HSBC

Personal Banking

Booklet

17 July 2024

HSBC Personal Banking Booklet

Contents

. WHO’S YOUR AGREEMENT BETWEEN?

. WHICH PRODUCTS AND SERVICES DOES THIS BOOKLET APPLY TO?

. WHERE WILL YOU FIND IMPORTANT INFORMATION ABOUT

YOUR AGREEMENT WITH US?

PART A: USING YOUR PERSONAL BANKING PRODUCTS

Acceptable Use Policy 13

Security

. HOW DO WE MAKE SURE WE’RE DEALING WITH YOU?

. KEEPING UP SECURITY

. WHAT SHOULD YOU DO IF YOU SUSPECT AN INCORRECT PAYMENT,

UNAUTHORISED PAYMENT OR MISTAKEN INTERNET PAYMENT

FROM YOUR ACCOUNT?

. WHAT YOU MUST REPORT TO US

. WHEN WE AREN’T RESPONSIBLE FOR THINGS THAT GO WRONG

Payments

. MAKING PAYMENTS ON BUSINESS DAYS

. ADJUSTING PAYMENTS TO YOUR ACCOUNT

. PAYMENTS INTO YOUR ACCOUNT (OTHER THAN BY CHEQUE)

. DIRECT DEBITS

. PAYMENTS INTO YOUR ACCOUNT BY CHEQUE

. PAYMENTS INTO YOUR ACCOUNT BY MISTAKE OR FRAUD

. WHEN WE CAN REFUSE TO ACCEPT PAYMENTS INTO YOUR ACCOUNT

. BLOCKING PAYMENTS, PAYMENT DEVICES, SERVICES AND ACCOUNTS

AND TEMPORARY TRANSACTION LIMITS

. HOW WE DECIDE WHETHER TO MAKE A PAYMENT FROM YOUR ACCOUNT

. PAYMENTS FROM YOUR ACCOUNT

. CANCELLING OR CHANGING PAYMENTS (OTHER THAN CHEQUES)

HSBC Personal Banking Booklet

. REFUNDS AND RETURNED PAYMENTS

Foreign Currencies

. FOREIGN CURRENCIES

Overdrafts, Charges and Interest

. OVERDRAFTS

. FEES AND CHARGES

. INTEREST

. STATEMENTS AND OTHER INFORMATION WE’LL GIVE YOU

Third Parties

. CAN SOMEONE ELSE OPERATE YOUR ACCOUNT FOR YOU?

. JOINT ACCOUNTS

. TRUST ACCOUNTS

. USING A THIRD-PARTY PROVIDER

PART B: BANKING SERVICES FEES AND CHARGES

. IMPORTANT INFORMATION ABOUT OUR FEES AND CHARGES

. CHARGES WE CAN’T CONTROL FOR PAYMENTS AND ATMS

. COLLECTING FEES AND CHARGES

. INTEREST RATES

. RECEIVING MONEY

. SENDING MONEY

. FOREIGN CURRENCY NOTES

. CHEQUES

. INTERNATIONAL TRANSACTION FEES OR CHARGES FOR HOME SMART,

HOME EQUITY, OFFSET SAVINGS AND HOME LOAN TRANSACTION

(NON OFFSET) ACCOUNTS

. PERSONAL CREDIT LINE

. BANK GUARANTEE

. OTHER SERVICES

PART C: OTHER IMPORTANT TERMS

. COMBINING ACCOUNTS AND SETTING-OFF

HSBC Personal Banking Booklet

. PRIVACY AND CREDIT INFORMATION

. HOW DO WE COMMUNICATE?

. INFORMATION WE NEED FROM YOU AND WHEN WE CAN DISCLOSE

INFORMATION ABOUT YOU

Changes to Your Agreement

. CHANGES WE CAN MAKE AFTER GIVING NOTICE

. HOW WE CAN TRANSFER ACCOUNTS

. WHAT HAPPENS IF YOU STOP USING YOUR ACCOUNT?

Closing your account

. HOW CAN YOU CLOSE YOUR ACCOUNT OR END THIS AGREEMENT?

. HOW CAN WE CLOSE YOUR ACCOUNT OR END THIS AGREEMENT?

. HELP WE CAN OFFER IF YOU WANT TO SWITCH TO ANOTHER

BANK ACCOUNT

Other useful information

. TRANSFERRING YOUR AGREEMENT AND THE SECURITY

. TAX

. RISKS ASSOCIATED WITH FOREIGN CURRENCY ACCOUNTS

. OUR RIGHTS

. RECOVERING COSTS AND EXPENSES FROM YOU

. COMMISSIONS

. TRANSACTION QUERIES

. COMPLAINTS, DISPUTED TRANSACTIONS AND INVESTIGATIONS

. RESULTS OF OUR INVESTIGATIONS

. WHAT COUNTRY’S COURTS AND LAWS APPLY TO THIS AGREEMENT

AND OUR DEALINGS

PART D: NATIONAL CREDIT CODE INFORMATION STATEMENT

Form 5—Information statement

. HOW CAN I GET DETAILS OF MY PROPOSED CREDIT CONTRACT?

. HOW CAN I GET A COPY OF THE FINAL CONTRACT?

. CAN I TERMINATE THE CONTRACT?

HSBC Personal Banking Booklet

. CAN I PAY MY CREDIT CONTRACT OUT EARLY?

. HOW CAN I FIND OUT THE PAY OUT FIGURE?

. WILL I PAY LESS INTEREST IF I PAY OUT MY CONTRACT EARLY?

. CAN MY CONTRACT BE CHANGED BY MY CREDIT PROVIDER?

. WILL I BE TOLD IN ADVANCE IF MY CREDIT PROVIDER IS GOING TO

MAKE A CHANGE IN THE CONTRACT?

. IS THERE ANYTHING I CAN DO IF I THINK THAT MY CONTRACT IS UNJUST?

. DO I HAVE TO TAKE OUT INSURANCE?

. WILL I GET DETAILS OF MY INSURANCE COVER?

. IF THE INSURER DOES NOT ACCEPT MY PROPOSAL, WILL I BE TOLD?

. IN THAT CASE, WHAT HAPPENS TO THE PREMIUMS?

. WHAT HAPPENS IF MY CREDIT CONTRACT ENDS BEFORE ANY

INSURANCE CONTRACT OVER MORTGAGED PROPERTY?

. IF MY CONTRACT SAYS I HAVE TO GIVE A MORTGAGE,

WHAT DOES THIS MEAN?

. SHOULD I GET A COPY OF MY MORTGAGE?

. IS THERE ANYTHING THAT I AM NOT ALLOWED TO DO WITH THE

PROPERTY I HAVE MORTGAGED?

. WHAT CAN I DO IF I FIND THAT I CANNOT AFFORD MY

REPAYMENTS AND THERE IS A MORTGAGE OVER PROPERTY?

. CAN MY CREDIT PROVIDER TAKE OR SELL THE MORTGAGED PROPERTY?

. IF MY CREDIT PROVIDER WRITES ASKING ME WHERE THE MORTGAGED

GOODS ARE, DO I HAVE TO SAY WHERE THEY ARE?

. WHEN CAN MY CREDIT PROVIDER OR ITS AGENT COME INTO A

RESIDENCE TO TAKE POSSESSION OF MORTGAGED GOODS?

. WHAT DO I DO IF I CANNOT MAKE A REPAYMENT?

. WHAT IF MY CREDIT PROVIDER AND I CANNOT AGREE ON

A SUITABLE ARRANGEMENT?

. CAN MY CREDIT PROVIDER TAKE ACTION AGAINST ME?

. DO I HAVE ANY OTHER RIGHTS AND OBLIGATIONS?

HSBC Personal Banking Booklet

This Personal Banking Booklet

This Personal Banking Booklet contains important information about the products

listed in clause 2 (‘Which products and services does this booklet apply to?’) and

must be read with the other documents that apply to those products. Those other

documents are detailed in clause 3 (‘Where will you find important information

about your agreement with us?’) of this booklet.

Certain terms in this booklet form part of the product terms of each of the

products in clause 2 (‘Which products and services does this booklet apply to?’)

of this booklet. When you enter into an agreement for one of those products, you

agree to the terms in this booklet that are identified as applying to those products

(whether in the product terms or in this booklet).

