© Chartered Professional Accountants of Canada. All rights reserved.

No part of this publication may be reproduced or transmitted, in any form or by any means, without the prior written consent of CPA Canada.

For information regarding permissions, please contact permi[email protected].

2023-09-05

Core 2 Self-Assessed Entrance Exam Solution

1. Which of the following is a valid reason to allocate the cost of a support department,

such as engineering services, to the products manufactured in an operating

department?

*a. To determine the net margin of the products.

@ Answer a) is correct. Net margins should be determined based on a product’s full

cost, including the allocation of indirect costs, so this is a valid reason for the allocation.

b. To reprimand the manager of a poorly performing operating department.

@ Answer b) is incorrect. Through the process of indirect cost allocation, managers of

operating departments receive information on the share of the indirect resources that

their department consumes. Such information can influence their behaviour, resulting in

a reduction in the consumption of that resource; however, cost allocations should never

be applied as punitive measures. Answer a) is correct. Net margins should be

determined based on a product’s full cost, including the allocation of indirect costs, so

this is a valid reason for the allocation.

c. To earn additional profits by inflating the cost of products manufactured for a potential

client.

@ Answer c) is incorrect. In establishing the full cost of a product, all costs, including

indirect costs, must be considered; however, the aim is not to inflate costs beyond what

is actually incurred in order to charge higher prices. Answer a) is correct. Net margins

should be determined based on a product’s full cost, including the allocation of indirect

costs, so this is a valid reason for the allocation.

d. Allocating support costs allows management to make the decision to abandon one of

the products manufactured in the operating department.

@ Answer d) is incorrect. Allocated costs should not be used in decision-making. Often,

the allocation will include costs that would be unaffected whether a product was

abandoned or not. Answer a) is correct. Net margins should be determined based on a

product’s full cost, including the allocation of indirect costs, so this is a valid reason for

the allocation.

Core 2 Self-Assessed Entrance Exam Solution

2 / 121

2. In which of the following circumstances is the zero-based budgeting approach most

useful?

a. In organizations involved in high-growth industries, where strategic decisions need to

be made quickly

@ Answer a) is incorrect. Organizations in high-growth industries where decisions need

to be made quickly are not likely to adopt zero-based budgeting, because the detailed

process underlying this approach to budgeting is very time consuming. Answer b) is

correct. Organizations that have access to a limited amount of resources and need to

justify their expenditures in detail are most likely to adopt a zero-based budgeting

approach.

*b. In governmental and non-profit sectors, where every expenditure must be justified

@ Answer b) is correct. Organizations that have access to a limited amount of

resources and need to justify their expenditures in detail are most likely to adopt a zero-

based budgeting approach.

c. In high-tech factories, where zero-defect policies are implemented

@ Answer c) is incorrect. The zero-based budgeting approach constitutes a very

detailed approach to budgeting. It bears no relation to organizations that implement

zero-defect policies. Answer b) is correct. Organizations that have access to a limited

amount of resources and need to justify their expenditures in detail are most likely to

adopt a zero-based budgeting approach.

d. In organizations that favour management flexibility and focus only on the big picture

@ Answer d) is incorrect. The zero-based budgeting approach constitutes a very

detailed approach to budgeting and control. Therefore, it cannot be said that

organizations that have adopted zero-based budgeting focus only on the big picture.

Answer b) is correct. Organizations that have access to a limited amount of resources

and need to justify their expenditures in detail are most likely to adopt a zero-based

budgeting approach.

Core 2 Self-Assessed Entrance Exam Solution

3 / 121

3. Orange Ltd. manufactures juice with two different ingredients: 100% of ingredient A is

added at the beginning of the production process; 100% of Ingredient B is added when

the juice is 60% complete. Conversion costs are added uniformly throughout the entire

production process.

Quality testing is conducted at the 60% conversion point, prior to adding ingredient B.

Rejected units at quality testing are accounted for as spoilage, and spoilage is included

in equivalent units of output. Production data for May, Year 5, are as follows:

WIP inventory, May 1 (25% converted) 40,250 units

Started in production 85,000 units

Spoiled 300 units

Completed production 90,000 units

WIP inventory, May 31 (80% converted) 34,950 units

For May, direct material costs incurred and in beginning WIP inventory totalled

$220,000 for ingredient A and $350,000 for ingredient B. Using the weighted average

method, what is the cost per equivalent unit (EU) for ingredient A and ingredient B?

a. $2.59 and $2.80

@ Answer a) is incorrect. It excludes beginning WIP in the calculation for A. Answer b)

is correct. EU of work done in May:

Units A B

Beginning WIP (25% converted) 40,250 40,250 40,250

Units started and completed

†

49,750 49,750 49,750

Spoiled units 300 300 0

Ending WIP (80% converted) 34,950 34,950 34,950

Total units accounted for 125,250 125,250 124,950

†

Units started and completed are calculated by completed production of 90,000 less

WIP inventory, May 1 of 40,250 = 49,750.

Cost per EU of A: $220,000 / 125,250 = $1.76

Cost per EU of B: $350,000 / 124,950 = $2.80

Core 2 Self-Assessed Entrance Exam Solution

4 / 121

*b. $1.76 and $2.80

@ Answer b) is correct. EU of work done in May:

Units A B

Beginning WIP (25% converted) 40,250 40,250 40,250

Units started and completed

†

49,750 49,750 49,750

Spoiled units 300 300 0

Ending WIP (80% converted) 34,950 34,950 34,950

Total units accounted for 125,250 125,250 124,950

†

Units started and completed are calculated by completed production of 90,000 less

WIP inventory, May 1 of 40,250 = 49,750.

Cost per EU of A: $220,000 / 125,250 = $1.76

Cost per EU of B: $350,000 / 124,950 = $2.80

c. $2.59 and $3.89

@ Answer c) is incorrect. It excludes beginning WIP in the calculation for A and ignores

ending WIP for B:

B

Beginning WIP (25% converted) 40,250

Units started and completed

†

49,750

Spoiled units 0

Ending WIP (80% converted) 0

Total units accounted for 90,000

†

Units started and completed are calculated by completed production of 90,000 less

WIP inventory, May 1 of 40,250 = 49,750.

Cost per EU of B: $350,000 / 90,000 = $3.89

Answer b) is correct. EU of work done in May:

Units A B

Beginning WIP (25% converted) 40,250 40,250 40,250

Units started and completed

†

49,750 49,750 49,750

Spoiled units 300 300 0

Ending WIP (80% converted) 34,950 34,950 34,950

Total units accounted for 125,250 125,250 124,950

†

Units started and completed are calculated by completed production of 90,000 less

WIP inventory, May 1 of 40,250 = 49,750.

Core 2 Self-Assessed Entrance Exam Solution

5 / 121

Cost per EU of A: $220,000 / 125,250 = $1.76

Cost per EU of B: $350,000 / 124,950 = $2.80

d. $2.44 and $3.89

@ Answer d) is incorrect. It uses units completed as the denominator:

Cost per EU of A: $220,000 / 90,000 = $2.44

Cost per EU of B: $350,000 / 90,000 = $3.89

Answer b) is correct. EU of work done in May:

Units A B

Beginning WIP (25% converted) 40,250 40,250 40,250

Units started and completed

†

49,750 49,750 49,750

Spoiled units 300 300 0

Ending WIP (80% converted) 34,950 34,950 34,950

Total units accounted for 125,250 125,250 124,950

†

Units started and completed are calculated by completed production of 90,000 less

WIP inventory, May 1 of 40,250 = 49,750.

Cost per EU of A: $220,000 / 125,250 = $1.76

Cost per EU of B: $350,000 / 124,950 = $2.80

Core 2 Self-Assessed Entrance Exam Solution

6 / 121

4. DBS Ltd. produces a single product. For the current year, budgeted sales volume is

90,000 units and budgeted production volume is 100,000 units. The following standards

were used in preparing the current year’s budget:

Selling price

$200 per unit

Variable direct material costs

$127 per unit

Variable direct labour costs

$6 per unit

Fixed manufacturing overhead

$2,800,000 per year

Fixed selling and administration

$300,000 per year

Assuming DBS Ltd. uses variable costing, what is its budgeted net profit for the current

year?

a. $1,600,000

@ Answer a) is incorrect. It uses 90,000 units for sales and 100,000 units for

manufacturing variable costs (that is, no items remaining in inventory). Answer b) is

correct. Budgeted profit = [($200 – $127 – $6) × 90,000] – ($2,800,000 + $300,000) =

$2,930,000.

*b. $2,930,000

@ Answer b) is correct. Budgeted profit = [($200 – $127 – $6) × 90,000] – ($2,800,000

+ $300,000) = $2,930,000.

c. $3,240,000

@ Answer c) is incorrect. It allocates all the costs, including fixed selling and

administration costs, to the product. Answer b) is correct. Budgeted profit = [($200 –

$127 – $6) × 90,000] – ($2,800,000 + $300,000) = $2,930,000.

d. $3,600,000

@ Answer d) is incorrect. It uses 100,000 units instead of 90,000 units for

sales. Answer b) is correct. Budgeted profit = [($200 – $127 – $6) × 90,000] –

($2,800,000 + $300,000) = $2,930,000.

