THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are

in any doubt about the action you should take, you are recommended to seek your own

financial advice immediately from an independent financial adviser who is authorised under

the Financial Services and Markets Act 2000 (as amended) (‘‘FSMA’’) if you are in the United

Kingdom, or from another appropriately authorised independent financial adviser if you are

in a territory outside the United Kingdom.

This document, which comprises a prospectus relating to M&G Credit Income Investment Trust plc

(the ‘‘Company’’) prepared in accordance with the Prospectus Rules has been approved by the

Financial Conduct Authority (the ‘‘FCA’’) and has been delivered to the FCA in accordance with

Rule 3.2 of the Prospectus Rules. This document has been made available to the public as

required by the Prospectus Rules.

Applications will be made to the UK Listing Authority and the London Stock Exchange for all of the

Ordinary Shares (issued and to be issued) in connection with the Initial Issue to be admitted to the

premium segment of the Official List and to trading on the premium segment of the London Stock

Exchange’s main market. Applications will be made for all of the Shares of the Company issued

pursuant to each Subsequent Placing under the Placing Programme to be admitted to the premium

segment of the Official List and to trading on the premium segment of the London Stock

Exchange’s main market. It is expected that Initial Admission of the Ordinary Shares to be issued

under the Initial Issue will become effective and that unconditional dealings will commence in the

Ordinary Shares at 8.00 a.m. on 14 November 2018. It is expected that Admissions pursuant to

Subsequent Placings under the Placing Programme will become effective and dealings will

commence between 15 November 2018 and 25 September 2019. No application has been made

or is currently intended to be made for the Shares to be admitted to listing or trading on any other

stock exchange.

The Company and each of the Directors, whose names appear on page 46 of this document,

accept responsibility for the information contained in this document. To the best of the knowledge

and belief of the Company and the Directors (who have taken all reasonable care to ensure that

such is the case), the information contained in this document is in accordance with the facts and

does not omit anything likely to affect the import of such information.

Prospective investors shoul d read the entire document and, in particular, the section

headed ‘‘Risk Factors’’ on pages 20 to 36 of this document when considering an investment

in the Company.

M&G CREDIT INCOME INVESTMENT TRUST PLC

(Incorporated in England and Wales with registered number 11469317 and registered as

an investment company under section 833 of the Companies Act)

Initial Placing, Offer for Subscription and Intermediaries Offer for a target issue in

excess of 250 million Ordinary Shares at 100 pence per Ordinary Share

Placing Programme for up to 400 million Ordinary Shares and/or C Shares

Admission to the premium segment of the Official List and to trading on the

premium segment of the London Stock Exchange’s main market

Investment Manager

M&G ALTERNATIVES INVESTMENT MANAGEMENT LIMITED

Sponsor, Financial Adviser, Bookrunner and Intermediaries Offer Adviser

WINTERFLOOD SECURITIES LIMITED

Winterflood Securities Limited (‘‘Winterflood Securities’’), which is authorised and regulated in the

United Kingdom by the Financial Conduct Authority, is acting exclusively, through its division

Winterflood Investment Trusts, as sponsor, financial adviser, bookrunner and Intermediaries Offer

Adviser for the Company and for no one else in relation to Admission of any Shares, the Initial

Issue, the Placing Programme and the other arrangements referred to in this document.

Winterflood Securities will not regard any other person (whether or not a recipient of this

document) as its client in relation to Admission of any Shares, the Initial Issue, the Placing

Programme and the other arrangements referred to in this document and will not be responsible to

anyone other than the Company for providing the protections afforded to its clients or for providing

any advice in relation to Admission of any Shares, the Initial Issue, the Placing Programme, the

contents of this document or any transaction or arrangement referred to in this document.

Apart from the responsibilities and liabilities, if any, which may be imposed on Winterflood

Securities by FSMA or the regulatory regime established thereunder, Winterflood Securities does

not make any representation, express or implied, in relation to, nor accepts any responsibility

whatsoever for, the contents of this document or any other statement made or purported to be

made by it or on its behalf in connection with the Company, the Shares, Admission of any Shares,

the Initial Issue or the Placing Programme. Winterflood Securities (and its affiliates) accordingly, to

the fullest extent permissible by law, disclaims all and any responsibility or liability (save for

statutory liability), whether arising in tort, contract or otherwise which it might otherwise have in

respect of the contents of this document or any other statement made or purported to be made by

it or on its behalf in connection with the Company, the Shares, Admission of any Shares, the Initial

Issue or the Placing Programme.

The Offer for Subscription and the Intermediaries Offer will remain open until 1.00 p.m. on

7 November 2018 and the Initial Placing will remain open until 2.00 p.m. on 8 November 2018.

Persons wishing to participate in the Offer for Subscription should complete the Application Form

set out in Appendix 1 to this document and the Tax Residency Self-Certification Form set out in

Appendix 2 to this document. To be valid, Application Forms and Tax Residency Self-Certification

Forms must be completed and returned with the appropriate remittance by post to the Receiving

Agent, Link Asset Services, Corporate Actions, The Registry, 34 Beckenham Road, Beckenham,

Kent BR3 4TU so as to be received no later than 1.00 p.m. on 7 November 2018.

Investors should rely only on the information contained in this document. No person has been

authorised to give any information or make any representations in relation to the Company other

than those contained in this document and, if given or made, such information or representations

must not be relied upon as having been so authorised by the Company, the Investment Manager

or Winterflood Securities. Without prejudice to the Company’s obligations under the Prospectus

Rules, the Listing Rules, the Disclosure Guidance and Transparency Rules and MAR, neither the

delivery of this document nor any subscription for or purchase of Shares pursuant to the Initial

Issue and/or the Placing Programme, under any circumstances, creates any implication that there

has been no change in the affairs of the Company since, or that the information contained herein

is correct at any time subsequent to, the date of this document.

Winterflood Securities and its affiliates may have engaged in transactions with, and provided

various investment banking, financial advisory and other services for, the Company and/or the

Investment Manager, for which they would have received customary fees. Winterflood Securities

and its affiliates may provide such services to the Company and/or the Investment Manager and

any of their respective affiliates in the future.

In connection with the Initial Issue and/or Subsequent Placings, Winterflood Securities and any of

its affiliates, acting as investors for its or their own accounts, may subscribe for or purchase

Shares and in that capacity may retain, purchase, sell, offer to sell or otherwise deal for its or their

own account(s) in the Shares and other securities of the Company or related investments in

connection with the Initial Issue and/or Subsequent Placings or otherwise. Accordingly, references

in this document to Shares being issued, offered, acquired, subscribed or otherwise dealt with,

should be read as including any issue or offer to, acquisition of, or subscription or dealing by

Winterflood Securities and any of its affiliates acting as an investor for its or their own account(s).

Neither Winterflood Securities nor any of its affiliates intends to disclose the extent of any such

investment or transactions otherwise than in accordance with any legal or regulatory obligation to

do so. In addition, Winterflood Securities may enter into financing arrangements with investors,

such as share swap arrangements or lending arrangements in connection with which Winterflood

Securities may from time to time acquire, hold or dispose of shareholdings in the Company.

The contents of this document are not to be construed as legal, financial, business, investment or

tax advice. Investors should consult their own legal adviser, financial adviser or tax adviser for

legal, financial, business, investment or tax advice. Investors must inform themselves as to: (a) the

legal requirements within their own countries for the purchase, holding, transfer, redemption or

other disposal of Shares; (b) any foreign exchange restrictions applicable to the purchase, holding,

transfer or other disposal of Shares which they might encounter; and (c) the income and other tax

consequences which may apply in their own countries as a result of the purchase, holding, transfer

or other disposal of, or subscription for Shares. Investors must rely on their own representatives,

including their own legal advisers and accountants, as to legal, financial, business, investment, tax,

or any other related matters concerning the Company and an investment therein. None of the

2

Company, the Investment Manager or Winterflood Securities nor any of their respective

representatives is making any representation to any offeree or purchaser of Shares regarding the

legality of an investment in the Shares by such offeree or purchaser under the laws applicable to

such offeree or purchaser.

