SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 1

Simple Home Insurance Policy

UIN No IRDAN144RP0002V02201617

Standard Policy Wordings

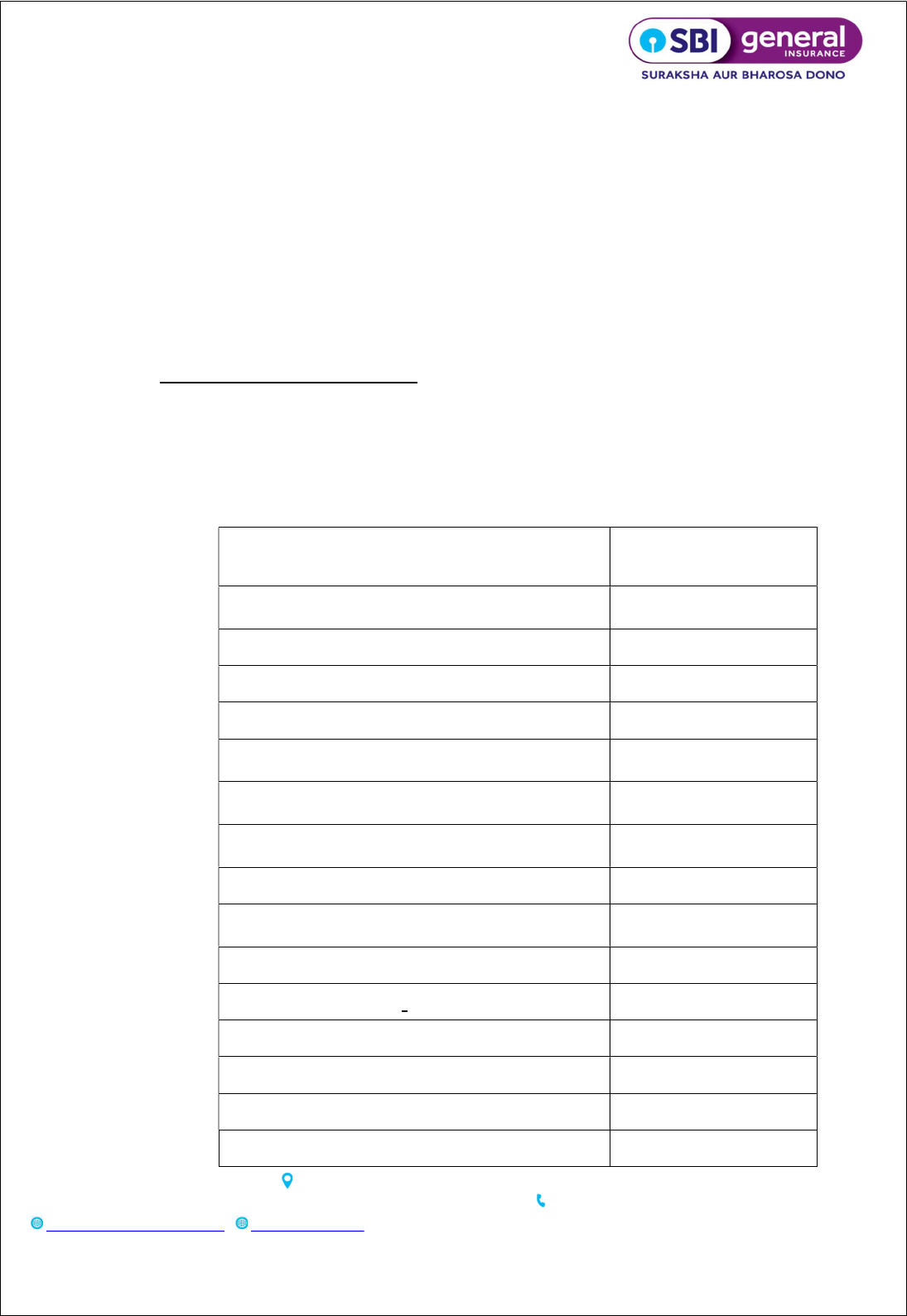

Contents

Page No.

Clause A. This Policy and the Insurance Contract

Clause B. Insured Events

Clause C. Home Building Cover

Clause D. Home Contents Cover

Clause E. Additional Covers

Clause F. Exclusions

Clause G. Conditions

Clause H. Changes to Covers

Clause I. Waiver of Underinsurance

Clause J. Other Details

Clause K. Grievances

Clause L. Information about Us

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 2

Simple Home Insurance Policy

UIN No._________________

You chose this Simple Home Insurance Policy and applied to Us for insurance covers of Your

choice. You paid Us the premium and gave Us information about Yourself, Your Home Building

and Home Contents. Based on Your confirmation that this information is true and correct, and in

return of accepting the Premium You have paid Us We promise to provide You insurance as stated

in this Policy Document and the Policy Schedule attached to it.

Clause A. This Policy and the Insurance Contract

1. Your Policy: This Simple Home Insurance Policy is a contract between You and Us as stated

in the following:

a. This Policy document,

b. The Policy Schedule attached to this Policy document,

c. Any Endorsement attached to and forming part of this Policy document,

d. Any Add-on to this Policy that You may have purchased from Us,

e. The proposals and all declarations made by You or on Your behalf.

2. To whom this Policy is issued and what it covers:

a. This Policy is issued to You and covers You and/or Your Home Building and/or Home

Contents as mentioned in the Policy Schedule.

b. If more than one person is insured under this Policy, each of You is a joint policyholder.

Any notice or letter We give to any of You will be considered as given to all of You. Any

request, statement, representation, claim or action of any one of You will bind all of You

as if made by all of You.

c. If You have mortgaged, pledged or hypothecated Your Home Building and/or Home

Contents with a Bank, the Policy Schedule will show an

‘Agreed Bank Clause’ and the name of such Bank. The terms and conditions of this

arrangement will be added to this Policy as an additional clause.

3. The Policy Schedule: The Policy Schedule is an important document about Your insurance

cover. It contains:

a. Your personal details,

b. the Policy Period,

c. the description of Your Insured Property,

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 3

d. the total Sum Insured, the Sum Insured for each cover or item covered, and any limits

and sub-limits,

e. the insurance covers You have purchased,

f. the premium You have paid for these insurance covers,

g. add-on covers opted by You,

h. other important and relevant aspects and information.

4. Special meaning of certain words: Words stated in the table below have a special meaning

throughout this Policy, the Policy Schedule and Endorsements.

These words with special meaning are stated in the Policy with the first letter in capitals.

