The Macro-Economic Effects

of Hurricanes

in The Bahamas

A CASE STUDY USING SATELLITE NIGHT LIGHT LUMINOSITY

MARIA ALEJANDRA ZEGARRA

LAURA GILES ALVAREZ

MIKAËL GARTNER

LUIS PALOMINO

The Macro-Economic Eects of Hurricanes in The Bahamas

ii

Copyright © 2021 Inter-American Development Bank. This work is licensed under a Creative Commons IGO 3.0

Attribution-NonCommercial-NoDerivatives (CC-IGO BY-NC-ND 3.0 IGO) license (https://creativecom-

mons.org/licenses/by-nc-nd/3.0/igo/legalcode) and may be reproduced with attribution to the IDB and

for any non-commercial purpose. No derivative work is allowed.

Any dispute related to the use of the works of the IDB that cannot be settled amicably shall be sub-

mitted to arbitration pursuant to the UNCITRAL rules. The use of the IDB’s name for any purpose other

than for attribution, and the use of IDB’s logo shall be subject to a separate written license agreement

between the IDB and the user and is not authorized as part of this CC-IGO license.

Note that link provided above includes additional terms and conditions of the license.

The opinions expressed in this publication are those of the authors and do not necessarily reflect the

views of the Inter-American Development Bank, its Board of Directors, or the countries they represent.

Acknowledgment

The authors would like to thank Franklin Jesus Espiga, David Rosenblatt, Yuri Chakalall, Maria

Eugenia Roca, Marisela Canache, Tsuneki Hori, Jimena Vazquez, and Daniela Carrera Marquis for their

support and contributions to this study.

The Macro-Economic Eects of Hurricanes in The Bahamas

iii

This paper analyses the macroeconomic eects

of Hurricanes Joaquin (2015), Matthew (2016),

Irma (2017), and Dorian (2019) across dierent

islands in The Bahamas. The methodology used,

based on Zegarra et al. (2020), uses historical

night light intensity data between 2015 and 2019

and monthly GDP. The analysis is complemented

by a breakdown of the direct and indirect costs

by island that compiles the information in the four

Damages and Losses Assessments conducted

by the Economic Commission on Latin America

and the Caribbean and the Inter-American Deve-

lopment Bank. The results suggest, first, that the

year-to-year nominal growth rate in The Bahamas

decreased during the month and quarter of each

hurricane event, but that there was no contrac-

tion of the country’s growth rate in the year of the

event. However, all islands showed a significant

contraction in GDP after the start of the COVID-19

outbreak, which overlapped with the eects of

Hurricane Dorian. Second, large islands like New

Providence and Grand Bahama experienced lar-

ger GDP contractions following the hurricanes, but

no such clear pattern was obtained for the Family

Islands. Third, macroeconomic recovery times to

achieve pre-hurricane GDP levels took between

4-8 months on average for the four events stu-

died. Fourth, the composition of sectors aect-

ed by the events did not seem to have a major

eect on the severity of the economic shock. For

all the hurricanes studied, tourism, transport infras-

tructure, and housing were recurrently the most

aected sectors. Based on the findings of the

analysis, recommendations include the following:

(1) Make greater use of these methodologies to

study the macroeconomic eects of natural disas-

ters, supplemented by microeconomic, social, and

sector-specific studies; (2) Conduct further ana-

lysis of island-specific economic drivers and

post-hurricane economic eects; and (3) Promote

climate change adaptation and disaster risk ma-

nagement to reinforce macroeconomic resilience

in sectors that drive national GDP and to foster

resilience in sectors and on islands.

Executive Summary

The Macro-Economic Effects

of Hurricanes

in The Bahamas

A CASE STUDY USING SATELLITE NIGHT LIGHT LUMINOSITY

The Macro-Economic Eects of Hurricanes in The Bahamas

iv

Table of Contents

1. Introduction ........................................................................................................................................1

2. Theoretical Context ........................................................................................................................4

3. Estimating the Macroeconomic Effects of Hurricanes in The Bahamas ......................6

3.1. Methodology ........................................................................................................................................................6

3.2. Results ................................................................................................................................................................... 6

3.3 Direct and Indirect Costs of Hurricanes: A Typology of Damage and Losses .............................13

Hurricane Joaquin ....................................................................................................................................................15

Hurricane Matthew ...................................................................................................................................................17

Hurricane Irma ...........................................................................................................................................................19

Hurricane Dorian .......................................................................................................................................................21

Summary .....................................................................................................................................................................23

4. Conclusion ...................................................................................................................................... 24

4.1. Limitations of the Study .................................................................................................................................25

4.2. Recommendations ..........................................................................................................................................25

Annex 1. Data and Methodology .................................................................................................. 26

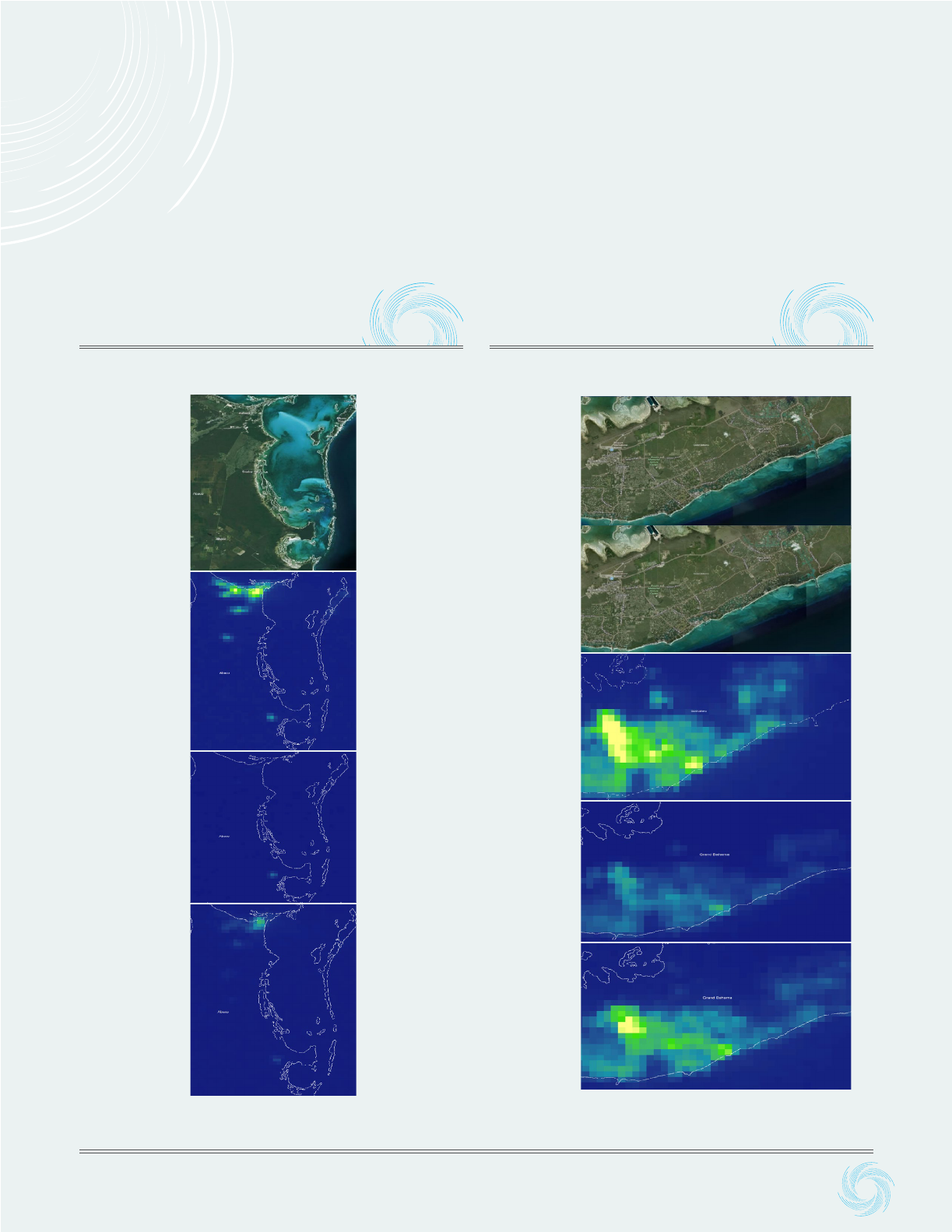

Annex 2. Luminosity Maps of Abaco, Grand Bahama, and New Providence ................ 31

