UNEMPLOYMENT

INSURANCE

BROUGHT TO YOU BY THE

OKLAHOMA EMPLOYMENT SECURITY COMMISSION

An Employer’s Guide to

Unemployment Insurance Compensation,

EmployerTaxes, Recruitment and More

OESC-175 Revised March 2019

1

The Oklahoma Employment Security Commission (OESC) is a one hundred percent (100%) federally

funded state agency dedicated to providing quality service and assistance to Oklahoma businesses and

job seekers.

Our mission is to enhance Oklahoma’s economy by:

Matching jobs and workers to increase the efficiency of local labor markets

Providing unemployment compensation to support unemployed workers and their communities

Preparing a skilled workforce to enhance and align their skills to meet local labor market needs

Gathering, analyzing and disseminating information about the labor force to improve local

economic decisions

OESC has always been at the forefront of cultivating emerging industries, supporting existing

businesses, and developing and enhancing the skills of the Oklahoma workforce. The challenge of

facing the demands of the labor market and economic uncertainties requires foresight and planning to

provide a skilled workforce for today and the future.

OESC has a vast amount of experience working with and supporting the business community. Whether

assisting with the recruitment and attraction of new employers or sustaining existing employers, OESC

is a vital partner of business. Through strategically placed Oklahoma Works centers across the state and

online through the job matching system, employers and job seekers can access a wide array of

workforce services designed to specifically meet their needs.

Richard McPherson

A MESSAGE FROM THE EXECUTIVE DIRECTOR

2

Oklahoma Employment Security Commission

P.O. Box 52003

Oklahoma City, Oklahoma 73152

Phone: (405) 557-7200

Web: https://www.ok.gov/oesc/

QUICK REFERENCE GUIDE

EZ TAX EXPRESS

Help Desk

(405) 557-5452

EMPLOYER ASSISTED CLAIMS

Mass Layoffs

(405) 557-5333

EMPLOYER COMPLIANCE

New Employers, Terminating Employers,

Address Changes, Quarterly Reports,

Payments, Amended Reports, Notice of

Non-Receipt, Wage Objections, FUTA

Certificates

(405) 557-5330

RATES

Employer Contribution Rates

(405) 557-7222

COLLECTIONS

Employer Tax Warrant Releases, Payment

Plans, Interest/Penalty Waivers

(405) 557-7253

WAGE CHARGES

Notice of Benefit Wages, Recall Credit

(405) 557-7223

TAX ENFORCEMENT (405) 557-5449

SUPPORT AND COMPLIANCE DIVISION

EMPLOYER CUSTOMER SERVICE

(405) 552-6799

Separations OES-617 (405) 962-7524

Wage Charging OES-502 (405) 962-7504

All Other Tax Issues (405) 557-7271

EMPLOYER FAX NUMBERS

3

Table of Contents

NOTE FROM THE DIRECTOR.............................................................................................................1

QUICK REFERENCE GUIDE ................................................................................................................2

TABLE OF CONTENTS ..........................................................................................................................3

FREQUENTLY ASKED QUESTIONS...................................................................................................4-5

EMPLOYER SERVICES .........................................................................................................................6-7

HIRE A VETERAN...................................................................................................................................8-9

UNEMPLOYMENT INSURANCE .........................................................................................................10-11

GENERAL PROVISIONS AND DEFINITIONS...................................................................................12-16

WAGES.......................................................................................................................................................17-19

EMPLOYER CONTRIBUTIONS ...........................................................................................................20-22

BENEFIT WAGE CHARGES..................................................................................................................23-24

REIMBURSING AND GOVERNMENTAL EMPLOYERS ................................................................25

UNEMPLOYMENT BENEFITS .............................................................................................................26-33

NEW HIRE REPORTING........................................................................................................................34-37

EMPLOYER RESPONSIBILITY ...........................................................................................................38

EZ TAX EXPRESS....................................................................................................................................39-41

UNEMPLOYMENT FRAUD ...................................................................................................................42-43

OKLAHOMA WORKS CENTER LOCATIONS..................................................................................44

OES-1 - Application for Oklahoma UI Tax Account Number.............................................................45

Instructions for Completing OES-1 .......................................................................................................46

OES-112 - Oklahoma New Hire Reporting Form .................................................................................47

OES-7 - Job Order Fax Form.................................................................................................................48

OES-24 - Employer’s Report on Termination of Business in Whole or in Part....................................49

OES-617 - Notice of Application for Unemployment Compensation...................................................50

Revised January 2019

This publication is issued by the Oklahoma Employment Security Commission, as authorized by provisions of the Oklahoma

Employment Security Act. The publication will be made available online. A copy has been deposited with the publication

clearinghouse of the Department of Libraries.

TABLE OF CONTENTS

4

Frequently Asked

Questions

CAN A CLAIMANT WHO QUITS WORK

RECEIVE UNEMPLOYMENT BENEFITS?

A claimant who voluntarily leaves their last work

without good cause connected to the work is subject

to a disqualification which denies benefits until the

claimant becomes reemployed and has earned wages

equal to or in excess of ten (10) times their weekly

benefit amount.

ARE YOU NOTIFIED OF CLAIMS FILED?

Yes, if you are the last employer for whom the

claimant worked at least 15 working days. The

office through which the claim was filed will mail to

you a form entitled “Notice of Application for

Unemployment.”

CAN YOU PROTEST A CLAIM?

Yes, you should file a protest upon receiving a

“Notice of Unemployment Compensation” when

you know of any reason why the claimant should not

receive Unemployment Benefits. Your reply in

writing must be faxed to (405) 962-7524 within ten

(10) days of the date the notice was mailed. If you

do not reply within ten (10) days, you may be

contacted by telephone for job separation or other

information. Telephone contact does not mean

you are an interested party.

If the individual voluntarily left work or was

discharged by you, your protest should include full

and complete facts. In the case of a voluntary quit,

include the reason the individual gave you for

leaving and explain why you do or do not think the

reason was justified. In the case of a discharge for

misconduct explain in detail the nature of the

misconduct.

1

2

3

WHAT IS “UNEMPLOYMENT BENEFIT

COMPENSATION?”

The Employment Security Act of 1980 provides that

under certain conditions payments of money may be

made to unemployed individuals from an

unemployment compensation fund contributed to by

employers subject to the Act.

WHO PAYS UNEMPLOYMENT

COMPENSATION TAX?

Oklahoma employers and nonprofit organizations

(other than those described in Section 501(C)(3) of

the IRS Code) pay the tax if they employ one or

more workers in each of twenty different calendar

weeks during a calendar year or if they have a

payroll of $1,500.00 in a calendar quarter or are

liable under the Federal Unemployment Tax Act.

Nonprofit organizations as described in Section

501(C)(3) of the IRS Code will be liable if they

employ four or more workers in each of twenty

different calendar weeks during a calendar year.

All state agencies, cities, towns, counties, public

trusts, or local school districts, including nonprofit

elementary and secondary schools, also pay

unemployment taxes.

Agricultural employers who have a total payroll of

$20,000.00 in any calendar quarter during a calendar

year or have ten or more employees in twenty

different calendar weeks during a calendar year are

required to also pay the tax.

Domestic employers such as private homes, local

college clubs or local chapters of college fraternities

or sororities who pay $1,000.00 cash remuneration in

any calendar quarter during a calendar year must also

pay the tax.

4

5

5

Frequently Asked

Questions

After the opinion of the Board of Review is issued,

further appeal may be made within thirty (30) days

to the district court having jurisdiction.

DO I HAVE TO STAY ON HOLD

FOREVER IF I CALL THE CALL

CENTER?

No, employers have a special customer service

number to call that gets answered promptly. If you

have any questions call (405) 552-6799.

