THIS DOCUMENT AND ANY ACCOMPANYING DOCUMENTS ARE IMPORTANT AND REQUIRE

YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take or

the contents of this document, you are recommended to seek your own independent

financial advice immediately from your stockbroker, bank, solicitor, accountant, or oth er

appropriate independent financial adviser, who is authorised under the Financial Services

and Markets Act 2000 (as amended) (“FSMA”) if you are in the United Kingdom, or from

another appropriately authorised independent financial adv iser if you are in a territory

outside the United Kingdom.

This document comprises a prosp ectus (the “Prospectus”) relating to JPMorgan Global

Growth & Income plc (the “Company”) in connection with the issue of Shares in the

Company pursuant to a scheme of reconstruction (“Scheme Shares”) of The Scottish

Investment Trust PLC (“SCIN”) under section 110 of the Insolvency Act 1986 (the

“Scheme”), prepared in accordance with the UK version of the EU Prospectus Regulation

((EU) 2017/1129) which is part of UK law by virtue of the Europ ean Union Withdrawal

Act 2018 (as amended and supplemented from time to time (including, but not limited to, by

the Prospectus (Amendment etc. ) (EU Exit) Regulations 2019/1234 and The Financial

Services and Markets Act 2000 (Prospectus) Regulations 2019)) (the “UK Prospectus

Regulation”) and the prospectus regulation rules of the Financial Conduct Authority (the

“FCA”) made pursuant to section 73A of FSMA (the “Prospectus Regulation Rules”). This

Prospectus has been approved by the FCA, as the competent authority under the UK

Prospectus Regulation. The FCA only approves this Prospectus as meeting the standards of

completeness, comprehensibility and consistency imposed by the UK Prospectus

Regulation. Such approval should not be considered as an endorsement of the Company

and of the quality of the Shares that are the subject of this Prospectus. Investors should

make their own assessment as to the suitability of investing in the Shar es.

Applications will be made for the Scheme Shares to be admitted to listing on the premium listing

category of the Official List and to trading on the Main Market, respectively. It is not intended that

any class of shares in the Company be admitted to listing or trading in any other jurisdiction. It is

expected that Admission will become effective and that dealings for normal settlemen t in the

Scheme Shares will commence at 8 a.m. on 1 September 2022.

JPMORGAN GLOBAL GROWTH & INCOME PLC

(a closed-ended investment company incorporated with limited liability under the laws of England and Wales

with company number 00024299)

Issue of Scheme Shares pursuant to a scheme of reconstruction of

The Scottish Investment Trust PLC under section 110

of the Insolvency Act 1986

Sponsor

Winterflood Securities Limited

The Company and each of the Direct ors and the prospective Directors whose names appear on

page 33 of this Prosp ectus accept responsibility for the information contained in this Prospectus. To

the best of the knowledge of the Company, the Directors and the prospective Directors, the

information contained in th is Prospectus is in accordance with the facts and this Prospectus makes

no omission likely to affect its import.

JPMorgan Funds Limited (the “Manager”) accepts responsibility for the information and opinions

contained in this Prospectus relating to it and all statements made by it. To the best of the

knowledge of the Manager, the information contained in this Prospectus related to or attributed to

the Manager and its Affiliates are in accordance with the facts and such parts of this Prospectus

make no omis sion likely to affect their import.

JPMorgan Asset Management (UK) Limited (the “Investment Manager” ) accepts responsibility for

the information and opinions contained in: (a) the risk factors contained under the following

headings: “ Risks relating to the Investment Policy” and “Risks relating to the Manager and the

Investment Manager”; (b) paragraph 3 (Investment Objective and Investment Policy), paragraph 5

(Benchmark), paragraph 7 (Dividend Policy) and paragraph 10 (Net Asset Value Calculation and

Publication)ofPartI(Information on the Company) of this Prospectus; (c) Part II (Market Outlook

and Investment Strategy) of this Prospectus; (d) Part III (Directors, Management and Administration)

of this Prospectus and any other information or opinion related to or attributed to it or to any of its

Affiliates. To the best of the knowledge of the Investment Manager, the information and opinions

contained in the Prospectus related to or attributed to it or any Affiliate of the Investment Manager

are in accordance with the facts and do not omit anything likely to affect the import of such

information and opinions.

Winterflood Secur ities Limited (the “Sponsor”) which is authorised and regulated in the United

Kingdom by the FCA, is acting exclusively for the Compa ny and for no one else in connection with

the Issue. The Sponsor will not be responsible to anyone (whether or not a recipient of this

Prospectus) other than the Company for providing the protections afforded to clients of the Sponsor

or for providing advice in relation to the Issue, the contents of this Prospectus or any matters

referred to in this Prospectus. This does not exclude any responsibilities which the Sponsor may

have under FSMA or the regulatory regime established thereunder.

Apart from the liabilities and responsibilities (if any) which may be imposed on the Sponsor by

FSMA or the regulatory regime established thereun der, the Sponsor makes no representations,

express or implied, nor accepts any responsibility whatsoever for the contents of this Prospectus

nor for any other statement made or purported to be made by it or on its behalf in connection with

the Company, the Shares or the Issue. The Sponsor and its Affiliates, to the fullest extent permitted

by law, accordingly disclaim all and any responsibility or liability (save as referred to above),

whether arising in tort, contract or otherwise which it or they might otherwise have in respect of this

Prospectus or any such statement.

THE SCHEME SHARES ARE ONLY AVAILABLE TO ELIGIBLE SCIN SHAREHOLDERS AND

ARE NOT BEING OFFERED TO EXISTING SHAREHOLDERS (SAVE TO THE EXTENT AN

EXISTING SHAREHOLDER IS ALSO AN ELIGIBLE SCIN SHAREHOLDER) OR TO THE PUBL IC.

The Company has not been and will not be registered under the United States Investment

Company Act of 1940 (the “US Investment Company Act”), and as such investors in the Scheme

Shares will not be entitled to the benefits of the US Investment Company Act. The Scheme Shares

have not been and will not be registered under the United States Securities Act of 1933 (the “US

Securities Act ”), or with any securities regulatory authority of any state or other jurisdiction of the

United States, and may not be offered, sold, resold, pledged, delivered, assigned or otherwise

transferred, directly or indirectly, into or within the United States or to, or for the account or benefit

of, any “U.S. persons” as defined in Regulation S under the US Securities Act (“US Persons”),

except pursuant to an exemption from, or in a transaction not subject to, the registration

requirements of the US Securities Act and in compliance with any applicable securities laws of any

state or other jurisdiction of the United States and in a manner which would not result in the

Company being required to register under the US Investment Company Act. There has been and

will be no public offer of the Scheme Shares in the United States.

This document does not address the US federal income tax considerations applicable to an

investment in the Scheme Shares. Each prospective investor should consult its own tax advisers

regarding the US federal income tax co nsequences of any such investment. The Scheme Shares

are being offered or sold only (i) outside the United States in “offshore transactions” to non-US

Persons pursuant to Regulation S under the US Securities Act, and (ii) to persons who are both

“qualified purchasers” as defined in the US Investment Company Act (“Qualified Purchasers”) and

“accredited investors” as defined in Regulation D under the US Securities Act (“Accredited

Investors”), pursuant to an exemption from the registration requirements of the US Securities Act,

and who, in the case of (ii), have executed an AI/QP Investor Letter in the form annexed to this

Prospectus (“AI/QP Investor Letter”) and returned it to the Company and Computershare as

registrar to SCIN.

Neither the US Securities and Exchange Commission (the “SEC”) nor any securities

regulatory authority of any state or other jurisdiction of the United States has approved or

disapproved of the Scheme Shares or passed upon or endorsed the merits of the offering

of the Schem e Shares or the adequacy or accuracy of this Prospe ctus. Any representation

to the contrary is a criminal offence in the United States.

In addition, the Scheme Shares are subject to restrictions on transferability and resale in certain

jurisdictions and may not be transferred or resold except as permitted under applicable securities

laws and regulations and under the Articles. Any failure to comply with these restr ictions may

2

constitute a violation of the securities laws of any such jurisdictions and may subject the holder to

the forced transfer and other provisions set out in the Articles. For further information on restrictions

on offers, sales and transfers of the Scheme Shares, please refer to the section entitled “Overseas

Excluded SCIN Shareholders” at paragraph 10 of Part IV (Details of the Scheme and the Issue)of

this Prospectus.

This Prospectus does not constitute or form par t of any offer or invitation to sell or issue, or any

solicitation of any offer to purchase, subscribe for or otherwise acquire, any securities by any person

in any circumstances or jurisdiction in which such offer or solicitation would be unlawful or would

impose any unfulfilled registration, qualification, publication or approval requirements on the

Company, the Manager, the Investment Manager or the Sponsor.

