NON INDIVIDUAL ACCOUNT OPENING FORM

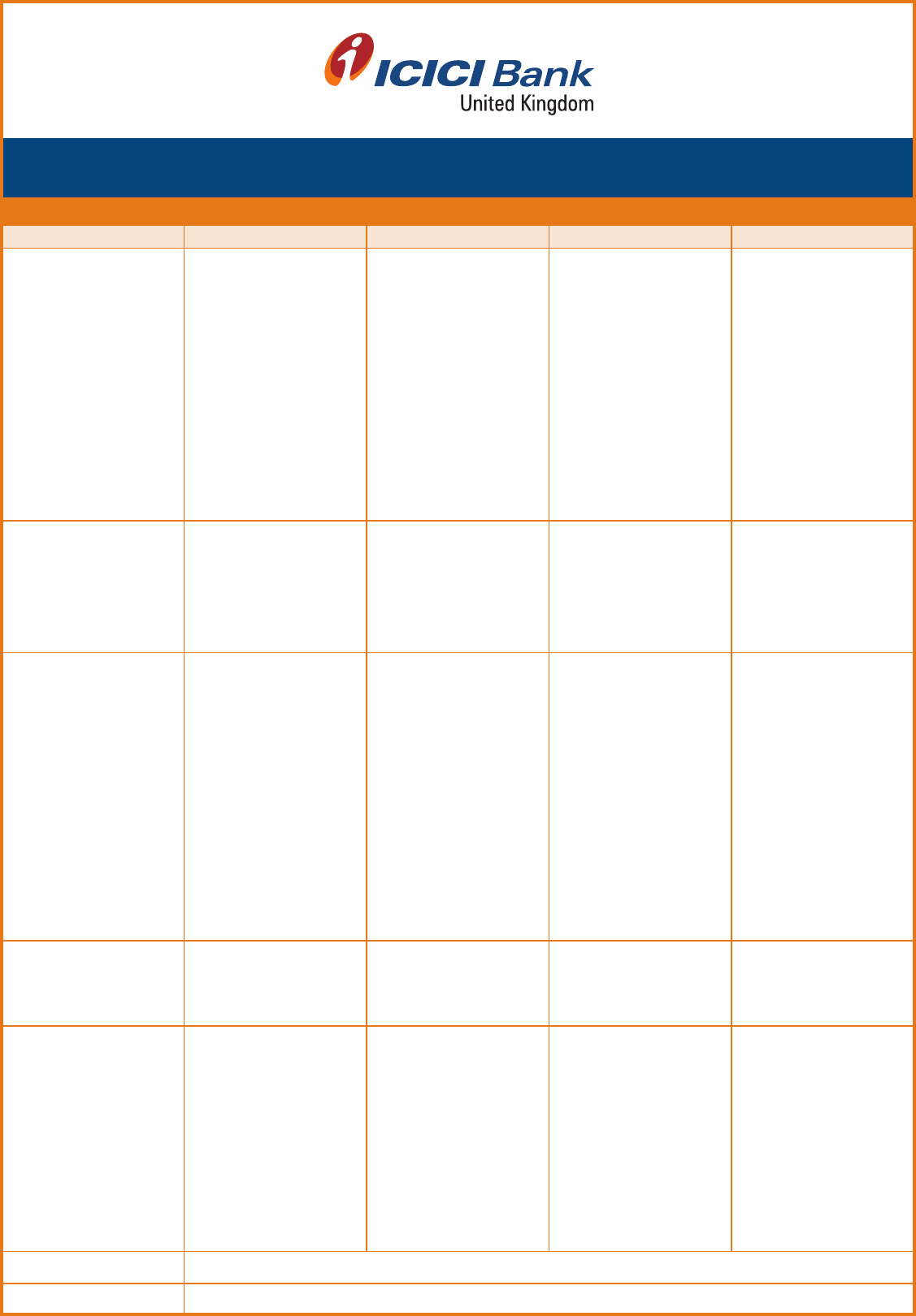

Documents required for account opening (please note bank may request additional documents to be provided in support of any application to open an account)

Document Type Proprietorship Firm Partnership Firm Limited Companies Trusts/Charity

Identity Of Business 1.Declaration by proprietor

(along with proof of trading

by providing invoice in the

name of the Proprietorship

Firm)

2.Bank statement in name

of the proprietorship firm for

the last 3 months

1. Original Partnership Deed

for verification along with

certified copy of Partnership

Deed (certified by any one of

the partners)

1. Certification of

Incorporation

2.List of all directors (this

needs to be certified by an

Independent Chartered

Account/Solicitor on their

letterhead)

3. Shareholding pattern

of the company clearly

specifying identity of all the

entities with

>

25% holding (this needs

to be certified by an

independent Chartered

Accountant/ Solicitor

on their letterhead)

1.Certification of

Registration of

Trusts/Charity/Society

2. Certified copies of rules

and regulations/bye-laws.

3.Complete list of trustees/

management committee/

governing body some more

information required:

a. Profile of the trust/charity/

society

b. Charity Framework

c. Summary of information

report on the

charity/trusts/society

d. Copy of the charity report

(for charity only)

Authority For Bank

Account

Proprietor’s Mandate letter

( as per format provided in

Section L)

Partnership Mandate Letter

(as per format provided in

Section L on the firm’s

letterhead and signed by all

the partners)

Board Resolution (as per

format provided in the

Section L on the company

letterhead and certified

by at least two officials -

director/secretary - of the

company)

Board Resolution (as per

format Provided in the

Section L on the

charity/trusts/societies

letterhead and certified

by at least two officials -

director/secretary of the

trust/Charity/Society)

Address Of Business 1.Current Council Tax

Demand letter (within 3

months) or

2.Current Bank Statement

(within 3 months) or

3. Current Utility Bills (except

Mobile Phone) (within 3

months)

or

4. Declaration from

proprietor that

trading address and

proprietor’s

address are same

*Statement/Bills printed

from the Internet are NOT

accepted

1.Current Council Tax

Demand letter (within 3

months) or

2.Current Bank Statement

(within 3 months) or

3. Current Utility Bills (except

Mobile Phone) (within 3

months) or

4. Certificate from an

independent chartered

accountant/solicitor (if no

address proof available)

*Statement/Bills printed

from the Internet are NOT

accepted

1.Current Council Tax

Demand letter (within 3

months)

or

2.Current Bank Statement

(within 3 months) or

3. Current Utility Bills (except

Mobile Phone) (within 3

months)

or

4. Certificate from an

independent chartered

accountant/solicitor (if no

address proof available)

*Statement/Bills printed

from the Internet are NOT

accepted

1.Current Council Tax

Demand letter (within 3

months)

or

2.Current Bank Statement

(within 3 months)

or

3.

