Stochastic Differential

Equations

Do not worry about your problems with mathematics, I assure you

mine are far greater.

Albert Einstein.

Florian Herzog

2013

Stochastic Differential Equations (SDE)

A ordinary differential equation (ODE)

dx(t)

dt

= f (t, x) , dx(t) = f(t, x)dt , (1)

with initial conditions x(0) = x

0

can be written in integral form

x(t) = x

0

+

t

0

f(s, x(s))ds , (2)

where x(t) = x(t, x

0

, t

0

) is the solution with initial conditions x(t

0

) = x

0

. An

example is given as

dx(t)

dt

= a(t)x(t) , x(0) = x

0

. (3)

Stochastic Systems, 2013 2

Stochastic Differential Equations (SDE)

When we take the ODE (3) and assume that a(t) is not a deterministic parameter

but rather a stochastic parameter, we get a stochastic differential equation (SDE). The

stochastic parameter a(t) is given as

a(t) = f(t) + h(t)ξ(t) , (4)

where ξ(t) denotes a white noise process.

Thus, we obtain

dX(t)

dt

= f (t)X(t) + h(t)X(t)ξ(t) . (5)

When we write (5) in the differential form and use dW (t) = ξ(t)dt, where dW (t)

denotes differential form of the Brownian motion,we obtain:

dX(t) = f(t)X(t)dt + h(t)X(t)dW (t) . (6)

Stochastic Systems, 2013 3

Stochastic Differential Equations (SDE)

In general an SDE is given as

dX(t, ω) = f (t, X(t, ω))dt + g(t, X(t, ω))dW (t, ω) , (7)

where ω denotes that X = X(t, ω) is a random variable and possesses the initial

condition X(0, ω) = X

0

with probability one. As an example we have already

encountered

dY (t, ω) = µ(t)dt + σ(t)dW (t, ω) .

Furthermore, f(t, X(t, ω)) ∈ R, g(t, X(t, ω)) ∈ R, and W (t, ω) ∈ R. Similar as

in (2) we may write (7) as integral equation

X(t, ω) = X

0

+

t

0

f(s, X(s, ω))ds +

t

0

g(s, X(s, ω))dW (s, ω) . (8)

Stochastic Systems, 2013 4

Stochastic Integrals

For the calculation of the stochastic integral

T

0

g(t, ω)dW (t, ω), we assume that

g(t, ω) is only changed at discrete time points t

i

(i = 1, 2, 3, ..., N − 1), where

0 = t

0

< t

1

< t

2

< . . . < t

N−1

< t

N

< T . We define the integral

S =

T

0

g(t, ω)dW (t, ω) , (9)

as the Riemannßum

S

N

(ω) =

N

i=1

g(t

i−1

, ω)

W (t

i

, ω) − W (t

i−1

, ω)

. (10)

with N → ∞.

Stochastic Systems, 2013 5

Stochastic Integrals

A random variable S is called the Itˆo integral of a stochastic process g(t, ω) with

respect to the Brownian motion W (t, ω) on the interval [0, T ] if

lim

N→∞

E

S −

N

i=1

g(t

i−1

, ω)

W (t

i

, ω) − (W (t

i−1

, ω)

= 0 , (11)

for each sequence of partitions (t

0

, t

1

, . . . , t

N

) of the interval [0, T ] such that

max

i

(t

i

− t

i−1

) → 0. The limit in the above definition converges to the stochastic

integral in the mean-square sense. Thus, the stochastic integral is a random variable,

the samples of which depend on the individual realizations of the paths W (., ω).

Stochastic Systems, 2013 6

Stochastic Integrals

The simplest p ossible example is g(t) = c for all t. This is still a stochastic

process, but a simple one. Taking the definition, we actually get

T

0

c dW (t, ω) = c lim

N→∞

N

i=1

W (t

i

, ω) − W (t

i−1

, ω)

= c lim

N→∞

[(W (t

1

, ω)−W (t

0

, ω)) + (W (t

2

, ω)−W (t

1

, ω)) + . . .

+(W (t

N

, ω)−W (t

N−1

, ω))

= c (W (T, ω) − W (0, ω)) ,

where W (T, ω) and W (0, ω) are standard Gaussian random variables. With

W (0, ω) = 0, the last result becomes

T

0

c dW (t, ω) = c W (T, ω) .

Stochastic Systems, 2013 7

Stochastic Integrals

Example: g(t, ω) = W (t, ω)

T

0

W (t, ω) dW (t, ω) =

= lim

N→∞

N

i=1

W (t

i−1

, ω)

W (t

i

, ω) − W (t

i−1

, ω)

= lim

N→∞

1

2

N

i=1

(W

2

(t

i

, ω) − W

2

(t

i−1

, ω)) −

1

2

N

i=1

(W (t

i

, ω) − W (t

i−1

, ω))

2

= −

1

2

lim

N→∞

N

i=1

(W (t

i

, ω) − W (t

i−1

, ω))

2

+

1

2

W

2

(T, ω) , (12)

where we have used the following algebraic relationship y(x − y) = yx − y

2

+

1

2

x

2

−

1

2

x

2

=

1

2

x

2

−

1

2

y

2

−

1

2

(x − y)

2

.

Stochastic Systems, 2013 8

Stochastic Integrals

We take now a detailed look at :lim

N→∞

N

i=1

(W (t

i

, ω) − W (t

i−1

, ω))

2

.

E[ lim

N→∞

N

i=1

(W (t

i

, ω) − W (t

i−1

, ω))

2

] = lim

N→∞

N

i=1

E[(W (t

i

, ω) − W (t

i−1

, ω))

2

]

= lim

N→∞

N

i=1

(t

i

− t

i−1

)

= T

Var[ lim

N→∞

N

i=1

(W (t

i

, ω) − W (t

i−1

, ω))

2

] = lim

N→∞

N

i=1

Var[(W (t

i

, ω) − W (t

i−1

, ω))

2

]

= 2 lim

N→∞

N

i=1

(t

i

− t

i−1

)

2

.

