Alabama Department

of Revenue

Motor Vehicle Division

Designated Agent Training Manual

About the Alabama Designated Agent Training

• The designated agent training course is a self-paced, training

tool for designated agents who will use the MyDMV system to

process Alabama title applications.

• The training program is presented in 8 self-paced quizzes.

• If you have any questions, please contact the Motor Vehicle

Division.

The following Topics are Covered in this Course:

• Module 1:Designated Agent Basics

• Alabama title law exemptions, designated agent responsibilities, the title application process, and the Driver Protection Privacy Act (DPPA)

• Module 2: Titles, Fraud Detection, and Remediation

• Security features

• Module 3:Title Application Basics

• Federal Truth in Mileage Act; odometer certification; completing a title assignment; Forms: Reassignment Form MVT 8-3, Correction Affidavit Form MVT 5-7,

and Affidavit for Assignment of Title from a Deceased Owner Form MVT5-6.

• Module 4: Title Assignments

• Primary supporting documents for title applications, sample title documents, title brands that may be found on an Alabama Certificate of Title, other primary

supporting documents, such as: tag receipts, military registrations, title bonds, and court orders

• Module 5: Power of Attorneys and Liens

• Power of Attorneys, Motor Vehicle Division Power of Attorney, Form MVT5-13, Secure Power of Attorney, Form MVT 8-4; How to perfect a lien; How to release

a lien.

• Module 6: Repossessions, Salvage, and Rebuilt Vehicles

• Repossessions, and salvage vehicles

• Module 7:Dealer Tags, Temporary Tags, & Sales Tax

• Dealer Plates, Sales Tax FAQ’s, & Dealer Temporary tags

• Module 8: Managing Title Work

• Logging in and completing Title applications

Designated Agent

Basics

Module 1

Alabama Title Law Exemptions

• The Alabama Uniform Certificate of Title and Anti-Theft Act

exempts certain vehicles

from titling requirements.

• The vehicles described in the following lessons are exempt

from titling

in the State of Alabama.

If a vehicle is not required to be titled, the Department of Revenue does

not maintain records for the vehicle.

If a vehicle is owned by one of the entities or groups below, it is exempt from

titling in the State of Alabama:

• A vehicle owned by the United States government or any agency thereof

• A vehicle owned by a manufacturer or dealer and held for sale, or a vehicle used by a

manufacturer solely for testing.

• A vehicle owned by a non-resident of this state and not required by law to be registered in this

state.

• A vehicle moved solely by animal power

• Vehicles that are low-speed, including neighborhood electric vehicles, defined as four-wheeled

motor vehicles with a top speed of not greater than 25 miles per hour, a gross vehicle weight

rating of fewer than 3,000 pounds, and complying with the safety standards provided in

49

C.F.R. Section 571.500

• Vehicles that are a motor-driven cycle as defined in Code of Alabama, 1975 §32-1-1.1

• Mini-trucks as defined in Code of Alabama, 1975 Section §40-12-240

• An implement of husbandry (equipment that is used exclusively for agriculture).

• Utility trailers (other than moving

General Exemptions

If a vehicle is owned by one of the entities or groups below, it is exempt from titling in the

State of Alabama:

• A vehicle owned by the United States government or any agency thereof

• A vehicle owned by a manufacturer or dealer and held for sale, or a vehicle used by a manufacturer solely for testing.

• A vehicle owned by a non-resident of this state and not required by law to be registered in this state.

• A vehicle does not require titling if an Alabama license plate issuing official has verified that both the current owner

& operator are recorded as the owner and operator on a currently effective certificate of title issued by another state

and the certificate of title is being held by a recorded lienholder.

• A vehicle moved solely by animal power

• Vehicles that are low-speed, including neighborhood electric vehicles, defined as four-wheeled motor vehicles with a

top speed of not greater than 25 miles per hour, a gross vehicle weight rating of fewer than 3,000 pounds, and

complying with the safety standards provided in 49 C.F.R. Section 571.500

• Vehicles that are a motor-driven cycle as defined in Code of Alabama, 1975 §32-1-1.1

• Mini-trucks as defined in Code of Alabama, 1975 Section §40-12-240

• Gooseneck Utility Trailers (20 or less model years) are NOT exempt and DO require titling in Alabama.

Special Mobile Equipment Vehicles &

Other Exemptions

• Every vehicle not designed or used primarily for the transportation of persons or property

and only incidentally operated or moved over the highway is exempt, including but not

limited to:

• Ditch-digging apparatus, road construction & maintenance machinery, bumper-pulled car

hauler trailers, bumper enclosed trailer, utility trailers, boat trailers.

• The term “Special Mobile Equipment Vehicles” does not include:

• Equipment used exclusively for agriculture (an implement of husbandry)

• Vehicles designed for the transportation of persons or property to which machinery has been

attached.

• Utility trailers defined as a vehicle without motive power designed to be drawn by a passenger

car or pickup truck (bumper-pulled), including folding or collapsible camping trailers.

• Bumper pull (enclosed or not)

• Bumper- pulled car hauler trailers

• Modular Home (manufactured homes model year 2000 and newer are subject to titling in

Alabama.

Pole Trailers

• Exemptions include every vehicle without motive power designed

to be drawn by another vehicle and attached to the towing vehicle by

means of a reach or pole, or by being boomed or otherwise secured

to the towing vehicle, and ordinarily used for transporting long or

irregularly shaped loads such as logs, poles, pipes, boats, or

structural members capable generally of sustaining themselves as

beams between the supporting connections.

Age of the Vehicle

• Alabama law provides that a vehicle may be exempt from title

requirements due to the age of the vehicle

.

The exemption due to age is applicable on January 1 of each year.

• The following vehicles are exempt from titling due to age:

• A motor vehicle greater than 35-model years old

• A manufactured home (1999 and prior) as defined in the Code of

Alabama, 1975 §32-20-2

• A trailer, semi-trailer, travel trailer, or moving collapsible and folder

camper more than 20 model years old

Vessel Titling

EFFECTIVE JANUARY 1, 2024

• ACT 2022-144 codified to the Code of Alabama 1975

• Title 33 Chapter 5B: Uniform Certification of Title for Vessels Act

Vessel Titling Requirements

• Vessels Required to be titled:

• Vessels constructed after December 31, 2023 (some exclusions apply)

• Vessels for which Alabama is the state of principal use on or after

January 1, 2024.

• Vessels less than 18 feet in length are only titled if they are propelled

by an engine of at least 75 horsepower or greater. (Includes: sailboats,

paddleboats, and rowboats).

Responsibilities of a Designated Agent

• Obtaining the information and documentation needed to complete the title application (per Administrative

Rule 810-5-75-.36)

• Physically inspecting a vehicle or manufactured home never titled in Alabama to verify the VIN and

descriptive data.

• Properly completing and signing the application.

• Properly assembling the title application package and all required supporting documents.

• Providing the owner/customer with a signed copy of the application.

• Submitting the title application and required fees to the ADOR within ten (10) calendar days (Code of

Alabama, 1975

§32-8-35). The vehicle must be registered within 20 days so that the title application will

serve as the permit for operation of the vehicle until registered (§

32-8-38).

• Following-up on rejected applications immediately to ensure the certificates of title are properly issued to

the applicant.

• DEALERS ONLY: Maintaining original records for at least one year and electronic records for 5 years of

every vehicle bought, sold, and exchanged for at least one year which must, include inventory records

(per

Administrative Rule 810-5-75-.42).

Things to Remember

• If you sell a vehicle, you are required to complete the paperwork. You are also

responsible for all applications completed with your dealer license or myDMV

account.

• You SHOULD NOT complete title application in myDMV for another dealer or an

unlicensed individual/dealer while signed in with your myDMV account.

•

Administrative Rule 810-5-75-.36 provides that dealers are prohibited from processing

title applications on behalf of another dealer unless both dealerships are owned by

the same entity.

• Administrative Rule 810-5-75-.60(6) provides that the department may revoke the

authority of a designated agent or title service provider if the designated agent or title

service provider fails to faithfully perform the duties under Chapter 8 or Chapter 20 of

Title 32 of the Code of Ala. 1975.

Title Application Assembly

• A complete title application packet includes supporting materials, and theses

must be submitted in the following order:

1. The signed and dated Title Application

2. The manufacturer’s certificate of origin OR certificate of title properly assigned to the

owner

3. Other supporting documents: reassignment forms, bills of sale, and power-of-attorney

• Helpful Tips for Completing Your Application:

• Only designated agents can submit the title application package electronically through

myDMV.

• The name of the owner(s) used on the title application must be the current legal name of

the owner(s) of the motor vehicle for which a certificate of title is requested as provided by

§

32-8-35 and §32-8-39, Code of Alabama, 1975

• As of November 1, 2021, all Designated Agents are required to upload the title application

packets into myDMV. Paper applications will no longer be accepted after this date.

