Department of Defense (DoD)

GUIDEBOOK FOR MISCELLANEOUS

PAYMENTS

February 2019

1

DoD Guidebook for Miscellaneous Payments

SUMMARY OF MAJOR CHANGES

All changes are denoted by blue font (note: hyperlinks are always

identified in blue, bold, italicized font).

Substantive revisions are identified below.

This version updates and replaces the December 2016 version.

PAGE

EXPLANATION OF CHANGE/REVISION

PURPOSE

Pages 82-83

Added a newly developed template for Student Loan

Repayments (SLRV). The template provides policy and

guidelines for the preparation and submission of student loan

repayments authorized by Title 5, United States Code

(U.S.C.) § 5379 and Office of Personnel Management

Guidance.

Addition

Pages 98-99

Revised the policy language in the Civilian Clothing

Allowance (CCAE) template to clarify the classification of

the payments as allowances (in accordance with Department

of Defense Instruction 1400.25, Volume 591), including the

clarification of documentary evidence required to support the

payment requests.

Revision

2

TABLE OF CONTENTS

MISCELLANEOUS PAYMENTS

Overview ............................................................................................................................................. 2

Alphabetical Listing of Miscellaneous Payment Categories ..................................................... 4

Abbreviation Codes ............................................................................................................................ 4

Non-Federal Entities ..................................................................................................................... 4

Employees/Military Members .................................................................................................... 7

Intra-Governmental ..................................................................................................................... 9

Templates for Processing Miscellaneous Payments-General Notes ............................................ 10

Payments to Non-Federal Entities ............................................................................................. 11

Employee Reimbursements ...................................................................................................... 94

Intra-Governmental ................................................................................................................. 140

Voucher Preparation Instructions (SF 1034 and OF 1164) .................................................... 150

3

DoD MISCELLANEOUS PAYMENTS

OVERVIEW

Purpose. The purpose of this guide is to assist Department of Defense (DoD) officials

in identifying mandatory requirements prescribed for DoD miscellaneous payments. This guide

prescribes policy for certain miscellaneous payments for Federal and Non-Federal entities. It

provides a high-level overview of policies and processes, with a goal of consolidating and

streamlining miscellaneous payment procedures across the Components. Use of the

"Abbreviation" miscellaneous payment codes (pages 6–10 of this guidebook) is mandatory for

any miscellaneous payment request within the DoD. If the entitlement system is unable to

capture or process the "Abbreviation" miscellaneous payments codes, the entitlement system

personnel must reach an agreement with the DFAS Tax Office regarding how payments will be

processed in order to ensure that proper tax withholding and/or reporting occurs. The policy

and procedures identified in this guide are derived from the Federal Acquisition Regulation

(FAR), the Defense Federal Acquisition Regulation Supplement (DFARS), the DoD Financial

Management Regulation (FMR), and other statutory and regulatory resources referenced

throughout. An authorized miscellaneous payment is defined as a payment that is not initiated

by a contract or task order, and is generally a one-time occurrence for which the government

receives benefit. Miscellaneous payments will be paid if the underlying expense was authorized

and if the claim is legally payable. See DoD FMR Volume 10, Chapter 12 for additional policy

concerning miscellaneous payments.

Policy.

A. A miscellaneous payment is defined as a valid obligation of the government having one

or more of the following attributes:

1. Payment under special authoritative arrangements other than a

formal contracting arrangement. These may include specific payment authorities pursuant to

legislation or Executive Orders. Example: Child care services and youth programs services for

dependents; financial assistance for providers.

2. Payments authorized under formal contracting arrangements that

may necessitate other payment methods. Examples: Payments for morale, welfare, and

recreation functions when use of the Government Purchase Card (GPC) is not feasible.

3. Payments for non-recurring, non-contractual purchases.

Examples: Payments for Attorney fees and other expenses awarded by a court, arbitrator, or

administrative board to the party prevailing in a civil action against DoD, when use of the GPC

is not feasible.

B. Submission and processing of miscellaneous claims for payment must be accomplished

electronically (DFARS Subpart 232.70), with limited exceptions as prescribed by DFARS

232.7002(a). Electronic submissions of miscellaneous payments may be submitted via the

4

Invoicing Receipt, Acceptance, and Property Transfer (iRAPT) part of the eBusiness Suite,

Enterprise Resource Planning (ERP) systems, or other approved electronic methods. Supporting

documentation, to include receipts, tickets, invoices, or other specific forms identified by each

template in this guide, must accompany each payment request. The electronically transmitted

payment request is treated the same as a paper request and must contain the required data

elements of a proper invoice (see FAR 32.905(b), “Content of Invoices”, and Title 5, Code

of Federal Regulations (CFR) § 1315).

C. Miscellaneous payments are subject to the obligation standards prescribed by the DoD

FMR Volume 3, Chapter 8.

D. The approved payment request must contain a valid line of accounting obligated as

specified in the DoD FMR Volume 3, Chapter 8. Due to the nature of miscellaneous payments,

and the absence of a contract number, processing of the payments through a DoD payment

system may require the configuration of unique standard document numbers.

E. All payment requests must have a valid line of accounting and a Tax Identification

Number (TIN) registered with the DoD in accordance with Title 31, United States Code

(U.S.C.), section 3325(d). In accordance with FAR 4.11, contractors and vendors doing

business with the Federal Government must register in the System for Award Management

(SAM), except as noted in FAR 4.1102. The exceptions include instances involving classified

contracts, purchases using the Government-wide commercial purchase card, and purchases

under emergency or contingency operations. Contractors and vendors are responsible for

keeping all SAM information current. In accordance with DoD Directive 5400.11,

Components must safeguard the privacy of all individuals and the confidentiality of all

personally identifiable information (PII), and take action to ensure that any PII contained in a

system of records used to conduct official business will be protected so that the security and

confidentiality of the information is preserved.

F. Certifying officers will ensure the accuracy of a voucher and supporting documents;

ensure transactions are legal, proper and correct; and ensure the obligation of funds are sufficient

for payment. Submitting activities must provide a copy of a Defense Department (DD) Form

577 (Appointment/Termination Record) for certifying officers, to the DFAS Indianapolis

Disbursing Operations (secure email: [email protected]).

Certifying officers are appointed only after completion of required training and can be held

pecuniarily liable for erroneous payments resulting from the performance of their duties (31

U.S.C. 3528). See DoD FMR Volume 5, Chapter 5 for additional policy concerning DD Form

577’s and certification of vouchers.

G. Reimbursement to entities or individuals can only occur if the underlying expense was

properly authorized and the claim is legally payable.

H. Title 31 CFR, Part 208 requires that Federal payments be made electronically, except as

prescribed by 31 CFR Part 208.4.

I. The GPC may be used for payment of certain miscellaneous payments for transactions

5

valued at or below the micro-purchase threshold (DFARS Part 213.270). If a non-Federal

entity does not accept the GPC, payment by convenience check may be another option. See

DoD FMR Volume 10, Chapter 23 for policy concerning the GPC and convenience checks.

J. The Intra-Governmental Payment and Collection (IPAC) system shall be used to

properly transfer funds to pay for goods and services exchanged between Federal agencies

(Treasury Financial Manual, Volume 1, Part 2, Chapter 4700, Appendix 10, Section 9.4.3).