Word /s Specific meaning

Accident

means sudden, unforeseen, and involuntary event caused

by external, visible, and violent means

Ambulance

A road vehicle operated by a licenced/authorised service

provider and equipped for the transport and paramedical

treatment of the person requiring medical attention.

Audio- and Audio-

Visual Appliances

The television sets and the related appliances forming part

of or attaching to a television set/s, and the antenna, both

external and internal and/or other Audio Appliances

and/or

other electronic appliances

, all as noted specifically in the

Schedule.

Bank A bank or any financial institution

Baggage

The articles and/ or personal effects of the Insured (other

than property of the Business) in packing or in containers

suitable and standard to the mode of travel that is

accompanied by the Insured or whilst such baggage is

lodged either in locked private

room of a hotel or guest

house or any other accommodation occupied by Insured

during the Insured’s stay at that location or in a public locker

facility availed by the Insured during the course of or at any

intermediate stage of the travel

Bodily Injury/ Injury

Accidental physical bodily harm excluding illness or disease

solely and directly caused by external, violent, visible and

evident means which is verified and certified by a Medical

Practitioner.

Break-in To entry into property illegally using actual

force or violence

of which there is visible evidence.

Business or Business

Purpose

Any full or part time, permanent or temporary, activity

undertaken with a view to profit or gain.

Burglary

an act involving the unauthorised entry to or exit from Your

Ho

me or attempt or threat thereof by unexpected, forcible,

visible and violent means, with an intent to commit an act of

Theft.

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 4

Carpet Area

1.

for the main building unit of Your Home, it is the net

usable floor area, excluding the area covered by the

external walls, areas under services shafts, exclusive

balcony or verandah area and exclusive open terrace

area, but including the area covered by t

he internal

partition walls of the residential unit;

2.

for any enclosed structure on the same site, it is the net

usable floor area of such structure; and

3.

for any balcony, verandah area, terrace area, parking

area, or any enclosed structure that is part of

Your

Home, it is 25% of its net usable floor area.

Cheque

Any bank draft drawn against deposited funds to pay a

specific sum to a specified payee on demand other than

drafts with a stamped signature.

Commencement

Date

It is the date and time from which the insurance cover under

this Policy begins. It is shown in the Policy Schedule.

Congenital Anomaly

Refers to a condition(s) which is present since birth, and

which is abnormal with reference to form, structure or

position.

a. Internal Congenital Anomaly -

Congenital

anomaly which is not in the visible and

accessible parts of the body.

b. External Congenital Anomaly -

Congenital

anomaly which is in the visible and accessible

parts of the body

Content The following not

used for Business or Business Purposes,

so long as they are owned by You and/or You or Your Family

are legally responsible for them:

1.

Household goods, such as furniture, fixtures, fittings,

home appliances, interior decorations, and items of

like nature.

2. Pe

rsonal Effects such as clothes and other articles

of a personal nature likely to be worn, used, or

carried including Personal Money, Jewellery and

Valuables up to the limit shown in the Schedule.

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 5

Cost of

Construction

The amount required to construct Your Home Building at the

Commencement Date.

This amount is calculated as follows:

a.

For residential structure of Your Home including

Fittings and Fixtures:

Carpet Area of the structure in square metres X Rate of Cost

of

Construction at the Commencement Date. The Rate of

Cost of Construction is the prevailing rate of cost of

construction of Your Home Building at the Commencement

Date as declared by You and accepted by Us and shown in

the Policy schedule.

b. For additional structures

: the amount that is based

on the prevailing rate of Cost of Construction at the

Commencement Date as declared by You and accepted by

Us.

Cumulative Bonus

Any increase or addition in the Sum Insured granted by the

insurer without an associated increase in premium.

Damage Actual and/or physical damage to tangible property;

Dependent The insured’s spouse or Parent or Parent- in-

law or child

who has been enrolled in the Policy and does not have an

independent source of earning

(rental or pension income is

not considered as an earning).

Domestic Staff

/Employee

Any person employed by You solely to carry out domestic

duties associated with Your Home but does not include any

person employed in any capacity in connection with any

Business, trade or profession.

Emergency

A serious medical condition or symptom resulting from Injury

or sickness which arises suddenly and unexpectedly and

requires immediate care and treatment by a Medical

Practitioner, generally received within 24 hours

of onset to

avoid jeopardy to life or serious long-

term impairment of the

Insured Person’s health, until stabilisation at which time this

medical condition or symptom is not considered an

emergency anymore.

Endorsement

A written amendment to the Policy that We make (additions,

deletions, modifications, exclusions or conditions of an

insurance Policy) which may change the terms or scope of

the original policy.

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 6

Family, Them or They You, Your spouse, Your children, Your p

arents, or any other

persons who:

i.

Are and continue to be normally resident with You

(excluding Domestic staff/ Employee), and

ii. Not paying a commercial rent.

Fungi

Any type or form of fungus, including but not limited to, all

forms of mold or mildew, and any mycotoxins, spores,

scents, vapour, gas, or substance, including any

byproducts, produced or released by Fungi.

General Contents General Contents are all the c

ontents of household use in

Your Home, e.g., furniture, electronic items and goods,

antennae, solar panels, water storage equipment, kitchen

equipment, electrical equipment (including those fitted on

walls), clothing and apparel and items of similar nature.

Grace Period the specified period of time

immediately following the

premium due date during which a payment can be made to

renew or continue a policy in force without loss of continuity

benefits such as waiting periods and coverage of pre-

existing diseases. Coverage is not available for the perio

d

for which no premium is received. (Grace period is

applicable only to the Personal Accident section of this

Policy).

Home Contents

Those articles or things in Your Home that are not

permanently attached or fixed to the structure of Your

Home. Home Con

tents may consist of General Contents

and/or Valuable Contents.

Hospital Any institution established for in-

patient care and day care

treatment of illness and/ or injuries and which has been

registered as a hospital with the local authorities under

Clin

ical establishments (Registration and Regulation) Act

2010 or under enactments specified under the schedule of

Section 56(1) and the said act Or complies with all minimum

criteria as under:

1.

Has qualified nursing staff under its employment round

the clock.

2. Has at least 10 in-

patient beds in towns having a

population of less than 1,000,000 and at least 15 in-

patient beds in all other places.

3.

Has qualified Medical Practitioner(s) in charge round

the clock.

4. A fully equipped operation theatre of its ow

n where

surgical procedures are carried out.

5.

maintains daily records of patients and make these

accessible to the Insurance Company’s authorized

personnel.