Notice to U.S. and other overseas investors

This document may not be used for the purpose of, and does not constitute, an offer or solicitation

by anyone in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful

or not authorised or to any person to whom it is unlawful to make such offer or solicitation.

This document is not being sent to investors with registered addresses in the United States,

Canada, Australia, the Republic of South Africa or Japan, and does not constitute an offer to sell,

or the solicitation of an offer to buy, Shares in any jurisdiction in which such offer or solicitation is

unlawful or would impose any unfulfilled registration, qualification, publication or approval

requirements on the Company or Winterflood. In particular, this document is not for release,

publication or distribution in or into the United States, Canada, Australia, the Republic of South

Africa or Japan.

The Shares have not been and will not be registered under the U.S. Securities Act of 1933, as

amended (the ‘‘U.S. Securities Act’’) or with any securities regulatory authority of any state or

other jurisdiction of the United States and the Shares may not be offered, sold, exercised, resold,

transferred or delivered, directly or indirectly, within the United States or to, or for the account or

benefit of, U.S. Persons (as defined in Regulation S under the U.S. Securities Act), except

pursuant to an exemption from, or in a transaction not subject to, the registration requirements of

the U.S. Securities Act and in compliance with any applicable securities laws of any state or other

jurisdiction in the United States. There will be no public offer of the Shares in the United States.

The Shares are being offered or sold outside the United States to non-U.S. Persons in offshore

transactions in reliance on the exemption from the registration requirements of the U.S. Securities

Act provided by Regulation S thereunder. The Company has not been and will not be registered

under the U.S. Investment Company Act of 1940, as amended (the ‘‘U.S. Investment Company

Act’’) and investors will not be entitled to the benefits of the U.S. Investment Company Act.

The Shares have not been approved or disapproved by the U.S. Securities and Exchange

Commission, any state securities commission in the United States or any other U.S. regulatory

authority, nor have any of the foregoing authorities passed upon or endorsed the merits of the

offering of Shares or the accuracy or adequacy of this document. Any representation to the

contrary is a criminal offence in the United States and any re-offer or resale of any of the Shares

in the United States or to U.S. Persons may constitute a violation of U.S. law or regulation. Any

person in the United States who obtains a copy of this document is requested to disregard it.

In relation to each member state in the EEA that has implemented the AIFM Directive, no Shares

have been or will be directly or indirectly offered to or placed with investors in that member state

at the initiative of or on behalf of the Company or the Investment Manager other than in

accordance with methods permitted in that member state.

Copies of this document will be available on the Company’s website (www.mandg.co.uk/

creditincomeinvestmenttrust) and the National Storage Mechanism of the FCA at

www.morningstar.co.uk/uk/nsm and hard copies of the document can be obtained free of charge

from the Company Secretary.

Without limitation, neither the contents of the Company’s or the Investment Manager’s

website (or any other website) nor the content of any website accessible from hyperlinks on

the Company’s or the Investment Manager’s website (or any other website) is incorporated

into, or forms part of this document. Investors should base their decision whether or not to

invest in the Shares on the contents of this document alone.

Dated: 26 September 2018

3

CONTENTS

Page

SUMMARY 5

RISK FACTORS 20

IMPORTANT INFORMATION 37

EXPECTED TIMETABLE 43

INITIAL ISSUE AND PLACING PROGRAMME STATISTICS 44

DEALING CODES 45

DIRECTORS, MANAGEMENT AND ADVISERS 46

PART 1 – INFORMATION ON THE COMPANY 48

PART 2 – M&G 56

PART 3 – THE INVESTMENT OPPORTUNITY AND ASSET CLASS

OVERVIEW 63

PART 4 – DIRECTORS, MANAGEMENT AND ADMINISTRATION 68

PART 5 – THE INITIAL ISSUE 74

PART 6 – THE PLACING PROGRAMME 80

PART 7 – TAXATION 85

PART 8 – GENERAL INFORMATION 89

PART 9 – AIFM DIRECTIVE ARTICLE 23 DISCLOSURES 118

PART 10 – DEFINITIONS 125

PART 11 – TERMS AND CONDITIONS OF INITIAL PLACING AND

PLACING PROGRAMME 132

PART 12 – TERMS AND CONDITIONS OF APPLICATION UNDER THE

OFFER FOR SUBSCRIPTION 142

APPENDIX 1 – APPLICATION FORM 157

APPENDIX 2 – INDIVIDUAL HOLDER TAX RESIDENCY SELF CERTIFICATION

FORM – SOLE HOLDING 164

4

SUMMARY

Summaries are made up of disclosure requirements known as ‘‘Elements’’. These elements are

numbered in Sections A-E (A.1-E.7). This summary contains all the Elements required to be included in a

summary for this type of securities and issuer. Some Elements are not required to be addressed which

means there may be gaps in the numbering sequence of the Elements. Even though an Element may be

required to be inserted into the summary because of the type of securities and issuer, it is possible that

no relevant information can be given regarding the Element. In this case a short description of the

Element is included in the summary with the mention of ‘‘Not applicable’’.

Section A – Introduction and warnings

Element

Disclosure

Requirement Disclosure

A.1. Warning This summary should be read as an introduction to this document.

Any decision to invest in Shares should be based on consideration

of this document as a whole by the investor. Where a claim relating

to the information contained in this document is brought before a

court, the plaintiff investor might, under the national legislation of

the Relevant Member State, have to bear the costs of translating

this document before the legal proceedings are initiated. Civil

liability attaches only to those persons who have tabled the

summary including any translation thereof, but only if the summary

is misleading, inaccurate or inconsistent when read together with

the other parts of this document or it does not provide, when read

together with the other parts of this document, key information in

order to aid investors when considering whether to invest in such

securities.

A.2. Subsequent resale or

final placement of

securities through

financial

intermediaries

The Company consents to the use of this document by

Intermediaries in connection with the subsequent resale or final

placement of securities by Intermediaries.

The offer period within which any subsequent resale or final

placement of securities by Intermediaries can be made and for

which consent to use this document is given commences on

26 September 2018 and closes at 1.00 p.m. on 7 November 2018,

unless closed prior to that date.

Any Intermediary that uses this document must state on its website

that it uses this document in accordance with the Company’s

consent. Intermediaries are required to provide the terms and

conditions of the Intermediaries Offer to any prospective investor

who has expressed an interest in participating in the Intermediaries

Offer to such Intermediary.

Information on the terms and conditions of any subsequent

resale or final placement of securities by any financial

intermediary is to be provided at the time of the offer by the

financial intermediary.

Section B – Issuer

Element

Disclosure

Requirement Disclosure

B.1. Legal and commercial

name

M&G Credit Income Investment Trust plc

B.2. Domicile and legal

form

The Company was incorporated in England and Wales on 17 July

2018 with registered number 11469317 as a public company limited

by shares under the Companies Act. The principal legislation under

which the Company operates is the Companies Act.

5

B.5. Group description Not applicable. The Company is not part of a group.

B.6. Major shareholders The Directors intend to subscribe for the following Ordinary Shares

pursuant to the Initial Issue:

Ordinary

Shares

David Simpson 25,000

Richard Bole´at 10,000

Mark Hutchinson 20,000

Barbara Powley 15,000

The Prudential Assurance Company Limited intends to subscribe

for the lower of (i) 80,000,000 Ordinary Shares and (ii) 25% of the

Ordinary Shares to be issued pursuant to the Initial Issue. The

Directors believe that this proposed investment strongly aligns the

interests of M&G with Shareholders.