Annex 3. Index of Tourism Arrivals and Economic Activity by Island ............................ 33

Annex 4. Indirect Cost Estimates ................................................................................................34

The Macro-Economic Eects of Hurricanes in The Bahamas

v

DaLA Damages and Losses Assessment

DMSP-OLS Defense Meteorological Satellite Program Operational Lines-can System

DSoB Department of Statistics of The Bahamas

ECLAC Economic Commission for Latin America and the Caribbean

EM-DAT Centre for Research on the Epidemiology of Disasters’ Emergency

Events Database

GDP Gross domestic product

IDB Inter-American Development Bank

IMF International Monetary Fund

NGDC National Geophysical Data Center

NOAA National Oceanic and Atmospheric Administration

PCHIP Piecewise Cubic Hermite Interpolating Polynomial

UNWTO United Nations World Tourism Organization

VIIRS Visible Infrared Imaging Radiometer Suite

WTTC World Travel and Tourism Council

Acronyms

The Macro-Economic Eects of Hurricanes in The Bahamas

1

1. Introduction

The Bahamas is a Caribbean archipelago country

highly dependent on tourism. The country is com-

prised of approximately 700 islands and 2,400

cays, with a land area of approximately 13,900

km2 and 3,500 km of coastline spread over the

southwestern portion of the North Atlantic. Thirty

islands are inhabited and 70 percent of the popu-

lation is located in New Providence, according to

the 2010 Bahamas Census. The Bahamas is cat-

egorized as a high-income country, and it relies

primarily on tourism for its economic activity.

Tourism accounts for 43.3 percent of GDP (in-

cluding direct and indirect eects), 52.2 percent

of jobs, and 81.6 percent of total exports (WTTC

2019). Most tourism in The Bahamas is beach- and

cruise-based (UNWTO 2021).

Due to its geography and location in the Atlantic

hurricane belt, The Bahamas is extremely vulner-

able to natural disasters and climate change. Ap-

proximately 80 percent of the country’s land mass

is within 5 feet (1.5 meters) of sea level and most of

the population and economic activity are located

near the coast. The country is particularly vulner-

able to tropical cyclones and climate change be-

cause of the large territorial area that it is spread

across, its large number of low-lying archipelagic

islands surrounded by warm shallow seas, and its

dispersed population. The Bahamas has been hit

by 25 hurricanes over the past 25 years. Between

1963 and 2019, 14 of the most devastating hurri-

canes in The Bahamas occurred on average every

four years, had an average impact of 5.1 percent of

GDP, and aected over 29,600 people (Center for

Research on the Epidemiology of Disasters 2019;

ECLAC 2020b; IMF, various years); Mooney and

Rosenblatt 2019).

Source: www.bahamas.gov.bs

Note: The Family Islands refers to all islands in The Bahamas

(approximately 700 islands) excluding New Providence Island

and Grand Bahama Island.

The Commonwealth of The Bahamas

Figure 1.

Due to climate change, increased water tempera-

ture in the North Atlantic and Caribbean will like-

ly increase the average strength and frequency

of tropical cyclones (Holland and Bruyère 2014;

Balaguru et al. 2018). Sea-level rise induced by cli-

mate change, combined with the aforementioned

characteristics of tropical cyclones, will likely ex-

acerbate cyclone-induced storm surge and flood-

ing going forward, thus increasing The Bahamas’

exposure and risks to related natural hazards.

2

Although this paper focuses on the most recent

events, The Bahamas has historically been hit regu-

larly by hurricanes and tropical cyclones. Since

the beginning of the 20th century, The Bahamas

has been impacted by 55 hurricanes, of which 13

were high-intensity events (Category 3 and high-

er). This paper focuses on the four most recent

Category 4 and 5 hurricanes for which a Dama-

ges and Losses Assessment (DaLA) was conduct-

ed by the Economic Commission for Latin Amer-

ica and the Caribbean (ECLAC) and the Inter-

American Development Bank (IDB) (Table 1):

Hurricanes Joaquin (2015), Matthew (2016), Irma

(2017), and Dorian (2019).

Hurricane Joaquin formed rapidly and impac-

ted the south-eastern Bahamas as a Category 4

hurricane between September 30 and October 2,

2015. Joaquin had sustained wind speeds of more

than 120 mph (210 km/h) and remained station-

ary over several islands for more than 36 hours.

The sparsely populated Acklins Island, Crooked

Island, Long Island, Rum Cay, and San Salvador

Island were the most aected. Prolonged high

winds and storm surge resulted in widespread

damage and flooding that persisted for days after

the hurricane’s departure. The rapid arrival of Hur-

ricane Joaquin provided little time for warning,

preparedness, or evacuation.

Hurricane Matthew impacted the primary eco-

nomic and population centres of The Bahamas as

a Category 3 and 4 hurricane in October 2016.

Matthew had been anticipated for days, provid-

ing ample time to warn the public, prepare, and

evacuate/shelter people in advance of the hurri-

cane’s landfall. Andros, Grand Bahama, and New

Providence were the most aected islands. Spe-

cifically, the hurricane had the greatest eect on

the country’s population centres, namely New

Providence (Nassau), Grand Bahama (Freeport)

and the district of North Andros. Damages were

mainly caused by high winds and storm surges

and were exacerbated by construction practices

and the presence of infrastructure and commu-

nities in vulnerable locations. Given the extensive

damage to the United States, additional resources

to support recovery eorts in The Bahamas were

delayed (ECLAC 2020a).

Hurricane Irma impacted the Southern Bahamas

islands as a Category 5 hurricane in September

2017, hitting the country on September 7 with

sustained winds of 175 mph (280 km/h). It then

weakened to a Category 4 storm, with sustained

winds of 150 mph (240 km/h) before its centre

passed over Ragged Island on September 8. Ack-

lins, Inagua (Great Inagua), and Ragged Island in

the south-eastern part of The Bahamas, as well as

Bimini and Grand Bahama in the north, were the

most aected. Fortunately, the country’s timely

warning systems allowed for the evacuation of

people in advance. Most of the damage resulted

from excess rainfall, storm surge, and flooding

(ECLAC 2017). Ragged Island, where Irma’s eye

passed, was the most heavily aected. An esti-

mated 90 percent of buildings were destroyed or

severely damaged in Duncan Town. The primary

cause of damage to the island was high wind, as

most of the settled area is elevated above areas

that were aected by storm surge. In Grand Baha-

ma and Bimini, marine facilities and coastal hou-

ses were mostly aected from storm surges and

isolated tornados.

Hurricane Dorian made landfall on Abaco on Sep-

tember 1, 2019, and then reached Grand Bahama

as a Category 5 storm the next day. Dorian was

the strongest hurricane on record to ever hit The

Bahamas. The hurricane made landfall in Abaco

with minimum sustained winds of 185 mph (280

km/h), then moved to the eastern side of Grand

Bahama as a Category 5 storm on September 2,

stalling over the island and then finally leaving the

next day. The central and northern parts of Aba-

co were aected by hurricane force winds, storm

surge, and flooding. Northern and Central Abaco

and Eastern Grand Bahama were the most aec-

ted parts of these islands, and there was also

some damage on the island of New Providence.

Storm surge and flooding caused the most severe

damage. Reconstruction was aected by the on-

set of the COVID-19 pandemic a few months later,

which has resulted in many lives lost and a stall of

economic activity across the country.

The Macro-Economic Eects of Hurricanes in The Bahamas

The Macro-Economic Eects of Hurricanes in The Bahamas

3

This paper analyses the macroeconomic eects

of Hurricanes Joaquin, Matthew, Irma, and Dorian

in The Bahamas across dierent islands. The

eects were reconstructed and back-analysed

using historical night light intensity data between

2015 and 2019, and monthly GDP by island, prior

to and immediately after each of the four hurri-

canes hit. This analysis is complemented with a

breakdown of the direct and indirect costs of the

hurricanes by island, compiling the information in

the DaLAs for these four events. DaLAs provide

a systematic and comparable account of the di-

rect and indirect costs by sector related to each

hurricane. They are based on the best available

information obtained through government sour-

ces, interviews, and site visits. They are performed

under time constraints within a few weeks after

the disaster.

Section 2 of this paper presents the theoretical

context of the analysis of the economic impact of

natural disasters and provides a summary of the

literature available on the topic.