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 7

Hospitalization or

Hospitalised

Admission in a Hospital for a minimum period of 24 In-

patient Care

consecutive hours except for specified

procedures/ treatments, where such admission could be for

a period of less than 24 consecutive hours.

Insured

The Person/s who has/have purchased Insurance Cover

under this Policy.

Insured Property

Your Home Building and Home Contents, or any item of

property covered by this Policy.

Jewellery

Articles of personal adornment containing gemstones,

silver, gold, platinum, or other precious metals.

Kutcha

Construction

Building(s) having walls and/or roofs of wooden

planks/thatched leaves and/or grass/hay of any

kind/bamboo/plastic cloth/asphalt/canvas/tarpaulin and the

like.

Larceny

unlawful taking and carrying away of Contents belonging to

You and/or Your Family with

the purpose of depriving You

and/or Your Family of its possession permanently.

Lost or Stolen

Means having been inadvertently lost or having been stolen

by a third party without Your assistance, consent, or co-

operation.

Market Value

Means the value at which property insured could be

replaced with one of the same kind, type, age and condition.

Medical Advice

Means any consultation or advice from a Medical

Practitioner including the issue of any prescription or repeat

prescription.

Medical Expenses

Those expenses that an Insured person has necessarily and

actually incurred on medical treatment on account of illness

or accident on the advice of Medical Practitioner, as long as

these are no more than would have been payable if the

Insure

d Person had not been insured and no more than

other hospitals or doctors in the same locality would have

charged for the same medical treatment.

Medically Necessary

Means any treatment, test, medication, or stay in Hospital or

part of stay in Hospital which,

i.

Is required for the medical management of the

Illness or Injury suffered by the Insured Person;

ii.

Must not exceed the level of care necessary to

provide safe, adequate and appropriate medical

care in scope, duration or intensity.

iii. Must have b

een prescribed by a Medical

Practitioner; and

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 8

iv.

Must conform to the professional standards

widely accepted in international medical practice

or by the medical community in India.

Medical Practitioner A person who holds a valid registration from the Medical

Council of any state or Medical Council of India or Council

for Indian Medicine or for Homeopathy set up by the

Government of India or a State Government and is thereby

entitled to practice medicine within its Jurisdiction; and is

acting within its scope and Jurisdiction of license.

Nominee

The person named in the Policy Schedule who is nominated

to receive the benefits in respect of an Insured Person under

the Policy in accordance with the terms and conditions of the

Policy, if the Insured Person is

deceased.

Plate Glass The glass as described in Policy Schedule

Portable Equipment

Photographic equipment, Laptops, Mobile Phones, Video

Cameras, telescopes, musical instruments, tablets, I-pods

and portable equipment of a similar nature which are

designed and capable of being carried or moved from one

location to another

.

Policy Period

Policy period means the period commencing from the

effective date and time as shown in the Policy Schedule and

terminating at Midnight on the expiry date as shown in the

Policy Schedule or on the termination of or the cancellation

of insurance as provided for in Clause G (III)

of this Policy,

whichever is earlier.

Policy Schedule

The document accompanying and forming part of the Policy

that gives Your details and of Your insurance cover, as

described in

Clause A (3)

of this Policy.

Premium

The premium is the amount You pay Us for this insurance.

The Policy Schedule shows the amo

unt of premium for the

Policy Period and all other taxes and levies.

Pre-existing

Conditions

any condition, ailment or injury or related condition(s) for

which there were sign or symptoms and/ or were diagnosed

and/ or for which medical advice/ treatmen

t was received

within 48 months prior to the first policy issued by the insurer

and renewed continuously thereafter.

Public Authority Any governmental, quasi-

governmental organisation or any

statutory body or duly authorised organisation with the

power t

o enforce laws, exact obedience, command,

determine or judge.

Pucca Construction Construction other than Kutcha Construction.

Reasonable and

Customary Charges

The charges for services or supplies, which are the standard

charges for the specific provider and consistent with the

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 9

prevailing charges in the geographical area for identical or

similar services, taking into account the nature of the

Illness/Injury invol

ved.

Replacement Cost/

Reinstatement Value

The value at which the property insured could be replaced

with new property of the same kind, type and specification

but not superior to or more extensive than the insured

property and includes wherever applicable freight, custom

duty, dismantling and re-erection cost and any other

relevant charges, if included in the Sum Insured.

Renewal

means the terms on which the contract of insurance can be

renewed on mutual consent with a provision of Grace Period

for treat

ing renewal continuous for the purpose of all waiting

periods.

Robbery

means the unlawful taking of money or other property from

Your care and custody by one who has caused or

threatened You with bodily harm or Injury or has put You in

the fear of

immediate Bodily Injury and committing an illegal

or violent act.

Spouse Your wife or husband.

Sum Insured

The amount shown as Sum Insured in the Policy

Schedule and as described in Clause C (4) and

Clause D

(2) of this Policy. It represents Our max

imum liability for each

cover or part of cover and for each loss.

Theft An act of directly or indirectly mis-appropriating

with an

intention of

illegally permanently depriving You and/or Your

Family of the Contents by any person by violent or

forceful

means or otherwise.

Total Loss

A situation where the Insured Property or item is completely

destroyed, lost or damaged beyond retrieval or repair or the

cost of repairing it is more than the Sum Insured for that item

or in total.

Unoccupied Yo

ur Home remaining unoccupied by You and/or Your

Family for more than 30 consecutive days.

Valuable Contents Valuable Contents

of Your Home consist of items such as

jewellery, silverware, paintings, works of art, antique items,

curios and items of similar nature.

Vehicle

means Your car, truck, jeep, motorcycle, recreational

vehicle, or camper.

We, Us, Our, Insurer

Simple Home Insurance Policy that has provided Insurance

Cover under this Policy; of the Company.

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 10

You, Your, Insured

The Insured Person/s who has/have purchased Insurance

Cover under this Policy; of such Insured Person/s.

Your Home

Building

Your Home Building

is a building consisting of a residential

unit, having an enclosed structure and a roof, basement (if

any) and used as a dwelling place described in detail as per

Clause C (2) of this Policy.

SECTION 1 – FIRE AND ALLIED PERILS

Clause B. Insured Events

We give insurance cover for physical loss or damage, or destruction caused to Insured Property by

the following unforeseen events occurring during the Policy Period.

The events covered are given in Column A and those not covered in respect of these events are

given in Column B.

