i

A Report to

Wells Fargo & Company

On its Efforts to Promote Racial Equity

December 2023

ii

I. Introduction ......................................................................................................................... 1

II. Methodology ....................................................................................................................... 5

III. DE&I Governance ............................................................................................................... 7

A. Operating Committee and Board of Directors ........................................................ 7

B. Diverse Segments, Representation, and Inclusion ................................................. 7

1. DSRI Structure ............................................................................................ 8

2. DE&I Strategic Priorities .......................................................................... 10

3. Monitoring Progress Toward Strategic Priorities ..................................... 10

4. DSRI Listening Tour and Innovation Summit .......................................... 11

C. Philanthropy and Community Impact ................................................................... 12

IV. DE&I Strategic Priority 1: Increasing Diverse Representation and Inclusion .................. 14

A. Anti-Discrimination and Harassment Policies and Investigation

Procedures ............................................................................................................. 14

1. Anti-Discrimination Policies ..................................................................... 14

2. Investigations ............................................................................................. 16

B. Recruitment ...........................................................................................................18

1. Talent Acquisition Structure and Process .................................................18

2. Partnerships .............................................................................................. 20

3. Other Talent Recruitment Programs ......................................................... 21

C. Inclusive Culture and Work Environment ........................................................... 22

1. DE&I Councils .......................................................................................... 22

2. Employee Resource Networks .................................................................. 24

3. DE&I Awareness Month and Cultural Heritage Months .......................... 25

4. Mentorship Programs ............................................................................... 25

5. DE&I Trainings ......................................................................................... 26

6. Professional Development Opportunities ................................................ 26

D. Performance Reviews ........................................................................................... 28

1. Performance Review Process .................................................................... 28

2. DE&I Recognition in Performance Reviews ............................................. 28

E. Compensation and Benefits .................................................................................. 29

1. P

ay Equity Review Process ....................................................................... 29

2. Benefits ..................................................................................................... 30

V. DE&I Strategic Priority 2: Better Serving and Growing Diverse Customer

Segments ........................................................................................................................... 32

A. Regulatory Framework ......................................................................................... 32

B. Home Lending ...................................................................................................... 33

iii

1. Home Lending and the Racial Wealth Gap .............................................. 33

2. Wells Fargo Home Lending ...................................................................... 34

3. Strategic Direction for the Home Lending Business ................................ 35

4. Dream. Plan. Home. Mortgage and Closing Cost Credit .......................... 38

5. Mortgage Applications .............................................................................. 38

6. Addressing Appraisal Bias ........................................................................ 39

7. Housing Access & Affordability Philanthropy .......................................... 42

C. Consumer, Small & Business Banking .................................................................. 46

1. Banking Inclusion ..................................................................................... 47

2. Small Business Banking ............................................................................ 58

D. Wealth & Investment Management ....................................................................... 61

1. The Racial Wealth Gap and Investing ....................................................... 61

2. Wells Fargo’s Wealth & Investment Management Division ...................... 61

3. WIM Programs and Initiatives ................................................................. 62

VI. DE&I Strategic Priority 3: Supporting and Increasing Spend with Diverse

Suppliers ........................................................................................................................... 64

A. Diverse Supplier Spend......................................................................................... 65

B. Encouraging Suppliers to Increase Diverse Spend ............................................... 65

C. Developing Diverse Suppliers ............................................................................... 66

1. Capacity Building Programs ..................................................................... 66

2. Supplier Showcases ................................................................................... 67

VII. Conclusion ........................................................................................................................ 69

This report reflects the views of the assessment team, which relied on data and representations

provided by Wells Fargo's management, employees, and third parties, some of which the

assessment team was not able to confirm independently. The assessment team did not

investigate specific allegations regarding potential legal, regulatory, or policy violations, or audit

Wells Fargo’s financial statements. The material in this report is intended for informational

purposes only, and does not constitute investment advice, a recommendation, or an offer or

solicitation to purchase or sell any securities or other financial investments to any person in any

jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the

securities laws of such jurisdiction.

1

I. Introduction

Wells Fargo

i

is the fourth largest bank in the United States measured by assets, as of

June 30, 2023. It provides a diversified set of products and services related to banking,

investment, and mortgages, as well as consumer and commercial finance, through four

reportable operating segments: Consumer Banking and Lending, Commercial Banking,

Corporate and Investment Banking, and Wealth & Investment Management.

1

Wells Fargo

serves 68 million customers worldwide, a third of all U.S. households, and over 10% of U.S.

small businesses.

2

The Bank operates approximately 4,300 branches and 11,000 ATMs in the

United States.

3

Wells Fargo holds approximately $1.9 trillion in assets

4

for its customers and,

as of September 30, 2023, employs more than 180,000 people in the United States. Five

strategic pillars guide the Bank’s activities: (i) Risk and Control Culture; (ii) Operational

Excellence; (iii) Customer-Centric Culture and Conduct; (iv) Technology and Innovation; and

(v) Financial Strength.

5

Chief Executive Officer Charles Scharf has stated that he recognizes that the size and

scale of Wells Fargo’s business carries with it “tremendous responsibility” and that the Bank’s

business “has tremendous impact upon people.”

6

He has stated that this responsibility includes

Wells Fargo’s “commitment to racial equity and closing the wealth gap in [the United States].”

7

The term “racial wealth gap” refers to persistent racial disparities in accumulated wealth among

households from different demographic groups in the United States.

8

As of March 2023, Black

and Hispanic households owned about $0.24 and $0.23 for every dollar of white household

wealth, respectively.

9

Recent data published by the Federal Reserve shows that Black and

Hispanic households earn about half as much white households.

10

The Center for American

Progress and U.S. Department of the Treasury have found that people of color are less

integrated into the financial system in the United States, and therefore lack access to

investment opportunities and affordable credit and have lower homeownership rates, making

building home equity and accumulating household wealth relatively more difficult.

11

The racial wealth gap is not the result of a single company or governmental policy.

Rather, scholars have concluded that the cumulative effect of various historical policies “bears

major responsibility for disparities in income, health, education, and opportunity that continue to

this day.”

12

The Federal Reserve Bank of Cleveland has described the racial wealth gap as “the

consequence of many decades of racial inequality that imposed barriers to wealth accumulation

either through explicit prohibition during slavery or unequal treatment after emancipation.”

13

The Treasury Department has similarly noted that the racial wealth gap is rooted in historical

racial inequality, stating that “policies, uneven enforcement of equal protections, and a failure to

invest in individuals harmed by de jure and de facto discrimination has resulted in vastly limited

opportunities and stark inequities between white and non-white Americans that have continued

to this day.”

14

Wells Fargo has undertaken efforts to advance racial equity and to help close the racial

wealth gap for many years. For example, in its 1977 Annual Report, the Bank discussed its

“minority purchasing program,” through which it purchased goods and services from minority-

owned firms.

15

In its 1999 Annual Report, the Bank’s then-Chairman and President and Chief

i

Wells Fargo & Company is a financial holding company and a bank holding company. Its principal

business is to act as a holding company for its subsidiaries, including its principal subsidiary, Wells Fargo

Bank, N.A., and the company's other operating subsidiaries. In this report, we use "Wells Fargo" and "the

Bank" to refer to both Wells Fargo & Company and its subsidiaries, and, in discussions of philanthropic

activities, the Wells Fargo Foundation.

2

Executive Officer noted that the Bank “must become an even more diverse organization,

reflecting the diversity of our markets.”

16

Moreover, as the largest bank home mortgage

originator in the United States in 2022, and the largest bank originator of home loans to people

of color for the past decade, Wells Fargo has recognized its potential to positively affect racial

equity in homeownership.

