©2018 Shelby Systems, Inc.

Other brand and product names are trademarks or registered trademarks of the respective holders.

ShelbyNext | Financials:

Accounts Receivable

Foundations

(Course #F123)

Presented by: Bill Ballou

Shelby Training Manager

2

Objective

To give an overview of the process and workings of the ShelbyNext | Financials: Accounts

Receivable application.

This session presents the following topics:

• How to set up Revenue Centers and Add Items

• How to add Customer and Bill To records

• How to create Invoices, Recurring Invoices, and Payments

• How to make Adjustments

• How to run Reports and Inquiries (including Statements)

3

Moving Through the Program

Here are just a few things that might be helpful as you navigate through this application. While

this browser interface feels significantly distinct from the Shelby v.5 environment, many of the

terms and certainly the functionality remain the same. You can always use the Help icon to

find help about any page you access.

Navigating to the Application

To begin using Accounts Receivable, you need to hover over the

word Applications in the upper left of your page and then click

the Accounts Receivable option.

Use this path to move between applications. Note that you can

hold the Ctrl key on your keyboard while clicking an application

to open that application in a new tab in your browser.

Navigating within the Application

Using the top navigation you have drop-down lists where the links are grouped to help you

move about within this application. These links are grouped by six categories:

• Enter (Add new): Invoice, Recurring Charge, Payment

• Manage (Process existing): Unposted Invoices, Recurring Charges, Payments

• View (Inquire on Processed Items): Transaction Inquiry

• Reports (All AR Reports): Customer List, Customer Labels, Item List, Aging Detail, Aging

Summary, Aging Period Summary, Monthly Statements, Payment Reports, Discount

Report, Sales Tax Report, Sales Report, Unapplied Cash List

• Modify (Set up application): Company Information, Revenue Center Information, Item

Information, Statement Design, Invoice Design, Control Table Information, Project

Information, Sales Tax Information, Preferences

• Utilities (Run occasionally): Void Payments, Apply Unapplied Cash, Apply Late Charges

4

Personalize Navigation (Creating favorite tasks or reports)

Users often have regular tasks associated with their

duties. You can save these often-needed tasks or reports

on the Right Side Navigation.

To add something to the Right Side Navigation, click the

Add to My Tasks link in the upper right of your work area.

This adds the task to your shortcuts found under My Tasks

in the right navigation bar.

To add a report, click the Add to My Reports link when

running the report you wish to add.

Current Financial Settings

In the upper right corner of every ShelbyNext | Financials page, you have a control that allows

you to alter your financial settings. You can control which Company, Fiscal Year, Period, Bank

Account, and Credit Card you are set to use. This controls where you post, what shows up on

the reports, and what bank account is used.

5

Getting Set up

Setting Up the Company Information

In Company Information (Accounts Receivable -> Modify -> Company Information), set up

Accounts Receivable for the current financial company.

• Accounts Receivable Types – Here you choose whether you are working in Open Item

(like doctor bills) or Balance Forward (like credit card statements) accounting.

• Accounting Types – Currently, the only option is to work in Accrual type accounting, so

you do not see this option listed on the page.

• Print Invoices? – Select this check box to print a copy of each invoice when posting your

invoices to history. (If you do not send invoices to your constituents, then it might be

wise to leave this unchecked.)

• Interface with General Ledger? – It is highly recommended that you check this box and

leave it checked so that all AR history matches with your GL history.

• Save Invoice Detail as Separate Invoices? – This splits each multi-line invoice into an

Invoice for each detail line.

• Duplicate Name on Entry? – When you create multiple invoices, the selected record

remains chosen for the next new invoice unless you edit that choice. This is helpful if

you regularly enter multiple invoices to the same record in one sitting.

• Last Invoice # Used – When you first begin using AR, this allows you to tell the program

the last number you used before beginning to track invoices in AR.

6

Setting Up a Revenue Center

Accounts Receivable -> Modify -> Revenue Center Information

The primary settings for a Revenue Center are Name, General Ledger connections, whether the

Revenue Center is active, and settings for Late Fees. Add a Revenue Center each time you want

to create a unique financial entity within Accounts Receivable. For each Revenue Center you set

up the General Ledger accounts. (The Accounts Receivable and Unapplied Cash accounts are

crucial for each revenue center and should not be shared among multiple revenue centers.)

If you choose to use Late Charges, the settings are at the bottom of each Revenue Center page.