Column A Column B

We cover physical loss or damage, or

destruction caused to the Insured

Property by

We do not cover any loss or damage,

or destruction caused to the Insured

Property

1. Fire

caused by burning of Insured Property

by order of any Public Authority.

2. Explosion or Implosion -

3. Lightning -

4.

Earthquake, volcanic eruption, or other

convulsions of nature

-

5.

Storm, Cyclone, Typhoon, Tempest,

Hurricane, Tornado, Tsunami, Flood

and Inundation

-

6.

Subsidence of the land on which Your

Home Building stands,

Landslide, Rockslide

caused by

a. normal cracking, settlement or

bedding down of new structures,

b. the settlement or movement of

made up ground,

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 11

c. coastal or river erosion,

d.

defective design or workmanship

or use of defective materials, or

demolition, construction, structural

alterations or repair of any property, or

groundworks or excavations.

7. Bush fire, Forest fire, Jungle fire -

8.

Impact damage of any kind, i.e.,

damage caused by impact of, or

collision caused by any external

physical object (e.g. vehicle, falling

trees, aircraft, wall etc.)

caused by pressure waves caused by

aircraft or other aerial or space devices

travelling at sonic or supersonic

speeds.

9. Missile testing operations -

10.

Riot, Strikes, Malicious Damages

caused by

a. temporary or permanent

dispossession, confiscation,

commandeering, requisition or

destruction by order of the

government or any lawful

authority,

or

b. temporary or permanent

dispossession of Your Home by

unlawful occupation by any person.

11

Acts of terrorism

(Coverage as per Terrorism Clause

attached)

Exclusions and Excess as per

Terrorism Clause attached.

12.

Bursting or overflowing of water tanks,

apparatus and pipes.

-

13.

Leakage from automatic sprinkler

installations.

a.

repairs or alterations in Your Home

or the building in which

Your Home is located,

b. repairs, removal or extension of

any sprinkler installation, or

defects in the construction known to

You.

14.

Theft within 7 (seven )days from the

occurrence of and proximately caused

by any of the above Insured Events.

if it is

a. of any article or thing outside

Your Home, or

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 12

of any article or thing attached from the

outside of the outer walls or the roof of

Your Home, unless securely mounted.

Clause C: Home Building Cover

1. What We cover

We cover physical loss or damage, or destruction of Your Home Building because of any

Insured Event listed in Clause B of this Policy. We also cover architect’s, surveyor’s, consulting

engineer’s fees, cost of removing debris as specified under Clause C (5) (f) of this Policy.

Further, We pay for Loss of rent and Rent for Alternative Accommodation, which will be paid

to the extent declared by You and agreed by Us as specified under Clause C (6) of this Policy

while Your Home Building is not fit for living following loss or damage due to an insured event.

2. Your Home Building

a. Your Home Building is a building consisting of a residential unit, having an enclosed

structure and a roof, basement (if any) and used as a dwelling place.

b. Your Home Building includes

i. fixtures and fittings permanently attached to the floor, walls or roof, like fixed sanitary

fittings, electrical wiring and other permanent fittings.

ii. the following ‘additional structures’ if they are on the same site, and are used as part

of Your Home Building:

a) garage, domestic out-houses used for residence, parking spaces or areas, if

any

b) compound walls, fences, gates, retaining walls and internal roads,

c) verandah or porch and the like,

d) septic tanks, bio-gas plants, fixed water storage units or tanks,

e) solar panels, wind turbines and air conditioning systems, central heating

systems and the like, if not included in Home Contents Cover,

iii. any other structure shown in the Policy Schedule.

c. Your Home Building does not include Contents of Your Home.

3. Use for residence:

a. We will pay only if Your Home Building is used for the purpose of residence of Yourself and

Your family, or of Your tenant, licensee, or employee.

b. We will not pay if

i. Your Home Building is used as a holiday home, or for lodging and boarding, or

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 13

ii. Your Home Building or any part of Your Home Building is used for purposes other

than residential except where it is used both for Your residence and for the purposes

of earning Your livelihood if You are self-employed or You have shifted Your office to

Your Home Building for a temporary period due to lockdown or closure of Your office

ordered by a public authority.

4. Sum Insured:

a. The Sum Insured for the Home Building Cover is the prevailing Cost of Construction of Your

Home Building at the Commencement Date as declared by You and accepted by Us and

will be the maximum amount payable in the event the Home Building is a Total Loss.

b. If the Policy Period is more than one year, We will automatically increase Your Sum Insured

during the Policy Period by 10% per annum on each anniversary of Your Policy without

additional premium for a maximum of 100% of the Sum Insured at the Policy

Commencement Date.

c. The Sum Insured will be automatically increased each day by an amount representing

1/365th of 10% of Sum Insured at the Policy Commencement Date for annual policies.

d. Restoration of Sum Insured : Except as stated in Clause G (III) (3) (b) of this

Policy, the insurance cover will at all times be maintained during the Policy Period to the

full extent of the respective Sum Insured. This means that after We have paid for any loss,

the policy shall be restored to the full original amount of Sum Insured. You must pay to Us

proportionate premium for the unexpired Policy Period from the date of loss. We can also

deduct this premium from the net claim that We must pay You.

5. What We pay

a. If You make a claim under the policy for damage to Your Home Building due to any of the

insured perils, We reimburse the cost to repair it to a condition substantially the same as its

condition at the time of damage. You must spend for repairs and claim that amount from

Us.

b. We will calculate the amount of claim on the basis of the actual Carpet Area subject to the

Carpet Area not exceeding that declared by You in the Proposal Form and stated in the

Policy Schedule.

c. The maximum We will pay for all items together is the Sum Insured shown in the Policy

Schedule for Home Building Cover. If the Policy Schedule shows any limit for any item,

such limit is the maximum We will pay for that item.

d. If Your Home Building is a Total Loss, We will pay You the Sum Insured of the Home

Building.

e. If only an additional structure is destroyed, We will pay You an amount equal to the Cost of

Construction of the additional structure.

f. In addition to what Clause C (5) (c) of this Policy provides for, We will pay You the following

expenses:

i. up to 5% of the claim amount for reasonable fees of architect, surveyor, consulting

engineer;

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 14

ii. up to 2 % of the claim amount for reasonable costs of removing debris from the

site.