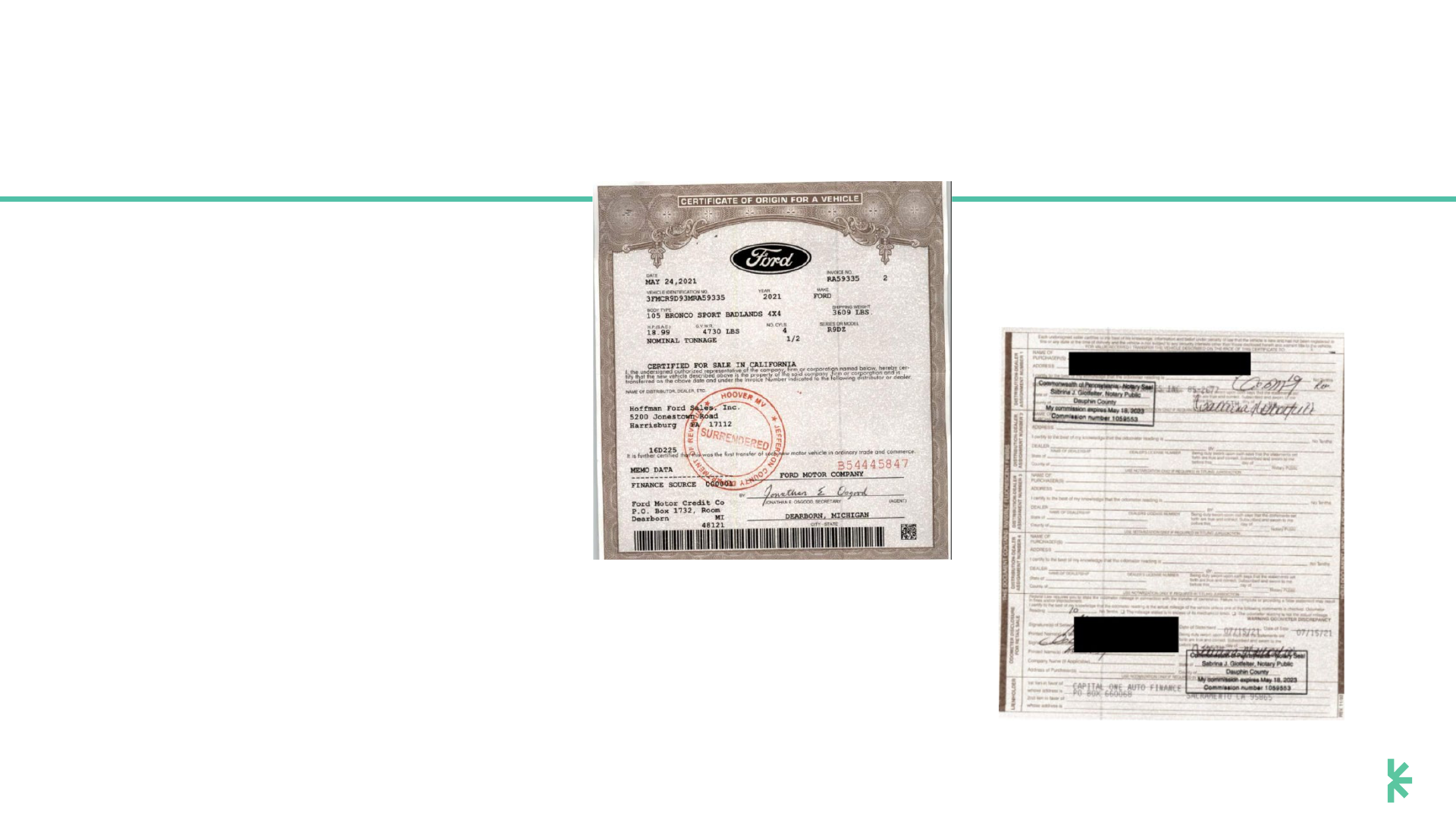

Application Packet Submission Requirements

• Requirement 1:

• In order to upload documents, designated agents and title service providers

must comply with Motor Vehicle Division

Administrative Rule 810-5-75-.42,

which requires designated agents and title service providers to write or stamp

the word “SURRENDERED” on the face of the title document.

• Requirement 2:

• The original title documents must be maintained by the designated agent or

title service provider for one (1) year and then electronically for an additional

four (4) years.

• Warning:

• Failure to comply with these requirements may result in the revocation of the

authority to act as a designated agent or title service provider.

Publicly Accessible Title Applications

• Replacement Title:

• Applicants should apply for this type of title online by using the Public Title Portal

when an existing Alabama title has been lost, stolen, or mutilated.

• Lien Filing or Transfer:

• To add a lien, continue a lien, or transfer a lien, the recorded lienholder can apply

online by using the Public Title Portal.

• Vehicle owners or lienholders can visit the Public Title Portal to do any of

the following:

• Apply for a replacement title

• Apply online to add, continue, or transfer a lien on an Alabama title

• Check the status of a title application (must know the application number and VIN)

• Update an undeliverable address (must know the application number and VIN)

Legalities

• In accordance with the Code of Alabama, 1975 §32-8-6 and §32-20-4, the charge to a

dealer for a title application is $15.00 ($20.00 for a manufactured home).

• In accordance with the Code of Alabama, 1975 §32-8-6 (b) The designated agents shall

add the sum of one dollar fifty cents ($1.50) for each transaction, as specified in

subsection (a), processed for which this fee is charged to be retained as the agent's

commission for services rendered, and all other fees collected shall be remitted to the

department in a manner prescribed by the department.

• Code of Alabama, 1975 §32-8-7 states, in part, that county licensing officials may

charge up to $18.00. However, a dealer cannot charge more than $16.50 for a title

application fee. Charging more than $16.50 for a title application is a violation of the

Code of Alabama, 1975 §32-8-7. Violations of §32-8 are considered misdemeanors or

felonies and can result in fines, penalties, and/or the revocation of your dealer license.

• A dealer is required to maintain blanket liability insurance and a bond. A designated

agent is required to maintain a bond (the dealer bond will satisfy the requirement for a

designated agent bond).

Legalities Continued

• If a licensee fails to maintain blanket liability insurance and

bond coverage and the insurance or bond is canceled for any

reason, the dealer license and Designated Agent authority

(access to MyDMV) will be revoked immediately, as provided by

Code of Alabama, 1975 §

40-12-396.

It is important to note that if you change bond or insurance companies or make any adjustments to

the insurance or bond, you should upload the updated documents to your account on the dealer

license portal. If you are not a dealer, you should report any changes to your bond or insurance to the

Motor Vehicle Division to prevent revocation of your license/designated agent status.

Bill of Sale

• What are the minimum requirements for a bill of sale?

• As prescribed by Code of Alabama, 1975 §40-23-104, and Administrative Rule 810-5-1-.246, in order for License

Plate Issuing Officials and law enforcement to determine if a bill of sale, invoice, or other sales document is valid, it

must contain the following 9 items:

1. Name of purchaser(s)

2. The complete physical address of the purchaser(s)

3. Date of sale or acquisition (month, day, year)

4. Complete vehicle description: VIN, make, year, model or series number, body type

5. Name(s) of seller(s), including DBA (doing business as) names

6. Complete address of seller(s)

7. If the seller is a licensed retail dealer, the following language must be included on the Bill of Sale or other sales

document: “Penalty of fifteen dollars ($15) due if vehicle is not registered in the name of the new owner within

20 calendar days” as required by Code of Alabama, 1975 §

40-12-260.

8. Signature(s) of seller(s) and purchaser(s) or authorized representative of seller(s) and purchaser(s)

9. A licensed dealer must include the purchase price upon which any state, county, or municipal sales tax was

paid and the amount and rate of sales or gross receipts tax collected at the time of purchase for the state,

municipality, and county where the sale was made, as provided by Code of Alabama, 1975 §

40-23-104

Bill of Sale Examples

Driver’s Protection Privacy Act (DPPA)

• The Federal Driver's Privacy Protection Act (DPPA) was enacted by Congress to protect

the interest of individuals and their privacy by prohibiting the disclosure and use of

personal information contained in motor vehicle registration records, except as authorized

by such individuals or law.

• Personal information is defined as information that identifies a person, including an

individual’s social security number, name, address, telephone number, and medical or

disability information.

