25 October 2023

ESMA32-1283113657-1041

Report

The Heat is On: Disclosures of Climate-Related Matters in the Financial

Statements

Photo: Eduardo Damasio

1

Table of Contents

Table of Extracts from 2022 Annual Financial Reports

Executive Summary .............................................................................................................. 2

1 Background .................................................................................................................... 4

2 Objectives ...................................................................................................................... 5

3 Scope and Methodology ................................................................................................. 6

4 Selected Topics .............................................................................................................. 8

4.1 Significant judgements, major sources of estimation uncertainty and accounting policies ..... 8

4.2 Impairment of non-financial assets ........................................................................................ 18

4.3 Useful lives of tangible and intangible assets ........................................................................ 27

4.4 Provisions .............................................................................................................................. 30

4.5 Other Accounting Topics ....................................................................................................... 34

5 Conclusion ....................................................................................................................38

Annex I: List of Selected Issuers ..........................................................................................39

Section

Example

Page

Themes

Significant

judgements,

major sources

of estimation

uncertainty and

accounting

policies

Example 1 – Traton SE

9

CO

2

emissions, Research & Development

(R&D)

Example 2 – Naturgy Energy Group SA

10

Sensitivity analysis, Provisions

Example 3 – Enel SpA

11

Impairment test, Useful lives of intangible

assets, Provisions

Example 4 – Air Liquide SA

13

CO

2

emissions, Sensitivity analysis

Example 5 – Equinor ASA

14

CO

2

emissions, Provisions

Example 6 – Solvay SA

16

CO

2

emissions

Impairment of

non-financial

assets

Example 7 – Endesa SA

19

Impairment test, CO

2

emissions

Example 8 – Imerys SA

20

Impairment test, Sensitivity analysis

Example 9 – Telia Company AB

21

Impairment test

Example 10 – Arkema SA

21

CO

2

emissions, Sensitivity analysis

Example 11 – Eni S.p.A.

22

CO

2

emissions, Sensitivity analysis

Example 12 – Saint-Gobain SA

23

CO

2

emissions, R&D, Sensitivity analysis

Example 13 – BASF SE

24

Impairment test

Example 14 – Uniper SE

25

Impairment losses

Useful lives of

tangible and

intangible

assets

Example 15 – Mercedes Benz Group AG

28

Useful lives intangibles, R&D

Example 16 – Iberdrola SA

28

Regulated activities

Example 17 – Hapag-Lloyd AG

29

Useful lives of tangible assets

Provisions

Example 18 – Électricité de France SA

31

GHG emission rights, renewable and energy

savings certificates

Example 19 – RWE AG

32

Provisions for mining damage

Example 20 – Repsol SA

32

CO

2

emissions

Other

accounting

topics

Example 21 – Technip Energies NV

35

Share-based payments

Example 22 – Fortum Oyj

36

Segments

2

Executive Summary

In 2022, ESMA communicated its strategic priorities for the 2023-2028 period. Amongst these priorities,

ESMA announced its commitment to enable sustainable finance by promoting high quality sustainability

disclosures. While financial reporting was not explicitly referred to in the areas where immediate action was

required, ESMA and European national enforcers (enforcers) have identified climate-related matters as a

European common enforcement priority (ECEP) for the last three years.

As this is a nascent area, ESMA understands that assessing how climate-related matters impact financial

reporting can be a challenge for issuers, auditors and users, particularly when such impacts are indirect or

relate to sectors which do not appear to be immediately exposed. Althou

gh ESMA considers that

International Financial Reporting Standards (IFRS) are fit for purpose and provide sufficient

basis for

issuers to account for and to disclose climate-related matters in financial statements, real life illustrations

of disclosures may assist issuers to better communicate such impacts and investors and other stakeholders

to better understand them and take them into account when making informed decisions.

This report aims to assist and to enhance

the ability of issuers to provide more robust disclosures and

create more consistency in how climate-related matters are accounted for in financial statements drawn up

in accordance with IFRS. The report focuses on disclosures related to climate matters included in the 2022

annual financial statements of European non-financial corporate issuers. However, ESMA points out that

the report does not set out best practices or prescribe the way in which the disclosure of climate-related

matters should be made in the financial statements.

The first three sections outline the background, objectives as well as scope and methodology of this report.

The report focuses on topics for which it is likely that climate-related matters have a higher impact. The

examples of disclosures included in the report provide practical illustrations on how climate-related matters

may be presented in IFRS financial statements. In doing so, ESMA highlights, in each example, key

aspects and provides insights that

explain why such disclosures may be useful to users of financial

statements. Finally, each section includes ESMA’s observations on areas of continued focus.

Finally, ESMA highlights that

this report does not address disclosures prepared in accordance with

sustainability reporting requirements (notably, their compliance, understandability, relevance, verifiability,

comparability, and faithful representation) and to which extent the actions taken or planned by the selected

issuers are sufficient to tackle climate change or lead issuers towards a sustainable path.

Next Steps

ESMA expects issuers (including their management, supervisory boards and audit committees) and

auditors to consider the illustrative examples of this report when considering

how to assess and disclose

the degree to which climate-related matters play a role into the preparation and auditing of IFRS financial

statements. Particularly, ESMA encourages issuers to consider the observations in the areas for continued

focus that accompany the disclosure excerpts presented in this report, and not to concentrate excessively

on the facts and circumstances presented by the examples (which are highly specific to the entities).

Finally, ESMA stresses that the

guidance addressing climate impacts is not exhaustive and is developing

at a fast pace. Issuers should closely follow the developments of standard setters in this area, and their

connection with sustainability reporting.

3

List of Acronyms

AFR

Annual Financial Report, comprising the audited financial statements, the management

report (including the non-financial information statement) and management’s

responsibility statement

CGU

Cash Generating Unit

CO

2

Carbon Dioxide

ECEP

European Common Enforcement Priorities

EEA

European Economic Area

EFRAG

European Financial Reporting Advisory Group

ESEF

European Single Electronic Format

ESMA

European Securities and Market Authority

Enforcers

National Enforcers in the European Economic Area

ESRS

European Sustainability Reporting Standards

EU ETS

European Union Emissions Trading Scheme

IAS

International Accounting Standards

IASB

International Accounting Standards Board

ISSB

International Sustainability Standards Board

IFRS

International Financial Reporting Standards

IFRS IC

International Financial Reporting Standards Interpretations Committee

Issuer

Legal entity whose securities are admitted to trading on EEA regulated markets

NCA

National Competent Authority

OAM

Official Appointed Mechanism

P&L

Statement of Profit or Loss

R&D

Research & Development

ViU

Value-in-Use

Disclaimer

This report has been compiled by ESMA in joint work with enforcers. The descriptions and disclosure extracts in this report

do not constitute guidelines, best practices, or illustrations of a single approach on how to disclose the impact of climate-

related matters in an issuer’s IFRS financial statements. The report presents disclosure examples solely based on the

extent to which the examples or parts thereof could be considered informative, understandable, and entity specific. Issuers

are ultimately responsible for compliance with IFRS principles.

Given that, in most cases, ESMA and enforcers did not carry out an examination of the information included in the

examples, these examples should not be taken as an indication of the compliance of the underlying information with IFRS.

ESMA and enforcers neither provide a view nor do they endorse how the issuers from whom disclosure extracts have been

included in the present report have applied IFRS standards in the financial statements with regards to recognition,

measurement, and presentation requirements.

Finally, the report does not assess whether the roadmap or the actions that issuers plan to undertake are sufficient to

achieve their own climate-related targets, commitments or any other regulatory requirements set out at national, European

or international level. In this report, ESMA and enforcers do not make any assessment as to whether the issuer’s actions,

operations or activities should be labelled as sustainable or are sufficient to move towards a sustainable path.