Please contact us on one of the phone or text telephone (TTY) numbers as

detailed in the table under clause 44 (‘How do we communicate?’) if:

• you are an indigenous customer or are in a remote area and would like

assistance with relevant products or accounts or

• you consider that you may be a vulnerable customer.

6

HSBC Personal Banking Booklet

. WHO’S YOUR AGREEMENT BETWEEN?

You We/Us/Our

Depending on your product (see your

product terms), “you” means the

person or persons we’ve:

• opened one or more accounts for or

• named as the borrower in your letter

of oer or schedule.

If permitted under your product

terms, this can also include a personal

representative, or anyone else who

takes over your legal rights or duties.

HSBC Bank Australia Limited

ABN 48 006 434 162

GPO Box 5302 Sydney NSW 2001

AFSL/Australian Credit Licence

232595)

T: 1300 308 008 www.hsbc.com.au

These also apply to anyone who we’ve

told you has taken over from us under

your agreement.

. WHICH PRODUCTS AND SERVICES DOES THIS BOOKLET

APPLY TO?

PRODUCTS

Transaction and Savings Accounts

Transaction Accounts

3 Everyday Global Account

3 Day to Day Account

3 HSBC Premier Children’s Savings

Account

Savings and Term Deposit Accounts

3 HSBC Bonus Savings Account

3 HSBC Everyday Savings Account

3 Term Deposit Account

7

HSBC Personal Banking Booklet

Home Loans

3 Standard Variable Loan

3 Home Smart® Loan

3 Home Equity Loan

3 Construction Loan

3 Home Value Loan

3 Fixed Rate Loan

3 Bridging Loan

Home Loan Transaction and Savings Accounts

3 Oset Savings Account 3 Home Loan Transaction

(Non Oset) Account

Credit Cards Personal Loans

3 HSBC Star Alliance Credit Card

3 HSBC Premier Credit Card

3 HSBC Premier Qantas Credit Card

3 HSBC Platinum Credit Card

3 HSBC Platinum Qantas Credit Card

3 HSBC Low Rate Credit Card

3 Personal Loan

Services

3 Online banking

3 Phone banking

3 Mobile banking

3 Digital wallets

This booklet also applies to any card we issue if your product terms state

that a card is issued.

8

HSBC Personal Banking Booklet

PRODUCTS WE NO LONGER OFFER

Transaction Account

3 HSBC Premier Cash Management Account

Overdrafts

3 Arranged Overdraft

Home Loans

3 Market Linked Loan

3 Home Rewards Loan

Credit Cards

3 Classic Credit Card

Bank Guarantee

3 Secured by Property

3 Secured by Cash

Credit Lines

3 Personal Credit Line

9

HSBC Personal Banking Booklet

10

. WHERE WILL YOU FIND IMPORTANT INFORMATION ABOUT

YOUR AGREEMENT WITH US?

The following table is a quick reference that sets out the type of information you

might be looking for, and where you might find that information. For a list of all

documents that form your agreement with us, see your product terms.

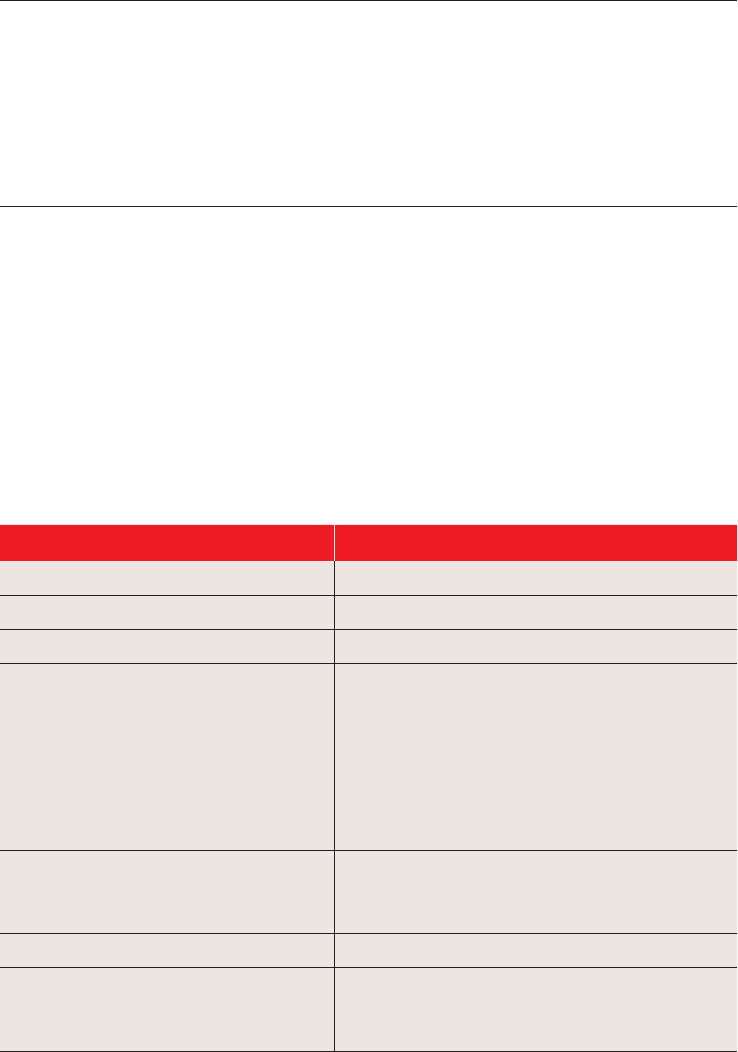

Terms Where you’ll find them

General terms that apply to our

products and services where specified

(e.g. transaction and savings, home

loans, credit cards, overdrafts and

personal loans).

Where specified in this booklet

Statutory Important Information notice

that applies to credit cards, home loans

and personal loans that are regulated

under the National Credit Code

Part D of this booklet

Specific terms for transaction accounts

and savings accounts

The Transaction and Savings Accounts

Terms

Specific terms for home loans The Home Loan Terms

Your letter of oer

Specific transaction terms for Oset

Savings Account, Home Loan

Transaction (Non Oset) Account,

Home Smart®, Home Equity, Home

Value and Standard Variable Rate loan

accounts

The Home Loan Terms

Your letter of oer

Specific terms for credit cards The Credit Card Terms

The credit card schedule

Your credit card oer document

Specific terms for personal loans The Personal Loan Terms

Your letter of oer

Specific terms for arranged overdrafts

(we no longer oer this product)

Your letter of oer (if applicable)

Specific terms for online and mobile

banking

The Online Banking Terms

HSBC Personal Banking Booklet

11

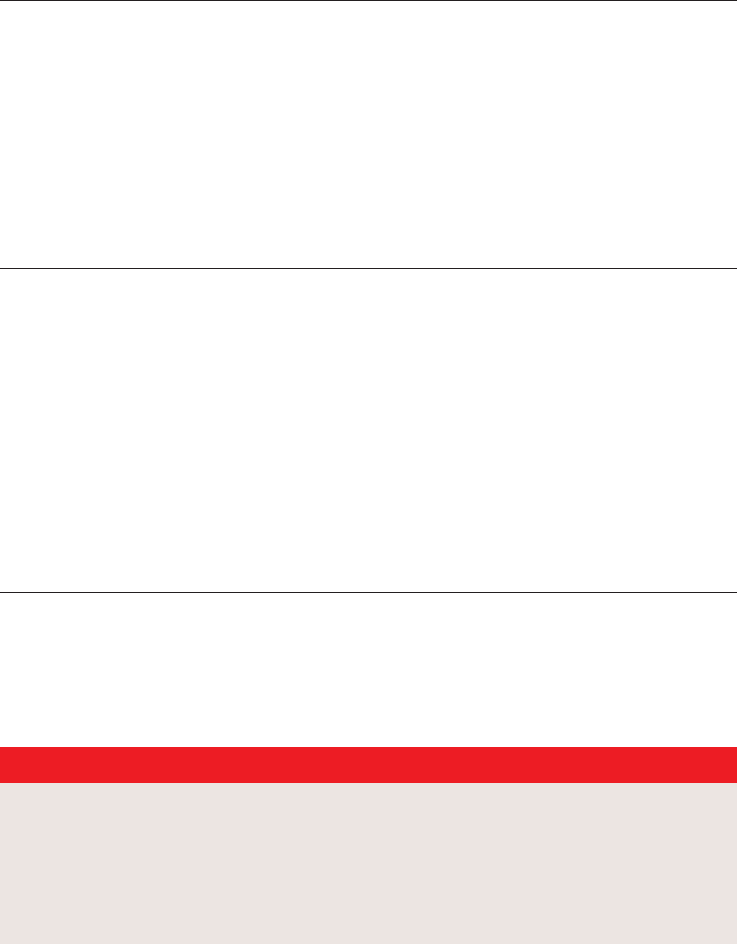

Terms Where you’ll find them

Interest rates

• For Transaction and Savings Accounts

For your current interest rate, please

check our website at hsbc.com.au

and click on the relevant product or

contact us at 1300 308 008.