• A person who knowingly obtains, discloses, or uses personal information from a motor

vehicle record, for a purpose not permitted under the DPPA shall be liable to the

individual to whom the information pertains, who may bring a civil action in a United

States district court. In addition, a person in violation of the DPPA Act is subject to criminal

penalties as provided by Title 18, U.S Code,

§2723

DPPA ACT

Titles, Fraud

Detection, &

Remediation

Module 2

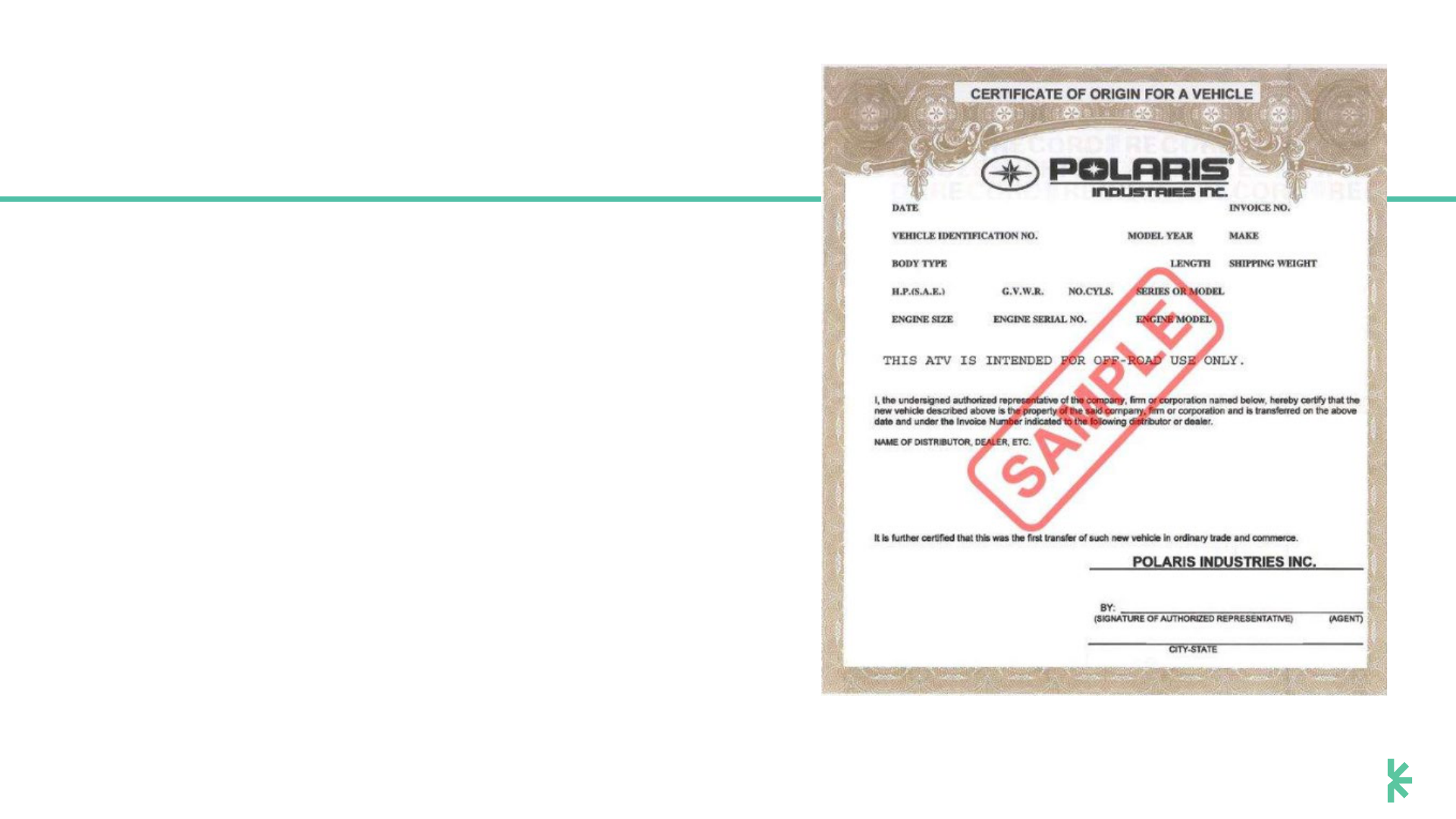

What is Manufacturer's Statement of

Origin (MSO)

The Manufacturer's Statement of Origin (MSO) is also known

as the Manufacturer's Statement Certificate of Origin (MCO).

These certificates are issued by the manufacturer and detail

information about the vehicle, including where the vehicle was

manufactured

Manufacturer’s Statement of Origin

Security Features

• In an effort to prevent counterfeiting, all Certificates of Origin should contain the following 9 security features:

1. Sensitized Security Paper or Non-Optical Brightener Paper: The use of either paper that is reactive to chemicals

commonly used to alter documents or paper without added optical brighteners that will not fluoresce under ultraviolet

light is required.

2. Engraved Border: This is a border produced from engraved artwork that appears on the front of the document.

3. Prismatic/Rainbow Printing: This type of printing is used as a deterrent to color copying. A Copy Void Pantograph,

where the word “void” appears when the document is copied may be present in lieu of or in addition to prismatic

printing.

4. Complex Colors: These are colors developed by using a mixture of two or more of the primary colors (red, yellow,

or blue) and black, if required.

5. Erasable Fluorescent Background Inks: These types of inks fluoresce under ultraviolet light and react to any

attempt to erase in such a manner as to be immediately detectable.

6. Background Security Design: This is marked by a repetitious design, consisting of a pattern, that hinders

counterfeiting efforts.

7. Microline: This appears as a line of small alpha characters in capital letters that requires a magnifying glass to read.

8. Consecutive Numbering: Documents that contain a number are consecutively numbered for control purposes.

9. Security Thread and/or Intaglio Printing: A thread may appear with or without watermark and the intaglio may or

may not be accompanied by a latent image.

MSOs & MCOs

Examples

• Because MCOs vary by manufacturer, remember that they

may have various security features in many combinations.

Manufacturers may choose to use the following types of

security features:

• Safety Blocks - An area that uses enhanced features to

prevent alteration, such as tints that indicate chemical or

mechanical alterations. Areas such as the odometer box

may have erasure-sensitive tints.

• Watermarks - A translucent design impressed on paper

during manufacture and visible when the paper is held to the

light.

• Microprinting - An anti-counterfeiting technique in which

very small text is added to the artwork. It is difficult or

impossible to read with the naked eye. This also makes it

difficult to reproduce accurately using copiers or scanners.

• Planchettes - A visual effect added to security paper as an

anti-counterfeiting measure

• Security Fibers - Both visible and non-visible fibers are

embedded and randomly distributed throughout the paper

during the manufacturing process.

MSOs & MCOs

Examples

Rainbow Printing Security Features

• This is an example of how manufacturers

may use the rainbow printing security

features on a certificate of origin for a vehicle.

Vehicle Title Security Features

• The Alabama Motor Vehicle Certificate of Title contains features that make it a secure

document. The security measures incorporated into Alabama’s title provide the state’s title

with the highest level of protection, which deters attempts at counterfeiting. All titles

issued by the Alabama Department of Revenue contain paper and print security features.

• A title typically contains pre-printed and variable-printed text to

display:

• Vehicle information

• Owner information

• Lienholder information

• Transfer of ownership- this area is often on the reverse side and must be completed and signed

by the owner/seller. The buyer’s information is typically handwritten in the spaces provided.

• Mileage/odometer information- mileage information is often contained on the vehicle title but

can also appear in a separate Odometer Disclosure Statement.

Watermarks

for Security

• A watermark is an

identifying image or

pattern in paper that

appears as various shades

of lightness/darkness

when viewed by

transmitted light, caused

by thickness or density

variations in the paper.

Watermarks are used on

government documents to

discourage counterfeiting.

Security Features

• Because security features may vary by jurisdiction, remember to look for other features

that may have been disturbed, damaged, or poorly counterfeited including:

• Safety Blocks - An area that uses enhanced features to prevent alteration, such as tints that

indicate chemical or mechanical alterations. Areas such as the odometer box may have

erasure-sensitive tints.

• Pantographs - In security printing, a method of making a tamper-resistant pattern in the

background of a document. Normally, these are invisible to the eye but become obvious when

the document is photocopied. Typically, they spell out “void”, “invalid”, or some other message.

• Seals - A tamper-evident feature to prove the authenticity of the document or signatures.

• Security Fibers - Both visible and non-visible fibers are embedded and randomly distributed

throughout the paper during the manufacturing process.

• Prismatic Print - Rainbow printing used as a deterrent to color copying.

• Sensitized Security Paper - Paper that is reactive to chemicals commonly used to alter

documents.

Tribal Nation Titles

Security Features

Tribal Nation Titles

Tribal Nations may also

issue original vehicle titles.

Like those from other

jurisdictions, these titles vary

among issuers. Look for the

appropriate information,

signatures, secure paper,

and security features

previously mentioned in this

course.

Knowledge Refresh

• Title Documents contain a number of security features that vary by

jurisdiction.

• Remember to look for security features that may have been disturbed,

damaged, or poorly counterfeited, including:

• Safety Blocks, Pantographs, Seals, and Security Fibers

• All Certificates of Origin should contain the same nine security features.

• Sensitized security paper or non-optical brightener paper, Engraved Border,

Prismatic/Rainbow Printing, Complex Colors, Erasable fluorescent background

inks, Background security design, Microline, consecutive numbering, security

thread and/or intaglio printing.

• Tribal Nations can also issue original vehicle titles.

Title Application

Basics

Module 3

Primary Documents Required

to Submit a Title Application

• The list below includes examples of the primary

supporting documents that will be covered in this

lesson:

• Manufacturer's Certificate (Statement) of

Origin (MCO / MSO)

• Alabama Certificate of Title

• Foreign Title Documents – Out of state title

documents

• Vehicle registration –if the vehicle is not

required to be titled

• Military registration

• The United States Government Certificate

to Obtain Title to a Vehicle (SF97)

• Court Order

• Title Bond

The Manufacturer’s

Certificate/Statement of Origin

• The Manufacturer's Certificate / Statement of Origins are

issued by the manufacturer and detail information about the

vehicle, including where the vehicle was manufactured.

