Focused On:

the Details

Bio-Rad Laboratories | Annual Report 2009

David Schwartz

CHAIRMAN OF THE BOARD

Norman Schwartz

PRESIDENT

Bio-Rad Laboratories | Annual Report 2009

Most letters to shareholders this year will make some reference to the economic

environment of 2009 and its ultimate effects on the year’s results. Like others, we too

experienced the economic adjustments in spending patterns by our customers.

On a reported basis, our sales increased only 1%. However, when you focus in on

the details, currency fluctuations had a major effect on the underlying growth, which

was actually 5.5% excluding the impact of currency changes. Another indicator of our

progress is net income which topped $145 million, an increase of 62% over last year.

FOCUSED ON: OUR SHAREHOLDERS

Apart from the economy and attention to

operational improvements, we continued

our usual focus of developing new prod-

ucts to meet the ever advancing needs

of our customers. To that end, there

are a number of exciting new products

introduced during the year and others

planned as 2010 progresses. Significant

among those introduced in 2009 were

new real-time thermal cycler systems; a

new line of reagents for quantitative PCR;

precast electrophoresis gels, which offer

our customers faster run times; mag-

netic bead assays for the research

Bio-Plex

®

system to improve perfor-

mance of the assays; and new assays

for the BioPlex

®

2200.

The new product pipeline for 2010 is

strong. Our Life Science Group has an

exciting lineup of interesting new prod-

ucts to be introduced throughout the

year. Our Diagnostics Group is planning

for three new BioPlex 2200 panels to

clear FDA approval and is preparing to

launch our new automated IH-1000 plat-

form to serve the blood typing market.

In the first few days of 2010, Diagnostics

completed the acquisition of some key

diagnostic product lines, further increas-

ing our offerings in the area of blood typ-

ing. This is an area where we have made

significant investments over the past few

years and the addition of these products

gives us access to the very important

North American market.

As with most companies in our markets,

the economy and its effects on business

was a major focus during the year. It

caused many to rethink their operations

and to make changes, some dramatic.

What was billed as a “stimulus package” at

the beginning of the year turned out to be

an anti-stimulus package, as our research

customers spent time writing grant propos-

als and carefully managing their current

grants in anticipation of fresh government

investments into basic research. Mean-

while, our Diagnostics business remained

robust. This was somewhat counter-intui-

tive, given higher levels of unemployment.

In our case, we were financially sound

and operationally streamlined, there-

fore we were somewhat insulated from

perturbations in our markets. Addition-

ally, our product line is not as tied to the

volatility of capital equipment markets in

contrast to some others. It was, never-

theless, a good time for us to re-evaluate

some of our day-to-day practices with

the purpose of improving cash flow.

As you can see in our financials, the

result was outstanding. Throughout the

Company, people looked at what was be-

ing done on a daily basis and discovered

hundreds of mostly small improvements

we could make which, when added up,

helped to increase our cash flow from

$191 million to $325 million. Some of

these were one time in nature, but we

expect many of them will be sustaining.

David Schwartz

CHAIRMAN OF THE BOARD

Norman Schwartz

PRESIDENT

Another area of continued investment for

us is in the fast growing markets of Asia,

Eastern Europe, and Latin America. All of

these areas are experiencing higher than

average growth rates and we foresee these

as continuing fertile ground for growth.

Balancing our product and market focus

is the need to continually improve and

streamline our operations to accommo-

date our growth and to remain competi-

tive. To that end, we are making a number

of operational improvements around

the way we transact business with our

customers and deliver products to those

customers. In 2009, we installed a new

e-commerce system in the U.S. and we will

roll this out to the rest of the world over

the next 12 to 18 months. We have also

embarked on a project to upgrade and

standardize some of our business systems.

The New Year brings with it renewed

optimism. While we will still approach the

near term with caution, we have a lot to

look forward to as we round the corner to

$2 billion. Thank you for your continued

interest in Bio-Rad.

page 2

Bio-Rad Laboratories | Annual Report 2009

A decade into the 21st Century, advances in

healthcare continue to offer the promise of new

and better therapies for disease control and

prevention. In virtually every field of biomedical

research and practice, significant progress

is being made in bringing new treatments to

market and improving existing procedures.

At Bio-Rad, we build the industry leading instruments and products

that help enable these advances. Our success is based on our

uncompromising focus on the most important details in any given

area—from shortening the time it takes to find high-value proteins to

making it easier to amplify DNA strands to accelerating the pace of

separations in gel electrophoresis.

Not all of these details are “small”. But they all make a huge difference

in the lives of the people who benefit from them.

Focused On: 2010

page 4

Instead of removing the hay, attract the needle.

FOCUSED ON: PROTEIN SAMPLE PREPARATION

It wasn’t so long ago that the

sequencing of the human genome

signaled a historic milestone in bio-

medical science, with the promise of

new and as-yet untapped possibilities

for the diagnosis of disease. While

this effort exponentially expanded our

knowledge of genes and their func-

tion, it also raised new and important

questions about the true causes of

disease—questions that were not

answerable by studying only the

genome. Genes alone cannot explain

the complexity of how the human

body works and what goes wrong

when a disease occurs. Much can be

explained, however, by studying the

intricate interactions of proteins.

DIGGING DEEPER

IN THE PROTEOME,

PROTEOMINER

™

PROTEIN ENRICHMENT

TECHNOLOGY ENHANCES

THE POTENTIAL

FOR BIOMARKER

DISCOVERY BY HELPING

RESE ARCHERS DISCOVER

“LOW ABUNDANCE”

PROTEINS OF INTEREST

THAT CANNOT BE

DE TECTED THROUGH

TR ADITIONAL METHODS.

Bio-Rad Laboratories | Annual Report 2009

page 6

FOCUSED ON: PROTEIN SAMPLE PREPARATION

As research progresses today, it is the highly complex proteome—the

set of proteins expressed by the genetic material of an organism that

are coded by genes—that offers the key to both disease research and

the discovery of protein biomarkers specific to a variety of diseases.

A major obstacle to finding these proteins,

however, is that only about 20 percent

of them are of interest to researchers.

These low-abundance yet information-rich

proteins are typically “hidden” among the

other proteins in the cell, which compli-

cates scientists’ search for them. So the

question becomes how to locate these

potentially “interesting” proteins—quickly

and efficiently—amidst all the filler.

Enter Bio-Rad. Until the introduction of

Bio-Rad’s ProteoMiner

™

protein enrich-

ment technology, the method of discovery

of proteins of interest has been an indirect

process of elimination referred to as a

“depletion” strategy: removing the high-

abundance, low value proteins to find the

low-abundance, high value proteins. In

other words, to find the “needle” remove

the “hay”. Unfortunately, during this

process, some of the high-abundance

proteins can adhere to the proteins of

interest. So as the hay is removed, some

of the needles get removed, too, making

this strategy highly inefficient.

However, with Bio-Rad’s ProteoMiner

protein enrichment technology, the low-

abundance proteins are targeted and

captured directly, resulting in a higher

concentration of these proteins of interest

at the conclusion of the process. More

needles, less hay.

Further, where conventional depletion

strategies tend to be antibody-based and

require a sample to be a bodily fluid such

as serum, ProteoMiner allows for non-

serum-based samples such as tissues

and saliva as well, resulting in far more

flexibility with sample sources.