As at 25 September 2018 (the latest practicable date prior to the

publication of this document) insofar as known to the Company,

there are no parties known to have a notifiable interest under

English law in the Company’s capital or voting rights.

All Shareholders have the same voting rights in respect of the

shares of the same class in the share capital of the Company.

Pending the allotment of Ordinary Shares pursuant to the Initial

Issue, the Company is controlled by Mark Hutchinson. The

Company and the Directors are not aware of any other person

who, directly or indirectly, jointly or severally, exercises or could

exercise control over the Company.

B.7. Key financial

information

Not applicable. No key financial information is included in this

document as the Company is yet to commence operations.

B.8. Key pro forma

financial information

Not applicable. No pro forma financial information is included in this

document.

B.9. Profit forecast Not applicable. No profit forecast or estimate is included in this

document.

B.10. Description of the

nature of any

qualifications in the

audit report on the

historical financial

information

Not applicable. There are no audit reports in this document.

B.11. Qualified working

capital

Not applicable. The Company is of the opinion that, on the basis

that the Minimum Net Proceeds are raised, the working capital

available to it is sufficient for its present requirements, that is, for at

least the next 12 months from the date of this document.

B.34. Investment policy Investment Objective

The Company aims to generate a regular and attractive level of

income with low asset value volatility.

Investment Policy

The Company seeks to achieve its investment objective by

investing in a diversified portfolio of public and private debt and

debt-like instruments (‘‘Debt Instruments’’). Over the longer term,

6

it is expected that the Company will be mainly invested in private

Debt Instruments, which are those instruments not quoted on a

stock exchange.

The Company operates an unconstrained investment approach

and investments may include, but are not limited to:

*

Asset-backed securities, backed by a pool of loans secured

on, amongst other things, residential and commercial

mortgages, credit card receivables, auto loans, student

loans, commercial loans and corporate loans;

*

Commercial mortgages;

*

Direct lending to small and mid-sized companies, including

lease finance and receivables financing;

*

Distressed debt opportunities to companies going through a

balance sheet restructuring;

*

Infrastructure-related debt assets;

*

Leveraged loans to private equity owned companies;

*

Public Debt Instruments issued by a corporate or sovereign

entity which may be liquid or illiquid;

*

Private placement debt securities issued by both public and

private organisations; and

*

Structured credit, including bank regulatory capital trades.

The Company will invest primarily in Sterling denominated Debt

Instruments. Where the Company invests in assets not

denominated in Sterling it is generally expected that these assets

will be hedged back to Sterling.

Investment restrictions

There are no restrictions, either maximum or minimum, on the

Company’s exposure to sectors, asset classes or geography. The

Company, however, achieves diversification and a spread of risk by

adhering to the limits and restrictions set out below.

Once fully invested, the Company’s portfolio will comprise a

minimum of 50 investments.

The Company may invest up to 30% of Gross Assets in below

investment grade Debt Instruments, which are those instruments

rated below BBB- by S&P or Fitch or Baa3 by Moody’s or, in the

case of unrated Debt Instruments, which have an internal M&G

rating below BBB-.

The following restrictions will also apply at the individual Debt

Instrument level which, for the avoidance of doubt, does not apply

to investments to which the Company is exposed through collective

investment vehicles:

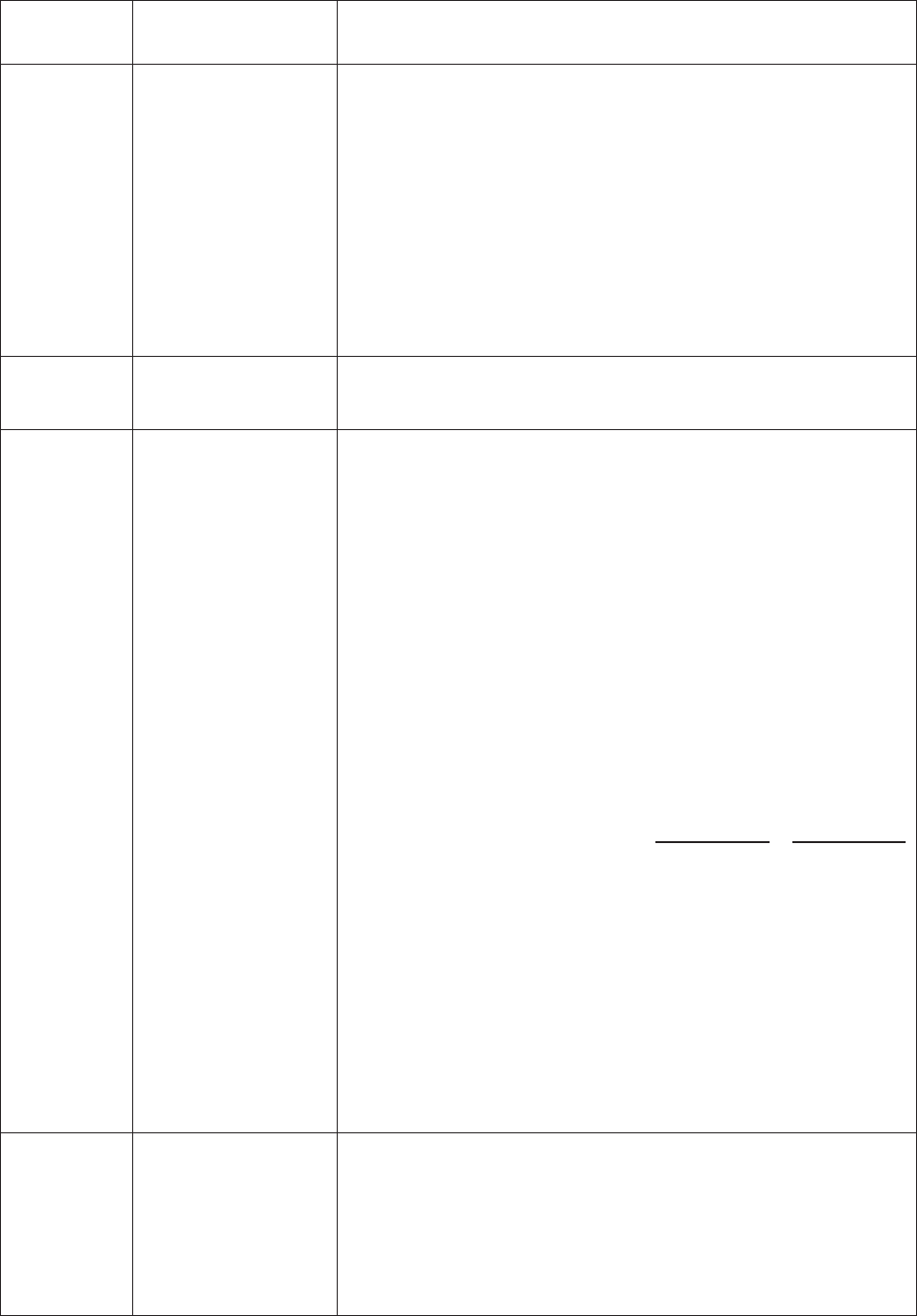

Rating

Secured Debt

Instruments

(% of Gross

Assets)

1

Unsecured

Debt

Instruments

(% of Gross

Assets)

AAA 5% 5%

2

AA/A 4% 3%

BBB 3% 2%

Below investment grade 2% 1%

1 Secured Debt Instruments are secured by a first or secondary fixed and/or

floating charge.

2 This limit excludes investments in G7 Sovereign Instruments.

7

For the purposes of the above investment restrictions, the credit

rating of a Debt Instrument is taken to be the rating assigned by

S&P, Fitch or Moody’s or, in the case of unrated Debt Instruments,

an internal rating by M&G. In the case of split ratings by recognised

rating agencies, the second highest rating will be used.

It is expected that the Company will typically invest directly, but it

may also invest indirectly through collective investment vehicles

which are expected to be managed or advised by an M&G Entity.