CAN OESC HELP ME FIND GOOD

EMPLOYEE PROSPECTS?

Yes, we have a vast array of employer resources

through our Oklahoma Works centers, job fairs,

OKJobMatch.com and onsite recruiting events.

Check out these and many more resources by visiting

www.ok.gov/oesc and clicking on Employer

Resources. You can also contact any of our

Oklahoma Works centers.

6

7

WHAT REPLY DO YOU RECEIVE IN

RESPONSE TO A PROTEST?

.When an employer’s timely protest is received, the

employer becomes an interested party to the

claim and will be mailed a notice of the

determination made in regard to the claim. The

determination is furnished on a form entitled Notice

of Determination.

If the claimant does not have sufficient wages within

their base period to qualify for unemployment

compensation, the employer will be notified by

letter.

CAN YOU APPEAL A DETERMINATION?

Yes. Either the employer or the claimant may file an

appeal if either party disagrees with the

determination. This appeal must be in writing and

postmarked or received within the time indicated on

the determination. If no appeal is filed within the

time period indicated on the determination, the

determination becomes final, and benefit payments

will be made or denied based on the determination.

WHAT HAPPENS WHEN AN APPEAL IS

FILED?

When an appeal is received from either the claimant

or the employer, the Appeal Tribunal schedules a

hearing and notifies all interested parties of the time

and the place of the hearing. Testimony given in

these hearings is under oath and is recorded. An

Administrative Hearing Officer considers the record

and renders the decision. Copies of the decision are

mailed to all interested parties. Further appeal from

this decision may be made to the Board of Review

within ten (10) days from the date of mailing the

decision.

9

10

8

6

EMPLOYER SERVICES

OKJobMatch.com is an easy way for employers to find qualified

candidates with the right skills. Employers are able to fill key

openings more rapidly, identify employee skill gaps relative to

the business’s current needs, analyze past job opportunity

placements to determine where the most successful candidates

come from, and determine where qualified candidates are located

within the state all within one system, thereby reducing the

extraordinary costs of traditional recruitment. Some key features

available to assist employers are:

Job Posting Creation: Employers can upload, improve, or create a job posting. Employers can create a

posting by answering questions about typical work activities of similar jobs and enhance the

description by adding related keywords or copying text from current job listings.

Application Management: Every resume received is analyzed in minute detail, evaluating a candidate’s

qualifications, skill gaps, and likely career path. This helps employers decide which candidates are

best aligned for the jobs they need to fill.

Talent Search: Employers can search for relevant talent from the Oklahoma Talent Bank. The system

provides automated pattern-based matching, the ability to find more resumes like a selected one, and a

robust set of structured search capabilities.

Job and Career Fair Events

Consulting, Job Listing, Job Description

Writing and Job Matching

Labor Market Information and Statistics

Employer Resources Videos - including

videos on topics such as Oklahoma

Unemployment Tax Filing (EZ Tax Express),

Unemployment Insurance and Appeals,

Separation Information, and Misclassified

Workers

Onsite Recruitment Events and Interviewing

Space

New Hire Reporting

Federal Bonding and Work Opportunity Tax

Credit (WOTC) (Tax Credit for Employers)

Employment Labor Law Posters

Oklahoma Employer Councils/Business

Seminars

Be sure to check out the many resources available to all of our valued employers by visiting

www.ok.gov/oesc or a local Oklahoma Works center near you.

7

EMPLOYER SERVICES

Tax Credit Information

Work Opportunity Tax Credit

Hiring From Target Groups

Federal Bonding

Oklahoma’s Economic Health

Employment and Wage Data

Labor Force Rates

Unemployment Rates

Economic Indicators

Population Estimates

Employee Skill Upgrading

Skill and Proficiency Testing

Career Readiness Certificates

Industry Specific Training

Hiring Needs

Job Order Posting

Employee Referrals

Job Description Development

Applicant Pre-Screening

Specialized Recruitment

Customized Recruitment Events

Job Matching

Whether you are looking for workers with just the right skills, needing access to tools to help your

employees, or seeking the latest state or local demographics we can help!

Employer Resources

Employer Resources Videos

Unemployment Informational Videos

Oklahoma Unemployment Tax Filing Video

Employment Labor Law Posters

Tax Information for Business/Self

Employed

Mass Layoff Services

Job Fairs

Employer Council Events

OKJobMatch.com Resume and Job Bank

8

HIRE A VETERAN

Hiring veterans is good for your company’s bottom line. Don’t know where to begin? Check out

“America’s Heroes at Work - Veterans Hiring Toolkit” at http://www.dol.gov/vets/ahaw/ for the step-by-

step guide to hiring what will be some of your best employees - VETERANS!

Top Ten Reasons to Hire Veterans

1. Ability to learn new skills and concepts. While in the military, service members undergo rigorous

training programs to become experts in a wide range of skills and concepts that can easily be transferred

to a civilian work environment. The skills service members have learned and applied in real-world

situations in the military make them ideal candidates to enhance your organization’s productivity.

2. Strong leadership qualities. The military trains service members to lead by example as well as

through direction, delegation, motivation, and inspiration in some of the toughest situations imaginable.

Service members are not only well-schooled in the academic theory of leadership; they also understand

and have used practical ways to manage behaviors for results.

3. Flexibility to work strongly in teams or work independently. Military training teaches service

members to work as a team by instilling a sense of responsibility to one's colleagues. In addition, the

size and scope of military operations necessitates that service members understand how groups of all

sizes relate to each other and support the overarching objective. While military duties stress teamwork

and group productivity, they also build individuals who are able to perform independently at a very high

level.

4. Diversity and strong interpersonal skills. Service members have learned to work side by side with

individuals regardless of race, gender, religion, ethnic and cultural backgrounds, economic status, and

geographic origins as well as mental, physical and attitudinal capabilities. Many service members have

also been deployed or stationed in numerous foreign countries which give them a greater appreciation

for the diverse nature of our globalized economy.

5. Ability to work efficiently and diligently in a fast-paced environment. Service members have

developed the capacity and time-management skills needed to know how to accomplish tasks correctly

and on time, in spite of limited resources and immense pressure.

6. Respect for procedures and accountability. Service members know how policies and procedures

enable an organization to be successful, and they easily understand their place within an organizational

framework. Service members understand the responsibility that comes with being responsible for the

actions of subordinates, and they understand how to properly elevate issues through the proper

supervisory channels.

7. Hands on experience with technology and globalization. Today's military uses the cutting-edge

technology to maintain our dominance over the enemy in the battlefield. From communications

technology to the security of computer networks and hardware, service members must stay aware of

emerging technologies in the public and private sector.

9

HIRE A VETERAN

8. Strong personal integrity. Military training demands that individuals not only abide by a strong

Code of Ethics, but that they live it each and every day. Military personnel are often trusted with

security clearances that give them access to highly sensitive information. An employee with a proven

track record of trustworthiness is often an asset to an organization.

9. Strong sense of health, safety and property standards. Service members are aware of health and

safety protocols both for themselves and the welfare of others. Individually, they represent a drug-free

workforce that is cognizant of maintaining personal health and fitness. On a company level, their

attentiveness and care translate into respect for employees, property and materials.

10. Triumph over adversity. In addition to dealing positively with the typical issues of personal

maturity, service members have frequently triumphed over great adversity. Service members have

proven their mettle in mission critical situations demanding endurance, stamina and flexibility. In the

case of wounded warriors, they have overcome severe disabilities, acquired injuries (including

invisible injuries) through strength, determination and personal conviction.

10

UNEMPLOYMENT INSURANCE

What is Unemployment Insurance?

Unemployment Insurance is a temporary income

intended to help workers who are unemployed

through no fault of their own. It is an insurance

fully funded by employers.