Current Utility Bills (except

Mobile Phone)

(within 3 months) or

4. Certificate from an

independent chartered

accountant/solicitor (if no

address proof

available)

*Statement/Bills printed

from the Internet are NOT

accepted

Identity Proof of

Authorised

Signatory/Signatories/

Proprietor/Ultimate

Beneficial Owner

1.Valid passport or

2.Valid photo card driving

licence (full) or

3. National identity card

1.Valid passport or

2.Valid photo card driving

licence (full) or

3. National identity card

1.Valid passport or

2.Valid photo card driving

licence (full) or

3. National identity card

1.Valid passport or

2.Valid photo card driving

licence (full) or

3. National identity card

Address Proof of

Authorised

Signatory/Signatories

Proprietor/ Ultimate

Beneficial Owner

1.Current Council Tax

Demand letter (within 3

months)

or

2.Current Bank Statement

(within 3 months) or

3. Current Utility Bills(except

Mobile Phone) within 3

months or

*Statement/Bills printed

from the Internet are NOT

accepted

1.Current Council Tax

Demand letter (within 3

months)

or

2.Current Bank Statement

(within 3 months) or

3. Current Utility Bills(except

Mobile Phone) within 3

months or

*Statement/Bills printed

from the Internet are NOT

accepted

1.Current Council Tax

Demand letter (within 3

months)

or

2.Current Bank Statement

(within 3 months) or

3. Current Utility Bills(except

Mobile Phone) within 3

months

or

*Statement/Bills printed

from the Internet are NOT

accepted

1.Current Council Tax

Demand letter (within 3

months)

or

2.Current Bank Statement

(within 3 months)

or

3. Current Utility Bills(except

Mobile Phone) within 3

month

or

*Statement/Bills printed

from the Internet are NOT

accepted

All documents listed for identity can be used as address proof provided the same is NOT submitted as proof of identity.

Financials Latest Annual Report/ Financial Statements Of The Business

1

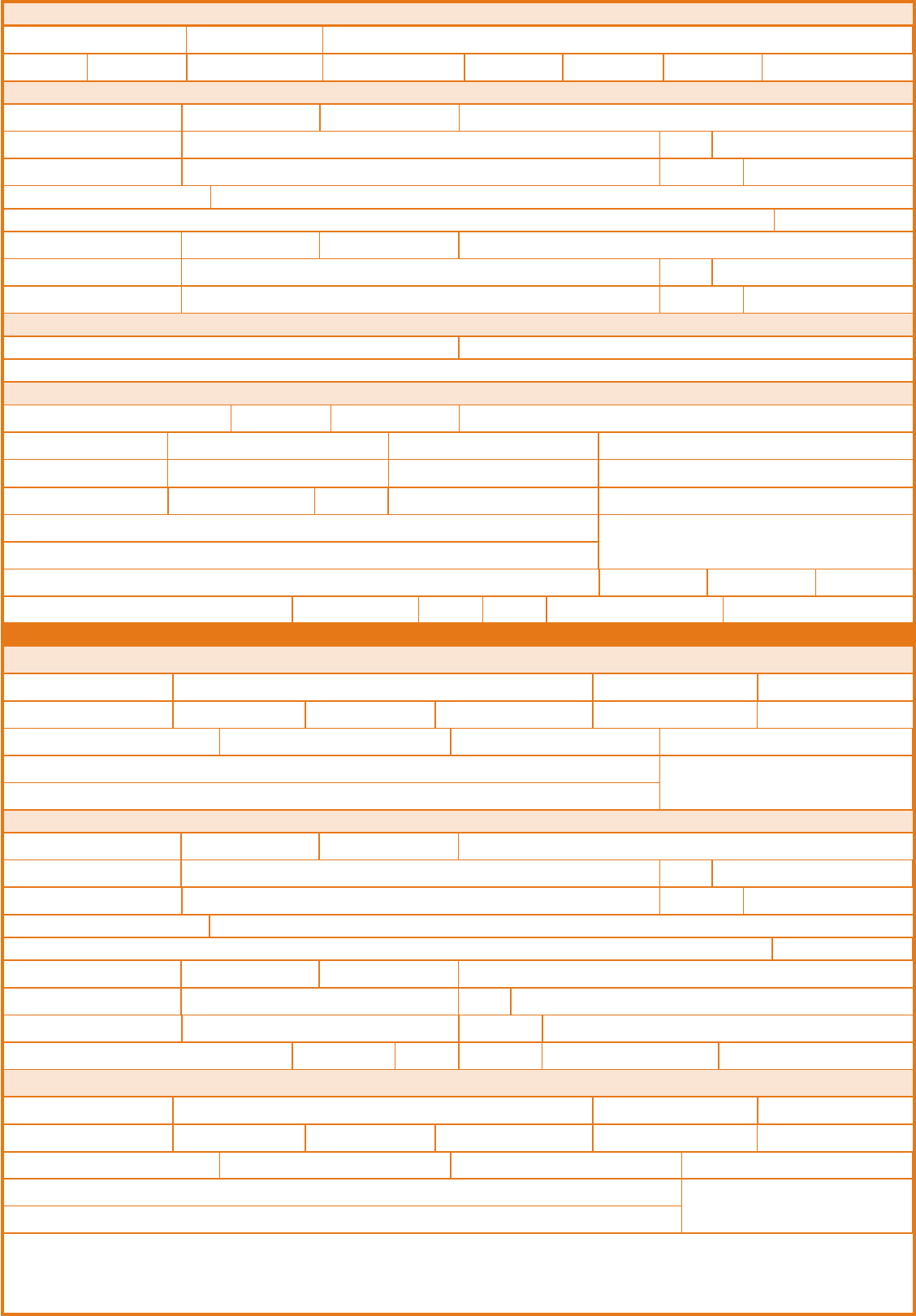

Section A – Business Details

Constitution Details

Business Name*

Registration Number* Date Of Establishment/Incorporation*

Country Of Incorporation* Tax Reference/VAT No.*

SIC Code (for UK incorporated entities only)

□ N/A

SIC Description

Are you a (select if applicable)

□ Credit Institution □ Debt Guaranteed Security Member

□ Pension/Retirement Funds □ Collective Investment Undertaking

□ Small Local Authority □ Insurance/Reinsurance Undertaking

(by ticking on any of the above; you become a part of the exclusion list specified under FSCS guidelines; for more information you can visit this link

http://www.fscs.org.UK/globalassets/disclosure-materials/fscs_2015_online-leaflet.pdf)

Registered Address

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Business Address (if different) □ Same as above

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Date of moving into this address

Previous Address (if applicable, or time at current address is less than 3 years)

□ N/A

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Contact Details

Business Telephone No.* + Mobile No.* +

Business E-Mail Address*

Industry Type*

Your business finances for the previous financial year; if you are a newly incorporated company, please provide projections for the current financial year

Actual Annual Sales Turnover* £ Balance Sheet Total* £

Actual Net Worth* £ No. Of Employees*

Your confirmation of account usage

What business purpose(s) will the account be used for?*

What will be the main type(s) of credit & debit transactions expected in the account (please include details of volume, amounts and the frequency of transactions?*

Credit Transactions*

(Type/Amount/Frequency)

Debit Transactions*

(Type/Amount/Frequency)

2

Constitution Type*

□ Sole

Proprietor

□ Partnership

Firm

□ Limited

Company

□ Trust/Charity □ Others

Registration Number Given By FCA/PRA/EU Authority

Section B – Account & Services

Type of Account

□ Current □ Savings □ Fixed Deposits

Currency Of Account*

□ GBP □ EUR □ USD

Branch Preference*

□ Birmingham □ East Ham □ Harrow

□ London □ Manchester □ Southall □ Wembley

What country/countrie(s) does the business deal with and for what

purpose(s)?*

DD / MM / Y Y

(Please specify)

MM / Y Y Y Y

Country Code / Area Code / Number

Country Code

Name (as per passport)*

Section C (Authorized signatories/Directors/Shareholders/Online users)

Identification Details

Type Of Identification*

□ Passport □ Driving License □ Others

Are you an ICICI Bank UK PLC Account Holder*

□ Yes □ No

If Yes; Customer Identification No.