Default Days Due automatically calculates the date to enter into the due date field when you

enter an Invoice. This sets the number of days after the current date for the program to use as a

default. You can easily choose another date in the invoice, if needed.

7

Setting Up Items

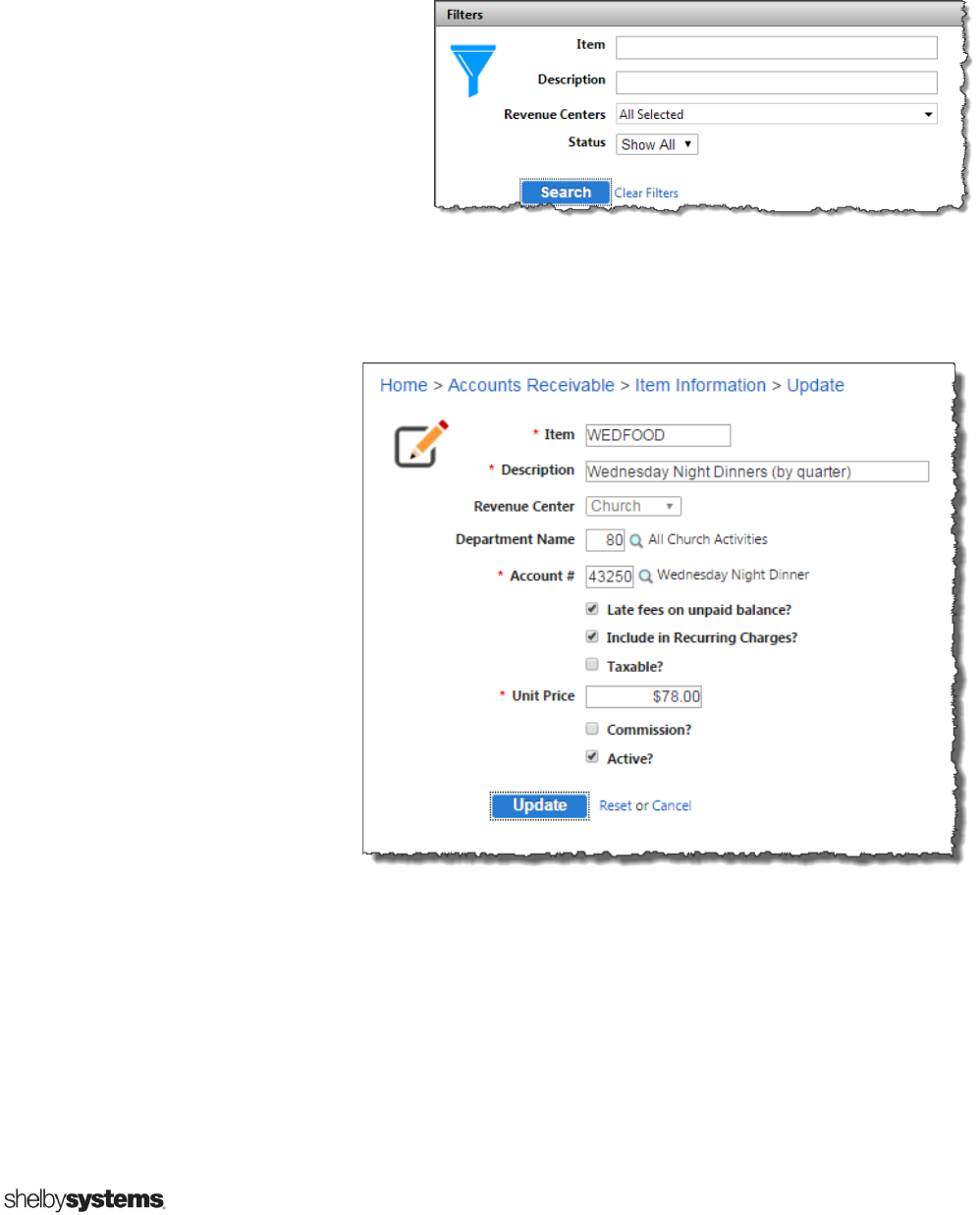

Searching for an Item

Because a database may have

many items, you are initially

brought to a search page to

narrow your results. Here you can

choose to filter by Item code, by

the Description, by Revenue

Center, or by Status (Active or

Inactive).

