Security for your paycheck

It’s easy to take the ability to earn an income for granted. But what would happen if an illness or injury left you

temporarily unable to work? The odds of becoming disabled, at least for a short period, may be higher than you

think – and more fi nancially disruptive .

How can short-term disability insurance help?

The group short-term disability insurance available through your employer can replace some of your income if you’re

unable to work for a short time due to illness or injury, the birth of a child or pregnancy-related complications. Insuring your

income is a great way to help provide fi nancial security for you and your loved ones. Short-term disability benefi ts can help

you focus on getting better instead of on your fi nances.

What do I need to know about my benefi ts?

• To receive benefi ts, you must satisfy your company’s

eligibility requirements and meet the defi nition of disability

as outlined in your policy.

• There may be an elimination or waiting period between

the date you become disabled and stop working and the

date benefi ts begin. Sick leave or paid time off may be

available during that time to help provide you with income.

• Once the waiting period is over, a typical plan will provide

a portion of the income you earned before your disability,

up to a maximum weekly benefi t.

• The length of time you receive benefi ts depends upon

your policy.

What should I expect when I fi le a claim?

Your case manager will review information received from you, your employer and your medical providers. It’s

important to submit the required information as quickly as possible so a decision can be made on your claim. If

you are expecting a child or have surgery ahead, get a jump-start on your claim by submitting some information

in advance.