17

In June 2023, Kristy Fercho, who leads Wells Fargo’s Diverse

Segments, Representation, and Inclusion (“DSRI”) team, noted that “[c]ommon pursuit of shared

goals and meaningful collaboration across the housing ecosystem are essential to driving

lasting impact,” and that Wells Fargo was “committed to continuing to play a leading role in the

effort to advance racial equity in homeownership.”

18

Events in 2020, including the murders of George Floyd and Ahmaud Arbery, focused

public awareness on racial injustice in the United States. That summer, Wells Fargo announced

several initiatives designed to reinforce its commitment to promoting racial equity. Wells Fargo

developed a comprehensive DE&I agenda that included efforts to identify and cultivate high

potential senior leaders from underrepresented backgrounds, and to include diversity and

inclusion measures among the factors that bear on the compensation of the Bank’s Operating

Committee members.

19

Also that summer, Wells Fargo’s CEO and other executive leaders

began meeting with groups of the Bank’s Black senior leaders to discuss ideas for enhancing

the Bank’s DE&I efforts and promoting diversity among its senior ranks. Wells Fargo has since

expanded these Executive Forums to include meetings with Hispanic/Latino, Asian, and women

senior leaders as well.

In September 2022, Wells Fargo engaged Covington & Burling LLP to conduct an

assessment of the Bank’s efforts in the United States to promote racial equity, serve customers

in historically underserved communities, and promote an inclusive workplace that values

diversity.

20

The company described the assessment as an important next step in its

commitment to promoting racial equity and closing the racial wealth gap, and as a means to

“measure [its] progress and hold [itself] accountable.”

21

This report contains Covington’s conclusions and related recommendations. It begins

with a description of the methodology used to conduct the assessment, followed by an overview

of Wells Fargo’s leadership structure and the Bank’s approach to promoting DE&I. This

includes a discussion of DSRI, the Bank’s centralized function responsible for coordinating its

DE&I efforts across the company. The report then provides a detailed description of the Bank’s

efforts to promote racial equity in the United States across its three DE&I strategic priorities.

DE&I Strategic Priority 1: Increase Diverse Representation and Inclusion. The

assessment team examined Wells Fargo’s efforts to foster an inclusive culture and work

environment for its employees, including those from underrepresented backgrounds, that

provides an equal opportunity to develop and advance. The assessment team concluded that

Wells Fargo has adopted policies and procedures that are well designed to help the Bank build

and sustain an inclusive workplace, and to identify and address allegations involving

discrimination or harassment. Wells Fargo’s recruitment practices and procedures, including its

Diverse Slate Guidelines, participation in conferences and recruiting events, and partnerships

with organizations and universities, help connect Wells Fargo with qualified candidates from

underrepresented backgrounds. Wells Fargo offers its employees a variety of trainings,

programs, and initiatives aimed at creating a more inclusive culture and work environment,

including through efforts supported by its DE&I councils and Employee Resource Networks

(ERNs). The Bank has implemented mentorship programs and DE&I training for its employees.

Wells Fargo has also taken steps to integrate DE&I into its performance review processes, such

3

as by including progress toward DE&I goals among the factors used to evaluate executive

performance.

Wells Fargo can continue its progress towards this strategic priority by taking steps

discussed further below, including offering greater opportunities for employee participation in

DE&I programs and incorporating feedback focused on DE&I from third-party benefits reviews

and employees into benefits offerings.

DE&I Strategic Priority 2: Better Serving and Growing Diverse Customer

Segments. The assessment team reviewed Wells Fargo’s work related to better serving and

growing diverse customer segments by examining the Bank’s home lending programs, banking

inclusion initiatives, small business programs, and wealth and investment management

programs.

Home Lending. After reviewing the Bank’s initiatives to advance racial equity in

homeownership, the assessment team concluded that Wells Fargo has undertaken significant

efforts over time to meet the mortgage needs of racial and ethnic minorities and to make home

financing more accessible to these groups through its philanthropic investments. In January

2023, Wells Fargo announced that its home lending business would emphasize lending to Bank

customers and underserved communities as a strategic focus. Wells Fargo has implemented

strategies to mitigate bias in the mortgage approval process and the real estate appraisal

process, including investigating complaints alleging discrimination or bias in these processes.

Additionally, Wells Fargo has implemented Special Purpose Credit Programs (SPCPs)

ii

authorized by Congress and the Federal Reserve Board, which are designed to assist minority

homeowners. The Bank is also working to fulfill its commitment to provide $1 billion in

philanthropic support to promote housing affordability in the United States. In addition to these

steps, Wells Fargo could enhance its home lending efforts by tailoring its unconscious bias

trainings to focus on how these issues may arise in the home lending and real estate appraisal

contexts, and conducting regular independent audits of any AI tools it plans to use in the

mortgage approval process.

Banking Inclusion. The assessment team reviewed Wells Fargo’s business and

philanthropic initiatives designed to bring unbanked and underbanked households into the

mainstream financial system. Wells Fargo’s Banking Inclusion Initiative brings together a

number of internal teams and external stakeholders to increase access to affordable digital

banking products and financial education. Wells Fargo makes philanthropic investments that

support programs focused on increasing savings, reducing debt, building credit scores, and

encouraging asset acquisition. Wells Fargo also promotes banking inclusion through various

products such as Clear Access Banking, and through partnerships with minority depository

ii

“In 1976, Congress amended the Equal Credit Opportunity Act (ECOA) to provide that it was not

discrimination for a ‘profit-making organization to meet special social needs’ by offering SPCPs which

follow standards prescribed by regulation.” The Federal Reserve Board has since implemented

regulations requiring that SPCPs “be established and administered pursuant to a written plan ‘that

identifies the class of persons that the program is designed to benefit and sets forth the procedures and

standards for extending credit pursuant to the program,’ and . . . the program is established to provide

credit ‘to a class of persons, who, under the organization’s customary standards of creditworthiness,

probably would not receive such credit or would receive it on less favorable terms than are ordinarily

available to other applicants[.]’” Brad Blower, Special Purpose Credit Programs Remain on Solid Legal

Ground Despite Supreme Court’s Affirmative Action Decision, NCRC (Sept. 11, 2023),

https://ncrc.org/special-pur

pose-credit-programs-remain-on-solid-legal-ground-despite-supreme-courts-

affirmative-action-decision/.

4

institutions (MDIs). Wells Fargo also partners with Operation HOPE, which provides financial

coaching to individuals. Wells Fargo’s opportunities to enhance its banking inclusion efforts

include exploring additional ways to meet the current needs of MDIs, and more clearly

differentiating between its business efforts and its philanthropic investments in the Bank’s

external reporting about the Banking Inclusion Initiative.

Small Business. The assessment team also examined the Bank’s programs designed

to address the needs of minority-owned and small business customers. The assessment team

concluded that Wells Fargo has taken steps to increase minority-owned small businesses’

access to financial services, as demonstrated by its support for Community Development

Financial Institutions (CDFIs) and projects such as an online portal to connect small business

customers with potential financing. Wells Fargo also collaborates with outside organizations,

such as chambers of commerce, to provide services and trainings to minority-owned small

businesses. Wells Fargo has opportunities to further increase its engagement with minority-

owned small businesses through additional programs and work with external partners.

Wealth & Investment Management. Wells Fargo has also implemented programs to

reach more diverse customers through its Wealth & Investment Management Division (WIM).

Over the past two years, WIM developed and launched an action plan to reach more potential

Asian-American customers, and undertook efforts to understand and better serve their needs.

WIM plans to implement similar action plans for customers in other racial and ethnic minority

groups. In addition, WIM regularly holds networking events designed to attract high net-worth

potential customers from diverse backgrounds and communities.