Create a New Item

An Item is the product or

service for which a

customer is paying your

organization. When setting

up an Item, you add an

Item code (up to 15 digits)

in the Item field and a

Description. Each item

belongs to a Revenue

Center and is linked to a

GL Department and

Account. You also choose

whether to allow Late Fees

or to include in Recurring

Charges.

You have the option to set a standard Unit Price for this Item, but you always have the option

to override this when using this item in an invoice.

8

Adding Records

You can either select

an existing record in

the database or add a

new record as you

create the invoice.

When creating an

invoice or clicking to

add a new customer,

use the search window

to select from existing

records in the

database.

It is good practice to always search for a record before adding it to be sure that the record does

not already exist in the database. If you do not find the record, close this window to add a new

record to the database.

When pulling in an

existing record, you

have the option to

add information

pertinent to Accounts

Receivable, such as a

default Bill To record.

(Another record who

is typically responsible

for the charges by the

customer – An

example might be a

student as the

customer with a

parent as the Bill To.)

On the ACH Accounts tab you can add the routing number and bank account number for this

customer to set up the process of drafting payments from a bank account.

9

Relationships

A new feature of Accounts Receivable is the ability to create relationships between records. If

you have an Arena database, those relationships that exist will come over into this screen. If

not, then you can link an individual to other records by relationships (either for the Primary

Family or for Other Relationships outside the primary family).

To add or edit Relationships, go to Modify / Customer Information and navigate to an individual

record. Within each record the Relationships tab is where you add or edit Primary Family

relationships and Other Relationships.

The Role choices for Primary

Family are set by the program,

Adult, Other Adult, Child, but the

Relationship for the Other

Relationships are user defined.

The Relationships for Other

Relationships are controlled

at Modify / Control Table

Information / Relationships.

You click Add New Type to

add a Description and the

Inverse Relationship.

10

Entering Invoices or Recurring Charges

AR allows the use of two types of invoices: one-time manual

invoices or recurring invoices. One-time invoices can be used

for things like annual registration fees, field trips, books,

events, etc. Recurring Charges are normally used for monthly

tuition charges or a quarterly charge for Wednesday night

meals.

Enter an Invoice

When you create an

invoice, the first window

encountered is where you

search for the Customer.

You can search for those

records already

associated with Accounts

Receivable or search from

All Applications to see

records in the database

that have not been

associated with Accounts

Receivable until now. If

you need to add a new

record, then click the button at the bottom left of the pop-up window.

If you select a record that already has a default Bill To, then that Bill To is used on the invoice;

otherwise, the Customer and the Bill To start out as the same record. You can click the link for

the Bill To and change which record is responsible for payment at any time in the invoice entry

process.

11

There are two parts to the Invoice page, the Header and Detail area. The header is information

related to the whole invoice, and the detail area could have several lines for charges to

different items. The Revenue Center chosen in the header area controls which Items are

available in the detail area, since each Item belongs to a Revenue Center.

New in the header area for those coming from Shelby v.5 is the Due Date field. This allows

users to record the date a customer is invoiced and the date a customer’s payment is due.

Because there is no Due Date field in Shelby v.5, all invoices converted from Shelby v.5 copy the

Invoice Date to the Due Date field. You can set a default number of days to use for the Due

Date field in the Revenue Center settings.

You can search for an Item by using the Search icon or by typing “S” when in the Item field.

Any default settings for that item auto populate the grid; however, you can overwrite the

description, the unit price, or the # of units purchased. Add a Project, if needed.

To add additional lines in the detail area, you have three options: Click the Add icon at the

end of the final line in the detail area, click the Add New Line in the upper left of the grid, or, if

you have multiple lines to add, you can use the option and add several lines at

once (edit to choose the number of lines you need).

If you want to save this invoice and add another, then click the button. If you want to

save this invoice and proceed to post your invoices, then click button.

12

Manage Unposted Invoices

After posting an Invoice, you go directly to the Unposted Invoices page, or if you need to

navigate to this page at a later time, go to Accounts Receivable -> Manage (hover to see a

drop-down list) -> Unposted Journals.

Select the Invoices you want to post by clicking the check box to the left of the row. When at

least one Invoice is selected, the two buttons become active. You can run and then print an

Invoice Edit Report by clicking the button, or you can use the

button to begin posting these invoices to history.

NOTE: Green buttons are always the path to posting to General Ledger history. Follow the

green buttons to complete your posting to the Ledger.