Section 3 analyses the intensity and length of the

economic impact of the four hurricanes on The

Bahamas using the satellite data on light intensity.

It also presents a breakdown of costs based on

the DaLAs. The final section presents the conclu-

sions of the paper.

Sources: Associated Press (2019); and authors’ calculations.

Note: Islands highlighted in bold are the two with the greatest damage (direct costs) based on Damages and Losses Assessments.

High-Category Hurricanes that Have Hit The Bahamas, 2015–2019

Table 1.

Year

2015

2016

2017

2019

Hurricane Joaquin

Hurricane Matthew

Hurricane Irma

Hurricane Dorian

4

4

5

5

Acklins Island, Crooked Island, Exuma and Cays,

Long Island, Rum Cay, and San Salvador Island

Andros Island, Grand Bahama Island, and New

Providence

Acklins Island, Andros Island, Bimini Islands,

Grand Bahama Island, Inagua, and Ragged Island

Abaco Island, Grand Bahama Island

Name Category Aected Islands

The Macro-Economic Eects of Hurricanes in The Bahamas

4

2. Theoretical Context

The literature on the economic impact of natural

disasters has grown quickly in recent years. Most

existing empirical evidence focuses on the short-

run eects of disasters – up to three years – with

an overall consensus that natural disasters hinder

per capita income and growth (Felbermayr and

Gröschl 2014; Raddatz 2009; Strobl 2012). Noy

(2009) further analyses some of the structural and

institutional traits of a country that exacerbate the

negative eect of disasters, concluding that coun-

tries with higher per capita income, better ins-

titutions, a higher literacy rate, greater openness

to trade, higher levels of government spending,

more foreign exchange reserves, and higher levels

of domestic credit and less open capital accounts

are better able to withstand an initial shock and

more eectively prevent further spillovers. This

contrasts with earlier work by Albala-Bertrand

(1993) and Skidmore and Toya (2002), who oc-

casionally find positive impacts on growth from

natural disasters. Loayza et al. (2012) highlight

that these positive impacts may be recorded for

smaller disasters (reflecting the post-disaster re-

construction stimulus), whereas large disasters al-

ways have negative eects on the economy in the

short run. Beyond growth, natural disasters have

also been shown to hinder investment and savings

and lead to higher debt accumulation.

There is less consensus on the long-run eects of

natural disasters – usually more than five years.

There is also a scarcity of research in this area,

partly due to the diculty of constructing ap-

propriate counterfactuals. The scarce evidence

also shows mixed results. On the one hand, some

studies identify a rebound in economic activity

due to rebuilding and the resumption of econo-

mic activity, which can erase losses from a disas-

ter. On the other hand, Noy and Nualsri (2007) find

negative growth impacts of natural disasters with

high casualty numbers but no significant eects

of disasters damaging the capital stock. Simi-

lar results are reported by Jaramillo (2009). Cres-

po Cuaresma, Hlouskova, and Obersteiner (2008)

attempted to investigate this creative destruction

hypothesis empirically and concluded that it most

likely only occurs in countries with high per capita

income. Finally, other studies found no statistically

significant eects of natural disasters on growth

(Raddatz 2009). Cavallo et al. (2010) conclude

that long-run eects on growth only occur if the

natural disaster is followed by a radical political

revolution (such as the Islamic Iranian Revolution

of 1979 or the Sandinista Nicaraguan Revolution of

1979). However, Raddatz (2009) finds that clima-

tic disasters have a negative long-run impact on

economic growth, but highlights that most of the

output cost of those events occurs during the year

of the disaster. There is also a fairly broad body of

empirical evidence that generally finds negative

and delayed recovery eects in the aftermath of

natural disasters. For example, Coman and Noy

(2012) analysed the long-term impact of Hurri-

cane Iniki (1992) on the economy of a Hawaiian is-

land and found that it took almost seven years for

the island’s economy to return to its pre-hurricane

per capita income level, and that the island never

fully recovered from the disaster’s out-migration

eect.

The Macro-Economic Eects of Hurricanes in The Bahamas

5

Traditional data sources and methods for study-

ing natural disasters have limitations. The vast

majority of existing studies rely on the Centre for

Research on the Epidemiology of Disasters’ Emer-

gency Events Database (EM-DAT). However, as

Strobl (2012) argues, the EM-DAT data are collec-

ted from various sources and there is potential that

the dataset may have measurement divergences.

Moreover, most empirical studies of the growth ef-

fects of natural disasters regress GDP growth on

a number of control variables (such as the saving

rate, fertility, or human capital) and add a measure

of disaster frequency or severity to the estimation

equation. As the eect of natural disasters on eco-

nomic growth might work through these control

variables, an “overcontrolling problem” is likely to

occur, which might result in insignificant eects

(Dell, Jones, and Olken 2014).

The Macro-Economic Eects of Hurricanes in The Bahamas

6

3. Estimating the Macro-

economic Eects of Hurricanes

in The Bahamas

This study presents a novel approach to identify

the economic eect of hurricanes in The Bahamas

through the use of satellite night light data. The

methodology follows numerous research studies

using luminosity measured from space to proxy

for economic activity, where the brightest areas

depict locations of high activity (Amavilah 2018;

Pinkovskiy and Sala-i-Martin 2016; Nordhaus and

Chen 2015; Henderson et al. 2012). Moreover, the

IDB has used luminosity data to analyse the bene-

ficial eects of coastal infrastructure in Barbados

(Corral et al. 2018) and to study the patterns of

poverty and inequality in Haiti (Pokhriyal et al.

2020). This study uses the variation in the ave-

rage brightness of the night lights on each island

to estimate the variation of economic activity be-

fore and after hurricanes hit The Bahamas.

1

To estimate the eect of hurricanes on the Bahami-

an economy, datasets were constructed to gene-

rate an economic activity index (Zegarra et al.

2020). First, a database with satellite imagery of

luminosity was constructed for The Bahamas with

data obtained through the National Geophysical

Data Center of the U.S. National Oceanic and At-

mospheric Administration (NOAA).

2

Second, a

population density series was developed for each

island by applying the Piecewise Cubic Hermite

Interpolating Polynomial to the population cen-

suses of 1980, 1990, 2000, and 2010. Third, lumi-

nosity levels and population density parameters

of a production function were estimated. Fourth,

The disaggregation of GDP by island confirms

that New Providence contributes on average

three-quarters of The Bahamas’ GDP and has

the strongest eect on the trajectory of nation-

al GDP. New Providence’s weight on national GDP

has averaged 73.4 percent of the total over the

past 28 years. Comparatively, Grand Bahama and

the Family Islands accounted for 14.3 percent and

12.3 percent of GDP, respectively, over the same

period (The Family Islands refers to all islands in

The Bahamas (approximately 700 islands) exclud-

ing New Providence Island and Grand Bahama Is-

land). On the Family Islands, 80 percent of GDP

is concentrated in five islands (Abaco, Andros,

3.1. Methodology

3.2. Results

a proxy of the GDP by island for 2013 was estima-

ted, taking into account that 2013 is the latest avai-

lable household survey that reports income and

expenses. Finally, an economic activity index was

generated considering the base year and thereby

estimating the GDP for the entire period of analy-

sis (see Annex 1 for more details on the data and

methodology). A similar approach to the metho-

dology was utilized to estimate a monthly econo-

mic activity index by island. The monthly econom-

ic activity index was calculated for the period from

January 2013 to May 2020, taking into account

that monthly basis maps are only available from

2013 onward A quarterly basis economic activity

index was estimated by aggregating the results

of the monthly-basis economic activity index by

calendar-year quarters.

1. As an example, Annex 2 shows maps of the night lights captured by satellites in Abaco and Grand Bahama before, during, and

after Hurricane Dorian struck the islands. The images for May 2020 show that the lights had not fully recovered from their pre-

hurricane levels in 2019.

2. Recently, NOAA discontinued the publication of a group of products, including the Visible Infrared Imaging Radiometer (VIIRS)

night light maps that were used in this study. Those maps are now publicly available through the academic sector at the Colorado

School of Mines at https://payneinstitute.mines.edu/eog/.

The Macro-Economic Eects of Hurricanes in The Bahamas

7

Eleuthera, Exuma-Cays, and Long Island), with the

greatest GDP share shifting over time between

various Family islands. As seen in Figure 2, the

weight of New Providence on national GDP in-

creased, from 72.8 percent in 1992 to 73.8 percent

in 2019. Similarly, the Family Islands increased

their GDP share from 12.2 percent in 1992 to 12.4

percent in 2019.