NOTE: The extracts of the disclosures included in this report were drawn from the English-language PDF versions of the

2022 annual financial reports (AFR) publicly available on the issuers’ website, which are variants of the official versions

compliant with the ESEF Regulation – European Single Electronic Format (ESEF). Also note that, in multiple instances,

this English-language version of the AFR is a translation from the original language of the issuer’s AFR. In the event of any

discrepancy, the original language version prevails.

4

1 Background

1. The pervasive nature of climate change has sprouted increasing concerns from investors

about the economic ramifications on issuers’ prospects. Issuers are urged by investors,

governments and the public in general to assess climate-related matters that they are facing

and to reflect such impacts in the financial statements. While climate is not explicitly referred

to in IFRS, issuers must consider climate risks and opportunities when applying IFRS

standards. To this effect, the International Accounting Standards Board (IASB) recently re-

published an educational material: Effects of climate-related matters on financial statements

1

,

which highlights potential impacts and required disclosures to be provided in financial

statements to reflect the effects of climate related matters.

2. Disclosures of climate-related matters in financial statements have been an area of focus for

ESMA and enforcers. In the last three years, ESMA and enforcers have identified climate-

related matters as an ECEP, both in relation to financial and non-financial information

2

.

Issuers, auditors and audit committees have been asked to pay particular attention to the

topic and to ensure transparency on how climate-related matters affect an issuer’s

performance, financial position and cash flows.

3. At the end of March 2023, ESMA published its annual report on Corporate reporting

enforcement and regulatory activities

3

. Results of the 2021 ECEP showed that there is

significant room for improvement in relation to disclosures of climate-related matters in IFRS

financial statements. More recently, ESMA published a progress report on greenwashing

4

. In

light of these publications, ESMA urges issuers to continue enhancing the information that

they disclose to enable investors to make informed decisions, to prevent greenwashing and

to contribute to investor protection.

4. This report, building on the IASB’s educational material and ESMA’s ECEP statements, aims

to offer a practical and real-life illustration of how selected European non-financial corporate

issuers have reflected the effects of climate-related matters into their 2022 annual financial

statements. ESMA urges issuers to consider the examples of this report and the insights

provided by ESMA when preparing and auditing the 2023 annual financial statements.

5. Finally, ESMA notes that, as climate-related matters evolve over time, other areas not

addressed in this report or in the ECEP may become relevant. Similarly, climate-related

impacts, which in the past were considered immaterial, may become material or more acute.

It is, therefore, paramount that all relevant stakeholders (especially issuers) continue to

closely monitor the developments arising from climate-related matters

5

and to assess if, how

and with what intensity such developments affect their activities, operations and,

consequently, their financial reporting.

1

IASB Educational Document, Effects of climate-related matters on financial statements, July 2023. (republished).

2

ESMA32-63-1186, European common enforcement priorities for 2021 annual financial reports, 29 October 2021.

ESMA32-63-1320, European common enforcement priorities for 2022 annual financial reports, 28 October 2022.

ESMA32-63-193237008-1793, European common enforcement priorities for 2023 annual financial reports, 25 October 2023.

3

ESMA32-63-1385, 2022 Corporate Reporting Enforcement and Regulatory Activities Report, 29 March 2023

4

ESMA30-1668416927-2498, Progress Report on Greenwashing, 31 May 2023

5

The IASB has announced that it will explore ways to improve reporting of climate-related and other uncertainties in the financial

statements, such as developing educational materials, illustrative examples and targeted amendments to IFRS, please see here.

5

2 Objectives

6. The report identifies and highlights practical examples from selected issuers’ 2022 AFRs,

pertaining to disclosures of climate-related matters in financial statements, to illustrate

aspects of past recommendations and requirements published by ESMA, enforcers and the

IASB. The report aims to contribute to issuers’ developments of how to disclose climate-

related matters into IFRS financial statements, and by doing so, generally improve the quality

of their financial reporting. Although the report draws from other areas of the AFR when

illustrating connectivity (see also Scope and Methodology

), it does not focus on disclosures

in the sustainability report or the management report. In this respect, ESMA believes that the

financial statements should stand on their own: users of the financial statements should not

need to consult the non-financial information included elsewhere in the AFR to understand

the current financial impacts of climate-related matters.

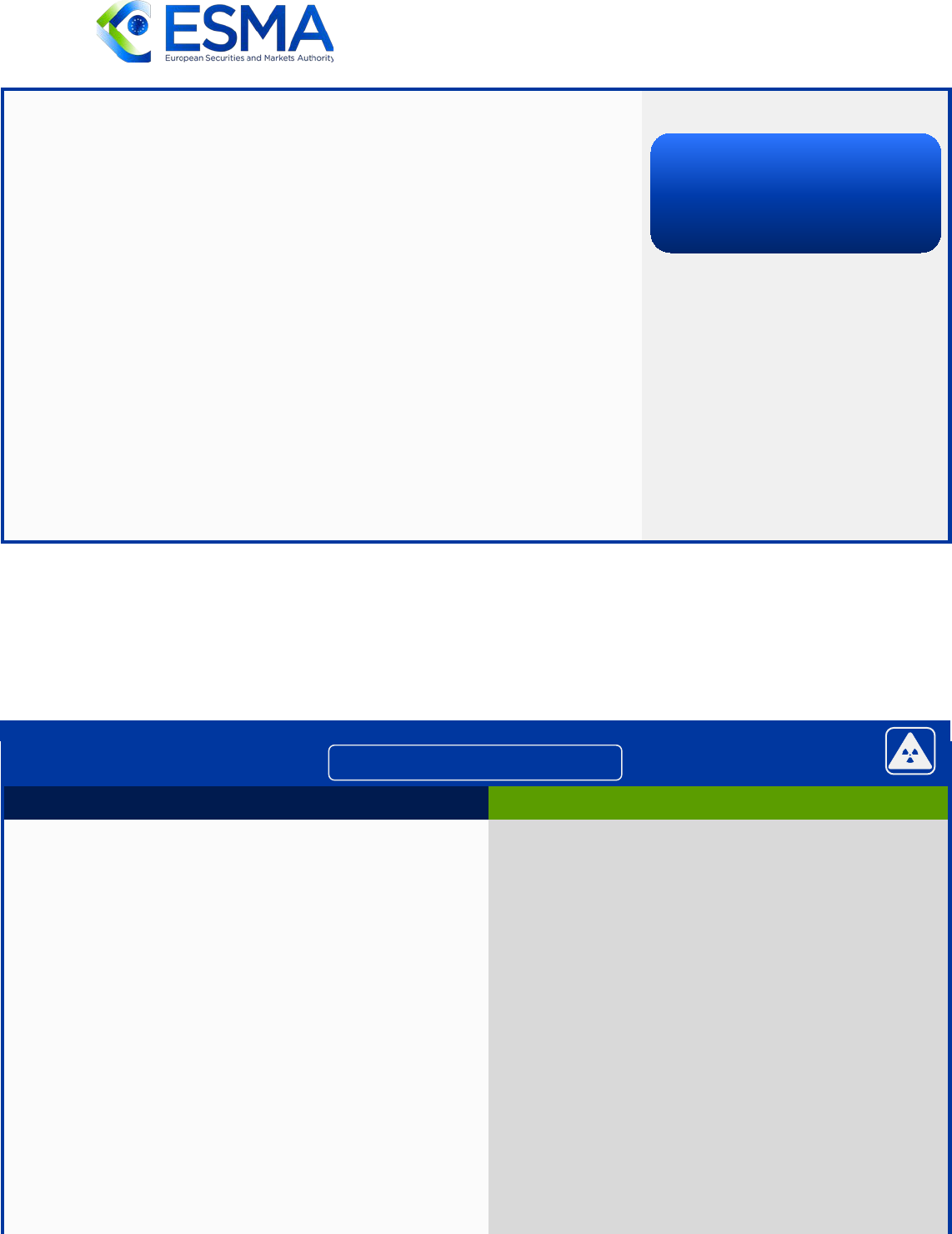

7. Figure 1 provides a brief snapshot of what the report is aiming to achieve, and what it is not:

F

IGURE 1 – MAIN OBJECTIVES OF THE REPORT

8. The report aims to demonstrate potential (but not the only) ways to disclose climate-related

matters in the financial statements. Issuers should adapt their disclosures to their own

specificities, business models, activities, and characteristics. When doing so, issuers should

consider the notion of materiality included in IFRS and further illustrated by the IASB in its

IFRS Practice Statement 2 Making Materiality Judgements published in 2017

6

. This non-

mandatory guidance includes an overview of the general characteristics of materiality,

presents a four-step materiality assessment process and provides helpful guidance on how

to make materiality judgements in specific circumstances.