The intent of Unemployment Insurance is to pay

benefits to eligible claimants during times of

unemployment when suitable work is not available.

The unemployment payment, while it provides

necessities for the unemployed worker, also

provides a consistent flow of funds into the

economy which supports the demand for consumer

goods and services and improves the worker’s

probability of being reemployed. Relief sustains the

economy as it shifts to recovery.

What is Unemployment Benefit

Compensation?

Under the Employment Security Act of 1980,

payments may be made under certain conditions to

unemployed individuals from an unemployment

compensation fund subsidized by employers subject

to the Act.

These payments are known as unemployment benefit

compensation.

Is There a Federal Unemployment

Insurance Law?

Federal legislation authorizing and governing state

unemployment programs is found in both the

Social Security Act and the Federal

Unemployment Tax Act.

The Social Security Act establishes:

Funding for state unemployed insurance

program administration

State law requirements

Federal unemployment compensation

accounts

The Federal Unemployment Tax Act establishes:

Federal unemployment tax rates

Credits against the tax

State law approval provisions

Definitions

Benefits are Payable to Individuals Who

Are:

Unemployed through no fault of their own

Able and available to look for and accept

employment

or

Monetarily eligible (Unemployed

individuals must monetarily qualify for

benefits.) The minimum monetary

qualifications are that the claimant earn at

least $1500 in taxable wages and have total

wages that equal or are in excess of one and

one-half times his high quarter wages.

However, if the individual earns wages

equal to or greater than the taxable limit for

the year in which the claim is filed, he will

be monetarily eligible.

11

UNEMPLOYMENT INSURANCE

What are the Unemployment Insurance

Rules?

The administrative rules governing the Oklahoma

unemployment insurance program are found in the

Rules for the Administration of the Oklahoma

Employment Security Act, 40 O.S. §240:1-1-1

through §240:25-3-1.

The Rules for the Administration of the

Unemployment Insurance Act are written

statements providing the administrative guidelines

for OESC to follow in delivering unemployment

insurance services. These administrative rules are

written under the authority of state and federal law

and have the effect of law.

What is the Unemployment Insurance

Act?

The purpose of the Employment Security Act of

1980, is to promote employment security by

increasing opportunities for placement through the

maintenance of a system of public employment

offices and to provide through the accumulation of

reserves for the payment of compensation to

individuals with respect to their unemployment.

40 O.S. §1-102.

Keep all account information up to date. OESC

sends notices to the addresses listed on an

employer’s Oklahoma account. If the address

information is notupdated,andthenotice goes to an

incorrect address, the notice will not be re-mailed,

and the employer will lose their right to be an

interested party to any subsequent determinations.

Questions regarding employer account

information can be directed to (405) 557-5330.

Please note that all address changes must be

submitted in writing or may be entered online

through EZ Tax Express.

https://eztaxexpress.oesc.state.ok.us

Have written policies and procedures. A claimant

cannot be denied for failing to follow policy or

procedure if they do not know what that policy or

procedureis or should havereasonablyknown.

Protest all claims where the separation was due to a

reason other than lack of work. Also protest a

claim any time the claimant is given severance

pay in accordance with company policy. There is

no guarantee that a timely response will result in

disqualification. However, since the employer

must prove misconduct in a discharge case, failing

to protest or provide information could easily result

in the allowance of benefits.

If there is no employer information, then misconduct will

only be proven if the claimant gives self-disqualifying

information.

Document everything. If a new policy is

created, have all employees sign a receipt

acknowledging they have been advised of the

policy. If a verbal warning isgiventoan employee,

document that the warning was given. If the

employee is given one final chance after an

incident takes place, document the fact that if it

occurs again the employee will be discharged.

How to Keep the Cost of

Unemployment Insurance Down?

There are a number of strategies that employers can

use to minimize costs associated with unemployment

insurance:

Pay employer taxes on time. If taxes are not

paid on time, the employer will only receive 90

percent of the Federal Unemployment Tax Act

(FUTA) credit.

12

Who is Required to Pay Unemployment

Tax?

40 O.S. §1-208 requires an employer to report and

pay the unemployment insurance tax if that

employer meets any one of the following criteria:

An employing unit that pays $1,500 in

wages in a calendar quarter

or

Employs one or more employees for any

portion of a week for any 20 weeks in a

calendar year

An employing unit that acquires substantially

all the organization, trade, business, assets, or

employees of a subject employer, or an

employing unit that acquires a portion of the

organization, trade, business, assets, or

employees of a subject employer.

An employing unit that has previously ceased

to be an employer but subsequently has

employment (except those that cease under

Termination of Coverage Provisions).

An employing unit that voluntary elects to

become subject.

Any department of Oklahoma or any state, all

instrumentalities and any political

subdivision.

An employing unit that is a non-profit

organization as described in 40 O.S. §1-210

(4) or that has a 501(c)(3) exemption issued

by the Internal Revenue Service, provided

they employ four or more employees for some

portion of a week during any 20 weeks in a

calendar year.

GENERAL PROVISIONS AND DEFINITIONS

An employing unit engaged in agricultural

employment that pays $20,000 in wages in a

calendar quarter or employs 10 or more

employees for any portion of a week for any

20 weeks in a calendar year.

An employing unit that pays $1,000 in wages

in a calendar quarter for domestic services.

An employing unit who is not an employer

by reason of any other provision of the

Employment Security Act of 1980. They

would be a subject employer and required to

report and pay tax on all Oklahoma wages if

they were subject to the FUTA.

The term “employer” shall include any Indian tribe

for which service in employment is performed.

What is an Employing Unit?

40 O.S. §1-209 defines “employing unit” to mean

any individual or type of organization, including any

partnership, association, trust, estate, joint stock

company, insurance company, limited liability

company or corporation, whether domestic or

foreign, or the receiver, trustee in bankruptcy,

trustee or successor thereof, or the legal

representative of a deceased person, which has in its

employ one or more individuals performing services

for it within this state.

Unless specifically exempted in 40 O.S. §1-210, all

individuals performing services for an employing

unit are considered employees of that employing

unit and should be reported as such on the State

Unemployment Tax Act (SUTA) reports each

quarter. The wage information and tax collected for

SUTA is used to calculate and pay unemployment

benefits to individuals who qualify.

13

GENERAL PROVISIONS AND DEFINITIONS

What is a Successor Employer?

A “successor employer” is an employing unit that

has acquired substantially all of the trade,

employees, organization, business or assets of the

predecessor employer and continued the operation.

The successor employer also acquires the

predecessor’s unemployment insurance tax rate and

history, including their actual contribution, benefit

experience and annual payrolls. The successor is

jointly and severally liable with the predecessor for

all contributions, interest, penalties and fees owed by

the predecessor employer.

A partial successor employer is an employing unit

that has acquired substantially all of the trade,

employees, organization, business, or assets of an

employer at one or more separate and distinct

establishments and continued the operation. To

acquire the portion of the experience rating account

that was purchased, the successor must send a

written application and the portion of history to be

transferred within 120 days of the acquisition.

If an employer transfers all or a portion of its

business to another employer and, at the time of

transfer, there is substantially common ownership,

management or control of the two employers, the

histories of the employers will be combined.

What is Employment?

“Employment” means work done for an employer by

individuals whom the employer pays, whether

permanently or temporarily employed, unless the

work is specifically exempt from coverage by the

provisions of 40 O.S. §1-210.

Employment encompasses services performed by

officers of corporations, including S corporations.

What Types of Employment are Exempt

From Unemployment Taxes?

Payments made for services that are exempt should

not be included on the quarterly wage report. The

following services are some examples of what does

not constitute employment and is exempt from

unemployment insurance taxes.