Do you need a Debit Card? (Offered only to Authorised Signatories with a single mode of operation)

□ Yes □ No □ N/A

Identification Number* Valid Till*

Tax Reference Number* Social Security Number (if issued)

Name (as per passport)*

.

3

Address Details

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Previous Address (if applicable, or time at current address is less than 3 years)

□ N/A

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Contact Details

Business Telephone No.* + Mobile No.* +

Business E-Mail Address*

Individual’s Details 2

Address Details

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Previous Address (if applicable, or time at current address is less than 3 years)

□ N/A

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Contact Details

Business Telephone No.* + Mobile No.* +

Business E-Mail Address*

Nationality* Country Of Residence* Date Of Birth* Place Of Birth*

Identification Details

Type Of Identification*

□ Passport □ Driving License

□ Others

Identification Number* Valid Till*

Tax Reference Number* Social Security Number (if issued)

Date of moving into this address*

Are you an ICICI Bank UK PLC Account Holder*

□ Yes □ No

If Yes; Customer Identification No.

Do you need a Debit Card? (Offered only to Authorised Signatories with a single mode of operation)

□ Yes □ No □ N/A

Position in the Company

□ Authorised Signatory □ Director □ Corporate Internet Banking User □ Other

□ Shareholder (UBO) – Please tick only if the % of ownership is more than 25%

□

N/A

Percentage of ownership (if you are a shareholder (UBO)) _____%

Position in the Company

□ Authorised Signatory □ Director □ Corporate Internet Banking User □ Other

□ Shareholder (UBO) – Please tick only if the % of ownership is more than 25%

□

N/A

Percentage of ownership (if you are a shareholder (UBO)) _____%

Nationality* Country Of Residence* Date Of Birth* Place Of Birth*

Date of moving into this address*

Individual’s Details 1

Mr./Mrs./Ms.

DD / MM/ YYYY

MM / Y Y Y Y

Country Code / Area Code / Number

Country Code

(Please specify)

DD/ MM/ YYYY

(Please specify)

Mr./Mrs./Ms.

DD / MM/ YYYY

MM / Y Y Y Y

Country Code / Area Code / Number

Country Code

(Please specify)

DD/ MM/ YYYY

(Please specify)

Name (as per passport)*

Nationality* Country Of Residence* Date Of Birth* Place Of Birth*

4

Individual’s Details 3

Identification Details

Type Of Identification*

□ Passport □ Driving License □ Others

Address Details

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Previous Address (if applicable, or time at current address is less than 3 years)

□ N/A

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Contact Details

Business Telephone No.* + Mobile No.* +

Business E-Mail Address*

Section D – Related Co

mpany details (Parent company /Holding company/Company director/Controlling company)

Address Details

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Are you an ICICI Bank UK PLC Account Holder*

□ Yes □ No

If Yes; Customer Identification No.

Previous Address (if applicable, or time at current address is less than 3 years)

□ N/A

Company Details 2

Date of moving into this address*

Date of moving into this address*

Identification Number* Valid Till*

Tax Reference Number* Social Security Number (if issued)

Are you an ICICI Bank UK PLC Account Holder*

□ Yes □ No

If Yes; Customer Identification No.

Do you need a Debit Card? (Offered only to Authorised Signatories with a single mode of operation)

□ Yes □ No □ N/A

Company Type

□ Parent Company □ Director □ Controller

□ Immediate Owner (Holding Company) – Please tick only if the % of ownership is more than 25%

□ N/A

Percentage of ownership _____ (%) (If you’re an Immediate Owner or a Parent Company)

Company Type

□ Parent Company □ Director □ Controller

□ Immediate Owner (Holding Company) – Please tick only if the % of ownership is more than 25%

□ N/A

Percentage of ownership _____ (%) (If you’re an Immediate Owner or a Parent Company)

Position in the Company

□ Authorised Signatory □ Director □ Corporate Internet Banking User □ Other

□ Shareholder (UBO) – Please tick only if the % of ownership is more than 25%

□ N/A

Percentage of ownership (if you are a shareholder (UBO)) _____%

Company Name Company Registration No.

Country of Incorporation Date of Incorporation Company Tax Reference No.

Company Name Company Registration No.

Country of Incorporation Date of Incorporation Company Tax Reference No.

Company Details 1

Mr./Mrs./Ms.

DD / MM/ YYYY

MM / Y Y Y Y

Country Code / Area Code / Number

Country Code

(Please specify)

DD/ MM/ YYYY

(Please specify)

D D / MM / Y Y Y Y

MM / Y Y Y Y

D D / MM / Y Y Y Y

5

Company Details 3

Address Details

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Are you an ICICI Bank UK PLC Account Holder*

□ Yes □ No

If Yes; Customer Identification No.

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

Are you a ICICI Bank UK PLC Account Holder*

□ Yes □ No

If Yes; Customer Identification No.

Previous Address (if applicable, or the time at the current address is less than 3 years)

□ N/A

Previous Address (if applicable, or time at current address is less than 3 years)