Clicking the Post Invoices button brings you the Final List of Invoices report and the page to

Finalize Post. Because this is your Final List of Invoices, this is a good report to print for your

records.

Click the Print icon along the top

bar to print this report.

13

Above the report are three very important items: A check box that allows you to Post Directly

to General Ledger without Editing (Otherwise the journal is in the Unposted Journals page

waiting to be posted.), your Posting Date (typically defaults to the current date), and the button

to Finalize Post.

You receive a confirmation of your Fiscal Year, Period, and Date for this posting. This completes

the posting of your invoices.

14

Entering Recurring Charges

The process to create Recurring Charges begins much the same as creating an individual

invoice–by hovering over Enter and clicking Recurring Charge.

Once you select the record you want as the customer, you come to the Recurring Charges page.

This is a bit like an invoice with some specific differences.

• Billing Option – What is the frequency or filter you use to select this charge when

applying recurring charges? (Hourly, Weekly, Monthly, Quarterly, etc. You can also

create your own customized choices.)

• Default Days Due – The Due Date for invoices is calculated based on this number when

the Recurring Charges are transferred.

• Start Date – When does this Recurring Charge begin to take effect?

• Limit – For a Recurring Charge you can set a cap or limited amount that is charged.

• Use Payment Schedule? – Once you set a Limit, you can establish a Payment Schedule

to set regular charges on a schedule. This creates a new tab where you can establish

dates and amounts to charge. These can be calculated automatically based on

frequency or manually set to specific days and irregular charges.