The distribution of this Prospectus and the offer of the Scheme Shares in certain jurisdictions may

be restricted by law. Other than in the United Kingdom, no action has been or will be taken to

permit the possession, issue or distribution of this Prospectus (or any other offering or publicity

material relating to the Scheme Shares) in any jurisdiction where actio n for that purpose may be

required or doing so is restricted by law. Accordingly, neither this Prospectus, nor any

advertisement, nor any other offering material may be distributed or published in any jurisdiction

except under circumstances that will result in compliance with any applicable laws and regulations.

Persons into whose possession this Prospectus (or any other offering materials or publicity relating

to the Scheme Shares) comes should inform themselves about and observe any such restrictions.

None of the Company, the Manager, the Investment Manager, the Sponsor or any of their respective

Affiliates or advisers, accepts any legal responsibility to any person, whether or not a prospect ive

investor, for any such restrictions.

The Company is a closed-ended investment company incorporated in England and Wales on

21 April 1887 with company number 00024299 and registered as an investment company under

section 833 of the Companies Act 2006 (the “Companies Act”).

Capitalised terms contained in this Prospectus shall have the meanings ascribed to them in Part VIII

(Definitions) of this Prospectus, save where the context indicates otherwise.

Prospective investors should read this en tire Prospectus and, in particular, the section

entitled “Risk Factors” beg inning on page 12 when considering an investment in the

Company.

This Prospectus is dated 5 August 2022.

3

TABLE OF CONTENTS

SUMMARY ................................................................................................................................... 5

RISK FACTORS ........................................................................................................................... 12

IMPORTANT INFORMATION ...................................................................................................... 24

EXPECTED TIMETABLE ............................................................................................................. 31

STATISTICS.................................................................................................................................. 32

DEALING CODES ....................................................................................................................... 32

DIRECTORS, ADVISERS AND OTHER SERVICE PROVIDERS.............................................. 33

PART I – INFORMATION ON THE COMPANY .......................................................... ................ 35

PART II – MARKET OUTLOOK AND INVESTMENT STRATEGY............................................. 40

PART III – DIRECTORS, MANAGEMENT AND ADMINISTRATION......................... ................. 44

PART IV – DETAILS OF THE SCHEME AND THE ISSUE........................................................ 50

PART V – UK TAXATION....................................................... ...................................................... 58

PART VI – ADDITIONAL INFORMATION ON THE COMPANY ................................................ 62

PART VII – FINANCIAL INFORMATION OF THE COMPANY ................................................... 82

PART VIII – DEFINITIONS........................................................................................... ................ 88

ANNEX – FORM OF AI/QP INVESTOR LETTER ...................................................................... 99

4

SUMMARY

1. Introduction

a. Name and ISIN of securities

i. Ticker for the Shares: JGGI

ISIN of the Shares: GB00BNYMKY695

b. Identity and contact details of the issuer

i. Name: JPMorgan Global Growth & Income plc (the “Company”)

Address: 60 Victoria Embankment, London, EC4Y 0JP (Tel: 020 7742 4000)

c. Identity and contact details of the competent authority

i. Name: Financial Conduct Authority

Address: 12 Endeavour Square, London, E20 1JN, United Kingdom (Tel: 0207 066 1000)

d. Date of approval of the Prospectus

i. 5 August 2022

e. Warnings

i. This summary should be read as an introduction to this Prospectus. Any decision to invest in ordinary shares of the Company being offered

pursuant to the Scheme (the “Scheme Shares”) should be based on consideration of this Prospectus as a whole by the investor. The investor

could lose all or part of the invested capital. Civil liability attaches only to those persons who have tabled the summary including any translation

thereof, but only if the summary is misleading, inaccurate or inconsistent when read together with the other parts of this Prospectus or it does not

provide, when read together with the other parts of this Prospectus, key information in order to aid investors when considering whether to invest in

the Scheme Shares.

2. Key information on the issuer

a. Who is the issuer of the securities?

i. Domicile and legal form, LEI, applicable legislation and country of incorporation

The Company is an investment company limited by shares, registered and incorporated in England and Wales under the Companies Act on

21 April 1887, with company number 00024299. The Company’s Legal Entity Identifier (LEI) is 5493007C3I0O5PJKR078. The Company carries

on, and intends to continue to carry on, its business at all times so as to retain its status as an investment trust for the purposes of section 1158

CTA 2010.

ii. Principal activities

The Company’s investment objective is to achieve superior total returns from world stock markets.

In order to achieve the investment objective and to seek to manage risk, the Company invests in a diversified portfolio of companies. The

Company manages liquidity and borrowings to increase potential Sterling returns to shareholders; the Board has set a normal range of 5 per cent.

net cash to 20 per cent. geared.

The Company’s aim is to provide a diversified portfolio of approximately 50-90 stocks in which the Portfolio Managers have a high degree of

conviction. At 31 July 2022, the number of investments held was 61. To gain the appropriate exposure, the Portfolio Managers are permitted to

invest in pooled funds. The Investment Manager is responsible for management of the Company’s assets. On a day-to-day basis the assets are

managed by Portfolio Managers based in London and in New York, supported by a strong equity research team.

The Company has implemented a passive currency hedging strategy that aims to make stock selection the predominant driver of overall Portfolio

performance relative to the benchmark, the MSCI All Countries World Index (in Sterling terms). This is a risk reduction measure, designed to

eliminate most of the differences between the Portfolio’s currency exposure and that of the Company’s benchmark. As a result, the returns

derived from, and the Portfolio’s exposure to, currencies may materially differ from that of the Company’s competitors who generally do not

undertake such a strategy.

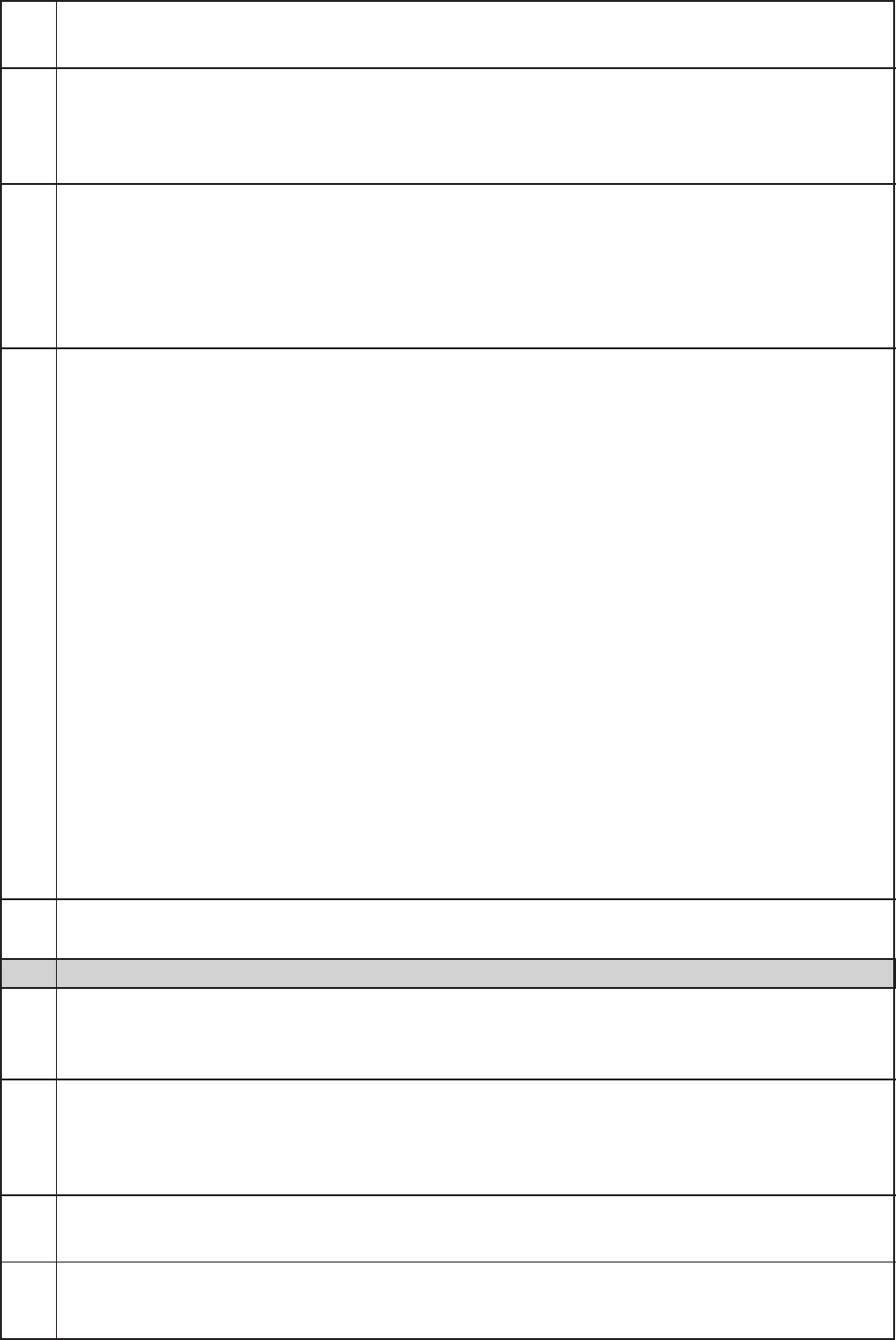

iii. Major Shareholders

The below table sets out the persons who had noti fied the Company of an interest which represents three per cent. or more of the voting share

capital of the Company, based on the information available to the Company as at 3 August 2022:

Shareholder No. of Shares

Percentage of

total issued

share capital

Interactive Investor 19,919,278 11.99%

Hargreaves Lansdown, stockbrokers 19,107,187 11.50%

Rathbones 15,614,794 9.40%

Canaccord Genu ity Wealth Management 7,857,379 4.73%

Charles Stanley 7,452,472 4.49%

AJ Bell, stockbrokers 6,954,570 4.19%

Redmayne Bentley, stockbrokers 5,758,530 3.47%

EFG Harris Allday, stockbrokers 5,356,214 3.22%

—————

Save as disclosed above, the Company is not aware of any person who, as at 3 August 2022, directly or indirectly, has a holding which is notifiable under applicable law or

who directly or indirectly, jointly or severally, exercises or could exercise control over the Company. There are no differences between the voting rights enjoyed by the

Shareholders described above and those enjoyed by any other holder of Shares.