Core 2 Self-Assessed Entrance Exam Solution

7 / 121

5. Deejay Co. uses a process costing system. In Department 2, direct materials are

added at the 50% stage of completion of the process, and conversion costs are added

uniformly throughout the process.

For the month of March, Department 2 had:

Beginning WIP

6,000 units, 60% completed as to conversion costs

Transferred in

42,000 units

Ending WIP

3,000 units 40% completed as to conversion costs

5,000 units 80% completed as to conversion costs

No spoilage was reported during March.

In computing the equivalent units (EU) of production for direct materials for the month of

March, how would the calculation of the weighted average method differ from that of the

FIFO method?

a. It would be 8,000 higher under the weighted average method than under the FIFO

method.

@ Answer a) is incorrect. The difference between the FIFO method and the weighted

average method of process costing in computing EUs of production is attributed to the

work done in the beginning WIP inventory. This answer assumes that it is the ending

WIP that causes the difference and the weighted average calculation would be higher,

as these items would be included. Answer b) is correct. There were 6,000 units in

beginning WIP inventory; therefore, the EU of production for transferred-in costs under

the weighted average method would be 6,000 higher than that of the FIFO method of

process costing.

*b. It would be 6,000 higher under the weighted average method than under the FIFO

method.

@ Answer b) is correct. The difference between the FIFO method and the weighted

average method of process costing in computing EU of production is attributed to the

work done in the beginning WIP inventory. There were 6,000 units in beginning WIP

inventory; therefore, the EU of production for transferred-in costs under the weighted

average method would be 6,000 higher than that of the FIFO method of process

costing.

Core 2 Self-Assessed Entrance Exam Solution

8 / 121

c. It would be 6,000 lower under the weighted average method than under the FIFO

method.

@ Answer c) is incorrect. The difference between the FIFO method and the weighted

average method of process costing in computing EU of production is attributed to the

work done in the beginning WIP inventory. However, it will be higher under the weighted

average method because of these units, not lower. Answer b) is correct. There were

6,000 units in beginning WIP inventory; therefore, the EU of production for transferred-in

costs under the weighted average method would be 6,000 higher than that of the FIFO

method of process costing.

d. It would be the same under the weighted average method as under the FIFO method.

@ Answer d) is incorrect. The difference between the FIFO method and the weighted

average method of process costing in computing EU of production is attributed to the

work done in the beginning WIP inventory. This answer does not consider the 6,000

units in beginning inventory. Answer b) is correct. There were 6,000 units in beginning

WIP inventory; therefore, the EU of production for transferred-in costs under the

weighted average method would be 6,000 higher than that of the FIFO method of

process costing.

Core 2 Self-Assessed Entrance Exam Solution

9 / 121

6. Molly Smith is the regional manager at a credit union and supervises four branch

managers. During the annual budgeting period, Molly provides some general guidance

and historical information to her branch managers on budget targets, but leaves the

actual budget preparation to the managers to encourage them to take ownership of their

plans. What budgetary approach are Molly and her managers displaying?

*a. Participative budgeting

@ Answer a) is correct. The managers are drafting their own budgets based on their

knowledge of their respective branches within the guidance given from Molly. They are

taking an active role in the budget creation process and will be more motivated to

achieve the targets because they set them.

b. Zero-based budgeting

@ Answer b) is incorrect. As Molly is providing historical information, this eliminates

zero-based budgeting as an approach. Answer a) is correct. The managers are drafting

their own budgets based on their knowledge of their respective branches within the

guidance given from Molly. They are taking an active role in the budget creation process

and will be more motivated to achieve the targets because they set them.

c. Traditional budgeting

@ Answer c) is incorrect. While the managers were provided some information, it

doesn’t state that there were general percentages applied to the budget. Furthermore,

the managers were able to adjust the budget to fit their needs, which is not aligned with

the traditional budgeting approach. Answer a) is correct. The managers are drafting

their own budgets based on their knowledge of their respective branches within the

guidance given from Molly. They are taking an active role in the budget creation process

and will be more motivated to achieve the targets because they set them.

d. Budget as a performance measure

@ Answer d) is incorrect. While the managers may be assessed on the budget, this isn’t

a budgetary approach. It was noted that Molly wanted them to take ownership; there

was no mention that the managers were going to be assessed on their adherence to the

budget. Answer a) is correct. The managers are drafting their own budgets based on

their knowledge of their respective branches within the guidance given from Molly. They

are taking an active role in the budget creation process and will be more motivated to

achieve the targets because they set them.

Core 2 Self-Assessed Entrance Exam Solution

10 / 121

7. Which of the following statements about balanced scorecards is true?

a. Balanced scorecards always have four perspectives.

@ Answer a) is incorrect. A balanced scorecard is tailored to each organization, and

while many organizations use the four perspectives, the balanced scorecards are more

about the process rather than the number of perspectives. Answer c) is correct. A

balanced scorecard can be used in many organizations and is not just a tool for profit-

oriented organizations.

b. Balanced scorecards are only for organization-wide performance management.

@ Answer b) is incorrect. A balanced scorecard can be drafted for individual employees

as well. Answer c) is correct. A balanced scorecard can be used in many organizations

and is not just a tool for profit-oriented organizations.

*c. Balanced scorecards can be used in not-for-profit organizations.

@ Answer c) is correct. A balanced scorecard can be used in many organizations and is

not just a tool for profit-oriented organizations.

d. Balanced scorecards must be updated annually.

@ Answer d) is incorrect. While it is recommended that balanced scorecards be

reviewed on a regular basis, there is no requirement to update them annually. Answer

c) is correct. A balanced scorecard can be used in many organizations and is not just a

tool for profit-oriented organizations.

Core 2 Self-Assessed Entrance Exam Solution

11 / 121

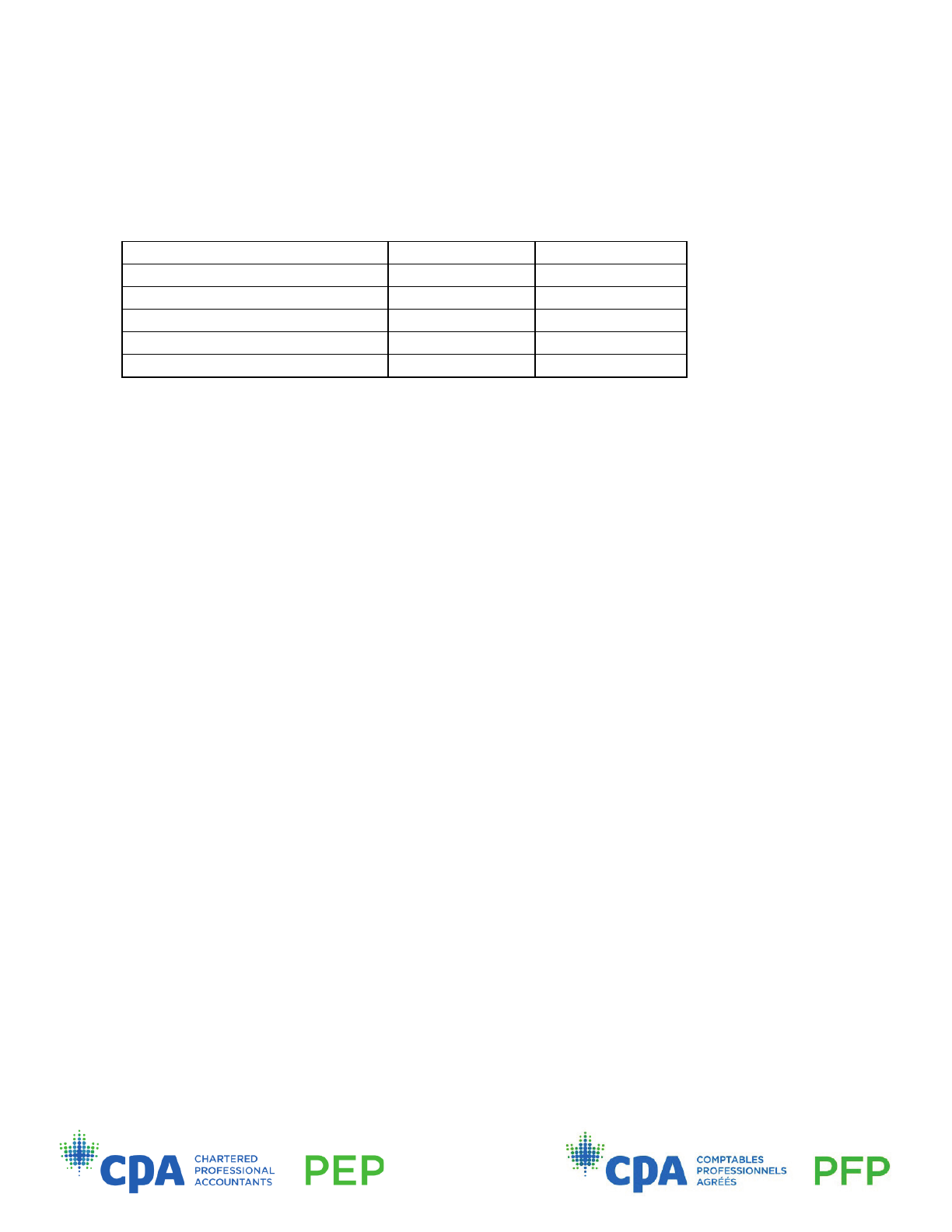

8. A manufacturer has the following data:

Hours required per unit

Department

Available annual

machine hours

Widget A

Widget B

Assembly

10,000

3

4

Packaging

4,000

1

2

The contribution margin (CM) per unit for Widget A is $12 and for Widget B is $14.

