1

ةروتاــف

Detailed Guidelines for

E-Invoicing

Version 2

MAY 2023

Fatoora

2

Contents

1. Introduction

1.1. E-Invoicing in Kingdom of Saudi Arabia (linking E-Invoicing Regulation with

the VAT Legislations)

1.2. Benefits of E-Invoicing

1.3. E-Invoicing phases

1.4. The Authority

1.5. Scope of this Guideline

2. Clarifications of the main terms used

3. Scope of E-Invoicing

3.1. Taxable Persons subject to E-Invoicing

3.2. Requirements to generate Electronic Invoices

4. Types of E-Invoices

4.1. Tax Invoice

4.1.1. Tax Invoices for Phase 1 (Generation Phase)

4.1.2. Tax Invoices for Phase 2 (Integration Phase)

4.2. Simplified Tax Invoice

4.2.1. Simplified Tax Invoices for Phase 1 (Generation Phase)

4.2.2. Simplified Tax Invoices for Phase 2 (Integration Phase)

4.3. Credit and Debit Notes

05

05

05

06

07

07

08

13

13

13

14

14

14

15

17

17

18

19

3

4.4. Sample visual examples of E-Invoices

5. E-Invoice Generation Phase Requirements and Timelines (Tax Invoice

vs. Simplified Tax Invoice Solutions)

5.1. Solution Requirements

6. E-Invoice Integration Phase Requirements and Timelines (Tax Invoice vs.

Simplified Tax Invoice Solutions)

6.1. E-Invoice Integration Phase Requirements and Timelines (Tax Invoices.

Simplified Tax Invoice Solutions)

6.2. Timelines

6.3. Technical Requirements

6.4. Clearance and Reporting

6.5. Prohibited Functions

6.6. E-Invoice Format

7. Rights and Obligations of Taxable Persons

7.1 Right to deduct / refund VAT

7.2 Obligations of taxable persons subject to E-Invoice regulation

7.3. E-Invoicing Record Keeping

7.4. Additional E-Invoicing Obligations (e.g. using compliant solutions,

maintaining the cryptographic stamp, etc.)

7.5. E-Invoicing Compliance Audit

20

21

21

29

29

31

31

31

34

36

37

37

37

38

38

39

4

8. Advance Payments

9. Integration with ZATCA

10. Failure Scenarios

11. Tax Invoice and Simplified Tax Invoice QR Code validation

FAQs

Contact Us

40

44

45

56

57

65

5

1. Introduction

1.1. E-Invoicing in Kingdom of Saudi Arabia (linking E-Invoicing Regulation

with the VAT Legislations)

Electronic Invoicing is a procedure that aims to convert the issuing of paper invoices as

well as credit and debit notes into an electronic process that allows the exchange and

processing of invoices, credit and debit notes in a structured electronic format between

the buyer and seller.

The E-Invoicing Regulation shall be read together with the Unified VAT Agreement (the

Agreement), the VAT Law published on 4/11/1438H and its amendments (the VAT Law), the

VAT Implementing Regulation (VAT Implementing Regulation) and the resolutions issued

pursuant to the Electronic Invoicing Regulation, including the resolution on the Controls,

Requirements, Technical Specifications and Procedural Rules (herein after referred to as

“E-Invoicing Resolution”) required for implementing Electronic Invoicing in the Kingdom

of Saudi Arabia.

1.2. Benefits of E-Invoicing

Electronic Invoicing has several benefits for both persons subject to E-Invoicing

Regulations and national economy, these benefits include but are not limited to:

A. Reduces cost of invoicing process

B. Prevents human error in invoicing process

C. Enhances digitalization in supply chain

D. Improves accounting and book keeping

E. Enhances business ecosystem with enriched fair competition and consumer protection

through provision of a unified process for validating and auditing invoices

6

F. Reduces hidden economy transactions

G. Reduces commercial concealment by increasing requirements related to invoice

tracking and data retention

H. Enriches the consumer experience and digitizing the consumer- supplier relationship

I. Increases compliance with tax obligations through enhanced verification of business

transactions

1.3. E-Invoicing phases

Electronic Invoicing is composed of two main phases, as follows:

1. Phase 1 (Generation Phase): Generation of Electronic Invoices Phase, where Persons

subject to the E-Invoicing Regulations must generate Electronic Invoices and associated

Electronic Notes in accordance with the clauses set forth under the Resolution on the

E-INVOICING BYLAW and The Controls, Requirements, Technical Specifications And

Procedural Rules For Implementing The Provisions Of The E-Invoicing Regulation and any

subsequent resolutions. This phase has been implemented effectively by 4th of December

2021.

2. Phase 2 (Integration Phase): Integration Phase, where Persons subject to the E-Invoicing

Regulations must integrate their systems with the Authority’s system (FATOORA) in

accordance with the clauses set forth under the Resolution on the Controls, Requirements,

Technical Specifications and Procedural Rules and any subsequent resolutions. The

second phase (integration phase) shall be implemented starting from 1st of January 2023

onwards. The second phase (integration phase) will be implemented in groups and will be

mandated to Persons subject to the E-Invoicing Regulations based on the criteria set by the

Authority. Notifications to the target groups will be initiated at least six months in advance.

7

1.4. The Authority

The Zakat, Tax and Customs Authority, also referred to as “the Authority” herein, is the

authority in charge of the implementation and administration of VAT (which may be referred

to hereinafter as “the Tax”) or (“VAT”). In addition to the registration and deregistration

of taxable persons for VAT, the administration of VAT return filing and VAT refunds, and

undertaking audits and field visits, the Authority also has the power to levy penalties for

noncompliance and is mandated to implement the E-Invoicing framework in KSA, which

was enforced through the E-Invoicing Regulations issued by the Board of Directors of the

Authority on December 4, 2020.

1.5. Scope of this Guideline

This Guideline addresses all Persons covered by the scope of application of Article (3) of

the E-Invoicing Regulation which covers:

● Taxable person that is a resident in KSA.

● The customer or any third party who issues a Tax Invoice on behalf of the taxable

person that is a resident in KSA according to the VAT Implementing Regulation.

This Guideline aims to provide more information on certain industries, transactions or

scenarios and provide more detailed information on how E-Invoicing will be applicable to

such industries, transactions or scenarios.

This Guideline contains and references several examples of electronic invoices against the

various invoices to be issued and the types of transactions. The complete list of examples

and the human readable format (PDF/A-3 with embedded XML) of the invoice and the XML

are included on the Authority’s Website. Please note that the Cryptographic Stamp value,

the QR Code value, and the Invoice Hash value in the XML examples are sample values.

This Guideline aims to simplify and clarify the end-to-end journey of the Taxable persons

through electronic invoicing, their obligations, and the overall solution requirements to

comply with electronic invoicing regulations.

This Guideline does not contain explanations of technical implementation details directed

at invoicing solution vendors.

8

2. Clarifications of the main terms used

This section provides clarifications of the definitions used under the Resolution, provides

some additional clarifications that will be helpful to better understand the terms used under

these guidelines, and clarifies the mechanism for applying the provisions related to the

Resolution.

2.1. Electronic Invoicing:

It is a mechanism that aims to transform the process of issuing paper invoices and notes

into an electronic process that allows the exchange of invoices and debit and credit notes

and their processing in a structured electronic format organized between the seller and the

buyer.

2.2. Tax Invoice:

A Tax Invoice as per Article 53(1) of VAT Implementing Regulations that is generated and

stored in a structured electronic format through electronic means. Standard Tax Invoices

are generally issued in Business to Business (B2B) transactions. A paper invoice that is

converted into an electronic format through copying, scanning, or any other method is not

considered an electronic invoice.

2.3. Simplified Tax Invoice:

A Simplified Tax Invoice as per Article 53(7) of VAT Implementing Regulations that is

generated and stored in a structured electronic format generally issued for a B2C (business

to consumer) transaction and does not generally include the buyer’s details

1

. Optionally,

Simplified Tax Invoices may also be issued for business-to-business transactions in case

the value of supply is below SAR 1,000.

1. Note that the buyer details may be required in specific cases where Simplified Tax Invoices are issued towards Supply of

Private Education and Private Health Care services to Saudi Citizens. These services are having a special tax treatment (treated

as “Zero Rated”) and the Kingdom bears the VAT for such services.

9

2.4. Electronic Note:

Debit and credit notes that must be issued in accordance with the Article 54 of VAT

Implementing Regulation, and which are generated and stored in a structured electronic

format through electronic means. Paper notes that are converted into electronic format

through copying, scanning, or any other method, are not considered electronic notes for

the purposes of this Regulation.

2.5. Debit Note:

Debit notes are issued by the sellers in order to issue a correction in value to buyers. Debit

notes are used for increasing the value of the original invoice or the VAT amount. Debit

notes follow the same format as the invoice for which they have been issued.

2.6. Credit Note:

Credit notes are issued by the sellers in order to refund buyers and are used to correct

invoices information if generated with an error. Credit notes follow the same format as the

invoice they have been issued upon.

2.7. E-Invoice Solution:

The compliant solution which is used for generating Electronic Invoices and Electronic

Notes. Such a solution must fulfil the specifications and requirements set forth under the

resolution on the Controls, Requirements, Technical Specifications and Procedural Rules

for Implementing the Provisions of the E-Invoicing Regulation. An E-Invoice Solution may

contain one or more Units.