6

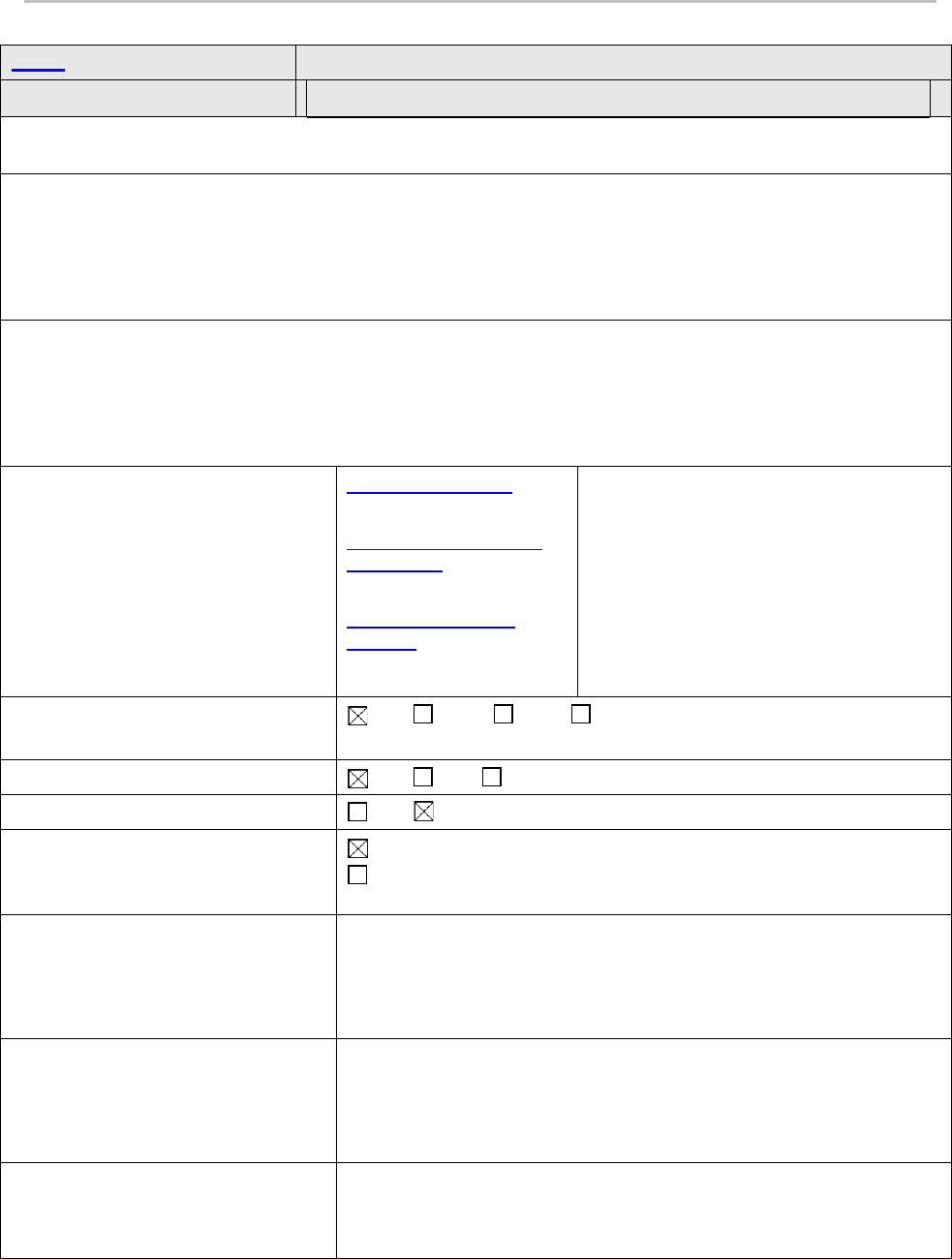

ALPHABETICAL LISTING OF MISCELLANEOUS

PAYMENT CATEGORIES

Existing Abbreviations. Use of the "Abbreviation" miscellaneous payment codes

(pages 6-10 of this guidebook) is mandatory for miscellaneous payments made by the DoD.

If the entitlement system is unable to capture or process the "Abbreviation" miscellaneous

payment codes, the entitlement system must reach an agreement with the DFAS Tax Office

regarding how payments will be processed.

Abbreviations. This guidebook does not encompass all miscellaneous payments

and primarily those with a less significant volume of requests may require special

handling. If a particular miscellaneous payment has not yet been assigned a code or

template and begins to recur in a volume that processing without the use of a specific

miscellaneous payment code becomes burdensome, then the organization being impacted

should contact DFAS (dfas.indianapolis-in.zpr.mbx.accountingpolicy[email protected])

with a recommendation to add a new code in this Guidebook.

Tax Withholding. The use of uniform miscellaneous payment codes is important to

determine the tax reporting and withholding applicable to payments and to determine the

applicability of Prompt Payment Act (PPA) or other required interest. These codes must be

captured in such a way that they can be used systemically to determine whether payments will

be cash- managed, whether PPA interest is due for late payments, and whether IRS Form 1099

reporting is required.

MISCELLANEOUS PAYMENTS

*An asterisk indicates that a template currently not included in the Guidebook

PAYMENTS TO NON-FEDERAL ENTITIES

Non-Federal entities include a state, interstate, Indian tribal or local government, as

well as private organizations

(http://www.dtic.mil/whs/directives/corres/pdf/100015p.pdf).

Miscellaneous Payment Category

Abbreviation

Agents (Used when disbursing vouchers are pro-

cessed)

AGNV

Ancillary Charges Associated with Fuel Cards

POLV

7

Miscellaneous Payment Category

Abbreviation

Apprehension Reimbursements and Confinement

Costs

ARCV

Apprehension Rewards

ARWV

Attorney Fees (Including Judgments and Settle-

ments Paid to the Attorney)

ATTV

Awards Made to Bid Protestors

AMBV

Government Card Services

BANV

Billeting, Non-Federal Entity

BLLV

Child Care (Non-Contractual)

CHCV

Civilian Clothing Allowance

CLTV

Contingency Funds for Entertaining Dignitaries

CONV

Contingency Funds for Investigative Expenses and

Confidential Military Purposes

DSSV

Demurrage

DEMV

EEO Payments Non-Federal Employee

EEOV

Express Mail Service

EMSV

Expert Witness Fees

EWIV

Fees, Licenses, Permits (Does not include MIPRs)

FLPV

Funeral, Internment, and Mortuary Expenses

FIMV

Gifts and Speaker Fees

GFTV

Grants

GRNV

Honorariums

HONV

8

Miscellaneous Payment Category

Abbreviation

Hospital Accreditation

HSPV

Lease and Rental Agreements

RENV

Legal Claims (Non-Federal Entity)

LGLV

Medical Services Provided by Civilian Non-

Federal Sources

MEDV

Military Clothing Allowance

MCAV

Miscellaneous Payment - Vendor

MISV

Military Training Service Support

MTSV

Morale, Welfare, Recreation, and General Enter-

tainment Expenses

MWRV

Official Representation Funds (ORF) Entertain-

ment

OREV

Official Representation Funds (ORF) Gifts and

Mementoes

ORGV

Patents, Copyright, and Designs

PATV

Professional Liability Insurance

PRLV

Purchase and Transportation of Special Items

(Blood)

PSBV

Purchase of Metered Mail - Paid to Private Entity

(Does not include small parcels)

POSV

Purchase of Special Items (Drinking Water)

PSWV

Rewards for Recovery of Lost DoD Property

RLPV

Student Loan Repayments

SLRV

9

Miscellaneous Payment Category

Abbreviation

Training and Education Expenses - Paid to Non-

Federal Entity (Non-Contract)

TRNV

Transportation for Local Move or Local Delivery

out of HHG Only (In/Out-Bound Local Moves)

