School Employees

Benefits Board (SEBB)

Program

Standard PPO Plan

4018486

INTRODUCTION

Premera Blue Cross is an Independent Licensee of the Blue Cross Blue Shield Association. The benefits,

limitations, exclusions and other coverage provisions in this booklet are subject to the terms of our contract with

the Group. This booklet is a part of that contract, which is on file in the Group's office and at Premera Blue Cross.

This booklet replaces any other benefit booklet you may have received. The Group has delegated authority to

Premera Blue Cross to use its expertise and judgment as part of the routine operation of the plan to reasonably

apply the terms of the contract for making decisions as they apply to benefits and claims situations. This does not

prevent you from exercising rights you may have under applicable state or federal law to appeal, have

independent review of our judgment and decisions, or bring a civil lawsuit challenging to any eligibility or claims

determinations under the contract, including our exercise of our judgment and expertise.

If any provision of this Plan is superseded by state or federal law, the Plan will comply with the applicable

law as it relates to those provisions.

Group Name:

Washington State Healthcare Authority For The School Employees Benefits Board

Program

Effective Date:

January 1, 2024

Group Number:

4018486

Plan:

Standard PPO

Certificate Form Number:

40184860124B

40184860124B

Discrimination is Against the Law

Premera Blue Cross (Premera) complies with applicable Federal civil rights laws and does not discriminate on the basis of race,

color, national origin, age, disability, or sex. Premera does not exclude people or treat them differently because of race, c olor,

national origin, age, disability, sex, gender identity, or sexual orientation. Premera provides free aids and services to people with

disabilities to communicate effectively with us, such as qualified sign language interpreters and written information i n other

formats (large print, audio, accessible electronic formats, other formats). Premera provides free language services to people

whose primary language is not English, such as qualified interpreters and information written in other languages. If you need

these services, contact the Civil Rights Coordinator. If you believe that Premera has failed to provide these services or

discriminated in another way on the basis of race, color, national origin, age, disability, or sex, you can file a grievance with: Civil

Rights Coordinator ─ Complaints and Appeals, PO Box 91102, Seattle, WA 98111, Toll free: 855-332-4535, Fax: 425-918-5592, TRS:

711, Email AppealsDepartmentInquiries@Premera.com. You can file a grievance in person or by mail, fax, or email. If you need help

filing a grievance, the Civil Rights Coordinator is available to help you. You can also file a civil rights complaint with the U.S.

Department of Health and Human Services, Office for Civil Rights, electronically through the Office for Civil Rights Complaint

Portal, available at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail or phone at: U.S. Department of Health and Human

Services, 200 Independence Ave SW, Room 509F, HHH Building, Washington, D.C. 20201, 1-800-368-1019, 800-537-7697 (TDD).

Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html.

Language Assistance

ATENCIÓN: si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame al 800-807-7310 (TRS:

711).

注意:如果您使用繁體中文,您可以免費獲得語言援助服務。請致電

800-807-7310

(

TRS

:

711

)。

CHÚ Ý: N

ế

u b

ạ

n nói Ti

ế

ng Vi

ệ

t, có các d

ị

ch v

ụ

h

ỗ

tr

ợ

ngôn ng

ữ

mi

ễ

n phí dành cho b

ạ

n. G

ọ

i s

ố

800-807-7310 (TRS: 711).

주의: 한국어를 사용하시는 경우, 언어 지원 서비스를 무료로 이용하실 수 있습니다.

800-807-

7310 (TRS: 711)

번으로 전화해 주십시오.

ВНИМАНИЕ: Если вы говорите на русском языке, то вам доступны бесплатные услуги перевода. Звоните 800-807-7310

(служба коммутируемых сообщений: 711).

PAUNAWA: Kung nagsasalita ka ng Tagalog, maaari kang gumamit ng mga serbisyo ng tulong sa wika nang walang bayad.

Tumawag sa 800-807-7310 (TRS: 711).

УВАГА! Якщо ви розмовляєте українською мовою, ви можете звернутися до безкоштовної служби

мовної підтримки. Телефонуйте за номером 800-807-7310 (служба комутованих повідомлень:

711).

,

800-807-7310 (TRS: 711)

注意事項:日本語を話される場合、無料の言語支援をご利用いただけます。

800-807-7310

(

TRS:711

)

まで、お電話にてご連絡ください。

ማስታወሻ: የሚናገሩት ቋንቋ ኣማርኛ ከሆነ የትርጉም እርዳታ ድርጅቶች፣ በነጻ ሊያግዝዎት ተዘጋጀተዋል ወደ ሚከተለው ቁጥር ይደውሉ

800-807-7310

(በስልክ ማገናኛ አገልግሎት:

711

).

XIYYEEFFANNAA: Afaan dubbattu Oroomiffa, tajaajila gargaarsa afaanii, kanfaltiidhaan ala, ni argama. Bilbilaa 800-807-7310 (TRS:

711).

7310

807

800

711

800-807-

7310 (TRS: 711)

ACHTUNG: Wenn Sie Deutsch sprechen, stehen Ihnen kostenlos sprachliche Hilfsdienstleistungen zur Verfügung.

Rufnummer: 800-807-7310 (TRS: 711).

:

,

,

, .

800-807-

7310 (TRS: 711).

ATANSYON: Si w pale Kreyòl Ayisyen, gen sèvis èd pou lang ki disponib gratis pou ou. Rele 800-807-7310 (TRS: 711).

ATTENTION: Si vous parlez français, des services d'aide linguistique vous sont proposés gratuitement. Appelez le 800-807-7310 (SRT :

711).

UWAGA: Jeżeli mówisz po polsku, możesz skorzystać z bezpłatnej pomocy językowej. Zadzwoń pod numer 800-807-7310 (TRS:

711).

ATENÇÃO: Se fala português, encontram-se disponíveis serviços linguísticos, grátis. Ligue para 800-807-7310 (TRS: 711).

ATTENZIONE: In caso la lingua parlata sia l'italiano, sono disponibili servizi di assistenza linguistica gratuiti. Chiamare il numero

800-807-7310 (TRS: 711).

هجوت

7310 (TRS: 711)-807-800

HOW TO USE THIS BOOKLET

This booklet will help you get the most out of your benefits. Every section contains important information, but the

ones below may be particularly useful:

• Summary Of Your Costs – A quick overview of what the plan covers and your costs

• How Providers Affect Your Costs — how using in-network providers will cut your costs

• Important Plan Information – Explains the allowed amount and gives you details on the deductible, copays,

coinsurance, and the out-of-pocket maximum.

• Covered Services – details about what's covered

• Prior Authorization – Describes the plan's prior authorization and emergency admission notification

requirements.

