Investor Presentation — Rentals

May 2024

Note Regarding Forward-Looking Statements: This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934 that involve risks and uncertainties, including, without limitation, statements regarding our beliefs about our strategies, future performance, and future targets for Rentals, the market for rental listings and

properties, renter and property manager behavior, and our expectations about our ability to translate our strategies into financial performance.

Statements containing words such as “may,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “predict,” “will,” “projections,” “continue,” “estimate,” “outlook,” “opportunity,” “guidance,” “would,” “could,” “strive,”

or similar expressions constitute forward-looking statements. Unless otherwise noted in the presentation, forward-looking statements are made based on assumptions as of May 1, 2024, and although we believe the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee these results. Differences in Zillow Group’s actual results from those described in these forward-looking statements

may result from actions taken by Zillow Group as well as from risks and uncertainties beyond Zillow Group’s control. Factors that may contribute to such differences include, but are not limited to: the current and

future health and stability of the economy and United States residential real estate industry, including changes in inflationary conditions, interest rates, housing availability and affordability, labor shortages and

supply chain issues; our ability to manage advertising and product inventory and pricing and maintain relationships with property managers; our ability to continue to innovate and compete successfully to attract

renters and property managers; our ability to effectively invest resources to pursue new strategies, develop new products and services and expand existing products and services into new markets; the duration and

impact of natural disasters, geopolitical events, and other catastrophic events (including public health crises); our ability to maintain adequate security measures or technology systems, or those of third parties on

which we rely, to protect data integrity and the information and privacy of our customers and other third parties; the impact of pending or future litigation and other disputes or enforcement actions; our ability to

attract, engage, and retain a highly skilled, remote workforce; acquisitions, investments, strategic partnerships, capital-raising activities, or other corporate transactions or commitments by us or others; our ability to

continue relying on third-party services to support critical functions of our business; our ability to protect and continue using our intellectual property and prevent others from copying, infringing upon, or developing

similar intellectual property, including as a result of generative artificial intelligence; and our ability to comply with domestic and international laws, regulations, rules, contractual obligations, policies and other

obligations to support our business and operations.

The foregoing list of risks and uncertainties is illustrative but not exhaustive. For more information about potential factors that could affect Zillow Group’s business and financial results, please review the “Risk Factors”

described in Zillow Group’s SEC filings. Except as may be required by law, Zillow Group does not intend and undertakes no duty to update this information to reflect future events or circumstances.

Note Regarding Data and Estimates: This presentation contains market and industry data and estimates made by independent parties and by Zillow Group relating to market size, opportunity, audience,

engagement, growth and other factors related to Zillow Rentals and the rentals industry. These data and estimates involve a number of assumptions and limitations, which may significantly impact their accuracy,

and you are cautioned not to give undue weight to such estimates. Projections, assumptions and estimates of future performance are necessarily subject to a high degree of uncertainty and risk.

Note Regarding Terminology: As used in this presentation, the following terms have the meanings specified below unless otherwise noted or the context indicates otherwise:

● Longtail: Residential rental property with less than 25 rental units, including single-family homes.

● Multifamily: Residential rental property with 25 or more rental units.

● Rental Unit: Residential rental unit occupied or intended for occupancy as separate living quarters.

● Vacancy: Rental unit which is unoccupied or available for rent for residential use.

● Rental Listing or Listing: Vacancy that is advertised as available for rent.

The trademarks included herein are the property of the owners thereof and are used for reference purposes only.

Legal Disclosure

2

Zillow Rentals Overview

Largest residential real estate brand and audience

1

, building the most comprehensive rental listings marketplace for

renters and property managers

Big Customer Problem

Renter movers are 3x number of for-sale movers. Fragmented

listings with no nationwide marketplace having 100% rental listing

coverage

Our Zillow Rentals Solution

Zillow, the housing super app — building most comprehensive set

of rental listings and end-to-end transaction solutions for renters

and property managers

Leading Real Estate Brand Translates to Leading Rentals Brand

Leading residential real estate brand drives leading online rental

audience, search position, traffic and preference among renters

2

Deep Technology and Marketplace Expertise

Engineering- and product-first, founder-led company using our

technology expertise to deliver value to renters and property

managers, building unique two-sided marketplace

Unique Supply Driving Two-Sided Marketplace Growth

>50% of all vacant listings are on Zillow Rentals today

2

, with limited

rentals marketing to date. Clear opportunity to increase marketing

efforts and accelerate two-sided marketplace growth

Large Audience and Listing Opportunity in Multifamily Rentals

Only 35% of multifamily listings and 30% of multifamily rental

audience on Zillow Rentals in 2023

2

. Focused on growing

multifamily brand awareness and continuing to grow share of

multifamily properties advertising on Zillow today

$1B+ Revenue Opportunity in Rentals

Our rentals marketplace has grown at a 42% revenue CAGR since

2015, and we see more than a $1 billion revenue opportunity over

time

2

3

1. Comscore data for the year ended December 31, 2023.

2. See subsequent slides for further information on the calculation and sources for statistical data provided on this slide. See Legal Disclosure slide for additional information about our forward-looking

statements.