THHV

Utility Payments – Interest Bearing

UTIV

Utility Payments – Tariff or Late Fee Bearing

UTTV

Veterinary Services for Contingency and/or Emer-

gency Conditions

VETV

Witness Attendance Fees

WITV

PAYMENTS TO EMPLOYEES/MILITARY MEMBERS

*An asterisk indicates that a template currently not included in the Guidebook

Miscellaneous Payment Category

Abbreviation

Adoption Expenses

ADPE

Award for Suggestion

SUGE

Billeting *

BLLE

Civilian Clothing Allowance

CCAE

Defense Security Service (DSS) Agents Miscella-

neous Expenses

(Includes Investigation Expenses and background

investigations), which formerly used iRAPT code

INVE)

DSSE

Employment-Related Judgments and Settlements

(Includes EEOC Judgments and Settlements that

formerly used iRAPT Code EEOC)

EEOE

Funeral, Internment, and Mortuary Expense

FIME

Fees, Licenses, and Permits

FLPE

Gifts

GIFE

Lease & Rental Agreements

RENE

10

Miscellaneous Payment Category

Abbreviation

Legal Claims

LGLE

Medical Services Provided by Civilian Non-

Federal Sources

MEDE

Miscellaneous Payment - Employee

MISE

Morale, Welfare, Recreation, and General Enter-

tainment Expenses

MWRE

Official Representation Funds (ORF) Entertain-

ment

OREE

Official Representation Funds (ORF) Gifts and

Mementos

ORGE

Patents, Copyright & Designs

PATE

Professional Liability Insurance

PRLE

Room and Board for Dependent Children

RERE

Reimbursements: Utility Reconnection and Tele-

communication Fees

REUE

Religious Services *

RELE

Respite Care

RSPE

Training/Education Expenses - (Non-Contract)

TRNE

Transportation Incentive Program

TRAE

Veterinary Service

VETE

PAYMENTS TO INTER/INTRA-FEDERAL GOVERNMENTAL

*An asterisk indicates that a template currently not included in the Guidebook

Miscellaneous Payment Category

Abbreviation

Foreign Government Payments (formerly ACSI)

FGPI

Non-Federal Government Payments (State/Local)

NFGI

Official Rep Funds-Entertainment

OREI

Official Rep Funds-Gifts and Mementoes

ORGI

Postage, Government Entity

POSI

Damages to GSA Motor Pool Vehicles *

DMPI

Fees, Licenses, Permits *

FLPI

Intergovernmental Personnel Act (IPA)* For IPA

payments, use IPAC and/or MIPR process *

IPAI

11

Miscellaneous Payment Category

Abbreviation

NAF (Payment made under the Uniform Funding

& Mgmt. Practice. Quarterly payment made to the

Community Family Support Center) *

NAFI

Purchase of Special Items (Border Clearance In-

spectors) *

SPEI

Training and Education Expenses - Paid to Federal

Government Entity (Non-Contract) *

TRNI

11

Templates for Processing Miscellaneous

Payments

GENERAL NOTES ON THE TEMPLATES

1.

Any reference to a Standard Form or DoD Form includes the electronic equivalent

of that form.

2.

Miscellaneous payments may have tax consequences as follows:

• Certain payments may be required to be reported to the

Internal Revenue Service (IRS) using either IRS Form

1099 or W2.

• Tax reporting is not required for employee-reimbursement-type

payments (e.g., clothing allowances, fire/police protection

equipment, training, household good damages, and personal

property loss).

• W2s and withholding are required for employee payments of wages

and employment compensation such as back pay related to

settlements and judgments.

3.

Payments to foreign governments require special handling and are not covered in

this document. (See local operating procedures.)

4.

"Pay as Soon as Possible" means to make payment to the vendor at the earliest

time possible once all required documentation, as required by 5 CFR 1315.9,

including EFT information, is received by the payment office.

5.

A miscellaneous payment code and template for Maintenance Services is not

included because these services are always purchased under contract.

6.

Standard Financial Information Structure (SFIS) - all appropriation data should

adhere to SFIS guidelines outlined by the Deputy Chief Financial Officer website.

7.

Preparation instructions for the Standard Form (SF) SF 1034 and the OF 1164

are provided as generally accepted guidelines for manual processing (page 150).

12

Payments to Non-Federal Entities

AGNV

Agents (Used when disbursing vouchers are processed.)

Reimbursement Type

Non-Federal entity payment

Short Description: Payments for purchases as a result of an emergency situation or contingency opera-

tion.

Description: Payments for purchases below the micro-purchase threshold as a result of an emergency

situation or contingency operation. Generally these items should be paid with the GPC but are purchased

using this process in circumstances where use of the GPC is not feasible.

Examples: Purchases include, but are not limited to, blood and water (in emergency situations), as well as

“Solatium Payments.”

Authority

FAR 13.306

DFARS 213.306

SF 44, Purchase Order--Invoice--

Voucher

SF 44, Pur

chase Order -- Invoice –

Voucher

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes

No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Certifi

ed SF 44; binding agreement with an agency, person, or business

concern; or approved purchase or entitlement authorization and certifica

-

tion of fu

nds.

Payment Request Docu-

ments

SF 44 cert

ified by Paying Agent.

Supporting Documents (re-

tained by Certifying Officer)

SF 44s or ot

her receipts.

Required Dates

Invoice Submitted Date (Invoice Date): Date of SF 44 or electronic

equivalent.

Invoice Received Date (INV RCVD): Date stamp of designated billing

office.

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): SF 44 Certifying Officer date.

Finalized Acceptance (MDSE ACCPT): SF 44 Certifying Officer date.

Amounts Payable: Approving Officials may approve payment for reasonable amounts that are supported

by receipts/invoices.

Voucher Preparation: See Page 151 of this guidebook for general instructions.

Condition for Payment: Approval for payment by the Certifying Officer.

Not Payable: Amounts claimed for reimbursement but not certified; amounts claimed for reimbursement

and certified which exceed established limits.

Appropriations: As stated in the Agreement or obligation document.

Standard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap-

propriation data should reflect the SFIS as outlined in the SFIS Matrix. Also depending on system the leg-

13

acy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting, Budget

Activity, and Period of Availability, and/or Legacy Reporting).

14

AMBV Awards Made to Bid Protesters

Reimbursement Type

Non-Federal entity payment

Short Description: Payment of awards made to successful bid protesters under the Competition in Con-

tracting Act of 1984 (CICA) (

10 USC 23

04

).

Description: If the Comptroller General determines that a solicitation for a contract or a proposed award

or the award of a contract does not comply with a statute or regulation, the Comptroller General may de

-

cide that

the protesting party is entitled to the following:

The paym

ent of costs associated with the filing and pursuing the protest, including reasonable attorney

fees.

The payment of costs of bid and proposal preparation.

Examples: Payments for bid and proposal preparation and attorney’s fees when awarded to the bid pro-

testor by the Government Accountability Office (GAO).

Authority

FAR, Part 6.1

10 USC 2304

Chapter 2 31 USC 3551,

3552,3553,3554,3555 ,3556

Full and Open Competition

Contracts Competition Require-

ments

Procurement Protest System

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes

No (Correct – PPA Interest for Contracts & Contract Disputes)

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Federal

Court order, Comptroller General decision, or settlement agree

-

ment.

Payment Request Docu-

ments

SF 1034 c

ertified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

Federal Court order, Comptroller General decision, or settlement agree-

ment.

A successful bid protester must certify, to the best of one’s knowledge

and belief, that the statement of costs submitted for payment: (1) con-

tains only costs that are legitimately payable pursuant to the guidance set

forth by the Government Accountability Office in connection with pay

-

ments of

attorney fees and bid preparation costs, and (2) are complete

and accurate.