• Exclusions — services that are either limited or not covered under this plan

• Medical Plan Eligibility And Enrollment – eligibility requirements for this plan

• How Do I File A Claim? — step-by-step instructions for claims submissions

• Complaints And Appeals — processes to follow if you want to file a complaint or an appeal

• Definitions — terms that have specific meanings under this plan. Example: “You” and “your” refer to

members under this plan. “We,” “us” and “our” refer to Premera Blue Cross in Washington and Premera Blue

Cross Blue Shield of Alaska in Alaska.

FOR MORE INFORMATION

You'll find our contact information on the back cover of this booklet. Please call or write customer service for help

with:

• Questions about benefits or claims

• Questions or complaints about care you receive

• Changes of address or other personal information

You can also get benefit, eligibility and claim information through our Interactive Voice Response system when

you call.

Online information about your plan is at your fingertips whenever you need it

You can use our website to:

• Locate a health care provider near you

• Get details about the types of expenses you're responsible for and this plan's benefit maximums

• Check the status of your claims

• Visit our health information resource to learn about diseases, medications, and more

TABLE OF CONTENTS

CONTACT US........................................................... (SEE BACK COVER OF THIS BOOKLET)

SUMMARY OF YOUR COSTS ............................................................................................................ 1

HOW PROVIDERS AFFECT YOUR COSTS ...................................................................................... 13

In-Network Providers .................................................................................................................. 13

Continuity of Care ....................................................................................................................... 13

Non-Participating ........................................................................................................................ 14

Balance Billing Protection ............................................................................................................ 15

Benefits For Out-Of-Network Or Non-Contracted Providers ........................................................... 15

IMPORTANT PLAN INFORMATION ................................................................................................. 15

Copayments (Copays) ................................................................................................................ 16

Split Copay For Office Visits ........................................................................................................ 16

Calendar Year Deductible ........................................................................................................... 16

Coinsurance ............................................................................................................................... 17

Out-Of-Pocket Maximum ............................................................................................................. 17

Allowed Amount.......................................................................................................................... 18

COVERED SERVICES ..................................................................................................................... 18

Acupuncture ......................................................................................................................... 19

Allergy Testing and Treatment ............................................................................................... 19

Ambulance ........................................................................................................................... 19

Blood Products And Services ................................................................................................ 20

Cellular Immunotherapy And Gene Therapy ........................................................................... 20

Chemotherapy And Radiation Therapy................................................................................... 20

Clinical Trials ........................................................................................................................ 20

Dental Injury and Facility Anesthesia...................................................................................... 21

Diagnostic X-Ray, Lab And Imaging ....................................................................................... 21

Dialysis ................................................................................................................................ 22

Emergency Room ................................................................................................................. 23

Foot Care ............................................................................................................................. 23

Gender Affirming Care .......................................................................................................... 23

Hearing Care ........................................................................................................................ 23

Hearing Hardware................................................................................................................. 24

Home Health Care ................................................................................................................ 24

Home Medical Equipment (HME), Orthotics, Prosthetics And Supplies ..................................... 25

Hospice Care ....................................................................................................................... 26

Hospital................................................................................................................................ 27

Infusion Therapy ................................................................................................................... 28

Massage Therapy ................................................................................................................. 28

Mastectomy and Breast Reconstruction ................................................................................. 28

Maternity Care ...................................................................................................................... 28

Medical Foods ...................................................................................................................... 29

Medical Transportation.......................................................................................................... 29

Medical Transportation – State Restricted Care ...................................................................... 30

Mental Health Care ............................................................................................................... 31

Neurodevelopmental Therapy (Habilitation) ............................................................................ 33

Newborn Care ...................................................................................................................... 33

Orthognathic Surgery (Jaw Augmentation Or Reduction) ......................................................... 34

Prescription Drug .................................................................................................................. 34

Preventive Care .................................................................................................................... 39

Professional Visits And Services ............................................................................................ 41

Psychological and Neuropsychological Testing ....................................................................... 42

Rehabilitation Therapy .......................................................................................................... 42

Skilled Nursing Facility Care .................................................................................................. 43

Spinal and Other Manipulations ............................................................................................. 43

Substance Use Disorder ....................................................................................................... 43

Surgery ................................................................................................................................ 44

Surgical Center Care – Outpatient ......................................................................................... 44

Temporomandibular Joint Disorders (TMJ) Care ..................................................................... 44

Therapeutic Injections ........................................................................................................... 45

Transplants .......................................................................................................................... 45

Urgent Care ......................................................................................................................... 46

Virtual Care .......................................................................................................................... 47

Weight Management ............................................................................................................. 47

WHAT DO I DO IF I'M OUTSIDE WASHINGTON AND ALASKA? ...................................................... 48

Out-Of-Area Care ....................................................................................................................... 48

CARE MANAGEMENT ..................................................................................................................... 50

Prior-Authorization ...................................................................................................................... 50

How Prior-Authorization Works .............................................................................................. 50

Prior-Authorization for Benefit Coverage ................................................................................ 50

Exceptions To Prior Authorization For Benefit Coverage.......................................................... 51

Prior-Authorization For Out-Of-Network Provider Coverage ..................................................... 51

Exceptions to Prior-Authorization For Out-Of-Network Providers .............................................. 51

Clinical Review ........................................................................................................................... 52

Personal Health Support Programs .............................................................................................. 52

Chronic Condition Management................................................................................................... 52

EXCLUSIONS .................................................................................................................................. 53

WHAT IF I HAVE OTHER COVERAGE? ........................................................................................... 56

Coordinating Benefits With Other Health Care Plans ..................................................................... 56

COB Definitions .................................................................................................................... 57

Primary And Secondary Rules ............................................................................................... 57

COB's Effect On Benefits ...................................................................................................... 58

Subrogation And Reimbursement ................................................................................................ 59

Uninsured And Underinsured Motorist/Personal Injury Protection Coverage ................................... 60

HOW DO I FILE A CLAIM?............................................................................................................... 74

Timely Filing ............................................................................................................................... 75

COMPLAINTS AND APPEALS......................................................................................................... 75

What You Can Appeal................................................................................................................. 76

Appeal Levels............................................................................................................................. 76

How To Submit An Appeal........................................................................................................... 76

If We Need More Time ............................................................................................................... 78

How To Ask For An External Review............................................................................................ 78

Additional Information About Your Coverage ................................................................................ 79

OTHER INFORMATION ABOUT THIS PLAN .................................................................................... 80

Conformity With The Law ............................................................................................................ 80

Entire Contract ........................................................................................................................... 80

Evidence Of Medical Necessity.................................................................................................... 80

The Group And You .................................................................................................................... 80

Healthcare Providers - Independent Contractors ........................................................................... 80

Intentionally False Or Misleading Statements ............................................................................... 80

Member Cooperation .................................................................................................................. 81

Newborn’s and Mother’s Health Protection Act ............................................................................. 81

Notice Of Information Use And Disclosure .................................................................................... 81

Notice Of Other Coverage ........................................................................................................... 81

Notices....................................................................................................................................... 81

Right Of Recovery ...................................................................................................................... 82

Right To And Payment Of Benefits............................................................................................... 82

Venue ........................................................................................................................................ 82

Women's Health and Cancer Rights Act of 1998 ........................................................................... 82

Workers’ Compensation Insurance .............................................................................................. 82

DEFINITIONS................................................................................................................................... 83

1 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

SUMMARY OF YOUR COSTS

This section shows a summary table of the care covered by your plan. It also explains the amounts you pay.

