Silviculture Handbook

April 2016 62-1 HB24315.62

CHAPTER 62

ECONOMIC CONSIDERATIONS

Chapter Index

1 Introduction 62-3

1.1 Goal of chapter 62-3

1.2 Overview 62-3

2 Economic rotation 62-4

2.1 What is economic rotation 62-4

2.2 Components of economic rotation 62-4

2.2.1 Establishment costs 62-5

2.2.2 Annual costs 62-5

2.2.3 Current and future timber prices 62-6

2.2.4 Annual growth and log grade changes 62-6

2.2.5 Revenue from commercial thinning 62-7

2.2.6 Revenue from harvest 62-8

2.2.7 Discount rate 62-8

3 Biological versus economic rotation 62-10

4 Economics of uneven aged management 62-11

5 Product considerations 62-11

6 Access to markets 62-12

7 Valuing non-timber forest resources 62-13

8 Forest economics in the value chain 62-13

8.1 Landowners 62-13

8.2 Loggers 62-14

8.3 Mills 62-14

8.4 Communities 62-15

9 References 62-16

Appendix A- Glossary 62-18

Appendix B- Formulas 62-23

Silviculture Handbook

April 2016 62-2 HB24315.62

Tables and Figures

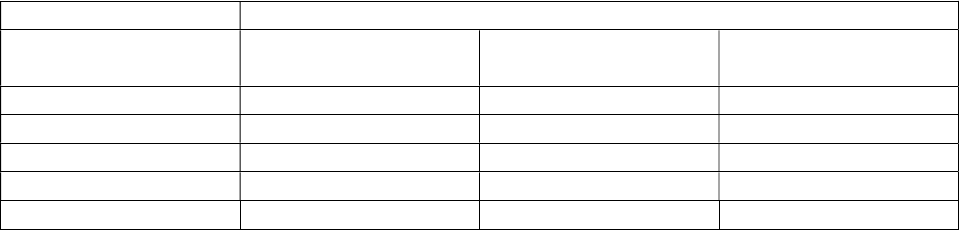

Table 1. The future value of establishment costs for a Michigan jack pine stand .................................. 62-5

Table 2. Relationship between grade change, value increase, and rates of return in a red oak tree. ....... 62-7

Table 3. Net present value of thinned and unthinned stands in Maine.................................................... 62-7

Table 4. Net present value per acre of a red pine stand at various discount rates .................................. 62-9

Figure 2. Economic rotation .................................................................................................................. 62-10

Figure 3. Biological versus economic rotation age ............................................................................... 62-10

Silviculture Handbook

April 2016 62-3 HB24315.62

1 Introduction

1.1 Goal of chapter

The goal of this chapter is to review economic aspects of forest management in order to more fully

integrate them with ecological and social aspects of management in Wisconsin. The considerations

presented will assist foresters in understanding economic aspects of management when writing and

implementing forest plans and designing and implementing harvests. These economic considerations are

intended to be used in combination with WDNR silviculture and forest management guidelines to

address integrated resource management objectives. This chapter does not attempt to explain all aspects

of forest economics or recommend specific management actions but is limited to defining general forest

economics subjects that are relevant to silviculture in Wisconsin. Not all management that is financially

attractive is sustainable. The Wisconsin Forest Management Guidelines (WDNR, 2011) provide a more

comprehensive overview of additional forest economics topics to assist in private land management.

1.2 Overview

Forest management practices are prescribed to satisfy sustainable landowner goals and achieve stand or

property level objectives. In forest management, individual trees, stands, and forests each have different

kinds of benefits and values. The most easily recognized is the revenue generated when timber is

harvested. Activities designed to achieve many management objectives can be costly and may not be

undertaken by the landowner unless there is an offsetting revenue stream. Timber revenue creates an

opportunity to achieve objectives. The economic benefits extend to the landowner, the logger, the mills,

the local communities that receive tax revenue and the indirect benefits of forest industry employees

spending their wages in the community. Protecting both short-term and long-term values and economic

benefits ensures the sustainability of the forest industry in Wisconsin. This chapter will discuss factors

that affect forest management including economic rotation age, economic considerations of even versus

uneven aged management, product considerations, access to markets, non-timber forest resources, and

the forestry value chain. The chapter is designed as an introduction to basic forest economic concepts,

with additional resources listed in the reference section.

A fundamental question in forest management is when to harvest trees. With even-aged management,

this question becomes “what is the optimal rotation age?” The economic rotation age maximizes the net

present value of the stand and forest type being considered. The economic rotation age may consider

only financial returns but could also include non-timber benefits. Adding non-timber benefits may more

accurately reflect landowner objectives, especially when the objectives are not easily quantified. The

components of an economic rotation are discussed in section 2.

Forestry textbooks that discuss even versus uneven aged management often assume that even aged

management leads to higher timber volumes and net present values based on financial returns. This is

not always the case and depending on the species uneven aged stands managed in a steady state can

provide better long run returns and higher quality trees. Section 3 will explain the importance of several

key economic differences between even and uneven aged stands.

Silviculture Handbook

April 2016 62-4 HB24315.62

Quality forest products have historically demanded higher prices in the market. It is important to

understand what markets are available and to plan harvests that utilize current markets and consider

future markets when considering long term management. Log grade is one measure to determine the

quality and value of a tree. Section 4 will discuss the basics of log grading and market considerations.

There are many things that affect the financial returns on a timber sale. Access to markets, including the

distance to the nearest mill and the marketability of the species, are two of many factors affecting timber

prices. Forest landowners must have access to markets for their wood products if these lands are to

remain financially productive. Section 5 will discuss the basics of market access and the importance of

considering potential markets for trees.

The final section will look at valuing non-timber resources. Most discussions on forest economics focus

on timber resources. But non-timber forest resources such as wildlife habitat or recreation may provide

value to landowners. Section 6 will briefly discuss the economics of valuing non-timber forest resources.

The final section will look at the role of forest economics in the value chain. Forest economics is a

consideration by landowners, loggers, log buyers, truckers, primary and secondary processors and

communities.

2 Economic rotation

2.1 What is economic rotation

The economic rotation age is that which maximizes the net present value (NPV) or willingness to pay

for bare land, of a stand managed with an even aged regeneration system. The economic rotation age

must compare the annual growth in timber value against the cost of holding the timber for an extra year.

