Instructions for Completing Form 1040X To Get an Economic

Stimulus Payment

If you have already filed your 2007 tax return but do not expect to receive an

economic stimulus payment (because, for example, your earned income was

less than $3,000 and you had no tax liability), you still may be eligible to receive

a stimulus payment. To be eligible, you must have received a total of $3,000 or

more in qualifying income. Qualifying income is your earned income plus:

• Social security benefits (including social security disability payments),

• Tier 1 railroad retirement benefits,

• Veterans disability and death benefits, and

• Nontaxable combat pay.

To receive a payment, you must amend your 2007 return on Form 1040X,

Amended U.S. Individual Income Tax Return, to report any of the qualifying

income listed above that was not reported on your original return.

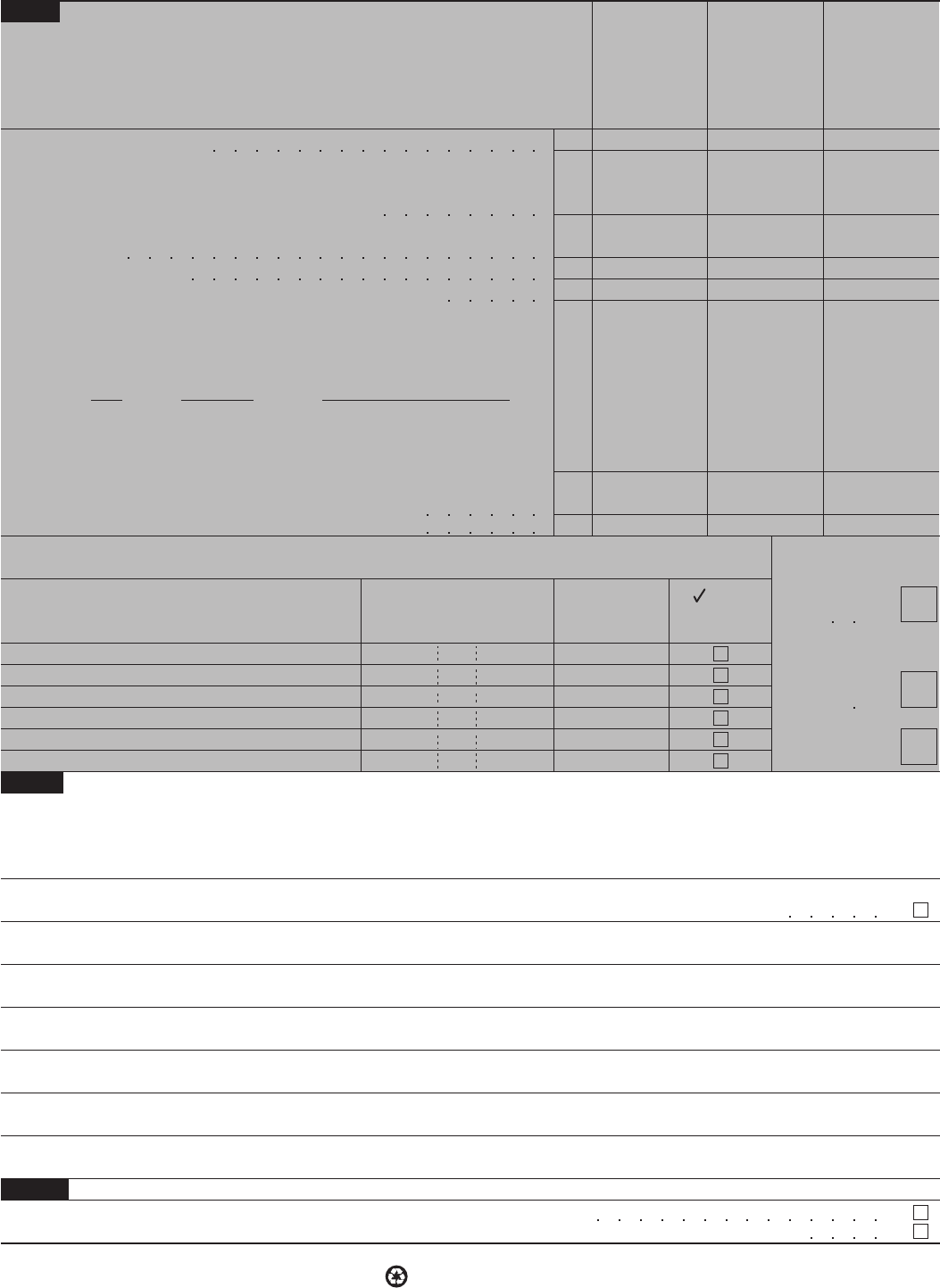

Complete only the lines (or sections) shown on the sample Form 1040X below.

Specific instructions for filling out your Form 1040X follow.

Top of form. Across the top of the form write “Stimulus Payment.”

Identifying information. Fill in your name, address, phone number, and social

security number in the spaces provided. Also fill in your spouse’s name and

social security number if you are married filing a joint return.

