Service Charges - Loans and Advances

A. Retail Loans

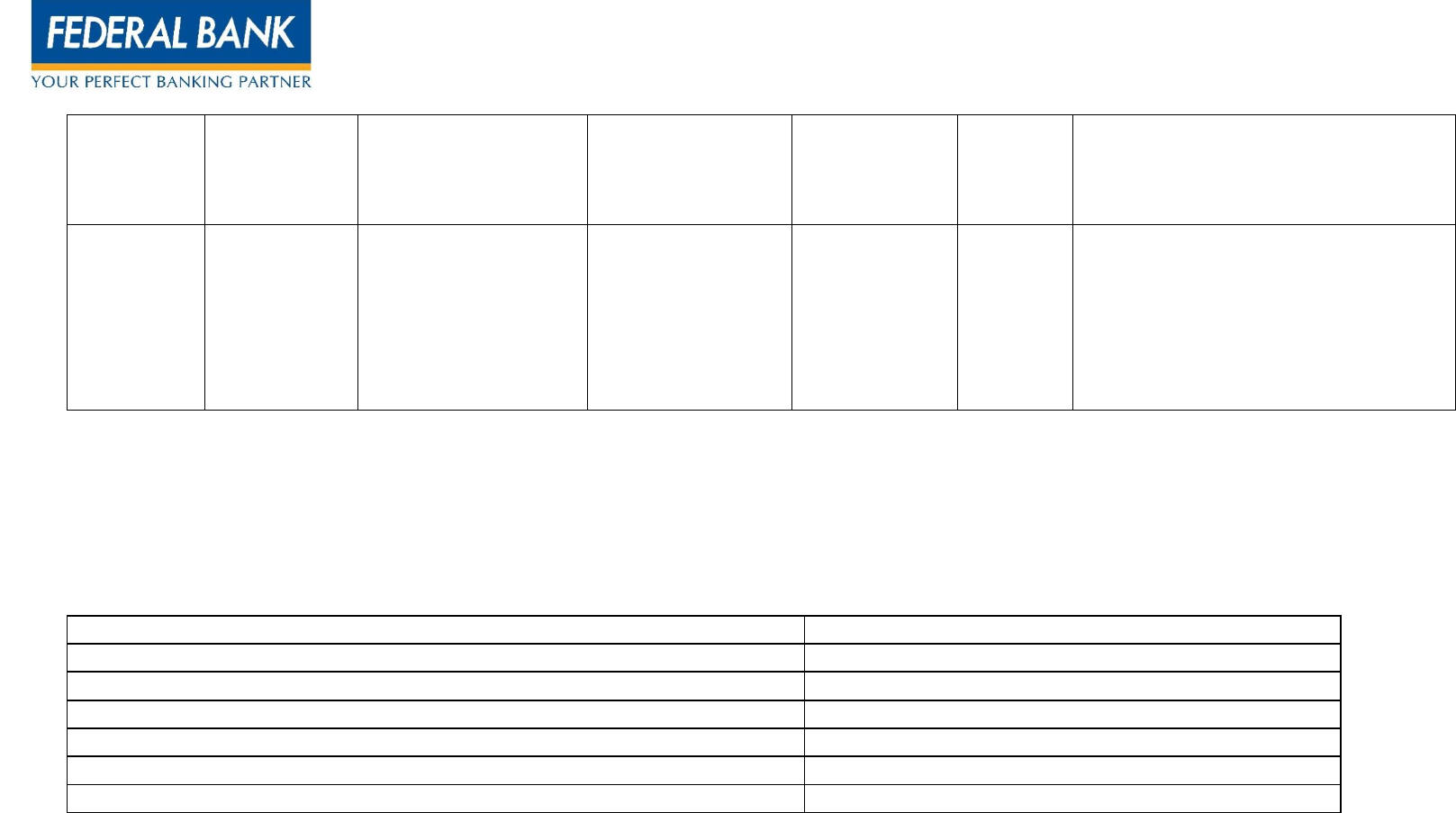

Loan Product

PF/ Admin fee

Prepayment /

Pre-closure charges

Charges for switching

loan from fixed to

floating rates and vice

versa

Charge

for CIBIL

report

Cersai

registration/mo

dification

charges

Easy Cash (against

securities other

than deposits)

