Long-Term Care Insurance Fraud,

Waste and Abuse Risk Management

A Survey of Industry Perspectives

June 2019

2

Copyright © 2019 Society of Actuaries

Long-Term Care Insurance Fraud, Waste and Abuse Risk Management

A Survey of Industry Perspectives

Caveat and Disclaimer

This study is published by the Society of Actuaries (SOA) and contains information from a variety of sources. It may or may not reflect the experience of any

individual company. The study is for informational purposes only and should not be construed as professional or financial advice. The SOA does not

recommend or endorse any particular use of the information provided in this study. The SOA makes no warranty, express or implied, or representation

whatsoever and assumes no liability in connection with the use or misuse of this study.

Copyright © 2019 by the Society of Actuaries. All rights reserved.

AUTHORS

Eileen J. Tell

Karen Smyth

Robert Eaton

SPONSOR

Long Term Care Insurance Section

Project Oversight

Group

Paul Colasanto

Perry Kupferman

Shawna Meyer

Rebecca Tipton

3

Copyright © 2019 Society of Actuaries

CONTENTS

Abstract

RESEARCH OBJECTIVES .............................................................................................................................................. 5

Expectations ............................................................................................................................................................. 5

RESEARCH METHODOLOGY ....................................................................................................................................... 7

Threats and Types of Fraud ........................................................................................................................................ 9

Industry Effectiveness, Tools and Resources ........................................................................................................... 10

Referral and Detection .............................................................................................................................................. 13

Relief and Resolution ................................................................................................................................................ 14

Regulatory Issues ...................................................................................................................................................... 16

DISCUSSION ............................................................................................................................................................ 19

APPENDIX: FULL SURVEY ......................................................................................................................................... 21

About The Society of Actuaries ............................................................................................................................... 22

4

Copyright © 2019 Society of Actuaries

ABSTRACT

Long-Term Care Insurance Fraud, Waste and Abuse Risk Management

A Survey of Industry Perspectives

The Society of Actuaries’ (SOA) Long Term Care (LTC) Section Council in 2018 approved

an initiative to survey LTC companies on their perspectives and practices regarding LTC

claims fraud, waste and abuse. There are many stakeholders who stand to benefit from a

better understanding of the risks posed by LTC claims fraud, waste and abuse risk and the

best practice strategies to address those risks:

1.

Policyholders.

When LTC insurance policyholders seek only legitimate or

contractual claims on their policy, LTC insurance companies are more likely to

remain financially healthy and thus better able to pay all future LTC insurance

claims. Conversely, LTC insurance claims fraud, waste and abuse may require

insurance companies to seek remunerative premium rate increases across all

policyholders.

2.

State insurance regulators.

Regulators wish to understand the difficulties facing

insurance companies. Some state insurance departments have investigative units

to combat fraud, waste and abuse, and would benefit from understanding

insurance company perspectives on this risk.

3.

Long-term care insurance companies.

LTC insurance companies wish to honor

legitimate and contractual claims while remaining financially viable. Claims fraud,

waste and abuse tend to increase claims and threaten future financial health.

4.

Reinsurance companies.

Similar to LTC insurance companies, reinsurance

companies face financial difficulties from claims fraud, waste, and abuse. Typically

reinsurers face this exposure from many insurance companies and many

geographies.

5.

Downstream industry participants.

Other parties such as third-party claims

administrators, care providers and state insurance guarantee funds also have

some stake in LTC claims fraud, waste and abuse.

This survey is intended to share insurance company risk management practices and

perspectives, so that these stakeholders may have a common understanding when

discussing fraud, waste and abuse in LTC insurance claims.

5

Copyright © 2019 Society of Actuaries

RESEARCH OBJECTIVES

The Society of Actuaries (SOA) Long Term Care (LTC) Section conducted a survey of the

leading LTC insurers’ management and perspectives of fraud, waste and abuse as it

relates to the adjudication and payment of benefits under long-term care insurance

contracts. The intent was to survey those long-term care insurers representing the

majority of in-force LTC policies—inclusive of those entities continuing to issue new

business and those managing closed blocks.

Definitions

For the purpose of responding to the survey, the following definitions were employed:

•

Fraud.

The intentional misuse of information to persuade another to part with

something of value or to surrender a legal right. It could also be an act of planned

deception or misrepresentation.

•

Waste.

To use, consume, spend or expend thoughtlessly or carelessly.

•

Abuse.

Providing information or documentation for a health care claim in a

manner that improperly uses program resources for personal gain or benefit, yet

without sufficient evidence to prove criminal intent.

Broadly speaking, the research objectives were:

• To understand companies’ perspectives with regard to key drivers of fraud, waste

and abuse and their opinions of the current and potentially available tools they

have for detection, prevention and recovery.

• To better understand the concerns companies have with their efforts to address

fraud, waste and abuse.

• To identify ways the industry can improve its relationship with regulators in

support of best practices for fraud prevention, detection and recovery.

Expectations

The SOA Long Term Care Section believes the issues identified in this report may serve as

a catalyst to educate both the industry and the regulatory community about the

challenges facing the LTC insurance industry to the extent that these findings generate

interest in action.

6

Copyright © 2019 Society of Actuaries

Insurance fraud is one of the most costly white-collar crimes in America today. Insurance

fraud is a crime in 48 states, plus the District of Columbia (DC). Forty-one states, plus DC

have an insurance fraud bureau charged with investigating and handling multiple lines of

insurance—including LTC. Most other lines of business have a much longer history of

paying claims than the LTC insurance industry and so too, a much longer history of

detecting, preventing and managing incidents of fraud, waste and abuse. It would be

naïve to believe that fraud, waste and abuse haven’t found their way into this industry.

By bringing to light industry concerns, experiences and perspectives, this survey may help

us identify new tools and strategies employed by other industries and to engage

regulators to help us with future prevention, detection and mitigation strategies.

The SOA supports thoughtful efforts to raise awareness of industry efforts surrounding

policy abuse and fraud to the regulatory community.