This section does not go into all the details of your coverage. See Covered Services to learn more.

First, here is a quick look at how this plan works. Your costs are subject to all of the following.

• Networks. To help control the cost of your care, this plan uses Premera's Heritage Prime network in

Washington. You may be able to save money if you use an in-network provider. For more network details, see

How Providers Affect Your Costs.

• Allowed amount. This is the most this plan allows for a covered service. See Important Plan Information for

details. For some covered services, you have to pay part of the allowed amount. This is called your cost

share. This plan's cost shares are explained below. You will find the amounts in the summary table.

• Copays. These are set dollar amounts you pay at the time you get some services. If the amount billed is less

than the copay, you pay only the amount billed. Copays apply to the out-of-pocket maximum unless stated

otherwise in the summary table. The deductible does not apply to most services that require a copay. Any

exceptions are shown in the table.

This plan has a different copay for office visits with specialists than with non-specialists. To find out which

providers get which copays, see How Providers Affect Your Costs.

In-Network Providers

Non-specialist professional visit copay

$25

Specialist professional visit copay

$50

• Deductible. The total allowed amount you pay in each year before this plan starts to make payments for your

covered healthcare costs. You pay down each deductible separately with each claim that applies to it.

In-Network Providers

Out-of-Network Providers

Individual deductible

$1,250

$2,000

Family deductible (not shown in the

summary table)

$3,125

$5,000

• Coinsurance. For some healthcare, you pay a percentage of the allowed amount, and the plan pays the rest.

This booklet calls your percentage “coinsurance.” You pay less coinsurance for many benefits when you use

an in-network provider. Your coinsurance is shown in the summary table.

In-Network Providers

Out-of-Network Providers

Coinsurance

20%

50%

• Out-of-pocket maximum (not shown in the summary table). This is the most you pay each calendar year for

any deductibles, copays and coinsurance. Not all the amounts you have to pay count toward the out-of-pocket

maximum. See Important Plan Information for details.

In-Network Providers

Out-of-Network Providers

Individual out-of-pocket maximum

$5,000

None

Family out-of-pocket maximum

$10,000

None

• Prior Authorization. Some services must be approved in advance before you get them, in order to be covered.

See Prior Authorization for details about the types of services and time limits. Some services have special

rules.

This plan complies with state and federal regulations about diabetes medical treatment coverage. See the

Preventive Care, Prescription Drug, Home Medical Equipment (HME), Orthotics, Prosthetics And Supplies,

and Foot Care benefits.

2 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

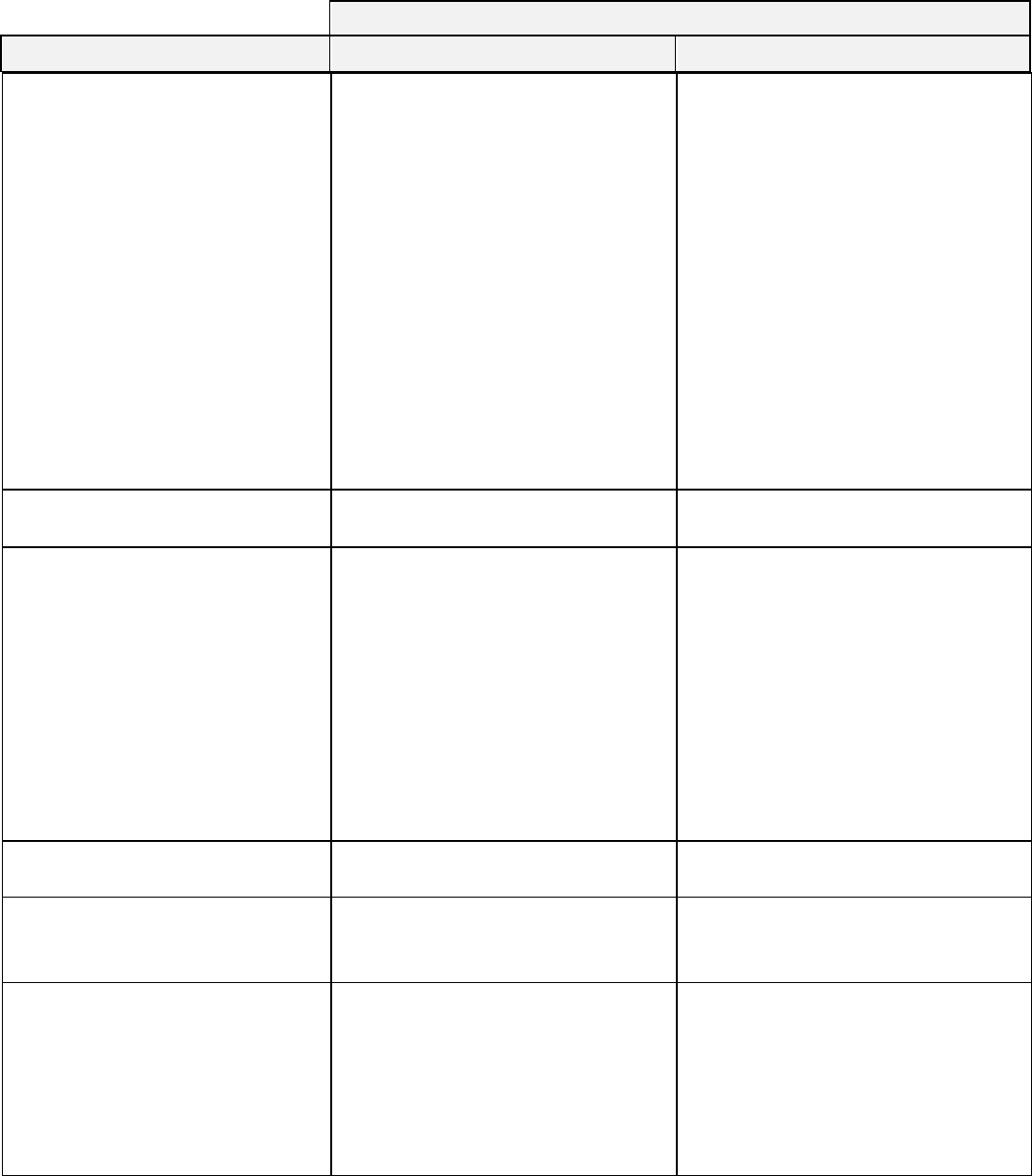

SUMMARY TABLE

The summary table below shows plan limits and what you pay (your cost shares) for covered services.