Services of an ordained minister in the exercise

of his/her ministry

Services performed by the spouse of an

individual owner (sole proprietor)

Services performed by an individual owner as a

sole proprietor

Services of a minor child (under 21) in the

employ of the parents

Services of parents in the employ of their sons

or daughters

Service performed by the partners in a

partnership

Services performed by an insurance agent or as a

licensed real estate agent, if all service is performed

for remuneration solely by commissions or fees

Services performed for a private for-profit

person or entity or entity by an individual

as a landman (See 40 O.S. §1-210(15)(x)

for additional information.)

40 O.S. §1-210(7) and §1-210(15)

14

GENERAL PROVISIONS AND DEFINITIONS

What is a Lessor Employer?

“Lessor employers” are employing units that

contract with other employers, individuals,

organizations or legal entities to provide “leased”

employees. The lessor employer is liable for

contributions on wages paid to individuals

performing services for the client lessees. The

lessee will be held jointly and severally liable with

the lessor employing unit unless the lessor

employer posts and maintains a surety bond.

What is a Professional Employer

Organization?

40 O.S. §1-209.2 Professional Employer

Organization, states:

A. 1. A “Professional Employer Organization” or

(PEO) is an organization that is subject to the

Oklahoma Professional Employer Organization

Recognition and Registration Act and which

meets the definition set out in paragraph 9 of

Section 600.2 of Title 40 of the Oklahoma

Statutes.

2.“Client” shall have the same meaning as

provided by paragraph 1 of Section 600.2 of Title

40 of the Oklahoma Statutes.

3.“Coemployer” shall have the same meaning as

provided by paragraph 2 of Section 600.2 of

Title 40 of the Oklahoma Statutes.

4.“Coemployment relationship” shall have the

same meaning as provided by paragraph 3 of

Section 600.2 of Title 40 of the Oklahoma

Statutes.

5.“Covered employee” shall have the same

meaning as provided by paragraph 5 of Section

600.2 of Title 40 of the Oklahoma Statutes.

B. For purposes of the Employment Security Act

of 1980, the PEO and its client shall be

considered coemployers of the covered

employees that are under the direction and

control of the client.

C. If a PEO fails to become or remain registered

under the Oklahoma Professional Employer

Organization Recognition and Registration Act,

the entity shall be considered a third-party

administrator of the client account. As a third-

party administrator, a power of attorney will be

required to obtain information from the client’s

account.

What is Interstate Employment?

Wages are reported to the OESC if:

The service is localized in Oklahoma.

Service is considered to be Oklahoma

employment if it is performed entirely within

Oklahoma. The service is also considered

Oklahoma employment if performed both

inside and outside of Oklahoma, but the

service outside of Oklahoma is incidental to

the service in Oklahoma.

The service is not localized in any state. If

the service is not localized in any state but

some of the service is performed in

Oklahoma, and

♦ The individual’s “base of operations” is in

Oklahoma, or if there is no base of

operations, then the place from which the

individual’s employment is directed or

controlled is in Oklahoma, or

♦ The individual’s base of operations or

place from which the service is directed or

controlled is not in any state where service

is performed, but the individual’s

residence is in Oklahoma.

15

GENERAL PROVISIONS AND DEFINITIONS

What Is Worker Misclassification?

Misclassifying workers as independent contractors,

who are in fact employees, creates significant

problems for the affected employees, competing

employers, and to the entire economy. Combatting

this practice has become a policy priority nationally.

OESC is a partner agency with the Internal Revenue

Service (IRS) in the Questionable Employment Tax

Practices Initiative that the IRS started. As such, we

share information.

Employment versus independent contractor status is

defined in 40 O.S. §1-210 (14). Oklahoma uses a

version of the ABC Test for worker

misclassification. We have no equivalent to Section

530 Safe Harbor, or the Voluntary Classification

Settlement Program provisions which the IRS

employs.

According to the ABC Test given in the Act, any

individual providing services for hire is an

employee until it is shown to the satisfaction of the

Commission that:

The individual is free from direction and

control

1

over his performance of service, and meets

one of the following:

The individual has his own independently

established business, or

The individual is performing services outside

the usual course of the business and outside

all places of business.

Individuals not meeting this criteria are considered

employees and should be reported by the employing

unit.

Should you have workers that you classify as

independent contractors or that you are

contemplating classifying as such, please contact

OESC for a determination in order to avoid possible

assessments, penalties, and interest at a later time.

What are EmployerAudits?

The U.S. Department of Labor, Employment and

Training Administration, sets mandatory

performance goals to ensure states are correctly

and efficiently administering the Unemployment

Insurance program. One of the required measures

is the employer audit program. Each state is

required to audit selected employers for

compliance with the Employment Security Act of

1980.

Employers are required by the Act to maintain

work records for a period of four years. These

records are to be open to inspection and subject to

being copied by OESC. These provisions are

found in 40 O.S. §4-502.

Records that are needed to complete an audit,

according to U.S. Department of Labor guidelines,

include:

Federal and/or state income tax returns

Franchise tax return (if employer is

incorporated)

Business licenses

Federal and state payroll reports

W-2 and W-3 forms

Individual earnings records, payroll register,

and time cards

Disbursement records (cancelled checks,

check stubs, cash disbursements journals,

check registers, ACH transactions)

1099 and 1096 forms

Master vendor files

1

This is explained in OESC Rules, §240:10-1-2. Definitions.

16

NOTE: If an employer is selected for audit, they will be notified by the

Compliance Enforcement Officer and advised of the time and date of the

audit.

GENERAL PROVISIONS AND DEFINITIONS

What are EmployerAudits? Continued

Contracts with individuals being treated as contractors as well as invoices, billing statements

or other records from same

Petty cash journal

Detailed general ledger

Chart of accounts and/or trial balance

Financial statements

Corporate or LLC minutes

Financial statements

Any other work records that may be required

Wage information and other confidential Unemployment Compensation information may be requested and utilized for other

governmental purposes, including, but not limited to, verification of an individual’s eligibility for other government programs.

17

What are Wages Paid?

“Wages paid” means wages actually paid to the

worker, provided that in the event of any distribution

of an employer’s assets through insolvency,

receivership, composition, assignment for the benefit

of creditors or termination of business, wages earned

but not actually paid shall be considered as paid.

Wages must be reported for the calendar quarter in

which they are paid.

WAGES

What are Taxable Wages?

“Taxable wages” means the wages paid to an

individual with respect to employment during a

calendar year for services covered by the Act or

other state unemployment compensation which

shall equal the applicable percentage of the state's

average annual wage for the second preceding

calendar year as determined by the OESC, rounded

to the nearest multiple of $100. The applicable

percentage is determined by the conditional factor in

place during the calendar year for which the taxable

wage is being calculated. The conditional factor is

determined pursuant to the provisions of 40 O.S. §3-

113. The applicable percentages are as follows:

40 percent during any calendar year in which

the balance in the Unemployment Insurance

trust fund is in excess of the amount required to

initiate conditional contribution rates, pursuant

to the provisions of 40 O.S. §3-113

Value of meals or lodging furnished by the

employees, that are provided on the

employer’s premises for the employer’s

convenience

Payment made under an approved

supplemental unemployment benefit plan

What are Wages?

“Wages” are defined in 40 O.S. §1-218. They

include all remuneration for services whether in

cash or any other medium. Dismissal payments

that the employer is required by law or contract to

make are wages, as are gratuities that are

customarily received in the course of an

employee’s work. The reasonable cash value of

items other than cash will be estimated in

accordance with the OESC Rules, §240:10-1-2.

Total wages are equal to gross wages less any

exemptions listed below.

