Oracle Fusion

Cloud SCM

Using Supply Chain Cost

Management

24C

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Contents

Get Help ................................................................................................................................ i

1

Introduction

1

Overview of Cost Management ................................................................................................................................................... 1

Supported Cost Methods .............................................................................................................................................................. 1

Time Zones and Dates .................................................................................................................................................................. 2

Overview of Importing Cost Data ............................................................................................................................................... 7

Web Services You Can Use to Integrate Cost Management ................................................................................................. 8

2

Receipt Accounting

11

Overview of Receipt Accounting ................................................................................................................................................ 11

Receipt Accounting Infolets ........................................................................................................................................................ 12

Considerations for Accrual Settings ......................................................................................................................................... 13

Receipt Accounting Tasks and Accounting Events ............................................................................................................... 13

Receipt Accrual, Reconciliation, and Clearing ........................................................................................................................ 16

Receipt Accrual Clearing Rules .................................................................................................................................................. 17

Receipt Accounting Cutoff Dates .............................................................................................................................................. 22

Overview of Accrual Reversal .................................................................................................................................................... 23

Period End Uninvoiced Receipt Accrual .................................................................................................................................. 24

How You Close a Receipt Accounting Period ......................................................................................................................... 32

Cost Management for Internal Material Transfers ................................................................................................................ 34

Receipt Accounting for Outside Processing ........................................................................................................................... 35

Receipt Accounting for Manual Procurement of Items for Work Orders ......................................................................... 36

Receipt Accounting for Drop Shipments ................................................................................................................................ 36

Global Procurement ..................................................................................................................................................................... 38

Receipt Accounting Examples .................................................................................................................................................. 44

Reports and Analytics for Receipt Accounting .................................................................................................................... 123

FAQ for Receipt Accounting Reports ..................................................................................................................................... 125

FAQs for Receipt Accounting ................................................................................................................................................... 126

3

Cost Planning

131

Cost Planning Process ................................................................................................................................................................ 131

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

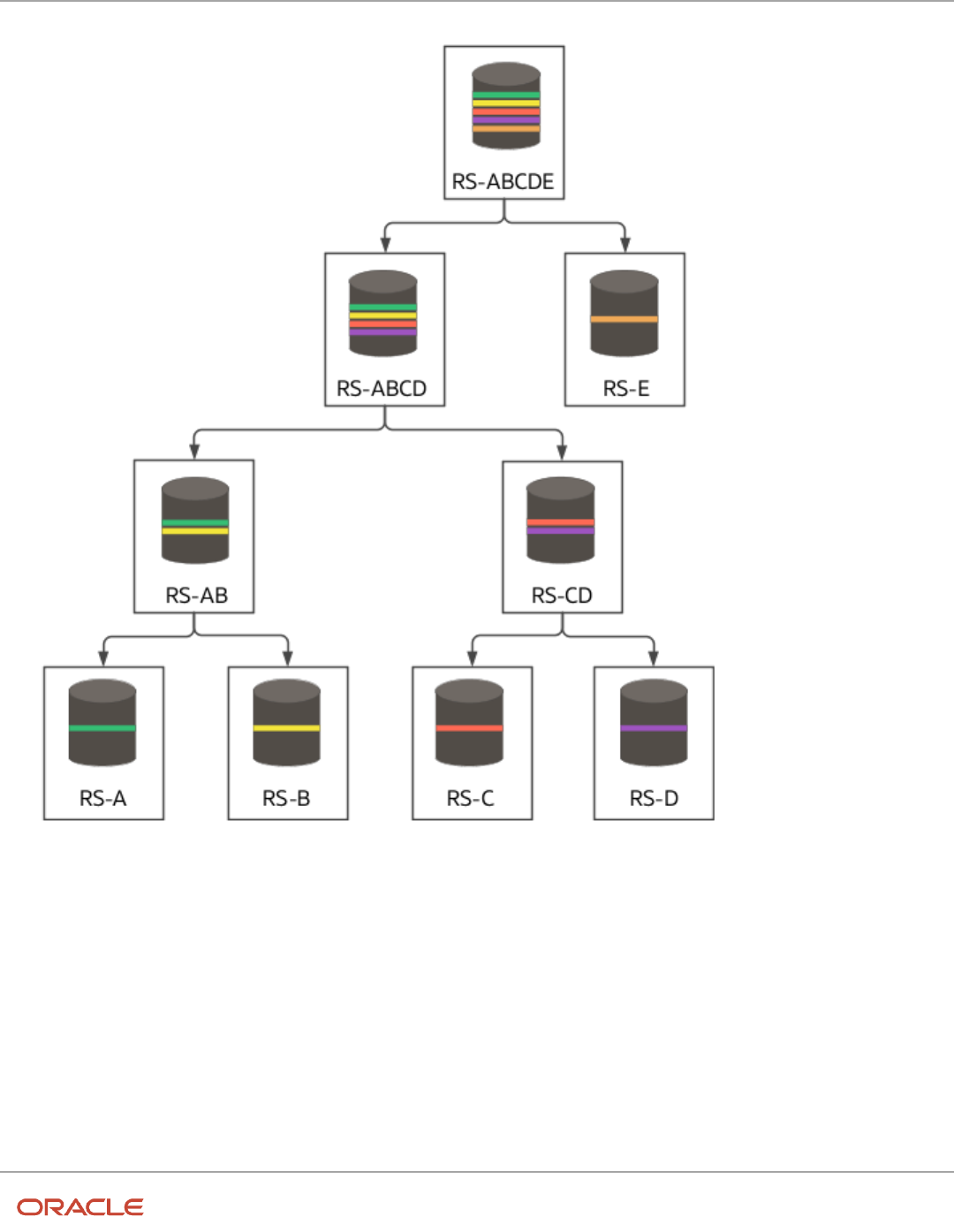

Supply Chain Cost Rollup .......................................................................................................................................................... 131

Cost Scenario ............................................................................................................................................................................... 136

Standard Costs ............................................................................................................................................................................ 146

Resource Rates ............................................................................................................................................................................ 150

Overhead Rates ............................................................................................................................................................................ 151

Cost Rollup ................................................................................................................................................................................... 154

Cost Analysis ............................................................................................................................................................................... 188

Publish Costs ............................................................................................................................................................................... 189

FAQs for Cost Planning ............................................................................................................................................................. 190

4

Cost Accounting

195

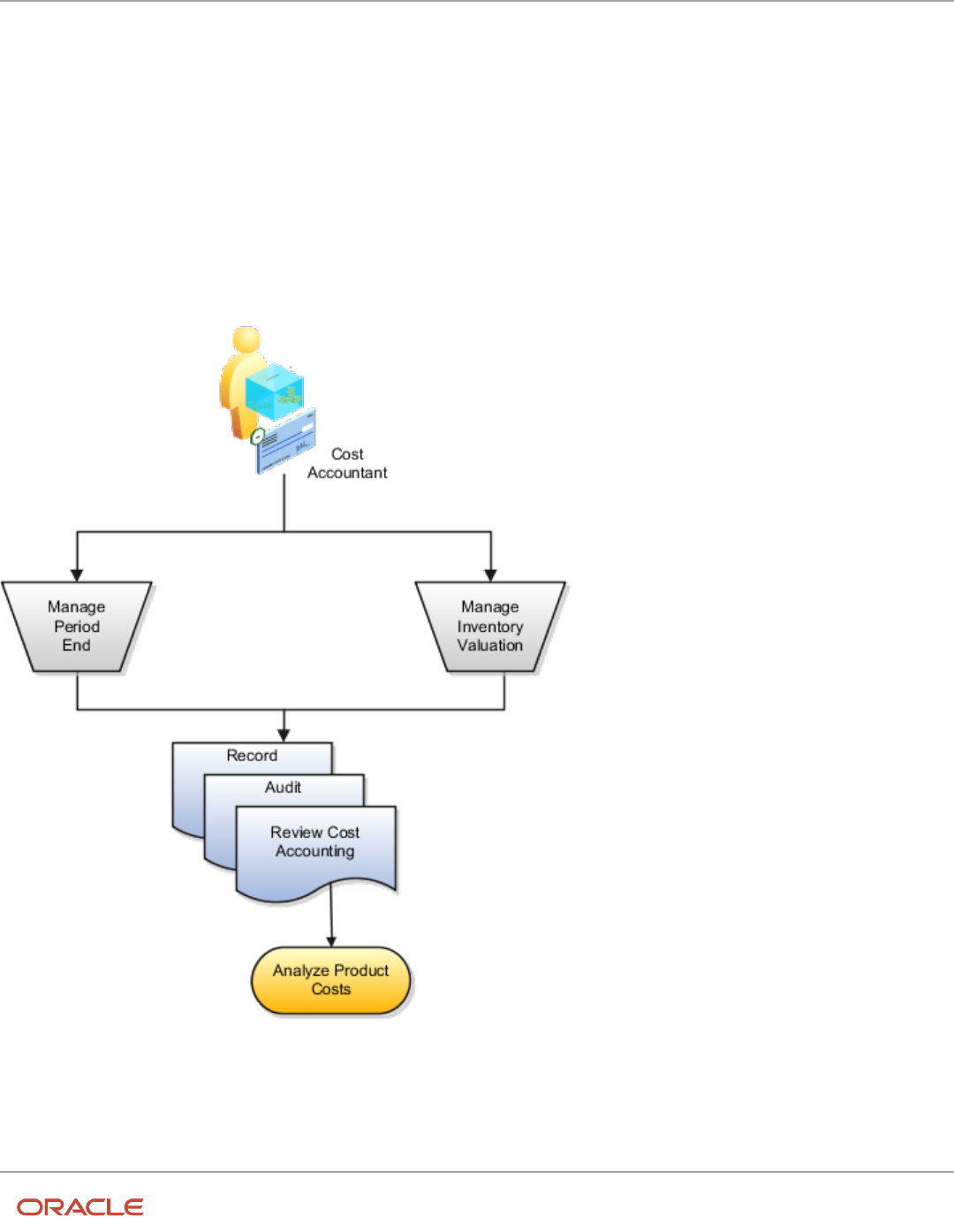

Overview of Cost Accounting .................................................................................................................................................. 195

Cost Accounting Infolets ........................................................................................................................................................... 196

Scheduled Processes for Cost Accounting ........................................................................................................................... 197

Cost Accounting Process .......................................................................................................................................................... 199

Cost Accounting Periods .......................................................................................................................................................... 208

Cost Processing ........................................................................................................................................................................... 213

Internal Material Transfers ....................................................................................................................................................... 252

Lot Transactions ......................................................................................................................................................................... 264

Cost of Goods Sold and Gross Margin ................................................................................................................................. 270

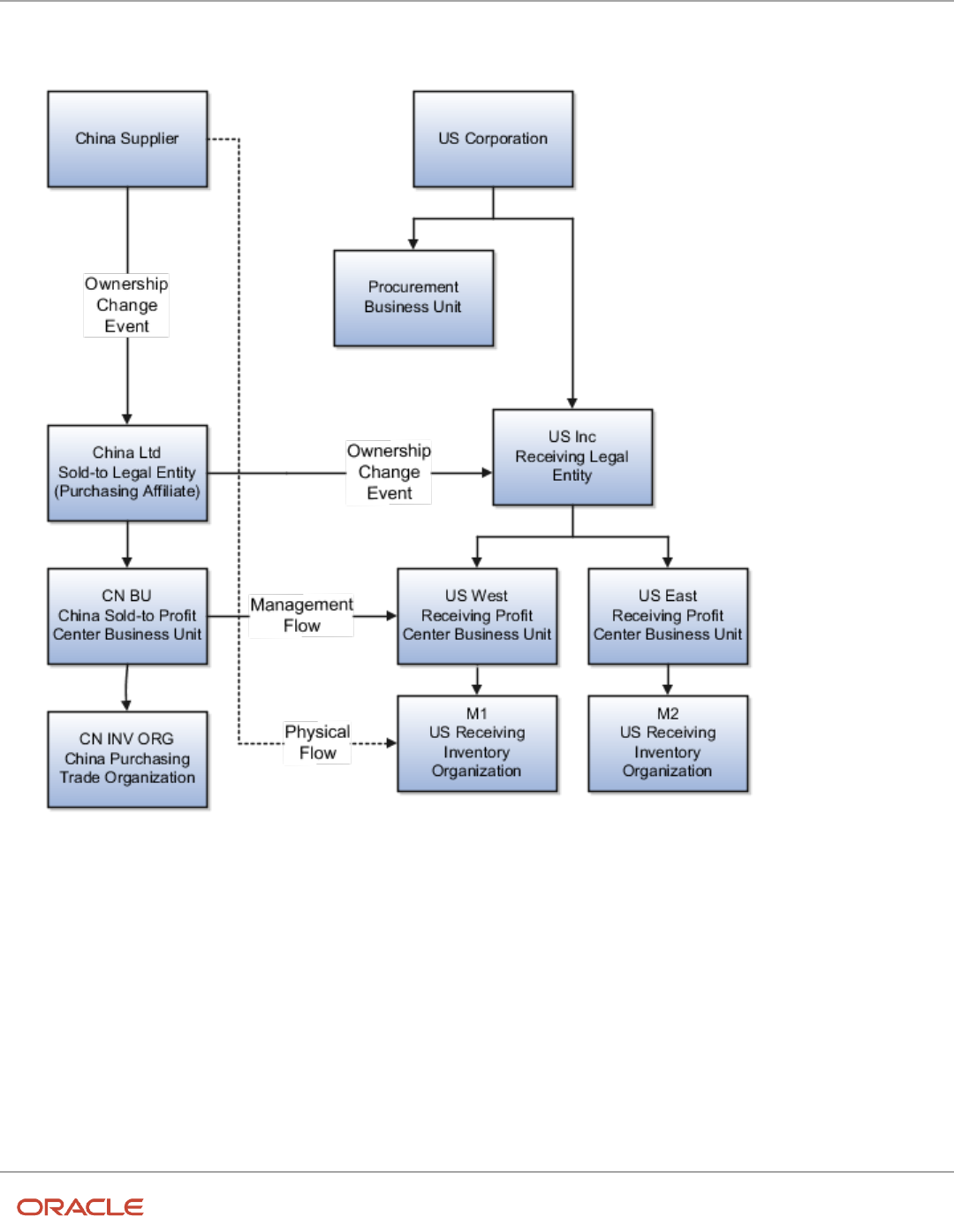

Global Procurement ................................................................................................................................................................... 277