Current market demand for Widget A is limited to 2,500 units per year. What is the

yearly product mix that maximizes profitability?

a. 0 Widget A, 2,000 Widget B

@ Answer a) is incorrect. This calculation maximizes Widget B based on the packaging

constraint (contributes $28,000). Answer c) is correct. Confirm using trial and error:

A

B

CM

0

2,000

$28,000

2,500

625

$38,750

Therefore, the optimal product mix is the maximum number of Widget A (2,500) and

using the remaining available machine hours to produce 625 units of Widget B.

b. 2,000 Widget A, 1,000 Widget B

@ Answer b) is incorrect. This calculation uses the point of intersection, even though it

does not maximize CM (contributes $38,000).

3A + 4B = 10,000

A + 2B = 4,000

Substituting: 3A + 4[(4,000 / 2) – A / 2] = 10,000

3A + 4(2,000 – 1 / 2A) = 10,000; A = 2,000

3(2,000) + 4B = 10,000; B = 1,000

The total CM is $12(2,000) + $14(1,000) = $38,000.

Answer c) is correct.

Confirm using trial and error:

A

B

CM

0

2,000

$28,000

2,500

625

$38,750

Therefore, the optimal product mix is the maximum number of Widget A (2,500) and

using the remaining available machine hours to produce 625 units of Widget B.

Core 2 Self-Assessed Entrance Exam Solution

12 / 121

*c. 2,500 Widget A, 625 Widget B

@ Answer c) is correct. Confirm using trial and error:

A

B

CM

0

2,000

$28,000

2,500

625

$38,750

Therefore, the optimal product mix is the maximum number of Widget A (2,500) and

using the remaining available machine hours to produce 625 units of Widget B.

d. 0 Widget A, 2,500 Widget B

@ Answer d) is incorrect. This calculation maximizes Widget B based on the assembly

constraint (contributes $35,000).

Answer c) is correct. Confirm using trial and error:

A

B

CM

0

2,000

$28,000

2,500

625

$38,750

Therefore, the optimal product mix is the maximum number of Widget A (2,500) and

using the remaining available machine hours to produce 625 units of Widget B.

Core 2 Self-Assessed Entrance Exam Solution

13 / 121

9. Russ has developed a new device that he hopes to produce and market on a large

scale. Russ will rent a production space for $500 per month and production equipment

for $800 per month. Russ estimates the material cost per unit will be $5 and the labour

cost per unit will be $3. Advertising and promotion will cost $900 per month. He will hire

workers so he can spend his time promoting the product.

In this context, the production space rental is a:

a. Fixed period cost

@ Answer a) is incorrect. Period costs are not related to manufacturing, and production

space is a manufacturing cost. Answer d) is correct because the production space is a

fixed monthly amount regardless of the activity. It is also used in the manufacturing

process; therefore, it is a product cost.

b. Variable period cost

@ Answer b) is incorrect. A variable cost is a cost that varies proportionately with

activity. The production space does not vary with activity. Period costs are not related to

manufacturing, and production space is a manufacturing cost. Answer d) is correct

because the production space rental is a fixed monthly amount regardless of the

activity. It is also used in the manufacturing process; therefore, it is a product cost.

c. Variable product cost

@ Answer c) is incorrect. A variable cost is a cost that varies proportionately with

activity. The production space does not vary with activity. Answer d) is correct because

the production space rental is a fixed monthly amount regardless of the activity. It is also

used in the manufacturing process; therefore, it is a product cost.

*d. Fixed product cost

@ Answer d) is correct. The production space rental is a fixed monthly amount

regardless of the activity. It is also used in the manufacturing process; therefore, it is a

product cost.

Core 2 Self-Assessed Entrance Exam Solution

14 / 121

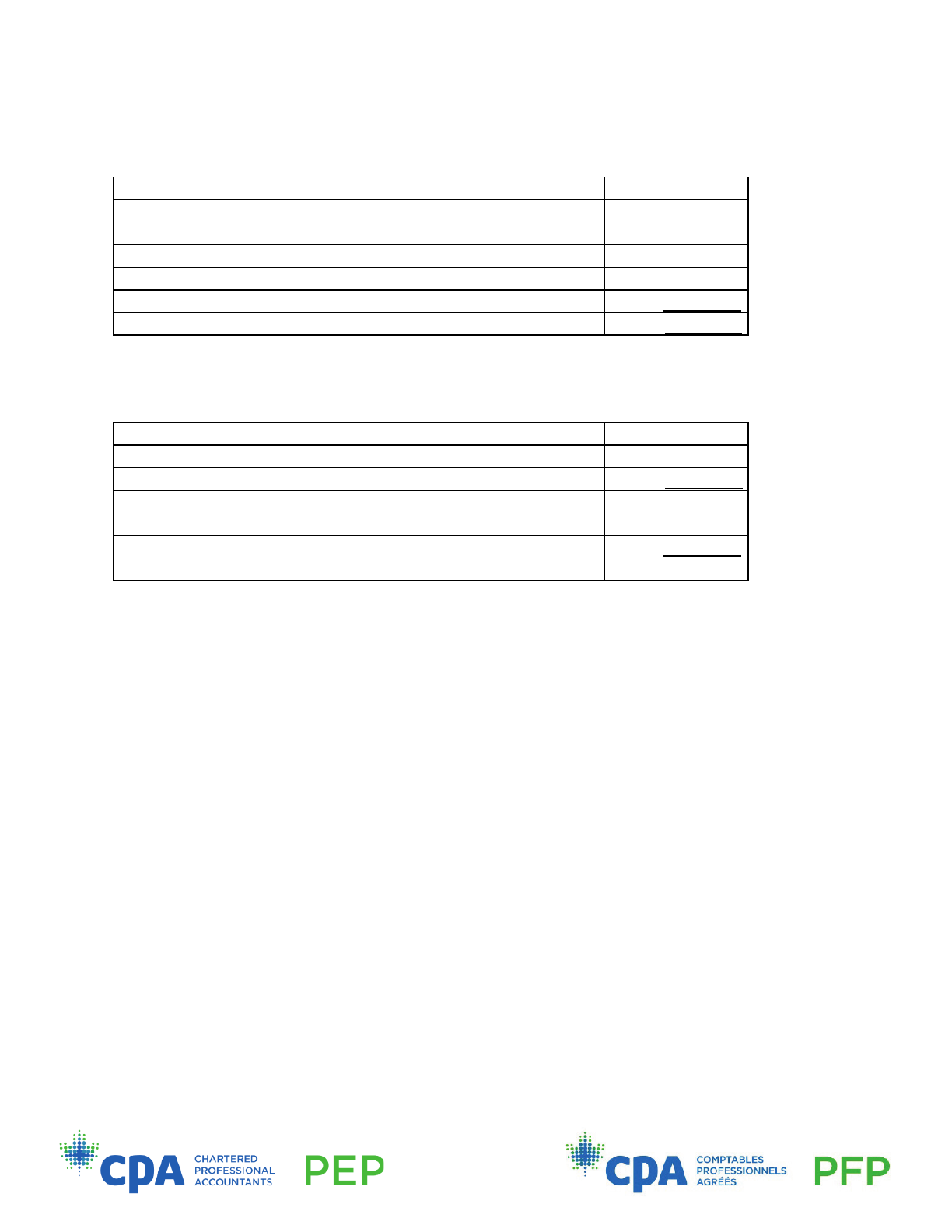

10. The following is information from the records of SKT Inc. for the month of June:

Opening inventory

June 1

Ending inventory

June 30

Purchased in

June

Direct materials

$100,000

$100,000

$920,000

Indirect materials

$20,000

$15,000

$40,000

Work-in-progress

0

0

n/a

Other expenses:

• Direct labour: $680,000

• Rent and utilities: $200,000

• Administrative salaries and benefits: $36,000

The rent and utilities covers the factory and the head office. SKT Inc. allocates 60% of

rent and utilities to manufacturing and 40% to selling and administration.