6. Loss of Rent and Rent for Alternative Accommodation: In addition to what Clause C (5)

(c) of this Policy provides for, We will pay the amount of rent You lose or alternative rent You

pay while Your Home Building is not fit for living because of physical loss arising out of an

Insured Event as follows:

a. If You are living in Your Home as a tenant, and You are required to pay higher rent for the

alternative accommodation, We will pay the difference between the rent for alternative

accommodation and the rent of Your Home Building.

b. We will pay the loss under this cover for an accommodation that is not superior to Your

Home Building in any way and in the same city as Your Home Building.

c. The amount of lost rent shall be calculated as follows:

Sum Insured for Cover for Loss of Rent (as declared by You in the Proposal Form and

specified by Us in the Policy Schedule) X Period necessary for repairs ÷ Loss of Rent

Period opted for.

d. This cover will be available for the reasonable time required to repair Your Home Building

to make it fit for living. The maximum period of this cover is three years from the date Your

Home Building becomes unfit for living. You must submit a certificate from an architect or

the local authority to show that Your Home Building is not fit for living.

e. Claim for loss of rent will be accepted only if We have accepted Your claim for loss for

physical damage to Your Home under the Home Building Cover.

Clause D: Home Contents Cover

1. What We cover:

We cover the physical loss or damage to or destruction of the General Contents of Your Home

caused by an Insured Event as listed in Clause B of this Policy. Valuable Contents of Your

Home are not covered under this Policy unless You have purchased the optional cover for the

Valuable Contents.

2. Sum Insured:

a. The Sum Insured for the Home Contents Cover is shown in the Policy Schedule and will be

the maximum amount payable in the event the Home Contents are destroyed/lost

completely.

b. The policy has a built-in cover for the General Contents of Your home equal to 20% of the

Sum Insured for Home Building Cover subject to a maximum of ₹ 10 Lakh (Rupees Ten

Lakh) provided You have opted for both Home Building and Home Contents cover. If You

choose to have a higher Sum Insured for Home Contents, You have to declare the Sum

Insured in the Proposal Form and pay additional premium.

c. If You have purchased only Home Contents Cover, You have to declare the Sum Insured

for the General Contents in the Proposal Form.

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 15

d. The Sum Insured You have chosen for General Contents must be enough to cover the cost

of replacement of the General Contents.

e. If You want to cover the Valuable Contents in Your Home, You must opt for the Optional

Cover for Valuable Contents as given in Clause E (1) (a) of this Policy.

f. Restoration of Sum Insured: Except as stated in Clause G (III) (3) (b) of this Clause below,

the insurance cover will at all times be maintained during the Policy Period to the full extent

of the respective Sum Insured. This means that after We have paid for any loss, the policy

shall be restored to the full original amount of Sum Insured. You must pay to Us

proportionate premium for the unexpired Policy Period from the date of loss. We can also

deduct this premium from the net claim that We must pay You.

3. What We pay

a. If the General Contents of Your Home are physically damaged by any Insured Event, We

will at Our option,

i. reimburse to You the cost of repairs to a condition substantially the same as its

condition at the time of damage, or

ii. pay You the cost of replacing that item with a same or similar item, or

iii. repair the damaged item to a condition substantially the same as its condition at

the time of damage.

b. The maximum We will pay for Home Contents is the Sum Insured shown in the Policy

Schedule for Home Contents Cover. If the Policy Schedule shows any limit for any item, or

category or groups of items, such limit is the maximum We will pay for that item.

Clause E: Additional Covers

1. Optional Covers:

a. Cover for Valuable Contents on Agreed Value Basis (under Home Contents cover):

For Valuable Contents, a value may be agreed upon by You and Us based on a valuation

certificate submitted by You and accepted by Us. However, We shall waive the requirement

of valuation certificate if the Sum Insured opted for is up to ₹ 5 Lakh (Rupees Five Lakh)

and Individual item value does not exceed ₹ 1 Lakh (Rupees One Lakh).

i. If the Valuable Contents of Your Home are physically damaged by any Insured

Event, We will pay the cost of repairing the item/s.

ii. If the Valuable Contents of Your Home are a Total Loss We will pay the Sum Insured

shown in the Policy Schedule for the Valuable item/s. If the Policy Schedule shows

any limit for any item, or category or groups of items, such limit is the maximum We

will pay for that item. Loss to only one item of a pair or set does not constitute loss

or damage to the entire pair or set.

b. Personal Accident Cover:

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 16

In the event an insured peril that caused damages to Your Home Building and/or Home

Contents also results in the unfortunate death of either You or Your spouse, We will pay

compensation of ₹ 5,00,000 (Rupees Five Lakh) per person.

In the event of the unfortunate death of the insured, the Personal Accident cover shall

continue for the spouse until expiry of the policy.

2. Add-ons:

You can opt for an Add-on by choosing from the Add-ons, if any, offered by Us under this

product and the ones that You have purchased will be mentioned in the Policy Schedule and

the relevant clause/s and/or endorsements will be attached to this Policy.

Specific Exclusions Applicable to Section I:

1. Loss or damage to bullion or unset precious stones, manuscripts, plans, drawings, securities,

obligations or documents of any kind, coins or paper money, cheques, vehicles, and explosive

substances unless otherwise expressly stated in the policy.

2. Loss of any Insured Property which is missing or has been mislaid, or its disappearance cannot

be linked to any single identifiable event.

3. Loss or damage to any Insured Property removed from Your Home to any other place.

4. Loss, damage or destruction to any electrical/electronic machine, apparatus, fixture, or fitting

by over-running, excessive pressure, short circuiting, arcing, selfheating or leakage of

electricity from whatever cause (lightning included). This exclusion applies only to the particular

machine so lost, damaged or destroyed.

5. Loss of earnings, loss by delay, loss of market or other consequential or indirect loss or

damage of any kind or description whatsoever.

6. Any reduction in market value of any Insured Property after its repair or reinstatement.

7. Any addition, extension, or alteration to any structure of Your Home Building that increases its

Carpet Area by more than 10% of the Carpet Area existing at the Commencement Date or on

the date of renewal of this Policy, unless You have paid additional premium and such addition,

extension or alteration is added by Endorsement.

8. Costs, fees, or expenses for preparing any claim.

Clause F. Other Section

You may opt any below section along with Section 1-Fire and Allied Perils. In consideration of

addition premium, it is hereby and agreed that We will pay/restrict the Sum Insured under below

listed covers subject to all terms, condition, exclusion applicable to the Policy.