5

iv. Directors

Tristan Hillgarth, James Macpherson, Sarah Whitney, Gay Collins, James Will (prospective), Jane Lewis (prospective), Thomas Michael Brewis

(prospective) and Neil Rogan (prospective)

v. Statutory auditors

Ernst & Young LLP of Atria One, 144, Morrison Street Edinburgh EH3 8EX.

b. What is the key financial information regarding the issuer?

i. Selected historical financial information

The key audited figures that summarise the financial condition of the Company in respect of the financial years ended 30 June 2019, 30 June

2020 and 30 June 2021, and for the unaudited financial information for the six-month period ended 31 December 2021, are set out in the tables

below.

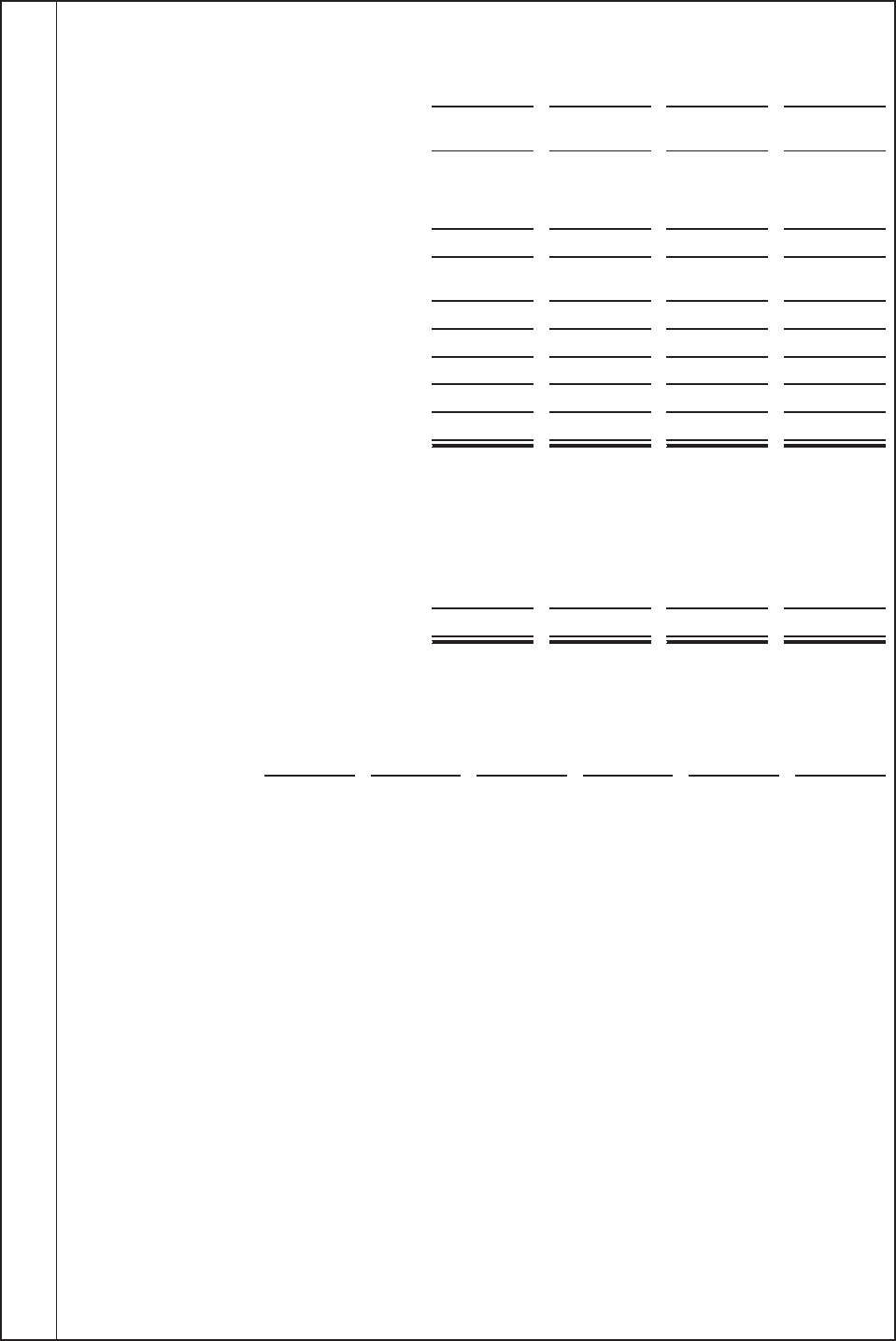

Statement of Comprehensive Income

For six-month

period ended

31 December

2021

(£'000)

For year ended

30 June

2021

(£'000)

For year ended

30 June

2020

(£'000)

For year ended

30 June

2019

(£'000)

Gains on investments at fair value through profit or loss 47,699 153,997 22,989 26,453

Net foreign currency gains 3,097 1,764 83 2,404

Income from investments 5,228 10,633 8,329 8,989

Interest receivable and similar income 20 49 212 109

Gross return 56,044 166,443 31,613 37,955

Management fee (1,464) (2,308) (1,906) (1,726)

Performance fee charge — (5,967) (507) 1,040

Other administrative expenses (279) (612) (565) (572)

Net return before finance costs and taxation 54,301 157,556 28,635 36,697

Finance costs (696) (1,038) (898) (896)

Net return before taxation 53,605 156,518 27,737 35,801

Taxation (621) (1,276) (1,091) (863)

Net return after taxation 52,984 155,242 26,646 34,938

Return per share 34.17p 106.46p 19.44p 26.78p

—————

No operations were acquired or discontinued in any of the financial years ended 30 June 2019, 30 June 2020 or 30 June 2021.

6

Statement of Financial Position

As at

31 December

2021

(£'000)

As at

30 June

2021

(£'000)

As at

30 June

2020

(£'000)

As at

30 June

2019

(£'000)

Fixed assets ————

Investments at fair value through profit or loss 718,013 654,694 473,187 458,287

Current assets ————

Derivative financial assets 2,671 2,567 2,026 1,770

Debtors 2,535 7,153 12,410 1,062

Cash and cash equivalents 62,745 55,933 36,972 12,499

67,951 65,653 51,408 15,331

Current liabilities ————

Creditors: amounts falling due within one year (9,589) (11,041) (13,710) (571)

Derivative financial liabilities (1,212) (1,271) (1,636) (1,298)

Net current assets 57,150 53,341 36,062 13,462

Total assets less current liabilities 775,163 708,035 509,249 471,749

Creditors: amount falling due after more than one year (49,918) (49,932) (30,032) (30,026)

Provision for liabilities and charges ————

Performance fee payable — (4,729) (380) (206)

Net assets 725,245 653,374 478,837 441,517

Capital and reserves ————

Called up share capital 7,899 7,746 7,746 7,746

Share premium 115,495 92,019 71,672 58,956

Capital redemption reserve 27,401 27,401 27,401 27,401

Capital reserves 574,450 526,208 372,018 347,414

Revenue reserve ————

Total shareholders’ funds 725,245 653,374 478,837 441,517

Net asset value per share 459.1p 432.3p 338.9p 332.4p

Statement of Changes in Equity

Called up

share capital

£'000

Share

premium

£'000

Capital

redemption

reserve

£'000

Capital

reserves

£'000

Revenue

reserve

£'000

Total

£'000

At 30 June 2019 7,746 58,956 27,401 347,414 — 441,517

Issue of shares from Treasury — 12,716 — 15,420 — 28,136

Net return ———21,163 5,483 26,646

Dividends paid in the year ———(11,979) (5,483) (17,462)

At 30 June 2020 7,746 71,672 27,401 372,018 — 478,837

Issue of shares from Treasury — 20,347 — 17,832 — 38,179

Net return ———147,284 7,958 155,242

Dividends paid in the year

———(10,926) (7,958) (18,884)