It must consider the marginal benefits and marginal costs of growing the forest one additional year.

2.2 Components of economic rotation

The economic rotation is the rotation age that maximizes the net present value. Calculating the economic

rotation age requires knowledge of the various cash flows associated with a single or multiple rotations

of a stand. One complication in determining economic rotation age is that the timing of a cost or revenue

can have a large effect on the value of the cost or revenue. To determine the net present value, all the

costs and revenues of owning the forest are discounted back to the present year. The formulas used to

discount costs and revenues to the present are presented in Appendix B. This section will look at seven

types of costs and revenues that influence the economic rotation age:

establishment costs (e.g., site preparation, tree planting, etc.)

annual costs of ownership and management

annual stand growth and log grade changes

current and future timber prices

revenue from commercial thinning

revenue from harvest

Silviculture Handbook

April 2016 62-5 HB24315.62

discount rate

2.2.1 Establishment costs

Site preparation and reforestation costs vary by location, current stand conditions, prior stand history,

landowner preferences, desired future stand objectives and budget. For a reforestation investment to be

financially viable, the present value of the estimated future returns must exceed the cost of reforestation.

High reforestation costs generally do not change the economic rotation age of a forest but may decrease

the overall returns if there is not a subsequent increase in revenue when the trees are harvested. The cost

of regeneration and site preparation methods needs to be compared to the future yield and quality of the

forest. For example if it costs $300 per acre to seed or plant a jack pine stand versus natural

regeneration, assuming a 50 year rotation and a 4% discount rate (Section 2.2.7) you need to earn $2100

more per acre at harvest to pay for the establishment costs. A present value is a value that is expressed in

terms of dollars received immediately. A future value is a value that is expressed in terms of dollars

received at some future time. In this case, it is a future value being calculated ($2100 additional future

dollars) and the additional amount of income needed per acre to offset the planting costs, assuming all

other factors (annual costs, growth rates, timber prices, etc.) are the same.

The additional income needed to offset various planting costs is shown in Table 1. A recent study by the

Michigan DNR found that successful natural regeneration on a red pine stand costs about $60/acre while

planting averaged $230/acre. However, a failed natural regeneration costs $400/acre. This is due to the

cost of regeneration surveys, additional administration expenses and additional roller chopping and/or

herbicide site preparation.

Table 1. The future value of establishment costs for a Michigan jack pine stand

Additional income nee

ded at harvest to offset planting costs

Establishment cost

(per acre)

Rotation age 50 Rotation age 60 Rotation age 70

$100

$711

$1,052

$1,557

$200

$1,421

$2,104

$3,114

$300

$2,132

$3,156

$4,671

$400

$2,843

$4,208

$6,229

$500

$3,553

$5,260

$7,786

2.2.2 Annual costs

Annual costs may include property taxes, certification, fertilization, management services (i.e.

management planning, value estimation, etc.), fire protection, stand maintenance or other activities.

Annual revenues may include money received from selling non-timber forest products or payments for

ecosystem services, which may include incentives provided to landowners. The revenues can be actual

or anticipated. Due to compounding of money, minimizing annual costs or maximizing annual revenues

is often the best way to increase returns to a forest stand. High annual costs shorten the economic

Silviculture Handbook

April 2016 62-6 HB24315.62

rotation age, decrease the total returns on the stand, and may cause the landowner to choose a less costly

and less productive silvicultural alternative.

Example: Lands enrolled in MFL incur lower property taxes than lands not enrolled in MFL. A red pine

plantation that is enrolled in MFL and pays $11/acre in taxes has an economic rotation age of 57 years

and a NPV of $755/acre. The same plantation that is not enrolled in MFL and pays $35/acre in taxes has

an economic rotation of 51 years and a NPV of $277/acre. High annual costs shorten the economic

rotation age and decrease the total returns on the stand.

2.2.3 Current and future timber prices

Future log and pulpwood prices can be calculated by inflating current prices and modified if there is an

expectation of a price increase or decrease for a tree species or a management practice. For instance, a

landowner may think certified wood will receive a price premium or a specific species will be in higher

demand. Log prices are determined by wood availability, consumer preferences and other market

fluctuations outside the control of foresters. Higher expected timber prices generally lengthen the

economic rotation age. Timber Mart North is a popular document for tracking current timber prices.

Example 1: Since 1996, prices for red pine have fluctuated from $29-$80/ cord and $90-$200/mbf

(Prentiss and Carlisle, 2014). If we assume the property is enrolled in MFL, a 4% rate of return and that

the stand will receive 4 thinnings beginning in year 27, the economic rotation age ranges from 57 to 75

years. If we receive the lowest prices at the final harvest and the intermediate thinnings, the rotation age

is 57 years and the NPV is $804/acre. If we assume we will receive the highest prices at the final

rotation and the intermediate thinnings, the rotation age is 75 years and the NPV is $2,543/acre.

2.2.4 Annual growth and log grade changes

As trees age, they grow both in height and diameter. As such, their total volume increases, usually

making them more valuable. Trees may be worth more per unit volume as they increase from lower

value to higher value products. Foresters can help maximize growth through forest management actions

such as timber stand improvement practices and intermediate thinnings. Well managed stands that

maximize their annual growth are often higher in value than unmanaged stands. Annual growth is used

to calculate the mean annual increment (MAI), periodic annual increment (PAI), and biological rotation

ages.

As trees increase in size, some logs may be moved into a higher grade. If a tree is close to the next grade

it may be economical to postpone harvesting it until the next stand entry. Error! Reference source not

found. demonstrates the relationship between grade change and value increase for a red oak tree. Where

a grade change occurs, the rate of return for postponing harvest is relatively large. But unless a grade

change occurs in the most valuable portion of the tree, the rate of return for postponing harvest can be

quite low. Table 2 demonstrates the change in rates of return as a tree moves up in grade. In table 1, the

rate of return on the entire tree is 4.5%, demonstrating the importance of the value change for the butt

log. In a situation like this, where (a) the rate of return in the butt log is low, (b) the grade change for

upper portions is uncertain and (c) holding the tree another 10 years increases risk to the valuable butt

Silviculture Handbook

April 2016 62-7 HB24315.62

log, the economic forester may very well decide that postponing harvest is not the most rational course

of action.

Table 2. Relationship between grade change, value increase, and rates of return in a red oak tree.