SECTION 2 – BURGLARY AND THEFT

A. What We Cover

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 17

We will pay You for the loss and Damage caused by Burglary or Theft including Larceny

and/or attempted Burglary or Theft including Larceny to:

a) Your Home subject to maximum payment of 10% of the Section Sum Insured or Rs

5,000 whichever is less

b) The Contents of Your Home up to the Section Sum Insured and/or

c) Newly purchased Contents i.e. purchased after commencement of the Policy, subject

to maximum payment of 10% of the Section Sum Insured or Rs 20,000 whichever is

less, duly supported by original purchase invoice/ bill and/or

d) Contents that You have placed in safe custody during Your temporary absence from

Your Home as long as the period of the placement of such Contents does not exceed a

total of 120 days in any one Period of Insurance, subject to maximum payment of 10%

of the Section Sum Insured or Rs 10,000 whichever is less and/or

e) Contents that have been moved to a private residential accommodation (not being Your

Home) that is being occupied by You and/or Your Family for a period not exceeding 30

consecutive days in any one Period of Insurance, subject to a maximum payment of

10% of the Section Sum Insured or Rs 10,000 whichever is less and/or

f) Personal Money not exceeding 1% of Section Sum Insured or Rs 10,000 whichever is

less.

B. What We NOT Cover

We will not make payment to You under this Section:

a) If the loss or Damage occurs while Your Home is Unoccupied unless the Company is

informed at the time of applying for insurance or prior to Your Home being unoccupied,

signified by an endorsement on the Policy by or on behalf of the Company.

b) If You and/or Your Family and/or Your Domestic Staff are directly and/or indirectly in

any way involved in or concerned with the actual or attempted Burglary, Theft and

Larceny.

c) Any loss or Damage in respect of any Kutcha Construction

d) For any loss or Damage to livestock, motor Vehicles, pedal cycles, Personal Money,

securities for money, stamp, bullion, deeds, bonds, bills of exchange, promissory notes,

stock or share certificates, business books, manuscripts, documents of any kind, unset

precious stones, Jewellery, Valuables, ATM or credit cards (unless previously

specifically declared to and accepted by Us and/or as provided in the Policy Schedule)

e) For the first Rs 1,000/- for each and every claim under this Section excluding claim for

Personal Money, Jewellery and Valuables. In case of a claim for Personal Money,

Jewellery and Valuables first Rs 2,000/-.

f) For loss or Damage to Personal Money, Jewellery and Valuables due to Larceny

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 18

g) For any loss or Damage caused by use of the key to the insured premises or any

duplicate thereof belonging to the Insured, unless such key has been obtained by

assault or violence or any threat thereof.

Additional Benefits

1) Property of domestic employees and guest

We will pay up to Rs 25,000/- during the Period of Insurance to cover the personal

belongings of Your Domestic Staff and guests while it is on the insured premises excluding

Jewellery, Personal Money or any other Valuables, items damaged due to perils covered

Section “Burglary and Theft”

First Loss Basis: (Applicable if it is shown on Your Schedule)

Option 1: (when total value of Contents is not declared)

Conditions applicable to Sections other than Section I: 2).e)i)3)g) shall not apply to this

benefit.

Option 2: (where total value of Contents is declared)

First Loss limit (expressed as % of the total value of Contents declared for insurance) will be as

specified in the Schedule and shall deemed as Section Sum Insured.

Conditions applicable to Sections other than Section 2).e)i)3)g) shall not apply to this benefit

and “Condition of Partial Average” as below shall apply.

Condition of Partial Average

It is hereby declared and agreed that this Policy is issued as the First Loss Insurance up to % of

the Insured’s total value of Contents (100%) as limit in the Schedule attached and forming part of

the Policy.

It is further declared and agreed in the event of total value of Contents at risk at the time of loss be

greater by more than 15% of the total value declared for the purpose of this insurance and

incorporated in the Schedule, the Insured shall be considered as being his own insurer, for the

difference, and shall bear ratable share of the loss accordingly. Every item, if more than one, of the

Policy, shall be separately subject to this condition.

Subject otherwise to terms, conditions and exceptions of the Policy.

SECTION 3 – PUBLIC LIABILITY

A. What We Cover

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 19

We will indemnify You against compensation and litigation expenses (incurred with Our

prior written consent), which You may become legally liable to pay anywhere in the World

on account of:

a) Accidental death or Bodily Injury/ Injury to any person other than You and/or Your Family

or Your Domestic Staff, subject to the Section Sum Insured for any one Accident or

series of Accidents arising from any one event or cause, and for all Accidents during

any Period of Insurance, and

b) Accidental Damage to property of any person other than You or Your Family or Your

Domestic Staff, subject to a limit of Section Sum Insured for any one Accident or series

of Accidents arising from any one event or cause, and for all Accidents during any Period

of Insurance, and

c) Claims payable by You to Your Domestic Staff under the Fatal Accidents Act 1855,

Workmen’s Compensation Act 1923 or any amendment thereto or common law subject

to the Section Sum Insured.

B. What We NOT Cover

We will not make any payment under this Section:

a) For Accidental death, Bodily Injury/ Injury or property Damage arising out of or incidental

to:

a. Your occupation or Business, trade or employment, or

b. Any structural alteration, additions, repairs or decoration to Your Home or

c. Any liability voluntarily assumed by You unless such liability would have

attached to You notwithstanding such voluntary assumption or

d. Your and/or Your Family’s ownership, possession, or custody of animals,

Vehicles, airborne or waterborne vessels or craft of any kind, or any

mechanically propelled Vehicle other than gardening equipment and

wheelchairs or

e. The transmission of any communicable disease or virus.

b) For Accidental death, Bodily Injury/ Injury or property Damage caused by, arising out of,

aggravated by or resulting from Fungi, wet or dry rot, or bacteria. This exclusion includes

any liability imposed on the Insured by any person and/or any Public Authority for any

loss or Damage caused by, arising out of, aggravated by or resulting from Fungi, wet or

dry rot or bacteria.

SECTION 4 – PLATE GLASS

A. What We Cover

We will indemnify You against Accidental loss or Damage to securely fixed plate glass

situated in Your home.

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 20

B. What We NOT Cover

We will not make any payment under this Section for loss or Damage:

a) Occurring during the course of removal, alteration or repairs on or about Your Home

b) Unaccompanied by breakage to glass

c) To frames or framework of any description, unless specifically declared to and accepted

by Us,

d) Caused by the disfiguration or scratching of glass, other than a fracture extending

through the entire thickness of the glass.

e) To embossed, silvered, lettered, ornamental, curved or any other glass whatsoever,

other than glass which is plain and of ordinary glazing quality, unless specifically

declared to and accepted by Us.

f) Consequent to the loss or Damage of plate glass including Injury arising from breakage

of glass or during replacement thereof.