15

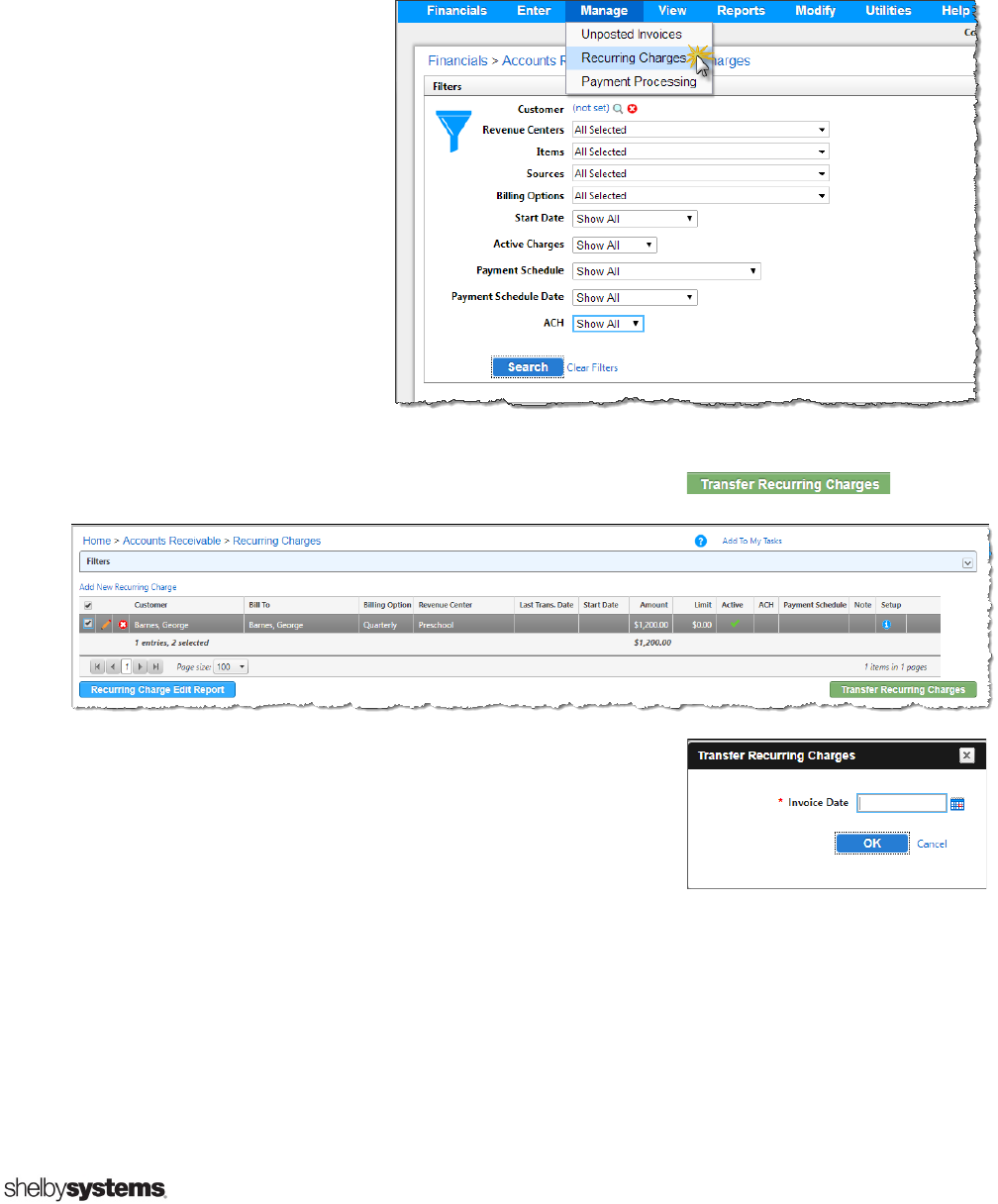

Manage Recurring Charges

Once the Recurring Charges are established, hover over Manage in the top navigation bar and

then choose Recurring Charges to transfer the Recurring Charges you need based on the many

filter options available.

Typically, you might filter by

Revenue Center and Billing

Options (many of which are

frequencies, such as monthly,

quarterly, and so on). If you

choose to use a Payment

Schedule, then you need to

choose it in your filters and

specify which date in the

Payment Schedule you are

transferring.

After selecting a filter for the Recurring Charges, a grid appears where you can choose which

ones to transfer. Once you have made your selections, click the button.

You are asked to select a date for your Invoices. Once you

select the Invoice Date, click OK, and then these charges

transfer to the Manage -> Unposted Invoice page as

Invoices.

16

Processing Payments

Enter Payments

Unless they are ACH drafts, payments to Accounts

Receivable are not automatic and are typically entered

once the payment arrives. Payment is found with

Invoice and Recurring Charge under Enter in the top

navigation menu.

Accounts Receivable -> Enter -> Payment

Payments are entered against the existing charges created by an invoice or recurring charge.

When you select the record of a “Bill To”, then all outstanding charges show in the detail area,

and the payment is applied to any or all of the current outstanding charges.

NOTE: If you receive a payment and apply it towards a customer (Bill To) who has no

outstanding charges, or if the customer pays more than is owed, you are left with

Unapplied Cash (or prepaid income).

The first screen to appear is your search window. You are looking for the “Bill To” or the person

responsible for payment. In our example, Billy Anderson is the customer, and his Bill To is his

father, Jim Anderson. The debt or responsibility is on Jim Anderson’s record, not Billy’s record.

When you select Jim, you move on to the Payment Processing page.

17

After selecting your Bill To, you select the Check #, the Check Date (or payment date), and the

Check Amount. You can also use any credit from any outstanding Unapplied Cash that might be

linked to this Bill To record.

If the dollar amount you entered in the Check Amount is to be applied, then tab

to the Auto Distribute button and tap the Enter key (on your keyboard) to

quickly apply all the payment to the different charges shown (typically addressing

the older charges first).

Each row represents an Invoice, and you can apply a Payment, a Discount, or a Write Off for

each row (Invoice). Once you have applied all the payments, you can then use the Apply button

to save this Invoice and begin on another, or click the Update button to save this Invoice and

move on to the Manage -> Payment Processing page to complete the processing of this

payment.

18

Payment Processing

First, search for the payments you want to process. The

filters that are presented allow you to filter by Revenue

Center, Source, or by the User who enters the

Payment.

Select the payments to process in the grid and click the blue Payment Edit Report to verify your

totals, or click the green Process Payments button to begin processing these payments into

history and General Ledger.

The Final Register report appears (which you should print or save as a PDF file) and then

Finalize Post by clicking the green button. Be sure your Posting Date matches with your posting

Period in the Current Financial Settings.

When Finalize Post is

selected, verify the Fiscal

Year, Period, and Posting

Date. Click OK, post your

payment to history, and

create a journal in

General Ledger.

19

Inquiring on Transactions

Easily find activity that is already posted, whether

Invoices or Payments, in Accounts Receivable -> View ->

Transaction Inquiry.

