SENATE BILL 20-215

BY SENATOR(S) Moreno and Donovan, Bridges, Danielson, Fenberg,

Fields, Ginal, Gonzales, Pettersen, Rodriguez, Story;

also REPRESENTATIVE(S) Kennedy and McCluskie, Benavidez, Bird,

Buckner, Buentello, Caraveo, Coleman, Cutter, Duran, Esgar,

Gonzales-Gutierrez, Gray, Herod, Hooton, Jaquez Lewis, Kipp, Lontine,

Melton, Michaelson Jenet, Mullica, Roberts, Snyder, Valdez A., Valdez D.,

Weissman, Woodrow.

CONCERNING MEASURES TO ADDRESS THE AFFORDABILITY OF HEALTH

INSURANCE FOR COLORADANS PURCHASING COVERAGE ON THE

INDIVIDUAL MARKET, AND, IN CONNECTION THEREWITH,

ESTABLISHING AN ENTERPRISE TO ADMINISTER A HEALTH INSURANCE

AFFORDABILITY FEE ASSESSED ON CERTAIN HEALTH INSURERS AND A

SPECIAL ASSESSMENT ON HOSPITALS TO FUND MEASURES TO REDUCE

CONSUMER COSTS FOR INDIVIDUAL HEALTH COVERAGE PLANS.

Be it enacted by the General Assembly of the State of Colorado:

SECTION 1. In Colorado Revised Statutes, add part 12 to article

16 of title 10 as follows:

PART 12

Capital letters or bold & italic numbers indicate new material added to existing law; dashes

through words or numbers indicate deletions from existing law and such material is not part of

the act.

HEALTH INSURANCE AFFORDABILITY ACT

10-16-1201. Short title.

THE SHORT TITLE OF THIS PART 12 IS THE

"HEALTH INSURANCE AFFORDABILITY ACT".

10-16-1202. Legislative declaration.

(1)

THE GENERAL ASSEMBLY

FINDS AND DECLARES THAT:

(a)

THE STATE, CARRIERS, AND HOSPITALS SHARE A COMMON

COMMITMENT TO ENSURING ALL COLORADANS HAVE ACCESS TO

AFFORDABLE HEALTH CARE COVERAGE BECAUSE ACCESS TO COVERAGE

IMPROVES HEALTH OUTCOMES AND PROVIDES FINANCIAL SECURITY FOR

COLORADANS;

(b)

HOSPITALS WITHIN THE STATE INCUR THE COSTS OF

UNCOMPENSATED CARE TO UNINSURED AND UNDERINSURED POPULATIONS;

(c)

THE ECONOMIC DOWNTURN DUE TO COVID-19 AND ITS IMPACTS

ON GROUP AND INDIVIDUAL HEALTH CARE COVERAGE IN THE STATE CREATES

ECONOMIC CHALLENGES FOR CARRIERS FROM THE POTENTIAL LOST REVENUE

IF PEOPLE DROP INSURANCE COVERAGE;

(d)

THIS PART 12 IS ENACTED TO PROVIDE THE FOLLOWING SERVICES

AND BENEFITS TO CARRIERS:

(I)

REDUCING THE NUMBER OF COLORADANS WHO LACK HEALTH

CARE COVERAGE BY HELPING COLORADANS TO MAINTAIN CONSISTENT

COVERAGE;

(II)

PROVIDING STABILITY IN THE INSURANCE MARKET;

(III)

REDUCING THE MOVEMENT OF INDIVIDUALS BETWEEN INSURED

AND UNINSURED STATUS;

(IV)

OFFSETTING THE COSTS CARRIERS WOULD OTHERWISE PAY FOR

COVERED PERSONS' HIGH MEDICAL COSTS SO THAT PREMIUMS ARE SET AT

MORE AFFORDABLE LEVELS; AND

(V)

CREATING A HEALTHIER RISK POOL FOR ALL CARRIERS BY

ESTABLISHING A PATH FOR CONSISTENT COVERAGE FOR INDIVIDUALS; AND

PAGE 2-SENATE BILL 20-215

(e)

THIS PART 12 IS ENACTED TO PROVIDE THE FOLLOWING SERVICES

AND BENEFITS TO HOSPITALS:

(I)

REDUCING THE AMOUNT OF UNCOMPENSATED CARE PROVIDED BY

HOSPITALS;

(II)

REDUCING THE NEED OF PROVIDERS TO SHIFT COSTS OF

PROVIDING UNCOMPENSATED CARE TO OTHER PAYERS; AND

(III)

EXPANDING ACCESS TO HIGH-QUALITY, AFFORDABLE HEALTH

CARE FOR LOW-INCOME AND UNINSURED COLORADANS.

(2) THE GENERAL ASSEMBLY FURTHER FINDS AND DECLARES THAT,

CONSISTENT WITH THE DETERMINATION OF THE COLORADO SUPREME COURT

IN

NICHOLL V. E-470 PUBLIC HIGHWAY AUTHORITY,

896 P.2d 859 (Cow.

1995), THE POWER TO IMPOSE TAXES IS INCONSISTENT WITH ENTERPRISE

STATUS UNDER SECTION 20 OF ARTICLE X OF THE STATE CONSTITUTION, AND

THE HEALTH INSURANCE AFFORDABILITY FEES AND SPECIAL ASSESSMENTS

CHARGED AND COLLECTED BY THE HEALTH INSURANCE AFFORDABILITY

ENTERPRISE ARE FEES, NOT TAXES, BECAUSE THE FEES AND ASSESSMENTS

ARE IMPOSED FOR THE SPECIFIC PURPOSE OF ALLOWING THE ENTERPRISE TO

DEFRAY THE COSTS OF PROVIDING THE BUSINESS SERVICES SPECIFIED IN

SECTION

10-16-1204

(1

)(a)

TO THE CARRIERS AND HOSPITALS THAT PAY THE

FEES AND ASSESSMENTS AND ARE COLLECTED AT RATES THAT ARE

REASONABLY CALCULATED BASED ON THE BENEFITS RECEIVED BY THOSE

CARRIERS AND HOSPITALS.

10-16-1203. Definitions.

AS USED IN THIS PART 12, UNLESS THE

CONTEXT OTHERWISE REQUIRES:

(1)

"BOARD"

MEANS THE HEALTH INSURANCE AFFORDABILITY BOARD

CREATED IN SECTION

10-16-1207.

(2)

"CHILDREN'S BASIC HEALTH PLAN" HAS THE MEANING SET FORTH

IN SECTION 25.5-8-103 (2).

(3)

"ENTERPRISE" MEANS THE COLORADO HEALTH INSURANCE

AFFORDABILITY ENTERPRISE CREATED IN SECTION 10-16-1204.

(4)

"FEDERAL POVERTY LINE" HAS THE SAME MEANING AS "POVERTY

PAGE 3-SENATE BILL 20-215

LINE", AS DEFINED IN 42 U.S.C. SEC. 9902 (2).

(5)

"FEE" MEANS THE HEALTH INSURANCE AFFORDABILITY FEE

ESTABLISHED AND ASSESSED PURSUANT TO SECTION

10-16-1205.

(6)

"FUND" MEANS THE HEALTH INSURANCE AFFORDABILITY CASH

FUND CREATED IN SECTION

10-16-1206.

(7)

"HOUSEHOLD INCOME" HAS THE SAME MEANING AS SET FORTH IN

26 U.S.C. SEC. 36B (d)(2) OF THE FEDERAL "INTERNAL REVENUE CODE OF

1986", AS AMENDED.

(8)

"MEDICAID" MEANS FEDERAL INSURANCE OR ASSISTANCE AS

PROVIDED BY TITLE XIX OF THE FEDERAL "SOCIAL SECURITY ACT", AS

AMENDED, AND THE "COLORADO MEDICAL ASSISTANCE ACT", ARTICLES 4,

5, AND 6 OF TITLE 25.5.