The Company may not invest more than 20% of Gross Assets in

any one collective investment vehicle and not more than 40% of

Gross Assets in collective investment vehicles in aggregate. No

more than 10% of Gross Assets may be invested in other

investment companies which are listed on the Official List.

Unless otherwise stated, the above investment restrictions are to

be applied at the time of investment.

Borrowings

The Company is expected to be managed primarily on an ungeared

basis although the Company may, from time to time, be geared

tactically through the use of borrowings. Borrowings would

principally be used for investment purposes, but may also be

used to manage the Company’s working capital requirements or to

fund market purchases of Shares. Gearing represented by

borrowing will not exceed 30% of the Company’s Net Asset

Value, calculated at the time of draw down, but is typically not

expected to exceed 20% of the Company’s Net Asset Value.

Hedging and Derivatives

The Company will not employ derivatives for investment purposes.

Derivatives may however be used for efficient portfolio

management, including for currency hedging.

Cash management

The Company may hold cash on deposit and may invest in cash

equivalent investments, which may include short-term investments

in money market type funds (‘‘Cash and Cash Equivalents’’).

There is no restriction on the amount of Cash and Cash Equivalents

that the Company may hold and there may be times when it is

appropriate for the Company to have a significant Cash and Cash

Equivalents position. For the avoidance of doubt, the restrictions

set out above in relation to investing in collective investment

vehicles do not apply to money market type funds.

Changes to the investment policy

Any material change to the Company’s investment policy set out

above will require the approval of Shareholders by way of an

ordinary resolution at a general meeting and the approval of the UK

Listing Authority.

B.35. Borrowing limits The Company is expected to be managed primarily on an ungeared

basis although the Company may, from time to time, be geared

tactically through the use of borrowings. Borrowings would

principally be used for investment purposes, but may also be

used to manage the Company’s working capital requirements or to

fund market purchases of Shares. Gearing represented by

borrowing will not exceed 30% of the Company’s Net Asset

Value, calculated at the time of draw down, but is typically not

expected to exceed 20% of the Company’s Net Asset Value.

8

B.36. Regulatory status As an investment trust, the Company will not be regulated as a

collective investment scheme by the FCA. However, from Initial

Admission, it will be subject to the Listing Rules, Prospectus Rules,

the Disclosure Guidance and Transparency Rules, Market Abuse

Regulation and the rules of the London Stock Exchange.

B.37. Typical investor The typical investors for whom an investment in the Company is

appropriate are institutional investors and professionally-advised or

financially sophisticated non-advised private investors who

understand and are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses (which may equal the whole amount invested) that

may result from such an investment. Such investors are

recommended to consult an independent financial adviser who

specialises in advising on the acquisition of shares and other

securities before making an investment. Furthermore, an

investment in the Company should constitute part of a diversified

investment portfolio.

B.38. Investment of more

than 20% of gross

assets in single

underlying asset or

collective investment

undertaking

Not applicable.

B.39. Investment of in

excess of 40% of

gross assets

in another collective

investment

undertaking

Not applicable.

B.40. Applicant’s service

providers

Investment Manager

The Company has appointed the Investment Manager to act as the

Company’s AIFM for the purposes of the AIFM Directive and

accordingly the Investment Manager is responsible for providing

discretionary portfolio management and risk management services

to the Company.

The Investment Manager is entitled to receive from the Company

an investment management fee which is calculated and paid

quarterly in arrears at an annual rate of (i) 0.5% per annum of the

prevailing published Net Asset Value until the end of the

Company’s first accounting period, 31 December 2019; and (ii)

0.7% per annum of the prevailing published Net Asset Value

thereafter.

Where the Company invests in a collective investment vehicle that

is managed or advised by an M&G Entity, the Investment Manager

will reduce its investment management fee by the amount of any

equivalent management fee that is charged to such collective

investment vehicle or such entity will rebate its management fee

such that the Investment Manager ensures the Company is not

charged twice. The above arrangement will not apply to any other

fees or expenses charged to the Company or any such entity in

which it invests.

9

The Investment Manager is also entitled to be paid half of any

arrangement fee charged by the Company to the issuer of a Debt

Instrument in which the Company invests. The balance of any

arrangement fee is retained by the Company.

The Investment Management Agreement is for an initial term of five

years from the date of Initial Admission and thereafter subject to

termination on not less than six months’ written notice by either

party. The Investment Management Agreement can be terminated

at any time in the event of the insolvency of the Company or the

Investment Manager or in the event that the Investment Manager

ceases to be authorised and regulated by the FCA (if required to be

so authorised and regulated to continue to carry out its duties under

the Investment Management Agreement).

Administrator

State Street Bank & Trust Company has been appointed to act as

the administrator of the Company. The Administrator is responsible

for general fund administration services including calculation of the

Net Asset Value, bookkeeping and accounts preparation.

Depositary

State Street Trustees Limited has been appointed as depositary to

provide depositary services to the Company, which will include

safekeeping of the assets of the Company. The Depositary is

permitted to delegate (and authorise its delegates to sub-delegate)

the safekeeping of the assets of the Company.

The Administrator and Depositary are entitled to a combined fee

(the ‘‘State Street Fee’’). The State Street Fee shall be up to 0.08%

of the Net Asset Value per annum. The fee is subject to a minimum

rate, whereby if the Net Asset Value is less than £250 million the

fee will be calculated as if the Net Asset Value were £250 million.

The State Street Fee is calculated monthly and payable monthly in

arrears. In addition, the Administrator and the Depositary are

entitled to certain transaction charges, each of which will be at

normal commercial rates and certain other fees for ad hoc services

rendered from time to time. The Administrator and the Depositary

are entitled to reimbursement of out-of-pocket expenses incurred

by them (and by subcustodians and depositories) on behalf of the

Company in connection with the performance of the services. The

Company shall also reimburse the Administrator and Depositary for

the reasonable fees and customary agents’ charges paid to any

sub-custodian (which shall be charged at normal commercial

rates). All amounts are exclusive of any VAT that may be charged

thereon.

Custodian

The Depositary has delegated safekeeping duties as set out in the

AIFM Directive and the FCA Handbook to State Street Bank &

Trust Company, whom it has appointed as global sub-custodian.

Company Secretary

Link Company Matters Limited has been appointed as the company

secretary of the Company to provide the company secretarial

functions required by the Companies Act.

Under the terms of the Company Secretarial Services Agreement,

the aggregate fees payable to Link Asset Services are £60,000 per

annum. In addition a fee of £30,000 is payable to Link Asset

Services for services undertaken as part of the Initial Admission

process.

10

Registrar

Link Asset Services has been appointed as the Company’s

registrar. The Registrar is entitled to a fee calculated on the basis

of the number of Shareholders and the number of transfers

processed (exclusive of any VAT).

Receiving Agent

The Company has appointed Link Asset Services to provide

receiving agent services in connection with the Initial Issue. The

Receiving Agent shall be entitled to receive a fee from the

Company of not less than £15,000 (exclusive of any VAT) in

connection with these services.

Auditor

Deloitte LLP has been appointed auditor of the Company. The

Auditor will be entitled to an annual fee from the Company, which

will be agreed with the Board each year in advance of the Auditor

commencing audit work.

B.41. Regulatory status of

the investment

manager, depositary

and custodian

The Investment Manager is authorised and regulated by the FCA

(FCA registration number 122011) as a full-scope alternative

investment fund manager for the purposes of the AIFM Rules.

The Depositary is authorised and regulated by the FCA.

The Custodian is authorised and regulated by the FCA and

authorised and regulated by the Federal Reserve Board.

