Finance: SUPPLIER INVOICE ACCOUNTING ADJUSTMENT

1

HOW TO CREATE A SUPPLIER INVOICE ACCOUNTING ADJUSTMENT

A Supplier Invoice Accounting Adjustment is a mechanism to adjust the worktags assigned to a

supplier invoice or procurement card transaction.

Supplier Invoice accounting Adjustments are not posted to the General Ledger until all

appropriate approvals have been received within Workday

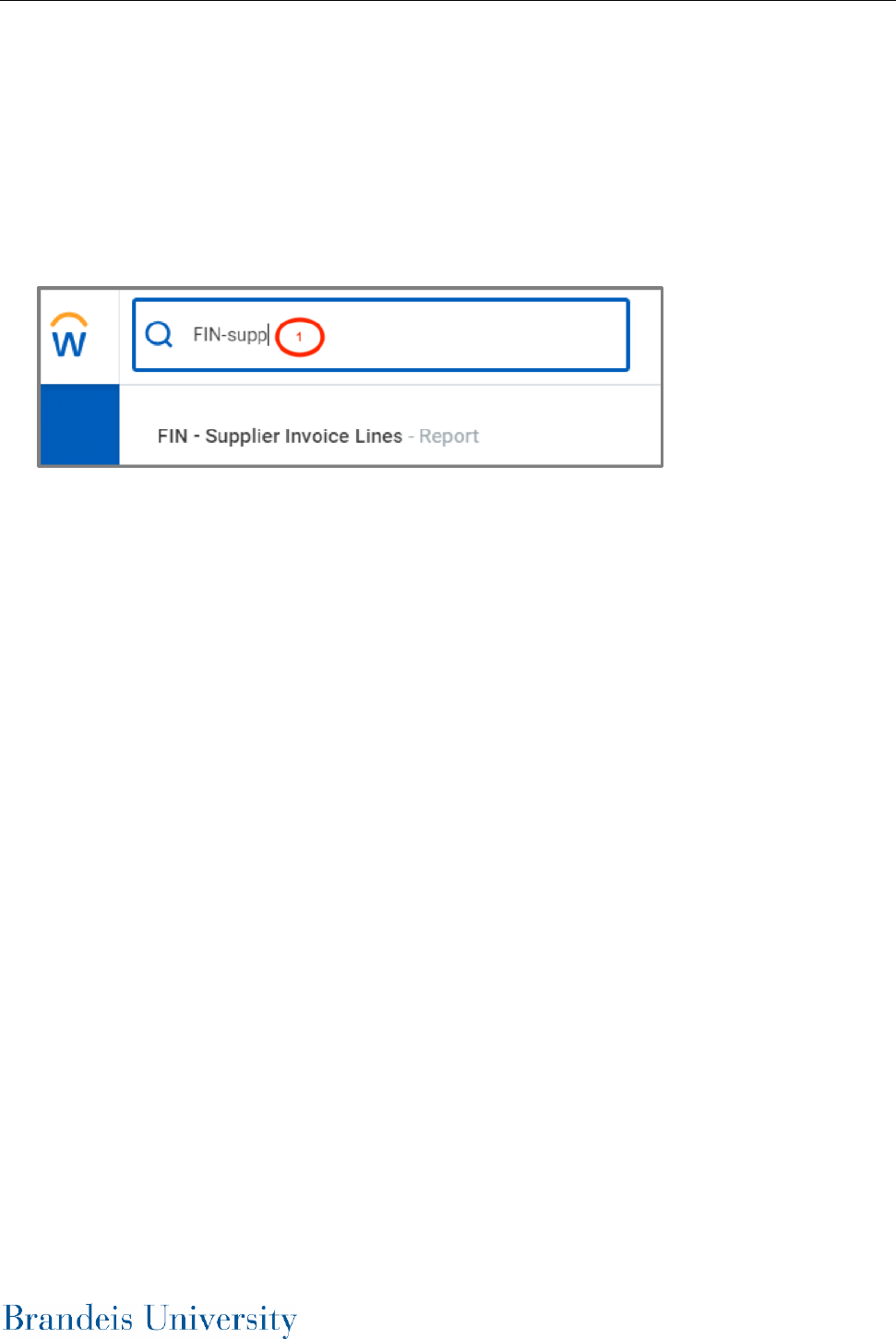

1. From the home screen of your Workday profile, click on the search bar at the top of the page. Type

in “FIN - Supplier Invoice Lines” and select the task from your search results.

2. The Organization is the cost center or cost center hierarchy. Multiple selections can be made.

3. The Invoice Status defaults to Approved. All invoices that have integrated into Workday and have

posted will be in the Approved status.

4. The Payment Status is the payment status of the invoice.

You can only adjust the accounting on a supplier invoice that has been paid

5. The Supplier is the supplier or vendor assigned to the invoice.

6. The Accounting Dates allow you to select a date range for your search.

7. The Worktags field allows you to search by specific worktags (other than cost center – see

Organization above) such as gift, grant, project, category, etc.

8. Click OK.

Finance: SUPPLIER INVOICE ACCOUNTING ADJUSTMENT

2

9. Click the Related Actions button to the right of the Supplier invoice you want to adjust.

Then click Accounting Adjust Accounting.

Finance: SUPPLIER INVOICE ACCOUNTING ADJUSTMENT

3

10. The Accounting Adjustment Date will default to today’s date. This will be the accounting date

of the adjustment entry.

11. The worktags on each line item can be adjusted, such as grant, gift, cost center, fund, etc.

When you adjust a worktag, the system will require you to select a Change Reason.

You cannot adjust the amount of a line or split a line into multiple lines. For example, if a

supplier invoice was supposed to be split over multiple funding sources and it wasn’t, this

change cannot be made via a supplier invoice accounting adjustment. A journal entry is

required to make this type of adjustment.

If you adjust the spend category, the account will automatically adjust accordingly.

12. Click the Accounting Adjustment Attachments tab and upload any supporting

documentation, such as emails, invoices, or written confirmations.

13. Click Submit.

14. Click Review.

You have two choices when advancing the accounting adjustment down the approval chain.

Selecting Approve will send the adjustment onto the next approver in the defined business

process, based on the worktags selected. Selecting Add Approvers will allow you to insert

multiple approvers of your choosing into the next step of the defined business process. This

functionality can be useful when you need to make a unique individual aware of the adjustment.

You can see who needs to approve the adjustment by clicking the Process tab on the entry.