Cost Accounting Examples ...................................................................................................................................................... 297

Cost Management for Project Driven Supply Chain .......................................................................................................... 374

Reports and Analytics for Cost Accounting ......................................................................................................................... 389

FAQs for Cost Accounting Reports ........................................................................................................................................ 397

Review Inventory Valuation ..................................................................................................................................................... 399

FAQs for Cost Accounting ........................................................................................................................................................ 401

5

Landed Cost Management

411

Overview of Landed Cost Management ................................................................................................................................ 411

Landed Cost Management Tasks ............................................................................................................................................ 412

Trade Operations ........................................................................................................................................................................ 413

Landed Cost Charge Lines ....................................................................................................................................................... 416

Trade Operation Statuses ......................................................................................................................................................... 418

Trade Operation Templates ...................................................................................................................................................... 419

Create Estimate Landed Costs ................................................................................................................................................ 419

How You Enable an Invoice for Landed Cost Processing ................................................................................................. 420

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Create Actual Landed Costs ..................................................................................................................................................... 421

Charge Invoice Association Status ......................................................................................................................................... 422

Upload Trade Operation Charges in a Spreadsheet ........................................................................................................... 423

Analyze Landed Costs .............................................................................................................................................................. 423

FAQs for Landed Cost Management ..................................................................................................................................... 424

6

Appendix: Events and Cost Accounting Distributions

427

Overview of Cost Accounting Distributions ......................................................................................................................... 427

Inventory Transaction Events .................................................................................................................................................. 427

Purchasing Events ..................................................................................................................................................................... 448

Sales Events ................................................................................................................................................................................ 459

Work in Process Events ........................................................................................................................................................... 460

Cost Adjustment Events .......................................................................................................................................................... 464

Consigned Material Events ..................................................................................................................................................... 466

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Get Help

Get Help

There are a number of ways to learn more about your product and interact with Oracle and other users.

Get Help in the Applications

Use help icons to access help in the application. If you don't see any help icons on your page, click your user image

or name in the global header and select Show Help Icons.

Get Support

You can get support at My Oracle Support. For accessible support, visit Oracle Accessibility Learning and Support.

Get Training

Increase your knowledge of Oracle Cloud by taking courses at Oracle University.

Join Our Community

Use Cloud Customer Connect to get information from industry experts at Oracle and in the partner community. You

can join forums to connect with other customers, post questions, suggest ideas for product enhancements, and watch

events.

Learn About Accessibility

For information about Oracle's commitment to accessibility, visit the Oracle Accessibility Program. Videos included in

this guide are provided as a media alternative for text-based topics also available in this guide.

Share Your Feedback

We welcome your feedback about Oracle Applications user assistance. If you need clarification, find an error, or just

want to tell us what you found helpful, we'd like to hear from you.

You can email your feedback to oracle_fusion_applications_help_ww_grp@oracle.com.

Thanks for helping us improve our user assistance!

i

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Get Help

ii

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

1 Introduction

Overview of Cost Management

Cost Management is a cost accounting solution that helps companies to effectively manage their product costing,

manufacturing, and inventory accounting business flows. The solution enables companies to maintain multiple cost

books and financial ledgers to better meet external regulatory reporting and internal management reporting needs.

It reduces manual cost maintenance tasks by providing automated rules-based engines and efficient cost processors

tuned for high volume transaction environments.

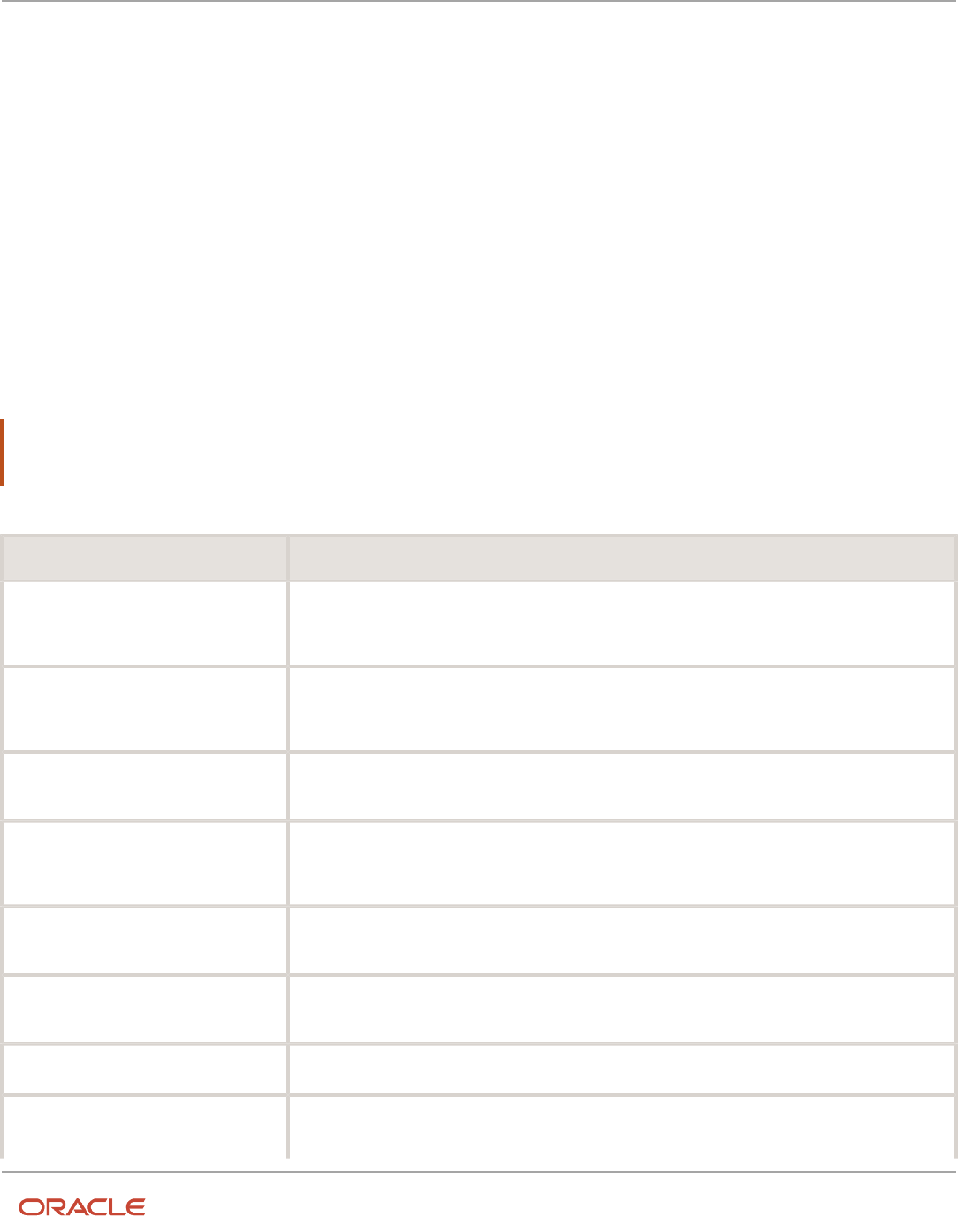

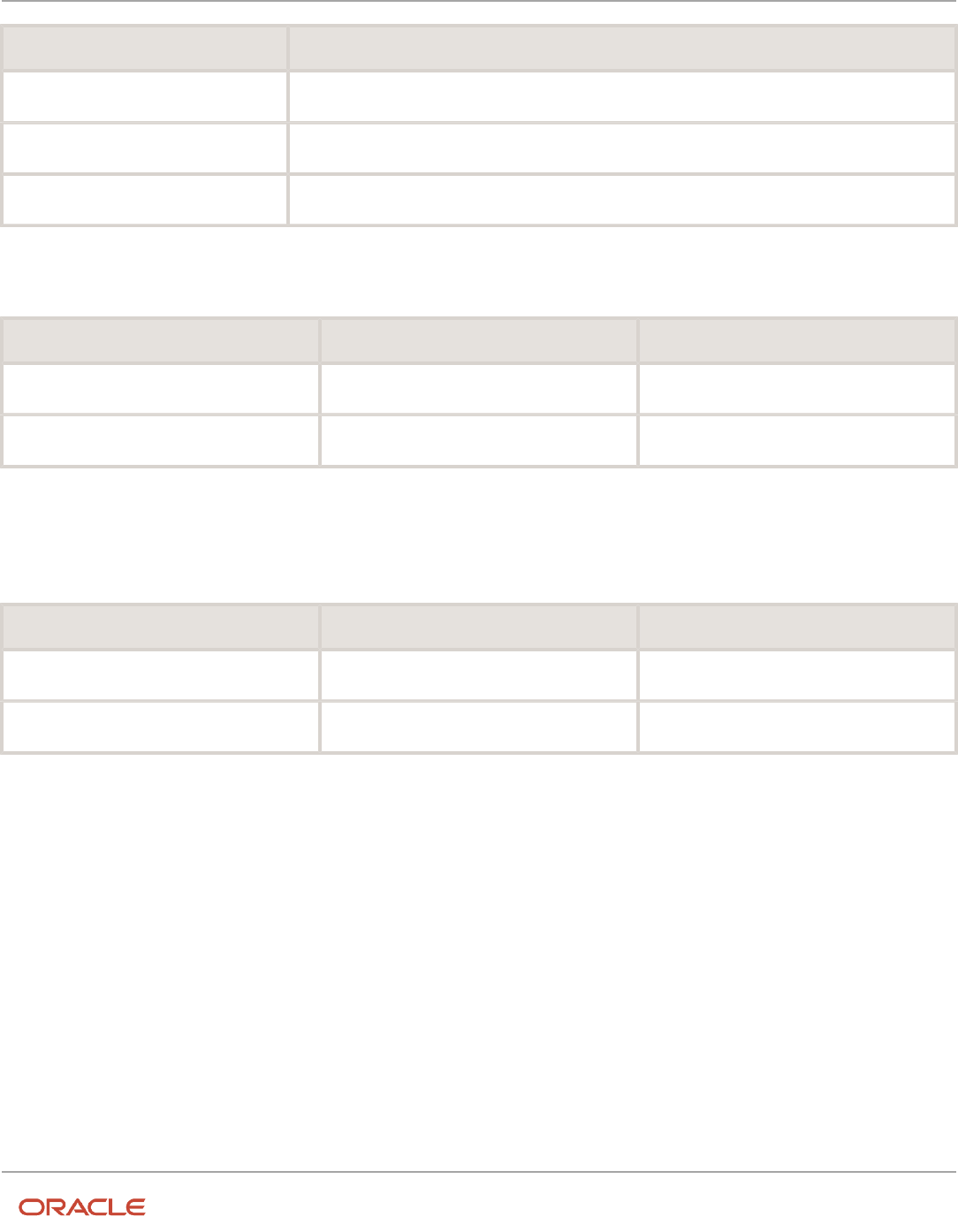

Cost Management and related features are covered in the documentation listed in the following table.

Functional Area Documentation

Cost accounting

See the Cost Accounting chapter of the Using Supply Chain Cost Management guide.

Receipt accounting

See the Receipt Accounting chapter of the Using Supply Chain Cost Management guide.

Landed cost management

See the Landed Costs chapter of the Using Supply Chain Cost Management guide.

Intercompany transactions and

intracompany flows

See the Using Supply Chain Financial Orchestration guide.

Subledger accounting for the French

market

See the Implementing Subledger Accounting for France chapter of the Implementing Manufacturing

and Supply Chain Materials Management guide.

Fiscal document capture for the Brazilian

market

See the Using Fiscal Document Capture guide.

Reports and analytics

See the Creating and Administering Analytics and Reports for SCM guide.

Related Topics

•

Overview of Cost Accounting

•

Overview of Subledger Accounting for France

Supported Cost Methods

The cost methods used to cost your transactions are configured using the Manage Cost Profiles task in the Setup and

Maintenance work area. You can use multiple cost methods in your cost profiles.

1

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

This table describes the supported cost methods.