Facility in the table below means hospitals or other medical institutions. Professional means doctors, nurses,

and other people who give you your care. When you see the term “No charge” in the table below, this means

that you do not have to pay any deductible, copay or coinsurance for covered services and the provider can not

bill you any amount. No cost shares means that although you do not pay any deductible, copay or coinsurance

for covered services, the provider can bill you for amounts over the allowed amount. A non-participating provider

can bill you for amounts over the allowed amount except for emergency services, covered air ambulance

services, or as prohibited by law.

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

3 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Acupuncture

calendar year visit limit: 24 visits

Substance use disorder-related: no

limit

$25 copay per visit, deductible waived

Deductible, then 50% coinsurance

Allergy Testing And Treatment

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Ambulance

Deductible, then 20% coinsurance

Deductible, then 20% coinsurance

Blood Products and Services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Cellular Immunotherapy And

Gene Therapy

Covered as any other in-network

service

Covered as any other out-of-network

service

Chemotherapy and Radiation

Therapy

Professional and facility services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Clinical Trials

Covers routine patient care during

the trial

You may have additional costs for

other services such as x-rays, lab,

prescription drugs, and hospital

facility charges. See those covered

services for details.

Covered as any other service

Covered as any other service

Dental Injury and Facility

Anesthesia

• Dental Anesthesia (up to age 19

when medically necessary)

• Inpatient facility care, and all

other professional services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Outpatient surgery center

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Anesthesiologist

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Dental Injury

• Office visit exams to determine

treatment needed

$50 copay per visit, deductible waived

Deductible, then 50% coinsurance

• Treatment

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Diagnostic X-Ray, Lab And

Imaging for medical conditions or

symptoms

Tests, lab, imaging and scans

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Diagnostic and supplemental breast

exams

No charge

Deductible, then 50% coinsurance

Dialysis

For permanent kidney failure. See

the Dialysis benefit for details.

• During Medicare's waiting period

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• After Medicare's waiting period

No charge

No cost-shares

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

4 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Emergency Room

• Facility charges

You may have additional costs

for other services. Examples are

X-rays or lab tests. See those

covered services for details.

The copay is waived if you are

admitted as an inpatient through

the emergency room. The copay

is waived if you are transferred

and admitted to a different

hospital directly from the

emergency room.

$150 copay per visit, then deductible,

then 20% coinsurance

$150 copay per visit, then deductible,

then 20% coinsurance

• Professional services

Deductible, then 20% coinsurance

Deductible, then 20% coinsurance

Foot Care

such as trimming nails or corns,

when medically necessary due to a

medical condition

• In an office or clinic

$25 or $50 copay per visit, deductible

waived

Deductible, then 50% coinsurance

• All other settings

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Gender Affirming Care

• Office and clinic visits

$25 or $50 copay per visit, deductible

waived

Deductible, then 50% coinsurance

• Other professional services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient facility care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Hearing Care

For hearing loss, often due to age

or noise exposure.

• Hearing Exams

Limit each calendar year:1

exam/test

No charge

Deductible, then 50% coinsurance

• Hearing Hardware

Limit of $3,000 per ear every 36

months

No charge

No cost-shares

Home Health Care

calendar year visit limit: None

• Home visits

• Prescription drugs billed by the

home health agency

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

5 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Home Medical Equipment (HME),

Orthotics, Prosthetics And

Supplies

• Sales tax for covered items

• Foot orthotics and therapeutic

shoes; calendar year limit: $300

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

except diabetes related

• Medical vision hardware

Hospice Care

Lifetime limit for terminal illness: 6

months

Lifetime limit for non-terminal

illness: none

Inpatient stay limit: 30 days

Home visits: Unlimited

Respite care: 240 hours lifetime

max

• Inpatient facility care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Home and respite care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Prescription drugs billed by the

hospice

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Hospital

• Inpatient Care

• Professional

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Facility

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Outpatient Care

• Professional

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Facility

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Infusion Therapy

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Massage therapy

calendar year limit: 24 visits

$25 copay per visit, deductible waived

Deductible, then 50% coinsurance

Mastectomy and Breast

Reconstruction

• Office and clinic visits

$25 or $50 copay per visit, deductible

waived

Deductible, then 50% coinsurance

• Surgery and other professional

services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient facility care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

6 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Maternity Care

Care during pregnancy, childbirth

and after the baby is born. See the

Preventive Care benefit for routine

exams and tests during pregnancy.

• Professional care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient hospital, birthing

centers and short-stay hospitals

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Abortion

No charge

Deductible, then 50% coinsurance

Medical Foods

includes phenylketonuria (PKU)

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Medical Transportation

Travel and lodging are covered up

to the IRS limitations

• For Transplants: $7,500 overall

limit, per transplants

Deductible, then 0% coinsurance

In-network deductible, then 0%

coinsurance

• For Cellular Immunotherapy

and Gene Therapy: $7,500 per

episode of care

No charge

No cost-shares

Special criteria are required for

travel benefits to be provided.

Please see the benefit coverage for

details.

Medical Transportation – State

Restricted Care

Benefits are limited to members

residing in states where laws

restrict access to care. Travel and

lodging are covered up to the IRS

limitations. Prior approval required.

• To/from provider for abortion

services

No charge

No charge

• To/from provider for medically

necessary gender affirming care

services

No charge

No charge

• Calendar year limit: $4,000

Special criteria are required for

travel benefits to be provided. See

the benefit for coverage details.

Mental Health Care

• Office and clinic visits

$25 copay per visit, deductible waived

Deductible, then 50% coinsurance

• Other professional services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient and residential facility

care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Outpatient facility care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

7 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Neurodevelopmental Therapy

(Habilitation)

See the Mental Health Care

benefit for therapies for mental

conditions such as autism.

• Outpatient care

calendar year visit limit: 45 visits

• Office and clinic visits

$50 copay per visit, deductible waived

Deductible, then 50% coinsurance

• Other outpatient services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient care

calendar year day limit: 45 days

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Newborn Care

• Inpatient care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Office and clinic visits

$25 or $50 copay per visit, deductible

waived

Deductible, then 50% coinsurance

• Other outpatient services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Orthognathic Surgery (Jaw

Augmentation or Reduction)

lifetime limit: None

• Office and clinic visits

$25 or $50 copay per visit, deductible

waived

Deductible, then 50% coinsurance

• Surgery and other professional

care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Outpatient surgery facility care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient hospital care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Prescription Drug Deductible

Separate from medical deductible

In-Network Pharmacy

Out-Of-Network Pharmacy

• Generic drugs

Waived

Waived

• Individual deductible for brand-

name and specialty drugs

$250

$250 (separate from in-network drug

deductible)

• Family deductible for brand-

name and specialty drugs

$750

$750 (separate from in-network drug

deductible)

Covered Drugs*

In-Network Retail Pharmacy

Out-Of-Network Retail Pharmacy

• Preferred Generic drugs

$9 copay

$9 copay

plus 40% coinsurance

• Preferred brand name drugs

30% coinsurance

70% coinsurance

• Non-preferred generic and brand

name drugs

50% coinsurance

90% coinsurance

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

8 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

In-Network Mail-Order Pharmacy

Out-Of-Network Mail-Order

Pharmacy

• Preferred Generic drugs

$18 copay

Not covered

• Preferred brand name drugs

30% coinsurance

Not covered

• Non-preferred generic and brand

name drugs

50% coinsurance

Not covered

*Your cost shares for covered

prescription insulin drugs will not

exceed $35 per 30-day supply of

the drug. The deductible does not

apply. Cost shares for covered

prescription insulin drugs apply

toward the deductible.