The capacity of Bio-Rad’s ProteoMiner

sample preparation tool to help unveil the

proteome has led to its worldwide use in

laboratories that are involved in the

discovery of protein biomarkers for

diseases. Capturing high-value proteins,

after all, captures attention.

page 8

The widest range of tests,

from the smallest drops of blood.

FOCUSED ON: IMMUNOHEMATOLOGY

Every year, millions of people receive

life-saving blood transfusions either to

replace blood lost during surgery or

as the result of a serious injury. Trans-

fusions may also be done on a regu-

lar basis for individuals whose bodies

cannot properly produce blood due

to an illness. For blood transfusions

to be safe and effective, donor blood

must be carefully screened and then

meticulously matched to a patient’s

blood type to ensure compatibility

between the two.

The human body’s biological defense

mechanism includes a sophisticated

system that recognizes “foreign”

substances—antigens, with names

like Duffy, Lewis, Kidd, and Kell—in

donor blood cells and in response

sends its own antibodies out to meet

them, and fight, if necessary. If the two

combatants are incompatible, the battle

is engaged: the cells clump together,

or agglutinate, and clog the vessels

carrying them, releasing hemoglobin

into the blood stream. The hemoglobin

is eventually transported to the kidney,

resulting in blockage, failure, and even,

possibly, death.

The answer is extremely complex, and it

is what immunohematology is all about:

the study of antigen-antibody reactions

as they relate to blood compatibility.

Immunohematology tests for the

attraction between the antigens on the

surface of a donor’s red blood cells

and the antibodies that are in a recipi-

ent’s plasma. In a three-step process,

an ABO typing test is first performed.

Next, after a basic match of blood

types has been made, a lab or hospital

performs a general antibody screen,

in which antibodies in the patient’s

plasma are combined with a red cell

reagent pool of the most clinically

significant antigens. And finally, if no

incompatibility is detected a “cross-

match” is performed, in which the red

cells in the donor blood and the plasma

of the patient are mixed together to

ensure that there is no reaction.

The underlying principle behind this

work is that, whether for transfusion

or transplantation, the more reagents

there are available to test, the greater

the number of incompatibilities that may

be ruled out, thus the greater the confi-

dence in the match.

As a global company, Bio-Rad has access

to multiple diverse blood sources,

allowing us to manufacture a large

number of reagent red cells that have

clinically relevant antigen profiles. In

addition, we have at our disposal a

significant arsenal of monoclonal and

polyclonal antibodies, which further

enlarge the pool of test cell possibilities,

allowing customers to dig deeper to

discover possible interactions between

antibodies and antigens.

But materials are only half the story.

We also provide a complete range of

technologies—from traditional test tube

methods to gel cards and microplates

for high-volume settings—that offer

blood banks, donor centers, hospitals,

and transfusion centers a wide spec-

trum of choice and flexibility in running

their tests. And finally, Bio-Rad offers

automated systems and comprehensive

software, as well as unparalleled tech-

nical support, so that customers get

the right products in the right configura-

tion at the right specificity.

The result is a comprehensive immu-

nohematology solution that enables the

widest range of tests from the smallest

drops of blood.

page 10

Bio-Rad Laboratories | Annual Report 2009

FOCUSED ON: IMMUNOHEMATOLOGY

So the question arises when a patient needs

blood: how can a hospital or clinic be sure

that—from vein-to-vein—a donor’s blood won’t

cause an adverse clinical reaction?

EVERY DETAIL MATTERS WHEN

IT COMES TO DETERMINING

COMPATIBILITY OF A DONOR’S AND

PATIENT’S BLOOD. BIO-RAD OFFERS

CLINICIANS THE TOOLS THEY NEED

TO DO THE DETECTIVE WORK—

ENSURING THEY FIND EXACTLY

WHAT THEY ARE LOOKING FOR:

A PERFECT MATCH.

page 12

Amplifying small fragments, for big results.

Use of Polymerase Chain Reaction,

known simply as PCR, has grown over

the last three decades to become

a common and often indispensable

technique used in a wide range of

medical and biological research areas,

from analysis and forensic investiga-

tion—where there may be only a few

drops of blood available—to the basic

study and identification of genes. Much

like a photocopier, PCR amplifies, or

replicates, a fragment of DNA—in this

case into thousands, millions, and even

billions of copies, allowing researchers

to have adequate samples with which

to make specific proteins, compare

gene sequences, and perform a variety

of other applications that lead to a

better understanding of the complex

biological systems around us.

FOCUSED ON: DNA RESEARCH

REFLECTING ON

ITS YEARS OF

EXPERIENCE WRITING

PCR PROTOCOLS,

BIO-RAD OFFERS

THE C1000 THERMAL

CYCLER’S PROTOCOL

AUTOWRITER TO HELP

RESEARCHERS GET

STARTED QUICKLY

ON THEIR PCR

EXPERIMENTS AND

OPTIMIZE THEIR RUN

TIMES FOR BEST

RESULTS.

Bio-Rad Laboratories | Annual Report 2009

page 14

FOCUSED ON: DNA RESEARCH

Bio-Rad has been an important contributor to the

success of PCR since 1989, supplying scientists

with thermal cyclers, reagents, and related products

designed to help make their tasks easier.

Thermal cyclers, as the name implies,

help in the PCR process by separating

DNA strands and re-annealing (or recom-

bining) them through a process of rapid

heating and cooling. Bio-Rad’s thermal

cycler products played an important role

in laboratories across the country and

around the world for the U.S. National

Institutes of Health’s massive Human

Genome Project, which was mapped in

2003. With this map in hand, a new, more

informed, journey began to discover new

pathways that may lead to a better under-

standing of gene function and therefore

the basis of disease.

In January 2008, Bio-Rad introduced

its next-generation PCR instrumentation,

the innovative 1000-series thermal cycling

platform, which for the first time allowed

researchers to automate the writing of

protocols used to amplify DNA. Prior to

this, protocols, or instructions, had to be

created by the researcher, meticulously

detailing every step of the heating and

cooling cycle, taking into account experi-

ment parameters such as PCR product

length, enzyme type, and DNA binding

temperatures. But with the protocol

autowriter on Bio-Rad’s C1000

™

thermal

cycler, all a researcher has to do is enter

these experiment parameters, and the

instrument automatically generates the

“recipe” the thermal cycler will use, based

on Bio-Rad’s long experience in the field.

As a result, researchers can obtain accurate

and reliable results with shorter run times

and optimized thermal performance.

What’s next? In today’s interconnected

world, researchers expect the flexibility of

having information on demand—wherever

they are. And so in 2009, Bio-Rad intro-

duced a real-time PCR application guide

for Apple’s iPhone. The application guide

puts at the fingertips of those conducting

PCR several helpful tools including tutorials,

troubleshooting tips, and assay-specific

information.

Think of it as another small step in large-

scale amplification.

page 16

A lot of confidence in a little vial.

FOCUSED ON: QUALITY CONTROLS

It’s the simple assurance of knowing

that a result is right. Of not having

to spend extra time or resources

determining whether an outcome is a

reliable result. Of having one less thing

to worry about.

And all thanks to a small bottle of

liquid. Call it liquid “gold”…

When a physician orders a test and a

sample of blood is drawn, the patient

sample is sent to a lab for testing to

determine, for example, what their

triglycerides, cholesterol, or glucose

levels are. The tests are run and the

results are produced, but before

they’re sent to the physician for review,

the laboritorian must ensure quality

results. That means verifying that all

of the variables that may have errone-

ously affected the results all worked

as they were supposed to.