□ N/A

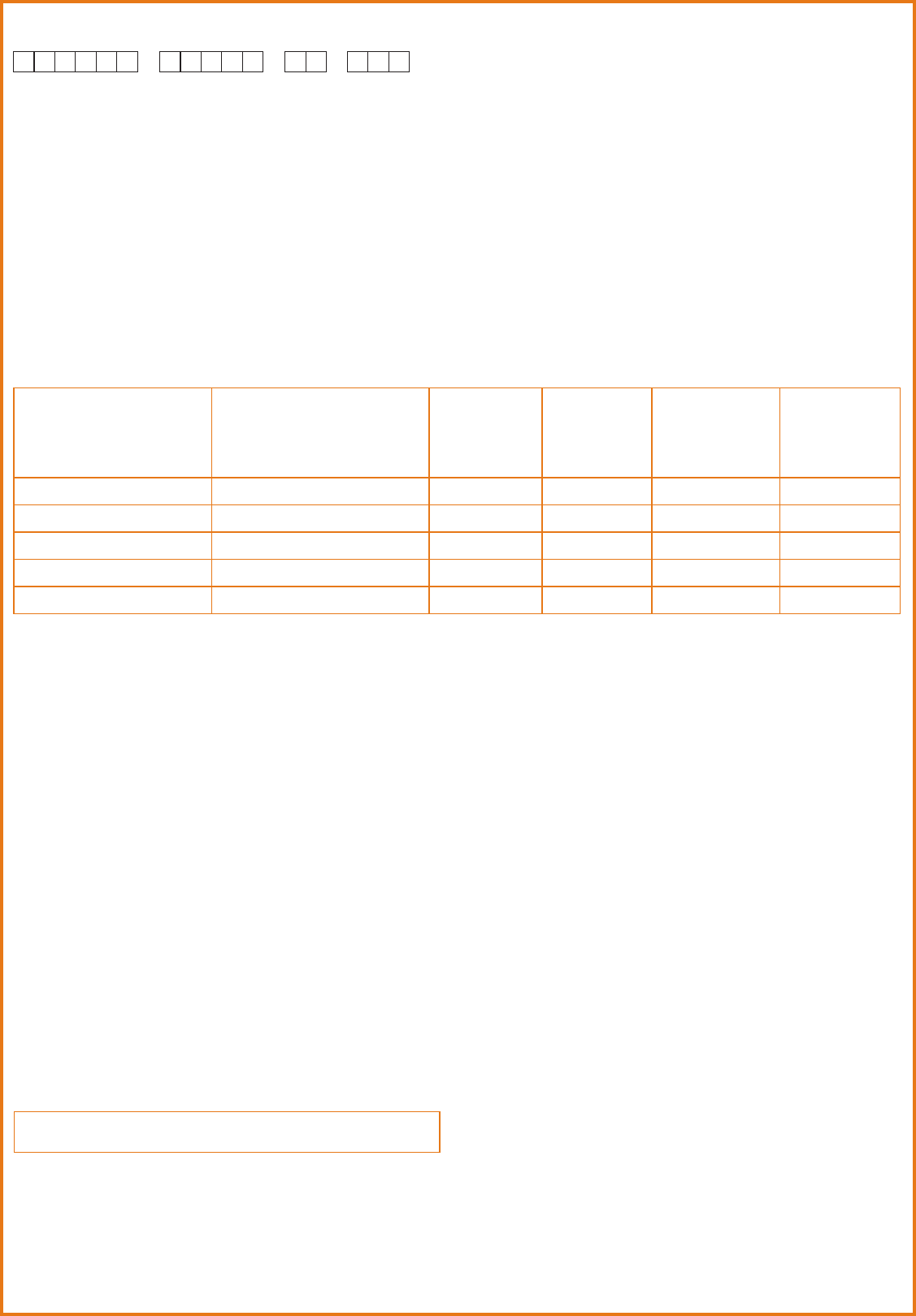

Section E – Tax Residency Details

For Sole traders/Proprietorship Concerns

We are required to collect details of your tax residency/citizenship under legislation for the automatic exchange of financial account information.

Are you a resident of tax in the UK? If yes; please fill details in below table

□ Yes □ No

Are you a citizen of the US? If yes; please fill w9 form and enter details in below table

□ Yes □ No

Are you a resident for tax in any other country? If yes; please fill details in below table

□ Yes □ No

Country Of Tax Residency Tax Identification Number (TIN)

Reason For Not Providing TIN

(Enter Reason A,B,C)

If Reason B Is Selected, Please

Explain Why You Are Unable To

Obtain A TIN

* The taxpayer identification number (TIN) is the unique identifier assigned

to you by the tax administration in the jurisdiction of tax residence. It is a

unique combination of letters and/or numbers used to identify an individual

or entity for the purposes of administering the tax laws of that jurisdiction.

It includes:

Reasons for NOT providing TIN (enter reason a, b or c)

• Social security number;

• Social insurance number;

• Citizen or personal identification code or number; or

• Resident registration number.

Reason A:The country where the account holder is a tax resident does NOT

issue TINs to its residents

Reason B:The account holder is otherwise unable to obtain a TIN or

equivalent number (please explain why you are unable to obtain a TIN in

the table below if you have selected this reason)

Reason C: No TIN is required. (Note. Only select this reason if the

authorities of the country of tax residence entered)

For Partnership/Limited Companies/Trusts/Charities/Others

Tax regulations require the collection of certain information about each account holder’s tax residency status. Please complete, where applicable, the

relevant sections below and provide any additional information as may be required. In certain circumstances there may be a requirement to share this

information with the tax authorities. If you have any questions about how to complete this form, please contact your tax advisor or local tax authority.

(to find the guidelines to fill this form can be found by visiting this link: http://www.icicibank.co.uk/personal/document-library.page?#busb)

If your organisation is resident in the United States or has multiple residencies, including the United States, in addition to the form, you should provide

a completed, signed and dated IRS form W-9.

Date of moving into this address*

Date of moving into this address*

Company Type

□ Parent Company □ Director □ Controller

□ Immediate Owner (Holding Company) – Please tick only if the % of ownership is more than 25%

□ N/A

Percentage of ownership _____ (%) (If you’re an Immediate Owner or a Parent Company)

Company Name Company Registration No.

Country of Incorporation Date of Incorporation Company Tax Reference No.

Address Details

Flat/Building No.* Flat/Building Name*

Street Name* City*

Country* Post Code*

MM / Y Y Y Y

D D / MM / Y Y Y Y

MM / Y Y Y Y

6

Tax residency (refer part-II of instructions)

A) I hereby certify that the entity or organisation identified above is incorporated and taxable in the US (specified US resident), please complete as appropriate:

□

Yes

□

No

If “Yes” you should provide a completed, signed and dated IRS form W-9 and please proceed to part iv and complete the declaration and signature section.

B) I hereby certify that the entity or organisation is a resident of: _______________________for tax purposes;

And

C) The entity or organisation’s tax identification number (TIN) or functional equivalent in its country of residence for tax purposes is: __________________

Or

D) The entity or organisation’s country of residence for tax purposes does NOT issue TINs or a

functional equivalent to its residents or the entity or organisation is otherwise unable to procure

TIN or a functional from its country of residence (please tick box if relevant).

And

If the entity or organisation is tax resident in more than one jurisdiction please complete the following section as appropriate for the additional jurisdictions.

country: __________________________________ TIN: _______________________ or TIN unavailable

□

country: __________________________________ TIN: _______________________ or TIN unavailable

□

Entity certification (refer part-III of instructions)

Section A – for a financial institution (FI) to complete If your organisation is a FI, please complete a) or b) below as appropriate:

(a) Participating FFI

□

or registered deemed compliant (including reporting model 1 FFI)

□

Please provide your organisation’s global intermediary identification number (GIIN):

□

If you do NOT have a GIIN but you are sponsored by another entity which does, please

Provide your sponsor’s GIIN above and state your sponsor’s name: _____________________________________

(b) If unable to provide a GIIN, please tick the reason why your organisation does NOT have a GIIN:

□

i) It is an exempt beneficial owner (i.e. An intersocial organisation):

□

ii) It is a certified deemed compliant financial institution (i.e. Registered charity):

□

iii) It is an owner documented foreign financial institution with specified us owners:

□

iv) It is a Non-Participating foreign financial institution:

□

v) Participating financial institution in Non-IGA jurisdiction:

□

vi) Other (please state): ______________________________________________________

□

For a Non-financial institution (NFI) to complete (if your organisation is a resident of the UK crown dependencies or Gibraltar, then please see Note 1, below):

If your organisation is NOT a FI, please confirm your organisation’s status below:

Active NFFE

□

Passive NFFE

□

Direct Reporting NFFE

Note 1: If our classification differs under the UK crown dependencies/Gibraltar intergovernmental agreements please note the alternative classification below:

UK-CD/Gibraltar classification: _______________________________________________________________________

□

7

If you are a direct reporting NFFE please provide your GIIN of the GIIN of your sponsoring entity and the name of the sponsoring entity:

_______________________________________________________________________

Please tick this box to confirm that the sponsoring entity has agreed with the entity identified above

□

(That is NOT a Non-Participating FFI) to act as the sponsoring entity for this entity:

For Passive NFFEs

For Passive NFFEs, please complete for each controlling person the table below (please continue on a separate sheet if necessary, signing, dating and attaching the

sheet to this form).

Controlling persons are defined as natural persons who exercise control over the entity or the shareholders of the entity based on local anti-money laundering

(AML) requirements.

In the case of a trust this means:

• The settlor;

• The trustees;

• The protector (if any);

• The beneficiaries or class of beneficiaries; and

• Any other natural person exercising ultimate effective control over the trust.

In the case of a legal arrangement other than a trust, it means persons in equivalent or similar positions.

If the controlling person(s) are US citizens then they should additionally complete and provide to us a w9 form.

Name Address

Tax residence(s)

(list all)

TIN(s) (provide

all)

Place of birth

(city/town & country)

and date of birth

(DD/MM/YYYY)

Type of controlling

person (Please

mention the

corresponding

number from the

below list*)

Declaration and signature

1. I authorise the recipient to provide, directly or indirectly, to any relevant tax authorities or any party authorised to audit or conduct a similar control of the

recipient for tax purposes, a copy of this form and to disclose to such tax authorities or such party any additional information that the recipient may have in

its possession that is relevant to the entity’s qualification for any benefits claimed on the basis of this declaration. I acknowledge and agree that information

contained in this form and information regarding income paid or credited for the benefit of relevant accounts may be reported to the tax authorities of the

country in which such income arises and that those tax authorities may provide the information in the country in which the entity is resident for tax

purposes.

2. I authorise the recipient to provide, directly or indirectly, a copy of this form and information relating to relevant accounts, as required by law, to: (i) any

person that has control, receipt, or custody of income to which this form relates; (ii) any person that can disburse or make payments of income to which

this form relates; or (iii) any party authorised to audit or conduct a similar control of aforementioned persons for tax purposes.

3. I certify that the entity named is the beneficial owner of all the income to which this form relates.

4. I understand that the bank is relying on this information for the purpose of determining the status of the applicant named above in compliance with the tax

regulations. The bank is NOT able to offer any tax advice on the regulations or its impact on the applicant. I should seek advice from a tax advisor for any

tax questions.

5. I undertake to notify the recipient of any change in circumstances that causes any certification on this form to become incorrect and to provide a suitably

updated form within 30 days of such change.

I certify that I have the capacity to sign for the entity. I declare that I have examined the information on this form and to the best of my knowledge and belief

the certification is true, correct, and complete.

Authorised Signatory Name: _______________________________________

Signature:

Date: _____________

a. The term ‘tax regulations’ refers to regulations created to enable automatic exchange of information and include the Foreign Account Tax Compliance Act

(FATCA), various agreements to improve intersocial tax compliance entered into between the UK, the Crown Dependencies and the Overseas Territories,

and the OECD Common Reporting Standard for Automatic Exchange of Information, as implemented in the relevant jurisdictions.

b. The definitions of these terms may be found in paragraphs §1.1471 – 1, §1.1471 – 5, §1.1471 – 6, §1.1472 – 1 and §1.1473 – 1 of the United States

Internal Revenue Code. If the country in which your organisation is resident has signed an Intergovernmental Agreement (IGA) with the United States or

with other relevant countries, please refer to the equivalent definitions in the relevant IGA and or the enabling legislation applicable to that country’s IGA.

c. Relevant accounts are any accounts opened with ICICI BANK UK PLC held by the entity or organisation Noted above.

*1.Controlling person of a legal person – control by ownership

2.Controlling person of a legal person – control by other means

3. Controlling person of a legal person – senior managing official

4.Controlling person of a trust – settlor

5. Controlling person of a trust – trustee

6. Controlling person of a trust – protector

7. Controlling person of a trust – beneficiary

8. Controlling person of a trust – other

9. Controlling person of a legal arrangement (non-trust) – settlor-equivalent

10. Controlling person of a legal arrangement (non-trust) – trustee-equivalent

11. Controlling person of a legal arrangement (non-trust) – protector-equivalent

12. Controlling person of a legal arrangement (non-trust) – beneficiary-equivalent

13. Controlling person of a legal arrangement (non-trust) – other-equivalent

DD/ MM/ YYYY

Section F – Company Details

If I/we have opted for Corporate Internet Banking, Debit Card services then I/we then declare that I/we have read, understood and agree to the terms

and conditions applicable to Corporate Internet Banking in relation to the operation of my/our Account as available on the website www.icicibank.co.uk,

and that I/we will adhere to all of the applicable terms and conditions.

I/We declare, confirm and agree:

a) That all the particulars and information given in this application form (and all documents referred to or provided herewith) are true, correct, complete,

and up-to-date in all respects and I/we have NOT withheld any information. I/We understand that certain particulars given by me/us are required for

regulatory reasons. I/We to provide any further information that ICICI BANK UK PLC or its group companies may require; and

b) That I/we have had No insolvency proceedings initiated against me/us, Nor have I/we ever been adjudicated insolvent. I/We have No County Court

Judgments registered against me/us; and

c) that I/we am/are NOT blacklisted under disqualified director register or adjudicated/convicted in any criminal proceedings under any criminal law.

I/We agree, undertake and authorise ICICI BANK UK PLC and/or its group companies to exchange, share or part with all the information, data or documents

relating to my/our application to other ICICI Group companies or credit reference agencies.

Marketing Consent

We would like to use your personal details in this Account Application from time to time to send you marketing information to inform you about ICICI Bank

UK PLC products and services which may be of interest to you. By opting into the following methods of communication, you confirm that we may contact

you for these purposes in one or more of the following ways:

□

By post □ By e-mail □ By social media □ By text □ By telephone □ No marketing by any of the above

You can, at any time, update the above preferences to request that we do NOT contact you by one, some or all channels, you can do this by visiting our

UK branches Please note: We DO NOT share your details with any third parties who may try to sell their products or services to you. Please also see our

privacy notice for more information in relation to how we collect and use personal information, http://www.icicibank.co.uk/personal/privacy-notice.page?

Section G – Authorisation

1. I/We consent to:

a. having read the list of important details/features of the product along with the Corporate Banking/Business Banking Terms and Conditions. I/We have

referred to the terms and conditions on the bank’s website link http://www.icicibank.co.UK/legal.html/inquired with the Bank’s relationship manager and

acquired a copy of the same.

b. my/our account is governed by the Corporate Banking/Business Banking terms and conditions and such other terms and conditions as specified by the

Bank from time to time; and

c. advising you promptly of changes, if any, in the mode of operation of the account, address and/or names of authorised signatories, etc. for the account

and such other changes along with appropriate board resolution if required.

2. I/we confirm the receipt of the information sheet and exclusion sheet. I/we also confirm that I/We have read the contents of these sheets.

3. I/We understand that on No occasion will our account be permitted by the Bank to go into overdraft. The Bank reserves the exclusive right in its sole

discretion to offer, limit or discontinue the overdraft facility.

4. The information provided in this application is correct to the best of my/our knowledge and belief. If false or inaccurate information is provided and fraud

is identified, details will be passed to regulatory authorities, including fraud prevention agencies to prevent fraud and money laundering.

Further details explaining how the information held by fraud prevention agencies may be used, can be obtained by writing to our Corporate Service team

at [email protected]. You can also refer to our account terms and conditions for further details.