3

Comparatively, Grand Bahama’s

share has declined from 15 percent in 1992 to 13.8

percent in 2019. This downward trend has shar-

pened since 2016 and would suggest that recovery

and reconstruction eorts after Matthew (2016),

Irma (2017), and Dorian (2019) were not su-

cient on this island to enable it to recover to the

pre-hurricane growth trajectory, reducing the

Source: Prepared by the authors based on the methodology

and databases explained in Annex 1.

Regional GDP as a Share of Total GDP in The

Bahamas, 1992–2020

Figure 2.

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

1992 1995

New Providence Grand Bahama Family Islands

2000 2005 2010 2015 2019

Source: Prepared by the authors based on the methodology

and databases explained in Annex 1.

Family Island GDP as a Share of Total Family

Islands’ GDP, 1992–2020

Figure 3.

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

1992 1995 2000 2005 2010 2015 2019

Abaco

Bimini

Exuma and Cays

Mayaguana

Spanish Wells

Acklins

Cat Island

Harbour Island

Ragged Island

Andros

Crooked Island

Inagua

Rum Cay

Berry Islands

Eleuthera

Long Island

San Salvador

3. The Family Islands are made up of 17 administrative regions.

potential growth of the economy. These types

of eects have been studied in Hsiang and Jina

(2014), Lee, Zhang, and Nguyen (2018), Hochrai-

ner (2009), and IDB et al. (2004). Comparative-

ly, as seen in Figure 3, the islands of Abaco and

Exuma-Cays increased their share of GDP; while

the islands of Andros, Eleuthera, and Long

Island reduced their share. For example, Abaco in-

creased its share in the GDP of the Family Islands

from 23.2 percent in 1992 to 30.2 percent in 2019,

while Andros’s share declined from 21.5 percent

in 1992 to 13.8 percent in 2019. In the case of the

Family Islands, there is therefore no clear pattern

relating the incidence of hurricanes to the share of

the islands’ economic activity on GDP.

The Macro-Economic Eects of Hurricanes in The Bahamas

8

Figures 4 and 5 show the dynamic evolution of

GDP between 1992 and 2020.

4

Overall, The Ba-

hamas has had a positive growth trajectory since

1992 that decelerated from 2000 onward. Grand

Bahama in particular shows stagnating growth

trend since 2001 (except for a period between

2004 and 2007), compared to New Providence,

the Family Islands, and The Bahamas as a whole

(Figure 4). Of the Family Islands, Exuma-Cays has

had the strongest growth trajectory since 1992,

followed by Abaco (Figure 5). Interestingly, both

Grand Bahama and the Family Islands had a re-

duction in GDP growth in 2016, which is not seen

for New Providence, coinciding with the arrival of

Hurricane Matthew. The figure also suggests that,

4. These series are indexed to 1992.

Source: Authors’ calculations based on the methodology and

databases explained in Annex 1.

Evolution of Nominal GDP in The Bahamas,

1992–2020 (Index, 1992 = 100)

Figure 4.

105.0

104.5

104.0

103.5

103.0

102.5

102.0

101.5

101.0

100.5

100.0

99.5

1992

1995

1998

2001

2004

2007

2010

2013

2016

2019

New Providence Grand Bahama

Family Islands The Bahamas

Source: Authors’ calculations based on the methodology and

databases explained in Annex 1.

Evolution of Nominal GDP in the Family Islands,

1992–2020 (Index, 1992 = 100)

Figure 5.

520

470

420

370

320

270

220

170

120

70

1992

1995

1998

2001

2004

2007

2010

2013

2016

2019

Abaco

Bimini

Exuma and Cays

Mayaguana

Spanish Wells

Acklins

Cat Island

Harbour Island

Ragged Island

Andros

Crooked Island

Inagua

Rum Cay

Berry Islands

Eleuthera

Long Island

San Salvador

despite the damage and losses due to Hurricane

Dorian in 2019, New Providence, Grand Baha-

ma, and the Family Islands experienced positive

growth rates for that year. This could be explained

by the significant increase in tourist arrivals in 2019

with respect to previous years (both for stopovers

and cruise passengers), which could have crow-

ded out the negative eect of the hurricane. Fi-

gure 5 suggests that there is no discernible eect

of hurricanes on the growth trajectory of indivi-

dual islands within the Family Islands. For exam-

ple, Hurricane Irma in 2017 had no negative eect

on most of the islands that are listed in Table 1,

which would seem counter-intuitive.

The Macro-Economic Eects of Hurricanes in The Bahamas

9

An analysis using monthly data also yields mixed

results. Figure 6 shows indexes of the evolution

of GDP for The Bahamas, New Providence, and

the Family Islands between January 2013 and May

2020.

5

The monthly data do seem to show a nega-

tive eect from three out of the four hurricanes

for all sets of islands. There is a slight negative

eect for larger islands, such as New Providence

and Grand Bahama. However, this eect does not

seem to be present for the Family Islands. As with

the yearly series, the results suggest that the path

of GDP of New Providence is a strong determinant

of the overall outcome of the country as a whole.

The series also show great levels of seasonality

due to tourist activity (with the exception of the

Family Islands).

6

Overall, islands experience a decrease in the year-

to-year nominal growth rate during the month and

quarter of a hurricane impact event, but do not

Source: Authors’ calculations.

Note: Vertical lines correspond to the month of occurrence of Hurricanes Joaquin (2015), Matthew (2016), Irma (2017), and Dorian

(2019).

Monthly GDP of The Bahamas, New Providence, Grand Bahama, and the Family Islands, 2013–2020

(Index, January 2013 = 100)

Figure 6.

5. The methodology to estimate these series is described in Annex 1.

6. In The Bahamas, the high season for tourism runs from December to May, when most tourists visit the archipelago. The rest of

the year is hurricane season, when there is a greater chance that the islands will be hit by tropical cyclones.

7. The average length of time for recovery from Hurricane Dorian is not included because it overlaps the eects of the COVID-19

crisis. According to our estimates, Grand Bahama recovered its pre-hurricane levels in January 2020, but its GDP dropped below

hurricane levels after the pandemic started.

show a contraction of the growth rate in the year

of the event. As seen in Table 2, given the yearly

frequency of hurricanes, the year-to-year growth

rates appear to reflect the cumulative eects of

the events, which do not appear to have a subs-

tantial eect on GDP.

New Providence and Grand Bahama experience

larger GDP contractions following major hurri-

canes than the Family Islands (Table 2). On ave-

rage, the Family Islands showed positive GDP

growth rates after Hurricanes Joaquin, Matthew,

Irma, and Dorian. Excluding Dorian, The Bahamas

takes an average of 4.5 months to economically

recover to its pre-hurricane GDP levels.

7

The pro-

cess of macroeconomic recovery (understood as

a return to the pre-hurricane GDP level) has not

been the same for each hurricane and has ranged

from four months after Hurricane Irma to eight

months after Hurricane Matthew. Moreover, the

108

107

106

105

104

103

102

101

100

99

98

97

96

95

Jan-13

Jan-14

Jan-15

Jan-17

Jan-18

Jan-19

Jan-20

Jan-16

Apr-13

Apr-14

Apr-15

Apr-16

Apr-18

Apr-19

Apr-20

Apr-17

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Oct-14

Oct-15

Oct-16

Oct-17

Oct-18

Oct-19

Oct-13

New Providence Grand Bahama Family Islands The Bahamas

The Macro-Economic Eects of Hurricanes in The Bahamas

10

Average New Providence

Grand Bahama

Family Islands

The Bahamas

2.3

0.7

1.9

1.8

-0.2

0.0

1.0

0.0

-2.0

-0.3

1.0

-1.4

Matthew

Irma

Dorian

New Providence

Grand Bahama

Family Islands (1)

The Bahamas

New Providence

Grand Bahama

Family Islands (5)

The Bahamas

New Providence

Grand Bahama

Family Islands (1)

The Bahamas

1.5

1.4

2.6

1.6

2.3

0.0

0.7

1.8

3.3

3.2

3.5

3.2

-1.0

-1.9

0.9

-0.9

1.8

0.9

1.5

1.6

-0.6

0.4

0.9

-0.3

-5.7

-2.6

1.0

-4.4

3.2

1.3

1.5

2.7

-1.6

-0.1

0.8

-1.2

macroeconomic recovery time and the eect of

hurricanes on growth vary across islands. This pro-

cess seems to depend on the size of the economy

of each island, the sectors and businesses present,

population movement, recovery plans, and poli-

tical decisions. For instance, it took around two

months for the Family Islands aected by Hurri-

cane Joaquin to return to their pre-disaster GDP

8. It is one thing is to return to pre-hurricane levels of monthly activity; it is another to return to the pre-hurricane trend. The latter

does not seem to have been the case, and as a result there is still lost growth (ceteris paribus).