Begin with a filter with various options to allow you to search either by Invoices or by

Payments. While there is certainly crossover of information, these two paths allow for different

sorts of searches depending on which type of entry is your focus.

Searching for the Bill To record, Jim Anderson, an Invoice search for Open and Closed Invoices

renders a grid looking like the screenshot below.

Searching for the same Bill To record filtering by posted Payments, the grid looks like the image

below. Notice there is nothing about the invoice. It is only about the payments.

In both cases you can open up a specific Payment or Invoice to find more information. You can

create a Transaction Inquiry Report or click the Excel

®

icon to send the whole report to an

Excel

®

spreadsheet.

You can also use the

Transaction Inquiry for

Invoices that are Open

to Unpost Invoice if

there have been no

payments to that

Invoice (making it a

Removable Invoice).

20

Making Adjustments

Voiding Payments

When you need to void a Payment, go to Accounts Receivable,

hover over Utilities, and then click Void Payments.

This allows you to create negative entries against those

payments you have already received and posted.

Search for the Bill To record, and then click the Search icon beside the Check # field to

search for any checks entered for this record. Click the Add to Grid button to send a void to the

grid to process this and any other payments in one transaction. Click Void Payments to send

this correction to history and a reversing entry to General Ledger and to Bank Account

Management.

Simply ❶ search for the Bill To name and then ❷ search for the check amount. (This fills in all

the fields for the check you select.) ❸ Once you are comfortable you found the incorrect

check, then ❹ click Void Payments to continue.

NOTE: You can always click the Delete icon to the left of an entry to remove any entry

from the grid that was added in error.

21

Applying Unapplied Cash

There are two ways to apply Unapplied Cash

(prepaid income) in ShelbyNext | Financials.

1. You can apply Unapplied Cash when you post a specific payment.

2. You can apply Unapplied Cash in bulk by Revenue Center or for

several Bill To records.

To list Unapplied Cash, go to Accounts

Receivable, hover over Reports, and then

click on Unapplied Cash List. You can filter by

Check Date, by Revenue Center, or by the

Bill To records.

Applying Unapplied Cash from Payment Processing Page

When you are processing an individual payment and see that the button is

active (not greyed out), then there is Unapplied Cash (credit) available for this customer that

can be applied against the invoices listed.

• Click the Add Unapplied Cash button, and this populates the Unapplied Cash field with

the total amount of this customer’s credit. This can then be applied manually against

any invoices in the grid below or by clicking the Auto Distribute button.

22

Applying Unapplied Cash from Utilities

To apply Unapplied Cash against several Invoices in bulk, go to Accounts

Receivable, hover over Utilities, and click on Apply Unapplied Cash.

On this filter screen use exactly the same choices as the Unapplied Cash List. Make your

selections and then click Search to begin posting the Unapplied Cash against the existing

Invoices. Print the report and click Finalize Post to commit to these changes and send the

necessary journal to the General Ledger.

23

Running Reports

There are several reports in Accounts

Receivable that show activity, that list

which customers have outstanding

payments, and that list statements for

customers.

These are grouped into Informational

Reports, Aging Reports, Statements,

and Misc. Reports.

Informational Reports

The Customer List is simply a list of

customers with address, phone, contact

name, tax-exempt ID, and (optionally) the

Bill To record, if applicable.

The Customer Labels print labels for any or all customers. These can have the full address or

just show the name (perhaps to use for a file folder if you keep invoices and paperwork for

customers).

An Item List is a summary report showing all the items and settings for those items: The Item

code, the Description, the Unit Price, as well as the Account #. The report also shows whether

Late Fee, Taxable, or Active check boxes are checked.

24

Aging Reports

The Aging Report in Shelby v.5 is one big report containing several reports and settings within

it. In an attempt to simplify those selections, this report is divided into three reports in

ShelbyNext | Financials: Aging Detail, Aging Summary, and Aging Period Summary. Each of

these reports has its own unique filters and controls.

The Aging Detail report

gives a detailed look at

Invoices and (optional)

Payments broken down

by record. An aging

summary shows any

open invoices for each

customer.

The Aging Summary

report is an abbreviated

version of the aging

report showing totals

owed by each customer

broken down by the

aging periods.

The Aging Period

Summary shows activity

by customer grouped by

period or date range. It

shows columns for the

Previous Balance,

Charges, Receipts, and

the Ending Balance.