• The MSO can be thought of as the birth certificate to a vehicle.

• The MSO is needed to certify extended warranties and protection

packages through the finance office and to obtain the car’s first title

and registration from the DMV.

The Front & Back of an MSO

The Front of an MSO

The front of the Manufacturer's

Statement of Origin contains detailed

information important to the identity of

a vehicle.

The Back of an MSO

The back of the Manufacturer's Statement of Origin

contains several assignments. An assignment is a

section on the title document which provides the

information necessary for legal transfer ownership of a

vehicle.

Alabama Certificate of Title and

Requirements

• What is an Alabama

Certificate of Title?

• An Alabama Certificate of

Title is a legal document

that records the owner

and identifying vehicle

information with the state

of Alabama.

• Vehicles newer than 35

model years old are

required to be registered

in Alabama and have an

Alabama Certificate of

Title.

Foreign Title Documents

• What is considered a Foreign Title Document?

• A Foreign Title Document is an out-of-state title that is recorded in the

database of another state. An out-of-state title can be transferred to the

state of Alabama; however, until the title transfer occurs, all title

transactions would have to be processed through the original state.

For Example:

The state of Georgia can only

process a replacement for a

Georgia title.

Out of State Title Examples

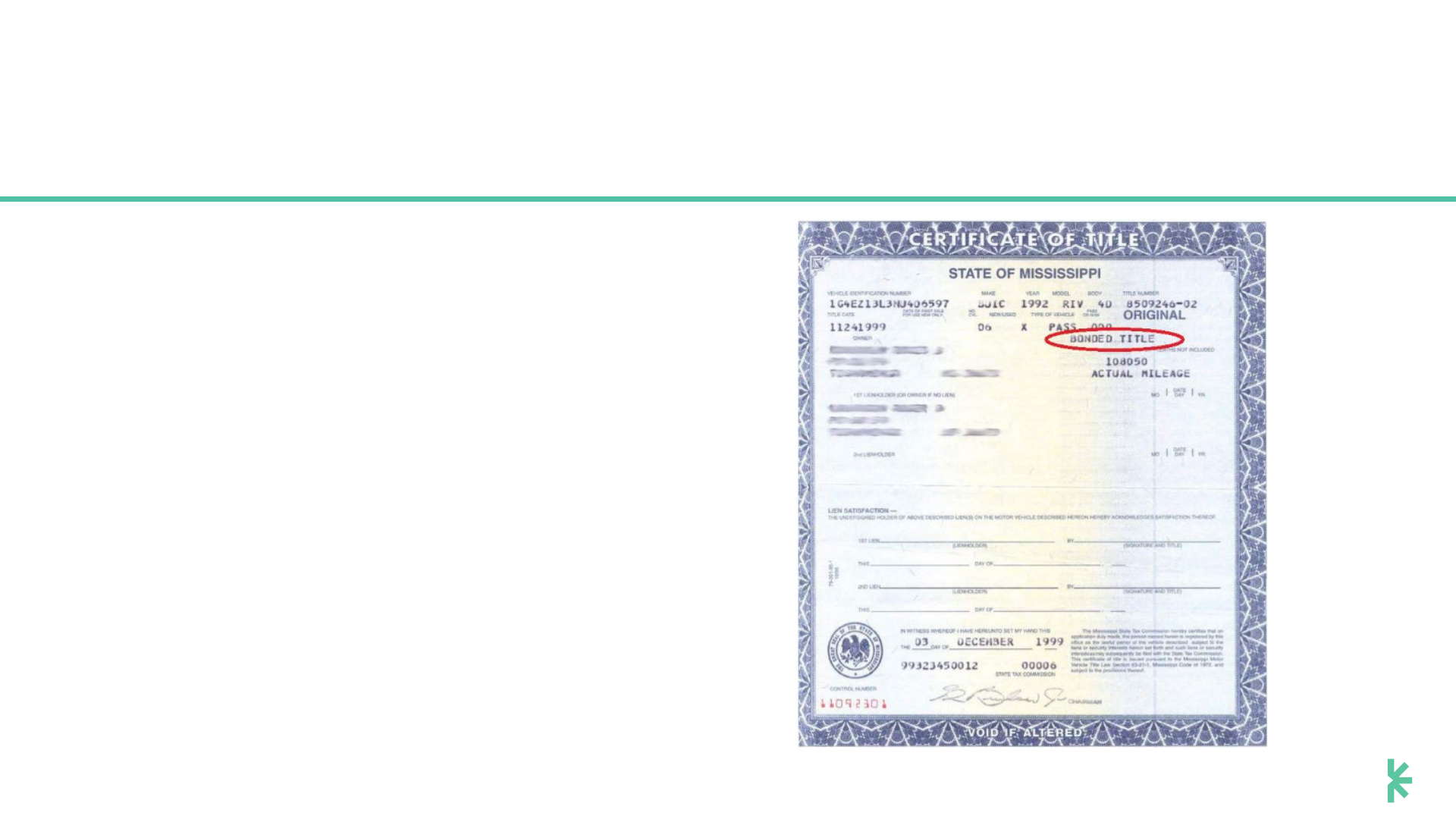

Mississippi Certificate of Title

• In this example, the

Mississippi title reflects a

brand of “Bonded Title” in

the right corner. The state

of Alabama does not accept

a bonded title from another

state, therefore, this vehicle

would be required to

undergo the surety bond

process in Alabama.

Out of State Title Examples

Florida Certificate of Title

• The first assignment for transfer

on a Florida Certificate of title is

presented on the face of the title.

• With an Alabama Certificate of

Title, the odometer certification

box is not checked for actual

mileage, whereas on the Florida

Certificate of Title, the box is

checked for actual mileage. Pay

close attention as marking the

odometer certification box

incorrectly could lead to an

odometer discrepancy brand on

the face of the title.

Out of State Title Examples

Georgia Certificate of Title Tennessee Certificate of Title

Out of State Title Examples

Arkansas Certificate of Title

The brand reflected on the left

side face of the title is “previous

damage.” If you are uncertain of

the meaning of a brand, you

should contact that jurisdiction.

Vehicle Registration Documents

• Title Laws Vary by State

• Due to laws varying by state, an out-of-state owner of a vehicle may not have a title. Therefore, if a vehicle

is exempt from titling in another jurisdiction, the registration will be used, in lieu of the title, as the primary

supporting document when applying for an Alabama Certificate of Title. In these situations, it is best to

validate the exemption with that jurisdiction.

• Below is an example of a Georgia Vehicle Registration:

Military Registration Documents

• Military Registration is acceptable as the primary supporting document if the vehicle has

not been previously titled when applying for an Alabama Certificate of Title.

• Below is an example of a Military Registration Documents:

The United States Government Certificate to

Obtain Title to a Vehicle (SF97)

• Government vehicles are

exempt from titling

requirements; however, if a

government vehicle is sold to

an individual, the vehicle is

required to be titled.

• The form that government

agencies must use to obtain a

title for a government vehicle.

Court Order

• A court order is an official proclamation by a judge (or panel of

judges) that defines the legal relationships between the parties

to a hearing, a trial, an appeal, or other court proceedings. Such

a ruling requires or authorizes certain steps by one or more

parties to a case.

• Title Procedures states: A court order must be certified by the

Clerk of Court or the Judge. (The Electronically Filed label is

also acceptable as certification).

Court Orders Continued

A title can be issued with a court

order. The most common court

order is a divorce decree. When a

court order is presented, it must

contain four essential elements:

1. The case number

2. The Clerk of Court’s or

Judge’s signature

3. Identify who the vehicle

ownership is being awarded

or given authority to sell the

vehicle.

4. The full VIN on the order

must clearly state/describe

the vehicle that is being

awarded.

Reporting Requirements & Involuntary Transfers

Reporting Requirements for a Court Order

• Code of Alabama 1975, §32-8-46, requires a person or entity

initiating an involuntary transfer by court order or operation of law to

give notice of the action to the Department at least 35 calendar days

prior to the date of the transfer. These laws were enacted to protect

lienholders and provide them with sufficient notice of transfer of a

vehicle for which they have an interest.

Transfer of ownership by court order should be reported through

the Department’s Involuntary Transfer Portal

Title Brands

• Title branding is the use of a designation on a vehicle’s title,

registration, or permit documents to indicate a particular

condition. In many jurisdictions, the designation is permanent.

Typically, the vehicle has been “written off” or “totaled” due to a

collision, fire, flood, or has been sold for scrap. This practice

both deters auto theft and protects consumers.

Title branding laws, regulations, and brand terms/definitions vary by

state/jurisdiction.

Common Brands That May Appear on An

Alabama Title

• Lemon Law Brand- This vehicle was returned to the manufacturer because it did not conform to its warranty.

• Salvage- A vehicle is determined to be salvaged when the damage to the vehicle is equal to or greater than 75% of its retail

value. Salvage is discussed in a later course.