0.15% of limit, subject to

minimum Rs. 150/-

Nil

0.25% of the balance

outstanding / Drawing

power whichever is

higher

Nil

Nil

Housing loan

0.50% of the limit sanctioned with

a min of Rs.10000/- and

maximum of Rs.2,00,000/-

1) Floating rate loans to Individuals –

Nil

2) Non-Individuals, Fixed rate,

Overdraft – 3% on the balance

outstanding or DP whichever is higher

3) Hybrid Loans –

Fixed Rate period- 3% on the balance

outstanding or DP whichever is higher

Floating Rate period

a) Term loans to Individuals –Nil

b) Non – Individuals, overdraft loans -

3% on the balance outstanding or DP

whichever is higher.

Nil

Nil

Property Power

loan

1% of the limit sanctioned with a

minimum of Rs.3000/-

Nil

Nil

Personal Car loan

Two wheelers – 2.50% (minimum

Rs.2500/-)

New Car Loans:

Upto Rs.5Lakh -Rs.2000/-

Above Rs.5.00L-Rs.4500/-

Used Car Loans:

Upto Rs.5Lakh -Rs.3000/-

Above Rs.5.00L-Rs.5500/-

Nil

Nil

Personal loan

Upto 3%

Floating Rate Schemes – Nil

Fixed Rate schemes- (Excluding Byom

Loans) 3%

Nil

Nil

Service Charges - Loans and Advances

Loan Product

PF/ Admin fee

Prepayment /

Pre-closure charges

Charges for switching

loan from fixed to

floating rates and vice

versa

Charge

for CIBIL

report

Cersai

registration/mo

dification

charges

Special Vidya Loan

For studies in India – NIL

For studies abroad - 0.25 % of the

loan amount (Maximum of

Rs.2500)

Floating rate loans to Individuals – Nil

Others – 3%

0.25% of the balance

outstanding / Drawing

power whichever is

higher

Nil

Nil

Career Solution

Loan

0.25% of loan amount - Minimum

Rs.1000/-

Floating rate loans to Individuals – Nil

Others – 3%

Nil

Nil

Penal charges applicable for loans and advances is published separately in the website of the bank.

Documentation Charges applicable on Retail Loans

Note: GST applicable on all the applicable charges will be additional.

Loan Amount

Documentation Charges

Upto Rs. 2 Lakhs

Nil

Rs 2 L - Rs 10 L

500/-

Rs 10 L- Rs 30 L

1000/-

Rs 30 L -Rs 50 lakhs

2500/-

Rs 50 Lakhs-Rs 1 Cr

5000/-

More than Rs 1 Cr

10000/-

1. Loans availed by staff members (both existing and retired), Interest subvention schemes, Gold loans, Govt. sponsored schemes other than NABARD

assisted schemes will be exempted.

Service Charges - Loans and Advances

B. SME Products

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

Commercial

Vehicle Loan

scheme

Term Loans

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee

(for un availed loans)

Loan @ ease

– OD against

deposit

OD

Nil

Nil

Nil

Nil

Nil

Loan @ease

against

approved

securities

OD

0.15% of the limit

subject to minimum of

Rs. 1000 /-.

Nil

Nil

Nil

Nil

Business

Loan Scheme

to Medical

Professionals

Term Loans

1.00% of the sanctioned

limit

Refer #Notes

1(point no. c)

Rs.1200/

Rs.15/-

50% of processing fee

(for un availed loans)

Loan Scheme

for Textile

Sector

CC

1%+GST of the limit on

sanction

0.5%+GST of the limit

on renewal

3% of the Limit

sanctioned

(including adhoc

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, collected on a

quarterly basis, for all loans above Rs.5

Lakhs, if utilization falls below 75% of the

limit. (b) For non-availment of limits

sanctioned , 50% of the Processing Fee

shall be collected as commitment

charges

Term Loan

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee (for un availed

loans)

Service Charges - Loans and Advances

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

CGTMSE

Power

OD/CC

1%+GST of the limit on

sanction

0.5%+GST of the limit

on renewal

3% of the Limit

sanctioned

(including adhoc

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limit sanctioned,

50% of the Processing Fee shall be

collected as commitment charges.