25

Accounts Receivable Statements

Statements are the reports used to communicate with a customer to show Invoices and

Payments. There are two very different types of statements offered:

• The Monthly Statement is a highly customizable report focused on the activity

associated with Invoices.

• The Payment Statement shows a simple breakdown of payments with a page break by

customer. This report can also be formatted as a Payment List to serve as an internal

report.

A Monthly Statement can be designed using the many options available by going to Accounts

Receivable. Hover over Modify and click on Statement Design. This control allows you to set

the text, figures, and even logos exactly where you want them and control which sections are

bolded, italicized, or a different font size.

Modify Statement Design

There are several tabs

dividing the various

areas to control in the

statement design.

The first tab, Paper,

controls the paper size

and the overall settings

for the report. Choose

the font, the layout of

the page sections, and

whether this is a detail

or summary report. If

you add a memo on a

payment, you can

choose to have that

print in the detail with

the payment rather

than the default phrase,

“Payment – Thank You.”

26

The second tab, Heading/Footing, controls the top and the bottom of the statement and such

things as the company’s name and address, the Bill To record’s name and address, and

(optionally) the customer’s information (if different from the Bill To – for example with a

Preschool).

For each of these items you can control the field that prints, add a heading (if you are using a

plain paper form), adjust the size and character of the text (bold, underlined, or italicized), and

indicate the exact point to place that text on the page.

The third tab, Body, is the detail section of the statement. Do not select vertical position, since

each line prints below the previous row. Similar to the previous tab, you choose the field to

display and the size and weight of the font. Select the horizontal offset (distance from the left

of the page) to determine the order and placement for each field on each detail row.

The fourth tab, Body Totals, allows you to add a row to show totals below the body section.

27

The final tab, Images, allows you to add up to four graphic images such as a logo or artwork to

your statement design. Select the file, determine the size, and specify the location for each file

you choose to use.

At the bottom of the statement design utility you have the option to test the statement design

or restore the design back to the default settings. Once you have the statement design set, you

Update the design.

28

Running the Monthly Statement Report

Go to Accounts Receivable, hover over Reports, and click Monthly Statements to begin

printing a statement to send to customers.

Select a date range and

the Due Date; then select

whether to include zero

balances, negative

balances, or Invoices with

zero balance.

Filter by Bill To records,

by Revenue Center, by

the Source, or by up to

five divisions (named

“School” in this example).

The Options tab allows

you to select a Statement

Design added and saved

before this. You can

select to create a new

Statement for each

Customer. (For example,

a parent can have a

separate statement for

each child.)

You can also change the sort order. (Use Bill To or Bill To Postal Code. If you choose to Print

One Statement Per Customer, use Customer, Customer Postal Code.)