B.42. Calculation of Net

Asset Value

The unaudited Net Asset Value will be calculated in Sterling by the

Administrator on a monthly basis, as described below and on the

basis of information provided by the Investment Manager. The Net

Asset Value per Ordinary Share (and Net Asset Value per C Share,

where applicable), calculated by dividing the relevant Net Asset

Value by the number of Shares in issue of the relevant class

(excluding Shares held in treasury), will be published both on a

cum-income and ex-income basis, via a Regulatory Information

Service and made available on the Company’s website as soon as

practicable thereafter.

The Net Asset Value for each class of Shares is the value of all

assets of the Company attributable to that class of Shares less its

share of liabilities to creditors, each determined in accordance with

UK GAAP.

Any suspension in the calculation of the Net Asset Value will be

notified via a Regulatory Information Service as soon as practicable

after any such suspension occurs.

B.43. Cross liability Not applicable. The Company is not an umbrella collective

investment undertaking and as such there is no cross liability

between classes or investment in another collective investment

undertaking.

B.44. No financial

statements have been

made up

The Company has not commenced operations and no financial

statements have been made up as at the date of this document.

B.45. Portfolio Not applicable. The Company is newly incorporated and does not

currently hold any assets as at the date of this document.

B.46. Net Asset Value Not applicable. The Company has not commenced operations.

11

Section C – Securities

Element

Disclosure

Requirement Disclosure

C.1. Type and class of

securities

The Company is targeting an issue in excess of 250 million

Ordinary Shares with a nominal value of £0.01 each at an Issue

Price of 100 pence per Ordinary Share pursuant to the Initial Issue.

The Company also intends to issue Ordinary Shares with a nominal

value of £0.01 each and/or C Shares with a nominal value of £0.10

each pursuant to the Placing Programme.

The ISIN of the Ordinary Shares is GB00BFYYL325 and the

SEDOL of the Ordinary Shares is BFYYL32. The ticker for the

Ordinary Shares is MGCI.

The ISIN of the C Shares is GB00BFYYT831 and the SEDOL of the

C Shares is BFYYT83.

C.2. Currency The Ordinary Shares and C Shares (if applicable) will be

denominated in Sterling.

C.3. Details of share

capital

The Company is targeting an issue in excess of 250 million

Ordinary Shares pursuant to the Initial Issue. The maximum

number of Ordinary Shares available under the Initial Issue is

400 million. The minimum size of the Initial Issue is 100 million

Ordinary Shares.

The actual number of Ordinary Shares to be issued pursuant to the

Initial Issue, and therefore the Initial Gross Proceeds, are not

known as at the date of this document but will be notified by the

Company via a Regulatory Information Service announcement prior

to Initial Admission. If the Minimum Gross Proceeds (or such lesser

amount as the Company and Winterflood Securities may agree) are

not raised, the Initial Issue will not proceed.

Set out below is the issued share capital of the Company as at the

date of this document:

Aggregate

nominal value Number

Management Shares of £1.00 each £50,000 50,000

Ordinary Shares £0.01 1

The Ordinary Share in issue is fully paid up. To enable the

Company to obtain a certificate of entitlement to conduct business

and to borrow under section 761 of the Companies Act, on

18 September 2018, 50,000 Management Shares were allotted to

Mark Hutchinson. The Management Shares are paid up as to one

quarter of their nominal value and will be redeemed immediately

following Initial Admission out of the proceeds of the Initial Issue.

The Directors have authority to issue, in aggregate, up to 400 million

Shares pursuant to the Placing Programme.

C.4. Description of the

rights attaching to the

securities

The holders of the Ordinary Shares and C Shares shall only be

entitled to receive, and to participate in, any dividends declared in

relation to the relevant class of Shares that they hold.

On a winding-up or a return of capital by the Company, if there are

C Shares in issue, the net assets of the Company attributable to the

C Shares shall be divided pro rata among the holders of the

C Shares. For so long as C Shares are in issue, and without

12

prejudice to the Company’s obligations under the Companies Act,

the assets attributable to the C Shares shall, at all times, be

separately identified and shall have allocated to them such

proportion of the expenses or liabilities of the Company as the

Directors fairly consider to be attributable to any C Shares in issue.

The holders of Ordinary Shares shall be entitled to all of the

Company’s remaining net assets after taking into account any net

assets attributable to the C Shares (if any) in issue.

The Ordinary Shares and the C Shares (if any) shall carry the right

to receive notice of, attend and vote at general meetings of the

Company.

The consent of either the holders of Ordinary Shares or the holders

of C Shares will be required for the variation of any rights attached

to the relevant class of Shares.

C.5. Restrictions on the

free transferability of

the securities

There are no restrictions on the free transferability of the Shares,

subject to compliance with applicable securities laws.

C.6. Admission Applications will be made to the UK Listing Authority and to the

London Stock Exchange for all of the Ordinary Shares issued and

to be issued pursuant to the Initial Issue to be admitted to the

premium segment of the Official List and to trading on the premium

segment of the London Stock Exchange’s main market.

Applications will be made to the UK Listing Authority and to the

London Stock Exchange for all of the Shares issued pursuant to the

Placing Programme to be admitted to the premium segment of the

Official List and to trading on the premium segment of the London

Stock Exchange’s main market.

It is expected that Initial Admission will become effective, and that

dealings in the Ordinary Shares will commence at 8.00 a.m. on

14 November 2018.

It is expected that any further Admissions under Subsequent

Placings will become effective and dealings will commence

between 15 November 2018 and 25 September 2019.

All Shares to be issued pursuant to a Subsequent Placing under the

Placing Programme will be allotted conditionally upon the relevant

Admission occurring.

C.7. Dividend policy The Company intends to pay two dividends in respect of the first

financial period following Initial Admission. The first interim dividend

is expected to be declared in July 2019 and paid in August 2019

and the second interim dividend is expected to be declared in

January 2020 and paid in February 2020. Thereafter the Company

intends to pay dividends on a quarterly basis with dividends

typically declared in January, April, July and October and paid in

February, May, August and November in each financial year.

The Company will target an annualised dividend yield of LIBOR

plus 2.5% (on the Issue Price) in respect of the Company’s first

financial period to 31 December 2019. The Company will target an

annualised dividend yield of LIBOR plus 4% (on the opening Net

Asset Value per Ordinary Share) in respect of each financial year

thereafter. Where LIBOR materially changes or ceases to be

provided, the Company shall determine a suitable replacement

benchmark and shall notify investors accordingly. The Directors

intend to apply the ‘‘streaming’’ regime to distributions of portfolio

13

interest returns paid by the Company, such that these distributions

are expected to be designated as payments of interest. If

appropriate, in addition to, or instead of, interest distributions, the

Company may also pay ordinary corporate dividends.

Investors should note that the target dividend is a target only and

not a profit forecast and there can be no assurance that such target

will be met.

In accordance with regulation 19 of the Investment Trust (Approved

Company) (Tax) Regulations 2011, the Company will not (except to

the extent permitted by those regulations) retain more than 15% of

its income (as calculated for UK tax purposes) in respect of an

accounting period.

In order to increase the distributable reserves available to facilitate

the payment of future dividends, the Company has resolved that,

conditional upon Initial Admission and the approval of the Court, the

amount standing to the credit of the share premium account of the

Company immediately following completion of the Initial Issue be

cancelled and transferred to a special distributable reserve. The

Company may, at the discretion of the Board, pay all or part of any

future dividends out of this special distributable reserve, taking into

account the Company’s investment objective.

Although there is no current expectation that they will exercise such

power, the Directors will have the power to pay dividends in relation

to the C Shares (if issued) in the event that the assets that are

attributable to the C Shares generate material income while the

C Shares are in issue.

C.22 Information about the

Shares

In the event that any C Shares are issued under the Placing

Programme, the investments which are attributable to the C Shares

following Conversion will be merged with the Company’s existing

portfolio. The new Ordinary Shares arising on Conversion of the

C Shares will, subject to the Articles, rank pari passu with the

Ordinary Shares then in issue.

The Ordinary Shares carry the right to receive all dividends

declared by the Company or the Directors, subject to the rights of

any C Shares in issue.