DE&I Strategic Priority 3: Supporting and Increasing Spend with Diverse

Suppliers. Finally, the assessment team considered Wells Fargo’s efforts to provide

opportunities for potential suppliers from underrepresented demographics to compete for Wells

Fargo’s business. The Supplier Diversity team is primarily responsible for these initiatives,

engaging with potential suppliers, and supporting the Bank’s capacity-building programs and

supplier showcases, which are designed to help smaller companies grow in size and acquire

business skills that will help them compete effectively for Wells Fargo’s business. Wells Fargo

has made progress toward increasing its direct and indirect diverse supplier spend. It has

opportunities to enhance the effectiveness of its supplier diversity efforts by training the

company’s various procurement teams about the Bank's supplier diversity program. This would

help to increase awareness within Wells Fargo of both the potential benefits to the Bank of

engaging with diverse suppliers, and the resources available to help facilitate this engagement.

5

II. Methodology

This report contains the assessment team’s evaluation of Wells Fargo’s initiatives aimed

at advancing racial equity, the assessment team’s observations regarding these initiatives, and

its recommendations to build on those efforts. To inform its observations and

recommendations, the assessment team considered many of Wells Fargo’s programs and

initiatives designed to advance racial equity in its workforce and in the communities it serves

and in which it does business.

Three questions guided the assessment team’s work:

(i) What internal or external commitments and efforts has Wells Fargo undertaken

to promote DE&I and racial equity within its own workforce as well as within the

communities it serves, through its home lending, small business, and banking

inclusion initiatives, as well as its diverse supplier program?

(ii) What progress has Wells Fargo made toward those commitments and what

barriers, if any, have impeded implementation of those efforts?

(iii) What additional steps could Wells Fargo take to fulfill its commitments related to

racial equity and DE&I?

To answer these questions, the assessment team:

(i) Reviewed policies, procedures, and reports and data provided by Wells Fargo,

such as Wells Fargo’s ESG reports, DE&I Reports, Employee Handbook, and

DE&I-related announcements and communications. The assessment team also

reviewed reports prepared by Wells Fargo’s data analytics functions to learn how

the Bank assesses its progress on efforts and initiatives related to racial equity.

(ii) Conducted approximately 60 briefings with approximately 100 Wells Fargo

subject matter experts. As part of Covington’s review of the company’s

workforce-related initiatives, the assessment team met with executives,

managers, and team members responsible for overall diversity strategy, talent

acquisition and retention, talent management, compensation, benefits, learning

and development, and employee programming and engagement. In Covington’s

review of Wells Fargo’s external initiatives, the assessment team met with line of

business and enterprise function

iii

leaders, executives, managers, and team

members responsible for banking inclusion, home lending, small business,

supplier diversity, and philanthropic initiatives.

(iii) Met with members of Wells Fargo’s Operating Committee, including its: (i) Chief

Executive Officer and President; (ii) Vice Chair of Public Affairs; (iii) Chief

Executive Officers for Consumer Lending, Consumer, Small & Business Banking,

Wealth & Investment Management, and Corporate & Investment Banking;

(iv) Senior Executive Vice President, Head of DSRI; (v) Senior Executive Vice

President, Head of Human Resources; and (vi) Senior Executive Vice President,

Head of Technology.

iii

Wells Fargo uses the term “enterprise functions” to describe key Bank-wide functions such as Human

Resources, Legal, and Technology.

6

(iv) Interviewed representatives of suppliers participating in Wells Fargo’s supplier

diversity and capacity building programs.

(v) Met with representatives of MDIs Wells Fargo has invested in and partnered with.

(vi) Held roundtables with leaders from Wells Fargo’s ERNs and DE&I councils.

(vii) Convened a listening session with representatives of civil rights and advocacy

organizations that had relevant subject matter expertise regarding the topics and

challenges within the scope of the assessment, including some organizations

with direct knowledge of Wells Fargo’s racial equity-related efforts and initiatives.

Throughout the project, Covington worked closely with a working group within Wells

Fargo. The working group periodically reported the assessment's progress to an internal

steering committee and the CEO. The assessment team also discussed the observations and

recommendations with Wells Fargo’s Board of Directors. Although Wells Fargo’s internal and

external efforts to promote racial equity are ongoing, unless otherwise noted, this report

describes Wells Fargo’s programs, policies, and initiatives as of September 30, 2023.

7

III. DE&I Governance

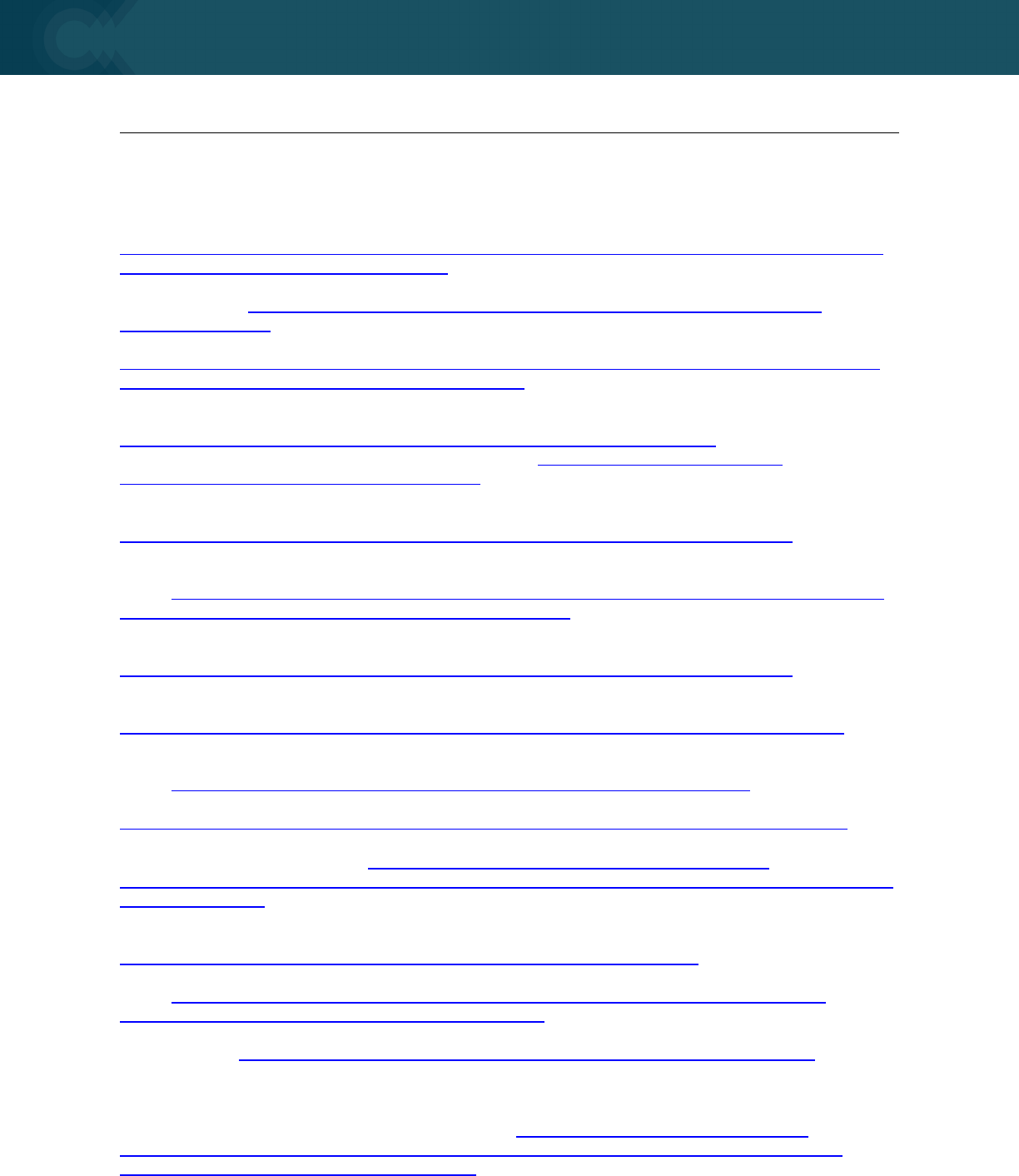

A. Operating Committee and Board of Directors

Wells Fargo’s Operating Committee is comprised of the CEO and his direct reports, who

include the Bank’s line of business CEOs and enterprise function-aligned leaders.