29

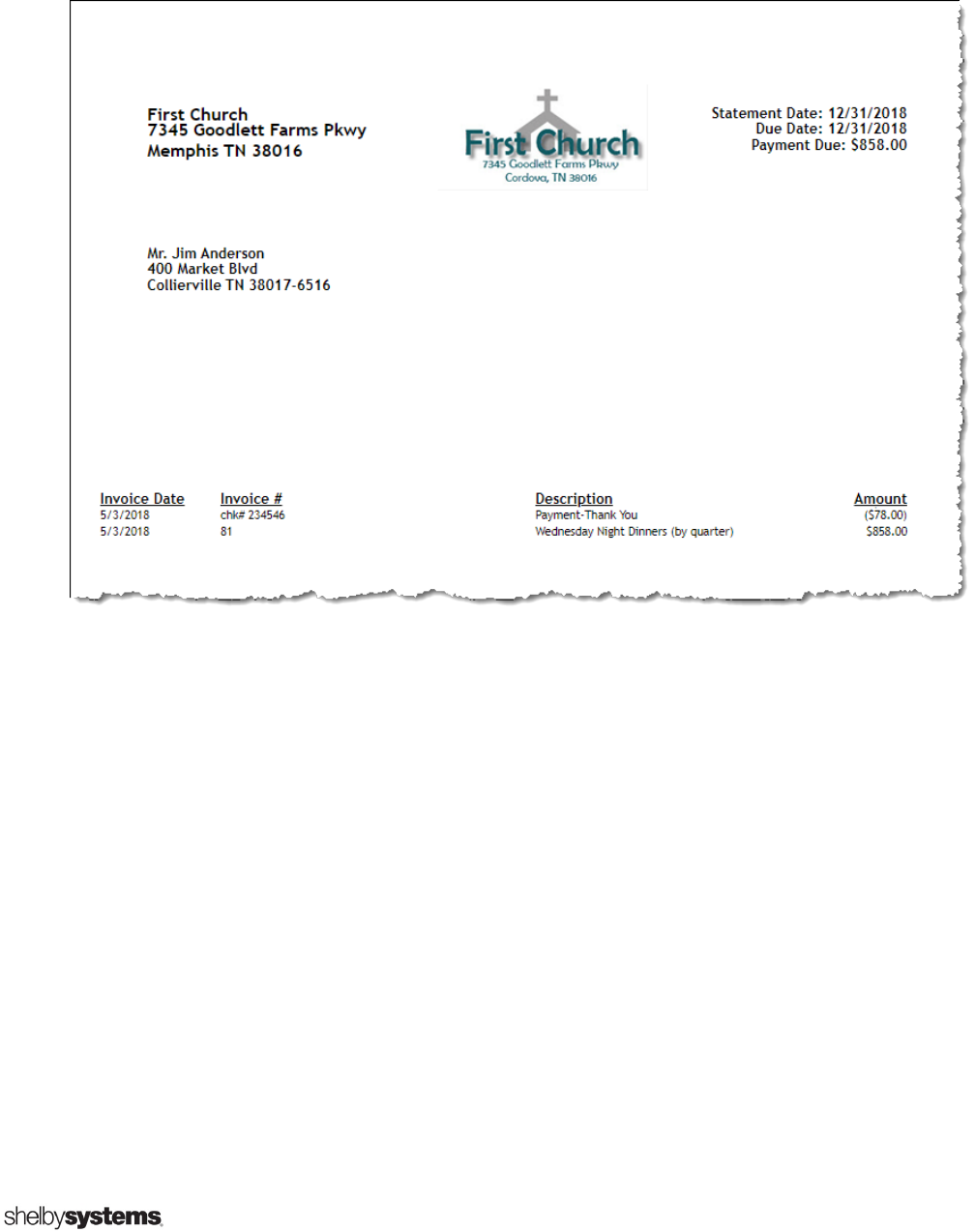

Because the Accounts Receivable statement design is so customizable, your statement can be

shaped to your needs, but here is one example of how it might look:

30

Running the Payment Reports

There are three versions of the report showing

Payments by Bill To records. Two of the reports

have a page break for each Bill To, so that they

can be sent out as a Statement or a Receipt. The

other version of this same information shows as

a List for internal information.

Payment Statements

A Payment Statement can be filtered by Date,

by Bill To records, or by Revenue Centers.

Once the report is narrowed to the records

needed, click Run Report.

Payment Receipt

A detailed listing of each check date

and check # for whatever payments

have been received.

31

Payment List

Choose list on the

options tab and use

any of the same filters

available on the filters

tab.

Misc. Reports

This unique collection of reports, except for the Unapplied Cash List, are not as commonly

used, but are helpful when needed.

Discount Report

A simple report showing discounts grouped by Customer or listed as separate invoices. Not

many organizations use Discounts.

Sales Tax Report

To track Sales Tax that Customer has applied. Not commonly used.

Sales Report

This is a report with lots of options for filtering and several options for viewing. This report can

also be automatically exported to an Excel

®

spreadsheet.

Unapplied Cash List

You have covered this report briefly on page 21. The purpose of this report is to show any

Income that has not been applied to an Invoice. You can filter by Revenue Center, by Source, or

by the Bill To record.

Bill Ballou

Shelby Training Manager

bill.ballou@shelbyinc.com

Bill Ballou has been a part of the Shelby training team for over 17 years and trains on both v.5

and ShelbyNext. He greatly enjoys working with the gifted trainers on his team. Bill brings a

vitality and life to training software and uses humor to help customers feel at ease with new

ideas. He has helped dozens of churches find solutions to tracking financial and gifts

information so they can do ministry more effectively. While Bill is known to geek out over

finding a new trick in Excel or in MS Reporting Services, his real excitement comes at that

moment in training when he can see that a trainee has made a key connection and has that

"ah-ha" moment light in the eyes. Bill worked for almost twenty years on staff at various

churches, so he has an appreciation for the questions and challenges of many of our users.

Training is a passion for Bill, and he loves that moment when he can see knowledge and ideas

transfer to another person.