To provide highly reliable controls, Bio-Rad

creates specially prepared samples. To

further enhance quality, Bio-Rad provides

powerful software for monitoring lab

performance, which offers labs a way to

track data points over time—through pa-

rameters such as mean, standard devia-

tion, and more—enabling them to keep

track of how their controls are performing

and to ensure that their instruments and

reagents are working properly. Then,

thanks to Bio-Rad’s QC data manage-

ment solutions that include large peer

groups of test systems and assay (test)

methods, labs are able to compare their

results with those from other labs around

the world. So they always know what to

expect from the systems they’re using.

No matter how you look at it, it’s a power-

ful guarantee of quality that produces gold

star results, coming from the smallest of

bottles.

Quality controls are known samples that

provide expected values and expected

results, ensuring that the most reli-

able data goes back to the physician or

healthcare worker—and, most impor-

tantly, to the patient. Controls are run the

same way and on the same instrument

as a patient sample. If the control delivers

expected results, then the laboritorian

can feel confident that the patient sample

run the same way will yield a reliable

result as well.

Physicians depend on the labs they use;

they assume that the sample they sent

was tested properly, so that they may in

turn make clinical decisions based on

those results. An incorrect diagnosis could

lead to over- or under-treatment, resulting

in potentially dire clinical consequences.

page 18

Bio-Rad Laboratories | Annual Report 2009

FOCUSED ON: QUALITY CONTROLS

In a continuum, that begins from the time a sample is drawn from

a patient, to how it was collected, handled, and stored, to the time it

is tested and the integrity of the instrument, reagents, and even the

individual conducting the test may come into question, the potential of

an error occurring exists. This is where quality controls come in.

BIO-RAD OFFERS

THE WORLD’S MOST

COMPREHENSIVE

MENU OF QUALITY

CONTROL PRODUCTS

COVERING ANALYTES

FOR IMMUNOASSAY,

THERAPEUTIC DRUG

MONITORING, CHEMISTRY,

CARDIAC ASSESSMENT,

IMMUNOLOGY, DIABETES,

INFECTIOUS DISEASE

TESTING AND MORE.

page 20

Getting the same performance,

in far less time.

Being one of the most basic tools and

commonly used techniques researchers

use in the lab, electrophoresis should

be as easy as making toast. It is the

technique of separating and identifying

DNA, RNA, or protein molecules by

applying an electric field to them. The

position of these molecules in the gel

reveals their size and electric charge.

This common lab procedure is among

one of the most widely used in a variety

of biotechnology applications, from

diagnosing and monitoring a wide range

of diseases and conditions to studying

the genetic makeup of living organisms

to determining the paternity of a parent.

In spite of its presence in labs worldwide,

electrophoresis can be a time-consum-

ing process. With gel cycles potentially

taking hours to run, academic and

pharmaceutical researchers must

consider the tradeoffs in a typical

workday of conducting multiple elec-

trophoresis procedures or doing other,

more productive, tasks. The result is a

workflow that is often far less efficient

than it could be.

As the industry leader in electrophoresis

for 35 years, Bio-Rad has been at the

forefront of making our customers’

workflows easier and more productive.

Over the years, we have focused

on three areas of improvement: the

reproducibility of results, ease of use,

and speed.

For years, scientists spent valuable

time and labor “hand casting” their

own gels. Even though hand-cast gels

are effective, they can be inconsistent

from batch to batch. This inconsistency

may be reflected in the gel’s reliability,

as well as in the reproducibility of its

results. Because researchers repeat

their experiments to ensure the accuracy

of their results, the last thing they want

to worry about is variable performance

of the gels.

FOCUSED ON: GEL ELECTROPHORESIS

BECAUSE GOOD IS NEVER

GOOD ENOUGH, BIO-RAD HAS

CONTINUED TO ENHANCE

THE PERFORMANCE OF ITS

GEL ELECTROPHORESIS

PRODUCTS, FOCUSING ON

EVERY DETAIL. AS A RESULT,

GEL ELECTROPHORESIS

CONTINUES TO GET EASIER—

AND NOW FASTER. IMAGINE

TOASTING A PIECE OF BREAD

IN JUST 20 SECONDS…

page 22

Bio-Rad Laboratories | Annual Report 2009

FOCUSED ON: GEL ELECTROPHORESIS

In the early 1990s, Bio-Rad gave researchers the option to

forego hand casting with the introduction of the first in our line

of easy-to-use, ready-to-run precast gels, offering results in

less than an hour. But we didn’t stop there.

Our customers rely on us for continuous

improvement. Through the years we’ve

continued to improve our gels’ resolution,

performance, and shelf life. In 2004, we

added automation to the process using

a lab-on-a-chip technology to create

the Experion

™

automated electrophoresis

system, giving researchers the ability to get

results even more quickly and efficiently.

And at the end 2009, we introduced a new

series of the next generation of precast

gels that promise to cut run cycles by

a factor of as much as six, bringing run

times down to as little as 10 minutes

without compromising performance. Our

new Mini-PROTEAN

®

TGX

™

precast gels

are designed to be completely plug-

and-play, working seamlessly with the

industry’s gold standard Laemmli buffer

system. Because Laemmli is the system

of choice for most researchers, it was

important that our gels be completely

compatible—working with what our

customers were already using, including

buffers, power supplies, and instruments.

In addition to their short run times and

high performance, the gels also feature a

long shelf life, allowing researchers to have

gels at their disposal in their laboratories.

With the Mini-PROTEAN TGX gels, the

improvement of a single, simple compo-

nent in an otherwise complex process

requires no changes to the way our cus-

tomers work. Except, perhaps, for getting

used to being able to do their research

faster, and ending up with more time on

their hands.

Call it our small way of accelerating the

pace of discovery to ultimately provide

better healthcare for all.

L I F E S C I E N C E S

Bio-Rad’s Life Science Group develops,

manufactures, and markets a wide range

of laboratory instruments, apparatus, and

consumables used for research in func-

tional genomics, proteomics, and food

safety. The group ranks among the top

five life science companies world-wide,

and maintains a solid reputation for quality,

innovation, and commitment to its cus-

tomers. Bio-Rad’s life science products

are based on technologies used to sepa-

rate, purify, identify, analyze, and amplify

biological materials such as proteins and

nucleic acids. These technologies include

electrophoresis, imaging, multiplex immu-

noassay, chromatography, microbiology,

bioinformatics, protein function analysis,

transfection, amplification, and real-time

PCR. Bio-Rad products support researchers

in laboratories throughout the world.

C L I N I C A L D I A G N O S T I C S

Clinical Diagnostics develops, manufac-

tures, sells, and supports a large portfolio

of products for medical screening and

diagnostics. Bio-Rad is a leading specialty

diagnostics company and its products are

recognized as the gold standard for

diabetes monitoring and quality control

(QC) systems. The company is also well

known for its blood virus testing and

detection, blood typing, autoimmune and

genetic disorders testing, and internet-

based software products. Bio-Rad’s

clinical diagnostics products incorporate

a broad range of technologies used to

detect, identify, and quantify substances

in bodily fluids and tissues. The results are

used as aids to support medical diagnosis,

detection, evaluation, and the monitoring

and treatment of diseases and other

medical conditions.

page 24

Bio-Rad Laboratories | Annual Report 2009

FOCUSED ON: THE BUSINESS OF BIO-RAD

Bio-Rad Laboratories has played a leading role in the

advancement of scientific discovery for nearly 60 years

by providing a broad range of innovative tools and services

to the life science research and clinical diagnostics markets.