What amount of indirect manufacturing costs would be charged to the cost of goods

manufactured in June?

a. $160,000

@ Answer a) is incorrect. It includes the cost of indirect materials purchased instead of

the cost of indirect materials used. Answer b) is correct.

Indirect materials used = $20,000 + $40,000 – $15,000 = $45,000

Rent and utilities allocated to manufacturing = 60% × $200,000 = $120,000

Indirect manufacturing costs = $165,000

*b. $165,000

@ Answer b) is correct.

Indirect materials used = $20,000 + $40,000 – $15,000 = $45,000

Rent and utilities allocated to manufacturing = 60% × $200,000 = $120,000

Indirect manufacturing costs = $165,000

c. $1,765,000

@ Answer c) is incorrect. This includes all manufacturing costs, instead of just the

indirect manufacturing costs. Answer b) is correct.

Indirect materials used = $20,000 + $40,000 – $15,000 = $45,000

Rent and utilities allocated to manufacturing = 60% × $200,000 = $120,000

Indirect manufacturing costs = $165,000

d. $1,085,000

@ Answer d) is incorrect. The incorrectly includes direct materials. Answer b) is correct.

Indirect materials used = $20,000 + $40,000 – $15,000 = $45,000

Rent and utilities allocated to manufacturing = 60% × $200,000 = $120,000

Indirect manufacturing costs = $165,000

Core 2 Self-Assessed Entrance Exam Solution

15 / 121

11. HWW Inc. has a job-order costing system. The company uses predetermined

overhead rates in applying manufacturing overhead costs to individual jobs. The

predetermined overhead rate in Department A is based on machine hours, and the rate

in Department B is based on direct materials cost. HWW has the following estimates for

the year:

Department A

Department B

Machine hours

50,000

68,000

Direct labour hours

45,000

60,000

Direct materials cost

$250,000

$220,000

Direct labour cost

$300,000

$280,000

Manufacturing overhead cost

$395,000

$455,000

What are the predetermined overhead rates for Department A and Department B?

a. $7.20 and 1.81

@ Answer a) is incorrect. Answer d) is correct. The estimated departmental

overhead/estimated drivers for the departments are calculated as follows:

A: $395,000 / 50,000 machine hours = $7.90/machine hour

B: $455,000 / $220,000 = 2.07 times direct material cost

b. $8.78 and 2.07

@ Answer b) is incorrect. Answer d) is correct. The estimated departmental

overhead/estimated drivers for the departments are calculated as follows:

A: $395,000 / 50,000 machine hours = $7.90/machine hour

B: $455,000 / $220,000 = 2.07 times direct material cost

c. $7.20 and 1.62

@ Answer c) is incorrect. Answer d) is correct. The estimated departmental

overhead/estimated drivers for the departments are calculated as follows:

A: $395,000 / 50,000 machine hours = $7.90/machine hour

B: $455,000 / $220,000 = 2.07 times direct material cost

*d. $7.90 and 2.07

@ Answer d) is correct. The estimated departmental overhead/estimated drivers for the

departments are calculated as follows:

A: $395,000 / 50,000 machine hours = $7.90/machine hour

B: $455,000 / $220,000 = 2.07 times direct material cost

Core 2 Self-Assessed Entrance Exam Solution

16 / 121

12. The budgeted total fixed and variable costs of the machine insertion activity centre

for XYZ Corp. in Year 8 is $530,000, assuming an activity level of 50,000 parts inserted.

Cost behaviour analysis indicates that the variable cost per part inserted is $2.20 and

that fixed costs remain the same within the relevant range of 48,000 to 52,000 parts

inserted. Activity analysis indicates that the cost driver for the machine insertion activity

is the number of parts inserted.

In preparing a flexible budget for Year 8 at an activity level of 51,000 parts inserted,

what would be the budgeted total costs of the machine insertion activity (rounded to the

nearest hundred dollars)?

a. $642,200

@ Answer a) is incorrect. It considers $530,000 as the fixed cost:

$530,000 + (51,000 × $2.20) = $642,200

Answer c) is correct:

Fixed machine insertion costs = $530,000 – (50,000 × $2.20) = $420,000

Flexible budget if 51,000 parts are inserted = (51,000 × $2.20) + $420,000 = $532,200

b. $540,600

@ Answer b) is incorrect. It considers that $530,000 is all variable costs:

$530,000 / 50,000 = $10.60; 51,000 × $10.60 = $540,600

Answer c) is correct:

Fixed machine insertion costs = $530,000 – (50,000 × $2.20) = $420,000

Flexible budget if 51,000 parts are inserted = (51,000 × $2.20) + $420,000 = $532,200

*c. $532,200

@ Answer c) is correct:

Fixed machine insertion costs = $530,000 – (50,000 × $2.20) = $420,000

Flexible budget if 51,000 parts are inserted = (51,000 × $2.20) + $420,000 = $532,200

d. $530,000

@ Answer d) is incorrect. It assumes all costs are fixed and do not vary with a change in

production.

Answer c) is correct:

Fixed machine insertion costs = $530,000 – (50,000 × $2.20) = $420,000

Flexible budget if 51,000 parts are inserted = (51,000 × $2.20) + $420,000 = $532,200

Core 2 Self-Assessed Entrance Exam Solution

17 / 121

13. A product is being produced that requires manufacturing space costing $1,000 per

month and the lease of equipment for $700 per month. The material cost will be $12 per

unit and the labour cost will be $13 per unit. Advertising and promotion will cost $2,000

per month.

Advertising and promotion is a:

a. Variable product cost

@ Answer a) is incorrect. A variable cost is a cost that varies proportionately with

activity, and advertising and promotion costs do not vary with activity. Further,

advertising and promotion is not attributable to the manufacturing process and therefore

is not a product cost. Answer c) is correct because advertising and promotion is not

attributable to the manufacturing process and therefore is a period cost. Advertising and

promotion does not vary with activity and is therefore fixed.

b. Fixed product cost

@ Answer b) is incorrect because advertising and promotion is not attributable to the

manufacturing process and therefore is not a product cost. Answer c) is correct because

advertising and promotion is not attributable to the manufacturing process and therefore

is a period cost. Advertising and promotion does not vary with activity and is therefore

fixed.

*c. Fixed period cost

@ Answer c) is correct because advertising and promotion is not attributable to the

manufacturing process and therefore is a period cost. Advertising and promotion does

not vary with activity and is therefore fixed.

d. Variable period cost

@ Answer d) is incorrect. A variable cost is a cost that varies proportionately with

activity, and advertising and promotion costs do not vary with activity. Answer c) is

correct because advertising and promotion is not attributable to the manufacturing

process and therefore is a period cost. Advertising and promotion does not vary with

activity and is therefore fixed.

Core 2 Self-Assessed Entrance Exam Solution

18 / 121

14. A factory manager’s salary is a:

a. Variable product cost

@ Answer a) is incorrect. The factory manager’s salary is fixed for the period and is not

variable. Answer b) is correct because the factory manager’s salary is related to the

manufacturing process and thus is a product cost. Also, it is fixed for the period.

*b. Fixed product cost

@ Answer b) is correct. The factory manager’s salary is related to the manufacturing

process and thus is a product cost. Also, it is fixed for the period.

c. Variable period cost

@ Answer c) is incorrect. The factory manager’s salary is fixed for the period and is not

variable. In addition, the cost is related to the manufacturing process and thus is not a

period cost. Answer b) is correct because the factory manager’s salary is related to the

manufacturing process and thus is a product cost. Also, it is fixed for the period.

d. Fixed period cost

@ Answer d) is incorrect. The factor manager’s salary is related to the manufacturing

process and thus is not a period cost. Answer b) is correct because the factory

manager’s salary is related to the manufacturing process and thus is a product cost.

Also, it is fixed for the period.

Core 2 Self-Assessed Entrance Exam Solution

19 / 121

15. Matilda Ma Home Accessories has determined that for its Floorina model of lamp,

the direct materials cost is $5 per unit and the direct labour cost is $4 per unit. Based on

20 monthly observations, the company ran a regression that projected the overhead

associated with this model of lamp as follows:

Overhead = $16,500 + $0.75X, where X is the direct labour cost.

The selling price for the Floorina lamp is $17 per unit. What is the expected gross

margin from sales of the Floorina lamp next month if sales volume is estimated to be

5,000 units?

*a. $8,500

@ Answer a) is correct.