Cost Method Description

Standard

Inventory is valued at a predetermined standard value. You track variances for the difference between

the standard cost and the actual transaction cost, and you periodically update the standard cost to

bring it in line with actual costs.

Actual

Tracks the actual cost of each receipt into inventory. When depleting inventory, the processor identifies

the receipts that are consumed to satisfy the depletion, and assigns the associated receipt costs to the

depletion.

Perpetual Average

The average cost of an item, derived by continually averaging its valuation after each incoming

transaction. The average cost of an item is the sum of the debits and credits in the inventory general

ledger balance, divided by the on-hand quantity.

Periodic Average

The periodic average cost method values inventory by including all the expenses and invoices for a

period and other adjustments that are known only at the end of the period. The periodic average cost

of an item is the average cost for the item in a given period for a cost organization, cost book, and

valuation unit combination.

Time Zones and Dates

Time Zone Settings

The application takes into consideration these time zones:

• Server time zone: The time zone configured on the application server. In the case of cloud servers, this time

zone is set as Coordinated Universal Time (UTC).

• Legal entity time zone: The time zone in which the organization's legal entity exists. This is defined as part of

the legal address linked to the legal entity. If you want the transactions to be accounted for in this time zone,

you must select the legal entity time zone check box in the legal entity definition.

• User preferred time zone: The time zone defined in the user preferences. This is the user's preferred time zone

for entering dates on UI and for displaying dates on the UI and reports. If not configured, this time zone defaults

to the server time zone.

Note: The user preferred time zone is only considered for entering and displaying dates on the UI and reports. This

time zone isn't used for determining the various accounting dates.

The transaction date of inventory and manufacturing transactions is one of the key inputs in determining the

accounting date and the period in which the transactions are recorded. The various accounting dates are defined or

derived in the application depending on the time zones enabled and configured. By default, the server time zone is

used. However, if the legal entity time zone is enabled, then this has an impact on how the dates are recorded and how

the various accounting dates are determined.

2

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

Related Topics

•

Set Up Legal Entity Time Zones

Impact of Legal Entity Time Zone on Accounting Dates

As mentioned earlier, the server time zone is used by default to record and derive the various accounting dates.

However, when the legal entity time zone is enabled, it plays an important role in how the accounting dates are recorded

and derived.

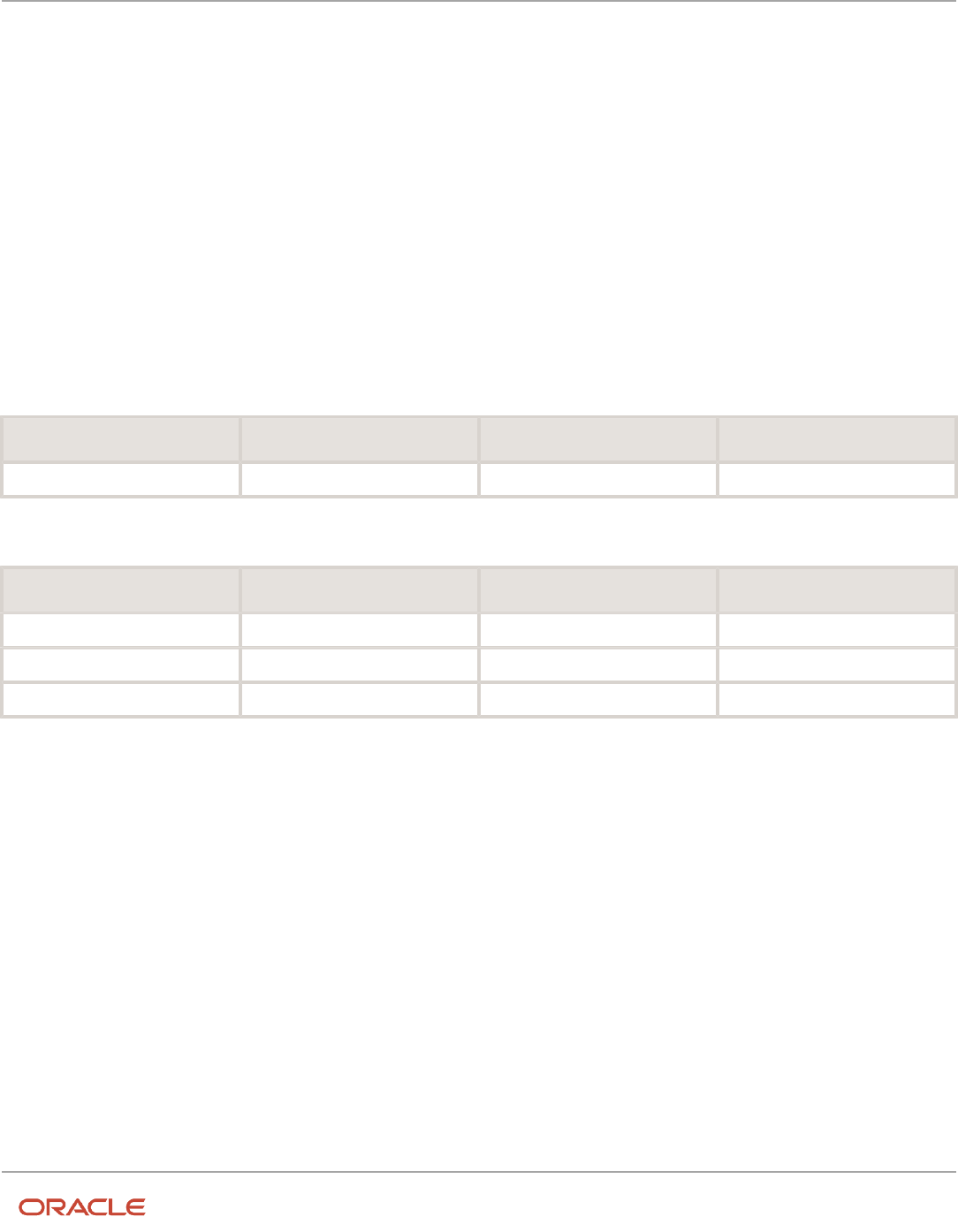

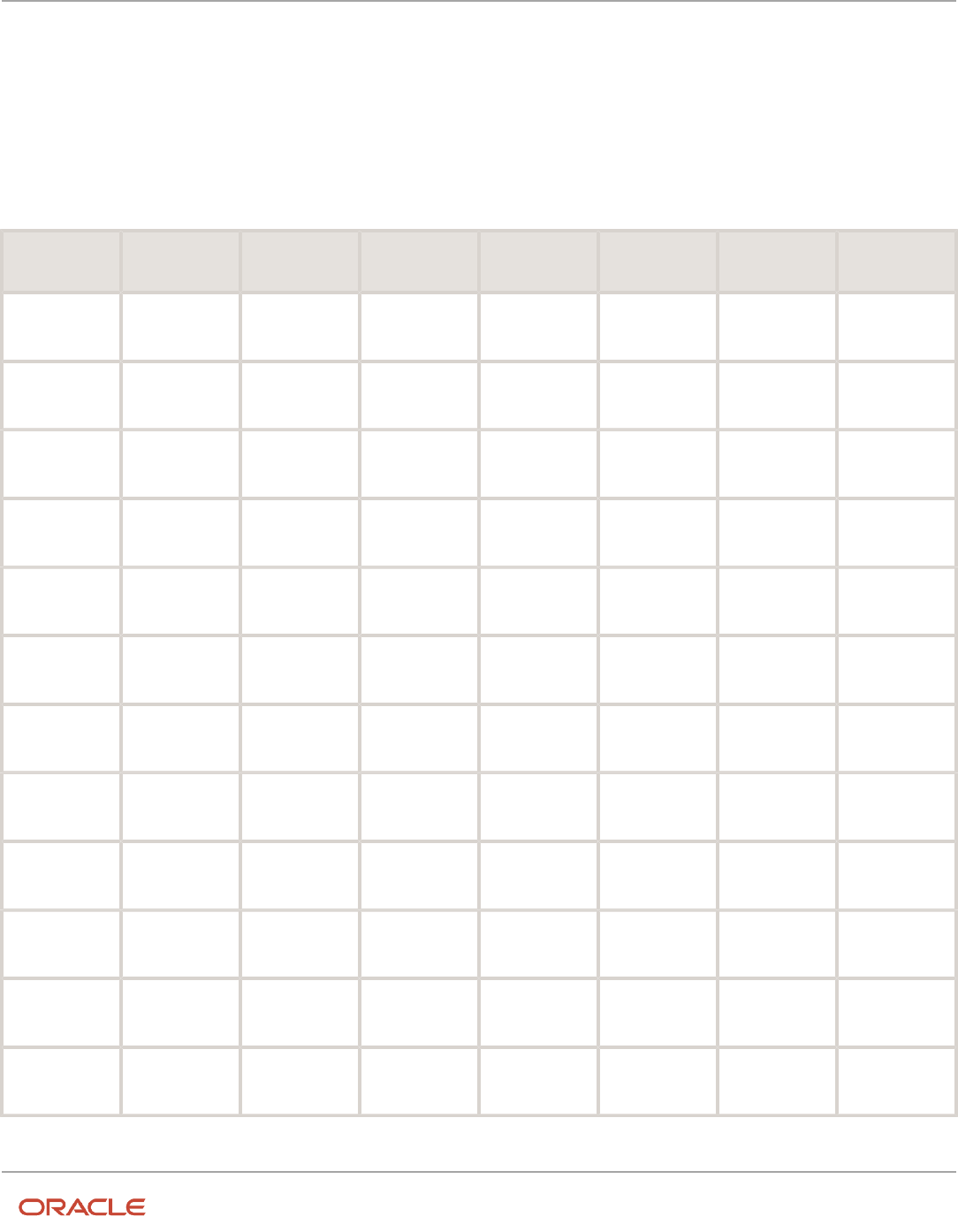

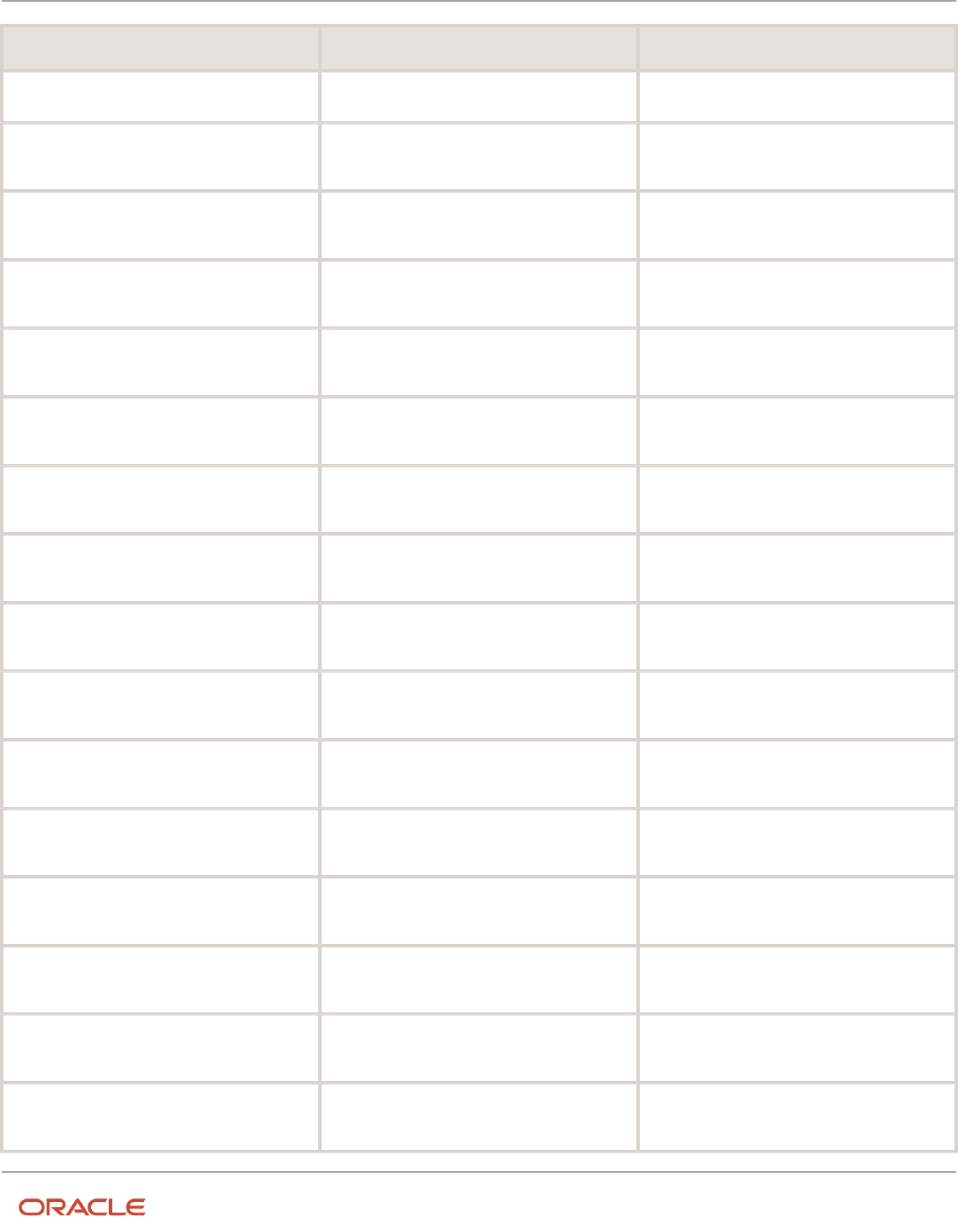

The table here lists time zone used for recording and deriving the accounting dates depending on whether the legal

entity time zone is disabled or enabled.

Date Legal Entity Time Zone Enabled

Cost date

The cost date is derived from the transaction date. The transaction date is converted into the legal

entity time zone.

Accounting date or general ledger date

This date is derived from the cost date. As the cost date is already in the legal entity time zone it

ensures that the transactions are accounted in the correct general ledger periods.

Cost cutoff date

The date entered by the user is in the legal entity time zone.

Cost adjustment date

The date entered by the user is in the legal entity time zone.

Transaction overhead effective date

The date entered by the user is in the legal entity time zone.

Cost scenario effective date

The date entered by the user is in the legal entity time zone. It's the effective start date for standard

costs, resource rates, and overhead rates after publishing the scenario.

Cost roll up date

For regular items, the work definition effective dates are converted into the legal entity time zone.

For configured items, the work order start dates are converted into the legal entity time zone.

Currency conversion

This uses the transaction date. The transaction date is converted into the legal entity time zone.

Period end validations

The transaction dates are converted into the legal entity time zone to determine if they should be

considered for period end validations.

Related Topics

•

Cost Cutoff Dates

•

Cost Accounting Period Statuses and Transaction Accounting

•

Is the accounting date of a transaction always the same as the costing date?

3

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

Example of How Transactions are Costed in the Legal Entity Time

Zone

Let's consider that these time zones are configured:

• Server time zone: UTC

• Legal entity time zone: PDT (UTC -7:00)

• User preferred time zone: IST ( UTC +5:30)

Scenario

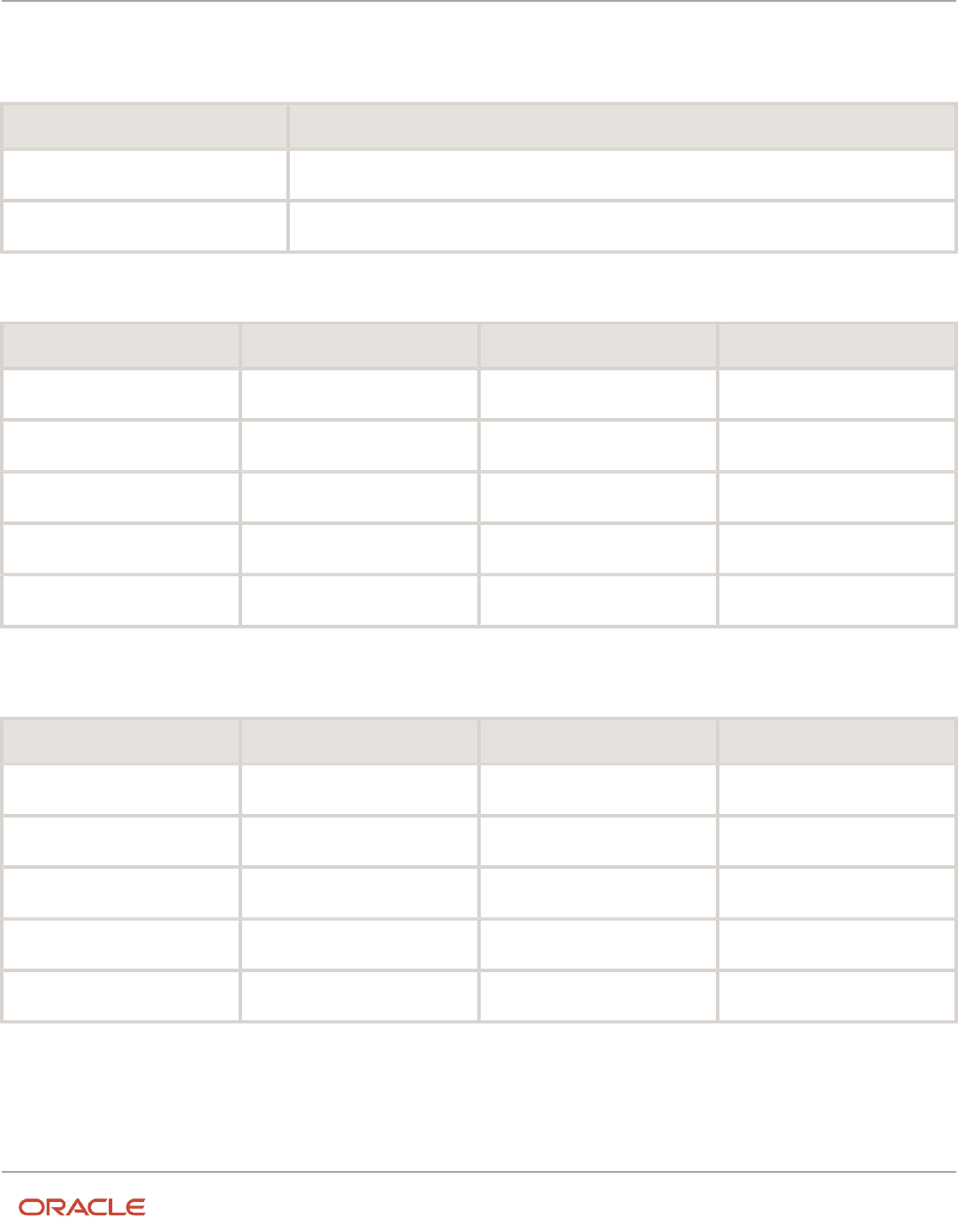

These transactions are entered in the application. The user entered date in this table is in the user preferred time zone,

which is IST (UTC +5:30). However, the dates are stored in the application in the server time zone, which is UTC.

Transaction Type User Entered Date Stored Date Quantity

Tx #1

Misc Receipt

8/1/16 10:30:00 AM

8/1/16 5:00:00 AM

100 EA

Tx #2

Misc Issue

8/15/16 11:00:00 AM

8/15/16 5:30:00 AM

- 20 EA

Tx #3

Shipment

8/30/16 05:00:00 PM

8/30/16 11:30:00 AM

- 30 EA

Tx #4

PO Receipt

9/1/16 08:00:00 AM

9/1/16 2:30 AM

70 EA

Tx #5

Misc Issue

9/3/16 11:00:00 AM

9/3/16 5:30:00 AM

- 10 EA

Also, consider the standard costs as listed here.

Start Date End Date Unit Cost

7/1/16

7/31/16

$1.00

8/1/16

8/31/16

$3.00

9/1/16

9/30/16

$2.00

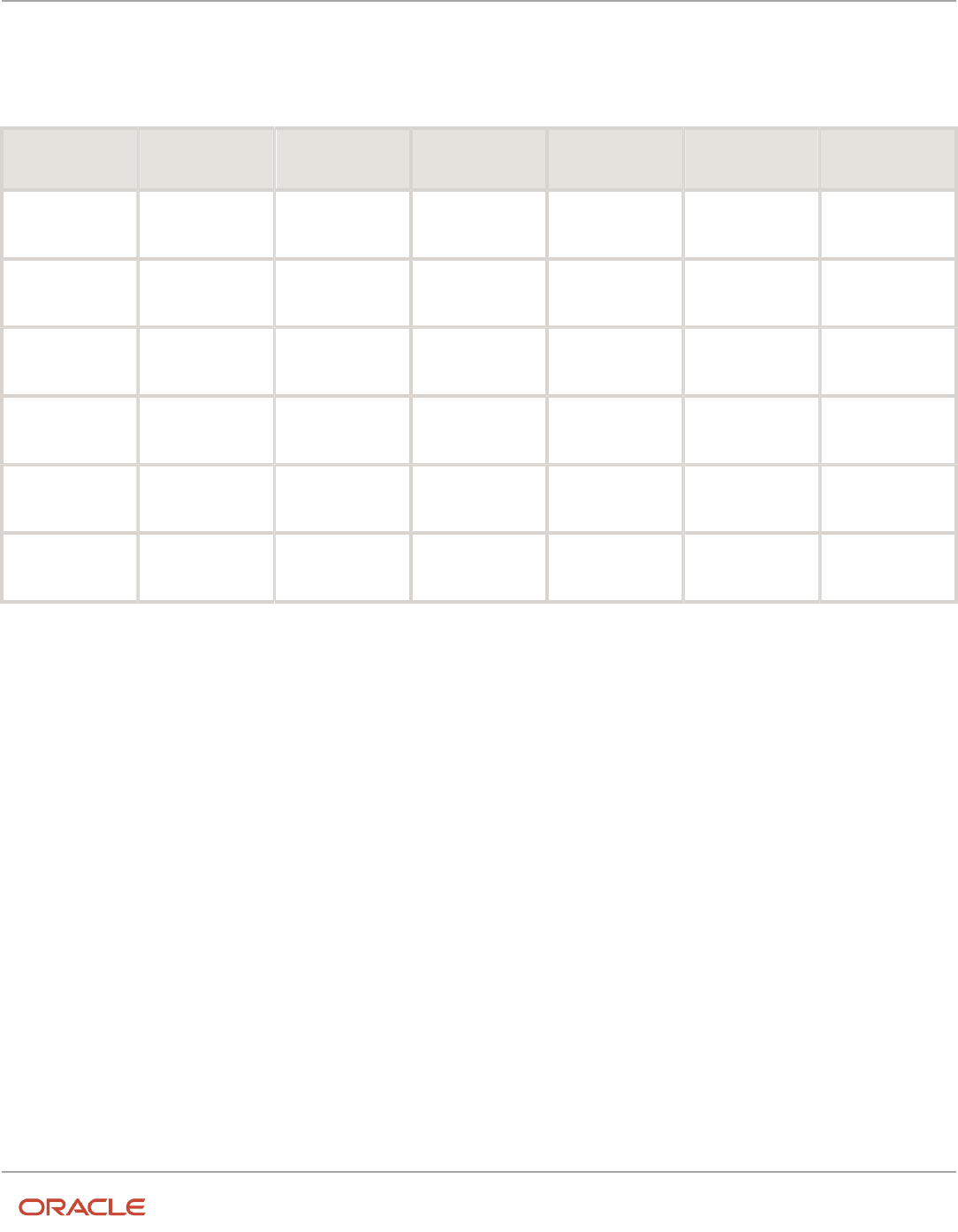

Analysis

If we consider the cost cutoff as 8/31/2016 11:59:59 PM (PDT), the transactions are costed as listed here. Here, the

transaction date is stored in the application in the server time zone, which is UTC, as also shown in the earlier table. The

cost date or general ledger date is in the legal entity time zone, which is PDT (UTC -7:00).

4

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

Transaction Stored Date Cost Date/GL

Date

Quantity Cost Inventory Value GL Period

Tx #1

8/1/16 5:00:00 AM

7/31/16 9:00:00

PM

100 EA

$1.00

$100.00

July-16

Cost Revalue

8/1/16 00:00:00

AM

8/1/16 00:00:00

AM

100 EA

$(3.00 - 1.00)

$200.00

August-16

Tx #2

8/15/16 5:30:00

AM

8/14/16 9:30:00

PM

- 20 EA

$3.00

- $60.00

August-16

Tx #3

8/30/16 11:30:00

AM

8/30/16 3:30:00

AM

- 30 EA

$3.00

- $90.00

August-16

Tx #4

9/1/16 2:30 AM

8/31/16 6:30 PM

70 EA

$3.00

$210.00

August-16

Tx #5

9/3/16 5:30:00 AM

9/2/16 9:30:00 PM

- 10 EA

-

-

-

As you can see, the last transaction isn't accounted for because the cost date is beyond the cost cutoff date in the legal

entity time zone.

The inventory value is as listed here.

Period Date Quantity Value

July-16

7/31/16

100

$100.00

August-16

8/31/16

120

$360.00

September-16

9/30/16

Date Display in Cost and Receipt Accounting UI

The user preferred time zone is used to display the date and time on the application UI. However, the application

displays some dates and times in the server time zone and some in the legal entity time zone, if enabled.

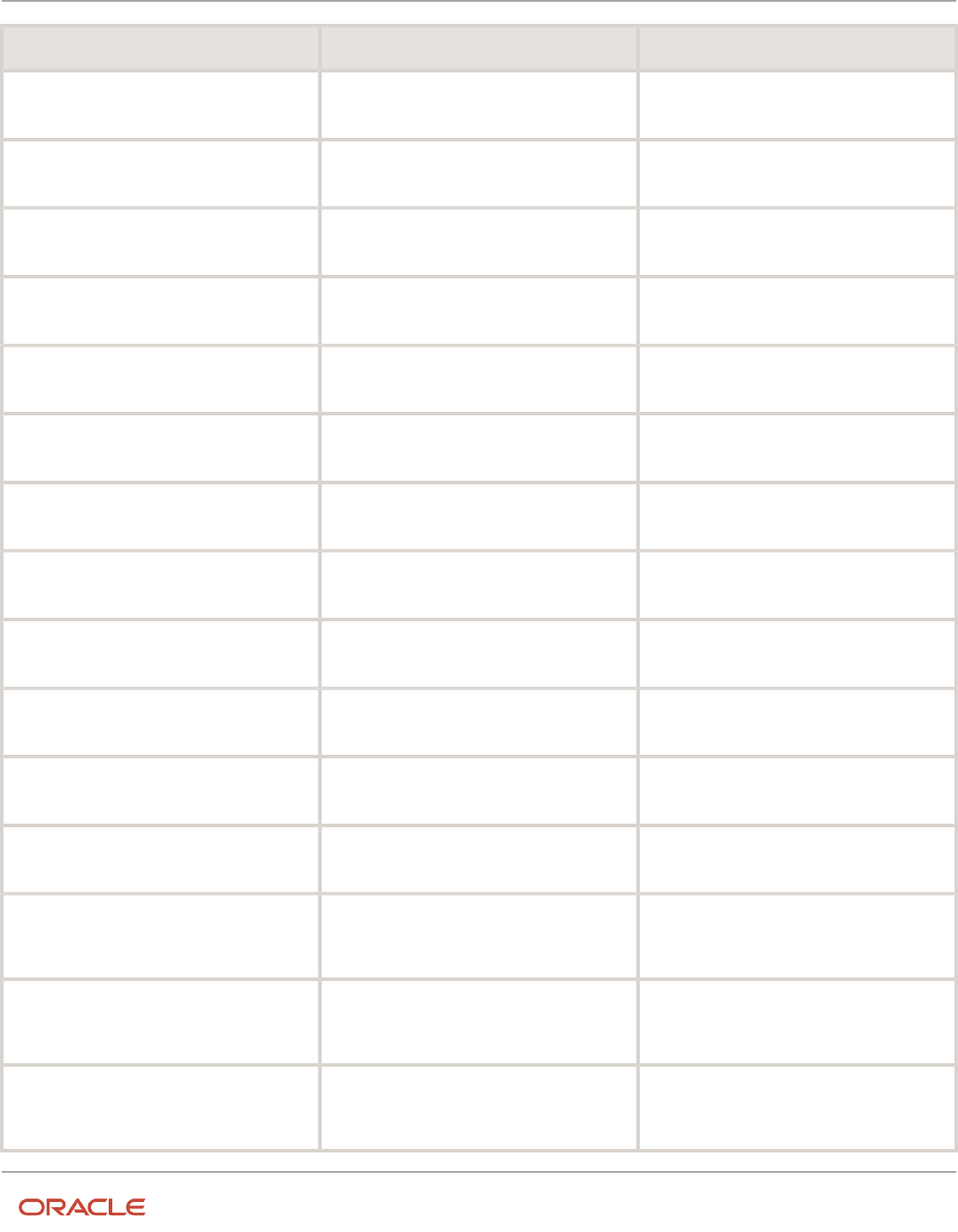

This table lists the various dates and the corresponding time zone in which they're displayed across the UI screens in the

cost planning functional area, when the legal entity time zone is enabled.

UI Screen Date Time Zone

Manage Cost Scenarios

Effective Date

Legal entity time zone

5

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

UI Screen Date Time Zone

Manage Standard Costs

Effective Start Date, Effective End Date

Legal entity time zone

Manage Resource Rates

Effective Start Date, Effective End Date

Legal entity time zone

Manage Overhead Rates

Effective Start Date, Effective End Date

Legal entity time zone

View Rolled-Up Costs

Effective Date

Legal entity time zone

View Scenario Exceptions

Effective Date

Legal entity time zone

Compare Standard Costs

Effective Start Date

Legal entity time zone

This table lists the various dates and the corresponding time zone in which they're displayed across the UI screens in the

cost accounting functional area, when the legal entity time zone is enabled.

UI Screen Date Time Zone

Review Item Costs

Cost As-of Date

Legal entity time zone

Review Item Costs

Transaction Date

User preferred time zone

Analyze Standard Purchase Cost Variances

From Date, To Date

Server time zone

Manage Accounting Overhead Rules

Start Date, End Date

Legal entity time zone

Manage Cost Adjustment

Adjustment Date, Cost Date

Legal entity time zone

Manage Cost Adjustment

Transaction Date

User preferred time zone

Create Cost Accounting Distributions

Cutoff Date

Legal entity time zone

Create Cost Accounting Distributions

Last Run Date

User preferred time zone

Manage Cost Accounting Periods

From Date, To Date

Legal entity time zone

Review Cost Accounting Processes

Transaction Date

User preferred time zone

Review Work Order Costs

Released Date, Completion Date, Closed Date

Legal entity time zone

Review Cost Accounting Distributions

Transaction Date

User preferred time zone

6

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

UI Screen Date Time Zone

Review Cost Accounting Distributions

Costed Date

Legal entity time zone

Review Inventory Valuation

Cost Date

Legal entity time zone

Create Accounting

End Date

Legal entity time zone

The transaction dates for these transactions in cost accounting are recorded in the legal entity time zone. The user

preferred time zone is ignored and the transaction dates are displayed time zone is the legal entity time zone.

• Standard cost revaluation transaction

• WIP revaluation transaction

• Resource rate revaluation transaction

• Cost adjustment transaction

This table lists the various dates and the corresponding time zone in which they're displayed across the UI screens in the

receipt accounting functional area, when the legal entity time zone is enabled.

UI Screen Date Time Zone

Adjust Receipt Accrual Balances

Last Activity Date

Legal entity time zone

Match Receipt Accruals

From Date, To Date

Legal entity time zone

Audit Receipt Accrual Clearing Balances

Transaction Date

User preferred time zone

Create Accounting

End Date

Legal entity time zone

The transaction dates for these transactions in receipt accounting are recorded in the legal entity time zone. The user

preferred time zone is ignored and the transaction dates are displayed time zone is the legal entity time zone.

• AP invoices (transaction date is based on the accounting date on the invoice)

• Manual accrual clearing

• Accrual reversal

• Expense adjustment (due to accrual clearing, reversal)

Overview of Importing Cost Data

You can use file-based data import to integrate Cost Management with external systems. Use the Standard Costs file-

based data import template to import standard costs from external sources into the Cost Accounting work area. You can

view the imported cost data on the Manage Standard Costs page. For more information on file-based data import, see

the chapter on Standard Costs Import in the File Based Data Import guide for Oracle Fusion Cloud SCM.

7

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

Related Topics

•

Import Standard Costs Using File-Based Data Import

Web Services You Can Use to Integrate Cost

Management

Oracle Fusion Cloud SCM provides REST web services you can use to access data stored in Oracle Cloud SCM and to

construct integrations to other systems. The following table describes some of the REST web services provided for Cost

Management integration tasks.

Task Description REST Service Name

Retrieve receipt transaction costs

Retrieve item cost details of purchase order and

internal receipt transactions, by calling a REST

web service. The retrieved receipt transaction

cost details can be used in conjunction with

cloud or third-party applications to create

analytical reports, or as inputs for other REST

web services, such as the Cost Adjustments

REST web service.

Receipt Costs

Manage cost accounting overhead rules

Create, update, or delete Cost Accounting

overhead rules by calling a REST web service.

You can create a new overhead rule, or update

an existing overhead rule, by specifying rule

details such as rule name, transaction type,

item category, effectivity date, and overhead

rate.

Overhead Rules for Cost Accounting

Create receipt and layer cost adjustments

Create receipt cost adjustments and cost

layer adjustments using a REST web service.

This capability is useful when you need to

create cost adjustments for a large number of

previously received items. You can, for example,

adjust the receipt cost of items to factor in the

rebated amounts of supplier rebates. Using

this REST service you can adjust receipt costs,

receipts with zero cost, and receipt layer costs. It

can be used in conjunction with other services,

such as the Receipt Costs REST service.

Cost Adjustments

Manage landed cost trade operations

Create, update, or delete landed cost trade

operations and associated charges using a

REST web service. Automatically create trade

operations when integrating with an external

system or when dealing with a high volume of

trade operations or a high volume of charges.

Landed Cost Trade Operations

8

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

For the full list of REST web services available for Cost Management, see the guide REST API for Oracle Fusion Cloud

SCM.

9

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 1

Introduction

10

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

2 Receipt Accounting

Overview of Receipt Accounting

Oracle Receipt Accounting is used to create, manage, review, and audit purchase accruals. It includes the following

features:

• Create Receipt Accounting Distributions. Create accounting distributions for receipts of accrue at receipt

purchase orders.

• Review Receipt Accounting Distributions. Review the accrual accounting distributions created by receipt

accounting for purchase order transactions, such as receipts, returns, corrections, and matches of uninvoiced

receipts to purchase orders. You can also review the accounting distributions created by receipt accounting for

deliveries that are expensed rather than stored as inventory.

• Manage Accrual Clearing Rules. Define business rules for the automatic clearing of balances in the purchase

order accrual accounts, set the conditions for each rule, and set the order in which rules must be applied.

• Match Receipt Accruals. Match purchase order receipt accruals with invoices from the payables application.

• Clear Receipt Accrual Balances. Automatic clearing of accrual balances based on predefined rules.

• Review Receipt Accrual Clearing Balances. Review the General Ledger accounted accrual balances on a periodic

basis.

• Adjust Accrual Clearing Balances. Review uncleared accrual balances and perform adjustments. Manually

adjust or clear accrual balances to inventory valuation for accounts not covered by automatic clearing rules, or

reverse such clearing adjustments.

• Run reports and analytics for Receipt Accounting. The reports available include the following:

◦

Accrual Clearing

◦

Accrual Reconciliation

◦

Uninvoiced Receipt Accrual

◦

Receipt Accounting Period Close

◦

Landed Costs

Note: You can run the Create Receipt Accounting Distributions, Match Receipt Accruals, and Match Receipt Accruals

process jobs for either all your business units or for a selected business unit. If you want to trigger these jobs using the

ERP integration service, ESS web service, or job sets then use the following job definitions:

Job Name ESS Job Definition

Create Receipt Accounting Distributions

ReceiptAccrualProcessMasterEssJobDef

Match Receipt Accrual

MatchReceiptAccrualMasterEssJobDef

Clear Receipt Accruals

AccrualClearRulesMasterEssJobDef

11

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Related Topics

•

Receipt Accrual, Reconciliation, and Clearing

•

Accrual Reversals

Receipt Accounting Infolets

The Overview page of the Receipt Accounting work area displays some infolets. These infolets are visible by default. You

can configure which infolets should be displayed on the page from My Infolets.

You can set the View By option on the page to view the information for a specific business unit or for all the business

units that you have access to. Also, if you have access to more than one business unit, then you can flip the infolet to

view the corresponding information for all the business units you have access to.

The table lists the infolets available in the Receipt Accounting work area.

Infolet Description

Accrual Write Off

The accrual amount that has been written off in the last seven days.

Charge Line Status

The count and status of trade operation charge lines for all the open trade operations. It provides a

quick actionable view to take necessary actions on the charge lines.

Cost of Receipts

The material cost from purchase orders, tax, landed cost charges, and payables variance for receipts in

the last seven days.

Exceptions

The number of exceptions logged by the Receipt Accounting processor.

Open Charge Invoice Associations

The count and status of the landed cost charge invoices that aren't fully associated to a trade operation

charge line.

Recent Processes

The recent processes run and their corresponding status. You can view the information for the last 25

processes that were run.

Trade Operations

The count of open trade operations.

Unmatched Accrual Balances

The open accrual balance for receipts corresponding to purchase order schedules set to accrue on

receipt. The infolet shows the accounted accrual balance as per Payables and Receipt Accounting

allowing you to monitor for any differences between them.

You can choose to not list and display one or more of the infolets on the Overview page by setting the profile option

code ORA_CMR_HIDE_INFOLETS on the Manage Receipt Accounting Profile Options page in the Setup and Maintenance

work area.

12

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Related Topics

•

Manage Cost Accounting Profile Options

Considerations for Accrual Settings

The key policy decision that you need to make for receipt accounting is whether or not you want to accrue at receipt.

This table outlines the points to consider for each accrual option.

Accrual Setting Points to Consider

Accrue at Receipt

• Purchases are accrued at receipt. An accrued liability account is credited when the goods are

received.

• Optional for expense destination purchases, and mandatory for inventory purchases.

• More accounting and more reconciliation than when accruing at period end. The receipt

accounting application provides tools to help reconcile the accrued liability clearing account.

• Accounting is more timely than when accruing at period end.

Accrue at Period End

• The accounts payable account is credited when the supplier invoice is processed in accounts

payable. Receipt accounting has a function to accrue uninvoiced receipts at period end.

• Less accounting and less reconciliation than when accruing at receipt.

• Accounting may be less timely than when accrued at receipt, but will be accrued by period end.

The accrual options are configured in the Procurement offering. For more information on configuring the accrual

options, see the related topics section.

Related Topics

•

Receipt Accrual, Reconciliation, and Clearing

•

Guidelines for Common Options for Payables and Procurement

•

How Purchase Order Schedule Defaults Work

Receipt Accounting Tasks and Accounting Events

Use Receipt Accounting to:

• Create accruals for purchase order receipts that are expensed or shipped to inventory.

• Create accruals for intercompany trade flows.

• Create receipt inspection accounting for purchase order and interorganization receipt flows.

• Support budgetary control and encumbrance accounting

Receipt Accounting also has tools to help you reconcile the accrual clearing accounts as the accruals are offset by the

accounts payable accounting when invoices are processed.

13

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Receipt Accounting Tasks and Accounting Events

The following table describes the Receipt Accounting tasks and processes to support receipt, inventory, and

manufacturing accounting, and the sequence in which the tasks should be executed.

Task Navigation Resulting Events

Transfer receipt transactions and tax

determinants from Receiving to Receipt

Accounting.

Scheduled Processes work area > Schedule New

Process > Transfer Transactions from Receiving

to Costing

• All receiving transactions are transferred

from the Receiving application to the

Receipt Accounting application, along

with the tax determinants and related

information that's present on receipts.

• Receipt transactions are then ready in the

Receipt Accounting application for further

processing.

Transfer accounts payable transactions from

Payables to Receipt Accounting.

Scheduled Processes work area > Schedule New

Process > Transfer Costs to Cost Management

• All payable invoices that are accounted

are transferred from the Accounts Payable

application to the Receipt Accounting

application.

• Payable Invoices are then ready in the

Receipt Accounting application for further

processing.

Create accounting distributions for receipts of

accrue at receipt purchase orders.

Receipt Accounting Work Area > Create Receipt

Accounting Distributions

• Accruals for all types of purchases

• Accrual accounting distributions at the

time of receipt or return of goods and

services

• Trade accrual distributions for global

procurement, interorganization transfers,

and cross-business unit shipments to

customers

• Accounting distributions for expense

destination deliveries of purchases

marked for accrual at receipt. These

purchases are typically for services

procurement, one-time item purchases,

and expense usage purchases.

• Accounting distributions for invoice

variances for IPV, ERV, TRV, TERV, and

TIPV

• Staging of variances into receiving

inspection for subsequent wash by

the inventory and expense revaluation

processes

• Accounting distributions for inventory and

expense revaluations

• Tax amounts are recalculated for

all receipt transactions. Taxes are

calculated by calling the Tax application

programming interface.

• Tax accounting distributions

• Budgetary control and encumbrance

accounting. You can enable and perform

14

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Task Navigation Resulting Events

budgetary control, encumbrance

accounting, or both. Budgetary control

and encumbrance accounting are optional

tasks, and are enabled in Financials.

Create period end uninvoiced receipt accruals.

Receipt Accounting work area > Create

Uninvoiced Receipt Accruals

• Provisional expense accruals for

purchases not marked for accrual at

receipt

Create subledger accounting.

Receipt Accounting work area > Create

Accounting

• Journal entries for receipt accounting

distributions

Review accrual distributions and tax

calculations.

Receipt Accounting work area > Review Receipt

Accounting Distributions

• Review accrual distributions and tax

calculations.

Clear receipt accruals.

Receipt Accounting work area > Clear Receipt

Accrual Balances

• Automatic clearing of accrual balances

based on predefined rules

• Staging of information for revaluation

of inventory and expenses by cost

accounting and receipt accounting

processes

Generate and view reconciliation reports.

Scheduled Processes work area > Schedule New

Process > Accrual Reconciliation report

Scheduled Processes work area > Scheduled

Processes > Accrual Clearing report

• Accrual Reconciliation report

• Accrual Clearing report

Create receipt accounting distributions.

Receipt Accounting work area > Create Receipt

Accounting Distributions

• Accounting distributions for cleared

accrual balances

• Revaluation and expense adjustment

entries for invoice variances or accrual

clearing events that modify acquisition

costs for purchases

Review uncleared accrual balances and perform

adjustments.

Receipt Accounting work area > Adjust Receipt

Accrual Balances

• Staging for manual intervention for

exceptions of high material value

• Manual accrual clearing

• Manual adjustments and reversals of prior

accrual clearing adjustments

• Automatic creation of accounting

distributions for these adjustments

Match purchase order receipt accruals with

invoices from payables.

Receipt Accounting work area > Match Receipt

Accruals

• Manual reconciliation of accrual balances

• Review and audit accrual balances that

were final accounted.

Review accrual clearing balances.

Receipt Accounting work area > Audit Receipt

Accrual Clearing Balances

• Audit the General Ledger accounted

accrual balances on a periodic basis.

15

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Related Topics

•

Receipt Accrual, Reconciliation, and Clearing

•

What is the recommended sequence for scheduling of receipt accounting processes?

•

Accrual Reversals

Receipt Accrual, Reconciliation, and Clearing

When goods are interfaced from Oracle Receiving to Oracle Receipt Accounting, Receipt Accounting recognizes the

liability to the supplier, and creates accruals for receipts destined for inventory or expense. For consigned purchases, the

supplier accrual is booked upon change of ownership.

Receipt Accounting then reconciles these accrual balances against the corresponding invoices from accounts payable

and clears them to inventory valuation.

The following discusses receipt accruals, their reconciliation, and clearing.

Receipt Accrual Creation

When goods are received and delivered to inventory or expense destinations, the receipt accounting application creates

accrued liability balances for the estimated cost of purchase order receipts. The application creates accruals for:

• Inventory destination receipts, which are always accrued on receipt

• Expense destination receipts, which are accrued on receipt, or at period end if the supplier invoice hasn't yet

been processed

When it processes the supplier invoice, Accounts Payable creates the actual supplier liability and offsets the accrual

balances. The accrued liability account typically has high volumes of entries going through it, and may have remaining

balances that must be justified if the account payable invoice hasn't yet been processed; or if the Account Payable

invoice has been processed, any remaining balance must be resolved and cleared. Receipt Accounting provides tools to

help with this reconciliation.

Receipt Accrual Reconciliation and Clearing

Some of the remaining balance in the accrued liability account can be automatically cleared by Receipt Accounting

and Cost Accounting to the appropriate purchase expense or asset account, based on your predefined clearing rules.

However, some of this balance will represent uninvoiced quantities, or other discrepancies which you will want to

resolve and clear manually.

You can manually clear receipt accrual balances from the Adjust Receipt Accrual Balances page for purchases without

receipts but with invoices matched to the order:

• You’ve matched an invoice incorrectly to a wrong PO distribution for which receipt didn't get created in the

period.

• You’ve open invoices for a receipt that was corrected or returned and the PO is closed.

This helps you to reconcile and clear out old accrual accounts in accounts payable for orders that are closed or no

further activity is expected in the period.

16

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Note:

• You can clear out old accruals in accounts payables without any receipts for orders that are matched to order

only.

• Use Accrual Clearing Reason as the accounting source to derive the relevant account for the Receiving

Inspection account.

• If the accrual balance is cleared assuming no further receipts, and subsequently if receipts are recorded, you

must manually reverse the accrual clearing for the accrual account to reconcile.

Example 1: Assume that the purchase order receipt is for 100 units at $5 each; the application creates a credit to the

accrued liability account in the amount of $500. When the corresponding invoice arrives from the supplier, it reflects

100 units at $6 each; the application debits the accrued liability account in the amount of $600. The difference of $100

automatically clears and flows to inventory valuation.

Example 2: Assume that the quantity received is 99.4, and the quantity on the supplier invoice is 100. The processor

doesn't always know if that's the final invoice or if more invoices are pending for the uninvoiced quantity. If small

variations are normal, you can set up rules to automatically clear small variations, while large variations are verified

manually. If there is a predefined rule for the treatment of such a discrepancy, the application automatically clears the

difference to inventory valuation. However if no such rule exists, then you must clear it manually.

Audit Receipt Accrual Clearing Balances

After accrual balances are cleared to the appropriate expense or asset account, you can review and audit the final

accounting distributions generated by Receipt Accounting.

Receipt Accrual Clearing Rules

Define accrual clearing rules to clear accrual balances automatically. Accrual balances are often of unknown origin and

unpredictable. With accrual clearing rules you can specify when accrual balances should be cleared and written off.

The Clear Receipt Accrual Balances process scans for applicable rules on the transactions, and clears the balances when

rule criteria are met. The following discusses the creation of accrual clearing rules using predefined attributes, and

illustrates the results with an example.

Note: You must ensure that the corresponding general ledger period is open before running the Clear Receipt Accrual

Balances process. If the period is closed, then the accrual clearing is moved to the next open period. If no other period

is open, then the event will fail with error. Before closing the general ledger period, you must ensure that all the events

in Receipt Accounting are fully accounted.

Predefined Attributes

The following table describes the attributes that are available in the Accrual Line tree in the Conditions browser:

Attribute Name Description

Purchase Order Distribution Identifier

Purchase order structure is based on the hierarchy of purchase order header > purchase order

line > purchase order schedule > purchase order distribution. The accounting for purchase order

17

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Attribute Name Description

transaction is at the lowest level of purchase order distribution. The accrual and charge account codes

are defined at this level. Invoices are matched and accrual is offset at the PO distribution level.

This attribute represents the PO distribution ID on the PO document.

Percentage Over-Invoiced

At each purchase order distribution level, receipt accounting tracks the original ordered quantity, total

received quantity, and total invoiced quantity.

Percentage Over-Invoiced Quantity represents the condition: IF (Net Rct qty - Invoice Qty)

< 0 then ABS(NetRecptQty - InvoiceQty)/ NetRecptQty

Percentage Uninvoiced

At each purchase order distribution level, receipt accounting tracks the original ordered quantity, total

received quantity, and total invoiced quantity.

Percentage Uninvoiced Quantity represents the condition: IF (Net Rct qty - Invoice Qty) >

0 then ABS(NetRecptQty - InvoiceQty)/ NetRecptQty

PO Status

Status of the purchase order document. If the PO status is Finally closed, then it's treated as Closed.

You can define the accrual clearing rules based on the PO Status.

PO Match Option

Invoice match option defined on the purchase order schedule. It can be PO or Receipt.

Invoice Age

Days or time since the latest invoice was recorded for a purchase order distribution.

Receipt Age

Days or time since the latest receipt was recorded for a purchase order distribution.

Over-Invoiced Quantity

When the invoiced quantity is greater than the ordered quantity, it represents the difference between

the two: IF (Net Rct qty - Invoice Qty) < 0 then Over Invoiced Quantity =

ABS(InvoiceQty - NetRecptQty)

Under-Invoiced Quantity

When the invoiced quantity is less than the ordered quantity, it represents the difference between

the two: IF (Net Rct qty - Invoice Qty) > 0 then Under Invoiced Quantity =

ABS(NetRecptQty - InvoiceQty)

Percentage PO Accrual Amount

The balance in the accrual account for a PO distribution divided by the accrual value for the ordered

quantity: Sum(accruals in CMR and AP)/PO amount

PO amount = Net Order Qty * PO Price

Accrual Clear Amount

Value of balance in an accrual account for a PO distribution. Net of accrual amount credited in Receipt

Accounting and that debited in Accounts Payable. To clear debit balance enter a positive number and

for credit balance enter a negative number.

Total Invoice Accrual Amount

Absolute value of balance (net of invoices and debit memos) in an accrual account in Payables

Subledger for a PO distribution.

Total Receipt Accrual Amount

Absolute value of balance (net of receipts, corrections and returns) in an accrual account in Receipt

Accounting Subledger for a PO distribution.

18

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Attribute Name Description

PO Distribution Number

This attribute represents the PO distribution number on the PO document, such as 1, 2, and so on, and

is different from the Purchase Order Distribution Identifier.

Supplier

Supplier name on the purchase order document.

Supplier Site

Supplier site code on the purchase order document.

Item

Item on the purchase order line.

Item Category

Item category on the purchase order line.

Accrual Amount Difference

Difference in accrual amount credited in Receipt Accounting and that debited in Accounts Payable.

Purchase Order Schedule Identifier

The identifier of the PO Schedule that uniquely identifies a PO Schedule number of PO.

Invoice Accrual Amount

Accrual amount debited on invoice in Accounts Payable for the item price.

Invoice Nonrecoverable Tax Amount

Accrual amount debited on invoice in Accounts Payable for the nonrecoverable tax.

PO Line Number

Line number on the Purchase Order Line.

Nonrecoverable Tax Amount Difference

Difference in the nonrecoverable tax amounts booked in Receipt Accounting and Accounts Payable for

a PO Distribution.

Inventory Organization Code

Code that uniquely identifies a Inventory Organization.

PO Total Amount

Total amount on the Purchase Order.

PO Number

Unique identifier for the Purchase Order.

PO Quantity

Quantity ordered from the Purchase Order.

Purchase Basis

The basis on which the purchase is done.

Received Accrual Amount

Amount received for PO distribution.

Received Nonrecoverable Tax Amount

Nonrecoverable tax in the amount received for PO distribution.

PO Shipment Number

Schedule in purchase order indicating place of delivery.

Invoice Quantity

Quantity invoiced for PO Distribution.

19

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Attribute Name Description

Invoice Recoverable Tax Amount

Recoverable tax amount on the invoice for a PO distribution.

Received Quantity

Quantity received for a PO distribution.

Received Recoverable Tax Amount

Recoverable tax amount on the receipt for a PO distribution.

Procurement Business Unit

Business unit performing procurement business function.

Purchase Order - Deliver to Location

Delivery location on the purchase order schedule indicating place of delivery.

Profit Center Business Unit

Indicates the business unit which serves as the profit center.

PO Destination Type

Destination type on the PO which can be inventory, expense, manufacturing or drop ship.

Item Description

Description of the item on the purchase order line.

Example

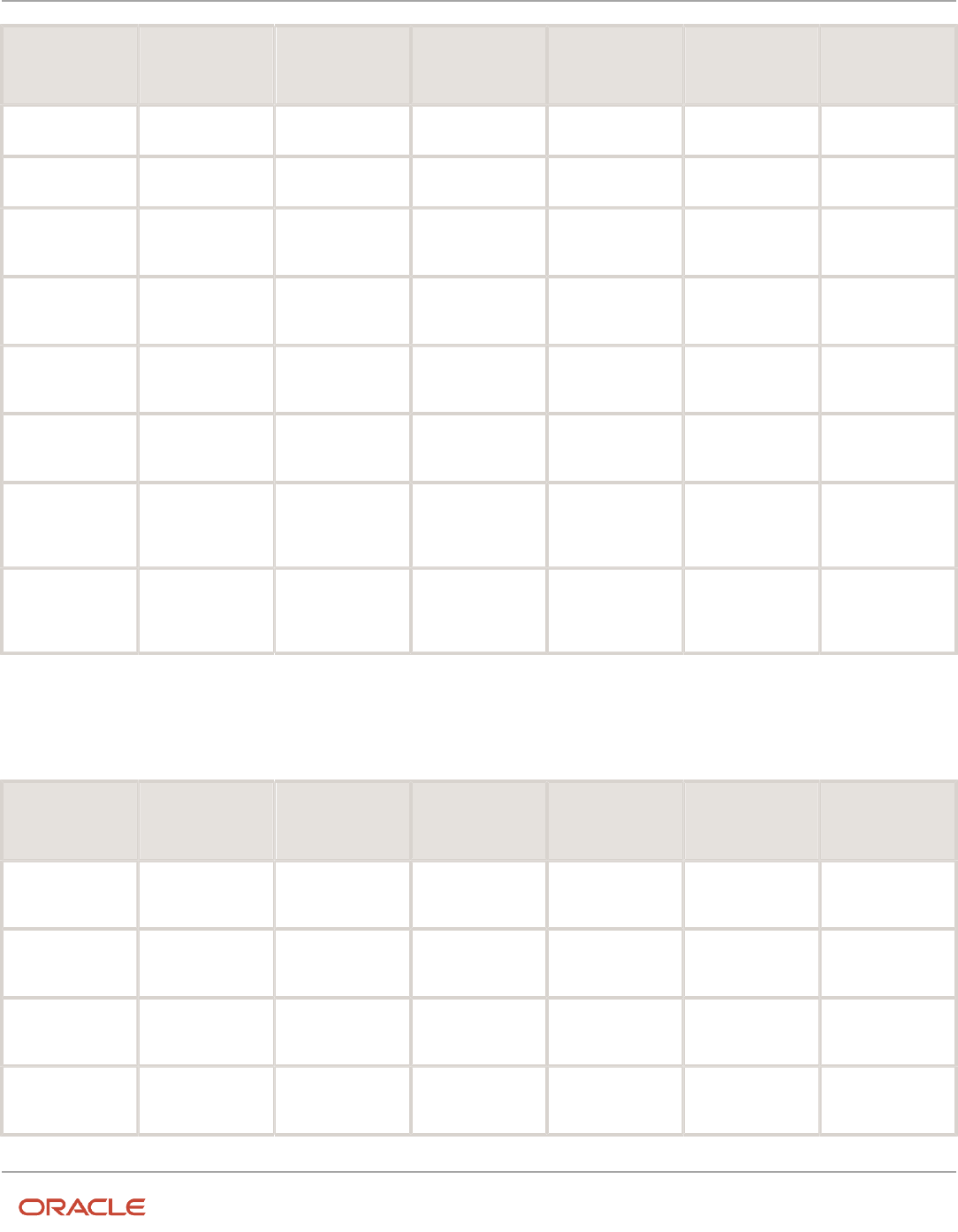

This example illustrates the distributions for a purchase order with associated receipts and invoices.

The following table describes the purchase order details:

PO Header Supplier Supplier Site Status

PO#1234

Advanced Network Devices

New York

Open/Close/Final Close

The following table describes the purchase order lines:

Item Item Category PO Price Ordered Quantity

AS54888

Raw Materials

100 USD

100 EA

The following table describes the purchase order schedules:

Schedule Order Quantity Match Option Status

1

100 EA

Order or Receipt

Open

The following table describes the receipts and invoices:

20

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Receipts Ordered Quantity Received Quantity Invoiced Quantity Accrual Account Status

Receipt 1

60

58

55

01-2210

Open

Receipt 2

40

40

45

01-2220

Open

The following table describes the purchase order distributions and accrual balances:

PO

Distribution

CMR Accrual

Amount (A)

AP Accrual

Account (B)

Accrual Clear

Amount (C) =

(A-B)

Under-

Invoiced

Quantity

Over-

Invoiced

Quantity

Percentage

Under-

Invoiced

Percentage

Over-

Invoiced

Percentage

PO Accrual

Amount (C)/

Ordered

Quantity*PO

Price

Distribution 1

58*100 USD =

5800 USD

55*100 USD =

5500 USD

300 USD

60 - 55 = 5

Not Applicable

5/58*100 =

8.62%

Not Applicable

300

USD/60*100

= 5%

Distribution 2

40*100 USD =

4000 USD

45*100 USD =

4500 USD

(500) USD

Not Applicable

45-40 = 5

Not Applicable

5/40*100 =

12.50 %

500

USD/40*100 =

12.50 %

The following table describes the Rule 1:

Attribute Operator Value Conditions

PO Status

=

OPEN

And

Percentage Under-Invoiced

Less Than

10%

Not Applicable

Results: The PO Status and the Percentage Under-Invoiced values meet the criteria of Rule 1; therefore the accrual

balance of 300 USD is automatically cleared.

The following table describes the Accrual Amounts Cleared Based on Rule 1:

PO

Distribution

CMR Accrual

Amount (A)

AP Accrual

Account (B)

Accrual Clear

Amount (C) =

(A-B)

Under-

Invoiced

Quantity

Over-

Invoiced

Quantity

Percentage

Under-

Invoiced

Percentage

Over-

Invoiced

Percentage

PO Accrual

Amount (C)/

Ordered

Quantity*PO

Price

Distribution 1

58*100 USD =

5800 USD

55*100 USD =

5500 USD

300 USD

60 - 55 = 5

Not Applicable

5/58*100 =

8.62%

Not Applicable

300

USD/60*100

= 5%

21

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

The following table describes the Rule 2:

Attribute Operator Value Conditions

PO Status

=

OPEN

And

Accrual Clear Amount

Less Than

Absolute (1000) USD

Or

Percentage Under-Invoiced

Less Than

10%

Or

Percentage Over-Invoiced

Less Than

10%

Not Applicable

Results: The PO Status, Percentage Under-Invoiced, and Accrual Clear Amount Absolute values meet the criteria of Rule

2; therefore the accrual balances of 300 USD and (500) USD are automatically cleared.

The following table describes the Accrual Amounts Cleared Based on Rule 2:

PO

Distribution

CMR Accrual

Amount (A)

AP Accrual

Account (B)

Accrual Clear

Amount (C) =

(A-B)

Under-

Invoiced

Quantity

Over-

Invoiced

Quantity

Percentage

Under-

Invoiced

Percentage

Over-

Invoiced

Percentage

PO Accrual

Amount (C)/

Ordered

Quantity*PO

Price

Distribution 1

58*100 USD =

5800 USD

55*100 USD =

5500 USD

300 USD

60 - 55 = 5

Not Applicable

5/58*100 =

8.62%

Not Applicable

300

USD/60*100

= 5%

Distribution 2

40*100 USD =

4000 USD

45*100 USD =

4500 USD

(500) USD

Not Applicable

45-40 = 5

Not Applicable

5/40*100 =

12.50 %

500

USD/40*100 =

12.50 %

Receipt Accounting Cutoff Dates

The accrual cutoff date enables you to control when backdated receipts are accounted.

The following describes how Receipt Accounting uses offset days to determine the accrual cutoff date for processing

backdated receipts.

Using Offset Days

Offset days define the grace period for processing backdated transactions in the prior GL period. You can indicate the

number of offset days for a business unit in the Receipt Accounting work area, on the Manage Accrual Clearing Rules

page, Manage Accrual Cutoff Rules tab. Receipt Accounting uses the offset days to calculate the accrual cutoff date.

22

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

For example, assume the number of offset days is 3, then the accrual cutoff date for processing receipts in the October

GL period is November 3:

• A receipt that is backdated to October 31 but is processed on November 3 is accounted in October

• A receipt that is backdated to October 31 but is processed on November 4 is accounted in the November GL

period

If the offset days are not defined, then the backdated receipts are processed in the prior GL period until the period is

closed.

Note:

• This is applicable only for Accrue at Receipt purchase orders.

• For Accrue at Period End purchase orders, use the Period End Accrual Cutoff and Accounting Date parameter

to set the appropriate cuttoff date when running the Create Uninvoiced Receipt Accrual process.

Related Topics

•

Receipt Accounting Tasks and Accounting Events

•

Create Uninvoiced Receipt Accrual

Overview of Accrual Reversal

Use the Create Accrual Reversal Accounting process in the Scheduled Processes work area to reverse accrual journal

entries. You can schedule this process to run automatically at predefined intervals, or run it on demand.

You can define how and when accrual reversals are automatically performed by:

• Indicating that an accounting event is eligible for accrual reversal.

• Determining when the accrual is reversed.

• Scheduling the Create Accrual Reversal Accounting process to generate the reversal entries.

For more information on accrual reversal, prerequisites, and step-by-step instructions, see the links in the Related

Topics section.

Related Topics

•

Accrual Reversals

•

How You Submit the Create Accrual Reversal Accounting Process

•

Submit Scheduled Processes and Process Sets

23

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Period End Uninvoiced Receipt Accrual

Receipt Accounting for Purchase Orders Set to Accrue at Period

End

You can run the Create Uninvoiced Receipt Accruals process to create accrual accounting for purchase orders that are

set to accrue at period end. This process creates accruals for purchase orders based on these conditions:

• Although the receipts have been received, accounting hasn't been created because the Accrue at Receipt option

isn't selected in the purchase order.

• Receipts haven't been invoiced or the invoiced quantity is less than the quantity received on the purchase order.

You must run this process after closing the Accounts Payable period and transferring all the Accounts Payable invoices

to Cost Management, and before you close the General Ledger period. Also, you can run this process as many times or

as frequently as required during the accounting period to have the latest expense and accrual information in your books

of accounts.