Founded in 1952, Bio-Rad has a global team of more than 6,800 employees and

serves more than 85,000 research and industry customers worldwide through its global

network of operations. Throughout its existence, Bio-Rad has built strong customer

relationships that advance scientific research and development efforts and support the

introduction of new technology used in the growing fields of genomics, proteomics,

drug discovery, food safety, medical diagnostics, and more.

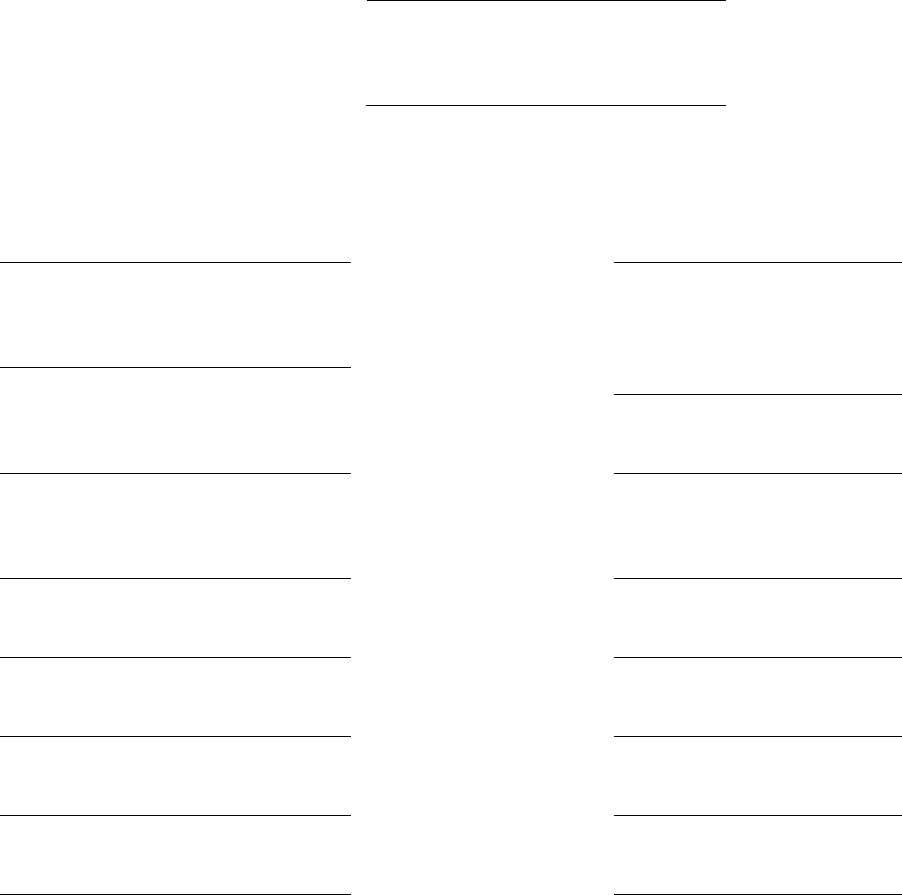

NET SALES

( I N M IL LI O N S )

05 06 07 08 09

CASH FLOW

FROM OPERATIONS

( I N M IL LI O N S )

05 06 07 08 09

BA SI C EARNINGS

PE R SHARE

05 06 07 08 09

2009 SALES BY REGION

2009 FINANCIAL HIGHLIGHTS

2005 2006 2007 2008 2009

( I N MI LL IO N S , E XC EPT P ER S HA RE D ATA )

Net Sales $ 1,181.0 $ 1,273.9 $ 1,461.1 $ 1,764.4 $ 1,784.2

Gross Profit $ 646.5 $ 712.5 $ 791.4 $ 962.5 $ 999.8

Research Expenditures $ 115.1 $ 123.4

(1)

$ 140.5

(1)

$ 159.5 $ 163.6

Net Income $ 81.6 $ 103.3 $ 93.0 $ 89.5 $ 144.6

Return On Sales 6.9% 8.1% 6.4% 5.1% 8.1%

Book Value Per Share $ 25.09 $ 30.92 $ 36.12 $ 38.11 $ 45.76

Basic Earnings Per Share $ 3.13 $ 3.92 $ 3.48 $ 3.30 $ 5.28

Cash Flow From Operations $ 108.3 $ 118.2 $ 191.6 $ 191.4 $ 325.1

FI VE -YEAR RECORD

1. EXCLUD ES $7.7 MILLION AND $4.1 MILLION OF PURCHAS ED R&D I N 2007 A ND 2006, RESPECTIVELY

38%

Americas

46%

Europe

16%

Pacific

Rim

$3.13

$3.92

$3.48

$3.30

$108.3

$118.2

$191.6

$191.4

$325.1

$1,181.0

$1,273.9

$1,461.1

$1,764.4

$1,784.2

$5.28

1959 1965 1970 1975 1980 1985 1990 1995 2000 2009

$1.2 billion

$1.1 billion

$1.3 billion

$1.5 billion

$1.6 billion

$1.7 billion

$1.4 billion

$1 billion

$900 million

$800 million

$700 million

$600 million

$500 million

$400 million

$300 million

$200 million

$100 million

FOCUSED ON: BIO-RAD SALES HISTORY

page 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

X

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2009

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

Commission file number 1-7928

BIO-RAD LABORATORIES, INC.

(Exact name of registrant as specified in its charter)

Delaware

94-1381833

(State or other jurisdiction of incorporation or organization)

(I.R.S. Employer Identification No.)

1000 Alfred Nobel Drive, Hercules, California

94547

(Address of principal executive offices)

(Zip Code)

Registrant's telephone number, including area code

(510) 724-7000

Securities registered pursuant to Section 12(b) of the Act:

Name of Each Exchange

Title of Each Class

on Which Registered

Class A Common Stock Par Value $0.0001 per share

New York Stock Exchange

Class B Common Stock Par Value $0.0001 per share

New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ X ] Yes

[ ] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes

[ X ] No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days.

[ X ] Yes

[ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

[ ] Yes

[ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained,

to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or

any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer

[ X ]

Accelerated filer

[ ]

Non-accelerated file

[ ]

(Do not check if a smaller reporting company)

Smaller reporting company

[ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes

[ X ] No

As of June 30, 2009, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the

Registrant’s Class A Common Stock held by non-affiliates was approximately $1,403,335,633 and the aggregate market value of the registrant’s

Class B Common Stock held by non-affiliates was approximately $36,812,367.

As of February 16, 2010, there were 22,429,100 shares of Class A Common Stock and 5,118,352 shares of Class B Common Stock outstanding.

Documents Incorporated by Reference

Document

Form 10-K Parts

(1)

Definitive Proxy Statement to be mailed to stockholders in connection with the

III

registrant's 2010 Annual Meeting of Stockholders (specified portions)

2

Bio-Rad Laboratories, Inc.