Variable cost per unit: $5 + $4 + ($0.75 × $4) = $12

Total contribution margin = ($17 – $12) × 5,000 = $25,000

Gross margin = $25,000 – $16,500 = $8,500

b. $19,750

@ Answer b) is incorrect. Answer a) is correct, calculated as follows:

Variable cost per unit: $5 + $4 + ($0.75 × $4) = $12

Total contribution margin = ($17 – $12) × 5,000 = $25,000

Gross margin = $25,000 – $16,500 = $8,500

c. $23,500

@ Answer c) is incorrect. Answer a) is correct, calculated as follows:

Variable cost per unit: $5 + $4 + ($0.75 × $4) = $12

Total contribution margin = ($17 – $12) × 5,000 = $25,000

Gross margin = $25,000 – $16,500 = $8,500

d. $36,250

@ Answer d) is incorrect. Answer a) is correct, calculated as follows:

Variable cost per unit: $5 + $4 + ($0.75 × $4) = $12

Total contribution margin = ($17 – $12) × 5,000 = $25,000

Gross margin = $25,000 – $16,500 = $8,500

Core 2 Self-Assessed Entrance Exam Solution

20 / 121

16. A company has the following machine hours and production costs for the last six

months of last year:

Month

Machine hours

Production cost

July

15,000

$12,330

August

13,500

10,300

September

11,500

9,580

October

15,500

12,080

November

14,800

11,692

December

12,100

9,922

If the company expects to incur 14,000 machine hours in January, what will be the total

production cost estimate using the high-low method?

a. $8,750

@ Answer a) is incorrect. Answer b) is correct, calculated as follows:

Variable costs = ($12,080 – $9,580) / (15,500 – 11,500) = $0.625

Fixed costs = $12,080 – ($0.625 × 15,500) = $2,392.50

$2,392.50 + (14,000 × $0.625) = $11,142.50

*b. $11,143

@ Answer b) is correct. The highest and lowest values of the independent variable

(machine hours) are used:

Variable costs = ($12,080 – $9,580) / (15,500 – 11,500) = $0.625

Fixed costs = $12,080 – ($0.625 × 15,500) = $2,392.50

$2,392.50 + (14,000 × $0.625) = $11,142.50

c. $11,544

@ Answer c) is incorrect. It uses the highest value of the dependent variable

(production cost). Answer b) is correct, calculated as follows:

Variable costs = ($12,080 – $9,580) / (15,500 – 11,500) = $0.625

Fixed costs = $12,080 – ($0.625 × 15,500) = $2,392.50

$2,392.50 + (14,000 × $0.625) = $11,142.50

d. $13,049

@ Answer d) is incorrect. Answer b) is correct, calculated as follows:

Variable costs = ($12,080 – $9,580) / (15,500 – 11,500) = $0.625

Fixed costs = $12,080 – ($0.625 × 15,500) = $2,392.50

$2,392.50 + (14,000 × $0.625) = $11,142.50

Core 2 Self-Assessed Entrance Exam Solution

21 / 121

17. Which of the following statements regarding the organizational performance

measurement tool Six Sigma is true?

a. It applies only to reducing manufacturing defects.

@ Answer a) is incorrect. Six Sigma goes beyond just improving manufacturing

processes.

Answer b) is correct. Six Sigma involves measuring and analyzing business processes

to improve quality for the customer through reduced cycle time, reduced defects, and

improved customer satisfaction.

*b. It uses statistical quality control and measurement methods to drive improvements in

key strategic processes.

@ Answer b) is correct. Six Sigma involves measuring and analyzing business

processes to improve quality for the customer through reduced cycle time, reduced

defects, and improved customer satisfaction.

c. It translates the company strategy into four balanced measurement perspectives.

@ Answer c) is incorrect. This is a description of the Balanced Scorecard tool.

Answer b) is correct. Six Sigma involves measuring and analyzing business processes

to improve quality for the customer through reduced cycle time, reduced defects, and

improved customer satisfaction.

d. It is focused on several categories, including leadership, strategic planning, and

results.

@ Answer d) is incorrect. These categories are specifically for application to the

Baldridge Award.

Answer b) is correct. Six Sigma involves measuring and analyzing business processes

to improve quality for the customer through reduced cycle time, reduced defects, and

improved customer satisfaction.

Core 2 Self-Assessed Entrance Exam Solution

22 / 121

18. Which of the following activities is most likely an example of a non-value-added

activity?

a. Putting a motor in an automobile in an automobile factory

@ Answer a) is incorrect. The most important characteristic of a non-value-added

activity is that it adds delay and cost to the production process without adding value. As

it is an essential part of the automobile, installing the motor definitely adds value to the

product.

Answer b) is correct. Moving work-in-process inventories in the factory is an operation

that has no impact on the value that the customer attributes to the product, and

therefore it does not add value. Furthermore, such moves are likely to increase

production delays, something that could actually have a negative impact on value.

*b. Moving work-in-process inventories from one part of the factory to another

@ Answer b) is correct. The most important characteristic of a non-value-added activity

is that it adds delay and cost to the production process without adding value. Moving

work-in-process inventories in the factory is an operation that has no impact on the

value that the customer attributes to the product, and therefore it does not add value.

Furthermore, such moves are likely to increase production delays, something that could

actually have a negative impact on value.

c. Delivering finished goods to the customer

@ Answer c) is incorrect. The most important characteristic of a non-value-added

activity is that it adds delay and cost to the production process without adding value. If a

product is delivered, the customer saves the time and resources necessary to get

access to the product and should therefore attach some value to the delivery process.

Answer b) is correct. Moving work-in-process inventories in the factory is an operation

that has no impact on the value that the customer attributes to the product, and

therefore it does not add value. Furthermore, such moves are likely to increase

production delays, something that could actually have a negative impact on value.

d. Adding spices to a cooked meal in a restaurant

@ Answer d) is incorrect. The most important characteristic of a non-value-added

activity is that it adds delay and cost to the production process without adding value.

Adding spices to a meal is likely to improve the meal’s taste and that should increase

the value of the meal to the customer.

Answer b) is correct. Moving work-in-process inventories in the factory is an operation

that has no impact on the value that the customer attributes to the product, and

therefore it does not add value. Furthermore, such moves are likely to increase

production delays, something that could actually have a negative impact on value.

Core 2 Self-Assessed Entrance Exam Solution

23 / 121

19. DBS Ltd. produces a single product. For the current year, budgeted sales volume is

90,000 units and budgeted production volume is 100,000 units. The following standards

were used in preparing the current year’s budget:

Selling price

$200 per unit

Variable direct material costs

$127 per unit

Variable direct labour costs

$6 per unit

Fixed manufacturing overhead

$2,800,000 per year

Fixed selling and administration

$300,000 per year

Assuming DBS uses absorption costing, what is its budgeted net profit for the current

year?

a. $1,600,000

@ Answer a) is incorrect. It uses 90,000 units for sales and 100,000 units for

manufacturing variable costs (that is, no items remaining in inventory). Answer c) is

correct.

Fixed cost per unit = $2,800,000 / 100,000 units = $28 per unit

Budgeted profit = [($200 – $127 – $6 – $28) × 90,000] – $300,000 = $3,210,000

b. $2,930,000

@ Answer b) is incorrect. This calculation represents profits using variable costing.

Answer c) is correct.

Fixed cost per unit = $2,800,000 / 100,000 units = $28 per unit

Budgeted profit = [($200 – $127 – $6 – $28) × 90,000] – $300,000 = $3,210,000

*c. $3,210,000

@ Answer c) is correct.

Fixed cost per unit = $2,800,000 / 100,000 units = $28 per unit

Budgeted profit = [($200 – $127 – $6 – $28) × 90,000] – $300,000 = $3,210,000

d. $3,240,000

@ Answer d) is incorrect. It allocates the fixed selling and administrative costs to the

product. Answer c) is correct.

Fixed cost per unit = $2,800,000 / 100,000 units = $28 per unit

Budgeted profit = [($200 – $127 – $6 – $28) × 90,000] – $300,000 = $3,210,000

Core 2 Self-Assessed Entrance Exam Solution

24 / 121

20. A manufacturer processes 100,000 kilograms of direct materials to produce two

products: Product X and Product Z.

Production (kg) at split-off

Selling price at split-off

Product X

15,000

$70

Product Z

40,000

$90

Waste

45,000

$0

The total costs incurred in the joint manufacturing process were $1,000,000.

Using the physical measures method, what are the joint costs allocated to products X

and Z (rounding to the nearest dollar)?

a. Product X: $437,500; Product Z: $562,500

@ Answer a) is incorrect. It uses unit selling price to determine the cost allocation ratios.

Answer d) is correct. It uses relative production volume to determine the ratios.

Product X: ($1,000,000 × 15 / 55) = $272,727

Product Z: ($1,000,000 × 40 / 55) = $727,273

b. Product X: $225,806; Product Z: $774,194

@ Answer b) is incorrect. It uses the relative sales value at split-off method. Answer d)

is correct. It uses relative production volume to determine the ratios.

Product X: ($1,000,000 × 15 / 55) = $272,727

Product Z: ($1,000,000 × 40 / 55) = $727,273

c. Product X: $500,000; Product Z: $500,000

@ Answer c) is incorrect. It simply allocates half the joint costs to each product. Using

the physical measure method, the products that are produced in greater quantity should

bear more costs. Answer d) is correct. It uses relative production volume to determine

the ratios.