On a winding-up, provided the Company has satisfied all of its

liabilities and subject to the rights conferred by any C Shares in

issue at that time to participate in the winding-up, the holders of

Ordinary Shares will be entitled to all of the surplus assets of the

Company.

Holders of Ordinary Shares and C Shares (if any) will be entitled to

attend and vote at all general meetings of the Company and, on a

poll, to one vote for each Ordinary Share or C Share held.

The consent of either the holders of Ordinary Shares or the holders

of C Shares will be required for the variation of any rights attached

to the relevant class of Shares.

The nominal value of the Ordinary Shares is £0.01 per Ordinary

Share.

The nominal value of the C Shares is £0.10 per C Share.

The Ordinary Shares will be in registered form, will be admitted to

the premium segment of the Official List and will be traded on the

London Stock Exchange’s main market. The Company will use its

reasonable endeavours to procure that, upon Conversion, the new

14

Ordinary Shares thereby arising are admitted to the premium

segment of the Official List and to trading on the premium segment

of the London Stock Exchange’s main market.

There are no restrictions on the free transferability of the Ordinary

Shares, subject to compliance with applicable securities laws.

Section D – Risks

Element

Disclosure

Requirement Disclosure

D.1. Key information on the

key risks that are

specific to the

Company or its

industry

*

The Company has no operating results, and it will not

commence operations until it has obtained funding through

the Initial Issue. As the Company lacks an operating history,

investors have no basis on which to evaluate the Company’s

ability to achieve its investment objective and provide a

satisfactory investment return.

*

The past performance of other investments managed or

advised by the Investment Manager’s investment

professionals cannot be relied upon as an indicator of the

future performance of the Company. Investor returns will be

dependent upon the Company successfully pursuing its

investment policy.

*

There can be no guarantee that the investment objective of

the Company will be achieved.

*

The Company may experience fluctuations in its operating

results due to a number of factors, including changes in the

values of investments made by the Company, changes in the

Company’s operating expenses, and general economic and

market conditions (including a deterioration in the

performance of the economies to which issuers of Debt

Instruments in which the Company invests are exposed, in

particular, the UK economy, changes to interest rates, credit

spreads, equity risk premium, inflation and bond ratings,

changes in laws or regulations, national and international

political circumstances and general market pricing of similar

investments).

*

Changes in tax legislation or practice, whether in the United

Kingdom or elsewhere, could affect the value of the

investments held by the Company, affect the Company’s

ability to provide returns to Shareholders, and affect the tax

treatment for Shareholders of their investments in the

Company (including rates of tax and availability of reliefs).

*

Whilst the use of borrowings should enhance the total return

on the Shares where the return on the Company’s portfolio of

investments exceeds the cost of borrowing, it will have the

opposite effect where the return on the Company’s portfolio of

investments is lower than the cost of borrowing. The use of

borrowings by the Company may increase the volatility of the

Net Asset Value per Share.

*

The departure of some or all of the Investment Manager’s

investment professionals could prevent the Company from

achieving its investment objective. The past performance of

the Investment Manager’s investment professionals cannot

be relied upon as an indication of the future performance of

the Company.

15

*

There is no guarantee that the Net Proceeds will be deployed

in a timely manner, or at all. Competition for investments may

result in the Company being unable to make investments or

lead to the available coupon on investments decreasing. Any

delay in the initial deployment of the Net Proceeds and/or the

transition of the Company’s portfolio to mainly private Debt

Instruments may have a material adverse effect on the

performance of the Company, the Net Asset Value, the

Company’s earnings and returns to Shareholders.

*

The Company will invest into illiquid public and private Debt

Instruments. Such investments may be difficult to value or

realise (if at all) and therefore the market price that is

achievable for such investments might be lower than the

valuation of these assets and as reflected in the Company’s

published Net Asset Value per Ordinary Share and/or Net

Asset Value per C Share.

*

Investment defaults may result in a loss of anticipated

revenues. These losses may adversely affect the

Company’s ability to pay dividends and, if the level of

defaults is sufficiently large, may result in the Company’s

inability to fully recover its investment. The risk of inability to

fully recover investments is higher for highly leveraged Debt

Instruments such as leveraged loans to private equity owned

companies.

*

The Company’s investments may be subject to interest rate

risk. When interest rates decline, the value of fixed rate

obligations can be expected to rise, and conversely when

interest rates rise, the value of fixed-rate obligations can be

expected to decline. In general, if prevailing interest rates fall

significantly below the interest rates on any Debt Investments

held by the Company, such investments are more likely to be

the subject of prepayments than if prevailing rates remain at

or above the rates borne by such investments.

*

Issuers of Debt Instruments in which the Company invests

may decide to prepay or redeem all or a portion of such Debt

Instruments at any time, and with respect to some of the

Company’s investments, without penalty. In the event of a

prepayment or redemption, the Company may not receive all

of the interest payments that it expected to receive, thereby

impacting negatively on the Company’s investment returns.

To the extent that any of the Company’s investments prepay,

are redeemed, mature or are sold it will ordinarily seek to

reinvest such proceeds. There can be no guarantee that such

further investments can be made in a timely manner (or at all)

and consequently the Company may hold material cash

balances pending reinvestment. Further, such proceeds may

be reinvested in investments with a lower yield and/or with

different characteristics to those replaced. Any delays in the

speed of capital deployment may have a material adverse

effect on the performance of the Company, the Net Asset

Value, the Company’s earnings and returns to Shareholders.

D.3. Key information on the

key risks that are

specific to the Shares

*

The value of an investment in the Company, and the returns

derived from it, if any, may go down as well as up and an

investor may not get back the amount invested.

*

The market price of the Shares may fluctuate independently

of their underlying net asset value and may trade at a discount

or premium to net asset value at different times.

16

*

The Directors are under no obligation to effect repurchases of

Ordinary Shares. Shareholders wishing to realise their

investment in the Company will therefore be required to

dispose of their Ordinary Shares through the secondary

market.

*

It may be difficult for Shareholders to realise their investment

and there may not be a liquid market in Shares.

Section E – Offer

Element

Disclosure

Requirement Disclosure

E.1. Net proceeds and

costs of the issue

The Initial Issue

The Company is targeting an issue in excess of 250 million

Ordinary Shares pursuant to the Initial Issue. The net proceeds of

the Initial Issue are dependent on the level of subscriptions

received. Assuming the gross proceeds of the Initial Issue are

£250 million, the net proceeds of the Initial Issue will be

approximately £247 million.

The costs and expenses of, and incidental to, the formation of the

Company and the Initial Issue are not expected to exceed

approximately £3 million, equivalent to 1.2% of the Gross

Proceeds, assuming Initial Gross Proceeds of £250 million. The

costs will be deducted from the Initial Gross Proceeds. It is

expected that the starting Net Asset Value per Ordinary Share will

be 98.8 pence, assuming Initial Gross Proceeds of £250 million.

The Placing Programme

The net proceeds of the Placing Programme are dependent, inter

alia, on, the Directors determining to proceed with a placing under

the Placing Programme, the level of subscriptions received, the

price at which such Shares are issued and the costs of the

Subsequent Placing.

The costs and expenses of issuing Ordinary Shares pursuant to

any Subsequent Placing will be covered by issuing such Ordinary

Shares at the prevailing published Net Asset Value per Ordinary

Share at the time of issue together with a premium to at least cover

the costs and expenses of the relevant Subsequent Placing of

Ordinary Shares (including, without limitation, any placing

commissions).

The costs and expenses of any issue of C Shares under the

Placing Programme will be paid out of the gross proceeds of such

issue and will be borne by holders of those C Shares only.

E.2.a. Reason for issue and

use of proceeds

The Initial Gross Proceeds will be utilised in accordance with the

Company’s investment policy, to meet the costs and expenses of

the Initial Issue and for working capital purposes.