6

IASB, IFRS Practice Statement 2 Making Materiality Judgements, September 2017.

What the Report Is...

an educational illustration using selected

European disclosures examples related

to climate-related matters in IFRS financial

statements

a non-exhaustive reflection of IFRS requirements

that can be relevant for climate-related matters

a collection of examples of climate-related

disclosures demonstrating certain ECEP

recommendations

Enforcers' views on how issuers may provide

more relevant and transparent information

to the market in relation to climate-related matters

in IFRS financial statements

What the Report Is Not...

a 'template' to use for disclosures or 'checklist'

of areas to look into

an assessment of the quality of financial reporting,

notably, measurement, recognition and

presentation of the selected examples

a rating of 'best in class' to any of the selected

issuers or providing a quality stamp

regarding the financial statements as a whole

an exhaustive sample coverage -i.e.,

it cannot be extrapolated to any given European

issuer population (country, sector, industry)

a view on issuers' ability to comply with disclosed

climate-related targets, commitments or to any

climate-related requirements

an assessment of the quality, completeness

or relevance of issuers' sustainability disclosures

6

9. Nevertheless, ESMA emphasises that, in accordance with paragraph 7 of IAS 1 Presentation

of Financial Statements, information is considered material if omitting, misstating, or

obscuring it could reasonably influence decisions that the primary users of financial

statements make based on those financial statements. This implies that issuers, when

assessing materiality, should consider what primary users of financial statements consider

relevant for their decision-making process, which should comprise quantitative and

qualitative considerations.

3 Scope and Methodology

10. This report addresses the following key topics:

F

IGURE 2 – SELECTED TOPICS

11. The report focuses on areas where the implications of climate-related matters are expected

to be the most material for the preparation of financial statements. However, the list is not

intended to be exhaustive. Issuers should assess if climate-related matters affect other areas

or topics when preparing their financial statements.

12. The following figure summarises the main principles used by ESMA and enforcers to select

disclosure excerpts from issuers’ financial statements for the purposes of this report.

F

IGURE 3 – HIGH-LEVEL PRINCIPLES USED FOR SELECTING DISCLOSURE EXTRACTS

The disclosure appears to be tailored to the issuer’s

specificities

Relevant information is put forward in a clear

and simple manner that is easy to follow

The information is organised in clear paragraphs

and appears to be presented in a suitable format

(narrative, tabular, etc.)

Assumptions and impacts are quantified to allow

investors to understand their effect

The information seems to be consistent across the

different areas of the financial statements without

compromising usefulness, yet avoiding repetition

7

The concept of connectivity

13. The concept of connectivity, as it relates to information included in financial statements and

non-financial reporting, is currently a topic of research and discussion across several

standard setters, most notably the IASB, the International Sustainability Standards Board

7

Note that the IFRS only allow cross-references to other sections of the AFR, including the management report, in the context of

IFRS 7 Financial Instruments Disclosures. Cross-references to other sections of the AFR can be used to avoid repetition or to link

to other information disclosed outside financial statements but they cannot be used for compliance purposes.

Significant judgements, major

sources of estimation uncertainty &

accounting policies

Impairment of non-financial assets

Useful lives of tangible and

intangible assets

Provisions Other accounting topics

Entity-specific

Simple and clear

Organised and well-formatted

Quantifications

Consistency within the financial

statements

7

(ISSB) and European Financial Reporting Advisory Group (EFRAG)

8

.

This ongoing work is

expected to set out a definition of connectivity and articulate criteria for ensuring

transparency, coherence and decision-usefulness of information across AFRs.

14. In the absence of a formal framework to assess connectivity and in order to identify examples

related to connectivity, ESMA and enforcers assessed the disclosures across issuers’ AFRs

against the following principles underpinning connectivity between financial statements and

non-financial information:

F

IGURE 4 – HIGH-LEVEL PRINCIPLES USED TO IDENTIFY CONNECTIVITY

9

Sample selection

15. The report includes disclosure extracts from the 2022 AFRs of non-financial corporate issuers

selected from nine sectors across nine EU/EEA countries. The report does not address

financial institutions. The nine industries or sectors were selected based on several criteria,

including but not limited to, the expected exposure to climate-related matters. However, other

industries, sectors or activities may be equally exposed to climate-related matters. Therefore,

ESMA urges issuers to assess their exposure to climate-related matters and adapt the

messages of this report to the specificities of their industries, sectors and activities.

16. Figure 5 below outlines the sectors of the issuers that were selected for the purpose of this

report (see also Annex I

):

FIGURE 5 – SECTORS OF SELECTED SAMPLE

17. Finally, the availability of an entity-issued version of the 2022 AFR in the English language

was a prerequisite

10

in the sample selection.

8

IASB and ISSB, Connectivity―what is it and what does it deliver?, 23 March 2023 and EFRAG, Connectivity between Financial

and Sustainability Reporting Information: Suggested scope and approach of EFRAG Research project, 8 February 2023

9

See also footnote 7

10

In multiple instances, the English-language version of the AFR is the issuer’s translation from the original language of the AFR.

In the event of any discrepancy, the original language version prevails.

Electricity Automotives Industrial

Transporta-

tion

Industrial

Metals &

Mining

Gas, Water

& Multi-

utilities

Oil, Gas

and Coal

Chemicals Construc-

tion &

Materials

Telecom-

munica-

tions

Is the information specific and useful

to the understanding of

the

financial statements or is it mere

ly

repeating the contents of the non-

financial section of the AFR?

Are there links within

and across the different components

of the AFR?

Is there complementarity between the

information included in the non-

financial section of the AFR and the

financial statements?

Do assumptions appear consistent

within and across the different

components of the AFR?

Consistency

&

Coherence

Complemen

tarity

Avoidance

of repetition

Cross-

referencing

8

4 Selected Topics

18. Each section starts with a snapshot of the relevant areas impacted by climate-related matters

and the applicable accounting requirements which ESMA’s study focused on, followed by

illustrations of related current disclosures.

19. The examples should be read together with the key areas for continued focus. These highlight

potential next steps for improvement, which may go beyond specific IFRS requirements

11

.

Such points stem from the review of a larger sample of extracts of 2022 AFRs (not exclusively

based on the examples included in this report) and the examinations carried out in the last

years by enforcers. Issuers, including those selected for this report, should consider the

examples as well as these points to further improve the quality and transparency of the

disclosures provided.

4.1 Significant judgements, major sources of estimation uncertainty

and accounting policies

4.1.1 Accounting requirements to consider

IAS 1 – Presentation of Financial Statements

Paragraphs 17c), 25-26, 31, 112, 122-124, 125-133

Climate-related matters may be relevant for multiple areas of an issuer’s financial

statements (especially for entities operating in the most impacted sectors). Such matters

may weigh in on an issuer’s significant judgements and major sources of estimation

uncertainty, as well as on uncertainty regarding going concern. IAS 1 outlines the

disclosure requirements behind such significant judgements and major sources of

estimation uncertainty.