Retirement plans other than deferrals under

certain sections of federal law

Sickness or accident disability plans

Medical and hospitalization insurance plans

Life insurance plans

Bona fide thrift or savings plan

Cafeteria plans as defined in federal law

Educational assistance excludable from

federal income tax (26 U.S.C. §125)

Dependent care assistance programs

excludable from federal income tax (26

U.S.C. §129)

Payment by an employer for agricultural or

domestic service of the employee’s share

of FICA without deduction from the

employee’s pay

Dismissal payments which the employer is

not required by law or contract to make

18

WAGES

Scenario3 Totalwages Taxablewages

Firstquarter2019 $2,348.00 $2,348.00

Secondquarter2019 $3,200.00 $3,200.00

Thirdquarter2019 $2,500.00 $2,500.00

Fourthquarter2019 $5,500.00 $5,500.00

2019total $13,548.00 $13,548.00

Scenario2 Totalwages Taxablewages

Firstquarter2019 $5,000.00 $5,000.00

Secondquarter2019 $6,200.00 $6,200.00

Thirdquarter2019 $8,350.48 $6,900.00

Fourthquarter2019 $5,500.00 $0.00

2019total $25,050.48 $18,100.00

Scenario1 Totalwages Taxablewages

Firstquarter2019 $19,000.00 $18,100.00

Secondquarter2019 $19,000.00 $0.00

Thirdquarter2019 $6,000.00 $0.00

Fourthquarter2019 $16,000.00 $0.00

2019total $60,000.00 $18,100.00

How Does an Employer Calculate the

Yearly Taxable Limitation Using Taxable

Wages?

Once an employer has determined their total wages as

defined by 40 O.S. §1-218, the employer can

determine how much of its total wages are taxable up to

the Taxable Limitation for each employee. This amount

is computed per employee per year.

The following scenarios are for example purposes

only. The 2019 taxable limitation was $18,100.

What are the Filing Deadlines?

An employer may file any quarterly report for the

current quarter or any past due quarter. The due

dates for OES-3 submission are as follows:

Quarter Months Due Date

First Jan, Feb, March April 30

Second April, May, June July 31

Third July, Aug, Sept Oct 31

Fourth Oct, Nov, Dec Jan 31

What are Taxable Wages? Continued

42.5 percent during calendar years in which

condition “a” exists

45 percent during calendar years in which

condition “b” exists

47.5 percent during calendar years in which

condition “c” exists

50 percent during calendar years in which

condition “d” exists

19

What Do We Mean By “File?”

When any document is required to be filed by the provisions of the Act or the Rules promulgated under the

authority of the Act with the OESC, any of its representatives, or the Board of Review for the Commission,

the term file, files, or filed shall be defined as follows:

Hand-delivered to the central administrative office of the OESC by close of business on or before

the date due

Faxed to the fax number indicated on the determination letter, order or other document issued by

OESC, by midnight on or before the date due. Timely faxing shall be determined by the date and

time recorded by the OESC fax equipment

Mailed with sufficient postage and properly addressed to the address indicated on the

determination letter, order or other document issued by OESC on or before the date due. Timely

mailing shall be determined by the postmark. If there is no proof from the post office of the date

of mailing, the date of receipt by the Commission shall constitute the date of filing

Electronically transmitted through data lines to OESC, as directed by the instructions on the

determination letter, order or other document issued by the Commission, by midnight on or

before the date due. Timely transmission shall be determined by the Commission’s transmission

log file

WAGES

20

EMPLOYER CONTRIBUTIONS

What is an Experience Rating?

“Experience rating” is the system by which tax rates

vary in relation to an employer’s experience with

unemployment. Experience rating has three major

objectives:

Serve as an incentive to stabilize employment

Produce proper allocation of the cost of

unemployment benefits

Encourage employer participation in the

program

When am I Eligible for an Earned

Experience Contribution Rate?

Unless you are subject to 40 O.S. §3-111 or 3-111.1,

beginning with the 2016 rate year, an employer shall

meet the At-Risk Rule, as defined by Section 3-

110.1, and be eligible for an earned tax rate if,

throughout the calendar year immediately preceding

the year for which the employer's tax rate is being

determined, there was an individual who could have

filed a claim for unemployment benefits in each

quarter of that year establishing a base period, as

defined by Section 1-202 of this title, which would

include wages from that employer.

When am I Eligible for a New

Contribution Rate?

Unless you are subject to 40 O.S. §3-111 or 3-111.1,

newly subject employers will be eligible for a new

contribution rate; for the 2019 rate year, the new

employer rate is 1.5%.

The new employer rate is applied to all newly subject

employers until sufficient experience history exists in

the employer account to meet the At-Risk Rule, as

defined by Section 3-110.1. If the account meets the

At-Risk Rule, the employer will qualify for an earned

experience contribution rate.

What Constitutes a Successor Employer?

Pursuant to 40 O.S. §3-111, any employing unit

which acquires substantially all of the trade,

organization, employees, business, or assets of an

employer and who continues the operations as a

going business on or before 10-31-16 shall be

determined to be a successor employer. The

successor employer shall acquire the experience

rating account of the predecessor employer,

including the predecessor’s actual contribution and

benefit experience, annual payrolls, and

contribution rate.

Pursuant to 40 O.S. §3-111.1, if an employer

transfers all or a portion of its business to another

employer and, at the time of transfer, there is

substantially common ownership, management or

control of the two employers, the histories of the

employers will be combined.

What is an Experience Period?

According to 40 O.S. §1-227, experience period

means:

For any tax year occurring after December 31,

2006, the most recent twelve (12) consecutive

completed calendar quarters occurring before

July 1 of the year immediately preceding the

year for which the employer’s contribution

rate is being calculated

An employer’s benefit wage ratio is the percentage

equal to the total of benefit wage charges in the

experience period divided by the timely taxable

payroll used to compute eligibility of claimants

during the same three-year experience period

immediately prior to July 1 of the year for which the

rates are being computed (a period less than three

years for newly subject employers).

21

EMPLOYER CONTRIBUTIONS

Experience

Rate Period

Benefit Wage

Charges

Timely Taxable

Wages

2016-2017 $10,000.00 $80,000.00

2017-2018 $6,000.00 $100,000.00

2018-2019 $7,000.00 $115,000.00

- $23,000.00 $295,000.00

What is the Benefit Wage Ratio?

An employer’s benefit wage ratio is the percentage

equal to the total benefit wage charges in the

experience period divided by the employer’s timely

taxable wages for the same experience period on

which contributions have been paid on or before

July 31 of the calendar year immediately preceding

the year for which the rate is being calculated.

When am I Notified of our Tax Rates?

All employers are notified of their contribution rate

on or before September 30 of the year prior to the

effective rate year with Form OES-48, Notice of

Employer’s Contribution Rate. This rate is

conclusive and binding upon the employer unless

the employer files a written protest within 20 days

of the date that the OES-48, Notice of Employer’s

Contribution Rate was mailed, including the

specific reasons for the protest. OESC will provide

a review and issue a determination. The employer

may appeal the determination within 14 days of its

postmark.

How is my Earned Contribution Rate

Computed?

Rates are computed for all eligible employers

effective January 1 of each calendar year. The

factors in the computation of an employer’s

contribution rate are:

An employer’s benefit wage ratio

State experience factor

Conditional factor (if applicable)

Employer’s benefit wage ratio = $23,000.00 divided

by $295,000.00 = 0.07797 = 7.8%

The state experience factor is 48%.

The benefit wage ratio and state experience factor

are then applied to the Rate Table to determine the

contribution rate:

https://www.ok.gov/oesc_web/documents/rates.pdf

Therefore, the employer’s contribution rate is

3.7%.

The following is an illustration of an employer’s

benefit wage ratio computation.

22

What is the State Experience Factor?

The state experience factor is calculated by

dividing total benefits paid from the

Unemployment Insurance trust fund for the most

recent 12 quarters by the total benefit wages of all

employers for the same 12-quarter period. The

following illustration shows how the state

experience factor was determined for 2019.