Disability insurance from Afl ac

Help protect your income from a

short-term disability

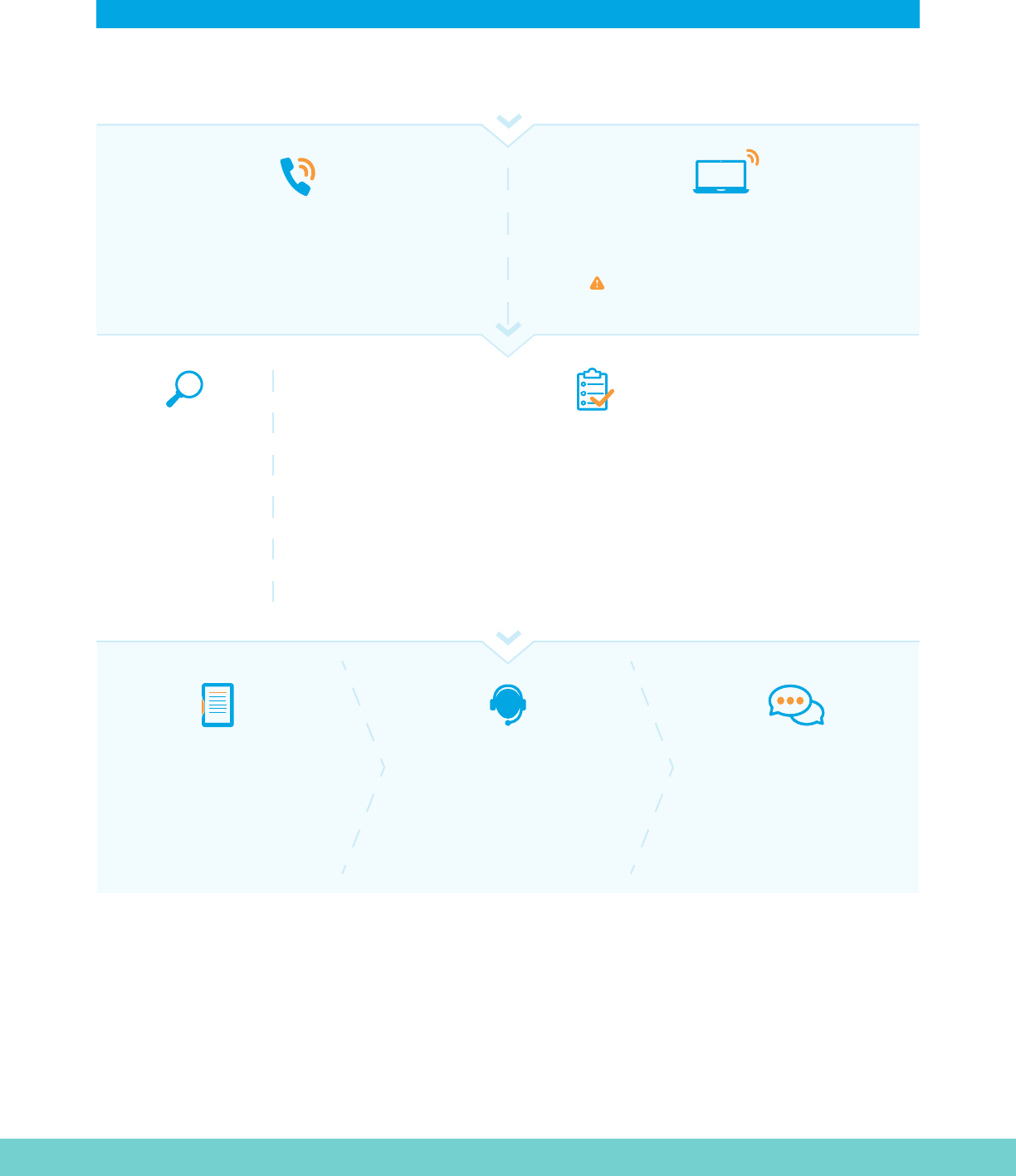

THE CLAIMS EXPERIENCE

INITIATE YOUR CLAIM

with one of these two methods:

CONTACT OUR CUSTOMER CARE CENTER

toll free at 800.206.8826 between 8 a.m.

and 8 p.m. ET, Monday through Friday.

LOG IN TO OUR PORTAL

at https://mygrouplifedisability.aflac.com. Once

logged in, select the Report a Leave button in My Cases.

Please use Google Chrome to ensure the best

online experience.

QUESTIONS

We will ask you

several questions

based on the type

of claim being

reported.

HELPFUL INFORMATION YOU SHOULD HAVE ON HAND WHEN

REPORTING A CLAIM

Illness/injury/surgery

Provider info, dates away from work,

diagnosis/condition

Pregnancy/childbirth

Estimated date of delivery, provider info, child’s

date of birth, dates away from work.

Behavioral health

Mental health treatment provider; inpatient

hospital info, if applicable; dates away from work.

Surgery

Provider info, dates away from work,

diagnosis/condition.

CASE NUMBER

Once intake is complete, you will

receive a case number. This number

will be referenced in the letter and

correspondence you receive for

future reference.

INTRODUCTORY CALL

Within two business days of reporting

your claim, a case manager will contact

you. The case manager will confirm the

info provided and ask any additional

questions needed to make an

initial decision.

WELCOME PACKET

We will mail a welcome packet that

includes: a letter summarizing your

benefits, next steps and applicable

forms. We will notify your employer by

email of your request.

Initiating a claim

Coverage is underwritten by Zurich American Life Insurance Company of New York and Zurich American Life Insurance of North America. In New York, the terms and conditions for the Group Short Term Disability

Income Insurance are set forth in policy form number 1000-ZAGP-DS-NY-01. The policies are issued by Zurich American Life Insurance Company of New York, a New York domestic life insurance company, located

at its registered home address of 150 Greenwich Street, Four World Trade Center, 54th Floor, New York, NY 10007-2366.

In all states other than New York, the terms and conditions for the Group Short Term Insurance are set forth in policy form number 1000-ZAGP-01-01 or applicable state variation. The policies are issued by Zurich

American Life Insurance Company, an Illinois domestic life insurance company, located at its registered home address of 1299 Zurich Way, Schaumburg, IL 60196.

The policies are subject to the laws of the state where they are issued. This material is a summary of the product features only. Please read the policy carefully for details. Certain coverages may not be available in

all states and policy provisions may vary by state. On March 19, 2020, Aflac, Inc. announced the agreement to acquire Zurich North America’s U.S. group benefits business (ZEB), which consists of group life, group

disability, and absence management products. Aflac Columbus and Aflac NY (Aflac) will reinsure, on an indemnity basis, Zurich’s U.S. in-force group life and disability policies. As of October 1, 2020, and subject to

customary closing conditions, Aflac will assume the administration of the aforementioned re-insured Zurich Employee Benefits policies and services.

WWHQ | 1932 Wynnton Road | Columbus, GA 31999. Aflac New York | 22 Corporate Woods Boulevard, Suite 2 | Albany, NY 12211.

AGC210074 EXP 1/22

How do I file a claim?

1. Claims may be led on our portal at mygrouplifedisability.aac.com

You may also visit the mobile-optimized site on your smart phone, tablet or computer to check the status of your

claim, upload documents and electronically sign forms, and access claims information. You can even sign up for live,

two-way text messaging with your case manager so you never miss an important voice mail or message.

2. Call toll free: 800.206.8826.

• 8 a.m.-8 p.m. ET, Monday-Friday.

• Our disability plans include the support of licensed masters-level social workers who are ready to assist when

you need help most.