Product X: ($1,000,000 × 15 / 55) = $272,727

Product Z: ($1,000,000 × 40 / 55) = $727,273

*d. Product X: $272,727; Product Z: $727,273

@ Answer d) is correct. It uses relative production volume to determine the ratios.

Product X: ($1,000,000 × 15 / 55) = $272,727

Product Z: ($1,000,000 × 40 / 55) = $727,273

Core 2 Self-Assessed Entrance Exam Solution

25 / 121

21. Which of the following statements about a well-designed performance measurement

system is true?

*a. It includes measures that are related to the goals of the organization.

@ Answer a) is correct. A performance measurement system should relate to the goals

of the organization, be reasonably objective, and be easily quantifiable.

b. It includes measures that primarily focus on immediate short-term concerns.

@ Answer b) is incorrect. Performance measures should be designed to balance

managers’ attention on both short- and long-term goals. Otherwise, managers may

make decisions that result in higher current-year profit, for example, at the expense of

investments that would result in even greater profits in future years. Answer a) is

correct. A performance measurement system should relate to the goals of the

organization, be reasonably objective, and be easily quantifiable.

c. It includes measures that are mostly qualitative and require judgment.

@ Answer c) is incorrect. Performance measures in a well-designed performance

measurement system should be reasonably objective and easily quantified. Answer a)

is correct. A performance measurement system should relate to the goals of the

organization, be reasonably objective, and be easily quantifiable.

d. It includes measures that are easily attainable to allow for positive morale.

@ Answer d) is incorrect. Performance measurement systems should measure

objectives that are attainable and are within control, but they should not be based on

ease of attainability. A challenging yet achievable goal should be the target for the

performance measure. Answer a) is correct. A performance measurement system

should relate to the goals of the organization, be reasonably objective, and be easily

quantifiable.

Core 2 Self-Assessed Entrance Exam Solution

26 / 121

22. ZIL Inc. operates two divisions, which are treated as investment centres. Data for

each division are as follows (in ’000s):

Division A

Division B

Net earnings

$65,000

$140,000

Total assets

$400,000

$850,000

The company’s required rate of return is 15%. The president wishes to evaluate the

performance of these divisions relative to one another and is unsure what the return on

investment or residual income would be for each division.

Based on the return on investment and residual income performance measures, which

of the following statements is true?

a. Division A performed better, because its residual income is higher than that of

Division B.

@ Answer a) is incorrect.

Division A does not have higher residual income than Division B.

Answer b) is correct.

Return on investment Division A = $65,000 / $400,000 = 16.3%

Return on investment Division B = $140,000 / $850,000 = 16.5%

Residual income Division A = $65,000 – ($400,000 × 0.15) = $5,000

Residual income Division B = $140,000 – ($850,000 × 0.15) = $12,500

Division B has a higher return on investment and residual income.

*b. Division B performed better, because its return on investment and residual income

are higher than those of Division A.

@ Answer b) is correct.

Return on investment Division A = $65,000 / $400,000 = 16.3%

Return on investment Division B = $140,000 / $850,000 = 16.5%

Residual income Division A = $65,000 – ($400,000 × 0.15) = $5,000

Residual income Division B = $140,000 – ($850,000 × 0.15) = $12,500

Division B has a higher return on investment and residual income.

c. Division A performed better, because its return on investment is higher than that of

Division B.

@ Answer c) is incorrect.

Division A does not have higher return on investment than Division B.

Answer b) is correct.

Return on Investment Division A = $65,000 / $400,000 = 16.3%

Return on Investment Division B = $140,000 / $850,000 = 16.5%

Residual Income Division A = $65,000 – ($400,000 × 0.15) = $5,000

Residual Income Division B = $140,000 – ($850,000 × 0.15) = $12,500

Division B has a higher return on investment and residual income.

Core 2 Self-Assessed Entrance Exam Solution

27 / 121

d. The divisions performed equally.

@ Answer d) is incorrect.

The divisions did not perform equally.

Answer b) is correct.

Return on investment Division A = $65,000 / $400,000 = 16.3%

Return on investment Division B = $140,000 / $850,000 = 16.5%

Residual income Division A = $65,000 – ($400,000 × 0.15) = $5,000

Residual income Division B = $140,000 – ($850,000 × 0.15) = $12,500

Division B has a higher return on investment and residual income.

Core 2 Self-Assessed Entrance Exam Solution

28 / 121

23. After an analysis of an organization’s operations, it was evident that department

performance varied and that every department worked independently to achieve

departmental objectives. The organization would like to improve overall product output,

which would require improvement from all departments.

To achieve this improvement, the organization should do which of the following?

a. Introduce cost savings as financial departmental performance measures.

@ Answer a) is incorrect. Introducing cost savings as financial departmental

performance measures addresses neither the differences between departments nor the

need for overall improvement. It may increase the gaps in departmental performance.

Answer d) is correct. Plant-wide incentive pay plans generally reward an increase in

organization-wide outcomes that directly affect the cost and/or profit picture of the

organization. Usually these plans reward increases in productivity of the organization as

measured by reduction of organizational costs, in comparison with industry

benchmarks.

b. Develop a wage structure.

@ Answer b) is incorrect. Although a wage structure creates a logical hierarchy of

wages, it does not address the overall goal of output improvement. Answer d) is correct.

Plant-wide incentive pay plans generally reward an increase in organization-wide

outcomes that directly affect the cost and/or profit picture of the organization. Usually

these plans reward increases in productivity of the organization as measured by

reduction of organizational costs, in comparison with industry benchmarks.

c. Increase the rewards offered to employees in well-performing departments.

@ Answer c) is incorrect. Increasing the reward offered to employees in well-performing

departments addresses neither the differences between departments nor the need for

overall improvement. It may increase the gaps in departmental performance. Answer d)

is correct. Plant-wide incentive pay plans generally reward an increase in organization-

wide outcomes that directly affect the cost and/or profit picture of the organization.

Usually these plans reward increases in productivity of the organization as measured by

reduction of organizational costs, in comparison with industry benchmarks.

*d. Launch a plant-wide incentive pay plan.

@ Answer d) is correct. Plant-wide incentive pay plans generally reward an increase in

organization-wide outcomes that directly affect the cost and/or profit picture of the

organization. Usually these plans reward increases in productivity of the organization as

measured by reduction of organizational costs, in comparison with industry

benchmarks.

Core 2 Self-Assessed Entrance Exam Solution

29 / 121

24. Glory Ltd. sells tires. In March, it had an opening inventory of 3,500 tires and it sold

5,000 tires. For April, budgeted sales are 5,250 tires and budgeted ending inventory is

3,000 tires. If there were 3,300 tires in inventory on March 31, how many tires should

Glory purchase in April?

*a. 4,950

@ Answer a) is correct.

April sales

5,250

April ending inventory

3,000

Total required

8,250

Less: opening inventory

3,300

Budgeted purchase

4,950

b. 8,250

@ Answer b) is incorrect. It ignores opening inventory. Answer a) is correct.

April sales

5,250

April ending inventory

3,000

Total required

8,250

Less: opening inventory

3,300

Budgeted purchase

4,950

c. 4,750

@ Answer c) is incorrect. It uses March opening inventory for April opening inventory.

Answer a) is correct.

April sales

5,250

April ending inventory

3,000

Total required

8,250

Less: opening inventory

3,300

Budgeted purchase

4,950

d. 1,950

@ Answer d) is incorrect. It omits April desired ending inventory. Answer a) is correct.

April sales

5,250

April ending inventory

3,000

Total required

8,250

Less: opening inventory

3,300

Budgeted purchase

4,950

Core 2 Self-Assessed Entrance Exam Solution

30 / 121

25. The first step in formulating next year’s master budget for a manufacturing company

is to project which of the following?

*a. Next year’s sales budget to decide next year’s sales volume

@ Answer a) is correct. The sales forecast is the usual starting point for budgeting

because production and inventory levels generally depend on the forecasted level of

sales.

b. Next year’s cash budget to decide if the company needs to take out a bank loan

@ Answer b) is incorrect. Cash budgets are prepared as part of the overall financial

plan. The cash budget forecasts cash receipts and disbursements for sales, product

costs, general and administrative costs, capital assets, investments, and financing.

Answer a) is correct. The sales forecast is the usual starting point for budgeting

because production and inventory levels generally depend on the forecasted level of

sales.

c. Next year’s materials and labour budget to decide on next year’s direct material costs

and direct labour costs

@ Answer c) is incorrect. The sales budget must be determined before the production

budget can be prepared. The production budget includes the direct materials, direct

labour, and overhead budgets. Answer a) is correct. The sales forecast is the usual

starting point for budgeting because production and inventory levels generally depend

on the forecasted level of sales.

d. Next year’s production budget to decide on next year’s production schedule

@ Answer d) is incorrect. The sales budget must be determined before the production

budget can be prepared. Answer a) is correct. The sales forecast is the usual starting

point for budgeting because production and inventory levels generally depend on the

forecasted level of sales.