No MLS system

No single marketplace

with 100% rental listing

coverage

9M

multifamily

Rentals

4.8M

2023 Homes Sold

4

MLS system

provides nearly

complete coverage

of for-sale properties

For Sale

4

1. 2023 year end estimates derived from the U.S. Census Bureau’s Current Population Survey dated January 30, 2024, and the 2021 Rental Housing Finance Survey, U.S. Department of Housing and Urban

Development.

2. Zillow internal data and estimates for 2023.

3. U.S. Census Bureau’s Current Population Survey dated January 30, 2024.

4. New and existing homes sold in 2023 according to the National Association of REALTORS® Economic Outlook as of December 2023.

PROBLEM:

Fragmented Rentals Marketplace

Renter movers are 3x the number of for-sale movers

60%

2

listed on Zillow 35%

2

listed on Zillow

17M

2023 Vacancies

2

26M

longtail (<25 units) total

22M

multifamily (25+ units)

total

8M

longtail

48M

2023 Rental Units

1

~100M

Owned Homes

3

Nearly all listed on Zillow

1. Zillow Group internal data and estimates.

2. Zillow Group internal data and estimates as of March 31, 2024.

3. Average monthly unique visitors on Zillow Rentals for January 2024–March 2024 estimated using Comscore data.

SOLUTION:

Most Comprehensive Marketplace for Renters and

Property Managers

Building the most comprehensive set of rental listings to serve all renters and property managers

5

High-quality traffic

1

and leads to property

managers

Focus on consumer

experience drives

#1 preference

among renters

1

Largest consumer audience

with ~27M monthly

unique visitors

3

Large coverage of rental

listings across longtail and

multifamily, with 1.8M

active rental listings

2

Rentals

Marketplace

6

Designed to provide renters with a delightful experience and property managers with the tools to manage and fill listings

Screen and app images are simulated for illustrative purposes. They may not be an exact representation of the product, and not all features are available on all listings or listing types.

Collect rent

ApplyTourSearch Sign a lease Pay

Mover

Property

Manager

TourList

Create a lease

Insure

Screen

SOLUTION:

Rentals is Part of Zillow’s Housing Super App

2023 Estimates

Longtail

(<25 units)

Multifamily

(25+ units)

Total

Rental properties

1

17M 140K 17M

Rental units

1

26M 22M 48M

Average unit turnover

2

30% 40% 35%

Units turned over annually 8M 9M 17M

Zillow Rentals listing share

2

60% 35% 50%

Total addressable market (TAM)

3

$25B

Zillow Rentals revenue share of TAM 1%

Large Addressable Market Opportunity

$25B rental market driven by high annual unit turnover

7

1. 2023 year end estimates derived from the U.S. Census Bureau’s Current Population Survey dated January 30, 2024, and the 2021 Rental Housing Finance Survey, U.S. Department of Housing and Urban

Development.

2. Zillow Group internal data and estimates.

3. See Part I, Item 1 in our Annual Report on Form 10-K for the year ended December 31, 2023, for further information on our calculation of total property manager advertising and technology spend.