It is currently expected that the Net Proceeds will be deployed in

accordance with the Company’s investment policy in the manner

set out below.

The Company expects the Investment Manager to deploy the Net

Proceeds in readily available public lower yielding assets within a

period of three months after Initial Admission (subject to market

conditions). Based on current market conditions, the Investment

Manager then intends to transition the Company’s portfolio of

investments such that it mainly comprises private Debt Instruments

in accordance with the Company’s investment policy. It is currently

17

expected that, subject to market conditions, such transition will be

completed by the end of the first accounting period of the

Company, i.e. by 31 December 2019.

The Directors intend to use the net proceeds of any Subsequent

Placing under the Placing Programme to acquire investments in

accordance with the Company’s investment policy and for working

capital purposes.

E.3. Terms and conditions

of the offer

Initial Issue

The Company is targeting an issue in excess of 250 million

Ordinary Shares pursuant to the Initial Issue comprising the Initial

Placing, the Offer for Subscription and the Intermediaries Offer.

The Initial Issue has not been underwritten. The maximum number

of Ordinary Shares to be issued under the Initial Issue is 400

million.

Ordinary Shares will be issued pursuant to the Initial Issue at an

Issue Price of 100 pence per Ordinary Share.

The Offer for Subscription and the Intermediaries Offer will remain

open until 1.00 p.m. on 7 November 2018 and the Initial Placing will

remain open until 2.00 p.m. on 8 November 2018.

If the Initial Issue is extended, the revised timetable will be notified

via a Regulatory Information Service announcement.

The Initial Issue is conditional, inter ali a, on:

*

Initial Admission having become effective on or before 8.00

a.m. on 14 November 2018 or such later time and/or date as

the Company and Winterflood Securities may agree (being

not later than 8.00 a.m. on 28 February 2019);

*

the Placing and Offer Agreement becoming wholly

unconditional in respect of the Initial Issue (save as to Initial

Admission) and not having been terminated in accordance

with its terms at any time prior to Initial Admission; and

*

the Minimum Gross Proceeds (or such lesser amount as the

Company and Winterflood Securities may agree) being

raised.

Placing Programme

Shares which may be made available under the Placing

Programme will, subject to the Company’s decision to proceed

with an allotment and issue at any given time, be issued at the

Placing Programme Price. The Placing Programme will open on

15 November 2018 and will close on 25 September 2019 (or any

earlier date on which it is fully subscribed or as otherwise agreed

between the Company and Winterflood Securities).

The minimum price at which Ordinary Shares will be issued

pursuant to the Placing Programme, which will be in Sterling, will be

equal to the prevailing published Net Asset Value per Ordinary

Share at the time of issue together with a premium to at least cover

the costs and expenses of the relevant Subsequent Placing of

Ordinary Shares (including, without limitation, any placing

commissions).

The issue price of any C Shares issued pursuant to the Placing

Programme will be 100 pence per C Share.

The Placing Programme is not being underwritten.

18

Each issue of Shares pursuant to a Subsequent Placing under the

Placing Programme is conditional, inter alia, on:

*

Admission of the relevant Shares occurring by no later than

8.00 a.m. on such date as the Company and Winterflood

Securities may agree from time to time in relation to that

Admission, not being later than 25 September 2019;

*

a valid supplementary prospectus being published by the

Company if such is required by the Prospectus Rules;

*

in the case of an issue of Ordinary Shares, the Placing

Programme Price being determined by the Directors; and

*

the Placing and Offer Agreement being wholly unconditional

as regards the relevant Subsequent Placing (save as to

Admission) and not having been terminated in accordance

with its terms prior to the relevant Admission.

E.4. Material interests The Prudential Assurance Company Limited intends to subscribe

for the lower of (i) 80,000,000 Ordinary Shares and (ii) 25% of the

Ordinary Shares to be issued pursuant to the Initial Issue.

E.5. Name of person

selling securities and

lock-up agreements

Not applicable. No person or entity is offering to sell Ordinary

Shares as part of the Initial Issue.

E.6. Dilution No dilution will result from the Initial Issue.

If 400 million Shares were to be issued pursuant to Subsequent

Placings, and assuming the Initial Issue had been subscribed as to

250 million Ordinary Shares, there would be a dilution of

approximately 61.5% in Shareholders’ voting control of the

Company immediately after the Initial Issue (and prior to any

conversion of C Shares). The voting rights may be diluted further

on conversion of any C Shares depending on the applicable

conversion ratio. However, it is not anticipated that there would be

any dilution in the Net Asset Value per Ordinary Share as a result of

the Placing Programme.

E.7. Estimated expenses The costs and expenses of, and incidental to, the formation of the

Company and the Initial Issue are not expected to exceed

approximately £3 million, equivalent to 1.2% of the Initial Gross

Proceeds, assuming Initial Gross Proceeds of £250 million. The

costs will be deducted from the Initial Gross Proceeds. It is

expected that the starting Net Asset Value per Ordinary Share will

be 98.8 pence, assuming Initial Gross Proceeds of £250 million.

All expenses incurred by any Intermediary are for its own account.

Investors should confirm separately with any Intermediary whether

there are any commissions, fees or expenses that will be applied by

such Intermediary in connection with any application made through

that Intermediary pursuant to the Intermediaries Offer.

The costs and expenses of issuing Ordinary Shares pursuant to

any Subsequent Placing will be covered by issuing such Ordinary

Shares at the prevailing published Net Asset Value per Ordinary

Share at the time of issue together with a premium to at least cover

the costs and expenses of the relevant Subsequent Placing of

Ordinary Shares (including, without limitation, any placing

commissions).

The costs and expenses of any issue of C Shares under the

Placing Programme will be paid out of the gross proceeds of such

issue and will be borne by holders of those C Shares only.

19

RISK FACTORS

Any investment in the Company should not be regarded as short-term in nature and

involves a degree of risk, including, but not limited to, the risks in relation to the Company

and the Shares referred to below. If any of the risks referred to in this document were to

occur this could have a material adverse effect on the Company’s business, financial

position, results of operations, business prospects and returns to Shareholders. If that were

to occur, the trading price of the Shares and/or their respective Net Asset Values and/or the

level of dividends or distributions (if any) received from the Shares could decline

significantly and investors could lose all or part of their investment.

Prospective investors should note that the risks relating to the Company, its investment

strategy and the Shares summarised in the section of this document headed ‘‘Summary’’

are the risks that the Board believes to be the most essential to an assessment by a

prospective investor of whether to consider an investment in the Shares. However, as the

risks which the Company faces relate to events and depend on circumstances that may or

may not occur in the future, prospective investors should consider not only the information

on the key risks summarised in the section of this document headed ‘‘Summary’’ but also,

among other things, the risks and uncertainties described below.

The risks referred to below are the risks which are considered to be material but are not

the only risks relating to the Company and the Shares. There may be additional material

risks that the Company and the Board do not currently consider to be material or of which

the Company and the Board are not currently aware.

RISKS RELATING TO THE COMPANY

The Company is a newly formed company with no separate operating history

The Company is a newly formed company incorporated in England and Wales on 17 July 2018.

The Company has no operating results and it will not commence operations until it has obtained

funding through the Initial Issue. As the Company lacks an operating history, investors have no

basis on which to evaluate the Company’s ability to achieve its investment objective and provide a

satisfactory investment return.

The Company’s returns will depend on many factors, including the performance of its investments,

the availability and liquidity of investment opportunities within the scope of the Company’s

investment objective and policy, the level and volatility of interest rates, conditions in the financial

markets and economy and the Company’s ability to successfully operate its business and

successfully pursue its investment policy. There can be no assurance that the Company’s

investment policy will be successful.