Specialty Drugs (per prescription

or refill). You must use a specialty

pharmacy for these drugs to be

covered.

In-Network Mail-Order Pharmacy

Out-Of-Network Mail-Order

Pharmacy

• Preferred specialty drugs

40% coinsurance

Not covered

• Non-preferred specialty drugs

50% coinsurance

Not covered

Exceptions

In-Network Retail or In-Network

Mail Order Pharmacy

Out-Of-Network Retail Pharmacy

• Needles and syringes purchased

with diabetic drugs

No charge

No cost-shares

• Certain prescription drugs and

generic over-the-counter drugs to

break a nicotine habit

No charge

Same as out-of-network retail

• Drugs on the Affordable Care

Act's preventive drug list

No charge

Same as out-of-network retail

• Oral chemotherapy drugs

No charge

No cost-shares

• Female contraceptive drugs,

devices and supplies

(prescription and over-the-

counter). Includes emergency

contraceptives.

No charge

Same as out-of-network retail

• Male contraceptive drugs,

devices and supplies

(prescription and over-the-

counter).

No charge

Same as out-of-network retail

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

9 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Preventive Care

(Limits on how often services are

covered and who services are

recommended for may apply.)

• Preventive exams, including

vision and oral health screening

for members under 19, diabetes

and depression screening

No charge

Not covered

• Immunizations in the provider's

office

No charge

Not covered

• Flu shots and other seasonal

immunizations at a pharmacy or

mass immunizer location

No charge

No cost-shares

• Travel immunizations at a travel

clinic or county health

department

No charge

No cost-shares

• Health education and training

(outpatient)

No charge

Not covered

• Nicotine habit-breaking programs

No charge

Not covered

• Fall prevention for members 65

and older

No charge

Not covered

• Nutritional counseling and

therapy

No charge

Deductible, then 50% coinsurance

• Pregnant member's care

(includes breast-feeding support

and post-partum depression

screening)

No charge

Deductible, then 50% coinsurance

• Screening tests (includes

prostate and cervical cancer

screening)

No charge

Deductible, then 50% coinsurance

• Screening mammograms

No charge

Deductible, then 50% coinsurance

• Colorectal cancer screening

No charge

Deductible, then 50% coinsurance

• Contraceptive and sterilization.

No charge

Deductible, then 50% coinsurance

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

10 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Professional Visits and Services

You may have extra costs for other

services like lab tests and facility

charges. Also see Allergy Testing

And Treatment and Therapeutic

Injections.

• Office and clinic visits, including

real-time visits using online and

telephonic methods with a

provider who also maintains a

physical location

$25 or $50 copay per visit, deductible

waived

Deductible, then 50% coinsurance

• Telemedicine with Traditional

Providers (General Medical)

$25 or $50 copay per visit, deductible

waived

Deductible, then 50% coinsurance

• Electronic visits (e-visits)

$25 or $50 copay per visit, deductible

waived

Not covered

• Other professional services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Psychological and

Neuropsychological Testing

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Rehabilitation Therapy

Cardiac or pulmonary rehabilitation

programs, or similar programs for

cancer or other chronic conditions

are not subject to a benefit limit.

• Outpatient Care

calendar year visit limit: 45 visits

• Office and clinic visits

$50 copay per visit, deductible waived

Deductible, then 50% coinsurance

• Other outpatient services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient Care

calendar year day limit: 45 days

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Skilled Nursing Facility Care

calendar year day limit: None

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Spinal and Other Manipulations

calendar year visit limit: 24 visits

$25 copay per visit, deductible waived

Deductible, then 50% coinsurance

Substance Use Disorder

• Office and clinic visits

$25 copay per visit, deductible waived

Deductible, then 50% coinsurance

• Other professional services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient care and residential

facility care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Outpatient facility care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

11 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Surgery

(includes professional services,

anesthesia and blood transfusions)

See the Hospital and Surgical

Center Care - Outpatient benefits

for facility charges.

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Vasectomy

No charge

Deductible, then 50% coinsurance

Surgical Center Care – Outpatient

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Temporomandibular Joint

Disorders (TMJ) Care

• Office and clinic visits

$25 or $50 copay per visit, deductible

waived

Deductible, then 50% coinsurance

• Other professional services

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Inpatient facility care

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Therapeutic Injections

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

Transplants

(Includes donor search and

donation costs)

• Inpatient facility care

Deductible, then 20% coinsurance

Not covered*

• Office and clinic visits

$25 or $50 copay per visit, deductible

waived

Not covered*

• Surgery and other professional

services

Deductible, then 20% coinsurance

Not covered*

*All approved transplant centers

covered at the in-network level

Please see Medical

Transportation for travel and

lodging benefits.

Urgent Care

Services at an urgent care center.

See Diagnostic X-Ray, Lab And

Imaging for tests received while at

the center. Your deductible and

coinsurance apply to facility

charges.

• Freestanding urgent care centers

Deductible, then 20% coinsurance

Deductible, then 50% coinsurance

• Urgent care centers attached to

or part of a hospital

$150 copay per visit, then deductible,

then 20% coinsurance

$150 copay per visit, then deductible,

then 20% coinsurance

YOUR SHARE OF THE ALLOWED AMOUNT

BENEFIT

IN-NETWORK PROVIDERS

OUT-OF-NETWORK PROVIDERS

12 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Virtual Care

Access to medical care using virtual

methods like secure chat, text,

voice or video chat.

Real-time visits via online or

telephonic methods with your doctor

or other provider who also

maintains a physical location, are

covered under other benefits of this

plan.

The same copay applies to both

specialists and non-specialists.

• Virtual general

medical/dermatology visits

$5 copay, deductible waived

Not applicable

• Virtual behavioral/mental health

$25 copay, deductible waived

Not applicable

• Virtual substance use disorder

visit

$25 copay, deductible waived

Not applicable

Weight Management

• Non-surgical weight management

As any other covered service

As any other covered service

• Surgical weight loss treatment

(Bariatric Surgery)

Deductible, then 20% coinsurance

Not covered

See the Weight Management

benefit for additional benefit

information.

13 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

HOW PROVIDERS AFFECT YOUR COSTS

This plan's benefits and your out-of-pocket expenses depend on the providers you see. In this section you’ll find

out how the providers you see can affect this plan's benefits and your costs.