Required Dates

Invoice Submitted Date (Invoice Date): Date of SF 1034 or electronic

equivalent.

Invoice Received Date (INV RCVD): Date stamp of designated billing

office.

Evidence Goods Tendered & Services Rendered Acknowledgement Date

(MDSE DEL): SF 1034 Certifying Officer date.

Finalized Acceptance (MDSE ACCPT): SF 1034 Certifying Officer date.

Amounts Payable: As stipulated in Federal Court order, Comptroller General Decision, or settlement

15

agreement.

Voucher Preparation: The Contracting Officer prepares an SF 1034. The following data must be includ-

ed: the payee’s name and either the Data Universal Numbering System (DUNS) number, either Commer

-

c

ial and Government Entity (CAGE) code, or NATO Commercial and Government Entity (NCAGE) code. If

the Non-Federal entity is a foreign entity doing business with DoD not in U.S. dollars; the payee’s name

and mailing address. See page 151 of this Guidebook for general instructions.

Voucher Support: A copy of the Comptroller General decision, along with a statement of costs incurred

and approved by the contracting officer.

Condition for Payment: As stated in Federal Court order, Comptroller General decision, or settlement

agreement.

U

pon receipt of the SF 1034 claiming payment, the Certifying Officer reviews the voucher for propriety

and, if proper, certifies the voucher. The SF 1034 must cite the payee’s name, TIN or Employee Identifica-

t

ion Number (EIN), mailing address, and banking information for EFT.

Not Payable: Amounts claimed but not authorized in Federal Court order, Comptroller General decision,

or settlement agreement.

Appropriations: As stated in the agreement or obligation document.

S

tandard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap-

pr

opriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on system

the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

P

ayment must be made from the funds of the activity funding the contract.

16

ARCV Apprehension Reimbursements and Confinement Costs

Reimbursement Type

Non-Federal entity payment

Short Description: Reimbursements for the apprehension and return of prisoners, deserters, and military

members absent without leave.

Description: Under 10 USC 956, certain amounts are authorized and paid for the apprehension, deten-

tion, and return to military control of prisoners, deserters, and military members absent without leave.

Payments include reimbursement for actual expenses (up to specified limits). In addition, payments are

authorized for the reimbursement of civil authorities for the cost of subsistence furnished to military per

-

sonnel

placed in their custody for safe-keeping at the request of military authorities.

Examples: Actual expenses for which reimbursement may be made, if considered justifiable and reim-

bursable by the commanding officer, include:

Taxicab, bus fare, or mileage at the per-mile rate established by the Joint Travel Regulation for a privately

owned conveyance when travel is performed by either a citizen or officer and prisoner, or a round trip from

either place of apprehension or civil police headquarters to place of return to military control.

Meals furnished to the member for which the cost was assumed by the apprehending person or agency

representative.

Telephone or telegraph communication costs.

Damage to property of the apprehending person or agency if caused directly by the member during his or

her apprehension, detention, or delivery.

Such other reasonable and necessary expenses incurred in actual apprehension, detention, or delivery.

Authority

10 USC 956

10 USC 7214

Deserters, prisoners, members ab-

sent without leave: expenses and

rewards

Apprehension of deserters and

prisoners; operation of shore patrols

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes

No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Cert

ified SF 1034; binding agreement with an agency, person, or busi

-

ness c

oncern; or approved purchase or entitlement authorization and

certification of funds.

Payment Request Docu-

ments

SF 10

34 certified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

1. Pr

oof of apprehension documented on DD Form 553,

Desert-

er/Absentee Wanted by the Armed Forces, or a certificate from the or-

ganization of absentee, or written notification from military or Federal

law enforcement officials stating that the absentee’s return to military

control was desired. 2. An itemized statement of allowable expenses.

Required Dates Invoice Submitted Date (Invoice Date): Date of DD Form 553, SF

1034 or electronic equivalent.

Invoice Received Date (INV RCVD): Date stamp of designated billing

office/receipt of prisoner return date.

17

Evidence Goods Tendered & Services Rendered Acknowledge-

ment Date (MDSE DEL): SF 1034 Certifying Officer date.

Finalized Acceptance (MDSE ACCPT): SF 1034 Certifying Officer

date.

Amounts Payable: Reimbursement for actual expenses. When a reward has not been offered or when

conditions for payment of a reward otherwise cannot be met, reimbursement, not to exceed $75, may be

made to any person or entity for actual expenses incurred in the apprehension, detention, or delivery to

military control of an absentee or deserter. If two or more persons or entities join in performing these ser

-

v

ices, payment may be made jointly or separately, but the total payment or payments may not exceed

$75.

Voucher Preparation: An SF 1034 is prepared by the activity to which the apprehended member was

released. The following data must be shown on the voucher:

The payee’s name, Taxpayer Identification Number (TIN), and mailing address; the military appropriation

of the parent military service of the person apprehended; and the banking information for EFT, DUNS

number, CAGE code, or NCAGE code.

T

he apprehended member’s name, Social Security Number (SSN), organization from which the appre-

hend

ed member was absent, and the date and place at which military authorities resumed control.

A

statement that the payee apprehended and detained, or apprehended and delivered, the member. See

page 151 of this Guidebook for general instructions.

Condition for Payment: Before a reimbursement is payable, a notification must be issued for the return

to military control of the absentee, deserter, or escaped military prisoner. Receipt of DD Form 553, De-

s

erter/Absentee Wanted by the Armed Forces, oral or written communication from military or Federal law

enforcement officials, or entering the individual’s name in the National Crime Information Center, consti

-

tut

es notification.

Not Payable: Reimbursement will not be made for:

Lodging at nonmilitary confinement facilities.

Transportation performed by the use of official Federal, state, county, or municipal vehicles.

Personal services of the apprehending, detaining, or delivering person or agency.

A

ctual expenses for the same apprehension and detention or delivery for which a reward has been paid.

Payment of actual expenses will be made in accordance with the expenses cited in the “Examples” sec-

tion of this template except when an itemized statement of costs approved by the Commanding Officer or

Provost Marshall is required and notice of DD Form 553 or other form is not required.

Appropriations: As stated in the agreement or obligation document.

S

tandard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap-

pr

opriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on system

the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

18

ARWV Apprehension Rewards

Reimbursement Type

Non-Federal entity payment

Short Description: Payment of rewards for apprehension and return of U.S. Military prisoners, deserters,

and members absent without leave.

Description: Under 10 USC 956, rewards are authorized and paid for the apprehension, detention, and

return to military control of U.S. Military prisoners, deserters, and members absent without leave.

amples:

A reward paid for the apprehension and delivery, to military control, of a member who is absent

without leave.

Authority

10 USC 956

10 USC 7214

Deserters, prisoners, members

absent without leave: expenses

and rewards

Appre

hension of deserters and

prisoners; operation of shore pa

-

tro

ls

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes

No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Cert

ified SF 1034; binding agreement with an agency, person, or busi

-

ness c

oncern; or approved purchase or entitlement authorization and

certification of funds.

Payment Request Docu-

ments

SF 10

34 certified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

Proof

of apprehension documented on DD Form 553, Desert

-

er/A

bsentee Wanted by the Armed Forces, or a certificate from the or

-

ganiz

ation of absentee, or written notification from military or Federal

law enforcement officials stating that the absentee’s return to military

control was desired.

Required Dates Invoice Submitted Date (Invoice Date): Date of SF 1034 or electronic

equivalent.

Invoice Received Date (INV RCVD): Date stamp of designated billing

office.

Evi

dence Goods Tendered & Services Rendered Acknowledge

-

men

t Date (MDSE DEL): SF 1034 Certifying Officer date.