Stochastic Systems, 2013 9

Stochastic Integrals

By reducing the partition, the variance becomes zero,

lim

N→∞

N

i=1

(t

i

− t

i−1

)

2

≤ max

i

(t

i

− t

i−1

) lim

N→∞

N

i=1

(t

i

− t

i−1

)

= max

i

(t

i

− t

i−1

) T

= 0 , (13)

since t

i−1

− t

i

→ 0. Since the expected value of

N

i=1

(t

i

− t

i−1

)

2

is T and the

variance becomes zero, we get

N

i=1

(W (t

i

, ω) − W (t

i−1

, ω))

2

= T (14)

Stochastic Systems, 2013 10

Stochastic Integrals

The stochastic integral has the solution

T

0

W (t, ω) dW (t, ω) =

1

2

W

2

(T, ω) −

1

2

T (15)

This is in contrast to our intuition from standard calculus. In the case of a deterministic

integral

T

0

x(t)dx(t) =

1

2

x

2

(t), whereas the Itˆo integral differs by the term −

1

2

T .

— This example shows that the rules of differentiation (in particular the chain rule)

and integration need to be re-formulated in the stochastic calculus.

Stochastic Systems, 2013 11

Stochastic Integrals

Properties of Itˆo Integrals.

E[

T

0

g(t, ω) dW (t, ω)] = 0 .

Proof:

E[

T

0

g(t, ω)dW (t, ω)] = E[ lim

N→∞

N

i=1

g(t

i−1

, ω)

W (t

i

, ω) − W (t

i−1

, ω)

]

= lim

N→∞

N

i=1

E[g(t

i−1

, ω)] E[

W (t

i

, ω) − W (t

i−1

, ω)

]

= 0 .

The expectation of stochastic integrals is zero. This is what we would expect anyway.

Stochastic Systems, 2013 12

Stochastic Integrals

Properties of Itˆo Integrals.

Var

T

0

g(t, ω)dW (t, ω)

=

T

0

E[g

2

(t, ω)]dt . (16)

Proof:

Var

T

0

g(t, ω)dW (t, ω)

= E

(

T

0

g(t, ω)dW (t, ω))

2

= E

lim

N→∞

N

i=1

g(t

i−1

, ω)

W (t

i

, ω) − W (t

i−1

, ω)

2

Stochastic Systems, 2013 13

Stochastic Integrals

= lim

N→∞

N

i=1

N

j=1

E[g(t

i−1

, ω)g(t

j−1

, ω)

(W (t

i

, ω) − W (t

i−1

, ω))(W (t

j

, ω) − W (t

j−1

, ω))]

= lim

N→∞

N

i=1

E[g

2

(t

i−1

, ω)] E[

W (t

i

, ω) − W (t

i−1

, ω)

2

]

= lim

N→∞

N

i=1

E[g

2

(t

i−1

, ω)] (t

i

− t

i−1

)

=

T

0

E[g

2

(t, ω)]dt . (17)

Stochastic Systems, 2013 14

Stochastic Integrals

The calculation of the variance of the Itˆo Integrals shows two important properties:

• E

T

0

g(t, ω)dW (t, ω)

2

=

T

0

E

g

2

(t, ω)

dt

•

T

0

E[g

2

(t, ω)]dt < ∞

The second property is the condition of existence for Itˆo integrals. The next property is

the linearity of Itˆo integrals:

T

0

[a

1

g

1

(t, ω) + a

2

g

2

(t, ω)]dW (t, ω)

= a

1

T

0

g

1

(t, ω)dW (t, ω) + a

2

T

0

g

2

(t, ω)dW (t, ω) , (18)

for numbers a

1

, a

2

and stochastic functions g

1

(t, ω), g

2

(t, ω).

Stochastic Systems, 2013 15

Itˆo’s lemma

As mentioned shown in the second example, the rules of classical calculus are not valid

for stochastic integrals and differential equations. It is the equivalent to the chain rule

in classical calculus. The problem can be stated as follows:

Given a stochastic differential equation

dX(t) = f(t, X(t))dt + g(t, X(t))dW (t) , (19)

and another process Y (t ) which is a function of X(t),

Y (t) = ϕ(t, X(t)) ,

where the function ϕ(t, X(t)) is continuously differentiable in t and twice continuously

differentiable in X, find the stochastic differential equation for the process Y (t):

dY (t) =

˜

f(t, X(t))dt + ˜g(t, X(t))dW (t) .

Stochastic Systems, 2013 16

Itˆo’s lemma

In the case when we assume that g(t, X(t)) = 0, we know the result: the chain rule

for standard calculus. The result is given by

dy(t) = (ϕ

t

(t, x) + ϕ

x

(t, x)f(t, x))dt . (20)

In the case of stochastic problems, we reason as follows: The Taylor expansion of

ϕ(t, X(t)) yields

dY (t) = ϕ

t

(t, X)dt +

1

2

ϕ

tt

(t, X)dt

2

+ ϕ

x

(t, X)dX(t)

+

1

2

ϕ

xx

(t, X)(dX(t))

2

+ h.o.t . (21)

Stochastic Systems, 2013 17

Itˆo’s lemma

We use (19) for dX(t) and get

dY (t) = ϕ

t

(t, X)dt + ϕ

x

(t, X)[f (t, X(t))dt + g(t, X(t))dW (t)]

+ϕ

tt

(t, X)dt

2

+

1

2

ϕ

xx

(t, X)

f

2

(t, X(t))dt

2

+ g

2

(t, X(t))dW

2

(t)

+2f(t, X(t))g(t, X(t))dt dW (t)

+ h.o.t . (22)

The differentials of higher order (dt, dW ) become fast zero, dt

2

→ 0 and

dtdW (t) → 0. The stochastic term dW

2

(t) according to the rules of Brownian

motion is given as

dW

2

(t, ω) = dt . (23)

Stochastic Systems, 2013 18

Itˆo’s lemma

Omitting higher order terms and using the properties of Brownian motion, we arrive at

dY (t) = [ϕ

t

(t, X) + ϕ

x

(t, X)f (t, X(t)) +

1

2

ϕ

xx

(t, X)g

2

(t, X(t))]dt

+ϕ

x

(t, X)g(t, X(t))dW (t) . (24)

Reordering the terms yields the scalar version of Itˆo’s Lemma:

dY (t) =

˜

f(t, X(t))dt + ˜g(t, X(t))dW (t) , (25)

˜

f(t, X(t)) = ϕ

t

(t, X) + ϕ

x

(t, X)f (t, X(t))

+

1

2

ϕ

xx

(t, X)g

2

(t, X(t)) , (26)

˜g(t, X(t)) = ϕ

x

(t, X)g(t, X(t)) . (27)

Stochastic Systems, 2013 19

Itˆo’s lemma

The term

1

2

ϕ

xx

(t, X)g

2

(t, X(t)) is often called the Itˆo corretion term, since this

does not occur in the det. case.