This plan makes available to you sufficient numbers and types of providers to give you access to all covered

services in compliance with applicable Washington state regulations governing access to providers. Our provider

networks include hospitals, physicians, and a variety of other types of providers.

This plan does not require use or selection of a primary care provider or require referrals for specialty care.

Members may self-refer to providers, including obstetricians, gynecologists and pediatricians, to receive care, and

may do so without prior authorization.

In-Network Providers

This plan is a Preferred Provider Plan (PPO). This means that the plan provides you benefits for covered

services from providers of your choice. Its benefits are designed to provide lower out-of-pocket expenses when

you receive care from in-network providers. There are some exceptions, which are explained below.

In-Network providers are:

• Providers in the Heritage Prime network in Washington. For accessing care in Clark County, Washington, you

also have access to providers through the BlueCard

®

Program.

• Providers in Alaska that have signed contracts with Premera Blue Cross Blue Shield of Alaska.

• For care outside the service area (see Definitions), providers in the local Blue Cross and/or Blue Shield

Licensee's network shown below. (These Licensees are called “Host Blues” in this booklet.) See Out-Of-Area

Care later in the booklet for more details.

• Wyoming: The Host Blue's Traditional (Participating) network

• All Other States: The Host Blue's PPO (Preferred) network

In-Network pharmacies are available nationwide.

In-Network providers provide medical care to members at negotiated fees. These fees are the allowed amounts

for in-network providers. When you receive covered services from an in-network provider, your medical bills will

be reimbursed at a higher percentage (the in-network benefit level). This means lower cost shares for you, as

shown in the Summary Of Your Costs. In-Network providers will not charge you more than the allowed amount

for covered services. This means that your portion of the charges for covered services will be lower.

Your choice of a particular provider may affect your out-of-pocket costs because different providers may have

different allowed amounts even though they all have an agreement with us or with the same Host Blue. You’ll

never have to pay more than your share of the allowed amount for covered services when you use in-network

providers.

A list of in-network providers is in our Heritage Prime provider directory. You can access the directory at any time

on our website at www.premera.com/sebb. You may also ask for a copy of the directory by calling customer

service. The providers are listed by geographical area, specialty and in alphabetical order to help you select a

provider that is right for you. You can also call the BlueCard provider line to locate an in-network provider. The

numbers are on the back cover of this booklet and on your Premera Blue Cross ID card.

We update this directory regularly, but the listings can change. Before you get care, we suggest that you call us

for current information or to make sure that your provider, their office location or their provider group is in the

Heritage Prime network.

Contracted Health Care Benefit Managers

The list of Premera’s contracted Health Care Benefit Managers (HCBM) and the services they manage are

available at partners-vendors and changes to these contracts or services are reflected on the website within 30

business days.

Continuity of Care

How Continuity of Care Works If a primary care provider contract is terminated without cause, continuing care

will be provided according to the details included in the member's notice of the contract termination. Additionally,

14 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

you may qualify for continuing care from non-primary care providers for Continuity of Care (COC) under certain

circumstances when a provider leaves your health plan’s network or your employer transitions to a new carrier.

This will depend on your medical condition at the time the change occurs. COC is a process that provides you

with short-term, temporary coverage at in-network levels for care received by a non-participating provider.

COC applies in these situations:

• The contract with your provider ends

• The benefits covered for your provider change in a way that results in a loss of coverage

• The contract between your company and us ends and that results in a loss of coverage with your provider

How you qualify for Continuity of Care You may qualify if you are in an "active relationship" or treatment with

your provider. This means that you have had three or more visits with the provider within the past 12 months and

you meet one or more of these conditions with respect to a terminated provider or facility :

• Undergoing a course of treatment for a serious and complex condition

• Undergoing a course of institutional or inpatient care

• Are scheduled for a non-elective surgery, including receipt of postoperative care

• Are pregnant and undergoing a course of treatment for the pregnancy

• Are receiving treatment for a terminal illness

We will notify you at least 30 days prior to your provider’s termination date. When a termination for cause

provides us less than 30 days notice, we will make a good faith effort to assure that a written notice is provided to

you immediately.

You can request continuity of care by contacting customer service. The contact information is on the back cover

of this booklet.

If you are approved for continuity of care, you will get continuing care from the terminating provider until the

earliest of the following:

• The 90

th

day after we notified you that your provider's contract ended

• The day after you complete the active course of treatment entitling you to continuity of care

If you are pregnant, and become eligible for continuity of care, you can continue with your provider throughout

your pregnancy, plus 8 weeks of postpartum care.

Continuity of care does not apply if your provider:

• No longer holds an active license

• Relocates out of the service area

• Goes on leave of absence

• Is unable to provide continuity of care because of other reasons

• Does not meet standards of quality of care

When continuity of care ends, non-emergent care from the provider is no longer covered. If we deny your request

for continuity of care, you may appeal the denial. See Complaints and Appeals.

Non-Participating Providers

Non-participating providers are either (1) providers that are not in one of the networks (Out-Of-Network) shown

above or (2) providers that do not have a contract with us (Non-Contracted). Except as stated in Benefits For

Out-Of-Network Or Non-Contracted Providers, or in a few specific benefits, services from these providers are

not covered.

• Out-of-Network Some providers in Washington have a contract with but are not in the Heritage Prime network.

In cases where this plan covers services from these providers, they will not bill you for any amount above the

allowed amount for a covered service. The same is true for a provider that is in a different network of the local

Host Blue plan.

• Non-Contracted Providers There are also providers who do not have a contract with us, Premera Blue Cross

Blue Shield of Alaska or the local Host Blue at all. These providers are called "non-contracted" providers in this

booklet. You may also be required to submit the claim yourself. See How Do I File A Claim? for details.

15 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Balance Billing Protection

Non-participating providers have the right to charge you more than the allowed amount for a covered service. This

is called "surprise billing" or "balance billing." However, [Washington state and] federal law protects you from

balance billing for:

Emergency Services from a nonparticipating hospital or facility or from a nonparticipating provider at the hospital

or facility.

Emergency services includes certain post-stabilization services you may get after you are in stable condition.

These include covered services provided as part of outpatient observation or during an inpatient or outpatient stay

related to the emergency visit, regardless of which department of the hospital you are in.

Non-emergency services from a nonparticipating provider at an in-network hospital or outpatient surgery

center. If a non-emergency service is not covered under the in-network benefits and terms of coverage under

your health plan, then the federal and state law regarding balance billing do not apply for these services.

Air Ambulance

Your cost sharing for non-participating air ambulance services shall be no more than if the services were provided

by an in-network provider. The cost sharing amount shall be counted towards the in-network deductible and the

in-network out of pocket maximum amount. Cost sharing shall be based upon the lesser of the qualifying payment

amount (as defined under federal law) or the billed amount.

For the above services, you will pay no more than the plan's in-network cost shares. See the Summary of Your

Costs. Premera Blue Cross will work with the nonparticipating provider to resolve any issues about the amount

paid. Premera will also send the plan's payments to the provider directly.