• Specially Constructed- A vehicle may be assembled from parts or by an assembly kit. An example of this is a “build your

own replica” of an antique car.

• Rebuilt Vehicle- A vehicle that has been restored in this state to its operating condition which existed prior to the event which

caused the salvage certificate of title to be issued.

• Reconstructed Vehicle- A vehicle that has been repurposed.

• Flood Damage- Flood damage occurs when an insurance company certifies water damage has caused the vehicle to be

salvaged (the amount of water damage is 75% or more of the fair market value of the vehicle).

• “This Title is Secured Under a Three (3) Year Surety Bond”

• “Previous Title is Electronic”- An electronic title was issued to the lienholder and must be converted, by the lienholder, to a

paper title for any further transactions.

• “This Vehicle May Be Subject to an Undisclosed Lien”- This legend can be removed from the title after four months.

• Odometer Reading is in Kilometers- The odometer reading should always be reported as miles. Vehicles brought in from

outside the United States may have reported odometer readings in official documents as kilometers.

• “This is a Replacement Certificate of Title and May be Subject to the Rights of a Person Under the Original

Certificate.”- All replacement certificates of titles are issued with this disclaimer.

Out of State Brands

• The state of Alabama does not accept bonded titles from other

states. To apply for a title on the state of Alabama with an out-

of-state title that a surety bond brand, the applicant must first

apply for a title surety bond through the department's surety

bond portal.

Undeliverable Address

• How is the Undeliverable Address flag used?

• When a title is undeliverable or returned by the postal service, the title

record will be marked as undeliverable. The undeliverable flag will not

be reflected on the certificate of title but is recorded in the title record

database.

The vehicle owner can update the address by visiting the Public Title

Portal, or the designated agent can update the address in myDMV. To

update the Public Title Portal address, the owner must have both the title

application number and the VIN number of the vehicle. Once the address is

corrected, the title will be mailed the following business day.

Odometer Legends

• The Federal Truth in Mileage Act is a federal law that governs odometer disclosure. It is important to note

that the Federal Truth in Mileage Act expanded odometer disclosure requirements effective January 1,

2021.

• Odometer Reading is Actual Mileage

• The mileage has been recorded and certified as required by the Federal Truth in Mileage Act.

• Exempt from Disclosure

• The mileage is not required to be certified as determined by the Federal Truth in Mileage Act.

• Exceeds Mechanical Limits

• If an odometer has reached the highest number mechanically available, or "rolled over," the title will indicate "exceeds

mechanical limits."

• Odometer Discrepancy

• A title will reflect "odometer discrepancy" when the department has reason to believe that the odometer reading does not

reflect the true mileage of the vehicle due to known previous recorded values for the vehicle.

• Odometer Not Certified

• This legend would commonly be reflected on a title when the transaction did not involve a transfer, and therefore, the mileage is not

required to be certified.

• Inoperable Odometer

• Odometer certification reading is unavailable.

Bonded Titles

• When Does a Vehicle Require a Bonded Title?

• A surety bond is necessary when the state does not have an accurate

record of ownership or when a valid title does not exist. Therefore, the

state does not have an accurate record of ownership. A bond is similar

to an insurance policy for the state. If another person makes an

ownership claim through the court system and is awarded the vehicle,

the state will make a claim against the bond to pay for the judgment

claim or award.

Titles issued with a surety bond as the primary supporting

document are secured under a three (3) year surety bond.

Common Reasons a Surety Bond Title

is needed

• Skips in the Chain of Ownership

• This occurs when the transfers on the back of the title are not in chronological order

or are incomplete- if a buyer or seller is not reported in one of the assignments

• A Dealership Closed

• When dealerships close without completing the title paperwork a surety bonded title is

necessary.

• The Owner Never Received the Title

• This occurs when the previous owner doesn't provide the new owner with the current certificate of title for

the vehicle.

If the Department is not satisfied as to the ownership of the vehicle or that there are no

undisclosed security interests in it, the department may, as a condition of issuing a

certificate of title, require the applicant to file with the Department a cash or surety bond (32-

8-36 or 32-20-24).

Applying for an Alabama Certificate of

Title Under Surety Bond

• To apply for an Alabama Certificate of Title, the applicant will

apply using the public Surety Bond Portal on myDMV.

Applicants must provide proof of ownership as part of the

application process. Valid forms of proof are:

1. Bill of Sale

2. The invalid title

3. Registration documents

4. Insurance settlement.

Surety Bond Approval

• Upon approval of the Surety Bond Portal Application, the applicant will be provided a

Certificate of Title Surety Bond Form (MVT 10-1) with a pre-determined amount. The

amount of the bond is based on standardized amounts of vehicle values. The applicant

must print the Certificate of Title Surety Bond Form (MVT 10-1) and have it completed by

an insurance agent.

• The applicant must take their Certificate of Title Surety Bond (Form MVT 10-1) to an

insurance company of their choice for completion. The insurance agent must complete

the MVT 10-1 in detail, which includes the certificate of title surety bond number, the

name of the surety company and the state of incorporation, the date of execution,

signatures of both the owner (principal) and the insurance agent and issue a company

seal directly on the form MVT 10-1. The insurance agent must also provide the applicant

with a power of attorney to accompany the Certificate of Title Surety Bond.

• Lastly, the applicant must take the completed Certificate of Title Surety Bond (Form MVT-

10) and the power of attorney provided to them by the insurance company, to any

Designated Agent so they can apply for an Alabama Certificate of Title.

Criteria for Standardized Bond

Amounts

• The charts below are available in the Surety Bond Portal and

represent the standardized amounts, which are based on the

vehicle's age and demonstrate how the bond amount are

determined.

• Alabama uses standardized bond amounts that are determined

using the VIN number. However, some states simply use fair

market value to determine the amount of the bond. When

applying for a bond, the system will print the bond with the

appropriate bond amount.

Bound Amounts

Trailers & Motorcycles

Passenger Vehicles and Pickup Trucks

Trucks, Buses, and Recreational Vehicles

Manufactured Homes

Bond Criteria

• Administrative Rule 810-5-75-.34 provides that when the

owner(s) of a vehicle deemed "salvage," applies for a certificate

of title under a surety bond, the bond amount must be:

• 25% of the bond amount for the vehicles less than ten (10) model years

old.

• 20% of the bond amount for the vehicles ten (10) or more model years

old.

Title Assignments

Module 4

Federal Truth-In-Mileage Act

• The Truth in Mileage Act (TIMA) of 1986 is a federal law that

requires the seller of a motor vehicle to provide an odometer

disclosure to the buyer at the time of sale or transfer of ownership. It

requires that the mileage registered on the odometer is accurately

recorded and certified by 2 independent sources, such as the car’s

owner and a company representative. The buyer must sign in

acknowledgment of the mileage disclosure given.

• TIMA is a federal law that also states the same person, or

representatives of the same company cannot sign to certify mileage.

The buyer (or a representative of the buyer) and the seller (or a

representative of the seller) must sign in the title assignment or re-

assignment to certify mileage.

• Effective January 1, 2021, the TIMA odometer disclosure

requirements increased from 10 years to 20 years. Vehicles

with a year model 2011 and forward are exempt after 20 years.

Vehicles with a year model 2010 and older will remain

exempted, but 2011 model vehicles will not be exempted until

the year 2031.

• Effective January 1, 2021, 2010-year model and older vehicles

will continue to be exempt from mileage.

• Effective January 1, 2021, 2011-year model and newer will still

require odometer disclosure for 20 years.

Odometer Reading Disclosure Timeframes

• Model year 2010 and older vehicles will continue to be exempt

from federal odometer disclosure requirements. However,

sellers of model year 2011 and newer must continue to disclose

odometer readings for 20 years.

• For example, sellers of model year 2011 vehicles must continue

to disclose odometer readings until 2031.

Exemptions from the Truth and

Mileage Act

• There are some vehicles that the Federal Truth-In-Mileage Act

does not apply to:

• Vehicles that are model year 2010 or older (applicable until 2031)

• Vehicles with a gross weight of 16,000 lbs or greater such as tractors

(18 wheelers), motorhomes, and some chassis and cab trucks.

• Beginning January 1, 2031:

• Any vehicle that is 20 years or less will be considered exempt from the

Federal Truth in Mileage Act. A 2011 model vehicle will not be exempt

until 2031. The exemption begins on the first day of a calendar year.

Why Would a Title Application Be

Rejected?

• The most common reason for a rejected title application is related to the Federal Truth-in-

Mileage Act.

• When the owner of the vehicle appoints the dealer as their POA and a representative of the

dealer signs as the seller (POA), and then a representative from the dealer signs on behalf of

the dealership as the buyer.

• Two independent parties are required to certify mileage. The federal law does not allow the

same person or two representatives of the same company to sign as both buyer and seller

certifying the odometer reading in the title assignment.

• There are Exceptions to the Rule:

• The Federal Truth-In-Mileage Act prohibits the same person or representative of the same

company from signing the odometer disclosure. The exception applies when a secure POA

is used (we will cover this process later in the course.)