We apply Itˆos formula for the following problem: ϕ(t, X) = X

2

with the SDE

dX(t) = dW (t). From the SDE, we get X(t) = W (t) and calculate the partial

derivatives of

∂ϕ(t,X)

∂X

= 2X,

∂

2

ϕ(t,X)

∂X

2

= 2, and

∂ϕ(t,X)

∂t

= 0. The Itˆo lemma yields

d(W

2

(t)) = 1dt + 2W (t)dW (t) . (28)

We rewrite the equation and use W (0) = 0

W

2

(t) = 1t + 2

t

0

W (t)dW (t) ,

t

0

W (t)dW (t) =

1

2

W

2

(t) −

1

2

t . (29)

Stochastic Systems, 2013 20

Itˆo’s lemma

We now allow that the process X(t) is in R

n

. We let W (t) be an m-dimensional

standard Brownian motion and f (t, X(t)) ∈ R

n

and g(t, X(t)) ∈ R

n×m

. Consider

a scalar process Y (t) defined by Y (t) = ϕ(t, X(t)), where ϕ(t, X) is a scalar

function which is continuously differentiable with respect to t and twice continuously

differentiable with respect to X. The Itˆo formula can be written in vector notation as

follows:

dY (t) =

˜

f(t, X(t))dt + ˜g(t, X(t))dW (t) , (30)

˜

f(t, X(t)) = ϕ

t

(t, X(t)) + ϕ

x

(t, X(t)) · f(t, X(t))

+

1

2

tr

ϕ

xx

(t, X(t))g(t, X(t))g

T

(t, X(t)))

, (31)

˜g(t, X(t)) = ϕ

x

(t, X(t)) · g(t, X(t)) , (32)

where “tr” denotes the trace operator.

Stochastic Systems, 2013 21

Itˆo’s lemma

Consider the following stochastic differential equation:

dS(t) = µ S(t)dt + σ S(t)dW (t) , (33)

We want to find the SDE for the process Y related to S as follows: Y (t) = ϕ(t, S) =

ln(S(t)) . The partial derivatives are:

∂ϕ(t,S)

∂S

=

1

S

,

∂

2

ϕ(t,S)

∂S

2

= −

1

S

2

, and

∂ϕ(t,S)

∂t

= 0.

Therefore, according to Itˆo we get,

dY (t) =

∂ϕ(t, S)

∂t

+

∂ϕ(t, S)

∂S

µS(t) +

1

2

∂

2

ϕ(t, S)

∂S

2

σ

2

S

2

(t)

dt

+

∂ϕ(t, S)

∂S

σS(t)

dW (t) , (34)

dY (t) = (µ −

1

2

σ

2

)dt + σdW (t) . (35)

Stochastic Systems, 2013 22

Itˆo’s lemma

Since the right hand side of (35) is independent of Y (t), we are able to compute the

stochastic integral:

Y (t) = Y

0

+

t

0

(µ −

1

2

σ

2

)dt +

t

0

σdW , (36)

Y (t) = Y

0

+ (µ −

1

2

σ

2

)t + σW (t) . (37)

Since Y (t) = ln S(t) we have found a solution for S(t) :

ln(S(t)) = ln(S(0)) + (µ −

1

2

σ

2

)t + σW (t) , (38)

S(t) = S(0)e

(µ−

1

2

σ

2

)t+σW (t)

, (39)

where W (t) is a standard BM.

Stochastic Systems, 2013 23

Itˆo’s lemma

Show for U(t) = X

1

(t)X

2

(t) with

dX

1

(t) = f

1

(t, X

1

)dt + g

1

(t, X

1

)dW (t) ,

dX

2

(t) = f

2

(t, X

2

)dt + g

2

(t, X

2

)dW (t) ,

that following formula is valid:

dU(t) = dX

1

(t)X

2

(t) + X

1

(t)dX

2

(t) + g

1

(t, X

1

)g

2

(t, X

2

)dt (40)

We show that we obtain the same result as in the previous formula by apply Itˆo’s

lemma. By (40) liefert

dU(t) = [ X

2

(t)f

1

(t, X

1

) + X

1

(t)f

2

(t, X

2

) + g

1

(t, X

1

)g

2

(t, X

2

)]dt

+[X

2

(t)g

1

(t, X

1

) + X

1

(t)g

2

(t, X

2

)]dW (t)

Stochastic Systems, 2013 24

Itˆo’s lemma

The partial derivatives of U are :

∂U

∂X

= (X

2

(t), X

1

(t))

T

,

∂

2

U

∂X

2

=

0 1

1 0

and

∂U

∂t

= 0.

dU(t) = [

∂U

∂t

+

∂U

∂X

[f

1

(t, X

1

), f

2

(t, X

2

)]

T

+

1

2

tr

∂

2

U

∂X

2

g

1

(t, X

1

)

2

g

1

(t, X

1

)g

2

(t, X

2

)

g

1

(t, X

1

)g

2

(t, X

2

) g

2

(t, X

2

)

2

]dt

+

∂U

∂X

[g

1

(t, X

1

), g

2

(t, X

2

)]

T

dW (t)

= [X

2

(t)f

1

(t, X

1

) + X

1

(t)f

2

(t, X

2

) + g

1

(t, X

1

)g

2

(t, X

2

)]dt

+[X

2

(t)g

1

(t, X

1

) + X

1

(t)g

2

(t, X

2

)]dW (t)

Stochastic Systems, 2013 25

Stochastic Differential Equations (SDE)

We classify SDEs into two large groups, linear SDEs and non-linear SDEs. Furthermore,

we distinguish between scalar linear and vector-valued linear SDEs.