Source: Authors’ calculations.

Note: Islands in italics are those impacted by the hurricane, with the number in parentheses indicating the number of Family

islands impacted.

Eect of Hurricanes in The Bahamas

Table 2.

Joaquin New Providence

Grand Bahama

Family Islands (6)

The Bahamas

2.1

-1.7

0.8

0.7

-1.0

0.6

0.8

-0.6

-3.9

0.3

0.6

-2.8

Nominal Growth Rate (year-over-year; percent)

Year Quarter Month

level, while for Grand Bahama it took six months

for that recovery after Hurricane Matthew. It

should be noted that the time for GDP to return to

its pre-hurricane levels may not reflect physical in-

frastructure, community, micro-economic, social,

and livelihood recovery times for The Bahamas as

a whole or for any individual island.

The Macro-Economic Eects of Hurricanes in The Bahamas

11

The economic indicator results presented in this

section suggest that hurricanes disrupt the eco-

nomic activity in the short term (<5 years), yet

other methodologies would be needed to assess

long-term eects (>5 years). Although the analy-

sis finds positive annual growth rates in the year

of these events, The Bahamas suers significant

damage and losses after natural disasters. It takes

years to recover, especially if damage is incurred

to the economic centres of New Providence and

Grand Bahama. It also takes longer to recover

when the events are closely spaced in time. There

are also substantial budget requirements to cover

hurricane-related expenses that involve redirec-

ting government and private resources that could

have been used for other initiatives to increase

productivity or foster development. This would

also have long-term investment, debt, and growth

eects on the country. A counterfactual scenario

on the growth rate, which is beyond the scope of

this paper, could provide a more accurate estimate

of the loss in growth due to hurricanes. Future re-

search could aim at building such counterfactu-

al scenarios at the island level to quantify these

kinds of eects.

Based on the results presented in this section,

Bahamian islands, particularly larger ones, show

an economic contraction in the month or quar-

ter of the disaster event, but this eect dissipates

in the annual estimates. Using yearly data, New

Providence and Grand Bahama do seem to show

modest changes in their GDP weight and growth

trajectories that could be associated with recent

hurricanes. However, no such evidence seems to

be available for the Family Islands. Using month-

ly data, the analysis also finds a slight negative

eect for larger islands such as New Providence

and Grand Bahama, but no discernible eects for

the Family Islands. Finally, when economic con-

tractions for the month, quarter, and year of the

event are compared, the analysis finds more preva-

lent negative eects for the month and quar-

ter but not for the year. The reasons for this are

complex and require more disaggregated data

by island to conduct a quantitative analysis

using counterfactual scenarios. For this reason,

the following paragraphs present various hypoth-

eses that could help explain these results.

Tourism flows could be osetting the eect of the

natural disaster in yearly estimates. Tourist arri-

vals, which are comprised of foreign air arrivals

and cruise passengers, are highly correlated with

the index on economic activity for The Bahamas.

In particular, cruise passenger trends are highly

correlated with the index on economic activity in

the Family Islands (87.9 percent),

9

New Providence

(87.1 percent), and Grand Bahama (60.4 percent)

(Annex 3).

10

Overall, cruise passengers increased

at an average pace of 3.5 percent from 1998 to

2019. New Providence hosts one of the world’s

busiest cruise ship ports and receives around 38

percent of the first port-of-entry cruise passen-

gers who visit the country.

11

The Family Islands

show the largest average growth rate of cruise

passengers (9 percent) compared to New Provi-

dence (4.9 percent) and Grand Bahama (2.2

percent).

Looking at historical arrivals data, tourism arri-

vals do not fall in the years covered in this study –

between 1998 and 2019, tourist arrivals only con-

tracted during the 2008–2009 global financial

crisis (Annex 3). There also seem to be substitu-

tion eects across islands, which could mitigate

the overall tourism eect for the whole territory.

For example, the number of cruise passengers de-

clined in 2015 in New Providence, but increased in

Grand Bahama, suggesting substitution of tourism

demand between these destinations. Qualitative

evidence would suggest that this can also happen

at a regional level. For example, numerous Cari-

bbean islands were impacted by back-to-back hu-

rricanes in 2017 (Hurricanes Irma and Maria). While

The Bahamas was hit by Irma, the tourism sector

in New Providence and Grand Bahama did not suf-

fer major damage. Thus, it is possible that tourist

and cruise ship travel from other Caribbean island

destinations may have been redirected to The

9. Due to the limited availability of data on tourist arrivals, the estimates on correlations for the Family Islands only include Abaco,

Andros, Berry Islands, Bimini, Eleuthera, Inagua, Long Islands, and San Salvador.

10. However, the correlations with foreign air arrivals show mixed results. While New Providence (70.7 percent) and the Family

Islands (82.3 percent) show a positive correlation between foreign tourist arrivals and the index on economic activity, Grand Ba-

hama (-80 percent) shows a negative correlation. Over the years, the number of cruise passengers has outweighed foreign air

arrivals. In 1998, half of the visitors were cruise passengers, whereas in 2019 they represented 75 percent of tourist arrivals.

11. Average share of yearly arrivals from 2015–2019.

The Macro-Economic Eects of Hurricanes in The Bahamas

12

Bahamas, with a positive eect on GDP. Annex 3

also reveals that the Family Islands have experi-

enced a sharp increase in cruise passenger arri-

vals since 2017, suggesting that this eect could

be osetting the eect of hurricanes in recent

years.

12

Strong tourism promotion campaigns fo-

llowing natural disasters, and the authorities’ close

coordination with resort/hotel, cruise ship, port,

and aviation operators, could have been factors

behind these trends. Therefore, rising tourism arri-

vals in recent years, irrespective of natural disas-

ters, could have overcome the negative economic

eect of hurricanes.

Highly correlated monthly economic activity in-

dexes among the Family Islands could mitigate

the economic eects of disasters on some of

these islands. The results suggest that the month-

ly index of economic activity for New Providence

is positively and significantly correlated with the

indexes in Grand Bahama and Harbour Island, but

not significantly correlated with those of the rest

of the Family Islands. The correlation matrix also

shows that Grand Bahama is negatively and signifi-

cantly correlated with the Family Islands. Although

still relatively small, economic activity on the Fam-

ily Islands is increasing and is positively correlated

among the islands, likely because of island-hop-

ping services oered both to resort-based and

cruise passengers. The mechanism behind these

correlations can be explained by two patterns: (1)

most of the country’s economic activity is concen-

trated in New Providence, and (2) economic acti-

vity in the Family Islands is highly connected.

Regarding the first pattern, most resort and

hotel-based tourism is concentrated in New Prov-

idence. Despite representing a lower proportion of

tourist arrivals, this concentration generates more

international tourism receipts compared to cruise-

based tourism.

13

For example, in 2019, resort and

hotel-based tourists represented only one-fourth

of total tourist arrivals, but those visitors spent

more time (an average length of stay of 6.4 days),

they accounted for more more total expenditure

(US$3.73 billion), and a higher average expen-

diture per tourist (US$2,070).

14

In comparison,

cruise passengers, who account for 75 percent of

tourist arrivals, accounted for total expenditure of

US$393 million and an average expenditure per

cruise-based tourist of US$72 (UNWTO 2021). In

addition, New Providence concentrates around

half of the country’s cruise-based tourism.

15

As a

result, tourism activity in New Providence likely

represents a large component of the value added

in the economy.

With respect to the second pattern – that econo-

mic activity in the Family Islands is highly connec-

ted – tourists can travel across the islands through

arranged boat tour packages, ferries, and short

air trips. These services are predominantly used

for daytrips, with tourists spending most of their

stay in New Providence resorts and hotels.