At 30 June 2021 7,746 92,019 27,401 526,208 — 653,374

Issue of shares 153 13,640 13,793

Issue of shares from Treasury — 9,836 — 6,858 — 16,694

Block-listing fees ———(102) — (102)

Net return ———49,176 3,808 52,984

Dividends paid in the year ———(7,690) (3,808) (11,498)

At 31 December 2021 7,899 115,495 27,401 574,450 — 725,245

7

Statement of Cash Flows

For the

six-month

period ended

31 December

2021

(£'000)

For year ended

30 June

2021

(£'000)

For year ended

30 June

2020

(£'000)

For year ended

30 June

2019

(£'000)

Net cash outflow from operations before dividends and

interest (3,399) (3,212) (2,363) (2,202)

Dividends received 4,857 8,535 7,288 7,954

Interest received 15 21 201 61

Overseas tax recovered 15 162 55 244

Interest paid (691) (893) (889) (892)

Net cash inflow from operating activities 797 4,613 4,292 5,165

Purchase of investments (259,876) (460,877) (462,896) (473,732)

Sales of investments 244,354 435,206 472,116 472,974

Settlement of forward currency contracts 2,931 811 184 4,393

Net cash (outflow)/inflow investing activities (12,591) (24,860) 9,404 (3,635)

Dividend paid (11,498) (18,884) (17,462) (16,129)

Issue of shares from treasury 16,694 38,179 28,235 11,819

Issue of shares 13,516 ———

Block listing fees (102) ———

Issue of secured bond loan (net of costs) — 19,894 ——

Net cash inflow/(outflow) from financing activities 18,610 39,189 10,773 (4,310)

Increase in cash and cash equivalents 6,816 18,942 24,469 4,490

Cash and cash equivalents at start of year 55,933 36,972 12,499 8,008

Unrealised gain on foreign currency cash and cash

equivalents (4) 19 4 1

Cash and cash equivalents at the end of the year 62,745 55,933 36,972 12,499

Increase in cash and cash equivalents 6,816 18,942 24,469 4,490

Cash and cash equivalents consist of: ————

Cash and short term deposits 9,454 8,350 5,255 518

Cash held in JPMorgan Sterling Liquidity Fund 53,291 47,583 31,717 11,981

Total 62,745 55,933 36,972 12,499

ii. Selected pro forma financial information

N/A

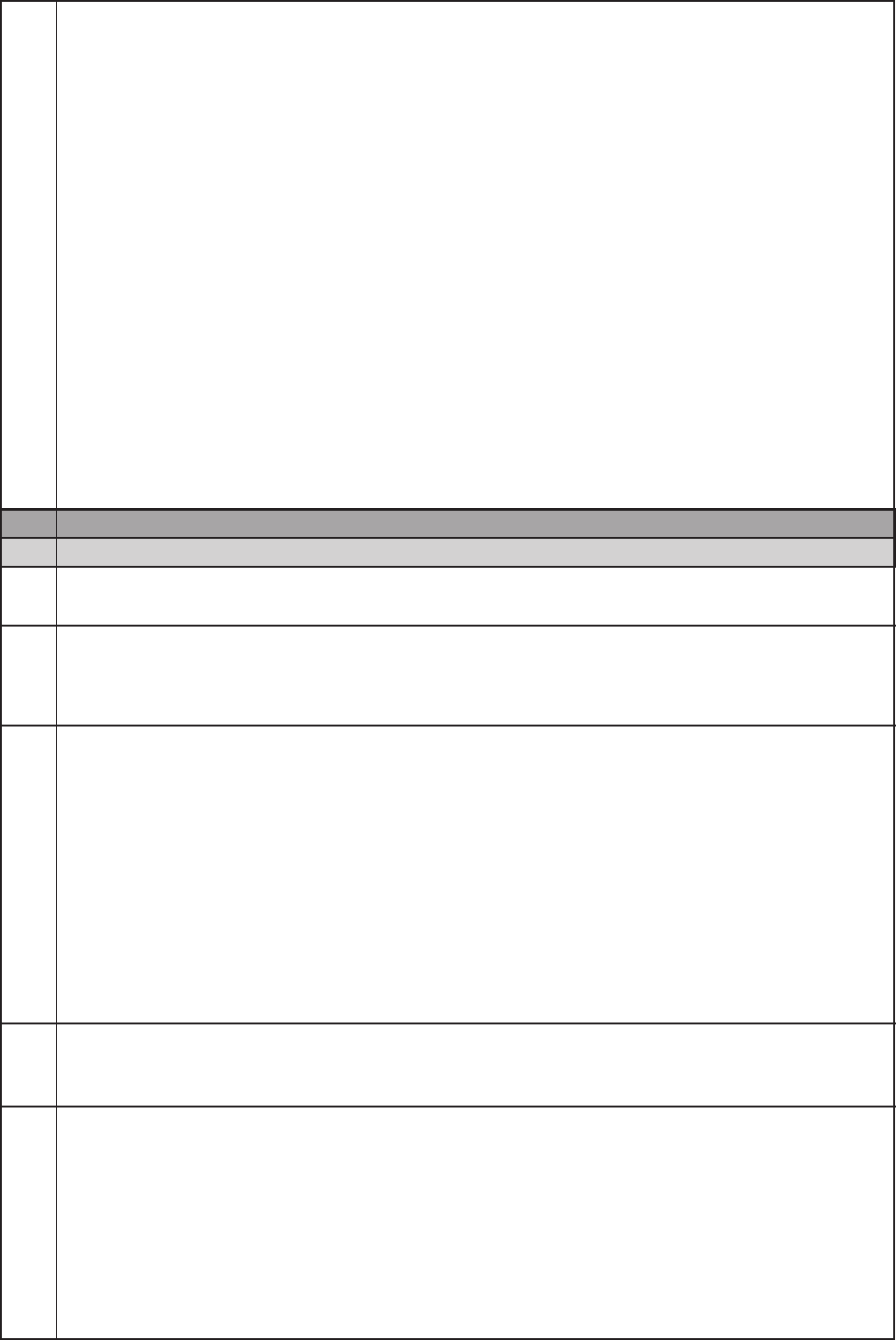

c. Closed end funds

i. Additional information relevant to closed end funds

The data set out in the table below is at the date of the latest published Net Asset Value of the Company as at the Latest Practical Date, being

3 August 2022:

Share class Total NAV (£) No. of Shares

NAV per share

(pence)

Ordinary 741,196,760 167,771,285 441.79

ii. The statement of comprehensive income for the Company can be found at row b(i)

iii. The statement of financial position can be found at row b(i) and c(i) above.

d. What are the key risks that are specific to the issuer?

i. Risks relating to the Company

*

The Company has no employees and the Directors have been appointed on a non-executive basis. The Company is therefore

reliant upon the performance of third-party service providers for its executive functions and is exposed to the risk that misconduct by

employees of those service providers, any failure by any service provider to carry out its obligations to the Company in accordance

with the terms of its appointment, and/or the termination of those appointments could have an adverse effect on the Portfolio and

the Company’s financial condition, results of operations and prospects, with a consequential adverse effect on the market value of

the Shares.

Risks relating to the Investment Policy

*

The investments of the Company are subject to the risk of changes in market prices and/or macroeconomic factors., including those

factors arising as a result of the current conflict in Ukraine which, in addition to its impact on human lives and livelihoods, is

beginning to have an impact on the global economy, ranging from decreases to supply (and/or increases to the costs) of goods to

increases (and increased volatility) in oil prices and inflation. In addition, the Company’s investments are subject to risks arising from

Inflation driven by the knock-on effects of COVID related disruptions to global supply chains, central bank stimulus and / or

underinvestment in critical industries and services. Any such changes could have an adverse effect on the value of the Portfolio, the

Company’s financial condition, results of operations and prospects, with a consequential adverse effect on returns to Shareholders

and the market value of the Shares.

8

*

The COVID-19 pandemic may adversely affect the performance of companies in the Portfolio, which may in turn adversely impact

the Company’s financial performance and prospects and the value of its Portfolio.

*

The due diligence process that the Investment Manager undertakes in evaluating the Company’s investments may not reveal all

facts that may be relevant in connection with such investments.

*

The Company’s investment strategy may involve the use of leverage, which exposes the Company to risks associated with

borrowings and the related grant of security over its assets.

*

The Company is exposed to currency and foreign exchange risk as a result of holding investments denominated in currencies other

than Sterling which could have an adverse effect on the Portfolio and the Company’s financial condition, results of operations and

prospects, with a consequential adverse effect on returns to Shareholders and the market value of the Shares.

*

Underperformance by the companies in the Portfolio, or other market factors, may cause the Company to fail to deliver its target

performance against the Benchmark and may affect the ability of the Company to achieve its investment objective.

Risks relating to the Manager and the Investment Manager

*

The success of the Company is dependent on the Manager and the Investment Manager and their expertise, key personnel, and

ability to source and advise appropriately on investments. As a result of this, the Portfolio, financial condition, results of operations,

prospects and the value of the Shares could be adversely affected by competitive pressures on the Manager and/or the Investment

Manager’s ability to source and make successful investments.