We start with the easy case, the scalar linear linear SDEs. An SDE

dX(t) = f(t, X(t))dt + g(t, X(t))dW (t) , (41)

for a one-dimensional stochastic process X(t) is called a linear (scalar) SDE if and

only if the functions f(t, X(t)) and g(t, X(t)) are affine functions of X(t) ∈ R and

thus

f(t, X(t)) = A(t)X(t) + a(t) ,

g(t, X(t)) = [B

1

(t)X(t) + b

1

(t), ··· , B

m

(t)X(t) + b

m

(t)] ,

where A(t), a(t) ∈ R, W (t) ∈ R

m

is an m-dimensional Brownian motion, and

B

i

(t), b

i

(t) ∈ R, i = 1, ··· , m. Hence, f (t, X(t)) ∈ R and g(t, X(t)) ∈ R

1×m

.

Stochastic Systems, 2013 26

Stochastic Differential Equations (SDE)

The linear SDE possesses the following solution

X(t) = Φ(t)

x

0

+

t

0

Φ

−1

(s)

a(s) −

m

i=1

B

i

(s)b

i

(s)

ds

+

m

i=1

t

0

Φ

−1

(s)b

i

(s)dW

i

(s)

, (42)

where we denote Φ(t) as the fundamental matrix, which we obtain from

Φ(t) = exp

t

0

A(s) −

m

i=1

B

2

i

(s)

2

ds +

m

i=1

t

0

B

i

(s)dW

i

(s)

, (43)

The solution is similar to the solution of ODEs.

Stochastic Systems, 2013 27

Stochastic Differential Equations (SDE)

Let us assume that W (t) ∈ R, a(t) = 0, b(t) = 0, A(t) = A, B(t) = B. We

want to compute the solution of the SDE

dX(t) = AX(t)dt + BX(t)dW (t) , X(t) = x

0

, (44)

We can solve it using (42) and (43):

Φ(t) = e

(A−

1

2

B

2

)t+BW (t)

, (45)

and (42) is easy to calculate since

x(t) = Φ(t)x

0

= x

0

e

(A−

1

2

B

2

)t+BW (t)

. (46)

Stochastic Systems, 2013 28

Stochastic Differential Equations (SDE)

The expectation m(t) = E[X(t)]and the second moment P (t) = E[X

2

(t)] for

dX(t) = (A(t)X(t) + a(t))dt +

m

i=1

(B

i

(t)X(t) + b(t))dW

i

(t) . (47)

can be calculated by solving the following system of ODEs:

˙m(t) = A(t)m(t) + a(t) , m(0) = x

0

, (48)

˙

P (t) =

2A(t) +

m

i=1

B

2

i

(t)

P (t) + 2m(t)

a(t) +

m

i=1

B

i

(t)b

i

(t)

+

m

i=1

b

2

i

(t)

, P (0) = x

2

0

. (49)

Stochastic Systems, 2013 29

Stochastic Differential Equations (SDE)

The ODE for the expectation is derived by applying the expectation operator on both

sides of (42).

E[dX(t)] = E[(A(t)X(t) + a(t))dt +

m

i=1

(B

i

(t)X(t) + b

i

(t))dW

i

(t) ]

E[dX(t)]

dm(t)

= (A(t) E[X(t)]

=m(t)

+a(t))dt

+

m

i=1

E[(B

i

(t)X(t) + b

i

(t))] E[dW

i

(t) ]

=0

dm(t) = (A(t)m(t) + a(t))dt . (50)

Stochastic Systems, 2013 30

Stochastic Differential Equations (SDE)

In order to compute the second moment, we need to derive the SDE for Y (t) = X

2

(t):

dY (t) =

2X(t)(A(t)X(t) + a(t)) +

m

i=1

B

i

(t)X(t) + b

i

(t)

2

dt

+2X(t)

m

i=1

B

i

(t)X(t) + b

i

(t)

dW

i

(t) (51)

dY (t) =

2A(t)X

2

(t) + 2X(t)a(t) +

m

i=1

B

2

i

(t)X

2

(t) + 2B

i

(t)b

i

(t)X(t)

+b

2

i

(t)

dt + 2X(t)

m

i=1

B

i

(t)X(t) + b

i

(t)

dW

i

(t) (52)

Stochastic Systems, 2013 31

Stochastic Differential Equations (SDE)

Furthermore, we apply the expectation operator to (52) and use P (t) = E[X

2

(t)] =

E[Y (t)] and m(t) = E[X(t)].

E[dY (t)] =

2A(t)E[X

2

(t)] + 2a(t)E[X(t)] +

m

i=1

B

2

i

(t)E[X

2

(t)]

+2B

i

(t)b

i

(t)E[X(t)] + b

2

i

(t)

dt

+E

2X(t)

m

i=1

B

i

(t)X(t) + b

i

(t)

dW

i

(t)

dP (t) =

2A(t)P (t) + 2a(t)m(t)

+

m

i=1

B

2

i

(t)P (t) + 2B

i

(t)b

i

(t)m(t) + b

2

i

(t)

dt

Stochastic Systems, 2013 32

Stochastic Differential Equations (SDE)

In the case that B

i

(t) = 0, i = 1, . . . , m, we are able to directly compute the

distribution. The scalar linear SDE

dX(t) = (A(t)X(t) + a(t))dt +

m

i=1

b

i

(t)dW

i

(t), (53)

with X(0) = x

0

is normaly distributed

P (X(t)|x

0

) ∼ N(m(t), V (t)) with expected value m(t) and variance V (t), which

are solutions of the following ODEs,

˙m(t) = A(t)m(t) + a(t) , m(0) = x

0

, (54)

˙

V (t) = 2A(t)V (t) +

m

i=1

b

2

i

(t) , V (0) = 0 . (55)

Stochastic Systems, 2013 33

Stochastic Differential Equations (SDE)

There are some specific scalar linear SDEs which are found to be quite useful in practice.

The simplest case of SDE is where the drift and the diffusion coefficients are independent

of the information received over time

dS(t) = µdt + σdW (t) , S(0) = S

0

. (56)

This model has been used to simulate commodity prices, such as metals or agricultural

products.