10

2.8. FATOORA Portal:

ZATCA’s portal through which Tax Invoice, Simplified Tax Invoice, and electronic credit/

debit note data is received, which are generated by the E-Invoice Solutions used by

Persons subject to the E-Invoicing Regulations. This portal aims to onboard the user’s EGS

Unit through generating cryptographic stamp identifier or renewing the existing one or

revoking it. In addition, the user can view the list of onboarded solutions and devices.

2.9. Cryptographic Stamp:

An electronic stamp which is created via cryptographic algorithms to ensure authenticity

of origin and integrity of content of the data for the Electronic Invoices and its associated

Electronic Notes, and to ensure the identity verification of the issuer for the Invoices and

Notes for the purpose of ensuring compliance with the provisions and controls of the VAT

Law and its Implementing Regulation regarding the generation of Electronic Invoices and

Notes. For technical details, please refer to the Security Features Implementation Standard.

2.10. Cryptographic Stamp Identifier (CSID):

A Cryptographic Stamp Identifier (CSID) is a unique identifier that links the E-Invoice

Solution Unit and a trusted third party able to confirm the identity of the Person subject

to the E-Invoicing Regulation and uniquely identify their unit. For technical details, please

refer to the Security Features Implementation Standard.

2.11. UUID:

A 128-bit number, generated by an algorithm chosen to make it unlikely that the same

identifier will be generated by anyone else in the known universe using the same algorithm.

The UUID is generated by a compliant E-Invoice Solution and stored inside the XML invoice.

Note: In Windows OS UUIDs are referred to by the term GUID.

11

2.12. QR Code:

A type of matrix barcode, with a pattern of black and white squares that is machine

readable by a QR code scanner or smart device camera in order to enable basic validation of

Electronic Invoices and Electronic Notes. For technical details, please refer to the Security

Features Implementation Standard.

2.13. Hash:

A hash function is any function that can be used to map data of arbitrary size to fixed-size

values called hashes that takes up minimal space. A hash procedure is deterministic -

meaning that for a given input value it must always generate the same hash value. It is not

possible to derive the original data from a hash; hence, hashing is meant to verify that a

file or piece of data hasn’t been altered. For technical details, please refer to the Security

Features Implementation Standard.

2.14. Invoice Reference Number:

A unique and sequential number that identifies the issued invoice by the E-Invoice Solution,

according to article 53 of the VAT Implementing Regulations. The VAT Implementing

Regulations did not specify a specific format for the Invoice Reference Number, and the

reference numbers may be different, for example, a different sequential reference number

for each branch, provided that the Tax Invoice is clearly and distinctly defined and follows

a sequence.

12

2.15. Clearance:

Clearance is the process where the Authority shall verify that the Electronic Tax Invoices

and their associated Electronic Notes transmitted to it (through integration) by the persons

subject to E-Invoicing Regulation, fulfil the controls and details specified in the E-Invoicing

Resolution, Annexes (1) and (2) of the Resolution, and the relevant technical documentation.

The Authority shall insert the Cryptographic Stamp only on the Invoices and Notes which

fulfil the aforementioned controls and details. Please note that the process of Clearance is

not applicable to Simplified Tax Invoices.

2.16. Reporting of Simplified Tax Invoices and their associated notes:

Reporting is the process of sharing of the Simplified Tax Invoices and their associated

Notes which are generated electronically - which include the Cryptographic Stamp as

specified in Clause (Fourth) of the E-Invoicing Resolution- with the Authority by the

persons subject to E-Invoicing Regulation. Persons subject to the E-Invoicing Regulation

will be required to transmit all Simplified Tax Invoices to the FATOORA Portal within (24)

hours from its issuance.

2.17. Human Readable Format:

The human readable format of the invoice is a recognizable invoice that can be read and

understood by a human reader (including buyers and the Authority).

2.18. The Authority’s Toolkit:

The Authority toolkit is the testing toolkits provided by the Authority to allow Persons

subject to the E-Invoicing Regulation to verify that their solutions generate compliant

invoices and can be validated by the FATOORA Portal after integration. There are three

tools provided the sandbox, SDK and web-based validator, for more details please check

the sandbox webpage.

13

3. Scope of E-Invoicing

3.1. Taxable Persons subject to E-Invoicing

● All Taxable Persons subject to E-Invoicing Regulations are obliged to generate

E-Invoices for all their transactions for which Tax Invoices must be issued, in addition to

the electronic notes that must be issued in the cases stipulated in the VAT Law and its

implementing regulations

● Taxable Persons who are subject to the E-Invoicing Regulation include:

1. Taxable person that is a Resident in the Kingdom.

2. The customer or any third party that issues a Tax Invoice on behalf of the taxable

person that is a Resident in the Kingdom according to Article 53 (3), on the

amendment of VAT Implementing Regulations which was approved by the Authority

in 2021/11/09 that implemented in Dec. 4th 2021

● Taxable Persons who are not Residents in KSA are not required to issue Electronic

Invoices or Electronic Notes for supplies or amounts received which are subject to tax

in KSA.

3.2. Requirements to generate Electronic Invoices

Electronic invoicing has not changed the requirements for issuing invoices, debit notes

or credit notes, and therefore, the issuance of invoices, debit notes or credit notes must

be adhered to in accordance with the provisions of the VAT Law and its implementing

regulations.

14

4. Types of E-Invoices

4.1. Tax Invoice

4.1.1. Tax Invoices for Phase 1 (Generation Phase)

a. A Tax invoice is an invoice issued for most B2B and B2G transactions with fields defined

in Article 53 (5), VAT Implementing Regulations and Annex 2 of E Invoicing Resolution.

The fields required for Generation Phase and Integration Phase to be included within

the Tax Invoice are included in the Annex 2 of the E-Invoicing Resolution.

b. For Phase 1 (Generation Phase), the taxpayer must generate a Tax Invoice including

additional data fields prescribed in the Annex 2 of E-Invoicing Resolution in an electronic

format using a compliant E-Invoice Generation Solution (EGS). There is no specific

format prescribed for Phase 1 Tax Invoices (such as XML format or PDF/A-3 format).

Taxpayers can generate it in any electronic format, however, a paper invoice that is

converted into an electronic format through copying, scanning, or any other method is

not considered a compliant E-Invoice.

c. Also, for the Phase 1 (Generation Phase) invoices, there is no specific format prescribed

for sharing / presentment to the buyers. Phase 1 invoices can be presented in the any

electronic format.

15

4.1.2. Tax Invoices for Phase 2 (Integration Phase)

a. For Phase 2 (Integration Phase), the taxpayer must generate a Tax Invoice including

additional data fields prescribed in the Annex 2 of E-Invoicing Resolution in an electronic

format using a compliant E-Invoice Generation Solution (EGS) which is Onboarded (click

here for detailed technical guideline which defines the onboarding process). Phase 2

(Integration Phase) Tax Invoices must be generated in XML format or a PDF/A-3 (with

embedded XML).

b. Phase 2 (Integration Phase) Tax Invoices must be submitted in XML format (not

PDF/A-3) to FATOORA Platform for “Clearance” using APIs. FATOORA Platform will

validate whether the Tax Invoice is compliant with XML Implementation Standard

and run additional referential checks. Once the Tax Invoice pass validation checks,

FATOORA Platform will “Clear” the Tax Invoice by including a Cryptographic Stamp

and a QR Code to the XML. The “Cleared” XML will be sent back to the taxpayer using

APIs. Further details are provided in Section 7 of this guideline.

c. Phase 2 (Integration Phase) invoices must be shared / presentment to the buyers in

XML or PDF/A-3 (with embedded XML) format.

Tax Invoices contain fields as per VAT legislations including the seller and buyer information,

transaction and goods/services details in addition to other technical fields that are to be

generated by the electronic invoicing solution. Sample images of the human readable

format of the Tax Invoice are included in Section 4.6 of this guideline. Samples must be

different for Phase 1 and Phase 2.

16

Example:

Al Salam Supplies Co. LTD is, a registered taxpayer in Riyadh. Al Kawther Markets, a

registered taxpayer, contracts Al Salam for providing their stores with goods. Once the

items have been delivered, Al Salam issued an electronic invoice through their invoicing

solution. The technical fields of the invoice are automatically generated by the solution,

where Al Salam only inserts information about Al Kawther and their details, goods sold, and

the total value and VAT value of the transaction. Al Salam archives a copy of the Tax Invoice

in their records on a system according to the provisions in VAT Law, VAT Implementing

Regulation, E-Invoicing Regulation and resolutions and all other relevant Laws in KSA.

Example:

Capital National Bank, a registered bank in KSA provided Al Amaal Company with a

corporate loan to finance the company’s operations. The bank issued a Tax Invoice

containing two items, bank commission with an amount of SAR 6,250.00 and loan’s Profit

Element with an amount of SAR 50,000.00. The bank commission is subjected to VAT

with a rate of 15%. The loan Profit Element will be exempt from VAT, the Bank should

issue a Tax Invoice for the taxable supplies from the E-Invoice Solution used by the bank

and if the bank decided to issue one invoice for both the taxable and exempt supplies then

this invoice should meet the requirements of the Tax Invoices.