Form 10-K December 31, 2009

TABLE OF CONTENTS

Part I. 3

Item 1. Business 3

Item 1a. Risk Factors 6

Item 1b. Unresolved Staff Comments 12

Item 2. Properties 12

Item 3. Legal Proceedings 13

Item 4. Submission Of Matters To A Vote Of Security Holders 13

Part II. 13

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities 13

Item 6. Selected Financial Data 15

Item 7. Management’s Discussion And Analysis Of Financial Condition And Results Of Operations 16

Item 7a. Quantitative And Qualitative Disclosures About Market Risk 28

Item 8. Financial Statements And Supplementary Data 29

Item 9. Changes And Disagreements With Accountants On Accounting And Financial Disclosure 66

Item 9a. Controls And Procedures 66

Item 9b. Other Information 68

Part III. 68

Item 10. Directors, Executive Officers And Corporate Governance 68

Item 11. Executive Compensation 68

Item 12. Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters 69

Item 13. Certain Relationships And Related Transactions, And Director Independence 69

Item 14. Principal Accountant Fees And Services 69

Part IV. 70

Item 15. Exhibits And Financial Statement Schedules 70

Signatures 71

3

PART I.

ITEM 1. BUSINESS

General

Founded in 1952 and incorporated in 1957, Bio-Rad Laboratories, Inc. (referred to in this report as “Bio-Rad,” “we,” “us,”

and “our”) was initially engaged in the development and production of specialty chemicals used in biochemical,

pharmaceutical and other life science research applications. In 1967, we entered the field of clinical diagnostics with the

development of our first test kit based on separation techniques and materials developed for life science research. We

expanded into the field of analytical and measuring instrument systems through internal research and development efforts

and acquisitions in the late 1970's and 1980's. In 1999, we acquired the stock of Pasteur Sanofi Diagnostics and the rights

to certain ancillary assets. This strengthened our position in the HIV and infectious disease testing market. In 2000 and

2004, we divested our semiconductor, optoelectronic metrology and confocal microscopy product lines. During 2007, we

acquired DiaMed Holding AG, enhancing our position in the immunohematology market.

As we broadened our product lines, we also expanded our geographical market. We have distribution channels in over

thirty countries outside the United States through subsidiaries whose focus is customer service and product distribution.

Bio-Rad manufactures and supplies the life science research, healthcare, analytical chemistry and other markets with a

broad range of products and systems used to separate complex chemical and biological materials and to identify, analyze

and purify their components.

Description of Business

Business Segments

Today, Bio-Rad operates in two industry segments designated as Life Science and Clinical Diagnostics. Both segments

operate worldwide. For a description of business and financial information on industry and geographic segments, see Note

13 on pages 62 through 65 of Item 8.

Life Science Segment

Life science is the study of the characteristics, behavior, and structure of living organisms and their component systems.

Life science researchers use a variety of products and systems including reagents, instruments, software and apparatus, to

advance the study of life processes, drug discovery, biotechnology and food pathogen testing, primarily within a laboratory

setting.

We focus on selected segments of the life science market which we estimate to be approximately $5 billion. The primary

technological applications that we supply to these segments consist of electrophoresis, image analysis, molecular detection,

chromatography, gene transfer, sample preparation and amplification. The primary end-users in our sectors of the market

are universities and medical schools, industrial research organizations, government agencies, pharmaceutical

manufacturers, biotechnology researchers and food testing laboratories.

Clinical Diagnostics Segment

We estimate the worldwide clinical diagnostics segment in which we participate to be approximately $10 billion. The

market encompasses a broad array of technologies incorporated into a variety of products used to detect, identify, monitor

and quantify substances in patient and donor blood or other bodily fluids and tissues. The vast majority of these tests are

performed "in vitro" (outside the body). The information generated by these tests helps physicians diagnose disease and

guide patient therapy and treatment, all of which helps improve patient care. It is estimated that diagnostic testing

influences 70% or more of patient care decisions made by doctors while comprising less than two percent of total

healthcare costs.

4

The market is split into several sub segments consisting of clinical chemistry, immunoassay, microbiology, hematology,

molecular, coagulation, blood banking and blood typing. Bio-Rad has significant positions in blood virus testing (blood

banking and immunoassay); immunohematology (blood typing); hemoglobin A1c testing for diabetes monitoring (clinical

chemistry and immunoassay); autoimmune disease testing (immunoassay); and quality control (crossing all sub segments).

Consumers of clinical diagnostic products are hospital laboratories, reference laboratories, physician office laboratories,

government agencies, and diagnostic manufacturers. Purchasing decisions are normally based on improving the healthcare

of patients, improving laboratory efficiency, and reducing overall costs. Bio-Rad's products and services generally meet or

exceed these criteria leading to strong customer loyalty and recurring revenue exceeding 70% of our total clinical

diagnostics sales.

Raw Materials and Components

We utilize a wide variety of chemicals, biological materials, electronic components, machined metal parts, optical parts,

minicomputers and peripheral devices. Most of these materials and components are available from numerous sources and

we have not experienced difficulty in securing adequate supplies.

Patents and Trademarks

We own numerous U.S. and international patents and patent licenses. We believe, however, that our ability to develop and

manufacture our products depends primarily on our knowledge, technology and special skills. We pay royalties on the

sales of certain products under several patent license agreements. We view these patents and license agreements as

valuable assets.

Seasonal Operations and Backlog

Our business is not inherently seasonal. However, the European custom of concentrating vacation during the summer

months usually tempers third quarter sales volume and operating income.

For the most part, we operate in markets characterized by short lead times and the absence of significant backlogs.

Management has concluded that backlog information is not material to our business as a whole.

Sales and Marketing

Each of Bio-Rad's segments maintains a sales force to sell its products on a direct basis. Each sales force is technically

trained in the disciplines associated with its products. Sales are also generated through direct mail advertising, exhibits at

trade shows and technical meetings, telemarketing, e-commerce and by extensive advertising in technical and trade

publications. Sales and marketing efforts are augmented by technical service departments that assist customers in effective

product utilization and in new product applications. We also produce and distribute technical literature and hold seminars

for customers on the use of our products.

Our customer base is broad and diversified. In 2009, no single customer accounted for more than two percent of our total

net sales. Our sales are affected by certain external factors. For example, a number of our customers, particularly in the

Life Science segment, are substantially dependent on government grants and research contracts for their funding. A

significant reduction of government funding would have a detrimental effect on the results of this segment.

Most of our international sales are generated by our wholly-owned subsidiaries and their branch offices. Certain of these

subsidiaries also have manufacturing facilities. Bio-Rad’s international operations are subject to certain risks common to

foreign operations in general, such as changes in governmental regulations, import restrictions and foreign exchange

fluctuations. However, our international operations are principally in developed nations, which we regard as presenting no

significantly greater risks to our operations than are present in the United States.

5

Competition

The markets served by our product groups are highly competitive. Our competitors range in size from start-ups to large

multinational corporations with significant resources and reach. Reliable independent information on sales and market

share of products produced by our competitors is not generally available. We believe, however, based on our own

estimates, no one company is so dominant that it prevents other companies, including Bio-Rad, from competing effectively.

We compete mainly in market segments where our products and technology offer customers specific advantages over the

competition. We tend to avoid head to head competition against entrenched competitors with me-too products.

Because of the breadth of its product lines, the Life Science segment does not face the same competitors for all of its

products. Competitors in this market include GE Biosciences, Life Technologies, Millipore and Thermo Fisher Scientific.

We compete primarily based on meeting performance specifications.

Major competitors in clinical diagnostics include Roche, Abbott Laboratories (Diagnostic Division), Siemens Medical

Diagnostics Solutions (formerly Dade-Behring, Diagnostics Products Corporation, and Bayer Diagnostics), Beckman

Coulter, Becton-Dickinson, bioMérieux, Johnson & Johnson (Ortho Clinical Diagnostics), Tosoh, Immucor, Cepheid, and

DiaSorin.