(9)

"MEDICARE" MEANS FEDERAL INSURANCE OR ASSISTANCE

PROVIDED BY THE "HEALTH INSURANCE FOR THE AGED ACT", TITLE XVIII

OF THE FEDERAL "SOCIAL SECURITY ACT", AS AMENDED, 42 U.S.C. SEC.

1395 ET SEQ.

(10)

"PREMIUM TAX CREDIT" MEANS THE REFUNDABLE TAX CREDIT

AVAILABLE PURSUANT TO THE FEDERAL ACT TO ASSIST CERTAIN

INDIVIDUALS IN PURCHASING A HEALTH BENEFIT PLAN ON THE EXCHANGE.

(11)

"PUBLIC BENEFIT CORPORATION" MEANS A PUBLIC BENEFIT

CORPORATION FORMED PURSUANT TO PART 5 OF ARTICLE 101 OF TITLE 7

THAT IS ORGANIZED AND OPERATED BY THE EXCHANGE PURSUANT TO

SECTION 10-22-106 (3) FOR THE PURPOSE OF ADMINISTERING AND

OPERATING A SUBSIDY TO REDUCE THE COSTS OF HEALTH CARE COVERAGE

OFFERED UNDER A STATE-SUBSIDIZED INDIVIDUAL HEALTH COVERAGE PLAN.

(12)

"QUALIFIED INDIVIDUAL" MEANS AN INDIVIDUAL, REGARDLESS

OF IMMIGRATION STATUS, WHO:

(a)

IS A COLORADO RESIDENT;

(b)

HAS A HOUSEHOLD INCOME OF NOT MORE THAN THREE HUNDRED

PERCENT OF THE FEDERAL POVERTY LINE; AND

PAGE 4-SENATE BILL 20-215

(c)

IS NOT ELIGIBLE FOR THE PREMIUM TAX CREDIT, MEDICAID,

MEDICARE, OR THE CHILDREN'S BASIC HEALTH PLAN.

(13)

"REINSURANCE PROGRAM" MEANS THE COLORADO

REINSURANCE PROGRAM CREATED IN PART 11 OF THIS ARTICLE 16.

(14)

"REINSURANCE PROGRAM CASH FUND" MEANS THE

REINSURANCE PROGRAM CASH FUND CREATED IN SECTION 10- 16- 1 107.

(15)

"STATE-SUBSIDIZED INDIVIDUAL HEALTH COVERAGE PLAN"

MEANS A SUBSIDIZED INDIVIDUAL HEALTH COVERAGE PLAN OFFERED BY

CARRIERS TO QUALIFIED INDIVIDUALS THROUGH THE PUBLIC BENEFIT

CORPORATION.

10-16-1204. Health insurance affordability enterprise - creation

- powers and duties - assess and allocate health insurance affordability

fee and special assessment.

(1) (a)

THERE IS HEREBY CREATED IN THE

DIVISION THE COLORADO HEALTH INSURANCE AFFORDABILITY ENTERPRISE.

THE ENTERPRISE IS AND OPERATES AS A GOVERNMENT-OWNED BUSINESS

WITHIN THE DIVISION FOR THE PURPOSE OF ASSESSING AND COLLECTING THE

HEALTH INSURANCE AFFORDABILITY FEE FROM CARRIERS THAT OFFER

HEALTH BENEFIT PLANS IN THE STATE AND A SPECIAL ASSESSMENT ON

HOSPITALS IN THE STATE AND USING AND ALLOCATING THE FEE AND

ASSESSMENT FOR THE PURPOSES SPECIFIED IN THIS PART 12 IN ORDER TO:

(I) PROVIDE THE FOLLOWING BUSINESS SERVICES TO CARRIERS THAT

PAY THE FEE:

(A)

OUTREACH AND RELATED WORK TO INCREASE ENROLLMENT IN

HEALTH BENEFIT PLANS OFFERED BY CARRIERS ACROSS THE STATE;

(B)

INCREASING THE NUMBER OF INDIVIDUALS WHO PURCHASE

HEALTH BENEFIT PLANS IN THE INDIVIDUAL MARKET BY PROVIDING

FINANCIAL SUPPORT TO INDIVIDUALS TO PURCHASE PRIVATE HEALTH

INSURANCE COVERAGE;

(C)

FUNDING THE REINSURANCE PROGRAM THAT OFFSETS THE COSTS

CARRIERS WOULD OTHERWISE PAY FOR COVERING CONSUMERS WITH HIGH

MEDICAL COSTS;

PAGE 5-SENATE BILL 20-215

(D)

IMPROVING THE STABILITY OF THE MARKET THROUGHOUT THE

STATE BY PROVIDING CONSISTENT PRIVATE HEALTH CARE COVERAGE AND

REDUCING THE MOVEMENT OF INDIVIDUALS FROM INSURED TO UNINSURED

STATUS;

(E)

REDUCING PROVIDER COST SHIFTING FROM THE INDIVIDUAL

MARKET AND THE UNINSURED TO THE GROUP MARKET; AND

(F)

CREATING A HEALTHIER RISK POOL FOR ALL CARRIERS BY

ESTABLISHING A PATH FOR CONSISTENT COVERAGE FOR INDIVIDUALS; AND

(II) PROVIDE THE FOLLOWING BUSINESS SERVICES TO HOSPITALS:

(A)

REDUCING THE AMOUNT OF UNCOMPENSATED CARE PROVIDED

BY HOSPITALS;

(B)

REDUCING THE NEED OF PROVIDERS TO SHIFT COSTS OF

PROVIDING UNCOMPENSATED CARE TO OTHER PAYERS; AND

(C)

EXPANDING ACCESS TO HIGH-QUALITY, AFFORDABLE HEALTH

CARE FOR LOW-INCOME AND UNINSURED COLORADANS.

(b) (I) THE ENTERPRISE CONSTITUTES AN ENTERPRISE FOR PURPOSES

OF SECTION 20 OF ARTICLE X OF THE STATE CONSTITUTION SO LONG AS IT

RETAINS THE AUTHORITY TO ISSUE REVENUE BONDS AND RECEIVES LESS

THAN TEN PERCENT OF ITS TOTAL REVENUES IN GRANTS, AS DEFINED IN

SECTION 24-77-102 (7), FROM ALL COLORADO STATE AND LOCAL

GOVERNMENTS COMBINED. SO

LONG AS IT CONSTITUTES AN ENTERPRISE

PURSUANT TO THIS SECTION, THE ENTERPRISE IS NOT A DISTRICT FOR

PURPOSES OF SECTION 20 OF ARTICLE X OF THE STATE CONSTITUTION.

(II) THE ENTERPRISE IS HEREBY AUTHORIZED TO ISSUE REVENUE

BONDS FOR THE EXPENSES OF THE ENTERPRISE, SECURED BY REVENUES OF

THE ENTERPRISE.

(2) THE ENTERPRISE'S PRIMARY POWERS AND DUTIES ARE:

(a) To ASSESS AND COLLECT THE FEE SPECIFIED IN SECTION

10-16-1205 (1)(a)(I);

PAGE 6-SENATE BILL 20-215

(b)

To ASSESS AND COLLECT THE SPECIAL ASSESSMENT ON

HOSPITALS SPECIFIED IN SECTION

10-16-1205

(1)(a)(II);

(c)

To ALLOCATE MONEY IN THE FUND IN ACCORDANCE WITH

SECTION 10-16-1205 (2);

(d)

To ISSUE REVENUE BONDS PAYABLE FROM THE REVENUES OF THE

ENTERPRISE;

(e)

(I) To ENGAGE THE SERVICES OF THIRD PARTIES SERVING AS

CONTRACTORS AND CONSULTANTS, INCLUDING THE DIVISION, FOR

PROFESSIONAL AND TECHNICAL ASSISTANCE AND ADVICE AND TO SUPPLY

OTHER SERVICES RELATED TO THE CONDUCT OF THE AFFAIRS OF THE

ENTERPRISE, WITHOUT REGARD TO THE "PROCUREMENT CODE", ARTICLES

101 TO 112 OF TITLE 24. THE ENTERPRISE SHALL ENCOURAGE DIVERSITY IN

APPLICATIONS FOR CONTRACTS AND SHALL GENERALLY AVOID USING

SINGLE-SOURCE BIDS.