The economic eect of hurricanes could be rela-

ted to the type of infrastructure and sectors aec-

ted by the event. If infrastructure is aected in

key sectors of an island’s economy, the economic

eects are likely to be larger. Recovery and re-

sumption of business activities could also be

delayed as insurance claims are settled and sub-

sequent repair/reconstruction works are under-

taken. Yet in the case of Family Islands, even if key

sectors are aected, high levels of correlation and

substitution eects (particularly among the Fa-

mily Islands themselves) could provide relief from

high direct and indirect costs associated with ex-

tensive losses and damages due to a natural disas-

ter. Heavy and extensive damage to a Family Is-

land may shift economic activities and population

to other islands, stimulating GDP activity on those

islands, combined with a surge of physical and fi-

nancial resources to the aected island to support

recovery activities. To oer greater insight on this

point, the next section uses a review of the DaLAs

12. These results only run up to 2019, before the COVID-19 crisis.

13. International tourism receipts are expenditures by international inbound visitors, including payments to national carriers for in-

ternational transport. These receipts include any other prepayment made for goods or services received in the destination country.

14. Stopovers are defined as persons staying for 24 hours or more. Hotel visitors help to make up the stopover visitors.

15. In 2019, New Providence received 78.4 percent of foreign air arrivals (visitors who come to the destination by air, which may

include stopover visitors, day visitors, and transit visitors) and 51.7 percent of sea arrivals (visitors who come to the destination by

sea, i.e., cruise arrivals and boaters/yachters). Most hospitality capacity was also concentrated in New Providence (79.4 percent of

available rooms). Grand Bahama accounted for 3.1 percent of foreign air arrivals, 8.5 percent of sea arrivals, and 9.1 percent of the

available rooms in the country. The outer islands accounted for 18.5 percent of foreign air arrivals, 39.8 percent of sea arrivals, and

the remaining 11.5 percent of rooms (UNWTO 2021).

The Macro-Economic Eects of Hurricanes in The Bahamas

13

to provide an overview of the estimated costs,

sector eects, and characteristics of each of the

four major hurricanes that are the subject of this

paper.

This section breaks down the volume and compo-

sition of costs incurred in each of the four hurri-

canes, distinguishing between direct and indirect

costs. Pelling, Özerdem, and Barakat (2002) and

ECLAC (2003) introduced a typology of disaster

impacts used by Cavallo et al. (2010) that distin-

guishes between direct and indirect damage due

to natural disasters. Direct damage includes da-

mage to fixed assets and capital, raw materials,

extractable resources, and morbidity and mortali-

ty that is a direct consequence of the disaster. In-

direct damage is related to subsequent economic

activity that cannot take place due to the disaster

and the redistribution of resources in the after-

math of the disaster.

Costs are calculated based on the DaLAs pu-

blished by ECLAC and the IDB. ECLAC is one of

the main international actors in conducting post-

disaster assessments,

16

and ECLAC and the IDB

completed four comprehensive and publicly avail-

able DaLAs in The Bahamas following the four

major hurricanes that are the subject of this study:

Joaquin, Matthew, Irma, and Dorian. These assess-

ments estimate disaster impacts and costs as well

as post-disaster sector-specific funding needs,

and also provide recommendations for recovery,

reconstruction, and short- and long-term disaster

risk reduction and management. The methodolo-

gy includes an estimate of the eects of the disas-

ter on assets (damage) and economic flows (loss-

es and additional costs). Other organizations, such

as the World Bank, have also developed damage

assessment methodologies, but this study uses

3.3 Direct and Indirect Costs

of Hurricanes: A Typology of

Damage and Losses

ECLAC’s assessment methodologies due to the

availability of consistent and methodologically

comparable assessments for The Bahamas for the

four hurricanes.

The DaLA methodology breaks down the impact

of natural disasters into damage, losses, and ad-

ditional costs. The damage assessment estimates

the eect of the disaster on assets, expressed in

monetary terms. These assets include physical

assets (such as buildings, installations, machi-

nery, furnishings, roads, etc.) and stocks of final

or semi-finished goods, raw material, materials,

and spare parts.

17

We equate damages to direct

costs, as defined in Cavallo & Noy (2009). Losses

are goods that go unproduced and services that

are unprovided during the period between the

disaster and full recovery or reconstruction. For

example, harvests might be reduced, industrial

production might decline, or revenues might be

foregone.

18

Losses can take place due both to as-

set damage, and thus be longer term, and to tem-

porary activity disruption. For example, one result

of the disaster may be in the form of additional

spending.

20

The estimates are obtained by com-

paring the outlook after the disaster with a base-

line that represents the counterfactual evolution

of each sector if the disaster had not occurred.

20

These additional costs are not associated with the

definitions used by the rest of the literature and

are therefore not included in this section.

The DaLA methodology provides rapid initial es-

timates of the damage and losses with recom-

mended actions to inform disaster response and

strategic planning. First, these assessments pro-

vide an early initial baseline estimate of damage

and losses to approximate the scale of the disaster

and the initial response/recovery resources need-

ed for each sector, based on the best available

information at the time of the field assessment.

The aim is for governments to then perform ad-

ditional detailed assessments to track and predict

medium- and long-term costs. Second, these

16. Since 1972, ECLAC has participated in 90 assessments of the social, environmental, and economic eects of disasters in 28

countries in Latin America and Caribbean. The agency has also published three methodological handbooks on the estimation of

damage and losses from disasters.

17. Damage is expressed in monetary terms estimated using the physical scale of the eect and a price to convert it into a value.

Damage is also measured relative to a baseline or pre-disaster situation, which is constructed using pre-disaster information on

the assets of dierent sectors.

18. Losses are a dynamic measure of flows, and their repercussions may persist over a length of time spanning beyond the time of

the valuation and could therefore be underestimated in the DaLA.

19. This includes additional spending associated with managing the emergency.

20. National accounts treat these flows dierently, as additional expenditures represent a temporary increase in the intermediate

consumption of a sector for a good or service restoration, which reduces its value added.

14

Additional costs

Direct costs

Losses

Indirect costs

Not included or used

Source: Authors’ compilation based on Cavallo & Noy (2009) and various DaLA reports.

Sources: ECLAC (2016, 2017, 2020a, 2020b); and International Monetary Fund, October 2020 World Economic Outlook.

Comparisons between the Terminology Used in Cavallo & Noy (2009) and the Economic

Commission for Latin America and the Caribbean in its Damages and Losses Assessments (DaLAs)

Total Direct and Indirect Costs per Hurricane

Table 3.

Table 4.

ECLAC DaLA Terminology

Joaquin (2015)

Millions of

U.S. Dollars

Millions of

U.S. Dollars

Millions of

U.S. Dollars

Millions of

U.S. Dollars

Percent

of GDP

Percent

of GDP

Percent

of GDP

Percent

of GDP

Damage

104.8

9.7

0.9

0.1

373.9

145.5

3.1

1.2

32.3

86.9

0.3

0.7

2,454.2

718.0

18.1

5.3

Direct costs

Direct costs

Cavallo et al. (2010) Terminology

Matthew (2016) Irma (2017) Dorian (2019)

assessments appear to capture high-level eects.

Third, DaLAs incorporate numerous assump-

tions that are appropriate for short-term damage

and loss estimates, and that can be revised by

the aected government once more detailed

assessments are performed. Table 4 presents a

summary value of direct and indirect costs for

Hurricanes Joaquin, Matthew, Irma, and Dorian.

The Macro-Economic Eects of Hurricanes in The Bahamas

The Macro-Economic Eects of Hurricanes in The Bahamas

15

Based on the 2015 DaLA, Hurricane Joaquin

caused US$104.8 million in direct costs, mostly

to roads, telecommunications and housing.

21

The

greatest direct costs were incurred on Long Is-

land (34 percent of direct costs, US$35.7million),

Acklins (25 percent of direct costs, US$26.5 mi-

llion), and San Salvador (19 percent of firect costs,

US$19.6 million). Damage to infrastructure was

the most prevalent, accounting for 53 percent of

all direct costs. Within infrastructure, roads were

the most aected subsector due to remote loca-

tions and weak pre-existing conditions. The tele-

communications subsector was the second most

aected sector, with direct damage reaching 20

percent of the network, valued at US$20.7 mi-

llion. In Rum Cay, the hurricane interrupted the

provision of electricity and telecommunications,

and the docks were also aected, which hindered

relief eorts. Social sectors were the next most

aected sector, accounting for 36 percent of all

direct costs (US$37.9 million), with the vast ma-

jority of that damage to housing infrastructure.