7

Copyright © 2019 Society of Actuaries

RESEARCH METHODOLOGY

Sample and Response Rate

. The Survey Team (“we,” “our”) gathered insights into fraud,

waste and abuse by issuing a web-based survey to the senior actuary or business practice

leader at nineteen (19) leading LTC insurers. One company reported no longer writing

business, another did not administer its own block, and two others had combined books

of business. Another was unable to participate for compliance reasons, for a remaining

viable sample of fifteen (15) companies able to respond. A total of thirteen (13)

companies completed the survey, for a response rate of 87%.

Questionnaire Development.

The Survey Team working group was formed in spring 2018

to begin development of the research questionnaire. To that end, ideas were collected

for areas of interest and concern from which the survey questionnaire would be built. In

May 2018, the Survey Team sent out a single-item questionnaire to members of the

Long-Term Care Anti-Fraud Forum (an inter-company effort focused on identifying and

sharing policies, procedures, tools and techniques, which may help with the prevention,

identification and mitigation of fraudulent long-term care insurance claims). The

questionnaire asked simply, “What questions should the Society of Actuaries ask when

surveying the long-term care insurance industry as it relates to LTC fraud, waste and

abuse?” Fifteen (15) companies responded, providing a wide range of questions of

interest to them. Many of the companies provided between five to seven questions each.

We analyzed the areas of interest expressed from that outreach, and sorted the

questions into key domains representing fraud, waste and abuse prevention, detection,

recovery and questions about the philosophical approach and the interface between

industry and the regulatory community. The Survey Team refined these items into a

questionnaire that would address the key research objectives without undue respondent

burden. The working group reviewed each draft of the survey to work toward the best

possible final draft.

We sent a pre-test version of the survey to three (3) volunteers from the industry’s Long-

Term Care Anti-Fraud Forum. We incorporated this feedback into the final questionnaire.

In the end, the survey comprised 30 questions, mostly closed-category responses. Survey

Monkey gave the survey a “great” rating for ease of completeness and an estimated

completion time of 15 minutes. Based on results, actual survey completion times ranged

from 7 minutes to 36 minutes.

We distributed the survey with an explanatory cover letter from the SOA in mid-

September 2018. We send periodic reminders and follow-up by both e-mail and

telephone. The Survey Team closed the data collection on January 15, 2019, and tallied

the responses.

8

Copyright © 2019 Society of Actuaries

Profile of Respondents

The respondents represent companies of all sizes:

• About 17% have less than 50,000 policies in force.

• Roughly 8% have between 50,000 and 99,999 insureds.

• Half the companies have blocks of business of 100,000 to 249,999 policies.

• Twenty-five percent (25%) have larger blocks of business.

Most often, the survey was completed by a company representative affiliated with the

business area of claims, either exclusively (five respondents) or in association with

actuarial (two respondents) or operations (two respondents). The remaining respondents

cited operations (2), actuarial (1) or corporate (1) as the business area they represent.

The responding companies also varied in terms of how long they have been writing LTC

policies, from as little as 10 years to several companies with more than 30 years of

experience. (See Table 1.)

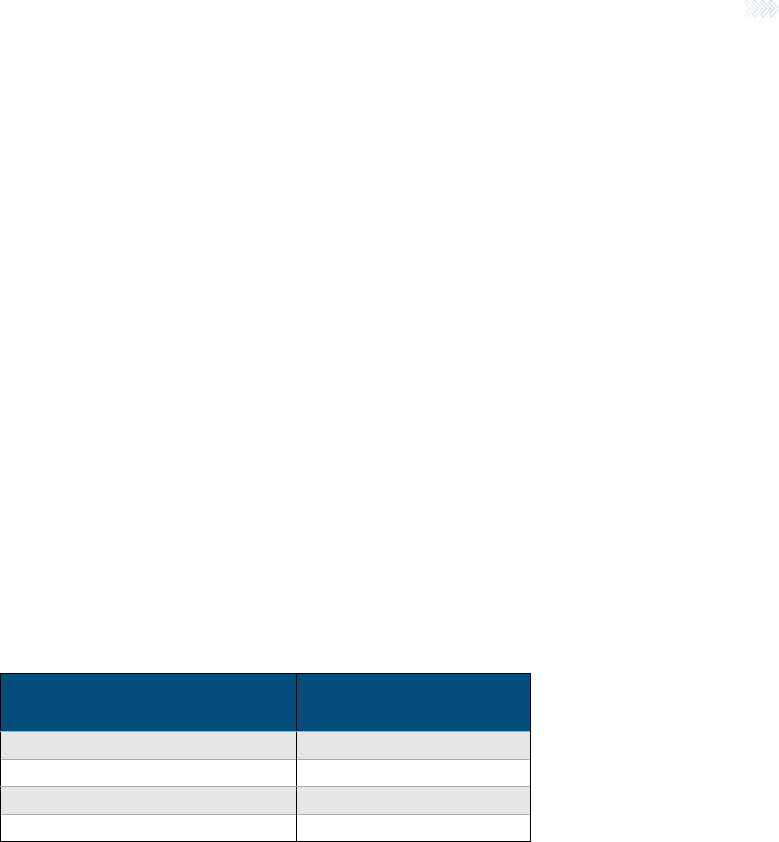

Table 1

NUMBER OF YEARS WRITING LTC POLICIES

Years in the Business*

Number of Responding

Companies

10 years

1

More than 20 years

3

More than 25 years

3

More than 30 years

6

*Question was open-ended so companies could respond as they chose.