The mean is E[S(t)] = µt + S

0

and the variance Var[S(t)] = σ

2

t. S(t) possesses

a behavior of fluctuations around the straight line S

0

+ µt.The process is normally

distributed with the given mean and variance.

Stochastic Systems, 2013 34

Stochastic Differential Equations (SDE)

The standard model of stock prices is the geometric Brownian motion as given by

dS(t) = µS(t)dt + σS(t)dW (t, ω) , S(0) = S

0

.

The mean is given by E[S(t)] = S

0

e

µt

and its variance by Var[S(t)] = S

2

0

e

2µt

(e

σ

2

t

−

1). This model forms the starting point for the famous Black-Scholes formula for option

pricing. The geometric Brownian motion has two main features which make it popular

for stock

The first property is that S(t) > 0 for all t ∈ [0, T ] and the second is that all returns

are in scale with the current price. This process has a log-normal probability density

function.

Stochastic Systems, 2013 35

Stochastic Differential Equations (SDE)

Another very popular class of SDEs are mean reverting linear SDEs. The model is

obtained by

dS(t) = κ[µ − S(t)]dt + σ dW (t, ω) , S(0) = S

0

. (57)

A special case of this SDE where µ = 0 is called Ohrnstein-Uhlenbeck process.

Equation (57) models a process which naturally falls back to its equilibrium level of µ.

The expected price is E[S(t)] = µ − (µ − S

0

)e

−κ t

and the variance is

Var[S(t)] =

σ

2

2κ

1 − e

−2κ t

.

Stochastic Systems, 2013 36

Stochastic Differential Equations (SDE)

In the long run, the following (unconditional) approximations are valid

lim

t→∞

E[S(t)] = µ

and

lim

t→∞

Var[S(t)] =

σ

2

2κ

.

This analysis shows that the process fluctuates around µ and has a variance of

σ

2

2κ

which depends on the parameter κ: the higher κ, the lower the variance.

This is obvious since the higher κ, the faster the process reverts back to its mean

value.

This process is a stationary process which is normally distributed.

Stochastic Systems, 2013 37

Stochastic Differential Equations (SDE)

A popular extension is where the diffusion term is in scale with the current value, i.e.,

the geometric mean reverting process:

dS(t) = κ[µ − S(t)]dt + σS(t)dW (t, ω) , S(0) = S

0

.

In this model S(t) ≥ 0, if S

0

≥ 0, µ > 0, and κ > 0.

The first mean reversion model(57) may produce negative values even for µ > 0.

Since the second mean-reversion model has always positive realizations, it is also

called log-normal mean reversion. This type of model is used to model interest rate or

volatilities.

Stochastic Systems, 2013 38

Stochastic Differential Equations (SDE)

In control engineering science, the most important (scalar) case is

dX(t) = (A(t)X(t) + C(t)u(t)) dt +

m

i=1

b

i

(t) dW

i

. (58)

In this equation, X(t) is normally distributed because the Brownian motion is just

multiplied by time-dependent factors.

When we compute an optimal control law for this SDE, the deterministic optimal control

law (ignoring the Brownian motion) and the stochastic optimal control law are the same.

This feature is called certainty equivalence. For this reason, the stochastics are often

ignored in control engineering.

Stochastic Systems, 2013 39

Stochastic Differential Equations (SDE)

The logical extension of scalar SDEs is to allow X(t) ∈ R

n

to be a vector. The rest of

this section proceeds in a similar fashion as for scalar linear SDEs. A stochastic vector

differential equation

dX(t) = f(t, X(t))dt + g(t, X(t))dW (t)

with the initial condition X(0) = x

0

∈ R

n

for an n-dimensional stochastic process

X(t) is called a linear SDE if the functions f (t, X(t)) ∈ R

n

and g(t, X(t)) ∈ R

n×m

are affine functions of X(t) and thus

f(t, X(t)) = A(t)X(t) + a(t) ,

g(t, X(t)) = [B

1

(t)X(t) + b

1

(t), ··· , B

m

(t)X(t) + b

m

(t)] ,

where A(t) ∈ R

n×n

, a(t) ∈ R

n

, W (t) ∈ R

m

is an m-dimensional Brownian motion,

and B

i

(t) ∈ R

n×n

, b

i

(t) ∈ R

n

.

Stochastic Systems, 2013 40

Stochastic Differential Equations (SDE)

Alternatively, the vector-valued linear SDE can be written as

dX(t) = (A(t)X(t) + a(t))dt +

m

i=1

(B

i

(t)X(t) + b

i

(t))dW

i

(t) . (59)

A common extension of the above equation is the following form of a controlled

stochastic differential equation as given by

dX(t) = (A(t)X(t) + C(t)u(t) + a(t)) dt

+

m

i=1

(B

i

(t)X(t) + D

i

(t)u(t) + b

i

(t)) dW

i

, (60)

where u (t) ∈ R

k

, C(t) ∈ R

n×k

, D

i

(t) ∈ R

n×k

.

Stochastic Systems, 2013 41

Stochastic Differential Equations (SDE)

The linear SDE (59) has the following solution:

X(t) = Φ(t)

x

0

+

t

0

Φ

−1

(s)

a(s) −

m

i=1

B

i

(s)b

i

(s)

ds

+

m

i=1

t

0

Φ

−1

(s)b

i

(s)dW

i

(s)

, (61)

where the fundamental matrix Φ(t) ∈ R

n×n

is the solution of the homogenous

stochastic differential equation.

Stochastic Systems, 2013 42

Stochastic Differential Equations (SDE)

The fundamental matrix Φ(t) ∈ R

n×n

is the solution of the homogenous stochastic

differential equation:

dΦ(t) = A(t)Φ(t)dt +

m

i=1

B

i

(t)Φ(t)dW

i

(t) , (62)

with initial condition Φ(0) = I, I ∈ R

n

×

n

e now prove that (61) and (62) are

solutions of (59). We rewrite (61) as

X(t) = Φ(t)

x

0

+

t

0

Φ

−1

(t)dY (t)

dY (t) =

a(t) −

m

i=1

B

i

(t)b

i

(t)

dt +

m

i=1

b

i

(t)dW

i

(t) .