The productive sector incurred 11 percent of di-

rect costs (US$11.2 million), predominantly in the

tourism subsector.

22

Most direct costs related to

telecommunications were due to fallen lines and

utility poles. Rum Cay suered an island-wide loss

of both mobile and wired services and damage to

fibre and copper cables and utility poles.

Joaquin generated US$9.7 million in indirect

costs, mostly in the tourism and social sectors.

Indirect costs were mostly caused in San Salva-

dor (48 percent of indirect costs, US$4.6 million)

and Long Island (37 percent, US$3.5 million). Rum

Cay was the smallest island in size and population

aected and therefore incurred the lowest cost

(34 percent, US$4.4 million). Its productive sector,

however, incurred the highest indirect costs (51

percent, US$4.9 million). This was exacerbated by

road = damage, which indirectly aected tourism

services and, through that impact, employment.

The next most aected sector in terms of indirect

Hurricane Joaquin

costs was the social sector (28 percent of total in-

direct costs US$2.7 million), while the infrastruc-

ture sector accounted for 14 percent of indirect

costs (US$1.3 million).

The total population aected by Joaquin reached

5,028, of which 61.5 percent were on Long Island,

18.7 percent on San Salvador, and 11.24 percent

on Acklins. Northern dwellings on Acklins were

the most severely aected by the storm. The most

inhabited dwellings on the east side of Crooked

Island were the most severely aected, which

showed how widespread the eect of the hurri-

cane was on the island’s population. The entire

population was impacted by the interruption of

water services. The south was the most damaged

part of the island. The entire population of Rum

Cay Island was aected due to electricity and tele-

communications disruptions. San Salvador also

recorded damage to dwellings across the whole

island. A large number of persons were tempo-

rarily relocated to New Providence, exacerbating

pre-hurricane depopulation trends that had been

taking place prior to the disaster.

21. Due to logistics, the DaLA team was unable to meet with the authorities in Rum Cay. Information for this island was compiled

with data from the government of The Bahamas.

22. The only aected islands with a port of entry were Long Island and San Salvador. With the exception of Club Med in San

Salvador, the hotels on the aected islands were small-scale establishments, most of which did not have insurance or financing

mechanisms to respond to the damage, which likely delayed reconstruction. Club Med was the largest private sector asset to be

directly impacted by Hurricane Joaquin.

16

Note: Categories with 0% have been omitted from the labels.

Source: ECLAC (2016).

Total Direct and Indirect Costs to The Bahamas from Hurricane Joaquin by Sector and Island

Figure 7.

Health

Education

Housing

Public buildings

Roads

Airports

Docks

Power

Telecomms

Water and sewerage

Tourism

Fisheries

a. Total Direct Costs by Sector

31%

2%

2%

2%

2%

1%

1%

1%

10%

20%

5%

23%

Acklins

Crooked Island

Long Island

Rum Cay

San Salvador

b. Total Direct Costs by Island

25%

18%

4%

19%

34%

Education

Housing

Power

Telecomms

Water and sewerage

Tourism

Fisheries

c. Total Indirect Costs by Sector

28%

7%

7%

2%

4%

51%

1%

Acklins

Crooked Island

Long Island

Rum Cay

San Salvador

d. Total Indirect Costs by Island

25%

18%

4%

19%

34%

The Macro-Economic Eects of Hurricanes in The Bahamas

The Macro-Economic Eects of Hurricanes in The Bahamas

17

Total direct costs to The Bahamas as a result of

Hurricane Matthew reached US$373.9 million. Of

the total direct costs, 54.5 percent was in the so-

cial sector, 10.2 percent in infrastructure, 34.8 per-

cent in productive sectors, and 0.5 percent in en-

vironment sectors. Housing was severely aected

by Hurricane Matthew, reaching US$200.1 million

(53.5 percent) in direct costs on New Providence,

Grand Bahama, Andros, and the Berry Islands.

Many costs to infrastructure were due to non-

compliance with structural criteria (inadequate

reinforcement or the concrete mix used). Direct

costs in the telecommunications sectors were es-

timated at US$9.9 million (2.6 percent), while di-

rect costs to the energy sector were estimated at

US$16.4 million (4.3 percent), mostly as a result

of high winds. Grand Bahama was the most aec-

ted by power outages, which continued over five

weeks after the event. Direct costs to the water

and sanitation sector reached US$1.2 million (0.3

percent). Total direct costs to the tourism sector

were US$129 million (34.5 percent). With regards

to the environment, the most damaged natural re-

source was native hardwoods and other non-pine

tree species on New Providence, Grand Bahama,

and Andros.

Hurricane Matthew

Indirect costs reached US$140.5 million, mostly

in tourism: 75.1 percent of indirect costs were in

the productive sectors, 14.9 percent in infrastruc-

ture, 9.9 percent in social sectors, and 0.1 percent

in environment sectors. Within productive sec-

tors, 80.7 percent of indirect costs were tourism-

related, while for infrastructure most indirect costs

(62.9 percent) were in telecommunications. The

telecommunications sector experienced wide-

spread outages (more so than from Hurricane

Joaquin), which led to indirect costs of US$13.6

million (9.6 percent). Grand Bahama and New

Providence had the longest outages. Electricity

outages had eects on the supply of water and

sanitation. Total indirect costs in the tourism sec-

tor reached US$88.3 million (62.8 percent), most-

ly incurred on Grand Bahama.

The impact on the population was moderate. No

deaths or injuries were reported during the event,

but 3,221 people were sheltered in 50 facilities

throughout the four aected islands analysed in

the DaLA.

18

Direct and Indirect Costs to The Bahamas from Hurricane Matthew by Sector and Island

Figure 8.

Education

Housing

Roads, ports and airports

Power

Telecommunications

Tourism

Education

Housing

Health

Power

Telecommunications

Tourism

Fisheries

a. Total Direct Costs by Sector

54%

4%

1%

35%

3%

3%

New Providence

Grand Bahama

Andros

Berry Islands

b. Total Direct Costs by Island

18%

6%

2%

74%

c. Total Indirect Costs by Sector

5%

9%

15%

61%

1%

1%

8%

New Providence

Grand Bahama

Andros

Other Islands

d. Total Indirect Costs by Island

33%

2%

4%

61%

The Macro-Economic Eects of Hurricanes in The Bahamas

Note: Categories with 0% have been omitted from the labels.

Source: ECLAC (2020a).

The Macro-Economic Eects of Hurricanes in The Bahamas

19

Total direct costs to The Bahamas from Hurricane

Irma were estimated at US$32.3 million, mostly

in water and sanitation and housing. Direct costs

related to social sectors reached US$16.8 million

(52 percent), most of which were in the housing

sector. The health sector incurred mild damage (2

percent of total direct costs). Hospitals in Free-

port and Nassau reported damage. Direct costs in

the infrastructure sector reached US$13.7 million

(42.4 percent), of which US$10.3 million (31.9 per-

cent) was in the transportation sector. Excluding

the Ragged Island airport, the greatest losses to

transport infrastructure were on Inagua. Roads,

and particularly those near the coast, were aec-

ted by the sea surge, and the airport on Ragged

Island suered damage to the terminal and run-

way. The ports in Bimini had considerable dam-

age due to the sea surge and tidal eects. Direct

costs to telecommunications, power, and water

and sanitation were US$2.1 million (6.5 percent),

US$800,000 (2.4 percent), and US$500,000 (1.5

percent), respectively. Ragged Island suered

the greatest costs to its telecommunications in-

frastructure (accounting for 69 percent of to-

tal telecommunications damages),

23

followed by

Grand Bahama and Inagua (both of which had

tornado damage), Bimini, and Andros. Damages

in the power sector were limited, partly due to

prior preparation before Irma reached The Ba-

hamas. However, the arrival of Hurricane Maria a

few months later impeded reconstruction in the

power sector on some islands such as Mayagua-

na. Direct costs in the water and sanitation sector

(US$500,000) were also limited, with the excep-

tion of Ragged Island and Bimini, which suered

damage. Ragged Island’s desalination plant and

the Bimini underwater line were both damaged. In

relative terms, productive sectors incurred a much

smaller share of direct costs at US$1.7 million, most

of which was in the tourism sector (US$600,000)

and fisheries sector (US$1.1 million).