22

As of

September 2023, 15 executives, in addition to the CEO, sit on the Operating Committee, 26.7%

of whom self-identify as racially or ethnically diverse. This is a significant increase from

December 31, 2019, approximately two months after the arrival of Wells Fargo’s current CEO,

when there were no members of the Operating Committee who self-identified as racially or

ethnically diverse.

As of

OC Members

(Excluding

CEO)

# Racially or

Ethnically

Diverse

% Racially or

Ethnically

Diverse

12/31/2019

13 0 0.0%

12/31/2020

17 3 17.6%

12/31/2021

17 4 23.5%

12/31/2022

16 5 31.3%

9/30/2023

15

4

26.7%

Among other responsibilities, Wells Fargo’s Board of Directors focuses on overseeing

management’s efforts to execute on the Bank’s strategy and to continue building an appropriate

risk and control infrastructure.

23

The Board carries out its oversight duties through six

committees, three of which are most relevant to this assessment:

24

• Risk Committee. Oversees Wells Fargo’s risk management framework and

independent risk management function.

• Corporate Responsibility Committee. Oversees significant strategies, policies, and

programs related to social and public responsibility.

• Human Resources Committee. Oversees human resources strategies such as talent

and leadership development, succession planning, and benefits and compensation, as

well as Wells Fargo’s DE&I efforts.

From 2019 through 2023, the percentage of members of the Board of Directors

identifying as racially or ethnically diverse has been between 23% and 29%.

B. Diverse Segments, Representation, and Inclusion

Wells Fargo established the Diverse Segments, Representation, and Inclusion function

(“DSRI”) in 2020.

25

DSRI describes its role as supporting diverse representation, equity, and

inclusion across all areas of the Bank, and responding to the evolving DE&I needs of its

employees, customers, stakeholders, and communities it serves.

8

1. DSRI Structure

The Head of DSRI, in conjunction with the heads of Wells Fargo’s lines of business and

enterprise functions, is responsible for integrating DE&I into every aspect of Wells Fargo’s

business, developing products and services for customers from underserved communities, and

driving DE&I initiatives across the Bank.

26

The Head of DSRI reports directly to Wells Fargo’s

CEO and has a seat on the Bank’s Operating Committee. This structure places the Head of

DSRI among the Bank’s most senior leaders, which reflects Wells Fargo’s commitment to DE&I.

Having a seat on the Operating Committee also allows the Head of DSRI to drive DE&I strategy

at the highest levels of the Bank.

Wells Fargo named Kleber Santos as the first Head of DSRI in 2020. Before joining

Wells Fargo, Santos had over 15 years of experience working in senior roles at another bank

and at a leading management consulting firm.

27

In July 2022, Wells Fargo named Santos as

the CEO of its Consumer Lending business, and in November 2022, Wells Fargo announced

that Kristy Fercho, who joined Wells Fargo in 2020 as the Head of Wells Fargo Home Lending,

would succeed Santos as Head of DSRI. Fercho joined Wells Fargo with over 18 years of

experience working in the home lending industry at Fannie Mae and another bank, where she

served as president of its mortgage division.

28

Wells Fargo’s record of selecting experienced

business leaders dedicated to DE&I to serve as Head of DSRI and promoting a DSRI leader to

lead a line of business underscores the Bank’s commitment to integrating DSRI into its business

operations.

Unlike DE&I functions at many large companies, DSRI is integrated throughout Wells

Fargo’s lines of business and enterprise functions. Several Wells Fargo groups actively support

DSRI’s work on Wells Fargo's DE&I initiatives. These groups report to the Head of DSRI

directly or through a dual reporting/dotted line. The Head of DSRI currently oversees seven

direct reports, who lead the following groups:

• DSRI Chief Administrative Office. The DSRI Chief Administrative Officer is

responsible for strategic execution for DSRI, which includes DE&I project intake and

oversight as well as DSRI’s business office functions. The Chief Administrative Officer is

the primary contact between DSRI and the various business lines and supports DSRI

efforts across the Bank. The Chief Administrative Officer is also responsible for the risk

and controls framework for DSRI and provides governance of DE&I initiatives across

Wells Fargo.

• DSRI External Engagement. The DSRI External Engagement team manages Wells

Fargo’s DE&I-related relationships with external partners and provides support for DSRI,

lines of business, and enterprise functions to further advance DSRI objectives.

• Internal Diversity, Equity & Inclusion. Internal Diversity, Equity & Inclusion aligns all

internal DE&I resources under one office. Internal Diversity, Equity & Inclusion is

responsible for setting the Bank’s global DE&I strategy and ensuring the Bank creates a

sustainable infrastructure across the enterprise to drive DE&I consistently throughout

Wells Fargo. It serves as a liaison between DSRI and lines of business in support of

their DE&I-related workforce activities, and consults and advises senior leadership, line

of business and enterprise function leaders, as well as HR. Internal Diversity, Equity &

Inclusion also oversees the Bank’s employee engagement initiatives, including by

providing operational support for the Bank’s ERNs and DE&I councils, which are

described in more detail below.

9

• DSRI Analytics, Insights, & Data. DSRI has centralized the analysis and reporting

associated with diverse employees and customers within the DSRI Analytics, Insights &

Data team. This team tracks key performance indicators (KPIs) and trends over time to

measure the effectiveness of DE&I and Diverse Customer Segments strategies. It also

offers insights into how strategies can be enhanced to drive acquisition, retention,

satisfaction, and growth among underrepresented segments. In addition, the team

analyzes and researches the specific behavior, preferences, and needs of diverse

customers and employees. The DSRI Analytics, Insights, & Data team reported that the

majority of their work has related to DSRI’s first strategic priority, increasing diverse

representation, described below.

• Hispanic/Latino Affairs. The Hispanic/Latino Affairs team manages a Hispanic/Latino

external engagement portfolio focused on national cultural engagement, executive

recruitment, business development, and stakeholder relations. The team is responsible

for identifying new and managing existing external partnerships, communicating with

Wells Fargo's Hispanic/Latino customer segments about how the Bank could better

serve the Hispanic/Latino community, and increasing the Bank's Hispanic/Latino

executive representation.

• Accessibility. The Chief Accessibility Officer is responsible for efforts to encourage

accessibility in all aspects of the Bank’s internal and external affairs. The Chief

Accessibility Officer is also accountable for the implementation of the Bank’s

Accessibility for Customers and Employees with Disabilities Policy, which establishes

Wells Fargo’s enterprise-wide requirements related to the Americans with Disabilities Act

and similar laws.

• Customer Strategy. The Head of Customer Strategy works with the enterprise strategy

team and each line of business to develop the overall strategy for each of the Bank’s

diverse customer segments. The Head of Customer Strategy also works with the

diverse segments leads and marketing teams for each line of business to share insights

that inform product development and execution plans.

Seven DSRI teams have leaders with a dual/dotted reporting line to the Head of DSRI

and to their respective line of business and enterprise function leaders: (i) Home Lending;

(ii) Wealth & Investment Management; (iii) Corporate & Investment Banking; (iv) Consumer,

Small & Business Banking; (v) DE&I Chief Operating Office; (vi) Commercial Banking; and

(vii) Technology. This dual reporting structure is intended to promote consistency in DE&I

efforts across the Bank while ensuring these DE&I teams are integrated within their individual

line of business and enterprise function and understand their unique business needs.