Core 2 Self-Assessed Entrance Exam Solution

31 / 121

26. Deatter Co. is a manufacturer of office furniture. It sells two products: X and Y. Cost

information is listed below:

Product

X

Product

Y

Selling price

$490

$560

Variable costs

280

420

Contribution

$210

$140

Machine hours to produce one unit

0.8

0.4

Maximum unit sales per month

525

700

The company presently operates the machine for a single eight-hour shift for 23 working

days each month. Management is thinking about operating the machine for two shifts,

which will increase the machine’s availability by another eight hours per day for 23 days

per month. This change would require additional fixed costs of $5,000 per month.

If the company decides to set up the new shift, what is the objective formula for the

month?

a. 262.5X + 350Y – 5,000 = profit

@ Answer a) is incorrect. The profit maximization formula does not factor in constraints,

such as machine hours per unit. The above formula highlights the hourly CM per

product. Machine hours to produce a unit would be used to assist in concluding on

which unit is more profitable, and would be produced first.

Answer c) is correct. The objective formula focuses on profit maximization. The

constraints are not part of this equation, as it is strictly focused on CM per unit, per

product, less monthly fixed costs.

b. 0.8X + 0.4Y ≤ 8 hours

@ Answer b) is incorrect. The above formula is a daily constraint on hours, and while

this is valuable information, this is not the objective of the analysis. The objective is

commonly profit maximization.

Answer c) is correct. The objective formula focuses on profit maximization. The

constraints are not part of this equation, as it is strictly focused on CM per unit, per

product, less monthly fixed costs.

*c. 210X + 140Y – 5,000 = profit

@ Answer c) is correct. The objective formula focuses on profit maximization. The

constraints are not part of this equation, as it is strictly focused on CM per unit, per

product, less monthly fixed costs.

Core 2 Self-Assessed Entrance Exam Solution

32 / 121

d. 0.8X + 0.4Y ≤ 368 hours

@ Answer d) is incorrect. The above formula is a monthly constraint on hours, and while

this is valuable information, this is not the objective of the analysis. The objective is

commonly profit maximization.

Answer c) is correct. The objective formula focuses on profit maximization. The

constraints are not part of this equation, as it is strictly focused on CM per unit, per

product, less monthly fixed costs.

Core 2 Self-Assessed Entrance Exam Solution

33 / 121

27. The production budget and the total number of units to be produced are as follows:

Q1

Q2

Q3

Q4

Units of production

63,600

54,400

40,600

48,400

The time required to produce one unit is 36 minutes. The direct labour cost per hour is

$11.25. What is the total annual direct labour cost?

a. $838,350

@ Answer a) is incorrect. It multiplies the units to be produced by 0.36 and $11.25 =

(207,000 × 0.36 × $11.25 = $838,350). Answer d) is correct.

Q1

Q2

Q3

Q4

Annual

Units to be produced (see

production budget)

63,600

54,400

40,600

48,400

207,000

Direct labour hours required

per unit

× 0.6

× 0.6

× 0.6

× 0.6

× 0 .6

Total labour hours required

38,160

32,640

24,360

29,040

124,200

Direct labour cost per hour

× 11.25

× 11.25

× 11.25

× 11.25

× 11.25

Total direct labour cost

$429,300

$367,200

$274,050

$326,700

$1,397,250

b. $2,328,750

@ Answer b) is incorrect. It multiplies the units to be produced by only the direct labour

cost per hour = (207,000 × $11.25 = $2,328,750). Answer d) is correct.

Q1

Q2

Q3

Q4

Annual

Units to be produced (see

production budget)

63,600

54,400

40,600

48,400

207,000

Direct labour hours required

per unit

× 0.6

× 0.6

× 0.6

× 0.6

× 0 .6

Total labour hours required

38,160

32,640

24,360

29,040

124,200

Direct labour cost per hour

× 11.25

× 11.25

× 11.25

× 11.25

× 11.25

Total direct labour cost

$429,300

$367,200

$274,050

$326,700

$1,397,250

Core 2 Self-Assessed Entrance Exam Solution

34 / 121

c. $326,700

@ Answer c) is incorrect. It only considers Q4 production. (48,400 × 0.6 × $11.25 =

$326,700). Answer d) is correct.

Q1

Q2

Q3

Q4

Annual

Units to be produced (see

production budget)

63,600

54,400

40,600

48,400

207,000

Direct labour hours required

per unit

× 0.6

× 0.6

× 0.6

× 0.6

× 0 .6

Total labour hours required

38,160

32,640

24,360

29,040

124,200

Direct labour cost per hour

× 11.25

× 11.25

× 11.25

× 11.25

× 11.25

Total direct labour cost

$429,300

$367,200

$274,050

$326,700

$1,397,250

*d. $1,397,250

@ Answer d) is correct.

Q1

Q2

Q3

Q4

Annual

Units to be produced (see

production budget)

63,600

54,400

40,600

48,400

207,000

Direct labour hours required

per unit

× 0.6

× 0.6

× 0.6

× 0.6

× 0 .6

Total labour hours required

38,160

32,640

24,360

29,040

124,200

Direct labour cost per hour

× 11.25

× 11.25

× 11.25

× 11.25

× 11.25

Total direct labour cost

$429,300

$367,200

$274,050

$326,700

$1,397,250

Core 2 Self-Assessed Entrance Exam Solution

35 / 121

28. Growit, a seed packing and distribution company, has just completed its first year of

operations and has started to compile its three-year operational budget. Growit is using

regression analysis in its business planning and has come up with four scenarios.

Which of the following represents the strongest relationship between the two variables,

based on the regression analysis summary output?

a. Biweekly maintenance costs and machine hours

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.805645917

R Square

0.649065343

Adjusted R Square

0.634443066

Standard Error

16960.32863

Observations

26

ANOVA

df

SS

MS

F

Significance F

Regression

1

12768560221

12768560221

44.38879984

6.84301E-.07

Residual

24

6903665933

287652747.2

Total

25

19672226154

Coefficients

Standard Error

t Stat

P-value

Lower 95%

Upper 95%

Lower 95.0%

Upper 95.0%

Intercept

439285.256

28757.1465

15.27569003

7.30E-14

379933.4227

498637.0893

379933.4227

498637.0893

Machine Hours

–1.817453317

0.272788817

–6.662492015

6.84301E-07

–2.380461765

–1.254444869

–2.380461765

–1.254444869

@ Answer a) is incorrect. While the r

2

is a reasonably high figure with 65% of the points

falling close to the linear line, the standard error is extremely high. The P-value for the t

stat is < 0.05, and therefore significant. However, the upper and lower 95% values are

negative, which suggests that as machine hours increase, the biweekly maintenance

decreases. Answer c) is correct. The r

2

shows a clear relationship between the two

variables with 84% of the points falling close to the linear line, but the standard error is

high, which is a cause for concern. The P-value for the number of units t stat is < 0.05,

suggesting a significant cause-and-effect relationship, and the upper and lower 95%

values are both positive. While this data set is the strongest provided, with a sample

size of 12, the results could be misleading, so it is recommended that Growit expand its

data set as the company obtains more information.

b. Monthly labour hours and overhead costs

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.855690647

R Square

0.732206484

Adjusted R Square

0.705427132

Standard Error

13029.68785

Observations

12

ANOVA

df

SS

MS

F

Significance F

Regression

1

4641961513

4641961513

27.34220358

0.000384861

Residual

10

1697727654

169772765.4

Total

11

6339689167

Core 2 Self-Assessed Entrance Exam Solution

36 / 121

Coefficients

Standard Error

t Stat

P-value

Lower 95%

Upper 95%

Lower 95.0%

Upper 95.0%

Intercept

31886.02682

9098.883615

3.504388908

0.005684675

11612.45072

52159.60291

11612.45072

52159.60291

Labour-hours

9.452139604

1.807645944

5.228977297

0.000384861

5.424453445

13.47982576

5.424453445

13.47982576

@ Answer b) is incorrect. While the r

2

is a reasonably high figure with 73% of the points

falling close to the linear line, the standard error is extremely high. The P-value for the

labour hours t stat is < 0.05, and the upper and lower 95% values are both positive,

suggesting that as labour hours increase, so do overhead costs. The small sample size

of 12 leads to a large standard error, suggesting that the results could be misleading.

Thus, while there is a trend, it would be better to expand the data set before relying on

this information. Answer c) is correct. The r

2

shows a clear relationship between the two

variables with 84% of the points falling close to the linear line, but the standard error is

high, which is a cause for concern. The P-value for the number of units t stat is < 0.05,

suggesting a significant cause-and-effect relationship, and the upper and lower 95%

values are both positive. While this data set is the strongest provided, with a sample

size of 12, the results could be misleading, so it is recommended that Growit expand its

data set as the company obtains more information.