Term loan

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

For non availment of limits sanctioned,

50% of the Processing Fee shall be

collected as commitment charges

Federal Rent

Securitisation

Loan

DL/TL/ OD

with

diminishing DP

1.00% of the limit (Min

Rs.2500/-),

0.50% -If lessee is our

Bank Min. Rs.500

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee

(for un availed loans)

Fed SME

Clean OD

OD

1.00% of the limit

sanctioned, at the

time of fresh sanction

& at time of renewal

0.50% of the limit

renewed.

3% of the Limit

sanctioned

(including adhoc-

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges.

Service Charges - Loans and Advances

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

LAP-OD

OD

1.00% of the limit

sanctioned, at the time

of fresh sanction & at

time of renewal 0.50%

of the limit renewed.

3% of the Limit

sanctioned

(including adhoc-

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges.

Contractor

Plus scheme

CC

1.00% of the limit

sanctioned, at the time

of fresh sanction & at

time of renewal 0.50%

of the limit renewed.

3% of the Limit

sanctioned

(including adhoc-

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges.

BG/LC

1.00% of the limit

sanctioned, at the time

of fresh sanction &

0.50% at time of

renewal for limit

renewed.

NA

Rs.1200/

Rs.15/-

For non availment of limits sanctioned -

50% of the Processing Fee shall be

collected as commitment charges.

Term loans

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee (for un availed

loans)

Service Charges - Loans and Advances

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

Addl. funding

facility

(Demand

Loan)

0.25% of the limit of

each tranche of bill

subject to Max.

Rs.5000/-(for the

borrowers enjoying WC

facility with us)/ 1% of

the limit of each

tranche of bill (for the

borrowers not enjoying

WC facility with us)

NA

Rs.1200/

Rs.15/-

NA

Business LAP

OD/CC

1%+GST of the limit on

sanction

0.5%+GST of the limit

on renewal

3% of the Limit

sanctioned

(including adhoc

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges.

Term loan

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

For non availment of limits sanctioned,

50% of the Processing Fee shall be

collected as commitment charges

(BG/LC)

1.00% of the limit

sanctioned, at the time

of fresh sanction & at

time of renewal 0.50%

of the limit renewed.

NA

Rs.1200/

Rs.15/-

For non availment of limits sanctioned -

50% of the Processing Fee shall be

collected as commitment charges.

Quick Biz

OD/CC

1%+GST of the limit on

sanction

0.5%+GST of the limit

3% of the Limit

sanctioned

(including adhoc

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Service Charges - Loans and Advances

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

on renewal

limit if sanctioned)

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges

Term loan

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee (for un availed

loans)

(BG/LC

1.00% of the limit

sanctioned, at the time

of fresh sanction & at

time of renewal 0.50%

of the limit renewed.

NA

Rs.1200/

Rs.15/-

For non availment of limits sanctioned -

50% of the Processing Fee shall be

collected as commitment charges.

Federal

Arthias

scheme

CC

1.00% of the limit

sanctioned, at the time

of fresh sanction & at

time of renewal 0.50%

of the limit renewed.

3% of the Limit

sanctioned

(including adhoc

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges.

GST Lite

OD/CC

1%+GST of the limit on

sanction

0.5%+GST of the limit

on renewal

3% of the Limit

sanctioned

(including adhoc

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

Service Charges - Loans and Advances

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

charges.

Term Loan

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee (for un availed

loans)

Stand up

India scheme

CC

0.25 % of the limit

sanctioned

3% of the Limit

sanctioned

(including adhoc-

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges.

Term Loan

0.50% of the limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of PF (for un availed loans)

Asset Backed

Loan Scheme

(Discontinue

d scheme)

TL /DL/ OD

(Diminishing

DP)

1% of the limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee (for un availed

loans)

Service Charges - Loans and Advances

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

Asset Prime

TL/DL

1% of the limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee (for un availed

loans)

Green Loan

OD/CC

1%+GST of the limit on

sanction

0.5%+GST of the limit

on renewal

3% of the Limit

sanctioned

(including adhoc

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges.

Term Loan

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee (for un availed

loans)

Asset Power

(Business

loan to

professionals

(Discontinue

d scheme)

Term Loans

0.50% of the limit

(Min.Rs 500/-)

Prepayment is

permitted.