DSRI also has DE&I Leads who are responsible, in partnership with OC leaders and HR,

for defining the DE&I strategic approach and program execution in their assigned lines of

business and enterprise functions. This includes attracting, retaining, and developing diverse

talent and supporting an inclusive culture and values. Diverse Segments Leaders similarly have

responsibility for defining the DE&I strategy and approach related to their line of business and

better serving and growing diverse customer segments. Diverse Segments Leaders serve the

Consumer, Small & Business Banking, Corporate & Investment Banking, Wealth & Investment

Management, Home Lending, and Commercial Banking lines of business.

The Bank is in the process of establishing segment leads within DSRI for Black/African

American, Asian American and Pacific Islander segments, and has named a segment lead for

10

the Hispanic/Latino segment. The segment leads will work with DSRI on recruiting, talent

management, and development for their respective segments. They will also work with HR to

review the Bank’s efforts to promote equitable representation and inclusion for all of the Bank’s

employees, including those from underrepresented backgrounds across all lines of business

and enterprise functions.

2. DE&I Strategic Priorities

DSRI’s initiatives are all rooted in and connected to Wells Fargo’s three DE&I strategic

priorities:

• Diverse Representation: Increasing diverse representation at all levels of the Bank

through an inclusive culture and work environment.

• Diverse Segments: Better serving and growing diverse customer segments in each line

of business.

• Diverse Suppliers: Supporting and increasing spend with diverse suppliers Bank-wide.

Wells Fargo formulated these three priorities in November 2021. After considering

feedback received from employees and external stakeholders during a 2023 listening tour,

described below, the DSRI team reevaluated the three priorities and recommitted to them.

Some lines of business and enterprise functions establish their own DE&I strategic

priorities, but all of these strategic priorities align to the three core priorities. For example, the

Consumer, Small & Business Banking line of business implemented additional priorities,

including increasing business leaders’ understanding of their workforce, gaps, and opportunities

for diverse representation and mobility. DSRI’s DE&I Strategy and Integration team, which is

part of the Internal Diversity, Equity & Inclusion team, serves as a liaison between DSRI and

lines of business and enterprise functions and supports their DE&I-related activities related to

increasing diverse representation. DE&I Strategy & Integration Consultants serve as DE&I

subject matter experts and assist in the design, development, and maintenance of DE&I best

practices, tools, and resources. The consultants also collaborate with HR to provide feedback

on employee policies, programs, and initiatives.

During the third quarter of 2022, the DSRI Chief Administrative Office designed a DSRI

Intake Tool to establish a centralized repository of new DE&I efforts across the Bank. The DSRI

Intake Tool allows lines of business and enterprise functions to submit new ideas that may align

with DSRI priorities for DSRI funding or other support. The DE&I Strategy and Integration team

then reviews submissions to determine if ideas align with DSRI priorities, and can submit the

ideas for funding or connect the employee who submitted the idea to others who may have

implemented similar ideas in a different line of business or enterprise function.

3. Monitoring Progress Toward Strategic Priorities

The DSRI Analytics, Insights, and Data team tracks KPIs and trends over time to

measure the effectiveness of DE&I programs and initiatives. Wells Fargo monitors diverse

representation across the entire employee population, including within its executive ranks. It

also measures its efforts to sustain an inclusive culture and work environment through DE&I-

related questions in global employee surveys, described in more detail below. The DSRI

Insights, Analytics, and Data team tracks various data points, including data regarding diverse

11

representation and from regular employee surveys. This information is summarized in reports

that may be presented to the CEO, the Operating Committee, the Board of Directors, the Head

of DSRI, or the Head of Human Resources.

Regarding its second strategic priority, Wells Fargo measures its market share in certain

lines of business.

iv

For example, it maintains analytics related to the mortgage approvals and

deposit account adoption and usage rates for customers from underrepresented communities.

To monitor progress toward its third strategic priority, Wells Fargo tracks its total percentage of

spending from diverse suppliers.

The Head of DSRI provides frequent reports to the CEO and also meets periodically with

the CEO one-on-one. The Head of DSRI also provides periodic updates to either the entire

Board, or to its Human Resources Committee. These presentations typically focus on progress

toward the DSRI KPIs, including progress on key DE&I strategic priorities and other key

updates. The presentations also highlight opportunities for growth and summarize feedback the

DSRI team has received from employees. For example, following the DSRI Listening Tour, the

presentation to the Human Resources Committee summarized feedback received during the

tour from employees and external stakeholders.

4. DSRI Listening Tour and Innovation Summit

In early 2023, the Head of DSRI completed a DSRI Listening Tour, during which she

traveled to five cities and met with over 1,900 Wells Fargo employees and 66 external

stakeholder partners from more than 50 non-profit organizations. In each city, the Head of

DSRI hosted: (i) a meet-and-greet reception to which all employees in each location were

invited; (ii) a town hall open to all employees in each location; (iii) a session with ERN leaders;

(iv) leader sessions for specific levels of managers; and (v) an external stakeholder session. In

addition to two virtual sessions for employees not located in the five cities the Head of DSRI

visited, she also hosted: (i) two sessions for Bank branch employees; (ii) Executive Leadership

Forums for Black/African American, Hispanic/Latino, and AAPI executives; (iii) a session for

Black executive women; (iv) an international session; and (v) a PRIDE session. She also

conducted sessions with DSRI employees to see if feedback varied between those hired to help

drive DE&I across the Bank and other employees.

The goals for the DSRI Listening Tour were to advance DE&I strategy, promote energy

and engagement around DE&I, and understand the greatest opportunities for improvement.

During the Listening Tour, the Head of DSRI engaged ERN leaders to better understand how to

enhance the ERN function across Wells Fargo. DSRI designed the leader sessions with the

goal of discussing the role and expectations of leaders in driving DE&I and understanding key

challenges they face.

Some key themes emerged from the DSRI Listening Tour. Employees recognized the

Bank’s strong commitment to DE&I and noted Wells Fargo’s progress towards building a

diverse and inclusive workplace. ERN leaders reported a strong sense of inclusion and

belonging in the workplace among many of their members. External stakeholders also

complimented Wells Fargo for its support of the diverse communities they serve.

iv

Except where it is permitted by law to collect demographic information (e.g., pursuant to the Home

Mortgage Disclosure Act), Wells Fargo relies on industry standard tools when estimating market share or

tracking adoption of its products and services by demographic.

12

The DSRI Listening Tour also identified opportunities for growth. Some participants

expressed a desire for increased transparency regarding data related to the Bank’s DE&I

initiatives and the Bank’s long-term DE&I strategy. The discussions also revealed that while

many leaders understood the value of DE&I, some employees felt the rationale for DE&I was

not as widely understood throughout the Bank as it could be. Listening Tour participants also

reported that early talent programs, like internship programs, worked well, but that Wells Fargo

would benefit from a more consistent strategy for talent mobility and better internal pipeline

management. External stakeholders also conveyed a desire to see Wells Fargo focus on

capacity-building and suggested that Wells Fargo award multi-year grants to provide a longer

timeframe to deliver outcomes, rather than one-time grants.

The Head of DSRI has also convened Innovation Summits, which are listening sessions

for DSRI employees to increase collaboration and share ideas, and develop a plan concerning

how to enhance DSRI’s work. As of November 2023, the Head of DSRI had hosted three

Innovation Summits.

C. Philanthropy and Community Impact

Wells Fargo’s Head of Philanthropy and Community Impact (PCI) is responsible for

overseeing the Bank’s community engagement and philanthropic investment strategy, including

grants made by the Wells Fargo Foundation.

29

PCI partners with national and local non-profit

organizations focused on its four strategic funding priorities: (i) Financial Health; (ii) Housing

Access and Affordability; (iii) Small Business Growth; and (iv) Sustainability, including

Environmental Justice.

30

PCI prioritizes efforts that support the needs of underserved

communities, including low-to-moderate income (LMI) communities, and advancing racial

equity.

31

PCI also makes local grants, on a limited basis, related to disaster relief, arts and

culture, civic engagement, education, human and social services, and workforce development.