Odometer Disclosure Statement

• An odometer disclosure statement is simply a declaration of a

vehicle’s mileage as indicated by its odometer reading at the

time of transfer and discloses whether or not, it's an accurate

odometer reading (i.e. Not Actual, Exceeds Mechanical Limits).

• On the back of an Alabama title, the title assignment has two

boxes provided specifically for the odometer disclosure

statement, if it is not ACTUAL MILEAGE. These boxes are

located above the signature lines.

Odometer Certification Requirements

• Vehicles must be a 2011 model or newer.

• The transferor of a non-exempt vehicle must disclose the odometer reading to the

transferee at the time of transfer.

• The disclosure shall concern the accuracy of the mileage reflected on the odometer.

• The transferor shall disclose, in the title assignment and/or an odometer disclosure

statement, by checking the appropriate block if the mileage reflected on the vehicle’s

odometer is not the actual mileage.

• The transferor must sign and print his or her name to complete the odometer

disclosure.

• The transferee must sign and print his or her name to acknowledge the odometer

disclosure.

• Requires that certain language be incorporated in the odometer disclosure.

• Prohibits the same person or representatives of the same company from making the

odometer disclosure and acknowledging that disclosure.

Completing the Odometer Certification

of the Title

• Completing the title assignment will be different when the

vehicle is exempt and when it is non-exempt.

• Regardless, you must complete the title assignment as seen below:

Odometer Certification

• A vehicle that is a 2011 model or newer is NOT exempt, and so

the entire assignment must be completed.

• For 2010 model vehicles or older, the following information is

not required, and the corresponding fields may be left blank:

• the odometer reading

• both the printed name and signature of the buyer.

• the printed name of the seller BUT the seller's signature is required and

serves to release their interest in the vehicle

Including more information is not wrong. Providing less information

will result in a rejection. So, when in doubt, complete the assignments in

their entirety.

Title Assignment Essentials

• Each title assignment must be fully completed at the time of transfer. All

information must be provided. The chain of ownership must be complete.

• Title Assignments must have all of the following items:

1. The date of sale

2. The buyer’s name and address

3. An Odometer Reading

• Remember: The odometer reading is NOT required when the vehicle is exempt under the Federal

Truth and Mileage Act.

4. Buyer(s) and Seller(s) Signatures

• Both the printed name and signature of the buyer is required unless the mileage is exempt (If the

mileage is exempt, then the buyer does not have to sign or print their name).

• The printed name and signature of the seller is required unless the mileage is exempt. If the mileage

is exempt the seller doesn’t have to print their name, the seller needs only to sign their name in order

to release their interest in the vehicle).

Title Assignment

Process

• The following scenario is an

example of a chain of

ownership that could occur for

dealers.

• It will show how vehicles move

through the various chains of

ownership with the same title

documents. You will also

observe how the process

changes once the vehicle is

sold to an individual rather than

another dealer. This procedure

is documented as the title

assignment on the right shows.

Any Alteration

includes:

1. Strike throughs;

2. Tracing over a

letter or

number;

3. Using a different

color ink in the

middle of a

name;

4. Using an ink

color other than

black or blue.

Selling a Car to a Dealer EXAMPLE

• In this example, Joe Jones owns the vehicle, and on January 15, 2019 he sells his vehicle

to a dealer, Magic Cars. The mileage is certified at 21,555.

• (Chain of Ownership documentation) Cindy Lee is a representative of Magic cars, so she

signs and prints her name on the bottom left of the first assignment. Any dealer

representative can sign on behalf of the dealer.

• However, the name of the individual –not the dealer name - must be listed as the buyer or

seller.

• On February 15, 2019 Magic City Sells the Car to Another Dealer

• Magic City must list their dealer license number at the top of this assignment. Although

Cindy Lee signed as the selling representative for Magic City, any rep could have signed

as the seller.

• On March 21, 2019, Top Rate Cars sold the vehicle. The vehicle is sold to another dealer,

Best Auto Sales.

What did you observe in this example?

a) The vehicle Can be transferred from dealer to dealer using the

back of the same title

b) Once sold to an individual, the vehicle would be officially titled

c) All of the above

• The correct answer is c) All of the above. The same title can be used

in between dealers, but an individual will not use the same process.

• There are different requirements for dealers vs individuals

• For dealers, all assignments on the back of the title must be completed in

their entirety for each transaction or it will be rejected.

Reminder

• As observed in the scenario above, a vehicle can be transferred from

dealer to dealer using the back of the title. However, once the vehicle is

transferred to an individual, the fehicle must be titled.

• Please Note: All assignments on the back of the title must be completed

in their entirety! Any information left incomplete will result in the title

application being rejected.

• As detailed in the scenario, the chain of ownership must be accurately

completed, and transfer dates must be chronological. If the assignments

do not accurately reflect the transfers that occurred, then a skip in the

chain of ownership has occurred, and the title is no longer valid.

• Please Note: Sometimes, all of the assignments on the back of the title

have been used and/or completed. That is when you need to use a Dealer

Reassignment Form (Form MVT8-3)

Understanding the Dealer Reassignments

• Things to Remember About the Dealer Reassignment Form

(MVT 8-3)

• This form can only be initiated by an Alabama Dealer.

• Form MVT 8-3 can be found here.

• It can only be initiated when all available assignments have been

completed. Once a re-assignment form has been initiated by someone

(even a dealer from another state), you are prohibited from using any

unused assignments on the title. Additional assignments must be made

on the re-assignment form.

• The MVT 8-3 cannot be used to correct an error in an assignment

Foreign Reassignment Supplement Forms

• Must be initiated by the dealer from the state where the form

originated.

• If an out-of-state dealer has left the back of a title and initiated a

re-assignment supplement form-subsequent dealers are

prohibited from using any unused assignments on the title. Any

additional assignments must be made on the out-of-state re-

assignment form.

Correcting an Error in a Title Assignment

• If an error is made in an assignment, it can be corrected using

the

Form MVT 5-7, Affidavit to Correct an Assignment on a

Certificate of Title.

• These are the things to remember when you need to complete

an affidavit:

• It can only be used to correct an error on the back of the title in an

individual assignment.

• It can only be used if the buyer or seller is a licensed Alabama dealer

or a legal resident of Alabama.

• It can be used to correct either an assignment by registered owner or a

reassignment by a licensed dealer.

• Must contain signatures of both the seller and the buyer.

Restrictions on the Use of Form MVT 5-7

• To correct information or errors on the face of the title - a corrected

certificate of title must be obtained from the issuing jurisdiction.

• For example, as a general affidavit, a one-and-the-same affidavit – a

separate affidavit must be provided for the error.

• To correct other documents such as a power of attorney- a new document

must be provided.

• When correction fluid appears in any area on the title – a replacement title

is required.

• To correct erasures; including typewriter lift-off – a replacement title is

required.

• To correct alterations caused by heavy lines or blotting out information – a

replacement title is required.

• To correct skips in the chain of ownership – a title bond is required.

Transferring the Title

• If the title of a vehicle is in the name of a deceased person, the process to transfer the title will

be different depending on if the owner’s estate has been probated or not.

• If the owner’s estate is probated:

• An individual signing on behalf of the deceased owner’s estate must provide a copy of the

letters of testamentary or letters of administration issued by the probate court.

• Note: A power of attorney cannot be used to sign on behalf of the executor or next of kin in

the title assignment on the back of the title.

• If the owner’s estate is not probated:

• The individual signing on behalf of the deceased owner must provide the following

documents:

• Properly completed Next of Kin Affidavit or form MVT 5-6. (Note: Upon clicking the link,

please enter the exact form number only in the Number Search box on the Forms page.)

• Copy of the owner’s death certificate.

• Note: A power of attorney cannot be used to sign on behalf of the executor or next of kin in

the title assignment on the back of the title.

Power of Attorneys

and Liens

Module 5

Power of Attorney

• What is a Power of Attorney?

• A Power of Attorney is a legal document that appoints or gives someone the

legal authority to act on behalf of another. A Power of Attorney should contain

the following essential information:

• Date document completed

• Name and address of individual appointed as attorney-in-fact

• Original signature of attorney-in-fact (required only if space provided for signature on

document)

• A complete description of the vehicle, including vehicle identification number (VIN),

year, make, model, and body type

• Purpose(s) for which the appointment is intended (owner shall place a checkmark

next to each purpose listed on the Power of Attorney Form

MVT 5-13, to detail which

appointment is intended)

• Original signature of the owner (individual appointing attorney-in-fact) and their

address

Types of Power of Attorney

• General and Durable Power of Attorney

• A General or Durable Power of Attorney grants full power and allows

the appointee to execute any legal matter. A good example of this is a

military person leaving the country granting their spouse full legal

power while they are away.

• Limited Power of Attorney

• A Limited Power of Attorney grants power to handle a certain type of

business or transaction. For example, handle the sale of a vehicle.

• Specific Power of Attorney

• A Specific Power of Attorney grants the appointee power to handle a

very specific named transaction. For example, title application only.