No Pre closure

charges.

Rs.1200/

Rs.15/-

50% of processing fee

(for un-availed loans)

Service Charges - Loans and Advances

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

SGB Biz

OD/CC

1%+GST of the limit on

sanction

0.5%+GST of the limit

on renewal

3% of the Limit

sanctioned

(including adhoc

limit if sanctioned)

Rs.1200/

Rs.15/-

a) 0.15% per quarter for the entire

unutilized portion, to be collected on a

quarterly basis, for all loans above Rs. 5

Lakhs, if utilization falls below 75% of the

limit.

(b) For non availment of limits

sanctioned, 50% of the Processing Fee

shall be collected as commitment

charges.

Term Loan

1.00% of the sanctioned

limit

Refer #Notes 1(point

no. c)

Rs.1200/

Rs.15/-

50% of processing fee (for un availed

loans)

Dealer

Financing

Arrangement

OD

As per agreement

NIL

Rs.1200/

Rs.15/-

As per agreement. 50% of the applicable

processing fee (for un availed loans)

PMMY

OD/CC

Shishu loans - Nil

Loans above Rs.50000 –

1.00% of the limit

sanctioned, at the time

of fresh sanction & at

time of renewal 0.50%

of the limit renewed.

NIL

Rs.1200/

Rs.15/-

0.15% per quarter of unutilized portion,

50% of PF (for un availed loans)

Term Loan

Shishu loans - Nil

Loans above Rs.50000 –

0.25% of the limit

NIL

Rs.1200/

Rs.15/-

50% of processing fee

(for un availed loans)

Service Charges - Loans and Advances

Loan

Product

Type of Loan

P F / Admin fee

Prepayment

charges

(Exempted types

refer #Notes 2)

Charges for

CIBIL report*

CIBIL

Detect

Charge

Commitment charges

LC/BG

Shishu loans – Nil

Loans above Rs.50000 –

1.00% of the limit

sanctioned, at the time

of fresh sanction & at

time of renewal 0.50%

of the limit renewed.

NIL

Rs.1200/-

Rs.15/-

NA

• Cibil Charges -(for loans above Rs.2.00L)

Notes:

• Penal charges applicable for loans and advances is published separately in the website of the bank.

• Commitment charges: Collected quarterly for limits above Rs.5L where average quarterly utilization is less than 75% of sanctioned limit.

• Details of discontinued schemes also included for reference.

• GST applicable on all the above charges will be additional

Documentation Charges

Loan Amount

Documentation Charges

Upto Rs. 2 Lakhs

Nil

Rs 2 L - Rs 10 L

500/-

Rs 10 L- Rs 30 L

1000/-

Rs 30 L -Rs 50 lakhs

2500/-

Rs 50 Lakhs-Rs 1 Cr

5000/-

More than Rs 1 Cr

10000/-

Service Charges - Loans and Advances

Loans and Advances

Loan Product

Processing Fee /

Administration fee

Prepayment options

and charges on loans

sanctioned / disbursed

/ renewed effective

from 01st Jan 2018 *

Charges for CIBIL

report (for loans

above Rs.2.00L)

Commitment

charges

Export

Advance

Coverage

Fees

Loans up to

Rs.25,000/-

NIL

NA

NA

NA

NA

Working capital

limit (Other than

Agri Loans)

1.00% of the limit sanctioned,

at the time of fresh sanction

& at time of renewal 0.50%

of the limit renewed.

3% of the Limit

sanctioned (including

adhoc-limit if

sanctioned) in case of

limit closed during the

tenure of loan.

CIBIL consumer

report- Rs.80/-

Commercial CIBIL

Report –Rs.1200/-

CIBIL Detect

Charges-Rs.15/-

a) 0.15% per quarter of the

unutilized portion, collected on

quarterly basis, for all loans above

Rs. 5 Lakhs, if utilization falls below

75% of the limit.

(b) For non availment of limits

sanctioned, 50% of the Processing

Fee shall be collected as

commitment charges.

0.9% per

annum for

the avg

utilization of

preshipment

limits,

collected on a

monthly

basis.

Term Loan (Other

than Agri Loans) /

Demand Loan

1.00% of limit

3% of the Balance

outstanding or DP

whichever is higher or

amount of prepayment

in case of limit closed

during the tenure of

loan.