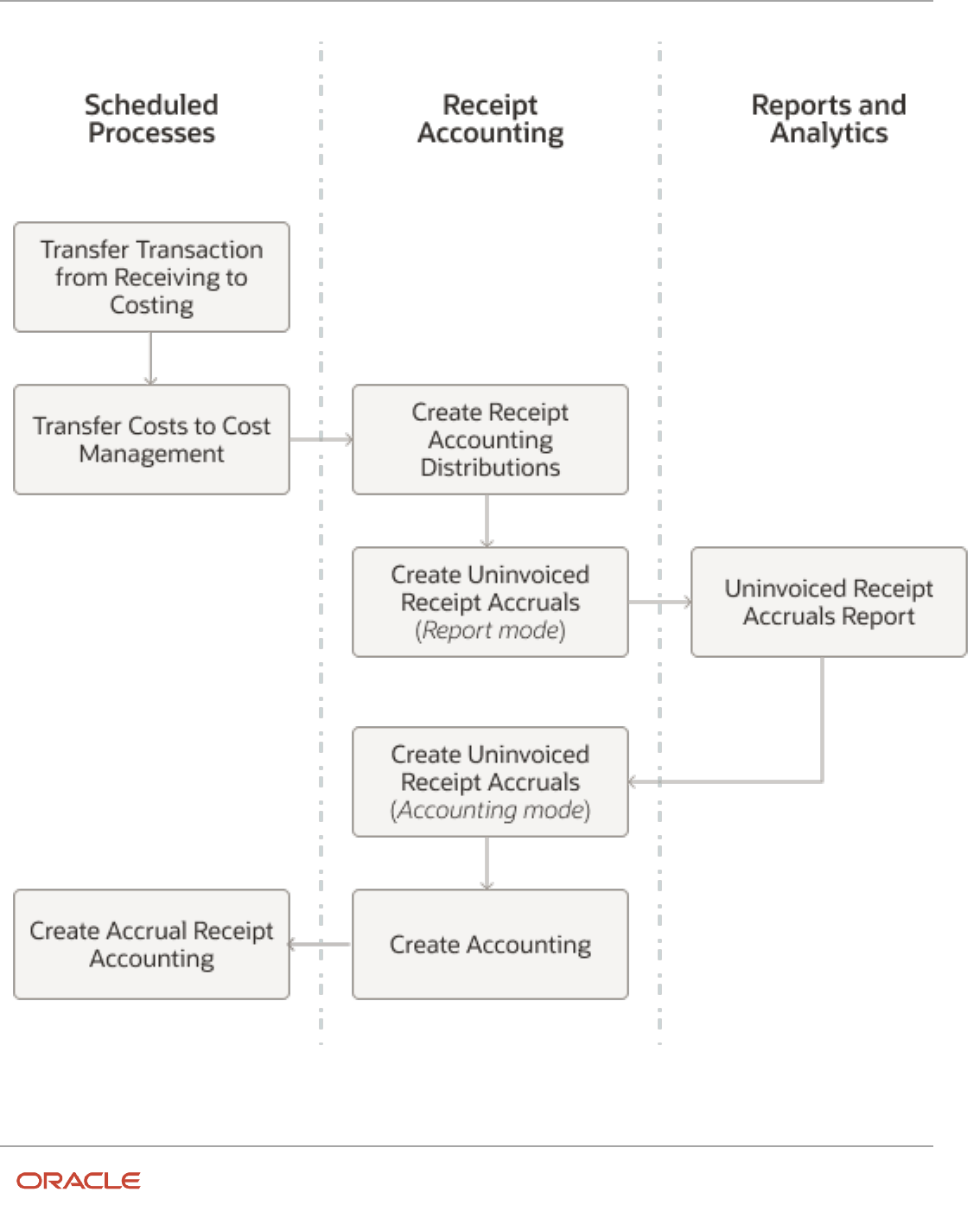

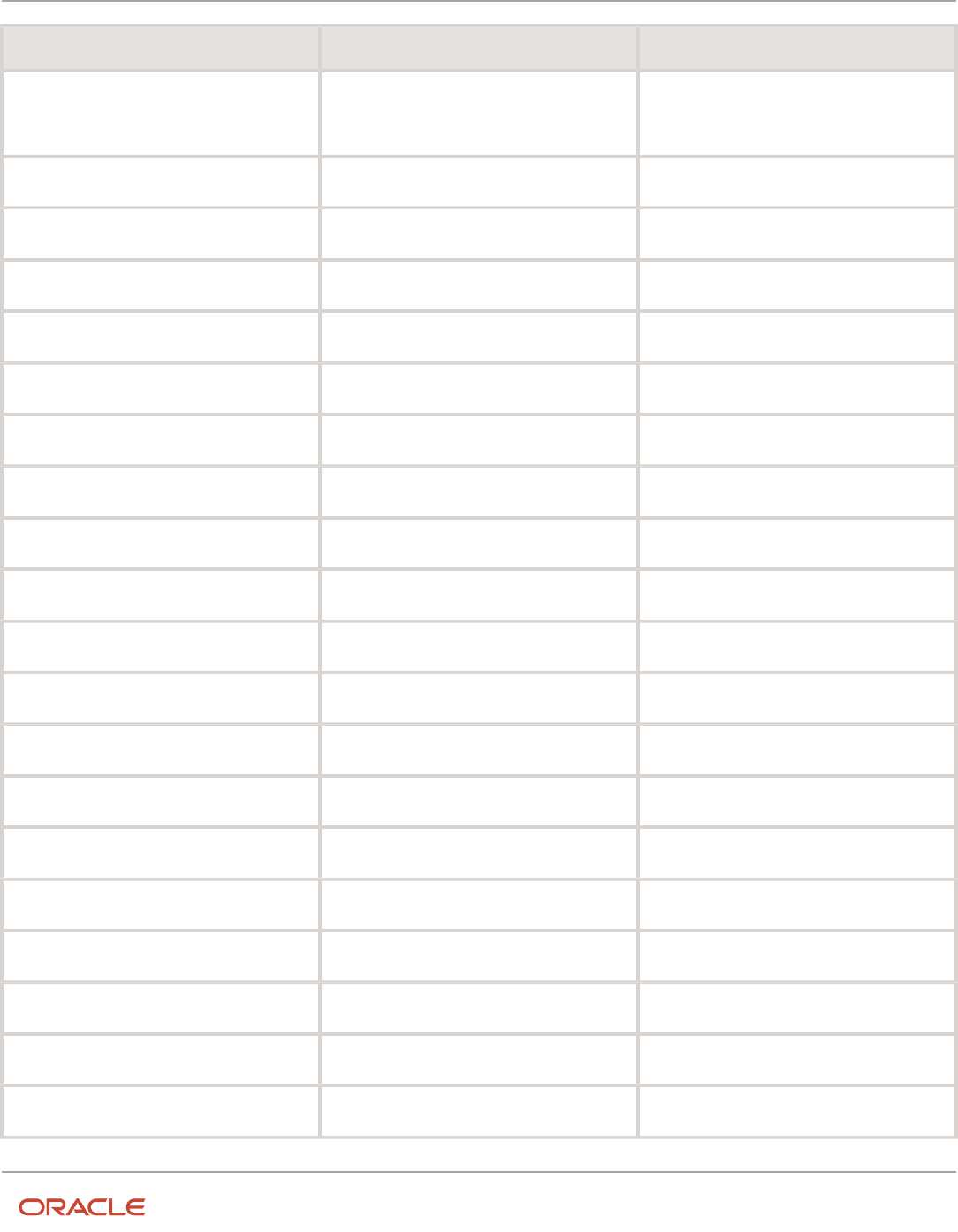

The image here shows the various processes and the sequence in which you must run them to create accruals for the

uninvoiced receipts. It also shows the work areas from where you can run these processes.

24

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

You start by running processes to transfer the receipt and invoice information to Cost Management. Then you run

the Create Receipt Accounting Distributions process so that the appropriate data is populated when you generate the

25

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Uninvoiced Receipt Accruals Report. Before you generate the report, you must also run the Create Uninvoiced Receipts

Accruals process in the Report accrual run mode.

The report helps you to understand the details about the uninvoiced purchase order receipts for which accruals will be

created. After reviewing the report, you can perform additional actions:

• Exclude receipt accruals from the report by accounting the corresponding invoices.

• Exclude receipt accruals from the report by setting purchase order schedule status to Finally Closed.

When you run the Create Uninvoiced Receipt Accruals process in the Accounting accrual run mode, the corresponding

distributions are created. Next, you run Create Accounting to transfer the distributions to SLA and General Ledger. And

lastly, you run the Create Accrual Reversal Accounting process, which creates a new journal entry on the first date of the

next open general ledger period.

The integration with General Ledger ensures that the period end accruals and also the reversals are automatically

created in General Ledger. By automatically creating the reversals, double booking doesn't occur when the invoices are

eventually received.

Before You Begin

Before you start creating the accruals for uninvoiced receipts at period end, make sure that you have completed all the

upstream processes, which include creation of receipts and the final accounting of invoices wherever possible.

Next, run these processes from the Scheduled Processes work area:

• Transfer Transactions from Receiving to Costing - This process transfers receipt information to Receipt

Accounting.

• Transfer Costs to Cost Management - This process transfers invoice information to Receipt Accounting.

Review the status of the processes to make sure that they have completed successfully.

After you transfer the receipt and invoice information to Receipt Accounting, run the Create Receipt Accounting

Distributions process from the Receipt Accounting work area. You then run the Create Uninvoiced Receipt Accrual

process in the Report accrual run mode followed by generating the Uninvoiced Receipt Accruals Report. You can also

run these processes from the Scheduled Processes work area.

Related Topics

•

How You Submit Accounting Process

•

Accrual Reversals

•

How You Submit the Create Accrual Reversal Accounting Process

•

Post Subledger Transactions to the General Ledger

Create Uninvoiced Receipt Accrual

The Create Uninvoiced Receipt Accrual process creates pairs of debit and credit accounting entries to accrue for receipts

of purchase orders that are set to accrue at period end.

You can monitor the uninvoiced receipt accrual amounts in preparation for period end by running the process in the

Report accrual run mode. However, you must run the process in the Accounting accrual run mode to create the final

accrual distributions, preferably after you have closed accounts payable for the period ensuring the period end accruals

accounted are for the same value that you've reviewed.

26

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Each time you run the Create Uninvoiced Receipt Accruals process, data is created for reporting that you can review by

running the Uninvoiced Receipt Accrual Report.

Note: For a selected period, if you run the process in the Accounting mode, you can't run the process again in the

Report mode. The subsequent runs of the process for the selected period must be in the Accounting mode.

1. In the Receipt Accounting work area, select the Create Uninvoiced Receipt Accruals task.

2. Enter appropriate values for the parameters listed in the table.

Parameter Description

Bill to Business Unit You can run the process for a specific Bill to Business Unit. Only the data for the profit centre

business units of the Bill to Business Unit to which you have data access and have pending

transactions will be processed. If you don't have data access to the selected Bill to Business

Unit, the process ends with Warning status.

Accrual Run Mode You can run the process in the Report or Accounting mode. When you run the process in the

Accounting mode, the final accrual distributions are created and ready to be posted to the

General Ledger.

Accounting Period The accounting period for which you want to run the process.

Period End Accrual Cutoff and

Accounting Date

Enter the period end accrual and accounting cutoff date. If you don't select any date, the last

date of the accounting period is considered as the cutoff and accounting date.

Commit Limit Enter a commit limit to fine tune the size of processing sets. The default setting is sufficient for

most typical cases.

Include Purchase Order Status Select the purchase order status to filter the purchase orders that must be considered for

creating the period end accrual amounts. By default, the process only considers purchase

orders that are open or in closed status for receiving to compute period end accrual amounts.

3. Click Submit.

The process creates the accounting distributions, which can be reviewed on the Review Receipt Accounting

Distributions page. On the Review Receipt Accounting Distributions page, search for transactions with the transaction

type Period End Accrual. You can scroll down on the page and select the Distributions and Journal Entries tabs to view

the accounting details.

Related Topics

•

Create Uninvoiced Receipt Accrual

Run Uninvoiced Receipt Accruals Report

You can run the Uninvoiced Receipt Accruals Report from the Reports and Analytics work area. This report helps you to

review the uninvoiced purchase order receipts due for accrual or already accrued for a given period.

After you run the Create Uninvoiced Receipt Accruals process in the Report accrual run mode, you can generate the

Uninvoiced Receipt Accruals Report. This ensures that the report shows the data based on the selection criteria with

27

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

which the Create Uninvoiced Receipt Accruals process was run, and thereby ensuring you know exactly what you accrue

and for what amount.

You can set these parameters when running the report.

Parameters Description

Business Unit

The business unit for which you want to generate the report.

Accounting Period

The accounting period for which you want to generate the report. You can select only one accounting

period at a time.

From Item and To Item

Set these parameters if you want to generate the report for a specific item.

From Item Category and To Item Category

Set these parameters if you want to generate the report for a specific item category.

Accrual Tolerance Amount

You can optionally specify an accrual tolerance amount and a comparison operator.

For example, if Accrual Tolerance Amount > 0 means the received amount is greater than the invoiced

amount. If Accrual Tolerance Amount = 0 means invoiced and received amounts are same. If Accrual

Tolerance Amount < 0 means invoiced amount is greater than received amount.

Supplier and Supplier Site

Set these parameters if you want to generate the report for a specific supplier or supplier site.

After you have reviewed the Uninvoiced Receipt Accruals Report and taken any necessary actions, you must run the

Create Uninvoiced Receipt Accruals process in the Accounting accrual run mode before running the Create Accounting

process.

If the accruals amounts listed in the report differ from the actual distributions created by the Create Uninvoiced Receipt

Accruals process, it could be due to any of the listed reasons:

• You have received and processed invoices between running the process and the report.

• You have returned the goods.

Create Accounting

Create Accounting transfers the distributions from Receipt Accounting to SLA and also to General Ledger.

You must run the Create Accounting process after you run the Create Uninvoiced Receipt Accruals process in the

Accounting accrual run mode. The Create Uninvoiced Receipt Accruals process creates the corresponding distributions

that you transfer to SLA and General Ledger by running the Create Accounting process.

1. In the Receipt Accounting work area, select the Create Accounting task.

2. Enter the values for these fields.

Field Value and Description

Subledger Application

Select Receipt Accounting.

28

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Field Value and Description

Ledger

Select the required ledger.

Process Category

Select Period End Transactions.

End Date

Set the date till which the transactions must be

accounted.

If the End Date is same as or earlier than the period end

date, you must run Create Accrual Reversal Accounting

after you run Create Accounting.

Accounting Mode

If you want to review the results, set the accounting

mode as Draft, else set it as Final.

Process Events

Select All.

Report Style

The style of report to be generated.

◦

Summary - Select this option if you want to review the results.

◦

Detail - Select this option if you want to know the details of which

transactions are accounted and which aren't.

◦

No report - Select this option if you don't want to generate the

report.

Transfer to General Ledger

Yes

This ensures that the period end accruals and reversals

are automatically created in General Ledger.

Post in General Ledger

Yes

This is mandatory to complete the accounting by

posting to General Ledger. Ensure that you've the

necessary privileges to access this option.

3. Click Submit.

29

Oracle Fusion Cloud SCM

Using Supply Chain Cost Management

Chapter 2

Receipt Accounting

Note:

• If you set Transfer to General Ledger and Post in General Ledger to No, then to complete the accounting by

transferring the records from SLA to General Ledger and posting them, you must run the Post Subledger

Journal Entries process from the Scheduled Process work area.