(II)

THE DIVISION SHALL PROVIDE OFFICE SPACE AND

ADMINISTRATIVE STAFF TO THE ENTERPRISE PURSUANT TO A CONTRACT

ENTERED INTO UNDER THIS SUBSECTION (2)(e).

(f)

To ENGAGE IN OUTREACH AND RELATED EFFORTS TO INCREASE

ENROLLMENT IN HEALTH BENEFIT PLANS ACROSS THE STATE; AND

(g)

To ADOPT AND AMEND OR REPEAL POLICIES FOR THE REGULATION

OF ITS AFFAIRS AND THE CONDUCT OF ITS BUSINESS CONSISTENT WITH THIS

PART 12.

(3) THE ENTERPRISE SHALL EXERCISE ITS POWERS AND PERFORM ITS

DUTIES AS IF THE SAME WERE TRANSFERRED TO THE DIVISION BY A TYPE

2

TRANSFER, AS DEFINED IN SECTION 24-1-105.

10-16-1205. Health insurance affordability fee - special

assessment on hospitals - allocation of revenues. (1)

(a)

(I) STARTING IN

THE 2021 CALENDAR YEAR, THE ENTERPRISE SHALL ASSESS AND COLLECT

FROM CARRIERS, BY JULY 15 EACH YEAR, A HEALTH INSURANCE

AFFORDABILITY FEE. THE FEE AMOUNT IS BASED ON THE FOLLOWING

PERCENTAGES OF PREMIUMS COLLECTED BY THE FOLLOWING CARRIERS IN

THE IMMEDIATELY PRECEDING CALENDAR YEAR ON HEALTH BENEFIT PLANS

PAGE 7-SENATE BILL 20-215

ISSUED IN THE STATE:

(A)

ONE AND FIFTEEN HUNDREDTHS PERCENT OF PREMIUMS

COLLECTED BY NONPROFIT CARRIERS; AND

(B)

Two AND ONE-TENTH PERCENT OF PREMIUMS COLLECTED BY

FOR-PROFIT CARRIERS.

(II) FOR THE 2022 AND 2023 CALENDAR YEARS, THE ENTERPRISE

SHALL ASSESS AND COLLECT FROM HOSPITALS A SPECIAL ASSESSMENT OF

TWENTY MILLION DOLLARS PER YEAR, SUBJECT TO SUBSECTION (5) OF THIS

SECTION. THE ENTERPRISE SHALL NOT COLLECT THE SPECIAL ASSESSMENT

FOR THE 2022 CALENDAR YEAR BEFORE OCTOBER 1, 2022.

(b) THE ENTERPRISE SHALL USE THE FEE, THE SPECIAL ASSESSMENT

ON HOSPITALS, AND ANY OTHER MONEY AVAILABLE IN THE FUND AS

FOLLOWS, ALLOCATED IN ACCORDANCE WITH SUBSECTION (2) OF THIS

SECTION:

(I)

To PROVIDE FUNDING FOR THE REINSURANCE PROGRAM;

(II)

To PROVIDE PAYMENTS TO CARRIERS TO INCREASE THE

AFFORDABILITY OF HEALTH INSURANCE ON THE INDIVIDUAL MARKET FOR

COLORADANS WHO RECEIVE THE PREMIUM TAX CREDIT;

(III)

To PROVIDE SUBSIDIES FOR STATE-SUBSIDIZED INDIVIDUAL

HEALTH COVERAGE PLANS PURCHASED BY QUALIFIED INDIVIDUALS;

(IV)

To PAY THE ACTUAL ADMINISTRATIVE COSTS OF THE

ENTERPRISE FOR IMPLEMENTING AND ADMINISTERING THIS PART 12, LIMITED

TO THREE PERCENT OF THE ENTERPRISE'S REVENUES. ACTUAL

ADMINISTRATIVE COSTS INCLUDE THE FOLLOWING:

(A)

THE ADMINISTRATIVE COSTS OF THE ENTERPRISE, INCLUDING THE

COSTS TO IMPLEMENT AND ADMINISTER THE PROGRAMS ESTABLISHED

PURSUANT TO THIS PART 12;

(B)

THE ENTERPRISE'S ACTUAL COSTS RELATED TO IMPLEMENTING

AND MAINTAINING THE FEE AND SPECIAL ASSESSMENT ON HOSPITALS,

INCLUDING PERSONAL SERVICES AND OPERATING EXPENSES; AND

PAGE 8-SENATE BILL 20-215

(C) THE COSTS FOR CONDUCTING ANALYSES NECESSARY TO

DETERMINE THE PAYMENTS TO BE MADE TO CARRIERS FOR THE PURPOSES

DESCRIBED IN SUBSECTION (1)(b)(II) OF THIS SECTION AND THE

REQUIREMENTS FOR STATE-SUBSIDIZED INDIVIDUAL HEALTH COVERAGE

PLANS OFFERED BY CARRIERS; AND

(V) To PAY THE COSTS FOR CONSUMER ENROLLMENT, OUTREACH,

AND EDUCATION ACTIVITIES REGARDING HEALTH CARE COVERAGE,

INCLUDING:

(A)

INCREASING GRANTS TO THE EXCHANGE'S CERTIFIED ASSISTANCE

NETWORK;

(B)

MARKETING FOR THE EXCHANGE;

(C)

GRANTS TO COMMUNITY-BASED ORGANIZATIONS THAT ARE ABLE

TO ASSIST WITH OUTREACH AND ENROLLMENT, PARTICULARLY IN

COMMUNITIES THAT FACE THE GREATEST BARRIERS TO ENROLLING IN

HEALTH CARE COVERAGE; AND

(D)

IMPROVING THE CONNECTION BETWEEN UNEMPLOYMENT

SERVICES AND ENROLLMENT IN HEALTH CARE COVERAGE.

(c)

THIS SUBSECTION (1) DOES NOT APPLY TO PLANS OR BENEFITS

PROVIDED UNDER MEDICAID, MEDICARE, OR THE CHILDREN'S BASIC HEALTH

PLAN.

(2)

(a)

THE ENTERPRISE SHALL TRANSMIT THE FEES AND SPECIAL

ASSESSMENTS COLLECTED PURSUANT TO THIS SECTION TO THE STATE

TREASURER FOR DEPOSIT IN THE HEALTH INSURANCE AFFORDABILITY CASH

FUND CREATED IN SECTION 10-16-1206 AND, EXCEPT AS PROVIDED IN

SUBSECTION (4) OF THIS SECTION, SHALL ALLOCATE THE MONEY IN THE FUND

IN ACCORDANCE WITH THIS SUBSECTION (2).

(b) THE ENTERPRISE SHALL ALLOCATE THE REVENUES COLLECTED IN

2021, AND ANY OTHER MONEY DEPOSITED IN THE FUND IN 2021, AS

FOLLOWS:

(I) UP TO THREE PERCENT FOR ACTUAL ADMINISTRATIVE COSTS AS

SET FORTH IN SUBSECTION (1)(b)(IV) OF THIS SECTION;

PAGE 9-SENATE BILL 20-215

(II)

To THE REINSURANCE PROGRAM CASH FUND, AN AMOUNT

NECESSARY TO FUND THE PAYMENT PARAMETERS OF THE REINSURANCE

PROGRAM, AS DETERMINED PURSUANT TO SECTION 10-16-1105 (2), NOT TO

EXCEED NINETY MILLION DOLLARS OR, IF THE REVENUES COLLECTED

PURSUANT TO SUBSECTION

(1)(a)

OF THIS SECTION ARE LESS THAN NINETY

MILLION DOLLARS, THE AMOUNT COLLECTED; AND

(III)

OF ANY REMAINING BALANCE [N THE FUND AFTER DEDUCTING

THE ALLOCATIONS SPECIFIED IN SUBSECTIONS (2)(b)(I) AND (2)(b)(II) OF

THIS SECTION:

(A)

UP TO ONE PERCENT OF THE TOTAL AMOUNT OF REVENUES

COLLECTED OR DEPOSITED INTO THE FUND IN 2021, BUT NOT MORE THAN ONE

MILLION FIVE HUNDRED THOUSAND DOLLARS, FOR IMPLEMENTATION COSTS

AND CONSUMER ENROLLMENT, OUTREACH, AND EDUCATION ACTIVITIES

REGARDING HEALTH CARE COVERAGE AS DESCRIBED IN SUBSECTION

(1)(b)(V)

OF THIS SECTION; AND

(B)

THE REMAINING BALANCE TO CARRIERS TO REDUCE THE COSTS

OF INDIVIDUAL HEALTH PLANS FOR INDIVIDUALS WHO PURCHASE AN

INDIVIDUAL HEALTH BENEFIT PLAN ON THE EXCHANGE AND RECEIVE THE

PREMIUM TAX CREDIT.