Complete line A if it applies to you. If you check the “Yes” box or fail to check

either box, we will change your address in our system to that shown on this Form

1040X. Any refund or correspondence will be sent to the new address. If you

check the “No” box, we will retain the address currently in our system and any

refund or correspondence will be sent to that address.

Part II, Explanation of Changes. Enter the type of qualifying income (see

above) you are reporting and the total amount. See the sample Form 1040X.

Signature. Form 1040X is not considered a valid return unless you sign it. If

you are filing a joint return, your spouse must also sign. Also, be sure to enter

the date.

Additional changes on Form 1040X. You can include additional changes to your

originally filed return on the “Stimulus Payment” Form 1040X. However, the only

information that will be used to figure your stimulus payment amount is the information

on your original return and the qualifying income you reported on this Form 1040X.

Reduced economic stimulus payment. If your original return qualified you for any

stimulus payment, filing a Form 1040X will not qualify you for an increased payment or

an additional payment. For example, you received a stimulus payment of $100 based on

your original 2007 return. You cannot amend that return to include additional qualifying

income and increase the amount of your stimulus payment. However, you may be able

to claim a credit on your 2008 return for the difference between the reduced stimulus

payment you received and the maximum stimulus payment to which you are entitled.

When to file. File Form 1040X after April 14, 2008. Once submitted, allow 8–12 weeks

processing time before making any inquiries regarding your economic stimulus payment.

Where to file. Mail your Form 1040X to the address shown below that applies to

you.

IF you live in… THEN use this address…

Alabama, Delaware, Florida, Georgia,

North Carolina, Rhode Island, South

Carolina, Virginia

Department of the Treasury

Internal Revenue Service Center

Atlanta, GA 39901

District of Columbia, Maine, Maryland,

Massachusetts, New Hampshire, New

York, Vermont

Department of the Treasury

Internal Revenue Service Center

Andover, MA 05501-0422

Arkansas, Connecticut, Illinois, Indiana,

Michigan, Missouri, New Jersey, Ohio,

Pennsylvania, West Virginia

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999

Alaska, Arizona, California, Colorado,

Hawaii, Idaho, Iowa, Kansas, Minnesota,

Montana, Nebraska, Nevada, New Mexico,

North Dakota, Oklahoma, Oregon, South

Dakota, Utah, Washington, Wisconsin,

Wyoming

Department of the Treasury

Internal Revenue Service Center

Fresno, CA 93888-0422

Kentucky, Louisiana, Mississippi,

Tennessee, Texas, APO, FPO

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301

A foreign country, or any other location not

previously listed

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215 USA

EXAM

PLE ONLY

DO NOT FILE

5

3

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

TLS, have you

transmitted all R

text files for this

cycle update?

Date

Action

Revised proofs

requested

Date Signature

O.K. to print

INSTRUCTIONS TO PRINTERS

FORM 1040X, PAGE 1 of 2

MARGINS: TOP 13 mm (

1

⁄2 "), CENTER SIDES. PRINTS: HEAD to HEAD

PAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 203 mm (8") 279 mm (11")

PERFORATE: NONE

Department of the Treasury—Internal Revenue Service

OMB No. 1545-0074

Amended U.S. Individual Income Tax Return

Form

(Rev. November 2007)

See separate instructions.

This return is for calendar year

, or fiscal year ended

,.

Your social security numberLast nameYour first name and initial

Last nameIf a joint return, spouse’s first name and initial Spouse’s social security number

Apt. no.

Home address (no. and street) or P.O. box if mail is not delivered to your home

Phone number

()

Please print or type

City, town or post office, state, and ZIP code. If you have a foreign address, see page 3 of the instructions.

A

B

Filing status. Be sure to complete this line. Note. You cannot change from joint to separate returns after the due date.

Qualifying widow(er)Head of householdMarried filing separatelyMarried filing jointlySingleOn original return

Qualifying widow(er)Head of household*Married filing separatelyMarried filing jointlySingleOn this return

B. Net change—

amount of increase

or (decrease)—

explain in Part II

A. Original amount or

as previously adjusted

(see page 3)

Income and Deductions (see instructions)

C. Correct

amount

1

1

Adjusted gross income (see page 3)

2

2

Itemized deductions or standard deduction (see page 4)

3

3

Subtract line 2 from line 1

4

Exemptions. If changing, fill in Parts I and II on the back

(see page 4)

4

Taxable income. Subtract line 4 from line 3

5

6

6

Tax (see page 5). Method used in col. C

7

7

Credits (see page 5)

8

8

Subtract line 7 from line 6. Enter the result but not less than zero

9

Other taxes (see page 5)

9

Tax Liability

Total tax. Add lines 8 and 9

10

10

11

11

Federal income tax withheld and excess social security and

tier 1 RRTA tax withheld. If changing, see page 5

12

12 Estimated tax payments, including amount applied from prior

year’s return

13

13 Earned income credit (EIC)

15

Credits: Federal telephone excise tax or from Forms 2439,

4136, 8885, or 8801 (if refundable)