Stochastic Systems, 2013 43

Stochastic Differential Equations (SDE)

X(t) = Φ(t)Z(t) , Z(t) =

x

0

+

t

0

Φ

−1

(t)dY (t)

dZ(t) = Φ

−1

(t)dY (t)

We use the Itˆo formula to calculate X(t) = Φ(t )Z(t):

dX(t) = Φ(t)dZ(t) + dΦ(t)Z(t) +

m

i=1

B

i

(t)Φ(t)Φ(t)

−1

b

i

(t)dt

= dY (t) + A(t)Φ(t)Z(t)dt +

m

i=1

B

i

(t)Φ(t)Z(t)dW

i

(t) +

m

i=1

B

i

(t)b

i

(t)dt

Stochastic Systems, 2013 44

Stochastic Differential Equations (SDE)

Noting that Z(t) = Φ

−1

(t)X(t) and using the SDE for Y (t), we get

dX(t) = dY (t) + A(t)Φ(t)Z(t)dt +

m

i=1

B

i

(t)Φ(t)Z(t)dW

i

(t) +

m

i=1

B

i

(t)b

i

(t)dt

=

a(t) −

m

i=1

B

i

(t)b

i

(t)

dt +

m

i=1

b

i

(t)dW

i

(t) + A(t)X(t)dt

+

m

i=1

B

i

(t)X(t)dW

i

(t) +

m

i=1

B

i

(t)b

i

(t)dt

= [a(t ) + A(t)X(t)]dt +

m

i=1

(B

i

(t)X(t) + b

i

(t))dW

i

(t) .

This completes the proof.

Stochastic Systems, 2013 45

Stochastic Differential Equations (SDE)

The expectation m(t) = E[X(t)] ∈ R

n

and the second moment matrix P (t) =

E[X(t)X

T

(t)] ∈ R

n×n

can be computed as follows:

˙m(t) = A(t)m(t) + a(t) , m(0) = x

0

, (63)

˙

P (t) = A(t)P (t) + P (t)A

T

(t) + a(t)m

T

(t) + m(t)a

T

(t)

+

m

i=1

[B

i

(t)P (t)B

T

i

(t) + B

i

(t)m(t)b

T

i

(t)

+b

i

(t)m

T

(t)B

T

i

(t) + b

i

(t)b

i

(t)

T

] , P (0) = x

0

x

T

0

. (64)

The covariance matrix for the system of linear SDEs is given by als

V (t) = Var{x(t)} = P (t) − m(t)m

T

(t) . (65)

Stochastic Systems, 2013 46

Stochastic Differential Equations (SDE)

The special case

dX(t) = (A(t)X(t) + a(t))dt +

m

i=1

b

i

(t)dW

i

(t)

with the initial condition X(0) = x

0

∈ R

n

is normally distributed, i.e.,

P (X(t)|x

0

) ∼ N(m(t), V (t))

where

˙m(t) = A(t)m(t) + a(t) m(0) = x

0

˙

V (t) = A(t)V (t) + V (t)A

T

(t) +

m

i=1

b

i

b

T

i

(t) V (0) = 0 .

Stochastic Systems, 2013 47

Stochastic Differential Equations (SDE)

As first example of a linear vector valued SDE, we consider a two dimensional geometric

Brownian motion:

dS

1

(t) = µ

1

S

1

(t)dt + S

1

(t)

σ

11

dW

1

(t) + σ

12

dW

2

(t)

, (66)

dS

2

(t) = µ

2

S

2

(t)dt + S

2

(t)

σ

21

dW

1

(t) + σ

22

dW

2

(t)

. (67)

Written in matrix form S = (S

1

, S

2

)

T

, the same SDE is given as:

A(t) =

µ

1

0

0 µ

1

a(t) =

0

0

B

1

(t) =

σ

11

0

0 σ

21

B

2

(t) =

σ

12

0

0 σ

22

Both processes S

1

(t) and S

2

(t) are correlated if σ

12

= σ

21

̸= 0. This model can be

easily extended to n processes.

Stochastic Systems, 2013 48

Stochastic Differential Equations (SDE)

The observed volatility for real existing price processes, such as stocks or bonds is itself

a stochastic process. The following model describes this observation:

dP (t) = µdt + σ(t)dW

1

(t) , P (0) = P

0

,

dσ(t) = κ(θ − σ(t))dt + σ(t)σ

1

dW

2

(t) , σ(0) = σ

0

.

where θ is the average volatility, σ

1

a volatility, and κ the mean reversion rate of

the volatility process σ(t). If this model is used for stock prices, the transformation

P (t) = ln(S(t)) is useful. The two Brownian motions dW

1

(t) and dW

2

(t) are

correlated, hence corr[dW

1

(t), dW

2

(t)] = ρ. This model captures the behavior of

real existing prices better and its distribution of returns shows “fatter tails”.