(c)

THE ENTERPRISE SHALL ALLOCATE THE REVENUES COLLECTED IN

2022, AND ANY OTHER MONEY DEPOSITED IN THE FUND IN 2022, AS

FOLLOWS:

(I)

UP TO THREE PERCENT FOR ACTUAL ADMINISTRATIVE COSTS AS

SET FORTH IN SUBSECTION (1)(b)(IV) OF THIS SECTION;

(II)

To THE REINSURANCE PROGRAM CASH FUND, EIGHTY-EIGHT

MILLION DOLLARS; AND

(III)

OF THE REMAINING BALANCE IN THE FUND AFTER DEDUCTING

THE ALLOCATIONS SPECIFIED IN SUBSECTIONS (2)(c)(I) AND (2)(c)(II) OF

THIS SECTION:

(A) THIRTY PERCENT TO CARRIERS TO REDUCE THE COSTS OF

INDIVIDUAL HEALTH PLANS FOR INDIVIDUALS WHO PURCHASE AN INDIVIDUAL

HEALTH BENEFIT PLAN ON THE EXCHANGE AND RECEIVE THE PREMIUM TAX

PAGE 10-SENATE BILL 20-215

CREDIT; AND

(B) SEVENTY PERCENT FOR SUBSIDIES FOR STATE-SUBSIDIZED

INDIVIDUAL HEALTH COVERAGE PLANS PURCHASED BY QUALIFIED

INDIVIDUALS.

(d) (I) THE ENTERPRISE SHALL ALLOCATE THE REVENUES COLLECTED

IN 2023 AND EACH YEAR THEREAFTER, AND ANY OTHER MONEY DEPOSITED

IN THE FUND IN 2023 AND EACH YEAR THEREAFTER, IN THE FOLLOWING

AMOUNTS AND ORDER OF PRIORITY:

(A)

FIRST, UP TO THREE PERCENT FOR ACTUAL ADMINISTRATIVE

COSTS AS SET FORTH IN SUBSECTION (1)(b)(IV) OF THIS SECTION;

(B)

SECOND, EIGHTEEN MILLION DOLLARS FOR SUBSIDIES FOR

STATE-SUBSIDIZED INDIVIDUAL HEALTH COVERAGE PLANS PURCHASED BY

QUALIFIED INDIVIDUALS;

(C)

THIRD, THE AMOUNT REMAINING IN THE FUND, UP TO

SEVENTY-THREE PERCENT OF THE TOTAL AMOUNT OF REVENUES COLLECTED

OR DEPOSITED INTO THE FUND IN THE APPLICABLE YEAR, BUT NOT TO EXCEED

NINETY MILLION DOLLARS, TO THE REINSURANCE PROGRAM CASH FUND; AND

(D)

FOURTH, TEN PERCENT OF THE TOTAL AMOUNT OF REVENUES

COLLECTED OR DEPOSITED INTO THE FUND IN THE APPLICABLE YEAR OR THE

AMOUNT REMAINING IN THE FUND, WHICHEVER IS LESS, TO CARRIERS TO

REDUCE THE COSTS OF INDIVIDUAL HEALTH PLANS FOR INDIVIDUALS WHO

PURCHASE AN INDIVIDUAL HEALTH BENEFIT PLAN ON THE EXCHANGE AND

RECEIVE THE PREMIUM TAX CREDIT.

(II) IF, AFTER MAKING THE ALLOCATIONS SPECIFIED IN SUBSECTION

(2)(d)(I) OF THIS SECTION, THERE IS MONEY REMAINING IN THE FUND IN THE

APPLICABLE YEAR, THE ENTERPRISE SHALL ALLOCATE THE REMAINING

MONEY FOR SUBSIDIES FOR STATE-SUBSIDIZED INDIVIDUAL HEALTH

COVERAGE PLANS PURCHASED BY QUALIFIED INDIVIDUALS.

(3) THE ENTERPRISE SHALL DISTRIBUTE THE ALLOCATIONS SPECIFIED

IN SUBSECTION (2) OF THIS SECTION IN ACCORDANCE WITH THE

REQUIREMENTS DETERMINED BY THE BOARD PURSUANT TO SECTION

10-16-1207 (4).

PAGE 11-SENATE BILL 20-215

(4)

IF THE COMMISSIONER, PURSUANT TO SECTION 10-16-1107 (4),

NOTIFIES THE BOARD THAT THE REINSURANCE PROGRAM WILL RECEIVE

FEDERAL FUNDING PURSUANT TO A FEDERAL REINSURANCE PROGRAM OR

OTHER FEDERAL FINANCIAL ASSISTANCE FOR THE REINSURANCE PROGRAM

THAT IS IN EXCESS OF FEDERAL PASS-THROUGH FUNDING RECEIVED

PURSUANT TO SECTION 10-16-1107 (1)(a)(I), THE ENTERPRISE MAY

ELIMINATE OR REDUCE THE AMOUNT OF ENTERPRISE REVENUES ALLOCATED

TO THE REINSURANCE PROGRAM PURSUANT TO SUBSECTION (2) OF THIS

SECTION BASED ON THE AMOUNT OF FEDERAL FUNDING THE REINSURANCE

PROGRAM RECEIVES, AS INDICATED IN THE COMMISSIONER'S NOTICE, AND

SHALL REALLOCATE THE PORTION OF THE ENTERPRISE REVENUES NO LONGER

ALLOCATED TO THE REINSURANCE PROGRAM TO THE OTHER PURPOSES

SPECIFIED IN SUBSECTION (2) OF THIS SECTION IN ACCORDANCE WITH THAT

SUBSECTION (2).

(5)

(a) THE SPECIAL ASSESSMENTS ON HOSPITALS UNDER SUBSECTION

(1)(a)(II) OF THIS SECTION MUST COMPLY WITH AND NOT VIOLATE 42 CFR

433.68. IF THE FEDERAL CENTERS FOR MEDICARE AND MEDICAID SERVICES

IN THE UNITED STATES DEPARTMENT OF HEALTH AND HUMAN SERVICES

INFORMS THE STATE THAT THE STATE WILL NOT BE IN COMPLIANCE WITH 42

CFR 433.68 AS A RESULT OF THE SPECIAL ASSESSMENT ON HOSPITALS

PURSUANT TO SUBSECTION

(1)(a)(II)

OF THIS SECTION, THE ENTERPRISE

SHALL REDUCE THE AMOUNT OF THE SPECIAL ASSESSMENT AS NECESSARY TO

AVOID ANY REDUCTION IN THE HEALTHCARE AFFORDABILITY AND

SUSTAINABILITY FEE COLLECTED PURSUANT TO SECTION 25.5-4-402.4.

(b) A HOSPITAL SHALL PAY THE SPECIAL ASSESSMENT IMPOSED

PURSUANT TO SUBSECTION (1)(a)(II) OF THIS SECTION FROM ITS GENERAL

REVENUES AND IS PROHIBITED FROM:

(I)

COLLECTING AN ASSESSMENT FROM CONSUMERS AS ANY TYPE OF

SURCHARGE ON ITS FEES;

(II)

PASSING THE SPECIAL ASSESSMENT ON TO CONSUMERS AS ANY

TYPE OF INCREASE TO FEES OR CHARGES FOR SERVICES; OR

(III)

OTHERWISE PASSING THE SPECIAL ASSESSMENT ON TO

CONSUMERS IN ANY MANNER.