15

16

Amount paid with request for extension of time to file (see page 5)

16

Payments

17

Amount of tax paid with original return plus additional tax paid after it was filed

17

18

18

Total payments. Add lines 11 through 17 in column C

Refund or Amount You Owe

19

19

Overpayment, if any, as shown on original return or as previously adjusted by the IRS

20

20

Subtract line 19 from line 18 (see page 6)

21

21

Amount you owe. If line 10, column C, is more than line 20, enter the difference and see page 6

22

22

Under penalties of perjury, I declare that I have filed an original return and that I have examined this amended return, including accompanying schedules

and statements, and to the best of my knowledge and belief, this amended return is true, correct, and complete. Declaration of preparer (other than

taxpayer) is based on all information of which the preparer has any knowledge.

Sign

Here

Your signature Date

Spouse’s signature. If a joint return, both must sign.

Date

Preparer’s SSN or PTINDate

Preparer’s

signature

Check if

self-employed

Paid

Preparer’s

Use Only

Firm’s name (or

yours if self-employed),

address, and ZIP code

EIN

Phone no. ( )

Cat. No. 11360L

Joint return?

See page 2.

Keep a copy for

your records.

Form 1040X (Rev. 11-2007)

Use Part II on the back to explain any changes

23

23

Amount of line 22 you want refunded to you

24

Amount of line 22 you want applied to your estimated tax

24

If the address shown above is different from that shown on your last return filed with the IRS, would you like us to change it

in our records?

If line 10, column C, is less than line 20, enter the difference

* If the qualifying person is a child but not your dependent, see page 3 of the instructions.

14

Additional child tax credit from Form 8812

14

1040X

For Paperwork Reduction Act Notice, see page 7 of instructions.

NoYes

John E.

Susan R.

1040 Main Street

Hometown, TX 77099

Michaels

Michaels

011 00 2222

011 00 1111

222 111-7777

✔

Write the words “Stimulus

Payment” across the top

“Stimulus Payment”

EXAM

PLE ONLY

DO NOT FILE

$3,400

3,300

3,200

3,100

3

I.R.S. SPECIFICATIONS

TO BE REMOVED BEFORE PRINTING

DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT

INSTRUCTIONS TO PRINTERS

FORM 1040X, PAGE 2 of 2

MARGINS: TOP 13 mm (

1

⁄2 "), CENTER SIDES. PRINTS: HEAD TO HEAD

PAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 203 mm (8") 279 mm (11")

PERFORATE: NONE

Page 2Form 1040X (Rev. 11-2007)

Exemptions. See Form 1040 or 1040A instructions.

A. Original

number of

exemptions

reported or as

previously

adjusted

Complete this part only if you are:

C. Correct

number of

exemptions

B. Net change

25

25

Yourself and spouse

Caution. If someone can claim you as a dependent, you cannot claim an

exemption for yourself.

26

26

Your dependent children who lived with you

Your dependent children who did not live with you due to divorce or

separation

27

27

28

28

Other dependents

29

Total number of exemptions. Add lines 25 through 28

29

30

31

No. of children

on 33 who:

33 Dependents (children and other) not claimed on original (or adjusted) return:

(b) Dependent’s social

security number

(c) Dependent’s

relationship to you

(a)

● did not live

with you due to

divorce or

separation (see

page 6)

Dependents

on 33 not

entered above

Explanation of Changes

Enter the line number from the front of the form for each item you are changing and give the reason for each

change. Attach only the supporting forms and schedules for the items changed. If you do not attach the required

information, your Form 1040X may be returned. Be sure to include your name and social security number on any

attachments.

If the change relates to a net operating loss carryback or a general business credit carryback, attach the schedule or form

that shows the year in which the loss or credit occurred. See page 2 of the instructions. Also, check here

Presidential Election Campaign Fund. Checking below will not increase your tax or reduce your refund.

If you did not previously want $3 to go to the fund but now want to, check here

If a joint return and your spouse did not previously want $3 to go to the fund but now wants to, check here

Part III

Part I

Part II

Multiply the number of exemptions claimed on line 29 by the amount listed

below for the tax year you are amending. Enter the result here.

Tax

year

Exemption

amount

But see the instructions for

line 4 on page 4 if the

amount on line 1 is over:

Printed on recycled paper

Last nameFirst name

● lived with

you

2007

2006

2005

2004

$117,300

112,875

109,475

107,025

(d) if qualifying

child for child tax

credit (see page 6)

Form 1040X (Rev. 11-2007)

● Increasing or decreasing the number of exemptions claimed on line 6d

of the return you are amending, or

● Increasing or decreasing the exemption amount for housing individuals

displaced by Hurricane Katrina.

31

If you are claiming an exemption amount for housing individuals displaced by

Hurricane Katrina, enter the amount from Form 8914, line 2 for 2005 or line 6

for 2006 (see instructions for line 4). Otherwise enter -0-

32

Add lines 30 and 31. Enter the result here and on line 4

32

30

Veterans disability benefit $15,500