9

Copyr

ight © 2019 Society of Actuaries

FINDINGS

Threats and Types of Fraud

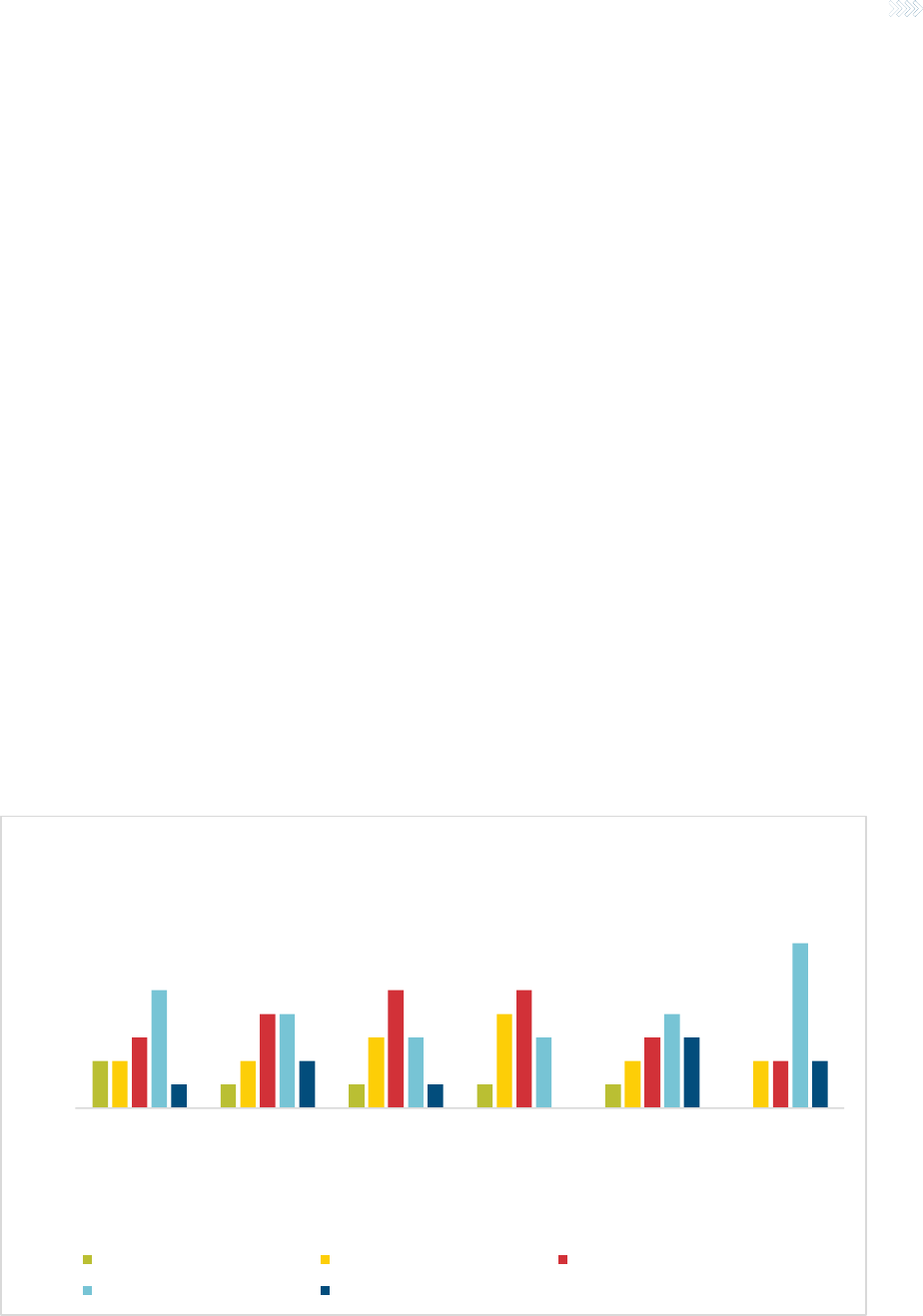

As a starting point, companies were asked to identify how significant to their company’s

overall experience were each of several different types and sources of fraud, waste and

abuse (FWA). In general, they were asked about claimant versus provider

misrepresentation and about the type of misrepresentations made, specifically about the

nature of loss or about services and billing. (See Figure 1.)

Claimant misrepresentation of loss received the highest score, with 15% of respondents

citing it as a very significant source of FWA. We note that the misrepresentation could

also include actions driven by family members, with or without the knowledge or consent

of the claimant. In contrast, only approximately 7% of respondents gave this high a rating

to any of the other sources. Combining the top two categories of significance (a score of

4 or 5 on a 5-point scale), provider misrepresentation of services and billing was cited by

38.5% of companies as a significant source of FWA. Respondents saw very little collusion

between providers and claimants as a source of fraud, waste and abuse experience.

In contrast, looking at the combination of “not very significant” and “not at all

significant,” just under half of the responding companies do not see claimant or provider

misrepresentation of loss as a significant source of potential FWA.

Figure 1

SIGNIFICANCE OF FWA TO LTC EXPERIENCE - See question 4 on page 23 for full X-axis category labels

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

Claimant…

Provider…

Claimant…

Provider…

Collusion between…

Collusion between…

How significant to your company's experience are these

sources of potential fraud, waste, and abuse?

Very Significant Somewhat Significant Neither Significant or Insignificant

Not very Significant Not at all Significant

10

Copyright © 2019 Society of Actuaries

When asked to rank each type of FWA in order of importance to their company’s overall

experience, the top response with 54% of companies citing it, is “claimants who

misrepresent impairments in an attempt to satisfy benefit eligibility.” This speaks to the

importance of strong protocols for determining benefit eligibility and appropriate

schedules for recertification. Ranking second, with 23%, is “providers billing for services

not rendered.”

With regard to the role that the location of the claim plays in FWA, 100% of the

responding companies identified “informal home care claims (e.g., independent provider

or family member)” as the largest portion of potential FWA referrals or investigations.

We note that some policies allow family members to provide informal care while others

do not. Additionally, with regard to claim type, insurers are more concerned about

functional impairment claims (54%) than cognitive impairment (23%), medical necessity

(15%) or other benefit triggers (8%). The low level of concern with medical necessity

triggers likely stems more from their extremely low prevalence in today’s products than

from the nature of the benefit trigger, although the survey did not probe on that concept

specifically.