Year 1 Year 10 Internal Rate of

Return

Value Increase

6” pulp stick, .024

cord, $0.12

8” sawbolt, 10 board

feet, $1.00

23.5% $0.88

8” sawbolt 10” grade 2 log, 30

board feet, $8.82

24% $7.82

10” grade 2 log 12” grade 1 log, 40

board feet, $19.00

8.0% $10.18

12” grade 1 log 14”veneer log, 60

board feet, $46.20

9.5% $27.20

14” veneer log 16” prime veneer log,

80 board feet, $97.44

8.0% $51.24

16” prime veneer log 18” prime veneer log,

110 board feet, $133.98

3.0% $36.54

18” prime veneer log 20” prime veneer log,

140 board feet, $170.52

2.5% $36.54

Change in entire tree

4.5%

$124.40

Source: WDNR, 2011

Each wood using industry has preferences and specifications. At some point trees can lose value if they

decrease in quality or exceed the mills maximum size requirements. Most mills will accept large

diameter logs but there may be quality challenges due to site conditions or past stand management.

Managing a forest to improve growth, vigor, quality and diversity usually maximizes financial returns. It

is also important to consider the impact of harvesting an individual tree on the stand-level management

objectives. While individual tree rates of return may be a consideration, this information needs to

evaluated in the context of stand-level management objectives.

2.2.5 Revenue from commercial thinning

When modelling a stand, the revenues from thinning are discounted back to the present time from the

year they occur and the revenues are assumed to be reinvested (back in forestry or in an alternative

investment) at the assumed discount rate. Thinnings generally do not change the economic rotation age

but will increase the NPV of the stand by providing intermediate income, higher quality trees and higher

merchantable stand volume. Table 33 demonstrates the difference in NPV (assuming a 4% discount rate)

for thinned and un-thinned conifer and mixed wood stands in Maine.

Table 3. Net present value of thinned and unthinned stands in Maine

Site Index Stand Type Thinning NPV

60 Pure Conifer No $834-$1116

Yes $1022-$1457

Mixed Forest No $825-$1093

Yes $928-$1463

Silviculture Handbook

April 2016 62-8 HB24315.62

80 Pure Conifer No $1531-$1821

Yes $1846-$2679

Mixed Forest No $1470-$1771

Yes $1754-$2665

Source: Saunders, et al, 2008

2.2.6 Revenue from harvest

The revenue from harvest is determined by tree, stand and market characteristics. Tree characteristics

include the species, quality, and size (diameter and height). Stand characteristics include the type of

silviculture system and type of harvest (Ex. clear cutting versus shelterwood or single-tree selection),

harvest volume, site accessibility, and distance to market. Market characteristics include current demand

for the products, what mills are currently accepting, currency exchange rates and other factors. Demand

changes may be due to change in consumer preferences or the general strength of the economy and these

can be difficult to predict when trying to determine economic rotation age. Most forestry costs increase

along with the inflation rate but stumpage prices may increase or decrease at other rates as supply and

demand change. For example, a red maple stand with a 20% lower stumpage price than expected lowers

the NPV by 15% and the economic rotation age by 9 years. This assumes a landowner is enrolled in

MFL, a discount rate of 4% and all other costs and benefits being equal under both stumpage prices.

2.2.7 Discount rate

The discount rate is the most critical component in understanding forest economics, economic rotation

ages and net present values. Most individuals feel a dollar received today is worth more than a dollar to

be received in the future. The discount rate is the rate at which future values are discounted to the

present. The higher the discount rate, the lower the present value of the forest.

Discount rates can be expressed in either real or nominal terms. A real discount rate has been adjusted

for inflation while a nominal discount rate includes inflation. For example, if the nominal rate is 8

percent and the inflation rate is 2 percent, the correct way to convert the nominal rate is (1.08/1.02)-1 =

.0588 = a real discount rate of 5.88%. Most forestry analyses are conducted using real discount rates, but

use of nominal rates is acceptable. The key is to match the type of cash flow with the type of discount

rate, i.e. if a real rate is used, cash flows should be inflation-adjusted.

Landowners decide on a discount rate by considering their alternative rate of return. That is, if they did

not invest in forestry, what rate of return could they earn in an alternative investment? The rate of return

is higher or lower depending on the riskiness of the investment. Investors require higher rates of return

to take on greater risk. Landowners must decide on a forestry discount rate by considering the rate of

return they could achieve in alternative investments, but adjusting for the riskiness of forestry compared

to the riskiness of the alternative investments. If forestry is judged to be less risky than the alternative

investment, then the forestry discount rate might be set lower than the alternative rate of return, and of

course vice versa.

Risk can be divided into two components: market or unique. Market risk is the degree of sensitivity of

Silviculture Handbook

April 2016 62-9 HB24315.62

the investment to the market as a whole and influenced by interest rate changes, general price swings,

and demand for the product. Unique risk is the portion of risk specific to the product and includes fire

and wind damage, changes in intrinsic values of the forest, poor silviculture, or changes to preferences

for certified wood.

Companies and individuals have a discount rate they apply to revenue and expense decisions but these

change as the economy changes. Today real discount rates for forestry are generally between 3-7%. At

the WDNR we generally use a real discount rate of 4%. In a red pine stand with four thinnings the

economic rotation age varies from 51-100 years based on a real discount rate of 3-5% as shown in Table

4. The table below is based on a single red pine stand and individual stands would produce different

rotation ages.

Table 4. Net present value per acre of a red pine stand at various discount rates

Discount rate

3%

4%

5%

Rotation age

50

$1,370

$895

$588

70

$

1,523

$913

$561

100

$1,614

$877

$510

Economic

rotation age

100 years 74 years 51 years

This assumes a price of $36/cord and $144/mbf, annual costs of $4, and thinnings at 27, 37, 47 and 62

years and 1/3 of the timber cut at each thinning.

As a stand ages the timber value growth declines. A rational investor chooses to harvest when the timber

value growth is equal to the chosen discount rate. Harvesting when timber is growing faster than the

discount rate is not maximizing returns because you are still earning more than alternative investments.

Harvesting timber when the timber value growth is lower than the discount rate means you are not

maximizing returns as you are better off to cut the trees and invest them in an alternative investment.

Figure 6 demonstrates the relationship between timber value growth, age of the stand and the discount

rate.

Timber Value Growth (percent)

Age of stand (in years)

r (discount rate)

Silviculture Handbook

April 2016 62-10 HB24315.62

Figure 6. Economic rotation

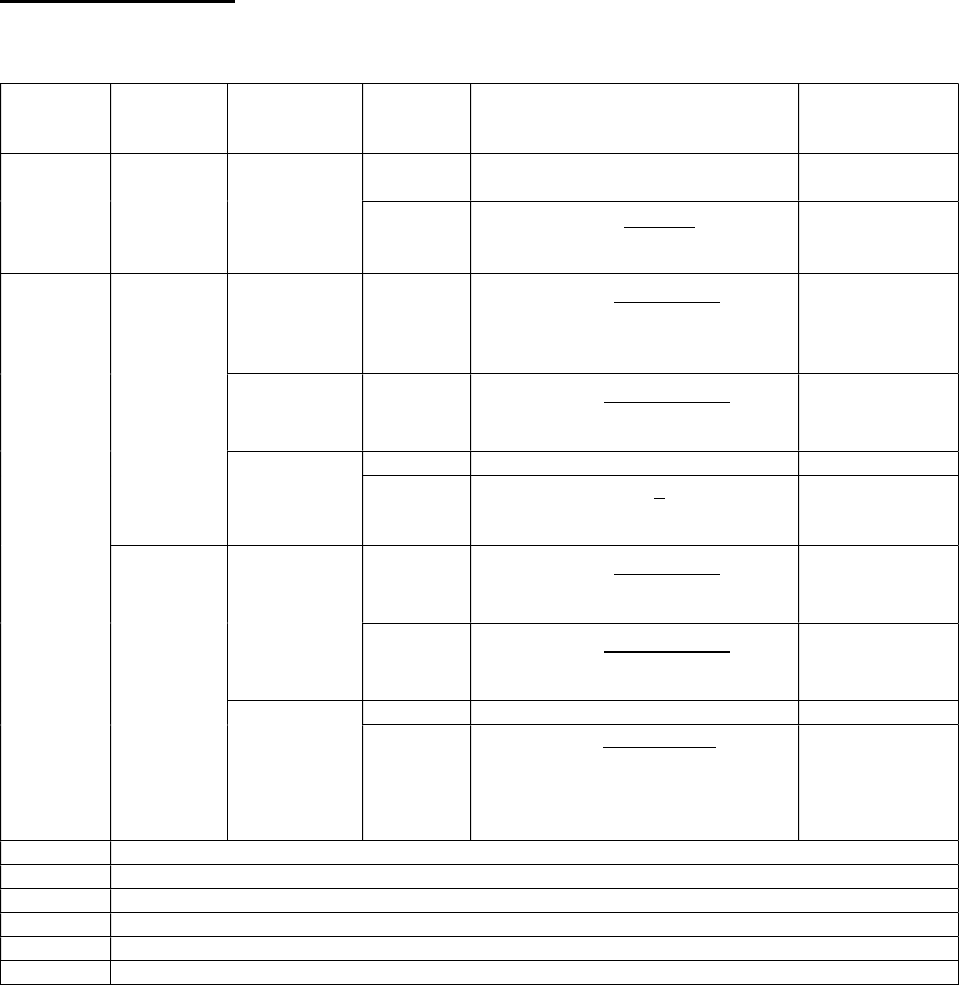

3 Biological versus economic rotation

The rotation age that maximizes the mean annual increment (MAI) is defined as the biological rotation.

The biological rotation age seeks to maximize the long-term sustained yield (i.e., volume yield over

multiple rotations) from a forest. In general, biological rotations do not consider financial costs and

benefits of harvesting and are unlikely to maximize economic returns on the forest investment while

economic rotations may not yield the highest ecological or social benefits. Stands may also be managed

on an extended rotation which does not maximize the financial rotation but may provide other ecological

benefits. Each rotation has various costs and benefits. The rotation age should be based on landowner

objectives. If a tree has reached financial maturity, carrying it until the next entry causes a loss in value

due to discount rates and risk of it losing value. In most cases the maximum NPV and MAI are not

sharp peaks with steep declines on either side of the maximum but usually a gradual plateau. The

gradual plateau allows for flexibility in interpreting the most efficient rotation. Figure 7 illustrates the

biological rotation that maximizes MAI and the economic rotation that maximizes NPV. An extended

rotation generally does not maximize financial benefits but may reflect other landowner objectives.

Figure 7. Biological versus economic rotation age

1.7

1.8

1.9

2.0

2.1

2.2

2.3

2.4

2.5

2.6

$750

$800

$850

$900

$950

$1,000

$1,050

$1,100

$1,150

50

53

56

59

62

65

68

71

74

77

80

83

86

89

92

95

98

101

104

107

110

113

116

119

Mean Annual Increment (cu ft/year)

Net Present Value

Age

NPV (trees only)

MAI, cu ft/year

Silviculture Handbook

April 2016 62-11 HB24315.62

4 Economics of uneven aged management

The economic goal of uneven aged management is a steady state which can provide stable returns

indefinitely. In a steady state, the present value of the harvest is directly proportional to the periodic

value of the harvest. The most important economic consideration is to leave desirable species and grades

in each cut, specifically trees with the highest potential to increase in value. Ideally the rate of increase

for each tree in the stand should be greater than the alternative rate of return. Steady economic returns

are important in even aged management as well and it is important to consider both the NPV and the

long run steady returns from a stand.

Existing studies provide evidence that uneven aged management can provide economics returns that are

similar to even aged management. Studies have shown that partial cutting can provide steady, long-term

rates of return between 4 and 6 percent (Buongiorno et al, 1994; McCauley and Trimble 1972; Miller,

1991; and Reed et al, 1986). The key economic considerations in uneven aged management are the

distribution of trees by size (or age) and the frequency of harvests. Uneven aged management is

characterized by periodic harvesting and any economic analysis should consider the frequency of

harvests and how much of the stand should be harvested at each entry.

5 Product considerations

Higher quality products usually command higher prices in the market. Log and lumber grades are as

important as volume in the economics of producing sawlogs. There is a relationship between log and

lumber grades. Log grades for softwood and hardwood lumber start with the same general steps:

1) Establish four grading faces

2) Determine number and length of clear cuttings on each face

3) Determine grade based on second worst face

Most log grading focuses on identifying veneer and the rest is identified as sawlog although in reality

there are three USFS hardwood log grades (F1, F2, F3) and two softwood grades. Veneer is not an

official USFS grade but is important. For more information on log grading the USFS offers several

publications (Rast, et al, 1973, Hanks et al, 1980). USFS log grades are not commonly used throughout

Wisconsin and often the Northern Hardwood Log Grading Rules published by Great Lakes Timber

Professionals Association are more common.

The hardwood and softwood log grades have sometimes been applied to logs in standing trees. Problems

often are encountered when estimating bark diameters and other factors. These difficulties are

compounded when trying to grade the upper logs. An alternative to grading logs in standing trees is

available in several publications (Miller and Hanks, 1986; and Brisbin and Sonderman, 1971). It

presents a system of tree grades that only require consideration of the butt log.

USFS log grades are used to predict the yield of lumber by grade. The National Hardwood Lumber

Association (NHLA) established yield tables that predict the volume of lumber by USFS grade, species

and diameter class. NHLA lumber grades are based on the minimum size of the board, the size cutting

Silviculture Handbook

April 2016 62-12 HB24315.62

permitted, the maximum number of cuttings permitted and the area of the board required in clear face

cuttings. There are five NHLA hardwood lumber grades: FAS, selects, 1, 2 and 3. Softwoods lumber

grades were established by the American Softwood Lumber Standard. Softwood lumber grades can be

classified into three major categories of use: yard lumber, structural lumber, and factory and shop

lumber. More information on lumber grades is available from the USFS (McDonald and Krestchmann,

1999) and UW-Extension (Govett, 2008).

It is important to consider log and tree grades when evaluating the economics of a stand. If you are

unsure, it is important to find a training session in your area to learn more about the factors involved in

determining log and tree grades.

It is important to manage for short and long term markets. It is also important to manage for quality and

quantity but to achieve this goal it helps to understand what the local markets are currently accepting.

Preferences for certain species change over time and impact the price mills are willing to pay.

Researching local markets will help to maximize economic returns for landowners.

6 Access to markets

There are many things that affect the bid price on a forest. Access to markets, including distance to the

nearest mill, access within the property, seasonality and the marketability of the species all influence bid

prices. Access to markets varies depending on location in the state. Currently, landowners in Northeast

Wisconsin are closer to a variety of local mills than landowners in Southwestern Wisconsin. Mills buy a

diversity of tree species and size classes and being closer to a variety of mills provides more

opportunities and often higher returns for landowners. Bid prices are also influenced by fuel prices as

they affect the cost of running equipment in the woods and the cost to transport the logs to the mill.

Landowners that are further from mills will be impacted by an increase in transportation costs.

Optimizing efficiencies in the woods will lower costs and increases the returns on the forestry

investment. Access within the property helps increase the timber sale marketability. Having established

roads or trails reduces logging costs. The distance from the landing to the logging site is important,

generally distances over ½ mile lower stumpage prices. An established landing saves the logger time

and leads to more competitive bids. The topography of the site affects the overall returns on the forest.

Sites with well-drained soils on level terrain are easier to operate compared to wet, steep or rocky sites

which lead to slower machine operation and higher machine maintenance costs.

Access issues are not limited to terrain or distance from mills. Access can also be a seasonal issue. When

considering the seasonality of a sale, factors such as seasonal hunting restrictions, frozen ground

restrictions, the presence of threatened, rare or endangered species, archeological sites, oak wilt

restrictions or other constraints can limit the opportunity to harvest and may result in lower bids.

Often a timber sale prospectus will include details that may lead to lower bids for the landowner. A

prospectus or contract may include seasonal hunting limitations or language that limits harvesting to

“frozen ground only”. Removing broad seasonal restrictions and allowing harvests on “frozen or dry”

ground may garner higher bids.

Silviculture Handbook

April 2016 62-13 HB24315.62

7 Valuing non-timber forest resources

Forests are often valued for their non-timber resources such as wildlife habitat or recreation. Valuing

non-timber resources is generally expressed as an annual dollar benefit. The WDNR forest management

guidelines state that “There are many benefits from owning and managing forests. Stocks and bonds are

usually purchased for the sole purpose of making money, and their financial performance is judged on

that basis alone. But forests are more than mere collections of trees, and landowners benefit from a wide

array of non-timber goods and services like berries and mushrooms, recreational enjoyment, aesthetics,

water quality, and wildlife. Some of these are traded in the marketplace, for example income from

leasing hunting rights, but most are not, and there is no easy way to determine their value to the

landowner. These non-market benefits can have significant value though, as evidenced by the prices

paid for forestland. Even land that is a long distance from a population center and has no unusual

attractions, such as lakes or streams, will typically be bought and sold for much more than its value for

timber production alone. Investment analysis that focuses only on costs and returns from timber

production will ignore important non-market benefits, and will provide an incomplete measure of total

investment performance” (WDNR, 2011).

Non-timber values are generally defined as direct, indirect and existence values. Direct use values are

things that involve direct human interaction. For example, non-timber forest products, recreation and

hunting are all direct use values. Indirect use refers to values that do not require human involvement.

Existence values are the values that people have for non-timber resources existing. Existence values are

often cultural uses or the importance of places. Most non-timber forest valuation focuses on direct and

indirect use values. Not considering the non-timber values can create problems with inefficient

allocation of resources or uninformed management decisions.

8 Forest economics in the value chain

The forest industry has an extensive history in Wisconsin and to continue forestry in the future we need

to maintain economically-viable and ecologically sustainable returns. Forest economics can help make

fully informed management decisions for landowners, loggers, log buyers, truckers, primary and

secondary processors and communities.

8.1 Landowners

Forest landowners are the base of the economic chain. Private forest land owners may work with

foresters to develop forest management plans and conduct timber sales. The timber sales can be

purchased by loggers, timber haulers, primary processors, and even secondary processors. After the sale

is purchased a logger harvests the selected trees, a timber hauler delivers them to a mill, which processes

the logs into any of several possible products. At all stages of the value-chain the owner of the timber or

logs tries to steer the products into their highest value use. This optimization is unique for everyone as

costs and benefits are different and units may be difficult to define. Foresters can help by looking for

ways to remain flexible in writing and interpreting management plans, lay out of harvests and working

with members of the forest industry.