10-16-1206. Health insurance affordability cash fund - creation.

PAGE 12-SENATE BILL 20-215

(1) THERE IS HEREBY CREATED IN THE STATE TREASURY THE HEALTH

INSURANCE AFFORDABILITY CASH FUND. THE FUND CONSISTS OF:

(a)

THE FEES COLLECTED FROM CARRIERS PURSUANT

TO

SECTION

10-16-1205 (1)(a)(I);

(b)

THE SPECIAL ASSESSMENTS COLLECTED FROM HOSPITALS

PURSUANT TO SECTION 10-16-1205 (1)(a)(II);

(c)

AN AMOUNT OF PREMIUM TAX REVENUES DEPOSITED IN THE FUND

PURSUANT TO SECTION 10-3-209 (4)(a)(III), NOT TO EXCEED, IN ANY YEAR,

TEN PERCENT OF THE TOTAL AMOUNT THE ENTERPRISE COLLECTS FROM

CARRIERS AND HOSPITALS UNDER SECTION

10-16-1205

(1)(a);

(d)

THE REVENUE COLLECTED FROM REVENUE BONDS ISSUED

PURSUANT TO SECTION 10-16-1204 (1)(b)(II); AND

(e)

ALL INTEREST AND INCOME DERIVED FROM THE DEPOSIT AND

INVESTMENT OF MONEY IN THE FUND.

(2)

MONEY IN THE FUND SHALL NOT BE TRANSFERRED TO ANY OTHER

FUND, EXCEPT AS PROVIDED IN SECTION

10-16-1205

(2), AND SHALL NOT BE

USED FOR ANY PURPOSE OTHER THAN THE PURPOSES SPECIFIED IN THIS PART

12.

(3)

ALL MONEY IN THE FUND IS CONTINUOUSLY AVAILABLE AND

APPROPRIATED TO THE ENTERPRISE TO USE IN ACCORDANCE WITH THIS PART

12.

(4)

THE FUND IS PART OF THE ENTERPRISE ESTABLISHED PURSUANT

TO SECTION 10-16-1204 (1).

10-16-1207. Health insurance affordability board - creation -

membership - powers and duties - subject to open meetings and public

records laws - commissioner rules.

(1) (a) THERE IS HEREBY CREATED

THE HEALTH INSURANCE AFFORDABILITY BOARD, WHICH BOARD IS

RESPONSIBLE FOR GOVERNANCE OF THE ENTERPRISE ESTABLISHED IN THIS

PART 12. THE BOARD CONSISTS OF THE FOLLOWING ELEVEN VOTING

MEMBERS:

PAGE 13-SENATE BILL 20-215

(I)

THE EXECUTIVE DIRECTOR OF THE EXCHANGE OR THE EXECUTIVE

DIRECTOR'S DESIGNEE;

(II)

THE COMMISSIONER OR THE COMMISSIONER'S DESIGNEE; AND

(III)

NINE MEMBERS APPOINTED BY THE GOVERNOR, WITH THE

CONSENT OF THE SENATE, AS FOLLOWS:

(A)

ONE MEMBER WHO IS EMPLOYED BY A CARRIER;

(B)

ONE MEMBER WHO IS A REPRESENTATIVE OF A STATEWIDE

ASSOCIATION OF HEALTH BENEFIT PLANS;

(C)

ONE MEMBER REPRESENTING PRIMARY CARE HEALTH CARE

PROVIDERS WHO DOES NOT REPRESENT A CARRIER;

(D)

THREE MEMBERS WHO ARE CONSUMERS OF HEALTH CARE WHO

ARE NOT REPRESENTATIVES OR EMPLOYEES OF A HOSPITAL, CARRIER, OR

OTHER HEALTH CARE INDUSTRY ENTITY. To THE EXTENT POSSIBLE, THE

GOVERNOR SHALL ENSURE THAT THE CONSUMER MEMBERS OF THE BOARD

ARE INDIVIDUALS WHO LACK AFFORDABLE OFFERS OF COVERAGE FROM

THEIR EMPLOYERS AND OTHERWISE STRUGGLE TO AFFORD TO PURCHASE

HEALTH INSURANCE.

(E)

ONE MEMBER WHO REPRESENTS A HEALTH CARE ADVOCACY

ORGANIZATION;

(F)

ONE MEMBER WHO IS A REPRESENTATIVE OF A BUSINESS THAT

PURCHASES OR OTHERWISE PROVIDES HEALTH INSURANCE FOR ITS

EMPLOYEES; AND

(G)

ONE MEMBER WHO REPRESENTS A RURAL, CRITICAL ACCESS, OR

INDEPENDENT HOSPITAL.

(b) To THE EXTENT POSSIBLE, THE GOVERNOR SHALL ATTEMPT TO

APPOINT BOARD MEMBERS WHO REFLECT THE DIVERSITY OF THE STATE WITH

REGARD TO RACE, ETHNICITY, IMMIGRATION STATUS, INCOME, WEALTH,

ABILITY, AND GEOGRAPHY. IN CONSIDERING GEOGRAPHIC DIVERSITY, THE

GOVERNOR SHALL ENSURE AT LEAST ONE MEMBER RESIDES ON THE EASTERN

PLAINS AND ONE MEMBER RESIDES ON THE WESTERN SLOPE AND, TO THE

PAGE 14-SENATE BILL 20-215

EXTENT POSSIBLE, SHALL ATTEMPT TO APPOINT MEMBERS FROM EACH

CONGRESSIONAL DISTRICT IN THE STATE.

(C) THE GOVERNOR SHALL MAKE INITIAL APPOINTMENTS TO THE

BOARD BY OCTOBER 1, 2020.

(2) (a) (I) EXCEPT AS PROVIDED IN SUBSECTION (2)(a)(II) OF THIS

SECTION, THE TERM OF OFFICE OF THE MEMBERS OF THE BOARD APPOINTED

BY THE GOVERNOR IS FOUR YEARS, AND THOSE MEMBERS MAY SERVE NO

MORE THAN TWO FOUR-YEAR TERMS.

(II) IN ORDER TO ENSURE STAGGERED TERMS OF OFFICE, THE INITIAL

TERM OF OFFICE OF THE MEMBERS OF THE BOARD IS:

(A) Two YEARS FOR THE MEMBERS APPOINTED PURSUANT TO

SUBSECTIONS (1)(a)(III)(A), (1)(a)(III)(C), AND (1)(a)(III)(F) OF THIS

SECTION AND FOR TWO OF THE MEMBERS APPOINTED PURSUANT TO

SUBSECTION (1)(a)(III)(D) OF THIS SECTION; AND

(B) FOUR YEARS FOR THE MEMBERS APPOINTED PURSUANT TO

SUBSECTIONS (1)(a)(III)(B), (1)(a)(III)(E), AND (1)(a)(III)(G) OF THIS

SECTION AND FOR ONE OF THE MEMBERS APPOINTED PURSUANT TO

SUBSECTION (1)(a)(III)(D) OF THIS SECTION.

(b)

MEMBERS OF THE BOARD APPOINTED BY THE GOVERNOR SERVE

AT THE PLEASURE OF THE GOVERNOR AND MAY BE REMOVED BY THE

GOVERNOR.

(c)

A MEMBER WHO IS APPOINTED TO FILL A VACANCY SHALL SERVE

THE REMAINDER OF THE UNEXPIRED TERM OF THE MEMBER WHOSE VACANCY

IS BEING FILLED.

(d)

MEMBERS OF THE BOARD MAY BE REIMBURSED FOR ACTUAL AND

NECESSARY EXPENSES, INCLUDING ANY REQUIRED DEPENDENT CARE AND

DEPENDENT OR ATTENDANT TRAVEL, FOOD, AND LODGING, WHILE ENGAGED

IN THE PERFORMANCE OF OFFICIAL DUTIES OF THE BOARD.