Finally, the survey asked about other situations related to a claim that might escalate the

potential for FWA. Assignment of benefits was cited by 54% of respondents as the top

reason. This makes sense because when the home care provider is paid directly, the

claimant or their family does not have the opportunity to review the bill and verify that

the charges being submitted accurately reflect the services provided to them. Just under

39% of respondents found that a rate increase was a potential trigger for an escalation in

FWA activity. Only 15% felt that a power of attorney situation posed a risk and 23% felt

that none of these factors were relevant. Other factors mentioned include having a

family member as a care provider or being in premium waiver status.

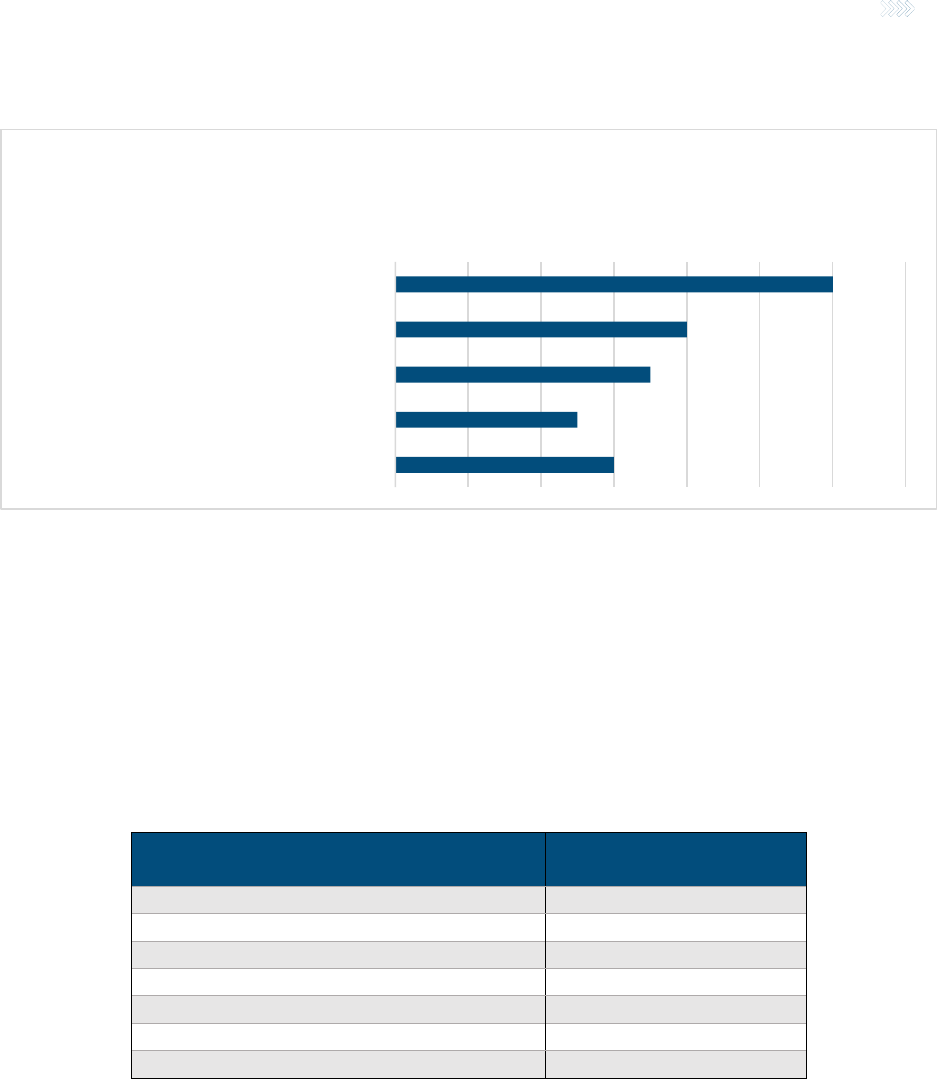

Industry Effectiveness, Tools and Resources

Companies may employ a wide variety of tools and practices in addressing fraud, waste

and abuse. We asked LTC insurers about some strategies that are more typically used in

other product lines that might have some applicability to LTC insurance. Assuming that

whatever regulatory changes would be needed to allow insurers to use these tools could

be obtained, we asked them to assess whether they have or would consider these

approaches. Results are summarized in Table 2.

The largest percent of carriers are already using required proof of payment for expenses

incurred (77%) and electronic tools that verify visits (46%) to validate claims. The top two

tools not currently being used but which a significant share of companies say they would

consider are a database similar to MIB where carriers can report and check suspected

11

Copyright © 2019 Society of Actuaries

fraudulent claimants and/or providers (85% would consider) and gathering forensic data

on mobile devices (54% would consider).

Table 2

TYPICAL PRACTICES TO COMBAT FWA IN LTC INSURANCE

Tool

Have

Considered

Would

Consider

Might

Consider

Would Not

Consider

Not

Familiar

Enough

to Know

Requiring proof of payment for

expenses incurred

77%

24%

—

—

—

Use of electronic visit verification tools

46%

46%

—

—

8%

Recorded interviews

31%

38%

31%

—

—

Pursuing a declaratory judgment

31%

23%

15%

8%

23%

Using field claim consultants to conduct

in-person claimant interviews to

complete claim forms

31%

31%

23%

15%

—

Examinations under oath

15%

38%

23%

8%

15%

MIB-like database for screening for

prior fraudulent claim activity

8%

85%

—

8%

—

Gathering forensic data on mobile

devices

0%

54%

15%

15%

15%

With regard to evaluating its efficacy at handling fraud, waste and abuse, the industry

does not give itself very good grades. None of the respondents feel that the industry is

either very or extremely effective. Just over half (54%) feel it is somewhat effective, and

39% say it is either not so effective or not at all effective.

The primary challenge to industry’s ability to effectively address these issues, cited by just

under 40% of respondents, seems to be the state of the knowledge, training and

technology to address fraud, waste and abuse. Companies feel they are still in the

learning and building phase with regard to these tools. Just under one-fourth of

respondents cite concern with either a lack of resources to address these issues or the

lack of compliance and regulatory support for taking action when fraud is identified. Only

a small portion of respondents (15%) feel that company concern with negative PR gets in

the way of effectively addressing fraud, waste and abuse. (See Figure 2.)

12

Copyright © 2019 Society of Actuaries

Figure 2

LTC INDUSTRY EFFECTIVENESS AT ADDRESSING FWA

Survey respondents had many suggestions for how groups such as SOA, ILTCI, the LTC

Anti-Fraud Forum, AHIP, ACLI and others might help industry address fraud, waste and

abuse. Key among the suggestions was education for all stakeholders, including

education within and across companies and education aimed specifically at regulators.

Some of the specific suggestions included in the following:

• Continue to illustrate and present different solutions and approaches; help

quantify the needs and the benefits of a FWA program.

• Highlight case studies and convene special discussion groups. Encourage

investigative vendors to participate.

• Meet more often as an industry to discuss fraud and ways to address it.

• Expand the conversation on this important topic.

• Increase both consumer and regulator awareness of the problem and its financial

impact.

• Lobby for state funds to address this issue and educate regulators.

• Advocate for regulatory changes to strengthen industry ability to enforce

contracts.

How effective is the industry at addressing fraud,

waste, and abuse?

Don't know/not sure Somewhat effective Not so effective Not at all effective

13

Copyright © 2019 Society of Actuaries

• Continue to support ongoing education for insurers, LTC vendors and state

insurance fraud departments.

Referral and Detection

Companies responded to nine questions regarding the referral and detection of FWA.

When asked how FWA is detected, companies signified that a few methods that were

widely used as shown in Table 3.

Table 3

REFERRAL AND DETECTION OF FWA

Detection Method

% of

Respondents

Red flags that staff are trained to

look for

100%

Secondary review by senior

claim staff, management, law

92%

Internal quality assurance

77%

When asked an open-ended question about the most important controls that companies

(or their TPAs) have in place to help prevent FWA, companies responded with a few key

themes:

• Data analytics

• Surveillance

• Electronic visit verification (EVV) on home health care invoices

• Training programs for claims and fraud analysts

Companies described the following new or creative methods they use to detect

fraudulent activity:

• High-risk scenario data profile development

• Social media searches

Companies indicated that staff are trained to spot potentially fraudulent activity. All of these

used red flag lists, and the majority employed on-the-job training of staff, as shown in Table 4.

14

Copyright © 2019 Society of Actuaries

Table 4

HOW STAFF ARE TRAINED

How Are Staff Trained?

%

Respondents

Red flag lists

100.0%

On the job training

92.3%

Formal training program

76.9%

Case illustrations

53.8%

All companies reported using surveillance to detect or investigate potential FWA, and a majority

of companies search social media in their investigations. Only three of the 13 respondents use

predictive analytics to help identify potential FWA. All respondents using predictive analytics

indicated that it is still too soon to tell whether or not the results are satisfactory.

For the eight respondents who have a dedicated fraud hotline, only two of them found the

hotline to be “somewhat effective”, with the rest indicating that the hotline was “not so

effective” (5) or “not at all effective” (1).

Finally, respondents were asked about the most important aspect of working with investigative

firms in pursing FWA. The following themes summarize the companies’ responses:

• Operate ethically / within compliance and regulatory laws and guidelines

• Expertise and knowledge of the LTC industry

• Communication: specific, clear and frequent

• Surveillance: interpretation and geographical reach

Relief and Resolution

Companies were asked about how confirmed cases of FWA were most typically resolved and

what types of relief were used. Respondents were asked to report all the actions that apply,

since they may take more than one action on a given claim or different actions for different

situations. Figure 3 shows that nearly all (92%) of the companies terminate the claim and just

under two-thirds (61%) will recover payments against the policy. Over half (54%) provide a

return of premium and end the policy, and just under half (46%) file a declaratory action against

the policyholder for rescission or policy surrender when FWA is discovered.

15

Copyright © 2019 Society of Actuaries

Figure 3

TYPE OF RELIEF USED FOR FWA

When asked which type of relief these companies use most often, more than half (53.8%) would

terminate the claim and just under one-third (30.8%) recover payments made against the policy.

Less than 10% give premiums back and end the policy.

Companies indicated other factors outside of the strength of the case that might determine the

type of recovery they would seek on a fraudulent claim. They were asked to identify all factors

that might apply, with the results shown in Table 5.

Table 5

FACTORS DETERMINING TYPE OF RECOVERY

Factors Influencing Type of Recovery Sought

on a Fraudulent Claim

Percent of Companies

Citing as Influencing Factor

Size of the claim

61.5%

Nature of the policy coverage

38.5%

Situs state for the policy

38.5%

Other (e.g., legal fees)

38.5%

Location of the claim

30.8%

Demographics of the claimant

23.1%

Policy premium payment status

7.7%

The frequency with which companies seek recovery on fraudulent claims also varies significantly.

In response to an open-ended question—“in what percent of fraudulent cases do you seek

recovery,” company responses ranged from “none to date” or “zero” or “limited” to “20% to

25%” to “75% to 80%” and a few respondents said 100%.

Just under one-third of the companies responding have prosecuted a claimant for insurance

fraud, waste or abuse. The remaining two-thirds have not done so. (See Figure 4)

0 2 4 6 8 10 12 14

Terminate the claim

Recover payments made against the policy

Give premium back and end the policy

Seek a declaratory judgment

File a declaratory action against a policyholder for

rescission or policy surrender

What are the types of relief/resolution your company pursues

after FWA confirmed?

16

Copyright © 2019 Society of Actuaries

Figure 4

RESPONDENTS’ RESULTS ON QUESTION ON REFERRAL AND PROSECUTION

Regulatory Issues

Overall, the industry does not feel that the regulatory community has a full understanding of the

nature, type and scope of FWA that is prevalent in the experience of the LTC insurance product

today. Just under 80% of respondents disagree or strongly disagree that the regulatory

community has a strong understanding of these issues, as shown in Figure 5.