Risks relating to regulation, taxation and the Company’s operating environment

*

The Company is subject to various political, economic and other risks (such as war, acts of terrorism, changes to any given

country’s political leader or significant economic downturns affecting global or more domestic markets) which may impact the

economic conditions in which the Company and companies in the Portfolio operate and may adversely impact global financial

markets and, consequently, the Company’s performance.

*

Changes in taxation legislation or practice in the United Kingdom or other jurisdictions to which the Company has exposure

(including the jurisdictions in which companies in the Portfolio are based) may adversely affect the Company and the tax treatment

for Shareholders investing in the Company.

*

Changes in laws or regulations governing the Company’s or the Investment Manager’s operations may adversely affect the business

and performance of the Company.

3. Key information on the securities

a. What are the main features of the securities?

i. Type, class and ISIN of the securities being admitted to trading on a regulated market

The Shares being offered under the Issue are ordinar y shares in the capital of the Company. The ISIN of the Shares is GB00BNYMKY695.

ii. Currency, denomination, nominal value, number of securities issued and term of the securities

The Scheme Shares are denominated in Sterling and are ordinary shares with a nominal value of £0.05 each in the capital of the Company. The

issue price of the Scheme Shares will be determined on the Calculation Date and will be released by way of an RIS announcement on or around

31 August 2022. The Shares have an infinite term.

iii. Rights attached to the securities

Variation of rights

If at any time the share capital is divided into different classes of shares, the rights attached to any class (unless otherwise provided by the terms

of issue) may, whether or not the Company is being wound up, be varied with the consent in writing of the holders of three-fourths of the issued

shares of that class or with the sanction of a special resolution passed at a separate meeting of the holders of the shares of that class.

Dividends

The holders of Shares are entitled to such dividends as may be declared by the Company from time to time. Shares held in treasury do not

receive dividends.

Distribution of assets on a winding up

On a winding up, the Shares (excluding treasury shares) shall rank equally for the nominal capital paid up thereon and in respect of any surplus.

Voting rights

Holders of Shares are entitled to attend, speak and vote at general meetings of the Company. Each Share (excluding shares in treasury) carries

one vote. Treasury shares do not carry voting rights.

iv. Relative seniority of the securities

The Scheme Shares are ordinary shares and will, when issued and fully paid, have the same rights as the existing Shares, including in respect of

rights to dividends and in respect of a winding up of the Company.

v. Restrictions on free transferability of the securities

At their absolute discretion, the Directors may refuse to register the transfer of a share in certificated form which is not fully paid provided that, if

the share is listed on the Official List of the FCA, such refusal does not prevent dealings in the Shares from taking place on an open and proper

basis. The Directors may also refuse to register a transfer of a share in cer tificated form unless the instrument of transfer:

*

is lodged, duly stamped, at th e registered office of the Company or such other place as the Directors may appoint and (except in

the case of a transfer by a financial institution where a certificate has not been issued in respect of the share) is accompanied by

the certificate for the share to which it relates and such other evidence as the Directors may reasonably require to show the right of

the transferor to make the transfer and/or the transferee to receive the transfer;

*

is in respect of only one class of share; and

*

is not in favour of more than four transferees.

9

The Directors may also refuse to register a transfer of a share in uncer tificated form to a person who is to hold it thereafter in certificated form in

any case where the Company is entitled to refuse (or is excepted from the requirement) under the CREST Regulations to register the transfer.

vi. Dividend policy

The Company has a distribution policy whereby at the start of each financial year the Company will announce the distribution it intends to pay

Shareholders in the forthcoming year in quarterly instalments. The Company’s intention is to pay dividends which, in aggregate, total at least 4 per

cent. of the Net Asset Value of the Company as at the end of the preceding financial year. The Company has announced that in relation to the

year commencing 1 July 2022, the Company intends to pay dividends totalling 17.0 pence per Share (being 4.25 pence per Share per quarter),

which represents an annual dividend equivalent to 4.23 per cent. of the unaudited Net Asset Value (cum income with debt at fair value) as at the

30 June 2022. The dividend policy is an objective only, is not a profit forecast and is not a guarantee that certain levels of dividends can be

achieved or dividend growth maintained nor an indication of the Company's expected or actual future results, which may vary.

b. Where will the securities be traded?

i. The Scheme Shares will be admitted to listing on the premium listing category of the Official List and to trading on the Main Market.

c. What are the key risks that are specific to the securities?

i. Risks relating to an investment in the Shares

*

It may be difficult for Shareholders to realise their investment as there may not be a liquid market in the Shares, and Shareholders

have no right to have their Shares redeemed or repurchased by the Company.

*

Investors may not recover the full amount of their investment in the Scheme Shares.

*

The Shares may trade at a discount to Net Asset Value and the price that can be realised for Shares will be subject to market

fluctuations.

4. Key information on the admission to trading on a regulated market

a. Under which conditions and timetable can I invest in this security?

i. General terms and conditions

The Scheme Shares being iss ued pursuant to the Issue are only available to Eligible SCIN Shareholders, pursuant to the terms of a scheme of

reconstruction of SCIN under section 110 of the Insolvency Act 1986 (the “Insolvency Act”).

The Issue is conditional, among other things, on:

*

the passing of the SCIN Resolution to be proposed at the First SCIN General Meeting and the SCIN Resolution to be proposed at

the Second SCIN General Meeting or any adjournment of those meetings and such SCIN Resolutions becoming unconditional in all

respects;

*

approval of the Allotment Resolution by Shareholders at the General Meeting of the Company and such Resolution becoming

unconditional in all respects;

*

the approval of the FCA and the London Stock Exchange to the Admission of the Scheme Shares to listing on the premium listing

category of the Official List and to trading on the Main Market of the London Stock Exchange, respectively occurring before

31 December 2022, or such other date as may be agreed between the Company and the Sponsor; and

*

the SCIN Board resolving to proceed with the Scheme.

ii. Expected timeta ble

General Meeting

Posting of Circular and Forms of Proxy for the General Meeting 5 August 2022

Latest time and date for receipt of Forms of Proxy for the

General Meeting

3:30 p.m. on 25 August 2022

General Meeting 3:30 p.m. on 30 August 2022

Announcement of results of the General Meeting 30 August 2022

Scheme

Publication of this Prospectus 5 August 2022

First SCIN General Meeting 11.00 a.m. on 22 August 2022

Record Date for entitlements under the Scheme 6.00 p.m. on 22 August 2022

SCIN Shares disabled in CREST 6.00 p.m. on 22 August 2022

Calculation Date for the Scheme 5.00 p.m. on 25 August 2022

Suspension of listing of SCIN Shares and SCIN’s register closes 7.30 a.m. on 31 August 2022

Second SCIN General Meeting 9.30 a.m. on 31 August 2022

Effective Date for implementation of the Scheme 31 August 2022

Announcement of results of the Scheme and respective FAVs per share 31 August 2022

Admission and dealings in Scheme Shares commence 8.00 a.m. on 1 September 2022

CREST accounts credited to SCIN Shareholders in respect of Scheme

Shares in uncertificated form

8.00 a.m. on 1 September 2022

Certificates despatched by post in respect of Scheme Shares By 9 September 2022

(or as soon as practicable thereafter)

Cancellation of listing of SCIN Shares as soon as practicable after the Effective Date

—————

References to times are to London times unless otherwise stated. Any changes to the expected timetable set out above will be noti fied to the market by the Company via

an RIS announcement.

iii. Details of admission to trading on a regulated market

10

The Shares are currently listed on the premium listing category of the Official List of the FCA and traded on the Main Market. Applications will be

made for the Scheme Shares to be issued pursuant to the Scheme to be admitted to listing on the premium listing category of the Official List and

to trading on the Main Market.

iv. Plan for distribution

The Company will notify SCIN Shareholders of the number of Scheme Shares to which each Eligible SCIN Shareholder is entitled and the results

of the Issue will be announced by the Company on or around 31 August 2022 via an RIS announcement. It is expected that Admission will

become effective and that unconditional dealings in the Scheme Shares issued pursuant to the Issue will commence at 8 a.m. on 1 September

2022.

v. Amount and percentage of immediate dilution resulting from the Issue

If 132,526,986 million Scheme Shares were to be issued (being the estimated number of Shares that can be issued pursuant to the Issue,

assuming that all SCIN Shareholders (including the Liquidators appointed in respect of Overseas Excluded SCIN Shareholders) are issued with

Scheme Shares, and that the ratio between the FAV per JGGI Share and FAV per SCIN Share is 2.002730) then, based on the issued share

capital at the date of this Prospectus, and assuming that: (i) an Existing Shareholder is not a SCIN Shareholder and is therefore not able to

participate in the Issue; and (ii) there had been no change to the Company’s issued share capital prior to Admission, an Existing Shareholder

holding 1 per cent. of the Company’s issued share capital at the date of this Prospectus would then hold 0.56 per cent. of the Company’s issued

share capital following Admission.

vi. Estimate of the total expenses of the Issue

To the extent that the Company has already incurred direct costs of the Transaction as at the Calculation Date, such costs will be added back to

the Company’s NAV for the purposes of calculating the JGGI FAV. In addition, any costs incurred or accrued by SCIN in connection with the

Scheme will be added back to SCIN’s net asset value for the purpose of calculating the SCIN FAV. Those costs will then be aggregated and

apportioned between the two companies on the following basis. The costs and expenses in connection with the Scheme will be split between the

Company and SCIN so as to provide for an equitable apportionment of the costs incurred in implementing the Transaction between the two

parties, having regard for, inter alia, the estimated respective expenses of the two companies and the relative benefits which the Scheme will

provide to each set of shareho lders. In summary:

(i) The direct costs incurred by the two companies will (to the extent they do not exceed the limits set out in (ii) below) be aggregated

with the SCIN Pension Costs and the SCIN Portfolio Realignment Costs. The Manager’s Contribution (defined below) will then be

deducted from the aggregate amount to determine the net costs of the Scheme (the “Net Scheme Costs for Apportionment”).