5. I/We may choose NOT to be included in the Bank’s Customer Mail Information Programme by ticking this box.

□

6. I/We authorise the Bank to obtain information about our ownership structure or identity, credit history and other banking histories from one or more

credit reporting/rating agency, other banks or any other source. I/We understand that this information will be used in conjunction with the request to

open or modify the terms of a deposit account being submitted by me/us for which I/we will be authorised signatory (ies). I/We further understand if

information in the credit report results in a decision to either disallow my/our signing authority on the account or disallow opening the account, the Bank

will communicate these facts to me/us.

7. The information may also be used for financial statistical analysis (for example, credit scoring/rating). I/We also understand that NO information will be

disclosed outside the ICICI BANK UK PLC unless for fraud prevention purposes as required by law, and/or regulatory obligations and unless I/We am/are

in default under an agreement, in which case the Bank may disclose the fact to licensed credit agencies/other banks/building societies.

Signature: Signature:

8

Signature: Signature:

Name of Authorised Signatory 1

Name of Authorised Signatory 2

Name of Authorised Signatory 3

Name of Authorised Signatory 4

Section H – Mandates/Resolution (to be filled in as per the Constitution Type)

Letter of Proprietorship and Letter of Undertaking

I __________________________________________________________________________________, hereby declare that I am conducting business in the name

__________________________________________________________________________________, and I am the Sole Proprietor/Self Employed of the said firm.

I request ICICI BANK UK PLC (hereinafter referred to as “the Bank”) to open an account in the above name. The Bank is hereby authorsed to use this

application form to open any new account as and when required by me, until and unless I specifically opt to provide a new application form. I hereby

declare that the above information is true and correct to the best of my knowledge. I understand that the account will be opened on the basis of the

information provided by me.

I __________________________________________________________________, (Sole Proprietor of the firm), am authorised to convey to the Bank acceptance

on behalf of the firm of the terms and conditions contained in the application form and on the website www.icicibank.co.uk, and agree to such changes

and modifications in the said terms and conditions as may be suggested by the Bank, Nominate, substitute, revoke and vary mandate etc. from time to

time and to execute such deeds, documents and other writings as may be necessary if required for this purpose.

I have read and understood the terms and conditions and are hereby approved and accepted and I am hereby authorised to accept such modifications

therein as may be suggested by the Bank.

I hereby agree, and request to the Bank that any cheque or such other instrument made payable to me or in the name of the above firm may be deposited

in the said account.

I agree that the Bank be, and is hereby authorised to accept all valid online instructions through the ‘Corporate Internet Banking’ service singly from me in

respect of firms account(s). The firm agrees to hold the Bank harmless, and their interest protected on account of it executing such instructions in the

manner provided by me.

I agree to comply with the Bank’s rules in regard to the conduct of the accounts. I understand that the information I have given may be used to offer other

services from the Bank. In this connection, contact may be made to me personally, or by direct marketing means.

I _____________________________________________________, (Sole Proprietor of the firm), am authorised to operate on behalf of the firm through

‘Corporate Internet Banking’ service on the firm‘s accounts including by causing a debit balance in company’s account(s) with the Bank, and/or continually

operate the account(s) even when overdrawn, as per the access specifications authorised in the Corporate Internet Banking form.

I resolve to provide to the Bank in writing any changes in personal details or circumstances that may change from time to time.

Signature In Individual Capacity & As Sole Proprietor/Self Employed

Date: _____________

Partnership Mandate Letter

To

ICICI BANK UK PLC,

We the undersigned, (insert names of all partners) ________________________________________________________________________________being all

partners in the Firm of ________________________________________________________________________________________________(the “Firm”),here by

request ICICI BANK UK PLC (“the Bank”) to open Current Account/Fixed Deposit Account(s)/Bank Accounts in the name of the Firm on the basis of the

above information.

We hereby declare that the above information is true and correct to the best of our knowledge.

We authorize officials namely, ______________________, ______________________and ______________________ be and hereby singly/jointly authorised

to open and operate the Partnership’s account(s) with the Bank. The authorised officials are also authorised to operate on behalf of the Firm through

‘Corporate Internet Banking’ service on the Firm’s account(s).

We hereby authorise the Bank to open any new account in the above names as and when the authorised person(s) request for the same and in which case

all the terms and conditions contained in the application form and Corporate Banking/Business Banking terms and conditions should apply.

We hereby authorise the Bank, until the Bank receives from the authorised person(s) a notice in writing to the contrary, to treat and consider the authorised

officials as empowered to act on behalf of our said partnership in all transactions with the Bank, and to instruct the Bank with regard to any account or

banking transactions of the partnership, and in particular without prejudice to the generality of the foregoing.

The Bank is hereby authorised and requested to open account(s) in the name of the Firm and:-

• To honour and comply with all cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments and orders expressed to be

drawn, accepted, made or given by any one of us in the name of the Firm at any time or times, whether our banking account is overdrawn or any overdraft

is increased by any payment thereof, or in relation thereto, or is in credit, or otherwise but without prejudice to your right to refuse to allow any overdraft

or increase of overdraft and for any balance on the said account which may become due to the Bank at any time we agree to be jointly and severally liable.

9

DD/ MM/ YYYY

• To honour and comply with all instructions to deliver or dispose of any securities or documents or property held by the Bank on our behalf to hold us

liable on all agreements and indemnities in connection with the issue of letters of credit, drafts and telegraphic transfers and with all banking transactions.

Provided any such cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments, orders, instructions, agreements and

indemnities are signed by any one of us in the name of the Firm.

• To treat all cheques, drafts, bill of exchange, promissory Notes, acceptances, negotiable instruments and orders as being endorsed on our behalf and to

discount or otherwise deal with them provided such endorsements purport to be signed by any one of us in the name of the Firm.

• To honour all instructions in connection with our account(s) given by any one of the authorised officials in person or online through the Bank’s Corporate

Internet Banking service and in particular, but without limiting the generality of the foregoing, all instructions relating to instruments and securities and the

charging, pledging, disposal and withdrawal thereof are in order if given by any one of us in the name of the Firm.

The Firm agrees to provide to the Bank in writing any changes in details or circumstances that may change from time to time.

We have read and understood the terms and conditions and are hereby approved and accepted and the partners be and are hereby severally/jointly

authorised to accept such modifications therein as may be suggested by the Bank.

The Firm shall, as and when necessary, supply to the Bank a list of the current partners and, if applicable, other officials authorised to sign with specimen

signatures.

We certify that the signatures set down within Section I of this account opening form are those of all the partners and of any other officers of the Firm

authorised to sign, that such signatures are the genuine signatures of such persons and that such signatures operate as the specimen signatures of each

of such persons.

Further, the authorised partner(s) or any other person authorised by partners be and are hereby authorised to receive the login ID and passwords, as may

be sent by the Bank, for using services on Corporate Internet Banking and are authorised severally to convey to the Bank acceptance on behalf of the Firm

of any transactions as well as to enter into transactions on behalf of the Firm on Corporate Internet Banking.

Yours faithfully,

PARTNER 1: Signature Name (In Capitals): __________________________________________________________________ Date: _____________

PARTNER 2: Signature Name (In Capitals): __________________________________________________________________ Date: _____________

PARTNER 3: Signature Name (In Capitals): __________________________________________________________________ Date: _____________

Board Resolution Format For Companies

To

ICICI BANK UK PLC,

We hereby certify that a resolution of the Board of Directors of__________________________________________________________________ (‘Company’),

was passed at a meeting of the Board duly convened and held on the______________________________ and has been duly recorded in the minutes book

of the said Company.