SECTION 5 – BAGGAGE

A. What We Cover

We will indemnify You,

a) For the Theft or Accidental loss, Damage or destruction anywhere in the World of

personal baggage accompanying and belonging to You and/or Your Family on a trip

undertaken outside of the municipal limits of the village, town, or city, in which You

and/or Your Family ordinarily reside.

b) For expenses incurred by You, whilst You and/or Your Family are on a personal trip,

for contingency purchase occasioned by a) above subject to maximum of 25% of

Section Sum Insured under this Section.

B. What We NOT Cover

We will not make payment to You under this Section:

a) For loss, Damage or destruction

a. Due to cracking, scratching or breakage of lens or glass whether part of any

equipment or otherwise to any item of a fragile or brittle nature (whether part of item

lost, damaged or destroyed or otherwise) unless the loss, Damage or destruction is

caused by an Accident involving the mode of transport of such item.

b. To any item of a perishable and/or consumable nature

c. To any item being conveyed by any carrier under the contract of affreightment.

d. To any loose item (including clothing) being worn or carried about during the trip.

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 21

e. Of any electrical item caused by misuse, use other than in accordance with the

manufacturer’s recommendation, defect, excessive pressure, short circuiting, arcing

or by the effects of electricity from whatever cause (including lightning)

f. Of any money, securities, stamps, Business books or documents, Jewellery,

watches, furs, precious metals, precious stones, gold or silver ornaments,

Valuables, travel tickets, Cheques and bank drafts.

g. To personal baggage that is not within the care, custody or control of You and/or

Your Family

h. To personal baggage caused by rats, fungus, insects or vermin

i. Caused by or arising from leakage, spilling or explosion of liquids, oils or similar

materials, or articles of a dangerous or damaging nature.

b) For the loss of personal baggage from a car unless such loss occurred by violent and

visible means from an enclosed saloon car that had its windows closed and locked and

other security devices, if any, properly applied.

c) For more than the sole value of an item comprising part of a pair or set, without

reference to any special value which such item may have had as a part of such pair or

set and not more than a proportionate part of the value of the pair or set.

d) The first Rs 1000 of each and every claim under this Section.

SECTION 6 – BREAKDOWN OF DOMESTIC ELECTRIC & ELECTRONIC APPLIANCES

A. What We Cover

We will indemnify You

1. Against repair costs (both parts and labor) occasioned by the unforeseen and sudden

mechanical and/or electrical breakdown of Your domestic electrical and electronic

appliances specified in the Schedule whilst contained or fixed in Your Home.

2. Against loss or Damage by Accidental external means to Audio & Audio-Visual

appliances as mentioned in the Schedule whilst contained or fixed in Your Home

B. What We NOT Cover

We will not make any payment under this section in respect of:

a) The cost of repair associated with any malfunction for which the manufacturer or

supplier of the domestic appliances is responsible.

b) The cost of repair associated with an item for which cover is available under any other

operative section of this Policy.

c) The cost of repair associated with breakdown occasioned by natural wear and tear.

d) The cost of repair associated with any appliances that has been modified in any manner

or is used for Business or Business purposes

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 22

e) The cost of repair associated with loss or Damage caused by or in process of erection,

cleaning, maintenance, repair, dismantling.

f) Loss or Damage caused by atmospheric or climatic changes, moths, insects and

vermin.

g) The cost of repair associated with the detention, seizure or confiscation by Public

Authorities of Your Domestic appliances

h) The cost of repair associated with the misuse of or use other than in accordance with

manufacturer’s recommendation of Your domestic appliances

i) The cost of repair associated with defects in wiring or electrical connections that are

not an integral part of Your domestic appliances

j) Any amount exceeding Section Sum Insured for each and every claim and for all claims

k) The first 1% of item Sum Insured or Rs 500 whichever is greater of each and every

claim

l) Loss or Damage to records, discs, cassettes or tapes.

Special Conditions applicable to this section in addition to the general conditions wherever

applicable

a) If the part required for the repair or replacement of the domestic electrical & electronic

appliances is not readily available in India, We may, in Our sole & absolute discretion,

instead pay either:

a. The price of the part quoted in the latest catalogue or price list issued by the

manufacturer or his agent in India or

b. If no such catalogue or price list exists, the price for such part quoted by the

manufacturer in its country of origin plus the relevant import duty and in either case

the reasonable cost of fitting such part not exceeding the Section Sum Insured

b) In case of a Total Loss, if damaged item is not replaced, Our payment to You will be reduced

by depreciation calculated at 10% per annum from the date of manufacture, subject to

maximum depreciation of 50% of the Replacement Cost not exceeding Section Sum

Insured.

First Loss Basis: (Applicable if it is shown on Your Schedule)

Option 1: (when total value of Contents is not declared)

Conditions applicable to Sections other than Section I 2) e) i) 3) g) shall not apply to this benefit.

Option 2: (where total value of Contents is declared)

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 23

First Loss limit (expressed as % of the total value of Contents declared for insurance) will be as

specified in the Schedule and shall deemed as Section Sum Insured.

General Condition 2) e) i) 3) g) shall not apply to this benefit and “Condition of Partial Average” as

below shall apply.

Condition of Partial Average

It is hereby declared and agreed that this Policy is issued as the First Loss Insurance up to % of

the Insured’s total value of Contents (100%) as limit in the Schedule attached and forming part of

the Policy.

It is further declared and agreed in the event of total value of Contents at risk at the time of loss be

greater by more than 15% of the total value declared for the purpose of this insurance and

incorporated in the Schedule, the Insured shall be considered as being his own insurer, for the

difference, and shall bear ratable share of the loss accordingly. Every item, if more than one, of the

Policy, shall be separately subject to this condition.

Subject otherwise to terms, conditions and exceptions of the Policy.

SECTION 7 – PERSONAL ACCIDENT

A. What We Cover

We will pay You or insured family members, aged between 3 months and 65 years the

benefits as set out below, :

1. Accidental Death:

a. This benefit is payable if You or the insured family member suffers an Injury

anywhere in the World during the Policy Period solely and directly due to an

Accident that occurs during the Policy Period and that results in death within 365

days from the date of the Accident.

b. Benefit payable under this section is 100% of the Primary member Sum Insured or

as mentioned in the Policy Schedule. In case of dependant or unemployed family

members benefit is restricted to 50% of the primary member Sum Insured or as

mentioned in the Policy Schedule.

c. Once a claim has been accepted and paid under this Benefit in respect of an

Insured Person, the Insured Person’s insurance cover under this Section of the

Policy including will immediately and automatically terminate.