For the terms on how interest is

paid, see clause 24 (‘Interest’) of

this booklet and the Transaction and

Savings Accounts terms.

• For home loans, credit cards,

personal loans and overdrafts

Please refer to the rate notices from

us, your letter of oer or credit card

schedule (as applicable). Our current

interest rates are also on our website

at hsbc.com.au and clicking on the

relevant product page.

Our current exchange rates

To find out our current indicative

exchange rate, please contact us in

branch or by phone at 1300 308 008

or check our website at hsbc.com.au

Digital wallets The HSBC with Apple Pay or HSBC

with Google Pay Terms and Conditions

(as applicable).

Laws and regulations

When we talk about “laws and regulations”, this includes all laws,

rules, regulations and codes of practice applicable to us and any

recommendations, requirements or decisions laid down by any court,

regulator, government authority or agency or other similar body that apply

to us.

HSBC Personal Banking Booklet

12

ePayments Code

The ePayments Code is a voluntary code that regulates electronic payments,

including ATM, EFTPOS and credit card transactions, online payments, online and

mobile banking, and BPAY®.

We warrant that we will comply with the ePayments Code.

Banking Code of Practice

The Banking Code of Practice (BCOP) sets out the standards of practice and

service in the Australian banking industry for individual customers, small business

customers and their guarantors. See BCOP for customer definitions. If BCOP

applies to you, the relevant provisions of that code apply when you use one of our

products or services.

You can obtain a copy of BCOP from our website, by calling us, or by asking in

our branch.

If you require further information on anything in our documents, you can request

it from us anytime.

Product Terms

When we say ‘product terms’ we mean the agreement between you and

us that specifically applies to the product or service you’ve taken out. Your

product terms state what documents and terms make up the agreement

between you and us.

HSBC Personal Banking Booklet

PART A: USING YOUR PERSONAL BANKING PRODUCTS

Part A of this booklet describes how you use your personal banking products,

security requirements and key features and services. If we make electronic banking

available, for example, through online banking, mobile banking, phone banking,

direct debits and credits, EFTPOS and credit and debit cards, you may give us

instructions electronically, and we are authorised to carry out those instructions

under the terms of the agreement between you and us.

Acceptable Use Policy

Our customers are important to us. This means that it is important that our

products, accounts and online banking services are not used in a way that harms

others or to perpetuate financial abuse.

You must not use our products, accounts or online banking services in a manner

which we determine on a reasonable basis does, or is likely to, result in financial

abuse. This can include where your conduct:

• is unlawful in a way that would reasonably cause harm to another person

• unreasonably impacts another persons’ ability to use our products, accounts

and services or

• is harassing, oensive, threatening, intimidating, abusive or caused or is likely

to cause or encourage physical or mental harm to another person or promotes

violence against any person, including customers of another bank.

Where we identify or are made aware of instances where in our reasonable opinion

a product, account or online banking service is being used in a manner that does

not comply with this Acceptable Use Policy as detailed above, we may respond

proportionately at any time, including immediately and without notice, and take any

action against you that is reasonably necessary to protect us or another person,

including:

• sending a cautionary notification requesting you to cease the conduct

13

EFTPOS or payment terminal

When we use the words ‘EFTPOS’ or ‘payment terminal’ we mean device

which accepts card payments.

HSBC Personal Banking Booklet

• restricting your access to a product or service

• blocking your accounts

• refusing to act on your instructions, including processing a payment or

• ending our banking relationship with you as set out in clause 50 (‘How can we

close your account or end this agreement?’).

If you are concerned about your banking safety, you can call us on

1300 308 008 (+61 2 9005 8220) or refer to our website at

hsbc.com.au/help/extra-care

Security

. HOW DO WE MAKE SURE WE’RE DEALING WITH YOU?

This clause applies to all products and services.

Before we provide information about your account, allow you to make payments

(where applicable), provide new services, open or close accounts and do other

things we’re asked to, we need to check your identity and make sure that the action

you’re asking us to take is authorised by you. The law may also require us to collect

identification information and verify your identity throughout our relationship.

You’ll need to undergo our verification of identity procedure before you open an

account. Depending on the type of account you open, we may use electronic

verification of identity (EVID). Otherwise, we’ll ask to see your identity documents

or ask to see these if you don’t pass EVID.

We may need to check that your signature on a document authorising a payment

matches a signature you’ve given us or on your card (if you have one). If you’re in a

branch, we may also ask for an identity document which has your photo on it (e.g.

a driver’s licence or passport).

Otherwise, where it is reasonable to do so, we’ll assume we’re dealing with you

and that we’re authorised to take action if your security details are used with phone

banking, online banking or mobile banking (or another service we provide for

accessing your accounts) or with a payment device (if you have one). We may add

other ways of checking your identity in the future.

14

HSBC Personal Banking Booklet

What is a ‘payment device’? What are ‘security details’?

This is a card (debit or credit), digital

wallet (such as Apple Pay or Google

Pay™), Secure Key (physical or digital)

or another device that you can use

(usually with security details) to make

payments, funds transfer and cash

withdrawal (where applicable), give

us instructions or access information

about your account.

These can be passwords, PINs,

passcodes, memorable data, biometric

data (such as a fingerprint, face picture

or voice ID) or any other information

or details that you’re required to

keep secret, that may be required to

authenticate a transaction or user, and

that you’ve set up with us or we give

you for use with a payment device

or phone banking, online banking or

mobile banking.

. KEEPING UP SECURITY

This clause applies to all products and services.

We’ll do all we reasonably can to prevent unauthorised access to your account.

You must also act reasonably to prevent misuse of your account by keeping your

payment devices and security details safe. If you don’t, we may take steps to

reduce loss, as described in clause 16 (‘Blocking payments, payment devices,

services and accounts and temporary transaction limits’) and you may become

responsible for the unauthorised payments and use on your account. Please see

clause 6 (‘What should you do if you suspect an incorrect payment, unauthorised

payment or mistaken internet payment from your account?’) for who is responsible

for unauthorised transactions.

Security Tips

These are tips for preventing misuse of your accounts (this isn’t a complete list) and

are for your information:

15

Your liability will be determined under the ePayments Code and not by these

tips.

HSBC Personal Banking Booklet

Don’t

7 allow anyone (other than an authorised signatory or third-party provider) to use

any payment device or tell them your security details or

7 choose security details that can be easily guessed by anyone else such as your

date of birth or a recognisable part of your name. This would be extremely

careless and may result in you being found responsible for unauthorised access

to your account using your security details or

7 write down or store any security details (such as a password or PIN) in a way

that can be understood or retrieved by someone else or keep them with your

payment device. Never allow your device or browser to automatically store your

banking passwords or

7 log in, or stay logged in, to an internet or mobile payment device or app if you’re

not in full control of it or it’s not in your possession or

7 tamper with any of the services (for example decompile, reverse-engineer,

translate, convert, adapt, alter, modify, enhance, add to, or delete) provided

through online banking or mobile banking or

7 use any services in any unlawful manner or purpose or act fraudulently or

maliciously (e.g. inserting a malicious code, virus, or harmful data into the

operating system of our online banking or mobile banking software).