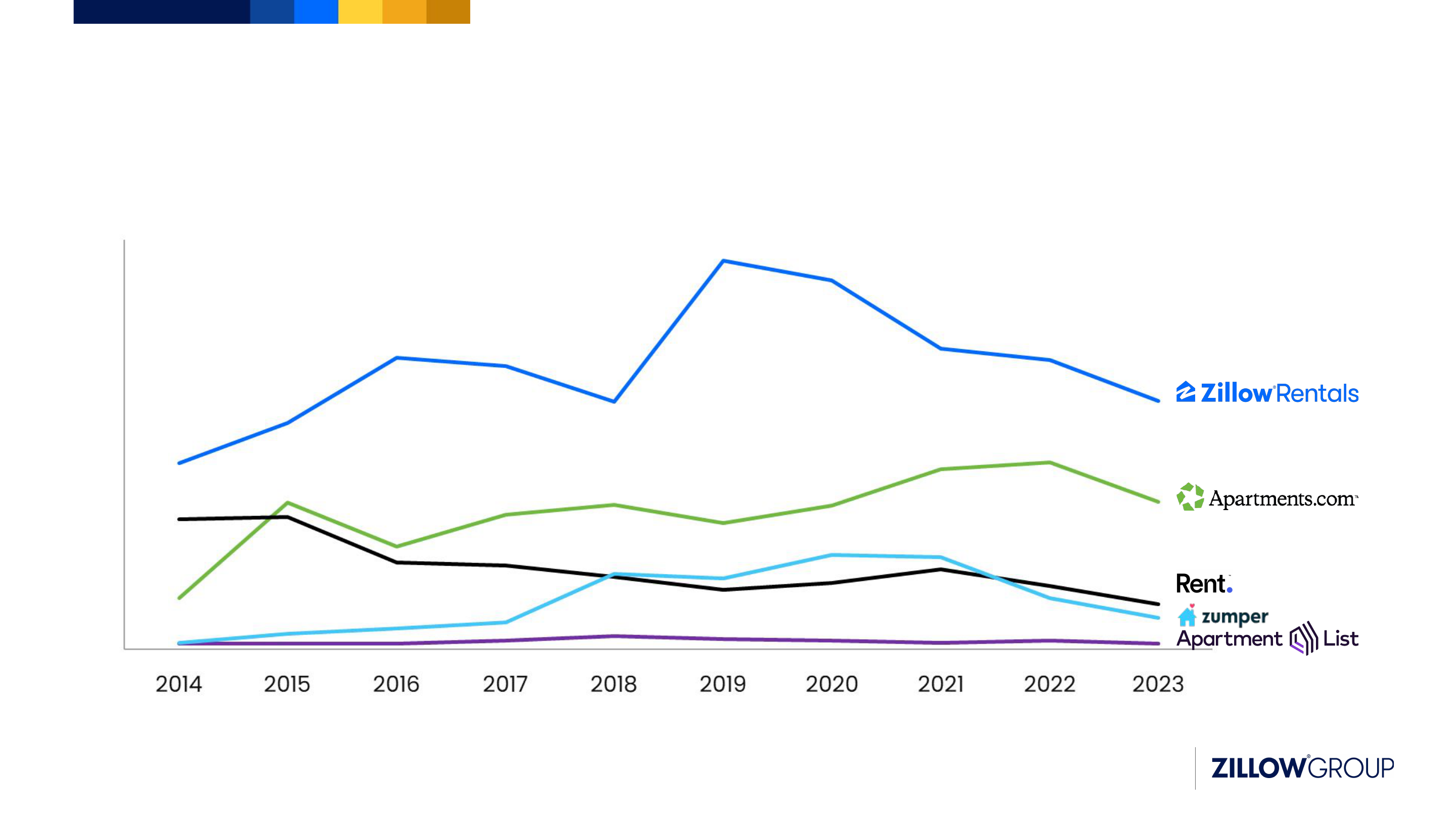

Zillow Rentals is most searched rentals marketplace

Leading Category Internet Search Position

Source: Google Trends (2014–2023) for search terms “Zillow rentals,” “apartments.com,” “Rent.com,” “apartmentlist,” “zumper.”

8

Google Trends relative

search volume 2014–2023

Leading Rentals Traffic

Product-led Zillow Rentals platform and unique listings

1

drive market-leading renter audience with limited marketing spend

1. Zillow Group internal data and estimates as of March 31, 2024.

2. Average monthly unique visitors on Zillow Rentals for September 2023–March 2024 estimated using Comscore data.

9

Comscore Average Monthly Unique Visitors

2

>50% Vacant Listings Share with Limited Marketing to Date

Large share of listings driven by strength of brand, products and services to renters and property managers

10

TTM % of U.S. vacant

listings on Zillow

1

TTM Zillow Rentals marketing

spend

1. Zillow Group internal data and estimates.

Trailing Twelve Months (TTM) Share of Vacant Listings and Zillow Rentals Marketing Spend

$6M $6M

$7M

$9M

$10M

$9M

$11M

Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24Q3’22

Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24

Multifamily Rentals Delivering Strong Growth

80% of Zillow’s multifamily revenue is in a paid inclusion

1

subscription model

11

Zillow Multifamily Properties

2

Zillow Multifamily Revenue (Trailing Twelve Months)

Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 Q1’24 Q3’22Q3’22

36% CAGR

1. Paid inclusion revenue excludes Zillow Lease Connect and pay-per-lease revenue.

2. Includes Zillow, Trulia and HotPads mobile apps and websites.

30% CAGR

Only 30% of multifamily audience on Zillow today — opportunity to accelerate awareness and share with targeted

marketing campaign

on Zillow

Rentals

Multifamily Audience Growth Opportunity

Large Multifamily Audience Opportunity

12

Monthly multifamily renter traffic

1

2024 Multifamily Rentals Brand Awareness Campaign

~70%

not on Zillow

Rentals

~30%

1. Zillow internal estimates based upon Comscore data as of March 31, 2024.

2022+

Accelerating

multifamily

properties and

revenue

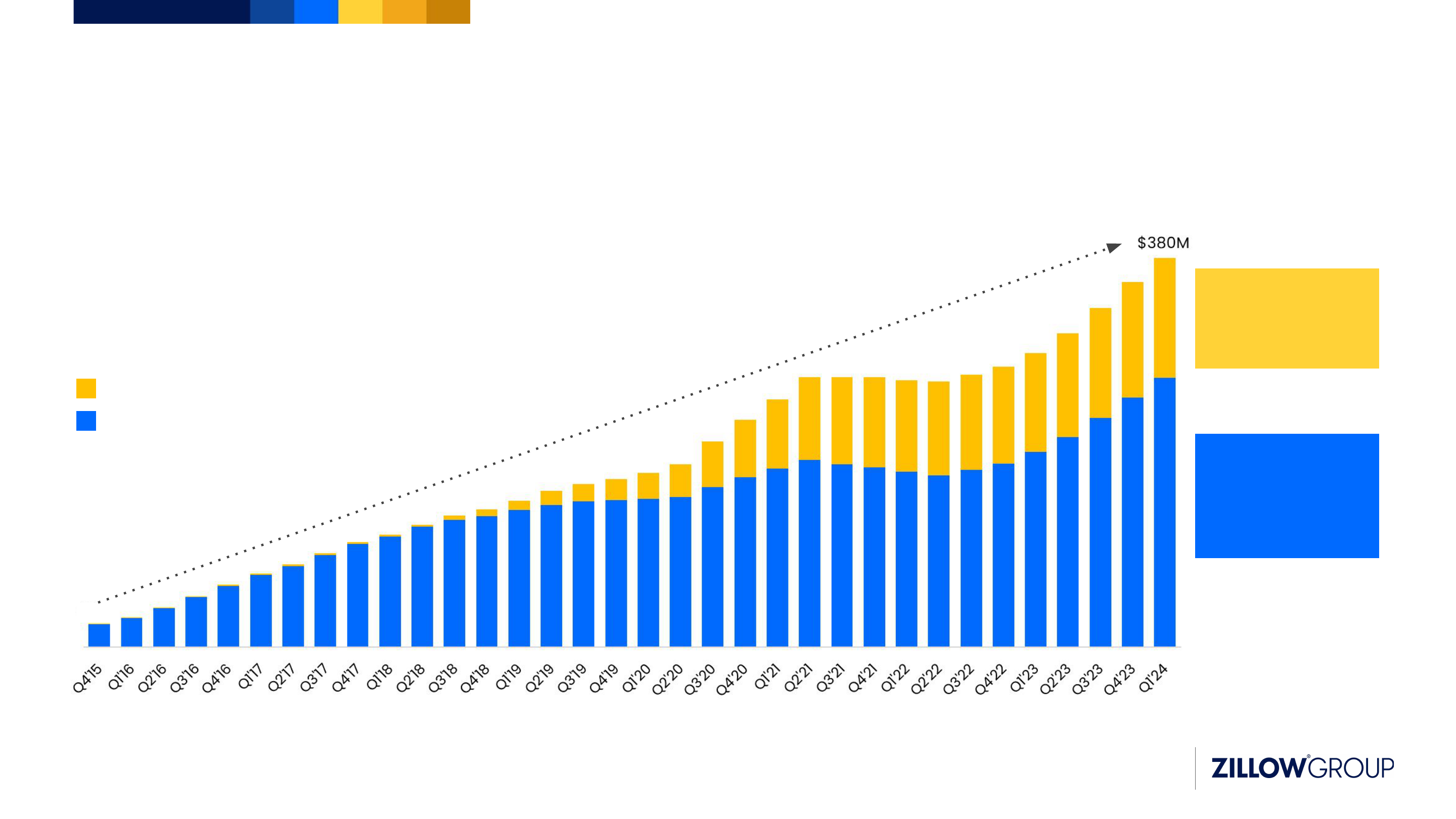

Executing Revenue Growth with $1B+ Revenue Opportunity

1

13

Trailing Twelve Months (TTM) Rentals Revenue

42% CAGR Q4’15 -Q1’24

Longtail, StreetEasy and other

Multifamily

Built unique longtail rental platform to fuel organic growth, now focused on scaling revenue across the marketplace

2018–2022

Built sustainable

longtail rental

platform

1. Zillow internal data and estimates. See Legal Disclosure slide for additional information about our forward-looking statements.

$21M