Silviculture Handbook

April 2016 62-14 HB24315.62

Landowners usually consider long and short term costs and benefits. Landowners, even those that derive

other benefits from the forests, may hope to receive a financial return. Small landowners may not have

maximizing financial returns as their primary goal but they often cannot afford to own forest land and

practice sound management without a modest return for their effort. By understanding forest economics,

landowners may be able to meet other ownership and management objectives (for example, invest

financial returns into habitat management). For industrial owners, maximizing returns is usually the

primary management objective. The returns on the forest are influenced by the landowner objectives and

may vary due to the size of the forest, access, available capital, silvicultural methods, and expected

services. Managing forests as cost-effectively as possible requires an understanding of the financial

aspects of decisions.

8.2 Loggers

A significant cost in the forestry value chain is the costs associated with harvesting and transporting the

wood. A forester is a key part of helping minimize costs associated with harvesting and transporting.

Inaccurate cruises, inappropriate harvesting restrictions, poor harvest layouts or access issues all lead to

higher costs to the logger and lower returns to the logger and landowner. A recent study found that

harvesting in the Lake States was 34-37% of the total supply chain costs (Gibeault and Coutu, 2014).

The study also found transportation costs averaged $0.19 per ton per mile in the Lake States and account

for 27% of the supply chain costs. Haul distances in the Lake States averaged 106 miles for conifer, 114

miles for hardwood and 72 miles for aspen (Gibeault and Coutu, 2014 and Baker et. al., 2013).

A 2013 study of felling productivity in Minnesota found that for every 1% increase in volume of

merchantable timber, productivity increased 0.3% (Goychuk, et. al., 2011). The study also found that

skidding productivity was improved by increases in the number and size of skid trails and landings and

the shape of the tract.

Loggers have money tied up in capital expenses and they need the equipment running all year in order to

afford to continue operating and have money available for other investments such as purchasing

stumpage. A study of Wisconsin loggers found the median capital investment was $223,000 and the

most productive operations (more than 15,000 cords per year) had median capital investments of $2

million (Rickenbach, et. al. , 2015).

8.3 Mills

Wisconsin has almost 1,300 forest products companies and 92% of the wood harvested in Wisconsin is

used by Wisconsin manufacturers. Capital investment in sawmills and paper mills continues to increase.

Mills need a steady sustainable source of wood to continue operations by maintaining equipment and

investing in upgrades. The cost of an average paper mill is $1 billion. The annual capital investment in

the US paper industry averages $10 billion/year (Glass, 2014). In 2013, the US paper industry spent $6.2

billion on capital investments and the wood products industry spent $3.6 billion. The paper industry is

the most capital intensive industry in the nation. Understanding what mills will accept and ensuring that

they have a year round supply of wood helps protect the jobs of the 55,000 people employed in paper

and wood products mills in Wisconsin.

Silviculture Handbook

April 2016 62-15 HB24315.62

8.4 Communities

Forestry is important to rural communities. It provides jobs, forest industry employees spend money in

local businesses and communities rely on tax revenue. The forest industry employs almost 60,000

people in Wisconsin. They earn $3.6 billion in wages and the money they spend in their communities

supports schools, hospitals, retail, restaurants, and other services. County forest timber sale revenues are

used to offset local tax levies. Lands enrolled in MFL receive a reduced property tax and in return they

pay a yield tax when they harvest. The yield tax is returned to counties and municipalities. The yield tax

brings in approximately $1.5 million a year in Wisconsin and the municipality where the timber was

harvested receives 80% while the county receives the remaining 20%. The rates for the yield tax are

based on the species and products harvested. In addition, local communities rely on a sustained yield of

products from the local forests. Healthy, well managed forests provide more economic benefits to a

community than degraded, unmanaged forests.

Silviculture Handbook

April 2016 62-16 HB24315.62

9 References

Baker, S., D. Greene, T. Harris, R. Mei. 2013. Regional cost analysis and indices for conventional

timber harvesting operations. Wood Supply Research Institute.

Brisbin, R. and D. Sonderman. 1971. Tree grades for eastern white pine. USFS Research Paper NE-214.

30pp.

Buongiorno, J., S. Dahir, H. Lu and C. Lin. 1994. Tree size diversity and economic returns in uneven

aged forest stands. Forest Science 40(1): 83-103

Cunningham, K. 2006. Forest landowners guide to field grading hardwood trees. University of

Arkansas. Division of Agriculture and Extension. Publication number FSA5014. 8pp.

Davies, Karl. 1999. The Myth of Low Tree Value Growth Rates. Massachusetts Woodland Steward. 29

(4).

Gibeault, F and P. Coutu. 2014. Wood supply chain component costs analysis: A comparison of

Wisconsin and U.S. regional costs. Steigerwaldt Land Services, prepared for Great Lakes Timber

Professionals Association. 41pp

Glass, B. 2014. Timber Trends. Campbell Global. 20pp.

Govett, R. 2008. Wisconsin local-use dimension lumber grading. University of Wisconsin Extension and

Wisconsin Department of Natural Resources.

Goychuk, D. M. Kilgore, C. Blinn, J. Coggins, R. Kolka. 2011. The effect of timber harvesting

guidelines on felling and skidding productivity in Northern Minnesota. Forest Science. 57(5): 393-407.

Hanks, L., G. Gammon, R. Brisbin, E. Rast. 1980. Hardwood log grades and lumber grade yields for

factory lumber logs. USFS Research Paper NE-468. 95pp

Klemperer, D. 1996. Forest Resource Economics and Finance. McGraw-Hill publishing.

McCauley, O. and G. Trimble. 1972. Forestry returns evaluated for uneven age management in two

Appalachian woodlots. Research Paper NE-244. Radnor, PA: USDA, Forest Service, Northeastern

Experiment Station, 12pp

McDonald, K. and D. Krestchmann. 1999. Commercial Lumber. Wood handbook-Wood as an

engineering material. USFS. FPL-GTR-113. Chapter 5.

Miller, G. 1991. Practicing uneven age management: does it pay? Some economic considerations.

Proceedings, Uneven Aged Management of Hardwoods in the Northeast. April 9-10. Lambertville, NJ.

Miller, G.; L. Hanks, H. Wiant. 1986. A key for the Forest Service hardwood tree grades. Northern

Journal of Applied Forestry. 3 (1986): 19-22.

North Central Research Station. 2006. Red pine management guide: A handbook to red pine

Silviculture Handbook

April 2016 62-17 HB24315.62

management in the North Central region.

Penn State Extension. 2008. To cut or not to cut: tree value and deciding when to harvest timber. Penn

State College of Agriculture Sciences.

Prentiss & Carlisle. 2014 Timber Mart North Price Report. Volume 20, number 2.

Rast, E.; D. Sonderman, G. Gammon. 1973. A guide to hardwood log grading. USFS GTR NE. 31pp.

Reed, D., M. Holmes, and J. Johnson. 1986. A 22-year study of stand development and financial return

in northern hardwoods. Northern Journal of Applied Forestry. 3:35-38.

Rickenback, M., M. Vokoun, S. Saunders. 2015. Wisconsin logging sector: status and future direction.

University of Wisconsin-Extension. 23pp.

Saunders, M., R. Wagner, R. Seymour. Thinning regimes for spruce-fir stands in Northeastern United

States and Eastern Canada. Cooperative Forestry Research Unit, University of Maine. 186pp

Wisconsin Department of Natural Resources. 2011. Wisconsin forest management guidelines. Pub-FR-

226 2011.

Silviculture Handbook

April 2016 62-18 HB24315.62

Appendix A- Glossary

Ad Valorem Tax-a tax levied as a percentage of asset value

Allowable cut-volume of timber that may be harvested during a given period to maintain sustained

production

Allowable-cut effect-allocation of anticipated future forest timber yields to the present allowable cut;

this is employed to increase current harvest levels (especially when constrained by evenflow) by

spreading anticipated future growth over all the years in the rotation

Alternative rate of return-the percent rate of return on capital in an investor’s best alternative.

Amortization-the process of gradually reducing some monetary amount over time, can referrer to

income tax calculations where some cost is gradually deducted over time.

Annualized cost (or revenue)-an equal annual payment with the same present value as payments that

are not annual. May be calculated for a fixed or infinite time horizon

Annuity-equal payments at regular intervals (for example monthly or yearly)

Appraisal-the procedure for finding market value of an asset

Benefit-cost ratio- ratio obtained by dividing the anticipated benefits of a project by its anticipated

costs. Either gross or net benefits may be used as the numerator

Bequest value-our willingness to pay for the opportunity to transfer resources to future generations

Biological rotation-a rotation age based on a biological, not economical, criterion and is usually based

on maximum mean annual increment

Board foot-unit of measurement represented by a 12- by 12- by 1-inch unfinished board

Capital-Plant, equipment, and related facilities used to produce goods and services

Capital budgeting-deciding how to invest money, the capital budget sot that its value to the investor is

maximized

Capital gain-difference between the sale prices and the purchase cost of an asset.

Capitalization rate-see discount rate

Capitalize-to find the present value or to discount. In income tax calculations it means to carry forward

ta capital expense and deduct it form sale proceeds of an asset to find taxable income

Commercial thinning-partial harvesting of a stand of trees for economic gains from the harvested trees

and to accelerate the growth of the trees left standing

Commercial timber-standing timber that can be sold for wood products and is available for harvest

Silviculture Handbook

April 2016 62-19 HB24315.62

Compound interest-earnings accruing as a percentage of capital value such that earnings occur on the

original capital and on all previous earnings

Compounding-refers to the process whereby a current capital investment (present value) grows over

time to a larger future value

Constant dollars-values expressed in real dollars of some base year, excluding inflation

Consumer price index (CPI)-an index of average prices for a typical market basket of consumer goods.

The index is set at 100 for a specified base year. The annual rate of change in the CPI is the

inflation rate for consumer goods.

Contingent valuation-a way to value nonmarket good and services by asking users the maximum

amount they would be willing to pay for them (willingness to pay_ or the minimum

compensation they’d require to willingly give them up (willingness to sell).

Cost of capital-the interest rate firms pay on capital raised for investment

Current dollars-values in dollars of the year in which they actually occur, including inflation. Also

known as nominal dollars

Cutting cycle-In uneven aged management, the number of years between partial cuts

Deflate-to deflate a current dollar value means to express it in constant dollars of a base year n,

removing inflation

Depletion-in income tax calculation, the deduction made for original purchase cost when assets are sold

Depreciation-an account charge for the wearing out of assets

Direct effects-income and employment resulting directly from constructing and operating a project

Discount rate-The interest rate at which future values are discounted to present values

Discounted cash flow-In evaluating investment opportunities, the various costs and benefits anticipated

in future years discounted to the present. These values are expressed by either (a) their

difference, giving a net present value, b) the benefit-cost ratio, or (c) calculating the discount rate

that equates them, giving the internal rate of return

Discounting-the process whereby a future value is reduced to arrive at the present value

Economics-the study of how best to allocate or distribute resources to maximize human well-being

Equity-the portion of a firm’s assets on which no debt is owed to creditors

Even aged-refers to forest in which trees have been established at about the same time and are thus

roughly the same age

Existence value-consumers’ willingness to pay for the assurance that something remains in existence,

Silviculture Handbook

April 2016 62-20 HB24315.62

even if they may never use it

Expected value-the sum of the possible values multiplied by their probabilities of occurrence (usually

used to refer to an expected cost or expected revenue)

Expensing-In income tax calculation, the practice of deducting or subtracting allowable costs from

income to arrive at the taxable income

Fee timber-timber that a firm owns outright on its lands, derived from the legal term, “ownership in fee

simple”

Financial maturity- the age beyond which an assets’ growth rate is unacceptable or less than the

owner’s minimum acceptable rate of return. Can refer to a forest or individual trees

Financial rotation-rotation of tree crops determined solely by financial considerations (which are

related to biological production potential) in order to obtain the highest monetary values over

time, in terms of optimum net present value

Fixed costs-costs that remain fixed as a firm’s output increases

Forest value growth percent-annual percent rate of change in the liquidation value of trees and land

Future value-the value of any income or wealth accumulated with compound interest to a specified

future date

Gross domestic product (GDP)-the market value of all goods and services produced by residents of a

nation in a year, excludes income of residents

Holding value-the owner’s net present value of future cash flows from an asset

Hurdle rate-a minimum acceptable rate of return or hurdle that new investments must clear before they

are acceptable to an investor

Indirect effects- The impact of local industries buying goods and services from other local industries.