Certifying Odometer with a Power of Attorney

• The Federal Truth-In-Mileage Act prohibits the same person or

representative of the same company from making the odometer

disclosure and acknowledging that disclosure. In other words, it

takes two separate parties to certify mileage. When this doesn't

occur, it is a common reason for a rejected title application.

• The error commonly happens when the owner of the vehicle

assigns the dealer as their Power of Attorney (POA) and when

the title arrives, a representative of the dealer signs on behalf of

the buyer or seller (POA), and a representative from the dealer

signs on behalf of the dealership as buyer or seller.

Things to remember

about POAs

• Remember: Two independent parties are

required to certify mileage. The person

appointed as POA should not be associated

with the dealership.

• In this example, a dealership representative

has signed as both seller and buyer to

certify the mileage on the back of the title.

The application was rejected because a

dealership was appointed as Power of

Attorney using the MVT 5-13, which does

not certify mileage. The dealership has

signed as both buyer and seller in the

assignment on the back of the title. Again,

two independent parties are required to

certify mileage on the back of the title,

therefore, the application was rejected.

Secure Power of Attorney

• The Secure Power of Attorney is used as an exception to the

rule that prohibits the same person or representatives of the

same company from signing the odometer disclosure.

• When can a Secure Power of Attorney (MVT 8-4) be used?

• The Federal Truth-in-Mileage Act of 1986 permits states to provide a

power of attorney form for use by owners when transferring their motor

vehicles, and their certificate of title is held by a duly recorded

lienholder, or the certificate of title is lost and a replacement certificate

of title must be obtained.

• How to obtain a Secure Power of Attorney form (MVT 8-4)?

• The Secure Power of Attorney Form MVT 8-4 can be printed. It is also

available at any of the dealer associations.

Secure Power of Attorney…CONTINUED

• The Federal Truth-in-Mileage Act of 1986 mandates:

• This form may ONLY be used when the title is physically held by the

lienholder or has been lost.

• This form must be submitted to the state by the person exercising

Powers of Attorney. Failure to do so may result in fines and/or

imprisonment.

Completing the Secure POA

• Step 1: Complete Part A & Document Mileage

• The first section to complete on Form MVT 8-4 is Part A: the Transferor’s

Power of Attorney to Disclose Mileage. You must disclose the mileage of the

vehicle in this section. The mileage for the vehicle will be certified on the day

the Secure POA is completed. When the title arrives, the information certified

on the Secure POA is then transferred to the title assignment-exactly as it is

stated on the Secure POA.

• The Federal Truth-In-Mileage Act of 1986 states:

• The secure power of attorney can be used to disclose the vehicle's odometer

reading by the titled owner and will also permit the transferee to complete the

assignment of title.

• The odometer disclosure and date recorded in the title assignment must be

exactly as stated on the odometer disclosure made on the Secure Power of

Attorney.

Completing the Secure POA

• Part B: Transferee’s Power Of Attorney To Review Title

Documents And Acknowledge Disclosure, is to be completed

ONLY if the title is outstanding and the vehicle is sold again.

• When should Part B of the Secure POA (Form MVT 8-4) be

completed?

• Outstanding Titles: Part B should be completed only if the title is

outstanding (waiting for a replacement or held by a lien holder) and the

vehicle is sold again.

Part B of the Secure POA…CONTINUED

Perfecting a Lien

• How is a lien perfected, and why is it important?

• Perfecting a lien means to record the lienholder’s security interest in the vehicle

according to statutory requirements. Perfecting a lien is important because the lien date

establishes priority against other creditors.

•

Article Three of the Alabama Uniform Certificate of Title and Anti-Theft Act prescribes the

exclusive method for perfecting security interests in motor vehicles required to be titled

under the Act.

• A security interest is perfected by the delivery to the department of the existing

certificate of title containing the name and address of the lienholder and the date of his

security agreement and the required fee.

• The lien is perfected as of the time of its creation if the delivery is completed within 30

days thereafter otherwise, as of the time of the delivery.

Please Note: If the title application package is received within 30 days, the lien is perfected as of the

creation date. However, if the title application package is received after 30 days, the lien is perfected as of

the date that the department receives the application.

Releasing a Lien

• A lien release is when the holder of a lien, or security interest in

a piece of property, lifts or waives the lien, rendering the

property free to purchase.

• The two ways a lien is released are:

• Release by signature

• Release by age

Lien Release by Signature

There are two conditions that apply to a lien released by signature:

• Title with Lien Release Requirements:

• Signature of authorized representative of lienholder

• Date of lien release

• Name of lienholder

• Separate Lien Release Requirements:

• Lien release must be on letterhead. If not on letterhead it must include the name of

the recorded lienholder.

• Lien release must provide the name of the owner with whom the lienholder held a

security agreement.

• Lien release must identify the vehicle by complete vehicle identification number (VIN).

• Lien release must state clearly that the lien has been released and show the date of

release.

• Lien release must be signed by an authorized representative of the recorded

lienholder.

Lien Release due to Age

There are two conditions under which age can result in a lien release:

• When a lien is more than 12 years old:

• Liens shall be considered satisfied after twelve (12) years from the date of the lien as

recorded on the certificate of title.

• Exceptions to this rule: manufactured homes, travel trailers, or vehicles that weigh more than

12,000 pounds gross weight.

• An Example: Consider a 2000 model year vehicle with a recorded lien date of 1/1/2000. The

lien is satisfied by operation of law, due to age, on 1/1/2012.

• The 12 Year/4 Year Rule: This release applies when a vehicle is older than 12 model

years and the lien is more than 4 years old.

• Lien shall be considered satisfied, and release shall not be required after four years from the

date of the security agreement as recorded on the face of the certificate of title.

• Exceptions to this rule are manufactured homes, travel trailers, or vehicles that weigh more

than 12,000 pounds gross weight.

• For example, consider a 2000 model year vehicle with a recorded lien date of 01/01/2010.

The lien is satisfied by operation of law, due to age, on 1/1/2014.

Things to Remember about Liens

• If a lien will be released by operation of the law, due to age, a

Designated Agent can extend the lien (prior to the lien release

date) by logging into MyDMV and creating an application for

Lien Management– Continue Lien.

Repossessions,

Salvage & Rebuilt

Vehicles

Module 6

Repossession Form MVT 15-1

• Repossessed Motor Vehicle Affidavit and Disposition of Vehicle

Under Lien, also known as Form MVT 15-1, must be completed

by the recorded lienholder when a vehicle is repossessed.

• The lienholder may assign the vehicle ownership without

obtaining a title in their name if their lien is recorded on the face

of the title.

• Things to consider before completing form MVT 15-1:

• The date of repossession is the date the lienholder recovers the vehicle

from the owner.

• The lien on the face of the title should not be released when a vehicle

has been repossessed.

Lienholder of Record Repossessions

• The MVT 15-1 is a supporting document to a title and cannot be

used to reflect a transfer of ownership. The actual transfer is

accomplished when the repossessing lienholder completes the

assignment by registered owner on the back of the title.

*Please note: A repossessing lienholder who is also a licensed dealer should complete the registered

owner section (not an assignment by the licensed dealer) since the vehicle is being sold as the result

of the repossession.

• If you are the recorded lienholder on the face of the title, simply

complete the Repossessed Motor Vehicle Affidavit and Disposition of

Vehicle Under Lien, Form MVT 15-1, and complete the back of the

title to transfer the vehicle.

Form MVT 15-1 is available to

download/print on the Department of Revenue website.

Unrecorded Lienholder Repossessions

• If a vehicle is repossessed before the lien has been recorded on

the certificate of title, the unrecorded lienholder must obtain the

certificate of title in their name before transferring the vehicle’s

title.

• The following documents must be submitted to title in the name

of the unrecorded lienholder:

1. A title application in the lienholder’s name

2. Certificate of title in the name off or assigned to the individual(s) from

whom the vehicle has been repossessed

3. Security agreement signed by the owner(s)

4. Repossessed Motor Vehicle Affidavit and Disposition of Vehicle

Under Lien (form MVT 15-1)

Salvage Vehicle Definitions and Requirements

• The following definition and requirements are found in Section 32-8-87,

Code of Alabama 1975.

• When the frame or engine is removed from a motor vehicle and not

immediately replaced by another frame or engine, or when an insurance

company has paid money or made other monetary settlement as

compensation for a total loss of any motor vehicle, the motor vehicle shall

be considered salvage.

• A total loss occurs when an insurance company or any other person pays

or makes other monetary settlements to a person/company when a vehicle

is damaged and the damage to the vehicle is equal to or greater than 75

percent of the fair retail value of the vehicle prior to the damage.

• Retail value is required to be based upon a current edition of a nationally

recognized compilation of retail values, including automated databases.

Salvage Vehicle Definitions and Requirements

CONTINUED

• A salvage vehicle is not legally operable on Alabama roadways.

• Alabama law will not allow a salvage title to be issued once a current salvage title

already exists. Ownership is transferred using the assignments on the back of the

title, however, the vehicle must undergo the rebuilt inspection process and only a

rebuilt title can be issued after a salvage title has been issued. Note: Only

licensed Alabama rebuilders can apply for rebuilt inspection, unless the vehicle

was an owner retained salvage.