Do

3 delete or deactivate any stored biometric access to a payment device (such as

fingerprint, face or voice ID) or to any device linked to a payment device used by

anyone else and

3 delete cards from a payment device or from any digital wallets accessed from

a payment device before you transfer possession of it to someone else (for

example if you sell it, give it to someone for repair or throw it away) and

3 follow all security measures provided by your mobile device manufacturer that

apply to your use of the mobile banking app or your mobile device. Never modify

the device or its system without the manufacturer’s permission (sometimes

referred to as ‘jail-broken’ or ‘rooted’), and always install and update all security

and software updates and

16

HSBC Personal Banking Booklet

3 keep your personal online banking account and mobile device secure by using

anti-virus and anti-spyware software and a personal firewall and

3 make sure you only access the online banking service directly from our website

or our ocial app from the app store. Don’t click on any email links and then

enter your personal details and

3 if you allow an authorised signatory or third party provider to use any payment

device or tell them your security details, make sure that they act reasonably

to prevent misuse of your payment devices and security details, including by

sharing these security tips with them and ask them to check our website for

additional tips.

Additional tips for protecting your account and for keeping your payment devices

and security details safe are on our website. Please check for any updates we

may make over time.

17

HSBC Personal Banking Booklet

18

. WHAT SHOULD YOU DO IF YOU SUSPECT AN INCORRECT

PAYMENT, UNAUTHORISED PAYMENT OR MISTAKEN INTERNET

PAYMENT FROM YOUR ACCOUNT?

This clause only applies to products that allow you to make payments from your

accounts – see your product terms.

What is an incorrect payment, unauthorised payment or mistaken internet

payment?

What is …

an incorrect payment? an unauthorised

payment?

a mistaken payment?

A payment that we have

made in error because

it has not been sent to

the person or account

you specified when you

asked us to make the

payment.

A payment made from

your account which

was not authorised by

you or someone you’ve

authorised to make

payments from your

account. A payment is

not ‘unauthorised’ where

it is performed by you or

by anyone else with your

knowledge and consent.

If you give someone

your payment device

or security details and

they use them to make a

payment, we may treat

the payment as if you

would have authorized

it depending on what

happened.

This is why you mustn’t

tell anyone your security

details or allow anyone

access to your payment

device.

A payment (other than

a payment using BPay®)

from your account using

a “pay anyone” banking

facility where funds are

paid into an account of

an unintended recipient

because you entered

a BSB and/or account

number that doesn’t

belong to the intended

recipient because of

your error or you being

advised of the wrong

details. This excludes

payments you made as a

result of a scam.

HSBC Personal Banking Booklet

19

What should you do?

If you think an incorrect unauthorised or mistaken internet payment has been

made, you need to report it to us. See clause 7 (‘What you must report to us’) for

further details. If you think a mistaken internet payment has been made, see the

clause ‘What happens if you make a mistaken internet payment?’ below.

Question Answer

What will we do

when you tell us

about an incorrect,

or unauthorised or

mistaken internet

payment?

We’ll let you know when we’ve received your report of an

incorrect, or unauthorised or mistaken internet payment.

We’ll investigate (and update you on) an unauthorised

payment in accordance with our obligations under the

ePayments Code. Please see clauses 58 (‘Transaction

Queries’), 59 (‘Complaints, disputed transactions and

investigations’) and 60 (‘Results of our investigations’)

for details about how to raise a transaction query, make

a complaint (if you are not satisfied with the outcome of

our investigation) and how we deal with investigations.

Will I always get my

money back?

For incorrect payments, yes, if we determine that the

payment was made due to our error, we will reverse the

payment, make any correction to your account in a way

that ensures you are no worse o and notify you as soon

as practicable.

For unauthorised payments, no. However, you may get

your money back in instances where:

• you have informed us immediately for circumstances

outlined in clause 7 (‘What you must report to us’) or

• you have told us about the transaction within the

timeframes set out in clause 59 (‘Complaints, disputed

transactions and investigations’) (where applicable)

and:

• a chargeback right exists and was found in your

favour or

• a recall of a payment from another bank is

successful.

HSBC Personal Banking Booklet

What happens if an unauthorised payment has occurred?

If we determine that the payment was an unauthorised payment, we will determine

your liability in accordance with the ePayments Code. This means that your liability

will generally be as set out in the following table:

Who’s responsible for unauthorised payments?

Question Answer

Can we take back a

refund we’ve made?

Yes. We can take back refunds after giving you reasonable

notice in the following circumstances:

• if information becomes available to us at a later date

and we can prove that you acted fraudulently or

• if a chargeback right that existed is later found to be

not in your favour or

• if we gave you a refund and we subsequently

determine that you are responsible for an unauthorised

payment (e.g. you knowingly gave your card and PIN to

someone else).

20

Will I always get my

money back?

See ‘What happens if an unauthorised payment has

occurred?’ below for more information.

For mistaken internet payments – see ‘What happens if

you make a mistaken internet payment?’ below.

When are you not

responsible?

Sometimes you’re not responsible. For example, where

you did not contribute to the loss a payment device or

passcode is forged, faulty, has expired or been cancelled

we’ve incorrectly debited your account twice there

has been fraud or negligence by us or a merchant or a

transaction that requires a passcode took place before

you were issued a passcode, or after you gave us notice

that the passcode was stolen or lost.

We will determine your liability in accordance with the

ePayments Code. You’re always responsible if you’ve

acted fraudulently.

HSBC Personal Banking Booklet

Who’s responsible for unauthorised payments?

Question Answer

What if it’s clear that

you’ve contributed

to the loss through

fraud or failed to

keep your security

details safe (for

example, you’ve

been extremely

careless in relation

to securing your

passcodes)?

You’re responsible for the losses from your account

that occur before you report the loss, theft or misuse

of your payment device or that you’ve failed to protect

your security details. We will determine your liability in

accordance with the ePayments Code.

What if it’s clear

you’ve contributed

to the loss by leaving

your card in an

ATM?

You’re responsible for losses that occur because you

did this, unless the ATM didn’t have reasonable safety

standards to try and reduce this risk. We will determine

your liability in accordance with the ePayments Code.

What if it’s clear

you’ve contributed

to the loss by having

unreasonably

delayed reporting:

• your lost, misused

or stolen payment

device or

• the fact that you

failed to keep

your security

details safe?

You’re responsible for all payments made from your

account made between when you first knew or should

have reasonably known that your device was lost

or stolen, to when you made the report. You are not

responsible for payments made after you report your lost,

misused or stolen payment device or security details.

We will determine your liability in accordance with the

ePayments Code.

21

HSBC Personal Banking Booklet

Who is responsible for technical problems?

Question Answer

What if there was a

fault with the system

or equipment that

you didn’t know

about?

You’re not responsible if there is a problem with the

payment that was caused by a fault with the system or

equipment of a party to a shared electronic network that

you didn’t know about. Our liability may be reduced if you

reasonably knew about the malfunction.

Limits on your loss

Could losses be

shared between us?

We will limit your liability for loss in accordance with the

ePayments Code. For example, if the unauthorised access

was your fault, but resulted in a loss that is more than

your daily limit, you may be responsible for the loss up to

your daily limit and we may be responsible for amounts

accessed over your daily limit.

What happens if you make a mistaken internet payment?

The first thing you need to do, is to tell us – see clause 7 (‘What you must report to

us’) for further details.

When you tell us that you’ve made a mistaken internet payment, we’ll acknowledge

this and will start investigating it. We’ll write to you within 30 Business Days to tell

you the outcome, and we aren’t required to do anything further if we don’t think

there’s been a mistaken internet payment.

You can report a mistaken internet payment by phoning us. Refer to clause 44

(‘How do we communicate?’) for how to contact us.

If we believe there has been a mistaken internet payment, we’ll ask (within 5

22

Important Information

We’re not responsible for payments where you gave us the wrong details.

When processing payment instructions, HSBC will only rely on the BSB

number, account number and bank details you provide, the account name is

not validated. Before proceeding with a payment instruction, it is important

that you always check the payment details provided carefully, because if the

payment is paid to an incorrect recipient, it may not be possible to recover it.

HSBC Personal Banking Booklet

Business Days of receiving your report) the receiving bank to return the money.

They must tell us within 5 Business Days that they’ve got our request and whether

the recipient who received the payment by mistake has enough money in their

account to cover the request we’ve made.

If we are satisfied that a mistaken internet payment has been made, the processes

we, and the receiving bank, will follow depends on when you reported the mistaken

internet payment, and whether the money is available, as set out in the table below.

23

Circumstances If reported

under 10 days

If reported

between 10 days

and 7 months

If reported after

7 months

There’s enough

money in the

account to cover

the mistaken

internet

payment.