17

4.2. Simplified Tax Invoice

4.2.1. Simplified Tax Invoices for Phase 1 (Generation Phase)

a. A Simplified Tax invoice is an invoice issued mostly for B2C transactions with fields

defined in Article 53 (8), VAT Implementing Regulations and Annex 2 of E Invoicing

Resolution. The fields required for Generation Phase and Integration Phase to be

included within the Simplified Tax Invoice are included in the Annex 2 of the E-Invoicing

Resolution.

b. Also, taxpayers have an option to generate Simplified Tax Invoices for the B2B

transaction if the value of Taxable Supplies is less than 1,000 SAR. It must be noted

that for Simplified Invoices for B2C transaction can be generated for any value (even for

transactions where value of Taxable Supplies exceed 1,000 SAR). This limit of 1,000

SAR is only applicable when the supplier chooses to issue Simplified Tax Invoice for

B2B transactions.

c. For Phase 1 (Generation Phase), the taxpayer must generate a Simplified Tax Invoice

including additional data fields prescribed in the Annex 2 of E-Invoicing Resolution

electronically using a compliant E-Invoice Generation Solution (EGS). There is no

specific format prescribed for Phase 1 Simplified Tax Invoices (such as XML format or

PDF/A-3 format). Taxpayers can generate it in any electronic format, however, a paper

invoice that is converted into an electronic format through copying, scanning, or any

other method is not considered a compliant E-Invoice generated electronically.

d. Simplified Tax Invoices that has been generated electronically must be shared /

presented to the buyers in a printed copy. Alternatively, such Simplified Tax Invoice or

its associated Notes - upon the agreement between the transaction parties - may also

be shared with customers in its electronic format or any other human readable format

with customers.

18

4.2.2. Simplified Tax Invoices for Phase 2 (Integration Phase)

a. The taxpayer must generate Simplified Tax Invoice including additional data fields

prescribed in the Annex 2 of E-Invoicing Resolution in an electronic format using a

compliant E-Invoice Generation Solution (EGS) which is Onboarded. Simplified Tax

Invoices must be generated in XML format or a PDF/A-3 (with embedded XML).

Taxpayer’s EGS solution must stamp the XML using CSID issued by ZATCA and also

include a QR Code which is compliant with Phase 2 requirements (9 tags in TLV base64

format).

b. Once a compliant Simplified Tax Invoice is generated (after stamping and applying

QR code), it must be shared / presented to the buyer immediately in a printed copy.

Alternatively, such Simplified Tax Invoice or its associated Notes - upon the agreement

between the transaction parties - may also be shared with customers in its electronic

format or any other human readable format with customers.

c. Taxpayers must submit the Simplified Tax Invoices in XML format (not PDF/A-3) to

FATOORA Platform for “Reporting” within 24 hours of generation using APIs. FATOORA

Platform will validate whether the Tax Invoice is compliant with XML Implementation

Standard and run additional referential checks. Once the Simplified Tax Invoice pass

validation checks, FATOORA Platform will provide an API response.

Example:

Al Salam Supplies Co. LTDs operate 3 stores in KSA with over 12 cash registers. Each cash

register generates Simplified Tax Invoices based on each sale to a customer, with a QR Code

applied to each invoice. All Simplified Tax Invoices that are generated by the cash registers

are then sent to Al Salam company’ central repository and finance management system.

Al Salam company archives copies of the E-Invoices in their records on a system according

to the provisions in VAT Law, VAT Implementing Regulation, E-Invoicing Regulation and

resolutions and all other relevant Laws in KSA. On 1st of January 2023 (according to the

phases and targeted groups of the integration), Al Salam company must report all invoices

issued within 24 hours from the time of issuance.

19

Example:

A Saudi citizen bought three items from Alwaha Pharmacy online store. Two items are

standard rated items with a VAT rate of 15% and the third item is zero rated since it›s

classified as medical goods according to the VAT law and regulations. Once the payment

has been made, the pharmacy issues a Simplified Tax Invoice through the pharmacy

application containing details on the items that the customer purchased and sends the

invoice to the customer’s registered email address.

Example:

Al Jouf Business School, a private university in KSA, issued a Simplified Tax Invoice for

term tuition to a female Saudi citizen. Since this is a private education service subject to the

standard tax rate, an invoice should be issued to the Saudi Citizen. This service is subject to

a special treatment which is considered as a “Zero Rated›› invoice as regulated by ZATCA,

the Saudi government will cover the VAT on behalf of the citizen. Therefore, the citizen

will not be charged VAT.

4.3. Credit and Debit Notes

Electronic Credit / Debit notes are issued for a Tax Invoices / Simplified Tax Invoices (after

an e- invoice has been issued), wherein the transaction is adjusted subject to Article 40 (1)

and Article 54(3) of VAT Implementing Regulations.

Credit and Debit notes must be issued with a reference to the original invoice(s) to which

they are issued. The reference fields can be used to indicate the Invoice Reference

Number(s) of Original Invoice(s) to which Credit Note pertains. In case, a single Credit

Note relates to multiple Original Invoices, then taxpayers can provide Invoice Reference

Numbers as a range (for example IRN from 001 to IRN 100 issued during the period 1 Jan

2022 to 31 March 2022). The type of credit/debit note follows the type of invoice that they

are issued against.

20

Example:

Data Extract Consulting company purchases several office furniture items from Zamil

Furniture Group. After they have been invoiced by Zamil, Data Extract wishes to return

several items that were defective. Zamil issues a credit note in order to refund the amount

paid, and the information is the same as the information contained in the Tax Invoice that was

issued for the sale. The credit note contains the Invoice Reference Number of the original

invoice. Data Extract archives a copy of the note in their records on a system according

to the provisions in VAT Law, VAT Implementing Regulation, E-Invoicing Regulation and

resolutions and all other relevant Laws in KSA.

4.4. Sample visual examples of E- invoices

Each type of E-Invoice and associated note may be presented in human readable form.

The fields required to be visible on such a representation are indicated in the E-Invoicing

Resolution in Annex (2). This section contains examples of fully compliant visualized

E-Invoices that contain the fields required starting 1st January 2023 (in waves by targeted

taxpayer groups).

21

5. E-Invoice Generation Phase Requirements and Timelines (Tax

Invoice vs. Simplified Tax Invoice Solutions)

5.1. Solution Requirements

Requirements for generating Tax Invoice and Simplified Tax Invoice starting from 4th

December 2021:

Requirements Tax Invoices Simplified Tax Invoices

Invoice

Generation

Invoice

generation

means

Electronic Invoices must be generated through electronic

means

Invoice fields

Generate electronic invoice with non-integration related

fields

Invoice format No format mandated

Invoice storage

Invoices must be archived as per VAT regulations and

accessible at any “ point in time to the Authority”