The Net Scheme Costs for Apportionment will be borne by each of the Company and SCIN pro rata by reference to their respective

FAVs (subject to the JGGI Cost Limit of £2.1 million, with SCIN bearing any Net Scheme Costs for Apportionment incurred or

accrued by the Company in excess thereof).

(ii) To the extent that:

a) SCIN’s Direct Costs exceed £2.7 million, such SCIN Excess Costs will be borne solely by SCIN and will be reflected

accordingly in the calculation of its FAV; and

b) the Company’s direct costs exceed £1.2 million, such excess costs will be borne solely by the Company and will be reflected

accordingly in the calculation of its FAV (such excess costs being the “JGGI Excess Costs”).

The total costs that the Company will incur in relation to the Transaction will be equal to the JGGI Apportioned Costs (as apportioned pursuant to

paragraph (i) above) and the JGGI Excess Costs (as defined in paragraph (ii)(b) above). On this basis, the costs to be borne by Shareholders,

after the deduction of the Manager’s Contribution (as defined below) and cost apportionment, are estimated to be approximately £2.98 million

(including VAT), equivalent to 0.41 per cent. of the Company’s Net Asset Value as at 3 August 2022.

The Manager has agreed to make a contribution to the costs of the Scheme equal to the Contribution Amount (the “Manager’s Contribution”).

The “Contribution Amount” shall be calculated by reference to the Management Fee that would be payable by the Company to the Manager for

the eight month period commencing on Admission based on the value of the net assets of the enlarged Company following completion of the

Scheme (determined by reference to the FAVs of the Company and SCIN). In satisfaction of the Manager’

s Contribution, the Manager will waive

its entitlement to be paid a Management Fee with effect from Admission until such time as the value of such waived Management Fee equals the

Contribution Amount.

vii. Estimated expenses charged to the investor

No expenses will be charged directly to investors by the Company in connection with the Issue o r Admission.

b. Why is this prospectus being produced?

i. Reasons for the Issue

The Scheme Shares are being issued to Eligible SCIN Shareholders, and to the Liquidators appointed in respect of Overseas Excluded

SCIN Shareholders, in connection with the recommended proposals to merge the Company and SCIN, pursuant to a scheme of reconstruction of

SCIN under section 110 of the Insolvency Act.

ii. The use and estimated net amount of the proceeds

The Scheme Shares are being issued to Eligible SCIN Shareholders, and to the Liquidators appointed in respect of Overseas Excluded

SCIN Shareholders, in consideration for the transfer of the Rollover Pool to the Company. The Rollover Pool will consist of investments aligned

with the Company’s Investment Policy, together with cash and cash equivalents. Any cash in the Rollover Pool and any proceeds of the realisation

of cash equivalents in the Rollover Pool will be used to acquire investments in accordance with the Company’s Investment Policy.

iii. Underwriting

The Issue will not be underwritten.

iv. Material conflicts of interest

There are no conflicts of interests th at are material to the Issue or the Admission.

11

RISK FACTORS

An investment in the Shares carries a number of risks including the risk that the entire investment

may be lost. In addition to all other information set out in this Prospectus, the following specific

factors should be considered when deciding whether to make an investment in, or otherwise acquire,

the Shares. The risks set out below are those which are considered to be the material risks relating to

an investment in the Shares but are not the only risks relating to the Shares or the Company. No

assurance can be given that Shareholders will realise profit on, or recover the value of, their

investment in the Shares, or that the Company will achieve any of its target returns. It should be

remembered that the price of securities and the income from them can go down as well as up.

The success of the Company will depend on the ability of the Investment Manager to pursue the

Investment Policy of the Company successfully and on broader market conditions and the risk factors

set out below in this section.

Prospective investors should note that the risks relating to the Company, its Investment Policy and

strategy and the Shares summarised in the section of this Prospectus headed “Summary” are the

risks that the Directors believe to be the most essential to an assessment by a prospective investor of

whether to consider an investment in the Shares. However, as the risks which the Company faces

relate to events and depend on circumstances that may or may not occur in the future, prospective

investors should consider not only the information on the key risks summarised in the section of this

Prospectus headed “Summary” but also, among other things, the risks and uncer tainties described in

this “Risk Factors” section of this Prospectus. Additional risks and uncertainties not currently known

to the Company or the Directors (including any prospective Directors) or that the Company or the

Directors (including any prospective Directors) consider to be immaterial as at the date of this

Prospectus may also have a material adverse effect on the Company’s financial condition, business,

prospects and results of operations and, consequently, the Company’s NAV and/or the market price of

the Shares.

Potential investors in the Shares should review this Prospectus carefully and in its entirety and

consult with their professional advisers before acquiring/receiving the Shares.

RISKS RELATING TO THE COMPANY

The Company has no employees and is reliant on the performance of third-party service providers

The Company has no employees and the Directors have been appointed, and the prospective Directors will be

appointed, on a non-executive basis. Whilst the Company has taken all reasonable steps to establish and

maintain adequate procedures, systems and controls to enable it to comply with its obligations, the Company is

reliant upon the performance of third-party service providers for its executive functions. In particular, the

Manager, the Investment Manager, the Registrar and the Depositary will be performing services which are

integral to the operation of the Company. Misconduct by employees of those service providers, any failure by

any service provider to carry out its obligations to the Company in accordance with the terms of its

appointment, and/or the termination of those appointments could have an adverse effect on the Portfolio and

the Company’s financial condition, results of operations and prospects, with a consequential adverse effect on

the market value of the Shares.

RISKS RELATING TO THE INVESTMENT POLICY

The investments of the Company are subject to the risk of changes in market prices and/or macroeconomic

factors

The Company is at risk from the failure of the entire investment strategy adopted by the Investment Manager

resulting from changes in market prices and/or macroeconomic factors, including those factors arising as a

result of the current conflict in Ukraine which, in addition to its impact on human lives and livelihoods, is

beginning to have an impact on the global economy, ranging from decreases to supply (and/or increases to the

costs) of goods to increases (and increased volatility) in oil prices and inflation. In addition, the Company’s

investments are subject to risks arising from inflation driven by the knock-on effects of COVID related

disruptions to global supply chains, central bank stimulus and / or underinvestment in critical industries and

services. While the Company will hold a diversified Portfolio, there are certain general market conditions in

which any investment strategy is unlikely to be profitable. The Investment Manager does not have the ability to

control or predict such market conditions.

The performance of the Company’s investments depends to a great extent on correct assessments of the

future course of market price movements and economic cycles. There can be no assurance that the Investment

Manager will be able to predict accurately these price movements or cycles. The global financial markets have

in recent years been characterised by great volatility and unpredictability.

General economic and market conditions, such as currency exchange rates, interest rates, availability of credit,

inflation rates, economic uncertainty, changes in laws, trade barriers, currency exchange controls and national

12

and international political circumstances may affect the price level, volatility and liquidity of securities and result

in losses for the Company. This could have an adverse effect on the value of the Portfolio, the Company’s

financial condition, results of operations and prospects, with a consequential adverse effect on returns to

Shareholders and the market value of the Shares.

Given that the Company invests predominantly in listed or quoted securities, the Company’s NAV is inherently

sensitive to the performance of world stock markets. If world stock markets experience volatility and disruption,

the Company’s NAV could also become volatile and it is likely that the Shares will trade at a discount to the

NAV. In any event, although the Company has the ability to provide liquidity in the form of share buybacks,

where the Shares trade at a discount to the NAV, this could make the Shares less liquid and more difficult to

sell.

This risk may be increased due to the impact of the COVID-19 pandemic. For more information, please also

see the risk factor entitled “The COVID-19 pandemic may adversely affect the performance of companies in the

Portfolio which may in turn adversely impact the Company’s financial performance and prospects and the value

of its Portfolio” below.