If the receiving

bank agrees a

mistaken internet

payment has been

made, they must

return the money

within 5 Business

Days of receiving

our request,

if possible, or

otherwise within

10 Business Days

of our request.

If they don’t

agree a mistaken

internet payment

has been made,

they may ask

the mistaken

recipient’s

permission to

return the money

as soon as

possible, but there

is no guarantee

The receiving bank

will investigate the

payment within 10

Business Days of us

contacting them.

If the bank agrees

a mistaken internet

payment has been

made, they will:

• notify the mistaken

recipient and

prevent them from

withdrawing that

money for 10 further

Business Days and

• give the mistaken

recipient 10

Business Days

(starting from the

date their account is

blocked) to object or

prove they are

entitled to the

money.

If the receiving

bank agrees a

mistaken internet

payment has been

made, it must

get the mistaken

recipient’s

consent to return

the money.

If the receiving

bank doesn’t

agree a mistaken

internet payment

has been made,

they may ask

the mistaken

recipient’s

permission to

return the money

as soon as

possible, but there

is no guarantee

they’ll transfer the

money to you as

soon as possible.

HSBC Personal Banking Booklet

24

Circumstances If reported

under 10 days

If reported

between 10 days

and 7 months

If reported after

7 months

that they’ll give

permission, or

the money will be

returned.

If the recipient does

not, the receiving

bank will return the

money within 2

Business Days after

the 10 Business Days

has expired.

If the receiving bank

doesn’t agree a

mistaken internet

payment has been

made, they may

ask the mistaken

recipient’s permission

to return the money

as soon as possible,

but there is no

guarantee that they’ll

give permission, or

the money will be

returned.

There’s not

enough money

in the account

When there’s not enough money in the account to cover the

mistaken internet payment, the receiving bank may decide to:

• recover the full payment

• recover a partial payment or

• not to recover any funds.

If the receiving bank decides to recover the full payment, it

must take reasonable steps to recover the funds, for example

by taking instalment payments from the mistaken recipient.

Refer to clause 9 (‘Making payments on Business Days’) of this booklet on how we

define a Business Day.

HSBC Personal Banking Booklet

25

If the payment was to another bank in Australia and we’re unable to recover your

money, you can ask us in writing to give you all the information we’ve been given

by the bank that received the money, so you can try to recover the money yourself.

If you’re unsatisfied with any way the investigation or process has been dealt with,

either by us or the receiving bank, you can make a complaint by following the steps

set out under Part C: Other Important Terms, of this booklet.

The amount you are responsible for will always be determined by us by complying

with the ePayments Code.

. WHAT YOU MUST REPORT TO US

This clause only applies to products that allow you to make payments – see your

product terms - or where you use online banking.

You must tell us immediately if there is an incorrect payment, an unauthorised

payment or mistaken internet payment (see clause 6 (‘What should you do if

you suspect an incorrect payment, unauthorised payment or mistaken internet

payment from your account?’).

You must also tell us immediately, if you suspect that any of the following has

occurred:

• a card or payment device is lost, stolen or misused.

• an access code or PIN becomes known to someone else or misused.

• a transaction may have been made without your authority.

• you’ve lost a bank cheque or personal cheque or where you were issued a

cheque book linked to your account, your cheque book.

• you suspect your security details are no longer safe.

• you believe you have made a mistake in instructing us to make a BPAY®

Payment.

• you’ve been a victim of identity fraud.

• if there are any delays or mistakes in processing a BPAY® payment.

• A BPAY® payment that has been made by us hasn’t been authorised.

• if you’ve been fraudulently induced to make a BPAY® payment.

HSBC Personal Banking Booklet

How we will respond to your report

We may cancel your access method and/or restrict your account, if this is

necessary. Where we cancel your access method, we will arrange for you to select

a new one.

We’ll acknowledge your report by giving you a reference number that verifies the

date and time we were contacted. You must keep this reference number as proof

that we were advised.

We’ll ask you to give us information or other help and this may include information

to the police to assist with any investigation.

What if you find it after you have reported it?

If you recover a card that has been reported lost or stolen, the card must not be

used again. The card should then be cut in half.

If you find a payment device or cheque after you have reported it lost, stolen or

misused, do not use it. You must return it to us or destroy it if we ask.

Our fees to send you a new or replacement payment device or passcode

We currently do not charge a fee to issue a new or replacement payment device

or passcode.

. WHEN WE AREN’T RESPONSIBLE FOR THINGS THAT GO WRONG

This clause applies to all products and services.

For when we are not responsible for incorrect payment, unauthorised payment

or mistaken internet payments, see Clause 6 (‘What should you do if you suspect

an incorrect payment, unauthorised payment or mistaken internet payment from

your account?’). For unauthorised payments, we will determine your liability in

accordance with the ePayments Code. For everything else, we won’t be responsible

for any losses you may suer if we can’t perform, or we delay in performing, our

obligations under this or any of our other agreements with you as a result of:

• any legal or regulatory requirements. This includes for example those relating

to the prevention, detection or investigation of financial crimes such as money

laundering, terrorist financing, bribery, corruption, fraud, tax evasion, economic

sanctions, or other unlawful activity or

26

HSBC Personal Banking Booklet

• us reasonably believing that we may fail to comply with a law, regulation, code,

court order or other requirement imposed on us if we act or choose not to act

or

• abnormal or unforeseeable circumstances including but not limited to systems,

network or equipment interruptions or failures, which are outside our (or our

agents’ and/or subcontractors’) control and which we could not have avoided

despite all eorts to the contrary or

• a merchant or ATM retaining or not accepting your payment device or

instructions (or the way in which it is conveyed to you).

Payments

Here we explain when and how payments can be made. This section only applies

to products that allow you to make payments – see your product terms – or where

you use online banking.

How we manage payments can depend on a variety of factors such as whether the

payment is made within Australia, or whether it is in Australian dollars. There may

also be additional rules applicable to your type of account or method of payment

which can be found in Part C: Other Important Terms of this booklet or the specific

product booklet.

. MAKING PAYMENTS ON BUSINESS DAYS

This clause applies to all products and services that allow you to make or receive

payments.

We will usually process payments on Business Days. Some branches are open on

a Saturday and can accept payments, but these will be reflected in your account

on the next Business Day. Payments between HSBC Australia accounts you make

using online banking quoting your BSB and account number are processed 24/7.

27

HSBC Personal Banking Booklet

. ADJUSTING PAYMENTS TO YOUR ACCOUNT

We may adjust payments to or from your account and the account balance for

example where we discover an error, a cheque is dishonoured, or a payment is

reversed. This may result in changes to your account e.g. to the interest payable.

We may notify you afterwards.

. PAYMENTS INTO YOUR ACCOUNT (OTHER THAN BY CHEQUE)

This clause does not apply to payments in or out of credit card or personal loan

products.

Payments can be paid into your account in dierent ways and will be available to

you at dierent times.

Payment using: When you can use the money:

Cash

At our self-service ATMs that

accept deposits

Immediately

Over the counter at our

branches (AUD, USD and

HKD only)

Immediately (except on weekends where money

will be credited the next Business Day)

28

Business Day

Business Days are usually Monday to Friday excluding:

• National public holidays in Australia and

• public holidays of the US and the currency country or region if you are

making an International Transfer via branch or

• public holidays of the currency country or region if you are making an

International Transfer via online banking or

• public holidays of the UK and the currency country or region if you are

making an International Transfer via mobile banking.

HSBC Personal Banking Booklet

29

Payment using: When you can use the money:

At other banks if they allow

you to do so

Immediately after we receive your money from

the other bank

Electronic payments

All payments in Australian

dollars (not including Fast

Payments)

By the end of the Business Day the payment is

received

Fast Payments in Australian

dollars

Payments may be received within a few seconds

of the sender making it, 24/7. This will depend

on the other bank, and whether the payments

platform that allows this is running at the time.

All payments not in Australian

dollars

For Everyday Global Account and Foreign

Currency Bonus Savings Account

Within 48 hours of us receiving your money from

the other bank.

Transactions can be settled in the same foreign

currency.