Judgements and accounting policies

Issuers are required to disclose information about the significant judgements (apart from

those involving estimations) that an issuer’s management has made in the process of

selecting and applying accounting policies and that have the most significant effect on the

amounts recognised in the financial statements. Where issuers make significant climate-

related judgements, issuers should consider disclosing the impact of the climate matters.

Estimates and assumptions

IAS 1 requires disclosure of information about assumptions and other major sources of

estimation uncertainty at the end of the reporting period that have a significant risk of

resulting in a material adjustment to the carrying amounts of assets and liabilities within the

11

Notwithstanding the proscribed in paragraphs 31 and 112(c) of IAS 1 Presentation of Financial Statements.

9

next financial year. When climate risks may lead to a significant material adjustment,

issuers should consider providing additional disclosures about key assumptions to enable

users to assess the impact of such climate risks on the issuer’s financial position, financial

performance and cash flows.

Particularly, issuers are required to provide disclosures regarding major sources of

estimation uncertainty (for example, in sensitivity analyses), which explain how the issuer

has incorporated the uncertainties in the estimates supporting the financial statements and

the sensitivities disclosed.

Finally, issuers are reminded that IAS 1 also require them

to disclose information not

specifically required by IFRS standards and not presented elsewhere

in the financial

statements, when such information

is relevant to an understanding of the impacts of

particular transactions, other events and conditions, or of the financial statements.

4.1.2 From principles to practice: relevant examples from selected issuers

20. The following extracts illustrate some potential ways to disclose information regarding the

climate-related assumptions and significant judgements made which may result in a material

adjustment in either the short or long term.

21. Traton SE, an automotive company, disclosed the effects of climate change and transition to

electric mobility in its 2022 annual financial statements, allocating a separate sub-section to

the topic in the discussion of estimates and management’s significant judgements.

EXAMPLE 1 – TRATON SE

Pages 151-152

6. Estimates and management’s judgment

(…)

Business performance

(…)

Additionally, an expansion in electric mobility is also projected in all segments in the

five-

year planning (see also the “Effects of climate change” section). The cornerstone

for the electrification of the commercial vehicle industry in Europe was laid in 2022 with

the establishment of the Milence joint venture. The purpose of the joint venture, which the

TRATON GROUP established together with Daimler Truck and the Volvo Group, is the

development of a charging infrastructure for heavy-duty trucks and coaches. The planning for

MAN Truck &

Bus also includes the positive impact of the realignment program initiated in

2021. Another goal is to guide Navistar to new strength. The measures for doing this range

from using the powerful component and technology setup within the TRATON GROUP and

expanding the Financial Services business, all the way to further leveraging one of largest

independent dealer and service network in the North American market, to which Navistar

already has access. The fact that Volkswagen Truck & Bus is becoming more international was

also factored into the planning.

Overall, these assumptions led to an expected

improvement in the growth rates in the core markets and in operating return on sales

(adjusted) up to 2027 across all cash-generating units to which goodwill is allocated.

Effects of climate change

(…)

In the course of preparing the consolidated financial statements, in particular for the five-

year planning and hence the derivation of future cash flows for impairment testing, the

potential impact of future regulatory requirements, in particular of the associated

transition to electric mobility, was taken into account

. In Europe, for example, the

European Union has mandated a reduction in CO2 emissions for new heavy-duty commercial

ESMA emphasis added in Orange

Disclosure of information

regarding business performance

and the transition to electric

mobility; includes the qualitative

impacts that transition plans are

expected to have on the issuer’s

activity.

10

vehicles over 16t within the current decade in Regulation (EU) 2019/1242. Using a

standardized procedure, the CO2 emissions of the vehicles in question must be cut by

15% by 2025 and 30% by 2030, compared with a reference value from an observation

period running from July 2019 to June 2020. If these emissions targets are not met, it is

possible that penalties will be imposed. Additionally, China has also set targets for reducing

truck CO2 emissions, and Brazil has submitted proposals to reduce the fuel consumption of

heavy-

duty commercial vehicles. The TRATON GROUP is also exposed to a possible further

tightening of CO2 and oxides of nitrogen (NOx) emissions regulations in the USA. The

TRATON GROUP is preparing the electrification of

its product portfolio to reflect the

regulatory timetables for its brands. Our aim is for zero-emission vehicles to make up

around half of all sales across all segments and regions in 2030 — provided the necessary

regulatory mechanisms and infrastructure are in place.

It is technically challenging and expensive to adapt commercial vehicles to new emissions

standards. To meet European Union and North American targets, it is imperative to use new

technologies that reduce CO2 and exhaust emissions. TRATON is therefore investing to a

substantial extent in climate-

friendly alternative drive systems, primarily battery electric

commercial vehicles. The research and development expenses associated with the

technology shift toward electric mobility total €2.6 billion for the period 2021 to 2026. In

turn, TRATON is scaling back its investments in traditional drives to less than one-fifth of

product development costs in 2026.

No impact on the useful lives of capitalized

development costs or items of property, plant, and equipment was identified in light of

the observation period of regulatory requirements and because of the parallel

production of battery electric vehicles and vehicles with combustion engines in the next

few years. Liabilities resulting from em

ission limits being exceeded do not currently

play any role

. However, the increased development activity in the field of electric mobility

resulted in a corresponding increase in recognized (intangible assets) and nonrecognized (cost

of sales) development costs.

22. Naturgy Energy Group SA, a multi-utilities company, included a summary of climate-related

objectives incorporated into the issuer’s strategic plan and presented a rather structured set

of disclosures of the main estimates and accounting judgements made in relation to such

climate-related objectives as well as risks, by asset group.

EXAMPLE 2 – NATURGY ENERGY GROUP SA

Pages 39-42

k. Climate change and the Paris Agreement

(…)

The main estimates and accounting judgements

made by Naturgy's management and

directors when preparing the 2022 consolidated annual accounts related to the expected

effects of climate change and the energy transition are described below.

1. Recoverability of non-financial assets

As described in Note 2.4.6., the cash flow projections used in the non-financial asset

impairment tests are based on the best available forward-looking information and reflect the

investment plans in place in each CGU at the time for maintaining the CGUs' operating

capacity

. These projections are in line with Naturgy's strategy that takes into consideration the

objectives of the Paris Agreement and have therefore been prepared based on the range of

economic conditions that might exist in the foreseeable future in relation to climate

change and the energy transition. The projections have taken into account the expected

impact on wholesale and retail electricity market prices resulting from the entry into

operation of new renewable generation facilities and de

velopments in gas, oil and

emission allowance prices, as well as expected demand.

(…)

2. Group's main assets subject to climate change and energy transition risk:

Coal-fired power plants

As mentioned above, in 2022 and 2021 the Group has not generated any coal-fired

electricity due to the closure in the first half of 2020 of all Naturgy's coal-fired power

plants. These facilities are fully depreciated/provisioned at 31 December 2022. Their

decommissioning commenced following the closure and is expected to be completed by

the end of the first quarter of 2025.

Combined cycle gas power plants

Disclosure of challenges faced

(such as potential non-

compliance with commitments)

and issuer’s actions to overcome

such challenges by investing in

R&D (quantification of R&D costs

until 2026 to shift to electric

vehicles).

Disclosure includes judgements

and estimations used by the

management that are more

sensitive to climate risks, such as

future cash flows (reflecting

transition to e-mobility) and

reduction of carbon dioxide (CO

2

)

emissions.

ESMA emphasis added in Orange

Reference to the alignment of

cash flow projections with the

issuer’s strategy, including the

expected impact on electricity

prices of renewables.

11

In Spain, it is important to bear in mind that the operation of these plants is included in the

Integrated National Energy and Climate Plan (PNIEC), aligned with the European objective of

achieving climate neutrality by 2050 […] At 31 December 2022, the carrying value of these

fixed assets is Euros 1,942 million, of which Euros 994 million relates to combined cycle

plants

in Spain. The carrying value of the total combined cycle generation facilities in Spain is

estimated for 2030, 2040 and 2050 at Euros 522 million, Euros 219 million and zero,

respectively. The carrying value, excluding goodwill, of the combined cycle plants in Mexico is

estimated for 2030, 2040 and 2050 at Euros 613 million, Euros 289 million and zero,

respectively. The use of external proj

ections based on lower energy prices compared

with the assumptions used by Naturgy and indicated in Note 4 could have an impact on

the recoverability of the carrying value of these assets recognised in the balance sheet

at 31 December 2022. See the sensitivity analysis in Note 4 below.

Hydroelectric power plants

(…)

Renewable energy assets

At 31 December 2022,

the carrying value of these fixed assets is Euros 4,999 million, of

which Euros 4,141 million relates to assets in Spain. The main

perceived risk is the

potential negative future evolution of solar and wind resources, which are the key

variables in the performance of this line of business. There may also be reductions in the

remuneration arrangements for renewable energies and lower prices

in marginal

wholesale markets due to an increase in renewable production with reduced variable costs. In

the impairment tests for 2022, no changes in the remuneration arrangements yet to be

approved have been considered and the forecasts for solar and wind resources have

been taken into account.

Electricity and gas transportation and distribution assets

(…)

Supply

(…)

The Group considers that the opportunities arising from the decarbonisation of the global

economy (growth in renewables, investment in smart integrating grids, transport electrification,

green hydrogen, etc.) outweigh the risks.

23. With the aim of facilitating investor’s access to information regarding material climate-related

matters in financial statements, ESMA has also encouraged issuers to provide all information

related to climate matters in one single note or to map out where the different notes address

such matters. In one table, electricity company Enel S.p.A. summarises and references

information that was included across the annual financial statements and which covers areas

that are impacted or may be impacted by climate-related matters in the future.

EXAMPLE 3 – ENEL SPA

Pages 298; 326

2.1 Use of estimates and management judgment

(…)

With regard to the effects of climate change issues, the Group believes that climate change

represents an implicit element in the application of the methodologies and models

used to perform estimates in the valuation and/or measurement of certain accounting

items.

Furthermore, the Group has also taken account of the impact of climate change in the

significant judgments made by management. In this regar

d, the main items included in

the consolidated financial statements at December 31, 2022 affected by management’s use

of estimates and judgments refer to the impairment of non-financial assets and obligations

connected with the energy transition, including those for decommissioning and site

restoration of certain generation plants.

For further details on these items, see note 19

“Property, plant and equipment”, note 24 “Goodwill”, and note 40 “Provisions for risks

and charges”.

(…)

5. Climate change disclosures

(…)

Disclosure of the issuer’s

exposure to climate change and

energy transition risks, key

assumptions and sensitivity

analysis for each main asset

group.

ESMA emphasis added in Orange

Short summary mentioning how

climate change impacts the issuer’s

financial information.

12

Considering the risks related to climate change and the commitments established under the

Paris Agreement, the Group has decided to achieve the carbon neutrality objectives in

advance and reflect its impact on assets, liabilities, and profit or loss, highl

ighting its

significant and foreseeable impacts as required under the Conceptual Framework of the

international accounting standards. In this regard, in accordance with the provisions of the

document published by the IFRS Foundation on November 20, 2020, the Group provides

explicit information in the notes to these consolidated financial statements regarding

how climate change is reflected in our accounts.

(…)

Mapping of different notes

addressing climate change matters.

13

4.1.3 Adding perspective: Connectivity across the AFR in relation to

significant judgements, major sources of estimation uncertainty and/or

accounting policies

24. Air Liquide SA, a chemicals company, disclosed its commitments and strategy put in place in

relation to climate objectives in its non-financial statement of its 2022 AFR. Where those

commitments and strategy had or were expected to have in impact on financial information,

Air Liquide included such information inside its financial statements.

EXAMPLE 4 – AIR LIQUIDE SA

Pages 40; 310-311

Financial Statements

Non-financial Information

31.4 Transition Risk – Greenhouse Gas Emissions

(…)

Air Liquide’s actions to limit transition risk impacts include:

Scope 2 reduction:

- Related to the 424 large air gas production units or ASUs, (scope

2 emissions) mainly by using renewable electricity: the deployment of

the Group’s actions in the 10 countries with the greatest potential will

significantly reduce scope 2 emissions. Since 2018, Air Liquide has

already signed 13 renewable energy supply contracts

for an

estimated annual quantity of 1.724 GWh/y (in a full year after start-up

of renewable production units). As the ASUs are almost all electrified,

they do not require any specific investment for the transition,

because emission reduction will be managed through renewable

energy purchase.

- Energy costs, including renewable energy costs do not represent

any financial risk as they are 100% passed-

through to the

customer according to the terms of the 15 years or more contracts.

Scope 1 reduction:

- Related to the 62 large hydrogen production units or SMRs, (scope

1 emissions), by capturing CO

2

. Air Liquide masters a complete

portfolio of proprietary technologies for capturing CO

2

. Thus, advanced

Cryocap™ CO

2

capture technology equipment has been in industrial

operation since 2015 on a hydrogen production unit in France. The

Group

was recently selected for financing via European

subventions for two carbon capture projects on SMRs. Thus, the

decarbonization of the Group’s 10 largest SMRs will reduce scope

1 emissions by more than 40%. No dismantling of existing SMRs

before the end of the contract is necessary to achieve the Group’s

climate objectives.

- The innovation capacity and technological know-how of Air Liquide’s

teams enable the Group to offer cleaner and more sustainable solutions

to reduce its own emissions and those of its industrial customers. The

Group focuses on technologies for climate solutions and energy

transition. In 2022, Air Liquide had more than 350 patent families on

hydrogen.

The Group’s Innovation expenses amounted to 308

million euros in 2022, including more than 100 million dedicated

to climate.

- The demand for low-carbon industrial gas at a higher price is growing

and makes it possible to remunerate the investment necessary for the

decarbonization of Air Liquide’s assets, in particular for the production

of hydrogen, as well as any additional costs linked to the supply of

renewable electricity.

In addition, financing programs in the form of

subsidies or tax credits are also implemented in Europe and more

recently in the United States in order to support, during a transition

period, the decarbonization of existing industrial assets and new units

of production.

Therefore, there is no indication of impairment for the

related assets.

Assets and Climate Risks

The main Group assets that impact the CO

2

footprint are:

– 424 large Air Gas production Units

, oxygen and nitrogen in

particular, which do not generate direct emissions but require

electricity. The CO

2

emissions linked

to this electricity are

accounted for in Scope 2;

– 62 large

hydrogen production units, which consume Natural

Gas and emit CO

2

accounted for in Scope 1.

-

In the Large Industries business, each air gas or hydrogen

production unit is linked to a long-

term customer contract,

lasting 15 to 20 years. Assets are amortized over the duration

of the contract, which limits the risk of impairment.

- Solutions have already been implemented to decarbonize existing

production units:

– for air gases (Scope 2 emissions) mainly by using low-carbon

electricity: the deployment of actions in the 10 countries with the

greatest potential will significantly reduce Scope 2 emissions. Since

2018, Air Liquide has already signed 13 renewable power

purchase agreements for about 460 MW.

As these assets are

more than 95% already electrified, they do not require any specific

investment for the transition;

–

for hydrogen production units or “SMR” (Scope 1 emissions), by

capturing CO

2

. (…)

The Group was recently selected for

financing via European funds for two carbon capture projects

on SMRs. The decarbonization of the Group’s 10 largest SMRs

will reduce Scope 1 emissions by more than 40%. No

dismantling of existing SMRs before the end of the contract is

necessary to achieve the Group climate objectives (…)

-

Energy costs (electricity for air gases and natural gas for

SMRs) and those related to CO

2

emissions (e.g. ETS scheme in

Europe) are re-invoiced 100% to the customer in the frame of a

long-

term contract. The Group also applies this business model to

ESMA emphasis added in Orange

14

- Costs related to CO

2

emissions (ex ETS scheme in Europe) are

100% passed-through to the customer according to the terms of

the 15 years or more contracts. The Group also applies this business

model to the supply of low carbon industrial gas, therefore Air Liquide

does not bear the risk associated with energy and CO

2

costs.

The potential impacts of transition risk have been analyzed in the

context of the 2022 Group’s Financial Statements closing, based

on the above-mentioned facts and assumptions. No significant impact

has been identified, either on the useful life or on the value of the

assets, on the client portfolio or on the cash flows generated by

existing activities or on provisions for risks and charges.

the supply of low-carbon gas, so Air Liquide does not bear the risk

associated with energy and CO

2

costs. (…) The sensitivity study

shows that, depending on the geography and the context, a

price starting from 80 to 150 euros per tonne of CO2

encourages the customer to decide toward the supply of low-

carbon hydrogen. This

price can be explicit or integrated into

regulatory obligations on the carbon footprint of end products.

(…)

The potential impacts of the risk related to the energy

transition were analyzed as part of the closing of the Group’s

financial

statements (see note 31 to the Consolidated financial

statements –

page 309) and no significant impact was

identified, mainly for the reasons mentioned above. (…)

4.1.4 Focus on CO

2

Emissions Trading Schemes: relevant examples from

selected issuers

25. There is a lack of specific guidance under IFRS for how to account for carbon dioxide (CO

2

)

emission allowances under an emissions trading scheme or renewable energy certificates,

whether allocated for free, or traded. In the last ECEP Statement, ESMA has called for

transparency in the accounting treatment applied regarding carbon and greenhouse gas

emission trading schemes.

26. Equinor ASA, an energy company, described its accounting policies related to EU Emissions

Trading System (EU ETS) allowances and disclosed the assessment underpinning how it

had considered the impact of the allowances on its 2022 financial statements.

EXAMPLE 5 – EQUINOR ASA

Pages 140-143

Note 3. Consequences of initiatives to limit climate changes

Accounting policies - cost of CO

₂

quotas

Purchased CO₂ quotas under the EU Emissions Trading System (EU ETS) are reflected at cost

in Operating expenses as incurred in line with emissions. Accruals for CO₂ quotas required to

cover emissions to date are valued at market price and reflected as a current liability within

Trade, other payables and provisions. Quotas owned, but exceeding the emissions incurred to

date, are carried in the balance sheet at cost price, classified as Other current receivables, as

long as such purchased quotas are acquired in order to cover own emissions and may be kept

to cover subsequent years’ emissions. Quotas purchased and held for trading purposes are

carried in the balance sheet at fair value, and the changes in fair value are reflected in the

Consolidated statement of income on the line-item Other income.

(…)

Impact on Equinor’s financial statements

CO₂-cost and EU ETS carbon credits

Our oil & gas operations in Europe are part of the EU Emission Trading Scheme (EU ETS).

Equinor buys EU ETS allowances (quotas or carbon credits) for the emissions related to our

oil & gas production and processing. Currently we receive a share of free quotas according to

the EU ETS regulation. The share of free quotas is expected to be significantly reduced in the

future.

Total expensed CO

₂

cost related to emissions and purchase of CO

₂

quotas in Equinor

related to activities resulting in GHG emissions (Equinor’s share of the operating

Financial impacts broken down by CO

2

emissions scope

consistent with the disclosures of commitments presented in

the non-financial statements as well as with explanations for

(not) recognising any provision or financial impact.

ESMA emphasis added in Orange

Description of the accounting

policies applied in the treatment

of CO

2

quotas, mention of

consumption, acquisition and

free allocated quotas.

Information regarding which line

items in the balance sheet and

statement of profit or loss (P&L)

are affected by the accounting of

CO

2

costs.

15

licences in addition to our land-based facilities) amounts to USD 510 million in 2022,

USD 428 million in 2021, and USD 268 million in 2020. A large portion of the cost of CO

₂

in

Equinor is related to the purchase of EU ETS quotas. The table below shows an analysis of

number of quotas utilised by Equinor’s operated licences and land-based facilities subject to

the requirements under EU ETS:

(…)

Effects on estimation uncertainty

(…)

Commodity prices

Equinor’s commodity price assumptions applied in value-in-use impairment testing, are

set in accordance with requirements in IFRS and based on management’s best estimate

of the development of relevant current circumstances and the likely future development of

such circumstances. This price-set is currently not equal to a price-set required to achieve

the goals in the Net Zero Emissions (NZE) by 2050 Scenario, nor a price-

set in

accordance with the Annou

nced Pledges Scenario as defined by the International

Energy Agency (IEA)

. A future change in the trajectory of how the world acts with regards to

implementing actions in accordance with the goals in the Paris agreement could, depending on

the detailed characteristics of such a trajectory, have a negative impact on the valuation of

Equinor’s property, plant and equipment in total. A calculation of a possible effect of using

the assumed commodity prices and CO

₂

prices in a 1.5ºC compatible NZE by 2050 Scenario

as estimated by IEA could result in an impairment of upstream production assets and

intangible assets around USD 4 billion before tax, see the sensitivity table below.

Similarly, we have calculated the possible effect of using prices according to the Announced

Pledges Scenario, a scenario which is based on all of the climate-related commitments

announced by governments around the Globe. Using this scenario, the world is expected

to reach a 1.8ºC increase in the year 2100, and this could result in an impairment of less

than USD 0.5 billion before tax using the same simplified model, see the sensitivity table

below.

(…)

Cost of CO

2

The EU ETS price has increased significantly from 25 EUR/tonne in 2020. The average

cost of EU ETS allowances was 81 EUR/tonne in 2022 (54 EUR/tonne in 2021). The price

is expected to remain high, in the region of 80 EUR/tonne for the next couple of years. Then

the price is expected to be 105 EUR/tonne in 2040 and thereafter increasing to 130

EUR/tonne in 2050.

As such, Equinor expects greenhouse gas emission costs to increase

from current levels and to have a wider geographical range than today, and a global tax on CO₂

emissions will have a negative impact on the valuation of Equinor’s oil and gas assets.

Currently, Equinor pays CO₂ fees in Norway, the UK, Germany and Nigeria. Norway’s Climate

Action Plan for the period 2021-2030 (Meld. St 13 (2020-2021)) which assumes a gradually

increased CO₂ tax (the total of EU ETS + Norwegian CO₂ tax) in Norway to 2,000 NOK/tonne

in 2030 is used for impairment calculations of Norwegian upstream assets.

Equinor’s response to this risk is evaluation of carbon intensity on both project and portfolio

level in our investment and divestment decisions.

We have also introduced an internal

carbon price, currently set at 58 USD/tonne and increasing towards 100 USD/ tonne by

the year 2030 and staying flat thereafter (in countries with higher carbon costs, we use the

country specific cost expectations), to be used in our investment decisions. This cost-scenario

is uncertain, but this extra cost serves as a placeholder for possible future CO₂ pricing systems,

making sure our asse

ts are financially robust in such a scenario. As such, climate

considerations are a part of the investment decisions following Equinor’s strategy and

commitments to the energy transition.

Climate considerations are also included in the impairment calculations directly by

estimating the CO

₂

taxes in the cash flows. Indirectly, the expected effect of climate change

is included in the estimated commodity prices where supply and demand are considered. The

CO

₂

prices also have effect on the estimated production profiles and economic cut-off

of the projects. Impairment calculations are based on best estimate assumptions. To

Assumptions regarding CO

2

emission costs by geographies in

impairment tests and sensitivity

analysis.