22

Security &

Integrity

QR code

QR code not mandated in the

Generation Phase

QR code included with

basic invoice and taxpayer

information

Crypto- graphic

stamp

No Cryptographic stamp mandated

Device

Registration

No device registration mandated

UUID Not mandated

Hash Not mandated

Integration

Connectivity Solution must be able to connect to the internet

Invoice

clearance

No invoice sharing / clearance

mandated

_

Invoice Upload _ No invoice upload mandated

23

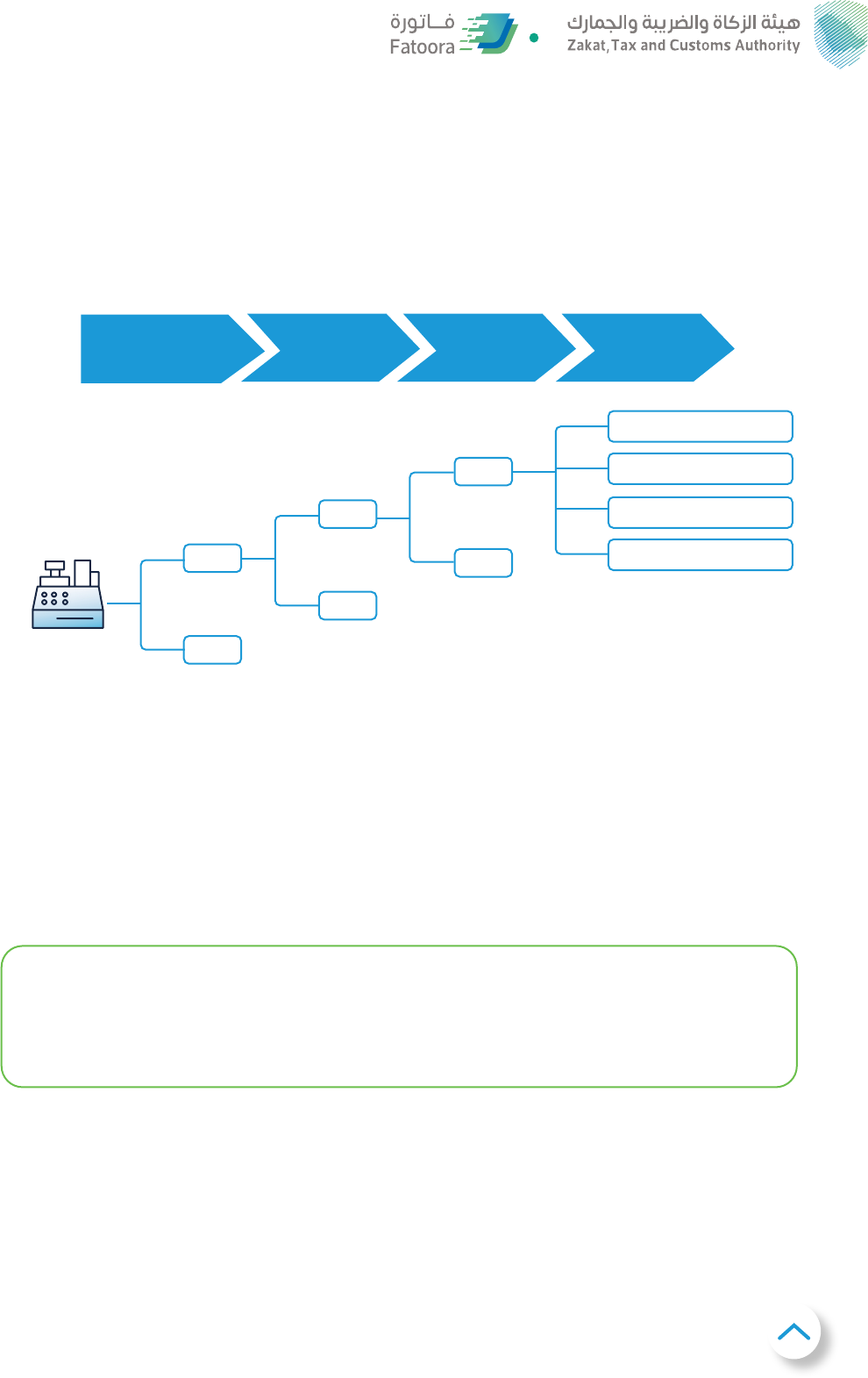

Illustrative: Tax Invoice Generation for B2B/G transactions

Illustrative: Simplified Tax Invoice Generation for B2C transactions

Supplier Buyer

2

1

Supplier shares invoice with the buyer

Supplier system generates invoice file

in an electronic format

Supplier system generates invoice with

QR code in an electronic format

Invoice data is stored by the supplier system

under required structure

Customer can scan QR code

through the ZATCA mobile app to

view basic invoice information

Supplier Customer

1

3

2

24

5.2. Timelines

Taxable persons subject to E-Invoice Regulation are obliged to generate Electronic Invoices

and Electronic Notes starting from 4th of December 2021.

The second set of requirements for E-Invoice generation are required starting from 1st

January 2023 (in waves by targeted taxpayer groups) as part of the Integration Phase.

5.3. Technical Requirements

● All E-Invoice Solutions must be able to connect to the internet in order to share invoices

with the Authority.

● The E-Invoice Solutions must be able to connect with an API published by the Authority

in order to share invoices. Specific integration requirements are published on the

Authority’s website, and E-Invoice Solution vendors will have enough time to update

their products and services.

● The E-Invoice Solutions must have tamper-proofing mechanisms that prevent any

modification or tampering with invoices or the solution itself, and must be able to record

and detect any tampering attempts.

25

5.4. Information Security

● Persons subject to the E-Invoicing Regulation must ensure that their Compliant

E-Invoice Solutions must be tamper-resistant and include a mechanism which prevents

tampering and reveals tampering attempts that might occur.

1. These solutions contain functionalities that prohibit users from directly changing

the solution and invoice generation.

2. The anti-tampering mechanisms include:

Prevention of invoice counter reset:

Resetting the invoice counter should not be a function available in an E-Invoice

Solution and access to the counter value should be protected from system users.

Prevention of date changes:

Resetting the system date should be inaccessible to system users.

Prevention of deletion or modification of invoices:

Users of the E-Invoice Solution should not have the ability to delete or change

E-Invoice and associated Note XML documents stored on by the solution. The

solution should be equipped with sufficient memory to store the E-Invoice and

associated Note XML documents generated by it.

Prevention of uncontrolled access:

Access to E-Invoice Solution functions must always be via a logged in user who is

granted access only to functions that are necessary to perform their role.

26

● As per VAT Implementing Regulations, if the data is hosted on the cloud, it must be

accessible through a direct link that can be made available to the Authority. This

requirement is mandatory for audit purposes as per VAT Implementing Regulations

● The system must allow Persons subject to the E-Invoicing Regulation to export and

save their invoices onto an external archival system

● Each stored invoice must follow a naming convention for naming of the file: VAT

Registration (tax registration number) + Timestamp (date and time at the point of

invoice generation) + Invoice Reference Number

● Taxpayer’s E-Invoice Solutions may reside on the cloud in accordance with VAT

Implementing Regulation, however additional non-tax-related regulations may apply

to the taxpayer entity, such as National Cybersecurity Authority published laws and

any other applicable regulations or controls

Prevention of export of stamping keys:

The cryptographic stamp identifier is associated with a unique private key that

should be generated by the solution, so that it may not be viewed or copied during

system initialization. Export of the key would enable theft of the E-Invoice Solution’s

identity, and so should be blocked by the solution vendor using a software or

hardware key vault.

● The Compliant Solution must be able to protect the generated Electronic Invoices

and Electronic Notes from any alteration or undetected deletion and contain some

functionalities which enable the taxable person to save Electronic Invoices and

Electronic Notes and archive them in XML format without Internet connection.

1. Once invoices are generated, they should not be deleted or altered by any user

2. The solution will also allow Persons subject to the E-Invoicing Regulation to store

the invoices once they are generated in a safe and secure manner to avoid leakage

or loss of information

27

5.5. Data Storage and Archival

Persons subject to the E-Invoicing Regulation may store their electronic invoices in a server

on-premises in the KSA or in the cloud as per their solution requirements and storage

requirements and according to the provisions in VAT Law, VAT Implementing Regulation,

E-Invoicing Regulation and Resolutions and all other relevant Laws in KSA.

5.6. Prohibited Functions

Starting the Generation Phase, an E-Invoice Solution must not have the following functions:

Function Definition

Anonymous access

Persons subject to the E-Invoicing Regulation cannot access the

system without logging into the system using unique login and

password or biometrics.

Ability to operate with

default password

Having a default password or factory password is not allowed.

Each system must require the user to reset the password on

first use.

Absence of user session

management

The system must log all user activities associated with the

invoice generating process, starting with login authentication and

continuing to all system functions.

Allow alteration or

deletion of generated

E-Invoices or their

associated notes

Persons subject to the E-Invoicing Regulation are not allowed to

modify or delete invoices once they are issued whether these are

generated by the system or outside it. If a user wishes to “cancel”

an invoice, this may only be done through issuing an associated

credit note and reissuance of a new invoice.

Allow for log

modification/deletion

The system must not allow any modification on system logs that

store the system’s activities.

All user activities can be logged and stored without any changes to

the system generated logs.

Generated with

inaccurate timestamps

Persons subject to the E-Invoicing Regulation are not allowed to

change time or date on the E-Invoice Solution in a way that would

result in the generated documents to contain false information.

28

Non-sequential log

generation

All log entries of the E-Invoice Solution must be time stamped and

linked by placing the hash of the previous invoice in the associated

field of the next invoice in a sequence, so that their order cannot be

changed.

Invoice counter reset

The E-Invoice Solution must not provide a feature where the invoice

counting can be reset.

Allow ability to

generate more than

one invoice sequence

at any given time

The E-Invoice Solution unit must not generate more than one

sequence so that all invoices generated by an E-Invoice Solution

Unit are linked using “Previous Invoice Hash” value

into a single chain.

5.7. E-invoice Format

● Starting on 4th December 2021, persons subject to the E-Invoicing Regulation may

utilize any format as a human readable format to share their electronic invoices up until

the Integration Phase.

● The human readable format can be presented provided that it is in Arabic (in addition to

any other language) and Arabic or Hindi numerals can be used (either of which will be

considered as Arabic in the invoices).

29

6. E-Invoice Integration Phase Requirements and Timelines (Tax

Invoice vs. Simplified Tax Invoice Solutions)

6.1. E-Invoice Integration Phase Requirements and Timelines (Tax Invoices.

Simplified Tax Invoice Solutions)

Requirements for generating Tax Invoice and Simplified Tax Invoice starting from 1st

January 2023 (in waves by targeted taxpayer groups):

Requirements Tax Invoices Simplified Tax Invoices

Invoice

Generation

Invoice

generation

means

Invoices must be generated through electronic means

Invoice fields

Generate additional fields required for integration and

compliance features

Invoice format Invoices must be generated in XML format

Invoice

storage

Invoices must be archived as per VAT regulations and

accessible at any point in time by the Authority

30

Security &

Integrity

QR code

No requirement from the

taxpayer. The QR code value

will be generated by

the taxpayer’s solutions and

the FATOORA Portal will

update the code during the

Clearance process. The QR

code will then be printed to

be visualized on the human

readable invoice by the

taxpayer.

QR code mandated with

additional information

Cryptographic

stamp

No requirement from the

taxpayer. Cryptographic

stamps are applied by the

FATOORA Portal.