Benefits paid divided by $ 848,616,617.62

Benefit Wage Charges $1,786,317,505.78

State Experience Factor for 2015

rounded to nearest whole percent

48%

What is the Conditional Factor?

Based on the solvency of the Unemployment

Insurance Trust Fund, the conditional factor is

computed annually in accordance with 40 O.S.

§3-113.

The method for determining an employer’s earned

experience rate involves comparing the employer's

own benefit wage ratio to the state experience

factor by the use of a table provided by law.

https://www.ok.gov/oesc_web/documents/rates.pdf

EMPLOYER CONTRIBUTIONS

23

How am I Notified of Benefit Wage

Charges?

If a claimant is allowed benefits based on the reason

for separation at the time an initial claim was filed,

and a valid benefit year has been established, an

OES-502, Notice of Benefit Wages, is mailed to all

base period employers showing the amount of base

period wages being charged to them when benefits

are paid to a claimant for the fifth week of

unemployment in the benefit year. A copy of this

notice should be retained for an employer’s

permanent record, as no additional transcript will be

furnished. An employer must protest the benefit

wage charge in order to be relieved of the charge.

BENEFIT WAGE CHARGES

What Are Benefit Wage Charges?

“Benefit wage charges” are the claimant’s taxable

base period wages reported by the employer to the

OESC for use in determining the claimant’s

eligibility to receive benefits. Benefit wage charges

to an employer’s account are used in computing the

employer’s contribution rate.

There may be instances where benefits are allowed,

but the employer may be relieved of a benefit wage

charge. More information on this can be found in 40

O.S. §3-105 and §3-106.

How Do I Protest a Benefit Wage

Charge?

The protest must be written and contain both the

basis for the protest and the circumstances of the

claimant’s last separation from the employer. The

protest must be filed within 20 days of the date of

issue on the Notice of Benefit Wages. Failure to

respond timely, without providing details

demonstrating good cause for late filing, will result

in no relief of the benefit wage charge.

Am I Notified of Action Taken on a

Protested Benefit Wage Charge?

The employer is notified with a Notice of

Cancellation of Benefit Wages if it is determined

that the base period charge has been cancelled and

will not be used in computing the employer’s tax

rate. However, if it is determined that the base

period wage charge will be used, the employer will

receive an OES-503, Notice of Determination to

Base Period Employer. The employer can appeal

this determination. The appeal must be in writing

and filed within 14 days after the OES-503, Notice

of Determination to Base Period Employer was

mailed.

24

BENEFIT WAGE CHARGES

What Are the Grounds for Protesting a Benefit Wage Charge?

An employer can protest a benefit wage charge when the claimant’s separation from the employer was under the

followingcircumstances:

Theemployeelefttheworkvoluntarilywithout good causeconnectedtothe work.

Theemployeewasdischargedformisconductconnectedwithhisorher work.

The employee was a regularly scheduled employee of that employer prior to the week the employee

separated from other employment, and remained an employee of the employer through the fifth

compensableweek ofunemploymentinhisorherestablished benefit year.

Theemployeewasseparatedfrom employmentasadirectresultofamajornatural disaster, declared as such

by the President pursuant to the Disaster Relief Act of 1974, P.L. 93-288, and such employee would

have been entitled to disaster unemployment assistance if employee had not received unemployment

insurance benefits.

The employee was discharged for unsatisfactoryperformance duringan initial employment probationary

period. As used in this paragraph, “probationary period” means a period of time set forth in an

established probationary plan which applies to all employees or a specific group of employees and does

not exceed ninety (90) calendar days from the first day a new employee begins work. The employee

must be informed of the probationary period within the first seven (7) work days. There must be

conclusive evidence to establish that the individual was separated due to unsatisfactory work

performance.

The employee left employment to attend training approved under the Trade Act of 1974 and is allowed

unemployment benefits pursuant to 40 O.S. §2-416.

The employee was separatedfromemploymentforcompellingfamilycircumstancesasdefined in 40 O.S.

§2-210.

The claimant was separated because of illness or disability which required cessation of work or change

in occupation.

The claimant was separated because of illness or disabilityof immediate family member.

The claimant was separated because their spouse obtained employment in a location outside of

commuting distance.

The claimant left a job as part of a plan to escape domestic violence or abuse.

25

What Are The Options For Tribal

Employers?

An Indian tribe or tribal unit may choose to pay

contributions in the same manner as

nongovernmental employees for profit. However, an

Indian tribe or tribal unit may also elect to make

reimbursing payments in lieu of contributions.

Indian tribes shall determine whether reimbursement

of benefits paid shall be elected by the tribe as a

whole, by individual tribal units, or by combinations

of tribal units.

What Are The Options For Reimbursing

and Governmental Employers?

Non-profit organizations, as defined by 40 O.S.

§1-210(4), and governmental employers may elect to

make reimbursing payments in lieu of contributions.

Rather than paying contributions based on a tax rate

derived from their experience history, reimbursing

employers make payments based on the full amount

of benefits paid to former employees for wages

which are attributable to their employ.

Reimbursing employers are required to reimburse for

benefits paid regardless of the reason for separation.

Governmental employers who choose not to elect to

make reimbursing payments shall make quarterly

payments based on a fixed 1% of taxable wages.

Reimbursing and governmental (1%) employers will

receive an OES-866, Notice to Reimbursing and

Governmental Employers at the time an

unemployment claim is filed. This notice only

provides the taxable wages earned from the employer

that were used in determining the claimant’s benefit

amount. It does not allow the employer the ability to

protest the claimant’s eligibility for benefits based

upon the separation from their employ. If a

reimbursing or governmental employer is the last

employer of 15 days or more, they will also receive

the OES-617, Notice of Application for

Unemployment Compensation. This notice does

allow the employer to protest the eligibility of the

claimant to receive benefits.

Following the end of the quarter, reimbursing

employers will receive the OES-876, Quarterly

Statement for Reimbursement of Benefits Paid.

REIMBURSING AND GOVERNMENTAL EMPLOYERS

This statement will detail the amounts of benefits

paid to claimants for which the employer is required

to make reimbursing payments to the Commission.

26

UNEMPLOYMENT BENEFITS

How Do I Protest Benefits?

When an employer receives a notice of application,

they will have 10 days from the postmark date of the

notice to protest the claim. If the tenth day falls on a

Saturday, Sunday or holiday, the employer will have

until the next working day. If an employer does not

protest by the tenth day, they will not be considered

an interested party to any subsequent

determinations.

When protesting claims, employers should provide

specific facts regarding the separation. Protests that

only say, “Discharged due to misconduct” fall short

of providing useful information. OESC needs to

know what caused the separation on that particular

day, whether the claimant had received any warnings,

and what the claimant should have done that could

have prevented the separation.

What is a Base Period?

The “base period” is the first four of the last five

completed calendar quarters immediately preceding

the first day of a claimant’s benefit year.

What is a Benefit Year?

A “benefit year” is a one-year unemployment

insurance benefit eligibility period that begins on

Sunday of the week the first valid unemployment

insurance claim is filed.

What is a Valid Claim?

A “valid claim” is an unemployment insurance

claim filed in accordance with the rules of the

OESC by a claimant who has the necessary

qualifying wages.

How Do You Qualify for Unemployment

Benefits?

In order to be eligible for unemployment benefits,

a claimant must be all of the following:

Separated from work or working less than

full time

Registered and diligently seeking work

during each week in which he/she applies

for benefits

Able to work and available to perform work

duties in keeping with education, training

and experience

A claimant's self-employment cannot interfere

with their availability for employment or the type

of work they are seeking. In addition, all self-

employment wages must be reported. The

claimant cannot be working on a commission or

receiving or seeking unemployment benefits from

another state or the United States.