Induced effects-The effect of income spent by employees

Impacts-total changes to the economy as a result of an event. Impacts=direct effects+ indirect effects+

induced effects

Inflation-a general increase in prices of all goods and services in an economy, usually expressed as an

inflation rate.

Input output analysis-a technique for measuring interdependencies between different sectors of an

economy and making economic forecasts

Interest- the payment made to lenders of money, often expressed as an interest rate

Internal rate of return-for a given project, the interest rate at which the present value of revenues

Silviculture Handbook

April 2016 62-21 HB24315.62

equals the present value of costs

Machine rate-cost per unit of time for owning and operating a logging machine or other piece of

equipment

Managed forest law- a landowner incentive program that encourages sustainable forestry on private

woodlands in Wisconsin

Marginal-in economics, added or extra, as opposed to total

Mean annual increment-average annual timber volume growth per unit area

Minimum acceptable rate of return-the lowest rate of return that will induce an investor to willingly

invest

Model-a simplified representation of an actual process, situation or object

Multiplier effect-the multiplied amounts of income, employment or sales beyond the initial amounts.

For example a 1.5 multiplier on employment means that for every 100 employees another 50

people are employed due to indirect or induced effects

Net income-total revenue minus total cost (usually synonymous with profit)

Net present value-present value of future revenues minus present value of future costs

Nominal-with respect to values or rates of return, in current dollars, including inflation

Nonmarket-not traded in the market for a price

Pareto optimum-a resource allocation where no change can make anyone better off without making

someone else worse off

Payback period-the number of years it takes to recover the final capital invested in a project

Periodic-occurring at regular intervals of more than one year (in this chapter)

Present value-any future value discount to a present value. Discounting is the reverse of compounding

Producer price index (PPI)- an index of average prices for a mix of industrial outputs, excluding

services for each year. The index is set to 100 for a base year.

Property tax-an annual tax levied as a percentage of property value.

Public good-a good or service not easily parceled out and sold. You can’t exclude those who don’t pay

for the good from receiving its benefits.

Rate of return-earnings on capital

Real-with respect to monetary values, excluding inflation

Silviculture Handbook

April 2016 62-22 HB24315.62

Regeneration-process by which trees are reestablished

Reinvestment rate-the rate of return at which you assume future income from a project could be

reinvested

Reservation price-the minimum stumpage price that will induce a forest owner to sell or plant forest

Risk-the variation in expected cash flow. The possibility of loss

Risk adjusted discount rate-the interest rate for discounting risky cash flows

Rotation-age, in years, at which timber is harvested

Roundwood-harvested wood in round or log form

Sawtimber-live trees capable of yielding sawlogs

Short run-in economics, the period of time for which some inputs are fixed

Stumpage value-the estimated or actual amount that buyers would pay for standing timber

Sunk costs-costs that have already been incurred

Supply-in economics, supply refers to the quantities of a good or service that a producer or group of

producers will supply per unit of time at different prices

Sustained yield-a commitment to continued long-term wood output through an even flow of timber

Trade-off-in a system of interrelated inputs and outputs, a trade-off refers to the process whereby

changing one output can change other outputs

Utility-in economics, human satisfaction or well-being

Valuation-the procedure for finding an individual investor’s value of an asset

Value added-the difference between the sale price of goods sold and cost of materials and supplies used

in production

Variable costs-costs that change as a firms output changes

Willingness to pay-a maximum monetary amount an individual is willing to pay for good or service

Willingness to pay for land-starting with bare land, WPL is the net present value of all future expected

cash flows discounted at some rate of return.

Yield tax-a tax levied as a percentage of harvested stumpage value

Source: Klemperer, 1996

Silviculture Handbook

April 2016 62-23 HB24315.62

Appendix B- Formulas

Decision Tree for Present Value and Future Value Formulas

Number of

Payments

Time

Between

Payments

Evaluation

Period

Time of

Value

Formula Formula Name

One Terminating Future

=

1

+

Future value of

an amount

Present

=

1

+

Present value of

an amount

Series Annual Terminating Future

=

1

+

−

1

Future value of a

terminating

annual series

Present

=

1

−

1

+

−

Present Value of

a terminating

annual series

Perpetual Future

=

Present

=

Present value of

a perpetual

annual series

Periodic Terminating Future

=

1

+

−

1

1

+

−

1

Future Value of

a terminating

periodic series

Present

=

1

−

1

+

−

1

+

−

1

Present value of

a terminating

periodic series

Perpetual

Future

=

Present

=

1

+

−

1

Present value of

a perpetual

periodic series

(Faustmann

Formula)

r

Annual interest rate/100

Vo

Present value (or initial value)

Vn

Future value after n years (including interest)

n

Number of years of compoundi

ng or discounting

P

Amount of fixed payment each time in a series (occurring annually or every t years)

t

Number of years between periodic occurrences of p

Source: Klemperer, 19

WISCONSIN DEPARTMENT OF NATURAL RESOURCES

NOTICE OF FINAL GUIDANCE & CERTIFICATION

Pursuant to ch. 227, Wis. Stats., the Wisconsin Department of Natural Resources has finalized and hereby certifies the

following guidance document.

DOCUMENT ID

FA-20-0001

DOCUMENT TITLE

Silviculture Handbook

PROGRAM/BUREAU

Forest Economics and Ecology, Applied Forestry Bureau

STATUTORY AUTHORITY OR LEGAL CITATION

S. 823.075, Wis. Stats. & NR 1.25, Wis. Admin. Code

DATE SENT TO LEGISLATIVE REFERENCE BUREAU (FOR PUBLIC COMMENTS)

2/10/2020

DATE FINALIZED

4/6/2020

DNR CERTIFICATION

I have reviewed this guidance document or proposed guidance document and I certify that it complies with sections

227.10 and 227.11 of the Wisconsin Statutes. I further certify that the guidance document or proposed guidance

document contains no standard, requirement, or threshold that is not explicitly required or explicitly permitted by a

statute or a rule that has been lawfully promulgated. I further certify that the guidance document or proposed guidance

document contains no standard, requirement, or threshold that is more restrictive than a standard, requirement, or

threshold contained in the Wisconsin Statutes.

March 27, 2020

Signature Date