Product Research and Development

We conduct extensive product research and development activities in all areas of our business, employing approximately

780 people worldwide in these activities. Research and development have played a major role in Bio-Rad's growth and are

expected to continue to do so in the future. Our research teams are continuously developing new products and new

applications for existing products. In our development and testing of new products and applications, we consult with

scientific and medical professionals at universities, hospitals and medical schools, and in the industry. Excluding

purchased in-process research and development expense, we spent approximately $163.6 million, $159.5 million, and

$140.5 million on research and development activities during the years ended December 31, 2009, 2008 and 2007,

respectively.

Regulatory Matters

The manufacturing, marketing and labeling of certain of our products (primarily diagnostic products) are subject to

regulation in the United States by the Center for Devices and Radiological Health of the United States Food and Drug

Administration (FDA) and in other jurisdictions by state and foreign government authorities. FDA regulations require that

some new products have pre-marketing approval by the FDA and require certain products to be manufactured in accordance

with “good manufacturing practices,” to be extensively tested and to be properly labeled to disclose test results and

performance claims and limitations.

As a multinational manufacturer and distributor of sophisticated instrumentation equipment, we must meet a wide array of

electromagnetic compatibility and safety compliance requirements to satisfy regulations in the United States, the European

Community and other jurisdictions. These requirements relating to testing and trials, product licensing, pricing and

reimbursement vary widely among countries.

Our operations are subject to federal, state, local and foreign environmental laws and regulations that govern such activities

as transportation of goods, emissions to air and discharges to water, as well as handling and disposal practices for solid,

hazardous and medical wastes. In addition to environmental laws that regulate our operations, we are also subject to

environmental laws and regulations that create liabilities and clean-up responsibility for spills, disposals or other releases of

hazardous substances into the environment as a result of our operations or otherwise impacting real property that we own or

operate. The environmental laws and regulations could also subject us to claims by third parties for damages resulting from

any spills, disposals or releases resulting from our operations or at any of our properties.

6

Employees

At December 31, 2009, Bio-Rad had approximately 6,600 full-time employees. Fewer than eight percent of Bio-Rad's

approximately 2,675 U.S. employees are covered by a collective bargaining agreement which will expire on November 7,

2012. Many of Bio-Rad's non-U.S. full-time employees, especially in France, are covered by collective bargaining

agreements. We consider our employee relations in general to be good.

Available Information

Bio-Rad files annual, quarterly, and current reports, proxy statements, and other documents with the Securities and

Exchange Commission (SEC) under the Securities Exchange Act of 1934. The public may read and copy any materials that

we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. The public

may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the

SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding

issuers, including Bio-Rad, that file electronically with the SEC. The public can obtain any documents that we file with the

SEC at http://www.sec.gov.

Bio-Rad’s website address is www.bio-rad.com. We make available, free of charge through our website, our Form 10-Ks,

10-Qs and 8-Ks, and any amendments to these forms, as soon as reasonably practicable after filing with the SEC.

ITEM 1A. RISK FACTORS

The following risk factors should be read carefully in connection with evaluating our business and the forward-looking

information contained in this Annual Report on Form 10-K. We believe that any of the following risks could have a

material affect on our business, operations, industry, financial position or our future financial performance. While we

believe that we have identified and discussed below the key risk factors affecting our business, there may be additional

risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely

affect our business, operations, industry, financial position and financial performance in the future.

Adverse changes in general domestic and worldwide economic conditions and instability and disruption of

credit markets could adversely affect our operating results, financial condition or liquidity.

Recent global market and economic conditions have been unprecedented and challenging with tighter credit conditions,

slower growth and recession in most major economies during 2009. Although signs of recovery may exist, there are

continued concerns about the systemic impact of inflation, the availability and cost of credit, a declining real estate market

and geopolitical issues that contribute to increased market volatility and uncertain expectations for the global economy.

These conditions, combined with declining business activity levels and consumer confidence, increased unemployment and

volatile oil prices, contributed to unprecedented levels of volatility in the capital markets during 2009. Any additional,

continued or recurring disruptions in the capital and credit markets may adversely affect our business, results of operations,

cash flows and financial condition.

As a result of these market conditions, the cost and availability of credit has been and may continue to be adversely affected

by illiquid credit markets and wider credit spreads. Concern about the stability of the markets generally and the strength of

counterparties specifically has led many lenders and institutional investors to reduce, and in some cases, cease to provide

credit to businesses and consumers. These factors have led to a decrease in spending by businesses and consumers alike.

Our customers and vendors may experience cash flow concerns and, as a result, customers may modify, delay or cancel

plans to purchase our products and vendors may increase their prices, reduce their output or change terms of sales.

Additionally, if customers’ or vendors’ operating and financial performance deteriorates, or if they are unable to make

scheduled payments or obtain credit, customers may not be able to pay, or may delay payment of, amounts owed to us.

7

Vendors may restrict credit or impose less favorable payment terms. Any inability of current and/or potential customers to

pay us for our products or any demands by vendors for accelerated payment terms may adversely affect our earnings and

cash flow. Additionally, strengthening of the U.S. dollar associated with the global financial crisis may adversely affect the

results of our international operations when those results are translated into U.S. dollars. Furthermore, the disruption in the

credit markets could impede our access to capital, especially if we are unable to maintain our current credit ratings. Should

we have limited access to additional financing sources when needed, we may decide to defer capital expenditures or seek

other higher cost sources of liquidity, which may or may not be available to us on acceptable terms. Continued turbulence

in the U.S. and international markets and economies, and prolonged declines in business and consumer spending may

adversely affect our liquidity and financial condition, and the liquidity and financial condition of our customers, including

our ability to refinance maturing liabilities and access the capital markets to meet liquidity needs.

We cannot assure you that we will be able to integrate acquired companies, products or

technologies into

our company successfully, or we may not be able to realize the anticipated benefits from the

acquisitions.

As part of our overall business strategy, we pursue acquisitions of and investments in complementary companies, products

and technologies. In order to be successful in these activities, we must, among other things:

•

assimilate the operations and personnel of acquired companies;

•

retain acquired business customers;

•

minimize potential disruption to our ongoing business;

•

retain key technical and management personnel;

•

integrate acquired companies into our strategic and financial plans;

•

accurately assess the value of target companies, products and technologies;

•

comply with new regulatory requirements;

•

harmonize standards, controls, procedures and policies;

•

minimize the impact to our relationships with our employees and customers; and

•

assess, document and remediate any deficiencies in disclosure controls and

procedures and internal controls over financial reporting.

The benefits of any acquisition may prove to be less than anticipated and may not outweigh the costs reported in our

financial statements. Completing any potential future acquisition could cause significant diversion of our management’s

time and resources. If we acquire new companies, products or technologies, we may be required to assume contingent

liabilities or record impairment charges for goodwill and other intangible assets over time. We cannot assure you that we

will successfully overcome these risks or any other problems we encounter in connection with any acquisitions, and any

such acquisitions could adversely affect our business, financial position or operating results.

The industries and market segments in which we operate are highly competitive, and we

may not be able to

compete effectively with larger companies with greater financial resources than we have.

The life science and clinical diagnostics markets are each highly competitive. Some of our competitors have greater

financial resources than we do and are less leveraged than we are, making them better equipped to license technologies and

intellectual property from third parties or to fund research and development, manufacturing and marketing efforts.