What Are the Maximum

Unemployment Benefit Amounts?

The unemployment benefit amount is determined

by the qualifying wages paid to a claimant during

the claimant's base period.

The benefit amounts are calculated each year. In

Oklahoma, weekly payments range from a

minimum of $16 to the current year's weekly

maximum of $520.00.

Computation of the maximum benefit amount

changes each year based on the conditional factor

associated with the state's Unemployment

Insurance Trust Fund.

The number of weeks a claimant can receive

unemployment benefits during his/her benefit year

is limited to a maximum of 26 weeks.

27

UNEMPLOYMENT BENEFITS

How to Apply for Unemployment

Benefits:

When an individual files a new claim for

unemployment benefits, OESC notifies the last covered

employer of 15 or more working days. When a

claimant returns to work during their benefit year and

is separated from the new job, the claimant can reopen

their current claim. If the claimant is separated from

employment for any reason other than lack of work, an

investigation will be conducted, and a determination will

be issued allowing or denying unemployment benefits in

accordance with state law. The employer will only be

an interested party to the determination if a timely,

response is received in accordance with 40 O.S.

§2-503. Employers who are not interested parties

will not receive a copy of the determination and will

not have appeal rights to any subsequent

determinations.

What is Able and Available?

The claimant must be able and available for work

each week. Any individual who is able or available

for work the majority of the week (three out of the

five normal workdays) is considered able and

available.

Can a Claimant Who Quits Collect

Unemployment Benefits?

A claimant who voluntarily leaves their last job

without good cause connected to the work is subject

to disqualification from benefits. The burden of

proof for good cause connected to the work in a

voluntary quit is on the claimant.

For a claimant to establish benefits after a

disqualification, they must be reemployed and earn

wages equal to or in excess of ten (10) times their

weekly benefit amount. However, there exists

certain circumstances that are not work related that

will result in allowance of benefits.

Can a Claimant Who is Fired for

Misconduct Collect Unemployment

Benefits?

A claimant discharged from their last work for

misconduct connected to the work is subject to

disqualification for benefits.

In cases of discharge for misconduct, the burden of

proof to establish misconduct is on the employer.

To lift the disqualification, the claimant must be

reemployed and earn wages equal to or in excess of

ten (10) times their weekly benefit amount.

What Are Other Separation Issues?

An individual who ceases work due to a labor

dispute or strike against their employer is ineligible

for benefits if they participate in the dispute and

voluntarily remain out of employment for purposes

of the dispute. This applies to all circumstances

except where the employer has locked out the

employees. Labor dispute issues are sent to the

OESC Appeal Tribunal for decisions.

28

UNEMPLOYMENT BENEFITS

Other Issues Affecting Eligibility:

A claimant can also be denied benefits or have

benefits reduced:

In cases involving fraud or misrepresentation

If the claimant is not able and/or available for

work in keeping with their prior work

experience, training and education

If the claimant is an alien not lawfully

permitted to work in the United States

Between two successive seasons, if benefits are

based on services performed as a professional

athlete, and services were performed in the

first season, and there is reasonable assurance

the claimant will perform services in the

second season

Between two academic years or terms, if

benefits are based on services performed as a

school employee, and there is reasonable

assurance that the claimant will perform such

services in the second academic year or term.

School employees are ineligible during

customary vacation periods or holiday recesses

if they have reasonable assurance of returning

to work

If the claimant is enrolled in scheduled school

activities and is not willing to quit school,

adjust their schedule or change shifts to secure

employment

Dismissal and/or severance payments required

by law or contract

Unemployment benefits under an

unemployment compensation law of another

state or the United States

Pension or retirement pay based on previous

work, if such payment is under a plan

maintained or contributed to by a base period

employer

What About Employees Working for

Temporary Agencies?

For the purposes of this section, the following

definitions apply.

“Temporary help firm” means a firm that

hires its own employees and assigns

them to clients to support or supplement

the client's work force in work situations

such as employee absences, temporary

skill shortages, seasonal workloads, and

special assignments and projects.

“Temporary employee” means an

employee assigned to work for the clients

of a temporary help firm.

A temporary employee of a temporary help firm will

be deemed to have left his or her last work

voluntarily without good cause connected with the

work if the temporary employee:

Does not contact the temporary help firm for

reassignment on completion of an assignment.

The temporary help firm shall establish the

manner for a temporary employee to

communicate that his or her assignment has

ended and that he or she is available for

reassignment at any time

Refuses a suitable job assignment, without good

cause

Communicates his or her decision to cease

seeking assignment for any period of time

Wages from part time employment

Vacation and/or sick leave payments in a

circumstance when required to return to work

on a specific date or at the end of a specific

vacation

29

UNEMPLOYMENT BENEFITS

What About Employees Hired for

Limited Periods of Time?

When an employer employs a worker for a limited

duration of time specified by the employer, the

worker is considered to have been laid off due to

lack of work at the end of the time period set by

the employer, provided that the worker's

separation was due only to the completion of the

workor the expiration of thetimeperiod

When an employer employs a worker for a limited

duration of time specified by the worker, the worker

is considered to have voluntarily quit work at the

end of the time period set by the worker, provided

that the worker's separation was due only to the

expirationof thetime period

This means that if the employee sets the dates of

employment then, upon completion of the length of time

specified by the employee, the employee isconsidered to

have quit the job. If the employer sets the dates of

employment then, upon completion ofthelength of time

specified by the employer, the employee is considered

to have been laid off due to a lack of work.

If the individual separates before the agreed upon last

day of employment, then OESC looks at why the

individual separated and makes a ruling upon the

reason for separation.

What About Employees Working for

Temporary Agencies? Continued

Becomes unavailable to accept a suitable job

assignment, without good cause

Accepts employment with a client of the

temporary help firm

Note: This provision shall apply only if the

temporary employee has been advised of the

obligations and has been provided a copy of a

separate document written in clear and concise

language that states the provision of this section and

that unemployment benefits may be denied for

failure to comply.

For unemployment insurance purposes, the

temporary help firm is deemed to be the employer of

the temporary employee. This means that regardless

of the particular business requirement of the

temporary agency, if the claimant contacts the

temporary service upon the completion of an

assignment, and no work is available, the claimant

will be considered to be laid off due to lackofwork.

In addition, the claimant must be made aware of the

requirement to check in upon the completion of an

assignment. The objective of the claimant is also

considered.

30

What if They Were Fired for Refusing to

Undergo Drug and Alcohol Testing?

An employee discharged on the basis of a refusal to

undergo drug or alcohol testing or a confirmed

positive drug or alcohol test conducted in accordance

with the provisions of the Standards for Workplace

Drug and Alcohol Testing Act shall be considered to

have been discharged for misconduct and shall be

disqualified for benefits pursuant to provisions of 40

O.S. §2-406. In any claim brought by the discharged

employee for compensation, a copy of the drug or

alcohol test results shall be accepted as prima facie

evidence of the administration and results of the drug

or alcohol test.

UNEMPLOYMENT BENEFITS

What Do I Need to Know About Drug and

Alcohol Testing?