0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8

Yes

No

After making a referral to a state fraud bureau, has your

company ever had a claimant prosecuted for insurance fraud,

waste or abuse?

17

Copyright © 2019 Society of Actuaries

Figure 5

RESPONDENTS’ RESULTS ON QUESTION WHETHER REGULATING COMMUNITY UNDERSTANDS FWA AND LTC

INSURANCE

Additionally, the industry believes that many referrals made by special investigative units (SIU)

are not pursued for a variety of reasons. Primary among these are budget constraints (69%) and

lack of understanding of the issues (62%). Industry also feels that states perceive the types of

misrepresentations of loss and billing that comprise fraud as “soft fraud” and for that reason are

reluctant to pursue (46%). Concern with consumer complaints or legal action (31%) or just plain

apathy on the issue (23%) may also be factors that the industry feels impede states’ willingness

to act on SIU referrals. A small percentage of respondents (15%) feel that the constraints

perceived in policy language explain why referrals are not pursued.

When asked whether any specific states are especially effective with regard to handling referrals

made by SIUs, a few respondents identified Louisiana, Florida and South Carolina based on their

individual experience there. Most others felt there was no perceived difference by state.

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0%

Not sure/don't know

Strongly disagree

Disagree

Agree

Strongly agree

Do you agree or disagree that the regulatory community has a

full understanding of the nature, type and scope of fraud, waste

and abuse prevalent in the LTC insurance industry today?

18

Copyright © 2019 Society of Actuaries

LIMITATIONS

While we received a credible response rate, the sample size at 13 companies is still small in

terms of representation of the LTC industry as a whole. Specifically, the companies included in

the survey are estimated to represent approximately 40% of the 7.4 million insured lives in the

industry. As a result of a smaller sample size, we are not able to analyze findings by size or type

of company or other variables that might differentiate perspectives or practices on the topic.

The study design was specifically seeking one perspective from each company, primarily focused

on the business leader with the greatest subject matter expertise. It would have been

interesting, however, to have explored how perspectives might differ across business units

within companies. For example, claims might find great value in an approach that legal and

compliance or management is less familiar or less comfortable with.

Finally, there were a number of good questions left on the “drawing board” from the survey

design team that had to be omitted to maintain the survey to a reasonable length. Hopefully,

this report will generate discussion and additional insights to further enrich the findings

presented here.

19

Copyright © 2019 Society of Actuaries

DISCUSSION

Claimants who misrepresent impairments to satisfy the benefit eligibility trigger was identified as

the highest type of fraud, waste and abuse that insurers encounter. The industry has not

reached a universal consensus about the best tools to establish eligibility, since each tool has its

own benefits and limitations. In-person benefit eligibility assessments represent a moment in

time against which to draw a conclusion, but aren’t helpful when a claim is filed after care has

already ended. A lack of standardization raises its own challenges when reviewing provider

records to determine needed assistance. While attending physician statements and medical

records can confirm a diagnosis or yield a score from a cognitive screening test, they aren’t

always the best source of information about activities of daily living. Furthermore, distinctions

between “hands-on assistance” versus “stand-by assistance” and the frequency and intensity of

needing such assistance can be challenging to pinpoint. Claims professionals do well to consider

all “tools in the tool box”—selecting the right ones for the task at hand to make the best

eligibility decision.

Providers who are overbilling for services in excess of what was rendered came in second place.

This issue is mostly linked to home care claims originating from an insurer’s concern that it can

be difficult to tell precisely how long a caregiver is there and what they are doing while with a

claimant. The good news on this front is that electronic visit verification (EVV) has made inroads

with home care providers, since all Medicaid-reimbursed home care providers must be using

EVV as of January 1, 2019. EVV is technology used during a home health care visit—through a

mobile or landline telephone—to check in and out—and some allow the recording of services

rendered. This technology has implications to the home health care delivery system beyond just

those Medicaid-reimbursed claims. It is important to note the government moved to mandate

EVV believing it would cut down on fraud and abuse.

The survey yields a finding that all carriers are using so-called “red flags” to help detect fraud,

waste and abuse. It is also common to detect potential fraud, waste or abuse through internal

quality assurance activity, through claim system controls and by training staff to follow standard

operating procedures for so-called “high risk claims.” While these are not unexpected results, it

is somewhat concerning that only a little over 20% of companies who responded indicated they

are employing automated or predictive data analytics to identify potentially suspect claims.

While it is encouraging that close to 40% of those who responded indicated they are considering

developing this tool, perhaps a lack of resources or know-how is limiting use of this detection

method. It is also possible the limitations of legacy systems, the data captured and the quality of

the data available may not be suitable. Predictive analytics doesn’t have a long track record as a

detection tool and the survey results indicated a universal belief that it is too soon to tell if it is

producing anticipated results. This is one area to watch for future outcomes. Furthermore, it

appears those who are thinking about it or haven’t begun to explore predictive analytics can

learn from those who have.

20

Copyright © 2019 Society of Actuaries

It is widely recognized that older LTC insurance policies were written without regard to many

newer fraud controls that are often written into newer insurance contracts. For example, many

newer policies have “proof of payment” language—not just “proof of loss” requirements.

Policies from other business lines allow insurers the right to take “Examinations under Oath” of

their claimants as well as the right to require production of relevant requested documentation.

Are there any strategies or steps that the LTC Anti-Fraud community might consider taking to put

the companies in a position to be able to take advantage of some of the basic fraud controls that

are simply not expressly included in the policy language?

Approximately 75% of responding carriers stated that they believed that the regulatory

community does not fully understand the nature, type and scope of fraud, waste and abuse

prevalent in the LTC industry, while less than 10% indicated that they believed the regulatory

community had such understanding. Assuming the carriers’ perspective has merit, what has led

to such a disconnect between the regulatory community and the carriers? More important, what

can we do as an industry to help educate the community on important LTC fraud issues and/or

close the knowledge gap?

The survey respondents provided many potential reasons why they believe state fraud bureaus

are pursuing long-term care fraud referrals at a lower frequency than deserved. Is there anything

that the industry can do to stimulate interest from the state fraud bureaus in opening more

fraud investigations into long-term care claims? Should carriers care if fraud bureaus are

pursuing LTC referrals, i.e., are carriers overstating the importance of the possibility of criminal

actions if the carriers are independently making their own claim decisions? What can carriers do

in strong cases when the state fraud bureau chooses not to pursue an investigation?

Last, the carriers were asked, “How effective do you think our industry is in addressing fraud,

waste and abuse?” No carrier indicated that the industry is extremely effective or very effective.

Rather, 55% responded that the industry was “somewhat effective,” while 40% indicated the

industry was either “not so effective” or “not effective at all.” If it is assumed that the industry

perspective is accurate, what are the primary reasons why the industry is so ineffective? Is the

industry trending toward improving its effectiveness in combating fraud? If so, what

improvements are carriers making to increase fraud, waste and abuse mitigation effectiveness?

21

Copyright © 2019 Society of Actuaries

APPENDIX: FULL SURVEY

The Society of Actuaries (SOA) Long Term Care Insurance Section is sponsoring this survey to

better understand the concerns companies have with their efforts to address fraud, waste and

abuse in LTC insurance. Specifically, we want help identifying ways that industry can improve its

relationship with regulators in support of best practices for fraud prevention, detection and

recovery. Please take a few minutes to share your opinions with us. ALL RESPONSES ARE

ANONYMOUS AND NO COMPANY RESPONSES WILL BE INDIVIDUALLY IDENTIFIED.

The person at your company who is likely best suited to complete this survey would be the LTC

business leader. We have attached a PDF version of the survey so that you may review it first to

determine who at your company should complete the survey. We encourage that individual to

obtain input from all relevant areas within the company working on these issues.

First - some basic definitions:

FRAUD - intentional misuse of information in order to persuade another to part with something of

value or to surrender a legal right. It could also be an act of planned deception or

misrepresentation;

WASTE - To use, consume, spend or expend thoughtlessly or carelessly;

ABUSE - Providing information or documentation for a health care claim in a manner that

improperly uses program resources for personal gain or benefit, yet without sufficient evidence to

prove criminal intent.

Introduction

1. First, please tell us in which business area of the company you are engaged (e.g., claims, legal,

actuarial, corporate, etc.?

*

2. And how long has your company been in the LTC business?*

3. Approximately how many policies does your company have inforce?*

Less than 50,000

50,000 to 99,999

100,000 to 249,999

250,000 to 399,999

400,000 or more

Not at all Significant Very Significant

Claimant

misrepresentation of

loss

Provider

misrepresentation of

loss

Claimant

misrepresentation of

services and/or billing

Provider

misrepresentation of

services and/or billing

Collusion between

claimants and providers

with regard to

misrepresentation of

loss

Collusion between

claimants and providers

with regard to

misrepresentation of

services and/or billing

4. Please indicate how significant each of the following is as a source of the fraud, waste and abuse your

company experiences.

*

5. Please rank each of the types of fraud, waste and abuse that your company experiences in the order

of significance to your company (in terms of either cost and/or prevalence) , with "1" being most significant

and "5" being least significant.

*

Claimants who misrepresent impairments in an attempt to satisfy benefit eligible

Claimants who misrepresent continuation of disability (deny recovery) in order to continue to receive benefits

Providers billing for services not rendered

Providers overbilling for service amounts in excess of what was rendered

Billing for providers who are not eligible under the contract

Already using Would consider Might consider Would not consider

Not familiar enough

to know

Examinations under

oath

Recorded interviews

Requiring proof of

payment for expenses

incurred

Pursuing a declaratory

judgment

Gathering forensic data

on mobile devices

Using field claims

consultant to interview

claimant in person and

complete a claim form

(not an assessment)

A database similar

to MIB (Medical

Information Bureau)

where carriers report

suspected fraudulent

claimants and/or

providers

Use of Electronic Visit

Verifications tools

6. Some practices in combating fraud, waste and abuse that are used in other insurance business lines are

shown below. We want to know if you think these might have some applicability to LTC insurance. Please

tell us whether you have or would consider any of these. As you consider them, please assume that

whatever regulatory changes needed to enable or allow you to use them could be obtained.

*

7. Which one of the following types of claim locations do you feel generates the largest portion of potential

fraud, waste and abuse referrals/investigations?

*

Nursing home

Assisted living facility

Formal home care claims

Informal home care claims (e.g., independent provider or

family member)

Other (please specify)

8. Which type of claim diagnosis do you feel generates the highest portion of potential fraud, waste and

abuse referrals/investigations?

*

Functional impairment

Cognitive impairment

Medical necessity

Other (please specify)

9. Are there other specific situations that you feel might escalate the potential for fraud, waste and abuse?

(Please check all that apply)

*

Assignment of Benefit

Rate increase

Power of attorney

None of the above

Other (please specify)

10. What do you feel is the most important control your company or TPA has in place to help prevent fraud,

waste and abuse?

*

11. How is fraud, waste and abuse detected at your company or TPA? (Please check all that apply)?*

Whistleblower program

Fraud warnings on letters

Fraud warnings on claim documents

Fraud warnings as part of policy fulfillment

Fraud hotline

Claim Systems Controls

Automated or Predictive Data Analytics

Internal quality assurance

Secondary review by senior claim staff, management, law

Standard operating procedures that provide guidance for

handling different types of "high risk" claims

Red flags that staff are trained to look for

None of the above

Other (please specify)

12. How are staff trained to spot potentially fraudulent activity? (Please check all that apply)*

Red flag lists

Case illustrations

Formal training program

On the job training

None of the above

Other (please specify)

13. Please tell us about anything new or creative that you have implemented to detect fraudulent activity

that hasn't yet been mentioned in this survey.

14. Which of the following techniques or tools do you use for detecting and/or investigating potential fraud,

waste and abuse? (Check all that apply)

*

Surveillance

Background checks

Social media checks

Unannounced visit

Other (please specify)

15. Do you use automated/predictive analytics to help more cost effectively identify which claims to pursue

for likely fraud, waste or abuse?