Please Note: The surprise billing protection does not apply to any other service from a non-contracted provider.

If the service is not listed above, you must pay any amounts over the plan’s allowed amount for the service

Amounts you pay over the allowed amount don’t count toward any applicable calendar year deductible,

coinsurance or out-of-pocket maximum.

Benefits For Out-Of-Network Or Non-Contracted Providers

The following covered services and supplies provided by out-of-network or non-contracted providers will always

be covered:

• Emergency services for an emergency medical condition. See the Definitions section for definitions of these

terms. This plan provides worldwide coverage for emergency services.

The benefits of this plan will be provided for covered emergency services without the need for any prior

authorization and without regard as to whether the health care provider furnishing the services has a contract

with us. Emergency services furnished by a non-participating provider will be reimbursed in compliance with

applicable laws.

• Services from certain categories of providers to which provider contracts are not offered. These types of

providers are not listed in the provider directory.

• Facility and hospital-based provider services received from a hospital that has a provider contract with Premera

Blue Cross.

• Covered services received from providers located outside the United States, the Commonwealth of Puerto Rico

and the U.S. Virgin Islands.

If a covered service is not available from an in-network provider, you can receive benefits for services provided by

an out-of-network or non-contracted provider. However, you or your out-of-network provider must request this

before you get the care. See Prior authorization to find out how to do this.

IMPORTANT PLAN INFORMATION

This section of your booklet explains the types of expenses you must pay for covered services before the benefits

of this plan are provided. (These are called “cost shares” in this booklet.) To prevent unexpected out-of-pocket

expenses, it’s important for you to understand what you’re responsible for.

The allowed amount is also explained.

You'll find the dollar amounts for these expenses and when they apply in the Summary Of Your Costs.

16 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

COPAYMENTS (COPAYS)

Copayments (“copays”) are fixed up-front dollar amounts that you’re required to pay for certain covered services.

Your provider of care may ask that you pay the copay at the time of service. If the amount billed is less than the

copay, you only pay the amount billed. Your copay amounts are shown in the Summary Of Your Costs.

SPLIT COPAY FOR OFFICE VISITS

This plan has two Professional Visit Copay amounts for in-network providers' office and home visits. When you

see one of the types of in-network providers shown below, you pay the non-specialist copay shown in the

Summary Of Your Costs for each office or home visit.

• Family practice physician

• General practice physician

• Internist

• Gynecologist

• Naturopath

• Advanced registered nurse practitioner (ARNP)

• Obstetrician

• Pediatrician

• Physician assistant

• Chiropractor

• Acupuncturist

Certain services don’t require a copay. However, the Professional Visit Copay may apply if you have a

consultation with the provider or receive other services. Separate copays will apply if you see more than one in-

network provider on the same day. But only one copay per provider, per day will apply. If you receive multiple

services from the same provider in the same visit and the copay amounts are different, then the highest copay will

apply.

For all other types of in-network providers covered by benefits subject to a professional visit copay, you pay the

specialist copay shown in the Summary Of Your Costs for each visit.

CALENDAR YEAR DEDUCTIBLE

A calendar year deductible is the amount of expense you must incur in each calendar year for covered services

and supplies before this plan makes a payment for most covered services. The amount credited toward the

calendar year deductible for any covered service or supply won’t exceed the allowed amount See the Allowed

Amount subsection below in this booklet.

While some benefits have dollar maximums, others have different kinds of maximums, such as a maximum

number of visits or days of care that can be covered. We don't count allowed amounts that apply to your

individual in-network or out-of-network calendar year deductibles toward dollar benefit maximums. But if you

receive services or supplies covered by a benefit that has any other kind of maximum, we do count the services

or supplies that apply to either of your individual calendar year deductibles toward that maximum.

The plan has separate deductibles for in-network and out-of-network providers. It could happen that you

satisfy one of these deductibles before the other. If this happens, you still have to pay cost-shares that

apply to the second deductible until it, too, is met.

Note: Each calendar year deductible accrues toward its applicable out-of-pocket maximum, if any.

Individual Deductible

An “Individual Deductible” is the amount each member must incur and satisfy before certain benefits of this plan

are provided.

Family Deductible

In addition to the individual deductible, we also keep track of the expenses applied to the family deductible which

are incurred by all enrolled family members combined. When the total equals a set maximum, called the “Family

Deductible,” we will consider the individual deductible of every enrolled family member to be met for the year.

17 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Only the amounts used to satisfy each enrolled family member's individual deductible will count toward the family

deductible.

Please note: No enrolled family member will be required to satisfy more than the individual deductible amount .

What Doesn't Apply To The Calendar Year Deductible?

Amounts that don't accrue toward this plan's calendar year deductible are:

• Amounts that exceed the allowed amount

• Charges for excluded services

• The penalty for not asking for prior authorization when the plan requires it. See Prior Authorization in the

Care Management section of this booklet.

• The difference in cost between a brand name drug and an equivalent generic drug when the plan requires the

generic drug to be dispensed in place of the brand name drug.

• Copays

• The coinsurance for in-network pharmacies stated in the Summary Of Your Costs

COINSURANCE

“Coinsurance” is a defined percentage of allowed amounts for covered services and supplies you receive. It's the

percentage you’re responsible for, not including copays and the calendar year deductible, when the plan provides

benefits at less than 100% of the allowed amount. You will find your coinsurance in the Summary Of Your

Costs.

OUT-OF-POCKET MAXIMUM

The “individual out-of-pocket maximum” is the maximum amount, made up of the cost shares below, that each

individual could pay each calendar year for certain covered services and supplies. Refer to the Summary Of

Your Costs for the amount of out-of-pocket maximums you're responsible for.

Once the out-of-pocket maximum has been satisfied, the benefits of this plan will be provided at 100% of

allowed amounts for the remainder of that calendar year for covered services that are subject to the

maximum.

Cost shares that apply to the out-of-pocket maximum are:

• Your coinsurance

• The calendar year deductibles

Once the family deductible is met, your individual deductible will be satisfied. However, you must still pay any

other cost shares shown in the Summary Of Your Costs until your individual out-of-pocket maximum is

reached.

• Copays

• The difference in cost between a brand name drug and an equivalent generic drug when the plan requires the

generic drug to be dispensed in place of the brand name drug.

There are some exceptions. Expenses that do not apply to the out-of-pocket maximum are:

• Charges above the allowed amount

• Charges not covered by the plan

• Copays for exams covered under the Hearing Exams benefit

• The penalty for not requesting prior authorization when needed. See Prior Authorization in the Care

Management section of this booklet.

In addition to the individual out-of-pocket maximum, we also keep track of the expenses applied to the family out-

of-pocket maximum which are incurred by all enrolled family members combined. When this total equals a set

maximum, called the “Family Out-of-Pocket Maximum,” we will consider the individual out-of-pocket maximum of

every enrolled family member to be met for that calendar year. Only the amounts used to satisfy each enrolled

family member’s individual out-of-pocket maximum will count toward the family out-of-pocket maximum.