32

PCI reports that in 2022, it funded a total of $300 million in philanthropic investments

through 4,100 grants.

33

That year, it worked with over 100 national partner organizations, which

it defines as “partners that share, guide, and amplify Wells Fargo’s aspiration to improve

financial well-being for all diverse segments and promote financial inclusion.”

34

Wells Fargo

reports on aspects of its philanthropic efforts in a variety of media,

v

including in its DE&I report,

its community giving webpage, and press releases on its website, but does not publish a

standalone report primarily focused on its philanthropy.

v

Wells Fargo relies on data it receives from grant recipients and other partners to assess the impact and

results of its philanthropic investments. It reports data provided by these third parties in its DE&I report

and other publications.

13

Recommendations for DE&I Governance

• Enhance coordination and collaboration between different teams charged with

defining and implementing DE&I priorities. Wells Fargo’s DSRI function and its

integration throughout the Bank reflect Wells Fargo’s commitment to promoting DE&I and

helping to address the racial wealth gap, as well as the Bank’s recognition that addressing

the needs and challenges of diverse markets is a business imperative that requires

coordination across different aspects of its operations. Enhanced coordination and

collaboration between key internal DE&I stakeholders, lines of business, and enterprise

functions could help scale some of DSRI’s programs and implement initiatives

consistently and effectively across the Bank. For example, Wells Fargo could increase

collaboration and communication between DE&I councils, ERNs, and HR by convening

meetings of representatives of these groups more regularly. Wells Fargo could also

expand the DSRI Innovation Summit to include other line of business and enterprise

function leaders responsible for implementing DE&I priorities.

• Collect and report on additional data to assess DE&I initiatives. To expand on its

current structure for collecting and reporting on KPIs related to its DSRI goals, Wells

Fargo could consider expanding its KPI reporting to include a greater focus on its second

and third overall objectives—better serving and growing diverse customer segments in

each line of business and supporting and increasing spend with diverse suppliers.

• Enhance communications with external partners, including civil rights

organizations and local non-profit organizations. More regularly informing and

updating external partners about the Bank’s initiatives and how these partners can assist

in implementing them could both increase awareness of the Bank’s progress and result in

the collection of helpful feedback.

• Issue a public report that summarizes Wells Fargo’s and the Wells Fargo

Foundation’s philanthropic investments. The report could describe Wells Fargo’s

philanthropic priorities, summarize new and existing grants, and provide data on impact.

Having a single report that focuses on the Bank’s philanthropic investments, instead of

reporting on aspects of its philanthropic efforts in a variety of documents, would provide a

more comprehensive and accessible overview of the Bank’s philanthropy.

14

IV. DE&I Strategic Priority 1: Increasing Diverse Representation and Inclusion

Wells Fargo’s first DE&I strategic priority focuses on fostering an inclusive culture and

work environment in order to increase diversity in its workforce, including racial and ethnic

diversity, at all levels of the Bank.

35

To accomplish this, Wells Fargo has implemented

workplace policies, programs, and initiatives and promotes the integration of DE&I goals and

priorities across all phases and aspects of the employee lifecycle.

Wells Fargo monitors its progress toward increasing diversity throughout the Bank by

tracking representation data at all levels, and year-over-year changes in that data.

36

This data

is based on demographic information that Wells Fargo employees self-report. Wells Fargo asks

employees to self-identify their ethnicity, sex, veteran status, disability status, gender identity,

and sexual orientation. Over 99% of employees have provided race or ethnicity information. To

promote transparency, Wells Fargo publishes this data annually in its DE&I Report. Wells

Fargo does not set representation goals.

As of September 30, 2023, Wells Fargo had over 180,000 employees in the United

States. The table below shows the percentages of Wells Fargo's U.S. employees and U.S.

executives who identified themselves as members of a particular demographic group.

Race/Ethnicity US Employees US Executives

White

53%

73%

Racially/Ethnically Diverse 46% 26%

Hispanic/Latino 17% 5%

Black or African American 14% 7%

Asian 12% 12%

Two or More Races 3% 2%

American Indian/Alaskan Native

< 1%

< 1%

Native Hawaiian/Other Pacific Islander

< 1%

< 1%

A. Anti-Discrimination and Harassment Policies and Investigation

Procedures

Wells Fargo’s workforce policies, designed to prevent discrimination and harassment

and promote equal employment opportunities for all employees, include the Code of Conduct;

the Anti-Harassment and Discrimination Policy; the Affirmative Action, Equal Employment

Opportunity Policy for the United States; and the Speak Up and Nonretaliation Policy.

1. Anti-Discrimination Policies

a. Code of Conduct

Wells Fargo’s Code of Conduct applies to all employees, including executive officers.

37

The Code of Conduct highlights the Bank’s commitment to diversity, equity, and inclusion, and

states that Wells Fargo encourages employees to contribute to a safe, inclusive environment

where differences are respected, to educate themselves on unconscious bias, and to solicit

diverse ideas that challenge thinking.

38

The Code of Conduct also sets expectations that

managers lead with integrity, demonstrate and reinforce the Code of Conduct, and hold

15

employees accountable for adhering to the Code of Conduct and related policies.

39

Wells Fargo

publishes its Code of Conduct on its website.

40

The Code of Conduct emphasizes Wells Fargo’s commitment to providing a workplace

free from harassment and discrimination based on an individual’s race, ethnicity, and other

protected characteristics.

41

It encourages employees to report potential misconduct to their

manager, and it also lists Employee Relations—a team within HR that specializes in helping

employees and managers resolve workplace conflicts—as a potential reporting channel.

42

The

Code of Conduct also informs employees that they may report misconduct using the EthicsLine

telephone hotline or the EthicsLine online reporting. EthicsLine is a third-party resource

available 24 hours a day, seven days a week.

43

Individuals who contact EthicsLine may choose

to remain anonymous, to the extent permitted by applicable laws and regulations.

44

Some

reporters choose to share contact information for potential follow-up from an investigator, but

the choice remains with the reporter.

The Code of Conduct provides that Wells Fargo expects managers to foster a work

environment where employees feel comfortable speaking up without fear of retaliation.

45

It

further states that Wells Fargo prohibits retaliation against any employee who reports

misconduct or participates in the investigation process, as described in more detail below.

46

b. Anti-Harassment and Discrimination Policy

Wells Fargo’s Anti-Harassment and Discrimination Policy, revised in 2023, “establishes

requirements for providing a workplace free from harassment and discrimination based on all

characteristics protected by applicable country-specific laws.” It applies broadly to all Wells

Fargo employees, business groups, and enterprise functions, and it applies to conduct both

inside and outside the workplace, including during work-related or Bank-sponsored events,

during business travel, at customer locations, and during remote work. The policy states that

Wells Fargo does not tolerate harassment or discrimination based on any characteristics

protected by applicable laws, including race, color, and national origin, as well as hairstyle or

hair texture. It also defines and provides examples of both discrimination and harassment.

Wells Fargo “encourages and expects all employees to report any concerns related to

harassment or discrimination, whether it’s directed at the employee or someone else, even if all

the facts are not immediately available or if it is unclear whether the conduct violates the Policy.”

The policy requires managers to report “all harassing or discriminatory concerns observed,

learned of, or received from employees against another employee (including an employee not

on the team, or another manager), contingent resource, third parties, customers, or other parties

external to Wells Fargo, unless the employee confirms, verbally or in writing, that the employee

has already reported the concern.”

For details on reporting misconduct, the policy refers employees to the Speak Up and

Nonretaliation Policy (described below), but it also explains that employees may report

misconduct to a member of management, the EthicsLine telephone hotline, EthicsLine online

reporting, or to Employee Relations or another HR Professional. The Anti-Harassment and

Discrimination Policy further provides that Wells Fargo will promptly investigate allegations of

harassment and discrimination “in an objective, thorough, consistent, and timely manner” and

prohibits retaliation against employees who in good faith report, provide information, or take part

in an investigation related to misconduct.

16

c. Affirmative Action and Equal Employment Opportunity

Policy for the United States

Wells Fargo’s Affirmative Action and Equal Employment Opportunity Policy for the

United States reflects its commitment to creating a workplace free of discrimination and

harassment based on legally protected characteristics. It provides that managers “must recruit,

hire, and promote employees based on their individual ability and experience,” and that

managers must administer employee compensation “in accordance with the company

commitment to providing fair and equitable pay.” It further provides that all employees may

participate in “company-sponsored educational, training, recreational, or social activities”

regardless of protected characteristics. The policy also reiterates that Wells Fargo prohibits

retaliation for filing a complaint, assisting or participating in an investigation, inquiring about or

discussing one’s own pay or the pay of another employee or applicant, opposing any unlawful

act or discriminatory practice, or exercising any rights protected under applicable laws and

regulations.

d. Speak Up and Nonretaliation Policy

The Speak Up and Nonretaliation Policy encourages employees to speak up and report

potential misconduct—including harassment, discrimination, or retaliation—using any of the

reporting channels listed in the Code of Conduct. Like the policies described above, it prohibits

retaliation. It provides examples of protected activity and makes clear that speaking up in good

faith about potential violations of the policy and participating in an investigation is one form of

protected activity. It lists specific examples of adverse employment actions that could be

retaliatory, including dismissal, suspension, demotion, transfer, reassignment, official reprimand,

adverse performance evaluation, withholding of work, or denial of any compensation or benefit.

e. Employee Awareness of Anti-Discrimination Policies and

Reporting Channels

Wells Fargo has taken steps to educate employees about reporting complaints, including

posting signage in its offices with information about the EthicsLine and how to report complaints,

and publishing articles on Wells Fargo’s intranet about reporting channels. Wells Fargo

conducts annual global employee surveys and quarterly pulse surveys, which address a variety

of issues related to Wells Fargo’s culture. Those surveys have not previously asked employees

about their awareness of anti-discrimination policies or reporting channels.

2. Investigations

a. Reporting Channels and Investigation Procedure

As described above, Wells Fargo’s policies encourage employees to report any potential

discrimination, harassment, or retaliation they experience, observe, or learn about through

others. Employees may report potential misconduct to a manager, the EthicsLine, Employee

Relations, or another Human Resources professional. If a manager receives a report of

misconduct, the manager must elevate the complaint to Employee Relations. When employees

bring complaints to Employee Relations, Employee Relations consultants conduct an initial

consultation with the complaining party. An Employee Relations Case Management Policy

directs Employee Relations consultants to remind employees that Wells Fargo does not tolerate

any retaliatory conduct directed at employees for participating in fact-gathering processes. If a

17

complaint involves potential misconduct, Employee Relations generally refers the complaint to

Conduct Management.

The Conduct Management team is responsible for managing Wells Fargo’s response to

conduct-related allegations, which includes overseeing the EthicsLine and conducting

investigations into potential misconduct. An Enterprise Investigations team within Conduct

Management conducts investigations into potential misconduct. Following the conclusion of an

investigation, the Enterprise Investigations team generally refers the investigation findings to

Employee Relations to review and recommend appropriate corrective action. Employee

Relations consultants perform this review utilizing guidelines, which are designed to promote

consistency in the evaluation process, and provide factors to be considered when

recommending an employment action.

Conduct Management has established KPIs to evaluate the investigations process, and

each month, Conduct Management assesses the percentage of investigations that met each

KPI. The KPIs relate to the timeliness, quality, and support for the outcome of the investigation.

b. Data Tracking and Reporting

Conduct Management is responsible for tracking allegations of misconduct within Wells

Fargo and for reporting its analysis of this data to leaders within the Bank. Conduct

Management tracks the number of allegations of misconduct received through different

reporting channels, as well as the number of allegations of misconduct reported within each line

of business and enterprise function. It also tracks allegation substantiation rates and

information about corrective actions taken. Conduct Management presents this data to various

management teams. Conduct Management also holds periodic investigation trends calls with

line of business and enterprise function leaders to review allegation data and trends, and these

leaders are expected to use this information to determine whether any action, like training, is

warranted.

Conduct Management presents certain categories of data to the Head of DSRI, including

key Conduct Management metrics and trends and allegation substantiation rates. Conduct

Management also updates the Head of DSRI on the trends associated with substantiated

allegations and corrective actions associated with each. Wells Fargo does not track or analyze

aggregated demographic data of complaining parties or subjects of complaints, and the reports

described above do not contain demographic data about complainants or subjects of reports.

18

Recommendations for Policies and Investigations

• Consider enhancements to policies to affirm Wells Fargo’s commitment to racial

equity. Wells Fargo’s comprehensive Anti-Harassment and Discrimination Policy lists

and describes prohibited behavior, and could be enhanced by addressing the concept of

racial microaggressions among the examples of prohibited behavior outlined in the policy.

• Take regular steps to assess employee awareness of and comfort with the Bank’s

anti-harassment and EEO policies and reporting channels. The EEO policies provide

guidance to employees regarding reporting channels and reporting processes. Wells

Fargo could consider adding questions to its to global employee surveys and pulse

surveys to gauge employee awareness of these policies and reporting channels.

• Track aggregated demographic data related to complainants and subjects of

complaints. Wells Fargo’s comprehensive data tracking related to employee complaints

could be enhanced by disaggregating data by employee demographics to track trends in

reports and substantiation rates.

B. Recruitment

Wells Fargo is committed to “attracting, developing, and retaining the best-qualified,

most diverse group of employees,” which includes “[b]uilding a diverse pipeline of candidates for

positions at all levels of the [Bank], including leadership positions.”

47

Wells Fargo has

established a structure and process to grow a diverse recruiting pipeline that includes programs

and initiatives, such as the use of Diverse Slate Guidelines; recruiting partnerships with

Historically Black Colleges and Universities (HBCUs) and Hispanic Serving Institutions (HSIs);

participation in the OneTen Coalition, a national initiative which aims to close the opportunity

gap for Black talent; and recruitment at various national diversity events.

1. Talent Acquisition Structure and Process

Talent Acquisition, a group within HR, is responsible for the full life cycle of recruiting for

all levels at Wells Fargo. Talent Acquisition identifies candidates from internal and external

sources, and its team members work closely with hiring managers and provide guidance on all

aspects of the talent acquisition process. The Head of Talent Acquisition reports directly to the

Head of Human Resources.

Within Talent Acquisition, a dedicated Targeted Sourcing Group—composed of a

Strategic Pipelining & Partnerships team, and a Diversity Sourcing Group—leads enterprise

DE&I talent programs and initiatives to expand and strengthen Wells Fargo’s diverse candidate

pipelines. Recruiters, who are part of the Talent Acquisition team, work with the Diversity

Sourcing Team to identify talent for open roles. To increase the diversity of candidate pools, the

Targeted Sourcing Group attends a variety of conferences and career fairs, leverages external

networks—including student organizations and alumni associations—and connects with

prospective candidates directly through other resources such as LinkedIn.

Wells Fargo’s talent acquisition process typically begins when a line of business or

enterprise function identifies a need and obtains an approved job requisition. Before posting an

open role internally or externally, recruiters generally review the draft job posting and remove

19

any potentially biased or non-inclusive language. A “Job Description Style Guide” advises

recruiters how to draft effective and inclusive job descriptions. Recruiters typically post the open

role internally and may post roles to various external job sites. Recruiters also may search for

qualified candidates directly using external sites, such as LinkedIn or Indeed. As described in

more detail below, certain roles are subject to Diverse Slate Guidelines, and recruiters can

engage the Diversity Sourcing Team to build a diverse candidate slate of qualified candidates.