Fin

alized Acceptance (MDSE ACCPT): SF1034 Certifying Officer

date.

Amounts Payable: A reward of $50 is paid for apprehension and detention until military authorities as-

sume physical control of the member. A reward of $75 is paid for the apprehension and delivery of the

member to military control.

19

Voucher Preparation: An SF 1034 is prepared by the activity to which the apprehended member was

released. The following data must be shown on the voucher:

The payee’s name, TIN, mailing address; the military appropriation of the parent military service of the

person apprehended; and the banking information for EFT, DUNS number, CAGE code, or NCAGE code.

The apprehended member’s name and SSN, the organization from which the apprehended member was

absent, and the date and place at which military authorities resumed control.

A statement that the payee apprehended and detained, or apprehended and delivered, the member. See

page 151 of this Guidebook for general instructions.

Condition for Payment: Before a reward is payable, there must be a notification issued for the return to

military control of the absentee, deserter, or escaped military prisoner. Receipt of DD Form 553, Deserter/

Absentee Wanted by the Armed Forces, oral or written communication from military or Federal law en-

f

orcement officials, or entering the individual’s name in the National Crime Information Center, constitutes

notification.

Not Payable: Amounts claimed for reimbursement but not certified; amounts claimed for reimbursement

and certified which exceed established limits.

Appropriations: As stated in the agreement or obligation document.

S

tandard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap-

pr

opriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on system

the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

20

ATTV

Attorney Fees (Including judgments and settlements paid to the

attorney.)

Reimbursement Type

Non-Federal entity payment

Short Description: Payment of attorney fees and other expenses awarded by a court, arbitrator or ad-

ministrative board to the party prevailing in a civil action against DoD.

Description: The Equal Access to Justice Act (EAJA) (5 USC 504 and 28 USC 2412) authorizes payment

of attorney fees and other expenses incurred by the prevailing party (other than the United States) in civil

actions and administrative proceedings. The party prevailing against DoD in adversary adjudication or in a

court action may obtain an award of attorney fees and other expenses incurred in connection with the

proceeding.

Examples: Attorney fees may be awarded pursuant to any of the following:

A no-fault settlement agreement

An informal adjustment

The Merit Systems Protection Board (MSPB)

An arbitrator

A Federal Court

The Equal Employment Opportunity Commission (EEOC)

Other appropriate authority.

Other expenses may include those for expert witnesses and for any study, analysis, engineering report,

test, or project necessary for the preparation of the prevailing party’s case.

Authority

5 USC 504 and 28 USC 2412

Equal Access to Justice Act

Tax Withholding

N/A FITW FICA State (Must name state)

The pay

ment of attorney fees to or on behalf of the complainant is taxa

-

ble t

o the complainant.

Tax Reporting

N/A W-2 IRS Form 1099

If the payment is made to both the attorney and the complainant, or to

just the attorney, two 1099s will be issued for the payment.

Prompt Pay Interest?

Yes

No (70 Comp. Gen. 664 (August 5, 1991))

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Court

order, settlement agreement, or order of an arbitrator or other ap

-

propri

ate authority.

Payment Request Docu-

ments

SF 10

34 certified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

Invoi

ce, court order, settlement agreement, or order of an arbitrator or

other appropriate authority.

The application for payment must be supported when required by an

itemized statement from the attorney, agent, or expert witness stating

the actual time spent and the rate at which fees and other expenses

were computed.

Required Dates Invoice Submitted Date (Invoice Date): Date of SF 1034 or electronic

equivalent.

Invoice Received Date (INV RCVD): Date stamp of designated billing

office.

21

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): SF 1034 Certifying Officer date.

Finalized Acceptance (MDSE ACCPT): SF 1034 Certifying Officer

date.

Amounts Payable: Payment is to be made in the amount approved by the court order, settlement

agreement, order of an arbitrator, or other appropriate authority.

Voucher Preparation: An SF 1034, clearly stating to whom the payment is to be made (individual attor-

ney or the law firm) is prepared by the legal office representing the activity against which the plaintiff was

awarded the judgment. See page 151 of this Guidebook for general instructions.

Condition for Payment: In adversary adjudications, application for the amount sought must be submitted

to the DoD activity involved within 30 days of final disposition in the adversary adjudication (5 USC 504).

In court actions, the application for an award of attorney fees and other expenses must be submitted to

the court within 30 days of final judgment in the action (28 USC 2412).

Upon receipt of the SF 1034 claiming payment, the Certifying Officer reviews the voucher for propriety

and, if proper, certifies the voucher. On the SF 1034, cite the payee’s name, TIN/Employer Identification

Number (EIN), mailing address, and banking information for EFT.

Not Payable: Attorney or agent fees in excess of $125 per hour unless the agency determines that an

increase in the cost of living or a special factor, such as the limited availability of qualified attorneys or

agents for the proceedings involved, justifies a higher fee (5 USC 504 (b)(1)(A)(ii)).

Appropriations: As stated in the agreement or obligation document.

S

tandard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap-

pr

opriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on system

the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting.)

T

he Department of Justice (DOJ), in most cases, is the Federal agency designated to represent DoD in

litigation. DOJ is funded to make payments of properly awarded attorney fees. (Fees awarded in discrimi

-

nat

ion cases are exceptions.) Attorney fees awarded by a court of competent authority are normally paid

by DOJ from its permanent appropriation. If such fees are not payable from this appropriation, DOJ will

provide guidance on a case-by-case basis. Attorney fees and other expenses awarded claimants under

the Equal Access to Justice Act are paid from funds available to the DoD activity at the time at which the

award is made.

22

BANV Government Card Services

Reimbursement Type

Non-Federal entity payment

Short Description: Payment of Centrally Billed Accounts (CBAs) and Unit Billed Accounts used to make

travel arrangements.

Description: A CBA is a Government Travel Charge Card (GTCC) issued to a DoD activity. CBAs are is-

sued to make travel arrangements and must be used in lieu of issuing a Government Transportation Re-

quest (SF 1169) for payment purposes. CBAs are issued for the following purposes:

A.

Transportation Accounts. Transportation GTCC accounts (CBAs) are issued to DoD activities for use in

purchasing transportation, including airline tickets, bus tickets, and rail tickets. Transportation accounts will

be used when a traveler has not been issued an Individually Billed Account (IBA) or is exempt from manda

-

tory us

e of the GTCC.

B.

Unit Travel Charge Cards. DoD Components may use unit travel charge cards for group travel require-

ments only when it is cost effective, in the best interest of the mission, and authorized by a Component

Program Manager (CPM). Categories of travelers whose travel expenses may be charged to unit travel

charge cards include, but are not limited to, new recruits and employees who do not yet have IBAs, prison

-

ers, D

oD group travelers, and foreign nationals participating in support of official DoD sponsored programs

or activities.

Examples: Military Entrance Processing Station uses a CBA to purchase lodging and transportation for

potential recruits.

Authority

DOD FMR, Volume 9, Chapter 3

Department of Defense Government

Travel Charge Card (GTCC)

(11) Tax Withholding (appli-

cable to employees)

N/A FITW FICA State (Must name state)

(12) Tax Reporting

N/A W-2 IRS Form 1099

(13) Prompt Pay Interest?

Yes No

(14) Cash Management Rule

Pay as soon as possible. Purchase Card billing statements should be

paid as soon as administratively possible when the rebate offered is

greater than the cost of funds as defined in Title 5, CFR Subpart 1315.8.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

(15) Obligating Documents

Certi

fied SF 1034, authorized obligation documents specific to their ser

-

vice/age

ncy or GSA or DoD forms specific for authorization of a claim that

contains the certification of funds availability for the intended purpose.