*c. Monthly number of units produced and distribution costs

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.917265618

R Square

0.841376214

Adjusted R Square

0.825513835

Standard Error

4912.063706

Observations

12

ANOVA

df

SS

MS

F

Significance F

Regression

1

1279822968

1279822968

53.0422476

2.65359E-05

Residual

10

241283698.6

24128369.86

Total

11

1521106667

Coefficients

Standard Error

t Stat

P-value

Lower 95%

Upper 95%

Lower 95.0%

Upper 95.0%

Intercept

5187.720758

4043.535292

1.282966608

0.228440481

–3821.837324

14197.27884

–3821.837324

14197.27884

Number of Units

0.532926491

0.073173925

7.283010888

2.65359E-05

0.369884826

0.695968156

0.369884826

0.695968156

@ Answer c) is correct. The r

2

shows a clear relationship between the two variables

with 84% of the points falling close to the linear line, but the standard error is high,

which is a cause for concern. The P-value for the number of units t stat is < 0.05,

suggesting a significant cause-and-effect relationship, and the upper and lower 95%

values are both positive. While this data set is the strongest provided, with a sample

size of 12, the results could be misleading, so it is recommended that Growit expand its

data set as the company obtains more information.

Core 2 Self-Assessed Entrance Exam Solution

37 / 121

d. Monthly number of shipments and logistics costs

SUMMARY OUTPUT

Regression Statistics

Multiple R

0.741157322

R Square

0.549314175

Adjusted R Square

0.504245593

Standard Error

8279.741616

Observations

12

ANOVA

df

SS

MS

F

Significance F

Regression

1

835565454.4

835565454.4

12.18840588

0.005811441

Residual

10

685541212.3

68554121.23

Total

11

1521106667

Coefficients

Standard Error

t Stat

P-value

Lower 95%

Upper 95%

Lower 95.0%

Upper 95.0%

Intercept

9073.11579

7195.257176

1.260985614

0.235938523

–6958.916275

25105.14785

–6958.916275

25105.14785

Number of Shipments

88.71220297

25.41030688

3.491189752

0.005811441

32.09451097

145.329895

32.09451097

145.329895

@ Answer d) is incorrect. While the r

2

shows some relationship between the inputs, as

53% of the points are close to the linear line, the standard error is high. The P-value for

the number of shipments t stat is < 0.05. The upper and lower 95% values are both

positive, but represent a very wide spread due to the small sample size and large

standard error. With a sample size of 12, the results could be misleading, so while there

is a trend, it would be better to expand the data set before relying on this information.

Answer c) is correct. The r

2

shows a clear relationship between the two variables with

84% of the points falling close to the linear line, but the standard error is high, which is a

cause for concern. The P-value for the number of units t stat is < 0.05, suggesting a

significant cause-and-effect relationship, and the upper and lower 95% values are both

positive. While this data set is the strongest provided, with a sample size of 12, the

results could be misleading, so it is recommended that Growit expand its data set as the

company obtains more information.

Core 2 Self-Assessed Entrance Exam Solution

38 / 121

29. Which of the following statements about transfer pricing is true?

a. Division managers favour cost-based transfer pricing because it typically yields an

equitable share of profits.

@ Answer a) is incorrect. Cost-based pricing may not lead to the most equitable share

of profits because there is little motivation to improve production efficiency. This is

because costs are transferred to the buyer with a set markup so their margin is

guaranteed. Answer c) is correct. A negotiated transfer price allows division managers

to come to an agreeable price as if they were unrelated parties, thereby promoting

autonomy among subunit managers. However, negotiation can be time-consuming, as

in any business dealings with unrelated parties.

b. A cost-based transfer price typically leads to optimal decisions by both the internal

seller and the internal buyer.

@ Answer b) is incorrect. A cost-based transfer price often encourages suboptimal

decisions by either the internal seller or the internal buyer. This is because when the

selling division has excess capacity, the company should purchase internally at cost

plus markup, even if it can purchase the product for less than that from an external

company, as it still benefits the company as a whole. It should be noted that if the

company can buy it cheaper than cost externally, it should temporarily cease production

and purchase it externally. Answer c) is correct. A negotiated transfer price allows

division managers to come to an agreeable price as if they were unrelated parties,

thereby promoting autonomy among subunit managers. However, negotiation can be

time-consuming, as in any business dealings with unrelated parties.

*c. A negotiated transfer price promotes autonomy among division managers, but it can

be time-consuming.

@ Answer c) is correct. A negotiated transfer price allows division managers to come to

an agreeable price as if they were unrelated parties, thereby promoting autonomy

among subunit managers. However, negotiation can be time-consuming, as in any

business dealings with unrelated parties.

d. Use of market-based transfer pricing motivates managers to deal with customers and

suppliers in the external market.

@ Answer d) is incorrect. The use of market-based transfer pricing motivates managers

to deal internally because they are no worse off than when dealing with external

suppliers or customers. Answer c) is correct. A negotiated transfer price allows division

managers to come to an agreeable price as if they were unrelated parties, thereby

promoting autonomy among subunit managers. However, negotiation can be time-

consuming, as in any business dealings with unrelated parties.

Core 2 Self-Assessed Entrance Exam Solution

39 / 121

30. Bartok Motors Inc. operates as a decentralized multidivisional company. The

Cantata Division purchases most of its motors from the Concerto Division.

The Concerto Division:

• has variable costs of $620 per motor

• has sufficient excess capacity to satisfy the Cantata Division’s motor requirements

• can sell motors to external customers for $890

Which of the following statements BEST describes acceptable transfer pricing at Bartok

Motors Inc.?

a. The minimum transfer price the Concerto Division is willing to accept on sales to the

Cantata Division is $620.

@ Answer a) is incorrect. It is not the only true statement. Answer a) is true because the

Concerto Division is not operating at capacity so there is no opportunity cost. Answer c)

is true because the Cantata Division can purchase the motors for $890 in the market,

and so this is the maximum transfer price the Cantata Division is willing to pay.

Therefore, because answers a) and c) are both true statements, answer d) is the correct

option.

b. The minimum transfer price the Concerto Division is willing to accept on sales to the

Cantata Division is $890.

@ Answer b) is incorrect. Because the Concerto Division has excess capacity, there is

no opportunity cost for transferring the motors to the Cantata Division up to full capacity.

Therefore, the Concerto Division would be willing to accept less than $890. The

minimum transfer price acceptable to them is the incremental costs for manufacturing

the motors, or $620 per motor. Answers a) and c) above are both true statements. And

because the Cantata Division can purchase the motors for $890 in the market, this is

the maximum transfer price the Cantata Division is willing to pay. Therefore, because

answers a) and c) are both true statements, answer d) is the correct option.

c. The maximum transfer price the Cantata Division is willing to pay on purchases from

the Concerto Division is $890.

@ Answer c) is incorrect. It is not the only true statement. Answer a) is true because the

Concerto Division has excess capacity, and so there is no opportunity cost for

transferring the motors to the Cantata Division up to full capacity. Thus, the minimum

transfer price acceptable to the Concerto Division is the incremental costs for

manufacturing the motors, or $620 per motor. Answer c) is true because the Cantata

Division would be willing to pay as much as market value, $890, for the motor.

Therefore, because answers a) and c) are both true statements, answer d) is the correct

option.

Core 2 Self-Assessed Entrance Exam Solution

40 / 121

*d. Both a) and c) above.

@ Answer d) is correct. Answers a) and c) are both true statements. Because the

Concerto Division has excess capacity, there is no opportunity cost for transferring the

motors to the Cantata Division up to full capacity. Thus, the minimum transfer price

acceptable to the Concerto Division is the incremental costs for manufacturing the

motors, or $620 per motor. The Cantata Division can purchase the motors for $890 in

the market, so this is the maximum transfer price the Cantata Division is willing to pay.

Core 2 Self-Assessed Entrance Exam Solution

41 / 121

31. The customer service department of Conglomerate Co. provides services for

several other divisions and to external customers. One of the internal customers is

Online and Catalogue Sales (OCS). The OCS division recently received an offer from

an external customer service company to provide services at a price of $5.00 per

customer service call.

The internal customer service department currently sells services to external customers

for $5.50 per call and has excess capacity. All of the customer service department costs

are fixed, and the allocated costs per call are as follows:

Labour cost

$2.00

Computer, telephone, and other office overhead

1.00

Total cost per call

$3.00

Which of the following transfer prices would most likely lead to a suboptimal decision by

the customer service department and/or the OCS division?

*a. Market-based price of $5.50 per call

@ Answer a) is correct. It would be in the best interests of the company as a whole to

use internal services because the customer service department has excess capacity

and the internal incremental cost per call is $0.00. However, the OCS division has

received an offer from an external company for $5.00 per call, so it might be unwilling to

purchase the customer services internally at $5.50 per call.

b. Cost-based price of $3.00 per call

@ Answer b) is incorrect. The OCS division would be willing to pay the full absorption

cost of $3.00 per call, which is less than the price from the external vendor. Answer a) is