Cryptographic stamp

mandated

Device

Registration

Compliant solutions must

be registered on the

FATOORA Portal following

the on boarding process

Compliant solutions must be

registered on the FATOORA

Portal following the on

boarding process

UUID To be included as part of the E-Invoice

Hash To be included as part of the E-Invoice

Connectivity

Solution must have ability

to connect to the internet for

invoice upload and clearance

Solution must have ability

to connect to the internet for

invoice reporting

Integration

Invoice

clearance

Sharing of invoices with the

FATOORA Portal in real- time

via API (for clearance)

_

Invoice

Reporting

_

Upload of invoices to the

FATOORA Portal via API

whenever connected

31

6.2. Timelines

Integration is the second phase of electronic invoicing where the Persons subject to the

E-Invoicing Regulation will be integrated with the FATOORA Portal through an Application

Programmable Interface (API) and will share invoices to the Authority.

Integration of the Persons with the Authority’s system (FATOORA) shall happen starting

from 1st January 2023 (in waves by targeted taxpayer groups).

6.3. Technical Requirements

Phase 2, which will be implemented in waves by target taxpayer groups starting from

January 1, 2023, entails additional technical requirements that e-invoicing solutions must

comply with, the integration of taxpayer e-invoicing solutions with ZATCA’s systems,

and the generation and storage of e-invoices in the required format (XML or PDF/A3 with

embedded XML).

6.4. Clearance and Reporting

Clearance: Each Tax Invoice generated electronically must be cleared by the Authority

as a prerequisite for sharing them with the buyers and for such Electronic Invoice to be

regarded as legal and valid.

Clearance is a real-time transaction integration model of Tax Invoices, where after

integration, the taxpayer directly sends the electronic invoice prior to sharing with the

buyer. Tax Invoices are then validated across several categories of varying level, and if

approved, are stamped by the Authority and returned to the taxpayer to be shared with the

buyer. Clearance applies to all Tax Invoices and their associated credit/debit notes.

32

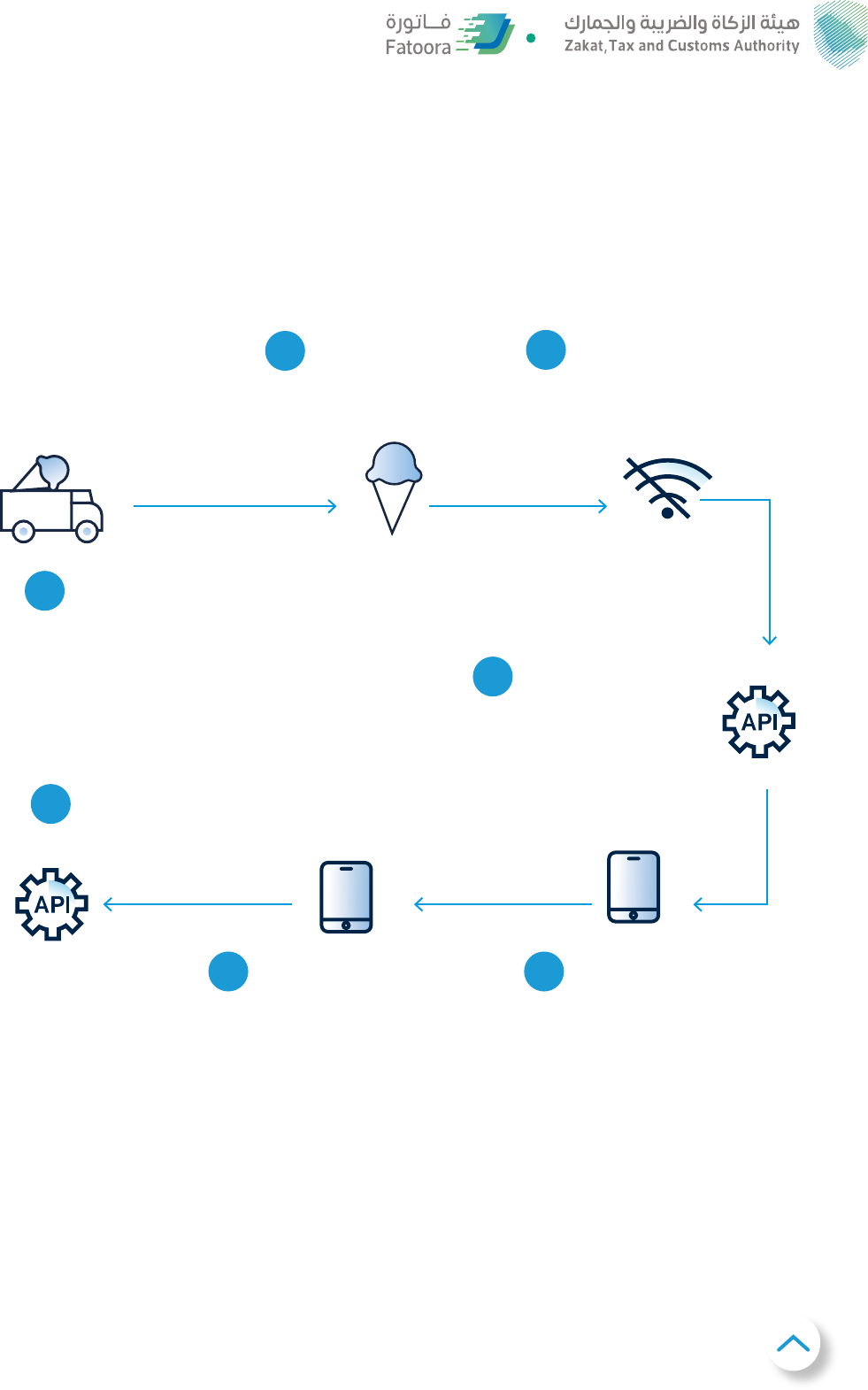

Invoicing model for Tax Invoices (usually issued by a business to another business)

E-invoice information shared by

seller’s solution

ZATCA shares back “cleared” e-invoice

with QR code and ZATCA’s stamp

Ability to scan the QR code

using ZATCA App

Store the “cleared” e-invoice in XML or

PDF/A-3 (with embedded XML) format

Share “cleared” e-invoice in XML or

PDF/A-3 (with embedded XML) format

Supplier

Platform

Buyer

1

2

5

3

4

Reporting: Taxable persons must report the Simplified Tax Invoices to the Authority.

Reporting is a near-real time transaction model, where Simplified Tax Invoices and

their associated Credit/Debit notes are uploaded to the FATOORA Portal within 24

hours from issuance. Once uploaded, Simplified Tax Invoices are then validated, and an

acknowledgement through the API is reported back to the taxpayer. Simplified Tax Invoices

must be generated using compliant E-Invoice Solutions and stamped by such solutions

as set out by the Authority requirements under the Controls, Requirements, Technical

Specifications and Procedural Rules for Implementing the Provisions of the E-Invoicing

Regulation and further subsequent resolutions.

33

Invoicing model for Simplified Tax Invoices (usually issued by a business to customer)

Share e-invoice in human-readable format whether printed or electronic

Ability to scan the QR

code using ZATCA App

E-invoice information shared

by seller’s solution in XML

format within 24 hours

Store the e-invoice electronically in XML

or PDF/A-3 (with embedded XML) format

Supplier

Platform

Customer

1

3

2

4

34

6.5. Prohibited Functions

Starting the Integration Phase, an E-Invoice Solution must not have the following functions:

Function Definition

Anonymous access

Persons subject to the E-Invoicing Regulation cannot access the

system without logging into the system using unique login and

password or biometrics.

Ability to operate with

default password

Having a default password or factory password is not allowed. Each

system must require the user to reset the password on first use.

Absence of user session

management

The system must log all user activities associated with the

invoice generating process, starting with login authentication and

continuing to all system functions.

Allow alteration or

deletion of generated

E-Invoices or their

associated notes

Persons subject to the E-Invoicing Regulation are not allowed to

modify or delete invoices once they are issued whether these are

generated by the system or outside it.

If a user wishes to “cancel” an invoice, this may only be done

through issuing an associated credit note and reissuance of a new

invoice.

Allow for log

modification/deletion

The system must not allow any modification on system logs that

store the system’s activities.

All user activities can be logged and stored without any changes to

the system generated logs.

Generated with

inaccurate timestamps

Persons subject to the E-Invoicing Regulation are not allowed to

change time or date on the E-Invoice Solution in a way that would

result in the generated documents to contain false information.

Non-sequential log

generation

All log entries of the E-Invoice Solution must be time stamped and

linked by placing the hash of the previous invoice in the associated

field of the next invoice in a sequence, so that their order cannot be

changed.

35

Invoice counter reset

The E-Invoice Solution must not provide a feature where the invoice

counting can be reset.

Allow ability to generate

more than one invoice

sequence at any given

time

The E-Invoice Solution unit must not generate more than one

sequence so that all invoices generated by an E-Invoice Solution

Unit are linked using “Previous Invoice Hash” value into a single

chain.

Time changes

The solution must not allow software time changes that will change

or modify the timestamp value during E-Invoice or Credit/Debit

Note issuing.

Export of stamping keys

The solution must not provide an option to export the cryptographic

stamp private stamping key of the solution.

36

6.6. E-Invoice Format

● After go-live of the Integration phase, electronic invoices must be produced in a specific

format with specific fields as per the Appendix (2) of the Electronic Invoicing Resolution.

E-Invoice Solution vendors are required to follow the specification as well as to certify

their product according to the process published by ZATCA.