The COVID-19 pandemic may adversely affect the performance of companies in the Portfolio which may in

turn adversely impact the Company’s financial performance and prospects and the value of its Portfolio

The COVID-19 pandemic significantly increased the level of macroeconomic and market uncertainty globally,

and may adversely affect the performance of companies in the Portfolio, which may in turn adversely impact

the performance of the Company itself. In addition, global capital markets saw significant volatility as COVID-19

had a sustained impact on business across the world. A resurgence of such volatility and downturn could have

an impact on the liquidity of the Shares.

The pandemic resulted in, and until fully resolved is likely to continue to result in, the following, among other

things: (i) government imposition of various forms of restrictions on the movement of people, resulting

in: (a) significant disruption to many businesses including both supply chains and demand, and (b) lay-offs of

employees, the effects of which were often temporary but were permanent for some of these businesses;

(ii) shutdowns and significant delays at government agencies; (iii) increased drawings by borrowers on revolving

lines of credit; (iv) increased requests by borrowers for amendments and waivers of their credit agreements to

avoid default, and increased defaults by such borrowers and/or increased difficulty in obtaining refinancing at

the maturity dates of their loans; (v) volatility and disruption across equity capital markets; and (vi) rapidly

evolving proposals and/or actions by state and federal governments to address problems being experienced by

the markets and by businesses and the economy in general.

The future development of the outbreak remains uncer tain and there is no assurance that the pandemic will not

have a material adverse impact on the performance of investments within the Portfolio and on the Company

itself. The extent of the impact will depend on the continued range of the virus, infection rates, the severity and

mortality rates of the virus, the continued efficacy of vaccines, the emergence of further variants of the virus

which may be more potent or transmissible, or vaccine-resistant, than current variants of the virus (including,

but not limited to, the Omicron variant), the steps taken nationally and globally to prevent the spread of the

virus as well as fiscal and monetary stimuli offered by governments globally.

The Investment Manager’s ability to operate effectively, including the ability of its personnel or its service

providers and other contractors to function, communicate and travel to the extent necessary to implement the

investment objective and Investment Policy of the Company has been, and may continue to be impaired by the

pandemic. The spread of COVID-19 within the Investment Manager or any of the Company’s other service

providers could also significantly affect the Investment Manager’s ability to properly oversee the affairs of the

Company (particularly to the extent that any affected personnel include key investment professionals or other

members of senior management).

Investors should be aware that if any of the global impacts of COVID-19 continue for a sustained period of

time, and should any of the risks identified above materialise, it could have a material adverse effect on the

value of the Portfolio, financial condition, results of operations and prospects, with a consequential adverse

effect on the returns to Shareholders and the market value of the Shares.

The due diligence process that the Investment Manager undertakes in evaluating the Company’s

investments may not reveal all facts that may be relevant in connection with such investments

Before making investments, the Investment Manager conducts such due diligence as it deems reasonable and

appropriate based on the facts and circumstances applicable to each investment. There can be no assurance

that due diligence investigations with respect to any investment opportunity will reveal or highlight all relevant

facts that may be necessary or helpful in evaluating that investment opportunity.

Any failure by the Investment Manager to identify relevant facts through the due diligence process may lead to

inappropriate investment decisions being made, or investments being made at a higher value than their fair

value, which could have an adverse effect on the value of the Portfolio, the Company’s financial condition,

13

results of operations and prospects, with a consequential adverse effect on the returns to Shareholders and the

market value of the Shares.

The Company’s investment strategy may involve the use of leverage, which exposes the Company to risks

associated with borrowings

Pursuant to its investment strategy, the Company uses borrowing to gear its Portfolio within a range of 5 per

cent. cash to 20 per cent. geared under normal market conditions. As such, the Company may be exposed to

interest rate risk due to fluctuations in the prevailing market rates. However, certain borrowings carry a fixed

rate of interest and therefore have no exposure to interest rate movements. In addition, with effect from the

Effective Date, the Company will become the issuer of the SCIN Bonds, being the 5.75 per cent. secured

bonds due 17 April 2030, which are secured by way of a floating charge to be created by the Company in

favour of The Law Debenture Trust Corporation p.l.c. as common security agent. The common security agent

will hold the secured property on trust for (i) the Trustee in respect of the SCIN Bonds and (ii) the holders of

the Company’s Notes, in accordance with the terms of the Security Trust and Intercreditor Agreement described

in paragraph 3 of Part IV (Details of the Scheme and the Issue) of this Prospectus. The SCIN Bonds contain

customary events of default, including acceleration of any other debt of the Company or security enforced.

Following the occurrence of any such event of default which is continuing, the Trustee in respect of the SCIN

Bonds would be able to instruct the common security agent to enforce the security under the floating charge.

In the event that the common security agent enforces such security, or any other lender enforces any security

they may have from time to time in respect of any debt held by the Company, the Company may be required

to sell investments (or the common security agent or relevant lender may have rights to force the sale of

investments) in order to satisfy such outstanding obligations. In such event, the value of the Portfolio could be

adversely affected if the Company obtains a lower price on such forced sale compared to the price at which

the relevant Investment was valued, which could have a consequential adverse effect on the returns to

Shareholders and the market value of the Shares.

While leverage presents opportunities for increasing total returns, it can also have the opposite effect of

increasing losses. If income and capital appreciation on investments made with borrowed funds are less than

the costs of the leverage, the Net Asset Value of the Company will decrease. The effect of the use of leverage

is to increase the investment exposure, the result of which is that, in a market that moves adversely, the

possible resulting loss to investors’ capital would be greater than if leverage were not used.

Currency and foreign exchange risk

The Company has and may in the future have further investments denominated in currencies other than

Sterling. The Company therefore is and will continue to be exposed to foreign exchange risk. Changes in the

rates of exchange between Sterling and any currency will cause the value of any investment denominated in

that currency, and any income arising out of the relevant investment, to go down or up in Sterling terms. The

Company may enter into hedging transactions to mitigate its exposure to fluctuations in foreign exchange rates.

However, such currency exposure could have an adverse effect on the Portfolio and the Company’s financial

condition, results of operations and prospects, with a consequential adverse effect on the returns to

Shareholders and the market value of the Shares.

The Company continues its passive currency hedging strategy (implemented in late 2009) that aims to make

stock selection the predominant driver of overall Portfolio performance relative to the benchmark, the MSCI All

Countries World Index (in Sterling terms). This is a risk reduction measure, designed to eliminate most of the

differences between the Portfolio’s currency exposure and that of the Company’s benchmark. As a result the

returns derived from, and the Portfolio’s exposure to currencies may differ materially from, that of the

Company’s competitors, who generally do not undertake such a strategy.

Underperformance by the companies in the Portfolio, or other market factors, may cause the Company to

fail to deliver its target performance against the Benchmark and may affect the ability of the Company to

achieve its investment objective

The Company’s investment objective is to achieve superior total returns from world stock markets. The success

of the Company is dependent on the continued ability of the Investment Manager to pursue the Company’s

Investment Policy successfully and on broader market conditions as discussed elsewhere in this Prospectus

(including the performance of world stock and securities markets and world economies more broadly), together

with the Investment Manager’s ability to continue to invest the Company’s assets on attractive terms, to

generate any investment returns for the Company’s investors. There is no assurance that any appreciation in

the value of the Shares will occur or that the investment objective of the Company will be achieved. This could

have an adverse effect on the Portfolio and the Company’s financial condition, results of operations and

prospects, with a consequential adverse effect on returns to Shareholders and the market value of the Shares.

Whilst not forming part of the Company’s Investment Policy, the Company has published a dividend policy

which sets out the target dividend that it expects to be able to pay to Shareholders. This dividend policy is

based on assumptions about market conditions, the economic environment and the availability and performance

14

of the Company’s investments in companies in the Portfolio. If these assumptions do not prove accurate in

reality (for example, in the case of underperformance of companies in the Portfolio or the manifestation of other

market-related risks referred to in this Prospectus), then there can be no assurance that the Company will be

able to deliver its target performance against the Benchmark. Any inability to pay target dividend amounts to

Shareholders is likely to have an adverse effect on the liquidity and market value of the Shares.

The Company is subject to risks associated with any hedging or derivative transactions in which it

participates

The Company does not normally enter into derivative transactions but can (and does) do so in limited

circumstances (with prior Board approval) for the purposes of efficient portfolio management (including for

hedging of foreign currency transactions). Derivative instruments in which the Company may invest may include

foreign exchange forwards, exchange-listed and over-the-counter (“OTC”) options, futures, options on futures,

swaps and similar instruments. Derivative transactions may be volatile and involve various risks different from,

and in certain cases, greater than the risks presented by other instruments. The primary risks related to

derivative transactions include counterparty, correlation, illiquidity, leverage, volatility and OTC trading risks.