Potential impacts of +1.5°C

by 2050, and +1.8°C by 2100

on assets valuations and

sensitivities for different external

climate scenarios.

16

reflect that carbon will have a cost for all our assets, the current best estimate is considered to

be EU ETS for countries outside EU where carbon is not already subject to taxation or where

Equinor has not established specific estimates.

(…)

27. Solvay SA, a chemicals company, described its accounting policies regarding to the

treatment of CO

2

emission rights, presenting these as inventories or derivatives depending

on its use.

EXAMPLE 6 – SOLVAY SA

Page 317

NOTE F25 INVENTORIES

Accounting policy

Cost of inventories includes the purchase, conversion and other costs incurred in bringing the

inventories to their present location and condition. The cost of inventories is determined by

using the weighted average cost method.

(…)

CO

2

emission rights

With respect to the mechanism set up by the European Union to encourage

manufacturers to reduce their greenhouse gas emissions, carbon dioxide (CO

2

)

emission rights are granted to the Group for free. The Group is also involved in Clean

Development Mechanism (CDM) under the Kyoto protocol. Under these projects, the Group

has deployed facilities in order to reduce greenhouse gas emissions at the relevant sites in

return for Certified Emission Reductions (CER).

In the absence of any IFRS regulating the accounting treatment of CO

2

emission rights, the

Group applies the Trade/Production model, according to which CO

2

emission rights are

presented as inventories if they will be consumed in the production process within the

next 12 months, or as

derivatives if they are held for trading. Energy Services is involved in

CO

2

emission rights’ trading, arbitrage and hedging activities. The net income or expense

from these activities

is recognized in “other operating gains and losses” (a) for the

industrial component, where Energy Services sells the excess CO

2

emission rights

generated by Solvay or where a Group deficit is recognized, as well as (b) for the trading

component, where Energy Services acts as a trader/broker with respect to those CO

2

emission rights.

In light of its centralized CO

2

emission rights’ portfolio management, for emission rights that are

substitutable between subsidiaries, the Group’s financial statements reflect the Group’s net

position. If this net position is negative, a provision is recognized, measured based on the

market price of the CO2 emission rights at reporting date.

(…)

The CO

2

emission rights amount to €57 million at the end of 2022. €16 million are

included in the inventories (for 2022 obligations) and €41 million are reported under

Other non-current assets (for obligations after 2022). (…)

Inventory write-downs are included in cost of goods sold in the consolidated income statement.

Consideration of CO

2

prices as a

key assumption in value in use

calculations. Steady decrease of

Brent prices.

ESMA emphasis added in Orange

Indication of the impacts on the

financial statements and which

line items are affected.

Information regarding the

accounting policy for CO

2

emission rights.

17

4.1.5 Areas for Continued Focus

To keep in mind

See also…

a) Where it could be reasonably expected by users that climate-related matters may

have a financial impact on financial statements (such as the

recognition of

impairment losses or provisions, or the revision of the useful lives of assets),

issuers (in particular, those belonging to sectors most exposed to climate) should

consider disclosing the assessments made, assumptions used (including the

time horizon), and the conclusions reached. This information may need to be

provided regardless of whether such assessments lead to changes in the useful

lives of assets, to the recognition of impairment losses,

provisions or the

disclosure of contingent liabilities.

b) When it is expected that the commitments and plans announced (such as issuers’

commitments to Net Zero) will impact financial information, issuers should

consider disclosing inside the financial statements

the risks and major

sources of uncertainty related to these commitments and plans

with a

quantification of each element, as well as potential mitigating actions to

address any risks identified.

c)

Issuers should consider complementing the disclosures surrounding major

judgements and estimations with

information about material exposures to

climate-related matters. For example, issuers may consider

quantifying and

disclosing (i) the carrying amounts of assets (e.g.

, by main group of assets or

geographies) and/or liabilities and, where possible, separately distinguishing its

exposure due to physical and/or transition risks, (ii) which line items in the balance

sheet and/or the P&L are more likely to be affected if climate matters materialise

(iii) and whether sensitivity analyses are necessary.

d) Issuers should ensure consistency between (i) the judgements and estimates

disclosed in the financial statements and the related uncertainties

, (ii) the

information included in other notes to the financial statements (e.g., impairment

of non-financial assets) and (iii) the information

disclosed with regards to

climate-related risks and uncertainties in the management report

and the

non-financial statements (e.g., CO

2

emissions).

e) Given the lack of IFRS guidance regarding the accounting treatment on CO

2

licences, certificates and trading schemes, issuers should consider disclosing the

accounting policies used for the recognition (e.g., which IFRS standard they

apply), measurement

(e.g., how prices/costs are determined, use of

internal/external sources) and presentation

(which line items are affected in the

balance sheet and the P&L) of such topics. To this end, issuers should consider

disclosing the main movements during the year

(e.g., acquisitions, sales,

consumption) separately. In this respect and considering paragraph 32 of IAS 1,

2021 ECEP

2022 ECEP

2023 ECEP

2021 ECEP

2022 ECEP

2022 ECEP

2021 ECEP

2023 ECEP

2023 ECEP

18

issuers should not offset assets and liabilities (e.g., CO

2

quotas owned,

acquired and used) unless required or permitted by an IFRS.

f) Issuers are encouraged to provide all information required to be disclosed under

IFRS on climate-related matters in one single note or to map out

where the

such matters are addressed in different notes.

g) Finally, issuers should carefully consider providing a balan

ced and consistent

presentation of climate-related disclosures made in other areas of the AFR and

the climate-related assumptions and estimates

disclosed specifically in the

financial statements.

2021 ECEP

2022 ECEP

2021 ECEP

2022 ECEP

4.2 Impairment of non-financial assets

4.2.1 Accounting requirements to consider

IAS 36 – Impairment of Assets

Paragraphs 9-14, 30, 33, 44, 130, 132, 134-135

IAS 36 sets out the overarching principles and related requirements for when issuers

must estimate recoverable amounts to assess both the impairment of non-financial assets

such as property, plant and equipment, right-of-use assets, intangible assets, as well as

goodwill. At the end of each reporting period, issuers must assess whether there is any

indication of impairment. This assessment must take into

account any external

information related to significant changes in the operational environment (for example,

the introduction of emission-reduction legislation, changes on consumer’s behaviours) of

the issuer which could give rise to an adverse effect on the issuer.

Under IAS 36, value-in-use (ViU) measurement involves estimating future

cash flow

projections for an asset in its current condition to be derived from its continuing use. Cash

flow projections should be based on reasonable and supportable

assumptions that

represent the management’s best estimates of future economic conditions. This may

entail considering whether climate-

related matters may affect the underpinning

assumptions. Additionally, where applicable, IAS 36 also require disclosures of the events

and circumstances that led to the recognition of an impairment loss and details regarding

the key assumptions used in the estimation of assets’ recoverable amounts and possible

changes in those assumptions.

Furthermore, IAS 36 foresees specific sensitivity analysis requirements, particularly when

a reasonably possible change in a key assumption related to a CGU’s recoverable

amount can lead to the carrying amount of the CGU to exceed its recoverable amount.

19

4.2.2 From principles to practice: relevant examples from selected issuers

4.2.2.1 Impairment testing using value-in-use (ViU)

28. In the following example, electricity company Endesa SA provides information regarding the

assumptions used in impairment testing and a description on the impacts of climate matters

in impairment testing.

EXAMPLE 7 – ENDESA SA

Pages 237-240

f.2. Calculation of recoverable amount

(…)

In estimating value in use, Endesa prepares pre-

tax cash flow projections based on the

latest budgets available. These budgets include Endesa management’s best estimates of

the income and expenditure of the CGUs according to industry projections, past

experience and future expectations. These projections cover the next three years, while

future cash flows until the end of the useful life of the assets, taking into account the

residual value, if any, and applying reasonable growth rates that do not, in any case, increase

or exceed growth rates for the industry.

(…)

f.3. Main assumptions used in determining value in use

(…) the approach used to assign value to the key assumptions considered has taken into

account the following items and/or parameters:

(…)

-

Average rainfall and wind potential levels: forecasts are drawn up on the basis of the average

weather conditions

in a year, taking account of historical conditions series. However,

the actual rainfall and wind potential levels of the preceding year were used for the first

year of the projection, adjusting the average year accordingly. (…)

- Assumptions for energy sal

e and purchase prices are made based on complex specifically

developed internal forecast models.

The pool price is estimated taking into account

different scenarios regarding the expected trend or performance in a series of

determining factors such as the

costs and productions of the different technologies,

electricity demand, commodity prices and other market and macroeconomic variables,

and, as a result of these models, the most likely scenario is considered. For these

purposes, the performance of the ele

ctricity pool price primarily affects the Iberian Peninsula

Generation Cash Generating Unit (CGU) (…)

- Energy transition scenarios and climate change impacts used in the valuation models

(see Note 5.1). (…)

The key assumptions used to determine value in use under the impairment tests of non-

financial assets as at 31 December 2022 (2023–2025 Strategic Plan) are as follows:

f.4. Impairment test

(…)

At 31 December 2021, the recoverable amount of the assets of the Non-mainland

Territories (“TNP”) of the Balearic Islands, Canary Islands, Ceuta and Melilla were re-

estimated, taking into account, among other aspects, the expected situation of the

commodity markets (fuel and carbon dioxide (CO

2

) emission rights) and the costs

expect

ed to be recovered for these items in accordance with the planned regulation, as

well as the estimated changes in the structure of future generation and their effects on

thermal generation. As a result of this re-estimation, an impairment of the Cash Generating

ESMA emphasis added in Orange

Tabular presentation of some

quantified assumptions related to

climate risks (including CO

2

prices) throughout the three years

business plan.

20

Units (CGUs) was recorded for each of the Non-mainland Territories (“TNP”) of the

Balearic Islands, Canary Islands, Ceuta and Melilla for a total amount of Euro 652 million

(see Notes 15 and 20.3).

Mainland coal-fired thermal power plants

At 31 December 2022, an impairment charge of 30 million Euro has been recognised for

the Los Barrios Port Terminal (Cádiz),

considering as a time horizon the current

concession of the Terminal, which ends in 2032. The request to extend the aforementioned

concession

until 2057, which is based on the investment in the execution phase of the Liquefied

Natural Gas (LNG) project at the Terminal, is pending resolution (see Notes 15 and 20.3). (…)

29. In the following example, industrial metals and mining company Imerys SA provides relevant

information on the exposure of assets to physical risks and how these risks were considered

in impairment tests.

EXAMPLE 8 – IMERYS SA

Pages 213; 238

Exposure to climate risks.

Given their geographic location, the Group’s entities may potentially be exposed to

physical risks related to climate change, such as flooding, heat waves, wildfires and

droughts. At December 31, 2022, the carrying amount of these sites represented 10.2% of

the Group’s consolidated assets (2.5% at December 31, 2021). Criteria for the identification

of these sites are described in Note 19.

(…)

Note 19 Impairment Tests

(…)

Furthermore, Imerys calculated its sensitivity to risks arising from climate change with

respect to the global warming scenario of +2°C by 2050, as projected by the International

Energy Agency (IEA) in its Stated Policies Scenarios published in the World Energy Outlook in

2019. Executive Management selected this scenario, which represents one of the three

trajectories modeled by the IEA, for the sensitivity tests as it is deemed to be reasonably

possible. Risks accounted for in this model are heat waves as identified by the S&P

Global Trucost Assessment, wildfires as identified by the FM Global Assessment and

the Angström index and drought as identified by the Water Risk Filter of the World Wild

Fund for Nature and the Deutsche Investitions- und Entwicklungsgesellschaft. Sites

included in the sensitivity exercise are those where risks are recognized as uninsurable

in the long term, based on the most recent information available at December 31, 2022

as well as those which are usually insurable, but are specifically recognized as

uninsurable due to specific climate conditions. On this basis, Executive Management has

estimated the frequency of planned closure for each site, as well as the corresponding

cash flow losses.

As summarized in the table below, the sensitivity calculated in the mid case scenario indicates,

in Performance Minerals, Asia Pacific (PMAPAC) excluding G&C, an impairment of -€12.5

million in the event of a 1.00% increase in the discount rate and an impairment of -€4.5

million in the event of a 1.00% decline in terminal growth rates. However, the sensitivity

calculated on risks and opportunities arising from climate change did not indicate any

impairment.

(…)

30. Telia Company AB, a telecommunications company, does not belong to a sector that

immediately appears to be most exposed to physical climate change or net-zero transition

risk. Nevertheless, the issuer disclosed the processes followed and assessments made when

verifying how climate-related matters impact key assumptions in the ViU calculations

considered in impairment test models:

Recognition of impairments due

to future evolution in the

commodity markets (fuel and

CO

2

emission rights) and the

non-renewal of the power plant.

ESMA emphasis added in Orange

Details of sensitivity analysis

performed to risks arising from

climate change with respect to

2°C by 2050.

Disclosure of the external

sources used and rationale for

selecting this source.

Quantitative information

regarding tangible assets’

exposure to climate risks.

21

EXAMPLE 9 – TELIA COMPANY AB

Page 165

Impairment testing

(…)

The key assumptions in the value in use calculations were sales growth, Adjusted EBITDA

margin development, the weighted average cost of capital (WACC), CAPEX-to-sales ratio

(CAPEX excluding Right-of-use assets), and the terminal growth rate of free cash flow.

CAPEX for Right-of-use assets has been considered in the impairment test model.

(…)

Approved forecasts consider potential significant climate related risks (as well as other

types of risks in Telia Company’s Risk Universe) and the group’s ongoing and future mitigating

activities.

Climate related risks are considered through, for example, the sales growth

forecasts which include offerings based on circular business models (e.g., pre-owned

phones, Device as a Service and buy back initiatives to enable reuse and recycling) and

product

s and services that enable our customers to reduce GHG emissions and energy

use (e.g., remote meetings, IoT and other data-driven services).

Further the EBITDA-margin and CAPEX-to-sales forecasts include impacts of higher energy

prices and Telia Company’s activities to manage the energy impacts and costs, including:

• increasing energy efficiency through new network hardware and power saving

features.

•managing power consumption through decommissioning legacy networks and

modernizing sites, for example copper-based access is replaced with mobile and fiber

connectivity and relevant units are placed outdoors to reduce the need of cooling and

• using renewable electricity when powering our operations covered by Guarantees of

Origins or secured through long-term Power Purchasing Agreements for solar and wind

and looking for alternatives to remaining fossil-based energy sources.

The CAPEX-to-sales forecasts are considering that investment decisions are preceded

by environmental screening of energy consumption, waste and GHG emissions, which

in turn affects for example product and service development and network construction. The

group-wide re-use and recycling program for network equipment is part of the forecasts.

(…)

4.2.2.2 Sensitivity Analysis

31. The following subsection provides illustrations on how climate risks were considered when

preparing sensitivity analyses as required by IAS 36.

32. In the following example, chemicals company Arkema SA provides information regarding the

assumptions used in sensitivity analysis in particular the potential impact that the increase of

CO

2

prices may have on EBITDA and consequently in the determination of the recoverable

amounts of different CGUs.

EXAMPLE 10 – ARKEMA SA

Page 323

8.5 Asset value monitoring

(…)

Sensitivity analyses

carried out at 31 December 2022, evaluating the impact of reasonable

changes in the basic assumptions – in particular the impact of a 1-point increase in the discount

rate, or of a change of minus 0.5 of a point in the perpetuity growth rate, or minus 10% in