● Once the integration resolution comes into full force starting from 1st January 2023 (in

waves by targeted taxpayer groups), E-Invoice Solutions must be able to generate

invoices and their associated notes in the XML format or PDF/A-3 format (with

embedded XML).

● For the Integration phase, persons subject to E-Invoicing Regulation must share the Tax

Invoice, or its associated Notes that has been electronically generated with customers

in the XML format or PDF/A-3 format (with embedded XML).

● For the Integration phase, persons subject to E-Invoicing Regulation must present to

their customers a printed copy of the Simplified Tax Invoice or its associated Notes

that has been generated electronically in the XML format or PDF/A-3 format (with

embedded XML) or, upon the agreement between the transaction parties, may also

share with customers in electronic format or any other human readable format. For

the Integration phase, human readable form includes the PDF or the printed Electronic

Invoice or Credit/Debit Note, with all required visible fields present.

● The human readable format can be presented provided that it is in Arabic (in addition to

any other language) and Arabic or Hindi numerals can be used (either of which will be

considered as Arabic in the invoices).

37

7. Rights and Obligations of Taxable Persons

7.1 Right to deduct / refund VAT

Starting from 4th December 2021, the taxable persons (Buyers) will have the right to deduct

VAT charged by the taxable suppliers’ subject to electronic invoicing regulation, provided

that the invoices used are electronically generated and fulfil the Generation requirements.

7.2 Obligations of taxable persons subject to E-Invoice regulation

In addition to the general obligations prescribed in the VAT legislations, taxable persons

subject to E-Invoice regulation are obliged to:

● Generate all E-Invoices (Tax Invoices and Simplified Tax Invoices) and its associated

notes that must be issued within the timelines specified in the VAT legislations, in an

electronic form starting from 4th December 2021 (the day following the expiration date

of the grace period specified in Article (7), paragraph (B) of the E-Invoicing Regulation

for E-Invoices).

● Starting from the Integration phase, Tax E- invoices must be cleared before being

shared with the clients and Simplified Tax Invoices must be reported to the FATOORA

Portal within 24 hours.

● Comply with all the provisions set forth under the E-Invoicing Regulation in addition

to the controls, requirements, technical specification and procedural rules specified in

the resolution on the Controls, Requirements, Technical Specifications and Procedural

Rules for Implementing the Provisions of the E-Invoicing Regulation. Fulfilment of

this requirement may be met by the taxpayer through obtaining a compliant E-Invoice

Solution that produces the types of Tax Invoice and/or Simplified Tax Invoice documents

and associated Notes that the taxpayer required to conduct their business.

38

● Adhere to the specified timelines for compliance with the specifications and

requirements of Electronic Invoices specified in the resolution on the Controls,

Requirements, Technical Specifications and Procedural Rules for Implementing the

Provisions of the E-Invoicing Regulation and mentioned in Section 1.3 of this Guideline.

7.3. E-Invoicing Record Keeping

Taxable persons must adhere to the record keeping requirements of Electronic Invoices,

Electronic Notes and its associated data, and any other requirements as per the applicable

laws and regulations and as described in Section 5.5 of this Guideline under the subheading

Data Storage and Archival.

7.4. Additional E-Invoicing Obligations (e.g. using compliant solutions,

maintaining the cryptographic stamp, etc.)

The taxable persons subject to the E-Invoicing Regulations must adhere to the following

obligations:

● Notify the Authority through the means specified by the Authority of any incidents,

technical error or emergency matters which hinder the generation of Electronic Invoices

or Electronic Notes and notify the Authority of recovery. Furthermore, to resume

generation and Clearance or Reporting of all E-Invoices and associated Notes as soon

as the Solution becomes operable.

● Not to use any E-Invoice Solution which is not compliant with the specifications and

requirements specified in the resolution on the Controls, Requirements, Technical

Specifications and Procedural Rules for Implementing the Provisions of the E-Invoicing

Regulation. Means of finding vendors, who have declared compliance or who have

been verified as compliant will be provided on ZATCA’s website with sufficient notice

to allow for necessary system purchase and/or upgrade.

39

● Register the E-Invoice Solution Units used for generating E-Invoices and their

associated Electronic Notes in accordance with the specified mechanisms and controls

specified in the resolution on the Controls, Requirements, Technical Specifications and

Procedural Rules for Implementing the Provisions of the E-Invoicing Regulation.

● Preserve the Cryptographic Stamp Identifiers and its associated components in a safe

way, and protect them from copying or illegal use, and not use them for purposes other

than those which they are intended for.

● Integrate with the Authority’s system (FATOORA) starting from the date specified in

the resolution on the Controls, Requirements, Technical Specifications and Procedural

Rules for Implementing the Provisions of the E-Invoicing Regulation and any subsequent

resolution in this regard.

7.5. E-Invoicing Compliance Audit

From time to time, Persons subject to the E-Invoicing Regulation may be subject to ZATCA

tax audit. In such situations, the taxpayer should cooperate with ZATCA auditors and provide

them with all the data required to enable them to check the taxpayer compliance with the

requirements mentioned in VAT legislations, and E-Invoice regulations and associated

resolutions. Taxpayers should also provide ZATCA auditors with the archived E-Invoice

and associated note files. See Section 5.5 for Data Storage and Archival requirements.

40

8. Advance Payments

1. Invoice towards Advance Payments and adjustment thereof from subsequent invoices:

As per VAT Regulations, receipt of payment in advance towards taxable supplies

necessitates issuance of a tax Invoice. Currently, from the XML perspective the value

on which VAT was paid via advance payment invoice can be adjusted from subsequent

invoices using the tag <cbc:PrepaidAmount>. However, based on requests from taxpayers

and to cater to different scenarios involving advance payment adjustments, ZATCA has

introduced additional data fields in the Data Dictionary and XML Implementation Standard

as explained below:

a. Invoice Type Code (BT-3): An invoice that is issued at the time of receiving payment in

advance must have Invoice Type Code (BT-3) as a fixed value “386”. The subsequent

invoice(s) where the advance is adjusted should have Invoice Type Code “388”.

b. Reference to Advance Payment Invoice in the subsequent invoice(s) where it is

adjusted: When an adjustment is required to be made on an invoice towards the VAT

paid earlier via Advance Payment Invoice, such adjustment can be made by providing

the following additional reference data:

● Invoice Reference Number – IRN (BT-1) of the Prepayment invoice(s). Additionally,

the UUID (KSA-1) of Advance Payment Invoice can also be provided (currently

optional but it shall be mandated in future)

● Issue date (BT-2) of the prepayment invoice(s)

● Issue time (KSA-25) of the prepayment invoice(s)

● The Invoice line document reference “Prepayment Document Type Code (KSA-

30)” must be provided as a fixed value “386”.

41

c. How to adjust the values on which VAT was paid upon issuance of Advance Payment

invoice from the subsequent invoice(s):

For adjusting the value, the taxpayer must provide the amount under the tag

<cbc:PrepaidAmount> (BT-113) as the Amount inclusive of VAT. Please note that this

field should be populated only if the taxpayer has issued a separate invoice at the time

of receiving payment in advance and not otherwise.

Once the field <cbc:PrepaidAmount> (BT-113) is populated, then corresponding rules

get triggered requiring the taxpayer to provide reference information (as explained

above) and quantitative information as described below:

● The adjustment has to be made by providing one consolidated sum per VAT

Category and per rate. For example, if Advance Payment was made with 10 line

items having VAT Category Code “S” and “Z” then only 2 consolidated lines must

be provided in subsequent invoice(s) while adjusting the advance as one line for

VAT Category Code “S” and another line for “Z”. This value has to be provided in

Prepayment VAT category Taxable Amount (KSA-31).

● Similarly, the VAT amount shall be provided for specific VAT Category Code under

Prepayment VAT Category Tax Amount (KSA-32) as sum total of tax amounts

subject to specific VAT Category code of the prepayment invoice(s).

● Each line should mandatorily contain the VAT Category Code of the associated

Prepayment invoice(s) under the prepayment VAT category code (KSA-33)

● Each line should also contain the VAT rate of the specific VAT Category code of the

prepayment invoice(s) as the prepayment VAT rate (KSA-34). Please note that

this rate may also be 5% in case advance payment was received when the VAT

Rate was 5%. This field addresses the concerns about VAT Rate change in handling

advance payment adjustments.

42

d. Validation of calculations related to adjustment of advance payment:

Please note that there is no real-time cross-check between data of Advance Payment

Invoice that is adjusted from subsequent invoices. However, such checks will be made

on the backend as part of analytics and discrepancies may be further investigated

resulting in initiation of audits.

There will be bare minimum arithmetic checks on a real-time basis as below:

● The Prepayment VAT Category Tax Amount (KSA-32) must be = Prepayment VAT

category Taxable Amount (KSA-31) x Prepayment VAT rate (KSA-34) /100) and

● If Pre-Paid amount (BT-113) is provided then the Pre-Paid amount (BT-113) must

equal the sum total of the Prepayment VAT category Taxable Amount (KSA-31)

and Prepayment VAT Category Tax Amount (KSA-32)

e. Rounding rules related to advance payment adjustments:

The following amounts related to adjustment of advance payment must be rounded to

two decimals:

● Pre-Paid amount (BT-113).