Moreover, competitive and regulatory conditions in many markets in which we operate restrict our ability to fully recover,

through price increases, higher costs of acquired goods and services resulting from inflation and other drivers of cost

increases. Our competitors can be expected to continue to improve the design and performance of their products and to

introduce new products with competitive price and performance characteristics. Maintaining these advantages will require

us to continue to invest in research and development, sales and marketing and customer service and support. We cannot

assure you that we will have sufficient resources to continue to make such investments or that we will be successful in

maintaining such advantages.

8

We have significant international operations which subject us to various risks such as

general economic and

market conditions in the countries in which we operate.

A significant portion of our sales are made outside of the United States. Our foreign subsidiaries generated 68% of our net

sales in the year ended December 31, 2009. Our international operations are subject to risks common to foreign operations,

such as general economic and market conditions in the countries in which we operate, changes in governmental regulations,

political instability, import restrictions and currency exchange rate risks. We cannot assure you that shifts in currency

exchange rates, especially significant strengthening of the U.S. dollar compared to the Euro, will not have a material

adverse effect on our operating results and financial condition.

We are dependent on government funding and the capital spending programs of our

customers, and the

effect of potential healthcare reform on government funding and our customers’ ability to

purchase our

products is uncertain.

Our customers include universities, clinical diagnostics laboratories, government agencies, hospitals and pharmaceutical,

biotechnology and chemical companies. The capital spending programs of these institutions and companies have a

significant effect on the demand for our products. Such policies are based on a wide variety of factors, including the

resources available to make such purchases, the availability of funding from grants by governments or government

agencies, the spending priorities among various types of equipment and the policies regarding capital expenditures during

industry downturns or recessionary periods. If government funding to our customers were to decrease, or if our customers

were to decrease or reallocate their budgets in a manner adverse to us, our business, financial condition or results of

operations could be materially adversely affected.

Healthcare reform and the growth of managed care organizations have been and continue to be significant factors in the

clinical diagnostics market. The trend towards managed care, together with efforts to reform the healthcare delivery system

in the United States and Europe, has resulted in increased pressure on healthcare providers and other participants in the

healthcare industry to reduce costs. Consolidation among healthcare providers has resulted in fewer, more powerful

groups, whose purchasing power gives them cost containment leverage. These competitive forces place constraints on the

levels of overall pricing, and thus could have a material adverse effect on our profit margins for products we sell in clinical

diagnostics markets. To the extent that the healthcare industry seeks to address the need to contain costs by limiting the

number of clinical tests being performed, our results of operations could be materially and adversely affected. If these

changes in the healthcare markets in the United States and Europe continue, we could be forced to alter our approach in

selling, marketing, distributing and servicing our products.

Our failure to improve our product offerings and develop and introduce new products may negatively

impact our business.

Our future success depends on our ability to continue to improve our product offerings and develop and introduce new

product lines and extensions that integrate new technological advances. If we are unable to integrate technological

advances into our product offerings or to design, develop, manufacture and market new product lines and extensions

successfully and in a timely manner, our operating results will be adversely affected. We cannot assure you that our

product and process development efforts will be successful or that new products we introduce will achieve market

acceptance.

If we experience a disruption of our information technology systems, or if we fail to

successfully implement,

manage and integrate our information technology and reporting systems, it could harm our

business.

Our information technology (IT) systems are an integral part of our business, and a serious disruption of our IT systems

could have a material adverse effect on our business and results of operations. We depend on our IT systems to process

orders, manage inventory and collect accounts receivable. Our IT systems also allow us to efficiently purchase products

from our suppliers and ship products to our customers on a timely basis, maintain cost-effective operations and provide

customer service. We cannot assure you that our contingency plans will allow us to operate at our current level of

efficiency.

9

Our ability to implement our business plan in a rapidly evolving market requires effective planning, reporting and analytical

processes. We expect that we will need to continue to improve and further integrate our IT systems, reporting systems and

operating procedures by training and educating our employees with respect to these improvements and integrations on an

ongoing basis in order to effectively run our business. If we fail to successfully manage and integrate our IT systems,

reporting systems and operating procedures, it could adversely affect our business or operating results.

Risks relating to intellectual property rights may negatively impact our business.

We rely on a combination of copyright, trade secret, patent and trademark laws and third-party nondisclosure agreements to

protect our intellectual property rights and products. However, we cannot assure you that our intellectual property rights

will not be challenged, invalidated, circumvented or rendered unenforceable, or that meaningful protection or adequate

remedies will be available to us. For instance, it may be possible for unauthorized third parties to copy our intellectual

property, to reverse engineer or obtain and use information that we regard as proprietary, or to develop equivalent

technologies independently. Additionally, third parties may assert patent, copyright and other intellectual property rights to

technologies that are important to us. If we are unable to license or otherwise access protected technology used in our

products, or if we lose our rights under any existing licenses, we could be prohibited from manufacturing and marketing

such products. We may find it necessary to enforce our patents or other intellectual property rights or to defend ourselves

against claimed infringement of the rights of others through litigation, which could result in substantial costs to us and

divert our resources. We also could incur substantial costs to redesign our products, to defend any legal action taken

against us or to pay damages to an infringed party. The foregoing matters could adversely impact our business.

We are subject to substantial government regulation.

Some of our products (primarily diagnostic products), production processes and marketing are subject to federal, state, local

and foreign regulation, including the FDA and its foreign counterparts. We are also subject to government regulation of the

use and handling of a number of materials and controlled substances. Failure to comply with present or future regulations

could result in substantial liability to us, suspension or cessation of our operations, restrictions on our ability to expand at

our present locations or require us to make significant capital expenditures or incur other significant expenses.

We are currently subject to environmental regulations and enforcement proceedings.

Our operations are subject to federal, state, local and foreign environmental laws and regulations that govern such activities

as transportation of goods, emissions to air and discharges to water, as well as handling and disposal practices for solid,

hazardous and medical wastes. In addition to environmental laws that regulate our operations, we are also subject to

environmental laws and regulations that create liability and clean-up responsibility for spills, disposals or other releases of

hazardous substances into the environment as a result of our operations or otherwise impacting real property that we own or

operate. The environmental laws and regulations also subject us to claims by third parties for damages resulting from any

spills, disposals or releases resulting from our operations or at any of our properties.

We may in the future incur capital and operating costs to comply with currently existing laws and regulations, and possible

new statutory enactments, and these expenditures may be significant. We have incurred, and may in the future incur, fines

related to environmental matters and liability for costs or damages related to spills or other releases of hazardous substances

into the environment at sites where we have operated, or at off-site locations where we have sent hazardous substances for

disposal. We can provide no assurance, however, that such matters or any future obligations to comply with environmental

laws and regulations will not have a material impact on our operations or financial condition.

10

Loss of key personnel could hurt our business.

Our products and services are highly technical in nature. In general, only highly qualified and trained scientists have the

necessary skills to develop and market our products and provide our services. In addition, some of our manufacturing

positions are highly technical. We face intense competition for these professionals from our competitors, customers,

marketing partners and other companies throughout our industry. We generally do not enter into employment agreements

requiring these employees to continue in our employment for any period of time. Any failure on our part to hire, train and

retain a sufficient number of qualified personnel could substantially damage our business. Additionally, if we were to lose

a sufficient number of our research and development scientists and were unable to replace them or satisfy our needs for

research and development through outsourcing, it could adversely affect our business.