*

Yes

Not yet but we are considering it

No

16. If you are using automated predictive analytics, how satisfied are you with the results?*

Very satisfied

Somewhat Satisfied

Not very Satisfied

Not at all satisfied

Too soon to tell

Not relevant - we are not using predictive analytics

17. What is the most important aspect of working with investigative firms on pursuing fraud, waste and

abuse issues?

*

18. If you have a dedicated fraud hotline, or if you encourage use of your customer service line for that

purpose, how effective do you feel it has been in generating useful referrals?

*

Very effective

Somewhat effective

Not so effective

Not at all effective

Other (please specify)

19. What are the types of relief/resolution your company pursues after fraud, waste or abuse is confirmed?

(Please check all that apply)

*

Terminate the claim

Recover payments made against the policy

Give premium back and end the policy

Seek a declaratory judgment

File a declaratory action against a policyholder for rescission

or policy surrender if fraud, waste or abuse is discovered

Other (please specify)

20. Which of these do you use most often? (Please choose only one)*

Terminate the claim

Recover payments made against the policy

Give premium back and end the policy

Seek a declaratory judgment

File a declaratory action against a policyholder for rescission

or policy surrender if fraud, waste or abuse is discovered.

Other (please specify)

21. Other than the strength of the case, what factors determine whether you seek some type of recovery

on fraudulent claims? (Please check all that apply)

*

The size of the claim

Location of the claim

Demographics of the claimant

Nature of the policy coverage

Situs state for the policy

Policy premium payment status

Other (please specify)

22. In what percent of fraudulent claim cases do you seek recovery?*

23. Do you agree or disagree that the regulatory community has a full understanding of the nature, type

and scope of fraud, waste and abuse prevalent in the LTC insurance industry today?

*

Strongly agree

Agree

Disagree

Strongly disagree

Not sure/don't know

24. The industry believes that many referrals made by Special Investigative Units (SIU) to State Fraud

Bureaus are not pursued. Why do you think this is? (Please check all that apply)

*

Budget constraints

Lack of understanding

Apathy

State sees it as "soft fraud"

Feeling of "goodwill" toward elderly - see them as "vulnerable"

population

Not want to "stir the pot"

Concerned with getting complaints or legal action

Constraints perceived in policy language

Other (please specify)

25. Is there any states that you feel are especially effective with regard to handling referrals made by

SIUs? And if so, why do you think that is the case?

26. Overall, how effective do you think our industry is in addressing fraud, waste and abuse?*

Extremely effective

Very effective

Somewhat effective

Not so effective

Not at all effective

Don't know/not sure

27. What do you think is the primary challenge our industry faces in not being more effective in addressing

these issues? (Please choose one)

*

Companies don't understand the problem well enough

Lack of compliance/regulatory support for taking action

Lack of resources to address these issues

Company doesn't prioritize these issues

Company concern with negative PR gets in the way

Still building knowledge, training and technology

I don't see a problem. I'm satisfied with how effectively

industry is dealing with this

Other (please specify)

28. After making a referral to a state fraud bureau, has your company ever had a claimant prosecuted for

insurance fraud, waste or abuse?

*

Yes No

29. What do you think groups like SOA, ILTCI, the LTC Forum, AHIP, ACLI and others should be doing to

address fraud, waste and abuse?

*

30. And finally, one last question. Are you aware that there is an industry group - the Anti-Fraud Forum -

that meets twice a year to share best practices regarding how to handle potentially fraudulent claims?

*

Yes No

31. If you would like more information about the Anti-Fraud Forum, send an email to Jeffrey Ferrand at

jferrand@fuzionanalytics.com

32. Thank you so very much for your participation in this survey. We will be sharing a summary of results

as soon as they are available. If you have any additional comments or concerns, please feel free to share

them with us in the space below.

22

Copyright © 2019 Society of Actuaries

About The Society of Actuaries

The Society of Actuaries (SOA), formed in 1949, is one of the largest actuarial professional organizations in the world

dedicated to serving 32,000 actuarial members and the public in the United States, Canada and worldwide. In line

with the SOA Vision Statement, actuaries act as business leaders who develop and use mathematical models to

measure and manage risk in support of financial security for individuals, organizations and the public.

The SOA supports actuaries and advances knowledge through research and education. As part of its work, the SOA

seeks to inform public policy development and public understanding through research. The SOA aspires to be a

trusted source of objective, data-driven research and analysis with an actuarial perspective for its members,

industry, policymakers and the public. This distinct perspective comes from the SOA as an association of actuaries,

who have a rigorous formal education and direct experience as practitioners as they perform applied research. The

SOA also welcomes the opportunity to partner with other organizations in our work where appropriate.

The SOA has a history of working with public policymakers and regulators in developing historical experience studies

and projection techniques as well as individual reports on health care, retirement and other topics. The SOA’s

research is intended to aid the work of policymakers and regulators and follow certain core principles:

Objectivity:

The SOA’s research informs and provides analysis that can be relied upon by other individuals or

organizations involved in public policy discussions. The SOA does not take advocacy positions or lobby specific policy

proposals.

Quality:

The SOA aspires to the highest ethical and quality standards in all of its research and analysis. Our research

process is overseen by experienced actuaries and nonactuaries from a range of industry sectors and organizations. A

rigorous peer-review process ensures the quality and integrity of our work.

Relevance:

The SOA provides timely research on public policy issues. Our research advances actuarial knowledge

while providing critical insights on key policy issues, and thereby provides value to stakeholders and decision

makers.

Quantification:

The SOA leverages the diverse skill sets of actuaries to provide research and findings that are driven

by the best available data and methods. Actuaries use detailed modeling to analyze financial risk and provide

distinct insight and quantification. Further, actuarial standards require transparency and the disclosure of the

assumptions and analytic approach underlying the work.

Society of Actuaries

475 N. Martingale Road, Suite 600

Schaumburg, Illinois 60173

www.SOA.org