● Prepayment VAT Category Taxable Amount (KSA-31)

● Prepayment VAT Category Tax Amount (KSA-32).

f. Currency of the advance payment adjustments:

The currency of advance payment adjustments should be same as the currency used in

the invoice. In other words, all currencyID attributes (BT-5) must have the same value

as the invoice currency code (BT-5).

43

g. What if the amount paid in advance is more than that is being adjusted?

In case the amount paid in advance is more than the amount of the subsequent invoice

that is being adjusted, the taxpayer has the option either to provide the full value on

which VAT was paid in advance (though being higher than the subsequent invoice) or to

limit the adjustment to the value of the current invoice. Both options are valid and XML

will not be rejected just because the advance payment value is higher than the current

invoice value.

For example, if the advance was received on 1 Jan 2023 for SAR 115,000 (100,000

+ 15,000 VAT) and this is being adjusted from a subsequent invoice of SAR 92,000

(80,000 + 12000 VAT) on 1 July 2023, then <cbc:PrepaidAmount> (BT-113) can either

be provided with the full value of advance payment as 115,000 which will result in

Amount Due for Payment as -23,000 or it can be limited to 92,000 resulting in Amount

Due for Payment as 0. Both options are valid, and decision may be taken based on

reconciliation process followed by the taxpayer.

Please note that, in the above scenario, if the full value of advance payment is adjusted

resulting in negative amount under the Amount Due for Payment and this amount has

to be refunded back to the customer, then a Credit Note for 23,000 has to be issued.

Such Credit Note should also be sent for Clearance / Reporting.

h. Technical details:

Developers may kindly refer to paragraph 9.5 of the XML Implementation Standard

to see the usage of UBL tags for advance payment adjustment. The examples cover

scenarios of one-to-one adjustment and many-to-one adjustments (where advances

received under multiple invoices can be adjusted against one final invoice).

It is important to note that some mandatory UBL tags which must be present in advance

payment adjustment lines with fixed value as “zero” (0) to avoid schema validation

errors or XSD errors. Therefore, it is important for developers to make use of all UBL

tags provided in paragraph 9.5 of the XML Implementation Standard to avoid errors/

warnings related to advance payment adjustments.

44

9. Integration with ZATCA

[for more details, please refer to detailed technical guideline]

Persons subject to the E-Invoicing Regulation will be integrated with the FATOORA Portal

starting from 1st January 2023 (in waves by targeted taxpayer groups), where compliant

E-Invoice Solutions will be able to connect to the API of the FATOORA Portal by following

the below steps:

● Taxpayer accesses FATOORA portal website (FATOORA.zatca.gov.sa) and logs in

using ERAD credentials

● Taxpayer requests OTP code(s) for solution(s) to integrate

● Taxpayer populates OTP code(s) in E-Invoice Solution(s)

● Taxpayer reviews if solution was successfully on-boarded

45

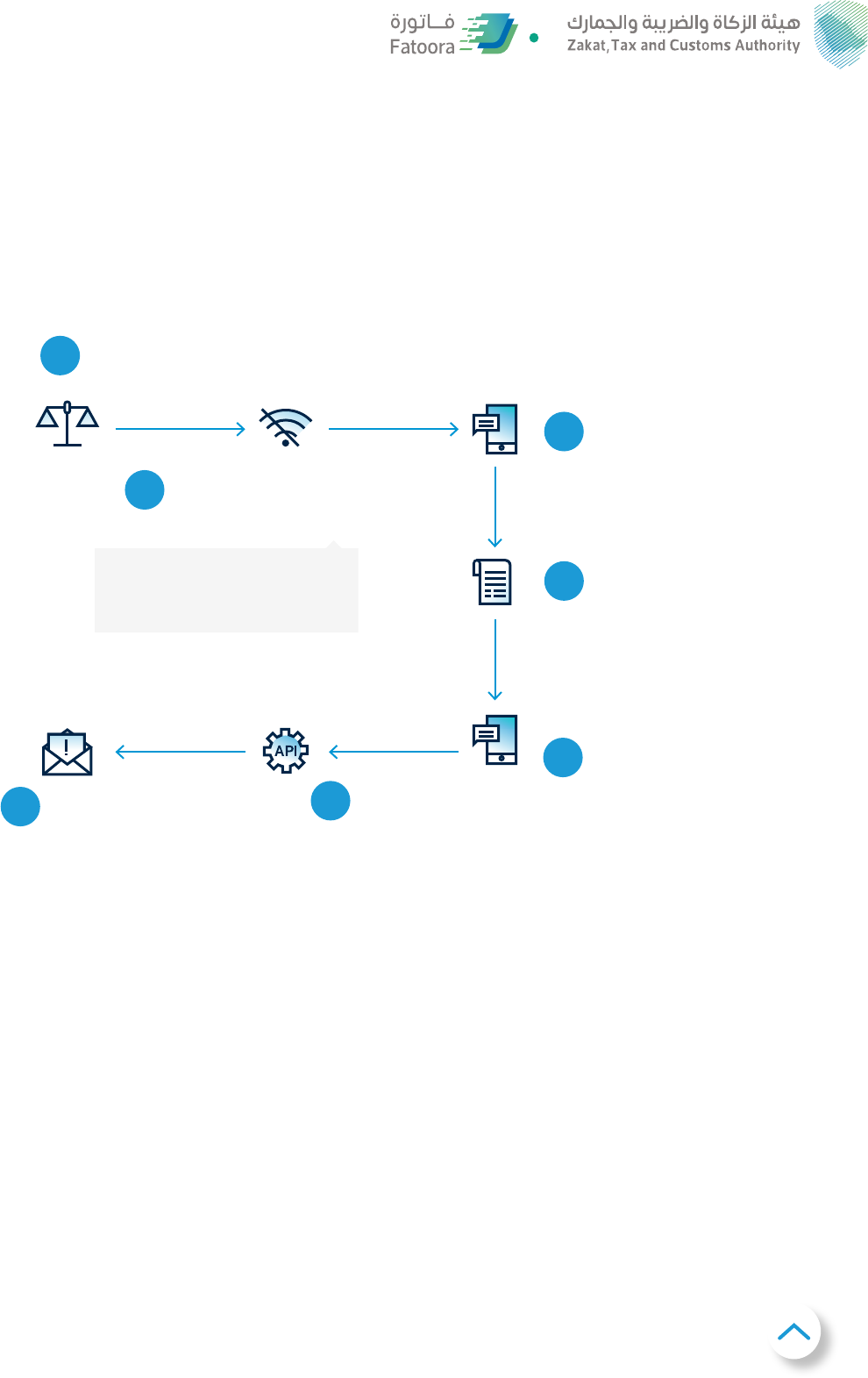

10. Failure Scenarios

Generated

e-invoices?

Supplier

YES

7. NO

6. NO

5. NO

1. Accepted

3. Rejected

4. Failed to connect

2. Accepted with warnings

YES

YES

Able to submit

e-invoice to

ZATCA?

Received

response from

ZATCA?

What is the

response?

Example reason

1. Fully compliant invoice

2. Minor mistake -e.g. missing building number

in address

3. Significant mistake -missing mandatory

fields, wrongly populated VAT values

4. Server overloaded by too many requests

5. ZATCA servers are down

6. No internet connectivity at the supplier

7. No electricity or broken device

Required action

No action required

No immediate action required-warnings should be investigated and

amended for next invoice

Invoice should be corrected based on the response and re-submitted

System should continue re-submitting same invoice until ZATCA servers

are responding

Share generated e-invoice and re-submit once issue fixed

Report failure to ZATCA, share e-invoice and re-submit once issue fixed

Report failure to ZATCA, continue business and re-generate once fixed

Deep-dive on the next pages

46

Failure to receive response from ZATCA - B2C scenario

Example scenario during temporary ZATCA issues

Supermarket is selling groceries to

walk-in clients

Supermarket issues

simplified tax invoice

to walk-in clients and

completes the transaction

1. TP should keep evidence of trying to clear the invoice to ZATCA.

Within 24 hours of the transaction,

supermarket needs to report the

simplified tax invoice to ZATCA

1

In case ZATCA's servers

are non-responsive, the

supermarket's server

should continue attempting

to report the simplified tax

invoice in regular intervals

until successful

1

2

3

4

47

Failure to receive response from ZATCA - B2B scenario

Example scenario during temporary ZATCA issues

Bank wants to issue standard tax invoices

to its business clients

ZATCA's servers are down and

bank cannot clear their invoices

Bank would re-try clearance for ~5

minutes (timing TBC)

If ZATCA servers remain non-

responsive, bank shares uncleared

invoice

1

, keeps records of the

transaction (Art. 7.5) and confirms the

existing contact details of buyer

Bank would continue attempting reaching

to ZATCA in regular intervals (~every 15

minutes - timing TBC with Technology)

Once clearance is successful,

bank shares the cleared

e-invoices with the buyers

by any preferred means

electronically

1

2

3

4

5

6

Since ZATCA is aware when the servers are

down, notifying ZATCA is not required. If

TP is unsure, they can always fill the failure

notifications as in other scenarios.

In case of extended outage, ZATCA might

notify taxpayers on its website.

1. Invoice will not be fully compliant but will be considered as VAT invoice until fully compliant invoices is issued immediately once the connection is back.