• The Department of Justice requires all junkyards and salvage yards handling five

or more junk or salvage vehicles per year to report to NMVTIS (National Motor

Vehicle Title Information System) with specific information on each junk or

salvage automobile obtained in whole or in parts in the prior month. NMVTIS is

intended to protect consumers from fraud and unsafe vehicles and to keep stolen

vehicles from being resold. Failure to report to NMVTIS as required is punishable

by a civil penalty of $1,000 per violation.

Salvage Vehicle Definitions and Requirements

CONTINUED

• NMVTIS allows the public to check whether a business is

registered to report to NMVTIS and the date of the registered

business’ last report. The public search can be found at

https://vehiclehistory.bja.ojp.gov/nmvtis/nmvtis_who_report

.

• Designated Agents shall complete a salvage application for title

in MyDMV. Non-Designated Agents should complete an

Application for Salvage Certificate of Title, Form

MVT 41-1,

found at: https://revenue.alabama.gov/forms/?d=motor-vehicle.

Rebuilt Vehicles

• The Department may issue a certificate of title to any motor

vehicle for which a salvage certificate has been issued by this

or any other state, and the vehicle has, in this state, been

completely restored to its operating condition which existed

prior to the event which caused the salvage certificate of title to

issue, provided all requirements of the Code of Alabama 1975,

Section 32-8-87, have been met.

• No certificate of title shall be issued for any motor vehicle for

which a "junk" certificate has been issued or for a vehicle which

is sold "for parts only” or if NMVTIS reflects the vehicle

disposition as “crush."

Salvage or Rebuilt Vehicles Disclosure

• Designated Agents are required by law to disclose, in writing, that a

vehicle is salvaged or rebuilt, even if the vehicle is donated.

• Code of Alabama 1975, §32-8-87, states, in part:

1. Each person who sells, exchanges, delivers, or otherwise transfers

any interest in any vehicle for which a title bearing the designation

"salvage" or "rebuilt" has been issued shall disclose in writing the

existence of this title to the prospective purchaser, recipient in

exchange, recipient by donation, or recipient by other act of transfer.

2. The disclosure shall be made at the time of or prior to the completion

of the sale, exchange, donation, or other act of transfer, and shall

contain the following information in no smaller than 10-point type:

"This vehicle's title contains the designation 'salvage' or 'rebuilt.'

Rebuilt Inspection FAQ

• Who can apply for a rebuilt inspection?

• The owner of the vehicle at the time of loss prior to the vehicle being deemed

salvage or a licensed rebuilder.

• What is the cost of an inspection

• The inspection fee is $75,00 and the title application fee is $15.00 for a total

of $90 payable at the time the title application is submitted.

• May I apply for an inspection of a vehicle that was rebuilt in another

state?

• No, Section 32-8-87, Code of Alabama 1975, provides only for inspections of

vehicles rebuilt in this state

• How do I schedule an inspection?

• Upon receipt, review, and approval of your application package, a Motor

Vehicle Inspector should contact you, within 5-7 business days, to schedule

the inspection.

Rebuilt Inspection FAQ…CONTINUED

• How do I submit an application?

• Rebuilders: Application packages are submitted in the same manner as all other title

applications.

• Individuals (owner retained): The individual must have been the titled owner of the vhicle

prior to the incident that caused the vehicle to be salvaged. The application form

INV 26-

15

, can be found on the department’s website at: https://www.revenue.alabama.gov/forms/

• What are the application requirements?

• Every application must indicate repairs made and/or component parts (major or minor)

replaced.

• Major parts replaced require a notarized bill of sale referencing the VIN

• Minor parts require a bill of sale notarization not required).

• Repairs should be entered on the application by selecting “other” under “Minor Parts”

• What documents are required to be submitted with the application?

• Outstanding salvage certificate of title.

• Notarized bills of sale for major parts and bills of sale for minor parts

Dealer Tags,

Temporary Tags and

Sales Tax

Module 7

Legal Dealer Tag Usage

• Where and who can legally display dealer tags?

• The legal use of dealer tags is limited to vehicles owned by the dealership

and held in the inventory for sale.

• Such use is limited to the following:

• The owner of the dealership

• Partners of the dealership

• Corporate officers of the dealership

• Employees of the dealership

• Prospective purchasers (limited to 72 hours)

• Temporarily Loaned Vehicles

• Vehicles temporarily loaned to customers while repairing their

vehicle or loaned to a high school for student driver education, as

long as no fees are charged.

Dealer Tag Usage

• Dealers may purchase a standard plate for inventoried vehicles including

those not qualified to display dealer plates. No motor vehicle ad valorem

taxes or sales tax shall be collected by the local issuing official when a

standard plate is issued for a motor vehicle held in inventory by a licensed

new or used motor vehicle dealer. §40-12-264(k)

• Dealer tags may NOT be used on the following vehicles, even when in the

dealer’s inventory:

• Rental or lease vehicles

• Tow Trucks

• Service Trucks or Vans

• Other vehicles used for any commercial purpose

*Any person who makes willful misstatements or files documents with

erroneous information in order to obtain motor vehicle plates may be

assessed a civil penalty of $1,000 by the department.

How are dealer tags obtained?

• Upon presentation of the dealer regulatory license and county

privilege license, tags will be issued by the Motor Vehicle

Division. Tags can be purchased through the dealer’s account in

MyDMV.

• Please Note: New franchise dealers may purchase up to 35

combined motorcycle and dealer plates. Used dealers may

purchase up to 10 combined motorcycle and dealer plates. Any

new or used dealer who completes title applications for 300 or

more vehicles during the previous dealer year may purchase a

combined total of up to 25 additional motorcycle and dealer

plates. §40-12-264

Temporary Tags

• A designated Agent may issue a temporary tag and temporary registration receipt valid for

twenty (20) days from the date of issuance to the owner of a motor vehicle that is to be

permanently licensed in any state. Only licensing officials may issue a temporary tag and

temporary registration valid for more than twenty (20) days

• Designated Agents and manufacturers who also issue temporary tags and temporary

registrations must maintain a record of all temporary tags and registrations issued for a

period of one year.

• The Alabama Department of Revenue may examine these records upon request. Failure

of a Designated Agent or manufacturer to faithfully perform its duties associated with the

issuance of temporary tags and registrations may result in the revocation of this authority

and the dealer’s license.

Temporary Tags CONTINUED

• Every vehicle operator should display the temporary tag per §32-6-51, Code of

Alabama 1975, on the vehicle for which it was issued (on the rear of the vehicle).

The temporary registration should be kept inside the motor vehicle.

• Temporary tags issued for a truck or truck tractor with a gross weight exceeding

12,000 pounds shall display the notation: “Unladen Weight Only.”

• Designated agents and manufacturers must request temporary tag material by

completing a Temporary Tag Application online through their MyDMV account.

Once you have ordered the material you will be able to print your temp tags when

needed.

Dealer Compliance

• There is a penalty for failure to obtain a license. A person that is subject to

the licensing requirements in the state of Alabama, but willfully fails to

acquire the license, shall be subject to a penalty of $500 for the first

violation and $1,000 for the second, or subsequent violation. §40-12-392.

• No person, other than a motor vehicle dealer, or lienholder, may sell a

motor vehicle without being currently recorded as the owner or lienholder

on the certificate of title- (or designated as the attorney in fact acting on

behalf of the titled owner or lienholder). Essentially, the law prohibits the

sale of a vehicle at consignment and provides that such vehicles may be

impounded by law enforcement. §40-12-391

Dealer Location Requirements

• The following is a list of permanent location requirements that all licensed dealers

must meet:

1. A building or structure from which sales of motor vehicles are conducted. The

building or structure must be owned, rented, or leased and must be used as an

office and a place to receive mail, keep records and conduct routine business,

including utilities under the name of the licensed business or the business

owner

2. Be properly zoned for business.

3. Have posted operating days/hours

4. Have an area designated as display space for the dealer's inventory

5. Sales shall be made only from the permanent location (with exception to offsite

license)

Dealer Sign Requirements

The following is a list of permanent location sign requirements that all licensed

dealers must meet:

1. Include the name under which the applicant is licensed

2. Clearly identifies the applicant's location as being the place of business of a

motor vehicle dealer.

3. Be a sufficient size to be legible from the street fronting the display area, or

from a distance to fifty yards, whichever is greater, so as to apprise a

reasonable consumer that a retail motor vehicle sales business is being

conducted at said location.

4. Must be a permanent structure or attached to the face of the building.

*Sales of new and used motor vehicles shall be made only from the permanent

location.

Dealer Offsite License Requirements

The following is a list of requirements that all licensed dealers must

meet when using an Offsite License:

1. Off-site licenses are required to be purchased 10 calendar days

prior to the beginning sale date.

2. Each sale shall not exceed 10 consecutive calendar days.

3. The sale must be conducted within the county or city where the

dealer maintains a permanent location.

*Please Note: Licensed dealers can conduct up to 3 off-site sales per

year

Facilitator License Requirements