For obligations see DoDFMR Volume 3, Chapter 8.

(16) Payment Request Doc-

uments

SF 1034 c

ertified by Certifying Officer external to payment office (see

DoDFMR Volume 5, Chapter 5).

(17) Supporting Documents

(retained by Certifying Of

-

ficer

)

Invoice, binding agreement, receipts, and approved purchase or entitle-

ment authorization and certification of funds document.

(18) Required Dates Invoice Submitted Date (Invoice Date): Invoice date (use prepared date

23

of SF 1034 if invoice date is missing)

Invoice Received Date (INV RCVD): Date stamp of designated billing

office (use invoice date if the date stamp is missing).

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): Date of delivery or service indicated on SF 1034 or

use invoice date if delivery date is not entered on SF 1034.

Finalized Acceptance (MDSE ACCPT): Date of acceptance indicated

on SF 1034 or use invoice date if acceptance date is not entered on the

/SF 1034.

(19) Amounts Payable: Approving Officials may approve payment for reasonable costs that are support-

ed by receipts/invoices.

(20) Voucher Preparation: See page 151 of this Guidebook for general instructions.

(21) Condition for Payment: Approval for payment by the Certifying Officer.

(22) Not Payable: Amounts claimed for reimbursement but not certified; amounts claimed for reimburse-

ment and certified which exceed established limits.

(23) Appropriations: As stated in the Agreement or obligation document.

(24) Standard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all

appropriation data should reflect the SFIS as outlined in the SFIS Matrix.

Also depending on system, the

legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

24

BLLV Billeting

Reimbursement Type

Non-Federal entity payment

Short Description: Payment of lodging costs to installation billeting offices.

Description: Payment of lodging costs to installation billeting offices when lodging is provided in kind.

Examples: Reserve Component personnel in an Inactive Duty Training (IDT) status at unit of assignment

Authority

DODI 1015.12

JTR, Chapter 7, Part K

Lodging Program Resource Man-

agement

Joint Federal Travel Regulation

(11) Tax Withholding (appli-

cable to employees)

N/A FITW FICA State (Must name state)

(12) Tax Reporting

N/A W-2 IRS Form 1099

(13) Prompt Pay Interest?

Yes

No

(14) Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

(15) Obligating Documents

Cert

ified SF 1034, authorized obligation documents specific to their ser

-

vic

e/agency or GSA or DoD forms specific for authorization of a claim that

contains the certification of funds availability for the intended purpose.

For obl

igations see DoDFMR Volume 3, Chapter 8.

(16) Payment Request Doc-

uments

SF 10

34 certified by Certifying Officer external to payment office (see

DoDFMR Volume 5, Chapter 5).

(17) Supporting Documents

(retained by Certifying Of

-

fi

cer)

Invoice, binding agreement, receipts, and approved purchase or entitle-

ment authorization and certification of funds document.

(18) Required Dates Invoice Submitted Date (Invoice Date): Invoice date (use prepared date

of SF 1034 if invoice date is missing)

Invoice Received Date (INV RCVD): Date stamp of designated billing

office (use invoice date if the date stamp is missing).

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): Date of delivery or service indicated on SF 1034 or

use invoice date if delivery date is not entered on SF 1034.

Finalized Acceptance (MDSE ACCPT): Date of acceptance indicated

on SF 1034 or use invoice date if acceptance date is not entered on the

/SF 1034.

(19) Amounts Payable: Approving Officials may approve payment for reasonable costs that are support-

ed by receipts/invoices.

(20) Voucher Preparation: See page 151 of this Guidebook for general instructions.

25

(21) Condition for Payment: Approval for payment by the Certifying Officer.

(22) Not Payable: Amounts claimed for reimbursement but not certified; amounts claimed for reimburse-

ment and certified which exceed established limits.

(23) Appropriations: As stated in the Agreement or obligation document.

(24) Standard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all

appropriation data should reflect the SFIS as outlined in the SFIS Matrix.

Also depending on system the

legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

26

CHCV Child Care (Non-Contractual)

Reimbursement Type

Non-Federal entity payment

Short Description: Payments to individuals for providing non-contractual childcare services.

Description: Payments to individuals for providing non-contractual reimbursement for childcare services,

including expenses associated with various military programs. All other types of childcare services are

contracted.

Examples: Payments to individuals for providing non-contractual childcare services.

Authority

10 USC 1798

Child care services and youth pro-

gram services for dependents: fi-

nancial assistance for providers

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

C

ertified SF 1034; binding agreement with an agency, person, or busi

-

nes

s concern; or approved purchase or entitlement authorization and

certification of funds.

Payment Request Docu-

ments

S

F 1034 certified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

I

nvoice, binding agreement, receipts, and approved purchase or entitle-

m

ent authorization and certification of funds document.

Required Dates Invoice Submitted Date (Invoice Date): Date of SF 1034 or electronic

equivalent.

Invoice Received Date (INV RCVD): Date stamp of designated billing

office.

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): SF 1034 Certifying Officer date.

Finalized Acceptance (MDSE ACCPT): SF 1034

Certifying Officer

date.

Amounts Payable: Approving Officials may approve payment for reasonable amounts that are supported

by receipts/invoices.

Voucher Preparation: See Page 151 of this guidebook for general instructions.

Condition for Payment: Approval for payment by the Certifying Officer.

Not Payable: Amounts claimed for reimbursement but not certified; amounts claimed for reimbursement

and certified which exceed established limits. Fee assistance amounts vary by program. For many pro-

grams, fee assistance will be based on family income and provider rate.

Appropriations: As stated in the agreement or obligation document.

S

tandard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap-

pr

opriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on system

the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

27

CLTV Civilian Clothing Allowance

Reimbursement Type

Non-Federal entity payment

Generally may be more appropriate for payment by GPC or contract.

Short Description: Allowance for civilian employee job-related clothing or uniforms.

Description: Civilian uniform allowances. Payments for clothing allowances approved for civilians to com-

plete job-related functions and for civilian uniform allowances. (See DoDI 1400.25 for annual limitations).

Examples: Fire fighters, security personnel.

Authority

10 USC 1593

5 USC 7903

DoD Instruction 1400.25,

Volume 591

Uniform allowance: civilian employ-

ees

Pr

otective clothing and equipment

DoD Civilian Personnel Man-

agement System: Uniform Al-

lowance Rates for DoD

Civilian Employees

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Cer

tified SF 1034; binding agreement with an agency, person, or busi

-

ness

concern; or approved purchase or entitlement authorization and

certification of funds.

Payment Request Docu-

ments

SF

1034 certified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

Inv

oice, binding agreement, receipts, and approved purchase or entitle

-

ment

authorization and certification of funds document.

Required Dates Invoice Submitted Date (Invoice Date): Invoice date (use prepared date

of SF 1034 if invoice date is missing).

Invoice Received Date (INV RCVD): Date stamp of designated billing

office (use invoice date if the date stamp is missing).

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): Date of delivery or service indicated on SF 1034.

Finalized Acceptance (MDSE ACCPT): Date of acceptance indicated

on SF 1034.

Amounts Payable: Approving Officials may approve payment for reasonable amounts that are supported

by receipts/invoices.

Voucher Preparation: See Page 151 of this guidebook for general instructions.

Condition for Payment: Approval for payment by the Certifying Officer.

Not Payable: Amounts claimed for reimbursement but not certified; amounts claimed for reimbursement

and certified which exceed established limits.

28

Appropriations: As stated in the agreement or obligation document.