Counterparty risk is the risk that a counterparty in a derivative transaction will not fulfil its contractual or

financial obligations to the Company or the risk that the reference entity in a swap or similar derivative will not

fulfil its contractual or financial obligations. Correlation risk is the risk that an imperfect or variable degree of

correlation between price movements of the derivative instrument and the underlying investment sought to be

hedged may prevent the Company from achieving the intended hedging effect or expose the Company to the

risk of loss. Liquidity risk is the risk that derivative transactions may not be liquid in all circumstances, such

that in volatile markets it may not be possible to close out a position without incurring a loss. Volatility risk is

the risk resulting from the fact that the prices of many derivative instruments, including many options and

swaps, are highly volatile, due to being influenced by, among other things, interest rates, changing supply and

demand relationships, trade, fiscal, monetary and exchange control programmes and policies of governments,

and national and international political and economic events and policies, as well as (in the case of options and

swaps agreements) the price of the securities or currencies underlying the relevant derivative agreement.

A small investment in derivatives could have a large potential impact on the Company’s performance, effecting

a form of investment leverage on the Portfolio. In certain types of derivative transactions, the entire amount of

the investment could be lost. In other types of derivative transactions, the potential loss is theoretically

unlimited.

The Company may be exposed to legal, political or other market risks through investing in companies in the

Portfolio located in overseas jurisdictions or traded on overseas stock markets

The Company invests in companies in the Portfolio incorporated or traded on stock markets outside of the

United Kingdom, which exposes the Company to the following risks:

*

adverse changes in local economic and political stability in countries in which a company in the Portfolio

is incorporated or the stock market on which the company in the Portfolio is traded, particularly where

such situations impact the revenues generated by those companies in the Portfolio, returns made to

overseas investors in those companies in the Portfolio, or other investor rights in relation to that company

in the Portfolio (such as liquidity rights);

*

exchange rate fluctuations between Sterling and the currency of a jurisdiction in which a company in the

Portfolio is domiciled or generates its income (as noted in more detail in the risk factor entitled “Currency

and foreign exchange risk” above);

*

unexpected changes in the regulatory environment, such as changes to a country’s (or an overseas stock

market’s) rules relating to: (i) investor protection or liquidity rights, (ii) listing on that stock market,

particularly where such rules become materially more burdensome for a company in the Portfolio;

(iii) payment of returns to overseas investors (whether as capital or income); or (iv) eligibility of overseas

investors to invest in a company in the Portfolio;

*

tax systems that may have an adverse effect on the revenue received by the Company and, in particular,

regulations relating to the imposition of any withholding taxes on the repatriation of capital or income from

those jurisdictions in which companies in the Portfolio are domiciled or generate income; and

*

the imposition, in the future, of any sanctions and corresponding banking restrictions in respect of a

jurisdiction in which a company in the Portfolio is incorporated or the stock market on which the company

in the Portfolio is traded.

Any of the above may have an adverse effect on the value of a company in the Portfolio and revenues

received by the Company from the relevant company in the Portfolio, which would in turn have an adverse

effect on the Company’s financial condition, business, prospects and results of operations and, consequently,

the Company’s Net Asset Value and/or the market price of the Shares, and the returns generated for

Shareholders.

15

The Company’s exposure to emerging markets at any given time is expected to be relatively small in the

context of the Portfolio (for example, as at the date of this Prospectus, the Company’s exposure to emerging

markets through its investment in the companies in the Portfolio is less than 3 per cent. of the Company’s Net

Asset Value). If the Company, in the future, increases its exposure to emerging markets, it would be

susceptible to risks associated with making investments in emerging markets which, in addition to those set out

above, may include exposure to less developed or less rigorously enforced investor protection laws or less

favourable insolvency regimes for creditors. This may impact the value of a company in the Portfolio and

revenues received from any companies in the Portfolio domiciled in (or traded on a stock market that is located

in) such emerging jurisdictions, particularly in times of distress for the relevant company in the Portfolio. If any

of these risks materialised, it could have an adverse impact on the Company’s Net Asset Value and/or the

market price of the Shares, and the returns generated for Shareholders.

The Company may invest in equities securities which rank behind other outstanding securities and

obligations of the issuer

The Company may invest in equities securities which rank behind other outstanding securities and obligations

of the issuer, all or a significant proportion of which may be secured on substantially all of that issuer’s assets.

The Company may, therefore, be subject to credit and liquidity risk in relation to such investments.

In the event of the liquidation of an issuer, holders of listed securities would typically be paid after the holders

of other securities. To the extent that the Company holds equity securities, it would typically be paid in respect

of such equity securities after holders of debt securities have been paid. Consequently, there is no guarantee

that the Company would receive any value for its holdings of an issuer’s listed securities if the issuer were to

go into liquidation. This could have a significant adverse effect on the value of the Portfolio, the Company’s

financial condition, results of operations and prospects, with a consequential adverse effect on returns to

Shareholders and the market value of the Shares.

The Company’s investments may be adversely affected by poor performance of a particular sector or

industry

The Company’s investments are intended to be diversified by sector and industry. The diversification of its

investments is intended to mitigate the Company’s exposure to adverse events associated with specific

investments and sectors. The Company’s returns may, however, still be adversely affected by the unfavourable

performance of particular sectors or industries if they affect the performance or prospects of companies in the

Portfolio. This adverse effect may be amplified if more companies the Portfolio are in, or connected to, the

affected sector or industry (in other words, if the Portfolio has a greater concentration of investments in any

affected sector or industry). This could have an adverse effect on the Portfolio and on the Company’s financial

condition, results of operations and prospects, with a consequential adverse effect on returns to Shareholders

and the market value of the Shares.

RISKS RELATING TO THE MANAGER AND THE INVESTMENT MANAGER

The success of the Company is dependent on the Manager and the Investment Manager and their expertise,

key personnel, and ability to source and advise appropriately on investments

In accordance with the Investment Management Agreement, the Manager is solely responsible for the

management of the Company’s investments, with the Manager delegating its portfolio management

responsibilities to the Investment Manager. The Company does not have any employees and its Directors are

appointed, and the prospective Directors will be appointed, on a non-executive basis. All of its investment and

asset management decisions are in the ordinary course made by the Manager and the Investment Manager

(and any of their delegates) and not by the Company. The Investment Manager is not required to and generally

does not submit individual investment decisions for approval to the Board. The Company is therefore reliant

upon, and its success depends on, the Manager and the Investment Manager and their personnel, services

and resources.

The Company is dependent on the services provided by the Manager and the Investment Manager. The

information contained in this Prospectus relating to the prior performance of investments made by the Manager

and the Investment Manager on behalf of the Company is being provided for illustrative purposes only and is

not indicative of the likely future performance of the Company. In considering the prior performance information

contained in this Prospectus, prospective investors should bear in mind that past performance is not

necessarily indicative of future results and there can be no assurance that the Company will achieve

comparable results or be able to avoid losses.

Returns on Shareholders’ investments in Shares will depend upon the Manager’s and the Investment Manager’s

ability to source and make successful investments on behalf of the Company in the face of competition from

other entities seeking to invest in investment opportunities identified for the Company. Competition can create

significant upward pressure on pricing, thereby reducing the potential investment returns. There is no guarantee

that competitive pressures will not have a material adverse effect on the Company’s

financial position and

returns for investors.

16

Many of the Manager’s and the Investment Manager’s investment decisions will depend upon the ability of their

employees and agents to carry out due diligence and obtain relevant information. There can be no guarantee

that such information will be available or that the Manager and the Investment Manager and their employees

and agents will be able to obtain it. The Manager and the Investment Manager may be required to make

investment decisions without complete information, or in reliance upon information provided by third parties that

is impossible or impracticable to fully verify. Further, the Manager and the Investment Manager may not

conduct due diligence which is wide enough in scope to reveal the potential risks of a particular investment.

There can be no assurance that the Manager and the Investment Manager will correctly identify and evaluate

the nature and magnitude of the various factors that could affect the value of and return on the Company’s

investments. Any failure by the Manager and the Investment Manager to perform effective due diligence on

potential investments may adversely affect the investment returns expected from a particular investment.

Further, the ability of the Company to pursue its Investment Policy successfully depends on the continued

service of key personnel of the Manager and the Investment Manager, and/or the Manager’s and the

Investment Manager’s ability to recruit individuals of similar experience and calibre. Whilst the Manager and the

Investment Manager seek to ensure that the principal members of its management teams are suitably

incentivised, the retention of key members of those teams cannot be guaranteed. There is no guarantee that,

following the death, disability or departure from the Manager or the Investment Manager of any key personnel,

the Manager or the Investment Manager would be able to recruit a suitable replacement or avoid any delay in

doing so. The loss of key personnel and any inability to recruit an appropriate replacement in a timely fashion

could have an adverse effect on the future performance of the Portfolio and on the Company’s financial

condition, results of operations and prospects, with a consequential adverse effect on returns to Shareholders

and the market value of the Shares.

Potential conflicts of interest

The Manager, the Investment Manager and their Affiliates serve as the manager, alternative investment fund

manager, investment manager and/or investment adviser to other clients, including funds and other mandates

that have similar investment objectives and policies to that of the Company. These services may on occasion

give rise to conflicts of interest with the Company may have an adverse effect on the Company’s business,

financial condition, results of operations and the market price of the Shares. For example, the Manager, the