A significant majority of our voting stock is held by the Schwartz family, which could lead

to conflicts of

interest.

We have two classes of voting stock, Class A Common Stock and Class B Common Stock. With a few exceptions, holders

of Class A and Class B Common Stock vote as a single class. When voting as a single class, each share of Class A

Common Stock is entitled to one-tenth of a vote, while each share of Class B Common Stock has one vote. In the election

or removal of directors, the classes vote separately and the holders of Class A Common Stock are entitled to elect 25% of

the Board of Directors, with holders of Class B Common Stock electing the remaining directors.

As of February 16, 2010, the Schwartz family collectively held approximately 16% of our Class A Common Stock and

90% of our Class B Common Stock. As a result, the Schwartz family is able to elect a majority of the directors, effect

fundamental changes in our direction and control matters affecting us, including the allocation of business opportunities

that may be suitable for our company. In addition, this concentration of ownership and voting power may have the effect of

delaying or preventing a change in control of our company.

The Schwartz family may exercise its control over us according to interests that are different from other investors’ or

debtors’ interests.

Our business could be adversely impacted if we have deficiencies in our disclosure controls

and procedures

or internal control over financial reporting.

The design and effectiveness of our disclosure controls and procedures and internal control over financial reporting may not

prevent all errors, misstatements or misrepresentations. We cannot assure you that our disclosure controls and procedures

over internal control of financial reporting will be effective in accomplishing all control objectives all of the time.

Deficiencies, particularly a material weakness in internal control over financial reporting, which may occur in the future

could result in misstatements of our results of operations, restatements of our financial statements, a decline in our stock

price, or otherwise materially adversely affect our business, reputation, results of operation, financial condition or liquidity.

Natural disasters, terrorist attacks or acts of war may cause damage or disruption to us and

our employees,

facilities, information systems, security systems, vendors and customers, which could

significantly impact

our net sales, costs and expenses, and financial condition.

We have significant manufacturing and distribution facilities, particularly in the western United States, France and

Switzerland. In particular, the western United States has experienced a number of earthquakes, wildfires, flooding,

landslides and other natural disasters in recent years. The occurrences could damage or destroy our facilities which may

result in interruptions to our business and losses that exceed our insurance coverage. Terrorist attacks, such as those that

occurred on September 11, 2001, have contributed to economic instability in the United States, and further acts of

terrorism, bioterrorism, violence or war could affect the markets in which we operate, our business operations, our

expectations and other forward-looking statements contained or incorporated in this document. Any of these events could

cause a decrease in our revenue, earnings and cash flows.

11

We may incur losses in future periods due to write-downs in the value of financial instruments.

We have positions in a variety of financial instruments including asset backed securities and other similar instruments.

Financial markets are quite volatile and the markets for these securities can be illiquid. The value of these securities will

continue to be impacted by external market factors including default rates, changes in the value of the underlying property,

such as residential or commercial real estate, rating agency actions, the prices at which observable market transactions

occur and the financial strength of various entities, such as financial guarantors who provide insurance for the securities.

Should we need to convert these positions to cash, we may not be able to sell these instruments without significant losses

due to current debtor financial conditions or other market considerations.

We have substantial debt and have the ability to incur additional debt. The principal and

interest payment

obligations of such debt may restrict our future operations and impair our ability to meet

our obligations

under our notes.

As of December 31, 2009 we and our subsidiaries have approximately $742.6 million of outstanding indebtedness. In

addition, the indenture governing our notes permits us to incur additional debt provided we comply with the limitation on

the incurrence of additional indebtedness and disqualified capital stock covenants contained in the indenture.

The following chart shows certain important credit statistics.

At December 31, 2009

(in millions)

Total debt

$

742.6

Stockholders’ equity

$

1,279.2

Debt to equity ratio

0.6

The incurrence of substantial amounts of debt may have important consequences. For instance, it could:

•

make it more difficult for us to satisfy our financial obligations, including those relating to the notes;

•

require us to dedicate a substantial portion of our cash flow from operations to the payment of interest and

principal due under our debt, including the notes, which will reduce funds available for other business

purposes;

•

increase our vulnerability to general adverse economic and industry conditions;

•

limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we

operate;

•

place us at a competitive disadvantage compared with some of our competitors that have less debt; and

•

limit our ability to obtain additional financing required to fund working capital and capital expenditures and

for other general corporate purposes.

Our ability to satisfy our obligations and to reduce our total debt depends on our future operating performance and on

economic, financial, competitive and other factors, many of which are beyond our control. Our business may not generate

sufficient cash flow, and future financings may not be available to provide sufficient net proceeds, to meet these obligations

or to successfully execute our business strategy.

12

The indenture governing our notes and the terms of other debt instruments, including without limitation our credit facilities

and other agreements we may enter in the future, contain or will contain covenants imposing significant restrictions on our

business. These restrictions may affect our ability to operate our business and may limit our ability to take advantage of

potential business opportunities as they arise. These covenants place restrictions on our ability to, among other things:

•

incur additional debt;

•

acquire other businesses or assets through merger or purchase;

•

create liens;

•

make investments;

•

enter into transactions with affiliates;

•

sell assets;

•

in the case of some of our subsidiaries, guarantee debt; and

•

declare or pay dividends, redeem stock or make other distributions to shareholders.

Our existing credit facility also requires that we meet certain financial tests and maintain certain financial ratios, including a

maximum consolidated leverage ratio test, minimum consolidated interest coverage ratio test and a minimum net worth test.

Our ability to comply with these covenants may be affected by events beyond our control, including prevailing economic,

financial and industry conditions. The breach of any of these restrictions could result in a default. An event of default

under our debt agreements would permit some of our lenders to declare all amounts borrowed from them to be due and

payable, together with accrued and unpaid interest. If we were unable to repay debt to our senior secured lenders, these

lenders could proceed against the collateral securing that debt. The collateral is substantially all of our personal property

assets, the assets of our domestic subsidiaries and 65% of the capital stock of certain foreign subsidiaries. In addition,

acceleration of our other indebtedness may cause us to be unable to make interest payments on our notes and repay the

principal amount of the notes or may cause the future subsidiary guarantors, if any, to be unable to make payments under

the guarantees.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We own our corporate headquarters located in Hercules, California. The principal manufacturing and research locations for

each segment are as follows:

Segment

Location

Owned/Leased

Life Science

Richmond, California

Owned/Leased

Hercules, California

Owned/Leased

Riom, France

Owned/Leased

Singapore

Leased

Clinical

Diagnostics

Hercules, California

Owned/Leased

Benicia, California

Leased

Irvine, California

Leased

Greater Seattle area, Washington

Owned/Leased

Plano, Texas

Leased

Lille, France

Owned

Greater Paris area, France

Leased

Nazareth-Eke, Belgium

Leased

Cressier, Switzerland

Owned/Leased

13

Most manufacturing and research facilities also house administration, sales and distribution activities. In addition, we lease

office and warehouse facilities in a variety of locations around the world. The facilities are used principally for sales,

service, distribution and administration for both segments.

ITEM 3. LEGAL PROCEEDINGS

We are party to various claims, legal actions and complaints arising in the ordinary course of business, including

intellectual property matters. We do not believe, at this time, that any ultimate liability resulting from any of these matters

will have a material adverse effect on our results of operations, financial position or liquidity. However, we cannot give

any assurance regarding the ultimate outcome of these lawsuits and their resolution could be material to our operating

results for any particular period, depending upon the level of income for the period.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS