollam,

Kota, Kozhikode, Kurnool, Lucknow, Ludhiana, Madurai, Malappuram, Malegaon,

Mangalore, Meerut, Moradabad, Mysore, Nagpur, Nashik, Nellore, Noida, Patna,

Pondicherry, Raipur, Rajkot, Rajahmundry, Ranchi, Rourkela, salem, Sangli, Siliguri,

Solapur, Srinagar,

Surat, Thiruvananthapuram, Palakkad, Thrissur, Tiruchirapalli, Tiruppur, Ujjain,

Vadodra, Varanasi, Vasai – Virar City, Vijaywada, Visakhapatnam, Warangal.

Tier-3

All other cities.

ROOM RENT CAPPING

Sum Insured

Tier 1 Centre

Tier 2 Centre

Tier 3 Centre

Room

Rent

ICU Rent

Room Rent

ICU Rent

Room Rent

ICU Rent

300000

4000

7500

3500

7500

3000

7500

400000

4000

7500

3500

7500

3000

7500

500000

4000

7500

3500

7500

3000

7500

750000

4000

7500

3500

7500

3000

7500

1000000

4800

9000

4200

9000

3600

9000

1500000

5600

10000

4900

10000

4200

10000

2500000

7200

12000

6300

12000

5400

12000

DISEASE WISE CAPPING

Type of Disease

Limits

Tier 1 Centre

Tier 2 Centre

Tier 3 Centre

Angioplasty

150,000

125,000

100,000

CA BG

250,000

200,000

150,000

Cataract

30,000

25,000

20,000

Cholecystectomy

50,000

45,000

40,000

Hernia

50,000

45,000

40,000

Knee Replacement -

Unilateral

175,000

150,000

100,000

Knee replacement -Bilateral

250,000

225,000

175,000

Prostrate

70,000

50,000

40,000

35

Gross

Monthly

Pension

Plan (Sum

Insured)

WITHOUT DOMICILIARY PLANS

WITH DOMICILIARY PLANS

Gross

Premium

(incl. GST)

Admissible

Subsidy

Premium

Payable by

Member

Gross

Premium

(incl.

GST)

Admissible

Subsidy

Premium

Payable by

Member

Upto Rs.

20000

300000

19,498

14624

4,874

33,170

15000

18,170

400000

30,784

15000

15,784

50,126

15000

35,126

500000

43,867

15000

28,867

69,966

15000

54,966

750000

86,213

15000

71,213

1,21,657

15000

1,06,657

1000000

1,30,975

15000

1,15,975

1,77,828

15000

1,62,828

1500000

2,56,992

15000

2,41,992

3,25,779

15000

3,10,779

2500000

2,75,005

15000

2,60,005

3,41,345

15000

3,26,345

Rs. 20001 - Rs.

30000

300000

19,498

11699

7,799

33,170

12000

21,170

400000

30,784

12000

18,784

50,126

12000

38,126

500000

43,867

12000

31,867

69,966

12000

57,966

750000

86,213

12000

74,213

1,21,657

12000

1,09,657

1000000

1,30,975

12000

1,18,975

1,77,828

12000

1,65,828

1500000

2,56,992

12000

2,44,992

3,25,779

12000

3,13,779

2500000

2,75,005

12000

2,63,005

3,41,345

12000

3,29,345

Rs. 30001 - Rs.

40000

300000

19,498

9749

9,749

33,170

12000

21,170

400000

30,784

12000

18,784

50,126

12000

38,126

500000

43,867

12000

31,867

69,966

12000

57,966

750000

86,213

12000

74,213

1,21,657

12000

1,09,657

1000000

1,30,975

12000

1,18,975

1,77,828

12000

1,65,828

1500000

2,56,992

12000

2,44,992

3,25,779

12000

3,13,779

2500000

2,75,005

12000

2,63,005

3,41,345

12000

3,29,345

Above Rs.

40000

300000

19,498

4875

14,623

33,170

8293

24,877

400000

30,784

7696

23,088

50,126

10000

40,126

500000

43,867

10000

33,867

69,966

10000

59,966

750000

86,213

10000

76,213

1,21,657

10000

1,11,657

1000000

1,30,975

10000

1,20,975

1,77,828

10000

1,67,828

1500000

2,56,992

10000

2,46,992

3,25,779

10000

3,15,779

2500000

2,75,005

10000

2,65,005

3,41,345

10000

3,31,345

Gross Monthly Pension = Basic Pension (uncommuted) + Dearness Relief