It was resolved that:

a. To honour and comply with all cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments and orders expressed

to be drawn, accepted, made or given on behalf of this Company at any time or times whether the banking account or accounts of this company are

overdrawn or any overdraft is increased by any payment thereof, or in relation thereto, or are in credit or otherwise but without prejudice to the Bank’s

right to refuse to allow any overdraft or increase of overdraft.

b. To honour and comply with all instructions to deliver, or dispose of any securities or documents or property held by the Bank on behalf of the

company; to hold the company liable on all agreements and indemnities in connection with the issue of letter of credit, drafts, and telegraphic transfers

and with all banking transactions. Provided any such cheques, drafts, bills of exchange, promissory Notes, acceptances, negotiable instruments and

orders, instructions, agreements and indemnities are signed by the persons holding the under mentioned offices for the time being.

c. To treat all cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments and orders as being endorsed on behalf of the

company and to discount or otherwise deal with them provided such endorsements purport to be signed by any of the Company’s authorised official

mentioned above.

4. The Company may avail the “Corporate Internet Banking” service for the account(s) opened with the Bank.

5. The above authorised officials are also authorised to operate the Company’s account(s) on behalf of the Company through “Corporate Internet

Banking” service of the Bank.

6. The Company’s officials, third party agencies (as authorised by the Company) ,employees may be provided a limited access of “Corporate Internet

Banking” services of the Bank with ‘view’ only or maker access to initiate payment/s which will only be approved by the above authorised officials (in

clause no.2) only.

10

1.. ICICI BANK UK PLC (’the Bank’) be appointed the Ba ers of the Company, regarding the Company’s account(s).

2.. The following authorised officials name , _______________________________________________________________________________________________

be and hereby □ singly / □ jointly authorised to open and operate the Company’s account(s) with the Bank,

3.. The Bank is hereby authorised and requested to open Bank Account(s) in the name of the Company and

DD/ MM/ YYYY

DD/ MM/ YYYY

DD/ MM/ YYYY

7. The Bank is hereby authorised to accept all valid instructions through the “Corporate Internet Banking” as per the below instructions specified under

this point. The Company does agree to hold the Bank harmless and their interest protected on account of it executing such instructions by the above

authorised officials in the manner provided.

8. The debit card is issued to authorised officials with a single mode of operation only

9. The aforesaid terms and conditions are hereby approved and accepted, and the authorised officials be and are hereby severally authorised to

accept such modifications therein as may be suggested by the Bank.To cancel all existing mandates (if any) in force at the date hereof with regard to

the Company’s existing account(s), which mandates are hereby terminated, provided that all authorities, instructions, instruments and transactions

authenticated in accordance with any existing mandate and purporting to have been given, made, issued or entered into prior to receipt by ICICI BANK

UK PLC of Notice of this Resolution shall have effect as between the company and ICICI BANK UK PLC as though this resolution had never been

passed.

10. The foregoing mandate and list of names remain in force until receipt by the Bank of a duly certified copy of resolution rescinding or amending the

same.

11. The Bank to be supplied with:

• A copy of the Company’s Memorandum & Articles of Association certified as being true, complete and up to date;

• The Company’s Certificate of Incorporation (to be copied and duly returned);

• If the Company is a Public Company, the Company’s Certificate to commence business; and

• Copies of any resolutions concerning the foregoing, which may be passed from time to time.

12. The Company agrees that any indebtedness or liability incurred by the Bank under this authority shall in the absence of any express written

agreement by the Bank to the contrary be due and payable on demand.

13. The Bank be and is by this resolution authorised to provide the Company’s auditors, from the time being and from time to time with such

information as the Company’s auditors may request from time to time, until Notice in writing to the contrary is received by the Bank.

14. The Company agrees to provide to the Bank in writing any changes in details or circumstances that may change from time to time.

15. The Company Secretary shall, as and when necessary, supply to the Bank a list of the current directors and, if applicable, other officials authorised

to sign with specimen signatures and the Bank may act on such lists signed by the Secretary.

16. The Company hereby confirms that NONE of the directors are or have been disqualified under the Company Directors Disqualification Act 1986, or

any similar overseas legislation covering the disqualification of directors or other officers of the company.

17. These resolutions are communicated to the Bank and shall constitute the Company’s Mandate to the Bank and remain in force until an amended

resolution can be passed by the Board of Directors and a copy thereof, certified by the Chairman and the Secretary or by any Director or the Secretary

acting or purporting to act on behalf of the Company shall have been received by the Bank.

18. In this resolution the expressions `Directors’ and ‘Secretary’ shall be construed as Director(s) and Secretary for the time being of the Company

and shall in the case of Director(s), include alternate Director(s) and in the case of Secretary shall include any Joint Secretary, Assistant Secretary or

Temporary Secretary.

19. We certify that the signatures set down within Section I of this account opening form are those of all the Directors, the Secretary and of any other

officers of the Company authorised to sign, that such signatures are the genuine signatures of such persons and that such signatures operate as the

specimen signatures of each of such persons.

Yours faithfully,

Director 1 Name:________________________________________________________ Signature:_________________________________ Date: _____________

Director 2 Name:________________________________________________________ Signature:_________________________________ Date: _____________

Company Secretary Name: ______________________________________________ Signature:_________________________________ Date: _____________

11

User Name

Transaction Limit Mode of Operation

(Singly/Jointly/

Severally)

Appover(s) Name(s)

From To

DD/ MM/ YYYY

DD/ MM/ YYYY

DD/ MM/ YYYY

Board Resolution for Trusts/Charity

To

ICICI Bank UK PLC

We hereby certify that a resolution of the__________________________________________________________________ (herein after referred to as Firm)

of __________________________________________________________________ were passed at a _____________________________________ Resolved that:

ICICI Bank UK Ltd (`the Bank’) be appointed the Bankers of the Firm, Regarding the Club/Society/ Charity/ Trust account(s) the bank and hereby authorised

and requested to open Bank Accounts in the above name immediately or as and when required in a future date and

To honour and comply with all cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments and orders expressed to be

drawn accepted made or given on behalf of this Firm at any time or times whether the banking account or accounts of this Firm are overdrawn or any

overdraft is or increase of overdraft.

To honour and comply with all instructions to deliver or dispose of any securities or documents or property held by the bank on behalf of the Firm; to hold

the firm liable on all agreements and indemnities in connection with the issue of letter of credit, drafts, and telegraphic transfers and with all banking

transactions.

Provided any such cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments and orders instructions agreements and

indemnities are signed by the persons holding the under mentioned offices for the time being _____________________________________

To treat all cheques, drafts, bills of exchange, promissory notes, acceptances, negotiable instruments and orders as being endorsed on behalf of the

Firm and to discount or otherwise deal with them provided such endorsements purport to be signed by _____________________________________

To cancel all existing mandates (if any) in force at the date hereof with regard to the Firm’s said Account(s) which mandates are hereby terminated.

Provided that all authorities, instructions, instruments and transactions authenticated in accordance with any existing mandate and purporting to have

been as though this resolution had never been passed. A list of the names and specimen signatures of the persons at present authorised to sign under

this resolution be furnished to the Bank. The foregoing mandate and list of names remain in force until receipt by the Bank of a duly certified copy of

resolution rescinding or amending the same.