Please note: In order to satisfy the in-network out-of-pocket amount, no enrolled family member has to pay more

than the individual out-of-pocket maximum.

18 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

ALLOWED AMOUNT

This plan provides benefits based on the allowed amount for covered services. We reserve the right to determine

the amount allowed for any given service or supply. The allowed amount is described below. There are different

rules for certain services as described below. These rules are shown below the general rules.

General Rules

• Providers In Washington and Alaska Who Have Agreements With Us

For any given service or supply, the amount these providers have agreed to accept as payment in full pursuant

to the applicable agreement between us and the provider. These providers agree to seek payment from us

when they furnish covered services to you. You’ll be responsible only for any applicable calendar year

deductibles, copays, coinsurance, charges in excess of the stated benefit maximums and charges for services

and supplies not covered under this plan.

Your liability for any applicable calendar year deductibles, coinsurance, copays and amounts applied toward

benefit maximums will be calculated on the basis of the allowed amount.

• Providers Outside The Service Area Who Have Agreements With Other Blue Cross Blue Shield

Licensees

For covered services and supplies received outside the service area, allowed amounts are determined as

stated in the What Do I Do If I’m Outside Washington And Alaska? section (Out-Of-Area Care) in this

booklet.

• Providers Who Don’t Have Agreements With Us Or Another Blue Cross Blue Shield Licensee

Except as stated below, the allowed amount for providers in the service area that don't have a contract with us

is the least of the three amounts shown below. The allowed amount for providers outside Washington or

Alaska that don't have a contract with us or the local Blue Cross and/or Blue Shield Licensee is also the least of

the three amounts shown below.

• An amount that is no less than the lowest amount the plan pays for the same or similar service from a

comparable provider that has a contracting agreement with us

• 125% of the fee schedule determined by the Centers for Medicare and Medicaid Services (Medicare), if

available

• The provider’s billed charges. Note: Ground ambulances are always paid based on billed charges.

If applicable law requires a different allowed amount than the least of the three amounts above, this plan will

comply with that law.

Non-Emergency Services Protected From Balance Billing

For these services, the allowed amount is calculated consistent with the requirements of federal or Washington

state law.

Emergency Services

The allowed amount for non-participating providers will be calculated consistent with the requirements of federal

or Washington state law. You do not have to pay amounts over the allowed amount for emergency services

delivered by non-participating providers or facilities.

Note: Non-participating ground ambulances are always paid based on billed charges.

If you have questions about this information, please call us at the number listed on your Premera Blue Cross ID

card.

Air Ambulance

The allowed amount for non-participating air ambulance providers will be calculated consistent with the

requirements of federal law.

COVERED SERVICES

This section of your booklet describes the services and supplies that the plan covers. Benefits are available for a

service or supply described in this section when it meets all of these requirements:

• It must be furnished in connection with either the prevention or diagnosis and treatment of a covered illness,

disease or injury.

19 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

• It must be medically necessary (see the

Definitions

section in this booklet) and must be furnished in a

medically necessary setting.

• It must not be excluded from coverage under this plan.

• The expense for it must be incurred while you’re covered under this plan.

• It must be furnished by a “provider” (see the

Definitions

section in this booklet) who’s performing services

within the scope of their license or certification.

• It must meet the standards set in our medical and payment policies. The plan uses policies to administer the

terms of the plan. Medical policies are generally used to further define medical necessity or investigational

status for specific procedures, drugs, biologic agents, devices, level of care or services. Payment policies

define our provider billing and payment rules. Our policies are based on accepted clinical practice guidelines

and industry standards accepted by organizations like the American Medical Association (AMA), other

professional societies and the Center for Medicare and Medicaid Services (CMS). Our policies are available to

you and your provider at www.premera.com/sebb or by calling customer service.

Benefits for some types of services and supplies may be limited or excluded under this plan. Refer to the actual

benefit provisions throughout this section and the Exclusions section for a complete description of covered

services and supplies, limitations and exclusions. You will find limits on days or visits and dollar limits in the

Summary Of Your Costs.

The Summary Of Your Costs also explains your cost share under each benefit.

Acupuncture

The technique of inserting thin needles through the skin at specific points on body to help control pain and other

symptoms. Services must be provided by a certified or licensed acupuncturist.

This benefit covers acupuncture to:

• Relieve pain

• Provide anesthesia for surgery

• Treat a covered illness, injury, or condition

See the Summary of Your Costs for benefit limitations.

Note: Acupuncture services when provided for substance use disorder conditions do not apply to the

Acupuncture benefit visit limits.

Allergy Testing and Treatment

Skin and blood tests used to diagnose what substances a person is allergic to, and treatment for allergies.

Services must be provided by a certified or licensed allergy specialist.

This benefit covers:

• Testing

• Allergy shots

• Serums

Ambulance

This benefit covers:

• Transport to the nearest facility that can treat your condition

• Medical care you get during the trip

• Transport from one medical facility to another as needed for your condition

• Transport to your home when medically necessary

These services are only covered when:

• Any other type of transport would put your health or safety at risk

• The service is from a licensed ambulance

• It is for the member who needs transport

20 Standard PPO Plan (Non-Grandfathered)

January 1, 2023

4018486

Air or sea emergency medical transportation is covered when:

• Transport takes you to the nearest available facility that can treat your condition

• The above requirements for ambulance services are met

• Geographic restraints prevent ground transport

• Ground emergency transportation would put your health or safety at risk

Ambulance services that are not for an emergency must be medically necessary and need prior authorization.

See Prior Authorization for details.

Blood Products And Services

• Blood components and services, like blood transfusions, which are provided by a certified or licensed

healthcare provider.

• Blood products and services that either help with prevention or diagnosis and treatment of an illness, disease,

or injury.

Cellular Immunotherapy And Gene Therapy

Treatment which uses your body’s own immune system or genes to treat disease.

These therapies are fairly new, and their use is evolving. They must meet three criteria in order to be covered:

• Prescribed by a provider

• Meet Premera’s medical policy (See www.premera.com/sebb or call customer service), and

• Approved by Premera before they can happen (See Prior Authorization)

This benefit covers:

Medically necessary cellular immunotherapy and gene therapy, like Chimeric Antigen Receptor T-Cell (CAR-T).

If you travel more than 50 miles for these therapies, keep all receipts. You can be reimbursed for some expenses,

up to $7,500 per episode of care. See Medical Transportation.

See Prior Authorization for more information on getting prior approval for services.

Chemotherapy And Radiation Therapy

Treatment which uses powerful chemicals (chemotherapy) or high-energy beams (radiation) to shrink or kill

cancer cells.

Chemotherapy and radiation must be prescribed by a doctor and approved by Premera to be covered. See Prior

Authorization.

This benefit covers: