2020 STIMULUS FACT SHEET

1- ELIGIBILITY: Who is eligible to receive a stimulus payment?

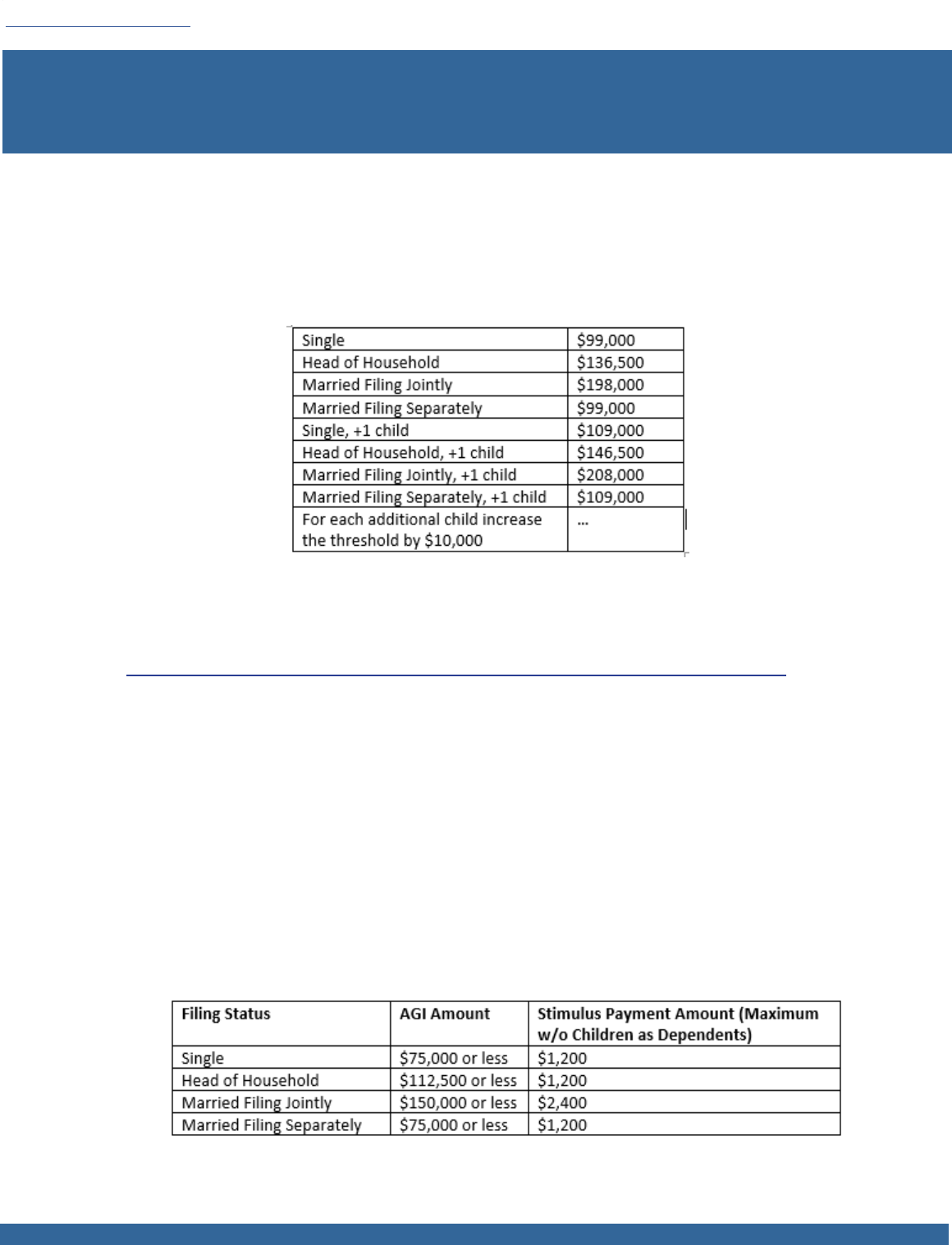

Individuals who have led a tax return for 2018 or 2019 or received Social Security benets or railroad retiree

benets in 2018 or 2019 will be eligible to receive a stimulus payment unless their federal adjusted gross income

exceeds the amounts shown below:

CALIFORNIA

The IRS will look at the 2019 tax return rst. If you have not led a 2019 return, the IRS will use your 2018 Adjusted

Gross Income to determine eligibility and the amount of the payment. For those who have not led their 2018 or

2019 tax return, the IRS recommends ling back taxes for 2018.

https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

Social Security beneciaries who do not le tax returns do not need to le now to receive a stimulus payment. The

CARES Act authorizes the IRS to obtain the necessary information from your Social Security Benet Statement or

the Social Security Equivalent Benet Statement.

2- PAYMENT AMOUNT: What is the amount of the stimulus payment?

The amount of the stimulus payment is determined based on your Adjusted Gross Income. People with amounts

shown below or less will receive the maximum stimulus payment. For incomes above these amounts, the stimulus

payment amount will be reduced starting at the thresholds shown below and will not be paid at all if your income is

above the eligibility thresholds shown in Table 1 above.

TABLE 1.

TABLE 2.

3- ADDITIONAL $500 for EACH DEPENDENT: Do I get extra money for my dependent children?

You will receive $500 for each qualifying dependent under age 17. The CARES Act uses Child Tax Credit eligibility

standards, so all children who are under age 17 who have not provided for more than half of their own expenses and

have lived with the taxpayer for more than six months are eligible. Adult dependents do not qualify for this payment.

College students aged 17 and older and elderly dependents will not qualify for their own stimulus payment, because

anyone who is claimed as a dependent on another person’s tax return will not be able to claim a stimulus payment

for themselves.

4- PAYMENT AMOUNT for INCOMES ABOVE LIMITS: What happens if I make more than the limit?

The total amount of the stimulus payment, including the $500 for each child dependent, will be reduced by $50 for

each $1,000 above the thresholds shown in Table 2 until the amount reaches the limit shown in Table 1.

5- TIMING and METHOD of PAYMENTS: When will the IRS send the payments and how?

Stimulus payments began during the last half of March and are distributed automatically, with no action required for

most people. The IRS will directly deposit the payment into the same banking account reected on the tax return

led or used for Social Security benets payments. Also, the Treasury is developing an online portal you can use to

get your banking information to the IRS, so that you can receive payments immediately as opposed to checks in the

mail. You must provide Social Security numbers in your tax returns for both yourself and your dependents to be able

to receive the full amount of the stimulus payment you are eligible for.

https://www.irs.gov/coronavirus/non-lers-enter-payment-info-here

6- REFUNDABLE TAX CREDIT: Will the stimulus payment be considered taxable income?

No. The stimulus payments are treated like an advance tax credit. Therefore, recipients won’t have to pay tax on the

amount they receive.

The IRS will use 2019 tax returns (2018 if the taxpayer has not led in 2019) to determine the credit amount and

reconcile the credit amount based on 2020 income. This means that if your adjusted gross income in 2020 ends up

being less than it was in the year used by the IRS to determine the amount of the stimulus payment, the taxpayer

will receive the additional credit in 2020. However, overpayments due to a higher income in 2020 will not be required

to be paid back.

7- CHILD SUPPORT: Will the stimulus payments be intercepted to pay past due child support?

Yes. The CARES Act does not allow states to avoid intercepting stimulus checks for past due child support.

8- JOINT RETURN: What happens if my spouse owes child support and we le a joint tax return?

If you are married ling jointly and you led an injured spouse claim with your 2019 tax return (or 2018 tax return

if you haven’t led your 2019 tax return), half of the total stimulus payment will be sent to you and only the half for

your spouse will be intercepted for past-due child support.

On April 22, the IRS announced a processing error in some cases with an injured spouse claim, with the result being

both halves of the stimulus check being intercepted. The IRS is working to x the problem, and has updated the

FAQs on their website (Question 26). If the incorrect intercept happened to you and your spouse, the injured spouse

will receive the unpaid half of the total payment when the IRS resolves the problem.