Reliance on third party service providers

The Company has no employees and the Directors have all been appointed on a non-executive

basis. The Company is reliant upon the performance of third party service providers for its

executive function. In particular, the Investment Manager, the Depositary, the Administrator, the

Secretary, the Registrar and third parties (which may include the Investment Manager or another

M&G Entity) providing debt administration services will be performing services which are integral to

the operation of the Company or the administration of its investments.

Failure by any service provider to carry out its obligations to the Company in accordance with the

terms of its appointment could have a materially detrimental impact on the operation of the

Company or administration of its investments. The termination of the Company’s relationship with

any third party service provider or any delay in appointing a replacement for such service provider,

could disrupt the business of the Company materially and could have a material adverse effect on

the Company’s performance.

Past performance cannot be relied upon as an indicator of the future performance of the

Company

The past performance of other investments managed or advised by M&G or any of M&G’s

investment professionals cannot be relied upon as an indicator of the future performance of the

Company. Investor returns will be dependent upon the Company successfully pursuing its

investment policy.

20

RISKS RELATING TO THE COMPANY’S INVESTMENT STRATEGY

The Company may not meet its investment objective and there is no guarantee that the

Company’s targeted dividend, as may be from time to time, will be met

The Company may not achieve its investment objective. Meeting the investment objective is a

target but the existence of such an objective should not be considered as an assurance or

guarantee that it can or will be met.

The Company’s investment objective is to generate a regular and attractive level of income with

low asset value volatility. The achievement of the target dividend and low asset value volatility will

depend upon, amongst other things, the Company successfully pursuing its investment policy and

the performance of its portfolio of investments. There can be no assurance as to the level of

income return or capital volatility over the long term. The declaration, payment and amount of any

dividend by the Company will be subject to the discretion of the Directors and will depend upon,

amongst other things, the Company successfully pursuing its investment policy and its earnings,

financial position, cash requirements, level and rate of borrowings and availability of profit, as well

as the provisions of relevant laws or generally accepted accounting principles from time to time.

Investor returns will be dependent upon the performance of the Company’s portfolio of

investments and the Company may experience fluctuations in its operating results

Any returns generated by the Company are reliant primarily upon the performance of the

Company’s investments. No assurance is given, express or implied, that Shareholders will receive

back any of their original investment in the Shares.

The Company may experience fluctuations in its operating results due to a number of factors,

including changes in the values of investments made by the Company, changes in the Company’s

operating expenses, and general economic and market conditions (including a deterioration in the

performance of the economies to which issuers of Debt Instruments in which the Company invests

are exposed, in particular the UK economy, changes to interest rates, credit spreads, equity risk

premium, inflation and bond ratings, changes in laws or regulations, national and international

political circumstances and general market pricing of similar investments). Such variability may lead

to volatility in the trading price of the Shares and cause the Company’s results for a particular

period not to be indicative of its performance in a future period and this may have a material

adverse effect on the performance of the Company, the Net Asset Value, the Company’s earnings

and returns to Shareholders.

Availability of appropriate investments and transition of the Company’s portfolio of investments

There is no guarantee that the Net Proceeds will be deployed in a timely manner, or at all, and the

Company has not committed to make any investments.

In addition, the Company is subject to competition in sourcing and making investments.

Competition for investments may result in the Company being unable to make investments or lead

to the available coupon on investments decreasing, which may further limit the Company’s ability to

generate its targeted dividend.

If the Investment Manager is not able to source a sufficient number of suitable investments within

a reasonable timeframe whether by reason of lack of demand, competition or otherwise, a greater

proportion of the Company’s assets will be held in cash for longer than anticipated and the

Company’s ability to achieve its investment objective will be adversely affected. To the extent that

any of the Company’s investments prepay, are redeemed, mature or are sold it will ordinarily seek

to reinvest the proceeds thereof in accordance with the Company’s investment policy. There can

be no guarantee that such further investments can be made in a timely manner (or at all) and

consequently the Company may hold material cash balances pending reinvestment. Further, such

proceeds may be reinvested in investments with a lower yield and/or with different characteristics

to those replaced. Any delays in the speed of capital deployment may have a material adverse

effect on the performance of the Company, the Net Asset Value, the Company’s earnings and

returns to Shareholders.

The Company expects the Investment Manager to deploy the Net Proceeds in readily available

public lower yielding assets within a period of three months after Initial Admission (subject to

market conditions). Based on current market conditions, the Investment Manager then intends to

transition the Company’s portfolio of investments such that it mainly comprises private Debt

Instruments in accordance with the Company’s investment policy. It is currently expected that,

21

subject to market conditions, such transition will be completed by the end of the first accounting

period of the Company, i.e. by 31 December 2019. There can be no guarantee that initial

deployment of the Net Proceeds and/or the transition of the Company’s portfolio of investments will

be achieved in the timeframes referred to above. Any delay in initial deployment of the Net

Proceeds and/or the transition of the Company’s portfolio of investments may have a material

adverse effect on the performance of the Company, the Net Asset Value, the Company’s earnings

and returns to Shareholders.

Sufficiency of due diligence

The due diligence process that the Investment Manager will undertake in connection with the

Company’s investments may not reveal all facts and circumstances that may be relevant in

connection with an investment.

When conducting due diligence and making an assessment regarding an investment, the

Investment Manager will be required to rely on resources available to it, including in certain

circumstances information provided by the target of the investment.

There can be no assurance that due diligence investigations with respect to any investment

opportunity will reveal or highlight all relevant facts and circumstances that may be necessary or

helpful in evaluating such investment opportunity.

Any failure by the Investment Manager to identify relevant facts and circumstances through the due

diligence process may lead to unsuccessful investment decisions, which may have a material

adverse effect on the performance of the Company, the Net Asset Value, the Company’s earnings

and returns to Shareholders.

Fraud, misrepresentation or omission risks

The value of the Company’s investments may be affected by fraud, misrepresentation or omission

on the part of any issuer of Debt Instruments in which the Company invests and/or by parties

related to the issuer (or related collateral and security arrangements). Such fraud,

misrepresentation or omission may adversely affect the value of the collateral underlying the

investment in question or may adversely affect the Company’s ability to enforce its contractual

rights or the issuer’s ability to fulfil its obligations in respect of the investment.

Cash management and credit risk of bank deposits

To the extent the Company has cash balances (including any un-invested proceeds of the Initial

Issue or any Subsequent Placing), these may be held on deposit with banks or financial

institutions. Returns on cash or cash-equivalents may be materially lower than those available on

the Company’s target investments and material cash balances may materially and adversely affect

the performance of the Company, the Net Asset Value, the Company’s earnings and returns to

Shareholders.

To the extent the Company holds material cash balances it will be subject to the credit risk of the

banks or financial institutions with which they are deposited. If any such bank or financial institution

were to become insolvent, or default on its obligations, the Company would be exposed to the

potential loss of the sum deposited. This may materially and adversely affect the performance of

the Company, the Net Asset Value, the Company’s earnings and returns to Shareholders.

Geographic concentration

The Company has no limit on exposure to a single geography and the Company will invest

primarily in Sterling denominated Debt Instruments. Accordingly, the Company’s portfolio may have

a significant exposure to the UK economy.

An economic slowdown in the UK or any other jurisdiction where the Company has significant

exposure could, depending primarily on the severity and duration of any economic slowdown, result

in the creditworthiness of the issuers of Debt Instruments in which the Company invests becoming

impaired which could cause an increased risk of investment default and cause the Company to

incur losses.

Sectoral diversification

The Company has no limit on its exposure to any sector which may lead to the Company having

concentrated exposure to certain business sectors from time to time. Concentration of exposure to

22

any one sector may result in greater Net Asset Value volatility and may have a material adverse

effect on the performance of the Company, the Company’s earnings and returns to Shareholders.

Changes in laws, government policy or regulations

The Company will be subject to laws, government policy and regulations enacted by national and

local governments. Any change in the law, regulation or government policy affecting the Company