The recruiter typically conducts a phone screener interview of identified qualified

applicants. The subsequent interview process varies depending on the role and line of business

or enterprise function, but the process is consistent for all applicants who apply for the same

role. Hiring managers typically distribute an interview guide listing the competencies for the

open position to interviewers, as well as interview questions and a rating scale. Recruiters also

may conduct reference checks depending on the role, though Wells Fargo does not require

reference checks for every position. The hiring manager and recruiter then work together to

select the most qualified candidate and formulate an offer.

In August 2022, Wells Fargo completed a review of its Diverse Candidate Slate

Guidelines. The review involved interviewing recruiters and hiring managers and hosting

listening sessions with a broader set of employees. Wells Fargo implemented updated Diverse

Candidate Slate and Interview Team Guidelines (“Diverse Slate Guidelines”) incorporating

feedback from the review in August 2022.

48

The Diverse Slate Guidelines apply to many mid-level and senior-level positions. For

those roles, managers and recruiters work together to cultivate a diverse pool of candidates,

which the guidelines define as a candidate pool for first-round interviews in which at least half of

the candidates self-identify as members of an underrepresented demographic based on race or

ethnicity, gender, disability status, veteran status, sexual orientation, or gender identity. Wells

Fargo invites candidates to self-identify on applications when applying for a position. The

guidelines also state that hiring managers should assemble diverse teams of interviewers,

which the guidelines define as an interview team with at least one interviewer who self-identifies

as a member of an underrepresented demographic as described above. If a hiring manager

does not provide a diverse slate of applicants for a role, the hiring manager is asked to provide

a rationale, which the recruiter and next-level manager then review. A candidate slate can meet

the definition provided in the guidelines even if no candidate is racially or ethnically diverse, as

long as the slate otherwise meets the criteria described above. A candidate slate composed

entirely of white women, or of white male veterans, would meet the definition contained in the

guidelines.

For roles that are subject to the Diverse Slate Guidelines, recruiters have access to

reports with aggregated data reflecting the diversity of the candidate pool for each job

requisition. These reports do not provide identifying demographic information specific to any

candidate. Recruiters do not receive data reflecting the percentage of the candidate slate

identified as underrepresented based on race or ethnicity, but rather the total percentage of the

slate that fits one or more of the criteria for establishing a diverse slate.

In August 2022, Wells Fargo required all hiring managers to complete a “Promoting

Diversity and a Positive Candidate Experience” training, which provided an overview of the

revised Diverse Slate Guidelines and the role of hiring managers in promoting adherence to the

Guidelines, with assessment questions embedded throughout the training. Wells Fargo now

requires this training for new senior employees and executives. Training for newly hired

20

recruiters incorporates the Guidelines, and recruiters receive quarterly refresher trainings, with

one module in those trainings focusing on the Diverse Slate Guidelines.

Currently, Talent Acquisition works with DSRI to report quarterly on metrics related to

the Diverse Slate Guidelines. These reports show the percentage of in-scope job requisitions

meeting the Guidelines across each line of business or enterprise function for that year-to-date

and include aggregated demographic data of candidates interviewed, offers, and hires for in-

scope roles. HR also presents some of this data to management.

2. Partnerships

The Targeted Sourcing Group attends a variety of conferences and career fairs hosted

by organizations, such as the National Association of Black Accountants, the National Society of

Black Engineers, the Society of Asian Scientists & Engineers, the Association of Latino

Professionals for America, and the Society of Hispanic Professional Engineers to enhance the

recruitment of a diverse pool of talent. Recruiters sometimes review resumes in advance of

these events and connect with qualified candidates at these conferences.

Wells Fargo also recruits at more than 15 HBCUs and more than 20 HSIs as part of its

recruiting efforts at a broad array of colleges and universities. An External Engagement team

within DSRI works with campus relationship managers and career services at HBCUs and HSIs

to identify talent—both current students and alumni—for internships and full-time roles.

Members of the External Engagement team attend hiring fairs, host resume workshops and

mock interviews, and host and attend other recruiting events at these schools. The External

Engagement team also informally works with a broader set of HBCUs and HSIs to identify talent

by attending recruitment events and inviting students to participate in mentorship programs and

virtual events, described in more detail below. Wells Fargo has increased its financial

investment in identifying and supporting talent from HBCUs and HSIs since 2020. From 2020 to

2023, Wells Fargo more than doubled the number of HBCU graduate hires into entry-level roles,

and it more than tripled the number of HSI graduate hires into entry-level roles in the same time

period.

Wells Fargo also offers a variety of mentorship programs and virtual events for university

students aimed at teaching students about various career pathways at Wells Fargo and

developing mentorship relationships with potential candidates. For example, the Senior Leader

Speaker Series connects HBCU and HSI students and recent graduates with leaders across

Wells Fargo to support their continued development and connect them with career opportunities

at Wells Fargo.

49

During the Senior Leader Speaker Series, Bank leaders share their

backgrounds and what led them to Wells Fargo, allowing students and recent graduates to learn

about career pathways at Wells Fargo. Wells Fargo’s Virtual Mentorship Series, led by the

ERNs—which are described in more detail below—offers sophomores at HBCUs and HSIs the

opportunity to learn about financial services and careers at Wells Fargo through networking and

professional development events.

50

A “Day in the Life” webinar series, targeted toward

students, provides an overview of the banking industry and describes a typical day in the life of

leaders at Wells Fargo.

The External Engagement team tracks the number of students Wells Fargo hires from

HBCUs and HSIs and the total number of attendees, interviews, offers, and hires stemming

from each recruiting event or conference. The External Engagement team regularly compiles

this information and presents it to Talent Acquisition leadership and other internal business

21

leads. DSRI also collaborates with the Talent Acquisition team on an ad hoc basis to assess

recruiting partnerships and programs.

3. Other Talent Recruitment Programs

Wells Fargo has implemented a number of other programs to help identify and develop

talent from a broad array of professional and personal backgrounds. For example, Wells

Fargo’s Career Development Program provides training, mentoring, and professional

development opportunities for employees in certain roles that require less than five years of

experience.

51

The Targeted Sourcing Group primarily sources talent without four-year degrees

for the program by leveraging partnerships with two-year colleges and posting opportunities to

external recruiting platforms. The Career Development Program is open to employees from all

demographic backgrounds, and Wells Fargo monitors participant demographics to assess

program diversity and equitable access. More than three quarters of the program participants in

2023 were from historically underrepresented backgrounds.

The Building Diverse Pathways program is a three-year program that is open to students

from all backgrounds and intends to provide students, including students from historically

underrepresented backgrounds, with a career path from intern to financial advisor.

52

The

program begins with a paid 10-week Banking and Financial Advising summer internship in Wells

Fargo’s WIM line of business. Sophomore and junior students are eligible for the internship,

which can lead to a full-time employment opportunity. Interns receive specialized training,

mentoring and career coaching, and access to networking events. The objective is to position

interns for a successful career and ultimately prepare them to grow a business portfolio within

WIM. In response to its initial posting for the program, Wells Fargo received more than 1,000

resumes for 50 openings.

53

Wells Fargo offered 50 internships in 2022, and again offered 50

internships in 2023. Wells Fargo reviews the demographics of the participants in the program to

understand the diversity of its interns and promote equitable access to the program.

Wells Fargo’s Glide – Relaunch program is an eight-week “returnship” program designed

for professionals from any background with at least seven years of experience seeking to re-

enter the workforce.

54

Participants spend 80% of their work directly related to the specific role

for which they were selected, and the remaining 20% on a program curriculum that includes

skills refresh, training, engagement with program graduates, and senior leader networking

opportunities. Following the paid returnship, Wells Fargo hires participants who meet certain

performance expectations into full-time roles with a minimum base compensation of $100,000.

Since 2022, 88% of all participants have converted to full-time employment with Wells Fargo.

55

Eligible participants may be from any demographic background. In the spring of 2023, 78% of