In order to establish that the drug or alcohol test of an

unemployment insurance claimant was conducted in

accordance with the Standards for Workplace Drug

and Alcohol Testing Act, 40 O.S. §551 through §565,

the employer must produce the following

documentation:

Documentation of a positive test result issued by

thetesting facility that performed the test

Documentation of the chain of custody of the

testing sample from the point of collection to

the testing facility

The medical review officer's certification of

proper testing standards and procedures

A statement concerning the circumstances, as

set out in 40 O.S. §554, under which the testing

was requested or required

A copy of the employer's drug testing policy,

as required by 40 O.S. §555

Documentation showing that the employer

provides an employee assistance program, as

required by 40 O.S. §561

Any evidence relevant to the adjudication of

questions of fact or law regarding drug or

alcohol testing that may be an issue in the

claim for unemployment benefits

The claimant must be tested for a valid reason. Valid

reasons include but are not limited to:

Testing of a new applicant

Testing under reasonable suspicion

Post-accident testing

Random testing

Scheduled periodic testing

If an employer does not have an established drug testing

policy that conforms to the Standards for Workplace

Drug and Alcohol Testing Act and that employer

discharges someone for testing positive for drugs,

the discharged individual cannot be disqualified

from receiving unemployment insurance because of

the positive drug test.

Who Has the Burden of Proof?

When an individual is discharged, the burden of

proof lies with the employer to show the discharge

was for misconduct connected with the work.

When an individual quits, the burden of proof lies

with that individual to show good cause for

quitting.

31

UNEMPLOYMENT BENEFITS

Am I Notified of Claims Filed Against

Me?

In accordance with 40 O.S. §2-503, the last

employer for whom the claimant worked at least 15

working days is notified when the claimant begins

receiving unemployment benefits. An OES-617,

Notice of Application for Unemployment

Compensation is mailed to the separating

employer. One important factor to protect an

employer is for the employer to respond to all

notices in a timely manner with complete

information. Appeal rights are based on written

responses.

Can a Claimant Refuse Offers of Suitable

Work?

An individual is disqualified from receiving benefits

if he/she fails to:

Diligently search for suitable employment at a

pay rate generally available in that area and

keeping with his/her prior experience,

education and training

Apply for work with employers who could

reasonably be expected to have work available

within the claimant's general geographic area

Present himself/herself as an applicant in a

manner designed to encourage consideration for

employment

Accept an offer of work from an employer,

including any former employer

Apply for or accept an offer of work when so

directed by the OESC Workforce Services staff

Accept employment pursuant to a hiring hall

agreement when so offered

Any individual violation of the first three stipulations

is disqualified for the week in which the violation

occurred. An individual in violation of the last three

stipulations is disqualified for the week in which the

violation occurred, and disqualification will continue

until the individual becomes reemployed and has

earned wages equal to or in excess of 10 times his/

her weekly benefit amount.

Any individual violating the last three requirements

due to illness, death of a family member or other

circumstances beyond his/her control will be

disqualified for regular benefits under this section

only for the week of the violation.

Further, any individual disqualified for the week of

the occurrence of such circumstances beyond his/her

control is not eligible for extended benefits for the

purposes of 40 O.S. §2-701 through §2-724 until

such individual has become re-employed and has

earned wages equal to at least 10 times his/her

weekly benefit amount.

Can I Appeal a Determination?

The employer or the claimant may file an appeal if

either interested party disagrees with the

determination. The appeal must be in writing and

postmarked or faxed within 10 days from the date

the determination was mailed. If no appeal is filed

within the 10-day period, the determination

becomes final, and benefit payments will be made

or denied based on the determination.

32

UNEMPLOYMENT BENEFITS

How to Protest an Unemployment Claim:

Many employers may not be aware of the

requirements of responding to notices of

unemployment claims. 40 O.S. §2-503(E) states:

E. Within ten (10) days after the date on the notice

or the date of the postmark on the envelope in

which the notice was sent, whichever is later, an

employer may file with the Commission at the

address prescribed in the notice written

objections to the claim setting forth specific facts

which

1. Make the claimant ineligible for benefits

under 40 O.S. §2-201 through §2-210;

2. Disqualify the claimant from benefits under

40 O.S. §2-401 through §2-419; or

3. Relieve such employer from being charged

for the benefits wages of such claimant.

If an employer protests with inadequate information,

they will receive a decision in the mail stating that

their protest has been received, but there is

inadequate information surrounding the separation to

make the employer an interested party. As a result,

the employer will not receive a copy of the

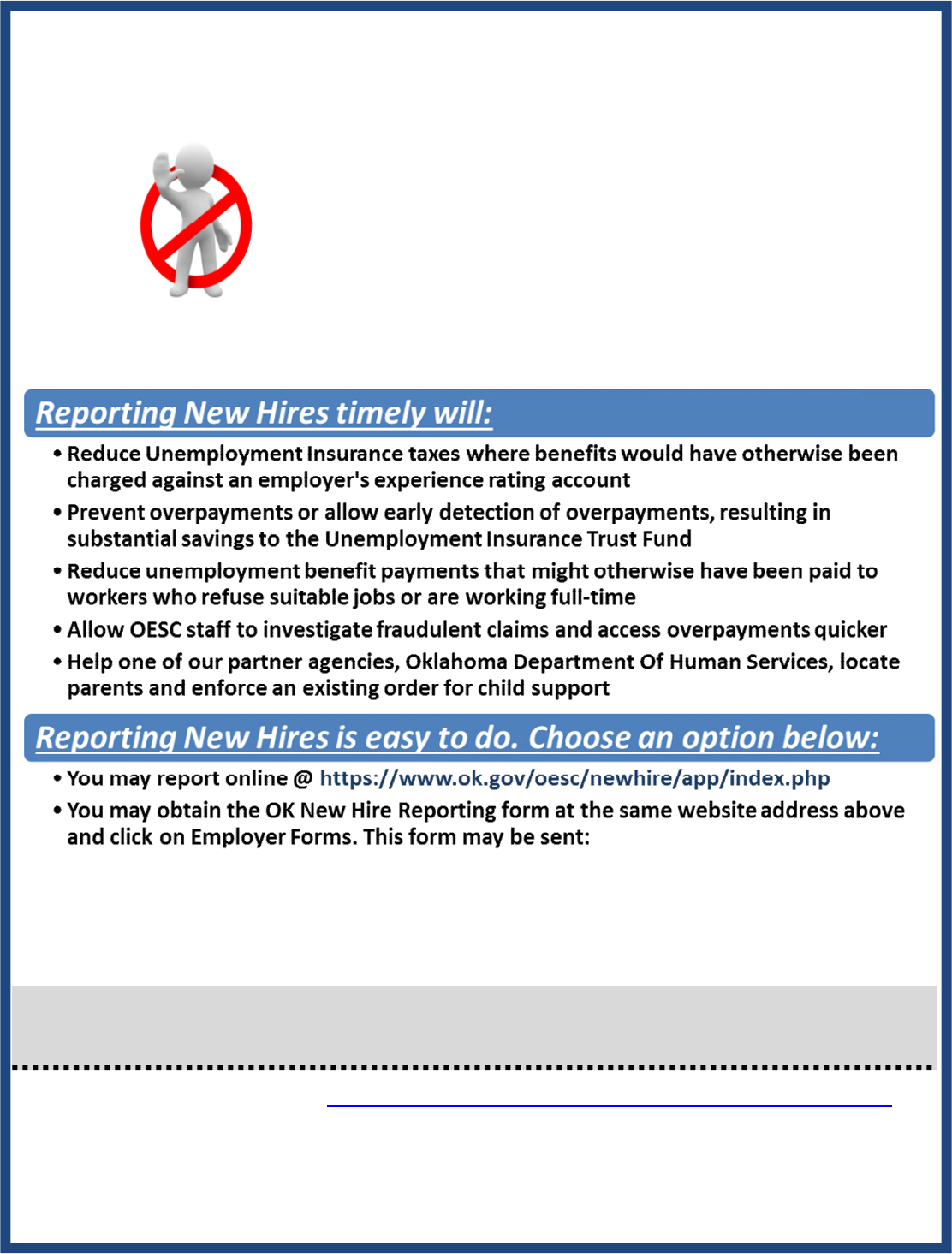

separation determination and will not have appeal