CIBIL consumer

report- Rs.80/- per

report

Commercial CIBIL

Report –Rs.1200/- &

CIBIL Detect

Charges-Rs.15/-

(a) For non availment of limits

sanctioned, 50% of the Processing

Fee shall be collected as

commitment charges.

NA

Non-fund based

limits

1.00% of the limit sanctioned,

at the time of fresh sanction

& at time of renewal 0.50%

of the limit renewed.

NA

NA

NA

NA

Advance against

securities other

than banks own

Deposit (AAS)

0.25% of the limit

NA

NA

NA

NA

#Notes1:

Service Charges - Loans and Advances

a) MSE loans sanctioned upto ₹5lakhs is exempted from Processing Fee

b) For OD/CC limits closed/taken over which are overdue for renewal: 2% of the sanctioned limit (including adhoc-limit if sanctioned) will be

collected as processing fee

c) For Term Loans closed/taken over before the contracted period.

Completed period after sanctioning

Applicable Prepayment penalty at the time of pre-closure

Up to 36 months

3% of the amount prepaid*

>36 months

2% of the amount prepaid*

* Amount prepaid = outstanding balance + overflow amount (if any), as on the date of pre closure.

#Notes2: Categories which are exempted from Prepayment Penalty:

a) Priority sector advances up to and including ₹25000/-

b) Floating rate term loans sanctioned to individuals other than for business purposes

c) Gold loans, Advance against Deposits & approved securities, all Staff loans including FHSS.

d) CDR accounts.

e) Borrowers classified as Micro and Small Enterprises(MSE) coming under the following categories, if closed from own funds

• All floating interest rate loans

• All fixed interest rate loans up to & including the limit of Rs. 50 L

Notes3:

Penal charges applicable for loans and advances is published separately in the website of the bank.

The following types of loans are outside the purview of policy on penal charges

1. Priority sector loans up to 25,000/-

2. Credit cards

3. External Commercial Borrowings

4. Trade credit including Rupee / Foreign Export Credit.

5. Foreign currency loans

Documentation Charges

Loan Amount

Documentation Charges

Upto Rs. 2 Lakhs

Nil

Rs 2 L - Rs 10 L

500/-

Rs 10 L- Rs 30 L

1000/-

Rs 30 L -Rs 50 lakhs

2500/-

Rs 50 Lakhs-Rs 1 Cr

5000/-

More than Rs 1 Cr

10000/-

Service Charges - Loans and Advances

NeSL Charges

(a) Submission

Service Type

Companies

Other Commercial Entities

Individuals

i) Data Submission Per Loan

record of a borrower for each

year

1st Loan Record - Rs.327/-

2-10 Loan Record- Rs.109/- each

11th onwards- Rs.54.5/- each

1st Loan record - Rs.163.5/-

2nd onwards - Rs.54.5/- each

All Loan Records- Rs.54.5/-

each

ii) Default Submission

Free

Free

Rs.54.5/- per instance

(b) Reports

i) One Annual Statement

Free

Free

Free

ii) Record of Default

Free

Free

Rs.54.5/- per Report

iii) Other Reports

Free

Rs.54.5/- per Report

Rs.54.5/- per Report

CERSAI Charges

• CERSAI charges will be levied for all loans, where Equitable Mortgage is created, at the rate of Rs.75/- and Rs.150/- for loan of amounts up

to Rs.5 Lakhs and above Rs.5 Lakhs respectively.

• Charges for modification of security interest, at the rate of Rs.75/- and Rs.150/- for loan amounts up to Rs.5 lakhs and above Rs.5 Lakhs

respectively.

• CERSAI Charges for movables at the rate of Rs.75/- and Rs.150/- for loan amounts up to Rs.5 Lakhs and above Rs.5 Lakhs respectively.