(3) THE BOARD SHALL MEET AS OFTEN AS NECESSARY TO CARRY OUT

ITS DUTIES PURSUANT TO THIS PART 12.

PAGE 15-SENATE BILL 20-215

(4) THE BOARD IS AUTHORIZED TO:

(a)

IMPLEMENT AND ADMINISTER THE ENTERPRISE;

(b)

ESTABLISH ADMINISTRATIVE AND ACCOUNTING PROCEDURES FOR

THE OPERATION OF THE ENTERPRISE;

(c)

RECOMMEND, FOR APPROVAL AND ESTABLISHMENT BY THE

COMMISSIONER BY RULE:

(I)

THE TIMING AND METHODOLOGY FOR ASSESSING AND

COLLECTING THE FEE AND SPECIAL ASSESSMENT, SUBJECT TO SECTION

10-16-1205 (1)(a);

(II)

THE DISTRIBUTION OF ENTERPRISE REVENUES ALLOCATED FOR

CARRIER PAYMENTS AND SUBSIDIES IN A MANNER THAT IMPROVES

AFFORDABILITY FOR SUBSIDIZED POPULATIONS AND INDIVIDUALS NOT

ELIGIBLE FOR THE PREMIUM TAX CREDIT, MEDICAID, MEDICARE, OR THE

CHILDREN'S BASIC HEALTH PLAN;

(III)

THE PAYMENTS AUTHORIZED BY THIS PART 12 TO BE MADE TO

CARRIERS TO REDUCE THE COSTS OF INDIVIDUAL HEALTH PLANS FOR

INDIVIDUALS WHO PURCHASE AN INDIVIDUAL HEALTH BENEFIT PLAN ON THE

EXCHANGE AND RECEIVE THE PREMIUM TAX CREDIT; AND

(IV)

THE PARAMETERS FOR IMPLEMENTING THE SUBSIDIES FOR

STATE-SUBSIDIZED INDIVIDUAL HEALTH COVERAGE PLANS AUTHORIZED BY

THIS PART 12, INCLUDING:

(A)

THE COVERAGE REQUIRED UNDER STATE-SUBSIDIZED

INDIVIDUAL HEALTH COVERAGE PLANS, WHICH COVERAGE MUST MAXIMIZE

AFFORDABILITY FOR QUALIFIED INDIVIDUALS AND MUST INCLUDE COVERAGE

FOR THE LOWEST INCOME GROUP, AS DETERMINED BY THE BOARD, THAT HAS

NO PREMIUM AND PROVIDES BENEFITS ACTUARIALLY EQUIVALENT TO NINETY

PERCENT OF THE FULL ACTUARIAL VALUE OF THE BENEFITS PROVIDED UNDER

THE PLAN; AND

(B)

THE CRITERIA AND PROCEDURES FOR DETERMINING WHETHER AN

INDIVIDUAL IS A QUALIFIED INDIVIDUAL ELIGIBLE TO ENROLL IN A

STATE-SUBSIDIZED INDIVIDUAL HEALTH COVERAGE PLAN; AND

PAGE 16-SENATE BILL 20-215

(d) ESTABLISH BYLAWS, AS APPROPRIATE AND CONSISTENT WITH

THIS PART 12, FOR ITS EFFECTIVE OPERATION.

(5)

THE COMMISSIONER SHALL ADOPT RULES NECESSARY FOR THE

ADMINISTRATION AND IMPLEMENTATION OF THIS PART 12. IN ADOPTING THE

RULES, THE COMMISSIONER SHALL CONSIDER THE RECOMMENDATIONS OF

THE BOARD AND SHALL EXPRESS IN WRITING THE REASONS FOR ANY

DEVIATION FROM THE BOARD RECOMMENDATIONS.

(6)

MEETINGS OF THE BOARD ARE SUBJECT TO THE OPEN MEETINGS

PROVISIONS OF THE "COLORADO SUNSHINE ACT OF 1972", CONTAINED IN

PART 4 OF ARTICLE 6 OF TITLE 24. EXCEPT AS OTHERWISE PROVIDED IN THE

"COLORADO OPEN RECORDS ACT", PART 2 OF ARTICLE 72 OF TITLE 24, OR

OTHER APPLICABLE STATE OR FEDERAL LAW, RECORDS OF THE BOARD AND

THE PROGRAM ARE SUBJECT TO THE "COLORADO OPEN RECORDS ACT".

10-16-1208. Limitation on authority - public option.

NOTHING IN

THIS PART 12 AUTHORIZES THE ENTERPRISE, THE BOARD, OR THE

COMMISSIONER TO ESTABLISH, ADMINISTER, OPERATE, OR REQUIRE

PARTICIPATION BY CARRIERS OR HOSPITALS IN A STATE OR PUBLIC OPTION

HEALTH COVERAGE PLAN.

SECTION 2.

In Colorado Revised Statutes, 10-16-107,

add

(8) as

follows:

10-16-107. Rate filing regulation - benefits ratio - rules.

(8) (a) THE COMMISSIONER MAY ADOPT RULES DESIGNED TO:

(I)

MAXIMIZE THE PURCHASING POWER OF EXCHANGE CONSUMERS

WHOSE HOUSEHOLD INCOME IS UP TO FOUR HUNDRED PERCENT OF THE

FEDERAL POVERTY LINE; AND

(II)

ASSURE PREMIUM PRICING THAT COMPLIES WITH THE

REQUIREMENTS IN THE FEDERAL ACT FOR MODIFIED COMMUNITY RATING.

(b) IN ADOPTING THESE RULES, THE COMMISSIONER MAY CONSIDER

THE RESULTS OF THE EVALUATION AND STUDY OF THE REINSURANCE

PROGRAM CONDUCTED PURSUANT TO SECTION 10-16-1104 (2).

SECTION 3.

In Colorado Revised Statutes, 10-16-1104,

amend

PAGE 17-SENATE BILL 20-215

(1)(g); and

repeal

(1)(f) as follows:

10-16-1104. Commissioner powers and duties - rules - study and

report.

(1) The commissioner has all powers necessary to implement this

part 11 and is specifically authorized to:

(f)

Assess special kcs against hospitals and, if applicable, carriers

continuous

op iation of

n-ifisurancc prograin, as piovi c i11

sretion

-

H3=

1-

6-

1

+0

-8-

;

(g)

IN ACCORDANCE WITH SECTION 10-16-1109, apply for a state

innovation waiver OR AN EXTENSION OF A STATE INNOVATION WAIVER;

APPLY FOR federal funds; or APPLY FOR both in

accordancc with section

, A WAIVER OR EXTENSION OF A WAIVER AND FEDERAL FUNDS for

the implementation and operation of the reinsurance program;

SECTION 4.

In Colorado Revised Statutes, 10-16-1105,

amend

(1)(a), (1)(b), (1)(c), (1)(e)(I), and (2)(b) introductory portion; and

add

(2)(a.5) as follows:

10-16-1105. Reinsurance program - creation - enterprise status

- subject to waiver or funding approval - operation - payment

parameters - calculation of reinsurance payments - eligible carrier

requests - definition.

(1) (a) There is hereby created in the division the

Colorado reinsurance program to provide reinsurance payments to eligible

carriers. Implementation and operation of the reinsurance program is

contingent upon approval of the A state innovation waiver, AN EXTENSION

OF A STATE INNOVATION WAIVER, or A federal funding request submitted by

the commissioner in accordance with section 10-16-1109.

(b) (I) The reinsurance program constitutes

an nt pi tsc ful

purposes-of-stetion-2-0-of-artiefe-X-of the-state-eonstitution-as-long-as

-

the

commissioncr,

on

on as

ana tnc program rcccives

)

I

aeai

g einments con'

.