The Bank be supplied with:

A copy of the Firms Rules and Regulations certified as being true, complete and up to date;

The Firms Certificate of Registration (wherever applicable)(to be copied and duly returned);

The copies of any resolutions concerning the foregoing, which may be passed from time to time;

The copy of Financial Statements if any;

The Firm agrees that any indebtedness or liability incurred by the Firm under this authority shall in the absence of any express written agreement by the

Bank to the contrary is due and payable on demand.

The Bank be and is by this resolution authorize to provide the Firm’s auditors from the time being and from time to time with such information as the Firm’s

auditors may request from time to time until notice in writing to the contrary is received by the Bank. The Firm agrees to provide to the Bank in writing any

changes in details or circumstances that may change from time to time.

The Secretary/Trustee shall, as and when necessary, supply to the Bank a list of the current governing body members and, if applicable, other officials

authorised to sign with specimen signatures and the Bank may on such lists signed by the Secretary/Trustee. These resolutions are communicated to the

Bank and shall constitute the Firm’s Mandate to the Bank and remain in force until an amended resolution can be passed by the Governing Body/Managing

Committee and a copy thereof, certified by the Secretary /Trustee or the Secretary /Trustee acting or purporting to act on behalf of the Firm shall have been

In this resolution the expressions and `Secretary’ `Trustee’ shall be construed as Secretary/Trustee for the time being of the Firm and shall, in the case of

Secretary shall include any Joint Secretary, Assistant Secretary or Temporary Secretary.

We certify that the signatures set down within Section B of this account opening form are those of all the governing body/managing committee and of

any other Officers of the Firm authorised to sign, that such signatures are the genuine signatures of such persons and that such signatures operate as the

specimen signatures of each of such persons.

Yours faithfully,

CHAIRMAN Signature Name (In Capitals) __________________________________________________________________

SECRETARY Signature Name (In Capitals) __________________________________________________________________

12

ICICI BANK UK PLC Telecommunications Authorisation

I/we authorize ICICI BANK UK PLC (the Bank) to accept and act upon instructions given through telephone, fax or email by me/us or any person authorised

by me/us subject to the following, which I understand and acknowledge:

• There are inherent risks in sending instructions by telephone, fax and email.

• Any email instructions must be sent from the registered email address held by the Bank.• When instructions are given to the Bank by telephone,

fax or email, the Bank will verify my/our identity by a telephone call to a number the Bank holds on record for me /us. During this call the Bank will ask

questions based on information known to the Bank about me/us and the transactions on my/our account. On confirmation of this information the Bank

will act on my/our instructions including payment of money from my/our account. If I/we am/are unable to answer these questions correctly, the Bank

may NOT act on our instructions.

• If the Bank is unable to contact me/us to verify the instructions, the Bank may NOT act on our instructions and any payments requested may be

delayed or NOT made.

• This telecommunications authorization will be applicable for any future accounts that I /we may open with the Bank.

• I/We understand that in addition to the above terms, this service is also governed by the Business Banking Terms and Conditions.

NAME OF THE COMPANY/ORGANISATION: __________________________________________________________

ADDRESS OF THE COMPANY ORGANISATION: ___________________________________________________________________________________________

_____________________________________________________________________________________________

NAME OF THE AUTHORISED SIGNATORY 1: _________________________________________________________

SIGNATURE: DATE: _____________

NAME OF THE AUTHORISED SIGNATORY 2: _________________________________________________________

SIGNATURE: DATE: _____________

For Bank Use Only

PEP Category: □ CHPEP – Category 1 □ Category 2 PEP □ Non PEP

Branch Code

RM Name and Employee ID

RM Signature and Date

BM/DBM/SRM Name and Employee ID

BM/DBM/SRM Signature and Date

13

Status Code □ COR □ BR

Risk Rating

DD/ MM/ YYYY

DD/ MM/ YYYY

Corporate Current Account – Summary of Information

Key Product Features

• Insta online transfers

• 24X7 online banking

• Free cheque book

• Free monthly statements

Key Facts

1. What will you have to pay us for our Corporate Current Account services?

There are charges for certain services/facilities provided for day to day running of the account. We recommend that you go through the rates and charges

before making a choice.

2. Who regulates us?

ICICI BANK UK PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation

Authority (Registration No. 223268). ICICI BANK UK PLC (Company No. 04663024) has its registered office at One Thomas More Square, London E1W

1YN.

3. What you should do if you have a complaint?

If you want to make a complaint, please contact us promptly at:

Customer Relations

ICICI BANK UK PLC

2nd Floor, One Thomas More Square

London E1W 1YN

Or

Email us at [email protected]

We will then arrange for a member of the complaints team to investigate and respond to you accordingly.

4. Are we covered by the Financial Services Compensation Scheme?

ICICI BANK UK PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation

Authority (Registration No. 223268). ICICI BANK UK PLC is covered by the Financial Services Compensation Scheme (FSCS). The FSCS can pay

compensation to depositors if a bank is unable to meet its financial obligations. Most depositors - including most individuals and small businesses - are

covered by the scheme.

In respect of deposits, an eligible depositor is entitled to claim up to £85,000. For joint accounts each account holder is treated as having a claim in

respect of their share, so for a joint account held by two eligible depositors, the maximum amount that could be claimed would be £85,000 each (making

a total of £170000). The £85,000 limit relates to the combined amount in all the eligible depositor’s accounts with the bank including their share of any

joint account, and NOT to each separate account.

For further information about the compensation provided by the FSCS (including the amounts covered and eligibility to claim) please ask at your local

branch, refer to the FSCS website, www.fscs.org.uk or call the FSCS on 0800 678 1100 or 020 7741 4100. Please Note only compensation-related

queries should be directed to the FSCS.

Before applying, please read the following documents carefully:

• Rates and Charges

• Corporate Banking/Business Banking Terms and Conditions (as applicable). These are our standard terms and conditions upon which we intend to rely

on our products and services. For your own benefit and protection, you should read these terms and conditions carefully. If you do NOT understand any

terms and conditions, please ask us for further information. Withdrawal Arrangement

• No notice period required for withdrawal below £2000

• For withdrawals greater than £2000, one day advance notice will be required at the concerned branch

• No restrictions on the number of withdrawals

• Refer Rates & Charges for charges

Standing Charges Refer Business Customers Rates & Charges

Minimum Balance Refer Business Customers Rates & Charges

Access Branch, Internet Banking

Other Charges As per the Rates and Charges

14

To learn more, contact us at:

www.icicibank.co.uk

Visit our branches at:

92 - 94 Soho Road, Handsworth, Birmingham B21 9DP

291, High Street North, Manor Park, East Ham E12 6SL

1 Thomas More Square; London E1W 1YN

(By appointments only. Please call customer care for an appointment.)

25/31 Cheetham Hill Road, Manchester M4 4FY

45 South Road, Southall, Middlesex UB1 1SW

47 Ealing Road, Wembley HA0 4BA

Unit 2, 1-9 St. Anns Road, Harrow, Middlesex HA1 1AS

ICICI Bank UK PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority (Registration Number: 223268).

ICICI Bank UK PLC is subject to the laws of England and Wales. Terms and conditions apply.