Stochastic Systems, 2013 49

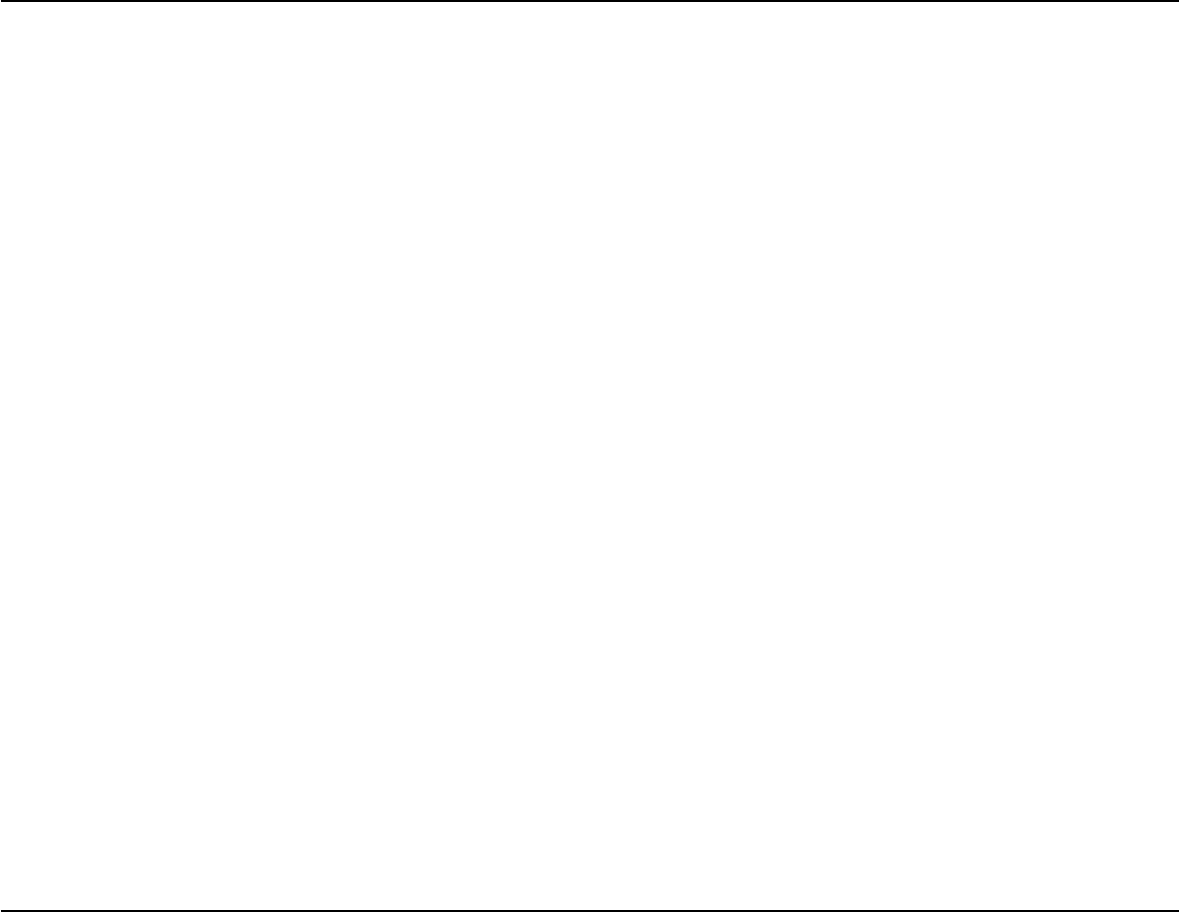

Stochastic Differential Equations (SDE)

Die system (68) can be rewritten as linear SDE:

A(t) =

0 0

0 −κ

a(t) =

µ

κθ

B

1

(t) =

0 1

0 σ

1

ρ

B

2

(t) =

0 0

0 σ

1

1 − ρ

2

,

wobei x(t) = (P (t), σ(t))

T

. The system (68) has the property, that the variance

of P (t) depends on the initial condition σ

0

For the parameters µ = 0.1, κ = 2,

θ = 0.2, σ

1

= 0.5 and ρ = 0.5, we calculate the standard deviation of P (t) with

σ

0

= 0.1 and alternatively with σ

0

= 0.8. The expected value of σ(t) has the

following evaluation over time m(t) = θ + (σ

0

− θ)e

−κt

and thus the variance of

P (t) depends on σ

0

.

Stochastic Systems, 2013 50

Stochastic Differential Equations (SDE)

0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

time

Standardabweichung

σ

0

=0.1

σ

0

=0.8

Abbildung 1: Stand. dev. of P (t) for different initial conditions of σ(t)

Stochastic Systems, 2013 51

Stochastic Differential Equations (SDE)

In comparison with linear SDEs, nonlinear SDEs are less well understood. No general

solution theory exists. And there are no explicit formulae for calculating the moments.

In this section, we show some examples of nonlinear SDEs and their properties.

In general, a scalar square root process can be written as

dX(t) = f(t, X(t))dt + g(t, X(t))dW (t)

with

f(t, X(t)) = A(t)X(t) + a(t)

g(t, X(t)) = B(t)

X(t) ,

where A(t), a(t), and B(t) are real scalars. The nonlinear mean reverting SDEs differ

from the linear scalar equations by their nonlinear diffusion term. For this process, the

distribution and moments can be calculated.

Stochastic Systems, 2013 52

Stochastic Differential Equations (SDE)

For a specific square root process with A(t) = 0, a(t) = 1 and B(t) = 2 we are

able to derive the analytical solution: The SDE

dX(t) = 1dt + 2

X(t)dW (t) , X(0) = x

o

,

has the solution X(t) = (W (t) + x

0

)

2

We verify the solution using Itˆo formula. We

use Φ(t) = X(t) = (Y (t) + x

0

)

2

and dY (t) = dW (t). The partial derivatives are

Φ

t

= 0, Φ

Y

= 2(Y (t) + x

0

), and Φ

Y Y

= 2. Thus

dΦ(t) = [Φ

t

+ Φ

Y

· 0 +

1

2

Φ

Y Y

· 1]dt + Φ

Y

· 1dW (t) ,

dΦ(t) = 1dt + 2(Y (t) + x

0

)dW (t) , ⇒ dX(t) = 1dt + 2

X(t)dW (t) ,

since

X(t) = Y (t) + x

0

.

Stochastic Systems, 2013 53

Stochastic Differential Equations (SDE)

Another widely used mean reversion model is obtained by

dS(t) = κ[µ − S(t)]dt + σ

S(t)dW (t) , S(0) = S

0

. (68)

This model is also known as the Cox-Ross-Ingersol processes.The process shows a

less volatile behavior than its linear geometric counterpart and it has a non-central

chi-square distribution. The process is often used to model short-term interest rates or

stochastic volatility processes for stock prices. Another often used square root process

is similar to the geometric Brownian motion, but with a square root diffusion term

instead of the linear diffusion term. Its model is given by

dS(t) = µS(t)dt + σ

S(t)dW (t) , S(0) = S

0

. (69)

Stochastic Systems, 2013 54

Stochastic Differential Equations (SDE)

The expected value for (69) is E[S(t)] = S

0

e

µt

and the variance is obtained by

Var[S(t)] =

σ

2

S

0

µ

e

2µt

− e

µt

.