Standard Financial Information Structure (Civilian): In an effort to achieve compliance with DoD’s BEA,

all appropriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on sys-

tem the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-

Accounting, Budget Activity, and Period of Availability, and/or Legacy Reporting.)

The payment will be charged to the same appropriation and subsidiary accounting data normally charged

for the salary of the personnel concerned.

29

CONV Contingency Funds for Entertaining Dignitaries

Reimbursement Type

Non-Federal entity payment

Short Description: Payments for Official Representation Using Contingencies Funds

Description: Payments for official representation by local commanders or other official authorized pur-

poses using contingency funds.

Examples: Entertainment of dignitaries

Authority

DoDI 7250.13

Use of Appropriated Funds for Offi-

cial Representation Purposes

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

C

ertified SF 1034; binding agreement with an agency, person, or busi

-

nes

s concern; or approved purchase or entitlement authorization and

certification of funds.

Payment Request Docu-

ments

S

F 1034 certified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

A

ll expenditures of contingency funds for official representation specifi

-

c

ally must be approved before the event by the applicable commander or

designee. Such approvals must be of formal record and, at a minimum,

indicate the purpose, number of guests, and estimated cost.

Required Dates Invoice Submitted Date (Invoice Date): Date of SF 1034 or electronic

equivalent.

Invoice Received Date (INV RCVD): Date stamp of designated billing

office.

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): SF 1034 Certifying Officer date.

Finalized Acceptance (MDSE ACCPT): SF 1034 Certifying Officer date.

Amounts Payable: Approving Officials may approve payment for reasonable amounts that are supported

by receipts/invoices.

Voucher Preparation: Payments are made on an SF 1034 and certified or approved by the commander

or designee. As an alternative, the commander or designee may submit a properly certified statement with

supporting documentation to the disbursing office for preparation and certification of the payment voucher.

See Page 151 of this guidebook for general instructions.

Condition for Payment: Approval for payment by the Certifying Officer.

Not Payable: Amounts claimed for reimbursement but not certified; amounts claimed for reimbursement

and certified which exceed established limits.

Appropriations: As stated in the agreement or obligation document

S

tandard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap-

pr

opriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on system

the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

30

DEMV Demurrage

Reimbursement Type

Non-Federal entity payment

Short Description: Freight payments to a local or short-haul carrier whose vehicle or vessel is delayed by

failure to load/unload the freight within the time allowed.

Description: Payments for failure to load/unload freight within time allowed. If payable by the DoD-

approved third-party payment service for transportation or under a contract, this should not be handled as

a miscellaneous payment.

Examples: Government unforeseen delays for loading or unloading carrier/vessel shipments.

Authority

FAR 47.208-1

DFARS 247.271-3

Report of Shipment—Advance no-

tice

C

ontracts for Transportation or for

Transportation Related Services—

Solicitation provisions, schedule

formats, and contract clauses

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes

No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Certified SF 1034.

Payment Request Docu-

ments

S

F 1034 certified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

I

nvoice, binding agreement, receipts and approved purchase or entitle-

m

ent authorization and certification of funds document.

Required Dates Invoice Submitted Date (Invoice Date): Date of SF 1034.

Invoice Received Date (Invoice RCVD): Date of SF 1034.

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): SF 1034 evidenced by authorized Certifying Officer

signature.

F

inalized Acceptance (MDSE ACCPT): SF 1034 evidenced by author

-

i

zed Certifying Officer signature.

Amounts Payable: Certifying Officers may approve and certify payment for amounts that are supported

by receipts/invoices.

Voucher Preparation: See Page 151 of this guidebook for general instructions.

Condition for Payment: Approval for payment by the Certifying Officer and supporting documents.

Not Payable: Payments to long-haul carriers and amounts not supported by supporting documentation.

Appropriations: As stated in the agreement or obligation document

S

tandard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap

-

pr

opriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on system

the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

31

EEOV

Non-Federal Employee EEO Payments

Reimbursement Type

Non-Federal payment

Short Description: Payments for Non-Federal employees related to judgments and settlements.

Description: Payment for settlement agreements may include compensatory damages as well as costs

incurred in processing the complaint.

Examples: Costs incurred in class action lawsuit settlements or other judgment expenses.

Authority

5 CFR 1201

29 CFR Chapter XIV

Merit Systems Protection Board

Equal Employment Opportunity

Commission

Tax Withholding (applicable

to employees)

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

If the payment is made directly to the complainant, the payment also

must be reported on Forms 1099-MISC

(1099 box 3).

Prompt Pay Interest?

Yes

No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Settlement agreement, Federal court order, or Federal administrative

order.

Payment Request Docu-

ments

S

F 1034

is required to each payee and certified by Certifying Officer ex-

ternal to payment office (see DODFMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

S

ettlement agreement; Settlement agreements must state what the pay

-

m

ent represents; e.g., compensatory damages.

Required Dates Invoice Submitted Date (Invoice Date): Invoice date (use prepared date

of SF 1034

if invoice date is missing).

Invoice Received Date (INV RCVD): Date stamp of designated billing

office (use invoice date if the date stamp is missing).

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): Date of delivery or service indicated on SF 1034.

Finalized Acceptance (MDSE ACCPT): Date of acceptance indicated

on SF 1034.

Amounts Payable: As stipulated in the settlement agreement, court order, or administrative order.

Voucher Preparation: After review and approval of the award letter by the legal counsel, prepare an SF

1034, supported by the award letter and approval, made jointly payable to the complainant. Requests to

make actual payments are initiated by the EEO manager of the legal office. A separate SF 1034 must be

issued for each person receiving payment. The SF 1034 must indicate whether the payment is taxable and

which portion. The SF 1034 must contain the TIN, formal claimant’s name (e.g., “Robert W. Smith” rather

than “Bob Smith”) and the mailing address or EFT information.

Condition for Payment: As stated in the settlement agreement, court order, or administrative order. The

chief EEO manager reviews and approves all EEOC billings and any related SF 1034

s before payment by

the disbursing office.

Not Payable: Amounts claimed but not authorized in the settlement agreement, court order, or administra-

tive order.

Appropriations:

32

Standard Financial Information Structure (Military): In an effort to achieve compliance with DoD’s BEA,

all appropriation data should reflect the SFIS as outlined in the SFIS Matrix.

All costs and expenses associated with these complaints are funded by the activity where the alleged dis-

crimination took place, using operating funds current at the time the services are requested. The EEOC will

bill this activity for any authorized and required expenses. Cite local operating funds current when the em-

ployee is notified of the amount payable on the claim for cost. In addition, rules under 29 CFR 1614

for

reinvestigations that became effective on 1 October 1992 may apply. Interest payments (when permitted

by statute) are to be charged to funds current when the award is made. The rate used is established by the

Internal Revenue Service (IRS). Note: This IRS rate is not the same as that used for interest under the

Prompt Payment Act.

33

EMSV Express Mail Service, Vendor

Reimbursement Type

Non-Federal payment

Generally may be more appropriate for payment by GPC

Short Description: Payments for Express Mail When GPC Not Accepted.

Description: Payment for Express mail associated to official business. Note: DOD FMR Volume 10,

Chapter 16, Paragraph 160703 mandates either GPC or a third party electronic payer system (i.e.

SYNCADA) be used for small package shipments. This code should only be used when these methods

are unavailable.

Examples: Small package delivery services for FEDEX, UPS, DHL.

Authority

DoD Directive 4525.6-M C7.2

DoD FMR Volume 10, Chapter 16

GSA Schedule

Department of Defense Postal

Manual

Payment for Postal Services and

Small Package Delivery Costs

Tax Withholding (applicable

to employees)

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes

No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Certified SF 1034;

binding agreement with an agency, person, or busi-

ness; or approved purchase or authorization and certification of funds.