• Charges for searching security interest on properties will be Rs.15/-

• Experian Commercial Including CMR charge Rs.1000/-

Inspection Charges (Other than Agri Loans)

Particulars

Charges

Inspection Within The Same Panchayat /Municipality/Corporation/10km Limits: Loans

i. Loans up to and inclusive of Rs.25,000/-

Nil

ii Loans above Rs.25,000 and Upto Rs.2,00,000

Rs.100 per annum

iii.Loans above Rs.2,00,000

0.005% of limit, with a minimum of Rs.100 and maximum of Rs.500 per inspection

Mudra Loans:

i. Loans upto Rs 200000

Nil

ii. Loans above Rs.200000 and Upto Rs.500000

Rs 100 per Quarter

iii. Loans above Rs.500000

Rs 150 per Quarter

Legal & Pre credit Inspection / verification charges

As per actuals

Inspection Beyond The Same Panchayat/Municipality/Corporation/10km Limits

Normal Charges + Actual Expenses incurred for conducting the inspection

Service Charges for issuing NOC/ Credit Opinion (wef 11-08-2019)

Service Charges - Loans and Advances

Details of borrower

Service Charges

Credit Limit less than Rs.10 L

Rs.1,000/-

Credit Limit of Rs.10 L and above to Rs.500 L (including Rs.500 L)

Rs.5,000/-

Credit Limits above Rs.500 L

Rs.20,000/-

Valuation Fees

Value of the Property

Branches coming under Network I

Branches coming under Network II

Valuation fee

Valuation fee

Up to & including Rs.5 lakhs

Rs.1300

Rs.1200

Above `5 Lakh to `10 Lakh

Rs.1950

Rs.1800

Above `10 Lakh to `50 Lakh

Rs.3900

Rs.6500

Above `50 Lakh to `1 Crore

Rs.6500

Rs.7800

Above `1 Crore to `5 Crore

Rs.7800

Rs.9750

Above `5 Crore to `25 Crore

Rs.9750

Rs.13000

Above Rs.25 Crores

Rs.13000

Rs.19500

Commission & SFMS Charges on Bank Guarantee: Refer Forex and Trade Service Charges Schedule

Commission and other charges on Inland Letters of Credit- Refer Forex and Trade Service Charges Schedule

Solvency Charges

Sub-item

Issuance Charges

Up to and including Rs.1 Lakh

Rs.1,000/-

Above Rs.1 Lakh and up to and including Rs.25 Lakhs

Rs.5,000/-

Above Rs.25 Lakhs up to and including Rs.50 Lakhs

Rs.7,500/-

Above Rs.50 Lakhs

Rs.20,000/-

Switching fees

Charges for switching loan from fixed to floating rates or vice versa

0.25% of the balance outstanding / Drawing power whichever is higher

Service Charges - Loans and Advances

C. Agri & Gold Loans

Loan Product

P F/ Admin fee

Prepayment options and charges

ACC/ FKC /Agri working capital

Up to Rs 25,000/- NIL

Above Rs 25,000/- - 1% of the limit subject to a

minimum of Rs 1,000/-

For limits above Rs 25000/-, Pre closure

charges @ 3% of the limit sanctioned or

balance outstanding whichever is higher.

Term Loan / Demand loan

Up to Rs 25,000/- NIL

Above Rs 25,000/- - 1% of the limit subject to a

minimum of Rs 1,000/-

For limits above Rs 25000/-, Pre closure

charges @ 3% on balance outstanding or DP

whichever is higher.

Agricultural Loan Against Gold

Ornaments (ADLG)

Rs.100 to Rs.1300

Nil

Interest Subvention KCC

Loan Amount

Processing Fee

Up to Rs.25,000

Nil

Above Rs.25,000 to Rs. 1 L

Rs 1000

Above Rs.1 L to Rs.2 L

Rs 2000

Above Rs.2 L

Rs 3000

Nil

Documentation Charges

Inspection Charge wef 01-11-2022

Loan Amount

Charge per inspection

Up to Rs.25,000.00

Nil

Above Rs.25,000.00 and up to Rs. 2 L

Rs 200 or *actual cost incurred for conducting inspection whichever is higher + GST.

Above Rs. 2 L and up to Rs. 10 L

Rs 350 or actual cost incurred for conducting inspection whichever is higher + GST.

Above Rs. 10 L

Rs 1000 or actual cost incurred for conducting inspection whichever is higher + GST.

* Actual Cost – actual expense (TA/Other expenses) incurred for conducting Inspection/Field visit.