For foreign currency payments, money will

be converted into Australian dollars using the

prevailing HSBC Real Time Exchange Rate that

applies to the relevant currency pair at the time of

processing, if any of the following applies:

• You don’t have a foreign currency account or

• The currency is not supported by Everyday

Global Account or the Foreign Currency Bonus

Savings Account or

• You have nominated an Australian dollar (AUD)

account to receive the payment.

For information on HSBC Real Time Exchange

Rates, see clause 21 (‘Foreign Currencies’), and

for information on applicable fees, see clause 34

(‘Receiving Money’).

HSBC Personal Banking Booklet

If you receive a payment in a dierent currency, we will convert it using the

prevailing HSBC Real Time Exchange Rate that applies to the relevant currency pair

at the time we process the payment. If the payment is to repay money you owe

us under an overdraft, there is a risk that the currency conversion may result in a

shortfall. We are not responsible for any exchange rate losses.

. DIRECT DEBITS

This clause only applies to products that allow you to make payments by direct

debit (or regular payments for credit products) – see your product terms.

Making payments by direct debit

You can set up a direct debit to make regular payments and fee payments

required under a loan with us. You should check with your financial institution if

direct debit is available from your nominated account before submitting a direct

debit request.

We will arrange for the money to be debited from a nominated account into

your HSBC account as authorised in your direct debit request. You must ensure

you provide us with correct debit account details. You must also ensure you

have sucient money in your account on the direct debit date for it to be made.

If you don’t, the direct debit will be rejected, you may incur fees (to cover our

reasonable costs incurred, and your bank may also charge you) and you must

arrange for your account to have sucient money within the next 7 days or

make the payment using another method. This may also impact your agreement

relating to the payment. We will provide you with 14 days’ written notice if we

make changes to our direct debit arrangements with you.

You may also authorise other merchants to direct debit your HSBC account to

collect payment. You can also ask us to give you a list of the direct debits and

recurring payments that you’ve made for up to 13 months.

Direct debit errors

You should contact us as soon as possible if you believe there is an error in

debiting your account. We will investigate this. If we find there was an error,

we will contact your other bank and ask them to adjust your account (including

any interest and charges) and let you know the outcome. If the error is due to

incorrect details you provided us, and we have debited an account that doesn’t

30

HSBC Personal Banking Booklet

belong to you, we may charge you a fee to cover our reasonable costs incurred in

fixing this and will return the money to the relevant account.

Cancelling a direct debit

See clause 19 (‘Cancelling or changing payments (other than cheques)’) of this

booklet for how to cancel a direct debit.

Your responsibility to update your direct debit

If you give someone else a direct debit authorisation, and you change your card

or account details, it is your responsibility to update your direct debit request. If

you do not, your payments may fail, and you may incur late payment fees.

. PAYMENTS INTO YOUR ACCOUNT BY CHEQUE

This clause only applies to products that allow you to pay cheques into your

account – see your product terms.

Depositing an Australian dollar cheque into your account

If deposited at our

branches:

Number of Business Days:

You’ll start earning interest On the day the cheque has been deposited

You‘ll be able to use the

money

Usually after 3 Business Days

We may not pay a cheque if there are reasonable grounds which are:

• if you have insucient funds in your account

• it’s a forgery

• it’s been materially altered

• it’s been reported lost or stolen

• a court order preventing the drawer’s account being used

• it’s been stopped by the drawer

• the date on the cheque is a future date

• it was dated more than 15 months earlier

31

HSBC Personal Banking Booklet

• it has been crossed ‘Not Negotiable Account Payee Only’ in favour of a person

other than you

• it is reasonably necessary to protect our legitimate interests.

If a cheque paid into your account is returned unpaid, we’ll tell you and take the

payment from your account. We may ask for payment again from the paying bank.

Paying foreign currency and foreign bank cheques into your account

We cannot always process a foreign cheque (including a cheque in AUD where

the paying bank is not in Australia). This may occur, for example, if exchange

controls apply. You’ll be responsible for the cost to us of processing or trying to

process a foreign cheque. We’ll take our charges, and any charges made by the

foreign bank or an agent we use to collect the payment, from the account you

told us to pay the cheque into.

To pay a foreign cheque into your account that has a dierent currency, we either

need to negotiate it or collect it. Whether we negotiate the foreign cheque or

collect it will depend upon our assessment of the risk involved in us negotiating

the cheque. Fees will apply. Our fees and charges are contained in Part B of this

booklet. The paying bank may also charge their fees and charges.

Negotiating a foreign cheque Collecting a foreign cheque

This means we’ll assume

that the cheque will clear.

We’ll convert the cheque into

Australian dollars using the

HSBC exchange rate at the time

of receiving the cheque and pay

that amount into your account

on within 3 – 4 Business Days

after we receive the cheque.

This means we’ll send the cheque to the

paying bank and only apply the payment to

your account when we receive the payment

from the paying bank. Before we apply it,

we’ll convert the amount into Australian

dollars using our HSBC exchange rate after

the paying bank pays us.

The time this takes will vary depending on

the paying bank or its country, and could take

between 6 – 8 weeks before the money is

deposited into your account. You can ask us

for details. We may use an agent to collect

payment.

32

HSBC Personal Banking Booklet

In both cases, if the foreign bank returns the cheque or asks for the money to

be returned, we’ll take enough money from your account to cover the payment

in the foreign currency. This is unlikely to be the same as the amount we paid

into your account if exchange rates have changed. We’ll do this even if you have

already spent the money and this may cause your account to become overdrawn

if you have insucient funds in your account. Fees and interest payable may

apply if your account becomes overdrawn – our fees and charges are set out in

Part B of this booklet.

Other cheque information

Where you were issued a cheque book linked to your account, we will only pay

the person named on the cheque if you cross the cheque with two parallel lines

with the words ‘not negotiable’ or ‘account payee only’, or you delete the words

‘or bearer’ which is pre-printed on the cheque. This provides extra security if your

cheque is lost or stolen.

Crossing a

cheque with

parallel lines

By crossing the cheque with two parallel lines, you’re telling

us not to pay the cheque over the counter. This means that we

can only pay the amount of the cheque into an account. This is

known as ‘crossing’ and is usually drawn vertically or in a right

elevation across the cheque, or in a right elevation in the top

left corner of the cheque.

Not

Negotiable

Writing ‘Not Negotiable’ between two parallel lines that have

crossed the cheque means that if the cheque is transferred

to a person, who is not the payee named on the cheque, the

unnamed holder has no greater rights to the cheque amount

than the person named on the cheque. This feature helps

protect the true owner of the cheque if it is lost or stolen.

For example, where a cheque has been stolen, the person who

had the cheque stolen from them and is named on the cheque

may recover the amount of the cheque from the unnamed

person who received payment, even if the person who

ultimately receives the payment had no part in the theft.

Not

Negotiable

Account

Payee Only

By writing ‘Not Negotiable Account Payee Only’ between

two parallel lines that have crossed the cheque, you’re telling

us that we can only pay the cheque into the account of the

named payee.

33

HSBC Personal Banking Booklet

Or bearer Our cheques are printed ‘or bearer’. This means that the

cheque is payable to the person presenting the cheque, unless

we suspect it has been stolen. By drawing a line through

the words ‘or bearer’, you’re telling us only to pay the payee

named on the cheque or to the person who has had the

cheque endorsed to them.

You will not receive a receipt from us where you deposit cheques in our branch

express boxes or when you post a cheque to us.

You can request us to stop a cheque by calling us or visiting one of our branches

and providing us the details of the cheque. We will need the cheque number,

payee name, date and amount of the cheque. A fee will apply – see clause 37

(‘Cheques’).

34

. PAYMENTS INTO YOUR ACCOUNT BY MISTAKE OR FRAUD

This clause only applies to products that allow you to make payments into your

account – see your product terms – or where you use online banking.

If we reasonably determine that a payment has been made into your account

as a result of mistake or fraud (including scams), we may take the money out of

your account and return the money to another person. Where that account has

insucient balance, we may take money from another account that you hold with

us so long as you are no worse o than had the payment not occurred. We may

also need to share information about you or your account with the sender and/or

their bank to do this.

We may not always be able to tell you before we do this. If we do not give you

prior notice we may give you general reasons for us taking action under this

clause afterwards (where it is appropriate for us to do so) but we do not have

to do so if we believe the law, or any regulation prevents us from doing so or

we believe doing so would compromise reasonable fraud prevention or security

measures, or cause harm to someone else.

If you receive a mistaken internet payment into your account, we will act in

accordance with the below table:

HSBC Personal Banking Booklet

35

Mistaken Internet Payments into your account

If reported to us less

than 10 days after the

payment is received

If reported to us

between 10 days and

7 months

If reported to us after

7 months

When we are contacted

by another bank, we will

investigate.

If we agree a mistaken

internet payment has

been made, we will

return the money from

your account within 5 –

10 Business Days.

Where you do not have

enough money to cover

the mistaken internet

payment, we may decide

to:

• return the full payment

• return a partial

payment or

• not return any funds.

If we decide to return the

full payment, we may

return the amount in

instalments.

If we don’t agree it’s

a mistaken internet

payment, we will ask for

your permission to return

the mistaken amount.

We will investigate within

10 Business Days of

being notified by another

bank.

If we agree a mistaken

internet payment has

been made:

• we will let you know

and place a block on

your account for that

amount (you won’t be

able to withdraw this

amount) for 10

Business Days

• you have a right to

object or prove you are

entitled to the money

within 10 Business

Days of your account

block.

• If you do not object or

provide proof (or you

are unsuccessful in

doing so), we will return

the amount to the

sender without your

permission.

Where you do not have

enough money to cover

the mistaken internet

payment, we may decide

to:

• return the full payment

We will investigate within

10 Business Days of

being notified by another

bank.

If we agree a mistaken

internet payment has

been made, we will

return the amount to the

sender, once we have

your permission.

Where you do not have

enough money to cover

the mistaken internet

payment, we may decide

to:

• return the full payment

• return a partial

payment or

• not return any funds.

If we decide to return the

full payment, we may

return the amount in

instalments.

If we don’t agree it’s

a mistaken internet

payment, we may ask for

your permission to return

the mistaken amount.

HSBC Personal Banking Booklet

36

If reported to us less

than 10 days after the

payment is received

If reported to us

between 10 days and

7 months

If reported to us after

7 months

• return a partial

payment or

• not return any funds.

If we decide to return the

full payment, we may

return the amount in

instalments and we will

do so in accordance with

the ePayments Code.

If we don’t agree it’s

a mistaken internet

payment, we may ask for

your permission to return

the mistaken amount.

If you receive benefits from Services Australia or Department of

Veterans’ Aairs, we’ll always follow the

Code of Operation: Recovery

of debts from customer nominated bank accounts in receipt of Services

Australia income support payments or Department of Veterans’ Aairs

payments,

to ensure you will still have enough money to meet essential

living expenses before we return a mistaken payment amount (including

a mistaken internet payment amount).

. WHEN WE CAN REFUSE TO ACCEPT PAYMENTS INTO YOUR

ACCOUNT

This clause only applies to products that allow you to make payments into your

account – see your product terms – or where you use online banking.

We can refuse to accept a payment into your account if it’s reasonable for us to

do so in the following circumstances:

• we reasonably believe that accepting it might cause us to breach a law,

regulation, code, court order, obligation imposed on us (including by third

parties) or any related internal policy or procedure or, might expose us to action

from any government, regulator, or law enforcement agency or

HSBC Personal Banking Booklet

• acting reasonably, we consider that accepting it might have a significant impact

on our reputation or is not in line with acceptable levels of risk to our business

or

• we suspect that there is fraudulent or criminal activity on the account or in

connection with the payment or

• there are reasonable administrative reasons that apply (for example, a cheque is

not written correctly – see clause 13 (‘Payments into your account by cheque’))

or

• it is reasonably necessary to do so to protect our legitimate interests.

We’ll let you know, unless we believe the law or regulation prevents us from

doing so, or for fraud prevention or security reasons.

16. BLOCKING PAYMENTS, PAYMENT DEVICES, SERVICES AND

ACCOUNTS AND TEMPORARY TRANSACTION LIMITS

We can block or suspend a transaction, your use of any payment device (and

your access to related services such as phone, online or mobile banking), keep

hold of your payment device, freeze your account or place temporary transaction

limits on your account if we reasonably believe it’s necessary because of:

• a significantly increased risk that you may be unable to pay any money you owe

us on the relevant account, or may no longer meet the minimum balance

required for your account or

• a significant increase of risk to our business which exceeds our internal policies.

We consider these risks to include those which are legal, regulatory, compliance

or reputational in nature or

• suspected fraudulent or criminal activity of any kind that is connected with

you or your account whether or not the suspected fraudulent or criminal

activity occurs using your account (such as financial crime like money

laundering, sanctions breaches, tax evasion or scams) or

• we need to comply with or, we suspect it may cause us to breach a law,

regulation, code, court order, our internal policies or procedures, other

obligations imposed on us (including by third parties) or, might expose us to

action from any government, regulator or law enforcement agency or

37

HSBC Personal Banking Booklet

• security concerns (for example, if we know or suspect that your payment device

and/or security details have been misused) or

• behaviour by you that was illegal, oensive, threatening, intimidating, abusive

or caused harm to another person or

• in the case of digital wallets, we are told to by the digital wallet provider or if our

arrangements with them are suspended or terminated or

• reasonable regulatory or administrative reasons or

• your account is in the process of being closed or

• we make a reasonable request for information, and you don’t give it to us.

If we do this, we may let you know why reasonably soon afterwards, unless we

believe the law, or any regulation prevents us from doing so or we believe doing

so would compromise reasonable fraud prevention or security measures, or

cause harm to someone else.

Any scheduled payments during any block or after closure will not be made

and we are not responsible for any losses this may cause. We’ll unblock the

transaction, payment device or service as soon as we believe the reason for it

ends (we may ask you for more information to help us assess if this is the case)

and if it doesn’t, we may reject your payment, keep and close your payment

device and refuse to issue replacements, close access to related services and

close your account.

17. HOW WE DECIDE WHETHER TO MAKE A PAYMENT FROM

YOUR ACCOUNT

This clause only applies to products that allow you to make payments from your

account – see your product terms – or where you use online banking.

We’ll make a payment from your account if you ask us to unless:

• you don’t have enough money in your account (including any overdraft we’ve

agreed) or

• you haven’t given us the account or reference details, or we know the details

you’ve given us are incorrect or

38

HSBC Personal Banking Booklet

• you’ve asked us to make the payment in a particular way and the recipient’s

bank doesn’t accept them or

• you’ve not provided any extra identification or information about the payment

that we’ve reasonably asked for or

• the payment exceeds a limit that we tell you when you make the payment or

• we need to block the payment – see clause 16 (‘Blocking payments, payment

devices, services and accounts and temporary transaction limits’) above.

When working out whether you have enough money in your account to make a

payment we include all payments that we know are due to be made out of the

account that day.

If you don’t have enough money at the start of the day to make a payment, and

you’ve set up a future payment or, where you were issued a cheque book linked

to your account, or a cheque payment is due, we’ll check again later that day

to see if we can make it (unless you’re trying to make the payment on a non-

Business Day).

If when we check again, we’re able to make some, but not all, of the payments

you’re trying to make that day, we’ll pay cheques first and then direct debits

and standing orders and, if there’s more than one, we’ll start with the smallest

payment. Any payments that we can’t make will be returned unpaid. There may

be fees we charge for any returned payments.

You’ll know we’ve refused to make a payment if:

• you’re making it via online banking or using mobile banking or phone banking

or

• you’re using a payment device (such as a card),

because the payment won’t be accepted. Where we refuse a payment, we’ll

make information available about why and what you need to do to correct any

errors that made us refuse it through online, mobile and phone banking. We’ll let

you know this information unless we believe the law, or any regulation prevents

us from doing so or for fraud prevention or security reasons or we think it will

cause harm to someone else.

39

HSBC Personal Banking Booklet

18. PAYMENTS FROM YOUR ACCOUNT

This clause only applies to products that allow you to make payments from your

account – see your product terms – or where you use online banking.

Cash withdrawals in branch If you’re withdrawing cash in branch:

3 Only AUD, USD or HKD can be withdrawn and you may be charged a fee.

Our fees and charges are contained in Part B of this booklet.

3 A number of our branches oer withdrawals of USD and HKD and

withdrawals in minimum multiples of 10 dollar notes in these currencies

apply. To find out please call us on 1300 308 008 or use our branch locator at

hsbc.com.au/locations

3 Please give the branch 24 hours’ notice for USD or HKD withdrawals, and we’ll

do our best to make this available, however it’s subject to currency availability

at an applicable branch.

Payments (other than by card or cheque)

To make a payment from your account you’ll need to give us details of the

account you want to make the payment to and any other details we ask for,

including payment references.

This is usually the BSB number and account number (or the equivalent

information for payments outside Australia) or (where available) a number that is

linked to these, such as a mobile number or Australian Business Number (ABN).

40

It’s your responsibility to check that the details are correct before asking us to

make a payment. We’ll make the payment using only these details, but we’ll

also ask you for the name of the person on the account.

Other banks and retailers may set their own restrictions and limits on transactions

and separate limits apply if you are making a transfer using our Global Transfers

service – see our Online Banking Terms.

We’ll process your payments in the order we receive your instructions.

HSBC Personal Banking Booklet

41

Type of payment Each user’s own daily limit

Between HSBC Australia accounts

you can operate

$500,000

To other accounts We’ll agree the limit with you.

Default limit: $5,000

Maximum limit: $50,000

To nominated accounts (service

available on request)

1

We’ll agree the limit with you.

Default limit: $100,000

Maximum limit: $250,000

BPAY® $25,000

1.

When we’re calculating the Australian dollar value of a foreign currency transaction to check if it’s

within the daily limit, we’ll use the HSBC Daily Exchange Rate that applies at the time you request

the transfer. For International Transfers made via mobile banking, the HSBC Real Time Exchange

Rate will always apply.

Cut-o time

This is the latest time on any given day that we can process instructions

or add payments to an account. Cut-o times may vary depending on the

currency of your payment, whether your payment is an internal transfer, to

another local bank or overseas. You can ask us for the relevant cut-o time

when you give us a payment instruction or by visiting our website.

We can’t control how a payee bank processes a payment so can’t guarantee

the exact date a payment will be received. Payments overseas take longer and

can typically take up to 10 Business Days or longer.

Note: if we don’t receive a payment request before the cut-o time on a

Business Day, we’ll treat your request as received on the next Business Day.

If you ask us to make a payment

on a future date then:

If you ask us to make regular

payments on future dates then:

We’ll make the payment on that date,

unless it’s a non-Business Day, in

which case we’ll make the payment on

the next Business Day.

We’ll make the payment on those

dates, unless any of them are a

non-Business Day, in which case the

payments will resume on the next

Business Day.

If you want to make a regular payment (such as a periodical payment) you must

set it up with us at least 3 Business Days in advance. If you’ve set this up to

be a specific number of regular payments, we don’t notify you when they’ve

finished, so you should check your statement regularly.

If you have set up a regular payment in a currency other than Australian dollars

(AUD), we’ll apply the HSBC Daily Exchange Rate that applies at the time we

process the payment.

Payments in foreign currencies

Please see clause 21 (‘Foreign currencies’) for more information on the HSBC

exchange rate we will use.

If you want to make a payment in a currency other than Australian dollars you can

ask us to convert the amount to be paid into that currency and we’ll tell you the

HSBC exchange rate that we’ll use. If you’re making this currency payment from

online banking after our currency cut-o time, we won’t tell you the HSBC exchange

rate that we will use, and your payment will be processed the next Business Day and

the HSBC Daily Exchange Rate at the time of our processing will apply. We won’t

change the rate if the payment goes ahead immediately. If the payment isn’t made

immediately, we’ll apply the HSBC exchange rate that applies at the time we process

the payment. If you make a payment to someone overseas, they’ll usually get it

within 10 Business Days, but it may take longer.

Currency cut-o times do not apply to International Transfers made via mobile

banking. For these payments, the HSBC Real Time Exchange Rate at the time we

receive the payment request will be used.

Where you make the same payment more than once within any 3 minute blocks

using our Global Transfers service, we will assume that you have made a mistake,

and will only process the first payment request.

You can also set up a periodical payment to make regular payments. If you have

42

HSBC Personal Banking Booklet

HSBC Personal Banking Booklet

insucient money in your account on 3 consecutive payment dates, we will cancel

the periodical payment. You may also be charged a dishonour fee. You can also

cancel a periodical payment through online banking or by visiting our branch at least

3 Business Days before the next payment date.

We have no control over when the person you’re paying processes a transaction, and

whether it’s in Australian dollars or a foreign currency. You should check this with

them. If they process payment in a foreign currency then you may have to pay more,

or less, depending upon the exchange rate at the time they process the transaction.

Payments by cheque

Where you were issued a cheque book linked to your account, you can only write

a cheque in Australian dollars – we do not issue foreign currency cheques.

To make a payment by cheque you need to write the name of the payee, the

amount of the payment (in numbers and words) and the date that you are signing

it. See clause 13 (‘Payments into your account by cheque’) which also contains

terms about making payments from your account by cheque.

Payments by Visa Debit cards (including digital wallet)

Visa Debit cards

Using your Visa

Debit card

Use your card for:

3 cash withdrawals

3 purchases

3 balance enquiries

3 deposits and withdrawals at our branches

You can also use your card by tapping it at an EFTPOS

terminal. You may have to enter your PIN if the purchase is

above a certain amount.

If you’re the only account holder, you can only have one card

linked to your account (including any overdraft facility). Joint

account holders can have up to two linked cards.

You can access up to two HSBC transactional accounts

linked with your card (or one if you have an Everyday Global

Account.) You must not use your card to purchase anything

illegal.

43

HSBC Personal Banking Booklet

Visa Debit cards

Digital wallets You can add your card onto a digital wallet (such as Apple

Pay or Google Pay™) and use it pay for goods and services.

Once a card is added to a digital wallet, you and any

additional cardholder can authorise transactions on the card

account. This is done by using the digital wallet in place of

the HSBC card. Some contactless payment terminals may

require you to enter your card PIN and where the payment

terminal does not recognise authorisation by means of

biometric data or the mobile passcode.

If a card is used through a digital wallet, the same terms

of your agreement apply as if the card was used as a card

without the digital wallet.

We do not provide services related to the digital wallet,

these are done so by other providers (such as Apple and

Google). Our obligation to you in relation to a digital wallet is

limited to securely providing information to other providers

(such as Apple or Google) in order to allow you to use your

card through a digital wallet on a mobile device. You should

always read the terms and privacy policy of a digital wallet

provider, and make sure they are credible.

Visa Debit card

limits

The below daily limits apply to your card each day between

12am to immediately before 12am on the following day,

AEST / AEDT.

Daily ATM/

EFTPOS

Withdrawal

Limit

Daily Visa

Transaction

Limit

Standard daily limit $2,000 $10,000

Maximum daily limit

You can request to change your

daily limit by contacting us

$5,000 $20,000

44

HSBC Personal Banking Booklet

If you use your Visa Debit card:

To make a purchase To make a payment

by giving the person

your card number and

expiry date

To withdraw cash

We’ll place a hold on this

money and it won’t be

available for you to use (as

this money is on hold and

will be taken from your

available balance), until

the Pending Transaction

is cleared for payment.

That person is entitled to

ask us to pay them from

your account, we have

to pay them and the left

column will apply.

We’ll take this money

if it’s available in your

account subject to limits

(discussed below).

45

Pending Transaction

Pending Transaction occurs when a payment has been authorised but is

still waiting for merchant confirmation. This amount is then deducted from

your available balance, not your account balance. The transaction will

show as pending on your account until the payment process is complete.

Pending transactions generally take up to 3 – 10 Business Days to process.

If you let a merchant use your card for pre-authorised payments (such

as a security deposit for a hotel booking or car hire), the money will be

deducted from your available balance and the merchant can hold this

money for up to 31 days.

Visa Debit cards

Merchants and other banks may set their own daily limits

and restrictions on card use including transaction limits. We

are not responsible for goods or services obtained by using

a Visa Debit card unless we have sold you those goods or

services.

Cancelling your

Visa Debit card

You can cancel your card by giving us notice and confirming

that you have destroyed your card. You can find more

information on Visa Debit cards at hsbc.com.au/debit

We may cancel your card when it is reasonably necessary to

protect you or us (for example, when we suspect fraudulent

activity). We will tell you if we cancel your card, and the

reason, unless we are prohibited from doing so.

HSBC Personal Banking Booklet