48

Failure to submit e-invoice to ZATCA- B2C scenario

Ice-cream truck is

selling ice-cream to

kids in schools in

remote areas

Merchants sells the

ice-cream and gives

simplified tax invoice

to the kids

As the school is in the remote

area, there is no internet

connection to report the

invoice immediately

The seller has officially

24 hours to report the

invoice to ZATCA - device

can automatically share

the invoice anytime the

connection is restored

In case the seller does

not manage to share the

invoice within 24 hours,

he should notify ZATCA

via a dedicated form on

ZATCA's website

Once the connection is

restored, merchant should

notify ZATCA again

Seller should immediately

report the transaction to

ZATCA

1

2

3

4

56

7

49

Failure to submite-invoice to ZATCA -B2B scenario

Lawyer wants to clear

and issue an invoice to

their business client

Due to extended internet

connectivity outage, lawyer cannot

submit invoice for clearance within

the 15 days of the following month

Merchant processes transactions,

shares uncleared invoice

1

, keeps

records of the transaction (Art.

7.5) and confirms the existing

contact details of buyer

Once internet connectivity is

restored, lawyer notifies ZATCA

that issue has been resolved

Lawyer submits

e-invoice for

clearance and issues

the invoice to the

customer

Lawyer shares the cleared

e-invoice with the buyer by any

preferred means electronically

Lawyer notifies ZATCA via a

dedicated form on ZATCA's

website on their mobile

1

2

4

5

6

7

3

As per Article (1)53 of KSA VAT

Regulations, Standard Tax Invoices

(B2B) can be issued within 15 days from the end

of the month in which supply takes place

1. Invoice will not be fully compliant but will be considered as VAT invoice until fully compliant invoice is issued immediately once the connection is

restored. Uncleared invoices will not be eligible for VAT deduction. TP should keep evidence of trying to clear the invoice to ZATCA (e.g. API log).

50

Failure to generate e-invoice - B2C scenario

The store’s device

broke down

Merchant notifies ZATCA via

a dedicated form on ZATCA’s

website immediately

Merchant reaches out to

their solution provider

regarding the issue

Merchant processes

transactions, issues invoice

manually

1

and keeps records

of the transaction (Art. 7.5)

Once device is fixed, merchant

notifies ZATCA that issue has

been resolved immediately

Merchant generates e-invoice

and reports it to ZATCA with

transaction date immediately

[OPTIONAL]

If customer requests it, merchant

has to share the generated

invoice with buyer electronically

or informs that invoice can be

collected in the store (Art. 7.5)

1 2 3

4

56

7

If TP reports fixes frequently or for extended

period of time, TP will be investigated further

by ZATCA on individual basis

1. Invoice will not be fully compliant, but will be considered as VAT invoice until fully compliant invoice is issued immediately once the device is fixed.

Manual invoice will not be eligible for VAT deduction.

51

Failure to generate e-invoice - B2B scenario

Manufacture is selling

equipment to an oil refinery

Due to cyber attack, the

manufacture is not able to

generate standard tax invoice as

their systems are blocked

Transaction can be processed as seller

can issue standard tax invoice within

15 days from the following month in

which the supply takes place

1

In case the systems are not restored

within these timelines, seller notifies

ZATCA via a dedicated form on

ZATCA’s website

Merchant processes transactions,

issues invoice manually

2

and keeps

records of the transaction (Art. 7.5)

Once system is restored, merchant

notifies ZATCA that issue has been

resolved immediately

Merchant generates standard

tax invoice and submits it for

clearance with transaction

date immediately

Merchant shares the e-invoice

with the buyer by any preferred

means electronically

1 2 3

4

5

67

8

1. Unless continuous supply, where seller should notify ZATCA immediately at the end of the supply month.

2. Invoice will not be fully compliant, but will be considered as VAT invoice until fully compliant invoice is issued immediately once the device is fixed.

Manual invoice will not be eligible for VAT deduction.

52

Failure to generate e-invoice - B2B Scenario - Walk-in B2B

Customer & Continuous Supplies

The store's device

broke down

Merchant notifies ZATCA via a

dedicated form on ZATCA's website

immediately

Merchant reaches out to their

solution provider regarding the issue

Merchant processes transactions,

issues invoice manually

1

and keeps

records of the transaction (Art. 7.5)

Merchant shares the e-invoice with

the buyer by any preferred means

electronically

Merchant clears invoice with ZATCA

with transaction date immediately

Once device is fixed,

merchant notifies

ZATCA that issue has

been resolved

immediately

If TP reports fixes frequently or for extended

period of time, TP will be investigated further by

ZATCA on individual basis

1

2

3

4

5

6

7

1. Invoice will not be fully compliant, but will be considered as VAT invoice until fully compliant invoice is issued immediately once the device is fixed.

Manual invoice will not be eligible for VAT deduction.

53

Overview of responses and required actions

Response Definition Required action

200

Action Successful N/A

202

Action Successful, but with

warnings

● Share warnings with solution provider

to correct at the earliest.

● Warnings are temporarily accepted and

might become rejections in the future.

● Continuous warnings by taxpayers

will be investigated by ZATCA and

taxpayers might be educated / audited

accordingly

303 Clearance switched off

Please submit via reporting

400 Action failed (rejected)

Review detailed message,

correct and resubmit

401 Unauthorized

Check authentication certificate and secret

and resubmit

413

Payload Too Large, invoice

not received

Please resend with smaller payload (invoice)

429

Too Many Requests, invoice

not received

Please resend

500

Internal Server Error, invoice

not received

Please resend

503

Service Unavailable, invoice

not received

Please resend

504

Request Timed Out, invoice

not received

Please resend

54

Overview of differences between responses to submitted documents

Response Definition Required action

Accepted

The document has

no fatal errors and no

warnings that results in

it being considered as a

valid document.

All information is fully in line with the XML

Implementation Standards, Data Dictionary and

E-invoicing Resolution

Accepted

with

warnings

The document has no

fatal errors but has

at least one warning

that results in it not

being considered as a

compliant document

however one that can

still be considered as an

accepted document

100+ possible combinations of warning messages,

e.g.:

● An Invoice shall have an Invoice number (BT-1).

● An Invoice shall contain the Seller name (BT-27).

● An Invoice shall contain the Seller postal address

(BG-5).

● The Seller postal address (BG-5) shall contain a

Seller country code (BT-40).

● Each Invoice line (BG-25) shall contain the Item

name (BT-153).

● The allowed maximum number of decimals for

the Paid amount (BT-113) is 2.

● Allowance amount (BT-92, BT-136) must equal

base amount (BT-93, BT-137) * percentage

(BT-94, BT-138) / 100 if base amount and

percentage exists.

● Previous invoice hash (KSA-13) must exist in an

invoice.

55

Response Definition Required action

Rejected

The document has at

least one fatal error

that results in it not

being considered as a

valid document

100+ possible combinations of error messages, e.g.:

● The VAT rates (BT-96119, BT-152)

● must be from 0.00 to 100.00, with maximum

two decimals. Only numerals are accepted, the

percentage symbol (%) is not allowed.

● An Invoice shall have an Invoice issue date (BT-2).

● An Invoice shall have an Invoice type code (BT-3).

● Base quantity (BT-149) must be a positive number

above zero.

● The document issue date (BT-2) must be less or

equal to the current date.

56

11. Tax Invoice and Simplified Tax Invoice QR Code validation

Customers and related stakeholders may validate the Tax Invoices and Simplified Tax

Invoice through scanning the QR code available on the invoice, by following the below

steps:

● Customer scans E-Invoice’s QR code content via VAT App

● VAT App verifies the E-Invoice’s QR code content is compliant

● VAT App displays the QR code content as well as the E-Invoice’s verification results

57

FAQs

What is Phase 2? When will it be enforced and to whom does it apply?

Phase 2 known as the Integration phase, during this phase, subjective taxpayers must

comply with Phase 2 business and technical requirements for the electronic invoices and

E-Invoice Solutions, and the integration with ZATCA’s system.

Phase 2 is enforceable starting from January 1, 2023 and implemented in waves by targeted

taxpayer groups. Taxpayers will be notified by ZATCA on the date of their integration at

least 6 months in advance.

How will ZATCA notify taxpayers about their integration wave?

The enforcement date for the first target group will not be earlier than January 1, 2023.

ZATCA will notify taxpayers of their Phase 2 wave at least six months in advance through

Official emails & SMS registered with ZATCA

What are the requirements for Phase 2?

Phase 2, which will be implemented in waves by target taxpayer groups starting from

January 1, 2023, entails additional technical requirements that E-Invoice solutions must

comply with, the integration of taxpayer E-Invoice Solutions with FATOORA Platform and

the issuance of electronic invoices in a specific format.

Due to the technical nature of the published requirements, it is recommended for

taxpayers to approach a solution provider or their internal technical teams to ensure their

E-Invoice Solutions are compliant with ZATCA’s regulations. In addition, developers and

subject matter experts may visit ZATCA’s website for viewing all requirements (business,

technical, security, etc.). Further details on the integration mechanisms and specifications

are published by ZATCA on the developer page on ZATCA’s E-Invoicing webpage https://

zatca.gov.sa/ar/E-Invoicing/Pages/ default.aspx.

58

Can a taxpayer use the same E-Invoice Solution that was used for Phase 1?

A taxpayer can use the same E-Invoice Solution that was used for Phase 1, by updating the

E-Invoice Solution to comply with the Phase 2 requirements.