&SU l

ong as

pursuant

o this scction, the program is not a district for puipo cs of scction

20-of artiele-X-of the-state-constitution IS PART OF THE COLORADO HEALTH

INSURANCE AFFORDABILITY ENTERPRISE ESTABLISHED PURSUANT TO PART

12 OF THIS ARTICLE 16.

program,

PAGE 18-SENATE BILL 20-215

(II) Subieet

-

terapproval-brthe

-

general-assembiy7either-try-bili-or

itrintresultition7and

-

after aPProvaHarthe

-

governorTurstrantto

-

stetion

-

39

of-artiel-e-V-o-f-the-state-constituti-orthe-commissionerTorrbehaff-erf-the

rcinsurancc

program, is hcrcby authorizcd to is

suc rcvcnuc bonds for the

expenses

of thc program, secured by revenues of thc program.

(c) If the

A

state innovation waiver,

AN EXTENSION OF A STATE

INNOVATION WAIVER,

or

A

federal funding request submitted by the

commissioner pursuant to section 10-16-1109 is approved, the

commissioner shall implement and operate the reinsurance program in

accordance with this section.

(e) (I) On a quarterly basis during the applicable benefit year,

(A) each eligible carrier shall report to the commissioner its claims

costs that exceed the attachment point for that benefit year.

(13)

-

Eacirhospital-thatis-strbieetterthe-special-fees-assessed-pnrstrant

tersection-1

-

0-1

-

6-1-1-0-8-sfrafFrep-art-terthe-e-ornmissierner-the-amtynnt-the

haspita-Fis-responsible-for fanding-irr the-henefit-year-,-and

fej-if-special-fees-are-assesse&against-earriers-prrsuant-to-sertion

-1-0-1-6-1-1-&8-(-1-)(b)Teaeltearrier-thatis-gubieet-to-the-special-fees-shalf report

to-the-commissioner orr its--coffeetecl-assessments-irr that-heneftt-yean

(2) (a.5)

To

THE GREATEST EXTENT POSSIBLE, THE COMMISSIONER

SHALL SET THE PAYMENT PARAMETERS FOR THE

2021

BENEFIT YEAR AT

AMOUNTS TO MAINTAIN THE TARGETED CLAIMS REDUCTIONS ACHIEVED IN

THE

2020

BENEFIT YEAR.

(b)

For the

2&24- 2022

benefit year

AND EACH BENEFIT YEAR

THEREAFTER,

after a stakeholder process, the commissioner shall establish

and publish the payment parameters for that benefit year by March

15

2e0

OF THE IMMEDIATELY PRECEDING CALENDAR YEAR. In

setting the payment

parameters under this subsection (2)(b), the commissioner shall consider the

following factors as they apply in each geographic rating area in the state:

SECTION 5. In Colorado Revised Statutes, 10-16-1106, amend

(4)

as follows:

PAGE

19-SENATE

BILL 20-215

10-16-1106. Accounting - reports - audits.

(4) On or before

November 1, 2020, and on or before November 1 202+

OF EACH YEAR

THEREAFTER,

the division shall include an update regarding the program in

its report to the members of the applicable committees of reference in the

senate and house of representatives as required by the "State Measurement

for Accountable, Responsive, and Transparent (SMART) Government Act",

part 2 of article 7 of title 2.

SECTION

6. In Colorado Revised Statutes, 10-16-1107,

amend

(1); and

add

(4) as follows:

10-16-1107. Funding for reinsurance program - sources -

permitted uses - reinsurance program cash fund - calculation of total

funding for program.

(1) (a) There is hereby created in the state treasury

the reinsurance program cash fund

REFERRED TO IN THIS SECTION AS THE

"FUND",

which consists of:

(I) Federal pass-through funding granted pursuant to 42 U.S.C. sec.

18052 (a)(3) or any other federal funds that are made available for the

reinsurance program;

(II)

Spccial fees assessed against hospitals and, if apphcablc,

carriers

as providedin scction10-16-1108;

ie

toIIowing amounts transrcrrca nom tllc gcncrat minato

• •

rcrnsurancc

program cash n , but only It house

IS enactc

a

at--the-ftrst-regular-session-of-th

-

c

sevcnirsrearrd-gerreral-assembir and

raid

tfry-Fortrnii-lifort-dal-larsTtransferredloqhe-fund-orritme-3-0132+;

(-1-

1

v9---Airamvunt-of-premiurn

-

tax

-

reverrtres

-

cieposited

-

in

-

the

-

fttnd

pursuant

o scction

(V) (II) Any money the general assembly appropriates to the fund

for the program;

AND

PAGE 20-SENATE BILL 20-215

(III) ANY AMOUNTS ALLOCATED TO THE FUND PURSUANT TO SECTION

10-16-1205 (2).

(b)

All money deposited or paid into or TRANSFERRED, ALLOCATED,

OR appropriated to the reinsurance program cash fund, including interest or

income earned on the investment of money in the fund, is continuously

available and appropriated to the division to be expended in accordance

with this part 11. Any interest or income earned on the investment of money

in the fund shall be credited to the fund.

(c)

The reinsurance program cash fund is part of the remsurancc

.

pi g

i

p

c

pursuant

—

to secti

on

COLORADO HEALTH INSURANCE AFFORDABILITY ENTERPRISE ESTABLISHED

PURSUANT TO PART 12 OF THIS ARTICLE 16.

(4) (a) IF, AFTER THE EFFECTIVE DATE OF THIS SUBSECTION (4), THE

UNITED STATES CONGRESS ENACTS AND THE PRESIDENT SIGNS FEDERAL

LEGISLATION ESTABLISHING OR THE SECRETARY OF THE UNITED STATES

DEPARTMENT OF HEALTH AND HUMAN SERVICES IMPLEMENTS A FEDERAL

REINSURANCE PROGRAM THAT PROVIDES FEDERAL FUNDING FOR THE

REINSURANCE PROGRAM OR OTHERWISE MAKES ADDITIONAL FEDERAL FUNDS

AVAILABLE FOR THE REINSURANCE PROGRAM IN EXCESS OF THE AMOUNT

RECEIVED AS FEDERAL PASS-THROUGH FUNDING PURSUANT TO SUBSECTION

(1)(a)(I)

OF THIS SECTION, THE COMMISSIONER SHALL NOTIFY THE HEALTH

INSURANCE AFFORDABILITY BOARD CREATED IN SECTION 10-16-1207 OF THE

AMOUNT OF FEDERAL FUNDING IN EXCESS OF THE FEDERAL PASS-THROUGH

FUNDING THAT WILL BE AVAILABLE FOR THE REINSURANCE PROGRAM AND

THE DATE THE FUNDING IS EXPECTED TO BE RECEIVED.

(b) IF THE REINSURANCE PROGRAM RECEIVES FEDERAL FUNDING AS

DESCRIBED IN THIS SUBSECTION (4) TO MAKE REINSURANCE PAYMENTS TO

CARRIERS IN A GIVEN YEAR AFTER THE HEALTH INSURANCE AFFORDABILITY

ENTERPRISE HAS ALLOCATED MONEY TO THE REINSURANCE PROGRAM

PURSUANT TO SECTION 10-16-1205 (2) FOR THAT YEAR, THE COMMISSIONER

SHALL RETURN TO THE ENTERPRISE THE ALLOCATION OR A PORTION OF THE

ALLOCATION, AS DETERMINED BY THE ENTERPRISE, BASED ON THE AMOUNT

OF FEDERAL FUNDING RECEIVED FOR THAT YEAR.

SECTION 7. In Colorado Revised Statutes, repeal 10-16-1108.

PAGE 21-SENATE BILL 20-215

SECTION 8.

In Colorado Revised Statutes, 10-16-1109,

amend

(1)(a) as follows:

10-16-1109. State innovation waiver - federal funding - Colorado

reinsurance program.