24

Tourism did

not incur large direct costs, but it was aected by

disrupted visitor inflows in the aftermath of the

Hurricane Irma

storm. Ragged island suered the largest share of

direct costs in the tourism sector (US$400,000),

followed by Bimini (US$700,000). In the fisheries

sector, the fishing port of Duncan Town on Rag-

ged Island and a ramp in Matthew Town on Inagua

were damaged.

25

New Providence incurred the

greatest direct costs (US$500,000).

Indirect costs were estimated at US$86.9 mi-

llion, mostly in tourism. In the social sector, indi-

rect costs reached US$2.4 million (2.8 percent), of

which US$1.5 million (1.7 percent) was in the ed-

ucation sector, US$500,000 (0.6 percent) in the

health sector, and US$400,000 (0.5 percent) in

housing. Indirect costs in infrastructure reached

US$3.7 million (4.2 percent), of which most was in

the transportation sector (US$2.2 million, 2.5 per-

cent). Low indirect costs in telecommunications

were due to the fact that most of the damage was

in lesser-populated areas, and outages that af-

fected larger groups of people were quickly fixed.

Tourism suered the bulk of indirect costs (78

percent, or US$68 million), mostly due to travel

disruptions in the aftermath of the event. Indirect

costs in the fisheries sector amounted to US$12.9

million (15 percent), mostly concentrated in New

Providence and Spanish Wells. Disruptions in fish-

eries were more severe, particularly as the lobster

fishing season ranges from August to March, with

the most productive months being August and

September.

Approximately 54,906 persons were aected by

Hurricane Irma (16 percent of the population).

Inagua was the only island that had been expe-

riencing a population decrease prior to the hu-

rricane, whereas Grand Bahama had been experi-

encing a population increase. Approximately 892

people were evacuated from three of the five is-

lands, including 365 from Bimini, 487 from Inagua,

and 40 from Ragged Island.

26

23. The direct costs to telecommunications include those reported by BTC and Cable Bahamas, as well as estimates on damage

that was not reported. Figures for ALIV are not included, as the company reported no significant damage.

24. In the fisheries sector, only direct costs related to commercial fishing vessels, fishing gear, and other equip-ment to prepare

or preserve the catch were considered.

25. Damage to the port of Duncan Town is accounted for in the infrastructure sector and damage for sports fishing is accounted

for in the tourism sector.

26. An emergency evacuation plan from the most threatened islands was executed prior to the arrival of Irma. Persons were taken

from Mayaguana, Inagua, Crooked Island, Acklins, Long Cay, and Ragged Island to Nassau.

The Macro-Economic Eects of Hurricanes in The Bahamas

20

Direct and Indirect Costs to The Bahamas from Hurricane Irma by Sector and Island

Figure 9.

Housing

Public Buildings

Education

Health

Roads

Airports

Docks

Seawall

Telecomms

Power

Water and sanitation

Tourism

Fishing

Acklins

Bimini

Grand Bahama

Inagua

Ragged Islands

Andros

Crooked Island

Long Island

Grand Bahama

Inagua

Ragged Islands

Crooked Island

a. Total Direct Costs by Sector

37%

8%

2%

8%

8%

2%

1%

3%

3%

3%

7%

13%

5%

b. Total Direct Costs by Island

25%

25%

18%

2%

2% 1%

14%

13%

c. Total Indirect Costs by Sector

78%

2%

1%

3%

15%

d. Total Indirect Costs by Island

11%

1%

0%

54%

34%

Housing and

Public Buildings

Health

Docks

Water and sanitation

Tourism

Fishing

1%

The Macro-Economic Eects of Hurricanes in The Bahamas

Note: Categories with 0% have been omitted from the labels.

Source: ECLAC (2017).

The Macro-Economic Eects of Hurricanes in The Bahamas

21

Total direct costs to The Bahamas from Hurricane

Dorian reached US$2.5 billion, with housing and

tourism particularly hard hit. Abaco suered 87

percent of the direct costs and Grand Bahama 13

percent. Direct costs to the social sector reached

US$1.6 billion (64 percent), with most of that in

Abaco. Within the social sector damage, almost

93 percent was in the housing subsector. Appro-

ximately 9,000 homes had direct damage, with

more than 75 percent of homes in Abaco direct-

ly damaged. Direct costs to the productive sector

reached US$620.9 million (24 percent), of which

US$529.6 (21.2 percent) was in the tourism sector.

Direct costs to infrastructure reached US$239.1

million (9.5 percent), of which 54.1 percent was

in the power sector. The airports suered high

operational damage due to flooding and roof fai-

lure due to high-speed winds, and seaports were

impacted by waves, storm surge, and wind. The

transport sector incurred US$50.8 million (2 per-

cent) in direct costs, with 53 percent of the da-

mage on Grand Bahama, almost all of it sustained

at the Grand Bahama International Airport.

Total indirect costs reached US$717.3 million,

mostly in tourism. Of the total, 70 percent was

in Abaco, 15 percent in Grand Bahama, and 15

percent in other islands. Indirect costs in the so-

cial sector reached US$93.2 million (13 percent),

of which US$65 million (2.6 percent) was in the

housing sector. Indirect costs in the environmen-

tal sector reached US$27.5 million (3.8 percent).

Wave action, storm surge, and high winds pro-

duced partial to severe destruction of mangroves,

coral reefs, seagrass beds, and forests on both Ab-

aco and Grand Bahama. As a result, ecosystems

were left in a critical state and pre-existing vulne-

rabilities were exacerbated, with an expected de-

crease in ecosystem services provision in the short

and medium term. Indirect costs in the productive

sector were approximately US$400.3 million (55.8

percent), of which 83.8 percent were in Abaco.

Hurricane Dorian

Of the total amount, 81.2 percent was in the tou-

rism sector. Hurricane Dorian impacted two major

tourist destinations of The Bahamas and disrupt-

ed the tourist flows for several days before and

after the storm in the rest of the Lucayan Archi-

pelago. Indirect costs in the infrastructure sector

reached US$197.1 million (27.5 percent), 35 per-

cent of which was in the power sector, followed by

telecommunications. Disruption of power services

was particularly notable on Abaco.

Most inhabitants of both islands were aected

by the hurricane, either directly or indirectly. The

total aected population reached approximately

29,472 persons (40 percent of the total combined

population of Abaco and Grand Bahama). As of

October 18, 2019, there were 67 confirmed deaths

and 282 missing persons.

The Macro-Economic Eects of Hurricanes in The Bahamas

22

Direct and Indirect Costs to The Bahamas from Hurricane Dorian by Sector and Island

Figure 10.

Housing

Education

Health

Power

Telecommunications

Water and Sanitation

Transport

Tourism

Commerce

Fisheries and Agriculture

Housing

Health

Power

Telecommunications

Commerce

Education

Power

Water and Sanitation

Tourism

Fisheries and Agriculture

a. Total Direct Costs by Sector

60%

3%

1%

2%

2%

1%

3%

1%

22%

5%

Abaco Gran Bahama

Abaco Gran Bahama Other islands

b. Total Direct Costs by Island

87%

13%

c. Total Indirect Costs by Sector

10%

8%

10%

5%

5%

2%

9%

3%

47%

1%

d. Total Indirect Costs by Island

70%

15%

15%

The Macro-Economic Eects of Hurricanes in The Bahamas

Note: Categories with 0% have been omitted from the labels.

Source: ECLAC (2020b).

The Macro-Economic Eects of Hurricanes in The Bahamas

23

The results presented in this section reinforce

previous results but also raise certain additional

points. Some interesting patterns appear when

comparing Tables 2 and 4.

1. Low direct and indirect costs could be related

to a smaller economic eect of natural disas-

ters. Hurricane Irma incurred significantly lower

direct and indirect costs than the other hurri-

canes. Table 2 in fact showed that the country

registered no economic eects in either the

month, quarter, or year of the event. However,

the results do not show that the greater the

direct and indirect costs, the greater the eco-

nomic eect. Hurricane Dorian resulted in the

largest costs by far but did not have the great-

est economic eect.

2. There does indeed seem to be a relation be-

tween what islands are aected and the se-

verity of the economic contraction. Hurricane

Matthew had the most severe economic eects

in the month of the event (4.4 percent contrac-

tion), and although it imposed lower overall

costs than Hurricane Dorian, both New Provi-

dence and Grand Bahama (the largest islands

economically) had the highest costs.

3. Neither the magnitude nor the composition of

costs seems to impact the economic eects of

the disasters on the Family Islands. The Family

Islands were most recurrently hit by these natu-