Loan Amount

Documentation Charges

Upto Rs. 2 Lakhs

Nil

Rs 2 L - Rs 10 L

500/-

Rs 10 L- Rs 30 L

1000/-

Rs 30 L -Rs 50 lakhs

2500/-

Rs 50 Lakhs-Rs 1 Cr

5000/-

More than Rs 1 Cr

10000/-

Service Charges - Loans and Advances

Valuation Fees

Value of the Property

Branches coming under Network I

Branches coming under Network II

Valuation fee

Valuation fee

Up to & including Rs.5 lakhs

Rs.1300

Rs.1300

Above 5 Lakh to 10 Lakh

Rs.1950

Rs.1950

Above 10 Lakh to 50 Lakh

Rs.3900

Rs.6500

Above 50 Lakh to 1 Crore

Rs.6500

Rs.7800

Above 1 Crore to 5 Crore

Rs.7800

Rs.9750

Above 5 Crore to 25 Crore

Rs.9750

Rs.13000

Above Rs.25 Crores

Rs.13000

Rs.19500

Review Charge with effect from 15th December 2023.

Schemes

Loan Amount

Annual/Regulatory Review Fee

All Agri Loan schemes which is

coming under the purview of

Annual/ Regulatory review

process.

Up to Rs.25,000/-

NIL

Above Rs.25,000/- to Rs.1 Lakh

Rs.100/-

Above Rs.1 Lakh to Rs.3 Lakh

Rs.300/-

Above Rs.3 Lakh to Rs.5 Lakh

Rs.500/-

Above Rs. 5 Lakh to Rs.10 Lakh

Rs.750/-

Above Rs.10 Lakh to Rs.25 Lakh

Rs.1000/-

Above Rs.25 Lakh to Rs.50 Lakh

Rs.1500/-

Above Rs.50 Lakh

Rs.2,000/-

Inspection Charges for Loans under Interest Subvention Schemes (other than gold loans) are as tabled below.

Scheme

Scheme Codes

Amount

Inspection Charge

Limits under Interest Subvention Scheme

(other than gold loans)

78434, 78492 & 78623

Irrespective of loan

amount

Nil

Penalty for delayed repayment for Gold loans (wef. 01/04/2024)Excluding GST)

Agri Gold Loans

Penal Charges – Up to 4%

Non Agri Gold Loans

Penal Charges – Up to 4%

Service Charges - Loans and Advances

Gold loan Processing Fees

Products

Applicable Processing Fees (Excluding GST)

Digi Gold (Revised wef 03-05-2024)

0.10% of the limit subject to a minimum of Rs.395 to be collected on next day of

disbursal and on anniversary date every year.

General Gold Loan (Revised wef 01-11-2023)

Rs.180 to Rs.270

GL Graded Interest Rate Scheme (Revised wef 20-04-2021)

0.35% of the limit subject to a minimum of Rs 350

Kisan Gold Scheme (Revised wef 01-11-2023)

Rs. 530 to Rs.1700

ISS KCC GOLD (Revised wef 20-04-2021)

@ 0.80% of sanctioned limit

MSME Gold Loan (Revised wef 01-11-2023)

Rs.180 to Rs.270

MSME Gold Loan OD

Up to 0.35%

KGL Limited

Rs 1900 to Rs 2900

Fed Smart Saver Scheme

0.50% of the limit subject to a minimum of Rs 500

Appraiser Charges for Gold loans (wef 01/11/2023)

Sanctioned Limit

Appraiser charges (Excluding GST)

Up to Rs 25000

Nil

Above Rs 25000 to Rs 50000

Rs.140

Above Rs 50000 to Rs 1 Lakh

Rs.200

Above Rs 1 Lakh to Rs 2 Lakh

Rs.220

Above Rs 2 Lakh to Rs 3 Lakh

Rs.300

Above Rs 3 Lakh to Rs 5 Lakh

Rs.430

Above Rs 5 Lakh

Rs.140 Per Lakh

Security Operation fee

Loan Types

Charge amount (Excluding GST)

OD-Digi-Gold

First 2 security operations in a month- Free

From 3rd security operation onwards Rs 250 shall be collected.

OD-Digi-Gold-NRI

Other Permitted Gold loan schemes

Rs 250+ GST for each security operation.

Overdue Notice Charges (wef 01/01/2024)

Loan Types

Charge amount (Excluding GST)

Gold Loans

Rs 250/-

Note: GST applicable on all the above charges will be additional.