Another widely used mean reversion model is obtained by

dS(t) = κS(t)[µ − ln(S(t))]dt + S(t)σdW (t) . (70)

Using the transformation P (t) = ln(S(t)) yields the linear mean reverting and

normally distributed process P (t):

dP (t) = κ[(µ −

σ

2

2κ

) − P (t)]dt + σdW (t) , (71)

Because of the transformation, S(t) is log-normally distributed. This model is used

to model stock prices, stochastic volatilities, and electricity prices. Because S(t) is

log-normally distributed, S(t) is always positive.

Stochastic Systems, 2013 55

Stochastic Differential Equations (SDE)

In this part, we introduce three major methods to compute solution of SDEs.

• The first method is based on the Itˆo integral and has already been used for linear

solutions.

• We introduce numerical methods to compute path-wise solutions of SDEs.

• The third method is based on partial differential equations, where the problem of

finding the probability density function of the solution is transformed into solving a

partial differential equation.

Stochastic Systems, 2013 56

Stochastic Differential Equations (SDE)

The stochastic process X(t) governed by the stochastic differential equation

dX(t) = f(t, X(t))dt + g(t, X(t))dW (t)

X(0) = X

0

is explicitly described by the integral form

X(t, ω) = X

0

+

t

0

f(s, X(s)) ds +

t

0

g(s, X(s)) dW (s) ,

where the first integral is a path-wise Riemann integral and the second integral is an

Itˆo integral.

In this definition, it is assumed that the functions f(t, X(t)) and g(t, X(t)) are

sufficiently smooth in order to guarantee the existence of the solution X(t).

Stochastic Systems, 2013 57

Stochastic Differential Equations (SDE)

There are several ways of finding analytical solutions. One way is to guess a soluti-

on and use the Itˆo calculus to verify that it is a solution for the SDE under consideration.

We assume that the following nonlinear SDE

dX(t) = dt + 2

X(t) dW (t) ,

has the solution

X(t) = (W (t) +

X

0

)

2

.

In order to verify this claim, we use the Itˆo calculus. We have X(t) = ϕ(W ) where

ϕ(W ) = (W (t) +

√

X

0

)

2

, so that ϕ

′

(W ) = 2(W (t) +

√

X

0

) and ϕ

′′

(W ) = 2.

Stochastic Systems, 2013 58

Stochastic Differential Equations (SDE)

Using Itˆo’s rule, we get

dX(t) =

f(t, X)dt + g(t, X)dW (t)

f(t, X) = ϕ(W )

′

1 +

1

2

ϕ

′′

(W )(2

X(t))

2

= 1

g(T, X) = ϕ

′

(W )(2

X(t)) = 2(W (t) +

X

0

) .

Since X(t) = (W (t) +

√

X

0

)

2

we know that (W (t) +

√

X

0

) =

X(t) and thus

the Itˆo calculation generated the original SDE where we started at.

Stochastic Systems, 2013 59

Stochastic Differential Equations (SDE)

For some classes of SDEs, analytical formulas exist to find the solution, e.g. consider

the following SDE:

dX(t) = f(t, X(t))dt + σ(t)dW (t) , X(0) = x

0

(72)

where X(t) ∈ R

n

, f(t, X(t)) ∈ R

n

is an arbitrary function, σ(t) ∈ R

n×m

and

dW (t) ∈ R

m

. This class of SDEs has the following general solution:

X(t) = Y (t) + F (t) (73)

dY (t) = f (t, Y (t) + F (t))dt , Y (0) = x

0

(74)

dF (t) = σ(t)dW (t) , F (0) = 0 . (75)

The SDE for F (t) can be integrated, i.e. F (t) =

t

0

σ(s)dW (s). When σ(t) = σ

than F (t) = σW (t).

Stochastic Systems, 2013 60

Stochastic Differential Equations (SDE)

SinceF (t) is know,, we are able to solve for Y (t) in in function of F (t).

Using Itˆo lemman, we show that X(t) = Y (t) + F (t) and this solves the SDE

dX(t) = dY (t) + dF (t) = f (t, Y (t) + F (t))dt + σ(t)dW (t)

= f (t, X(t))dt + σ(t)dW (t) (76)

This solution is not very suprising, since X(t) is the sum of the process of Y (t) and

the BM of F (t).

Stochastic Systems, 2013 61

Stochastic Differential Equations (SDE)

For another class of SDEs, exist an analytical formula for their solution:

dX(t) = f(t, X(t))dt + c(t)X(t)dW (t) , X(0) = x

0

, (77)

where f (t, X(t)) ∈ R, c(t) ∈ R and dW ∈ R. DThe solution can be derived as

follows:

X(t) = F

−1

(t)Y (t) (78)

dF (t) = F (t)c

2

(t)dt − F (t)c(t)dW (t) , F (0) = 1 (79)

dY (t) = F (t)f(t, F

−1

Y (t))dt (80)

The proof is similar to the first case, sice the diffusion is linear.

Stochastic Systems, 2013 62

Stochastic Differential Equations (SDE)

Calculate the analytical solution for

dX(t) =

dt

X(t)

+ αX(t)dW (t) , X(0) = x

0

.

F (t) = e

1

2

α

2

t−αW (t)

, dY (t) =

F (t)

F

−1

(t)Y

dt =

F

2

(t)

Y

dt

dY (t)Y (t) = F

2

(t)dt ,

1

2

Y

2

(t) =

t

0

F

2

(s)ds + C

0

Y (t) =

x

2

0

+ 2

t

0

e

α

2

s−2αW (s)

ds

1

2

X(t) = e

−

1

2

α

2

t+αW (t)

x

2

0

+ 2

t

0

e

α

2

s−2αW (s)

ds

1

2

Stochastic Systems, 2013 63

Stochastic Differential Equations (SDE)

However, most SDEs, especially nonlinear SDEs, do not have analytical solutions so

that one has to resort to numerical approximation schemes in order to simulate sample

paths of solutions to the given equation.

The simplest scheme is obtained by using a first-order approximation. This is called the

Euler scheme

X(t

k

) = X(t

k−1

) + f(t

k−1

, X(t

k−1

))∆t + g(t

k−1

, X(t

k−1

))∆W (t

k

) .

The Brownian motion term can be approximated as follows:

∆W (t

k

) = ϵ(t

k

)

√

∆t ,

where the ϵ(.) is a discrete-time Gaussian white process with mean 0 and standard

deviation 1.

Stochastic Systems, 2013 64