(1) (a) For purposes of implementing and operating

the reinsurance program as set forth in this part 11 for plan years starting on

or after January 1, 2020 2021, the commissioner may apply to the secretary

of the United States department of health and human services for:

(I) A

two-ycar statc innovation waiver In accordance with section

1332 of the federal act, codified at 42 U.S.C. sec. 18052, and 45 CFR

155.1300:

(A)

ONE OR MORE EXTENSIONS OF THE INITIAL TWO-YEAR STATE

INNOVATION WAIVER RECEIVED BEFORE THE EFFECTIVE DATE OF THIS

SUBSECTION (1)(a)(I), AS AMENDED, OF UP TO FIVE YEARS PER EXTENSION;

OR

(B)

A NEW STATE INNOVATION WAIVER OF UP TO FIVE YEARS TO

FOLLOW THE INITIAL TWO-YEAR STATE INNOVATION WAIVER APPROVED

BEFORE THE EFFECTIVE DATE OF THIS SUBSECTION (1)(a)(I), AS AMENDED,

AND SUBSEQUENT EXTENSIONS OF ANY NEW STATE INNOVATION WAIVER

APPROVED BY THE SECRETARY;

(II) Federal funds for the reinsurance program; or

(III) A NEW OR EXTENDED state innovation waiver and federal funds.

SECTION 9.

In Colorado Revised Statutes, 10-16-1110,

repeal

(2)

as follows:

10-16-1110. Repeal of part - notice to revisor of statutes.

(2) This

SECTION 10.

In Colorado Revised Statutes, 10-3-209,

amend

(4)(a)(III) as follows:

10-3-209. Tax on premiums collected - exemptions - penalties.

(4) (a) The division of insurance shall transmit all taxes, penalties, and

fines it collects under this section to the state treasurer for deposit in the

PAGE 22-SENATE BILL 20-215

general fund; except that the state treasurer shall deposit amounts in the

specified cash funds as follows:

(III) (A) For the 2020-21 STATE FISCAL YEAR and

EACH

state fiscal ycai

YEAR THEREAFTER, in the rcinsurance

program HEALTH

INSURANCE AFFORDABILITY cash fund created in scc

ion10-16-1107

SECTION 10-16-1206, an amount equal to the amount of premium taxes

collected pursuant to this section in the 2020 calendar year OR ANY

SUBSEQUENT CALENDAR YEAR that exceeds the amount of premium taxes

collected pursuant to this section in the 2019 calendar year, SUBJECT TO

SUBSECTION (4)(a)(III)(B) OF THIS SECTION.

(B) This

-

subseetiorr(

4-

X*Hitis

-

rePreafed7effective

-

RePtember

20235 THE AMOUNT OF PREMIUM TAXES DEPOSITED IN THE HEALTH

INSURANCE AFFORDABILITY CASH FUND PURSUANT TO THIS SUBSECTION

(4)(a)(III) IN ANY GIVEN YEAR SHALL NOT EXCEED TEN PERCENT OF THE

AMOUNT OF REVENUES COLLECTED BY THE HEALTH INSURANCE

AFFORDABILITY ENTERPRISE PURSUANT TO SECTION 10-16-1205 IN THAT

YEAR. THE HEALTH INSURANCE AFFORDABILITY BOARD ESTABLISHED IN

SECTION 10-16-1207 SHALL NOTIFY THE TREASURER OF THE MAXIMUM

AMOUNT OF PREMIUM TAXES THAT MAY BE DEPOSITED IN THE HEALTH

INSURANCE AFFORDABILITY CASH FUND TO COMPLY WITH THIS SUBSECTION

(4)(a)(III)(B).

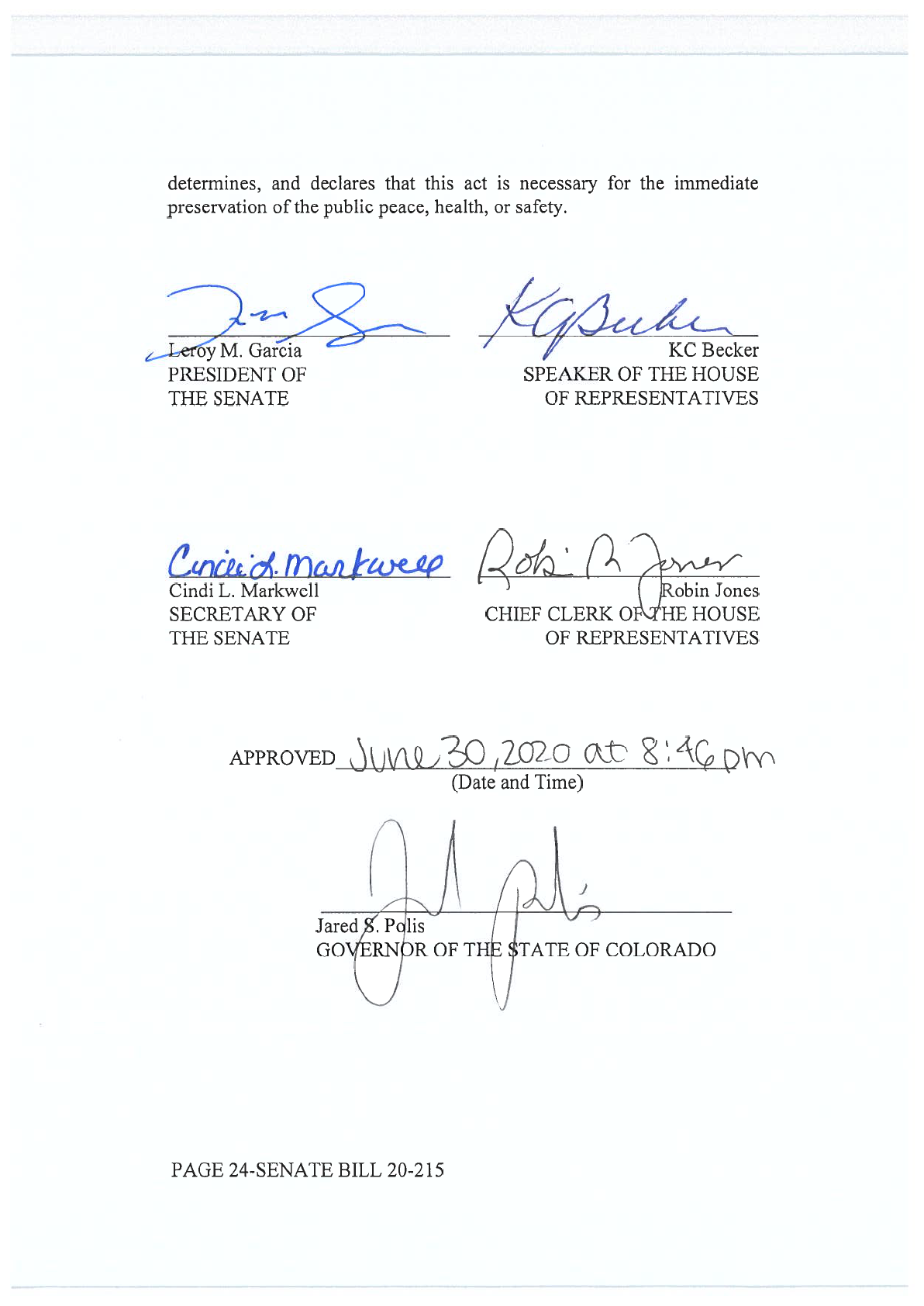

SECTION 11. Safety clause. The general assembly hereby finds,

PAGE 23-SENATE BILL 20-215

Jared

lis

GO

RN R OF T TATE OF COLORADO

...Z.-.01.

oy M. Garcia

PRESIDENT OF

THE SENATE

determines, and declares that this act is necessary for the immediate

preservation of the public peace, health, or safety.

KC Becker

SPEAKER OF THE HOUSE

OF REPRESENTATIVES

culfr

infA

m

tow

.0f.

poL__0\

Cindi L. Markwell

Robin Jones

SECRETARY OF

CHIEF CLERK OFQ'HE HOUSE

THE SENATE

OF REPRESENTATIVES

APPROVED

3u

v

u:60,2D

-

2_0

at 2 i4C

e c)

vy-,

(Date and Time)

PAGE 24-SENATE BILL 20-215