JUNE 2018

Edit me

Aerospace Competitive Economics Study

(ACES)

Edit me

.

This page left intentionally blank

Teal Group Corporation

3900 University Drive

Suite 220

Fairfax, VA 22030

Phone: (703) 385-1992

CONTENTS

INTRODUCTION.............1

SUMMARY OF

FINDINGS......................3

Aircraft Markets &

Production Site

Factors........................5

The World Aircraft Market:

Best of

Times..........................5

Jetliners

Predominate.................7

Boeing & the Middle

Market.......................10

Production Site

Factors......................12

MOST COMPETITIVE

OVERALL......................14

1. Washington.........15

2. Ohio...................16

3. North Carolina.....17

4. Kansas...............18

5. Colorado.............19

6. Georgia..............20

7. Utah...................21

8. Texas.................22

9. Arizona...............23

10. Alabama...........24

FULL RESULTS.............25

Category

Rankings...................25

Individual

Rankings...................26

METHODOLOGY,

WEIGHTING &

METRICS......................34

.

Edit me

Aerospace Competitive

Economics Study (ACES)

JUNE 2018

Prepared for: International Association of Machinists (IAM) District 751

Society of Professional Engineering Employees in Aerospace (SPEEA) on

behalf of the Choose Washington New-Mid Market Airplane (NMA) Council

Prepared by: Teal Group Corporation

Richard Aboulafia, Vice President of Teal Group: The Aerospace

Competitive Economics Study is anchored by aerospace industry analyst

Richard Aboulafia, who provided in-depth aerospace insight and qualitative

analysis for the Study. Richard Aboulafia is Vice President of the Teal Group

and has spent over three decades analyzing the aerospace and defense

industry. Mr. Aboulafia frequently offers his analysis in major national news

media and writes regular columns for Aviation Week & Space Technology

and Forbes.com.

Contact: 202.352.6294

Tom Zoretich, Senior Economist and Director of Strategic Studies at

Teal Group: Teal Group Senior Economist & Director of Strategic Studies

Tom Zoretich oversaw quantitative and economic analysis for the ACES

Report and Rankings. Mr. Zoretich has worked as an economist with

Standard & Poor’s, McGraw-Hill, The US Department of Commerce, and the

Bureau of Economic Analysis. Mr. Zoretich has also directed and contributed

to projects for dozens of government and Fortune 500 clients, including the

US Department of Defense, US Department of Homeland Security, Northrop

Grumman, General Dynamics and IBM.

Contact: 571.201.4943

Evan Woods, Chief Consultant at Olympic Analytics: Olympic

Analytics Founder and Chief Consultant Evan Woods built the model

architecture and analyzed data for the ACES Rankings. Mr. Woods works on

research projects for unions, non-profits and government agencies. Mr.

Woods has conducted research for and consulted with The World Bank,

International Labor Organization and a number of national labor unions. He

holds a Masters in Economics from UCLA and has taught economics at three

colleges and universities.

Contact: 206.707.5980

Aerospace Competitive Economics Study | 1

Introduction

The findings of the Aerospace Competitive Economics Study (ACES) presented in this report

address the competitive business environment that aerospace manufacturing and final

assembly companies face when they consider locating in any of the 50 U.S. states or the

District of Columbia. The results offer a comparative tool to help public and private interests

evaluate the strengths and weaknesses of individual states as they look to attract new or

expand existing aerospace manufacturing projects. While the results of this report should not

be the only factor in determining a manufacturing location, they can provide significant

assistance in understanding important underlying capabilities that can best support the

aerospace sector.

The ACES report begins with a summary of the ACES rankings, followed by an industry

analysis of aircraft markets and production site factors. The industry analysis section reviews

the latest trends in the world aircraft market, commercial jetliner sales, the military market

and competitive conditions in the market for midsize aircraft. Discussion and analysis from

this industry section provides context for the ACES rankings.

The ACES rankings methodology is quantitative in nature; meaning that it is based on

empirical measures of a state’s economy and many of the associated factors that contribute

to the ability of commercial enterprises to efficiently and profitably produce an aerospace-

related product. While the focus is on empirical data, we recognize that there are other

factors that cannot be measured, or for whatever reason have not been measured, that also

contribute to a state’s ability to positively support aerospace manufacturing. In this case, we

make no attempt to include qualitative factors, such as political and labor relations, but we

recognize their potential value in a fully comprehensive assessment.

The ranking methodology presented here uses forty-one metrics that are assigned to eight

categories. Details on the individual metrics are included near the end of this report.

Individual metrics were chosen based on relevance, availability, consistency across states

and potential impact to production and profitability. Wherever possible, and where relevant,

metrics were chosen based on their ability to characterize the aerospace sector.

The eight categories included in ACES are presented in the table to the left. The assigned

weights are based on an assessment of how impactful the category might be to the overall

productivity and profitability of an aerospace company. The

higher the likely impact to the income statement and profits,

the higher the weight assigned. The metrics and categories

chosen include elements that are directly or indirectly

impactful. Direct impacts score a higher weight than indirect

impacts. Additional discussion of the methodology is presented

at the end of this document.

2 | Aerospace Competitive Economics Study

The Costs category carries the greatest individual weight (twenty percent). The metrics

included in this category (labor, material, energy and construction costs) are more directly

related to a company’s actual cost of operations than are metrics in other categories (i.e.

education levels or spending on R&D). The Costs category is not intended to fully represent

the actual cost of operations, but only aggregate measures that relate to operational costs,

thereby impacting the overall competitive environment. A company’s actual costs of

operations are heavily dependent on its structure, requirements, supplier relationships and

agreements, and numerous other factors.

It should be noted that labor and material cost metrics included in the study measure the

cost of these inputs per dollar of output. This allows the study to incorporate the productivity

of inputs, rather than simply measuring absolute labor and material costs.

Labor & Education and Taxes & Incentives have the same weight (17.5%), as do Industry and

Infrastructure (15%), reflecting each category’s slightly lower contribution to overall

competitiveness. In total, these top five weighted categories comprise eighty-five percent of

the overall rankings. Finally, Economy, Research & Innovation, and Risk to Operations fill out

the remaining fifteen percent.

As the results show, some states are highly competitive across a number of the categories

and individual metrics included in the categories, while other states are strong in a category

or two, or not competitive in the least. The ACES analysis and findings focus on the

aerospace sector, but some of the results for non-aerospace specific categories could apply to

other sectors.

Additionally, state category rankings may change substantially from year-to-year. Tax

metrics, for instance, are influenced by government policy which can change quickly within a

legislative session, with rates adjusted and incentives increased, reduced or repealed. This

year’s ACES Rankings represent a quantitative snapshot of the current competitive landscape

rather than an analysis of long term trends.

Finally, aerospace manufacturing encompasses a broad array of processes and products, and

these different goods depend on different attributes in a production site. For example,

manufacturing avionics or satellites involves a greater emphasis on a skilled engineering

workforce, and relatively little emphasis on infrastructure. On the other hand, heavy

manufacturing of large metal aerostructures involves greater emphasis on a skilled

manufacturing workforce and physical infrastructure; composite structures would involve a

greater emphasis on energy costs.

Given these diverse requirements, our criteria weightings and data reflect a balanced

approach. In general, we have tried to look at the qualities most desirable for the

manufacture or final assembly of large aerospace structures. ACES Rankings data for sales,

exports, value added and other industry metrics are drawn from the aerospace product and

parts manufacturing industry group (NAICS Code 3364), which includes “establishments

primarily engaged in manufacturing aircraft, missiles, space vehicles and their engines,

propulsion units, auxiliary equipment, and parts thereof.” A manufacturer seeking to build,

for example, missile engines or flight simulators, might apply alternative weighting to the

various metrics and categories, or include a different set of industry data.

3 | Aerospace Competitive Economics Study

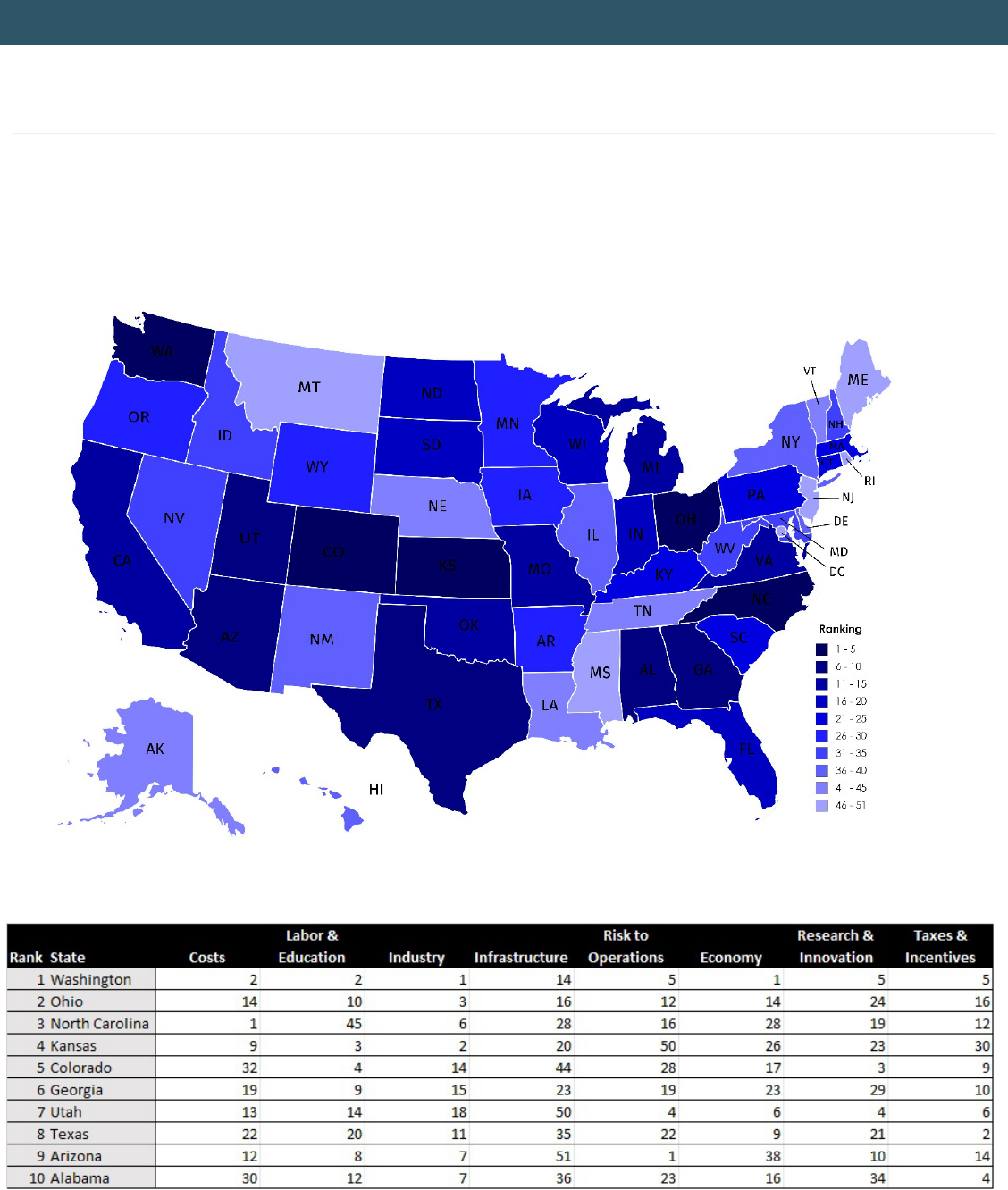

Summary of Findings

Based on the research conducted for this study, the states of Washington, Ohio, North

Carolina, Kansas and Colorado offer the most competitive business environments for the

manufacture of aerospace equipment. These states ranked high in a number of the

evaluation categories and corresponding metrics.

Washington scored extremely well across all categories and was a top ten finisher in all

but one. It ranked first in two categories: Economy and Industry, while finishing second

in Labor & Education and Costs. It was ranked number five in Risk to Operations,

Research & Innovation and Taxes & Incentives. Infrastructure was the only category

where Washington fell outside the top ten.

Ohio had the second highest overall rank, with significant separation between it and the

state of Washington. Demonstrating the substantial gap between first and second, Ohio

finished in the top ten in only two categories, Labor & Education and Industry. It did

finish in the second ten in a number of categories, thereby reinforcing its overall strong

showing. These categories included: Economy, Risk to Operations, Infrastructure, Costs,

and Taxes & Incentives.

North Carolina also had a strong showing in a number of categories and finished as the

third highest ranked state. It finished first in the most important and highest weighted

category, Costs. In addition, it had very strong rankings with two other top ten finishes

in Taxes & Incentives and Industry. It had two second ten rankings in Research &

Innovation and Risk to Operations.

Kansas came in fourth overall, with top ten category rankings for Industry, Labor &

Education and Costs. It was at the bottom of the second ten for Infrastructure. Kansas

was a poor performer in Risk to Operations, coming in at number fifty.

Colorado ranked fifth overall. It is particularly strong in Research & Innovation, Labor &

Education and Taxes & Incentives, having top ten finishes in these three categories. The

Economy and Industry categories came in second ten highest rankings. It did not score

well in the important Costs category, thereby substantially limiting its ability to score

even higher in the overall aerospace competitiveness ranking.

The remaining top ten is rounded out by Georgia, Utah, Texas, Arizona and Alabama.

Utah was very strong in four categories: Research & Innovation, Economy, Taxes &

Incentives and Risk to Operations. Georgia finished in the top ten in the Labor & Education

category, while Alabama was very strong in Taxes & Incentives, and Industry.

Arizona ranked number one in the Risk to Operations category and finished top ten in two

other categories: Industry and Labor & Education. Texas was highly ranked in the Taxes and

Incentives category and scored well in Economy, Industry and Labor & Education.

4 | Aerospace Competitive Economics Study

Top 5 States for Each Category

5 | Aerospace Competitive Economics Study

Aircraft Markets & Production Site

Factors

The World Aircraft Market: Best of Times

The competition for aerospace production work among US states and regions is intensifying for a simple reason: The outlook

for the aircraft industry is now the best it has been for decades. Topline output continues at near record levels. Key segments

look set for growth through the next three years, at least. There are areas of concern, and not all manufacturers will benefit

equally, but overall the industry is in excellent shape.

World industry output in 2017 came to just over $180 billion. Deliveries in 2014-2016 have all been at about this level in

constant 2018 dollars (2015 was the all-time record, at $183.5 billion).

However, the industry has been stuck on this plateau not for market reasons, but rather for reasons relating to production

ramp difficulties with key new programs. Single aisle jetliners represent 25% of the value of this industry, and difficulties in

transitioning between the last generation and the next generation have resulted in the present level of stalled output. The F-

35 Joint Strike Fighter’s slow production ramp has contributed to this problem.

But these numbers represent only the value of deliveries; they exclude the broader footprint of the industry, which is about

two to three times as large as the value of total new build aircraft. The numbers also exclude research and development

funding, and the generally more lucrative aftermarket sustainment business.

Therefore, since the new aircraft market is worth $180-$210 billion per year, we reckon that the total aircraft industry

contributes $700-900 billion annually to the world economy (that covers the broader industry footprint plus research and

sustainment). And this figure excludes numerous related industries, such as airlines, air traffic control, and military air base

support services.

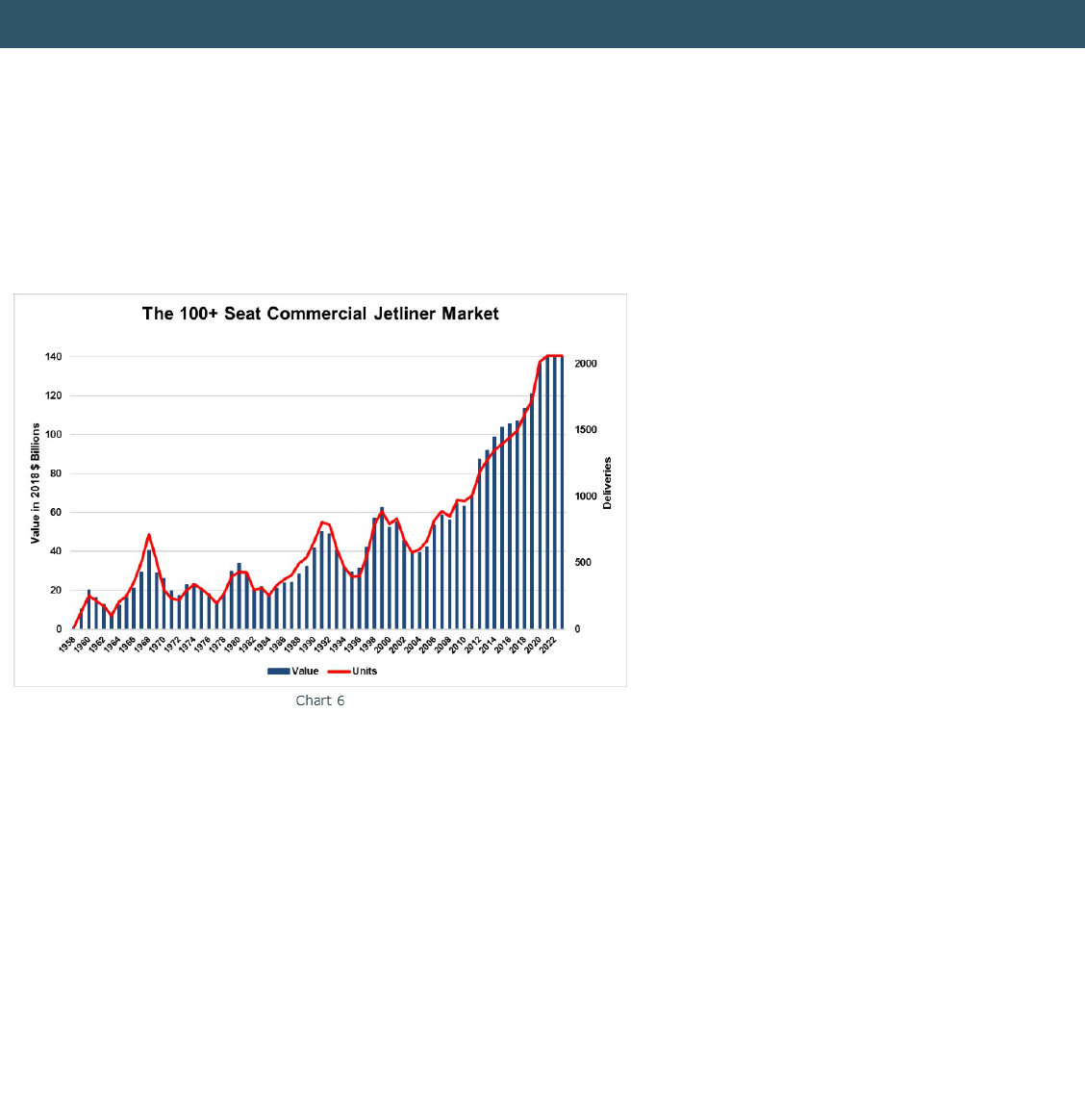

As the chart to the right indicates, for the past 15

years, topline deliveries growth has come

primarily from the civil markets, with a 3.7%

compound annual growth rate (CAGR) by value.

Military markets have grown at a 2% pace, but

higher defense budgets will grow this in the

coming few years.

6 | Aerospace Competitive Economics Study

As chart 2 below indicates, US primes’ share of this industry has remained relatively steady at just above 50% by value of

deliveries for the last two decades. As the industry topline has grown, so has US output.

While this chart measures output solely at the prime level, US industry continues to do very well at the subcontractor level,

exceeding the 50% mark in most key segments (engines, avionics, etc.) and equaling the 50% level in others (aerostructures,

control systems, etc.).

The primary drivers of US industry at the prime

level include Boeing jetliners and fighters,

Lockheed Martin fighters, Gulfstream business

jets, and rotorcraft from all three primes

(Boeing, Textron/Bell, and Lockheed

Martin/Sikorsky). Many other smaller

manufacturers play a supporting role.

Given the relatively steady state nature of this

industry, where there are few major disruptions

and product life cycles are measured in decades,

it isn’t surprising that the US’s aerospace trade

surplus is relatively steady.

As chart 3 below indicates, the US has enjoyed a

roughly 2.5-1 aerospace trade advantage by

value with the rest of the world for decades.

This higher ratio of recorded exports (compared

with 1-1 output at the prime level, shown in the

previous chart) reflects US industry’s success at

the subcontractor level, along with success in

space systems, missiles, and in other markets.

7 | Aerospace Competitive Economics Study

Jetliners Predominate

The world aircraft industry today is increasingly controlled by Airbus and Boeing. First, large commercial jets are now about

60% of total industry output by value, not just at the final delivery level but through most of the component and structures

supply chain, too. The chart below indicates the relationship between commercial aircraft and the other segments.

Second, Airbus and Boeing dominate because they

are absorbing a greater share of the industry. The

acquisition of Bombardier’s CSeries – to be

completed in the middle of 2018 – gives Airbus a

new line of 110/130-seat jets, provisionally known

as the A210 and A230. Meanwhile, Embraer and

Boeing are moving towards creating a joint

venture – to be controlled by Boeing – covering

Embraer’s E-Jet series, spanning 75-120 seats.

Therefore, in a year, the entire jet transport

industry will be controlled by just two companies.

And barriers to entry remain extremely high, as

evidenced by China’s multi-decade effort to break

into the market, with few signs of success. Russia

is trying to re-enter this industry, but aside from

one money-losing regional jet it also faces a long

and difficult road.

This industry is not just protected by high entry

barriers; it also features extreme concentration at the top, in terms of major revenue-producers. Just a small number of

jetliner models play a pivotal role in driving the market. The chart below shows revenue from deliveries over the past ten

years and Teal Group’s forecast for the next ten. The two major single aisle programs – Airbus’s A320 series and Boeing’s 737

family – constitute 25% of industry revenue.

Of the top five programs (which represent half the

aircraft industry in revenue) just one, Lockheed

Martin’s F-35 Joint Strike Fighter, is not a jetliner.

Jetliners comprise eight of the top ten aviation

manufacturing programs.

Today, the jetliner market is extremely strong. In

fact, some are questioning whether the market

has moved beyond cyclicality.

Since the jet age began, the market has seen a

recurring pattern of roughly seven good years

followed by three bad years, with deliveries in the

bad years falling by 30-40%, or more, by value.

Yet since 2004, the industry has enjoyed strong

growth, with the exception of the 2016-2017

hiatus (due largely to the single aisle deliveries

pause before A320neo and 737MAX deliveries

ramp up).

With the exception of a few sluggish twin aisle

programs, OEM plans call for continued growth

through 2020, at least. The A320 family is on course for 60 planes per month, with the 737 headed for 57 per month. Boeing

plans to raise 787 output from 12 to 14 per month in 2019.

8 | Aerospace Competitive Economics Study

If the current rumors are correct and Airbus and Boeing both go to 70 single aisles per month by 2023, the single aisle

segment would have seen 450% growth (by value of deliveries) over 19 years, in constant year dollars. More single-aisle jets

will have been delivered between 2010 and 2024 than were delivered in the first 51 years of the jet age, 1958-2009.

With over 12,000 jetliners on backlog at Airbus and Boeing alone, this momentum will continue through the end of the decade,

largely due to those two new single aisle models. These single aisles represent 50% of industry output by value.

This means the jetliner market will have a 16-year growth cycle, and possibly longer. That’s over twice as long as the usual

seven-year boom, and this time, hopefully, we won’t see an unpleasant bust cycle on the other side. The current Airbus and

Boeing jetliner deliveries plan, and its relationship to the history of the market, is illustrated by the chart below.

There have been three drivers behind this

remarkable boom since 2004, and all of them are in

very good shape.

One is the remarkable rise of China, both as an

economy and as a jetliner market. In 2001, China

accounted for just 3% of world jetliner output,

scarcely higher than in 1991. By 2015, this had hit a

record of 22%, making China the largest jetliner

market in the world. In 2017 it reached 22.8%.

This excludes leased jets delivered to China that

year. And China’s banks and lessors played an even

larger role in world jetliner finance.

Two other key exogenous factors impacting jet

demand are the price of fuel and the cost of capital.

But it’s the ratio between those two indicators that

helps drive jetliner market health.

As of this writing, fuel is just above what might be

termed the Goldilocks zone, $71/bbl for West Texas Intermediate. If fuel goes down, to $40 or below, airlines will be far less

likely to re-equip with new, more efficient jets, and more likely to keep older equipment longer. If fuel goes up, to $80 or

above, airlines will have a harder time making money, and as they raise fares to compensate travel demand will likely fall.

But today’s fuel prices are reasonably healthy for the industry.

Meanwhile, cash is still very cheap. The Federal Funds Effective Rate is just 1.5%, up from an extended period at around 0%.

This is forecasted to get to 2.1% this year but considering that as recently as 2007 it was 5%, interest rates are still

reasonably low.

The ratio between the cost of money and the cost of fuel plays a big role in airline thinking. A combination of 0% interest and

$100 fuel effectively means that an airline should absolutely finance new jet purchases to replace older, less efficient jets.

Today’s ratio is still pretty good. By historical standards there’s still a gap between these two metrics, even if it’s far less

profound than in 2009-2014. But 5% interest rates and $40 fuel would mean a lot of airlines simply hang on to older

equipment.

9 | Aerospace Competitive Economics Study

Over the past two years, a third factor driving jetliner demand has kicked in. Airline traffic demand has been unusually

strong. Revenue Passenger Kilometers (RPKs) grew 7.6% in 2017, well above the 5.5% average rate of the last ten years,

according to the International Air Transport Association (IATA). Even the long-depressed air cargo market is back; Freight Ton

Kilometers (FTKs) grew by 9% last year, the strongest numbers since the 2010 recovery. Airline industry profits have been

strong, too, with $35.6 billion earned in 2016, and IATA now forecasting $31.4 billion in 2017.

This traffic growth (and industry health) far exceeds the pace of world economic growth. There’s a long-established link

between GDP and traffic, and traffic is now outperforming the usual GDP multipliers by a healthy margin. It’s hard to say

whether this will continue, but even if RPK growth falls to 2016’s 6.3% level, that’s sufficient to keep jetliner demand strong.

While traffic is outperforming economic growth, the latter is also quite strong. The U.S. economy has now been expanding for

nine straight years, with no signs of a slowdown. The IMF and OECD are both forecasting global growth of 3.9% this year, up

from 3.7% in 2017. All the major regions of the world are enjoying this growth, and China, again the biggest single market

for jetliners, is still growing at around 6.5%.

There are many things that could go wrong. In addition to a decline in passenger traffic and economic growth, a trade war

with China or a slowdown in China's economy, and changes to the fuel prices/interest rates ratio, there’s always the risk of an

exogenous shock, such as a war or a terror attack. But our baseline scenario calls for growth through 2020. At that point,

jetliner industry output, in real dollars, will be worth three times the level in 2004, when this super-cycle began.

The jetliner industry’s remarkable growth is accompanied by a strong military aircraft market. However, as the chart to the

right indicates, the US part of this market is increasingly dominated by Lockheed Martin’s F-35. Also, there are even fewer

new product launches in the military market than there are in the civil markets.

Despite its current good fortunes, Boeing faces a few

challenges in the future. The military market outlook

described above is clearly not in its favor. It’s one of

the biggest curiosities that the world’s largest military

aviation program is a US program, but the US’s biggest

aerospace company is one of the very few companies

in the world without any kind of role in that program

(the F-35). Northrop Grumman has won the B-21

bomber contract.

While the T-X trainer is still up for grabs, there are

three competitors, and even if Boeing wins it would not

provide much growth.

Also, as discussed above, even the current remarkable

jetliner market will run out of growth in the next few

years. Clearly, if Boeing wants to keep growing its

revenue and profits, it will need to try new approaches.

This explains why the company has established a

separate aftermarket division, to pursue sustainment opportunities. It also explains why the company is establishing new

capabilities in propulsion, actuation, and avionics, to pursue vertical integration opportunities.

But a third approach will be to look at where the company is weakest against Airbus, and to see what can be done to regain

lost market share in that segment. The New Midsize Airplane (NMA) is a response to that middle market weakness.

10 | Aerospace Competitive Economics Study

Boeing & the Middle Market

In most segments, Boeing is ahead of Airbus in deliveries and backlog. Yet in aggregate, as indicated in our backlog

comparison chart, Airbus is ahead by value of backlog. This is because Airbus enjoys a commanding lead in exactly one

segment: the 190/250-seat middle market.

Just below the middle market, the 737MAX8 and

A320neo look evenly matched. Just above the

middle market, in twin aisles, the 787-9/10 are

generally doing better than the A350-900 and

A330-900. Above that, the 777X is well ahead of

the A350-1000. The 747-8 and A380 have

ceased to be major factors in the market.

But in between the first two of these two

segments, the largest 737MAXs – 9 and 10 – are

being outgunned by the A321neo. The latter has

about 2,000 orders, while there are just over 500

known MAX 9/10 orders (more may come from

the “undetermined” group of MAX orders, but this

would be at the expense of the MAX8).

The current state of 190/250-seat backlogs can

be seen in our chart, which clearly shows that if it

weren’t for this segment Boeing’s overall backlog

would be well ahead.

Boeing’s response to this challenge is the proposed NMA, a clean-sheet twin aisle design which will seat 220-260 passengers

with 5,000-5,500-nm range. Air Lease Corp. Executive Chairman Steven Udvar-Hazy even gave it a proper Boeing

designation: the 797.

There are two possible problems with Boeing’s

NMA concept. First, there’s the market. Any

projection of trends over the past 30 years—

airliner fleets, orders and deliveries—clearly

shows that single-aisle middle-market jets have

enjoyed stronger growth than twin-aisle middle

market jets. The mid-market demand ratio is

now at least 3:1 in favor of single-aisles.

This middle market preference for single aisles

explains the very large A321neo order book. It

also may explain why orders for 250-seat twin-

aisles—particularly the 787-8 and A330-800 –

have been eclipsed by orders for larger 300-seat

variants.

Norwegian’s plans to start transatlantic service

with 737 MAXs, along with the increased number

of other transatlantic single-aisle routes, suggest

that, if anything, some twin aisle midsize

demand will migrate downward to the single

aisle segment.

11 | Aerospace Competitive Economics Study

Second, there are the higher costs associated with twin-aisles.

A glance at operating and production economics (block hour cost per seat and realized price per seat, respectively, illustrated

in our chart) clearly shows that there’s a significant gap between single- and twin-aisle jets. A single-aisle product is

inherently cheaper to buy, build and fly. Low-cost carriers seeking fast turnaround times may like the idea of two aisles, in

theory. But if twin-aisle operating economics remain distinctly higher than single-aisles’, it is unlikely that faster turnaround

times will actually trump lower operating costs.

Boeing is aware of this problem. Company

representatives have made it clear that the NMA

needs to offer twin-aisle capabilities—range,

comfort, capacity, and faster turnaround time—

with single-aisle economics.

If Boeing is successful with this, they will have a

product that likely stimulates demand in the

mid-market twin-aisle segment. This is a

reasonable goal.

One big reason that orders for the 787 and

Airbus A330neo series have migrated to the

larger members of these families is that these

aircraft are built with the structures and systems

needed for longer routes and larger models.

A plane that’s optimized for the shorter and

lighter routes, like the NMA, should convince

airlines to fly new thinner routes between new

city pairs.

But there are no guarantees that Boeing will be

able to bridge the cost gap between single- and twin-aisle jets with the NMA. And new technologies developed for the NMA—

particularly new engine technologies—could be used to help lower single-aisle operating costs, too, keeping the gap in place.

Boeing has been in this position before. In the late 1970s, it bifurcated its middle market product launch decision, creating the

single-/twin-aisle 757/767 family. This was seen as a necessary response to the clear line between single and twin aisle

market requirements, and ultimately both products succeeded. But these are different times in terms of new product

development spending levels and company tolerance for risk.

As a result, Boeing is now leaning towards a twin aisle NMA, with the 737MAX10 filling some of the 757 roles. Again, the

company needs to do everything it can to make the NMA competitive with single aisle jets.

12 | Aerospace Competitive Economics Study

Production Site Factors

Boeing’s need for an ironclad NMA business case relies on many factors on the supply side. Supplier costs, aftermarket rights,

and technology and materials decisions all play key roles. But the economics associated with site selection will play a role too,

both for final assembly and any separate fuselage or wing manufacturing location.

An aerospace company’s need to looking at production site options as part of establishing a business case for a new program is

a relatively recent development in the jetliner industry. Historically, most jetliners have been built at legacy production sites.

Given very high barriers to entry in this business, and given very long product life cycles (the 737 last year set a record at 50

years in production), this is not surprising.

This means aircraft have been produced where successful companies were established themselves, usually many decades ago.

Sometimes, these companies were established in places for relatively arbitrary reasons, such as Boeing’s original start in a

wooden shipyard in Seattle, and its utility for wooden seaplanes. Often, aerospace companies were located in places far from

an enemy threat, such as Russia’s Siberian-based aircraft factories, or almost all of France’s aerospace industry.

Until the 1990s, this reliance on legacy manufacturing sites didn’t change very much. Successful companies turned their

legacy sites into industrial powerhouses; unsuccessful companies reduced their legacy sites to museums. In 2016, the last C-

17 rolled off the line in Long Beach. This represented the last jet built in California, the last of thousands of aircraft.

Today, state and regional competitiveness matters, but in the first decades of the jet age success was determined by company

success or failure and the attributes of the sites themselves seldom played much of a role. McDonnell Douglas failed as a

jetliner prime not because Long Beach was a terrible place to build planes; rather, it just systematically underinvested in new

technology and products. If Boeing had been located in Long Beach, and McDonnell Douglas had been located in the Puget

Sound, it’s quite likely that the fortunes of these two regions as aerospace manufacturing centers would have been reversed.

But Boeing invested in the future, which helped create and maintain a skilled workforce, and many other attributes that make

the Puget Sound a great place to build aircraft.

While manufacturers generally stayed in their legacy regions, two other trends had a material impact on the evolution of

aircraft production. The first was outsourcing. While Boeing regrets going too far in outsourcing design and integration work

on the 787, the idea of spreading production to risk-sharing partners has been around for half a century, or longer. The entire

body of the 747 was outsourced to Northrop in the 1960s.

Increasingly, this outsourcing went global, largely as a result of much broader macroeconomic trends. As borders and

governments gave ground to multinational enterprises and economic liberalization, international trade grew at a record pace.

Container boxes and ships, air cargo, CAD/CAM, the internet and logistical software provided tools to accelerate globalization.

Distance became less relevant. Manufacturing became less vertical, creating global supply chains and industrial

arrangements. US manufacturers have been transformed by this new paradigm, enjoying remarkable profitability over the

past few decades.

Meanwhile, as noted above, Boeing is pursuing vertical integration opportunities. In the case of the 777X wing, this work will

indeed be located near the final assembly line. But in the case of other systems, most notably propulsion systems, the work

will be placed away from final production. For example, Boeing’s propulsion unit is building 737MAX engine nacelles in South

Carolina, across the country from Renton. It might be part of Boeing, yet it still represents distributed manufacturing.

13 | Aerospace Competitive Economics Study

The idea of a “supersite,” where all components and structures for a given aircraft are built in the same region, is generally

not regarded as a valid approach. In good times, such a supersite would see very high wage inflation for engineers and

manufacturing workers, with Boeing and its contractors all poaching employees from each other. And in a bust cycle, the

region would be hit hard by very high unemployment rates.

The second aircraft industry trend over the past few decades has been the establishment of secondary final assembly lines, or,

as they are sometimes termed today, Final Assembly and Check Out (FACO) lines. Military programs have relied upon FACOs

since before World War One. But with its China facility constructed to build MD-80s, McDonnell Douglas extended the concept

to jetliners.

Airbus has further led the way in adapting this idea for jetliners. At first, the European company used the concept to establish

a secondary single aisle line, in Germany, at a member company facility. But today, it has transplant lines in Mobile, Alabama,

and Tianjin, China. It will also use its Mobile facility to build the CSeries in a secondary line when that acquisition is

completed.

This second trend, of secondary assembly lines, was enabled by the first trend. Basically, with sections of the aircraft built

elsewhere, it became less expensive to establish secondary final assembly lines, because they didn’t need to have a heavy

level of local production.

Inevitably, this led to a move away from legacy sites for final assembly lines on new programs. One of the first abortive

instances of this took place on the MD-95, later designated the Boeing 717. In November 1994 McDonnell Douglas announced

that it had signed up Dalfort Aviation, a Texas-based overhaul company, to handle final assembly of the aircraft. However,

this was later cancelled, and the 717 was built at Long Beach.

The 787 was the first Boeing aircraft which involved a very active manufacturing site selection process. After surveying

numerous alternatives in the US, including South Carolina, Texas, and Alabama, Boeing selected Everett, Washington in

December 2003. However, Boeing later decided to establish a second production line in Charleston, South Carolina.

The 787 was followed by the 737MAX. As a derivative rather than a clean-sheet design, the incumbent 737 production site

had an advantage. Even though Boeing executives said they would look at alternative sites, Boeing management worked with

labor and other parties, under Project Pegasus, to come to mutually agreeable terms to keep the line in Washington.

This was followed by the 777X site selection process, which also involved a derivative jet. While this was a far more

contentious process, which, in theory, involved a much closer look at alternative sites, Boeing kept the line in Everett.

So far, Airbus has yet to look at alternatives to Toulouse and Hamburg for its primary jetliner final assembly lines, and

Embraer has not looked outside of Sao Jose Dos Campos. However, Embraer has moved business jet production lines to

Florida. But Bombardier did investigate alternatives to Mirabel for CSeries jetliner production, at the start of the program.

Boeing, of course, will continue its stated policy of examining many alternatives for future jetliner programs. And to

summarize, the success of Boeing’s NMA will depend on choosing the optimal site, or sites, for manufacturing and final

assembly.

The changing nature of aviation manufacturing means that this plane could be built anywhere, but top states maintain

competitive advantages outlined in the ACES rankings below.

14 | Aerospace Competitive Economics Study

Most Competitive Overall

The top performing states are presented in the chart and table below. Based on the various measures included in ACES, these

states represent the most competitive business environments for the manufacture or final assembly of large aerospace

structures. Each of these ten states incorporates multiple factors that contribute to its competitiveness ranking.

ACES Ranking

15 | Aerospace Competitive Economics Study

1. Washington

The State of Washington is a strong first place finisher as the most competitive

place for aerospace manufacturing operations. It scores high in nearly all the

evaluation categories and many of the individual metrics.

In terms of Costs (#2),

Labor & Education (#2),

Industry (#1), and Economy

(#1), it performs at or near

the very top. Washington is

also rated in Taxes

&Incentives (#5), Risk to

Operations (#5), and

Research & Innovation (#5).

Only the Infrastructure

category (#14) presents a

modest constraint on its

dominant position.

Washington has a large aerospace presence led by The Boeing Company. Many

other suppliers, manufactures and vendors support the aerospace industry as

well, evidenced by the #3 Supplier Density ranking. Washington ranks high in

many of the metrics that closely relate to aerospace.

What makes it especially

competitive is its advantages

beyond aerospace experience,

namely low Energy Costs (#1),

which are increasingly important

due to the growing use of

energy-intensive composite

structures manufacturing in

aircraft, high Port Volume (#4),

low Insurance Losses (#2), high

Patents per Capita (#3), high

Private R&D (#5), and lower

Individual Income Tax (#1) and Manufacturing Taxes (#4).

At Boeing’s Composite Wing Center in Everett, workers on the

autoclave began producing the carbon fiber stringers that will form the

long single-piece composite spars for the 777x, set to enter service in

2020. Boeing’s facility has attracted new suppliers as well.

Héroux-Devtek’s Everett facility, opened in 2016, began producing 100

shipsets of landing gear for the Boeing 777/777X under a contract that

runs through 2024.

In December, Spanish engineering firm MTorres opened a new plant

near the Composite Wing Center to produce advanced manufacturing

robots used in the 777x carbon-fiber spars production process.

16 | Aerospace Competitive Economics Study

2. Ohio

Finishing as the second most competitive state is Ohio.

It has a well-established

aerospace industry and ranks

number three in that category. Key

measures contributing to its

position include attractive Unit

Labor Costs (which reflect

productivity in the ACES

methodology), modest Risk to

Operations and competitively

configured Taxes & Incentives.

Ohio ranks just at the bottom of

the top ten in the Labor & Education category with the 7 highest density of

Aerospace Engineers in the nation.

Reflecting its aerospace

experience, Ohio ranks high in

Aerospace Sales, Aerospace

Value-Added, Aerospace Exports

and Supplier Density. It has a

solid infrastructure ranking and

scores high in Airports and Freight

Railroad.

It falls within the highest quarter

in Risk to Operations which is

highly competitive with top ten

rankings in Insurance Losses and Insurance Premiums.

th

Much of Ohio’s Aerospace industry is anchored by Wright-Patterson Air

Force Base in Dayton. The base directly and indirectly generates $3.7

billion in wage income and 51,000 jobs in the area. Fully 19% of all of

Ohio’s aerospace and aviation industry jobs are in the Dayton area.

GE Aviation employs 7,400 manufacturing workers in Greater

Cincinnati. It’s one of the world’s largest jet engine production site.

In November 2017, GE Aviation inked a $600 million contract with

Chile’s Sky Airline to provide maintenance for the airline’s LEAP-1A

engines. The engines are built in Cincinnati by CFM International, a

joint venture between GE and Safran Aircraft Engines.

17 | Aerospace Competitive Economics Study

3. North Carolina

Cost competitiveness plays a key role in making North Carolina an attractive state

for aerospace companies.

It scores #1 in Labor Cost

and #2 in Material Cost,

thereby propelling it to #1

in Overall Costs. It also

ranks within the top

twenty in the other two

cost metrics, Energy Cost

and Construction Cost.

Costs were a key factor in

HondaJet’s decision to

launch a new production

program in North

Carolina, the first

successful new jet startup in decades.

North Carolina also does very well with respect to the Industry category at #6,

scoring top ten finishes in Aerospace Employee Growth, Aerospace Value Added,

Aerospace Sales and Crowding Out.

A competitive tax

environment contributes

to North Carolina’s strong

ranking and places it near

the top ten in the Tax &

Incentives category. It

ranks as the #7 state in

terms of Corporate

Income Tax.

Other metrics that help

propel North Carolina to

#3 in the overall ranking

are low Insurance Losses and solid Research & Innovation scores, with top ten

finishes in Private R&D, High Tech Establishments and Patents Per Capita.

HondaJet deliveries began In December 2015, giving the state its first

jet production line.

North Carolina has a number of aerospace clusters, including facilities

centered around Union County and Monroe near Charlotte and

production located at the Global Transpark in Kinston, NC.

Several major international aerospace firms have facilities in North

Carolina, including GE Aviation, Honda Aircraft Co., BAE Systems,

Honeywell, B/E Aerospace, Spirit Aerosystems, Curtiss-Wright Corp.,

LORD and HAECO.

In December 2017, Spirit Aerosystems announced it would be

investing more than $55.7 million to expand its Kinston, NC site.

18 | Aerospace Competitive Economics Study

4. Kansas

Kansas finishes as the fourth most competitive state for aerospace manufacturing

operations. It ranks near the top in two key categories, Industry and Labor &

Education, coming in at #2 and #3, respectively.

With respect to its high

Industry category ranking,

there are four individual

metrics that contribute to its

strong performance: Supplier

Density (#1 among all

states), Aerospace Value

Added (#4), Aerospace Sales

(#5) and Aerospace Exports

(#12).

Within the Labor & Education

category, Kansas does very well with respect to Aerospace Production Workers

(#1) and Aerospace Engineers (#3). Also contributing to its high ranking are top

twenty finishes in Graduate Degrees and High School Degree or More.

Kansas is also the ninth

highest ranked state in the

Costs category and is highly

competitive with respect to

Material Cost (#9). Other key

contributing metrics include

Road Conditions at #1, which

helps Kansas finish with a top

twenty ranking in

Infrastructure.

Kansas boasts the top-ranked aerospace supplier density in the nation,

hosting firms like Spirit AeroSystems, Honeywell and Garmin. Wichita,

the “air capital of the world”, leads in small planes, thanks to

Textron/Cessna and Bombardier/Learjet.

In September 2017, Orizon Aerostructures Inc. a manufacturer of

complex subassemblies for the aerospace industry, announced it was

moving production from Missouri to a new 205,000-square-foot plant

in Olathe, KS.

In December 2017, Spirit AeroSystems announced it would invest $1

billion in its Wichita factory and add 1,000 jobs, including many union

machinist and engineering positions. The company followed that up in

February 2018 with an announcement of bonuses equal to more than

10% for Society of Professional Engineering Employees in Aerospace

(“SPEEA”) union engineers and other Spirit workers.

19 | Aerospace Competitive Economics Study

5. Colorado

Colorado ranks as the fifth most competitive state.

It has a fast-growing aerospace

sector and ranks #2 in

Aerospace Employee Growth.

Other key measures

contributing to its position

include highly competitive

rankings for Labor & Education

(#4), Research & Innovation

(#3) and Taxes & Incentives

(#9).

Colorado ranks #4 in the Labor

& Education category, with a number of high performing metrics. It is #5 in

Engineering BAs, #6 in Aerospace Engineers, #8 in Aerospace Production Workers

and #8 in Graduate Degrees.

Equally impressive is the state’s

#3 ranking as the most

competitive state in terms of

Research & Innovation.

Coupled with its strong position

in Labor & Education, this gives

Colorado a strong stake in

future aerospace sector

development. With respect to

Research & Innovation it

performs well in all four metrics, with especially impressive rankings for High Tech

Establishments (#4) and Public R&D (#7).

The University of Colorado receives more NASA research funding than

any other public university in the nation, and overall, CU faculty

received over $1 billion in federal, state and local research grants.

In October 2017, CU Boulder doubled-down on that success,

announcing construction of an $83 million, 139,000-square-foot

aerospace engineering building that will open in 2019.

Colorado’s space industry continues to rapidly develop. Colorado-

based United Launch Alliance beat out SpaceX for an Air Force satellite

launch contract worth $191 million in 2017 and Denver-based

Lockheed Martin Space Systems holds the contract to build the Orion

spacecraft, an important component of NASA’s multi-billion dollar

deep-space exploration program.

20 | Aerospace Competitive Economics Study

6. Georgia

Georgia finishes as the sixth most competitive state for aerospace manufacturing.

It ranks near the top in two

categories, Labor & Education

and Taxes & Incentives,

coming in at #9 and #10

respectively.

Georgia also has three other

categories that fall in the top

twenty, Industry (#15), Costs

(#19) and Risk to Operations

(#19).

Contributing to Georgia’s strength in Labor & Education was its #6 ranking for the

Aerospace Production Worker metric and it’s #14 ranking for the Aerospace

Engineers metric.

Taxes & Incentives is bolstered

by its twin #7 rankings in Total

Taxes/GDP and Sales Tax.

Other individual metrics that

make Georgia attractive are

Port Volume (#3), GDP Per

Capita Growth (#5),

Aerospace Exports (#6),

Aerospace Sales (#7) and

Aerospace Value Added (#7).

Lockheed Martin’s Marietta facility is home to the C-130 line, the

longest-lived military aircraft program in world history.

In April 2018, Gulfstream Aerospace Corp. announced an investment of

$55 million that will create an estimated 200 new aerospace jobs in

Savannah. The operations will focus on support, maintenance and

refurbishment of the Gulfstream fleet.

Georgia Tech hosts the second-ranked Aerospace Engineering program

in the nation behind MIT. In June 2017, it opened the Boeing

Manufacturing Development Center within its 19,000-square foot Delta

Advanced Manufacturing Pilot Facility. Students at the center will

partner with Boeing researchers to explore ways to increase

automation in Boeing’s production process.

Pratt & Whitney will invest nearly half a billion dollars in its Columbus,

Georgia facility. This is estimated to create more than 500 new jobs

related to the growing needs of its Geared Turbofan engine and F-135

production lines.

21 | Aerospace Competitive Economics Study

7. Utah

A number of categories play an important role in Utah’s seventh highest ranking

as an aerospace competitive state.

It scores particularly high in

Research and Innovation,

coming in at #4 in this

category. Utah’s ranking for

all four of the metrics that

make up this category are

make up this category are

within or near the top ten.

For High Tech Establishments

it is #6.

Utah also is #4 in the Risk to

Operations category.

Insurance Premiums are relatively low, giving it the #2 ranking for this metric.

While Utah’s ranking for the

Costs category is just

outside the top ten at #13, it

performs extremely high for

two of the metrics in this

group: Unit Material Cost

(#1) and Energy Cost (#8).

Utah is also a solid

performer in Taxes &

Incentives. The state is #4

overall in the category,

ranking high in Workers Compensation (#6) and Total Taxes/GDP (#8).

Utah supports research and innovation through its Utah Science,

Technology and Research (USTAR) Initiative, providing grants, training

and research. In November 2017, USTAR opened a new USTAR

Innovation Center facility near Hill Air Force Base aiming to seed new

aerospace and innovation companies in the state.

Albany Engineered Composites continues to grow along with the F-35,

787, and GE/Safran’s Leap-1 engine, on which Albany produces a

variety of advanced structures.

Parker Hannifin announced in January 2018 that it would move 77

repair operations jobs to Ogden, UT and make a $2.8 million capital

investment after receiving a tax rebate from the Governor’s Office of

Economic Development (GOED).

Ram Company, a designer and manufacturer of solenoids, valves and

manifolds for the aerospace industry received a 10-year freeze on tax

increases from the City of St. George, UT in April 2018.

22 | Aerospace Competitive Economics Study

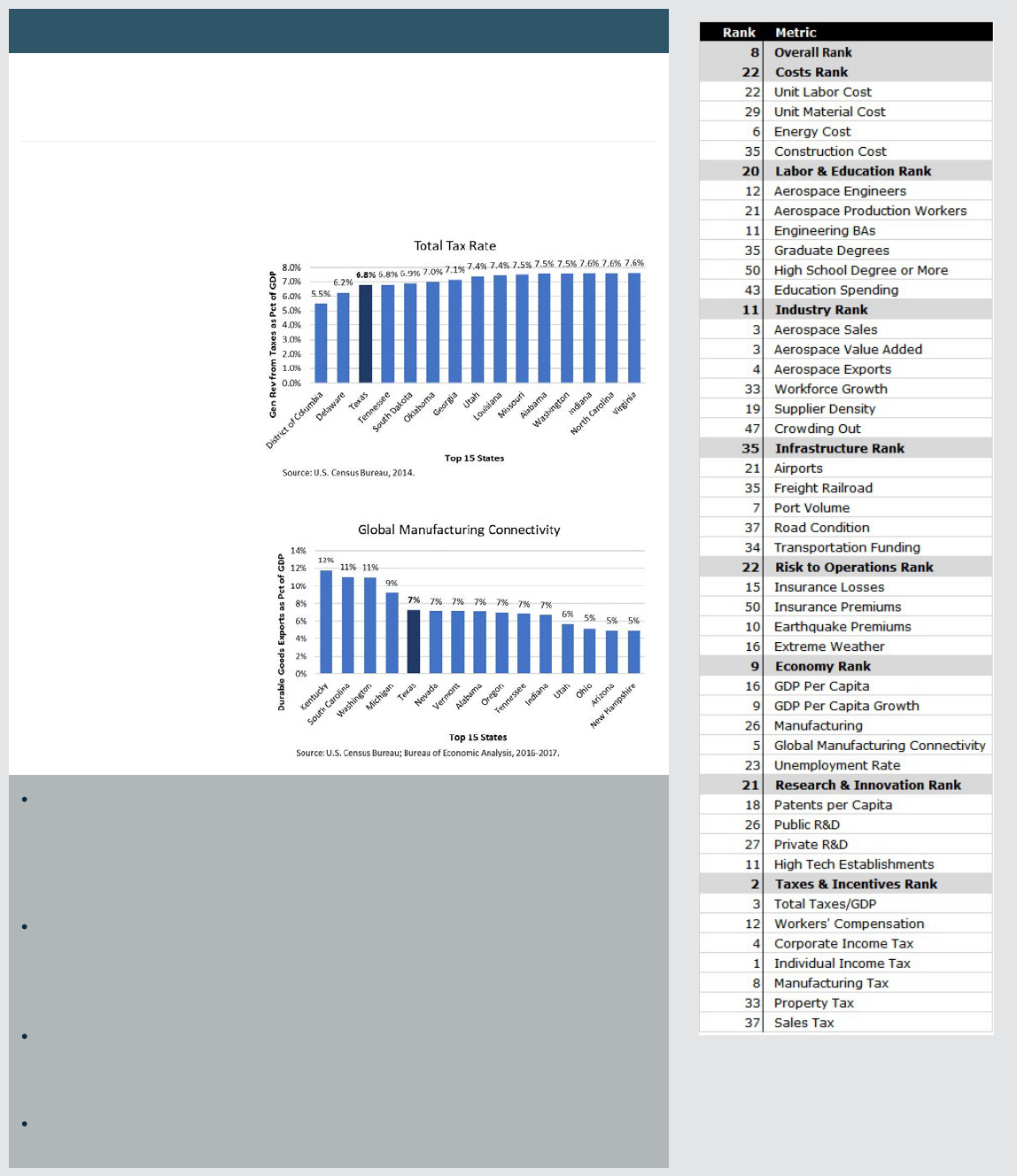

8. Texas

Texas is one of seven states that do not have a state income tax, thereby helping

to lift the state to the #2 ranking in Taxes & Incentives and contributing to Texas’

#8 overall competitiveness ranking.

Key metrics supporting the

state’s excellent tax position

are: Individual Income Tax

(#1), Total Taxes/GDP (#3),

Corporate Income Tax (#4)

and Manufacturing Tax (#8).

Economy is Texas’ second

highest ranked category at

#9, where it scored high for

Global Manufacturing

Connectivity (#5) and GDP Per Capita Growth (#9).

Texas has a strong aerospace

presence and ranks #11 in the

Industry category, including

top five rankings for

Aerospace Sales, Aerospace

Value Added and Aerospace

Exports.

Lockheed Martin which already employs about 14,500 people at its

Fort Worth plant manufacturing the F-35 is working to add another

1,800 employees by 2020. The F-35 is the largest defense program in

the world. Bell Helicopter Textron is the state’s second largest

aerospace prime.

In April 2017 Boeing announced that it would invest $3 billion to set

up a new division in Plano, Texas that focuses on training, supply

chain management, aircraft modernization and data optimization for its

customers.

Boeing’s venture investment division, Horizon X, invested in Texas-

based SparkCognition, an artificial intelligence and machine-learning

company.

Firefly Aerospace was approved by the U.S. Air Force to take over

Space Launch Complex 2 at Vandenberg Air Force Base.

23 | Aerospace Competitive Economics Study

9. Arizona

Arizona ranks in the top ten in four categories, the top twenty for two more,

making the state a highly competitive environment for aerospace manufacturing

companies.

Arizona is #1 in the Risk to

Operations category, relying on

strong scores in all four metrics,

especially Extreme Weather

(#5) and Insurance Premiums

(#7).

Arizona ranks seventh highest

in the Industry category, based

on competitive rankings in

Supplier Density (#4),

Aerospace Value Added (#5)

and Aerospace Sales (#6).

In addition, Arizona is the eight

strongest state in the Labor &

Education category, boasting a

#5 ranking for Aerospace

Production Workers.

Arizona’s fourth top ten category

is Research & Innovation (#10).

The state places in the top

twenty in each of the four

metrics in this category,

demonstrating a strong,

consistent performance.

In April 2018, Orbital ATK, producer of rocket launch vehicles and

propulsion systems, broke ground on two new buildings in Chandler,

AZ which will total 617,000 sq ft when they open in September 2019.

In August 2017, the City of Mesa, AZ also broke ground on a 150,000

sq ft industrial facility designed to attract aerospace and defense

businesses to the Falcon Field District.

Mesa is home to Boeing’s Apache attack helicopter program, and MD

Helicopters.

24 | Aerospace Competitive Economics Study

10. Alabama

Finishing out the top ten is Alabama. Taxes and Incentives competitiveness plays

an important role in making Alabama an attractive state for aerospace

companies. It scores #4 in this category with highly competitive rankings in

Manufacturing Tax (#3), Property Tax (#3) and Sales Tax (#7). For Total

Taxes/GDP, the state is ranked just outside the top ten (#11).

Alabama ranks as the seventh

most competitive state in the

Industry category with solid

performance across several

metrics, including Supplier

Density (#8), Aerospace Value

Added (#12) and Aerospace

Exports (#15). Aerospace

Employment Growth (#16) is

another contributing factor to the

state’s strength in the category.

Alabama was able to leverage its very strong showing in Aerospace Engineers

(#2) and Aerospace Production Workers (#13) metrics to achieve a #12 ranking

for the Labor & Education category.

Other measures where the state performs well include Public R&D (#4 among all

states), Manufacturing (#5) and Global Manufacturing Connectivity (#8).

In April 2018, Boeing completed a new 28,000 sq ft facility to support

its Patriot Advanced Capability-3 (PAC-3) missile seeker program.

In October 2017, Aerojet Rocketdyne broke ground on a 136,000 sq

ft manufacturing facility in Huntsville, AL that could bring 800 private

space industry jobs to the region.

In 2017, the Huntsville City Council agreed to pay millions in tax

credits and exemptions to Blue Origin to incentivize the company to

build a manufacturing facility in Huntsville that could eventually

employ up to 400 new workers. Taxpayers will also fund grading of

the site, road improvements and utilities.

In order to keep up with other states in automotive and aerospace

research and development, the University of Alabama launched its

Automotive-Aerospace Accelerator.

In July 2017, Boeing reaffirmed its commitment to growing its

Alabama-based aerospace operations. Boeing, already with an

Alabama workforce of roughly 2,700 employees indicated that it was

looking to add 400 more by 2020, while making a capital investment

of $70 million.

Safran, the French aerospace giant, announced in August 2017 that it

would launch a manufacturing operation at the Mobile Aeroplex in

Mobile, AL. The operation will produce and install aircraft engine

nacelles.

25 | Aerospace Competitive Economics Study

Full Results

Category Rankings

26 | Aerospace Competitive Economics Study

Individual Rankings

Category 1: Costs

Metrics Included:

Unit Labor Cost - The

amount of labor,

measured by payroll,

necessary to produce $1

in aerospace revenue

Unit Material Cost - The

27 | Aerospace Competitive Economics Study

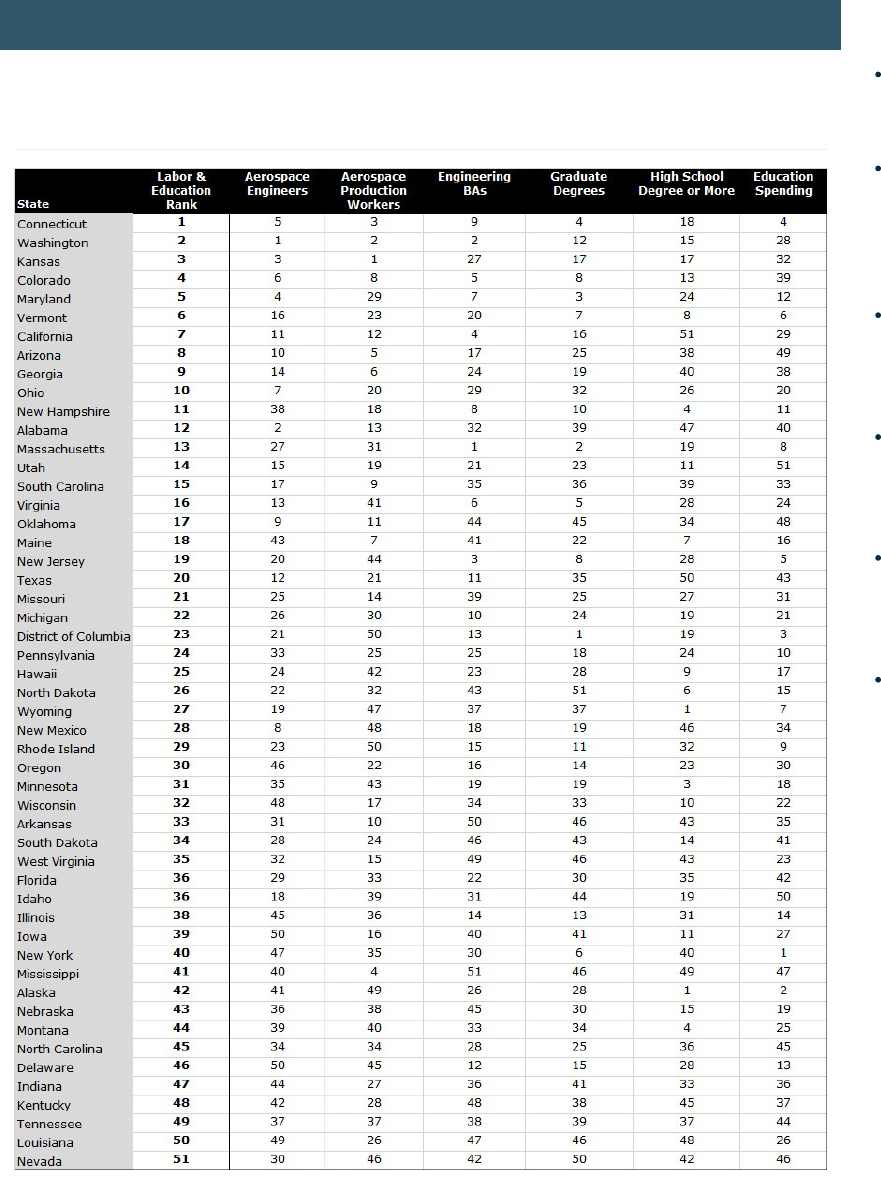

Category 2: Labor & Education

Metrics Included:

Aerospace Engineers -

The Aerospace Engineers

per 1000 jobs

Aerospace Production

Workers - The Aerospace

Production Workers

Hours/(Total Employees

x Average Hours)

Engineering BAs - The

percentage of population

25+ with an engineering

B.A.

Graduate Degrees - The

percentage of population

25+ with an advanced

degree

High School + - The

percentage of population

25+ with at least a high

school education

Education Spending -

Primary and Secondary

Education Spending Per

Pupil

28 | Aerospace Competitive Economics Study

Category 3: Aerospace Industry

Metrics Included:

Aerospace Sales -

Aerospace Parts and

Manufacturing Total value

of shipments and receipts

for services

Aerospace Value Added -

Aerospace Parts and

Manufacturing Value

Added

Aerospace Exports -

Aircraft, Spacecraft and

Parts Exports

Employee Growth -

Percent Increase in

Aerospace Employees

Supplier Density -

Aerospace Parts and

Manufacturing

establishments/Total

establishments

Crowding Out - Federal

Aerospace Manufacturing

Contracts/Total value of

shipments and receipts

for services

29 | Aerospace Competitive Economics Study

Category 4: Infrastructure

Metrics Included:

Airports - Airports per

Square Mile

Freight Railroad - Total

Freight Railroad miles

per Square Mile

Port Volume - Total

Container Traffic at U.S.

Ports

Road Condition - Index of

Road Quality

Transportation Funding -

Total Airport, Highway,

Seaport and Transit

spending/Population

30 | Aerospace Competitive Economics Study

Category 5: Risk to Operations

Metrics Included:

Insurance Premiums

–Average Homeowners

Insurance Premiums

Insurance Losses -

Incurred Insurance

Losses, Commercial

Insurance, by

State/State GDP

Earthquake Premiums -

Total Earthquake

Premiums/Population

Extreme Weather - Total

number of storm events

per Square Mile

31 | Aerospace Competitive Economics Study

Category 6: Economy

Metrics Included:

GDP Per Capita - GDP

Per Capita

Growth in GDP Per

Capita - GDP Per Capita

5-Year Growth

Manufacturing Industry -

Durable Goods

Output/State GDP

Global Manufacturing

Connectivity - Durable

Goods Exports/State GDP

Unemployment Rate

32 | Aerospace Competitive Economics Study

Category 7: Research & Innovation

Metrics Included:

Patents per Capita -

Patents Issued to

Residents/Total

Population

Public Research and

Development - Federal

R&D Spending for

Selected Agencies/State

GDP

Private Research and

Development - Private

R&D from All

Sources/State GDP

High Tech Establishments

– Percent of Businesses

in Industries with High

Science, Engineering,

and Technology (SET)

Employment

33 | Aerospace Competitive Economics Study

Category 8: Taxes and Incentives

Metrics Included:

Total Taxes/GDP - Total

Taxes as a percent of

State GDP

Workers’ compensation

premium rate

Corporate Income Tax -

Top Corporate Income

Tax Rate, or Implied

Corporate Income Tax

Rate using B&O and

Aerospace Margin

Personal Income Tax -

Top Individual Income

Tax Rate

Manufacturing Tax -

Taxes on Production and

Imports Minus Subsidies

for Durable Goods

Manufacturing/GDP for

Durable Goods

Manufacturing

Property Tax - State &

Local Property Tax

Collection Per Capita /

GDP Per Capita

Sales Tax - General Sales

Tax Rate

34 | Aerospace Competitive Economics Study

Methodology, Weighting & Metrics

Numerous quantitative measures were evaluated for inclusion in the ranking methodology. Some were included, and others

rejected. For inclusion, a variable must meet all or most of the following criteria:

1. Important to manufacturing costs and profitability

2. Readily available for all 50 states and the District of Columbia

3. Uniformity of calculation and reporting, so that the variable can be fairly compared across all states

4. Publicly available data

5. Available for a recent year

6. Aerospace industry specific

In the final analysis, 41 quantitative measures were included in the ACES model. Each was included in one of

the following categories:

1. Manufacturing Costs

2. Labor & Education

3. Aerospace Industry

4. Infrastructure

5. Risk to Operations

6. Economy

7. Research & Innovation

8. Taxes & Incentives

Each metric is ranked by state based on the absolute variable value. The result is a matrix of rankings by metric by state: 41

metrics by 51 states. The rankings for all metrics and all states are presented in the tables below.

Weighting of Metrics

Once the metrics where chosen, based on the criteria outlined above, weights were established for each of the categories and

for each of the metrics within a category. The final decision for establishing weights was based on a review of potential impact

to a typical aerospace company’s income statement and profitability. The more directly impactful a category (or individual

metric) was believed to be, the higher the weight assigned. For example, Costs are more directly linked and impactful to an

individual corporation’s overall cost structure and ability to generate profit than are indirect impacts from the state’s Economy.

Therefore, Costs receive a weight of 20%, while Economy receives a weight of only 5%.

Likewise, the specific metrics within a category received a higher weight depending on their perceived income statement

impact within the overall category. Where individual metrics were perceived to be somewhat equal in importance, or their

impact was understood to be less direct to the income statement, then similar weights were assigned, or the weighting was

clustered in a narrow range.

The rankings for each category of metrics (i.e. Infrastructure) is calculated by multiplying each of the category’s metric

weights by its corresponding metric rank. Then each state’s resulting ranking for a category is multiplied by the corresponding

category rank, resulting in the overall rank.

It should be noted that anyone can construct their own model framework and weighting scheme from the information

provided in this report. The weights can be changed and then multiplied by each of the metric ranks to determine alternative

category ranks, which can then be multiplied by alternative category weights to arrive at alternative overall state rankings.

Estimation of Metrics

The ACES Rankings include data that are as aerospace-specific as possible while also remaining publicly available for all 50

states and the District of Columbia, and for the large majority of metrics, data were available for every state. However, for a

handful of metrics, data were missing for one or more states. In these cases, analytical techniques were used to come to an

accurate estimation of the state’s missing data for that metric. These techniques used data from the previous year, data from

the state’s census sub-region and data from a broader NAICS category to develop an accurate estimate.

35 | Aerospace Competitive Economics Study

Categories & Metrics Included in ACES

category

Metric

Notes

Source

Co

st

s

Labor 8t

E

du

ca

tion

Indus

t

ry

Inf

rastru

ctu

re

Ri

s k

to

Ope

rati

on

s

Ec

on

o

my

Rese

arch &

Inn

o

vati

on

Ta

xes

8t

In

cen

t

iv

es

LXli

t Labor Cost

LXli

t Material Cost

En

ergy Cost

Construction Cost

Aerospace Engineers

Aerospace Producti

on

'M:lrkers

Engineering

BAs

Graduate Degrees

High School +

Education

Spendng

Aerospace Sales

Aerospace Value Added

Aerospace Exports

Bn

pl

oyee Gr

owt

h

Suppli

er

Density

crow

ding

OJt

Air

ports

Freigh:

Rai

lroad

Port

Vo

l

ume

Road Condition

Transportation Fundi

ng

Insurance Premi

ums

Insurance Losses

Earthquake Premi

um

s

Extreme Weather

GOP

Per

cap

i

ta

Growth

in

GOP Per

ita

Marufacturi

ng

I

ndustry

Global Manufacturi

ng

Connec

ti

vi

ty

LXlem

ploy

mert

Rate

Paterts

per

Capita

Pub

lic Research and

Devel

opm

ert

Pr

iv

ate

Research and

Devel

ert

High Tech

Establishm

erts

Total Taxes/GOP

'M:lrkers' COmpensation

Corporate

Income

Tax

Personal Income Tax

Marufactu

r

ing

Tax

Property Tax

Sales Tax

The

amourt

ri

labor,

meastred

by

payroll, necessary

to

produce

$1

in revenue

2016

The

amourt

ri

materials necessary

to

pr

oduce

$1

in revenue

(20

16)

The cost

(cents/k

il

owatt

hotr)

f

or

th

e Industrial

En

d-Use Sector

(December 2017)

The National Association

ri

BLi

lders

mod

i

fie

rs

for

construction costs

for

buildin b

state

2017

The

Aerospace Production Workers

Hatrs/(Tota

l Bnployees x

Average Hours)

(2

016)

The

percentage

of

popul

at

ion

25+

with

an

engi

neer

i

ng

B.A. (2016)

The

percentage

of

population

25+

with

an

advanced degree

(2

016)

The

percentage

of

population

25

+

with

at

least a

hgh

school

education ( 2016)

Pr

i

mary

and Secondary Education Spending Per

Pupi

l

(2

015)

Aerospace Parts

and

Manliacttr

ing Total value

ri

shpments

and

recei s f

or

services

2016

Aerospace Parts and

Manliacttr

ing Value Added (2016)

Ai

rc

raft, Spacecraft and Parts Exports

(20

1

7)

Pet

Increase in A

er

ospace

8np

loyees (2012 -

20

1

6)

Aerospace Parts and

Manliacturing

establi

shmerts/Total

establishm

erts

(20

15)

Federal Aerospace

Manliacttring

Cont

r

acts/

Total value

ri

shpmerts

and receipts

for

services (FY 2016)

Ai

rports

per

Sq

Mile (

20

1

3)

Total Freigh:

Ra

ilroad

mi

les

per

Sq

Mi

le (

20

12)

Total

Cortainer

Traffic

at

u.

s.

Ports (2016)

I

ndex

c:i

Road Quality (2013)

Total Airport, Highway, Seaport

and

Transit

spendng/Popuat

i

on

(2

014

)

Average HomeoiM'lers Insurance Premiums (

20

1

5)

CU

r

rert

2012 - 2016

In

curred Insurance Losses, Commercial

Ins

trance

b

State

CU

rrent State

GOP

2012 - 2016

T

ot

al

number

of

storm events

per

Sq

Mile (

20

1

2-

20

16)

Real

GO

P Per Capita

(4Q

20

1

6-

3Q

2017)

Real

GOP

Per Capita 5-Year Gr

owth

(4Q

2011-

3Q

201

2,

4Q

2016-

2017

Real

Durable Goods OJtpLt/Real State

GOP

(4Q

20

1

6-

3Q

2017)

cu

r

rert

Dtrab

le Goods Exports/CUrr

ent

State

GDP (4Q

2016-

3Q

2017)

U

nemploymert

Rate (December 2017)

Patents I ssued

to

Residents/Total Population

(2017)

currert

Federal R&D Spending

for

Selected Agencies/CUrrent State

GOP

(2015)

CU

r

rert

Pri

vate

R&D from A

ll

So

tr

ces/CUr

rent

St

ate

GOP

(20

13)

Pet

c:i

Businesses in I nd

ust

ries with High Science,

En

gineering,

and

Technology

(S

ET

) E

mp

loyment

(20

1

4)

CUrrert Total Taxes

as

a

pet

of

CUr

r

ert

State

GOP

(

2014

)

Workers'

com

pensation premium r

ate

(20

16

)

Actual

or

Esti

mated

Corporate Inc

ome

T

ax

Rate (Esti

mated

using

B&O

and

Aerospace Margin)

(2

01

7)

Top

Indv

idual Inc

ome

Tax Rate (2017)

CUrrert Taxes on Production and

Im

ports

Minus Subsi

des

f

or

Durable Goods

Marufactur

i

ng/Ctrrert

GOP

fo

r Durable Goods

Manliacturing

(2015)

CUrrert

State

& Loca Property Tax Collection

Per

Capita

(2

014)

I

cu

r

rert

GDP P

er

ita

2014

U.S. Census B

ur

eau

U.S. Census B

ur

eau

U.S.

En

ergy

Irto

r

m~on

Admin

istra

ti

on

National BLild ng Cost

Marual

u.s. B

treau

c:i

Labor Statistics

u.s

. Census Bureau

U.S.

Btreau

c:i

Labor Statistics

u.s. Census Bureau

U.S. Census Bureau

U.S

. Census Bureau

U.S. Census Bureau

u.s

. Census B

ur

eau

U.S. Census B

ur

eau

U.S. B

treau

c:i

Economic Anal sis

World

In

stit

Lte

for Strategic

Economic Resea-ch

u.s.

&HQVMXVBtreaX

u.s.

Census B

ur

eau

u.

s.

Btreau

USASpending.

go

v

U.S. Census

Bur

eau

U.

S. Department

c:i

Tr

ansportation

u.

s. Department

c:i

Transportation

Association of American

Rai

lr

oads

U.

S. Army Corps

of

Engineers

U.

S. Department

ri

Transportation

U.

S. Census Bureau

I

nstrance

I

rt

or

m

ation

I

nst

i

tute

U.S.

Btreau

c:i

Economic Analysis

u.s

.

Btreau

c:i

Economic Analysis

U.S. National Oceanic and

Atmospheric Admi

nistrat

i

on

Bureau

c:i

Economic Analysis

u

.s.

Btreau

c:i

Economic Analysis

u

.s.

Btreau

c:i

Economic Analysis

U.S. Census Bureau

u

.s.

B

treau

c:i

Economic Analysis

u

.s.

Btreau

c:i

Labor Statistics

U.S. P

atert

and Trademark Office

National Science Foundation

National Science Foun

dat

ion

National Science Foun

dat

ion

U.

S. Census Bureau

u.s. B

treau

c:i

Economic Analysis

Oregon

Departmert

c:i

Con

sun

er

and

Business Services

Tax Policy

In

st

i

tLte

, Delaware

Divi

sion

of

Revenue, Nevada

D

artment

c:i

Taxation Ohio