Payment Request Docu-

ments

S

F 1034

certified by Certifying Officer external to payment office (see

DODFMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

Inv

oice or receipt.

Required Dates

Invoice Submitted Date (Invoice Date): Invoice date (use prepared date

of SF 1034

if invoice date is missing).

Invoice Received Date (INV RCVD): Date stamp of designated billing

office (use invoice date if the date stamp is missing).

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): Date of delivery or service indicated on SF 1034.

Finalized Acceptance (MDSE ACCPT): Date of acceptance indicated

on SF 1034.

Amounts Payable: Approving officials may approve payment for reasonable costs that are supported by

receipts/invoices

Voucher Preparation: See page 151 of this Guidebook for general instructions.

Condition for Payment: Approval for payment by the certifying officer.

Not Payable: Amounts invoiced but not certified.

35

EWIV Expert Witness Fee

Reimbursement Type

Non-Federal entity payment

Short Description: Payment of fees to Non-Federal individuals called upon to provide expert testimony or

provide specialized information relevant to the case being adjudicated.

Description: Expert Witness Fees apply to Non-Federal employees who are paid fees other than travel

and transportation allowance and witness attendance fees while serving as an expert witness in legal pro-

c

eedings. These payments must be vendor payments and not processed through an alternate entitlement

system (i.e., Travel Pay).

Examples: A Non-Federal employee subpoenaed for any legal proceedings to provide expert testimony

(i.e., forensic experts, chemists, toxicologists, qualified physicians); approved by a convening authority to

testify at court-martials or similar legal proceedings.

Authority

28 USC 2412 Costs and fees

(11) Tax Withholding (appli-

cable to employees)

N/A FITW FICA State (Must name state)

(12) Tax Reporting

N/A W-2 IRS Form 1099

(13) Prompt Pay Interest?

Yes No

(14) Cash Management Rule

P

ay as soon as possible. Pay by day 30 from the Finalized Ac

-

c

eptance (MDSE ACCPT) date.

(15) Obligating Documents

C

ertified SF 1034, authorized obligation documents specific to their ser

-

v

ice/agency or GSA or DoD forms specific for authorization of a claim that

contains the certification of funds availability for the intended purpose.

F

or obligations see DoDFMR Volume 3, Chapter 8.

(16) Payment Request Doc-

uments

S

F 1034 certified by Certifying Officer external to payment office (see

DoDFMR Volume 5, Chapter 5).

(17) Supporting Documents

(retained by Certifying Of-

ficer)

Invoice, binding agreement, receipts, and approved purchase or entitle-

ment authorization and certification of funds document.

(18) Required Dates Invoice Submitted Date (Invoice Date): Invoice date (use prepared date

of SF 1034 if invoice date is missing)

Invoice Received Date (INV RCVD): Date stamp of designated billing

office (use invoice date if the date stamp is missing).

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): Date of delivery or service indicated on SF 1034 or

use invoice date if delivery date is not entered on SF 1034.

Finalized Acceptance (MDSE ACCPT): Date of acceptance indicated

on SF 1034 or use invoice date if acceptance date is not entered on the

36

/SF 1034.

(19) Amounts Payable: Approving Officials may approve payment for reasonable costs that are support-

ed by receipts/invoices.

(20) Voucher Preparation: See page 151 of this Guidebook for general instructions.

(21) Condition for Payment: Approval for payment by the Certifying Officer.

(22) Not Payable: Amounts claimed for reimbursement but not certified; amounts claimed for reimburse-

ment and certified which exceed established limits.

(23) Appropriations: As stated in the Agreement or obligation document.

(24) Standard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all

appropriation data should reflect the SFIS as outlined in the SFIS Matrix.

In addition, depending on sys-

tem, the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-

Accounting, Budget Activity, and Period of Availability, and/or Legacy Reporting).

37

DSSV

Contingency Funds for Investigative Expenses and Confidential

and Non-Confidential Military Purposes

Reimbursement Type

Non-Federal entity payment

Short Description:

Payments of expenses for non-confidential or classified and confidential military inves-

tigations.

Description: Payments generally are for confidential military purposes and include miscellaneous ex-

penses for investigations.

Examples: Payments to the Criminal Investigative Organizations for use as part of criminal and/or under-

cover operations and payments to local governments for transcripts, court records, photographs, etc. The

DSS Headquarters provides the servicing entitlement office its accounting classification for reimburse-

m

ents. Such authority will be cited on the claim for reimbursement

Authority

DSS Headquarters

Executive Order 12829

10 USC 127

10 USC 422

DoD Directive 5105.42

Army Regulation 20-1

Authority will be cited on the claim

for reimbursement.

National Industrial Security Program

E

mergency and extraordinary ex

-

pens

es

U

se of Funds for Certain Incidental

Purposes

Defense Security Service (DSS)

Inspector General Activities and

Procedures

Tax Withholding

N/A FITW FICA State (Must name state)

Tax Reporting

N/A W-2 IRS Form 1099

Prompt Pay Interest?

Yes

No

Cash Management Rule

Pay as soon as possible.

Pay by day 30 from the Finalized Acceptance (MDSE ACCPT) date.

Obligating Documents

Certified SF 1034 for non-classified investigation expenses. The

DD

281 will be used for reimbursement of expenses related to classified or

confidential military investigations; binding agreement with an agency,

person, or business concern; or approved purchase or entitlement au-

t

horization and certification of funds.

Payment Request Docu-

ments

S

F 1034 certified by Certifying Officer external to payment office (see

DoD FMR Volume 5, Chapter 5).

Supporting Documents (re-

tained by Certifying Officer)

R

eceipts to support non-classified expenses or classified or confidential

investigation expenses. The DD Form 281, Voucher for Emergency or

Extraordinary Expense Expenditures, must be used for expenses involv

-

i

ng classified or confidential military purposes.

Required Dates Invoice Submitted Date (Invoice Date): Date of SF 1034 or electronic

equivalent.

Invoice Received Date (INV RCVD): Date stamp of designated billing

office.

Evidence Goods Tendered & Services Rendered Acknowledgement

Date (MDSE DEL): SF 1034 Certifying Officer date.

Finalized Acceptance (MDSE ACCPT): SF 1034 Certifying Officer date.

Amounts Payable: Approving Officials may approve payment for reasonable amounts that are supported

38

by receipts/invoices.

Voucher Preparation: See Page 151 of this guidebook for general instructions. Payments are normally

made on a DD Form 281. Exceptions are processed on other appropriate voucher forms. The original of all

vouchers such as DD Form 281, SF 1034, and SF 1080, except for collection and correction vouchers, are

returned to the originator. The original voucher and supporting documents are retained by designated In-

telligence Contingency Fund (ICF) Managers. The vouchers are prepared in original and four copies using

the applicable form. All other supporting documents are retained by the originating office.

Condition for Payment: Approval for payment by the Certifying Officer.

Not Payable: Amounts claimed for reimbursement but not certified, amounts claimed for reimbursement

and certified which exceed established limits.

Appropriations: As stated in the agreement or obligation document

Standard Financial Information Structure: In an effort to achieve compliance with DoD’s BEA, all ap-

propriation data should reflect the SFIS as outlined in the SFIS Matrix. In addition, depending on system

the legacy line of accounting may be applicable (Department Regular, Main Accounting, Sub-Accounting,

Budget Activity, and Period of Availability, and/or Legacy Reporting).

39

FIMV Funeral, Internment, and Mortuary Expenses

Reimbursement Type

Non-Federal entity payment

Short Description: Mortuary expense for deceased personnel