2. Permanent Total Disablement:

a. This benefit is payable if You or the insured family member suffers an Injury

anywhere in the World during the Policy Period solely and directly due to an

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 24

Accident that occurs during the Policy Period and that results in the Permanent

Total Disablement of the Insured Person which is of the nature specified in the

table below, within 365 days from the date of the Accident.

Nature of Permanent Total Disablement

Percentage of the Sum

Insured payable for Insured

Total and irrecoverable loss of sight in both eyes 100%

Loss by physical separation or total and

permanent loss of use of both hands or both feet

100%

Loss by physical separation or total and

permanent loss of use of one hand and one foot

100%

Total and irrecoverable loss of sight in one eye

and loss of a Limb

100%

Total and irrecoverable loss of hearing in both

ears and loss of one Limb/ loss of sight in one

eye

100%

Total and irrecoverable loss of hearing in both

ears and loss of speech

100%

Total and irrecoverable loss of speech and loss

of one Limb/ loss of sight in one eye

100%

Permanent, total and absolute disablement (not

falling under any one the above) which results in

the Insured Person being unable to engage in

any employment or occupation or business for

remuneration or profit, of any description

whatsoever which results in Loss of

Independent Living

100%

For the purpose of this Benefit,

- Limb means a hand at or above the wrist or a foot above the ankle;

- Physical separation of one hand or foot means separation at or above wrist

and/or at or above ankle, respectively.

The Benefit as specified above will be payable provided that:

i. The Permanent Total Disablement is proved to Our satisfaction; and a disability

certificate issued by a civil surgeon or the equivalent appointed by the District,

State or Government Board is given to us;

ii. The Permanent Total Disablement continues for a period of at least 180 days

from the commencement of the Permanent Total Disablement, and We are

satisfied at the expiry of the 180 days that there is no reasonable medical hope of

improvement and such disability is permanent at the end of this period;

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 25

b. In case of dependant or unemployed family members benefit is restricted to 50%

of the payable Sum Insured as per the table above.

c. If the Insured Person dies before a claim has been admitted under this Benefit,

then no amount will be payable under this Benefit;

d. Once a claim has been accepted and paid under this Benefit then the Insured

Person’s insurance cover under this Section of the will immediately and

automatically terminates.

3. Permanent Partial Disablement:

a. This benefit is payable if You or the insured family member suffers an Injury

anywhere in the World during the Policy Period solely and directly due to an

Accident that occurs during the Policy Period and that results in the Permanent

Partial Disablement of the Insured Person which is of the nature specified in the

table below, within 365 days from the date of the Accident.

Nature of Permanent Partial Disablement

Percentage of the

Sum Insured payable

i. Total and irrecoverable loss of sight in

one eye

50%

ii. Loss of one hand or one foot

50%

iii. Loss of all toes - any one foot

10%

iv. Loss of toe great - any one foot

5%

v. Loss of toes other than great, if more

than one toe lost, each

2%

vi. Total and irrecoverable loss of hearing

in both ears

50%

vii. Total and irrecoverable loss of hearing

in one ear

15%

viii. Total and irrecoverable loss of speech

50%

ix. Loss of four fingers and thumb of one

hand

40%

x. Loss of four fingers

35%

xi. Loss of thumb- both phalanges

25%

xii. Loss of thumb- one phalanx

10%

xiii. Loss of index finger-three phalanges

10%

xiv. Loss of index finger-two phalanges

8%

xv. Loss of index finger-one phalanx

4%

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 26

xvi. Loss of middle/ring/little finger-three

phalanges

6%

xvii. Loss of middle/ring/little finger-two

phalanges

4%

xviii. Loss of middle/ring/little finger-one

phalanx

2%

The Benefit specified above will be payable provided that:

i. The Permanent Partial Disablement is proved to Our satisfaction; and a

disability certificate issued by a civil surgeon or the equivalent appointed by

the District, State or Government Board is given to Us;

ii. The Permanent Partial Disablement continues for a period of at least 180

days from the commencement of the Permanent Partial Disablement and

We are satisfied at the expiry of the 180 days that there is no reasonable

medical hope of improvement and such disability is permanent at the end

of this period;

iii. If the Insured Person dies before a claim has been admitted under this

Benefit, then no amount will be payable under this Benefit;

iv. If the Insured Person suffers a loss that is not of the nature of Permanent

Partial Disablement specified in the table above, then Our medical advisors

will determine the degree of disablement and the amount payable, if any;

v. We will not make any payment under this Benefit if We have already paid

or accepted any claims under Sections of Accidental Death or Permanent

Total Disablement in respect of the Insured Person and the total amount

paid or payable under the claims is cumulatively greater than or equal to

the Sum Insured for that Insured Person;

b. Once a claim has been accepted and paid under this Benefit the Insured Person’s

insurance cover under this Policy shall continue, subject to availability of the Capital

Sum Insured.

4. Repatriation of Mortal remains:

This benefit is payable if we have accepted claim under Accidental Death section. We

will make a onetime lump sum payment for expenses incurred in transporting insured

person’s mortal remains to Your Home, subject to a maximum of 2% of Sum Insured

per person or Rs 7500 whichever is less on per policy year basis.

5. Ambulance Expenses:

a. This benefit is payable if any of the insured person suffers an Accident-causing

Injury that requires Hospitalisation. We will provide for reimbursement of

Reasonable and Customary expenses up to Rs 5000 on per policy per year basis

that are incurred towards transportation of an Insured Person by a registered

healthcare or Ambulance service provider to a Hospital for treatment of an Injury

SBI General Insurance Company Limited

SBI General Insurance Company Limited. Registered and Corporate Office: “Natraj” 301, Junction of Western Express Highway & Andheri

Kurla – Road, Andheri (East), Mumbai – 400 069|CIN: U66000MH2009PLC190546 | Toll free: 18001021111 |

[email protected] | www.sbigeneral.in | For more details on the risk factor, terms, and conditions, please refer to the Sales

Brochure and Policy Wordings carefully before concluding a sale| SBI Logo displayed belongs to State Bank of India and used by SBI General

Insurance Company Limited under license | IRDAI Reg No: 144 |UIN: IRDAN144RP0002V02201617

Simple Home Insurance– Policy Wordings 27

in case of an Emergency, necessitating the Insured Person’s admission to the

Hospital. The necessity of use of an Ambulance must be certified by the treating

Medical Practitioner.

b. Reasonable and Customary expenses shall include: